4. Customer Service

4.1 Introduction

After an application has cycled through the Line of credit origination process, it becomes an account. Account maintenance and collections tasks can be performed with Oracle Financial Services Lending and Leasing’s Customer Service screen.

The Customer Service screen enables you to view and manage all customer information in a centralized location to ensure data integrity and provide better service. Oracle Financial Services Lending and Leasing provides online real-time information about the applicant(s), contract, account balances, dues, transactions, call activities, and comments. Oracle Financial Services Lending and Leasing also supports back-dating of financial transactions till the account’s opening date.

Activating an Account

An account is automatically activated when you fund the contract using Funding main tab or convert from a legacy system. You cannot activate an account using the Customer Service screen.

Posting and Reversing Payments

A payment can be posted and reversed on the Payments screen. You cannot post and reverse the payment in Customer Service screen. (For more information, see the Payment Processing chapter)

Account Mask

After an application completes the Line of credit origination cycle and is funded or is ported into the system, it becomes an account and receives an account number. The system assigns account numbers using the following logic:

YYYYMMNNNNNNNX

where:

YYYYMM = contract date

NNNNNNN = serial number

X = check digit

The system sorts accounts using the NNNNNN portion only. That portion is referred to as the account ID.

4.1.1 Quick Search section

Conditions and Queues

During the Line of credit application process,applications had a status and sub status Accounts do not have sub statuses; instead, accounts use conditions. Conditions further define the status of an account; for example: delinquent, bankruptcy, scheduled for charge off, Do Not Charge Off. Conditions can be applied automatically by the system based on set up, and manually by the system users using Customer Service screen.

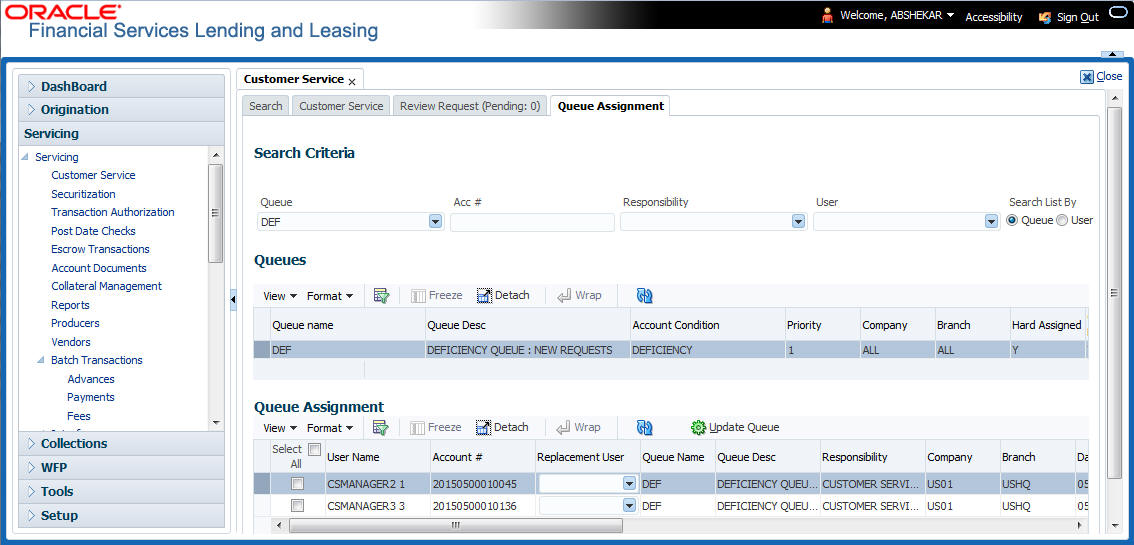

The system can assign accounts to specific users by way of queues. Queues are a work flow management tool that allow the users to work on accounts sequentially from a prioritized list, rather than having to manually search for and load them. Queues are created and sorted during nightly processing. Examples of customer service queues include due date change requests, delinquent accounts, deferment requests, and title and insurance follow-up.

Account conditions serve as default queues; that is, an account’s condition determines which queue the account is in.

In the following example, account has a condition of deliNquent, noted in the Conditions section and Status field. The account was loaded from delinquent queue, DELq (d).

A queue can be associated with only one condition. In the following example, the Delinquent queue is associated with the Delinquent condition. However, an account can have more than one condition, so an account can be in more than one queue. Multiple queues can be created for a single condition. Account attributes (such as number of days delinquent and product code) can be used for assigning accounts to a queue and sorting accounts within a queue.

You can quickly load an account from a queue using Next Account button in the Quick Search section.

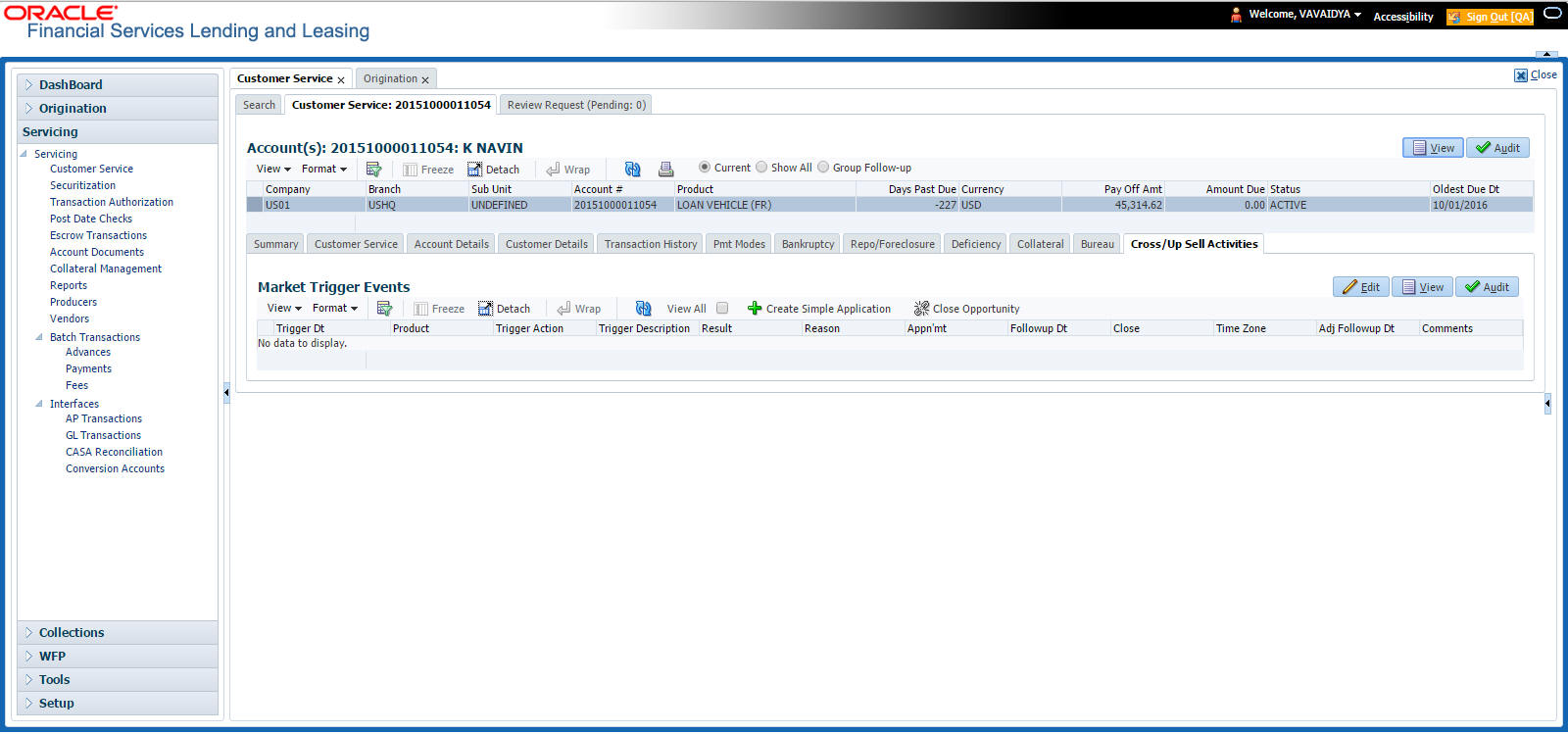

4.2 Customer Service screen

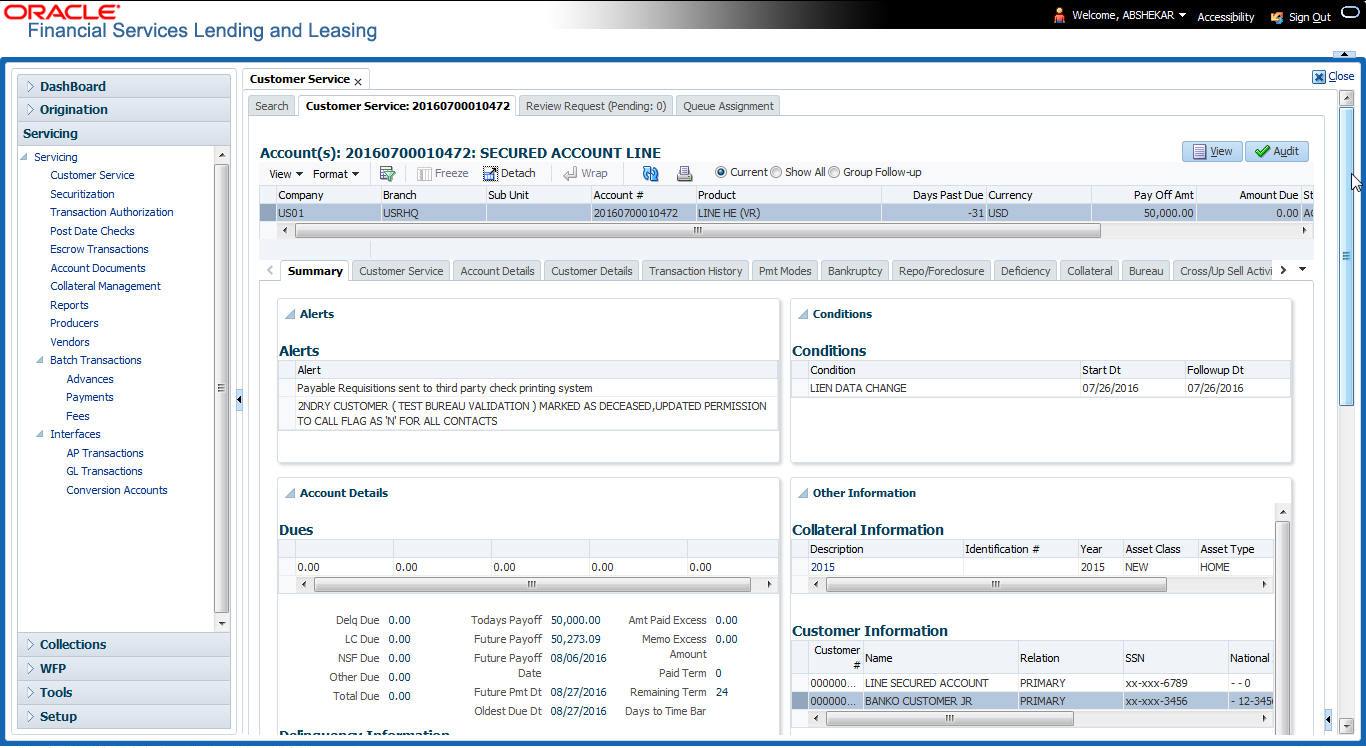

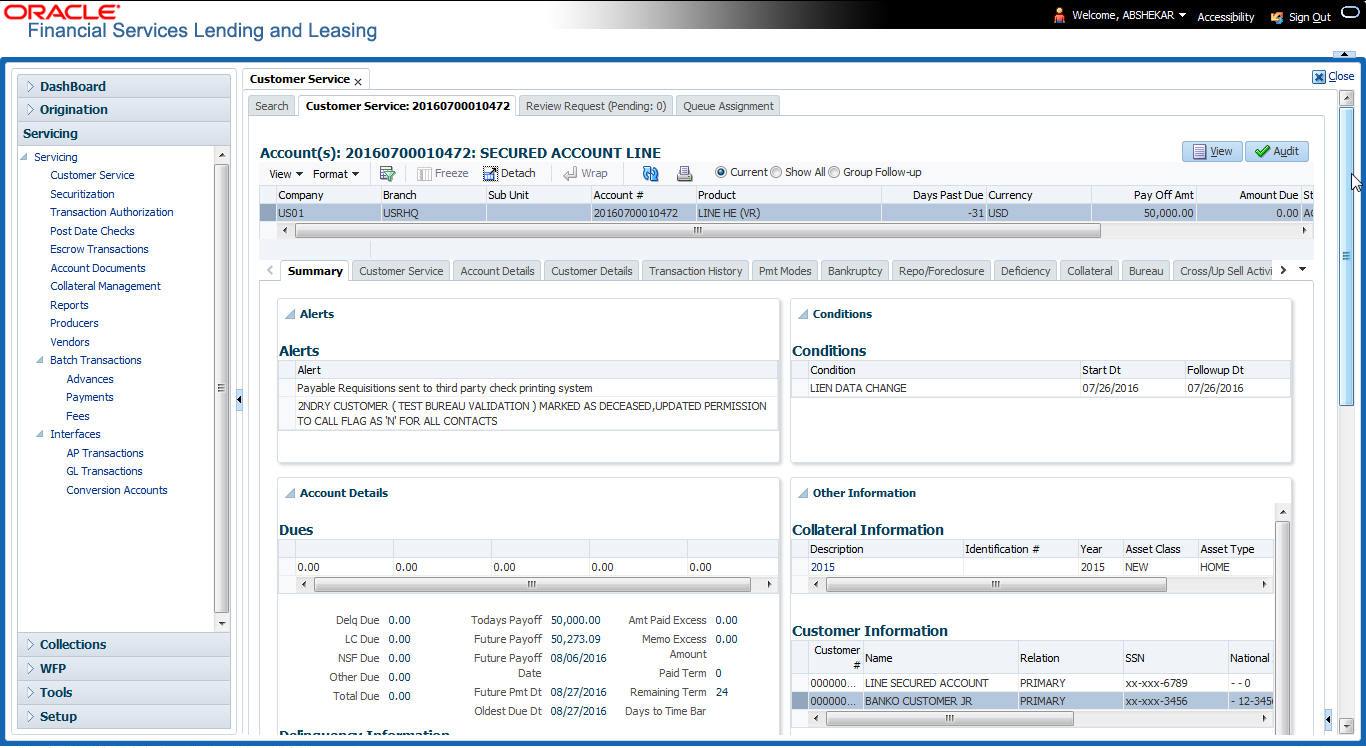

Most of the screens on Customer Service screen contain Account(s) and Customer(s) sections as a header. The Account(s) section provides a quick overview of an account by displaying its company, branch, account number, product, payoff amount and amount due, status, and oldest due date. The information on Customer Service screen always refers to the account selected in this section.

The Customer(s) section displays information about customer(s) attached to the account. The information on Customer Service screen always refers to the customer selected in this section.

To view account details in Account(s) and Customer(s) sections, open Customer Service screen and load the account you want to work with.

On Customer Service screen’s Account(s) section, view the following information: The system filters and displays information based on your selection:

Command Button: |

Action Performed: |

Current |

Displays the current search account only. It does not matter how that account was searched like using account search screen or selected a queue from drop-down and pressed ‘Next’ button or account number was directly pasted in Acc# text box and pressed Submit button.This is the default option. |

Show All |

Displays the related accounts based on current selected customer’s customer Id. To view the details of account number(s) other than current account, select the account in Account(s) section and click Submit. |

Group Follow-up |

Displays the set of accounts that share same account condition as the selected account and bear same Customer Id. Other than having same account condition and Customer Id, the queue currently selected should have the Group Follow-up Indicator enabled in queue setup and follow-up date should fall in range of organization level system parameter UCS_GROUP_FOLLOWUP_DAYS. |

In Account(s) section, click View to view the following information:

In this field: |

View this: |

Company |

The company of the account. |

Branch |

The branch of the account. |

Account # |

The account number. |

Product |

The product for the account. |

Days Past Due |

The total number of days elapsed past due date. |

Currency |

The currency for the account. |

Pay Off Amt |

The current payoff amount for the account. |

Amount Due |

The current delinquent amount due for the account. |

Status |

The account’s status. |

DLQ Reason |

The delinquency reason that gets auto updated by the system as one of the following when the account is marked delinquent. - 1st Payment Delinquency, when the first payment is delinquent. - NSF Delinquency, when the payment amount on due date results in NSF (non sufficient funds) in the account. - Matured Delinquency, when account reaches the ‘Maturity Date’ with some delinquency amount. Note: System automatically removes the delinquency reason on the account if the payment is received. However, if the same payment is reversed, the conditions are posted back. |

Oldest Due Dt |

The oldest due date. |

The system allows quick search of an account through Quick Search section in the right hand side of screen irrespective of the customer service screen on which you are working on. This is available in addition to the Quick Search section available in Results tab.

For more details on Quick Search refer ‘Search Functions’ chapter.

Comments can be added using Add Comment section in the right hand side of screen irrespective of screen you are working on. This is available in addition to the Comments sub tab available under Customer Service tab. This facilitates quick and easy reference.

For details on Comments refer Comments sub tab section in this chapter.

Call Activity functionality can be performed using Add Call Activity section in the right hand side of screen irrespective of the screen you are working on. This is available in addition to the Call Activities sub tab available under Customer Service tab. This facilitates quick and easy reference.

For details on Call Activity refer Call Activities sub tab section in this chapter.

4.3 Customer Service screen’s Summary tab

Open Customer Service screen and load the account you want to work with. By default the Customer Service screen opens the Summary tab.

Alerts section

Any comment posted as an alert, are displayed in the alert section of Summary tab.

Conditions section

You can view any conditions like Bankruptcy, Repossession, Foreclosure etc posted on an account. The condition is posted in the account with a start date which is the effective date and follow up date which indicates the next follow-up date for further process.

Dues section

Unpaid dues and the dates are displayed in a tabular form. Details of payment amount due, fee due, payoff are also displayed.

In this field: |

View this: |

Delq Due |

The total delinquent amount that is due so far in the account. |

LC Due |

The total amount of non-sufficient fee due in the account. |

NSF Due |

The non sufficient funds fee due. |

Other Due |

The total of any other dues pending in the account. |

Total Due |

The total of all dues including payment amount and all applicable fees. |

Today’s Payoff |

If the account is to be paid off as per the current date and the amount payable by the borrower. |

Future payoff |

The total Amount due on a future date. The borrower can know the total pay off amount for a future date, say 10 days from today. |

Future Payoff Date |

The date on which the future payoff is due. |

Future Pmt Dt |

The date till which the future payoff quote is valid. |

Oldest Due Dt |

The due date. |

Amt Paid Excess |

The excess amount paid. |

Memo Excess Amount |

The excess amount paid towards the membership fee. |

Paid Term |

The total count of paid dues. |

Remaining Term |

The total count of remaining outstanding dues to be paid. |

Days to Time Bar |

View the total number of days remaining to reach the time bar end date. |

Delinquency Information Section

View the following information in the Delinquency Information section:

In this field: |

View this: |

Late |

Total number of times the account was delinquent for less than 30 days since start date. |

30 |

Total number of times the account was delinquent for over 30 days since start date. |

60 |

Total number of times the account was delinquent for over 60 days since start date. |

90 |

Total number of times the account was delinquent for over 90 days since start date. |

120 |

Total number of times the account was delinquent for over 120 days since start date. |

150 |

Total number of times the account was delinquent for over 150 days since start date. |

180 |

Total number of times the account was delinquent for over 180 days since start date. |

Category |

The delinquency category. |

Days |

The number of days delinquent. A negative number in this fields denotes the number of days until a payment is due. |

Broken Promises (Life) |

Total number of broken promises since the account start date. |

Broken Promises (Year) |

Total number of broken promises since this year. |

Kept Promises (Life) |

Total number of fulfilled promises since the account start date excluding Broken and Cancelled Promises. |

Kept Promises (Year) |

Total number of fulfilled promises since this year excluding Broken and Cancelled Promises. |

NSF (Life) |

Total number of non sufficient funds since the account start date. |

NSF (Year) |

Total number of non sufficient funds since this year. |

Collector |

The default collector working on the account. |

Activities Section

View the following information in the Activities section:

In this field: |

View this: |

Active Dt |

The date account was made active. |

Last Activity Dt |

The date on which most recent activity was performed in the account. |

Due Day |

The due day for payment. |

Last Pmt Amt |

The last payment amount. |

Customer Grade |

The customer grade. |

App# |

The application number from which this account was created. |

Producer |

The producer through which the account was sourced. |

X-ref |

The cross reference number of third party origination system. |

Paid Off Dt |

The date on which account was paid off. Note: Filed has value only if account has Paid-off condition. |

Effective Dt |

The date account became effective. |

Current Pmt |

The current payment amount. |

Last Bill Amt |

The last bill amount. |

Last Pmt Amt |

The last payment amount. |

Chargeoff Dt |

The Date on which account was charged off. Note: This is applicable only if account has Charged-off condition. Else, no value displayed. |

Military Duty |

If selected, indicates that at the time of billing, the customer was in active military duty and qualifies for rates in accordance with Service members Civil Relief Act (SCRA) of 2003. |

Customer Score |

The customer score. |

Behaviour Score |

The behavior score. |

Due Date Change section

The Due Date Change section displays the remaining number of transactions available for the account in the Summary tab. You can view the following information under Due Date Change section.

In this Field: |

Do This: |

Last Txn Dt |

The last date on which the due date was changed. |

Rem. Txn. Limit (Life) |

Remaining number of due date changes allowed till account closure. |

Rem. Txn. Limit (Year) |

Remaining number of due date changes in the account for current calendar year. |

Extensions section

The Extensions section displays the remaining number of transactions available for the account in the Summary tab. You can view following extension details as per the conditions maintained in the contract.

In this Field: |

Do This: |

Rem. Txn. Limit (Year) |

Remaining number of extensions in the account for current calendar year. |

Rem. Txn. Limit (Life) |

Remaining number of extensions in the account till closure. |

Last Txn Dt |

The date when last extension was made. |

Exten. Gap Rem. (Months) |

The number of months remaining before you can post Extensions for an account. |

Contract Information

You can view the contract information recorded during the funding process. It’s a display only version of the same information found on the Funding screen’s > Contract screen.

In this Field: |

Do This: |

Contract Dt |

View the contract funded date. |

Term |

View the contract term. |

Rate |

View the interest rate. |

Maturity Dt |

View the contract maturity date. |

Credit Limit |

View the total credit limit issued. |

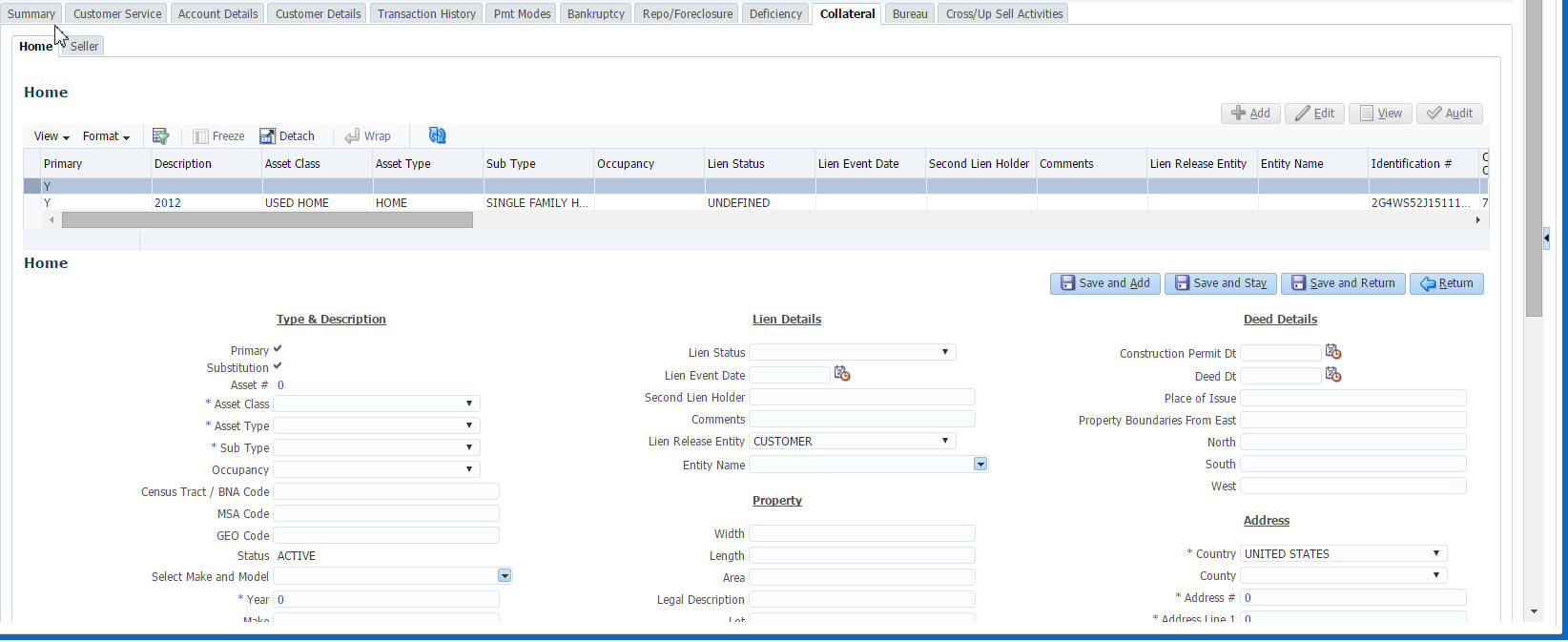

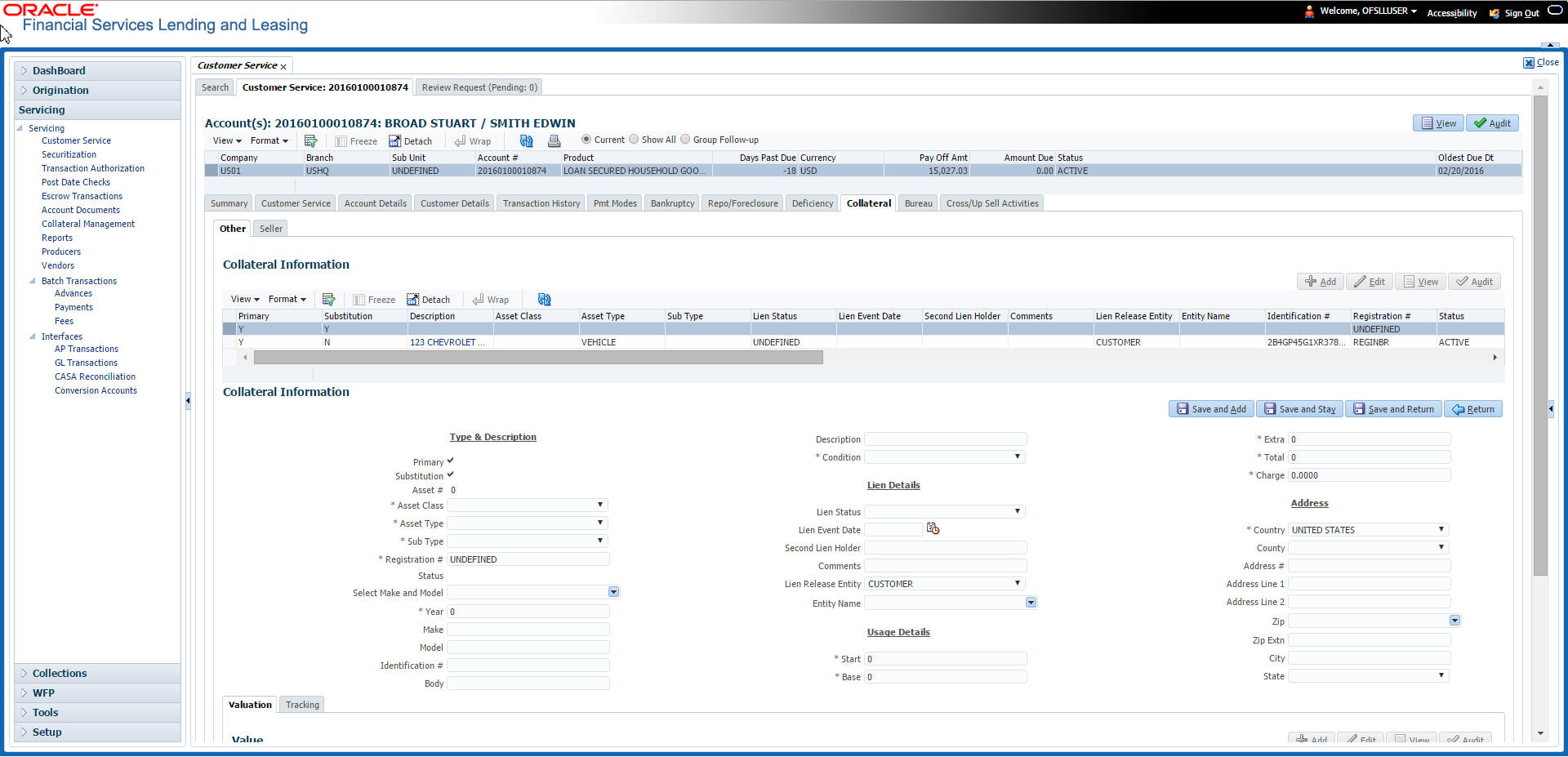

Collateral Information section

You can view the Collateral Information in this section:

In this field: |

View this: |

Description |

A brief description on the collateral. This is a hyper-link which when clicked opens Collateral Management screen with relevant collateral details. |

Identification # |

The identification number of the collateral. This is a hyper-link which when clicked takes you to the collateral management screen with the relevant asset details. |

Year |

The year of manufacture of the collateral. |

Asset Class |

The asset class of the collateral. |

Asset Type |

The type of collateral. |

Sub Type |

The sub type of the collateral. |

Customer Information section

On Customer Service screen’s Customer Information section, select the record you want to work with and view the following information:

In this field: |

View this: |

Customer # |

Customer identification number (unique customer identifier). |

Name |

Customer’s full name. |

Relation |

Customer’s relationship to the account. |

SSN |

Customer’s social security number. If the organizational parameter UIX_HIDE_RESTRICTED_DATA is set to Y, this appears as a masked number; for example, XXX-XX-1234. |

Birth Dt |

Customer’s date of birth. |

Gender |

Customer’s gender. |

Customer Details section

In this field: |

View this: |

Customer’s e-mail address. |

|

Language |

Language spoken by the customer. |

Marital Status |

Customer’s marital status. |

Disability |

Customer’s disability indicator If selected, this indicates that the customer is disabled. |

Skip |

Customer’s skip indicator. If selected, this indicates that the customer is a skip debtor. This is selected using the Maintenance screen. |

Stop Correspondence |

Stop correspondence indicator. If selected, Oracle Financial Services Lending and Leasing will not send correspondence to customer. This is selected using the Maintenance screen. |

Privacy Opt-Out |

Privacy opt-out indicator. If selected, indicates that customer does not want the FI to share his /her information with any other body, other than regulatory requirements. (optional). |

Active Military Duty |

Customer’s Active Military Duty indicator. If selected, this indicates that the customer is serving Military Duty. This is selected using the Maintenance screen. |

Time Zone |

Customer’s time zone. |

Address Information section

In this field: |

View this: |

Type |

Address type. |

Current |

If selected, indicates that this is the current address. |

Permission to Call |

If selected, indicates that you can contact the customer. |

Mailing |

If selected, indicates that this is the mailing address. |

Address |

Address details. |

Phone |

Phone number. |

Employment Information section

In this field: |

View this: |

Type |

Address type. |

Current |

If selected, indicates that this is the current address. |

Permission to Call |

If selected, indicates that you can contact the customer. |

Employer |

Employer Details |

Address |

Address details. |

Phone |

Phone number. |

Telecom Information Section

In this field: |

View this: |

Type |

The type of phone contact such as Home / Office / Car / Mobile phone. |

Permission to Call |

Permission as either Yes ‘Y’ or No ‘N’ to contact the customer over phone. |

Phone |

The customer’s phone number. |

Extn |

The customer’s phone extension. |

Time Zone |

The customer’s time zone. |

Best day to call |

Preferred day of the week to contact the customer, if specified. |

Best Time To Call |

Preferred time to contact the customer, if specified. |

Outbound Call History

Displays outbound call statistics with following references:

In this field: |

View this: |

Today |

The total number of outbound calls as of today. |

Last 7 days |

The total number of outbound calls in the past 7 days. |

Last 30 days |

The total number of outbound calls in the past 30 days. |

Work Order Details

Displays work order details as indicated below:

In this field: |

View this: |

Work Order # |

View the work order number. |

Case # |

View the case number if associated with the work order. |

Work Order Type |

View the type of work order. |

Vendor |

View the vendor to whom the work order is assigned. |

Status |

View the status of work order. |

4.4 Customer Service screen’s Customer Service tab

Open the Customer Service screen and load the account you want to work with. Click the Customer Service tab to view the sections under it.

4.4.1 Call Activities sub tab

Call activity section includes calls from customer, calls you make regarding the account or changes to the condition of the account. Entries in the Call Activities section are listed in reverse chronological order of follow-up date.

Each action and result has a code and description. The code for the call action and call result is what appears on the Call Activity sub screen. The Call activity action codes (Action field) and call activity results codes (Results field) are user-defined.

The Call Activities sub tab displays all the call activities defined by users in both “Customer Service > Call Activities tab” and in “Right Hand Splitter > Add Call Activity section”.

4.4.1.1 Recording a Call Activity

To record a call activity

- Open the Customer Service screen and load the account you want to work with.

- Click Customer Service sub tab and then click

Call Activities tab under it. Click Add. The system displays

the following screen.

- You can complete the following optional fields:

- Perform any of the Basic Operations mentioned in Navigation

chapter.

In this field:

Do this:

Dt

System defaults the current date.

Action

Select the action performed from the drop-down list.

Result

Select the result of the action from the drop-down list. Depending on the action selected, filtered results are displayed for selection.

Contact

Select who person you contacted from the drop-down list.

Reason

Select the reason for the communication from the drop-down list.

Promise Date

Select the promise date from the adjoining calendar.

Promise Amt

Specify the promise amount.

Condition

Select the condition or queue type from the drop-down list.

The list displays a combination of all the possible conditions depending on the action and result selected along with any open conditions applicable on the account. You can select ‘None’ if there are no specific conditions.

Appointment

Check this box to take an appointment.

If Appointment is checked, then system allows you to select date and appointment time as per customer request. If appointment flag is not checked, then you can only enter the date with date picker.

Followup Dt

Specify the next follow-up date. Based on this date, system automatically adds the account in queue for follow-up.

Time Zone

Select the time zone of the customer.

Group Followup

Check this box to enable group followup.

Comment

Specify additional information of the call activity, if any.

- Perform any of the Basic Actions mentioned in Navigation chapter.

- Click to Save and Add to add a new record. Click to Save and Return to return to the main screen. The system creates two entries on Customer Service screen for the call activity.

The codes for Action and Result appear as a record on the Customer Service screen, under Call Activities tab. The description for Action and Result appear as a system generated comment on the Customer Service screen, under Comments tab. If the account is delinquent, then the delinquency days is also appended in the system generated comment.

4.4.1.2 Making an Appointment

The Appointment box on Call Activities section enables you to schedule an account to appear in a particular queue at a future date and time. When you make an appointment, account will appear in the front of queue listed in the Conditions field at the time listed in the Follow Up Dt field.

In order to view the account, you must be working in that queue at follow up time. Refer the ‘Recording a Call Activity section’.

To make an appointment

- Open Customer Service screen and load the account you want to work with.

- Click Customer Service sub tab and then click Call Activities tab under it.

- Click Add and specify the field details on Call Activities section (Refer, Recording a call activity section).

- In Condition field, select the condition for queue you want the account to appear in.

- In Follow Up Dt field, select the date and time you want account to appear using the calendar. This can be either current day or a day in future.

- Select the Appn’mt box.

- Click Save And Add / Save And Return.

If account is not worked within the queue on day of the appointment, nightly jobs will cancel the appointment. If the account’s queue condition changes during nightly batch jobs, the outstanding appointments are cancelled.

4.4.1.3 Cancelling an Appointment

Using the Call Activities screen, you can cancel an appointment for an account. The account will still appear in the queue on follow up date, but no longer receive a priority.

To cancel an appointment

- Open Customer Service screen and load the account you want to work with.

- Click Customer Service sub tab and then click Call Activities tab under it.

Click Add. The system displays Call Activities screen.

If you need to change time for the appointment, create a new entry on

account’s Call Activities section with the same condition,

but enter a new follow up date. If you need to cancel the appointment,

create a new entry on account’s Call Activities section

with same condition, but don’t check the Appointment

check box.

(To create a new entry, refer Recording a Call Activity section.)

- Click Save.

4.4.1.4 Recording a Promise to Pay

If you record an action on Call Activities screen as a ‘promise to pay’, it appears as a record on the Account Details screen’s Promises section. The Promises section enables you to quickly view these actions without searching for them individually.

To record a promise to pay

- Open Customer Service screen and load the account you want to work with.

- Click Customer Service sub tab and then click Call Activities tab under it.

- Click Add. The system displays the Call Activities screen. In Action field, select the action which is already performed, such as DC - Dealer Called

- In the Result field, select a result involving a promise to pay, such as PP - PROMISE TO PAY.

- You can complete the following optional fields:

In this field:

Do this:

Contact

Select the contact type. (Who was the person you communicated with?).

Reason

Select the reason, as stated by the contacted person. (What is the reason for this contact?).

- In the Promise Dt field, record date when the person you spoke with promises to make payment.

- In the Promise Amt field, record amount of payment the person you spoke with promises to pay.

- In the Condition field, select the condition or queue type.

- In the Follow up Dt field, enter next follow-up date for the promise-to-pay or accept the default date.

- Click Save. The system automatically notes this information as an entry on the Promises and Comments sub screens.

Note

If payment amount is within the tolerance limit, promise is considered to be kept. If the payment amount is not within tolerance limit, promise is considered to be broken.

4.4.1.5 Cancelling a Promise to Pay

Oracle Financial Services Lending and Leasing enables you to cancel promises to pay using the Account Detail’s screen Call Activities section. You might do this when a customer informs you prior to the promise date that he or she cannot make the payment.

To cancel the existing promise to pay

- Open the Customer Service screen and load the account you want to work with.

- Click Customer Service sub tab and then click Call Activities tab under it.

- Click Add. The system displays the Call Activities screen.

- Select the call activity entry for the promise to pay you want to cancel.

Click the Cancel box. The promise is marked as cancelled and will not be considered when processing promises; in other words, it will not be counted as either satisfied or broken.

4.4.1.6 Posting Offline Call Activities

The system facilitates posting of offline call activities against an account.

To Post Offline Call Activities:

- The source file is provided in CSV format (pre-determined for fields & size). Each field in the file is separated by a comma (,) and each line is separated by return (New Line).

- A batch job Offline call activity posting, loads the provided flat file in the specified format and system will process it line by line.

- For each line, the system posts Call Action Code and the corresponding Call Result Code, for a given account number with SYSDATE.

- The system will perform respective call activities and sets the follow-up date as SYSDATE + Follow up Days (As provided in the feed file)

- During offline call activity, you can specify comments, if any, in the comments field. The system defaults comments received from offline call activity in the comments section sub tab under Customer Service screen.

- During offline call activity, you can also include the alert flag as ‘Y’ or ‘N’ for a comment as the last parameter (i.e. after comments and separated by a comma). Oracle Financial Services Lending and Leasing recognizes this comment as an alert and displays in Customer Service > Summary Tab, in Alerts section.

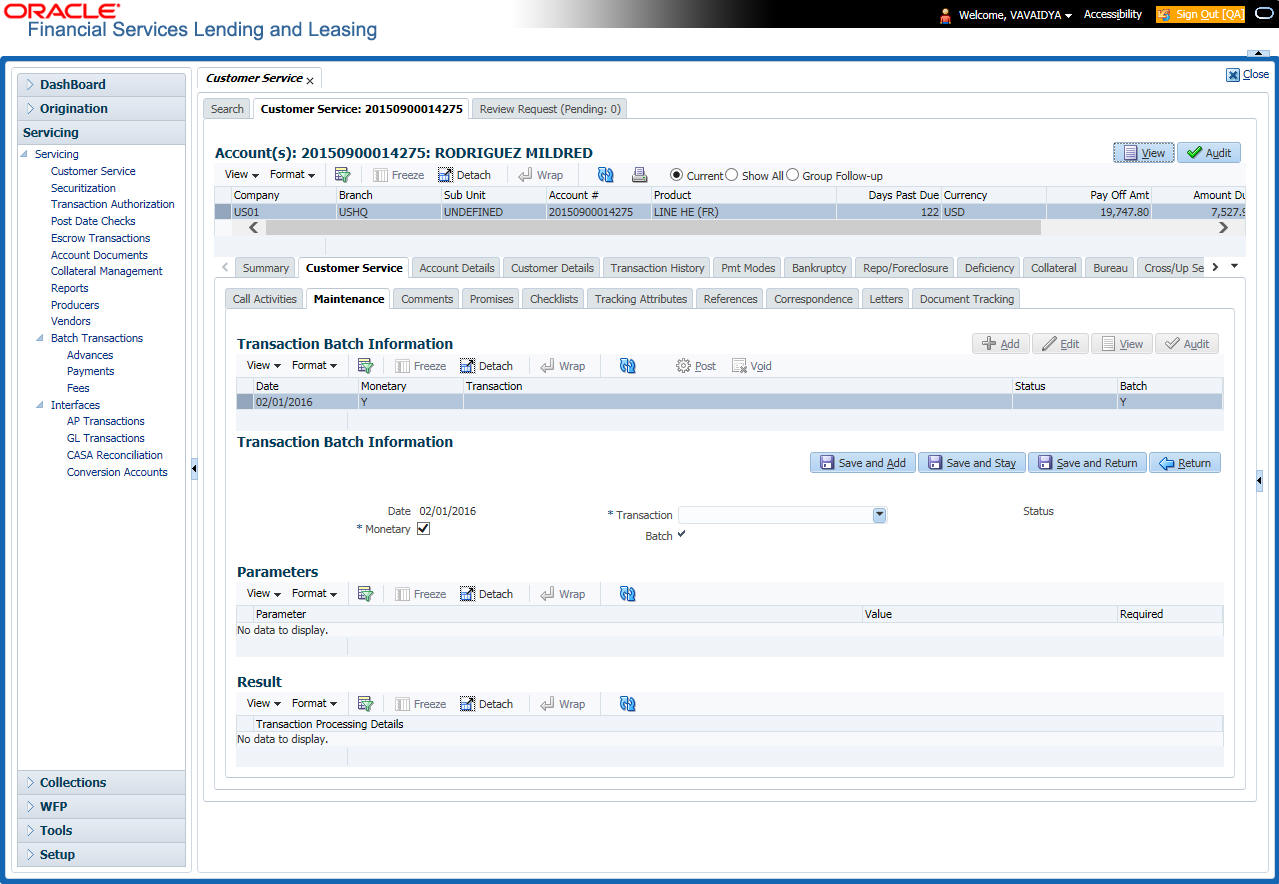

4.4.2 Maintenance sub tab

The Customer Service screen’s Maintenance screen acts as a single command stations that enables you to post a wide array of monetary and non monetary transactions for any given account. Transaction available is based on the account’s Line of credit produce and the user’s responsibility. This section explains how to complete the following tasks:

Monetary tasks

Line of Credit:

- Apply, adjust, or waive servicing expenses

- Adjust or waive late charges

- Adjust or waive non-sufficient funds

- Apply, adjust, or waive repossession expenses

- Apply, adjust, or waive bankruptcy expenses

- Apply or adjust phone pay fees

- Change an index/margin rate

- Apply, adjust, or cancel financed insurance

- Payoff an account

- Charge-off an account/Do Not Charge-Off an account.

- Close an account

- Indicate a borrower as on or off active military duty

- Post a credit limit

- Activate, adjust, cancel, or waive a credit insurance disability

- Activate, adjust, cancel, or waive a credit insurance life

- Adjust or waive an advance transaction fee

- Adjust or waive a membership fee

- Adjust or waive an over limit fee

- Adjust, charge-off, or waive the advance/principal balance

- Adjust the interest balance

- Stop interest accrual

Non-Monetary tasks

Line of credit:

- Update a customer’s name

- Maintain customer details

- Mark a customer as a skipped debtor

- Change a customer’s Privacy Opt-Out indicator

- Stop correspondence

- Modify financed insurance information

- Start or stop an ACH

- Reprint a statement (batch only)

- Add or stop servicing of accounts with post dated checks as a repayment method

- Adjust Dealer Compensation

The system enables you to post a monetary transaction immediately or submit it for nightly processing. The transaction is identified as either a ‘real-time’ or nightly batch transaction in Oracle Financial Services Lending and Leasing’s transaction setup codes. The system also enables you to cancel the future dated transactions or transactions those have been submitted for nightly processing. All activities in the account, including who performed it, date and time stamp, are captured in the audit trail.

4.4.2.1 Creating Monetary and Non monetary Transactions

All monetary and non monetary tasks listed in the appendix Transaction Parameters are available for use on Maintenance screen. Each task requires a Transaction value and a Parameter value.

To use the Maintenance screen to complete monetary transaction

- Open Customer Service screen and load the account you want to work with.

- Click Customer Service sub tab and then click

Maintenance tab under it.

- On the Maintenance screen’s Action section, click AddIn the Transaction Batch Information Section section:

- Select the Monetary box to complete a monetary transaction.

-or-

- Clear the Monetary box to complete a non monetary transaction.

- In the Transaction field, select transaction for the task you want to complete. Transaction availability depends on the type of Line of credit account, whether the transaction is monetary or non monetary, and user responsibility.

Note that, during set up, all transactions are configured to be processed either in real time or as a batch transaction. Accordingly, the ‘Batch’ check box is selected only if the selected transaction is to be performed through batch execution.

- Click Load Parameters.

- Specify all the required parameter values and click Post.

The system displays result (success or failure) in the Results section.

You can cancel a transaction by selecting the record and clicking Void. The parameter ‘TPE_TXN_POST_DEFAULT_GLDATE’ is used to default the transaction date to GL date. If the ‘Default Transaction Date to GL Date’ is Yes, then GL date will be defaulted as transaction date. If the value is ‘No’, then the transaction date will not be defaulted and you can specify the transaction date manually.

When transaction date is not equal to or less than the system date, transaction is considered to be back dated. System Date is ‘OFSLL System Date’ which is the GL Date. When user posts the back dated transaction, system displays warning message as “Confirm to post the back dated transaction” with YES/NO. If user selects 'Yes', then transaction proceeds. If user selects 'No', then the transaction gets cancelled.

System displays back dated posting warning message only if the parameter ‘TPE_SHOW_BACKDATE_WARNING’ is set to ‘Y’

When an ‘ON MILITARY DUTY TRANSACTION’ is posted in an account:

- The system restricts users from bankruptcy /repossession/foreclosure conditions.

- System posts DO NOT CHARGE OFF condition on that account to exclude the account from Auto Charge Off process.

- The DO NOT CHARGE OFF condition is removed when 'OFF Military Duty' transaction is posted.

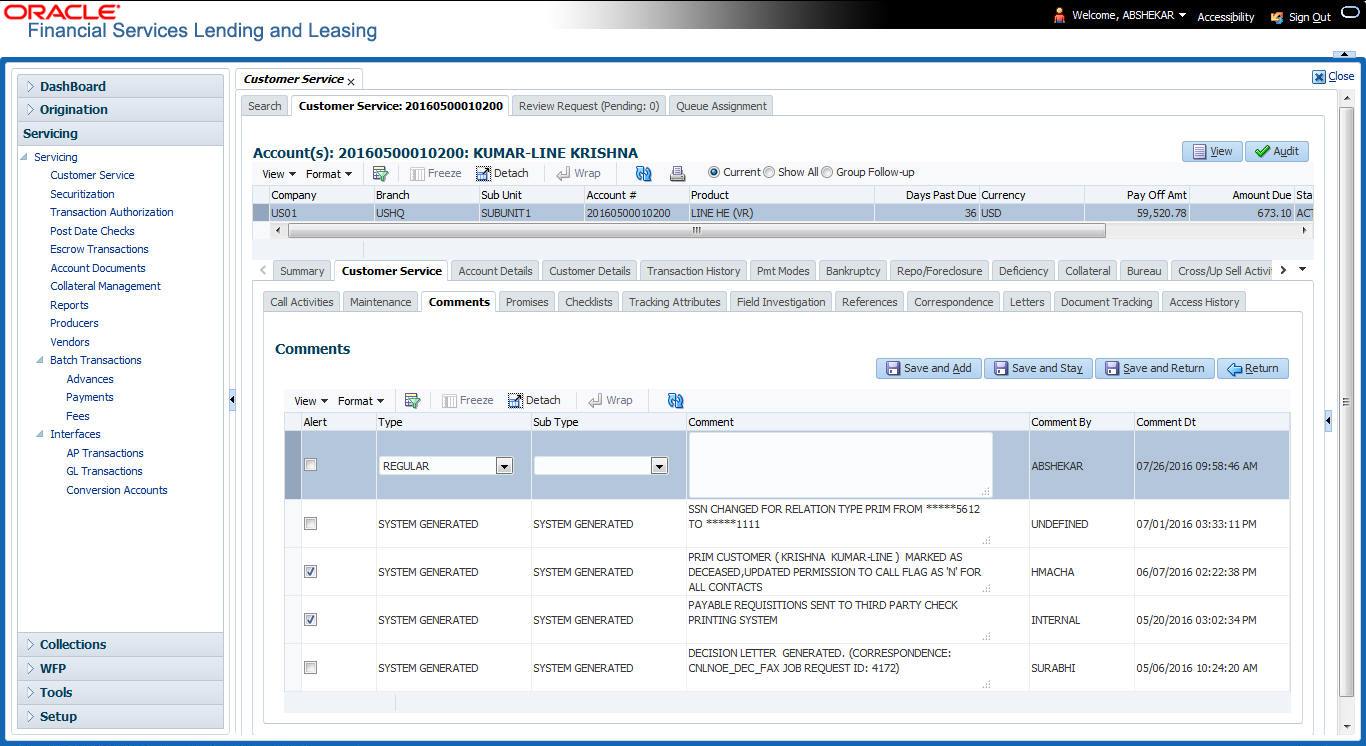

4.4.3 Comments sub tab

Oracle Financial Services Lending and Leasing enables you to record/delete comments on the Customer Service screen using Comments tab. These comments also appear under the Comments sub tab.

All the user added Comments in either Customer Service > Comments tab or in Right Hand Splitter > Add Comment section, are displayed in the Comments sub tab including system generated comments.

4.4.3.1 Recording an Additional Comment

To record an additional comment

- Open the Customer Service screen and load the account you want to work with.

- Click Customer Service sub tab and then click Comments tab under it.

- Click Add. The system displays the Comments

screen.

- If you want to tag this comment as important, select the Alert box. If selected, the comment appears on Customer Service screen’s Alerts section, after Save.

- In the Type field, select what type of comment you are adding.

- In the Sub Type field, select what sub type of comment you are adding.

- In the Comment field, specify your comment.

- Click Save and Add to add a new record. Click Save and Return to return to the main screen.

Comments can be viewed under the Comments tab View the following:

In this field: |

View this: |

Alert |

If selected, Oracle Financial Services Lending and Leasing to recognizes this comment as an alert and displays in Customer Service > Summary Tab, in Alerts section. |

Type |

The type of comment. |

SubType |

The sub type of comment. |

Comment |

The text message entered in the Add Comments section. |

Comment By |

The user ID of person who entered comment in the Add Comments section. |

Comment Dt |

The date on which comment was entered in the Add Comments section. |

4.4.3.2 Deleting Comment(s)

You can delete ‘REGULAR’ type comments displayed in the Comments sub tab.

To delete a comment

- Open the Customer Service screen and load the account you want to work with.

- Click Customer Service sub tab and then click Comments tab under it.

- Select the row which consists of the comment and click Delete from the actions.

- Click ‘Yes’ to confirm delete in the warning message displayed.

4.4.4 Promises sub tab

The system automatically updates promise to pay request information as an entry under the Promises sub tab based on value defined in parameter at setup level.

In this field: |

View this: |

Promise Amt |

The amount promised. |

Promise Dt |

The date by which customer promises to pay the said amount. |

Taken By |

The user who took promise. |

Taken Dt |

The date promise was taken. |

Collected Amt |

The amount collected against the promise. |

Broken ind |

If ‘Y’, indicates that this is a broken promise. |

Cancelled |

If ‘Y’, indicates that this is a cancelled promise |

If a call was recorded as a Promise to Pay on the Call Activities section, it will appear under the Promises sub tab. The Promises sub tab enables you to quickly view details about the call and subsequent actions and displays 25 most recent promises to pay.

A promise is considered to be broken in either of the following conditions:

- If system does not receive the promised amount ‘ON or Before’ the promised date.

- If a payment is received but the paid amount is not up to the tolerance limit, as defined in Setup > Contract screen.

System automatically updates the consolidated status of all promises in Customer Service > Summary tab, ‘Delinquency Information’ section. View the following information in the Promises sub tab.

Create Multiple Promises

In the Promises sub tab, you can capture more than one Promise at a go and track all promises, instead of adding multiple call activities to capture multiple promises.

To record multiple promises related to call activity, Click Create Multiple Promises. The system displays the ‘Promises’ section with the following fields:

In this field: |

View this: |

Action |

Select the type of action from the drop-down list. |

Result |

Select the required result of action from the drop-down list. The Result field drop-down list displays only “Promise to Pay” related results based on the action selected. |

Contact |

Select the type of person you contacted from the drop-down list. |

Reason |

Based on the account condition and the reason stated by the contact, select the appropriate reason from the drop-down list. |

Promise St Dt |

Select the date from which the first promise is made from the adjoining calendar icon. |

Frequency |

Select the frequency of payment from the drop-down list. |

Promise Amt |

Specify the amount promised by the contact. Ensure that you do not enter zero or a decimal value. |

No. of Promises |

Specify the total number of promises made by the contact. A minimum of one promise need to exist. |

Appointment |

Select the check box if a prior appointment is to be taken for future follow-up. |

Comment |

Specify additional details of the promise, if any. |

Click Create to record the promise details. Based on the number of promises, equivalent records are created in the section below with the following information:

In this field: |

View this: |

Promise Dt |

The first record indicates the promise start date and subsequent records will have dates incremented based on frequency and number of promises. |

Promise Amt |

View the amount promised. |

Reason |

Indicates the reason stated by the contact. |

Contact |

Indicates the contact selected. |

FollowUp Dt |

Indicates the followup date which is auto calculated by the system by adding 2-3 additional days from the promise date. |

Appointment |

Indicates if a prior appointment is required for future follow-up. |

Comment |

Specify additional details of the promise, if any. |

If required, You can further modify the details of each record.

Click Save and Return. The recorded promises are populated in Call Activities tab for tracking.

For more information on Call Activities, refer Customer Service > Call Activities sub tab section.

4.4.5 Checklists sub tab

In this field: |

View this: |

Promise Amt |

The amount promised. |

Promise Dt |

The date by which customer promises to pay the said amount. |

Taken By |

The user who took promise. |

Taken Dt |

The date promise was taken. |

Collected Amt |

The amount collected against the promise. |

Broken |

If selected, indicates that this is a broken promise. |

Cancelled |

If selected, indicates that this is a cancelled promise |

Oracle Financial Services Lending and Leasing enables you to use checklist to ensure that procedures are followed to complete various tasks. This instructional information appears under the Checklist sub tab.

4.4.5.1 Completing a Checklist for an Account

To complete a checklist for an account

- Open the Customer Service screen and load the account you want to work with.

- Click Customer Service tab, Click Checklist

sub tab.

- In the Check List Type field, select the type of checklist you want to complete and then click Load Checklist. The system loads checklist in the Checklist and Checklist Action sections.

- Under Action - Regular tab, Click Edit. In the Action field, select an action you want to complete.

- Under Action - Document tab, Click Edit. In Document tab, you can track documents pertaining to the checklist type and update the status.

- Note your work with the Yes/No/NA option buttons. You can also add comments to each action on the checklist in the Comment column.

- Click Save and Add to add a new record. Click Save and Return to return to the main screen.

4.4.6 Tracking Attributes sub tab

The Tracking Attributes screen enables you to link information to an account that is not tracked by default in the system, but is part of your company’s business practices; for example, the location of important documents, how customers receive pay checks, or the hint questions for remembering a PIN. Such attributes are defined during system setup.

To use the Customer Service screen’s Tracking Attributes screen

- Open the Customer Service screen and load the account you want to work with.

- Click the Customer Service tab, then click Tracking Attributes sub tab.

- Click Load Tracking. The system loads the

tracking parameters.

- Complete Tracking section by entering the requested parameter in the Value field.

- Save any changes you made to the account.

4.4.7 Field Investigation Sub Tab

The Field Investigation sub tab allows you to record the field investigation details for further processing. Field investigation primarily consists of verifying cusotmer’s contact points and the other details to be verified such as address, employment, asset etc through a specific verifying agency.

To record field investigation and create work-order

- Open the Customer Service screen and load the account you want to work with.

- Click the Customer Service tab, then click

Field Investigation sub tab.

- In Field Investigation section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields are given below:

Field |

Do this |

Customer |

Select the customer attached to the account from the adjoining drop-down list |

Verification Type |

Select the field verification type from the adjoining drop-down list. |

Verification Agency |

Select the verification agency from the adjoining drop-down list. |

Status |

Select the field verification status from the adjoining drop-down list. |

Spoke to |

Specify the name of the person contacted during field verification. |

Call Dt |

Select the date when the customer was contacted from the adjoining calendar. |

# of Attempts |

Specify the number of attempts made to contact the customer. |

Result |

Select the field verification result from the adjoining drop-down list |

- Perform any of the Basic Actions mentioned in Navigation chapter.

- In Verification Details section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields are given below:

Field |

Do this |

Remarks |

Specify remarks, if any regarding the field verification. |

Verification Match |

Check the box if the verification has matched. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

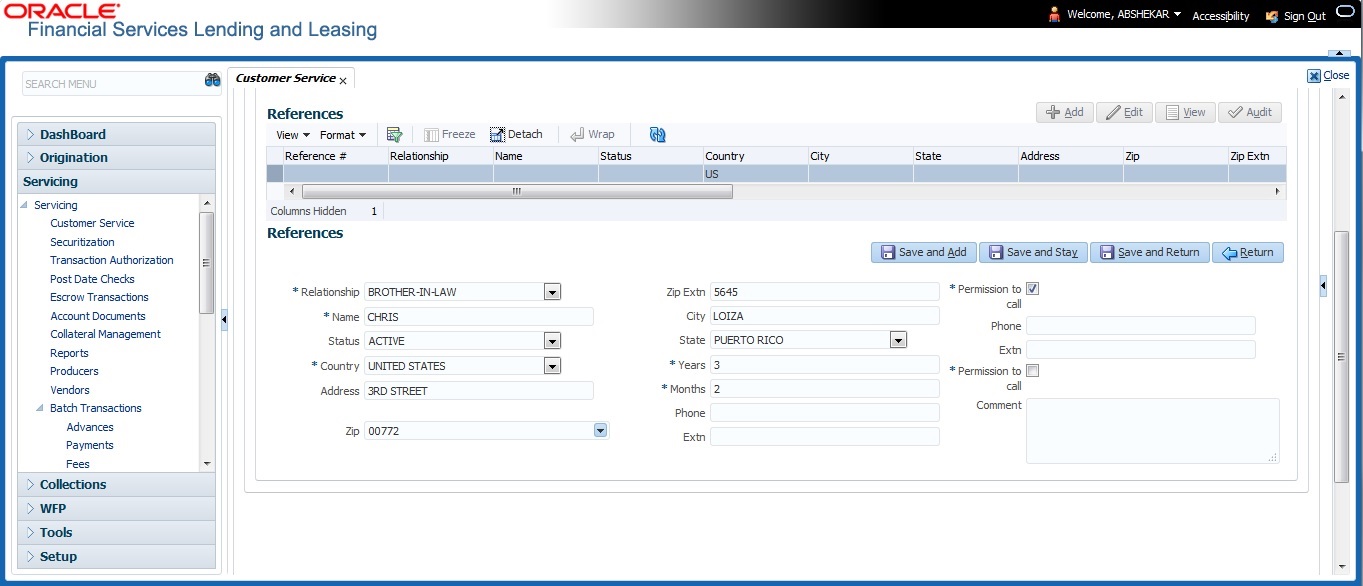

4.4.8 References sub tab

The References sub tab enables you to view/add/edit references attached to the account during Line of credit origination cycle.

To use the Customer Service screen’s References screen

- Open the Customer Service screen and load the account you want to work with.

- Click the Customer Service tab, then click References sub tab.

- Click Add.

Specify the following details:

In this field: |

Specify this: |

Relationship |

Referee's relationship with borrower. |

Name |

Referee's name and details in the following fields. |

Status |

Select the status of the reference as either ‘Active’ or ‘Inactive’ from the drop-down list. |

Country |

The country. |

Address |

The address line. |

Zip |

The zip code. |

Zip Extn |

The zip code extension |

City |

The city. |

State |

The state. |

Years |

Number of years that the reference is known by the borrower. |

Months |

The number of months that the reference is known by the borrower. |

Phone |

The reference’s primary phone number. |

Extn |

The reference’s primary phone extension. |

Permission to call |

Check this box if customer has provided permission to contact through the specified phone number. When selected, system auto validates this option against the phone number specified. Atleast one phone number should have the permission to call for successful pre-qualification of the account. Else, an error message is displayed. |

Phone |

The reference’s secondary phone number. |

Extn |

The reference’s secondary phone extension. |

Permission to call |

Check this box if customer has provided permission to contact through the specified phone number. When selected, system auto validates this option against the phone number specified. Atleast one phone number should have the permission to call for successful pre-qualification of the account. Else, an error message is displayed. |

Comment |

The comments regarding the reference. |

- Click Save and Add to add a new record. Click Save and Return to return to the main screen.

Note

You can also post a non-monetary transaction to add or modify contact reference details. For more details, refer to Appendix - ‘Transaction Parameters’ chapter. For references updated through the Customer Service screen, system automatically appends a comment as 'Direct Update' while posting the respective transactions.

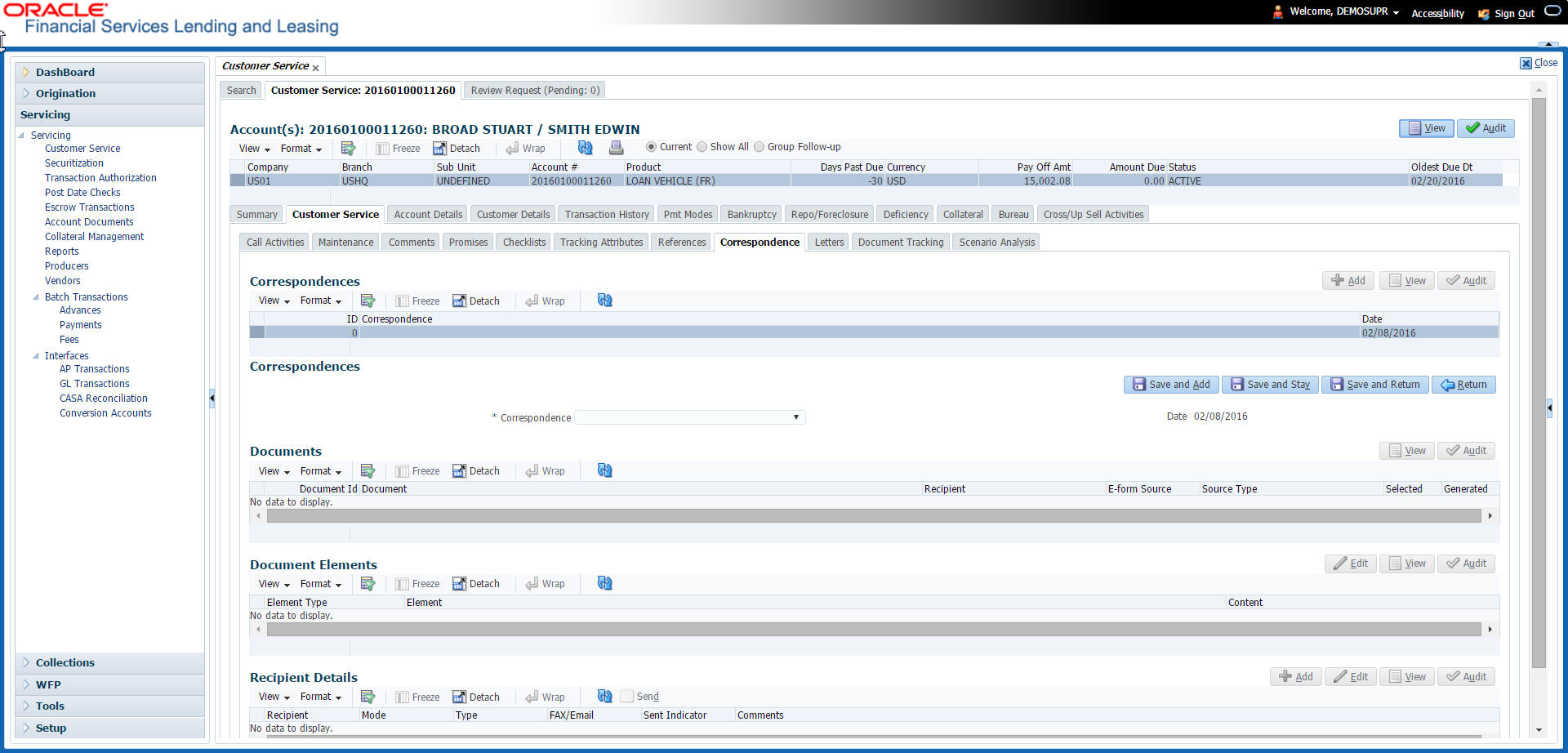

4.4.9 Correspondence sub tab

Ad-hoc correspondence enables you to include information from accounts in document templates you create yourself without manually transferring the data. Ad-hoc documents can be generated as either Microsoft Word or PDF files.

Ad-hoc correspondence can be viewed on the Correspondence screen when you have opened an account. The screen enables you to generate a new letter or view a previously generated letter.

To generate an ad hoc correspondence

- Open the Customer Service screen and load the account you want to work with.

- Click the Customer Service tab, then click

Correspondence sub tab.

- In the Correspondence section,

click Add. In the Correspondence section, use

Correspondence field to select type of correspondence you

want to generate. The system displays following information in the Correspondence

screen for selected type of correspondence:

In this field:

View this:

Id

The correspondence id.

Correspondence

The correspondence which is to be generated.

Date

The correspondence generation date.

- In the Correspondence section, click Save. The Documents section displays all types of documents available for the type of correspondence you selected.

- In the Documents section, click View.View

the following information for each document:

In this field:

View this:

Document Id

The document Id.

Document

The document description.

Recipient

The recipient description.

E-Form Source

The e-form source.

Source Type

The source type.

Generated

’Y’ indicates that Oracle Financial Services Lending and Leasing generated the document.

Selected

’Y’ indicates that this document is selected to be included in the correspondence.

- In the Documents section, select the correspondence you want to view.

- The Document Elements section displays elements of the system used to generate correspondence.

- Click All to view all elements in the correspondence.

- or -

- Click User Defined, to view user-defined elements

in the correspondence. In the Document Elements section,

view the following information:

In this field:

Do this:

Element Type

View the document element type.

Element

View the element description.

Content

Enter/view value of the element.

- In the Document Elements section, click User Defined and complete Content fields for Element fields you want to include in the correspondence.

- In the Document Elements section, click Save.

- In the Document Elements section, click View.

The system displays a PDF of the ad hoc correspondence.

4.4.9.1 Recipient Details Sub Tab

The recipient details sub tab facilitates you to send ad-hoc correspondence to Customers, Producers, and Others as an email.

To add recipient details

- Open the the Customer Service screen and load the account you want to work with.

- Click Correspondence > Recipient Details.

- Perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Recipient |

Select the recipient from the drop-down list. The list displays the following options: - Applicant - Customer - Producer - Others |

Mode |

Select the mode of correspondence from the drop-down list. The list displays the following options: - Fax |

Type |

Based on the recipient selected, the following type of correspondence is listed for selection: When the recipient is selected as Customer / Producer, the Type is defaulted as ‘Email’ and associated email ID is selected for correspondence. You can also change the Type to ‘Adhoc’ and specify the required email ID. When the recipient is selected as ‘Others’ you can specify the email ID in Type field for correspondence. |

FAX/Email |

View the status of FAX/Email selected. |

Comments |

Specify additional information as comments. |

- In the Recipient Details section, click Save.

- Click Send to email the correspondence details to the specified recipients.

System validates the correspondence details and generates a PDF document through BI Publisher with the Correspondence details. The same is emailed to the specified recipient as an attachment and a system generated comment is updated in ‘Comments’ Tab. The correspondence consists of following header details::

Alert |

Type & Subtype |

Comment |

Comment By |

Comment Date |

N |

System Generated |

<Type> <Correspondence type> sent to <Recipient Type> through < Mode> to <'Email' id> |

Logged in user |

Current System date with time stamp |

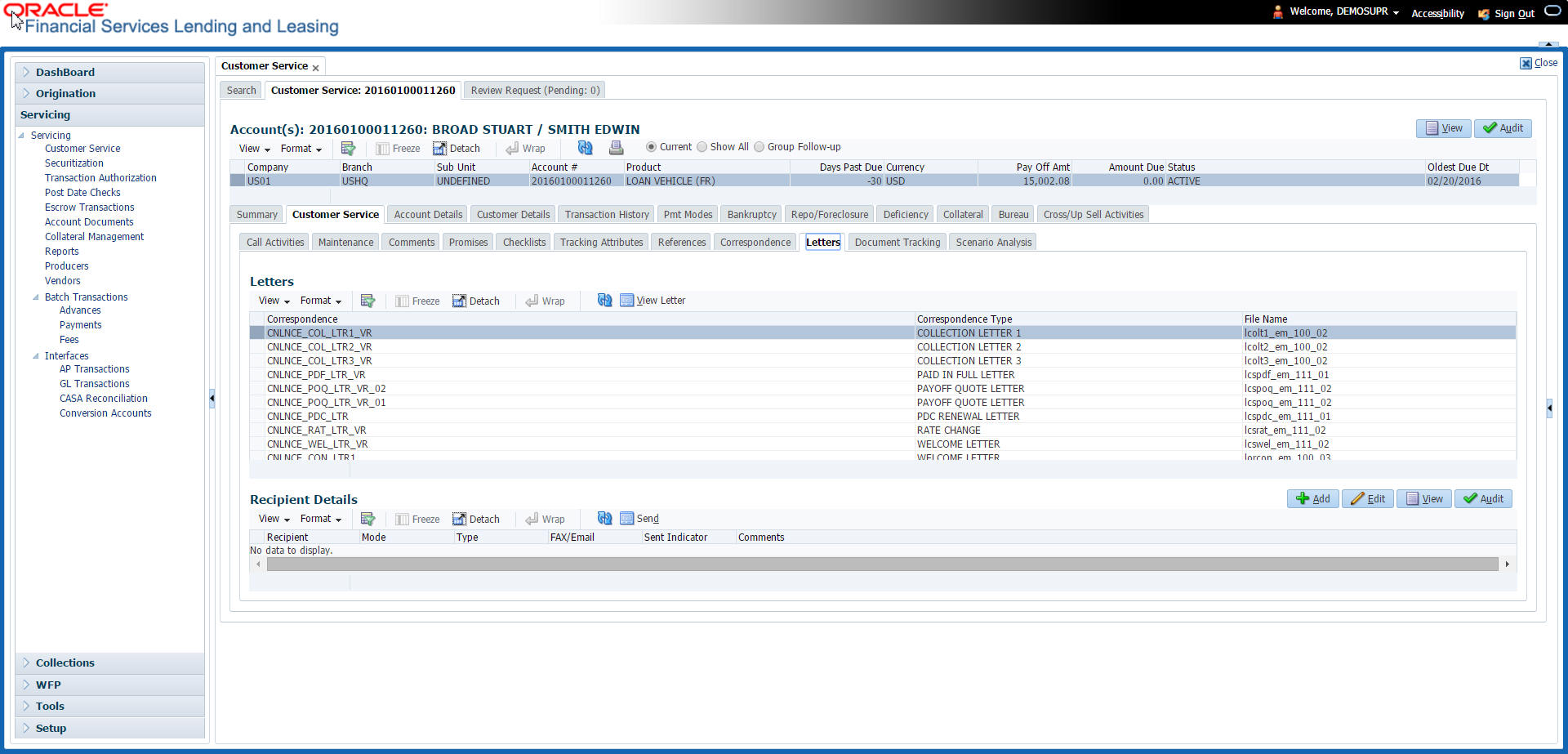

4.4.10 Letters sub tab

The Oracle Financial Services Lending and Leasing Customer Service screen’s correspondence address matters regarding customer service and collections for accounts. They also enable financial organizations to manage bulk mailings. The Letters screen enables you to create and view the following types of correspondence:

- Welcome letter

- Paid in Full letter

- PayOff quote letter

- Rate change intimation letter

- PDC renewal letter

- Servicing:

- Pay Off quote letter

- PDC renewal letter

You can view format of all the above letter types by clicking ‘View Letter’ button. In case, the correspondence to a particular customer has been stopped using the Maintenance, ‘View Letter’ button will not be displayed and only Letters screen will be available.

To use the Letters screen

- Open the Customer Service screen and load the account you want to work with.

- Click the Customer Service tab, then click

Letters sub tab.

Recipient Details

In the Recipient Details section, you can maintain the recipient details to whom the letter should be sent. You can specify the following recipient details:

Field: |

Do this: |

Recipient |

Select the recipient from the drop-down list. The list displays the following options: - Applicant - Customer - Producer - Others |

Mode |

Select the mode of correspondence from the drop-down list. The list displays the following options: - Fax |

Type |

Based on the recipient selected, the following type of correspondence is listed for selection: When the recipient is selected as Customer / Producer, the Type is defaulted as ‘Email’ and associated email ID is selected for correspondence. You can also change the Type to ‘Adhoc’ and specify the required email ID. When the recipient is selected as ‘Others’ you can specify the email ID in Type field for correspondence. |

FAX/Email |

View the status of FAX/Email selected. |

Comments |

Specify additional information as comments. |

- In the Recipient Details section, click Save.

- Click Send to email the correspondence details to the specified recipients.

System validates the correspondence details and generates a PDF document through BI Publisher with the Correspondence details. The same is emailed to the specified recipient as an attachment and a system generated comment is updated in ‘Comments’ Tab. The correspondence consists of following header details:

Alert |

Type & Subtype |

Comment |

Comment By |

Comment Date |

N |

System Generated |

<Type> <Correspondence type> sent to <Recipient Type> through < Mode> to <'Email' id> |

Logged in user |

Current System date with time stamp |

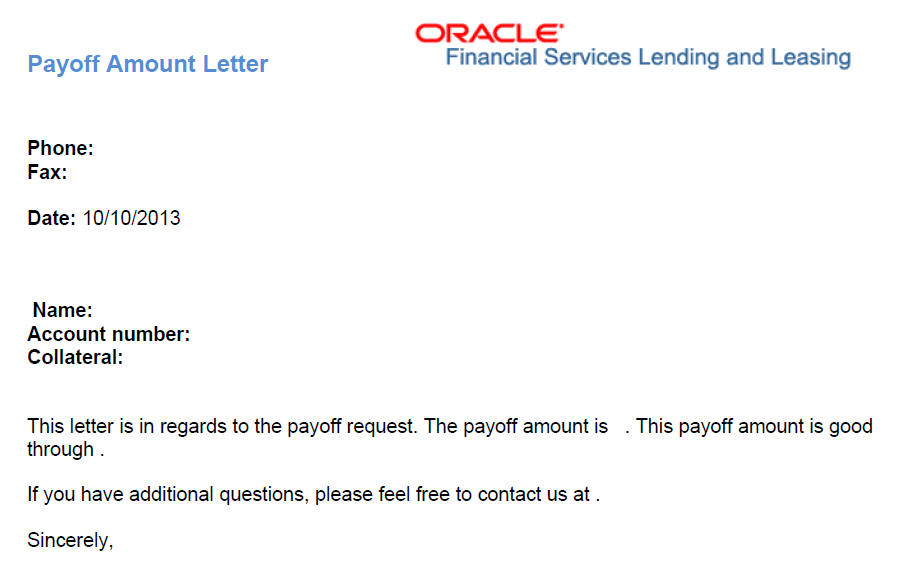

4.4.10.1 Servicing: Payoff Quote

The predefined Payoff Quote is sent if a payoff quote is requested for an account. Payoff quotes can be manually generated using Maintenance screen on the Customer Service screen with the monetary Payoff Quote transaction.

To generate a payoff quote letter

- Open the Customer Service screen and load the account you want to work with.

- Click the Customer Service tab, then click Letters sub tab.

- On the Letters section, select Payoff Quote Letter.

- Click View Letter to generate Payoff Quote

Letter.

4.4.10.2 Servicing: Rate Change Intimation Letter

For line of credits with interest rates based on index- it is standard practice to inform the borrower about upcoming interest rate changes due to a change in the rate index. Oracle Financial Services Lending and Leasing can print pre-rate change intimation letters both automatically and manually. The Rate Change Intimation letter informs borrowers that their rate index has changed. All borrowers with the changed index may receive a rate revision on the extn rate change, which is due after X days (X is a company parameter that can be set with pre-process days).

The Rate Change Intimation letter is available only for variable rate line of credits.

To generate the Rate Change Intimation letter

- Open the Customer Service screen and load the account you want to work with.

- Click the Customer Service tab, then click Letters sub tab.

- On the Letters section, select Rate Change Intimation Letter.

- Click View Letter to generate Rate Change

Intimation Letter .

4.4.11 Document Tracking sub tab

You can view the documents attached to a particular account by loading the account on Customer Service screen, then clicking the Document Tracking sub tab. You can also open the Document Tracking screen and select from a list of all accounts with documents attached on the Document Tracking screen.

To use the Document Tracking screen

- Open the Customer Service screen and load the account you want to work with.

- Click the Customer Service tab, then click

Document Tracking sub tab.

- In the Documents section, select

the document you want to view and view the following information:

In this field:

Do this:

Document Type

View the document type.

Comment

Specify comment.

- In the Account Document Details section, select the document you want to view and click Show in the Details column.

- In the Account Document Details section, click

View to view the following information:

In this field:

Do this:

Document Type

View the document type.

Document Sub Type

View the document sub type.

Version

View the version. Version numbers will be incremental by batch job, first version will start with 1.0.

Page #

View the page number. In multiple paged documents, choose 1 in the Page # field on Account Document Details section to view all the pages in the document.

Choose a specific page number to view only that page.

Document File Type

View the document file type.

Status

View the status of the document.

Tracker #

View the tracking number of the document.

Docket #

View the docket number of the document.

Location

View the location of the document.

Received Dt

View the received date of the document.

Effective Dt

View the effective date of the document.

Expiry Dt

View the expiration date of the document.

Comment

Specify comment.

- Click View Document. The system opens a File Download dialog box.

- Click Open to view the document in the browser screen

-or-

- Click Save to download the document to a location of your choice.

- If you want, add comments to the Comments field in the Documents and Account Document Details sections.

- Save your entry.

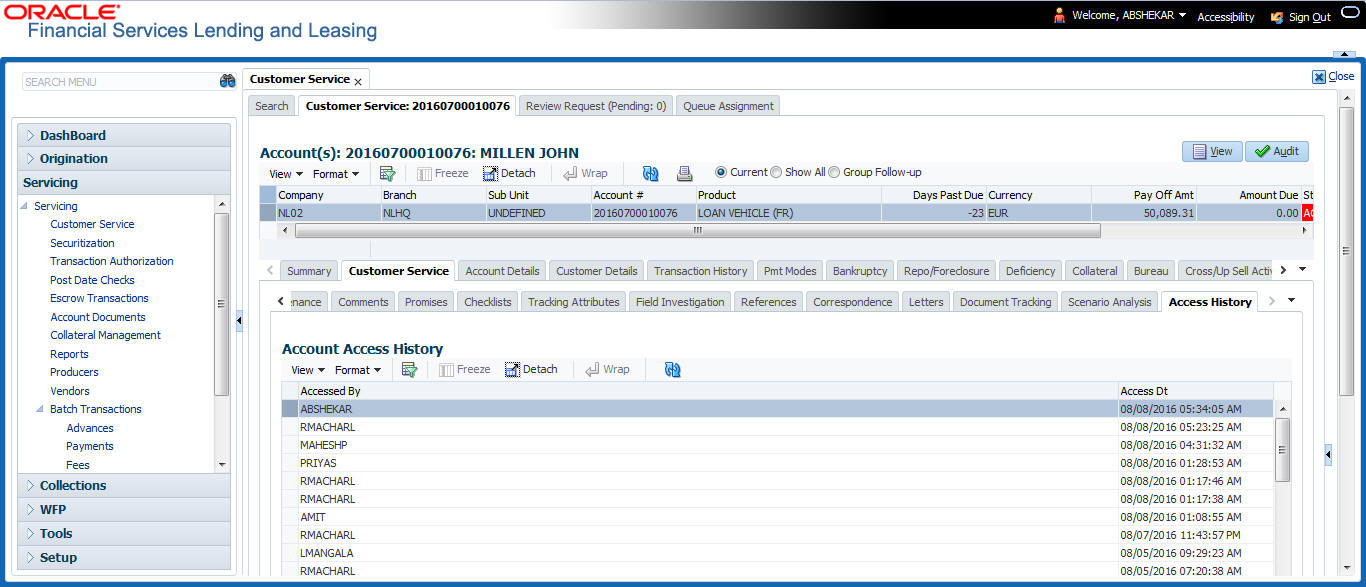

4.4.12 Access History

The Access History tab in Customer Service screen displays the list of users who have accessed a particular account in Oracle Financial Services Lending and Leasing application.

Irrespective of the action performed on the account or the way through which the account is accessed such as using search, queue/conditions, review requests and so on, system records every access and displays the user details in ‘Account Access History’ section.

Starting with the last user, the Account Access History section displays the list in descending order along with their logged-in User ID (Accessed By), date and time (Access Dt) of login in separate columns.

To view the account access history

- Open the Customer Service screen and load the account you want to work with.

- Click the Customer Service tab, then click

Access History sub tab.

You can click  (refresh) to fetch the

latest data.

(refresh) to fetch the

latest data.

4.5 Customer Service screen’s Account Details tab

Open the Customer Service screen and load the account you want to work with. Click the Account Details tab to view the sections under it.

4.5.1 Account Details sub tab

Oracle Financial Services Lending and Leasing enables you to view account details using Account Details sub tab.

In the Account Information section click View.

View the following information for Line of credit servicing product.

In this field: |

View this: |

Stop Accrual |

If selected, indicates that the accrual has been stopped for the account. |

Index Type |

The index type. |

Index Rate |

The current index rate. |

Margin Rat |

The current margin rate. |

Rate |

The current rate. |

Last Rate Change Dt |

The last Rate change date. |

Accural Start Dt |

The accural start date. |

Last Accural Dt |

The last accural date. |

Rate Start of the Year |

The start rate of the year. |

# of Rate changes (Year) |

The number of times rate changes are granted (year). |

# of Rate changes (Life) |

The number of times rate changes are granted (life). |

Extn and Due Dates |

|

# of Extensions (Year) |

The number of times extensions granted (year). |

# of Extensions (Life) |

The number of times extensions granted (life). |

# of Extension Term (Year) |

The number of terms extensions granted (year). |

# of Extension Term (Life) |

The number of terms extensions granted (life). |

# of Due Day Changes (Year |

The number of due day changes allowed in a year. |

# of Due Day Changes (Life) |

The number of due day changes allowed in a life of an account. |

Last Extn Dt |

The last extn date. |

Due Day Change Dt |

The due day change date. |

Credit Details |

|

Credit Limit |

Total credit limit. |

Hold (-) |

Held credit limit. |

Consumed (-) |

Consumed credit limit. |

Suspended(-) |

Suspended credit limit. |

Available Credit (=) |

Available credit limit. |

Over Limit Year |

Overlimit granted (year). |

Over Limit Life |

Over limit granted (life). |

Last Advance Dt |

The last advance date |

Last Advance Amt |

The last advance amount |

Cure Letter - This section displays the ‘Cure Letter’ details if it has been issued on the account on nonconforming to certain terms that are in violation of obligations and which are to be fixed within the time provided in cure letter. |

|

Start Date |

Displays the start date mentioned in Cure letter. |

Expiry Date |

Displays the date when the Cure notice expires. |

Others |

|

Stmt preference mode |

The account statement preference mode (Email or PHYSICAL) as defined in Origination > Contract screen is displayed here. |

Time Bar Details - System considers those accounts which are in ACTIVE or CHARGED OFF status and having dues, as time barred debts and displays the following time bar details: |

|

Start Date |

View the time bar start date which is the last payment date made on the account. The time bar years is calculated starting from this date. |

End Date |

View the time bar end date. System calculates this date from the start date till the total time bar years specified in Setup > Products > Contract screen. |

Days to Time Bar |

View the total number of days remaining to reach the time bar end date. |

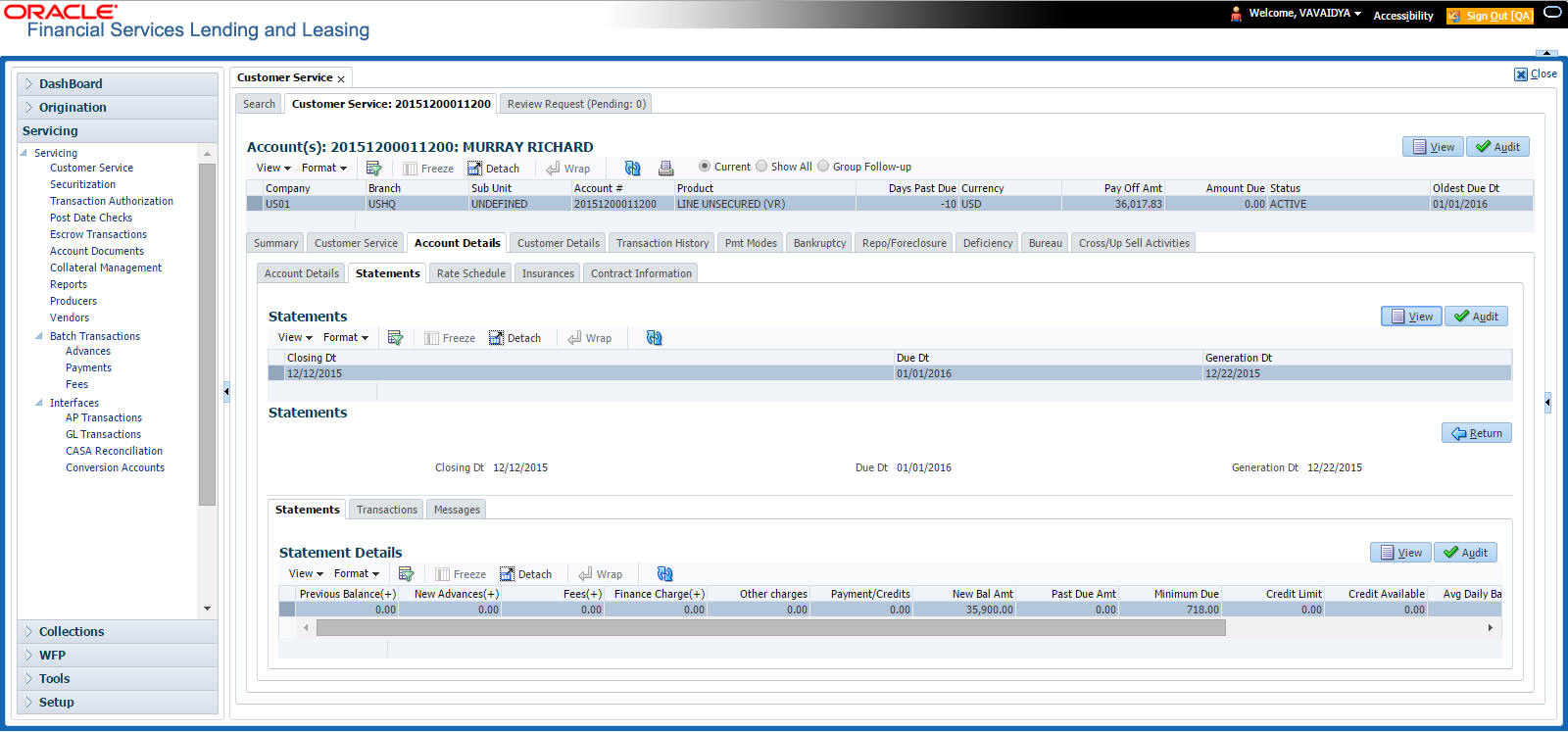

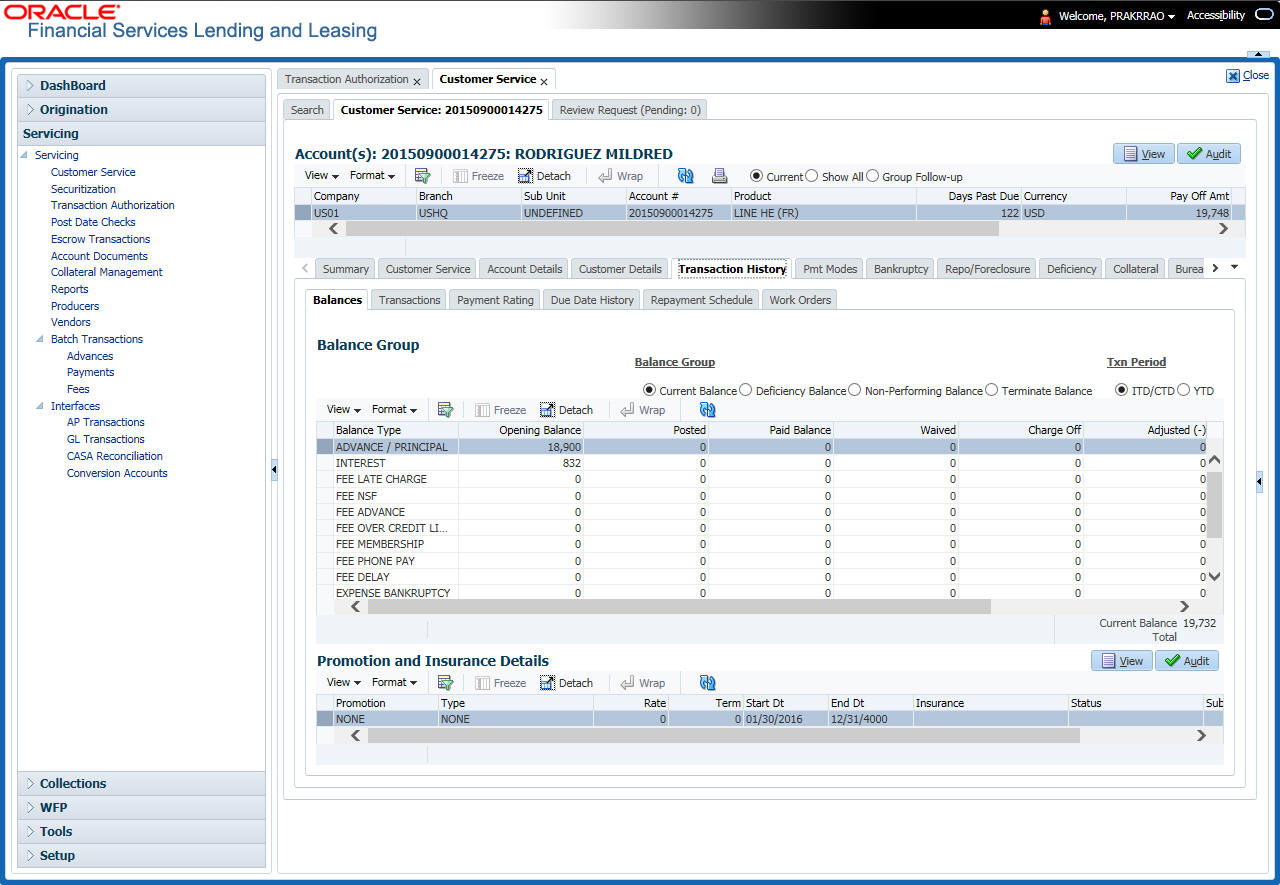

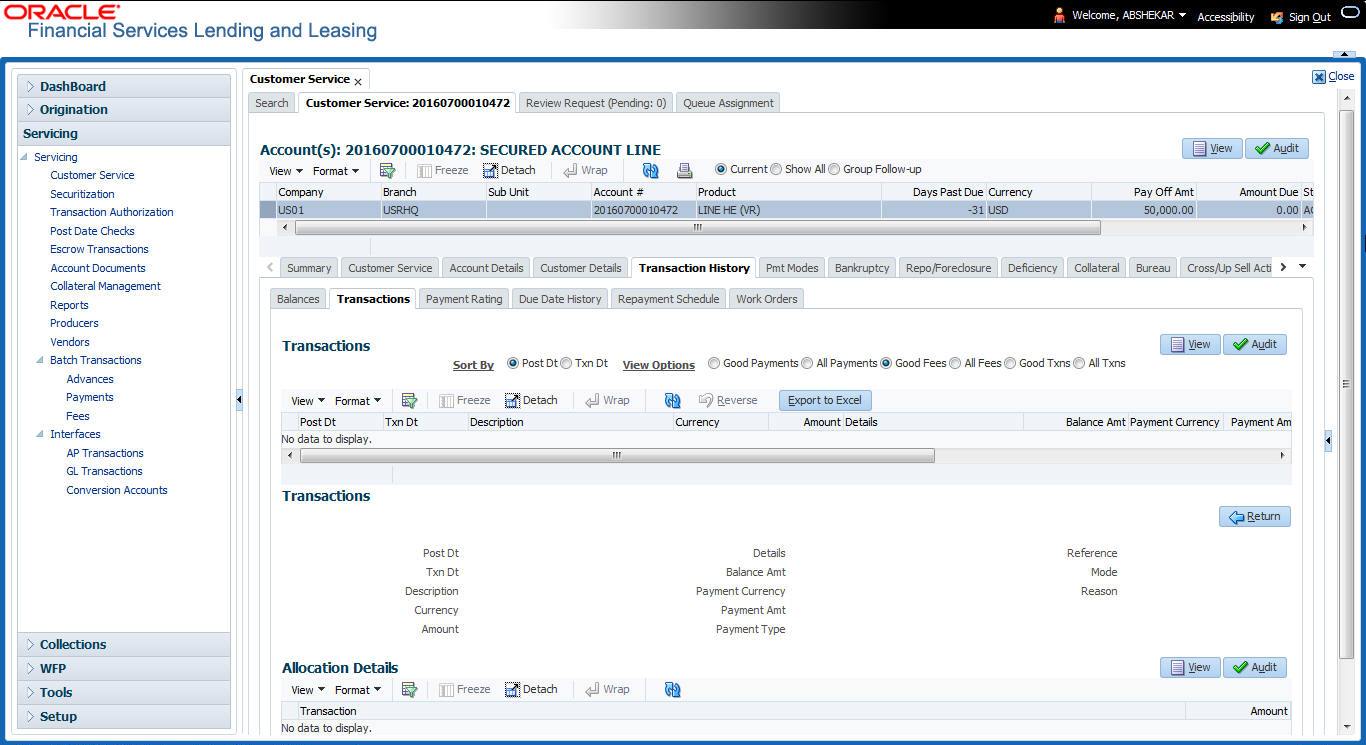

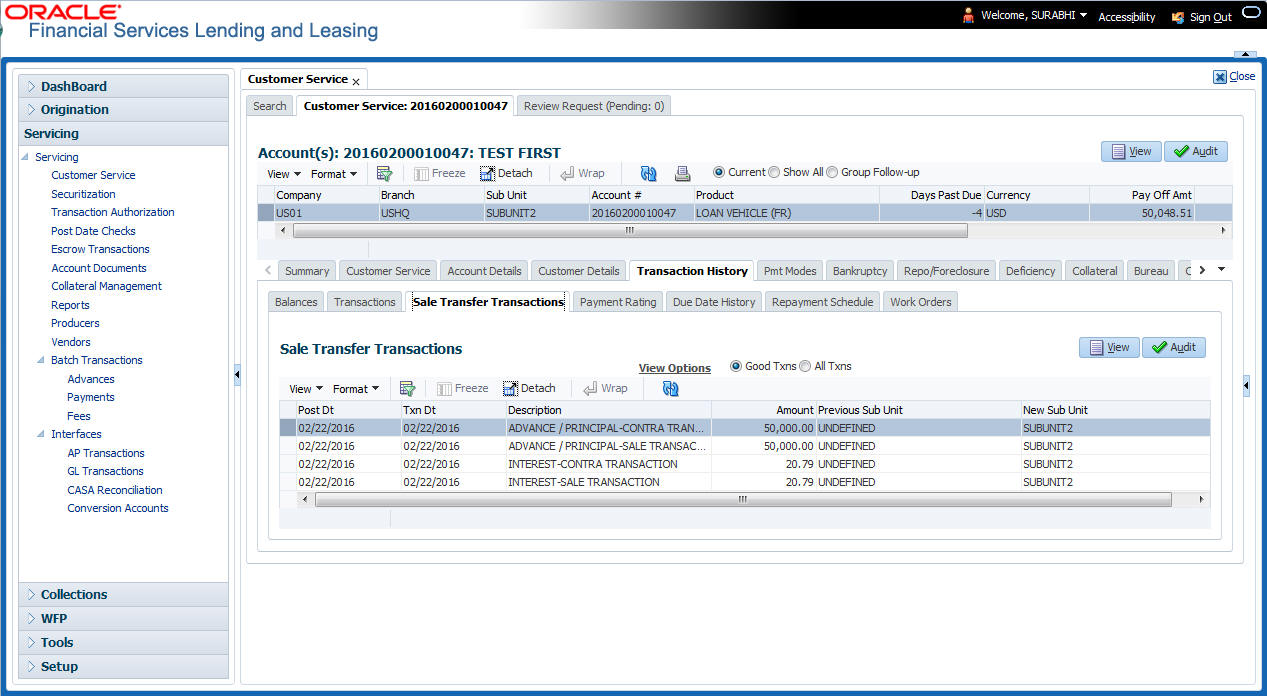

4.5.2 Statements sub tab

The Statements screen contains three display only sections. The Statements section displays a list of all statements generated during life of the account. The Transaction section displays monetary transactions applied to the account from closing date of the previous statement through closing date of the current statement. The Messages section displays user-defined message that appears in the statement.

To view the Statements screen

- Open the Customer Service screen and load the account you want to work with.

- Click the Account Details tab, then click Statements

sub tab.

- In the Statements section, click View.

- View the following information:

In this field:

View:

Closing Dt

The statement closing date.

Due Dt

The statement due date.

Generation Dt

The statement generation date.

In the Statements Details section, select the statement you to view and click View.

- View the following:

In this field:

View:

Previous Balance(+)

The previous existing balance.

New Advances(+)

New advances allowed.

Fees(+)

Fees charged.

Finance Charge(+)

Applicable Financial charges.

Other charges

Applicable other charges.

Payment/Credits

Payments or credits issued.

New Bal Amt

New balance amount available.

Past Due Amt

Past due amount existing.

Minimum Due

Minimum due amount to be paid.

Credit Limit

Total credit limit issued.

Credit Available

Total available credit limit.

Avg Daily Balance

Average daily balance in account.

Daily Periodic Rate

Daily periodic expense rate.

Annual Rate

Annual rate on the account.

Days in Cycle

Total number of accounted days.

- Click Transactions sub tab and click View

- View the following information:

In this field:

View:

Txn Dt

The transaction effective date.

Transaction Type

The type of transaction.

Amount

The transaction amount.

Click Messages sub tab and click View.

- View the following information:

In this field:

View:

Sequence

The sequence number.

Message

The message.

4.5.3 Rate Schedule sub tab

The Rate Schedule section contains information about rate adjustments, such as the sequence and number of adjustments.

To view the Rate Schedule screen

- Open the Customer Service screen and load the account you want to work with.

- Click the Account Details tab, then click Rate Schedule

sub tab.

The Rate Schedule section only applies to variable rate loans.

- In Rate Schedule section, click View.

- View the following information:

In this field:

View this:

Seq

The sequence number for rate adjustment.

Adjustment Frequency Type

The rate adjustment frequency type.

Period

The rate adjustment period for the frequency.

# of Adjustments

The number of rate adjustments for the frequency.

4.5.4 Insurances sub tab

If insurance information was entered on Funding screen during Line of credit origination, you can view financed insurance information on the Customer Service screen’s Insurances screen. The Insurances screen displays the details of all financed insurances, including cancellation and refund information whenever applicable. It also displays the insurances that were financed after funding of Line of credit using the Customer Service screen’s Maintenance screen.

To view the Insurances screen

- Open the Customer Service screen and load the account you want to work with.

- Click the Account Details tab, then click Insurances

sub tab.

- On the Insurances screen, view

the following information in Insurance Information section:

In this field:

View:

Contractual

If selected, indicates that the insurance policy is required by contract.

Insurance Type

The insurance type.

Company

The insurance company.

Policy#

The insurance policy number.

Effective Dt

The insurance effective date.

Premium Amt

The insurance premium amount.

Term

The insurance term.

Status

The insurance status.

Click View and view the following information:

In this field: |

View: |

Policy Information section: |

|

Contractual |

If selected, indicates that the insurance policy is required by contract. |

Insurance Type |

The insurance type. |

Insurance Plan |

The insurance plan. |

Company |

The insurance company. |

Policy# |

The insurance policy number. |

Effective Dt |

The insurance effective date. |

Premium Amt |

The insurance premium amount. |

Commission Rule |

The rule of commission. |

Primary Beneficiary |

The primary beneficiary of the insurance. |

Secondary Beneficiary |

The secondary beneficiary of the insurance. |

Status |

The status. |

Sub Status |

The sub status. |

Insurance Mode |

The insurance mode. |

Phone |

The insurance company’s primary phone number. |

Phone 2 |

The insurance company’s alternate phone number. |

Itemization |

The contract itemization. |

Expiry Dt |

The insurance expiry date. |

Term |

The term of insurance. |

Commission Amt |

The insurance commission amount. |

Comments |

The comments regarding the insurance policy. |

Cancellation/Refund section: |

|

Policy Cancellation Dt |

The insurance cancellation date. |

Refund Allowed |

If selected, a refund is allowed. A selected box indicates that the insurance premium can be rebated to the customer in case of early payoff. |

Grace Days Cancellation Fee Allowed |

If selected, indicates that cancellation fees during grace period is allowed. |

Cancellation Fees |

View amount of the cancellation fee to be charged when the insurance is cancelled. |

Complete Refund |

If selected, a complete refund is allowed. |

Term Remaining |

The remaining term on the insurance at cancellation. |

Refund Calculation Method |

The refund calculation method. |

Grace Days |

View the number of grace days allowed for cancellation without charging a cancellation fee. |

Estimated Refund Amt |

The estimated insurance refund. |

Received Refund Amt |

The insurance refund received. |

Itemization |

The contract itemization. |

- In the Insurance Tracking section, click Create Tracking. The system loads insurance tracking parameters in the Insurance Tracking section.

- If you want to reduce the list of parameters, select a

sub attribute in the unlabelled Sub Attribute box next to Create Tracking

button.

If your system has been configured to use the Sub Attribute field, only attributes in a particular group appear in the parameter display. - Click Edit and complete the Parameter and Value fields.

- Click Save.

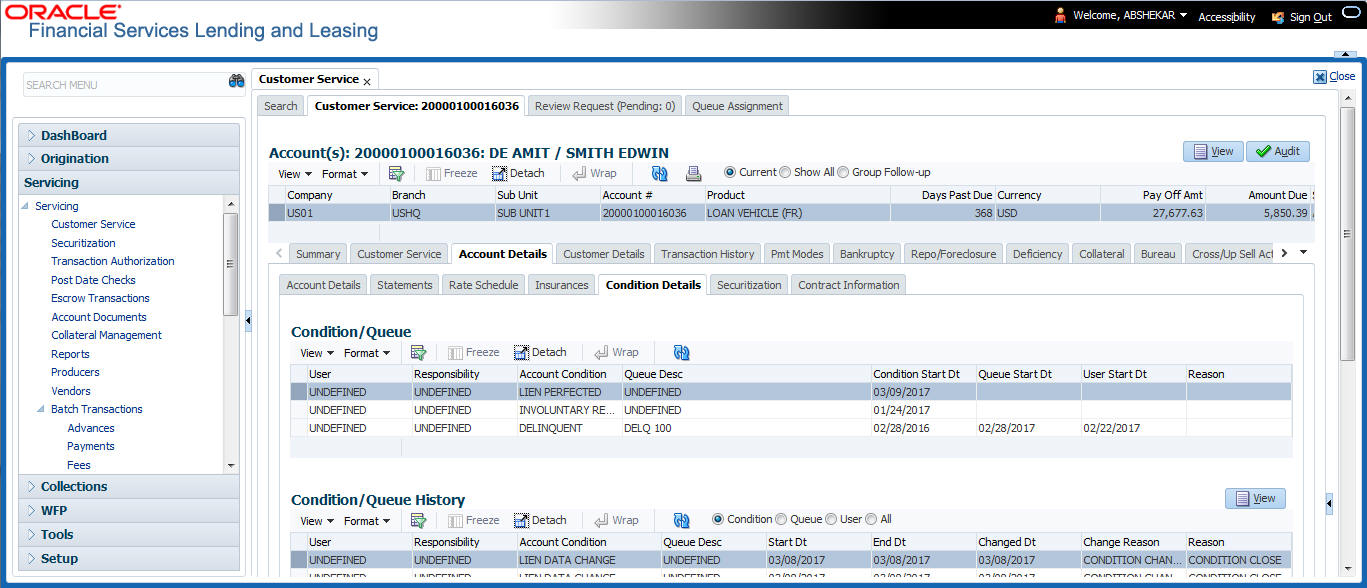

4.5.5 Condition Details sub tab

The Customer Service screen’s Condition Details tab displays the detailed log report of Account Vs Queue configuration changes i.e. every time an account has been changed from one queue/user/condition to another.

To view Condition Details

- Open the Customer Service screen and load the account you want to work with.

- Click Account Details tab, then click Condition

Details sub tab.

The Condition Details tab is further categorized into following sections:

- Condition/Queue

- Condition/Queue History

Condition/Queue

The Condition/Queue section displays the closed Conditions, Queues and User changes which were defined initially and later re-assigned to different Queues with Hard Assigned Users.

A current active Condition can be opened in any of the following cases:

- When a Call Activity is posted with Conditions on account

- When Conditions are posted by specific batch events

- When Conditions are posted by specific transactions (For example, Borrower on Military duty)

The Condition/Queue section displays the following information:

- User (Current Queue Assigned User If any)

- Responsibility (Current User Responsibility)

- Account Condition

- Queue Description

- Condition Start Dt

- Queue Start Dt

- User Start Dt

Condition/Queue History

The Condition/Queue section displays only the closed Conditions which were defined on the account and later was re-assigned to different Queues with Hard Assigned Users.

The Condition/Queue History section displays the following information:

- User (Old Queue Assigned User If any)

- Responsibility (Old User Responsibility)

- Account Condition

- Queue Description

- Start Date

- End Date

- Changed Date

- Change Reason

- Reason (specified in Queue Assignment tab)

In the Condition/Queue History section, select the required record and click ‘View’.

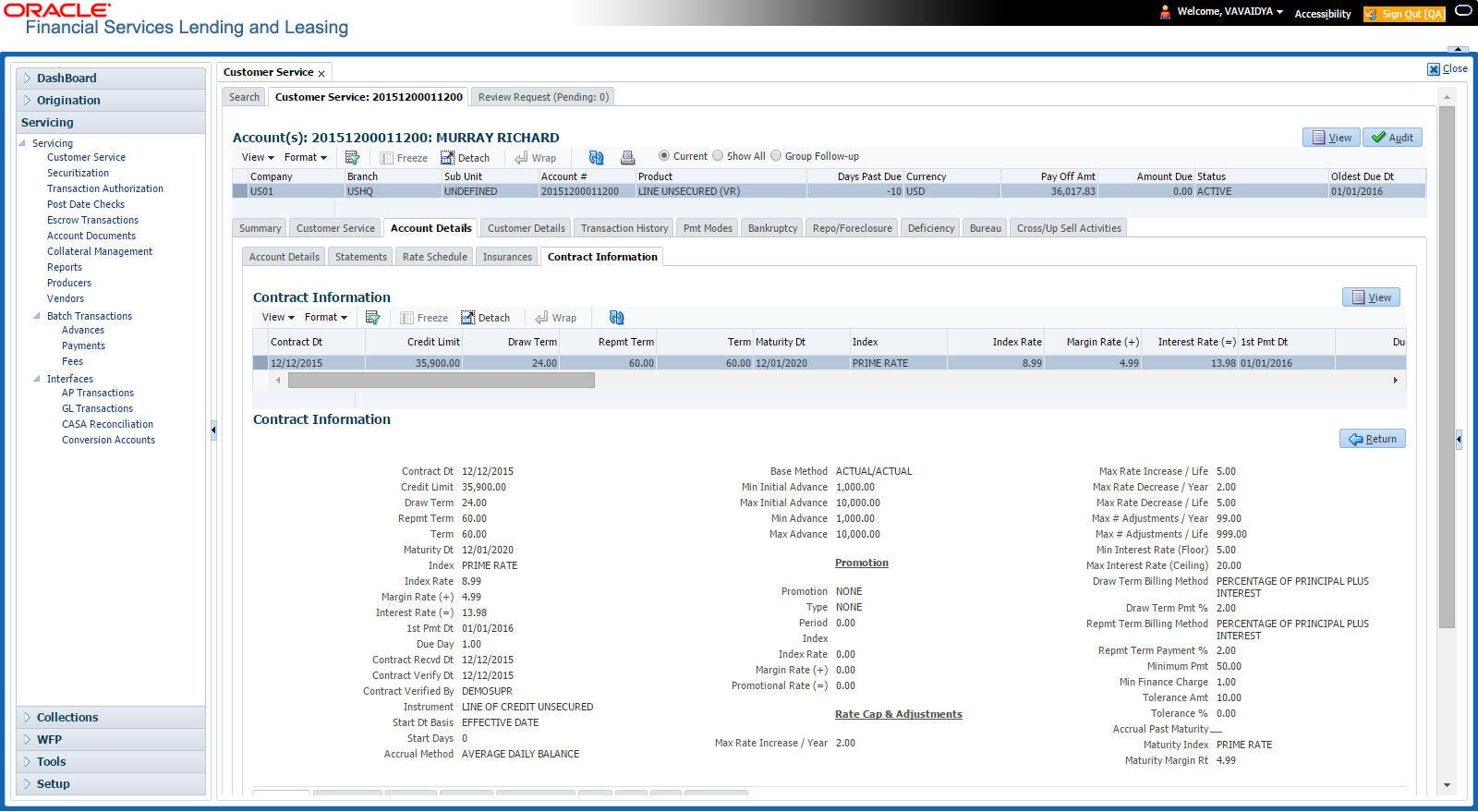

4.5.6 Contract Information sub tab

The Customer Service screen Contract sub tab enables you to view contract and truth-in-lending information recorded during the funding process. It’s a display only version of the same information found on the Funding screen’s Contract screen.

To view an account’s contract information

- Open the Customer Service screen and load the account you want to work with.

- Click Account Details tab, then click Contract

Information sub tab.

- Line of credit Use the following sub tabs to view more information about the contract, if available:

- Contract

- Repayment

- Itemization

- Trade-In

- Insurances

- ESC

- Compensation

- Subvention

- Proceeds

- Disbursements

- Fees

- ACH

- Coupon

- PDC

- References

- Real Estate

For more information on the sub tabs of the Contract tab, refer the section Contracts tab in Funding chapter of the Origination User Guide.

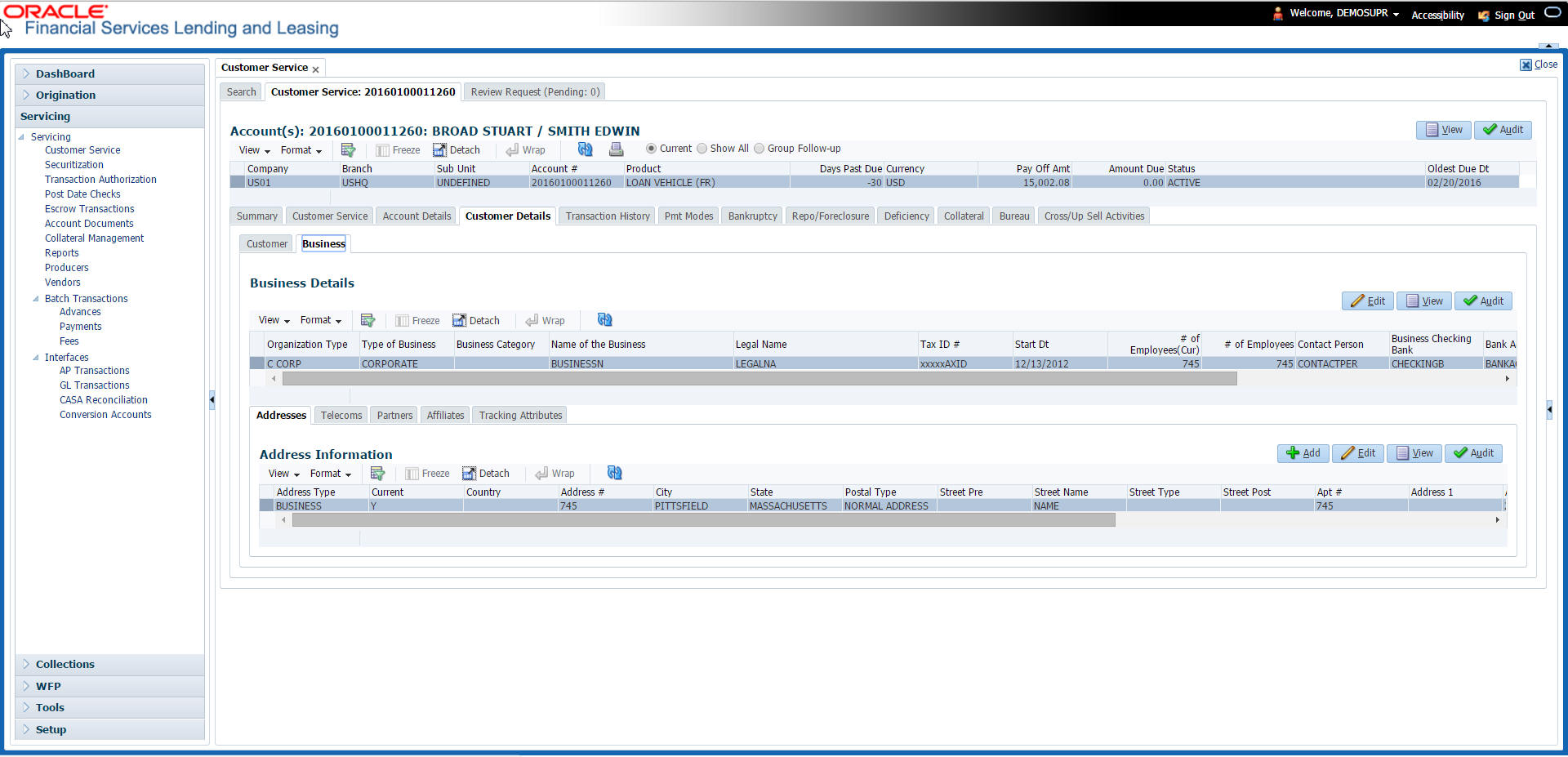

4.6 Customer Service screen’s Customer Details tab

Open the Customer Service screen and load the account you want to work with. Click the Customer Details tab to view the sections under it.

Customer Details screen displays the information gathered on application entry process regarding the customer and customer’s address, employment data, and phone numbers. Using this screen, you can update or add to a customer’s address, employment information, or phone listing. Whenever you add or edit the customer details, a system generated comment will be posted in the account to keep record of old and new details.

Note that the ‘Edit’ option on this screen has user level security defined and based on your responsibility, you can either edit a few or all of the fields. The difference is that, you may either have access to edit only non-PII (Personal Identifiable Information) fields or edit all possible fields as per the customer maintenance transaction.

The list of possible editable fields in both these scenarios is given below:

Edit non-PII fields |

All editable fields |

Marital Status |

Birth Date |

Language |

Marital Status |

Education |

Language |

Mother's Maiden Name |

Education |

Class Type |

Mother's Maiden |

Class Type |

|

Stop Correspondence |

|

Disability |

Stop Correspondence |

Skip |

Disability |

Privacy opt out |

Skip |

Existing CIF |

Privacy Optout |

|

Existing CIF |

|

Identification Details like |

|

Passport |

|

Issue Date |

|

Expiry Date |

|

Visa # |

|

Nationality |

|

National ID |

|

SSN |

|

License # |

|

License State |

To view or edit customer information

- Open the Customer Service screen and load the account you want to work with.

- Click Customer Details sub tab.

- In the Customer Information section,

click View the following information:

In this field:

View this:

Customer Information section

Customer #

Customer number.

Relation

Customer ‘s relation with the bank.

ECOA

The Equal Credit Opportunity Act code.

Name

Customer’s name.

Birth Dt

Customer’s date of birth.

Marital Status

Customer’s marital status.

Enabled

Status of the account.

Language

Customer’s language.

Education

Customer’s education.

Mother’s Maiden Name

Customer’s mother’s maiden name.

Class Type

Customer’s class type.

Email

Customer’s e-mail address.

Stop Correspondence

Customer’s stop correspondence indicator. If selected, this indicates that the system will not send the customer any correspondence, such as monthly statements. This is selected using the Maintenance screen.

Disability

Customer’s disability indicator.

Skip

Customer’s skip indicator. If selected, this indicates that the customer is a skip debtor. This is selected using the Maintenance screen.

Bankruptcy

Customer’s bankruptcy indicator.

Privacy Opt-Out

Privacy opt-out indicator. If selected, indicates that the applicant has elected to refrain from the non-public sharing of information.

Insurance Opt Out

Insurance Opt Out indicator. If selected, indicates that the applicant has elected to refrain from insurance related inquiries.

Marketing Opt Out

Marketing Opt Out indicator. If selected, indicates that the applicant has elected to refrain from marketing related inquiries.

Share Credit Opt Out

Share Credit Opt Out indicator. If selected, indicates that the applicant has elected to refrain from financial information and share credit related inquiries.

Existing CIF

If selected, indicates that the customer is an existing CIF.

Update Customer Info

If selected, indicates that the system was allowed to override the existing customer information with the latest address and communication details during account creation.

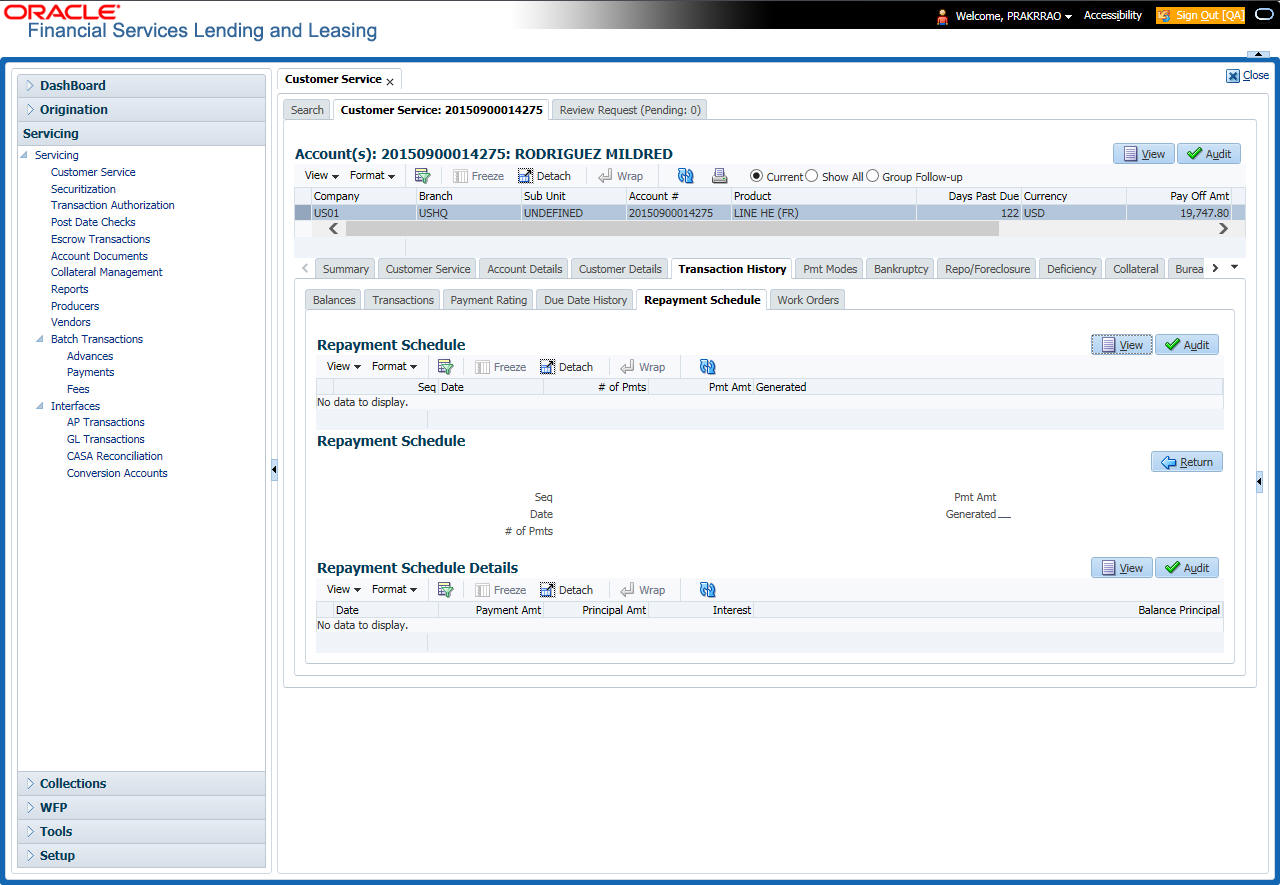

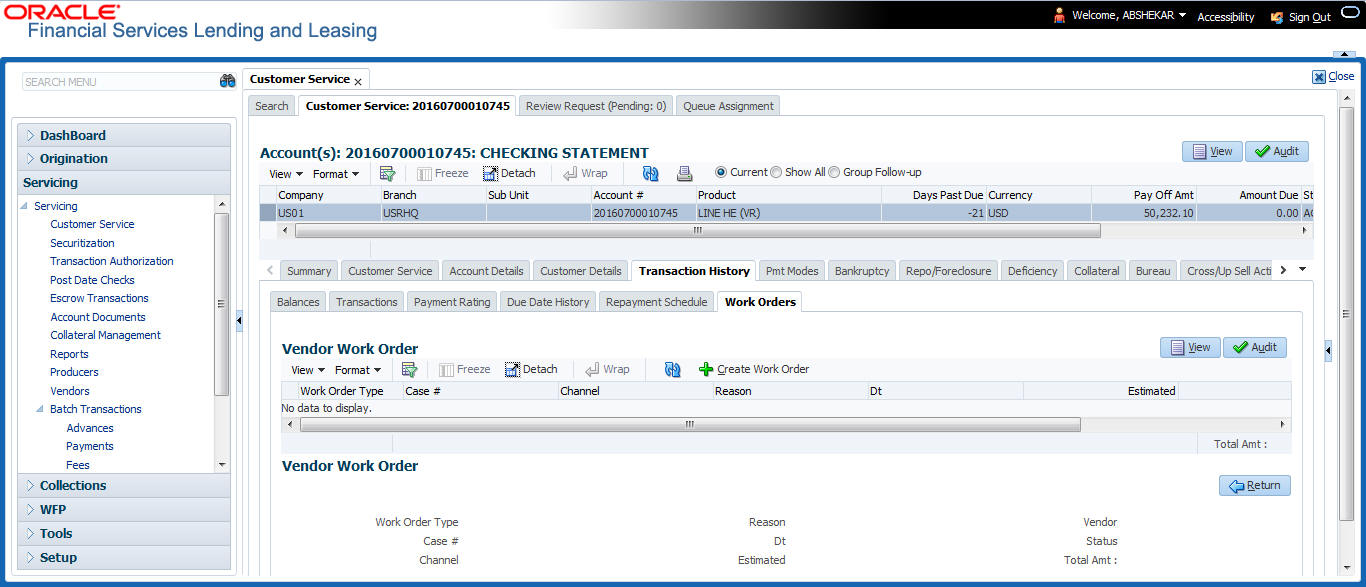

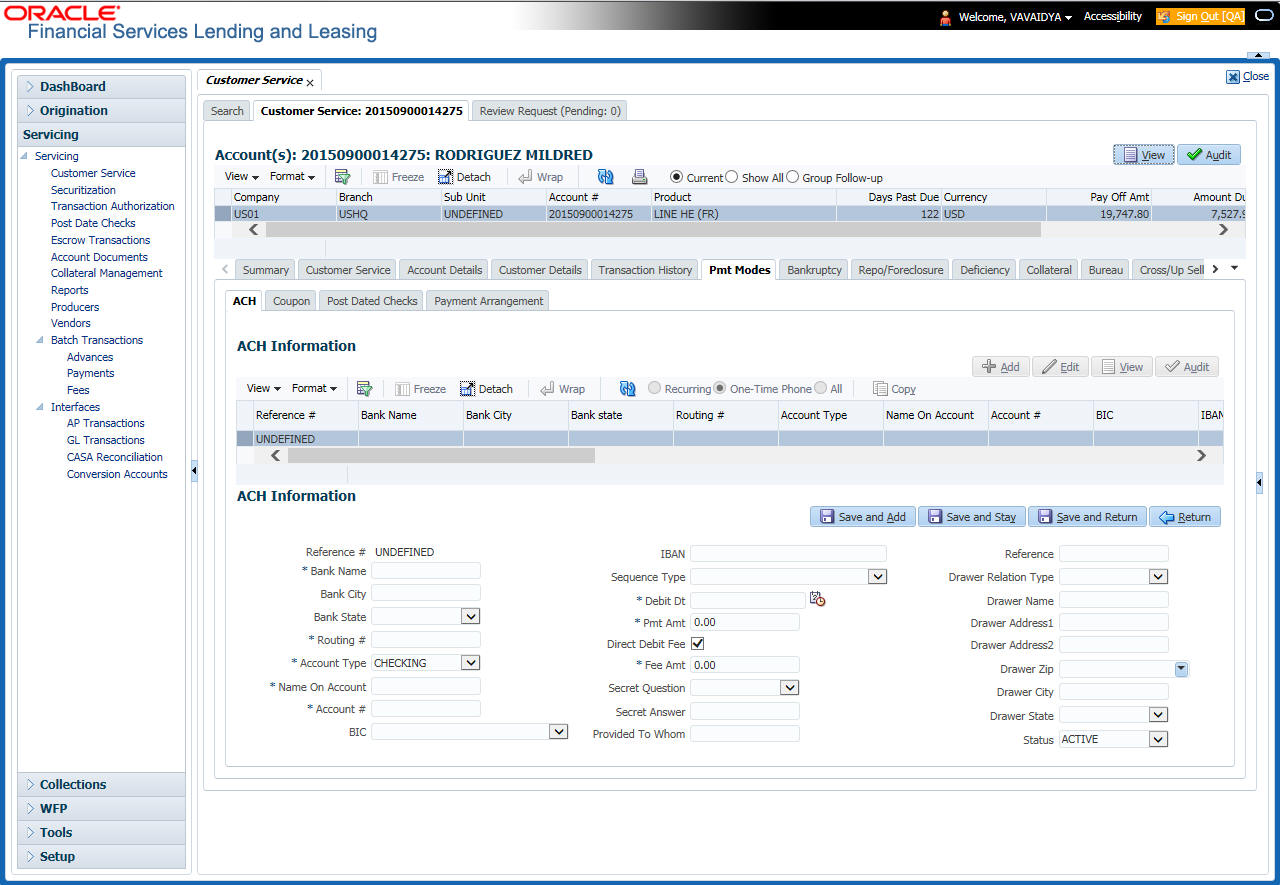

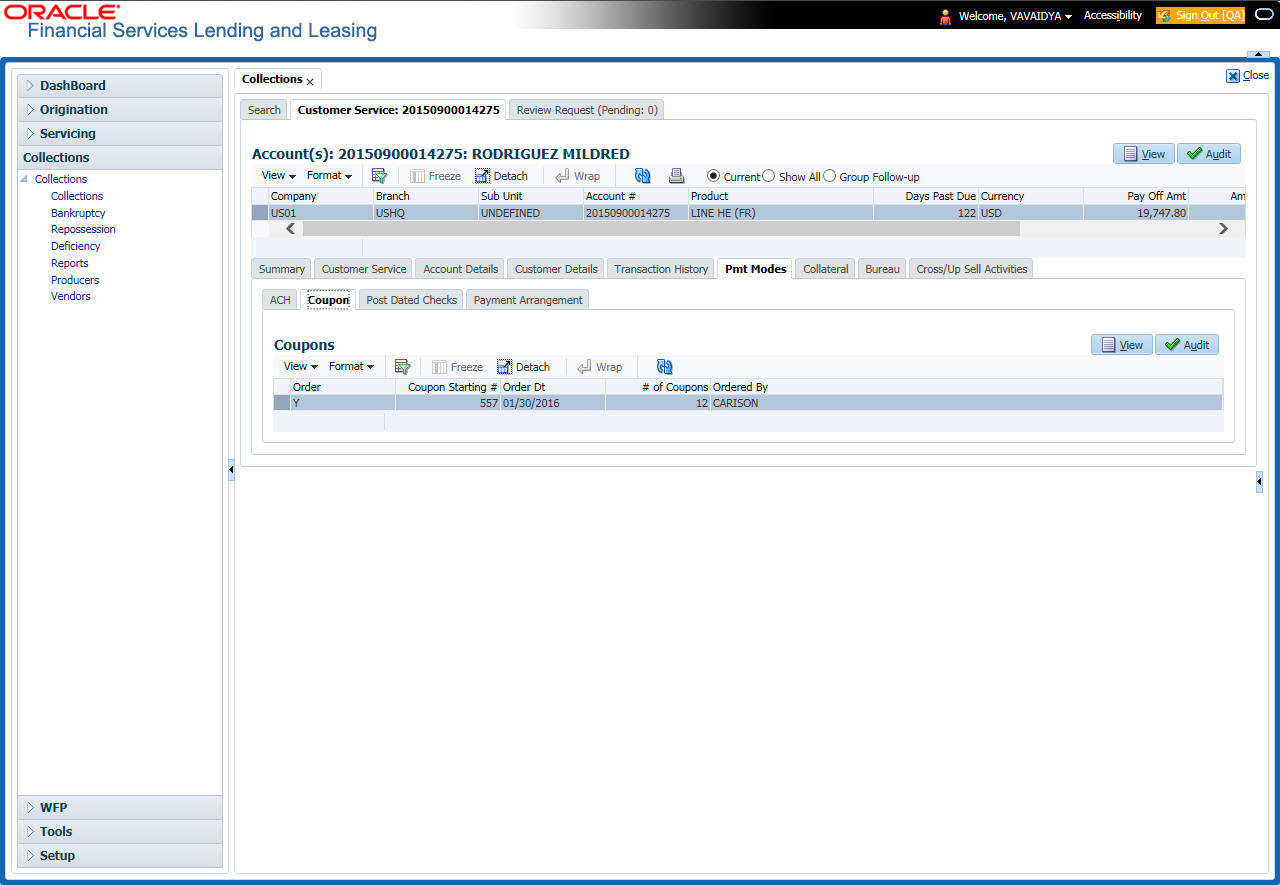

Identification Details section