8. Rolling-over a Drawdown Loan

A rollover is the renewal of a loan. Instead of liquidating a loan on maturity, you can roll it over into a new loan. The outstanding principal and other components of the old loan are rolled-over with or without the interest outstanding on it. In the context of Loan Syndication, you may require to rollover a borrower draw down loan under a borrower tranche of a borrower facility contract.

You can rollover a loan that you are processing, provided a rollover is allowed for the product, the loan involves.

When a loan is rolled over, it can be processed in the following manner, depending upon your specification:

- A new loan with a different contract reference number is initiated

- The original loan could be split into multiple loans as a result of the rollover

- The original loan could be consolidated along with other loans as a result of the rollover

For a borrower draw down loan, typically, a new loan would be required to be initiated on rollover, and further, a split or consolidation may be required.

This chapter contains the following sections:

- Section 8.1, "Features of the Product Rollover Details screen "

- Section 8.2, "Specifying Contract Rollover Details"

8.1 Features of the Product Rollover Details screen

When defining a borrower draw down product, you have to specify whether loans involving the product can be rolled-over. If rollover has been allowed for a product, all the loans involving the product can, by default, be rolled-over.

However, a loan involving such a product will be rolled-over only if it is not liquidated, on it’s Maturity Date. You can choose not to rollover a loan involving a product with the rollover facility. This can be indicated when processing the loan.

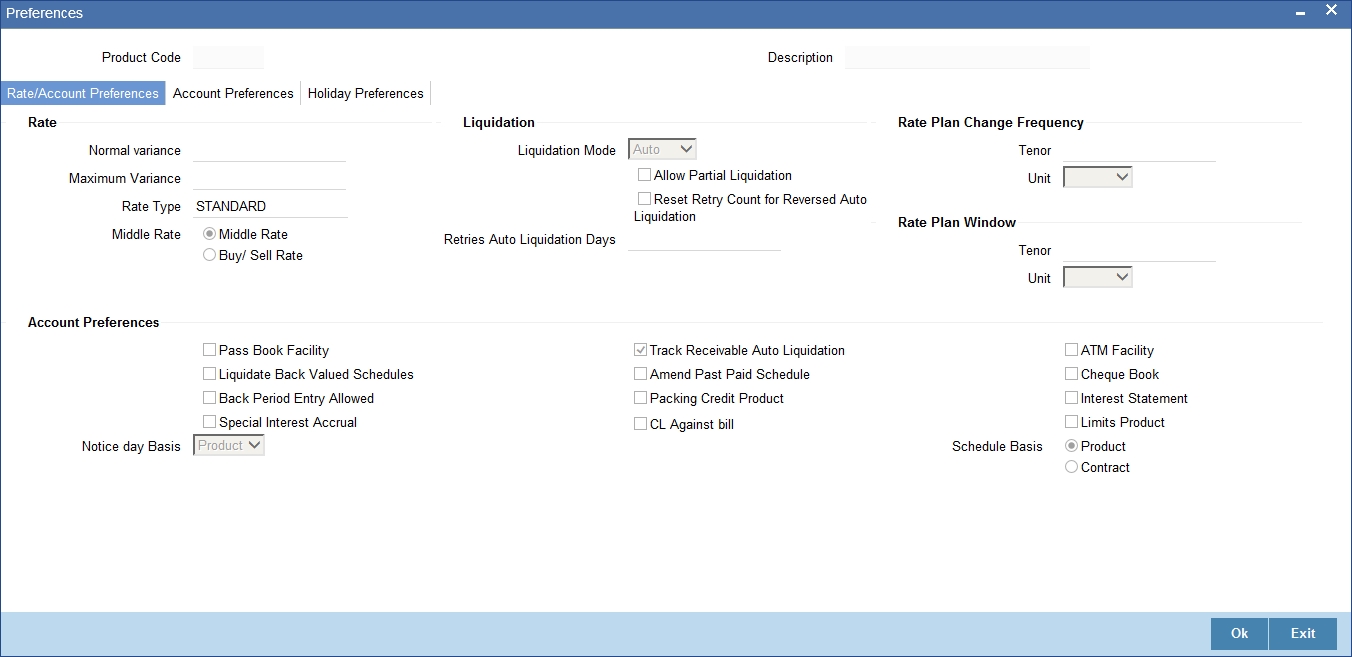

The rollover details for the borrower draw down product that you are defining can be specified in the ‘Preferences’ button of the ‘Loan Syndication Product’ screen.

You can invoke the screen ‘Loan Syndication Product’ screen by typing ‘LSDPRMNT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. Click ‘Preferences’ button.

You define the rollover preferences for a borrower loan product in the same manner as you would for a normal loan product.

For details, refer the section ‘Rollover Preferences’ in the chapter ‘Defining Product Categories and Products’ in the Retail Lending user manual.

Only those preferences that you would define specifically for Loan Syndication borrower draw down loan products are explained in this chapter.

8.2 Specifying Contract Rollover Details

Instead of liquidating a borrower draw down loan on maturity date, you can renew it into a new borrower draw down loan contract, or split it into multiple borrower draw down contracts, or consolidate it into a single new borrower draw down contract along with other borrower draw downs. As part of rolling over a contract, the original contract should be liquidated and a new contract should be initiated. In Oracle FLEXCUBE, these two processes are done in a single step.

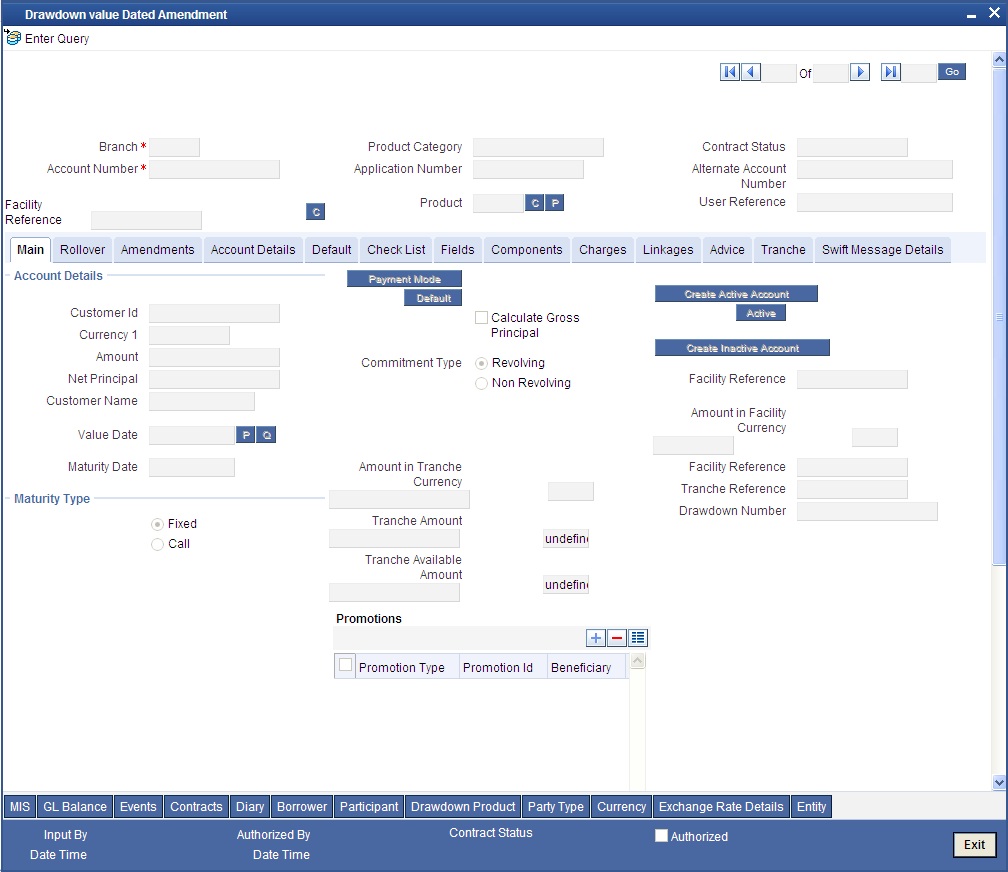

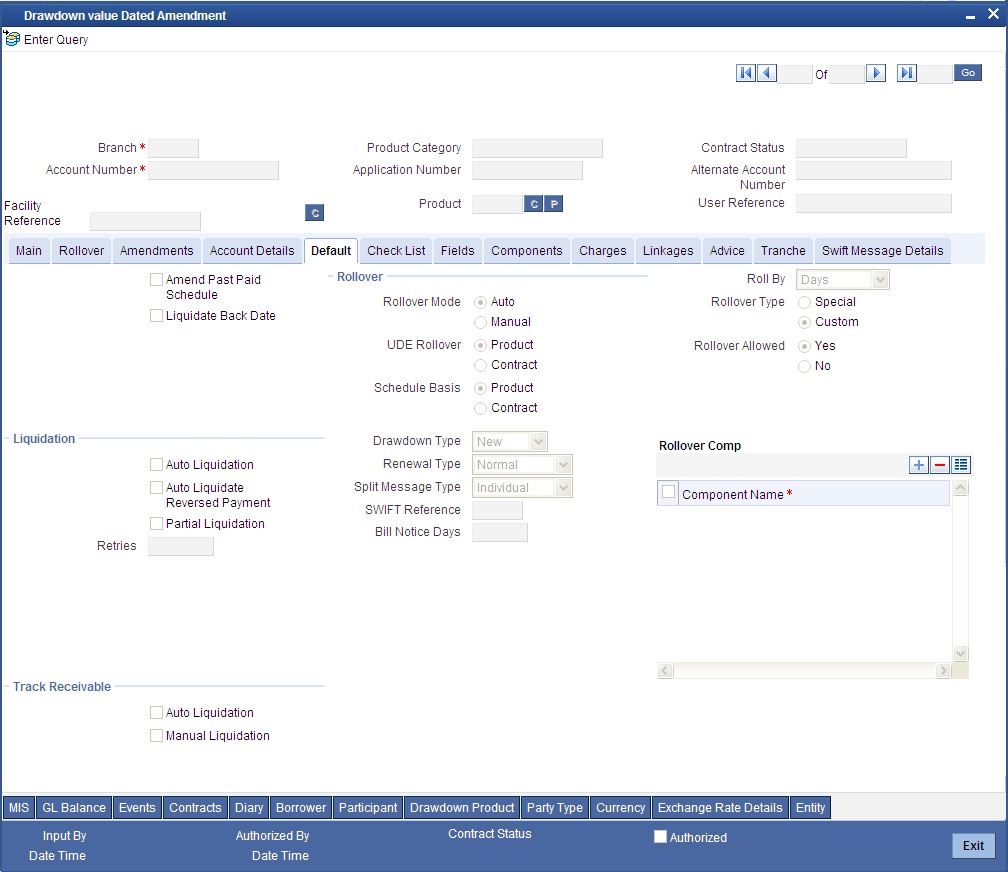

A borrower draw down loan contract inherits the rollover preferences defined for the borrower draw down loan product it uses. These preferences are displayed in the ‘Default’ Tab of the ‘Drawdown value Dated Amendment’ screen.

You can invoke this screen by typing ‘LSDDDAMD’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

This section contains the following topics:

- Section 8.2.1, "Rollover Preferences for Borrower Drawdown Loan Contract"

- Section 8.2.2, "Specifying Details for Normal Rollover"

- Section 8.2.3, "Specifying Details for Rollover Consolidation"

- Section 8.2.4, "Advices for a Rolled-over Loan"

- Section 8.2.5, "Authorizing a Manual Rollover"

8.2.1 Rollover Preferences for Borrower Drawdown Loan Contract

By default, for a borrower draw down loan, the rollover mechanism is defaulted as “New Contract”, and cannot be changed. This indicates that rolling over the contract will create a new borrower draw down loan contract.

The rollover method indicates:

- whether a single new contract must be created when the original contract is rolled over

- whether the original contract must be split into multiple contracts when rolled over

- whether the original contract must be consolidated into one single contract along with other contracts, when rolled over

The rollover method specified for the product used by the contract is defaulted, and you can change it when you enter the contract, if required.

8.2.2 Specifying Details for Normal Rollover

If you have chosen the rollover method as ’Normal’, then you must enter the corresponding details for the rollover, in the ‘Default’ Tab in the ‘Drawdown Details’ screen.

In the case of normal rollover, the system creates a new draw down contract (with a new contract reference number) for the original one being rolled over.

All the preferences in the ‘Default’ Tab that are applicable for rollover of normal loans, are also applicable for draw down loans, and you can specify the preferences in the same manner as you would for a normal loan contract.

You will need to specify a special rollover amount for the rollover contract whether it is a normal, split or consolidated rollover. The rolled over contract will have the same product as that of its parent contract. The rolled over contact will also have a Value Date equal to the Maturity Date of the parent contract. Back dated rollovers are also not permitted for any type of rollover. You can rollover a loan from the ‘Contract Online’ screen. In the ‘Contract Online’ screen, click on the ‘Roll-over’ icon to rollover a contract. Subsequently, you can change the rollover instructions. When you click the ‘Roll-over’ icon, the ‘Default’ Tab is shown in the edit mode. You can specify the rollover instructions (including interest rate of the main component and the refinance rate) for the rolled over contract.

For details, refer the section ‘Rollover Preferences’ in the chapter ‘Defining Product Categories and Products’ in the Retail Lending user manual.

Only those preferences specific to Loan Syndication draw down loans are explained here.

Specifying the maturity days

For fixed maturity types, you must specify the number of days to be added to the new value date of the rolled-over contract, to arrive at its maturity date.

Specifying the maturity basis

You must indicate the tenor basis upon which the maturity days specified for the rolled-over contract will be reckoned, in the Roll By field. The options are Days, Months, Quarters, Semi-annuals and Years.

If you specify the ‘days’ maturity basis, and do not specify the maturity days, the system ‘rounds’ the tenor of the original contract to the nearest maturity days basis. The rounded tenor is considered as the new tenor of the rolled-over contract.

Specifying the Refinancing Rate

You need to specify the refinancing rate for the rolled over contract.

Specifying the Margin for the Interest Basis

You need to specify the margin for the corresponding component of the rolled over contract.

Specifying the Drawdown Schedule Number

You need to specify the drawdown schedule number of renewal type under the tranche which must be applied on the rollover contract in the case of a normal contract being rolled over.

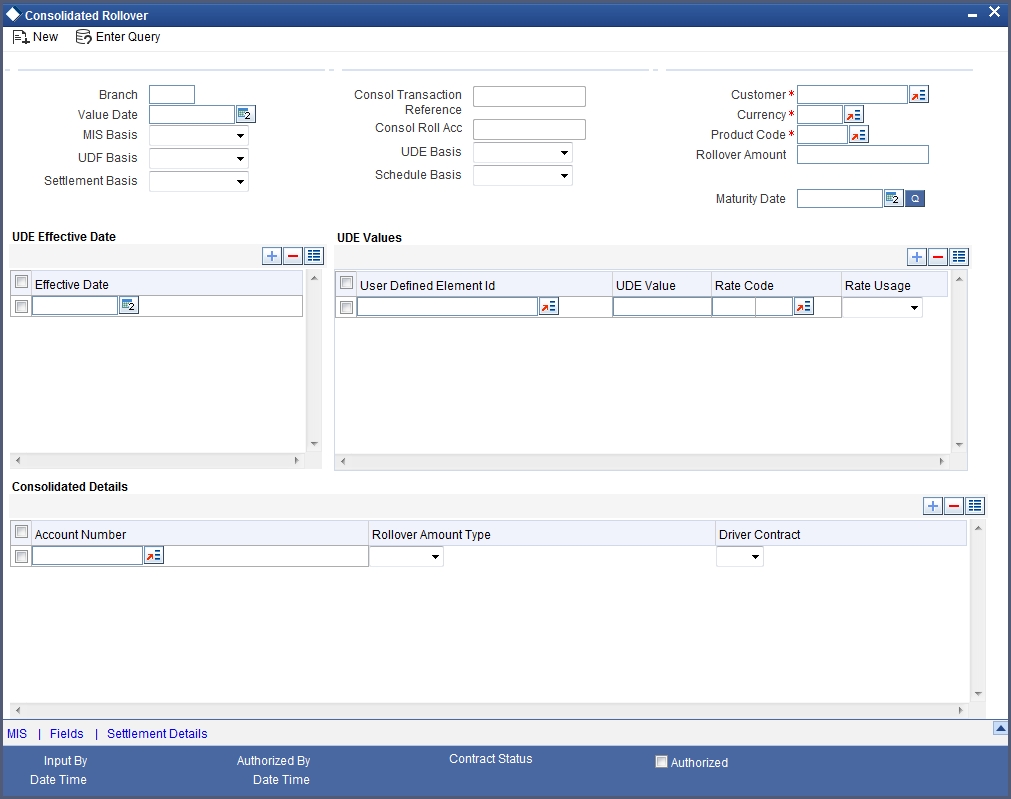

8.2.3 Specifying Details for Rollover Consolidation

If you have chosen the rollover method as “Consolidation”, then you must enter the corresponding details for the consolidation, in the ‘Consolidation Rollover’ screen, which you can invoke from the application browser. You can invoke this screen by typing 'CLDCROLL' in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In this screen, you must specify the reference number of the tranche under which you wish to consolidate draw down contracts, as part of the rollover operation.

For a borrower tranche, you can only consolidate draw down contracts:

- of the same customer

- maturing on the same date

- of the same currency

- if the ‘Cascade Participation’ preference has been set for the tranche

When you select the tranche reference number, the draw down product code for the tranche is displayed. You can select the draw down loans under the tranche to be consolidated.

You must specify the following details for the consolidated rolled-over contract:

8.2.3.1 Maturity details

You can indicate whether the consolidated contract has a fixed maturity date, or matures at call or notice. For contracts maturing at notice, you can indicate the applicable notice days.For fixed maturity type contracts, you can specify the maturity date. For fixed maturity type contracts, you can specify the number of days to be added to the value date to arrive at the maturity date.

8.2.3.2 Schedule Basis

You can indicate whether the repayment schedules for the consolidated contract must be defaulted from the tranche product or from the driver contract.

8.2.3.3 Specifying draw down schedule to which consolidated contract must be linked

You must specify the number of the draw down schedule of renewal type under the tranche, to which the consolidated contract must be linked.

8.2.3.4 Settlement Basis

You can indicate whether settlement details for the consolidated contract must be defaulted from the tranche product, or the driver contract, or must be user- defined. If user-defined, you can specify the details in the Settlement Message Details screen. Click ‘S’ button in the ‘Consolidation Rollover’ screen and invoke the ‘Settlement Message Details’ screen.

8.2.3.5 MIS Basis

You can indicate whether MIS details for the consolidated contract must be defaulted from the tranche product, or the driver contract, or must be user- defined. If user-defined, you can specify the details in the MIS screen. Click on the ‘M’ button in the Consolidation Rollover screen to invoke the MIS screen.

8.2.3.6 UDF Basis

You can indicate whether user-defined fields for the consolidated contract must be defaulted from the tranche product, or the driver contract, or must be user- defined. If user-defined, you can specify the details in the User Defined Fields screen. Click on the ‘F’ button in the Consolidation Rollover screen to invoke the User Defined Fields screen.

.

8.2.3.7 Interest components for the consolidated contract

You can define the interest components to be applicable for the consolidated contract. The interest rate can be defaulted from either the tranche product, or the driver contract, or a special rate can be entered. If a special rate is to be entered, you can specify the required rate in the Rate field.

8.2.3.8 Consolidation preferences for driver contracts

As part of the preferences for the consolidation contract, you can identify contracts from which information such as settlement details, schedules, MIS details and so on, can be defaulted. These contracts are called driver contracts. You can select the contracts to be used as driver contracts, in the Participant Ref No field.

You must specify the following details for the driver contracts:

- How the rolled over amount is reckoned. This could be just the outstanding principal, or outstanding principal together with interest.

8.2.4 Advices for a Rolled-over Loan

In the Product Events Definition screen, you can define the events for which advices are to be generated, for loans involving a product. An advice will be generated when a loan is rolled-over, if specified to do so, for the product the loan involves. Generation of advices upon rollover, if specified, will be as follows:

- When the loan is rolled-over with interest (that is, the entire outstanding amount in the original loan is rolled-over without any component of the original loan being liquidated), the liquidation advice for the original loan will not be generated. Instead, a rollover advice, with the details of the liquidation of the original loan and its subsequent rollover into a new loan, will be generated.

- When the loan is rolled with an amount, that is not the entire outstanding amount in the original loan, the liquidation advice(s) for the original loan will be generated along with the rollover advice.

8.2.5 Authorizing a Manual Rollover

The operations on a loan like input, modification, manual liquidation and manual rollover have to be authorized by a user other than the one who performed the operation. All the loans should be authorized before you can begin the End of Day operations. When a loan has been rolled-over manually, you have to do two authorizations:

- One, for the liquidation of the original loan

- Two, for the initiation of the new loan

When you call such a loan for authorization, the details of the liquidation of the original loan will be displayed. At the time of authorizing rolled over contracts, you need to enter the values for the re-key fields (specified at the product level).