9. Automatic Processes

9.1 Introduction

In Retail Bills module of Oracle FLEXCUBE, you may configure certain tasks to take place automatically as part of batch processes. A batch process is an automatic program, which is scheduled to run as a mandatory program at the beginning of day (BOD) or end of day (EOD) process.

This chapter discusses the batch programs that you may set up for the retails bills module.

This chapter contains the following sections:

- Section 9.2, "Maintaining Mandatory Batch Programs"

- Section 9.3, "Auto Liquidation of Outward Instruments"

- Section 9.4, "Collateralization of Outward Instruments"

- Section 9.5, "Dispatching Outward Bill/Cheque for Collection"

- Section 9.6, "Clearing Post Dated Instruments"

- Section 9.7, "Auto Liquidation of Inward Instruments"

- Section 9.8, "Auto Liquidation of Cash Letter"

- Section 9.9, "Instrument Location Update"

9.2 Maintaining Mandatory Batch Programs

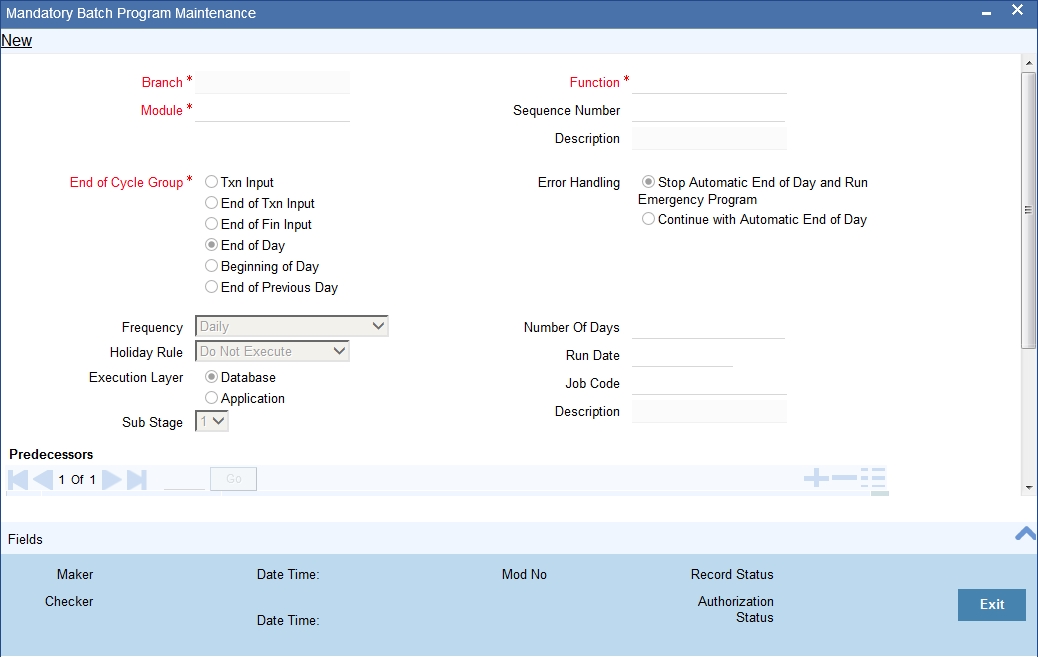

The system triggers the batch processes automatically based on the details maintained in ‘Mandatory Batch Program Maintenance’ screen.

To invoke the ‘Mandatory Batch Program Maintenance’ screen, type ‘EIDMANPE’ in the field at the top right corner of the application tool bar and clicking on the adjoining arrow button.

Specify the following details:

Module

Select the module code ‘RB’ from the adjoining option list.

Function Identification

Specify the function ID of batch that you wish to run. The adjoining option list displays all batch processes available for the module.

You can configure the batch to be run at various stages of day like EOD, EOTI etc.

For further details about this screen, refer the chapter ‘Setting- up Mandatory Programs for EOD’ in the AEOD User Manual.

9.3 Auto Liquidation of Outward Instruments

You can configure a batch for automatic liquidation of the following retail bills instruments:

- Outward bill for collection

- Outward cheque for collection

- Outward cheque for clearing

- FCY Cheque under cash letter

- Overseas cheques payable abroad under collection

You can configure the batch ‘RBBAUTIQ’ to run at BOD stage as part of EOD process.

If the option ‘Process Till Next Working Day -1’ is set to ‘Yes’ and the due date falls on a holiday. then auto liquidation can happen at EOTI. If the option ‘Process Till Next Working Day’ is set to ‘No’ and the due date falls on a is holiday, then auto liquidation can happen at BOD.

This batch will liquidate/realize the outstanding bills and cheques marked for auto liquidation on a given day.

Note

On the due date the instrument should not have been:

- Dishonoured

- Protested

- Returned

- Closed

- Realized

In case of financed instruments, the system will liquidate the loan account and credit the remaining proceeds to the customer.

If the instrument is collateralized, then the system will close the collateral and pool and limit will be reset on limit liquidation. If the collateral is attached to existing pool, then the pool cannot be closed if there are multiple collaterals with different expiry date. In such case, the collateral will be de-linked from the existing pool and available amount of pool will be reduced.

If automatic liquidation fails during the batch process, then the system will schedule it for the subsequent BOD process until the number of attempts specified in the ‘Product Preferences’ is completed.

If the instrument is financed, then the system closes the loan account and credits the remaining proceeds to the customer.

System updates the status and triggers 'LIQD' event.

9.4 Collateralization of Outward Instruments

You can configure a batch for automatic collateralization of the following retail bills instruments:

- Outward Bill for collection

- Outward cheque for collection

- Outward Cheque for clearing

You may configure the batch ‘RBBCOBAT’ to run at PEOTI stage as part of EOD processes.

When this batch is triggered, the system collateralizes the outward instruments in the collateral status ‘To be Collateralized’ and instrument should not have been:

- Dishonoured

- Protested

- Returned

- Closed

- Realized

Instrument will be collateralized on FIFO basis.

On successful collateralization, the system links the collateral with the collateral pools that was selected at the time of contract creation. In case there is no existing pool, then the system creates the collateral and collateral pools and then attaches the collateral to the pools.

Once the process is completed, the system updates the status of the instrument as ‘Collateralized’.

If you have mentioned a collateral pool at the time of instrument booking, then the system creates new collateral and attaches it to the collateral pool.

If you have not mentioned a collateral pool, then the system creates a new collateral and links it with a newly created collateral pool.

The system updates the instrument collateral status as ‘Collateralized’ and triggers ‘CBAT’ event. In case the collateral process fails, the system retains the status of the instrument collateral as ‘To be collateralized’.

9.5 Dispatching Outward Bill/Cheque for Collection

You can configure a batch for preparing the dispatch covering letters for outward instruments that needs to be sent for collection on a given date. You may configure the batch ‘RBBDIBAT’ to run at BOD stage as part of EOD processes.

This batch prepares the dispatch covering letter for outward instruments which should be sent for collection on or before the current date. That is, the system will pickup the instruments whose date of dispatch is on or before the current system date.

After dispatch on BOD, the dispatch annexure and letter for dispatch lot reference will be in non-generated status and will be generated if the messaging job is run.

System updates the Instrument status and location and triggers 'DISP' event. The contingent liability passed during the booking event will be reversed and a new set of liability entries are generated.

The instruments of product type outward bill/cheque for collections, which are due for dispatch, i.e. the ‘to be dispatched date’ is less than or equal to system date and instrument is not dispatched, not realized, not dishonoured, not protested, not returned, not closed will be considered for dispatch process.

9.6 Clearing Post Dated Instruments

You can configure a batch for creation of clearing contracts on the activation date of outward cheques for clearing. If the activation date of a post dated cheque falls on or before the current system date, then the system will create a clearing contract for that instrument. This will be done for all instruments whose activation date is either the current date or a previous date.

You may configure the ‘RBBCLGBT’ batch to run at BOD stage as part of the EOD processes.

System creates the Outward clearing contracts and updates the instrument status and location and triggers 'CLGN' event.

The activation date of ‘Outward Check for clearing’ product type instruments is less than or equal to system date and not realized, not closed, not returned will be considered for this batch process.

9.7 Auto Liquidation of Inward Instruments

You may configure a batch for automatic realization of inward retail instruments (inward bills / cheques for collection). You may configure this batch to run at BOD stage as part of EOD processes.

This batch will liquidate the inward bills / cheques marked for auto liquidation on a given date. i.e., Instrument value date should be less than or equal to current system date.

The instrument status should not be any of the following:

- Dishonoured

- Protested

- Returned

- Closed

- Realized

If automatic liquidation fails during the batch process, then the system will schedule it for the subsequent BOD process until the number of attempts specified in the ‘Product Preferences’ is completed. On successful liquidation, proceeds will be credited to the ‘Credit Account for Realization’.

System realizes and debits the proceeds from the customer and credits it to Nostro Account.It updates the Instrument status and location and triggers 'DISP' event.

9.8 Auto Liquidation of Cash Letter

You can configure a batch for automatic realization of cash letter credits on the bank value date. You may configure the ‘RBBAUTIQ’ batch to run at BOD stage as part of EOD processes.

This batch liquidates / realizes the cash letter arrangement marked for auto liquidation on the current date. On successful liquidation, the system debits the proceeds from Nostro account and credits it to ‘Cash Letter Suspense GL’ maintained in ‘Branch Parameters Maintenance’ screen.

The system realizes the cash letter and debits the proceeds from Nostro account and credits it to 'Cash Letter Suspense GL'.It triggers 'CLQD' event.

9.9 Instrument Location Update

You can configure a batch to update the instrument location for outward instruments maintained at ‘LOCH’ event. The batch ‘RBBLOCCH’ may be configured to run at PEOTI stage as part of EOD processes.

This batch triggers ‘LOCH’ event and updates the instrument location for outward bill / cheque maintained at ‘LOCH’ event. The batch also updates the instrument location from Teller to Vault during batch operations.

Charges and advices will not be applicable for this event.