8. Annexure B – Examples of Processing Interest Rate and Currency Options in Oracle FLEXCUBE

The examples given in this annexure explain the life-cycle processing for Interest Rate and Currency options.

Local currency entries have not been shown and will be passed according to the local currency of the branch and the exchange rate between the settlement currency and the local currency.

This chapter contains the following sections:

- Section 8.1, "Examples"

- Section 8.2, "Explanation of Terms Associated with IRO Markets / Transactions"

8.1 Examples

This section contains the following topics:

- Section 8.1.1, "Example I - Interest Rate Options"

- Section 8.1.2, "Example II - Currency Options"

- Section 8.1.3, "Example III – Contingent Entries and Delta Accounting"

- Section 8.1.4, "Example IV – Swaption with European Expiration"

- Section 8.1.5, "Examples of Different Types of Exotic Currency Options"

8.1.1 Example I - Interest Rate Options

To protect your bank from an increase in interest rates, you have decided to buy an interest rate cap with the following terms on a trade deal:

| Example I | |||

|---|---|---|---|

| Booking Date | 1-Feb-2000 | ||

| Value Date | 31-Mar-2000 | ||

| Maturity Date | 31-Mar-2003 | ||

| Interest Payment (Arrears) Dates | Sept 30 & Mar 31 | ||

| Reference Interest rate | 6-Month LIBOR | ||

| Rate Fixing Lag | 5 Days | ||

| Reset Basis | Period end Date | ||

| Reset Date Movement | Backward | ||

| Strike Rate | 9% | ||

| Contract Amount | USD 50000 | ||

| Contract Currency | USD | ||

| Option Premium | 2% of Principal | ||

| Premium Currency | USD | ||

| Premium Pay Date | 15-FEB-2000 | ||

| Fair Value at Inception | 1200 USD | ||

| Numerator Method | 30-EURO | ||

| Denominator method | 360 | ||

| Denominator basis | Per Annum | ||

| Amortization Frequency | Quarterly | ||

| Amortization Month | May | ||

| Amortization Day | 31 | ||

| Revaluation Frequency | Quarterly | ||

| Revaluation Month | May | ||

| Revaluation Day | 31 | ||

The accounting entries that will be passed in the system are as follows:

Contract Booking (BOOK)

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | MKT_VAL_PUR_OPT | PUR_OPTION_PREM | .02*50000 =1000 | USD | 01-Feb-00 | ||||||

| Cr | OPT_PREM_PAY | PUR_OPTION_PREM | 1000 | USD | 01-Feb-00 | ||||||

| Dr | MKT_VAL_PUR_OPT | PUR_INCEP_GAIN | 1200-1000 = 200 | USD | 01-Feb-00 | ||||||

| Cr | PUR_IN_GAIN_DEF | PUR_INCEP_GAIN | 200 | USD | 01-Feb-00 |

Premium Payment (PRPT)

Actual premium payment happens on 15-Feb-2000

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | OPT_PREM_PAY | PUR_OPTION_PREM | 1000 | USD | 15-Feb-00 | ||||||

| Cr | CUSTOMER | PUR_OPTION_PREM | 1000 | USD | 15-Feb-00 |

Amortization of inception Gain/Loss (AMRT)

First Amortization and revaluation will be performed on 31-May-2000

| Inception Gain | = | 1200 – 1000 (Contract FV – Option Premium) = 200 USD | |||

This amount is to be amortized from 31-Mar-2000 to 31-Mar-2003 (36 Months * 30) days.

Amortization is performed based on the actual number of days in a year. However, for this example we will assume 360 days in a year and 30 days in a month.

Amortized inception gain till 31-May-2000 = 200 * (2*30) / (36*30) = 11.11 USD

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | PUR_IN_GAIN_DEF | PUR_NET_INCEP_GAIN | 11.11 | USD | 31-May-00 | ||||||

| Cr | PUR_IN_GAIN_OPT | PUR_NET_INCEP_GAIN | 11.11 | USD | 31-May-00 |

Next Amortization will be on 31-Aug-2000

Amt to Amortize till date =200 * (5*30) / (36*30) =27.78 USD

Amt already Amortized = 11.11 USD

Current Amt to Amortize = 27.78 – 11.11 =16.77 USD

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | PUR_IN_GAIN_DEF | PUR_NET_INCEP_GAIN | 16.77 | USD | 31-Aug-00 | ||||||

| Cr | PUR_IN_GAIN_OPT | PUR_NET_INCEP_GAIN | 16.77 | USD | 31-Aug-00 |

Revaluation of Option (REVL)

Assume that the Contract Fair Value as on 31-MAY-20000 is 1100 USD.

Revaluation Gain on Inception was 1200 (Contract FV on Inception) – 1000 (Option premium) = 200 USD.

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | RV_GAIN_PUR_OPT | PUR_LAST_REVL_GAIN | 200 | USD | 31-May-00 | ||||||

| Cr | MKT_VAL_PUR_OPT | PUR_LAST_REVL_GAIN | 200 | USD | 31-May-00 | ||||||

| Dr | MKT_VAL_PUR_OPT | PUR_ REVL_GAIN | 1100 – 1000 = 100 | USD | 31-May-00 | ||||||

| Cr | RV_GAIN_PUR_OPT | PUR_REVL_GAIN | 100 | USD | 31-May-00 |

Next Revaluation will happen on 31-Aug-2000. Suppose the Fair Value of the contract on 31-Aug-2000 is 700 USD.

Last Revaluation Gain = 100 USD

Current Revaluation Loss = 1000 (Option Premium) – 700 (FV on 31-Aug-2000) = 300 USD

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | RV_GAIN_PUR_OPT | PUR_LAST_REVL_GAIN | 100 | USD | 31-Aug-00 | ||||||

| Cr | MKT_VAL_PUR_OPT | PUR_LAST_REVL_GAIN | 100 | USD | 31-Aug-00 | ||||||

| Dr | RV_LOSS_PUR_OPT | PUR_REVL_LOSS | 300 | USD | 31-Aug-00 | ||||||

| Cr | MKT_VAL_PUR_OPT | PUR_REVL_LOSS | 300 | USD | 31-Aug-00 |

Rate Fixing (RTFX) and Exercise of Option (EXER)

According to the Rate fixing Lag, Reset Basis and Reset Date Movement, Rate fixing event (RTFX) will take place on 25-Sep-2000 and settlement amount will be determined.

If 6M LIBOR is 11% on 25-Sep-2000 then

Settlement amount = 50000 * (11-9)% * 180 / (360*100) = 500 USD

Actual settlement for this amount will be happen on 30-Sep-2000.

Accounting entries passed on event EXER

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | PUR_OPT_SET_REC | PUR_INTR_SETL_AMT | 500 | USD | 25-Sep-00 | ||||||

| Cr | PUR_OPT_INCOME | PUR_INTR_SETL_AMT | 500 | USD | 25-Sep-00 |

Exercise Settlement (EXST)

Exercise settlement will happen on the 30-Sep-2000 for the above exercise:

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | CUSTOMER | PUR_SETL_AMT | 500 | USD | 30-Sep-00 | ||||||

| Cr | PUR_OPT_SET_REC | PUR_SETL_AMT | 500 | USD | 30-Sep-00 |

The event RTFX will be triggered on every rate fixing date. Event EXER and EXST will be triggered depending on whether the option is in the money or not on the rate fixing date.

Final Settlement

Now suppose the option is in-the money on the last rate fixing date (Final settlement). The following events and accounting entries will be processed.

Rate Fixing event (RTFX) will be on 26-Mar-2003.

If 6M LIBOR is 12% on 26-Mar-2000 then

Settlement amount = 50000* (12-9)% * 180 / (360*100) = 750 USD

Revaluation on final Settlement will be triggered @ Current FV (Settlement amount).

Last Revaluation Gain = 50 USD (Assumed)

Current Revaluation Loss = 1000 (Option premium) – 750 (Settlement amount) = 250 USD

Revaluation of Option (REVL) - Final Settlement

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | RV_GAIN_PUR_OPT | PUR_LAST_REVL_GAIN | 50 | USD | 26-Mar-03 | ||||||

| Cr | MKT_VAL_PUR_OPT | PUR_LAST_REVL_GAIN | 50 | USD | 26-Mar-03 | ||||||

| Dr | RV_LOSS_PUR_OPT | PUR_REVL_LOSS | 250 | USD | 26-Mar-03 | ||||||

| Cr | MKT_VAL_PUR_OPT | PUR_REVL_LOSS | 250 | USD | 26-Mar-03 |

Amortization of inception Gain/Loss (AMRT) - Final Settlement

Residual amortization of Inception Gain will be done on final settlement

Total Amt to Amort = 200 USD

Amt already Amortized = 175 USD (Assumed)

Current Amt to Amort = 200 – 175 = 25 USD

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | PUR_IN_GAIN_DEF | PUR_NET_INCEP_GAIN | 25 | USD | 26-Mar-03 | ||||||

| Cr | PUR_IN_GAIN_OPT | PUR_NET_INCEP_GAIN | 25 | USD | 26-Mar-03 |

Exercise of Option (EXER) - Final settlement

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | PUR_OPT_SET_REC | PUR_SETL_AMT | 750 | USD | 26-Mar-03 | ||||||

| Cr | MKT_VAL_PUR_OPT | PUR_SETL_AMT | 750 | USD | 26-Mar-03 |

Moving Revaluation Gain/Loss to Income/Expense on Final Settlement

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | PUR_OPT_EXPENSE | PUR_REVL_LOSS | 250 | USD | 26-Mar-03 | ||||||

| Cr | RV_LOSS_PUR_OPT | PUR_REVL_LOSS | 250 | USD | 26-Mar-03 |

Moving Inception Gain to Income on Final Settlement

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | PUR_IN_GAIN_OPT | PUR_INCEP_GAIN | 200 | USD | 26-Mar-03 | ||||||

| Cr | PUR_OPT_INCOME | PUR_INCEP_GAIN | 200 | USD | 26-Mar-03 |

Exercise Settlement (EXST) - Final settlement

Exercise settlement will happen on the 31-Mar-2003 for the above exercise:

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | CUSTOMER | PUR_SETL_AMT | 750 | USD | 31-Mar-03 | ||||||

| Cr | PUR_OPT_SET_REC | PUR_SETL_AMT | 750 | USD | 31-Mar-03 |

Termination (TERM)

Now suppose the above contract is terminated on 10-Oct-2000 after the first exercise.

Suppose the contract is sold back to the writer of the option for 800 USD whereas the Contract Fair Value on 10-Oct-2000 was 1100 USD

Contract FV on termination = 1100 USD

Termination Loss = 1100 – 800 = 300 USD

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | CUSTOMER | PUR_TERM_FV | 1100 | USD | 10-Oct-00 | ||||||

| Cr | MKT_VAL_PUR_OPT | PUR_TERM_FV | 1100 | USD | 10-Oct-00 | ||||||

| Dr | PUR_OPT_EXPENSE | PUR_TERM_LOSS | 300 | USD | 10-Oct-00 | ||||||

| Cr | CUSTOMER | PUR_TERM_LOSS | 300 | USD | 10-Oct-00 |

REVL at termination

Revaluation will be triggered @ Contract Fair Value at termination

Last Revaluation Loss = 300 USD (As on 31-Aug-2000)

Current Revaluation Gain =1100 (FV at termination) – 1000 (Option premium) =100 USD

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | MKT_VAL_PUR_OPT | PUR_LAST_REVL_LOSS | 300 | USD | 10-Oct-00 | ||||||

| Cr | RV_LOSS_PUR_OPT | PUR_LAST_REVL_LOSS | 300 | USD | 10-Oct-00 | ||||||

| Dr | MKT_VAL_PUR_OPT | PUR_REVL_GAIN | 100 | USD | 10-Oct-00 | ||||||

| Cr | RV_GAIN_PUR_OPT | PUR_REVL_GAIN | 100 | USD | 10-Oct-00 |

AMRT at termination

Inception gain to Amortize = 200 USD

Amt amortized till date = 27.78 USD (As on 31-Aug-2000)

Amt to amortize on termination = 200 – 27.78 =172.22 USD

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | PUR_IN_GAIN_DEF | PUR_NET_INCEP_GAIN | 172.22 | USD | 10-Oct-00 | ||||||

| Cr | PUR_IN_GAIN_OPT | PUR_NET_INCEP_GAIN | 172.22 | USD | 10-Oct-00 |

Moving Revaluation Gain/Loss to Income/Expense on Final Settlement

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | RV_GAIN_PUR_OPT | PUR_REVL_GAIN | 100 | USD | 10-Oct-00 | ||||||

| Cr | PUR_OPT_INCOME | PUR_REVL_GAIN | 100 | USD | 10-Oct-00 |

Moving Inception Gain to Income on Final Settlement

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | PUR_IN_GAIN_OPT | PUR_INCEP_GAIN | 200 | USD | 10-Oct-00 | ||||||

| Cr | PUR_OPT_INCOME | PUR_INCEP_GAIN | 200 | USD | 10-Oct-00 |

Expiry (EXPR)

Now suppose the option is out-of-the-money on the last rate fixing date (Final settlement). The following events and accounting entries will be processed.

Rate Fixing event (RTFX) will happen on 26-Mar-2003

Expiry (EXPR) event will be triggered on 31-Mar-2003

Event REVL (On Expiry)

Revaluation on Expiry will be triggered @ 0

Last Revaluation Gain = 50 USD (Assumed)

Current Revaluation Loss = 1000 (Option premium) – 0 = 1000 USD

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | RV_GAIN_PUR_OPT | PUR_LAST_REVL_GAIN | 50 | USD | 26-Mar-03 | ||||||

| Cr | MKT_VAL_PUR_OPT | PUR_LAST_REVL_GAIN | 50 | USD | 26-Mar-03 | ||||||

| Dr | RV_LOSS_PUR_OPT | PUR_REVL_LOSS | 1000 | USD | 26-Mar-03 | ||||||

| Cr | MKT_VAL_PUR_OPT | PUR_REVL_LOSS | 1000 | USD | 26-Mar-03 |

Event AMRT (On Expiry)

Residual amortization of Inception Gain will be done Expiry

Total Amt to Amort = 200 USD

Amt already Amortized = 175 USD (Assumed)

Current Amt to Amort = 200 – 175 = 25 USD

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | PUR_IN_GAIN_DEF | PUR_NET_INCEP_GAIN | 25 | USD | 26-Mar-03 | ||||||

| Cr | PUR_IN_GAIN_OPT | PUR_NET_INCEP_GAIN | 25 | USD | 26-Mar-03 |

Moving Revaluation Gain/Loss to Income/Expense on Final Settlement.

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | PUR_OPT_EXPENSE | PUR_REVL_LOSS | 1000 | USD | 26-Mar-03 | ||||||

| Cr | RV_LOSS_PUR_OPT | PUR_REVL_LOSS | 1000 | USD | 26-Mar-03 |

Moving Inception Gain to Income on Final Settlement

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | PUR_IN_GAIN_OPT | PUR_INCEP_GAIN | 200 | USD | 26-Mar-03 | ||||||

| Cr | PUR_OPT_INCOME | PUR_INCEP_GAIN | 200 | USD | 26-Mar-03 |

8.1.2 Example II - Currency Options

On 1st June 2002, your bank buys a call option on 1000USD (in terms of INR) with a strike price of INR 50, and December 31st 2002 as the maturity date. The parameters of the deal are as follows:

| Contract Type | Hedge | ||

|---|---|---|---|

| Contract Amount | 1000 | ||

| Contract Currency | USD | ||

| Counter Currency | INR | ||

| Option premium | 2500 INR | ||

| Booking Date | 01 | ||

| Jun | 2002 | ||

| Value Date | 01 | ||

| Jun | 2002 | ||

| Premium Pay Date | 01 | ||

| Jun | 2002 | ||

| Strike price | 50 INR/USD | ||

| Current Spot Rate | 52 INR/USD | ||

| Option Style | Plain Vanilla | ||

| Expiration Style | American | ||

| Earliest Exercise Date | 15 | ||

| Oct | 2002 | ||

| Barrier Type | Double Knock Out | ||

| Barrier | 53 INR/USD | ||

| Lower Barrier | 48 INR/USD | ||

| Rebate | 100 AUD | ||

| Payment At | Maturity | ||

| Barrier Window Start Date | 01 | ||

| Sep | 2002 | ||

| Barrier Window End Date | 01 | ||

| Nov | 2002 | ||

| Revaluation Frequency | Half Yearly | ||

| Revaluation Start Month | August | ||

| Revaluation Start Day | 1 |

It is assumed the local currency in this case is neither USD nor INR or AUD

Intrinsic Value at Inception – Intrinsic value at inception is the pay off that would occur to the buyer if he were to exercise the option today.

Intrinsic Value = Contract Amount * (Spot rate – Strike Rate) in Counter CCY

In this case the payoff will be = 1000 * (52 –50) = 2000 INR

Time Value of the deal = Option premium paid – Intrinsic Value

= 2500 – 2000 = 500 INR

If the spot rate on the booking day was say 49 INR/USD (Lower than the strike rate), then the intrinsic value of the deal will be 0 and the time value will be the option premium paid.

BOOK

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | PUR_IV_DEF | PUR_INCEP_IV | 2000 | INR | 01-Jun-02 | ||||||

| Cr | OPT_PREM_PAY | PUR_INCEP_IV | 2000 | INR | 01-Jun-02 | ||||||

| Dr | PUR_TV_DEF | PUR_INCEP_TV | 500 | INR | 01-Jun-02 | ||||||

| Cr | OPT_PREM_PAY | PUR_INCEP_TV | 500 | INR | 01-Jun-02 |

PRPT

Since option premium is paid on the booking date itself, this event will trigger along with the BOOK event.

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | OPT_PREM_PAY | PUR_OPTION_PREM | 2500 | INR | 01-Jun-02 | ||||||

| Cr | CUSTOMER | PUR_OPTION_PREM | 1000 | INR | 01-Jun-02 |

REVL

Amortization of Time Value will occur on 01-Aug-2002 as per the revaluation frequency.

Amt to Amort Till date = 500 * 60 / (7 * 30) = 142.86 INR

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | EXP_ON_HEDGE | NET_AMORT_TV | 142.86 | INR | 01-Jun-02 | ||||||

| Cr | PUR_TV_DEF | NET_AMORT_TV | 142.86 | INR | 01-Jun-02 |

Option Getting Knocked Out

An option may get knocked out if the spot rate touches or crosses a predefined barrier between the barrier window start date and end date.

Event KNOT (Knock Out)

Now suppose, on 10-Sep-2002, the spot rate touches or crosses 53 INR/USD. The option will be Knocked Out and a pre specified rebate of 100 AUD will be paid at maturity. On Knock Out deferred intrinsic value and the remaining time value is recognized as Expense.

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | PUR_REBATE_REC | PUR_REBATE_AMT | 300 | AUD | 10-Sep-02 | ||||||

| Cr | PUR_OPT_INCOME | PUR_REBATE_AMT | 300 | AUD | 10-Sep-02 | ||||||

| Dr | PUR_HED_EXPENSE | PUR_INCEP_IV | 2000 | INR | 10-Sep-02 | ||||||

| Cr | PUR_IV_DEF | PUR_INCEP_IV | 2000 | INR | 10-Sep-02 |

Remaining amortization of time value is done at the time of the option getting knocked out and the total expense is moved to the main option expense GL.

REVL on Knock Out

TV amortized Till date = 142.86 INR

Total TV to be amortized = 500 INR

Current TV to be amortized = 500 – 142.86 = 357.14 INR

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | EXP_ON_HEDGE | NET_AMORT_TV | 357.14 | INR | 10-Sep-02 | ||||||

| Cr | PUR_TV_DEF | NET_AMORT_TV | 357.14 | INR | 10-Sep-02 |

Moving Inception TV to final Expense GL from Revaluation Expense GL

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | PUR_HED_EXPENSE | PUR_INCEP_TV | 500 | INR | 10-Sep-02 | ||||||

| Cr | EXP_ON_HEDGE | PUR_INCEP_TV | 500 | INR | 10-Sep-02 |

Event KNST (Knock Out Settlement)

In the above case the rebate is actually received on the maturity date of the contract. Accounting entries posted on the maturity i.e. 31-Dec-2002 are –

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | CUSTOMER | PUR_REBATE_AMT | 300 | AUD | 31-Dec-02 | ||||||

| Cr | PUR_REBATE_REC | PUR_REBATE_AMT | 300 | AUD | 31-Dec-02 |

Option not getting Knocked In

Let us assume that the barrier type is Double Knock In instead of Double Knock Out. If the option gets knocked in during the barrier window, it can be exercised any time according to the Expiration style. If it doesn’t get knocked in, a rebate may be payable at expiry. Let us suppose that the option doesn’t get knocked in. The accounting entries and the events triggered at expiry in this case are given below.

REVL at expiry

TV amortized Till date = 142.86 INR

Total TV to amortize = 500 INR

Current TV to amortize = 500 – 142.86 = 357.14 INR

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | EXP_ON_HEDGE | NET_AMORT_TV | 357.14 | INR | 31-Dec-02 | ||||||

| Cr | PUR_TV_DEF | NET_AMORT_TV | 357.14 | INR | 31-Dec-02 |

KIST (Knock In settlement) at expiry

As mentioned above, a rebate amount may be payable to the buyer of the option on expiry if the option does not get knocked in during the barrier window.

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | CUSTOMER | PUR_REBATE_AMT | 300 | AUD | 31-Dec-02 | ||||||

| Cr | PUR_OPT_INCOME | PUR_REBATE_AMT | 300 | AUD | 31-Dec-02 |

EXPR (Expiry)

On Expiry, the deferred intrinsic value is recognized as expense

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | PUR_HED_EXPENSE | PUR_INCEP_IV | 2000 | INR | 31-Dec-02 | ||||||

| Cr | PUR_IV_DEF | PUR_INCEP_IV | 2000 | INR | 31-Dec-02 |

Moving Inception TV to final Expense GL from Revaluation Expense GL

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | PUR_HED_EXPENSE | PUR_INCEP_TV | 500 | INR | 31-Dec-02 | ||||||

| Cr | EXP_ON_HEDGE | PUR_INCEP_TV | 500 | INR | 31-Dec-02 |

Contract Termination (TERM)

Now let us assume that the currency option contract was terminated on 01-Sep-2002

Termination Value (User I/P) = 2700 INR

Termination Gain = 2700 – 2000 (Inception IV) = 700 INR

Accounting entries passed at termination –

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | CUSTOMER | PUR_INCEP_IV | 2000 | INR | 01-Jul-02 | ||||||

| Cr | PUR_IV_DEF | PUR_INCEP_IV | 2000 | INR | 01-Jul-02 | ||||||

| Dr | CUSTOMER | HED_TERM_GAIN | 700 | INR | 01-Jul-02 | ||||||

| CR | PUR_GAIN_DEF | HED_TERM_GAIN | 700 | INR | 01-Jul-02 |

Event REVL at termination

Remaining time value of the option is recognized as expense on termination.

TV amortized Till date = 142.86 INR (As on 01-Aug-2002)

Total TV to be amortized = 500 INR

Current TV to be amortized = 500 – 142.86 = 357.14 INR

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | EXP_ON_HEDGE | NET_AMORT_TV | 357.14 | INR | 01-Sep-02 | ||||||

| Cr | PUR_TV_DEF | NET_AMORT_TV | 357.14 | INR | 01-Sep-02 |

Moving Inception TV to final Expense GL from Revaluation Expense GL after REVL on TERM.

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | PUR_HED_EXPENSE | PUR_INCEP_TV | 500 | INR | 01-Sep-02 | ||||||

| Cr | EXP_ON_HEDGE | PUR_INCEP_TV | 500 | INR | 01-Sep-02 |

AMDG after termination

Deferred termination gain in case of hedge deals is amortized over a period from Contract termination date (01-Sep-2002 in this case) to the contract maturity date. Suppose according to the frequency of amortization, deferred termination gain is amortized on the 01-Nov-2002.

Amount to be amortized Till date = 700 * (2 * 30) / (6 * 30) = 233.33 INR

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | PUR_GAIN_DEF | NET_GAIN_DEF | 233.33 | INR | 01-Nov-02 | ||||||

| CR | PUR_OPT_INCOME | NET_GAIN_DEF | 233.33 | INR | 01-Nov-02 |

If there is no other frequency of amortization between the contract termination date and contract maturity date where the deferred termination gain can be amortized, the remaining part will be amortized on the contract maturity date. Since the contract has already been terminated, only the event AMDG will be triggered. The accounting entries are

Amt to amortize till date = 700 INR

Amt already amortized = 233.33 INR

Current amount to amortize = 700 – 233.33 = 467.67 INR

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | PUR_GAIN_DEF | NET_GAIN_DEF | 467.67 | INR | 31-Dec-02 | ||||||

| CR | PUR_OPT_INCOME | NET_GAIN_DEF | 467.67 | INR | 31-Dec-02 |

Contract Exercise (EXER)

Contract Exercise will happen depending on the Expiration style. In this case, since it’s a Plain Vanilla option with American Expiration style, it can be exercised anytime between the earliest exercise date (15-Oct-2002) and contract maturity (31-Dec-2002) if it doesn’t get knocked out during the barrier window.

Suppose the spot rate on 15-Dec-2002 is 55INR/USD. Since the strike is 50 INR/USD, the option is in the money on this date and the buyer may exercise the option.

Settlement Amount = 1000 (Contract Amount) * (55 – 50) = 500 INR

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | PUR_OPT_SET_REC | PUR_INCEP_IV | 2000 | INR | 15-Dec-02 | ||||||

| CR | PUR_IV_DEF | PUR_INCEP_IV | 2000 | INR | 15-Dec-02 | ||||||

| Dr | PUR_HED_EXPENSE | HED_EXER_LOSS | 1500 | INR | 15-Dec-02 | ||||||

| Cr | PUR_OPT_SET_REC | HED_EXER_LOSS | 1500 | INR | 15-Dec-02 |

It is important to note here that even though, the option is in the money, the amount tag populated here is HED_EXER_LOSS. This is so because even though the buyer of the option is getting a pay off equal to 500 INR, he is in an over all loss of 1500 INR (Inception IV – pay off).

AMRT on EXER

Remaining time value of the option is recognized as expense at the time of Exercise.

TV amortized Till date = 142.86 INR (As on 01-Aug-2002)

Total TV to be amortized = 500 INR

Current TV to be amortized = 500 – 142.86 = 357.14 INR

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | EXP_ON_HEDGE | NET_AMORT_TV | 357.14 | INR | 15-Dec-02 | ||||||

| Cr | PUR_TV_DEF | NET_AMORT_TV | 357.14 | INR | 15-Dec-02 |

Moving Inception TV to final Expense GL from Revaluation Expense GL on EXER after AMRT.

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | PUR_HED_EXPENSE | PUR_INCEP_TV | 500 | INR | 15-Dec-02 | ||||||

| Cr | EXP_ON_HEDGE | PUR_INCEP_TV | 500 | INR | 15-Dec-02 |

EXST (Exercise Settlement) after EXER

The following accounting entries will be passed on settlement after exercise of the currency option above. In this case the settlement event will be triggered along with the exercise event.

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | CUSTOMER | PUR_SETL_AMT | 500 | USD | 15-Dec-02 | ||||||

| Cr | PUR_OPT_SET_REC | PUR_SETL_AMT | 500 | USD | 15-Dec-02 |

8.1.3 Example III – Contingent Entries and Delta Accounting

This section is applicable only for physical currency options. Let us consider the following parameters of a deal.

| Contract Type | Trade | ||

|---|---|---|---|

| Buy or Sell | Sell | ||

| Call or Put | Call | ||

| Contract Amount | 1000 | ||

| Contract Currency | USD | ||

| Counter Currency | GBP | ||

| Exchange rate b/n USD/GBP | 1.5 | ||

| Option premium | 2500 INR | ||

| Booking Date | 01 | ||

| June | 2002 | ||

| Value Date | 01 | ||

| June | 2002 | ||

| Premium Pay Date | 01 | ||

| Jun | 2002 | ||

| Strike price | 50 INR/USD | ||

| Current Spot Rate | 52 INR/USD | ||

| Option Style | Plain Vanilla | ||

| Expiration Style | American | ||

| Earliest Exercise Date | 15 | ||

| Oct | 2002 | ||

| Barrier Type | Double Knock Out | ||

| Barrier | 53 INR/USD | ||

| Lower Barrier | 48 INR/USD | ||

| Rebate | 100 AUD | ||

| Payment At | Maturity | ||

| Barrier Window Start Date | 01 | ||

| Sep | 2002 | ||

| Barrier Window End Date | 01 | ||

| November | 2002 | ||

| Maturity Date | 31 | ||

| Description | 2002 |

Since the exchange rate between USD/GBP on inception is 1.5, the counter currency amount (Contract amount in counter currency) is 1000*1.5 = 1500 GBP.

On 01-Jun-2002 the booking event will trigger with the following contingent entries.

Since the other entries have already been explained we will not be explaining those entries again.

Suppose the LCY is INR. Let us assume the rate between USD/INR is 40 and GBP/INR 30.

The LCY amount for contract currency amount = 1000*40 =40000

LCY amount for Counter Currency amount = 1500*30 = 45000

Average LCY amount = (40000+45000)/2 = 42500

BOOK

| Dr/Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | LCY AMT | Date | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | CON_WRI_CALL | WRI_CALL_AMT | 1500 | GBP | 42500 | 01-Jun-02 | |||||||

| Cr | CON_WRI_CAL_OFF | WRI_CALL_AMT_EQ | 1000 | USD | 42500 | 01-Jun-02 |

Suppose the delta factor maintained for 01-Jun-2002 is 0.8. The delta amount will be calculated as follows:

Counter Currency Amount * delta factor =1500*0.8 =1200 GBP.

At the end of the day when the batch process is run, the delta accounting entries will be posted as follows:

DLTA

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | CON_DELTA_AC | DELTA_AMT | 1200 | GBP | 01-Jun-02 | ||||||

| Cr | CON_DELTA_OFF | DELTA_AMT | 1200 | GBP | 01-Jun-02 |

Now on 2nd of June, when the batch process is run, the previous days delta entries will be reversed. Suppose the delta factor maintained for 01-Jun-2002 is 0.6. The delta amount will be calculated as follows:

Counter Currency Amount * delta factor = 1500*0.6 =900 GBP

DLTA

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | CON_DELTA_OFF | ANTI_DELTA_AMT | 1200 | GBP | 02-Jun-02 | ||||||

| Cr | CON_DELTA_AC | ANTI_DELTA_AMT | 1200 | GBP | 02-Jun-02 | ||||||

| Dr | CON_DELTA_AC | DELTA_AMT | 900 | GBP | 02-Jun-02 | ||||||

| Cr | CON_DELTA_OFF | DELTA_AMT | 900 | GBP | 02-Jun-02 |

Suppose the option gets knocked out on 01-Sep-2002, the entries passed will be as follows:

DLTA

| Dr/ Cr | Accounting Role | Amount Tag | FCY Amount | FCY CCY | Date | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | CON_DELTA_OFF | ANTI_DELTA_AMT | 900 | GBP | 01-Sep-02 | ||||||

| Cr | CON_DELTA_AC | ANTI_DELTA_AMT | 900 | GBP | 01-Sep-02 |

KNOT (Only contingent reversal is shown)

Assuming that the rates between USD/INR and GBP/INR have not changed for calculation of LCY amount. Any such change will be taken care of by the account revaluation batch.

| Dr/ Cr | Account role code | Amount tag | FCY Amount | FCY CCY | LCY AMT | Date | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dr | CON_WRI_CAL_OFF | WRI_CALL_AMT_EQ | 1000 | USD | 42500 | 01-Sep-02 | |||||||

| Cr | CON_WRI_CALL | WRI_CALL_AMT | 1500 | GBP | 42500 | 01-Sep-02 |

The above example is only for a Written and Call physical currency option. For other Purchase/Written – Call/Put options, you can refer Annexure A for a list of accounting entries.

8.1.4 Example IV – Swaption with European Expiration

On 01-Jan-1998, Tata Projects Ltd. (TPL) foresees a 3-year floating rate-funding requirement, contingent on being awarded a tender after 9 months. A forward swap contract will prove costly if the tender bid is unsuccessful. Instead, TPL buys a payer’s swaption from National Bank with an exercise date matching the tender acceptance date – 31-Aug-1998. If interest rates rise by end-August, TPL can raise floating rate funds in the market and simultaneously exercise the in-the-money swaption. Then, it will pay fixed rate interest to National Bank and receive floating rate interest from them, with which it will pay back in the market. If interest rates decline, the swaption may be out of the money and TPL will let it expire and fund itself at the lower rate that it gets in the market.

Assume that TPL buys a payer’s swaption from National Bank with the following terms:

| Booking date | 01-Jan-1998 | ||

|---|---|---|---|

| Option expiration date | 01-Sep-1998 | ||

| Exercise style | European | ||

| Exercise date | 01-Sep-1998 | ||

| Option Type | Right to pay fixed rate (payer’s swaption) | ||

| Premium | 1 % of notional principal | ||

| Settlement | Deliverable |

Terms of the underlying swap between TPL and National Bank:

| Notional Principal | 50,000,000 USD | ||

|---|---|---|---|

| Effective Date | 01-Sep-1998 | ||

| Fixed Rate | 9.5% p.a. payable semi annually | ||

| Floating Rate | 6-Month LIBOR | ||

| Fixed & Floating Payment Dates | March 1 and September 1, starting March 1, 1999 and ending September 1, 2001 | ||

| Floating Rate Reset Dates | Given in the following table |

On 30-Aug-98, the market swap rate for a 3-year fixed to LIBOR swap with half-yearly resets is 10% -- that is, fixed rate has to be paid at 10% to receive LIBOR at six-monthly intervals over the next 3 years.

Since the market rate is higher than the strike rate (9.5%), TPL exercises the swaption. Simultaneously, it borrows 50,000,000 USD from the market with six-monthly interest payment at LIBOR.

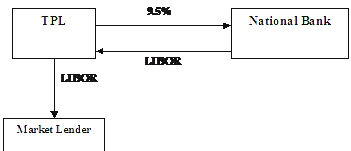

The resultant swap after exercise of the swaption, along with the impact of the market borrowing, is diagrammatically shown as follows:

The floating rates obtaining on the various rate reset dates are as follows:

| Reset Date | LIBOR (%) | ||

|---|---|---|---|

| Aug 30, 1998 | 9.8 | ||

| Feb 27, 1999 | 9.2 | ||

| Aug 30, 1999 | 9.5 | ||

| Feb 28, 2000 | 8.9 | ||

| Aug 30, 2000 | 9.7 | ||

| Feb 27, 2001 | 10.2 |

The fixed and floating payments over the life of the swap will be:

| Date | Fixed Rate Payment (Paid by TPL) (USD) | Floating Rate Payment (Paid by National Bank) (USD) | |||

|---|---|---|---|---|---|

| Mar 1, 1999 | 50MM*9.5*181/36000=2,388,194.44 | 50MM*9.8*181/36000=2,463,611.11 | |||

| Sep 1, 1999 | 50MM*9.5*184/36000=2,427,777.78 | 50MM*9.2*184/36000=2,351,111.11 | |||

| Mar 1, 2000 | 50MM*9.5*182/36000=2,401,388.89 | 50MM*9.5*182/36000=2,401,388.89 | |||

| Sep 1, 2000 | 50MM*9.5*184/36000=2,427,777.78 | 50MM*8.9*184/36000=2,274,444.44 | |||

| Mar 1, 2001 | 50MM*9.5*181/36000=2,388,194.44 | 50MM*9.7*181/36000=2,438,472.22 | |||

| Sep 1, 2001 | 50MM*9.5*184/36000=2,427,777.78 | 50MM*10.2*184/36000=2,606,666.60 |

8.1.5 Examples of Different Types of Exotic Currency Options

Given below are examples of the different styles of Exotic Currency options.

Example 1

On 01-Jun-2003, Options Bank buys a call option on 10,000 USD against INR with a strike price of 50 INR. Maturity date – 31-Dec-2003. Premium paid – 100 USD.

Parameters of the deal:

- Contract Amount – 10,000

- Contract Currency - USD

- Counter Currency – INR

- Option premium – 100 USD

- Strike price - 50 INR/USD

- Current Spot Rate – 48 INR/USD

- Option Style – Binary

- Expiration style - American

- Barrier - None

- Fixed Amount to be paid - 500

- Fixed Amount Currency – EUR

- Earliest exercise date – 01-Oct-2003

If at any time during 01-Oct-2003 and 31-Dec-2003, the spot rate touches or crosses 50 INR/USD, the seller of the option becomes liable to pay a fixed amount of 500 EUR to Options Bank. This example also illustrates that the settlement does not have to be in the contract currency or the counter currency. It can be in a pre-determined currency, which may be different from both.

Example 2

We continue with the Example 1, but add on the following new parameters:

- Barrier type - Double Knock Out

- Barrier - 52 INR/USD

- Lower barrier - 47 INR/USD

- Rebate - 20 EUR

- Barrier Window Start Date - 01-Sep-2003

- Barrier Window End Date - 01-Nov-2003

If, at any time during 01-Sep-2003 and 01-Nov-2003, the spot rate touches or crosses 52 INR/USD or becomes less than 47 INR/USD, this option will cease to be in effect (will be knocked out). The option writer will pay a rebate of 20 EUR to Options Bank. If, on 15-Oct-2003, the spot rate touches the strike price, the option can be exercised even though the barrier window has not yet been completed. In this case, the seller of the option becomes liable to pay a sum of 500 EUR to Options Bank.

Example 3

We continue with Example 1, but add on the following new parameters:

- Barrier type - Single Knock In

- Barrier - 52 INR/USD

- Option Style - Digital

- Rebate - 20 EUR

- Expiration Style - European

- Barrier Window Start Date - 01-Sep-2003

- Barrier Window End Date - 01-Nov-2003

If any time during 01-Sep-2003 and 01-Nov-2003, the spot rate touches or crosses 52 INR/USD, this option will come into effect (get knocked in). Now, if on 31-Dec-2003, the spot rate is equal to or greater than 50 INR/USD (the strike price), the seller of the option will pay a fixed amount of 500 EUR to Options Bank. If the spot rate is below 50 INR/USD on31-Dec-2003, the option expires worthless.

If the above option never comes into existence because of the spot rate never touching 52 INR/USD between 01-Sep-2003 and 01-Nov-2003, then a rebate amount of 20 EUR will be paid to Options Bank by the seller of the option.

Example 4

On 01-Jun-2003, National Bank buys a call option on 10,000 USD against the INR with a strike price of 50 INR with 31-Dec-2003 as the maturity date. National Bank pays a premium of 100 USD for the option.

Parameters of the deal:

- Contract Amount – 10000

- Contract Currency - USD

- Counter Currency – INR

- Option premium – 100 USD

- Current Spot Rate – 48 INR/USD

- Option Style – No Touch

- Fixed Amt to be paid - 500

- Fixed Amount Currency – EUR

- Barrier - 49 INR/USD

- Lower Barrier – 46 INR/USD

- Rebate - 50 AUD

- Barrier Window Start Date - 01-Sep-2003

- Barrier Window End Date - 01-Nov-2003

Here, if at any time during 01-Sep-2003 and 01-Nov-2003, the spot rate touches or goes below 46 INR/USD or touches or goes above 49 INR/USD, the option will be knocked out and a rebate of 50 AUD will be paid by the seller of the option to National Bank, either on the knock out date or on maturity (31-Dec-2003). If the spot rate does not touch either barrier during the barrier window, a fixed amount of 500 EUR will be paid by the seller of the option to National Bank on the maturity date.

8.2 Explanation of Terms Associated with IRO Markets / Transactions

Option Buyer (holder)

This is the party that obtains, on payment of a fee, the right to lend or borrow (notionally) a pre-determined quantity of money at a specified rate of interest for a specified period starting from a specified date. In effect, she obtains the right to compensation in the event of a future adverse movement in a floating benchmark interest rate, which can, for example, be the USD 6-month LIBOR.

Option Seller (writer)

This is the party that enters into an obligation, in return for a fee, to provide compensation to the option buyer in the event of a future adverse movement in a floating benchmark interest rate.

Example

On May 02, 2003, Sarah Williams buys a Put IRO from Options Bank, giving her the right to lend 1 million USD at 5% for the period July 01, 2003 to December 31, 2003. The benchmark rate is 6-M LIBOR. On June 27, 2003, when rate fixation takes place for the period July 01 – December 31, 2003, 6-M USD LIBOR is 4%. Options Bank has to pay Sarah Williams a sum of:

1,000,000 X ((0.05-0.04) X (183/360)) = 5,083.33 USD

Had USD LIBOR for the period July 01 – December 31, 2003 been 5.5%, Sarah Williams would not have exercised the Call IRO.

Notional principal / Contract amount

This is the underlying principal amount, based on which payments or receipts for an IRO are calculated. It is ‘notional’, since the IRO contract contains no obligation for either counterparty to lend or borrow funds at the contracted rate. In the previous example, the notional principal is 1,000,000 USD.

Premium

This is the upfront fee or price paid by the option buyer to the option writer. This is sometimes expressed as a percentage of the notional principal / contract amount. The premium is usually payable on the same day when the option deal is struck, or within two business days from the deal date.

Transaction date / Deal date / Trade date

This is the business day on which the option deal is entered into.

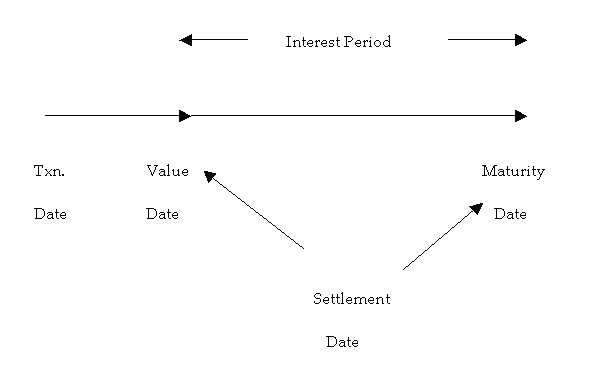

Interest period

The interest period or the contract period is the duration for which the underlying interest rate is to apply and is the tenor basis on which the settlement amount is computed. This is the period between the value date and the maturity date. In the previous example, the interest period is between July 01 and December 31, 2003.

Value date / Effective date

This is the business day which is the first day of the interest period. In the previous example, July 01, 2003 is the value date.

Maturity date

This is the last day of the interest period. In the previous example, December 31, 2003 is the maturity date.

Settlement date

This is the date on which the settlement is effected. The settlement date can either be the value date (for deals settling in advance) or the maturity date (for deals settling in arrears).

Fixing date / Strike date / Exercise date

This is the date on which the strike and reference rates (both are defined later in this document) are compared and the settlement amount is arrived at. This is usually either the same date as the value date or a couple of days prior to the value date.

The above dates are depicted in the figure given below:

Reference / Underlying rate

This is the rate against which the strike rate is compared to determine the payable or receivable amount. Typically, the reference rate is a benchmark market interest rate, such as the LIBOR.

Strike rate / Exercise rate

This is the rate mentioned in the option contract, against which the reference rate as on the day of exercise is compared. If the reference rate is below or above the strike rate (depending on whether the option is a put or a call), payment is required to be made to the option buyer by the option writer. An option holder ‘strikes’ (exercise her option) at this rate, or a rate lower (if put) or higher (if call) than this rate.

In the previous example, the strike rate is 5%.

Intrinsic value

The intrinsic value of an IRO contract on any given day is the pay-off to the option holder if the option is exercised on that day. Refer to the pay-off diagrams earlier in this section.

Time value

Apart from the intrinsic value, the value of an option also contains another – a probabilistic – component, which is based on a forecast of the possible movement of the reference / underlying rate over the time left till maturity. This component of the option’s value – called the time value – is a function of the volatility of the underlying and the time to expiry. Time value is determined by Oracle FLEXCUBE as the user-entered fair value of the option, less its intrinsic value.

Settlement amount

This is the amount payable by the writer to the holder on the settlement date when the option is exercised. The exact quantum of the settlement amount is shown below. As can be seen, the strike rate is compared to the reference rate on the settlement date. The settlement date can be the maturity date of the contract (end of the interest period) or the value date of the contract (beginning of the interest period). If the contract is settled on the value date, the amount that changes hands is the discounted present value of the settlement amount.

| Option Type | Settlement on Maturity Date | Settlement on Value Date | |||

|---|---|---|---|---|---|

| Put | P * N * (S-R)/(Y*100) | [P * N * (S-R)/(Y*100)] / [ 1 + (R*N/Y*100)] | |||

| Call | P * N * (R–S)/(Y*100) | [P * N * (R–S)/(Y*100)] / [ 1 + (R*N/Y*100)] |

Where:

P = notional principal (which is contractually agreed);

N= number of days in the contract period (as per the contract);

S = strike rate (contractually agreed);

R = reference rate (value of the benchmark, say, LIBOR, as on the rate fixing date)

Y = number of days in the year (this depends on day count convention)

In-the-money, Out-of-the-money and at-the-money

An option is said to be in-the-money if the settlement amount is positive, that is, the strike rate is more favorable than the reference rate and the IRO is exercised. If the reference rate is more favorable than the strike rate, the IRO is not exercised and is said to be out-of-the-money. If the reference rate is exactly equal to the strike rate, the IRO is said to be at-the-money.

Note

The pay-off to the option holder is the settlement amount, less the upfront premium that she pays when entering into the option contract.

The IRO terminology mentioned above is applicable to COs as well. While understanding these terms for COs you will have to read them in context.