An in principal approval loan is a loan which indicates whether bank can potentially lend the amount to the borrower.

In principal approval is availed in the following scenarios:

Following is other important information pertaining to in principal approval:

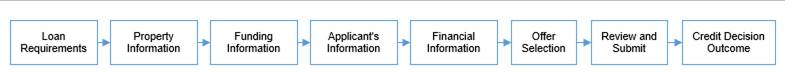

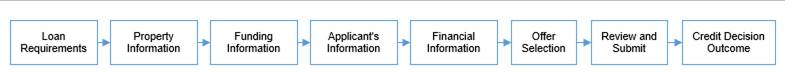

In Principal Approval Workflow

Following are the steps involved as part of application submission:

![]() How to reach here:

How to reach here:

Dashboard > In Principle Approval

To apply for in principal approval loan

Loan Requirement

|

Field Name |

Description |

|---|---|

|

Help us understand your loan requirements |

|

|

What is your purpose for this loan ? |

Reason to borrow the loan amount. |

|

Loan Amount |

The loan amount that the applicant would like to borrow. |

|

Loan Term |

Tenure of loan in years and months to repay the loan amount. |

|

Is there a co-applicant |

Indicates if there is a co-applicant along with the primary applicant. |

|

Is Co-applicant an existing user |

Indicates whether co-applicant is an existing user. This field appears, if you select Yes, in the Is there a Co-ApplicantAn applicant refers to an individual or a non-individual (organization or trust) who has applied for one or more main lines. ? field. |

|

Co-applicant Customer ID |

Indicates the co-applicants customer ID. This field appears, if you select Yes, in the Is Co-Applicant an existing user ? field. |

|

Send Verification Code via |

Indicates the channel on which the verification code is to be sent. The options are:

This field appears, if you select Yes, in the Is Co-Applicant an existing user ? field. |

In the applicant Information screen enter the information like, salutation, first name, middle name, and last name.

Applicant Information

|

Field Name |

Description |

|---|---|

|

Salutation |

Salutation of applicant. The options are:

|

|

First Name |

First name of the applicant. |

|

Middle Name |

Middle name of the applicant. |

|

Last Name |

Last name of the applicant. |

In the property Information screen enter the appropriate information like, property details and address of the property.

Property Information

|

Field Name |

Description |

|---|---|

|

Property Details |

|

|

Ownership Type |

Property ownership type, whether the property is jointly owned or a single owner. |

|

Owners of the Property |

Name of the owners of the property. |

|

Type of Property |

Kind of property, whether the property is residential property, commercial property, etc. |

|

Sub-Type |

Sub type of the property within the type of property. |

|

Purchase Price |

Purchase price of the property. |

|

Address of the Property |

|

|

Country |

Country in which the property is located. |

|

Address Line 1 |

Address line 1 of the property. |

|

Address line 2 |

Address line 2 of the property. |

|

City |

City name where the property is located. |

|

State |

Name of the state where the property is located. |

|

Zip Code |

Zip code of the property. |

|

Is this your primary place of residence ? |

Indicates whether it is the primary place of residence. |

In the funding information system displays the information like, property purchase price, requested loan amount, total fees etc. and the user can confirm on the contribution amount.

Funding Information

|

Field Name |

Description |

|---|---|

|

Property Purchase Price |

Purchase price of the property as entered in the previous step. |

|

Requested Loan Amount |

Loan amount requested to buy the property as entered in the requirements section. |

|

Total Fees |

Fees to be paid for loan processing. |

|

Lenders Mortgage Insurance |

Insurance amount paid against the mortgage loan. |

|

Total Cost |

Total cost of the loan that is property purchase price + total fees + lenders mortgage insurance. |

|

Your Contribution |

Contribution to be made by the loan applicant. |

to save the modified loan details.

to save the modified loan details.In the primary Information screen enter the appropriate information like, salutation, first name, last name, date of birth, citizenship, etc.

Primary Information

|

Field Name |

Description |

|---|---|

|

Salutation |

Salutation of applicant. The options are:

|

|

First Name |

First name of the applicant. |

|

Middle Name |

Middle Name of the applicant. |

|

Last Name |

Last name of the applicant. |

|

Date of Birth |

Date of birth of the applicant. |

|

Gender |

Applicants gender. |

|

Marital Status |

Marital status of the applicant. The options are:

|

|

Number of Dependents |

Number of people dependent on the applicant. |

|

Country of Citizenship |

Applicants country of citizenship. |

|

Permanent Resident |

Indicates whether applicant is permanent resident. |

|

Country of Residence |

The residence country name of the primary applicant. This field appears if you select No in the Permanent Resident field. |

In the proof of identity section enter the identity details such as, identity type, ID number, and expiry date.

Proof of Identity

|

Field Name |

Description |

|---|---|

|

Identity |

|

|

Type of Identification |

Identification type of the applicant. The identification type could be:

|

|

ID Number |

Identification number corresponding to the identification type. |

|

Expiration Date |

Identification proof expiry date. |

In the contact information section enter the contact details such as, accommodation type, address, city, state, zip, email ID, etc.

The Previous Residential Address section appears if the applicant is staying at the current location for less than the specified period.

Contact Information (Current and Previous Residential Address)

|

Field Name |

Description |

|---|---|

|

Residential Address |

|

|

Country |

Residing country name of the applicant. |

|

Address 1-2 |

Address details of the applicant. |

|

City |

City where the applicant resides. |

|

State |

State name of the applicant. |

|

Zip Code |

Zip code of the applicant. |

|

Staying Since |

The date since the applicant is staying at the current address. |

|

Accommodation Type |

Residential accommodation type of the applicant. The accommodation types are:

|

|

Previous Residential Address |

|

|

Country |

Country where the applicant stayed prior to the current residence. |

|

Address Line 1-2 |

Address details where the applicant stayed prior to the current residence. |

|

City |

City where the applicant stayed prior to the current residence. |

|

State |

State where the applicant stayed prior to the current residence. |

|

Zip Code |

Zip code where the applicant stayed prior to the current residence. |

|

Accommodation Type |

Residential accommodation type of the applicant. The accommodation types are:

|

|

|

|

|

|

Email ID of the applicant. |

|

Please confirm your email ID |

Re-enter the email ID to confirm. |

|

Phone Number |

|

|

Phone Type |

Type of phone. The options are:

|

|

Primary Phone Number |

Phone number corresponding to the selected phone type. |

|

Add an alternate phone number |

Alternate phone number other than the primary phone. |

|

Phone Type |

Alternate phone type. The options are:

This field appears if you select Yes in the Add an alternate phone number field. |

|

Alternate Phone Number |

Alternate phone other than primary phone number. This field appears if you select Yes in the Add an alternate phone number field. |

|

Default as that of Primary Applicant |

Indicates whether address details of co-applicant is same as primary applicant. This field appears if you Yes in the Is there a co-applicant field in the loan requirement screen. |

The Landlord Details section appears if you select Rented option in the Accommodation Type list.

Contact Information (Landlord Details)

|

Field Name |

Description |

|---|---|

|

Rented |

|

|

Landlord's Full Name |

Full name of the landlord. |

|

Country |

Country name where the landlord resides. |

|

Address Line 1 |

Address line 1 of the landlord. |

|

Address line 2 |

Address line 2 of the landlord. |

|

City |

City name where the landlord resides. |

|

Zip Code |

Zip code of the location where the landlord resides. |

|

Mobile Number |

Mobile number of the landlord. |

In the employment section, enter the employment details, employer name, employment status, employment type, and start date.

Note: The additional employment details section appears if the current employment is less than the number of specified years.

Employment Information

|

Field Name |

Description |

|---|---|

|

Employment Type |

Occupation type of the applicant. The types are:

|

|

Employment Status |

Occupation status of the applicant. The options are:

|

|

Employer Name |

Name of the company or firm in which the applicant is employed. |

|

Start Date |

Employment start date of the applicant. |

|

Designation |

Designation of the applicant. |

|

Gross Annual Salary |

Annual salary of the applicant. |

|

Country |

Country name in which the applicant is employed. |

|

Address Line 1-2 |

Applicants office address details. |

|

City |

City name in which the applicant is employed. |

|

State |

State name where the applicant is employed. |

|

Zip Code |

Zip code of the location where the applicant is employed. |

to add more than one employment information.

to add more than one employment information.Note: You can lick  to edit the employment information.

to edit the employment information.

Financial Profile

Note: To add and delete income details, click  and

and ![]() icons respectively.

icons respectively.

Income Information

|

Field Name |

Description |

|---|---|

|

Primary Income |

|

|

Income Type |

Income type of the applicant. The income type could be:

|

|

Gross Income |

Gross amount of income earned. |

|

Net Income |

Net amount of income. |

|

Frequency |

Income frequency of the applicant. The frequency could be:

|

Note: To add and delete expense details, click  and

and ![]() icons respectively.

icons respectively.

Expense Information

|

Field Name |

Description |

|---|---|

|

Primary Expense |

|

|

Type of Expense |

Expenditure type for an applicant. |

|

Total Expense Value |

Total expense value incurred by the applicant. |

|

Frequency of Expense |

Expense frequency for the expense. The frequency could be:

|

Note: To add and delete asset details, click  and

and ![]() buttons respectively.

buttons respectively.

Asset Information

|

Field Name |

Description |

|---|---|

|

Primary Assets |

|

|

Type of Asset |

Type of asset the applicant is holding. The asset could be:

|

|

Value |

Market value of the asset. |

Note: To add and delete liability details, click  and

and ![]() buttons respectively.

buttons respectively.

Liability Information

|

Field Name |

Description |

|---|---|

|

Primary Liability |

|

|

Type of Liability |

Liability type for an applicant. |

|

Original Value |

Original value of the liability. |

|

Outstanding Value ($) |

Outstanding value of the liability. |

to edit the loan requirement details.

to edit the loan requirement details.To register an applicant

Register Applicant

|

Field Name |

Description |

|---|---|

|

|

The email ID of the co-applicant. |

At any point you can cancel an application.

To cancel an application

Cancel Application

|

Field Name |

Description |

|---|---|

|

Reason for Cancelling |

Indicates the reason to cancel an application. The cancellation reason could be:

|

|

Please Specify |

Specify the reason to cancel the application. This field appears if you select Others option in the Reason for Cancelling. |

To save an application

Save and Complete Later

|

Field Name |

Description |

|---|---|

|

|

The email ID of the user. |

|

Confirm Email |

To confirm re-enter the email ID entered in the Email field. |

|

Password |

Indicates the password required for login. |

|

Confirm Password |

To confirm re-enter the password entered in the Password field. |

Note: The saved application appears in Track Application under In Draft. You can click the application summary and resume application submission process.

The track application allows you to view the progress of the application. Through track application you can:

To track an application

Submitted Application

|

Field Name |

Description |

|---|---|

|

Application ID |

Application reference number. It is a unique number generated by the application and allotted to an application. |

|

Amount |

The approved loan amount. |

|

Applicant Name |

Name of the loan applicant. |

|

Submitted On |

Application submission date. |

|

Status |

Current status of the application. |

Application Summary

|

Field Name |

Description |

|---|---|

|

Application Summary |

|

|

Applicant Name |

Loan applicants name. |

|

Purpose |

Purpose of loan application. |

|

Requested Amount |

The amount for which the loan is applied. |

|

Approved Amount |

Loan amount approved by the bank including the fees, and other costs. |

|

Tenure |

Loan repayment tenure. |

|

Loan Date |

Loan application date. |

Status History

Status history displays the status of the various stages of loan application, remarks, user name, and date on which the status is updated.

|

Field Name |

Description |

|---|---|

|

Status History |

|

|

State |

Application status. |

|

Remarks |

Displays the remarks if any. |

|

Acted By |

User ID who has processed the account application. |

|

Updated On |

Account application updated date. |

FAQs

![]() I am an existing customer of the bank but do not have channel access, how can I proceed?

I am an existing customer of the bank but do not have channel access, how can I proceed?

![]() Can I proceed with the application if I am not an existing channel user?

Can I proceed with the application if I am not an existing channel user?

![]() Why am I required to specify whether I am a first time home buyer or not, in the application?

Why am I required to specify whether I am a first time home buyer or not, in the application?

![]() Why am I asked to capture previous residential address details?

Why am I asked to capture previous residential address details?

![]() Why am I being asked to capture previous employment details?

Why am I being asked to capture previous employment details?

![]() Can the co-applicant perform all the pending tasks in the application tracker?

Can the co-applicant perform all the pending tasks in the application tracker?