The certificate of deposit account application has been created so as to enable customers to apply for a deposit account by providing details of the deposit to be opened along with minimal personal details. All the required disclosures and notices are displayed as part of the application and all regulations governing the bank and applicant involved have been kept in mind while identifying information to be captured.

The application tracker has been built so as to enable tracking of the application once it has been submitted. The application tracker also enables the applicant to retrieve and complete an application that has been saved.

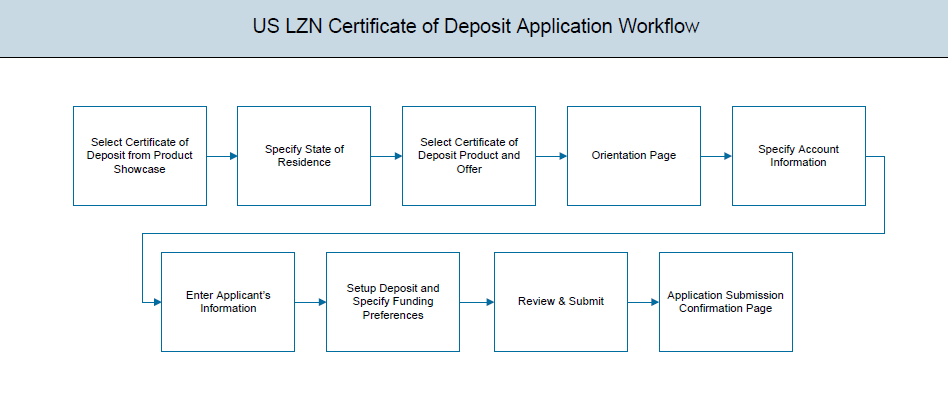

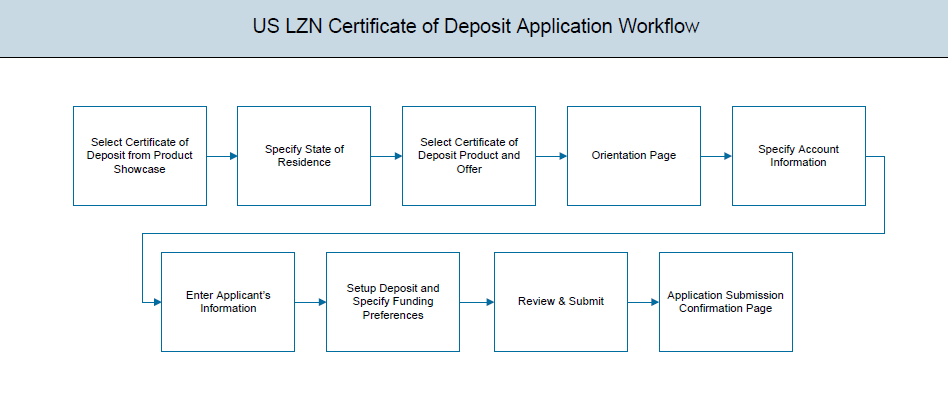

Certificate of Deposit Workflow

Following are the steps involved as part of application submission:

![]() How to reach here:

How to reach here:

Dashboard > Certificate of Deposits

To apply for certificate of deposit:

State of Residence

|

Field Name |

Description |

|---|---|

|

Please select your state of residence |

|

|

Select State |

You are required to select the state in which you reside. |

Certificate of Deposit Requirement

|

Field Name |

Description |

|---|---|

|

Which currency should this account have? |

The currency (US dollars) of the deposit account will be displayed. |

|

Would you like to add a co-applicant? |

You can identify whether a co-applicant is to be added to the application or not. |

|

Is Co-applicant an existing user |

Indicates whether the co-applicant is an existing user. This field appears, if you select Yes, in the Would you like to add a co-applicant? field. |

|

Co-applicant Customer ID |

You are required to enter the co-applicant’s customer ID, if the co-applicant is an existing user. This field appears, if you select Yes, in the Is Co-applicant an existing user? field. |

|

Send Verification Code via |

Indicates the channel on which the verification code is to be sent. The options are:

This field appears, if you select Yes, in the Is Co-applicant an existing user? field. |

Applicants Profile Details

In the primary Information screen enter the appropriate information like, salutation, first name, last name, date of birth, citizenship, etc.

Primary Information

|

Field Name |

Description |

|---|---|

|

Salutation |

Salutation of applicant. The options are:

|

|

First Name |

First name of the applicant. You can modify the first name, if required. The first name appears, If it is updated in the ApplicantAn applicant refers to an individual or a non-individual (organization or trust) who has applied for one or more main lines. Information section. |

|

Middle Name |

Middle Name of the applicant. You can modify the middle name, if required. The middle name appears, If it is updated in the Applicant Information section. |

|

Last Name |

Last name of the applicant. You can modify the last name, if required. The last name appears, If it is updated in the Applicant Information section. |

|

Gender |

Applicants gender. |

|

Suffix (Optional) |

Suffix of the applicant. The suffix appears, If it is updated in the Applicant Information section. |

|

Date of Birth |

Date of birth of the applicant. The date of birth is validated against the selected state of residence to check the age of majority. |

|

Citizenship |

Applicants country of citizenship. By default the system displays United States as country of citizenship. Select the new country name if the applicant is non resident of United States. |

|

Permanent Resident |

Indicates whether applicant is permanent resident. United States citizens or resident aliens are allowed to submit applications. The applications of residents, other than United States is rejected. |

|

Country of Resident |

This field is enabled only if you have identified that you are not a permanent resident of the United States by selecting No in the Permanent Resident field. In this case, you are required to identify the country in which you reside. |

In the proof of identity section enter the social security number, identity type, state of issue, ID number, and expiry date.

Proof of Identity

|

Field Name |

Description |

|---|---|

|

Social Security Number |

Indicates the social security number of the United States resident. |

|

Type of Identification |

Identification type of the applicant. The identification type could be:

|

|

State of Issue |

State name where the identification type is issued. This field appears if you select State ID or Driving License in Type of Identification list. |

|

ID Number |

Identification number corresponding to the identification type. |

|

Expiration Date |

Identification proof expiry date. The expiration date should not be the backdated date. |

In the contact information section enter the contact details such as, email, current residential address, and phone number.

Enter the Previous Residential Address details if you have stayed at the current location for less than the specified period.

Contact Information

|

Field Name |

Description |

|---|---|

|

|

|

|

|

Email ID of the applicant. |

|

Confirm Email |

Re-enter the email ID to confirm. |

|

Phone Number |

|

|

Phone Type |

Type of phone. The options are:

|

|

Primary Phone Number |

Phone number corresponding to the selected phone type. |

|

Alternate phone number |

Alternate phone number other than the primary phone. Click Yes if you wish to add an alternate phone number. |

|

Phone Type |

Phone type being added as alternate phone number. The options are:

This field appears if you select Yes in the Add an alternate phone number field. The phone types are same as primary phone type, if you select Work Mobile as primary type than the same does not appear in the alternate phone type. |

|

Phone Number |

Phone number corresponding to the alternate phone type. This field appears if you select Yes in the Add an alternate phone number field. |

|

Residential Address |

|

|

Accommodation Type |

Residential accommodation type of the applicant. The accommodation types are:

|

|

Address 1-2 |

Address details of the applicant. |

|

City |

City where the applicant resides. |

|

State |

State name of the applicant. |

|

Zip Code |

Zip code of the applicant. |

|

Staying Since |

Date since when the applicant is staying at the current address. If the date is less than the specified number of period, the Previous Residential Address section appears. |

|

Previous Residential Address |

|

|

Accommodation Type |

Residential accommodation type of the applicant. The accommodation types are:

|

|

Address line 1-2 |

Address line 1 and 2 of the previous residence. |

|

City |

City name of your previous residence. |

|

State |

State name of your previous residence. |

|

Zip Code |

Zip code of your previous residence. Enter the zip code in format zip+4 in addition to regular format. |

In this section enter details of your employment over a defined period starting with your current primary employment. The details required are type of employment, subsequent status, and if you are salaried or self employed, the company or employer name and date on which specific employment was started.

Employment Information

|

Field Name |

Description |

|---|---|

|

Employment Type |

The type of your current primary employment. The types are:

|

|

Employment Status |

Occupation status of the applicant. The options are:

If you select Others option in the Employment Type list, following options may appear:

|

|

Company Name or Employer |

Name of the company or firm in which the applicant is employed. This field appears if you select Salaried or Self Employed in Employment Type list. |

|

Start Date |

Date on which you started the employment. This field appears if you select Salaried or Self Employed in Employment Type list. |

Note: You can lick  to edit the employment information.

to edit the employment information.

This page comprises of two sub sections, one in which you can define details of your deposit account such as deposit amount, tenure and interest frequency, and the other in which you can specify funding details such as the method through which you will fund the initial deposit on your account and to specify details of funding including amount to be funded and subsequent account or card details from which the amount is to be debited.

Setup Your Deposit

|

Field Name |

Description |

|---|---|

|

Deposit Amount |

The amount for which you wish to open a deposit account with the bank. |

|

Tenure |

The tenure or term for which the deposit is being opened. The acceptable term range will be displayed against this field. You can specify term in years, months and days. |

|

Interest Payout Frequency |

The frequency in which you would like to receive interest. This field will be displayed once you have defined the amount and tenure for which you are opening a deposit with the bank. This field will contain all the possible interest payout frequencies based on the amount and tenure you have entered. |

|

Interest Rate |

The interest rate applicable on the deposit account. The interest rate will be fetched and displayed once you have specified all details of the deposit i.e. amount, tenure and interest payout frequency. |

|

Your Funding Source |

|

|

I will use my Credit Card |

Select this option if you wish to transfer funds from your credit card. |

|

I will use my Debit Card |

Select this option if you wish to transfer funds from your debit card. |

|

I will transfer funds from another account with the bank (Your savings or checking account) |

Select this option if you wish to transfer funds from your savings or checking account held with the bank. This option will be available only if you are an existing customer of the bank. |

|

I will transfer funds from my account at another bank (Your bank charges may apply) |

Select this option if you wish to transfer funds from your savings or checking account held with another bank. This option will be available only if you are an existing customer of the bank. |

|

Account Number |

This field will be displayed only if you have selected the option to fund your account from one of your savings or checking accounts held with the bank. All your active savings and checking account that are held with the bank will be displayed in a dropdown and will be available for selection with the exception of any accounts that are in a debit block state. |

|

The following fields appear if you opt to fund your account via an account held with another bank |

|

|

Account Number |

All your linked savings and checking accounts will be displayed in this dropdown and will be available for selection. |

|

Account Name |

This field will be displayed once you have selected an account. This field will display the name of your account. |

|

Bank ID |

The ID of the bank in which your account is held. This field will be displayed once you have selected an account. |

|

Bank Branch |

The branch at which your account is held. This field will be displayed once you have selected an account. |

|

The following fields are displayed if you opt to fund your account via credit card or debit card |

|

|

Card Type |

Enter your card’s network provider. For example: VISA, American Express, Discovery. |

|

Card Number |

Enter your card number as it is printed on the card. |

|

Expiration Date (Month and Year) |

Enter the month and year on which your card expires. |

|

Name on Card |

Enter your name as it is printed on the card. |

|

Security Code |

Enter the security code of your card. Your security code is the three digit number printed on the back of your card. On an American express credit card, it is the four digit number printed on the front of your card just above your card number. |

The review and submit page consists of the following two sub sections:

Disclosures and Consents

|

Field Name |

Description |

|---|---|

|

ESIGN Disclosure |

|

|

I have reviewed and consent to the ESIGN Disclosure |

Indicates to provide consent to the Esign disclosure. |

|

TIN Certification and Backup Withholding |

|

|

I certify and sign under penalty of perjury, that all 4 tax status certification statements above are true |

Select this check box to acknowledge that you accept the information submitted by you is correct. |

|

Additional Disclosure |

|

|

I acknowledge that I have reviewed and agree to the Product Legal Documents and Privacy Policy Notice |

Indicates to acknowledge that you have read the product legal document and privacy policy of the bank. |

to edit the loan requirement details.

to edit the loan requirement details.This section displays a message confirming that the application has been submitted along with details on additional steps that might be required to be taken by the applicant or the bank. If the bank has configured the debit bureau check step for certificate of deposit applications, the debit decision outcome is also displayed and if positive, the account number that is generated to the bank is displayed as well.

To register an applicant:

Register Applicant

|

Field Name |

Description |

|---|---|

|

|

The email ID of the co-applicant. |

|

Confirm Email |

To confirm re-enter the email ID. |

|

Password |

Indicates the password required for the login. |

|

Confirm Password |

To confirm re-enter the password. |

At any point you can cancel an application.

To cancel an application:

Cancel Application

|

Field Name |

Description |

|---|---|

|

Reason for Cancelling |

Indicates the reason to cancel an application. The cancellation reason could be:

|

|

Please Specify |

Specify the reason to cancel the application. This field appears if you select Others option in the Reason for Cancelling. |

There will be two scenarios in this case

To save an application:

Save Later

|

Field Name |

Description |

|---|---|

|

|

The email ID of the user. |

|

Confirm Email |

To confirm re-enter the email ID entered in the Email field. |

|

Password |

Indicates the password required for login. |

|

Confirm Password |

To confirm re-enter the password entered in the Password field. |

Note: The saved application appears in Track Application under In Draft. You can click the application summary and resume application submission process.

The track application allows you to view the progress of the application. Through track application you can:

To track an application:

Submitted Application

|

Field Name |

Description |

|---|---|

|

Certificate of Deposit Offer Name |

The name of the certificate of deposit offer for which application was made. |

|

Deposit Amount |

The amount for which the deposit was applied. |

|

Application ID |

Application reference number. It is a unique number generated by the application and allotted to an application. |

|

Amount |

The approved loan amount. |

|

Applicant Name |

Name of the loan applicant. |

|

Submitted On |

Application submission date. |

|

Status |

Current status of the application. |

You can click on the View Complete Application link provided on the screen to view the complete application in PDF format.

Application Summary

|

Field Name |

Description |

|---|---|

|

Certificate of Deposit Offer Name |

The name of the certificate of deposit offer for which application was made. |

|

Deposit Amount |

The amount for which the deposit was applied. |

|

Application ID |

Application reference number. It is a unique number generated by the application and allotted to an application. |

|

Applicant Name |

Name of the applicant. If application is joint, the name of the co-applicant will also be displayed. |

|

Submitted On |

Application submission date. |

|

Account Created |

The account number of the deposit if it has been generated. The account number will be displayed in masked format. |

|

Status |

Current status of the application. |

|

Following fields appear if you click View Complete Application link. |

|

|

Offer Name |

The name of the certificate of deposit offer that you applied for. |

|

Account Type |

The type of account i.e. individual or joint. |

|

Account Holders |

The names of the applicants will be displayed. |

|

Deposit Amount |

The amount for which the deposit was applied. |

|

Term |

The term of the deposit will be displayed. |

|

Interest Rate |

The interest rate applicable on the account will be displayed. |

|

Interest Payment |

The interest payment frequency will be displayed. |

|

Maturity Date |

The date on which the deposit will mature. |

Status history displays the status of the various stages of loan application, remarks, user name, and date on which the status is updated.

Status History

|

Field Name |

Description |

|---|---|

|

Status History |

|

|

State |

Application status. |

|

Remarks |

Displays the remarks if any. |

|

Acted By |

User ID who has processed the account application. |

|

Updated On |

Account application updated date. |

Document upload allows you to upload the documents which are required for the application processing. You can upload multiple documents for a document type. Simultaneously you can upload multiple documents. You can also delete a document that has been uploaded. This section will only be displayed if any documents are required to be uploaded by the applicant/s.

To upload / remove a document:

Note: Click  to remove the uploaded document.

to remove the uploaded document.

|

Field Name |

Description |

|---|---|

|

Choose File |

File to be uploaded. |

FAQs

![]() Can I apply for a certificate of deposit account if I am not a citizen of the United States?

Can I apply for a certificate of deposit account if I am not a citizen of the United States?

![]() Why do I have to provide my Social Security Number (SSNSocial Security Number) in the application? How does the bank ensure that my information is safe?

Why do I have to provide my Social Security Number (SSNSocial Security Number) in the application? How does the bank ensure that my information is safe?

Your Social Security Number is masked as soon as you enter it so as to eliminate the risk of shoulder surfing security threat.

![]() Why do you require the expiry date of my identity proof?

Why do you require the expiry date of my identity proof?

![]() Can I provide my P.O. box as residential address?

Can I provide my P.O. box as residential address?

![]() I have my entire zip code i.e. in zip+4 format. Can I provide my entire zip code?

I have my entire zip code i.e. in zip+4 format. Can I provide my entire zip code?

![]() Can I fund my deposit through multiple modes?

Can I fund my deposit through multiple modes?

![]() Why do I have to give my consent to all the disclosures displayed under the Review & Submit section?

Why do I have to give my consent to all the disclosures displayed under the Review & Submit section?

![]() I am an existing customer of the bank but do not have channel access, how can I proceed?

I am an existing customer of the bank but do not have channel access, how can I proceed?

![]() . Can I proceed with the application if I am not an existing channel user?

. Can I proceed with the application if I am not an existing channel user?

![]() Why am I asked to capture previous residential address details?

Why am I asked to capture previous residential address details?

![]() . Is it mandatory to change the default configuration for an account as part of application tracker?

. Is it mandatory to change the default configuration for an account as part of application tracker?

![]() Can the co-applicant perform all the pending tasks in the application tracker?

Can the co-applicant perform all the pending tasks in the application tracker?