13. Reports

You can generate the following reports for the Loans Syndication (LS) module of Oracle FLEXCUBE:

- Section 13.1, "Participant Drawdown Contribution Report"

- Section 13.2, "Participant Tranche Contribution Report"

- Section 13.3, "Commitment Fee Due Report "

- Section 13.4, "Commitment Fee Paid Report"

- Section 13.5, "Tranche Drawdown Detail Report"

- Section 13.6, "Drawdown Interest Due Report"

- Section 13.7, "Participant Drawdown Repayment Detail Report"

- Section 13.8, "Facility Borrower Contact Detail Report"

- Section 13.9, "Tranche Borrower Contact Detail Report"

- Section 13.10, "Drawdown Borrower Contact Detail Report"

- Section 13.11, "Active Facility Drawdown Detail Report"

- Section 13.12, "Facilities Detail Report"

- Section 13.13, "Participant Facility Detail Report"

- Section 13.14, "User Operations Detail Report"

- Section 13.15, "Administrator Facility Detail Report"

- Section 13.16, "Borrower Facility Detail Report"

- Section 13.17, "Ad-hoc Fee Detail Report"

- Section 13.18, "Participant Ad-hoc Fee Report"

- Section 13.19, "Facility Tranche Volume Detail Report"

- Section 13.20, "Facility Utilization Detail Report"

- Section 13.21, " Syndication Volume Detail Report"

- Section 13.22, "Participant Transfer Detail Report"

- Section 13.23, "Fiscal Diary Report"

- Section 13.24, "Fiscal Documentation Diary Detail Report"

- Section 13.25, "New Base Records Report"

- Section 13.26, "FX Unconfirmed Analysis –1 Day Report"

- Section 13.27, "Outstanding FX Contracts Report "

- Section 13.28, "Outstanding FX Contracts with NPV Profit/Loss Report "

- Section 13.29, "MM Unconfirmed Contracts Report "

- Section 13.30, "FX Unconfirmed Contracts Report"

- Section 13.31, "Comfort – Potential Errors Report "

- Section 13.32, "FX Summary Report "

- Section 13.33, "MM Summary Report "

- Section 13.34, "FX Contracts – Cancelled Report after Cable Sent Report "

- Section 13.35, "MM Contracts – Cancelled Report after Cable Sent Report "

- Section 13.36, "NPV Handoff – Exceptions Report "

- Section 13.37, "Reversed MM Contracts Report"

- Section 13.38, "Facility Detail Report"

- Section 13.39, "Tranche Borrower Report"

Each of the above reports is discussed in detail, in the following sections of this document.

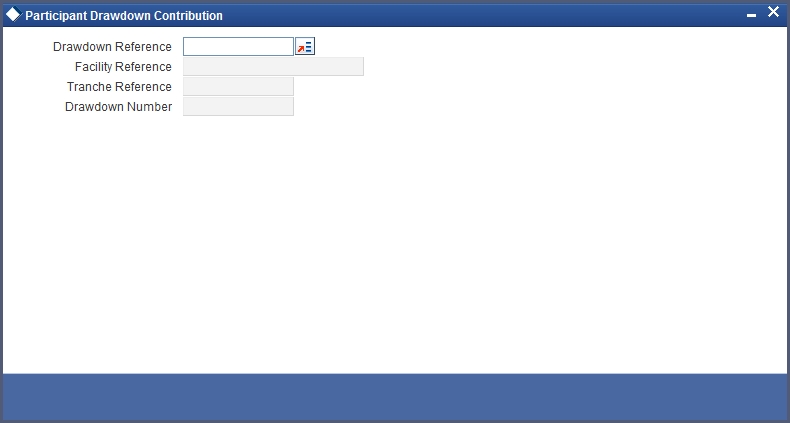

13.1 Participant Drawdown Contribution Report

The banks or financial institutions that pool funds to meet the borrowing requirements of customers along with the syndication agency are known as participants. This report gives the details of all the participants involved in disbursing the loan and the amount contributed by each participant towards the drawdowns.

13.1.1 Selection Options

You can indicate preferences for the generation of the report. The contents of the report will be determined by the preferences that you indicate.

You can invoke this screen by typing ‘LSRPPADC’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

The preferences that you can specify are as follows:

- Based on a specific Drawdown Reference number. On selection of the drawdown, the corresponding Facility Reference number and the Tranche Reference number under which the selected drawdown is initiated will also be displayed.

- If you select the ‘All’ option, the details of all the drawdowns initiated under all the Facility and Tranche contracts of your bank will be displayed in the report.

- If you choose a specific drawdown, its sequence number will also be displayed.

13.1.2 Contents of the Report

The contents of the ‘Participant Drawdown Contribution’ report are discussed under the following heads:

Header of the Report

The Header carries the title of the Report, information on the branch code, the branch date, the user ID, the module name, the date and time at which the report was generated and the page number of the report.

Body of the Report

The following details of the participants will be displayed in this report:

| Facility Ref No | The Contract Reference Number of the borrower facility contract (main syndication contract) finalized between the borrowing customer and one or more participants. | ||

|---|---|---|---|

| Tranche Ref No (Filter field) | Under the main syndication contract, this is the Reference Number of the tranche under which the drawdown loan contracts are initiated. | ||

| Drawdown Reference No | This is the contract reference number of the drawdown that is defined under a tranche of the main syndication contract. | ||

| User Ref No | The User Reference Number. | ||

| Counterparty | The counterparty name | ||

| Drawdown Currency | The currency in which the draw down loan amount is expressed. | ||

| Drawdown Amount | The amount that is drawn under each draw down loan linked to the tranche. | ||

| Customer (participant) Name | Name of the participants in the tranche contract to which each of the drawdown loan contract is linked. | ||

| Drawdown Base Currency | The currency in which the draw down amount allotted to each participant is expressed. | ||

| Drawdown Base Amount | The drawdown amount for each participant, expressed in the currency of the tranche under which it is defined. | ||

| Drawdown Date | The date on which each draw down loan (defined under the tranche) is requested by the borrower, based on the syndication contract. | ||

| Tenor | The tenor of a scheduled draw down loan under a tranche. | ||

| Maturity Date | The date on or before which all tranches and drawdowns under the syndication contract is scheduled to mature. | ||

| Exchange Rate | The exchange rate that is used if the draw down currency is different from the currency of the tranche contract or the account to which it is linked. | ||

| Component | The type of component | ||

| Rate | The interest rate that is applied on the participant leg tranche or draw down contracts under the syndication contract. | ||

| Interest Type | The method according to which the number of days is computed for calculation of interest for each participant in the syndication contract. | ||

| Participant Number | The number allotted to each participant of the drawdown contract. | ||

| Name | The name of the participant | ||

| Contact Name | You can maintain several entities for each participant/borrower. An entity is an additional dimension in the customer address (eg. Admin, Finance, HR etc. may different dimensions of a corporate customer). This is the name of the entity for each participant. All correspondence for the customer will be sent to this entity. | ||

| Allocation Amount | The drawdown amount contributed by each participant in a syndication contract. | ||

| DD Currency | This is the currency in which the amount of the borrower tranche contract is expressed. | ||

| Base Currency Amount | This is the currency amount in which the borrower tranche contract amount is expressed. | ||

| Base Currency | This is the currency in which the borrower tranche contract amount is expressed. |

The report also gives the sum total of the allocation/participant amount and the totals of the allocated amount in the tranche currency.

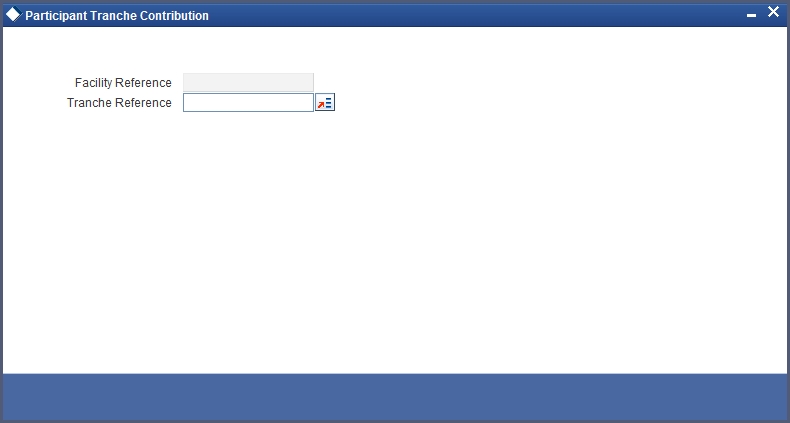

13.2 Participant Tranche Contribution Report

This reports describes the details of all the participants involved in the syndication contract, their original commitment amount and the actual amount available.

13.2.1 Selection Options

You can generate this report to obtain the participant details for:

- A specific tranche (in this case the reference number of the facility contract under which the selected tranche is booked will also be displayed), or

- All tranche contracts disbursed at your bank till date.

You can invoke this screen by typing ‘LSRPPTCO’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

13.2.2 Contents of the Report

The contents of the participant tranche contribution report are discussed under the following heads:

Header of the Report

The Header carries the title of the Report, information on the branch code, the branch date, the user ID, the module name, the date and time at which the report was generated and the page number of the report.

Body of the Report

The following details of the participants will be displayed in this report:

| Facility Ref No | The Contract Reference Number of the borrower facility contract (main syndication contract) finalized between the borrowing customer and one or more participants. | ||

|---|---|---|---|

| Value Date | The date on which the main syndication contract is initiated in the system. | ||

| Amount | The amount agreed upon between the borrowing customer and the participants of the main syndication contract. | ||

| User Ref No | The User Reference Number. | ||

| Maturity Date | The date on or before which all tranches and drawdowns under the borrower facility contract is scheduled to mature. | ||

| Counterparty | The name of the counterparty | ||

| Tranche Ref No (Filter Field) | Under the main syndication contract, this is the Reference Number of the tranche under which the draw down loan contract is initiated. | ||

| Participant ID | The ID allotted to each participant of the main syndication contract. | ||

| Participant Name | Name of the participants involved in the main syndication agreement with the borrowing customer. | ||

| Contact Name | This is the name of the entity for each participant. All correspondence for the customer will be sent to this entity. | ||

| Address | The address of the participant for correspondence. The address can include Telephone number/Telex Code/GCN Code/Fax No/e-mail address of the participant. | ||

| Commitment Currency | The currency in which the commitment contracts between each player in a tranche (i.e., the borrowing customer and the participants) is entered into. | ||

| Original Amount | The contribution of each participant as agreed upon at the level of a tranche opened under the main syndication contract. | ||

| Available Amount | The actual amount contributed by a participant as drawdowns under a tranche of the main syndication contract. |

The report will also display the totals of the original commitment amount and the sum of the available commitment amount as of date.

13.3 Commitment Fee Due Report

The Commitment Fee Due Report describes the fee amount due from the borrowing customer over a given period and its logical distribution amongst the participants who had contributed in meeting the loan requirements of the customer.

If you generate the report manually (from the Reports Browser), you can specify preferences for the generation of the report. The content of the report is determined by the following preferences.

- The commitment fee due from customers over a specific period i.e. the ‘From’ and ‘To’ dates.

- The Tranche Reference number for which commitment fee details have to be obtained. If you select the ‘ALL’ option, the fee details for all the Tranche contracts will be included in the report.

13.3.1 Contents of the Report

The contents of the commitment fee due report are discussed under the following heads:

Header of the Report

The following fields will be displayed in the header of the report:

| Facility Ref No/Borrower Name | The Contract Reference Number of the borrower facility contract and the name of the borrowing customer with whom you have finalized the syndication contract. | ||||

|---|---|---|---|---|---|

| Tranche Ref No (Filter Field | Under the main syndication contract, this is the Reference Number of the tranche under which drawdown loan contracts are initiated. | ||||

| Component Name | This is the fee component applicable for the borrower leg contract. This is the component that is tracked across the borrower and the participant legs of the tranche or drawdowns under the tranche. | ||||

| Tranche Currency | The currency of the commitment contract at the level of a tranche that is opened under the main syndication contract. | ||||

| Commitment Fees calculated for the

period: Amount, Period (Days), Interest Rate |

Amount: This is the fee amount, calculated for a given period and distributed to each of the participants involved in the contract. | Period: This is the period (in days) for which the fee is calculated. | Interest Rate: This is the interest rate that is applied on the participant leg tranche or draw down contracts under the syndication contract. |

The following details of the participants will be displayed in the report:

| Customer (Participant) No (Sort Field) | The number allotted to each participant of the drawdown contract. | ||

|---|---|---|---|

| Customer (Participant) Name | Name of the participants in the tranche contract to which each of the drawdown loan contract is linked. | ||

| Contact Name | This is the name of the entity for each participant. All correspondence for the customer will be sent to this entity. | ||

| Fee Currency | The currency in which the fee amount is computed. | ||

| Fee Amount | This is the amount to be distributed to each of the participants, out of the liquidated fee amount of the borrower leg contract. | ||

| Skim Margin Amount | Typically, all the participants would share the interest earned on the drawdown loans in the ratio of their participation. However, the syndication agency can decide to give a lesser percentage to each participant. This difference between the asset (share as per the participation ratio) and income (actual share received) ratio is known as the skim margin amount. The skim margin amount is the syndication agency’s profit on the commitment. |

The report will also display the totals of the fee amount that is distributed among all the participants.

13.4 Commitment Fee Paid Report

This report describes the details of fee amount that is actually collected from the borrowing customer over a given period and its actual distribution amongst the participants who had contributed in meeting the loan requirements of the customer.

You can generate this report based on the following preferences:

- The commitment fee paid by customers over a specific period i.e. the ‘From’ and ‘To’ dates.

- The Tranche Reference number for which commitment fee paid details have to be obtained. If you select the ‘ALL’ option, the fee details for all the Tranche contracts will be included in the report.

13.4.1 Contents of the Report

The contents of the commitment fee paid report are discussed under the following heads:

Header of the Report

The following fields will be displayed in the header of the report:

| Facility Ref No/Borrower Name | The Contract Reference Number of the borrower facility contract and the name of the borrowing customer with whom you have finalized the syndication contract. | ||

|---|---|---|---|

| Tranche Ref No (Filter Field) | Under the main syndication contract, this is the Reference Number of the tranche under which drawdown loan contracts are initiated. | ||

| Component Name | This is the fee component applicable for the borrower leg contract. This is the component that is tracked across the borrower and the participant legs of the tranche or drawdowns under the tranche. | ||

| Tranche Currency | The currency of the commitment contract at the level of a tranche that is opened under the main syndication contract. | ||

| Commitment Fees Received | Fees that is received from the borrowing customer towards the commitment contract. |

The following details of the participants will be displayed in the report:

| Customer (Participant) No (Sort Field) | The number allotted to each participant of the drawdown contract. | ||

|---|---|---|---|

| Customer (Participant) Name | Name of the participants in the tranche contract to which each of the drawdown loan contract is linked. | ||

| Contact Name | This is the name of the entity for each participant. All correspondence for the customer will be sent to this entity. | ||

| Fee Currency | The currency in which the fee amount is paid. | ||

| Fee Amount Paid | This is the amount that is paid to each participant, out of the liquidated fee amount of the borrower leg contract. | ||

| Skim Margin Amount | The difference between the asset (share as per the participation ratio) and income (actual share received) ratio is known as the skim margin amount. The skim margin amount is the syndication agency’s profit on the commitment. |

The report will also display the totals of the fee amount that is paid to each participant taking part in the drawdown contracts.

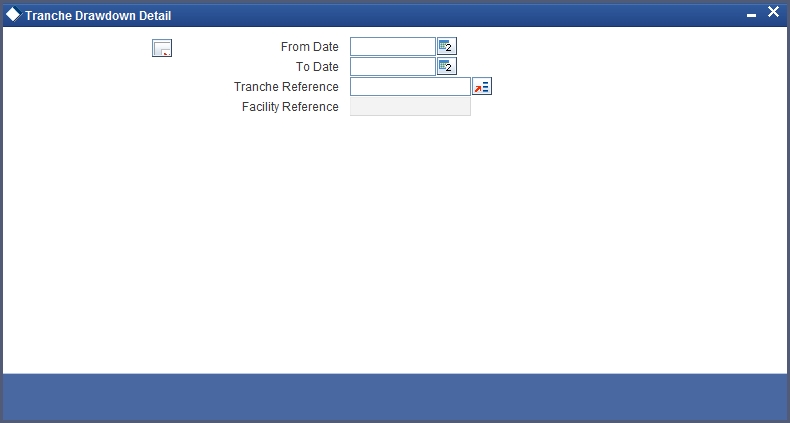

13.5 Tranche Drawdown Detail Report

A facility is a specific service, scheme or product that you make available to customers. Also, you can disburse loans through a draw down, from any of the tranches under a facility contract. The Tranche Drawdown Detail Report describes the drawdown details for a Facility and a Tranche over a given period.

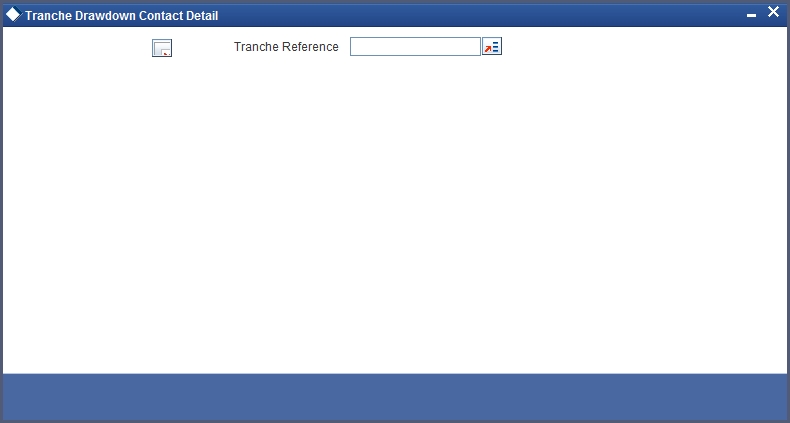

13.5.1 Selection Options

- You can choose to generate the report to list the drawdowns under a tranche and a facility as of a specific date or over a specified period in time (by indicating the ‘From’ and ‘To’ date of the period).

- The Tranche Reference number for which the drawdown details have to be obtained. If you select the ‘ALL’ option, the details of all the drawdowns booked under all the tranche contracts initiated at your bank will be included in the report.

You can invoke this screen by typing ‘LSRPTDDT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

13.5.2 Contents of the Report

The contents of the tranche drawdown details report are discussed under the following heads:

Header of the Report

The Header carries the title of the Report, information on the branch code, the branch date, the user ID, the module name, the date and time at which the report was generated and the page number of the report.

The following details of the participants will be displayed in the report:

| Facility Ref No | The Contract Reference Number of the borrower facility contract and the name of the borrowing customer with whom you have finalized the syndication contract. | ||

|---|---|---|---|

| Tranche Ref No. (Filter field) | Under the main syndication contract, this is the Reference Number of the tranche under which drawdown loan contracts are initiated. | ||

| User Ref No | The User Reference Number. | ||

| Customer Ref No | The Customer Reference Number of the borrower | ||

| Total Amount settled | The total loan amount settled. | ||

| Customer Name | The name of the customer | ||

| Commitment Fees for the period | This is the fee amount that is collected from the borrowing customer and calculated for a given period. | ||

| Drawdown Reference Number | This is the contract reference number of the drawdown that is defined under a tranche of the main syndication contract. | ||

| Drawdown Schedule No (Sort field) | This is the schedule number of the drawdown defined under a tranche of the main facility contract. | ||

| Drawdown Amount | This is the drawdown amount. | ||

| Drawdown Date | The date on which each draw down loan under the tranche will be requested by the borrower, based on the syndication contract. | ||

| Maturity date | The date on or before which all drawdowns under a tranche are scheduled to mature/expire. | ||

| Borrower | Name of the borrowing customer for each drawdown contract defined under a tranche. |

The report also gives the totals of all the drawdown loan amounts under the tranche.

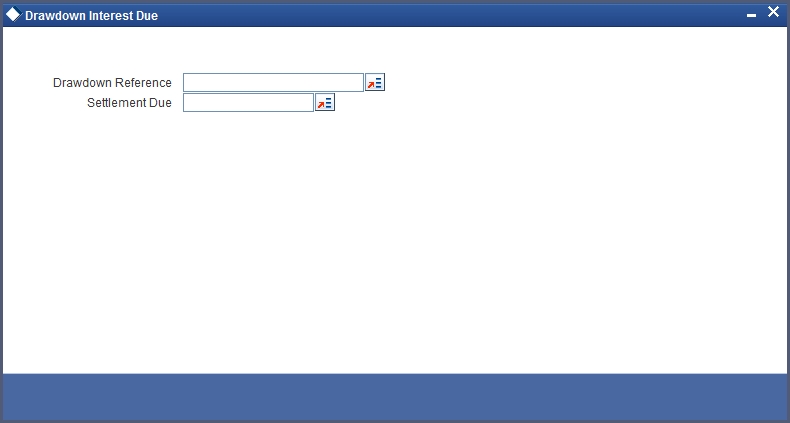

13.6 Drawdown Interest Due Report

The participants in a syndication contract share the interest in the ratio of their participation that was agreed upon at the time of entering the tranche. You can get the details of the projected/future interest allocation per participant in the Drawdown Interest Due Report.

13.6.1 Selection Options

You can generate this report to obtain the interest due on:

- A specific drawdown, or

- All drawdowns disbursed at your bank till date.

You can invoke this screen by typing ‘LSRPDDID’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

13.6.2 Contents of the Report

The contents of the Drawdown Interest Due report are discussed under the following heads

Header of the Report

The Header carries the title of the Report, information on the branch code, the branch date, the user ID, the module name, the date and time at which the report was generated and the page number of the report.

Body of the Report

The following details of the participants will be displayed in this report:

| Facility Ref No | The Contract Reference Number of the borrower facility contract (main syndication contract) finalized between the borrowing customer and one or more participants. | ||

|---|---|---|---|

| Tranche Ref No | The Reference Number of the borrower tranche under which the drawdown loan contracts is initiated. | ||

| Drawdown No (Filter field) | The request ID number for the drawdown loan contract. | ||

| User Ref No | The User Reference Number | ||

| Borrower ID | The ID of the borrower | ||

| Base Currency | This is the currency in which the borrower tranche contract amount is defined. | ||

| Borrower Name | The name of the borrower | ||

| Component Name | The name of the interest component that is applied to the borrower leg as well as the participant leg contracts. | ||

| Base Currency Name | This is the name of the currency in which the Interest Amount is specified. This could be the local currency or the contract currency. | ||

| Drawdown date | The date on which each draw down loan (defined under the borrower tranche) is requested by the borrower, based on the syndication contract. | ||

| Base Currency Amt. | The drawdown amount for each participant, expressed in the currency of the tranche under which it is defined. | ||

| Maturity Date | The date on or before which all tranches and drawdowns under the borrower facility contract is scheduled to mature. | ||

| Exchange rate | The exchange rate that is used if the draw down currency is different from the currency of the tranche contract or the account to which it is linked. | ||

| Request ID | The ID of the requester. | ||

| Component | The name of the component that is applied to the borrower leg as well as the participant leg contracts. | ||

| Drawdown Amt | The amount that is drawn under each draw down loan linked to the tranche. | ||

| Interest Rate | The interest rate that is applied on the participant leg tranche or draw down contracts under the facility borrower contract. | ||

| Interest Basis | The method according to which the number of days is computed for interest calculation. This is applied specifically for the interest derived by each participant as per the bower facility contract. | ||

| Period (days) | This is the period (in days) for which interest on the drawdown loan is calculated. | ||

| Interest Calculated From To | The date range for which interest is calculated on the drawdown loan contract. | ||

| Party ID/ Participant Name | Name and ID of the participants in the tranche contract to which each of the drawdown loan contract is linked. | ||

| Contact Name | This is the name of the entity for each participant in the drawdown. All correspondence for the customer will be sent to this entity. | ||

| Currency | The currency in which the draw down loan amount is expressed. | ||

| Allocation Amt | The drawdown amount (expressed in the drawdown currency) contributed by each participant in a syndication contract i.e. the amount being disbursed in each draw down. | ||

| Interest Amount | The interest amount received by each participant in the ratio of his or her participation. | ||

| Skim margin amount | The difference between the asset (share as per the participation ratio) and income (actual share received) ratio is known as the skim margin amount. The skim margin amount is the syndication agency’s profit on the commitment. | ||

| Total | The total of the allocation amount and the sum of the interest amount received by each participant. |

13.7 Participant Drawdown Repayment Detail Report

When one or more participants join together to meet the funding requirements of a borrowing customer, the interest earned on the loans are distributed between the participants in the ratio of their participation. You can generate the Participant Drawdown Repayment Detail report to view the allocation of interest and principal repayments, made by the borrower, between the various participants.

You can generate this report to obtain the participant repayment details for:

- A specific drawdown, or

- All drawdowns disbursed at your bank till date.

13.7.1 Contents of the Report

The contents of the participant drawdown repayment detail report are discussed under the following heads:

Header of the Report

The following fields will be displayed in the header of the report:

| Facility Ref No | The Contract Reference Number of the borrower facility contract (main syndication contract) finalized between the borrowing customer and one or more participants. | ||

|---|---|---|---|

| Customer (Borrower) No. /Name | The number and name of the borrowing customer taking part in the drawdown loan contract under a borrower tranche. | ||

| Tranche Ref No | The Reference Number of the borrower tranche under which the drawdown loan contracts is initiated. | ||

| Component Name | The name of the interest component that is applied to the borrower leg as well as the participant leg contracts. | ||

| Base Currency | This is the currency in which the borrower tranche contract amount is defined. | ||

| Currency Name | This is the name of the currency in which the Interest Amount is specified. This could be the local currency or the contract currency. | ||

| Drawdown date | The date on which the draw down loan (defined under the borrower tranche) is requested by the borrower, based on the main borrower facility contract. | ||

| Maturity Date | The date on or before which all tranches and drawdowns under the borrower facility contract is scheduled to mature. | ||

| Period (days) | This is the period (in days) for which interest on the drawdown loan is calculated. | ||

| Base Currency Amt. | The drawdown amount for each participant, expressed in the currency of the borrower tranche under which it is defined. | ||

| Exchange rate | The exchange rate that is used if the draw down currency is different from the currency of the borrower tranche contract or the account to which it is linked. | ||

| Drawdown No (Filter Field) | The request id number for the drawdown loan contract. | ||

| Drawdown Amt/Optional Currency | The amount that is drawn under each draw down loan linked to the tranche and the currency in which the draw down loan amount is expressed. | ||

| Interest Rate | The interest rate that is applied on the participant leg tranche or draw down contracts under the facility borrower contract. | ||

| Interest Basis | The method according to which the number of days is computed for interest calculation. This is applied specifically for the interest derived by each participant as per the bower facility contract. | ||

| Interest Calculated From To | The date range for which interest is calculated on the drawdown loan contract. |

The following details of the participants will be displayed in this report:

| Customer (Participant) No. (Sort Field) | The number allotted to each participant of the drawdown contract. | ||

|---|---|---|---|

| Customer (Participant) Name | Name of the participants in the tranche contract to which each of the drawdown loan contract is linked. | ||

| Contact Name | This is the name of the entity for each participant of the drawdown. All correspondence for the customer will be sent to this entity. | ||

| Optional Currency | The currency in which the draw down loan amount is expressed for each participant. | ||

| Optional Currency Allocation Amt. | The drawdown amount, expressed in the drawdown currency, that is contributed by each participant in the facility borrower contract i.e. the amount being disbursed in each draw down. | ||

| Interest Amount | The interest amount (sum of all the interest components) received by each participant in the ratio of his or her participation. | ||

| Skim margin amount | The difference between the asset (share as per the participation ratio) and income (actual share received) ratio is known as the skim margin amount. The skim margin amount is the syndication agency’s profit on the commitment. |

The report also displays the totals of the allocation amount and the sum of the interest amount received by each participant.

13.8 Facility Borrower Contact Detail Report

For each participant and borrower, you can maintain several different entities. When you initiate a borrower facility contract, you have to specify the name of the entity for each borrower. All customer correspondence will be sent to this entity. The Facility Borrower Contact Details report describes the entity for the borrower, for a particular facility.

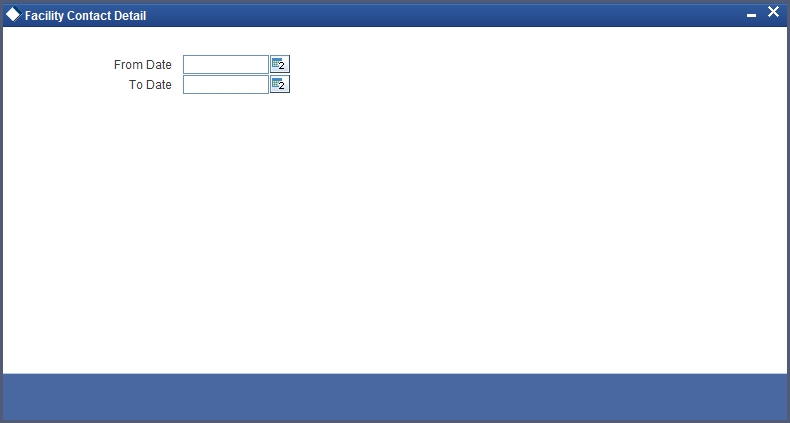

13.8.1 Selection Options

You can generate this report to obtain the borrower contact details for facility contracts:

- A specific tranche (in this case the reference number of the facility contract under which the selected tranche is booked will also be displayed)

You can invoke this screen by typing ‘LSRBRDET’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

13.8.2 Contents of the Report

The contents of the Facility Borrower Contact Detail report are discussed under the following heads:

Header of the Report

The Header carries the title of the Report, information on the branch code, the branch date, the user ID, the module name, the date and time at which the report was generated and the page number of the report.

The details of the borrower that would be displayed in the report are as follows:

| Facility Ref No (filter field) | The Contract Reference Number of the borrower facility contract (main syndication contract) finalized between the borrowing customer and one or more participants. | ||

|---|---|---|---|

| User Ref No | The User Reference Number of the borrower facility. | ||

| Customer No | The number and name of the borrowing customer taking part in the borrower facility contract. | ||

| Customer Name | The name of the borrowing customer taking part in the borrower facility contract. | ||

| Contact ID | The ID of the borrower. | ||

| Name/ Address (Sort Field) | This is the name and address of the entity for each borrower as defined in the main facility contract. All correspondence for the customer will be sent to this entity. | ||

| Description | The description of the entity for each borrower as defined in the main facility contract. | ||

| Telno./Telno.Ext./Faxno./FaxnoExt. | The address of the entity selected for the borrower. The address can include the Telephone No/ Extn, Fax No/ Extn. | ||

| Telex Code/ Answerback/GCN | The Telex code, GCN etc of the borrower | ||

| Country/FaxInd./Email address | The Country ID, e-mail address etc |

13.9 Tranche Borrower Contact Detail Report

Just as you have contact details for a borrower facility contract, you can maintain entities for borrower of a particular tranche as well. The Tranche Borrower Contact Details report describes the entity for the borrower.

You can generate this report to obtain the borrower contact details for:

- A specific tranche if the product type is selected as ‘Tranche’ (in this case the reference number of the facility contract under which the selected tranche is booked will also be displayed), or

- All tranche contracts disbursed at your bank till date.

13.9.1 Contents of the Report

The contents of the tranche borrower contact detail report are discussed under the following heads:

Header of the Report

The following fields will be displayed in the header of the report:

| Facility Ref No (Filter field) | The Contract Reference Number of the borrower facility contract (main syndication contract) under which the tranche contract is initiated. | ||

|---|---|---|---|

| Tranche ref no (Filter Field) | The Reference Number of the borrower tranche that is initiated under the main borrower facility contract. | ||

| Customer (Borrower) No/Name | The number and name of the borrowing customer taking part in the borrower facility contract. |

The details of the borrower that would be displayed in the report are as follows:

| Contact name. (Sort Field) | This is the name of the entity for each borrower as defined in the borrower tranche contract. All correspondence for the customer will be sent to this entity. | ||

|---|---|---|---|

| Contact Address | The address details of the entity selected for the borrower. The address can include the Telephone No/Extn, Fax No/Extn, the Telex Code, GCN, Country Id, e-mail address etc. |

13.10 Drawdown Borrower Contact Detail Report

Just as you maintain entity details for customers taking part in facility and tranche contracts, you can maintain entities for the borrower of a drawdown loan contract as well. This report describes the entity selected for a borrower of a drawdown.

13.10.1 Selection Options

You can generate this report to obtain the borrower contact details for a specific drawdown if the product type is selected as ‘Drawdown’ (in this case the reference number of the facility contract and the tranche contract under which the selected drawdown is booked will also be displayed).

You can invoke this screen by typing ‘LSRDDBRC’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

13.10.2 Contents of the Report

The contents of the Drawdown Borrower Contact Detail report are discussed under the following heads:

Header of the Report

The Header carries the title of the Report, information on the branch code, the branch date, the user ID, the module name, the date and time at which the report was generated and the page number of the report.

The details of the borrower that would be displayed in the report are as follows:

| Facility Ref No (Filter field) | The Contract Reference Number of the main borrower facility contract under which the tranche linked to the drawdown contract, is initiated. | ||

|---|---|---|---|

| Tranche Ref No (Filter Field) | The Reference Number of the borrower tranche under which the borrower drawdown contract is initiated. | ||

| Drawdown Ref No. (Filter Field) | The Reference Number of the drawdown loan contract initiated under the tranche contract. | ||

| User Ref No | The User Reference Number. | ||

| Facility Name | The name of the facility | ||

| Customer Name | The name of the borrowing customer taking part in the borrower drawdown contract. | ||

| Counterparty | The name of the counterparty. | ||

| Contact ID | The contact ID of the borrower. | ||

| Name. (Sort Field) | This is the name of the entity for each borrower as defined in the borrower tranche contract. All correspondence for the customer will be sent to this entity. | ||

| Telno./Telno.Ext./Faxno./FaxnoExt. | The address of the entity selected for the entity. The address can include the Telephone No/ Extn, Fax No/ Extn. | ||

| Telex Code/ Answerback/GCN | The Telex code, GCN etc. of the entity | ||

| Country/FaxInd./Email address | The Country ID, e-mail address etc of the entity. |

13.11 Active Facility Drawdown Detail Report

A facility product is used to process participant/borrower facility contracts. This is parent contract under which you can process borrower tranche or draw down contracts. This report describes the drawdown details for a particular facility that is still active in the system. It is sorted based on the value date and request date.

13.11.1 Selection Options

You can generate this report to obtain the details of drawdowns under a facility contract that is still active. The report can be generated for a specific facility contract, or all facility contracts initiated at your bank as on the date of report generation.

You can invoke this screen by typing ‘LSRPFDDT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

13.11.2 Contents of the Report

The contents of the Facility Drawdown Detail report are discussed under the following heads:

Header of the Report

The Header carries the title of the Report, information on the branch code, the branch date, the user ID, the module name, the date and time at which the report was generated and the page number of the report.

The details of the borrower that would be displayed in the report are as follows:

| Facility Ref No (Filter field) | The Contract Reference Number of the main borrower facility contract under which the drawdown contract is initiated. | ||

|---|---|---|---|

| Customer No | The number of the borrowing customer taking part in the borrower drawdown contract. | ||

| Base Currency | This is the currency in which the borrower facility contract amount is defined. | ||

| User Ref No | The User Reference Number. | ||

| Customer (Borrower) Name | The number and name of the borrowing customer taking part in the borrower drawdown contract. | ||

| Date | The date on which the draw down loan is requested by the borrower. |

The report also displays the totals of all the drawdown amounts.

13.12 Facilities Detail Report

You can generate a report to obtain the details of facility contracts that are initiated at your bank. The Facilities Detail Report gives you this information. This report describes the details of facilities whose maturity date falls within a given period.

You can generate this report to obtain the details of:

- A specific facility contract, or

- All facility contracts initiated at your bank as on the date of report generation.

13.12.1 Contents of the Report

The contents of the facilities detail report are discussed under the following heads:

Header of the Report

The following fields will be displayed in the header of the report:

| From Date/To Date (Filter field) | To recall, you can generate this report for a given maturity date range. This is the ‘From’ and ‘To’ dates (as specified by you) for which the facilities report is to be generated. |

|---|

The details of the facilities that would be displayed in the report are as follows:

| Facility Ref No (Sort field) | The Contract Reference Number of the borrower facility contracts initiated at your bank whose maturity date falls within the specified date range. | ||

|---|---|---|---|

| Facility Name | The name of the facility product used to process the facility contract. | ||

| Facility Amount | The amount of the facility contract, as agreed upon by the players i.e. the borrowing customer and the participants. | ||

| Currency | The currency in which the facility contract amount is expressed. | ||

| Facility Start Date | This is the date that indicates the beginning of the period for which the facility product is available for use. | ||

| Facility End Date | This is the date that indicates the end of the period for which the facility product is available for use. |

The report also displays the totals of the facility amount grouped by their currencies.

13.13 Participant Facility Detail Report

To view the details of the lead agent and the participants involved in each facility generate the participant facility detail report. This report displays the record of all the participants contributing for the facility.

If you generate the report manually (from the reports Browser) you can specify preferences for the generation of the report. You can choose to generate the report to list the activities and events that were performed on syndication contracts as of a specific date or over a specified period in time.

This report describes the activities under the following search criteria:

- The type of customer whether he is a borrower or a participant.

- The product type of the loan. Select the type – facility, tranche or Drawdown.

- The participant facility detail over a specific period i.e. the ‘From’ and ‘To’ dates.

13.13.1 Contents of the Report

The contents of the ‘Participant Facility Detail Report’ have been discussed below:

Body of the Report

| Report Date | Date on which the report is being generated. | |||

|---|---|---|---|---|

| Customer (Participant) No/ Name | Name and number of the participants in the tranche contract to which each of the drawdown loan contract is linked. | |||

| Customer (Participant) Country | The country name of the participant | |||

| GFCID | The customized UDF maintained under customer maintenance. | |||

| Customer (Borrower) No/ Name | The number and name of the borrowing customer with whom you have finalized the syndication contract. | |||

| Base Currency | The currency of the contract. | This is the currency in which the amount of the borrower tranche contract is expressed. | ||

| Outstanding Balance | This is the balance amount that is outstanding. | |||

| Facility Ref No | The Contract Reference Number of the main syndication contract between the borrowing customer and one or more participants. | |||

| Contact | Name of the contact person for each participant in the drawdown. |

13.14 User Operations Detail Report

All operations of a user (maker or checker) on a syndication contract, as well as the tranche contracts and the draw down loan contracts under a tranche of the agreement contract, at the branch can be viewed through the User Operations Details report. This report gives the details of all the operations performed by user.

This report describes the activities under the following search criteria:

- The identity of the user who has performed the activity or event on the bill i.e. maker or the checker.

- The unique ID assigned to the name the user.

- The list of user operation details over a period in time, specify the ‘From’ and ‘To’ date of the period.

This period should be specified by providing the From and To dates of the period.

13.14.1 Contents of the Report

The contents of the ‘User Operations Detail Report’ have been discussed below:

Body of the Report

| Number Of activities | The number of events input or authorized by the user depending upon whether it is a maker or checker report. | ||

|---|---|---|---|

| % Of activities | The percentage of the total events for the number of activities. | ||

| No of O/S Advances (Drawdowns not matured) | The number of active drawdowns input by the user. | ||

| % Of O/S Advances | The percentage of the total active drawdowns. |

13.15 Administrator Facility Detail Report

Your bank may wish to assign appropriate administrators to Loan Syndication contracts. This reports describes the details of all such administrators of the loan.

You can choose to generate the report to list the administrator facility details as of a specific date or over a specified period in time (by indicating the ‘From’ and ‘To’ date of the period).

13.15.1 Contents of the Report

The contents of the report have been discussed below:

Body of the Report

| Facility Ref No. (sort field) | The Contract Reference Number of the main syndication contract (between the borrowing customer and one or more participants). | ||

|---|---|---|---|

| Customer (Borrower) No/Name | The number and name of the borrowing customer with whom you have finalized the syndication contract. | ||

| Facility Start Date | The date on which the main syndication contract is initiated in the system. | ||

| Facility Ref No Amount | The value date and Amount specified in the Syndication contract to which the present tranche is attached. | ||

| No. Of O/S | The number of outstanding drawdowns under the facility. | ||

| Active | The status of the facility contract (active/ matured) | ||

| Loan Administrator | The unique ID assigned to the name the administrator of the tranche or drawdown contract. |

13.16 Borrower Facility Detail Report

In the case of a syndication contract, the entities involved in a contract are the borrowing customer, the lead agent and the participants for any tranche of the agreement. You can view the details of the borrowing customer with whom you have finalized the syndication contract through this report.

This reports describes the borrower details under the following search criteria:

- The type of customer whether he is a borrower or a participant.

- The facility Reference number for which borrower facility details have to be obtained. If you select the ‘ALL’ option, the fee details for all the facility contracts will be included in the report.

13.16.1 Contents of the Report

The contents of the borrower report have been discussed below:

Body of the Report

| Facility Ref No. | The reference number of the contract for which you are generating the report. | ||

|---|---|---|---|

| Customer (Borrower) No | The code of the customer with whom this syndication contract has been finalized. This, typically, is the borrowing customer. | ||

| Customer (Borrower) Name | The name of the borrower with whom the contract has been finalized. | ||

| Customer (Borrower) Country | The country to which the customer (borrower) belongs. | ||

| Maturity Date | This is the date on or before which all tranches and drawdowns under the syndication contract should be maturity dated. | ||

| GFCID | The customized UDF maintained under customer maintenance. |

13.17 Ad-hoc Fee Detail Report

For all syndication contracts you can define ad hoc special amount fee. The adhoc fee component facility is applicable to Syndication Facility (LN), Syndication Borrower (LS) and Syndication Participant (LL) module.

This report describes the ad hoc details under the following search criteria:

- The type of customer whether he is a borrower or a participant.

- The product type of the loan. Select the type – facility, tranche or Drawdown.

- The list of ad hoc fee that applied over a period in time, specify the ‘From’ and ‘To’ date of the period.

13.17.1 Contents of the Report

The contents of the adhoc fee details report has been discussed below:

Body of the Report

| Borrower/Participant (Filter field) | The number allotted to each participant of the main syndication contract. | ||

|---|---|---|---|

| Date range (Filter field) | The list of ad hoc fee that applied over a period in time, specify the ‘From’ and ‘To’ date of the period. | ||

| Draw down No (Sort field) | This is the contract reference number of the drawdown that is defined under a tranche of the main syndication contract. | ||

| Tranche ref no | Under the main syndication contract, this is the Reference Number of the tranche under which the drawdown loan contracts are initiated. | ||

| Facility Ref No | The Contract Reference Number of the main syndication contract between the borrowing customer and one or more participants. | ||

| Customer (Borrower) No | The number of the borrowing customer with whom you have finalized the syndication contract. | ||

| Customer (Borrower) Name | The name of the borrowing customer with whom you have finalized the syndication contract. | ||

| Value Date | The initiation date for ad hoc fee schedule. | ||

| Amount | The amount agreed upon between the borrowing customer and the participants of the main syndication contract. |

13.18 Participant Ad-hoc Fee Report

The participants in a syndication contract share the ad hoc fee in the ratio of their participation that was agreed upon at the time of entering the tranche. You can get the details of the projected/future ad hoc fee allocation per participant in the Participant Ad hoc Fee Report.

This report describes the ad hoc details for a participant under the following search criteria:

- The name of the participant in the tranche contract to which each of the drawdown loan contract is linked.

- The list of ad hoc fee that applied over a period in time, specify the ‘From’ and ‘To’ date of the period.

- The request id number for the drawdown loan contract.

13.18.1 Contents of the Report

The contents of the adhoc fee report for a participant have been discussed below:

Body of the Report

| Borrower/Participant (Filter field) | The number allotted to each participant of the main syndication contract. | ||

|---|---|---|---|

| Participant (Filter field) | The name of the participant in the tranche contract to which each of the drawdown loan contract is linked. | ||

| Date range (Filter field) | The list of ad hoc fee that applied over a period in time, specify the ‘From’ and ‘To’ date of the period. | ||

| Draw down No (Sort field) | The request id number for the drawdown loan contract. | ||

| Tranche ref no | Under the main syndication contract, this is the Reference Number of the tranche under which the drawdown loan contracts are initiated. | ||

| Facility Ref No | The Contract Reference Number of the main syndication contract and the name of the borrowing customer with whom you have finalized the syndication contract. | ||

| Customer (Borrower) No | The number of the borrowing customer taking part in the drawdown loan contract under a tranche. | ||

| Customer (Borrower) Name | The name of the borrowing customer taking part in the drawdown loan contract under a tranche. | ||

| Value Date | The value date of the last ad hoc fee schedule. | ||

| Amount | The amount agreed upon between the borrowing customer and the participants of the main syndication contract. |

13.19 Facility Tranche Volume Detail Report

A facility is a specific service, scheme or product that you make available to customers. Also, you can disburse loans through a draw down, from any of the tranches under a syndication contract. The Facility Tranche Volume Detail Report describes the details for a Facility and a Tranche over a given period.

This report describes the activities under the following search criteria:

- The number allotted to each participant of the main syndication contract.

- The Facility Reference number for which facility details have to be obtained. If you select the ‘ALL’ option, the details for all the contracts will be included in the report.

13.19.1 Contents of the Report

The contents of the ‘Facility Tranche Volume Detail Report’ have been discussed below:

Body of the Report

| Customer (Borrower) No/Name | The number allotted to each participant of the main syndication contract. | ||

|---|---|---|---|

| Facility Ref No. | The Contract Reference Number of the main syndication contract (between the borrowing customer and one or more participants). | ||

| Facility Start Date | The date on which the main syndication contract is initiated in the system. | ||

| Facility End Date | The date on which the main syndication contract is scheduled to mature. | ||

| Facility amount | The amount agreed upon between the borrowing customer and the participants of the main syndication contract. | ||

| Facility Currency | The currency of the main syndication contract, in which the contract amount is expressed. | ||

| No. Of Tranches | The number of tranches under the facility. |

The report will also display the totals of the number of outstanding facilities and on the number of outstanding tranches.

13.20 Facility Utilization Detail Report

A facility is a specific service, scheme or product that you make available to customers. Also, you can disburse loans through a draw down, from any of the tranches under a syndication contract. The Tranche Drawdown Detail Report describes the drawdown details for a Facility and a Tranche over a given period.

This report gives the volume of the utilization of this facility by the customers.

13.20.1 Selection Options

You can configure this report to display details for facility utilization detail report from the Reports Browser.

You can invoke this screen by typing ‘LSRPFUTI’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

The report can be generated for a specific facility contract, or all facility contracts initiated at your bank as on the date of report generation.

13.20.2 Contents of the Report

The contents of the ‘Facility Utilization Detail’ Report have been discussed below:

Header of the Report

The Header carries the title of the Report, information on the branch code, the branch date, the user ID, the module name, the date and time at which the report was generated and the page number of the report.

Body of the report

The details of the borrower that would be displayed in the report are as follows:

| Facility Ref No/User Reference Number (Sort field) | By default, the Contract Reference Number generated by the system is considered to be the User Reference Number for the contract. | ||

|---|---|---|---|

| Borrower Name | The name of the borrower | ||

| Signing Date | The facility contract book date. | ||

| Maturity Date | The date on or before which the facility contract gets matured. | ||

| Domicile | The country to which the facility customer belongs. | ||

| Facility Amt. | The amount agreed upon between the borrowing customer and the participants of the main syndication contract. | ||

| Drawn Total (base) | The total amount that is drawn under the main syndication contract. | ||

| Undrawn Total (base) | The total amount that is under the main syndication contract that is not utilized. |

13.21 Syndication Volume Detail Report

The Loan Syndication module of Oracle FLEXCUBE addresses loan operations of a bank or a financial institution that enters into Loan Syndication contracts with borrowing customers (borrowers), and plays the role of a lead agent in the contract. This report details the total volume of loan operations undertaken by the bank.

This report describes the activities under the following search criteria:

- The unique ID assigned to the name the administrator.

- The loans disbursed over a specific period i.e. the ‘From’ and ‘To’ dates.

13.21.1 Contents of the Report

The contents of the ‘Syndication Volume Detail Report’ have been discussed below:

Body of the Report

| From and To Date (Filter) | The loans disbursed in a period of time - ‘From’ and ‘To’ date of the period. | ||

|---|---|---|---|

| Administrator (Filter) | The unique ID assigned to the name the administrator. | ||

| Number Of facilities (initial) | The number of facilities active as of the start date given in the report date range. | ||

| New Facilities | The number of new facilities input each day. | ||

| Close outs (matured Facilities) | The number of facilities maturing each day. | ||

| Current Facilities (No as of month end) | The number of active facilities at the end of each month. | ||

| Billings Re Principal/Interest | The number of billing notices sent to the borrower for re principal or interest. | ||

| Drawdowns (New Requests for cash) | The number of new drawdown schedules booked for the contract each day. | ||

| Rollovers (Extension of Above) | The number of contract rollovers occurred for the day. | ||

| Repayments (To Include Pre-Payments/ Partial Payments) | The number of payments made for each Drawdown for the day. | ||

| Rate Fixings (count 1 per loan) | The number of exchange rate fixing applied for the loan. | ||

| Participant Amendments/Transfers | The number of participant amendments everyday. | ||

| No. of Participants | The number of newly added participants during participant amendment every day. |

13.22 Participant Transfer Detail Report

The user can amend participants of a tranche or a drawdown. After capturing the transfer details, the system will amend the corresponding facility/tranche and drawdown contract and apply the transfer ratios to the relevant participants. This report displays all such transfer details.

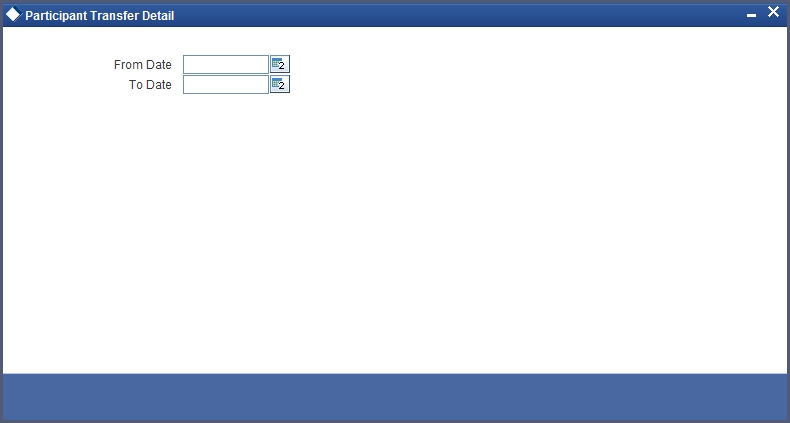

13.22.1 Selection Options

You can configure this report to display details for participant transfer detail report from the Reports Browser.

You can invoke this screen by typing ‘LSRPPRAM’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can choose to generate the report to list the details of the transfer under a tranche and a facility as of a specific date or over a specified period in time (by indicating the ‘From’ and ‘To’ date of the period).

13.22.2 Contents of the Report

The contents of the ‘Participant Transfer Detail Report’ have been discussed below:

Header of the Report

The Header carries the title of the Report, information on the branch code, the branch date, the user ID, the module name, the date and time at which the report was generated and the page number of the report.

Body of the Report

The following details of the participants will be displayed in this report:

| Facility Ref No | The Contract Reference Number of the main syndication contract between the borrowing customer and one or more participants. | ||

|---|---|---|---|

| Facility Name | The name of the main syndication contract between the borrowing customer and one or more participants. | ||

| User Ref No | The User Reference Number. | ||

| Drawdown Ref No | This is the contract reference number of the drawdown that is defined under a tranche of the main syndication contract. | ||

| Tranche Ref No | Under the main syndication contract, this is the Reference Number of the tranche under which the drawdown loan contracts are initiated. | ||

| Date of Transfer | Date on which the transfer was initiated. | ||

| Transfer Amount | The amount that is transferred under each draw down loan linked to the tranche. | ||

| Currency | The currency in which the draw down loan amount is expressed. | ||

| Maker | The Login ID of the user who has performed the activity or event on the bill. | ||

| Checker | The Login ID of the user who has authorized the activity or event on the bill. | ||

| Drawdown Number | This is the schedule number of the drawdown defined under a tranche of the main syndication contract. | ||

| Old Participant customer no, Name and Contact name | The name of the previous participant customer in the drawdown loan contract under a tranche and the name of the contact person for that participant. | ||

| New Participant customer no, Name and Contact name | The name of the new participant customer taking part in the drawdown loan contract under a tranche and the name of the contact person for each participant in the drawdown. |

13.23 Fiscal Diary Report

A diary event signifies occurrences (other than accounting entries being passed) in the life cycle of a contract, at which appropriate messages would need to be generated. This report displays the details of the fiscal diary events associated with each of the Loan Syndication modules.

This reports describes the activities under the following search criteria:

- The type of the customer for the facility i.e. borrower or participant.

- The Contract Reference number for which fiscal diary details have to be obtained. If you select the ‘ALL’ option, the fiscal details for all the contracts will be included in the report.

- The fiscal diary details over a specific period i.e. the ‘From’ and ‘To’ dates.

13.23.1 Contents of the Report

The contents of the fiscal diary report are discussed under the following heads:

Header of the Report

The following fields will be displayed in the header of the report:

| Facility Ref No | The Contract Reference Number of the borrower facility contract (main syndication contract) finalized between the borrowing customer and one or more participants. | ||

|---|---|---|---|

| Diary Report From Date/To date | The fiscal diary details over a specific period i.e. the ‘From’ and ‘To’ dates. |

Body of the Report

The content of the ‘Fiscal Diary Report’ has been discussed below:

| Event date (Sort Field) | The system date on which the diary event is defined. | ||

|---|---|---|---|

| Loan Administrator | The unique ID assigned to the name the administrator. | ||

| Facility ref no | The Contract Reference Number of the main syndication contract (between the borrowing customer and one or more participants). | ||

| Customer name of default borrower | The Contract Reference Number of the main syndication contract and the name of the borrowing customer with whom you have finalized the syndication contract. | ||

| Tranche ref no | Under the main syndication contract, this is the Reference Number of the tranche under which drawdown loan contracts are initiated. | ||

| Draw Down ref. No. | This is the contract reference number of the drawdown that is defined under a tranche of the main syndication contract. | ||

| Event Seq. No. | The sequence number of the drawdown loan under a tranche. | ||

| Event Description | The description of the draw down loan under a tranche. | ||

| Diary Details | The diary event that is allowed for the facilities. |

13.24 Fiscal Documentation Diary Detail Report

All the details for the fiscal diary detail will be recorded in the user-defined fields for the diary events. You can generate the documentation details report to view the documentation diary details applicable for facilities.

You can get the Fiscal Documentation Diary Detail Report based on the following criteria:

- The customer for the contract whether the customer is a borrower or a participant.

- The product type of the loan. Select the type – facility, tranche or Drawdown.

- The document received over a specific period i.e. the ‘From’ and ‘To’ dates.

13.24.1 Contents of the Report

The contents of the fiscal documentation diary detail report are discussed under the following heads:

Header of the Report

The following fields will be displayed in the header of the report:

| Status: Actioned/ Unactioned/ Both | The status of the facility contract whether it is active, matured or both. | ||

|---|---|---|---|

| Facility Ref No | The reference number of the contract for which you are generating the report. | ||

| Diary Report From Date/ To date | The diary report generated over a specific period i.e. the ‘From’ and ‘To’ dates. |

Body of the Report

The contents of the ‘Fiscal Documentation Diary Detail Report’ have been discussed below:

| Action date (Event date) | For a payment type of product, you should define the action to be taken when an instruction is not executed because of lack of funds. The date specified for this instruction is shown here. | ||

|---|---|---|---|

| Loan Administrator | The unique ID assigned to the name the administrator. | ||

| Facility Ref No | The Contract Reference Number of the main syndication contract (between the borrowing customer and one or more participants). | ||

| Tranche Ref No | Under the main syndication contract, this is the Reference Number of the tranche under which the drawdown loan contracts are initiated. | ||

| Start date | The date on which the main syndication contract is initiated in the system. | ||

| Follow Up | This is the reason for which the notice was sent. It can be acknowledgment, confirmation or outstanding charges. | ||

| Date Received | Indicates the date on which the documents were received. | ||

| Date Sent | Indicates the date on which the documents were sent to the customer. | ||

| Event Seq. No. | This is the sequence number of the event used to uniquely identify the diary event. | ||

| Event Description | The description of the event you specified in the earlier field is displayed here. | ||

| Diary Details-Tags and values | The diary event that is allowed for the facilities. |

13.25 New Base Records Report

This report displays all the new customer records opened on the current business date. It is printed everyday during the batch process.

You can generate the report based on the following criteria:

- The Branch for which the report is printed. Select a branch from the option list provided.

- The Date for which you wish to generate the report. Enter the date.

13.25.1 Contents of the Report

The contents of the ‘New Base Records Report’ are discussed below:

| Branch Code | This is the local branch where the Customer Record has been opened. | ||

|---|---|---|---|

| Customer Number | This is the customer number of the Customer Record. | ||

| Customer Name | This is the customer name as per the customer record. | ||

| Domicile | This is the domicile as recorded in the customer record. |

13.26 FX Unconfirmed Analysis –1 Day Report

This report displays a listing of all customers against whom FX contracts were booked on the current business date. It also displays the number of deals booked against these customers, the number of unconfirmed deals and the percentage of unconfirmed deals. This report is printed everyday during the batch process.

You can configure this report to display details of FX Unconfirmed Analysis- 1 Day Report. You can generate the report based on the following criteria:

- The Branch for which the report is printed. Select a branch from the option list provided.

- The Date for which the report is printed. Enter a date.

13.26.1 Contents of the Report

The contents of the ‘FX Unconfirmed Analysis –1 day Report’ are discussed below:

| Counterparty | This is the counterparty of the Contract Record. | ||

|---|---|---|---|

| Counterparty Name | This is the name of the Customer Record for the Contract Record’s Counterparty | ||

| Contracts booked today | This is the number of contracts booked for the counterparty for the date for which the report is being generated. | ||

| Contracts unconfirmed | This is the number of unconfirmed contracts booked for the counterparty on the report date. | ||

| Percentage unconfirmed | This is the percentage of unconfirmed contracts booked for the counterparty on the report date. |

13.27 Outstanding FX Contracts Report

This report displays a listing of all FX contracts that are not yet liquidated and are grouped by counterparty. It is printed every month during the batch process.

13.27.1 Selected Options

You can configure this report to display details of Outstanding FX Contracts Report. You can generate the report based on the following criteria:

- The Branch for which the report is printed. Select a branch from the option list provided.

- The Date for which the report is printed. Enter a date.

13.27.2 Contents of the Report

The contents of the ‘Outstanding FX Contracts Report’ are discussed below:

| Counterparty | This is the counterparty of the Contract Record. | ||

|---|---|---|---|

| Counterparty Name | This is the Customer Record name for the Contract Record’s Counterparty. | ||

| Contract Reference Number | This is the Contract Record’s Reference Number. | ||

| Custom Reference Number | This is the Contract Record’s Custom Reference Number. | ||

| Trade Date | This is the FX Contract Record’s Trade Date | ||

| Value Date | This is either the Contract Record’s Bought Value Date or Sold Value Date, which ever is later. | ||

| Buy Currency | This is the FX Contract Record’s Bought Currency | ||

| Buy Amount | This is the FX Contract Record’s Bought Amount | ||

| Sold Currency | This is the FX Contract Record’s Sold Currency | ||

| Buy Amount | This is the FX Contract Record’s Bought Amount | ||

| Deal Rate | This is the FX Contract Record’s Exchange Rate |

13.28 Outstanding FX Contracts with NPV Profit/Loss Report

This report displays a listing of all FX contracts that are not yet matured, grouped by counterparty. It also displays additional details such as value date, forward rate and net NPV (profit or loss). This report is printed once a month as part of the batch process.

13.28.1 Selected Options

You can configure this report to display details of FX Contract with NPV Profit/ Loss Report. You can generate the report based on the following criteria:

- The Branch for which the report is printed. Select a branch from the option list provided.

- The Date for which the report is printed. Enter a date.

13.28.2 Contents of the Report

The contents of the ‘FX Contracts with NPV Profit/Loss Report’ are discussed below:

| Counterparty | This is the Contract Record’s Counterparty. | ||

|---|---|---|---|

| Counterparty Name | This is the Customer Record name for the Contract Record’s Counterparty. | ||

| Contract Reference Number | This is the Contract Record’s Reference Number. | ||

| Custom Reference Number | This is the Contract Record’s Custom Reference Number. | ||

| Trade Date | This is the Trade date of the FX Contract Record | ||

| Value Date | This is either the FX Contract Record’s Bought Value Date or Sold Value Date, whichever is later. | ||

| Buy Currency | This is the FX Contract Record’s Bought Currency | ||

| Buy Amount | This is the FX Contract Record’s Bought Amount | ||

| Sold Currency | This is the FX Contract Record’s Sold Currency | ||

| Buy Amount | This is the FX Contract Record’s Bought Amount | ||

| Deal Rate | This is the FX Contract Record’s Exchange Rate | ||

| NPV profit/loss in LCY | This is the FX Contract Revaluation Record’s Net Present Value in Local currency. | ||

| NPV profit/loss in USD | This is the FX Contract Revaluation Record’s NPV in USD. |

13.29 MM Unconfirmed Contracts Report

This report gives details of all unconfirmed MM contracts. It is printed daily as part of the batch process.

13.29.1 Selected Options

You can configure this report to display details of MM Unconfirmed Contracts Report. You can generate the report based on the following criteria:

- The Branch for which the report is printed. Select a branch from the option list provided.

- The message group. Select from the option list provided.

- The Counterparty Type, either Bank Transfer or Customer Transfer.

- The Unconfirmed Days, which is the number of days up to which the contracts are not confirmed. Enter a value

- The date for which the report is printed. Enter a date.

13.29.2 Contents of the Report

The contents of the ‘MM Unconfirmed Contracts Report’ are discussed below:

| Message Group | This is the Message Group for the Contract Record’s Counterparty. | ||

|---|---|---|---|

| Counterparty | This is the Contract Record’s Counterparty. | ||

| Counterparty Name | This is the Customer Record name for the Contract Record’s Counterparty. | ||

| Oracle FLEXCUBE Reference Number | This is the Contract Record’s Reference Number. | ||

| Custom Reference Number | This is the Contract Record’s Custom Reference Number. | ||

| Contract Type | This is the MM Contract Record’s Product Type. | ||

| Trade Date | This is the MM Contract Record’s Trade Date. | ||

| Value Date | This is the MM Contract Record’s Value Date. | ||

| Maturity Date | This is the MM Contract Record’s Maturity Date. | ||

| Amount | This is the MM Contract Record’s Amount. | ||

| Deal Currency | This is the MM Contract Record’s Deal Currency. | ||

| Interest Rate | This is the MM Contract Interest Record’s Interest Rate | ||

| Our Receive | This is the Contract Settlement Record’s Our Receive account | ||

| Their Receive | This is the Contract Settlement Record’s Their Receive account. |

Apart from this, the report contains summary information specifying the number of unconfirmed transactions for the following buckets:

- Less than or equal to 7 days

- Greater than 7 days and less than or equal to 14 days

- Greater than 14 days and less than or equal to 28 days

- Greater than 28 days and less than or equal to 42 days

- Greater than 42 days and less than or equal to 91 days

- Greater than 91 days and less than or equal to 180 days

- Greater than 180 days

13.30 FX Unconfirmed Contracts Report

This report gives details of all unconfirmed FX contracts. It is printed daily as part of the batch process.

13.30.1 Selected Options

You can configure this report to display details of FX Unconfirmed Contracts Report. You can generate the report based on the following criteria:

- The Branch for which the report is printed. Select a branch from the option list provided.

- The Message Group. Select a group from the option list provided.

- The Counterparty Type, either Bank Transfer or Customer Transfer.

- The Unconfirmed Days that is, the number of days up to which the contracts are not confirmed. Enter a value

- The Date for which the report is printed. Enter a date

13.30.2 Contents of the Report

The contents of the ‘FX Unconfirmed Contracts Report’ are discussed below:

| Message Group | This is the Message Group for the Contract Record’s Counterparty. | ||

|---|---|---|---|

| Counterparty | This is the Contract Record’s Counterparty. | ||

| Counterparty Name | This is the Customer Record’s name for the Contract Record’s Counterparty. | ||

| Oracle FLEXCUBE Reference Number | This is the Contract Record’s Reference Number. | ||

| Custom Reference Number | This is the Contract Record’s Custom Reference Number. | ||

| Trade Date | This is the FX Contract Record’s Trade Date | ||

| Value Date | This is the FX Contract Record’s Bought Value Date or Sold Value Date, whichever is later. | ||

| Buy Currency | This is the FX Contract Record’s Bought Currency. | ||

| Buy Amount | This is the FX Contract Record’s Bought Amount. | ||

| Sold Currency | This is the FX Contract Record’s Sold Currency. | ||

| Buy Amount | This is the FX Contract Record’s Bought Amount. | ||

| Deal Rate | This is the FX Contract Record’s Exchange Rate. | ||

| Our Receive account | This is the Contract Settlement Record’s Our Receive Account. | ||

| Their Receive | This is the Contract Settlement Record’s Their Receive Account. |

Apart from this, there will be summary information specifying the number of unconfirmed transactions for the following buckets:

- Less than or equal to 7 days

- Greater than 7 days and less than or equal to 14 days

- Greater than 14 days and less than or equal to 28 days

- Greater than 28 days and less than or equal to 42 days

- Greater than 42 days and less than or equal to 91 days

- Greater than 91 days and less than or equal to 180 days

- Greater than 180 days

13.31 Comfort – Potential Errors Report

This report gives listing of all the FX contracts, grouped by Broker, that are not yet confirmed. It is printed daily as part of the batch process.

You can configure this report to display details of Comfort – Potential Errors Report. You can generate the report based on the following criteria:

- This is the Branch for which the report is printed. Select a branch from the option list provided

- This is the Date for which the report is printed. Enter a date.

13.31.1 Contents of the Report

The contents of the ‘Comfort – Potential Errors Report’ are discussed below:

| Broker Code | This is the FX Contract Record’s External Broker Code. | ||

|---|---|---|---|

| Broker Name | This is the External Broker Record Name for the Contract Record’s External Broker Code. | ||

| Counterparty | This is the Contract Record’s Counterparty. | ||

| Counterparty Name | This is the Customer Record name for the Contract Record’s Counterparty. | ||

| Oracle FLEXCUBE Reference Number | This is the Contract Record’s Reference Number. | ||

| Custom Reference Number | This is the Contract Record’s Custom Reference Number. | ||

| Trade Date | This is the FX Contract Record’s Trade Date | ||

| Value Date | This is either the FX Contract Record’s Bought Value Date or Sold Value Date whichever is later. | ||

| Buy Currency | This is the FX Contract Record’s Bought Currency | ||

| Buy Amount | This is the FX Contract Record’s Bought Amount | ||

| Sold Currency | This is the FX Contract Record’s Sold Currency | ||

| Buy Amount | This is the FX Contract Record’s Bought Amount | ||

| Deal Rate | This is the FX Contract Record’s Exchange Rate |

13.32 FX Summary Report

This report gives a listing of the summary of all FX contracts booked on the current business day, grouped by Counterparty. This report is printed daily as part of the batch process.

You can configure this report to display details of FX Summary Report. You can generate this report based on the following criteria: