4. Defining Matching Rules

4.1 Introduction

There are certain standard rules that you can apply while matching nostro entries. As match rules are maintained at the bank level and are common to all the branches of your bank, you need not specify the details of a rule each time you need to use it. Instead, you can maintain its details in the Match Rule Definition screen.

The advantage of maintaining match rules is that at the time of automatically reconciling and matching external entries, you need to just specify the code assigned to the rule. All the details maintained for the rule will be automatically picked up and made applicable to the Nostro entries. This reduces your effort as you do not need to enter the parameters of a rule each time you need to use it.

Each match rule that you define for reconciling Nostro entries can be devised using the following parameters:

- Value date of the transaction

- Internal reference number

- External reference number

- The aggregation of internal or external entries

You can specify several rules using various combinations of the above parameters.

This chapter contains the following sections:

- Section 4.2, "Maintaining Reconciliation Rule"

- Section 4.3, "Features of the Reconciliation Rule Definition Screen"

4.2 Maintaining Reconciliation Rule

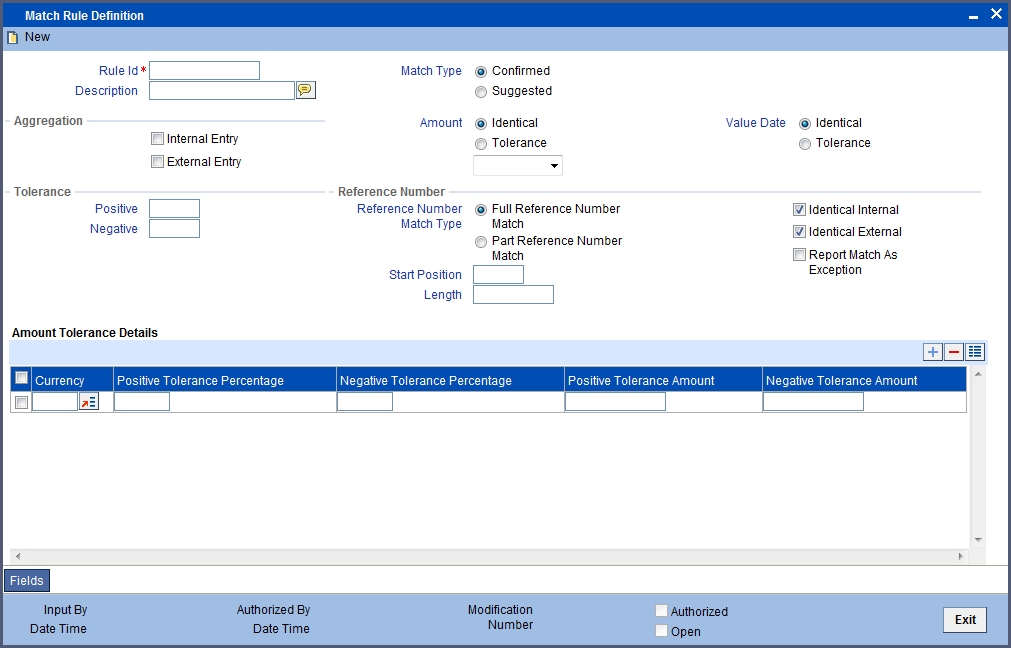

You can invoke the ‘Reconciliation Rule Maintenance’ screen by typing ‘REDRULDF’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

If you are maintaining details of a new rule, click the new button on the Application toolbar.

The ‘Reconciliation Rule Maintenance’ screen is displayed without any details.

If you are calling a Rule Definition record that has already been defined, double-click a rule of your choice from the summary screen.

4.3 Features of the Reconciliation Rule Definition Screen

Assigning the Reconciliation Rule a Code

In Oracle FLEXCUBE, each matching rule that you define is identified by a fifteen-character code called a Rule Code. You can follow your own convention for devising this code.

The code that you assign to a rule should be unique as it is used to identify the rule across the branches of your bank. When you need to make the rule applicable while reconciling nostro entries, you need to just specify the code assigned to the rule. The attributes of the rule will automatically become applicable for matching transactions.

After you assign a matching rule a code, you can specify the parameters based on which internal and external transactions should be matched when the rule is used. The parameters that you can use to define a rule are the:

- The Aggregation of internal or external entries

- Value Date of the transaction

- Internal Reference Number

- External Reference Number

You can specify several rules using various combinations of the above parameters.

Determining Match Type

You can decide whether the Automatic matching process should perform a confirmed match or suggested match.

- Confirmed Match (Confirmed): The automatic matching process will mark the match status as ‘Open’ and the matched entries will be in an authorized state

- Suggested Match (Suggested): The automatic matching process will mark the match status as ‘Suggested’ and the matched entries will be in an authorized state. The matched entries need to be manually confirmed using manual matching in order to complete the full matching process.

You can choose to either confirm or reject suggested matches. On confirmation the match status will be changed from ‘Suggested’ to ‘Open’. If confirmed, system will pass adjustment entries.

Indicating that Entries should be Aggregated

An internal entry is one that was passed by one of the modules of Oracle FLEXCUBE. An external entry is one passed by a correspondent bank in response to the entries originating from your side.

Internal transactions which match certain criterion can be aggregated before they are matched and reconciled by the automatic matching process. The criterion for aggregation is as follows:

- Identical value date

- Identical internal or external reference number, as the case may be

For a match rule that you define, you can indicate either of the following:

- The internal entries should be aggregated and then matched

- External entries should be aggregated and then matched

- That both the internal and external entries under a transaction should be aggregated and then matched

This would facilitate the matching of one or many internal transactions with one or many external transactions.

Consider the following example.

Friendly Neighborhood Bank (FNB) has placed US $100,000 with Greenville Global Banking (GGB), Bangalore.

The various components of the placement are:

| Component | Amount | ||

|---|---|---|---|

| Principal | US $100,000 | ||

| Charges | US $1000 | ||

| Interest | US $2500 |

The entries passed at FNB:

Component - Principal

| Debit / Credit | Account | ||

|---|---|---|---|

| Dr | Loan GL | ||

| Cr | GGB |

Component - Interest

| Debit / Credit | Account | ||

|---|---|---|---|

| Dr | GGB | ||

| Cr | INT_INC |

Component - Charges

| Debit / Credit | Account | ||

|---|---|---|---|

| Dr | GGB | ||

| Cr | CHG_INC |

At GGB, the following entries are passed:

All the components of the transaction will be contained in the external statement. Oracle FLEXCUBE will check for the aggregation criteria and then aggregates the external entry and matches them.

The components of the external entry when aggregated amounts to US $103500.

Component - Principal

| Debit / Credit | Account | ||

|---|---|---|---|

| Dr | FNB | ||

| Cr | INT_GL |

Component - Interest

| Debit / Credit | Account | ||

|---|---|---|---|

| Dr | INTERNAL GL | ||

| Cr | FNB |

Component - Charges

| Debit / Credit | Account | ||

|---|---|---|---|

| Dr | INTERNAL GL | ||

| Cr | FNB |

Using the Value Date as a Matching Rule Parameter

While defining a rule, you can indicate preferences for the matching criterion - Value Date. You have either of the option to indicate whether:

- The value date of the internal and external transaction should be identical

- You can define a positive and negative tolerance within which the value date of a transaction should fall

Indicating Identical Value Dates

Choose this option to indicate that the automatic matching process should match an external transaction with an internal transaction, only if the value date of the internal transaction is identical with the value date of the external transaction.

Indicating a Tolerance Range

You also have the option to specify that the automatic matching process should match an external transaction with an internal transaction, if the value date of an external transaction is within a permissible tolerance range.

If you choose this option you should also specify the upper (positive) and a lower (negative) limit of the tolerance range.

The positive and negative tolerance is taken into consideration while the automatic matching process is run. This process will match those external transactions with a value date greater than or lesser than the value date of the internal transaction within the tolerance range that you indicate.

Using Reference Number as a Matching Rule Parameter

You can use the reference number assigned to the transaction as a parameter for matching and reconciling Nostro entries. You have the option to use either the internal or external reference number as a matching criterion or you could use both.

In Oracle FLEXCUBE, you can indicate whether the full reference number or a part of it should be used for matching entries.

Using the Full Reference Number for Matching

If you indicate that full numbers need to be matched, you need to indicate whether the internal or external reference number should be matched. Your internal reference is the other entity’s external reference and their internal reference is your external reference.

Consider the following example.

Friendly Neighborhood Bank (FNB) has placed US $100,000 with Greenville Global Banking (GGB), Bangalore.

FNB which uses Oracle FLEXCUBE has assigned the placement the following reference number:

FNB s internal reference - 000MP01973640001

This is FNB s internal reference for the transaction. When the placement is recorded at GGB it is assigned the following reference:

GGB s internal reference - 2980631000

FNB s internal reference is GGB s external reference and GGB s internal reference is FNB s external reference.

Using Partial Reference Numbers for Matching

If you indicate partial matching, you can indicate the portion of the reference number that needs to be matched. In the case of partial matching you need to indicate the:

- Starting position in the reference number.

- Length of the matching portion.

This will apply to both internal as well as external reference numbers.

Consider the following example.

The reference numbers generated in Oracle FLEXCUBE is a combination of a three-digit branch code, a four-character product code, a five-digit Julian Date and a four-digit serial number. A typical reference number would look like:

000MP01973640001

The bank with which you are matching entries generates ten digit reference numbers. Therefore the reference numbers generated by the other bank can records only the first ten digits of your reference number.

You have selected partial matching of reference numbers and indicated the following preferences:

- Start position - 1

- Length of matching position - 10

When the transaction returns for matching Oracle FLEXCUBE will automatically check only the first ten characters of the reference number and match the entries.

Using Your Internal Reference Number as a Matching Parameter

As a matching rule criterion you can indicate that the internal reference number you assigned to the transaction should be identical with the external reference number of the transaction.

Using the External Reference Number as a Matching Parameter

As a matching rule criterion you can indicate that your external reference number should match with the internal reference number assigned to the transaction assigned by the other entity.

Using Amount as a Matching Parameter

The two options are:

- Identical: During auto matching of entries, the internal and external entries will be matched only if amount of the entries are identical

- Tolerance: During auto matching of entries, the internal entry will be matched to an external entry if the amount of external entry is within tolerance range, calculated based on the internal amount and tolerance parameters.

You can further detail Amount Tolerance as:

- Amount: The tolerance can be defined as a flat amount.

- Percentage: The tolerance can be defined as a Percentage value.

These parameters can be defined for each currency. When a currency amount is not defined, tolerance amount will be considered to be zero by default.

Currency

All valid currencies in the system will be available for selection here. The tolerance limits can be different for different currencies.

Positive Percentage Tolerance

You can capture the percentage of positive deviation from a possible match. This will be allowed if the rule definition allows a tolerance for the amount and tolerance type is defined as percentage.

Negative Percentage Tolerance

You can capture the percentage of negative deviation from a possible match. This will be allowed if the rule definition allows a tolerance for the amount and tolerance type is defined as percentage.

Positive Amount Tolerance

You can use this to capture the positive deviation in amount for a possible match. This will be allowed if the rule definition allows a tolerance for the amount and tolerance type is defined as Amount.

Negative Amount Tolerance

You can use this to capture the negative deviation in amount for a possible match. This will be allowed if the rule definition allows a tolerance for the amount and tolerance type is defined as Amount.

Consider the following example.

Suppose the following are the internal entries passed by Flex cube for nostro accounts.

| Dr/Cr | Account | Currency | Amount | Reference | |||||

|---|---|---|---|---|---|---|---|---|---|

| Cr | Nostro | USD | 10000 | R1 | |||||

| Cr | Nostro | USD | 10000 | R2 | |||||

| Cr | Nostro | USD | 10000 | R3 | |||||

| Cr | Nostro | USD | 500 | R4 | |||||

| Cr | Nostro | USD | 20000 | R5 | |||||

| Cr | Nostro | USD | 30000 | R6 |

The following are the sequence of rules to be applied for Auto Matching.

| Rule | Match type | Internal ref | External ref | Value date | Amount type | Tolerance | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| R1 | Confirmed | Identical | Identical | Identical | Identical | None | |||||||

| R2 | Confirmed | Identical | Identical | Identical | Tolerance | -100 and +100 | |||||||

| R3 | Suggested | Identical | Identical | Identical | Tolerance | -5% and +5% |

The following are external entries sent by another bank.

| Dr/cr | Account | Currency | Amount | Reference | |||||

|---|---|---|---|---|---|---|---|---|---|

| Dr | External A/c | USD | 10000 | R1 | |||||

| Dr | External A/c | USD | 10000 | R2 | |||||

| Dr | External A/c | USD | 9900 | R3 | |||||

| Dr | External A/c | USD | 600 | R4 | |||||

| Dr | External A/c | USD | 21000 | R5 | |||||

| Dr | External A/c | USD | 29000 | R6 |

Matching Details using the above set of factors are as follows:

Rule R1 Matching Details – Matched based on Identical Amount.

| Rule | Match reference | Internal entry | External entry | Match Status | Adjustment entry | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Rule1 | M1 | R1 | R1 | OPEN | None | ||||||

| Rule1 | M2 | R2 | R2 | OPEN | None |

Rule R2 Matching Details – Matched based on Amount Tolerance.

| Rule | Match reference | Internal entry | External entry | Match Status | Adjustment entry | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Rule2 | M3 | R3 | R3 | OPEN | 100 | ||||||

| Rule 2 | M4 | R4 | R4 | OPEN | 100 |

Since R2 is a confirmed match, adjustment entries are posted during automatic matching.

Rule R3 Matching Details – Matched based on Amount Tolerance

| Rule | Match reference | Internal entry | External entry | Match Status | Adjustment entry | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Rule3 | M5 | R5 | R5 | SUGGESTED | None | ||||||

| Rule3 | M6 | R6 | R6 | SUGGESTED | None |

Since R3 is a suggested match, adjustment entries are not posted during automatic matching. Rather they are posted only after the user confirms the entries during manual matching. If the entries matched during auto matching are rejected by the user, the entries become available for re matching.

Validations

- Suggested Match type is allowed only if the amount matching is set as Tolerance. This validation will be done during save operation of the rule definition. If the amount matching set is identical and the match type is Suggested, the system will display an error message as ‘For Suggested Match Type, Amount Type Cannot be Identical’.

- The tolerance type list item will be error disabled if the amount defined is ‘identical’. It will be enabled only if amount matching type is ‘Tolerance’

- The currency and Tolerance related parameters will be enabled only if amount matching is ‘Tolerance’

- If tolerance type is percentage then only percentage related fields in amount tolerance details will be enabled

- If the tolerance type is amount then only amount related fields will be enabled in amount tolerance details

- During automatic matching using suggested rule, the negative and positive tolerance range will be calculated based on the internal amount and the system fetches all the external entries whose amount is in between Negative tolerance and positive tolerance range. If a record is found in this range then the system matches the internal and external entry. If multiple external records are fetched then the system will not match the entries

- If Internal entry aggregation is set in the rule definition, the system calculates the sum of all the internal entry amounts whose internal reference, external reference and value date is identical. The Negative and positive tolerance range is calculated on the aggregated internal amount. If external entry aggregation is set then the aggregated external entry will be picked whose amount is a median between Negative tolerance and positive tolerance range. If external aggregation is not set ,then the individual entries will be fetched whose amount is a median Negative tolerance and Positive tolerance range

- The suggested matching will be processed as authorized record during automatic matching. During this matching the match indicator will be ‘Y’, authorization status will be ‘authorized’ and Match status will be ‘Suggested’. If the suggested match is to be approved, then it has to be approved using ‘confirm action’ in the manual reconciliation screen

- In case of confirmed match type with amount tolerance, the system will pass the adjustment entries during automatic matching