3. Building Interest Classes

A class is a specific type of component that can be built with certain attributes. This chapter explains how interest classes are built and how attributes are defined.

When building an interest class, certain attributes, such as the following can be defined:

- The module in which you would use the class

- The interest type

- The association event

- The basis amount on which the interest is paid

- The rate type

- The default rate code (for floating interest)

- The default tenor

This chapter contains the following sections:

- Section 3.1, "Introduction"

- Section 3.2, "Specifying Currency-wise Limits for Interest Rate Application"

- Section 3.3, "Processing CPR (Conditional Prepayment Rate) Loans"

- Section 3.4, "Calculating Loan Interest Accrual on Principal Outstanding"

3.1 Introduction

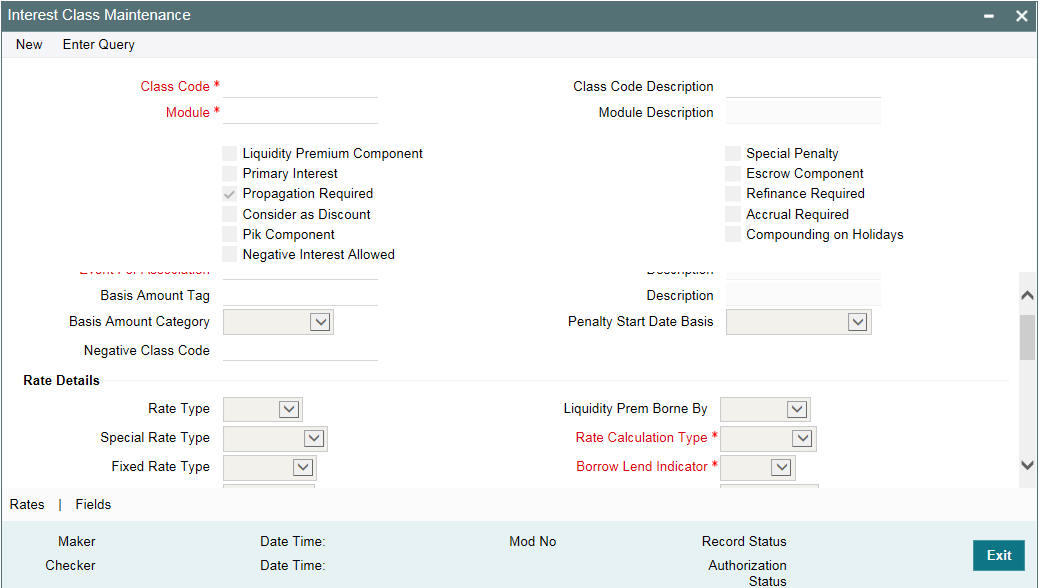

You can define the attributes of an interest class, in the ‘Interest Class Maintenance’ screen.

You can access this screen by typing LFDINTCL in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Before defining the attributes of an interest class, you should assign the class a unique identifier, called the Class Code and briefly describe the class. A description would help you easily identify a class.

An interest class is built for use in a specific module. This is because; an interest component would be applied on different basis amounts, in different modules.

Note

Basis Amount Tags available would depend on the module for which you build the class.

Events

The term Event can be explained with reference to a deal. A deal goes through different stages in its life cycle, such as:

- Contract Booking

- Money Settlement of contract

- Reversal of a contract

- Cancellation of a contract

Each stage is referred to as an Event in Oracle Lending.

The event at which you would like to associate the interest component, being defined, to a contract is referred to as the Association Event.

Basis Amount Tag

The basis on which an interest is calculated is referred to as the Basis Amount. When building an interest class, you have to specify the tag associated with the Basis Amount.

The attributes defined for an interest class, will default to all products with which you associate the class. When maintaining interest details for a product, you can change these default attributes. Contracts maintained under a product will acquire the attributes defined for the loan product.

Note

The amount tag ‘SCH_AMT_OS’ is the basis for calculation of late payment charge. It constitutes the total amount outstanding across all components due on a particular schedule date, provided late payment charge is applicable to these components. If you select the Basis Amount Tag as ‘SCH_AMT_OS’, then the following check boxes are disabled:

- Primary Interest

- Consider as Discount

- PIK Component

Specifying the amount category

Indicate the category of the component on which the interest has to be applied. The available options are:

- Expected

- Overdue

- Normal

- Outstanding

- Overdue OS

- Sch-Overdue

If Normal is selected, the balance on which interest has to be applied will be the Expected Balance (assuming that all the scheduled repayments, defined for the contract, are made on time). An example of this category is the application of interest on the principal of a loan.

If Overdue is selected, the balance on which interest has to be applied will be the amount that is outstanding, based on the repayment schedule defined for the contract. An example of this category is the application of penalty interest, on the principal or interest, when a repayment has not been made as per the schedule.

If Outstanding is selected with the amount category as principal, the interest is calculated on the balance of the total principal outstanding amount.

If Overdue OS is selected with the amount category as principal, the interest is calculated on the principal overdue outstanding.

If SCH-Overdue is selected, then the basis amount refers to amount outstanding on a particular schedule due date. If you select the ‘Basis Amount Tag’ as ‘SCH_AMT_OS’, then system defaults the ‘Amount Category’ as ‘Sch-Overdue’ and disables this field.

Select the applicable category using the drop-down list. The system defaults to Normal.

Specifying the penalty start day basis

Oracle Lending calculates the penalty in case the loan payment is not made on the principal schedule date. However, if the payment date falls on a holiday, the penalty can be calculated depending on the start date that you specify in this screen:

If you have specified that penalty start date basis as the Due Date, the penalty will be calculated from the due date of payment even if it falls on a holiday.

If you have specified that the penalty start basis be Next Working Day, the penalty will be calculated from the working day following the holiday. Thus the system will waive the penalty for the holiday (s).

Example

Assume a loan principal payment schedule falls on 11th October 2003, which is maintained as a holiday in Oracle Lending.

In addition, there is a deficit of funds in the customer’s account for making the payment.

If you have selected the due date option, Oracle Lending calculates the penalty from 11th October 2003.

If you have selected the next working day option, the system calculates the penalty from 13th October 2003 and waives the penalty for 11th and 12th October.

You can choose to accrue the interests due on a contract. To accrue the interest payable on a contract, choose the ‘Accrual Required’ option.

The accrual details that you define for an interest class defaults to all products with which you associate the class. When maintaining interest accrual details for a product, you can change these default details. Contracts maintained under a product acquires the accrual details defined for the product. However, you can define unique accrual details for a contract.

Specifying Rate Details

Rate Type

The interests paid on contracts can be at a Fixed Rate, or on the basis of a Floating Rate. If you indicate that interests should be calculated on the basis of a Floating Rate, you must specify the ‘Periodic’ Floating Rate Type.

For all contracts maintained under products, associated with a class, the interest will be by default calculated using the specified Rate type.

If you select the ‘Basis Amount Tag’ as ‘SCH_AMT_OS’, then system defaults the ‘Rate Type’ as ‘Special’ and disables this field.

Special Rate Type

Select the special rate type from the adjoining drop-down list. This list displays the following values:

- Fixed Rate

- Flat Amount

This field is enabled only if the ‘Special Penalty Component’ box is checked. By default, system displays the value of ‘Special Rate Type’ as ‘Fixed Rate’.

Indicating the Fixed Rate Type

If the rate type is ‘Fixed’, you have to indicate whether the rate would be entered by the user or needs to be picked up from the rate maintenance table. The following options are available:

- User Input (U) – This option may be used if you want the user to specify the rate of interest applicable on the contract

- Standard (S) – If you opt for this option, the system will pick-up the rate from the ‘Standard Rate Maintenance’ screen. This rate is combination of the Standard Rate, Amount-Slab-Wise Spread and Tenor-wise Spread. However, you can change this rate at the contract level

- For contracts involving fixed rate interest components, your bank may require choosing the applicable rate from historical floating rates for a floating rate code that has been maintained for a treasury source. For such requirements, select the TREASURY option in the Fixed Rate Type field. This option is applicable only for interest classes that you define for the Loans module.

When you enter a fixed rate loan contract or Money Market deal which involves an interest component class for which the TREASURY Fixed Rate Type option has been indicated, the historic floating rates maintained for the default floating rate treasury designated for your branch, are available for choosing.

Specifying the method for Interest Computation

You need to specify the method to be used for computation of interest. The available options are:

- Simple - indicates that the interest would be computed using the Simple Interest formula

- Compound - indicates that the interest would be compounded

Indicating whether compounding of interest on holidays is required

You can opt to compound interest on holidays. Select the ‘Compounding on Holidays’ option to indicate the same.

An example to show compounded interest calculation is given under the section titled ‘Defining interest details’.

Special Penalty Comp

System automatically checks this box if you select the ‘Basis Amount Tag’ as ’SCH_AMT_OS’ and you cannot modify it.

Specifying the Default Fixed Rate Code

If you opt for ‘Standard’ rate type, you have to select rate code based on which rate pick-up would be done.

All the rate codes maintained through the ‘Standard rate code maintenance’ screen will be available for selection in the option-list provided. The Standard rates maintained (in the Standard Rate Maintenance screen) for the selected rate code would be applicable on all products associated with the Interest class being maintained.

Specifying the Prepayment Penalty Rate Code

Likewise, select the rate code based on which the system will pick-up the prepayment penalty rate for all contracts under the product. Whenever a prepayment is processed, the prepayment penalty rate maintained for the selected rate code will be applied on all the contracts associated with this interest class.

Choosing the Default Floating Rate Code

Interest payable on contracts would be calculated at specific rates. When building an interest component, you have to specify the rate at which the interest should be computed. When associating a rate code (that you have maintained in the Rate Codes Maintenance screen) with the interest component that you are building, the rates corresponding to the code will be used to compute interest.

The details defined for an interest class will default to all products with which the class is associated. When maintaining interest details for a product, you can change this default information. Contracts maintained under a product will acquire the interest details defined for the contract product. However, you can define unique interest details specific to a contract.

When maintaining a contract, you can choose to waive the rate code altogether or amend the properties of the code to suit the security.

If you allow amendment of a rate code, you can specify if you would like to allow rate code amendment after the association event.

You can also allow the amendment of the rate value (corresponding to a rate code).

Each rate code is associated with a tenor. For instance you have a Rate Code ‘LIBOR’. You can link any number of tenor codes to the same rate code.

Tenor Code |

Description |

1W |

One week rate |

2W |

Two week rate |

2M |

Two months rate |

6M |

Six months rate |

1Y |

One year rate |

When building an interest component, you can specify a Tenor Code that you would like to associate, with the Floating Interest Rate Code. Interests for contracts (maintained under a product with which you associate the class) will be calculated using the rate corresponding to the Rate Code and the Tenor Code.

Indicating whether interest should be applied on premature withdrawal

You can opt to waive Interest on premature withdrawal of the loan. Select the ‘No interest on premature withdrawal’ option to indicate that interest needs to be waived if premature withdrawal (partial of full) is done for the loan.

Reapplying interest rate on prepayment

If the ‘Fixed’ rate type is ‘Standard’, you can opt to reapply interest when a prepayment is made.

You can reapply interest on one of the following:

- On Prepaid Amount – Select this option to indicate that interest on the prepaid amount would be recalculated during prepayment based on the rate applicable for the current tenor of the loan.

- On Outstanding Balance – This option indicates that interest is recalculated on the outstanding balance during prepayment based on the rate applicable for the current tenor of the loan

Enabling the Consider as Discount option

While defining an interest class for either the loans or the bills module, you can indicate whether the interest component is to be considered for discount accrual on a constant yield basis and whether accrual of interest is required.

If you select the ‘Consider as Discount’ option the interest received against the component is used in the computation of the constant yield and subsequently amortized over the tenor of the associated contract. By checking this option, you can also indicate whether the component should be included in the Internal Rate of Return computation.

If you select the ‘Accrual Required’ option, the interest is accrued depending on the accrual preferences defined for the product.

If neither option is selected, the interest is not accrued, but is recognized as income on interest liquidation.

The ‘Consider as Discount’ option is not available if the amount category is Penalty.

Note

- For bearing contracts, if the option ‘Consider as Discount’ is checked then the option ‘Accrual Required’ also has to be checked. If the option ‘Accrual Required’ is not checked, the option ‘Consider as Discount’ is disabled.

- For Discounted contracts, you can select either one of the options or both together. If the options ‘Accrual Required’ and ‘Consider as Discount’ are selected then discounted interest is considered for IRR calculation. If the option ‘Accrual Required’ is not selected and ‘Consider as Discount’ is selected, then discounted interest is considered a part of the total discount to be accrued.

- The ‘Consider as Discount’ option is not available if the amount category is Penalty.

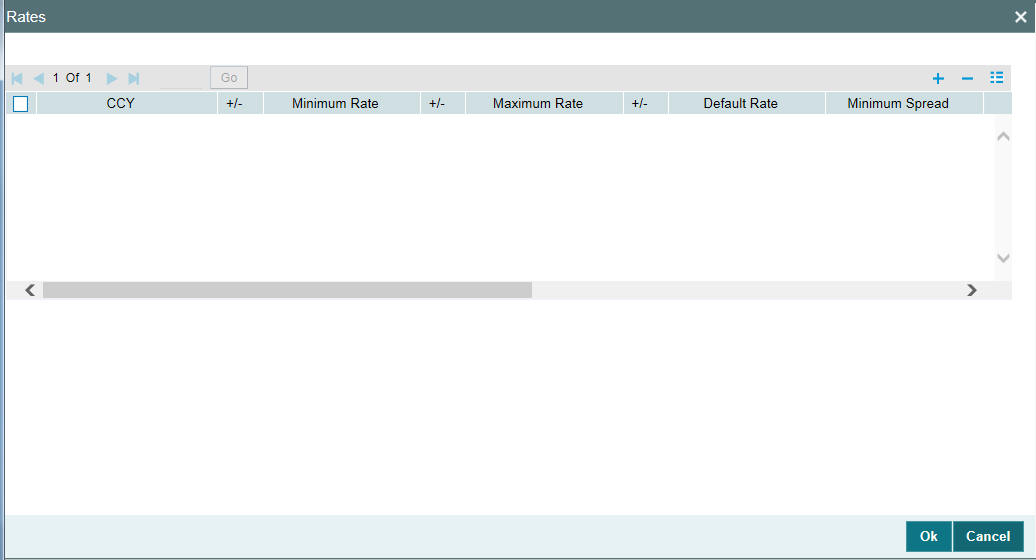

3.2 Specifying Currency-wise Limits for Interest Rate Application

When you define an interest class, you can specify the limits applicable

for the interest component, and the rules according to which interest

amounts in respect of the interest component must be rounded. To define

the rules, click the‘Rates’

button in the ‘Interest Class Maintenance’ screen. The ‘Rates’

screen is displayed.

In this screen, the following limits and rounding rules can be defined for each currency and for each tenor:

- For fixed rate components, the default rate to be applied in respect of the interest component

- The allowable limits for the interest rates in respect of the component. You can define the minimum and maximum applicable interest rates. If the interest rate falls below the minimum, the minimum rate is applicable; similarly, if the interest rate exceeds the maximum, the maximum rate is applicable

- For floating rate components, the allowable limits for the spread that can be applied on the floating rate. If the spread falls below the minimum, the minimum spread is applicable; similarly, if the spread exceeds the maximum, the maximum spread is applicable

- The basis on which interest is calculated for each currency, for which the limits are applicable

- How the interest amounts in respect of the interest component in the specified currency are to be rounded – truncated, rounded up, rounded down or rounded near

- If truncation is opted for, the number of digits after the decimal place, to which interest amounts in respect of the interest component in the specified currency must be truncated. The number of digits specified for truncation cannot exceed the allowed decimal places for the specified currency. If not specified, the number of decimals indicated in the Currency Definition for the specified currency is picked up by the System

- For the Round Up, Round Down and Round Near options, the rounding unit which is the lowest possible measure in which the interest amounts, in respect of the interest component in the specified currency, can be considered. This value cannot be less than the rounding unit for the specified currency in the Currency Definition. If not specified, the rounding unit indicated in the Currency Definition for the specified currency is picked up by the System

Note

- When generic interest limits are being defined for all currencies in the Currency-wise Limits screen (that is, the ALL option has been selected in the Currency field), the fields relating to rounding rules are not available for definition

- The currency rounding rules can be defined only for classes that would be maintained for Loans and Money Market modules

Specifying the interest period basis

You can indicate how the system must consider the tenor basis upon which interest is computed over a schedule or interest period, in respect of the interest component.

You can specify the interest period basis for each currency in the Currency-wise Limits screen, which you can invoke by clicking the Rates button in the Interest tab in the ‘Interest Class Maintenance’ screen.

You can choose any of the following options:

Including the From Date

For all schedules, the period considered for interest calculation would include the start date and exclude the end date. Therefore, the value date of the loan is considered for interest calculation and the maturity date is excluded.

Including the To Date

For all schedules, the period considered for interest calculation would exclude the start date and include the end date. Therefore, the value date of the loan is excluded, but the maturity date is included for interest calculation.

Including both From and To Dates

The period considered for interest calculation would include both the value date and the maturity date. This would mean:

- For the first schedule, it would include the Value Date. Interest would be calculated for the Value Date

- For the last schedule, it would include the Maturity Date. Interest would be calculated for the Maturity Date

Excluding both From and To Dates

The period considered for interest calculation would exclude both the value date and the maturity date. This would mean:

- For the first schedule, it would exclude the Value Date. No interest would be calculated for the Value Date

- For the last schedule, it would exclude the end date. No interest would be calculated for the Maturity Date

Note

This feature is only available for classes that would be maintained for Loans module.

Maintaining positive or negative values for interest limits and the default rate

When you maintain currency-wise interest rate limits for the interest class, you can indicate the applicable sign for the interest limits values as well as for the default rate value. If required, you can assign the negative sign, indicating a negative range for the limits, or a negative default rate.

In the case of Default Rate, the assigned sign is defaulted along with the rate specified, for contracts that use a product associated with this class.

Click on the Rates button in the Interest tab in the ‘Interest Class Maintenance’ screen, to invoke the Currency-wise Limits screen.

Note

This feature is only available for classes that would be maintained for the Money Market module.

3.3 Processing CPR (Conditional Prepayment Rate) Loans

CPR (Conditional Prepayment Rate) Loans are referred to the loans which have the interest on Principal Outstanding fixed till maturity and floating rate thereafter.

Oracle Lending allows you to create a secondary interest component which can be applicable only after the maturity date of a loan on the total principal outstanding. While defining the interest class definition for the secondary interest component, you should specify the amount tag as ‘Principal’ and the amount category as ‘Overdue OS’ and the rate type as ‘Floating’ which gets defaulted to the ‘Interest Class Maintenance’ screen also.

Note

Interest computation on Outstanding Principal balance is applicable for Normal-Bearing type of loans.

3.4 Calculating Loan Interest Accrual on Principal Outstanding

When you select amount category as ‘Outstanding’ for calculating the interest the interest is calculated on the balance of the total principal outstanding amount. ’Loan and Commitment- Contract Input’ screen accepts the schedules for Interest which is defined for this amount category.

The accrual logic remains the same and to arrive at the daily average amount the total interest is divided by the number of days. However, the computation of interest schedules change based on the above setup.

Example;

A contract is booked with the following details

Principal Amount |

12000000 |

Interest Rate |

10% |

Value Date |

28-Sep-05 |

Maturity Date |

28-May-06 |

The amount category is maintained as “Expected” and the schedules of Principal and Interest are defined as monthly. The schedules get defined in the following manner.

Principal |

Interest Rate |

Start Date |

End Date |

No of Days |

Principal Schedule |

Interest Amount |

Daily Avg Amount |

12000000 |

10% |

28-Sep-05 |

28-Oct-05 |

30 |

2000000 |

100000 |

3333.33333 |

10000000 |

10% |

28-Oct-05 |

28-Nov-05 |

31 |

2000000 |

86111.1111 |

2777.77778 |

8000000 |

10% |

28-Nov-05 |

28-Dec-05 |

30 |

2000000 |

66666.6667 |

2222.22222 |

6000000 |

10% |

28-Dec-05 |

28-Jan-06 |

31 |

2000000 |

51666.6667 |

1666.66667 |

4000000 |

10% |

28-Jan-06 |

28-Feb-06 |

31 |

2000000 |

34444.4444 |

1111.11111 |

2000000 |

10% |

28-Feb-06 |

28-May-06 |

89 |

2000000 |

49444.4444 |

555.555556 |

However the schedules will get defined in the following manner for the contract with same details as above, if the amount category is maintained as “Outstanding”.

Principal O/s |

Interest Rate |

Start Date |

End Date |

No of Days |

Principal Schedule |

Interest Amount |

Daily Avg Amount |

12000000 |

10% |

28-Sep-05 |

28-Oct-05 |

30 |

2000000 |

100000 |

3333.33333 |

12000000 |

10% |

28-Oct-05 |

28-Nov-05 |

31 |

2000000 |

103333.333 |

3333.33333 |

12000000 |

10% |

28-Nov-05 |

28-Dec-05 |

30 |

2000000 |

100000 |

3333.33333 |

12000000 |

10% |

28-Dec-05 |

28-Jan-06 |

31 |

2000000 |

103333.333 |

3333.33333 |

12000000 |

10% |

28-Jan-06 |

28-Feb-06 |

31 |

2000000 |

103333.333 |

3333.33333 |

12000000 |

10% |

28-Feb-06 |

28-May-06 |

89 |

2000000 |

296666.667 |

3333.33333 |

Here even though the schedules are defined for monthly payment schedules of Principal, the schedules are computed on the Loan Principal Outstanding since the Principal amount is not ‘expected’ to be paid at the time of Loan Initiation.

Now assuming that the payment of principal which was due on 28-Oct-2005 was paid along with the interest due on the scheduled due date, then the schedules are redefined as under.

Principal O/s |

Interest Rate |

Start Date |

End Date |

No of Days |

Principal Schedule |

Interest Amount |

Daily Avg Amount |

12000000 |

10% |

28-Sep-05 |

28-Oct-05 |

30 |

2000000 |

100000 |

3333.33333 |

10000000 |

10% |

28-Oct-05 |

28-Nov-05 |

31 |

2000000 |

86111.1111 |

2777.77778 |

10000000 |

10% |

28-Nov-05 |

28-Dec-05 |

30 |

2000000 |

83333.3333 |

2777.77778 |

10000000 |

10% |

28-Dec-05 |

28-Jan-06 |

31 |

2000000 |

86111.1111 |

2777.77778 |

10000000 |

10% |

28-Jan-06 |

28-Feb-06 |

31 |

2000000 |

86111.1111 |

2777.77778 |

10000000 |

10% |

28-Feb-06 |

28-May-06 |

89 |

2000000 |

247222.222 |

2777.77778 |

The accrual amount on the EOD of 28-Oct-2005 with the next working day as 29-Oct-2005 is 2777.78

Note

Even a prepayment of Principal will change the accrual amount.

Example;

If a contract has been booked with the following details,

Principal Amount |

12000000 |

Interest Rate |

10% |

Value Date |

28-Sep-05 |

Maturity Date |

28-May-06 |

Assuming that all the repayment schedules except the last two schedules have been paid, the schedules are the following:

Principal O/s |

Interest Rate |

Start Date |

End Date |

No of Days |

Principal Schedule |

Interest Amount |

Daily Avg Amount |

12000000 |

10% |

28-Sep-05 |

28-Oct-05 |

30 |

2000000 |

100000 |

3333.33333 |

10000000 |

10% |

28-Oct-05 |

28-Nov-05 |

31 |

2000000 |

86111.1111 |

2777.77778 |

8000000 |

10% |

28-Nov-05 |

28-Dec-05 |

30 |

2000000 |

66666.6667 |

2222.22222 |

6000000 |

10% |

28-Dec-05 |

28-Jan-06 |

31 |

2000000 |

51666.6667 |

1666.66667 |

4000000 |

10% |

28-Jan-06 |

28-Feb-06 |

31 |

2000000 |

34444.4444 |

1111.11111 |

4000000 |

10% |

28-Feb-06 |

28-May-06 |

89 |

2000000 |

98888.8889 |

1111.11111 |

The highlighted schedules are unpaid. On the EOD of 28-May-2006, the Main Interest Component Accrual stops and the Floating Interest component starts computing the interest based on the maintenance, with the basis amount as 4000000.