The credit card application is created to enable customers to apply for a credit card by providing basic personal and financial details. The applicant can also define preferences such as whether authorized users are to be added to the card and if balance transfers are to be defined. All the required disclosures and notices are displayed as part of the application and all regulations governing the bank and applicant involved have been kept in mind while identifying information to be captured.

The application tracker is built to enable tracking of the application once it is submitted. The application tracker also enables the applicant to retrieve and complete an application that is saved. Additionally, the applicant can perform certain tasks from the application tracker such as uploading documents required by the bank, specifying additional card preferences such as delivery preferences and card customizations including defining card background and name to be printed on the card.

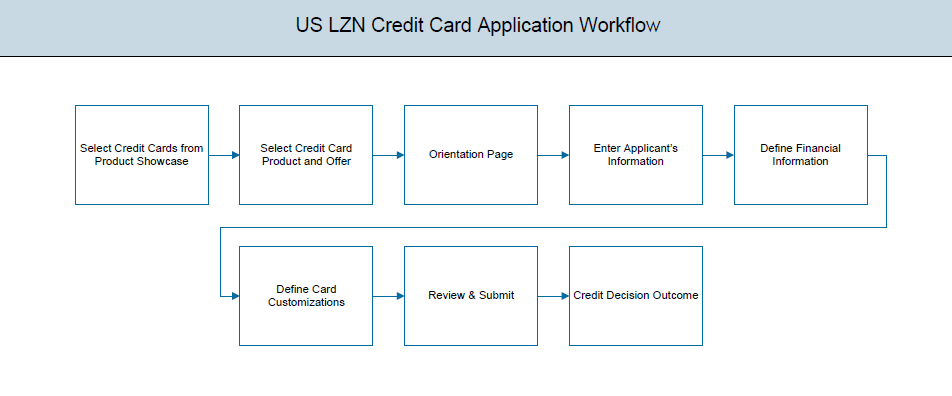

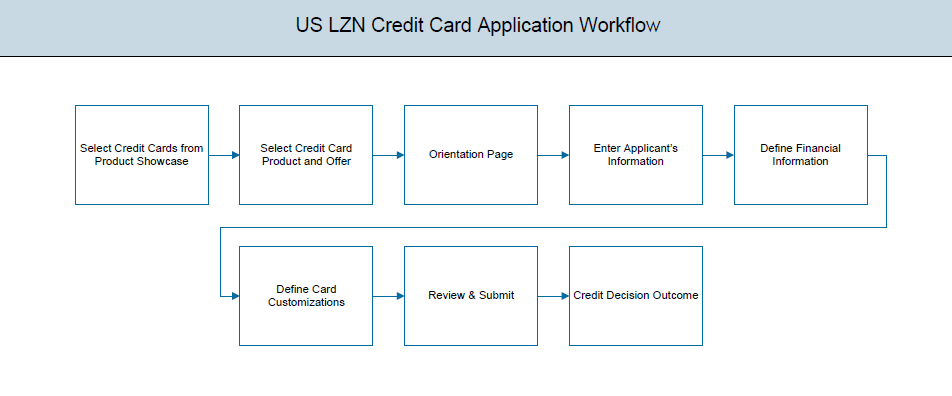

Credit Card Application Workflow

The credit card application process consists of the following steps:

![]() How to reach here:

How to reach here:

Dashboard > Credit CardA credit card is a payment card issued to users (cardholders) as a method of payment.

To apply for credit card:

In the primary Information screen enter the appropriate information like, salutation, first name, last name, date of birth, citizenship, etc.

Primary Information

|

Field Name |

Description |

|---|---|

|

Salutation |

Select your salutation. The options are:

|

|

First Name |

Enter your first name. |

|

Middle Name |

Enter your middle name here. This field is optional. |

|

Last Name |

Enter your last name. |

|

Suffix (Optional) |

Enter your suffix. This field is optional. |

|

Date of Birth |

Your date of birth in format MM/DDDirect Debit/YYYY. The system validates your date of birth so as to identify whether you have attained age of majority. |

|

Citizenship |

The country of which you are a citizenship. By default, United States will be selected. You can change this value to reflect the country of which you are a citizen. |

|

Permanent Resident |

You are required to identify whether you are a permanent resident of the United States or not. If your citizenship is any other than United States and if you are also not a permanent resident of the United States, you will not be able to proceed with the application as, currently, only US citizens or resident aliens are allowed to submit applications only. |

|

Country of Residence |

This field is enabled only if you have identified that you are not a permanent resident of the United States by selecting No in the Permanent Resident field. In this case, you are required to indentify the country in which you reside. |

In the proof of identity section enter the social security number, identity type, state of issue, ID number, and expiry date.

Proof of Identity

|

Field Name |

Description |

|---|---|

|

Social Security Number |

Enter your Social Security Number. |

|

Type of Identification |

The identification that you want to provide as proof of identity. The identification type could be:

|

|

State of Issue |

The state in which your ID as selected in Type of Identification field, has been issued. This field is not displayed if you have selected Matricular Consular Card as Type of Identification. |

|

ID Number |

Identification number corresponding to the identification type. |

|

Expiration Date |

The date on which you ID expires. The system will validate if the expiration date has passed or if it is a valid date i.e. not one that is too ahead in the future (the number of years will be defined by the bank) and will display an appropriate error message. In this case, you can either modify the expiration date or select a different ID to submit as proof of identity, one which has a valid expiration date. |

In the contact information section enter contact details including your email address, phone numbers, and current residential address. You will be required to enter details of your previous residence if you have stayed at your current residence for less than the amount of time required. This amount of time is defined by the bank in terms of years.

Contact Information

|

Field Name |

Description |

|---|---|

|

|

|

|

|

Your Email ID. |

|

Confirm Email |

Re-enter the email ID to confirm. |

|

Phone Number |

|

|

Phone Type |

Type of phone number that is being added as primary. The options are:

|

|

Primary Phone Number |

Phone number corresponding to the selected phone type. |

|

Alternate phone number |

You can select Yes if you want to add an alternate phone number. It is not mandatory to add an alternate phone number. |

|

Phone Type |

Type of phone number that is being added as an alternate number. The options are the same as those available for the phone type of primary phone number. The type selected as primary phone type will not be part of the list. Hence you cannot enter two phone numbers of the same type. This field is displayed if you select Yes in the Add an alternate phone number field. |

|

Phone Number |

Phone number corresponding to the selected alternate phone type. This field is displayed if you select Yes in the Add an alternate phone number field. |

|

Residential Address |

|

|

Accommodation Type |

The type of residence. The accommodation types are

|

|

Address 1-2 |

Your address details. |

|

City |

The city in which you reside. |

|

State |

The state in which you reside. |

|

Zip Code |

The zip code of your residence. You can enter the zip code in format zip+4 in addition to regular format. |

|

Staying Since |

Date since which you have been residing at the current address. If you identify a date that is less than the minimum amount of time required for you to have resided in the current residence, the system will display fields in which you can specify you previous residence address. |

|

Previous Residential Address |

|

|

Accommodation Type |

The type of residence. The accommodation types are :

|

|

Address line 1-2 |

Address details of your previous residence. |

|

City |

The city in which you resided previously. |

|

State |

The state in which you resided previously. |

|

Zip Code |

The zip code of your previous residence. You can enter the zip code in format zip+4 in addition to regular format. |

In this section enter details of your employment over a defined period starting with your current primary employment. The details required are type of employment, subsequent status, date on which specific employment was started and if you are salaried or self employed, the company or employer name. If the amount of time at which you have been employed in your current employment is less than the required amount, the system will display fields in which you can enter details of previous employment.

Employment Information

|

Field Name |

Description |

|---|---|

|

Primary Employment |

|

|

Employment Type |

The type of your current primary employment. The types are:

|

|

Employment Status |

The status of your employment. The options in this field will depend on your selection as employment type. If you have selected the option Salaried or Self Employed the options will be:

If you select Others option in the Employment Type list, following options may appear:

|

|

Company Name or Employer |

Name of the company or firm at which you are employed. This field will be displayed only if you have selected Salaried or Self Employed as Employment Type. |

|

Start Date |

The date on which you started current employment. |

|

Additional Employment |

|

|

Employment Type |

The type of employment. The types are:

|

|

Employment Status |

The status of your employment. The options in this field will depend on your selection as employment type. If you have selected the option Salaried or Self Employed the options will be:

If you select Others option in the Employment Type list, following options may appear:

|

|

Company Name or Employer |

Name of the company or firm at which you are employed. This field will be displayed only if you have selected Salaried or Self Employed as Employment Type. |

|

Start Date |

The date on which you started employment at the specific company or organization. |

|

End Date |

The date on which you employment at the specific company or organization ended. |

to add more than one employment information.

to add more than one employment information. Note: You can lick  to edit the employment information.

to edit the employment information.

This page comprises of multiple sections in which you can enter your financial details in the form of income, expenses, assets, and liabilities.

In this section enter details of all income that you want to be considered to be the basis on which you will make credit card payments. Hence, any income earned as alimony or child support need not be identified here if you do not wish for it to be considered.

You can add multiple records of income upto a defined limit. Click the  icon to add additional income records and the

icon to add additional income records and the ![]() icon against a specific record to delete it.

icon against a specific record to delete it.

Income Information

|

Field Name |

Description |

|---|---|

|

Primary Income |

|

|

Source of Income |

The source of your primary income. Examples of source of income can be rental income, salary, etc. |

|

Gross Income |

Gross amount of income earned. |

|

Net Income |

Net amount of income. The net income field will be defaulted with the gross income amount entered and can be changed. |

|

Frequency |

The frequency at which you earn the particular income. Examples of income frequency can be Monthly, Yearly, etc. By default Yearly will be selected in this field. You can change this value as required. |

icon to add another income records.

icon to add another income records.In this section enter details of all expenses you incur on a regular basis. You can add multiple expense records up to a defined limit. Click the  icon to add additional expense records and the

icon to add additional expense records and the ![]() icon against a specific record to delete it.

icon against a specific record to delete it.

Expense Information

|

Field Name |

Description |

|---|---|

|

Primary Expense |

|

|

Type of Expense |

The type of expense. Example - household, school fees, etc. |

|

Total Expense Value |

The total value of expenditure against the specific type identified. |

|

Frequency of Expense |

The frequency at which you incur the specific expense. By default the value Monthly will be selected and can be changed. |

icon to add another expense records.

icon to add another expense records.In this section enter details of all assets owned by you. You can add multiple asset records up to a defined limit. Click the  icon to add additional asset records and the

icon to add additional asset records and the ![]() icon against a specific record to delete it.

icon against a specific record to delete it.

Assets

|

Field Name |

Description |

|---|---|

|

Primary Assets |

|

|

Type of Asset |

Type of asset owned by you. Examples of assets are – Home, Savings account with bank, etc. |

|

Value |

The market value of the asset. |

icon to add another asset records.

icon to add another asset records.In this section enter details of all your liabilities. You can add multiple records up to a defined limit. Click the  icon to add additional records and the

icon to add additional records and the ![]() icon against a specific record to delete it.

icon against a specific record to delete it.

Liabilities

|

Field Name |

Description |

|---|---|

|

Primary Liability |

|

|

Type of Liability |

The type of liability being defined. Examples can be home loan, personal loan, credit card debt, etc. |

|

Original Value |

Original value of the liability. |

|

Outstanding Value |

Outstanding value of the liability. |

icon to add another asset records.

icon to add another asset records.In this section you can define preferences related to your credit card. You can opt to add authorized users on your card and also define details of balances to be transferred to your new card.

Customize Card

|

Field Name |

Description |

|---|---|

|

Authorized Users |

|

|

Add an authorized user |

You can add an authorized user by selecting Yes. The following fields to capture authorized user’s information are displayed if you select option Yes. |

|

Authorized Users <Number> |

|

|

Salutation |

Specify the authorized user’s salutation. Examples of salutation are Mr., Mrs., Dr. |

|

First Name |

Enter the authorized user’s first name. |

|

Middle Name |

Enter the authorized user’s middle name. This field is optional. |

|

Last Name |

Enter the authorized user’s last name. |

|

Suffix |

Enter the authorized user’s suffix. This field is optional. |

|

Date of Birth |

Enter the authorized user’s date of birth in format MM/DD/YYYY. The system validates the authorized user’s date of birth so as to identify whether the authorized user meets the age requirements as defined by the bank. |

|

Citizenship |

The country in which the authorized user is a citizen. By default, United States will be selected. You can change this value to reflect the country of which the authorized user is a citizen. |

|

Permanent Resident |

Whether the authorized user is a permanent resident of the United States or not. If citizenship is any other than United States and if the authorized user is not a permanent resident of the United States, you will not be able to add the authorized user. |

|

Country of Residence |

This field is enabled only if you have identified that the authorized user is not a permanent resident of the United States by selecting No in the Permanent Resident field. In this case, the authorized user’s country of residence is required to be identified. |

|

Social Security Number |

Enter the authorized user’s Social Security Number. |

|

Residential Address |

|

|

Address is same as primary applicant’s |

Select this option if your address is the same as that of the primary applicant’s. The system will populate the primary applicant’s address in this section. |

|

Accommodation Type |

The authorized user’s residence type. The accommodation types are:

|

|

Address 1-2 |

The authorized user’s address details. |

|

City |

The city in which the authorized user resides. |

|

State |

The state in which the authorized user resides. |

|

Zip Code |

The zip code of the authorized user’s residence. You can enter the zip code in format zip+4 in addition to regular format. |

|

Staying Since |

Date since which the authorized user has been residing at the current address. If you identify a date that is less than the minimum amount of time required for the user to have resided in the current residence, the system will display fields in which you can specify the previous residence address of the authorized user. |

|

Previous Residential Address |

|

|

Accommodation Type |

The authorized user’s residence type. The accommodation types are:

|

|

Address 1-2 |

Address details of previous residence. |

|

City |

The city in which the authorized user had resided previously. |

|

State |

The state in which the authorized user had resided previously. |

|

Zip Code |

The zip code of the authorized user’s previous residence. You can enter the zip code in format zip+4 in addition to regular format. |

|

Balance Transfer |

|

|

Transfer a balance to my new card |

You can select option Yes to specify balance transfer details. The following fields in which you can enter balance transfer details are displayed if you select Yes. |

|

Balance Transfer <Number> |

Each balance transfer record that you define will be numbered. |

|

Card Issuer |

The name of the institution that issued the card from which balance is to be transferred to your new card. |

|

Payee Name |

The name of the card holder from which balance is to be transferred. |

|

Card Number |

The number of the credit card from which balance is to be transferred. |

|

Transfer Amount |

The amount to be transferred. The system will validate this amount so as to ensure that it is not higher than the maximum credit limit of your new card. Additionally, if you are adding more than one balance transfer, the system will run a validation to ensure that the total transfer amount is not more than the credit limit of your card. |

The following is applicable for both Authorized Users as well as Balance Transfer sub sections:

add another authorized user.

add another authorized user.

edit the information of a previously entered record.

edit the information of a previously entered record. The review and submit page consists of the following two sub sections:

Disclosure and Consents

|

Field Name |

Description |

|---|---|

|

ESIGN Disclosure |

|

|

I have reviewed and consent to the ESIGN Disclosure |

Indicates to provide consent to the Esign disclosure. |

|

Certification |

|

|

I have read and agree to the above statements |

Indicates the agreement with the terms and conditions and certifications defined. |

To register an applicant:

Register Applicant

|

Field Name |

Description |

|---|---|

|

|

The email ID of the co-applicant. |

|

Confirm Email |

To confirm re-enter the email ID entered in the Email field. |

|

Password |

Indicates the password required for login. |

|

Confirm Password |

To confirm re-enter the password entered in the Password field. |

At any point you can cancel an application.

To cancel an application:

Cancel Application

|

Field Name |

Description |

|---|---|

|

Reason for Cancelling |

Indicates the reason to cancel an application. The cancellation reason could be:

|

|

Please Specify |

Specify the reason to cancel the application. This field appears if you select Others option in the Reason for Cancelling. |

There will be two scenarios in this case

To save an application:

|

Field Name |

Description |

|---|---|

|

|

The email ID of the user. |

|

Confirm Email |

To confirm re-enter the email ID entered in the Email field. |

|

Password |

Indicates the password required for login. |

|

Confirm Password |

To confirm re-enter the password entered in the Password field. |

Note: The saved application appears in Track Application under In Draft. You can click the application summary and resume application submission process.

The track application allows you to view the progress of the application. Through track application you can:

To track an application:

Submitted Application

|

Field Name |

Description |

|---|---|

|

Application ID |

Application reference number. It is a unique number generated by the application and allotted to an application. |

|

Amount |

The approved loan amount. |

|

Applicant Name |

Name of the loan applicant. |

|

Submitted On |

Application submission date. |

|

Status |

Current status of the application. |

This screen displays the options that you can select to perform any of the following actions

In this section you can configure your card i.e. the primary card as well as the cards of your authorized users.

Card Preferences

|

Field Name |

Description |

|---|---|

|

Primary Card |

|

|

Name on Card |

You can specify the name that you want to be embossed on your card. |

|

Card Design |

You can select the bank ground design that you want printed on your card. |

|

Image on Card |

You can upload an image to be printed on your card. |

|

Authorized User Cards |

|

|

Authorized User’s Name |

The name of the authorized user will be displayed on an accordion. If you click on this accordion, the section in which you can configure the particular authorized user’s card will be expanded. Once you have configured the authorized user’s card and saved the same, the section will be minimized and the |

|

Name on Card |

You can specify the name that you want to be embossed on the authorized user’s card. |

|

Image on Card |

You can upload an image to be printed on the authorized user’s card. |

In this section you can define delivery preferences pertaining to where you want your card, PINPersonal identification number (PIN) is a secret number given to an account holder to be used when they put their credit card or cash card into an automatic teller machine (ATM). If the number they use is correct they will be allowed to access their account., periodic statements to be delivered. The delivery preferences specified for card and PIN will be applicable for your authorized users’ cards and PINs as well.

Delivery Preferences

|

Field Name |

Description |

|---|---|

|

Card Delivery |

You can identify whether you want your card to be delivered to your residential address, to a branch of choice or you can also define an address where you would like your card to be delivered. The options are:

|

|

PIN Delivery |

You can identify whether you want your PIN to be delivered to your residential address, to a branch of choice or you can also define an address where you would like your card to be delivered. The options are:

|

|

Statement Delivery |

You can identify whether you want your periodic statements to be delivered via post or as a soft copy through email. The options are:

|

|

Address |

If you have selected the option Home, in either Card Delivery or PIN Delivery fields, your current residential address as entered in the Contact Information section of the application form will be displayed below that field indicating that your card or PIN will be delivered to your residential address. Additionally, if you have selected the option Post or Both in Statement Delivery, your current residential address will be displayed below the Statement Delivery field. |

|

Select Branch |

This field will be displayed below the Card Delivery/PIN Delivery field if you have selected the option Branch in either of the two fields. You will be able to search for or enter the name of the branch at which you want your card/PIN to be delivered. Once you have selected a branch, the full name and address of the branch will be displayed below the field. |

|

Address Line 1 - 2 |

Details of the address at which you want your card/PIN to be delivered. |

|

City |

The city in which you want your card/PIN to be delivered. |

|

State |

The state in which you want your card/PIN to be delivered. |

|

Zip Code |

The zip code of the address at which you want your card/PIN delivered. You can enter the zip code in format zip+4 in addition to regular format. |

|

Your email |

Your email address will be displayed below the Statement Delivery field, if you have selected the option Online or Both. |

In this section, the names of membership programs affiliated with your new credit card will be displayed. You can link your membership ID of each respective program to your card so as to earn membership rewards when using your card to make purchases from these institutions.

|

Field Name |

Description |

|---|---|

|

Membership Name |

The name of the institution that has a membership with the card you have applied for. |

|

Membership Number |

You can enter your ID number that you hold with the specific membership institution so as to link your membership to the card. |

This screen displays a summary of your credit card application. You can click on the View Complete Application link provided on the screen to view the complete application in PDF format.

|

Field Name |

Description |

|---|---|

|

Offer Name |

The name of the credit card offer that you applied for. |

|

Card Type |

The card network i.e. VISA, Mastercard, American Express, etc. |

|

Approved Credit Limit |

The approved credit limit on your card. |

|

Applicant Name |

Your name as entered in the application. |

|

Application Fees |

The amount of fees charged for the processing of the application. |

|

Card Customizations |

|

|

Authorized Cards |

Whether you have opted to add authorized users to your card or not. The values displayed can be either Yes or No. |

|

Balance Transfers |

Whether you have opted to have balances of any cards transferred to your new card. The values displayed can be either Yes or No. |

|

Delivery Preferences |

The delivery preferences along with details as defined by you for your card, PIN and/or statement will be displayed in this sub section. |

|

Membership Linkages |

The membership linkages, if any, defined by you in the Membership Linkage section of Additional Preferences in the App. Tracker. |

Status history displays the status of the various stages of loan application, remarks, user name, and date on which the status is updated.

Status History

|

Field Name |

Description |

|---|---|

|

Status History |

|

|

State |

Application status. |

|

Remarks |

Displays the remarks if any. |

|

Acted By |

User ID who has processed the account application. |

|

Updated On |

Account application updated date. |

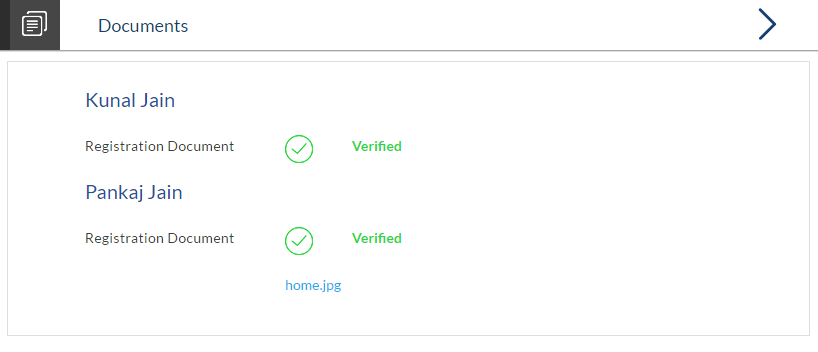

Document Upload

Document upload allows you to upload the documents which are required for the application processing. You can upload multiple documents for a document type. Simultaneously you can upload multiple documents. You can remove any uploaded document.

To upload / remove a document:

Document Upload

Note: Click  to remove the uploaded document.

to remove the uploaded document.

|

Field Name |

Description |

|---|---|

|

Choose File |

File to be uploaded. |

Uploaded Document

FAQs

![]() Can I apply for a credit card if I am not a citizen of the United States?

Can I apply for a credit card if I am not a citizen of the United States?

![]() Why do I have to provide my Social Security Number (SSNSocial Security Number) in the application? How does the bank ensure that my information is safe?

Why do I have to provide my Social Security Number (SSNSocial Security Number) in the application? How does the bank ensure that my information is safe?

![]() Why do you require the expiry date of my identity proof?

Why do you require the expiry date of my identity proof?

![]() Can I provide my P.O. box as residential address?

Can I provide my P.O. box as residential address?

![]() I have my entire zip code i.e. in zip+4 format. Can I provide my entire zip code?

I have my entire zip code i.e. in zip+4 format. Can I provide my entire zip code?

![]() Do I need to include the income I get as alimony in the income section of the application?

Do I need to include the income I get as alimony in the income section of the application?

![]() Can I add multiple authorized users to my card?

Can I add multiple authorized users to my card?

![]() What are the eligibility requirements to be met for someone to be added as an authorized user?

What are the eligibility requirements to be met for someone to be added as an authorized user?

![]() Can I transfer balances from multiple cards to my new card?

Can I transfer balances from multiple cards to my new card?

![]() . Is there a maximum limit defined on the amount of balance that can be transferred to my card?

. Is there a maximum limit defined on the amount of balance that can be transferred to my card?

![]() Why do I have to give my consent to all the disclosures displayed under the Review & Submit section?

Why do I have to give my consent to all the disclosures displayed under the Review & Submit section?

![]() 14. I am an existing customer of the bank but do not have channel access, how can I proceed?

14. I am an existing customer of the bank but do not have channel access, how can I proceed?

![]() Can I proceed with the application if I am not an existing channel user?

Can I proceed with the application if I am not an existing channel user?

![]() Why am I asked to capture previous residential address details?

Why am I asked to capture previous residential address details?

![]() Is it mandatory to change the default configuration for an account as part of application tracker?

Is it mandatory to change the default configuration for an account as part of application tracker?

![]() Why am I being asked to capture previous employment details?

Why am I being asked to capture previous employment details?