5. Processing a Payment or Collection Transaction

In the Payments and Collections module of Oracle FLEXCUBE, a product refers to a specific type of transfer of funds. For example, you may process payments/collections that involve transfer of funds between accounts maintained at your bank. You can define this type of internal payment /collection as one of the payment/collection products at your bank.

Defining a product makes it easier for you to enter transactions. The other advantage of defining a product is that you can define certain general attributes for a product, which will default to all contracts processed under it.

Note

Contracts are customer specific. A customer could make a payment through your bank (local payments) or collect payments from debtors through your bank (direct debits or requests for debit).

Every time you process a transaction, you do not have to specify its general attributes, since a transaction acquires the attributes defined for the product it involves. You can change these default attributes to suit a specific transaction.

You can capture the details of a Payment/Collection transaction in the PC Transaction Input online screen.

This chapter contains the following sections:

- Section 5.1, "Payment/Collection Transactions Details"

- Section 5.2, "Simplified Entry of Payments and Collection Transactions"

- Section 5.3, "Transaction Authorization"

- Section 5.4, "Multilevel Authorization of a Contract"

- Section 5.5, "Collection Transaction"

- Section 5.6, "Exchange Rate for a Transaction"

- Section 5.7, "Input of Exchange Rates Authorization"

- Section 5.8, "Exchange Rate Refresh"

- Section 5.9, "Credit Exceptions"

- Section 5.10, "Customer Legs Consolidation"

- Section 5.11, "Consolidation Exception Queues"

- Section 5.12, "Transaction History Summary"

- Section 5.13, "Transaction Exception Summary"

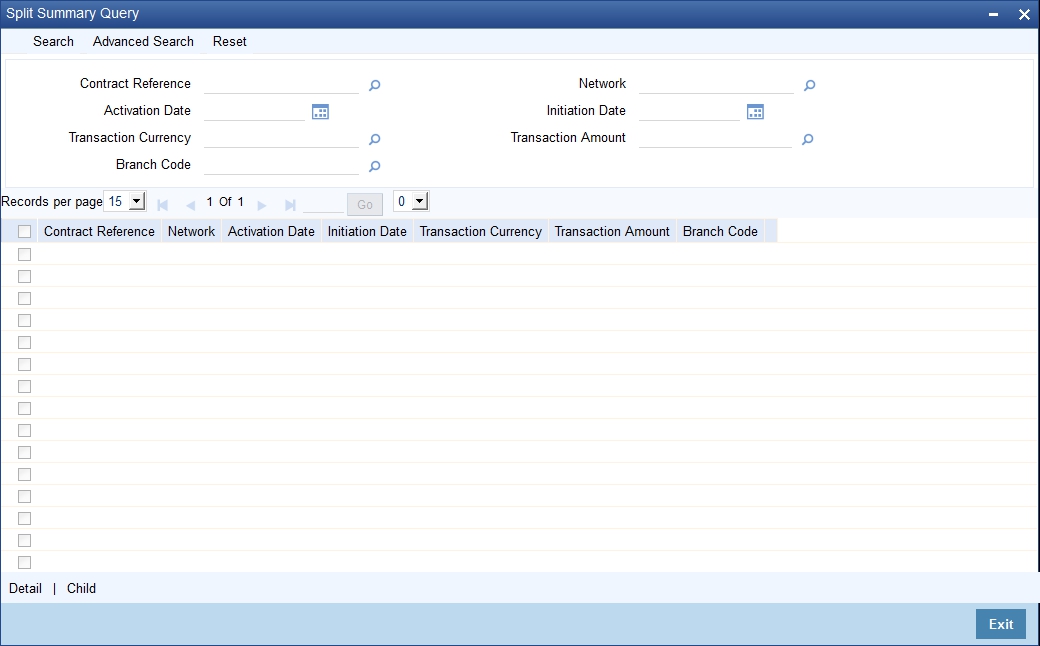

- Section 5.14, "Split Transactions Summary"

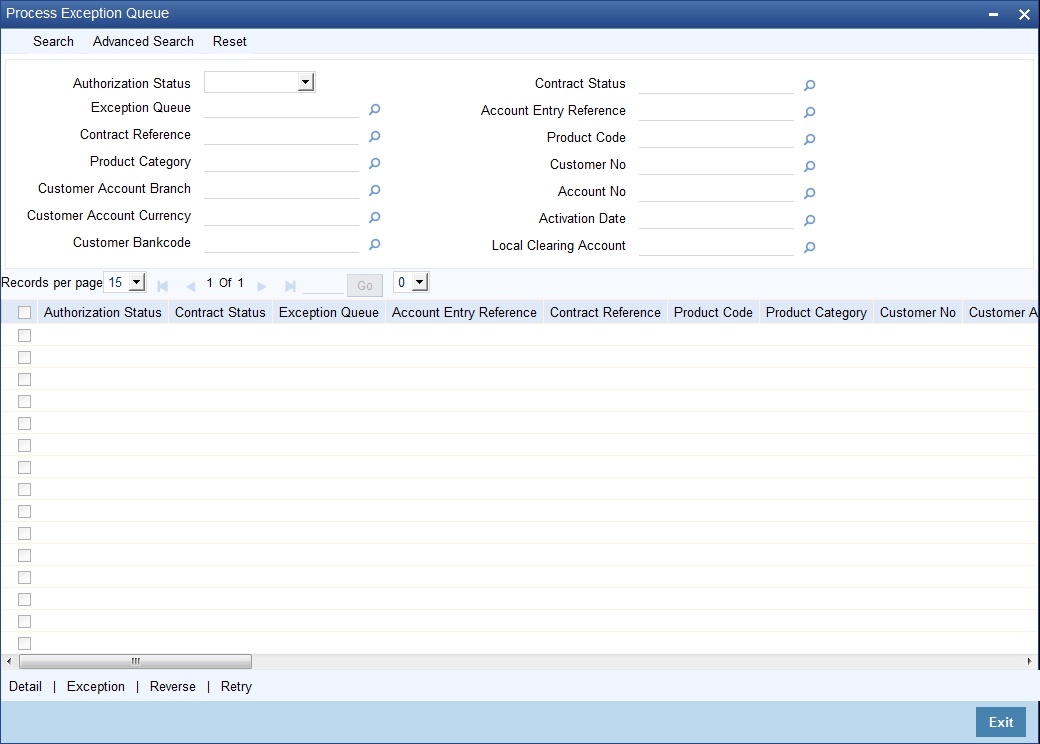

- Section 5.15, "Process Exception Queues"

- Section 5.16, "Exchange Rate Queues"

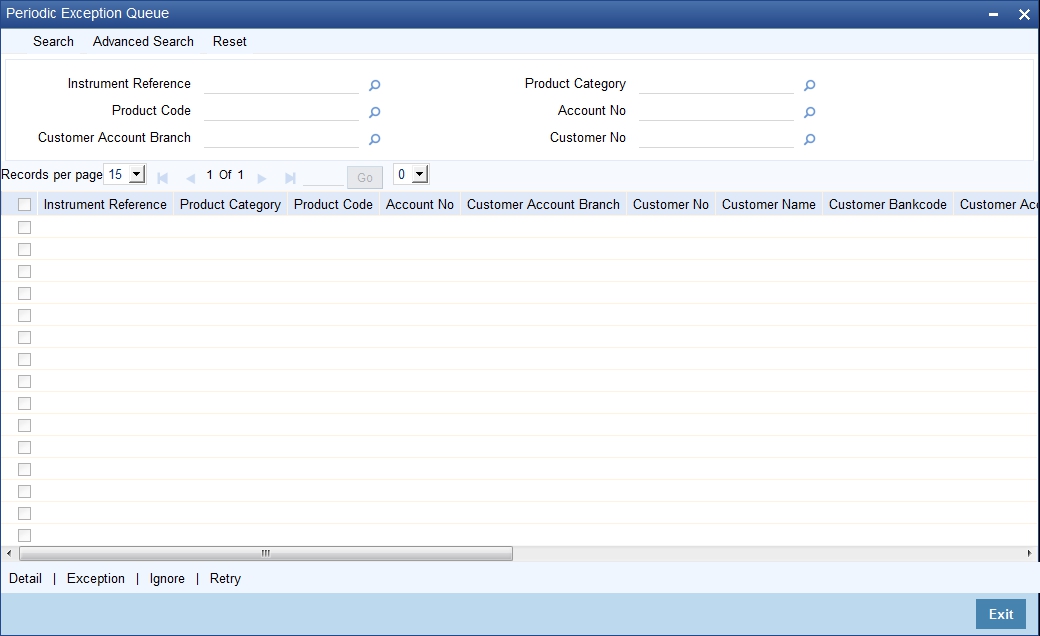

- Section 5.17, "Periodic Exception Queues"

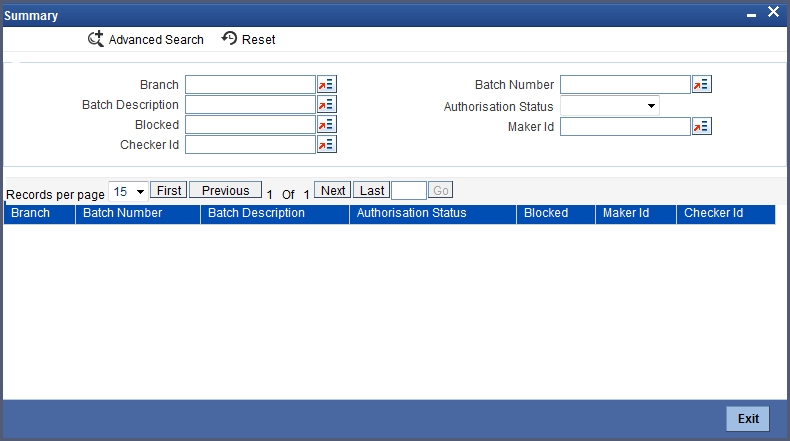

- Section 5.18, "The Batch Browser"

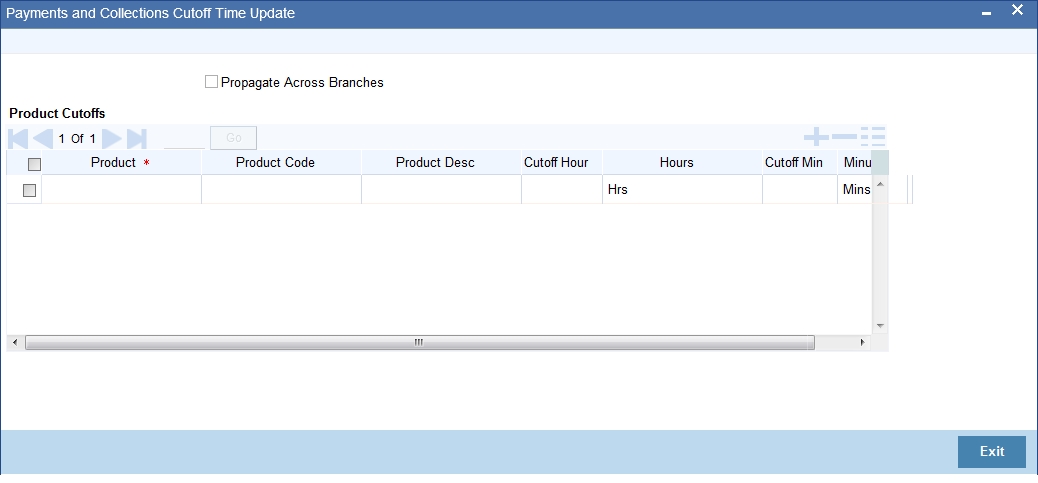

- Section 5.19, "Updating Cut-Off Time Status"

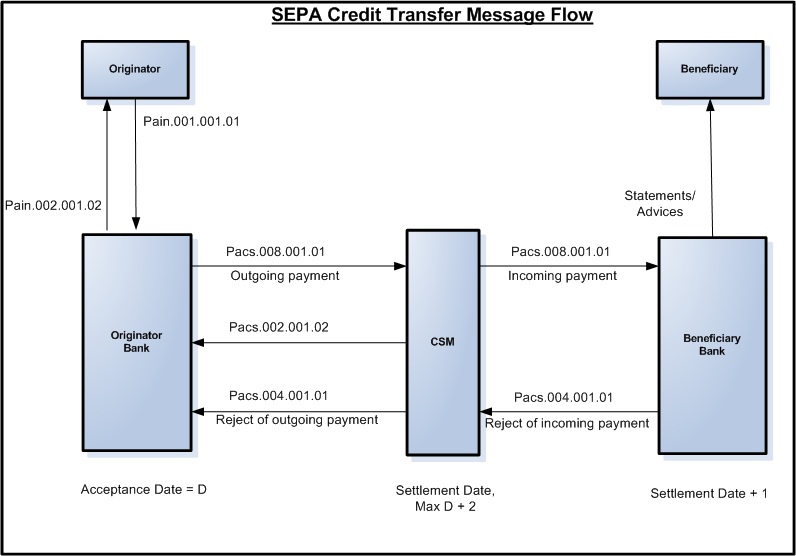

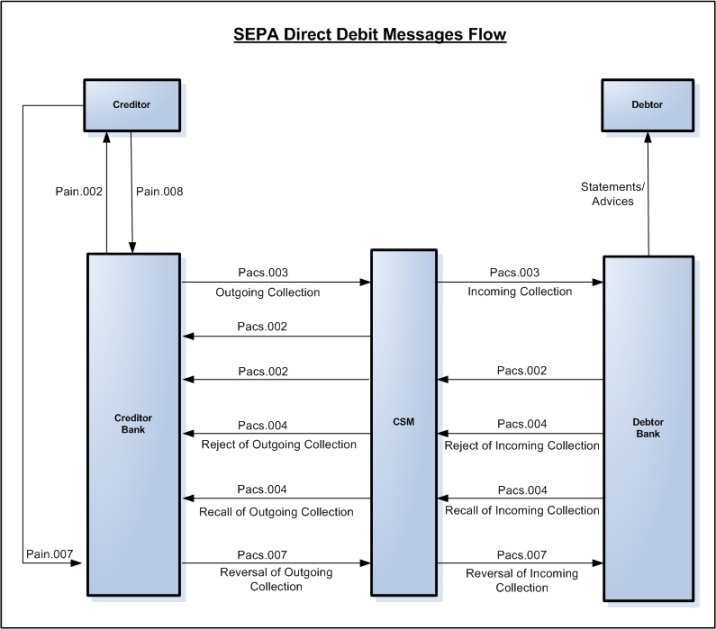

- Section 5.20, "SEPA Credit Transfers and Direct Debits"

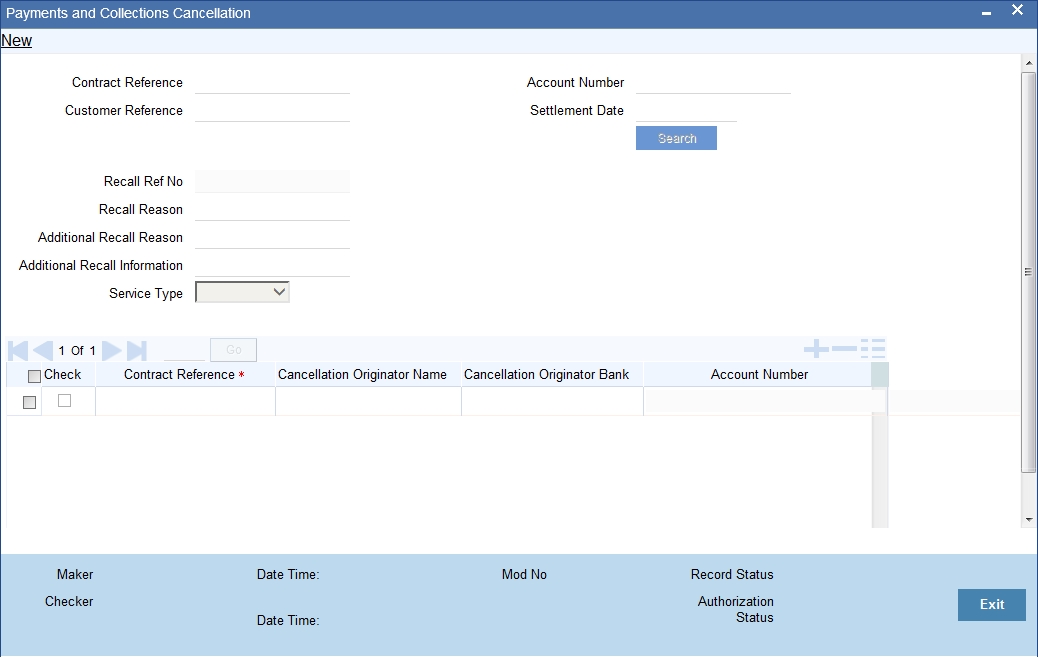

- Section 5.21, "Payment Cancellation Request"

- Section 5.22, "Handling Cancellation of Outgoing Payments & Collections that are not dispatched to CSM"

- Section 5.23, "Handling Manual Rejection of Cancellation (Camt.056) for Payments and Collections"

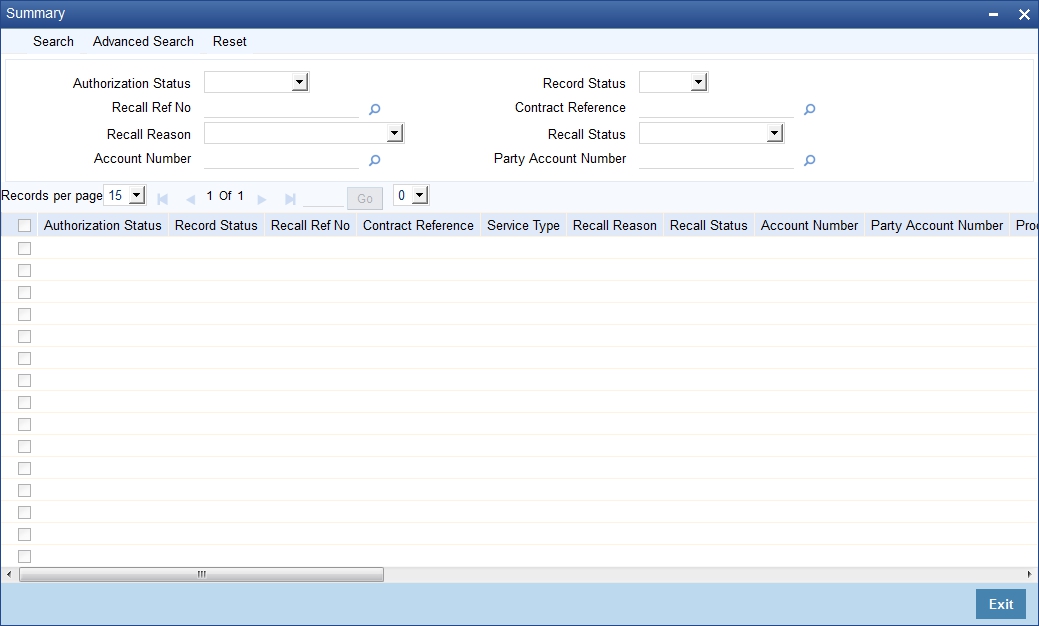

- Section 5.24, "SEPA Payment Cancellation Summary Details"

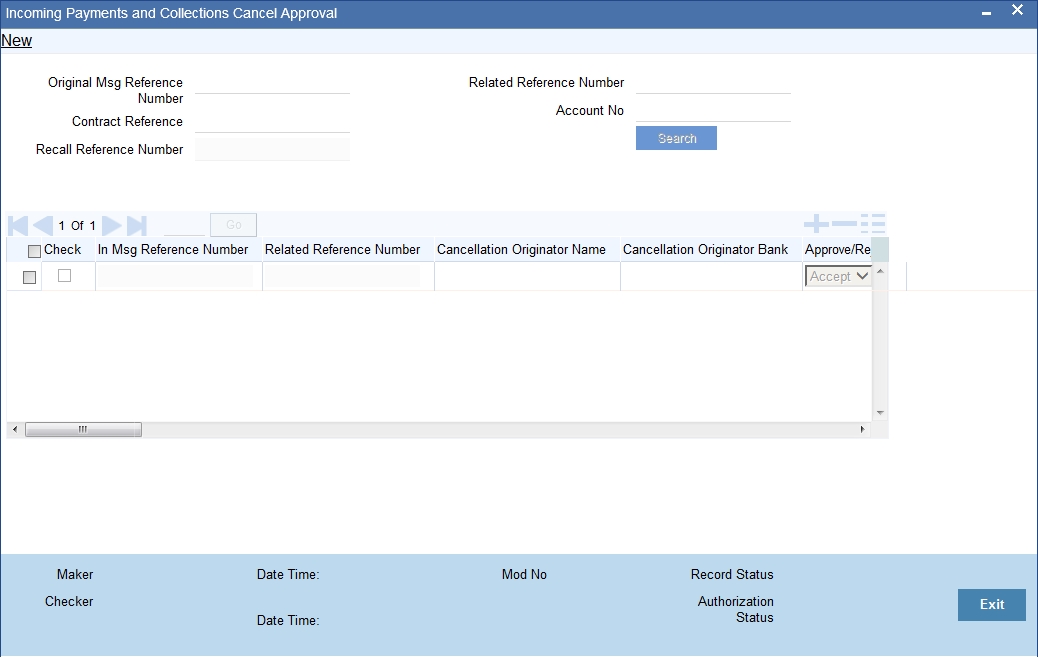

- Section 5.25, "Incoming Camt.056 Messages"

- Section 5.26, "Handling of Camt.056 for Incoming payments in Transaction Repair queue"

- Section 5.27, "Handling of Camt.056 for Incoming Collections in Transaction Repair queue"

- Section 5.28, "Handling Conflict Scenarios"

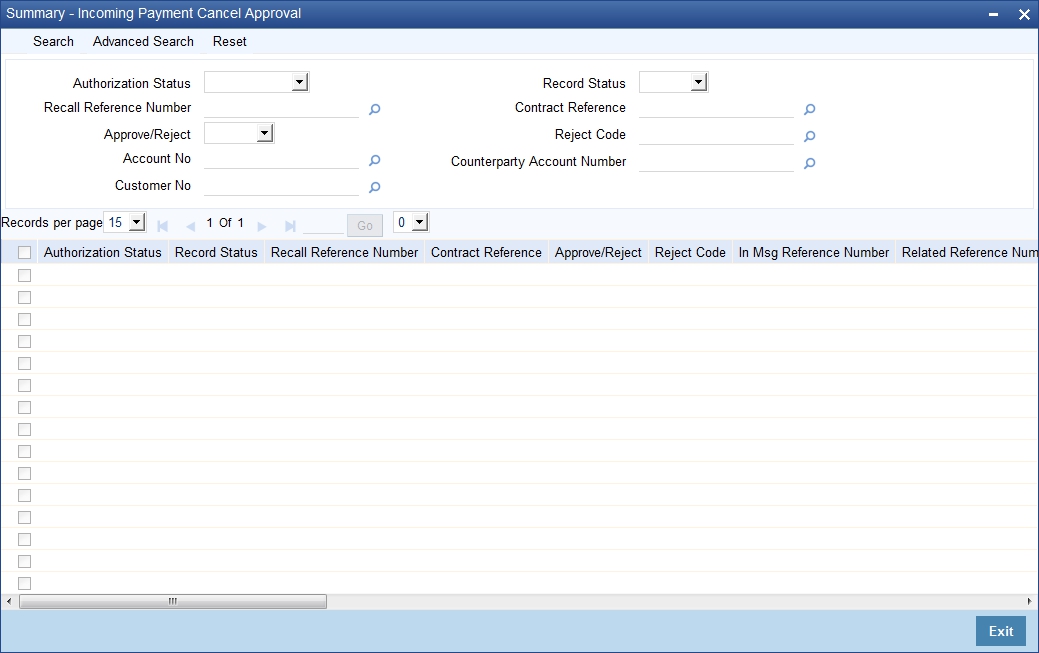

- Section 5.29, "Viewing SEPA Payment Cancellation Approval Summary Details"

- Section 5.30, "Negative Answer to Recall of a Credit Transfer - Camt.029.001.03"

- Section 5.31, "Incoming Camt.029.001.03"

- Section 5.32, "Maintaining Parameters for SEPA Transactions"

- Section 5.33, "SEPA Transaction Process Flow"

- Section 5.34, "Validations done on the SCT and SDD Messages"

- Section 5.35, "Refund Compensation and Balancing Payment for Debtor Bank"

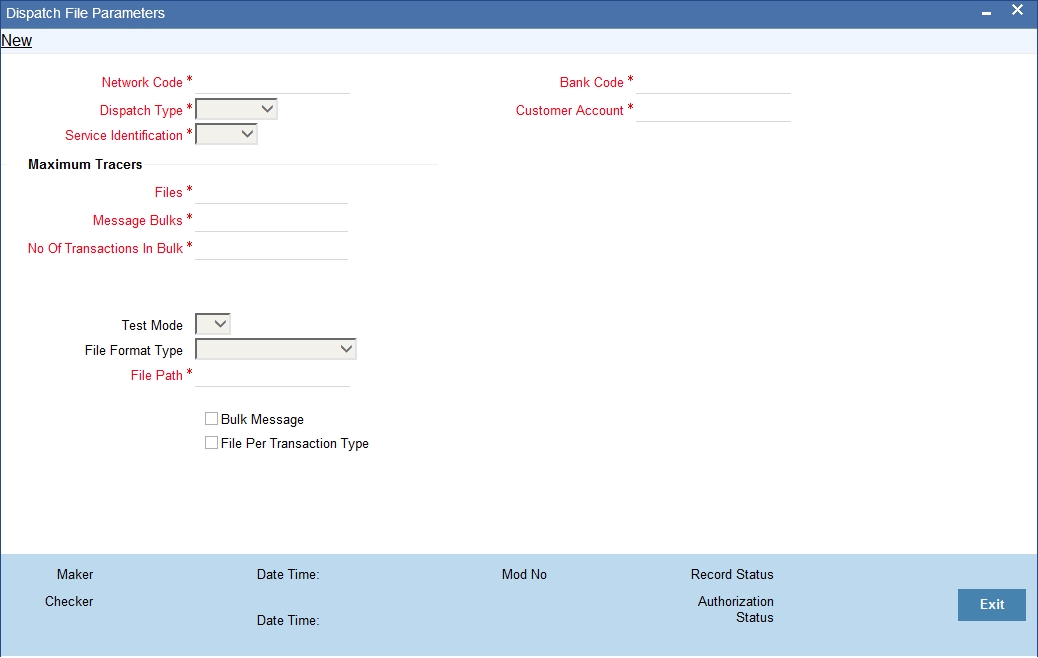

- Section 5.36, "Dispatch File Parameters"

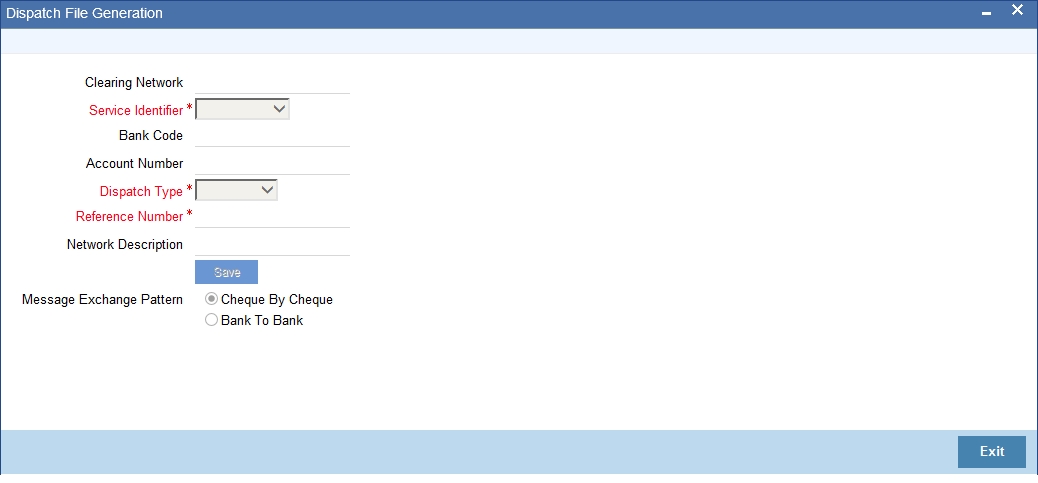

- Section 5.37, "Dispatch File Generation"

- Section 5.38, "Payment Gateway Message Browser"

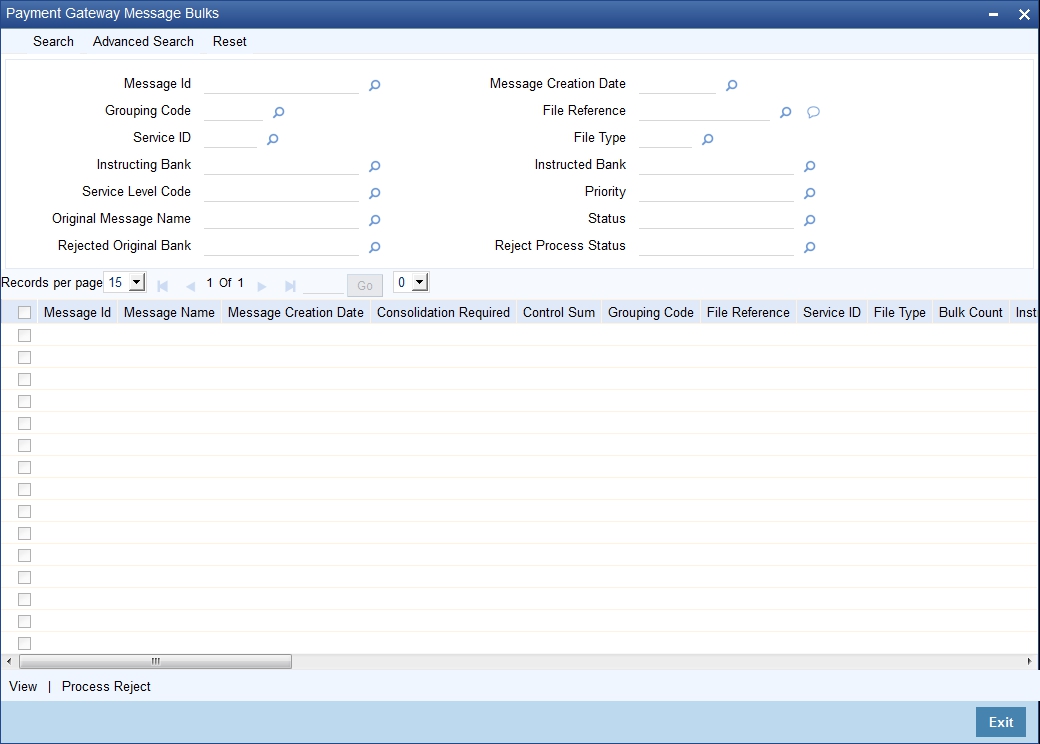

- Section 5.39, "Payment Gateway Message Bulks"

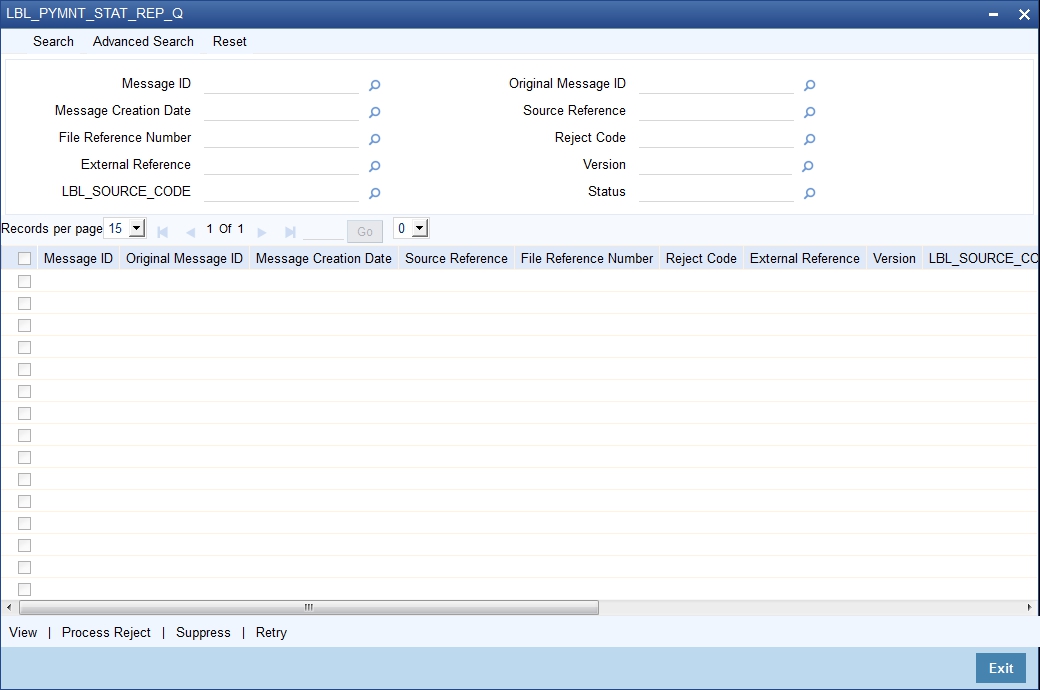

- Section 5.40, "Payment Status Report"

- Section 5.41, "Black List and White List of Creditors"

- Section 5.42, "Managing Mandate"

- Section 5.43, "Expiry Date Processing"

- Section 5.44, "Maximum Amount per Transaction Restrictions"

- Section 5.45, "Maximum Amount per Calendar Year Restrictions"

- Section 5.46, "Number of Transactions Restrictions per Calendar Year"

5.1 Payment/Collection Transactions Details

This section contains the following topics:

- Section 5.1.1, "Entering a Transaction"

- Section 5.1.2, "Main Tab"

- Section 5.1.3, "Transaction Details Tab"

- Section 5.1.4, "Collection Details Tab"

- Section 5.1.5, "Party Details Tab"

- Section 5.1.6, "Message Details Tab"

- Section 5.1.7, "UDF Tab"

- Section 5.1.8, "Split Details Button"

- Section 5.1.9, "MIS Details Button"

- Section 5.1.10, "Event Details Button"

- Section 5.1.11, "Duplication Details Button"

- Section 5.1.12, "Project Details Button"

- Section 5.1.13, "Tax Button"

- Section 5.1.14, "Queue Log Button"

- Section 5.1.15, "Viewing Payments and Collection Transactions"

5.1.1 Entering a Transaction

You can invoke the ‘PC Transaction Input online’ screen from the Application Browser.

You can invoke this screen by typing ‘PCDTRONL’ in the field at the top right corner of the Application tool bar and click on the adjoining arrow button. To enter a transaction in this screen, select new icon from the toolbar.

In this screen, you must enter the following details:

Product Category

Enter a valid product category code. The transaction that you are capturing will be associated with the product category you specify. If you enter a valid code, the Transaction Input screen is displayed.

Batch Number and Batch Description

Specify the Batch Number and a description of the batch. (A batch is used to group transactions.).

When you confirm your input, the main ‘PC Transaction Input’ screen is displayed. In this screen, you will view the batch number to which your transaction will be posted, the current number, and the reference number of the transaction you are capturing..

The following details are displayed in the main screen of the contract:

Product Category

The category you specified on invoking this screen will default here. You cannot change the default.

Product Code

Specify the product that you wish to use to process the contract. Based on the product code, the system will default the currency code linked to this product in the ‘Txn CCY’ field. Alternately, the system can also arrive at the product code based on the currency specified in the ‘Txn CCY’ field.

Network

Specify the clearing network for the contract. Based on the network ID, the system will default the currency code linked to this network in the ‘Txn CCY’ field.

Collection Type

The Collection Type of the transaction will be displayed. This could be either DD or RFD.

RFD Type

If the incoming collection transaction is an RFD, specify the RFD type. This could be any one of the following:

- No Tracking: indicates that the RFD is not considered for approval or rejection

- Full Payment: indicates that the RFD is processed for payment of full transaction amount

Partial Payment: indicates that the RFD is processed for partial payment

Contract Reference

The system identifies every transaction with a unique reference number. You can view the reference number for the transaction that you are capturing.

Customer Reference

The custom reference number for the contract is displayed.

Product Type

It defines the product and the product category of collection, payment. In PC transaction input it will be defaulted from the Product Category.

Source Reference

The system identifies every transaction with a unique source reference number. You can view the reference number for the transaction that you are capturing.

Specify the following details in the main screen of the contract:

5.1.2 Main Tab

As mentioned earlier, the PC Transaction Input screen is used to enter the details of a local payment/collection transaction.

Apart from the standard fields that are available, you will view the user-defined fields that the administrator at your customer station has maintained. These fields will be displayed in the sequence that your administrator has specified when defining the product category.

Customer Details

Account Number

Click ‘A’ and select a valid customer account form the option list. The list displays all customer accounts maintained in Oracle FLEXCUBE, or a GL for which posting is allowed (for instance, a cash GL in case of remittance of cash handed over the counter) in this field. The option list displays customer accounts and internal GLs with the corresponding Clearing Account Number and the IBAN Account Number (for GLs, as maintained in the ‘Chart of Accounts’).

Note

- If you have specified an account that uses an account class that is restricted for debit or credit transactions for the product, an override is sought when you attempt to save the contract.

- If the customer account is the debit account for a transaction, you can indicate a GL of type Asset, Liability, Income and Expense type only. Cash GLs cannot be specified.

- During upload of incoming payments (File upload), the batch process checks whether the beneficiary/customer account number is an IBAN account and resolves the customer account for the specified IBAN. If it is not found, the System checks the customer account (or GL) in LCF format, and resolves the customer account for the specified LCF number. If checks for IBAN and LCF formats fail, the System checks for the customer account. If the customer account is also not present the contract is marked for repair.

- If you specify a Trust account, you will have to capture project details in the ‘Project details’ sub-screen by clicking ‘Project Details’ button. If you do not capture project details, the system will display an error message while saving.

You can also select the account number as the CL account number. If the account is CL account, then the system will initiate CL manual payment for the following product types:

- Incoming Payment

- Direct Debit (Outgoing Collection)

The system will reverse the CL manual payments for Reject/Recall /Reversal of Outgoing Collection or Incoming Payment product types.

The IBAN of the loan account will be displayed in the ‘Counterparty IBAN’ field of the transaction.

To view the joint holder’s details of an account and the mode of operation maintained at the account level, place the cursor on the Account Number field and press Ctrl+J. The system displays the ‘Joint Holder’ screen.

For more information on the ‘Joint Holder’ screen refer to the section ‘Joint Holder Maintenance’ in the Core User Manual.

Account Description

The system displays the description of the specified account number based on the details maintained at ‘Customer Account Maintenance’ level.

Account Branch

This is maintained for the branch in customer account maintenance screen. The branch will be defaulted when you save the PC transaction.

Account Currency

This is maintained for the account in customer account maintenance screen. The values maintained will be defaulted when you save the PC transaction.

Available Balance

The available balance of the customer will be defaulted here when you save the PC transaction. The balance is maintained in the customer account maintenance screen.

Account in LCF

You can specify the customer account in Local Clearing Format in the A/C LCF field.

Customer Name

The name of the customer who is linked to the customer account will be defaulted here when you save the PC transaction. The name is maintained in the customer account maintenance screen.

Customer Number

The system defaults the customer number of the customer linked to the PC transaction.

Bank Code

You can enter the bank code and the account in LCF (local clearing format) for the transaction. The option list displays the Bank Code, Name, Bank Code Type and City for each bank in the list. The Bank Code, Name and City details are displayed on the Transaction Input screen when you select the bank code.

Bank Name

The system displays the name of the bank.

Bank Address 1

Specify the address of the customer’s bank name specified.

Bank Address 2

Specify the address of the customer’s bank name specified.

Note

- The fields Bank Name, Bank Address 1 and 2 are not sent out in the outgoing Pacs.008.001.02 message.

- These fields available at common payment message browser are mapped to fields at Payments and Collections Transaction Input for the new fields

Branch Name

The system displays the branch name of the bank.

Clearing Branch

The clearing branch for the specified customer bank code is displayed in this field.

Bank City

The system displays the bank city.

Additional Customer Details

Click on ‘Additional Customer Details’ to maintain the additional details of the customer.

Customer Address

You can specify the address of the customer involved in the contract. You can specify up to five lines of address information.

Customer Information

If you need to specify other information regarding the customer of the transaction, free format 35-character text fields are provided, with appropriate labels applicable for your installation. You can specify the customer information such as Surname, Email, ID No, Telephone and Customer Reference in these fields.

Communication Mode

Indicate the mode of the communication to the customer to intimate about the beneficiary account credit. You can select one of the following options:

- Mobile

- Email ID

The above field is enabled only for the product that uses the NEFT clearing network, i.e., Network Qualifier of the Clearing network should be NEFT.

Customer Reference

Specify the customer reference number.

Mobile Number/Email ID

Specify the mobile number or Email ID of customer.

Customer BIC ID

Specify the Bank Identification Code for the Customer.

Customer Scheme Name Type

Select the Identification Scheme Type of the Customer from the drop-down list and the available options are:

- C - Code

- P - Proprietary

Customer Scheme Name

Specify the value for Identification Scheme Name field.

If Scheme Name type is C then the Scheme Name can be selected from LOV and can have one of the values mentioned in value list depending on Organization Identification or Private Identification.

If the Scheme Name Type is P then you can enter the value for the field.

Customer Identification details

You need to specify customer identification details of the customer of the transaction, free format 35-character text fields are provided, with appropriate labels applicable for your installation.

You can specify the following details:

- Identification

- Identification Value

- Country

- Issuer

- City Of Birth

- Country of birth

Counter party Details

The Bank Code, Name and City details are displayed on the Transaction Input screen when you select the bank code.

Account Number

You can specify the account of the counterparty here. In case of internal transfers, the account needs to be a valid account of Oracle FLEXCUBE either in Oracle FLEXCUBE or in the Local Clearing Format. You can also select an account number from the option list provided. In such a case, the system will default the counterparty name and the address lines as maintained for that account. If at the time of selection of counterparty account, Bank Code is null, then Bank Code and Name will also get defaulted.

Counter party Name

Specify the nameof the customer (counter party).

You can click ‘Learning Database’ button to invoke the learning database to specify the counter party details. All counter parties involved with the specific customer of the contract, are displayed in the learning database.

You can select the Counter party Bank Code, Counter party Account Number and Name of the required counter party.

Bank code

Select a valid bank code maintained in Oracle FLEXCUBE. If you select a code from the option list, the bank name is displayed instantly. If you choose to enter the code, the name of the bank is displayed when you save the transaction.

Validations for counterparty details for bank transfers:

- For bank-to-bank transfers it is not mandatory to specify the counterparty account and name. If you indicate only the counterparty bank code it is considered as a beneficiary institution. If you indicate both the Counterparty Bank Code and Counterparty Name, the Counterparty Bank Code is interpreted as the Account With Institution, and the Counterparty Name is interpreted as Beneficiary Institution.

- If both the Counterparty Bank Code and Counterparty Name are specified for bank-to-bank transfers, the system validates the Counterparty name with that maintained in the PC Bank Directory. The System also checks to ensure that both the Counterparty Bank Code and Counterparty Name have been defined with the same Bank Code Type.

Bank Name

Specify the counterparty bank name.

Bank Address 1

Specify the address of the counterparty bank.

Bank Address 2

Specify the address of the counterparty bank.

Virtual Account

Specify the virtual account number in this field. Based on the virtual account code and transaction currency, the system derives the linked physical account. If no physical account is mapped, then the default physical account linked to the virtual account is derived.

If you change the defaulted physical account and if is not linked to the virtual account then system will replace the derived physical account providing an override for the same.

Virtual Account will not be allowed for Outgoing Payments (as it is applicable only for Credit transactions) and Collections.

Virtual Account Name

The account name of the virtual account number is displayed in this field.

Additional Counterparty Details

Click on ‘Additional Counterparty Details’ to maintain additional details on the counterparty.

Counterparty Information

If you need to specify other information regarding the counterparty of the transaction, free format 35-character text fields are provided, with appropriate labels applicable for your installation.

You can specify the counterparty information in these fields:

Surname

Specify the surname of the counterparty.

Father Name

Specify the father’s name of the counterparty.

Telephone

Specify the contact number of the counterparty.

Email ID

Specify the email Id of the counerparty.

Facebook ID

Specify the facebook Id of the counterparty.

Remarks

Specify remarks, if any.

Counterparty Address

You can specify the address of the counterparty involved in the contract. You can specify up to five lines of address information.

Counterparty BIC ID

Specify the Bank Identification Code for the Counterparty.

Counterparty Scheme Name Type

Select the Identification Scheme Type of the Counterparty from the drop down list.

The valid field can be:

- C - Code

- P - Proprietary

Counterparty Scheme Name

Specify the value for Identification Scheme Name field.

If Scheme Name type is C then the Scheme Name can be selected from LOV and can have one of the values mentioned in value list depending on Organization Identification or Private Identification.

If the Scheme Name Type is P then you can enter the value for the field.

Counterparty Date of Birth

Specify the date of birth of the Counterparty.

Counterparty Identification details

You need to specify other information regarding the counterparty of the transaction, free format 35-character text fields are provided, with appropriate labels applicable for your installation.

You can specify the following details:

- Currency

- ID

- ID Type

- ID Value

- Other ID Type

- Country

- Issuer

- City Of Birth

- Country Of birth

Counterparty Bank

Direct Participant

This is the Direct Participant for the Counterparty BIC and is derived from the Clearing Network information maintained in the ‘PC Bank Directory’ screen. Only if the counterparty is an indirect participant of the network, the system displays the direct participant of the corresponding counterparty BIC. In case of counterparty being direct participant, the field is null.

Transaction Details

Book Date

The system displays the book date of the transaction.

Activation Date

This is the activation date of the contract. The system defaults to the current date. However, you can change this. Since you can post back-value dated PC transactions, for the purpose of risk tracking you can indicate a date beyond which users will be prevented from posting a back value dated transaction by enabling the Back-Value Check Required in the ‘Branch Preference’ screen. The System validates whether the activation date falls within the maximum period up to which back valued posting can be processed.

Transaction Currency

Enter the currency for the transaction. You can click on the adjoining option list to choose from a list of valid currency codes maintained in the system. Input to this field is mandatory. If the network ID is input, then the system will be display the currency linked to the clearing network in this field. If the product code is input, then the system will display the currency linked to the product in this field. You will not be able to change the defaulted value. The system will ensure that this currency code is the same as that linked to the product code and network ID of the contract.

Amount

This refers to the transaction amount, i.e. the actual amount transferred during the transaction. For example, if the you have maintained the Charge Mode’ as ‘Discount’ at the Product Preference level, then the actual amount sent to the beneficiary will be the difference between transaction amount and charge.

On saving the transaction after entering all the required details in the system, the system validates the value of the transaction amount against the following:

- Product transaction limit

- User Input limit

If the transaction currency and the limit currency are different, then the system converts the amount financed to limit currency and checks if the same is in excess of the product transaction limit and user input limit. If this holds true, the system indicates the same with below override/error messages:

- Number of levels required for authorizing the transaction

Transaction amount is in excess of the input limit of the user

Foreign Currency Amount

The system displays the foreign currency which is involved in the PC transaction.

Remitted Amount

The system displays the remitted amount that is involved in the PC transaction.

LCY Equivalent

The system displays the transaction amount in the local currency.

Total Charge Amount

This field displays the total charge amount in local currency which is the sum of all the charge amount computed or specified for all five charge sets.

Collection Status

The status of the transaction is displayed at the bottom of the screen.

The following details are displayed.

- Contract Status

- Authorization Status

- Exception Queue

- Collection Status

Exchange Rate

The exchange rate of the transaction will be displayed in case the customer account is in a foreign currency (only for payment transactions).

Exception Queue

The name of the queue to which the transaction is logged in case of any processing exception is displayed here

Message Status

If the outgoing payments workflow is applicable for the transaction, the status of the message is displayed here.

Batch Number

The batch number, to which the transaction will be posted, is displayed here.

Batch Description

The description associated with the batch is displayed here.

FX Contract Reference

Specify the FX Contract Reference number you need to link to the PC contract, for the currency pair. The adjoining option list displays Forward Deal Type FX contracts which are authorized and active. Select the appropriate one.

The system disables Rate Date and Rate Serial, if the FX Contract Reference number is specified.

While entering a payment contract, the system facilitates you to choose a FX forward contract. This FX forward contract must meet the following requirements:

- The FX contract must be the only Forward Deal Type

- The FX forward contract must be active and authorized.

- Option Date is mandatory for the FX forward contract

- For an outgoing PC Transaction, the Transaction Currency of the PC Transaction must be equal to the Sold Currency of the FX contract and Customer Account Currency of the PC Transaction must be equal to the Bought Currency of the FX contract.

- For Incoming PC Transaction the Transaction Currency of the PC Transaction will be equal to the Bought Currency of the FX contract and Customer Currency of the PC Transaction will be equal to the Sold Currency of the FX contract.

- For Outgoing or Incoming PC Transaction the Customer Entry Date must be greater than or equal to the Option date and less than the maturity date (min of Bought Value Date and Sold Value Date) of the FX contract

- The Customer of the PC Transaction must be the Counterparty of the FX contract

- The unutilized Amount of the FX contract must be greater than or equal to the PC Transaction amount.

- The unutilized sold Amount of the FX contract must be greater than or equal to the transaction amount for Outgoing PC Transaction or unutilized buy Amount of the FX contract must be greater than or equal to the transaction amount for Incoming PC Transaction.

- The FX forward contract linked to PC Transaction cannot be part of combination product. It cannot have NDF feature and settlement cannot be through CLS

- The FX contract linked as Collateral cannot be linked to PC Transaction.

If any of the above criteria is not met then the system displays an appropriate error message.

The following validations and processes are involved:

- FX contract can be linked only for Payment transactions.

- Linking FX contract to PC transaction is optional for cross currency transaction. If linked, then the system considers the FX contract exchange rate as the exchange rate for the PC transaction

- During creation and modification of the PC transaction, FX Contract can be linked to PC transaction

- FX contract will not be linked to a PC transaction with Auto Exchange Rate checkbox checked at PC product level.

- While saving a PC Transaction, the system triggers LINK event in FX to decrease the available utilization amount

- If the FX linked PC Transaction is deleted before authorization, then the system deletes the existing LINK event in FX to increase the unutilized amount.

- If the FX linked PC Transaction is modified before authorization,

then if;

- FX linkage is removed, the system deletes the existing LINK event in FX to increase the unutilized amount

- FX linkage is attached, the LINK event is created in FX to decrease the unutilized amount

- The transaction amount is increased, the system validates if the outstanding amount of the linked FX forward contract would cover the increased amount. If it is, then the system deletes the existing LINK event (FX with old amount) and increases the unutilized amount. This is followed by creation of new LINK event and decrease in the unutilized amount.

- The transaction amount is decreased, the system deletes the existing LINK event and increases the unutilized amount followed by LINK event to create a new linkage and decrease the unutilized amount.

- The Customer Entry Date is modified, the system will validate if the new Customer Entry Date is greater than or equal to the option date and less than the maturity date (min of Bought Value Date and Sell Value Date). If it is, then the system deletes the existing LINK event (FX with old Value date) and increases the unutilized amount followed by LINK event to create the new linkage (FX with new Value date) and decreases the unutilized amount. If the condition is not satisfied, then the system displays an appropriate error message.

- For an Outgoing Payment Transaction, if Debit Entry Liquidation (DRLQ) event is triggered, then the system creates PLIQ event in FX to pass the reverse contingent entries to the equivalent amount of the PC Transaction.

- For PC Incoming Payment Transaction, if Credit Entry Liquidation (CRLQ) event is triggered, then the system creates PLIQ event in FX to pass the reverse contingent entries to the equivalent amount of the PC Transaction.

- If the FX linked PC Transaction (future dated) is amended after authorization,

then if

- FX linked is removed, the system creates DLNK event FX to increase the unutilized amount.

- New FX linkage is created, the system creates LINK in FX to decrease the unutilized amount

- The transaction amount is increased, the system validates if the outstanding amount of the linked FX forward contract would cover the increased amount. If it is, then the system triggers DLNK event to delink the old linkage (FX with old amount), increase the unutilized amount followed by LINK event to create the new linkage (FX with new amount) and decrease the unutilized amount.

- The transaction amount is decreased, the system triggers DLNK event to delink the old linkage, increase the unutilized amount. This is followed by LINK event to create the new linkage and decrease the unutilized amount

- The Customer Entry Date is modified, the system validates if the new Customer Entry Date is greater than or equal to the Option Date and less than the maturity date (min of the Bought Value Date and Sell Value Date). If it is, then the DLNK event will delink the old linkage (FX with old Value date) and increase the unutilized amount. This is followed by LINK event to create the new linkage (FX with new Value date) and decrease the unutilized amount.

- If in FX linked PC Transaction the Customer or the Currency is modified, then the system will not allow you to save transaction, unless the linked FX Contract is removed from the PC Transaction

- Reversal of FX linked PC transaction before liquidation will decrease the FX contract utilization. However, if the reversal is after liquidation, it will have no impact on the utilization of the FX contract. So if the PC contract is reversed prior to liquidation, then the system will send DLNK details to FX contract to update the utilization.

Customer Consolidation at Product Level

Specify the preference for consolidating customer at product level, by selecting an appropriate option from the drop-down list. The options available in the drop-down list are:

- Yes

- No

- Blank

Customer Consolidation Across Products

Check this box to consolidate the transactions of a customer across the products.

Customer Consolidation Reference

The system displays the customer consolidation reference number. If ‘Customer Consolidation at Product Level’ or 'Customer Consolidation Across Products' is checked, then a unique customer consolidation reference number is captured for all those transactions booked Manually. If 'Customer Consolidation Across Products' is checked then system populates the customer consolidation reference number with Payment Information ID generated at the Common Payment Gateway for all those transactions consolidated for a customer across different products.

Account Entry Reference

The system displays the account entry reference.

Service Level Code

Priority, which is a user defined field, set at the product category level is defaulted in this screen.

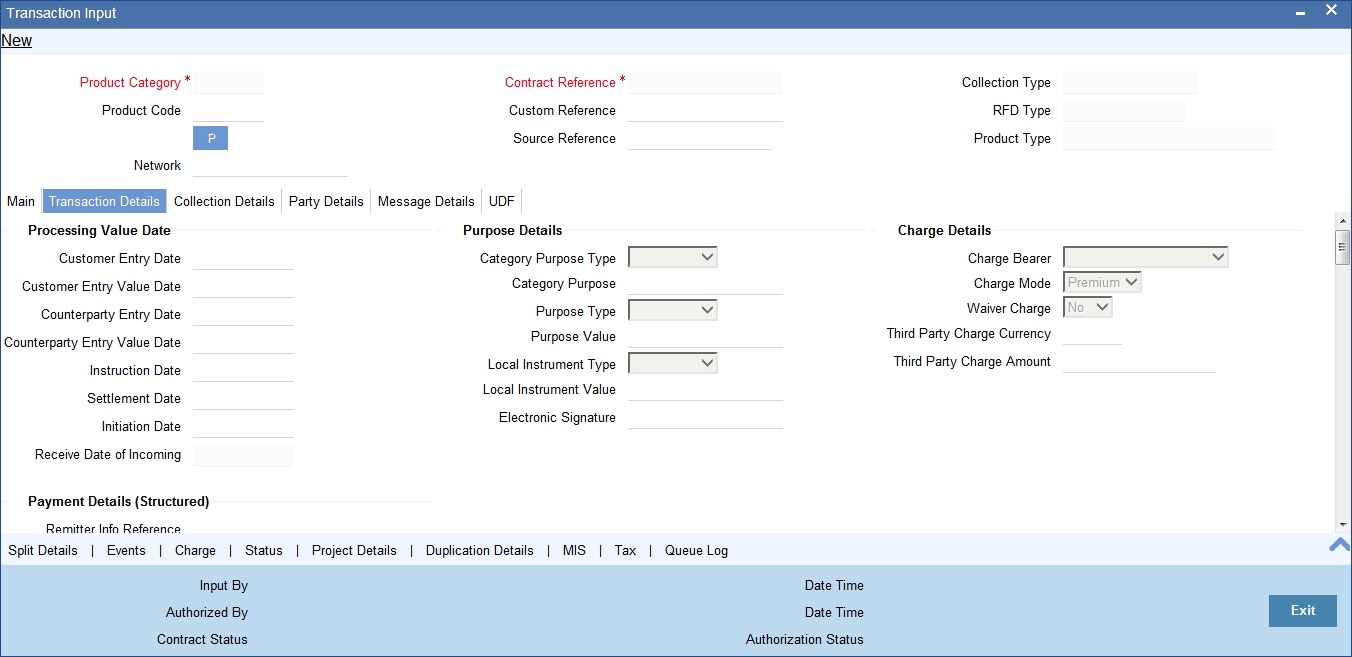

5.1.3 Transaction Details Tab

Click on the ‘Transaction Details’ tab to capture transaction details.

Processing Value Date

Customer Entry Date

This indicates the date on which the customer account will be debited for outgoing transfers and credited for incoming transfers. If you do not input a date here, it will be derived from the activation date by adding the working days to the value of customer entry days specified for the product. The values will be used based on the cutoff status of the transaction.

Customer Entry Value Date

This indicates the value date of the debit entry for outgoing transfers and credit entry for incoming transfers. If you do not input a date, it will be derived from the activation date by adding the working days to the value of customer entry value days specified for the product. The values will be used based on the cutoff status of the transaction.

Counterparty Entry Date

This indicates the date on which the counterparty account will be credited for outgoing transfers and debited for incoming transfers. If you do not input a date, it will be derived from the activation date by adding the working days to the value of counterparty entry days specified for the product. The pre/post cutoff values will be used based on the cutoff status of the transaction.

Counterparty Entry Value Date

This indicates the value date of the credit entry for outgoing transfers and debit entry for incoming transfers. If you do not input a date, it will be derived from the activation date by adding the working days to the value of counterparty entry value days specified for the product. The pre/post cutoff values will be used based on the cutoff status of the transaction.

Instruction Date

This indicates the requested execution date of the SCT transaction and Collection due date of an SDD transaction. This is a display only field.

Settlement Date

Specify the inter bank settlement date of the incoming instruction.

Initiation Date

The date and time when the transaction was received through the Electronic Banking System is displayed.

Receive Date of Incoming

The system displays the incoming receive date.

Purpose Details

Category Purpose

Specify the category purpose of the credit transfer from the option list.

Purpose Type

Select the purpose type of the credit transfer from the drop-down list. Following are the options available in the drop-down list:

- Proprietary

- Code

Purpose Value

Specify the purpose value of the credit transfer.

Local Instrument Type

Select the local instrument type from the drop-down list. Following are the options available in the drop-down list:

- Proprietary

- Code

The value for the field is defaulted as 'CODE'. The field is enabled if the 'product type 'is 'Outgoing Collection'.

Note

- If the 'Collection Scheme type' is maintained at product level, then system validates 'local instrument value' to 'Collection Scheme Type' value maintained at product level and 'local instrument type' as 'Code'.

- If the 'Collection Scheme type' is not maintained at product level, then System will not validate on 'local Instrument value' and 'Local instrument type'.

- If 'product type' is 'Incoming Collection',STP rule and Setup are done in such a way that value of 'Local Instrument value' is considered in addition to the existing parameters to resolve in to the product with collection scheme type as 'COR1,CORE and B2B'.

- A new static data for the ISO Code 'FF05' with description as 'Invalid Local Instrument Code' will be released.

- A new static data for an error code 'PC-SVV-09K' will be released and used if Debtor mandate not found for shorter time cycle transactions.

- A new static data for an error code 'PC-SVV-09L' will be released and used if Creditor mandate not found for shorter time cycle transactions.

- During incoming Collection Processing, System checks for the Debtor Mandate created for shorter time cycle transactions (COR1), if it is not found then it raises an error (FF05).

- The error code 'PC-SVV-09K' is mapped with ISO Code 'FF05' in 'Payments & Collections Auto Reject Mapping Maintenance' screen (PCDERRCD) in order to reject the Incoming Collection Transaction automatically when debtor mandate not found. If auto reject mapping is not configured then incoming collection transaction will be moved into Transaction Repair (TR) queue.

- During Outgoing Collection Processing, System checks for the creditor mandate created for shorter time cycle transactions. If it is not found then it will display an error (PC-SVV-09L) and saves the transaction.

Local Instrument Value

The value for the field is defaulted from the 'collection scheme type 'field, maintained at product level. You can modify this value. The field is enabled if the 'product type 'is 'Outgoing Collection'.

- The Local Instrument Value defaulted or entered for the transaction should be same as the Collection Scheme Type of the outgoing collection Product. Validation would be added for the same.

- Static data for error code 'PC-SVV-09N' would be available and used when Local Instrument Value and Collection Scheme Type doesn't matches.

- If Local Instrument Value is not specified for outgoing collection, the collection scheme type specified at the product would be defaulted with Local Instrument Type as 'Code'.

- If 'Collection Scheme Type' is not maintained at product level then system will not validate on 'Local Instrument Value' and 'Local Instrument Type'.

- Validation will be done such that for the Collection Scheme type 'B2B', the selected customer should not be of type 'Individual'.

- During processing, if Local Instrument Value is 'B2B' and if Creditor's account is individual customer's account then system will raise an error 'PC-SVV-09M'.

- In case the creditor account is Joint account then the customer type of the main customer only will be checked. Customer types of the joint customers will not be checked.

Electronic Signature

Specify the electronic signature of the debtor.

Charge Details

Charge Bearer

This indicates which party will bear the charges associated with the payment. This value is received from the incoming SEPA instruction and you are not allowed to change this. For manually input transaction this will be defaulted from the Product Maintenance.

Charge Mode

You can indicate whether charges applicable for the transaction are to be applied over and above the transaction amount (premium) or subtracted from the transaction amount (discount).

Waive Charge

This field defaults the value of charge waiver from the product preference maintenance. Also, the option in this field can be changed and the selected option is reflected across the individual charge waivers for all charge sets.

Third Party Charge Currency

Select the third party charge currency from the adjoining option list.

Third Party Charge Amount

Specify the third party charge amount.

Payment Details (Unstructured)

Remitter Reference

Specify the remitter reference number.

Remitter Code

Specify the remitter code.

Remitter Information Issuer

Specify the issuer of the remitter information.

Additional Remittance Info

Specify additional remittance information, if any.

Structured Invoicee Details

Identification Type

Select the identification type from the adjoining drop-down list. The options available are:

- Private

- Organization

BIC

Specify the bank identifier code.

Name

Specify the name of the invoicee.

Address 1 and 2

Specify the address of the invoicee.

Country

Specify the country of the invoicee.

Structured Invoicer Details

Identification Type

Select the identification type from the adjoining drop-down list. The options available are:

- Private

- Organization

BIC

Specify the bank identifier code.

Name

Specify the name of the invoicer.

Address 1 and 2

Specify the address of the invoicer.

Country

Specify the country of the invoicer.

Payment Details (Structured)

Payment Details 1, 2, 3 and 4

Specify the payment details.

Sender Receiver Information

Sender Receiver Details

Specify the sender receiver details.

Sender Receiver 1, 2, 3 and 4

Specify the sender receiver information.

P2P Payments

Customer Debit Reference Number

The system displays the customer debit reference number.

Note

If the P2P payment type is ‘Customer Debit’, then the customer debit reference number will be same as the contract reference number.

If the P2P payment type is ‘Test Transaction’ or P2P Final Payment, then the customer debit reference number will be customer debit reference.

Amount Block Reference Number

The system displays the amount block reference number.

Test Transaction Reference Number

The system displays the test transaction reference number.

Note

If the P2P payment type is ‘Customer Debit’, then the test transaction reference number will be null.

If the P2P payment type is ‘Test Transaction’, then the test transaction reference number will be same as the contract reference number.

If the P2P payment type is ‘P2P Final Payment’, then the test transaction reference number will be reference number of the test transaction involved in P2P payment.

P2P Payment Type

The system displays the value maintained for ‘P2P Payment Type’ maintained for the product in the transaction.

Processing P2P Final Payment

During the P2P final payment transaction, an outgoing payment is created for P2P Final Payment Transaction. When the customer debit transaction is processed, the customer ledger in the debit liquidation is replaced with the suspense GL of the bank for debiting the transaction amount. The debit GL used for debit liquidation is maintained at contract level. This GL is used during the reject of P2P final payment transaction processing to credit the transaction amount in credit liquidation. When an ‘Amount Block’ request is processed, the amount block on senders’s account is released. Hence for the final payment the transaction amount will be debited from sender’s account and will be credited to the clearing suspense GL.

Processing P2P Customer Debit Payment

During customer debit transaction, an outgoing payment of type ‘Book Transfer’ is created. You have to specify the email ID, telephone number or facebook details for the transactions with P2P payment type as ‘Customer Type’. For the customer type other than ‘Customer Debit’, it is mandatory to specify the counterparty bank code and counterparty account umber details. During the customer debit transaction processing, following transaction data would be logged into 'P2P Payment Beneficiary Registration Queue' to track the beneficiary registration till the end date:

- Contract Reference Number

- Branch Code

- Sender Account Number

- Beneficiary's Email ID

- Beneficiary's Telephone

- Beneficiary's Facebook ID

The end date for the beneficiary registration is derived based on the 'Registration Period in Days' parameter value from P2P payments parameters level. The derived end date will also be logged into 'P2P Payment Beneficiary Registration Queue'. Credit GL used for the credit liquidation will be maintained at contract level. This GL is used during the Reject of customer debit transaction processing for debiting the transaction amount in debit liquidation.

Processing Amount Block

The system creates an amount block on the sender's account for the transaction amount on receipt of amount block request from the external system. A failure response message is sent to the external system in case of any error during amount block processing.

During the amount block processing, following transaction data would be logged into 'P2P Payment Beneficiary Registration Queue' to track the beneficiary registration till the end date.

- Amount Block Number

- Branch Code

- Account Number

- Beneficiary's Email ID

- Beneficiary's Telephone

- Beneficiary's Facebook ID

The end date for the beneficiary registration would be derived based on the 'Registration Period in Days' parameter value from P2P payments parameters level.The derived end date is logged into 'P2P Payment Beneficiary Registration Queue' and will be updated as expiry date in Amount Block Input function.

Exception Details

Reject Code

The reject code, if any, that was specified for rejection of the transaction, is displayed here.

Reject Detail

The reject reason, if any, corresponding to the reject code is displayed here.

Reject Code Additional

This is the reject reason for the reject messages. This will be used in case the reject reason is not covered by available ISO reject codes.

Compensation Amount

Specify the amount that the debtor bank has to receive from the creditor bank.

It should always be Euro (EUR)

Their Reference

This is the reference number of the counterparty bank for collections (for instance, incoming collections). This is the reference that would be sent back when any responses are sent back to the counterparty bank.

Original Collection Reference

If you are rejecting or recalling a collection transaction, you must specify the reference number of the original collection transaction.

CSM Reject Reference No

The system displays the CSM reject reference number.

CSM Reject Code

The system displays the ISO reject code for the rejection from Clearing Settlement Mechanism.

CSM Reject Detail

The system display the CSM Reject Detail to describe the ISO reject code for the rejection from CSM.

Reject Originator Name

The system displays the reject originator name.

Reject Originator Bank

The system displays the reject originator bank.

Reject Reference Number

The system displays the reject reference number.

Payment Reject Date

Specify the payment reject date from the adjoining calendar.

Other Details

Cutoff Status

This indicates if the transaction was received before the cutoff time defined for the product.

Cover required

The system displays the cover message preference you have maintained for the counterparty as part of the Clearing Network maintenance. The system defaults the values in Direct Participant and Cover field only if you have maintained the information for the contract. In case you have maintained the counter party bank code without a clearing network, the system defaults the values for both the above fields only after you save the contract.

Generate Advice

You can indicate whether a customer advice needs to be generated for the contract. If you do not specify this, after product resolution, the transaction acquires the specification defined for the product.

Generate Remit Slip

Check this box to generate remit slip.

Bank Redirect

Check this box to indicate whether the transaction must be redirected from the customer or counterparty bank to any other bank.

Auto Response

Indicate if a system generated response is required for the collection transaction.

Account Redirected

Check this box to redirect the transaction from customer or counterparty account to any other account.

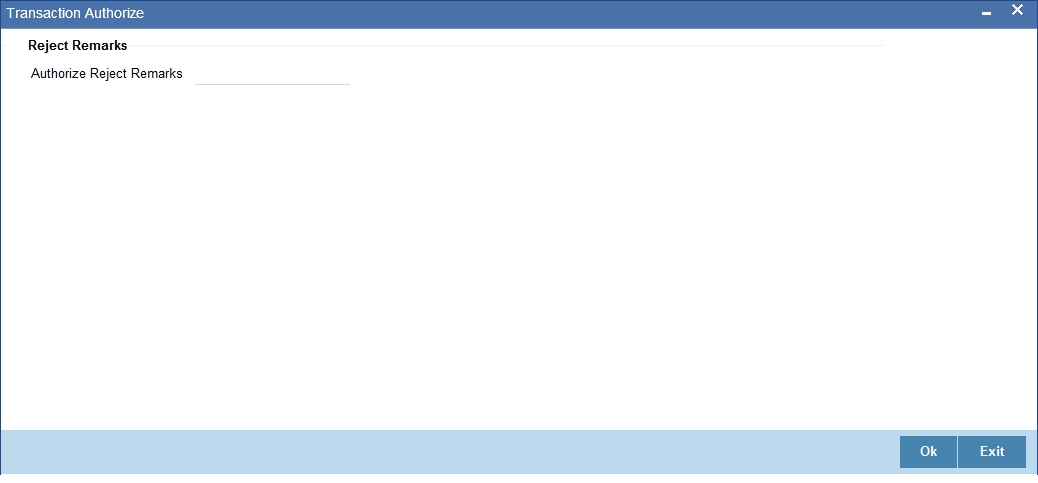

Auth Reject Remarks

The system displays the authorization reject remarks.

Payment Reference

Station ID

The system displays the station identification

Clearing System ID

Specify the clearing system identification.

Priority

The system displays the priority order of the messages.

Source Code

The system displays the source code.

Event Details

Last Event Code

The system displays the last event code.

Next Event Code

The system displays the next event code.

Next Event Date

The system displays the next event date.

Payment Split Details

You can maintain the following payment split details here:

Split Number

Specify a valid number for the payment split.

Split Transaction Reference

Specify a valid transaction number for payment split.

Split Indicator

Select a valid indicator for the payment split from the adjoining drop-down list. The list displays the following values:

- Not Applicable

- Parent

- Child

Invoice Split Required

Check this box if you need to invoice the split required.

5.1.4 Collection Details Tab

General Collection Details

Creditor Identification

For an Incoming Collection transaction or its reject / recall, mention the Creditor ID

Agreement Identification

For Collection transactions, enter the Creditor or Debtor Agreement ID as applicable.

Debtor Category

Select the debtor category from the adjoining option list.

Mandate/ Agreement Details

Sequence Type

Select the sequence type of the DD transaction as first collection or One-off. The following options are available:

- FRST – First Collection

- FNAL – Final Collection

- OOFF – One Off Transaction

- RCUR – Recurring Transaction

Sign Date

This indicates the date on which the mandate was signed by the debtor. This would be defaulted based on the mandate ID selected. This is a display only field.

Amend Indicator

Select the option to indicate if the mandate has been amended or not. The values available in the drop down are ‘Yes’ and ‘No’. The value that you select here is populated in the outgoing message for an outgoing collection transaction.

Amend Type

Specify the type of mandate amend that has been done. This is applicable only if ‘Mandate Amend Ind’ is selected as ‘Yes’. This value is populated in the outgoing message of the outgoing collection transaction

Original Mandate ID

Specify the original mandate ID if the mandate is amended. This is applicable only if amend indicator is selected as ‘Yes’.

Orginal Debtor Account

Specify the original Debtor Account under the scheme if the mandate is amended. This is applicable only if amend indicator is selected as ‘Yes’ scheme if the mandate is amended. This is applicable only if amend indicator is selected as ‘Yes’.

Original Debtor Bank

Specify the original Debtor bank BIC under the scheme if the mandate is amended. This is applicable only if amend indicator is selected as ‘Yes’.

Creditor Scheme Details

Scheme Identification

Select the scheme identification code of the creditor from the drop-down list. Following are the options available in the drop-down list:

- Private Identification

Scheme Identification Type

Specify the scheme identification type of the creditor from the option list.

Scheme Identification Value

Specify the scheme identification value of the creditor.

Scheme Type

Specify the scheme type of the creditor.

Original Creditor Scheme Details

Identification

Select the scheme identification code of the original creditor from the drop-down list. Following are the options available in the drop-down list:

- Private Identification

Creditor Name

Specify the name of the original creditor.

Identification Value

Specify the scheme identification value of the original creditor.

Scheme Type

Specify the scheme type of the original creditor.

Other Details

Collected Amount

Specify the collected amount.

Related Transaction

The system displays the related transaction.

Response Date

Specify the date beyond which an incoming collection transaction cannot be rejected. If you do not specify this, the date is picked up from the customer agreement.

Response Advice Required

Indicate whether response advice needs to be sent for this collection transaction. By default, the system picks up this specification from the customer agreement

Response Advice Basis

Specify the response advice basis from the adjoining drop-down list. the options are:

- Response Date

- Event Date

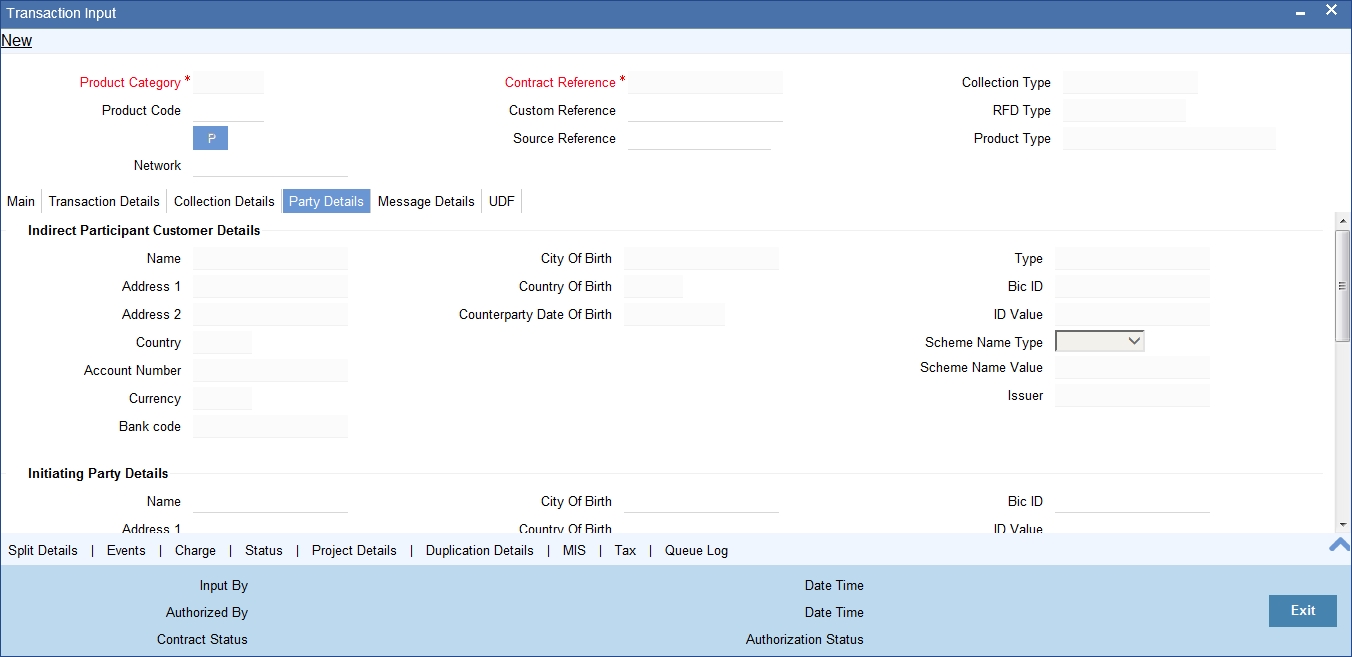

5.1.5 Party Details Tab

Indirect Participant Customer Details

Indirect Participant Customer Name

Specify the name of the customer participating in the indirect transaction.

Indirect participant Customer Address1 and 2

Specify the address of the customer participating in the indirect transaction.

Indirect participant Country

Specify the country of the customer participating in the indirect transaction.

Indirect Participant BIC ID

Specify the Bank Identification Code for the Indirect Participant.

BIC ID is only applicable for Organizational identification details.

Indirect Participant Scheme Name Type

Select the Identification Scheme Type of the Indirect Participant from the drop down list.

The valid values are:

- C - Code

- P - Proprietary.

Indirect Participant Scheme Name

If Scheme Name type is C then select the Scheme Name from the values mentioned in the LOV depending on Organization Identification or Private Identification.

If Scheme Name type is P then enter the Scheme Name your own.

Indirect Participant Date of Birth

Specify the Date Of Birth of the Indirect Participant. Input the Date of Birth is only for Private identification.

Identification Value

Specify the identification value. This is optional.

Issuer

Specify the Identification Issuer of the customer. This is an optional field. This is applicable for Organization identification as Proprietary Identification or Private Identification.

City of Birth

Specify the city of birth of the Customer. This will be enabled and is mandatory for identification type as Date and place of birth.

Country of Birth

Select the country of birth of the Customer. Country - Specify the address country code of the customer from the option list. This is optional.

Account Number

Specify the account number of the customer participating in the indirect transaction.

Currency

Specify the currency that is used in an indirect transaction

Bank Code

Specify the Bank code of the bank that has participated in a transaction.

Initiating Party Details

Name

Specify the name of the initiating party. This is an optional field.

Address Line 1

Specify the address line1 of the initiating party. This is an optional field.

Address Line 2

Specify the address line 2 of the initiating party. This is an optional field.

Country

Select the country of the initiating party from the option list. This is a mandatory field if the address details are specified.

Issuer

Specify the Identification Issuer of the initiating party. This is an optional field. This is applicable for Organization identification as Proprietary Identification or Private Identification.

City of Birth

Specify the city of birth of the Initiating party.

Initiating Party Identification

Select the unique way of identifying the initiating party from the drop-down list. The following are the options available:

- Organization Identification

- Private Identification

Country of Birth

Select the country of birth of the Initiating Party from the option list.

Initiating Party BIC ID

Specify the Bank Identification Code of the Initiating Party.

Initiating Party Scheme Name Type

Specify the Identification Scheme Type of the Initiating party and available options are:

- C - Code

- P - Proprietary.

Initiating Party Scheme Name

If Scheme Name type is C then select the Scheme Name from the values mentioned in the LOV depending on Organization Identification or Private Identification.

If Scheme Name type is P then enter the Scheme Name your own which can contain free format text and should of length 35.

Initiating Party Date of Birth

Specify the Date Of Birth of the Initiating party.

Identification Value

Specify the identification value. This is optional.

Ultimate Debtor Details

Customer Name

Specify the name of the ultimate debtor.

ID

Select the identification code of the ultimate debtor from the drop-down list. Following are the options available in the drop-down list:

- Organization Identification

- Private Identification

ID Value

Specify the identification value of the ultimate debtor.

Issuer

Specify the other identification type issuer of ultimate debtor.

City of Birth

Specify the city of birth of ultimate debtor.

Country of Birth

Specify the country of birth of ultimate debtor.

Ultimate Debtor BIC ID

Specify the Bank Identification Code for the Ultimate Debitor.

BIC ID is only applicable for Organizational identification details.

Ultimate Debtor Scheme Name Type

Specify the Identification Scheme Type of the Ultimate Creditor and the available options are:

- C - Code

- P - Proprietary.

Ultimate Debtor Scheme Name

If Scheme Name type is C then select the Scheme Name from the values mentioned in the LOV depending on Organization Identification or Private Identification.

If Scheme Name type is P then enter the Scheme Name your own which can contain free format text and should of length 35.

Ultimate Debtor Date of Birth

Specify the Date Of Birth of the Ultimate Creditor.

Input the Date of Birth is only for Private identification.

Ultimate Creditor Details

Name

Specify the name of the ultimate creditor.

ID

Select the identification code of the ultimate creditor from the drop-down list. Following are the options available in the drop-down list:

- Organization Identification

- Private Identification

ID Value

Specify the identification value of the ultimate creditor.

Issuer

Specify the other identification type issuer of ultimate creditor.

City of Birth

Specify the city of birth of ultimate creditor.

Country of Birth

Specify the country of birth of ultimate creditor.

Ultimate Creditor Name

Specify the Name of the Beneficiary Reference Party.

The field can contain any free format text of length 70.

Ultimate Creditor BIC ID

Specify the Bank Identification Code for the Ultimate Creditor.

BIC ID is only applicable for Organizational identification details.

Ultimate Creditor Scheme Name Type

Specify the Identification Scheme Type of the Ultimate Creditor.

The valid values are:

- C - Code

- P - Proprietary.

Ultimate Creditor Scheme Name

If Scheme Name type is C then select the Scheme Name from the values mentioned in the LOV depending on Organization Identification or Private Identification.

If Scheme Name type is P then enter the Scheme Name your own which can contain free format text and should of length 35.

Ultimate Creditor Date of Birth

Specify the Date Of Birth of the Ultimate Creditor. Input the Date of Birth is only for Private identification.

5.1.6 Message Details Tab

You can capture the following details here:

Dispatch Details

Dispatch

This indicates whether the contract needs to be dispatched to clearing. In case of incoming transactions, dispatch is not allowed. If you do not specify this, after product resolution, the transaction acquires the specification defined for the product.

Redispatch Required

Indicate if this outgoing collection transaction needs to be redispatched if rejected.

Dispatch Date

This is the date on which the transaction will be sent for dispatch. If you do not enter a date, it will be derived from the activation date by adding the working days to the value of dispatch days specified for the product. The pre/post cutoff values will be used based on the cutoff status of the transaction.

Recall Message Details

Message Creation Date

The system displays the message creation date.

Recall Message Reference

The system displays the recall message reference number.

Recall Message Name

The system displays the recall message name.

Recall File Reference Number

The system displays the recall file reference number.

Status

The system displays the status of the recall request.

Note

- When you generate the recall request (Camt.056) message for the contract, then the system displays the details with status as 'Sent'.

- When you receive the negative response to the recall request (Camt.029) message, then the system displays the status as 'Failed'.

If the network is SEPA then for Local Instrument Type 'CODE', the Local Instrument Value should be CORE (COR) or B2B for outgoing collection. If Local Instrument Value is not entered as COR/B2B for outgoing collection contract, then system displays an error message as Invalid Local Instrument Value, value should be either CORE/B2B'.

When the system generates Camt.056 message, then the system displays the recall details in the Message Details tab. The system changes the recall message status to Rejected if the Camt.056 message is either rejected by SEPA or Camt.029 message is received. On receipt of Pac.004, system reverses the original contract. The system does not change the recall message status to any other status as it remains 'Sent'.

Incoming Message Details

Specify the following incoming message details:

File Reference

Specify the reference number of the file that is used in the incoming message processing.

Message ID

Specify the mode to identify a message.

Message Name

Specify the name of the message that is been referred in the incoming messages.

Message Creation Date

Specify the date on which a message was created.

Instructing Bank

Specify code of the instructing bank from which the message was instructed.

Instructed Bank

Specify code of the instructed bank to which the message was instructed.

Settlement Method

Specify the settlement mode.

Outgoing Message Details

You can maintain the following outgoing message details:

Outgoing File Reference No

This indicates the file reference number of the incoming message. This is a display only field.

Outgoing Message ID

This is a unique message bulk reference number populated from the incoming instruction. This is a display only field.

Outgoing Message Name

This indicates the message name identifier of the outgoing message. For e.g. Pain.001.001.01.

Message Creation Date

This indicates the date and time the transaction was created. This is a display only field and is defaulted with the value in the incoming message.

Original Message Details

Name

This indicates the message name of the original instruction for which a new instruction is received. This is a display only field.

Reference Number

This indicates the message identification of the original instruction for which a new instruction is received. This is a display only field.

Amount

The system displays the new instructions received for the original amount.

Original Settlement Currency

This indicates the settlement amount and currency of the original instruction. This is a display only field.

Source Reference

This indicates the source reference number of the original instruction for which reject/refund is received. This is a display only field.

Settlement Date

This indicates the settlement date of the original instruction. This is a display only field.

Original Payment Info ID

Specify the unique identification, as assigned by the original sending party, to unambiguously identify the payment information group. This field maps to field Payment Info ID of Common Payment Gateway.

Redispatch Details

Redispatch Number

Specify the redispatch count for the parent transaction which is being redispatched.

Redispatch Reference

For collection transactions, specify the reference number of the parent transaction that is being redispatched.

Redispatch Indicator

This indicates whether the collection transaction has been redispatched. If it has not been redispatched, this field indicates 'Not Applicable'. If the transaction has been redispatched, this field indicates whether the transaction being viewed is a parent transaction or a child transaction.

Auto Redispatch

Indicate if this outgoing collection transaction needs to be redispatched automatically if rejected.

Redispatch Date

Specify the date of redispatch of the parent transaction

5.1.7 UDF Tab

In the ‘PC Transaction Input’ main screen, based on the preferences assigned to the product category of the transaction, the contract User Defined Fields are displayed in the UDF tab in the screen, and you can specify the values for these fields, which are applicable for the contract.

You can execute queries on the user-defined fields, and select specific records based on the user-defined fields.

You can maintain the following details:

Field Name and Description

System displays the name and description of the UDF.

5.1.8 Split Details Button

Click the ‘Split Details’ button to specify multiple debit / credit accounts for the transaction so that the ‘Split Details’ screen can be viewed.

Only leaf GL transactions involving local currency can be entered in the Split Details screen. You can specify the MIS code for each split leg using the ‘MIS’ button against each split entry.

The sum of the amounts specified in the ‘Split Details’ screen is defaulted to the main transaction input screen. The first GL account specified in the ‘Split Details’ screen is defaulted as the customer account in the main ‘PC Transaction Input’ screen, and is also used in the corresponding payment message.

Specifying Contract Split Details

Serial Number

The system displays the serial number of the contract.

Branch

The system displays the branch where a contract is present.

Account Number

The system displays the account number of the contract

Currency

The system displays the currency that is used in a transaction.

Amount

The system displays the amount here.

MIS

The system displays the MIS details of the contract

Total Amount

The sum of the split amount is displayed in this field. This amount is displayed in the main screen as the actual amount.

The following details need to be specified in the respective tabs of the Transaction Input Screen:

- Transaction Details Tab

- Split Number

- Split Parent Reference Number

- Split Indicator

- Invoice Split Required

- Authorization Reject Remarks

- Message Details Tab

- Auto Redispatch

- Redispatch Date

- Message Details Tab

- Incoming Message Details

File Ref No

Message Identification

Message Name

Msg Creation Date

Instructing Bank

Instructed Bank

Settlement Method

Note

While you are processing a transaction you have the option of retrieving details based on Product Category, Counterparty bank and Account combination by clicking the History button.

Reactivate Event Processed

This is a display field that indicates that the contract is re-activated on rejection of rejection process.

5.1.9 MIS Details Button

The MIS details for the contract can be captured through the MIS screen. Click the ‘MIS’ button from the PC Transaction Input screen to invoke the ‘Transaction MIS Details’ screen. If you do not specify MIS details for a transaction, it acquires the MIS specifications made for the product under which it is processed.

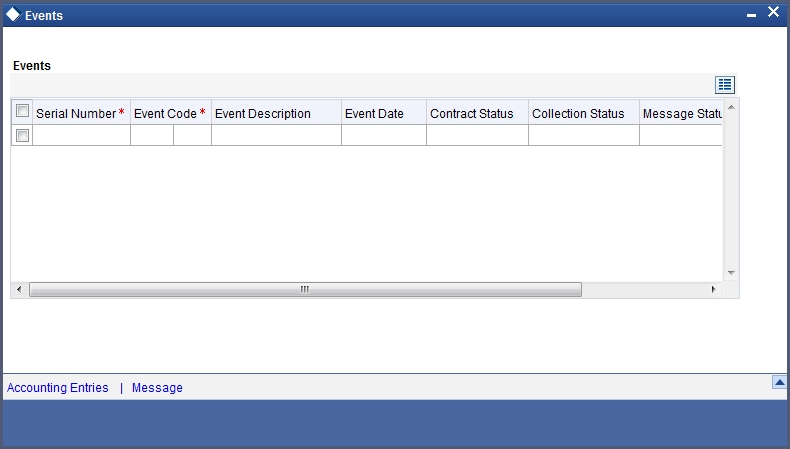

5.1.10 Event Details Button

All events, overrides, and accounting entries triggered by the user who processes the transaction during its life cycle are logged in the ‘PC Contract View Events’ screen, which you can invoke by clicking ‘Events’ button in the ‘PC Transaction Input’ screen.

The following details are displayed:

- Event Details – This provides all the user-initiated events during the life cycle of the contract.

- Accounting Details - This provides all a list of the accounting entries passed by the system for the contract. Click ‘Accounting Entries’ button in the ‘PC Contract ‘View Events’ screen to view these details.

- Override Details – Here you can view the overrides provided for the transaction during its life cycle.

- Message Details - Click ‘Message’ in the ‘PC Contract View Events’ screen to view the messages (advices) generated against each event. Click the Print button to print the advices.When you click the EXIT button the system displays a message if the advices are printed for the first time, Click OK if the print is successful

Note

When Duplicate Advice Tracker field is checked and you click the EXIT button on the advice generation screen, the system displays a message “Print Successful?”. Click OK button to confirm the successful printing. Every subsequent print of the advices will be considered as duplicate advice. For more information on Duplicate Advice Tracker refer to section “Messaging Branch Parameters Maintenance” in the Core User Manual.

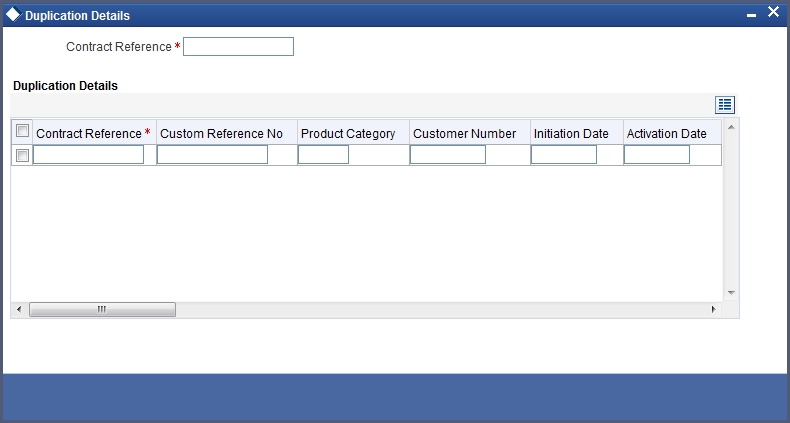

5.1.11 Duplication Details Button

The system checks for duplicate transactions while booking contracts based on the number of days for duplicate check maintained at the ‘Branch Parameters Maintenance’ screen and the duplication preferences set at the product category level. The system displays the duplicate contract reference number if there is a single match else it displays the following override message;

‘Duplicate Contracts recognized based on the product category preference’

You can view all the duplicate contracts in the ‘Duplication Details’ screen. Click ‘Duplication Details’ button in the ‘PC Transaction Input’ screen to invoke this screen.

Here you can view the following details:

- Contract reference no

- Custom Reference no

- Source Ref no

- Product Cat

- Customer Acc No

- Counterparty Acc No

- Counterparty Bank Code

- Counterparty Name

- Txn Ccy

- Txn Amt

- Activation Date

- Payment Details

Note

Duplication check is done based on the following criteria:

- Number of duplication days that is maintained at the ‘Branch Parameters Maintenance’ screen.

- Duplication recognition that is selected at the ‘Payments and Collection Product Category Maintenance’ screen,

- The duplication details are persistent and can be viewed by the authorizer too.

- If duplication details are not maintained at branch level for Payments and Collections, no duplicate checks will be carried out.

5.1.12 Project Details Button

Click the ‘Project Details’ button in the ‘Payments & Collections Transaction Input’ screen and invoke the ‘Project Details’ screen. You will have to capture project details in this screen only if the credit account is a Trust account.

Specify the following details:

Project Name

Specify the developer project name for which payment is being made. The adjoining option list displays all valid projects maintained in the system. You can select the appropriate one. Input to this field is mandatory.

If you specify the Unit ID, the system will display the corresponding project name here.

Unit Payment

Indicate whether the transaction is a unit payment or not by choosing the appropriate value from the adjoining drop-down list. The following values are available:

- Yes

- No

Unit ID

Specify the unit ID of the project. This field will be enabled only if you have selected ‘Yes’ against ‘Unit Payment’. The adjoining option list displays all unit IDs along with the unit holder names corresponding to the project name chosen. You can select the appropriate one.

Deposit Slip Number

Specify the deposit slip number for the payment.

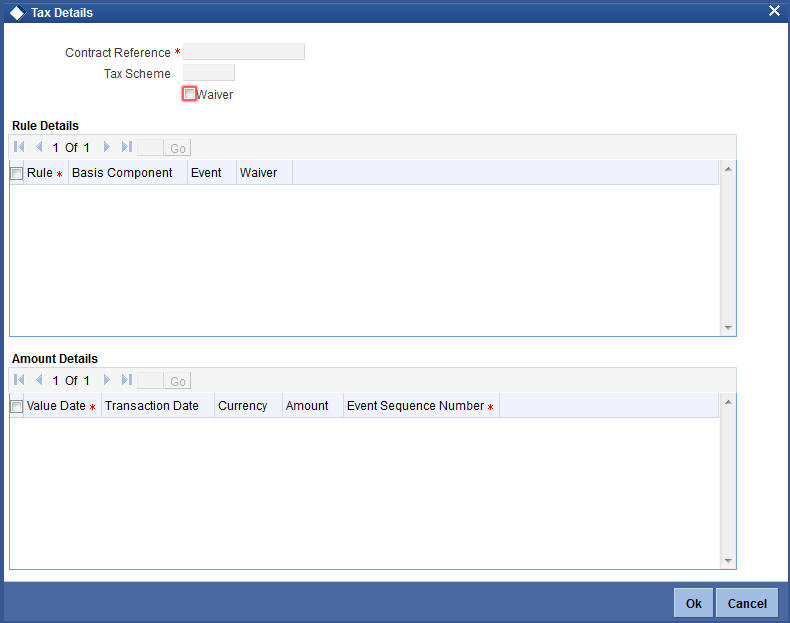

5.1.13 Tax Button

You can view a tax scheme defined in the tax. Click ‘Tax’ button in the ‘Payments and Collection Transaction Input’ screen to invoke the ‘Tax’ screen.

You can compute the tax based upon the tax rule and linked amount from PC contract and liquidate the tax in the appropriate event.

You can specify the following details:

Contract Reference

The system displays the contract reference number.

Tax Scheme

The system displays the tax scheme details.

Waiver

Check this box to indicate waiver details.

Rule Details

Rule

The system displays the rule details.

Basis Component

The system displays the basis component details.

Event

The system displays the event details.

Waiver

Check this box to indicate waiver details.

Amount Details

Value Date

The system displays the value date.

Transaction Date

The system displays the transaction date.

Currency

The system displays the currency details.

Amount

The system displays the amount details.

Event Sequence Number

The system displays the ESN details.

While saving a PC contract, for outgoing PC payment, the beneficiary bank will be the beneficiary customer. If there is no classification for the beneficiary bank, then the system will treat the contract as a normal PC contract with no applicability of FATCA. This is applicable in case of external clearing contracts also.

For an incoming PC payment, the customer who owns the account being credited will be the beneficiary customer.

If an incoming collection results in an independent outgoing payment, the system will consider FATCA applicability as part of the outgoing payment and not as part of the incoming collection. If an incoming collection results in a direct debit, then the beneficiary customer will be the bank to which the payment is being sent.

If the contract is being closed, then the system will remove the contract row from the tracking table and the customer’s FATCA balance will be updated accordingly if required.

5.1.14 Queue Log Button

Audit logs will be logged when a PC transaction is entered into the queue due to exception and an action is triggered on it. Audit logs will be triggered for the following actions on queue.

- Accept

- Carry Forward

- Retry

- Reject

- Reverse

- Post to Suspense

- Authorize

The Audit logs are captured whenever a PC transaction moves into the following queues:

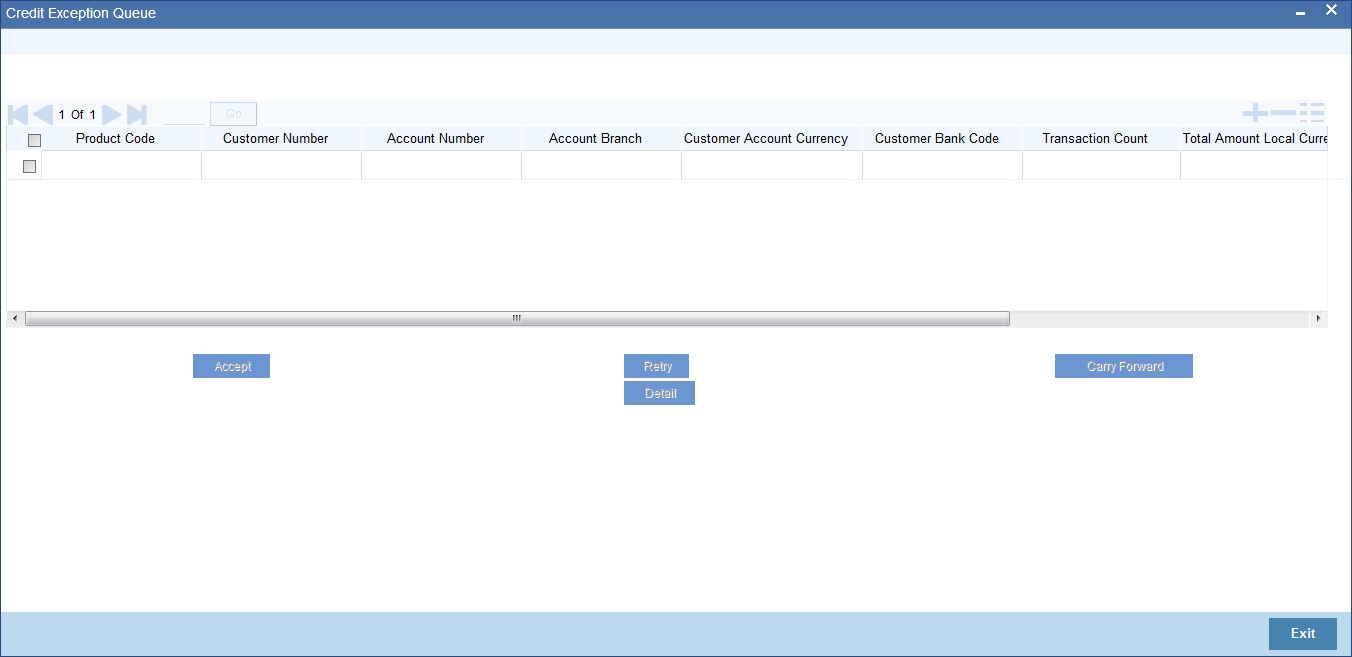

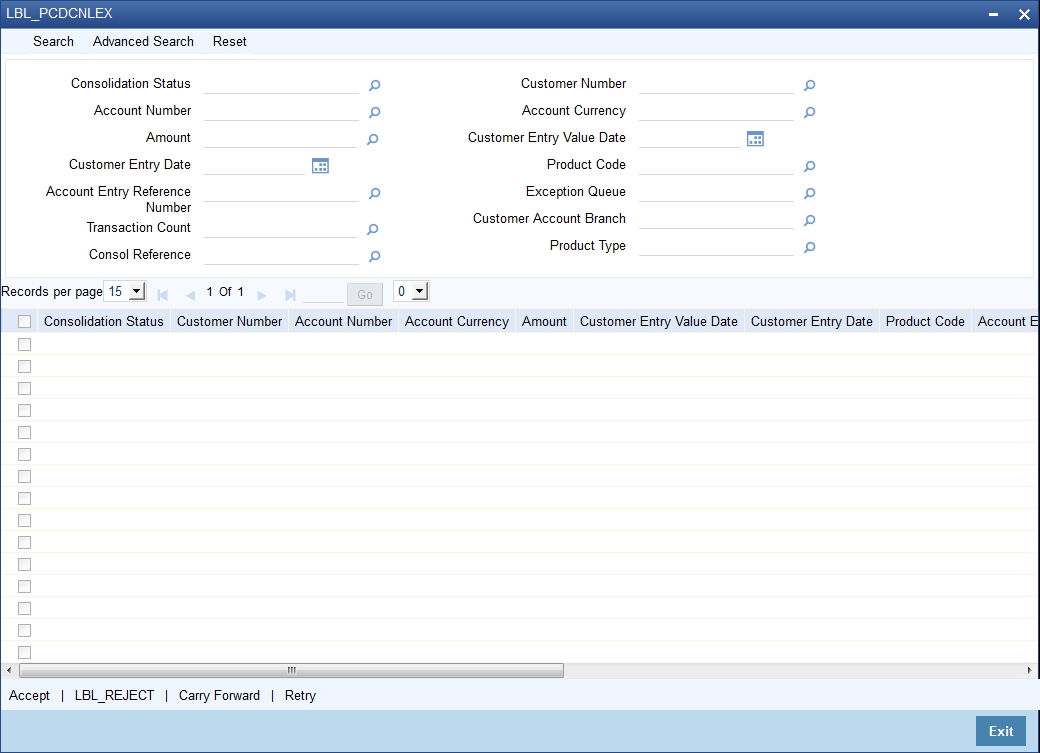

- Consolidation Exception Queue (PCSCNLEX)

- Credit Exception Queue (PCDCRXSQ)

- Credit Exception Detailed Queue (PCSCRXSD)

- Exchange Rate Queue (PCSXRXSQ)

- Incoming Authorization Queue (PCSIAUTQ)

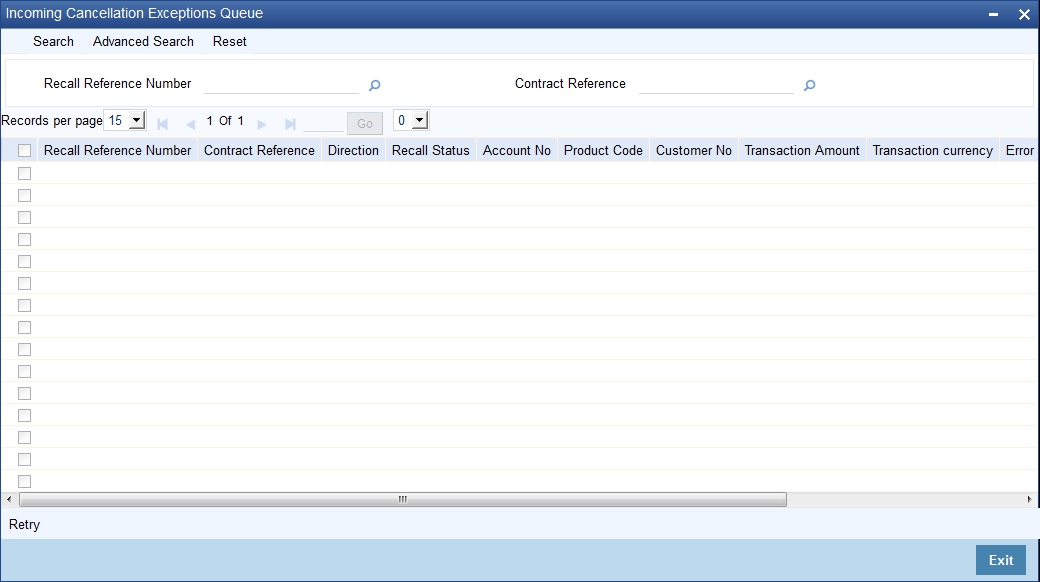

- Incoming Cancellation Exception Queue (PCSCANEX)

- Incoming Payment Repair Queue (PCSIPRSQ)

- Authorizer 1 Queue (PCSAUTQ1)

- Authorizer 2 Queue (PCSAUTQ2)

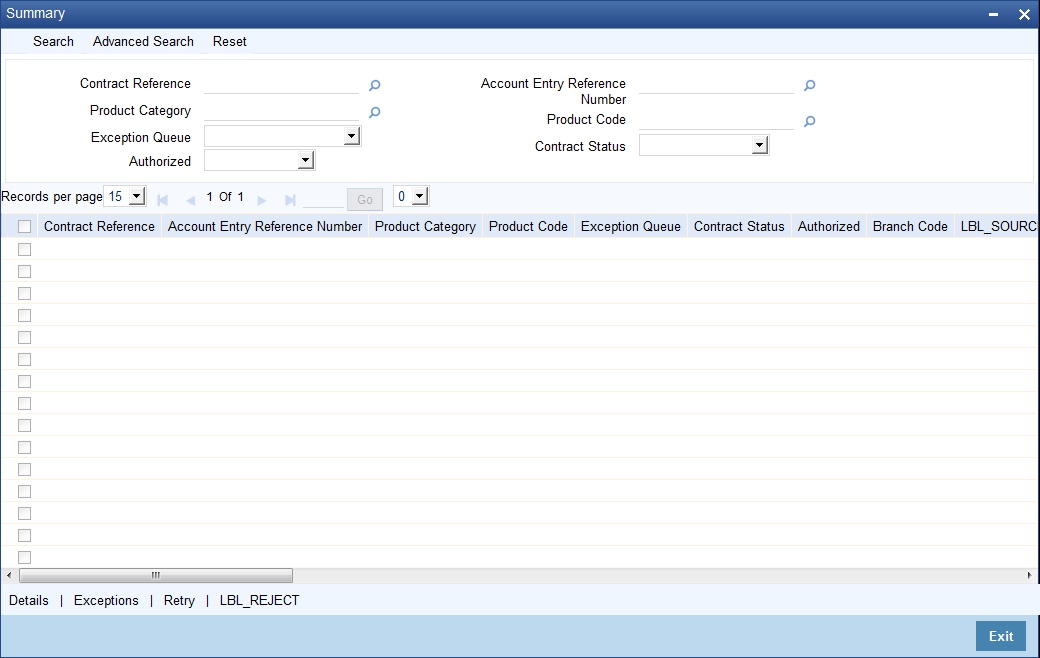

- Process Exception Queue (PCSPEXSQ)

- Release Queue (PCSRLXSQ)

- Transaction Exception Queue (PCSTEXSQ)

You can view the audit log information using the ‘Queue Log’ screen. Click ‘Queue Log’ button on the ‘Payments and Collection Transaction Input’ screen to invoke the ‘Queue Log’ screen.

You can view the following details:

User ID

The system displays the User ID.

Action

The system displays the action taken on the queue.

Date Time

The system displays the date and time when the action was taken.

Function ID

The system displays the function ID.

Queue Name

The system displays the name of the queue on which action was taken.

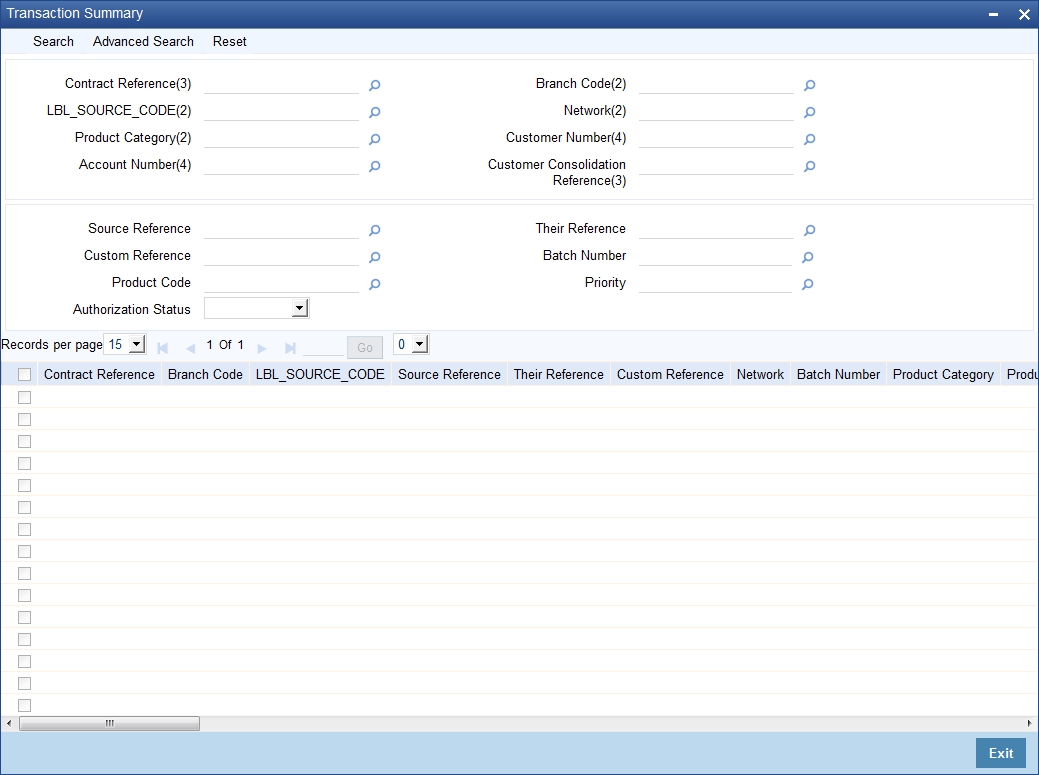

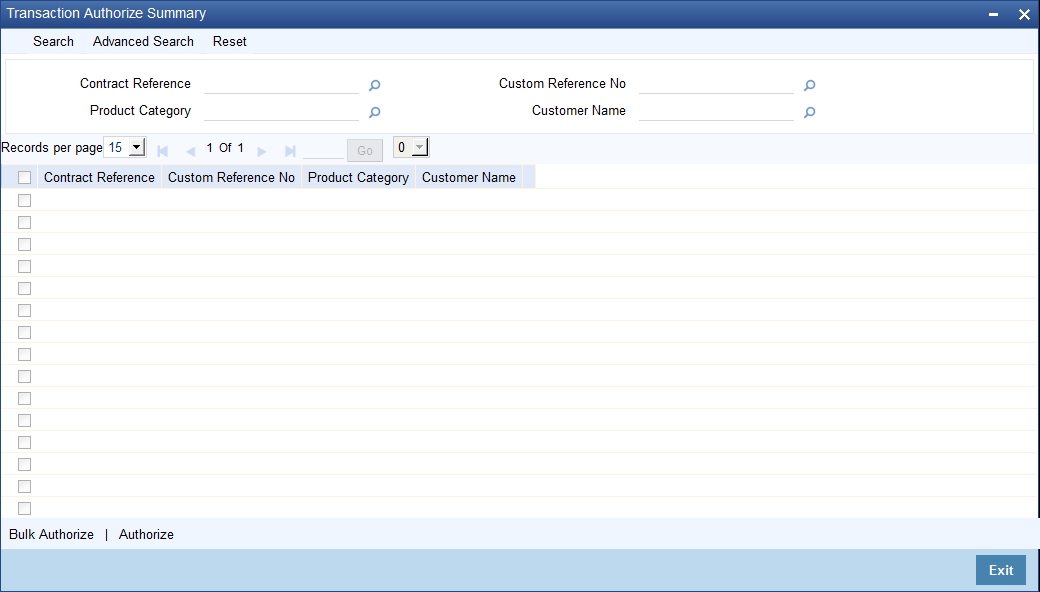

5.1.15 Viewing Payments and Collection Transactions

You can view the Payments and Collection Transactions using ‘Payments and Collection Transactions Summary’ screen. To invoke this screen, type ‘PCSTRONL’ in the field at the top right corner of the Application tool bar and click the adjoining arrow button:

You can click ‘Search’ button to view all the pending functions. However, you can to filter your search based on any of the following criteria:

- Contract Reference

- Source Code

- Their Reference

- Network

- Product Category

- Priority

- Branch Code

- Source Reference

- Custom Reference

- Batch Number

- Product Code

- Customer Number

Click ‘Search’, the system displays the following details based on the specified search criteria:

- Contract reference

- Branch Code

- Source Code

- Source reference

- Their Reference

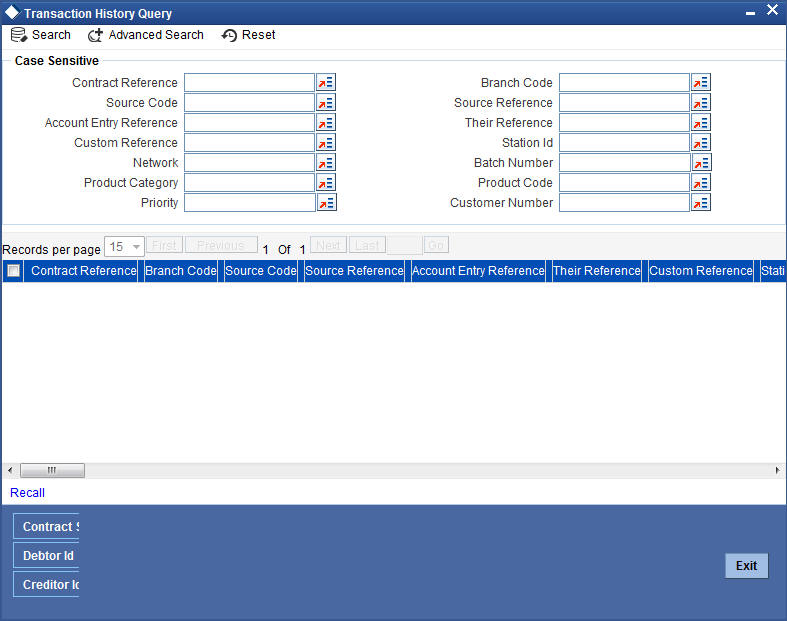

- Custom reference

- Network

- Batch Number

- Product Category

- Product Code

- Priority

- Customer Number

- Bank Code

- Account LCF

- Account Branch

- Account Number

- Account Currency

- Foreign Currency Amount

- Remitted Amount

- Exchange Rate

- Bank Code

- Account Number

- Counter Party Name

- Cutoff Status

- Activation date

- Redispatch Required

- Agreement ID

- Reject Code

- Reject detail

- Compensation Amount

- Original Collection Reference

- Clearing Branch

- Transaction Currency

- Local Currency Equivalent

- Auto/manual

- Acknowledgement Status

- Contract Status

- Reject reference Number

- Creditor ID

- Exception Queue

- Collection Status

- Authorization Status

- FX Contract Reference

- BIC ID

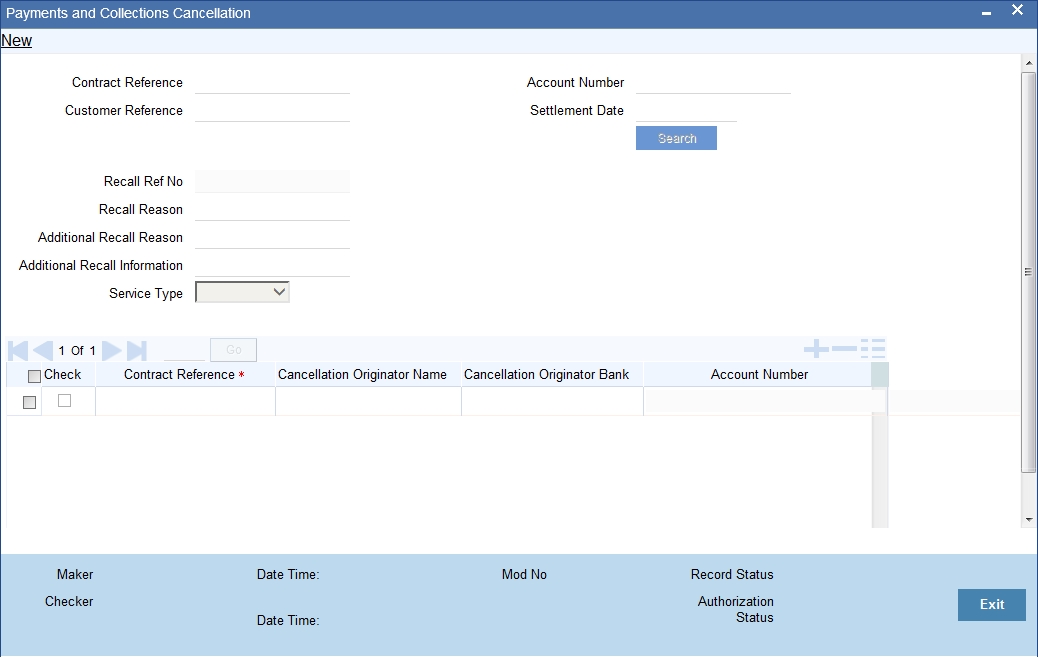

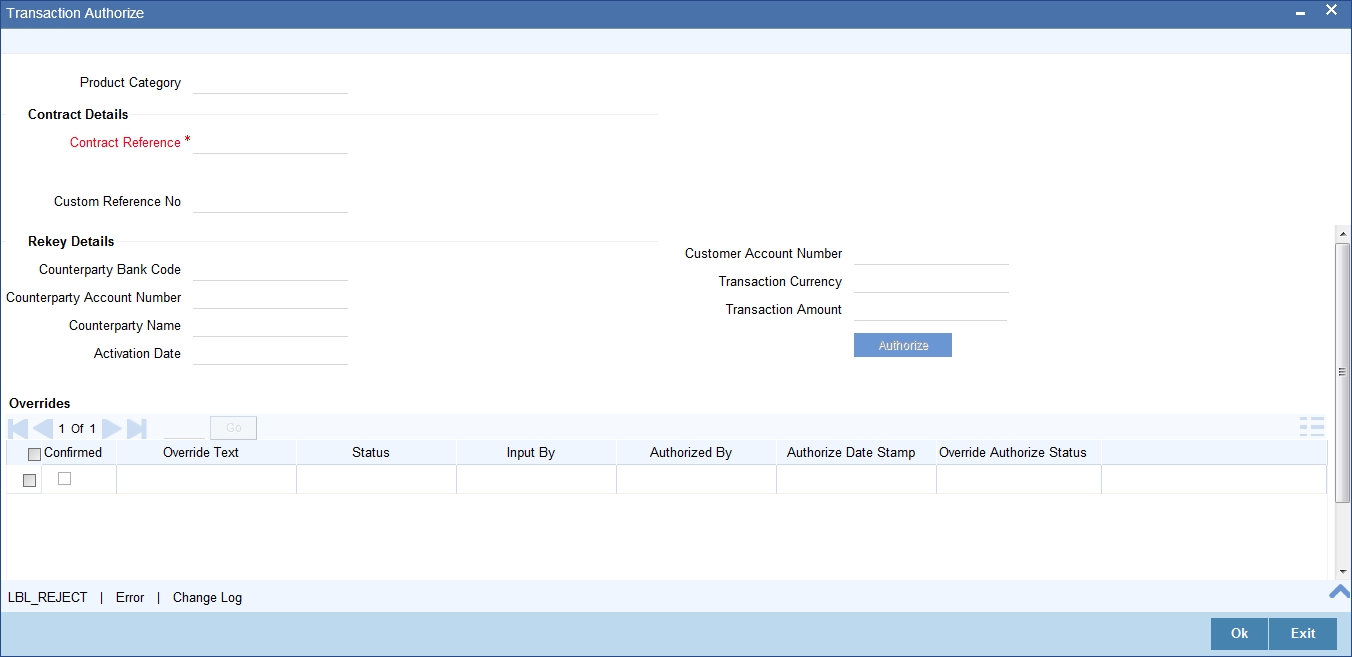

5.2 Simplified Entry of Payments and Collection Transactions

This section contains the following topics:

5.2.1 Invoking PC Fast Transaction Input Screen

For entry of transactions using the following product types, a simplified transaction entry screen, the ‘PC Fast Transaction Input’ screen, is provided to enable you to key in transactions with the basic transaction details.

- Outgoing/Incoming Payments

- Outgoing/Incoming Direct Debits

- Outgoing/Incoming Request For Debits