6. Maintaining Parameters for Global Liquidity Management

You need to maintain certain parameters before you define account structures for global liquidity management process. They are:

● System Setup

● Country Regulatory Compliance Setup

● Bank Setup

● Branch Setup

● Payment Instruction Setup

● Currency Setup

● Currency Pair Setup

● Currency Exchange Setup

● Branch Holiday Setup

● Currency Holiday Setup

● Customer Setup

● Account Setup

● Sweep Frequency Setup

● External System Setup

● Sweep Product Setup

● Sweep Instruction Setup

● MBCC Currency Cutoff Setup

● Interest Rule Setup

● Interest Product Setup

● Interest UDE Setup

● Interest Product Mapping Setup

● File Upload

This chapter contains the following sections:

● Section 6.2, "Maintaining System Setup"

● Section 6.3, "Maintaining Bank Setup"

● Section 6.4, "Maintaining Branch Details"

● Section 6.5, "Maintaining Payment Instructions"

● Section 6.6, "Maintaining Currency Definitions"

● Section 6.7, "Maintaining Country Regulatory Compliance Setup"

● Section 6.8, "Maintaining Currency Exchange Setup"

● Section 6.9, "Maintaining Branch Holiday Setup"

● Section 6.10, "Maintaining Currency Holiday Setup"

● Section 6.11, "Maintaining Customer Setup"

● Section 6.12, "Maintaining Account Setup"

● Section 6.13, "Maintaining Sweep Frequency Setup"

● Section 6.14, "Maintaining External System Setup"

● Section 6.15, "Maintaining Sweep Product Setup"

● Section 6.16, "Maintaining Sweep Instruction Setup"

● Section 6.17, "Maintaining Currency Cut off Setup"

● Section 6.18, "Maintaining Interest Rule Setup"

● Section 6.19, "Maintaining Interest Product Setup"

● Section 6.20, "Maintaining Interest UDE Setup"

● Section 6.21, "Maintaining Interest Product Mapping Setup"

● Section 6.22, "Maintaining File Upload"

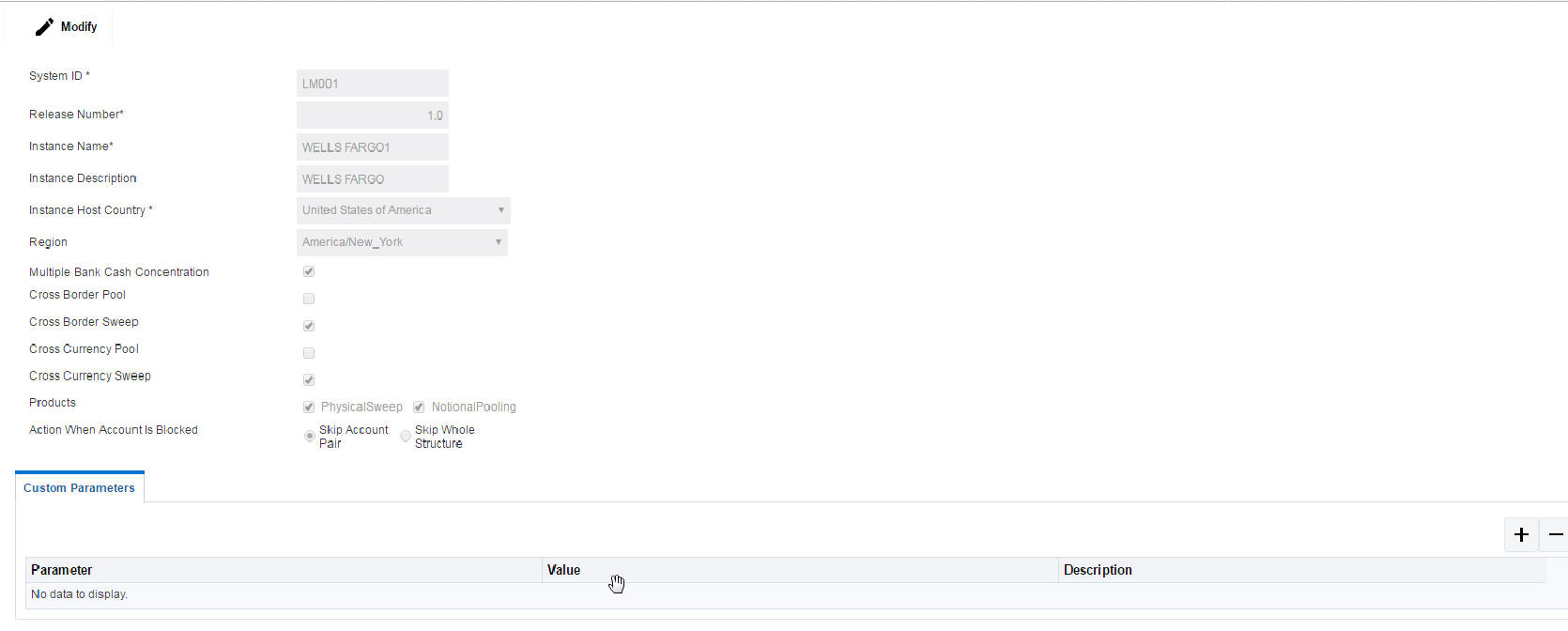

You can use the System Setup for maintaining the system level parameters.Click on Setup Tab to open the setup page. Now click on System Setup to open the system setup page..

You are required to input the following details in this screen:

System ID

Specify the unique system ID. This is usually a back-end upload.

Release No

Specify the LM release number. This is usually a back-end upload.

Instance Name

Specify the name of the LM instance.This is usually a back-end upload

Instance Description

Specify a description if any for the instance.This is usually a back-end upload.

Instance Host Country

Select the ISO code of the country in which the instance has been installed from the drop down list.

Region

Select the region in which the instance is installed from the drop down list.

Multiple Bank Cash Concentration

Check this box to allow set up of Multi Bank Cash Concentration Liquidity Structures.

Cross Border Pool

Check this box to allow cross border pairs in pool liquidity structures.

Cross Border Sweep

Check this box to allow cross border pairs in sweep liquidity structures.

Cross Currency Pool

Check this box to allow cross currency structures in pool Liquidity Structures.

Cross Currency Sweep

Check this box to allow cross currency structures in sweep Liquidity Structures.

Products

Select the type of products allowed in the structure. The options are:

● Physical Sweeping - Check this box to allow only sweep structures in the system

● Notional Pooling - Check this box to allow only pooling structures in the system

Action When Account Is Blocked

Indicate the action to be taken by the system when an account in the structure is blocked. You can select one the following options;

● Skip Account Pair - Skip the account pair and continue with the rest of the structure

● Skip Whole Structure - Skip the whole structure

Custom Parameters

Specify any custom parameters specific to the instance. Click ‘+’ to add a row and specify the Parameter, Value and Description of the same.Click ‘-’ to remove a row.

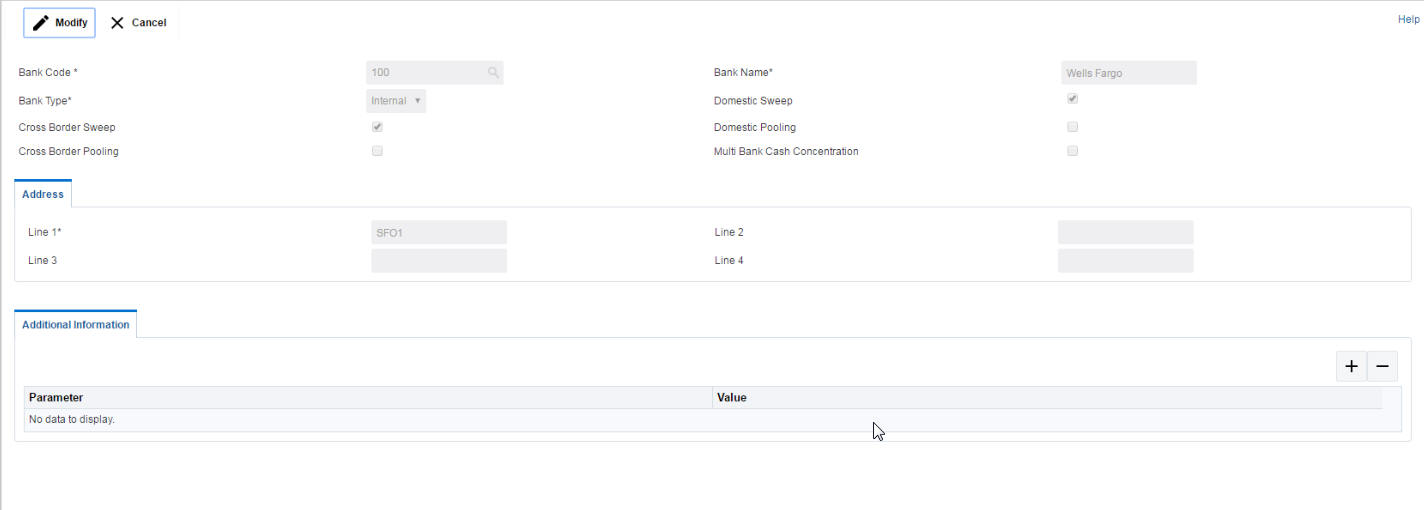

Bank setup maintenance captures details of the banks participating in Liquidity Management. This set up is done both for the Host bank and the External banks.Click on Bank Setup link in the System Setup page to open the Bank Maintenance page.

You are required to input the following details in this screen:

Bank Code

Specify the bank code. You can select the bank code from the option list.

Bank Name

The system displays the bank name based on the selected bank code.

Bank Type

Select the bank type from the drop down list. The options are:

● Internal - This is the bank that is implementing the GLM

● External - These banks are different from the implementing bank

Domestic Sweep

Check this box if selected banks allow domestic sweeps.

Cross Border Sweep

Check this box if selected banks allow cross border sweeps

Domestic Pooling

Check this box if selected banks allow domestic pooling.

Cross Border Pooling

Check this box if selected banks allow cross border pooling.

Multi Bank Cash Concentration

Check this box if the selected banks is to participate in MBCC.

If the Bank is internal and this box is selected, it means that the host bank supports MBCC.

If the Bank is external and this box is selected, it means that the host bank can create MBCC structures involving these banks

Address

Specify the address of the bank.

Additional Information

Specify additional parameters if any. Click ‘+’ to add a row and specify the Parameter, Value of the same. Click ‘-’ to remove a row.

Upload

Click Upload button to upload the bank details using excel sheet.

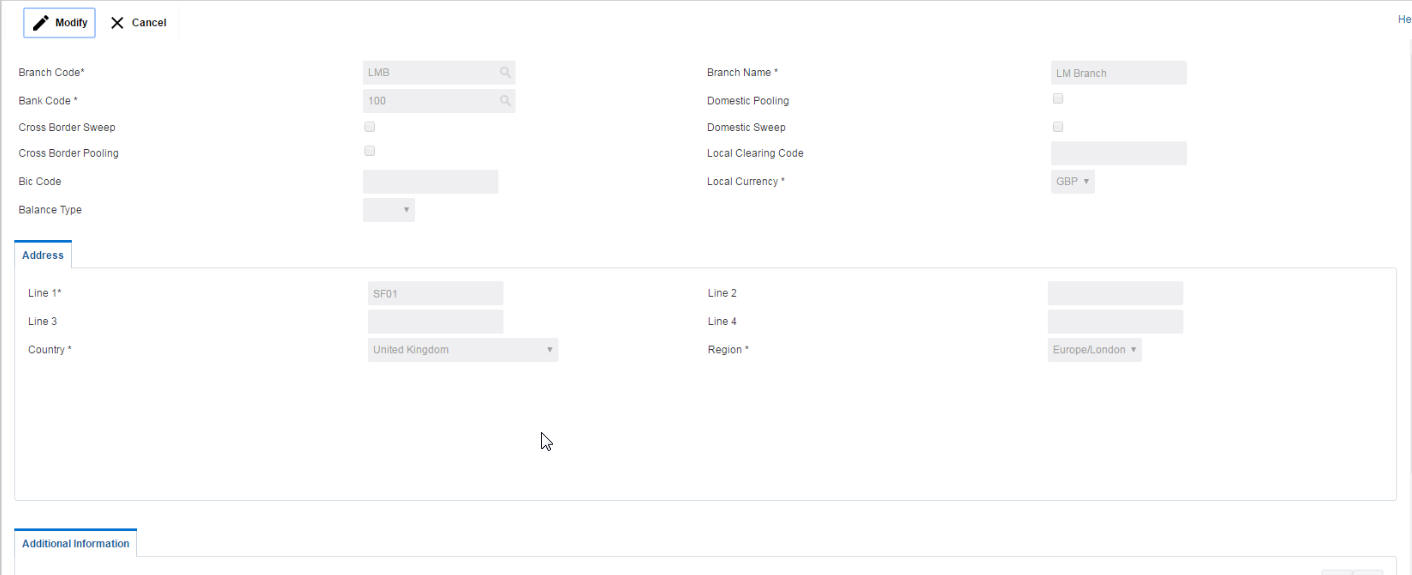

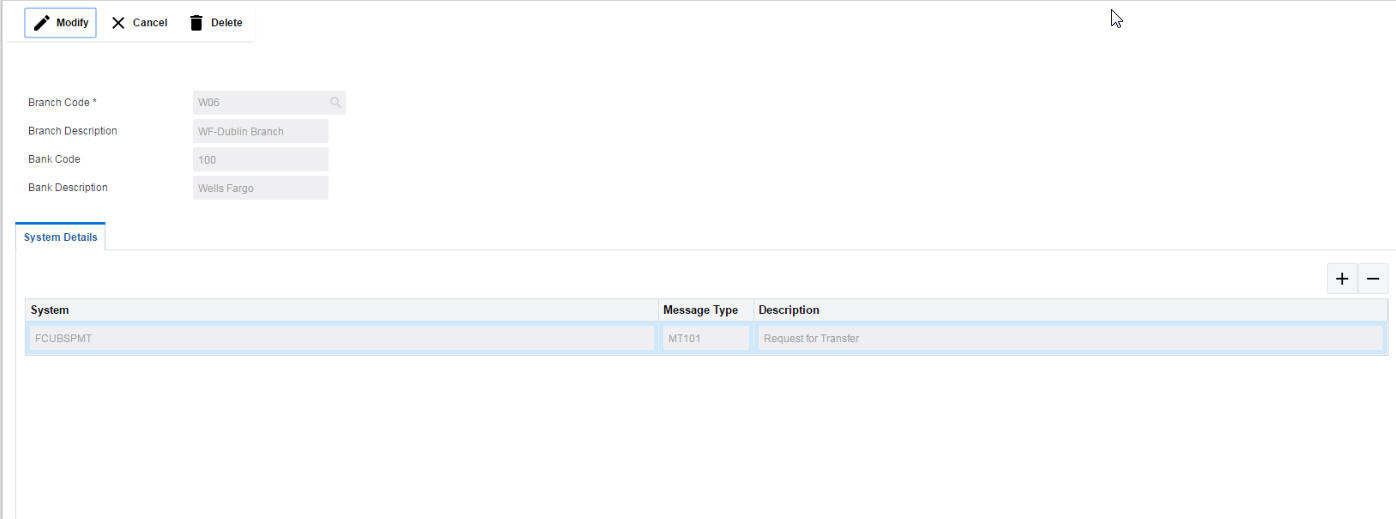

6.4 Maintaining Branch Details

Branch setup allows you to maintain the branch details. Click on Branch Setup link in the Setup page to open the Branch Maintenance page

You are required to input the following detail in this screen:

Branch Code

Specify the branch code.

Branch Name

Specify the name of the branch.

Bank Code

Specify the bank code. You can select the bank code from the option list.The list displays all the bank codes maintained in the system.

Domestic Sweep

Check this box if the selected branch allows domestic sweeps.

Cross Border Sweep

Check this box if the selected branch allows cross border sweeps.

Domestic Pooling

Check this box if the selected branch allows domestic pooling.

Cross Border Pooling

Check this box if the selected branch allows cross border pooling.

Local Clearing Code

Specify local clearing code for the selected branch.

BIC Code

Specify BIC code relevant for the branch.

Local Currency

Select the local currency used by the branch from the drop down list.

Balance Type

Select the balance type from the drop down menu. The options are:

● Online - The account balances are fetched from DDA when sweep happens

● Offline - The account balances maintained in LM by file upload are fetched for sweeps

Address

Specify the address of the branch in the text fields.

Additional Information

Specify additional information if any. Click ‘+’ to add a row and specify the Parameter and Value. Click ‘-’ to remove a row.

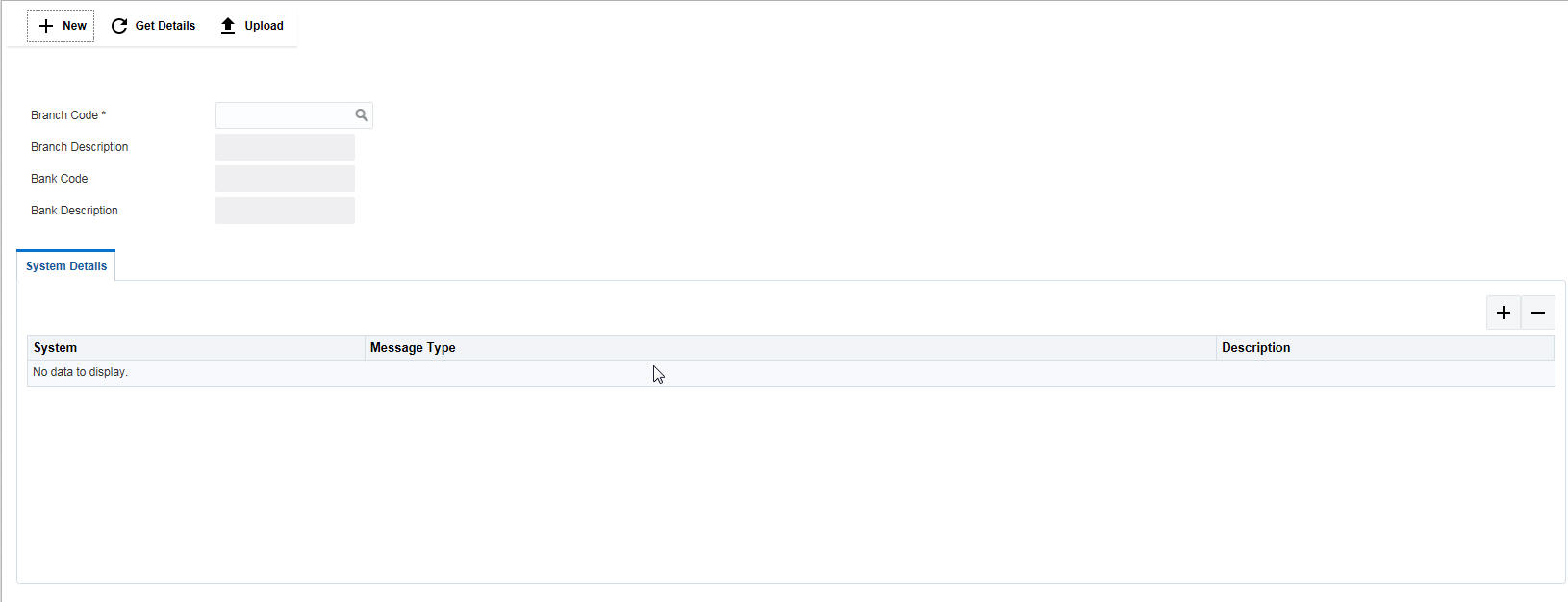

6.5 Maintaining Payment Instructions

Payment Instructions are maintained to define cross border payments for banks. Click on Payment Instruction Setup link in the Setup page to open the Payment Instruction Setup page..

Click on New button to add a new payment instruction. You are required to input the following details in this screen:

Branch Code

Specify the branch code for which the instruction is to be set. You can select the relevant bank code from the option list. The list displays all the branch codes maintained in the system.

Branch Description

The system displays the name of the branch based on the selected branch code.

Bank Code

The system displays the bank code to which the selected branch belong to.

Bank Description

The system displays the name of the bank.

6.5.1 Maintaining System Details

Click ‘+’ to add a row

You can specify the following system details:

System

Specify the payment system to be used for payment. It can be SWIFT, local Clearing etc

Message Type

Specify the message type used for the system.

Description

Specify a description for the message type.

Click ‘-’ to remove a row.

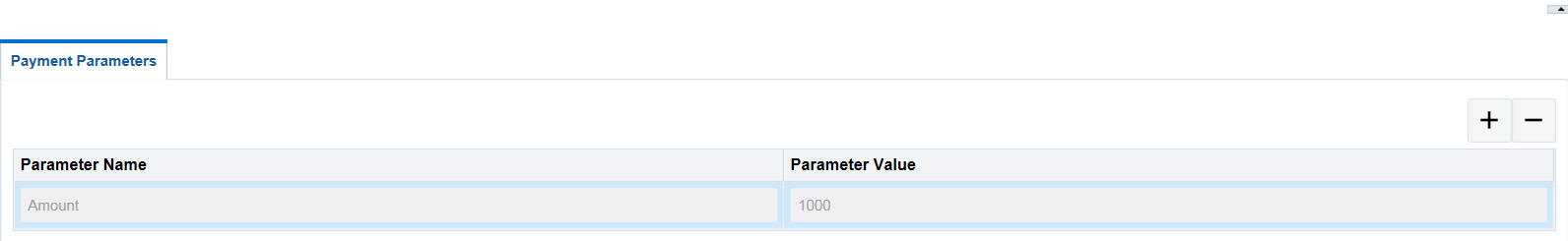

6.5.2 Maintaining Payment Parameters

Specify the payment parameters for each system. Select the System for which the payment parameters are to be set. Click ‘+’ to add a row.

You can specify the following details:

Parameter Name

Specify the parameter name.

Parameter Value

Specify the parameter value.Dynamic values are entered as #.

Click ‘-’ to remove a row.

Click Save button to save the changes.

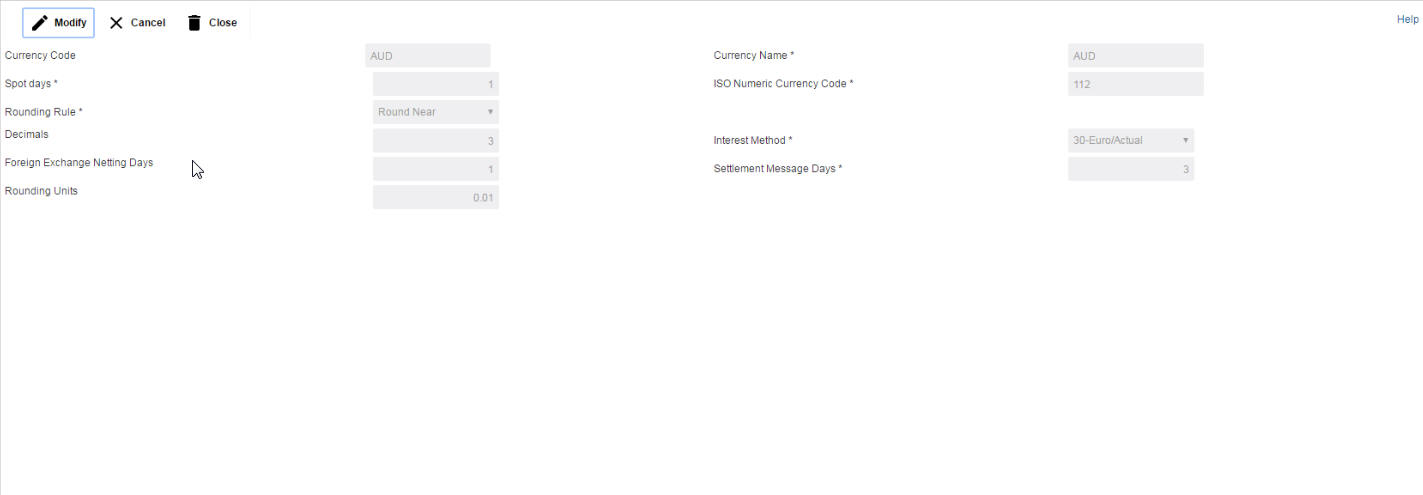

6.6 Maintaining Currency Definitions

Currency setup allows to maintain and define the currencies supported by the bank. Click on Currency Setup link in the Setup page to open the Currency Definition page.

Click on New button to add a new currency. You are required to input the following details in this screen:

Currency Code

Specify the currency code of the currency.

Currency Name

Specify the name of the currency.

Spot Days

Specify the spot days for the foreign exchange of currency.

ISO Numeric Currency Code

Specify the ISO numeric currency code for the added currency.

Rounding Rule

Select the rounding rule for the currency from the drop down menu. The options are:

● Truncate

● Up

● Down

● Round Near

Decimals

Specify the decimals allowed for the currency.

Interest Method

Select the interest method for the currency from the drop down list. The options are:

● 30 - Euro/360

● 30- US/360

● Actual/360

● 30 - Euro/365

● 30- US/365

● Actual/365

● 30 - Euro/Actual

● 30- US/Actual

● Actual/Actual

Foreign Exchange Netting Days

Select the foreign exchange netting days for the currency.

Settlement Message Days

Select the settlement message days for the currency.

Rounding Units

Specify the rounding units for the currency

Click Save to save the details.

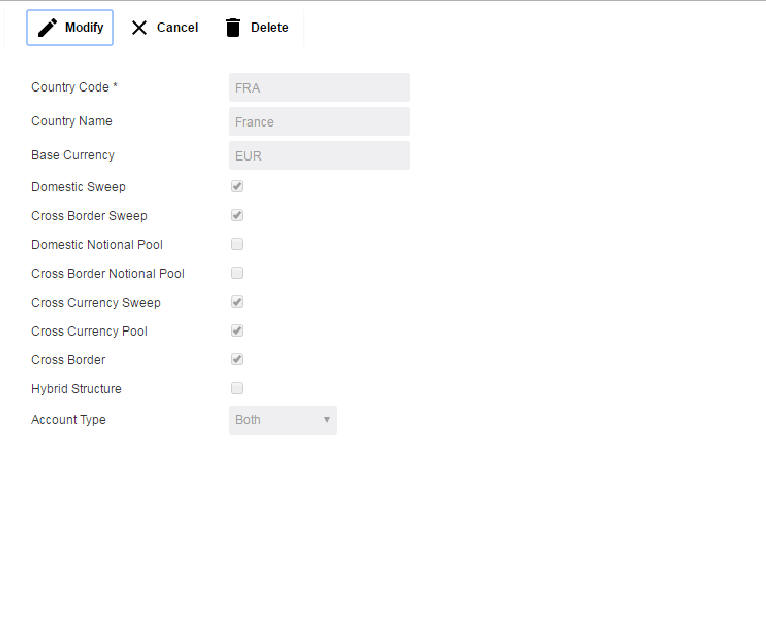

6.7 Maintaining Country Regulatory Compliance Setup

Country Regulatory Compliance setup allows you to define country level liquidity management regulatory compliance. Click on Country Regulatory Compliance Setup link in the Setup page to open the Country Regulatory Compliance Setup page.\

Click on New button to add regulatory compliance for a country. You are required to input the following details in this screen:

Country Code

Specify the country code of the country for which the compliance is to be set. You can select the relevant country code from the option list. The list displays all the country codes maintained in the system

Country Name

Specify the name of the country.

Domestic Sweep

Check this box to allow domestic sweep for the accounts in the country.

Cross Border Sweep

Check this box to allow cross border sweep for the accounts in the country.

Domestic National Pool

Check this box to allow domestic notional pool for the accounts in the country.

Cross Border Notional Pool

Check this box to allow cross border notional pool for the accounts in the country.

Cross Currency Sweep

Check this box to allow cross currency sweeps for accounts in the country

Cross Currency Pool

Check this box to allow cross currency pools for accounts in the country

Cross Border

Check this box to allow cross border account pairs in the country

Hybrid Structure

Check this box to allow hybrid structures in the country

Allowed Account Type

Select the account type allowed in the country from the drop down list. The options are:

● Resident

● Non Resident

● Both

● Not Applicable

Click Save to save the details.

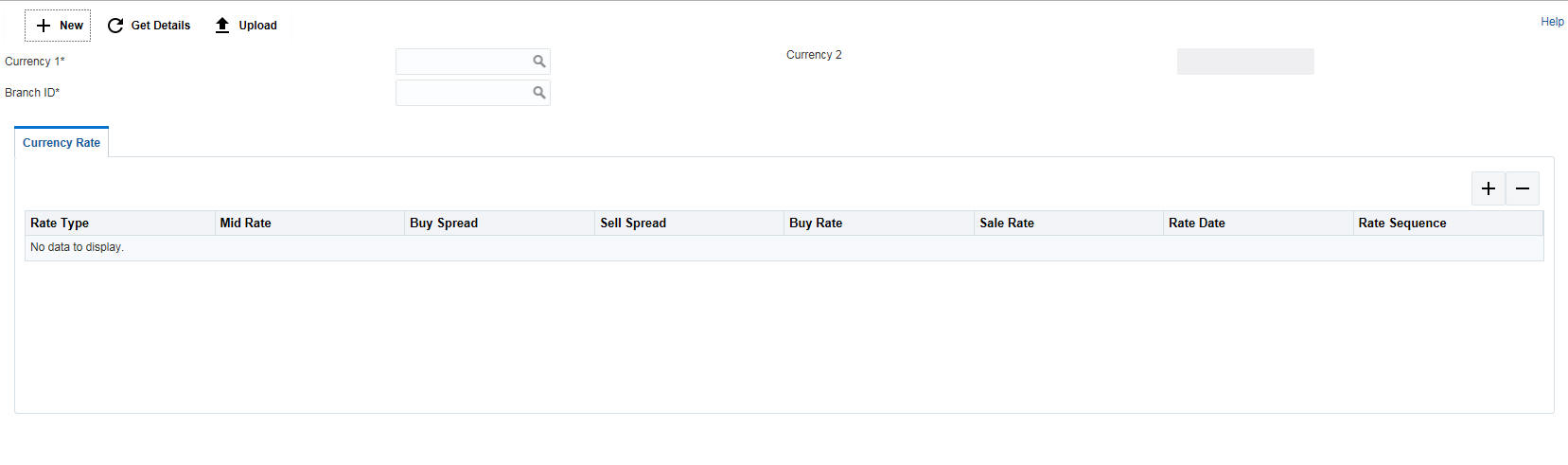

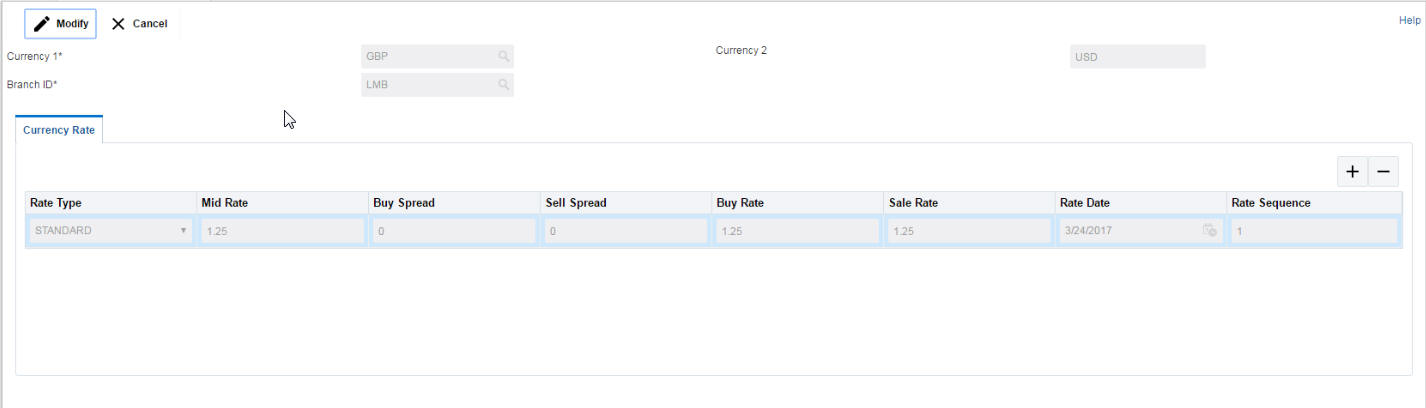

6.8 Maintaining Currency Exchange Setup

Currency Exchange setup allows you to define the currency exchanges rates for pairs. Click on Currency Pair Setup link in the Setup page to open the Currency Pair Maintenance page.\

Click on New button to setup currency exchange rates. You are required to input the following details in this screen:

Currency 1

Specify the first currency for the pair.

Currency 2

Specify the second currency for the pair.

Branch ID

Specify the branch ID for which the currency exchange rate is created. You can select the branch ID from the option list. The list displays all the branch IDs maintained in the system.

Click ‘+ button to add rows in Currency Rate section.

You can specify the following details:

Rate Type

Select the rate type from the drop down list. The options are:

● TC

● BILLS

● CASH

● DD

● STANDARD

● REVAL

● LREPAY

Mid Rate

Specify the mid rate for the currency pair.

Buy Spread

Specify the buy spread rate for the currency pair.

Sell Spread

Specify the sell spread rate for the currency pair.

Buy Rate

Specify the buy rate for the currency pair.

Sale Rate

Specify the sale rate for the currency pair.

Rate Date

Specify the rate date for the currency pair.

Rate Sequence

Specify the rate sequence for the currency pair.

Click Save to save the details.

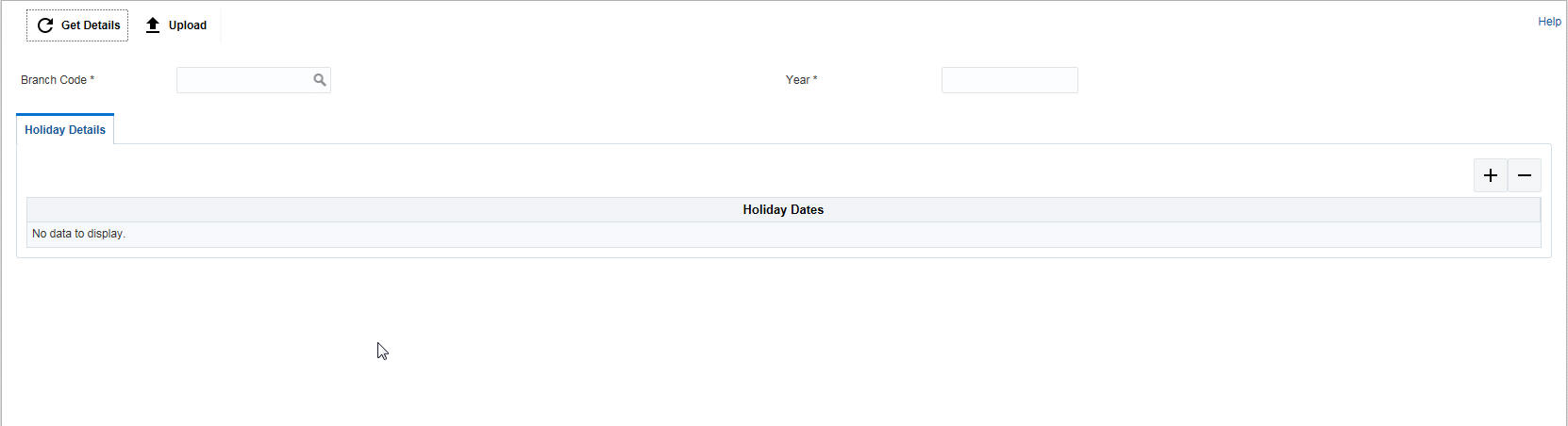

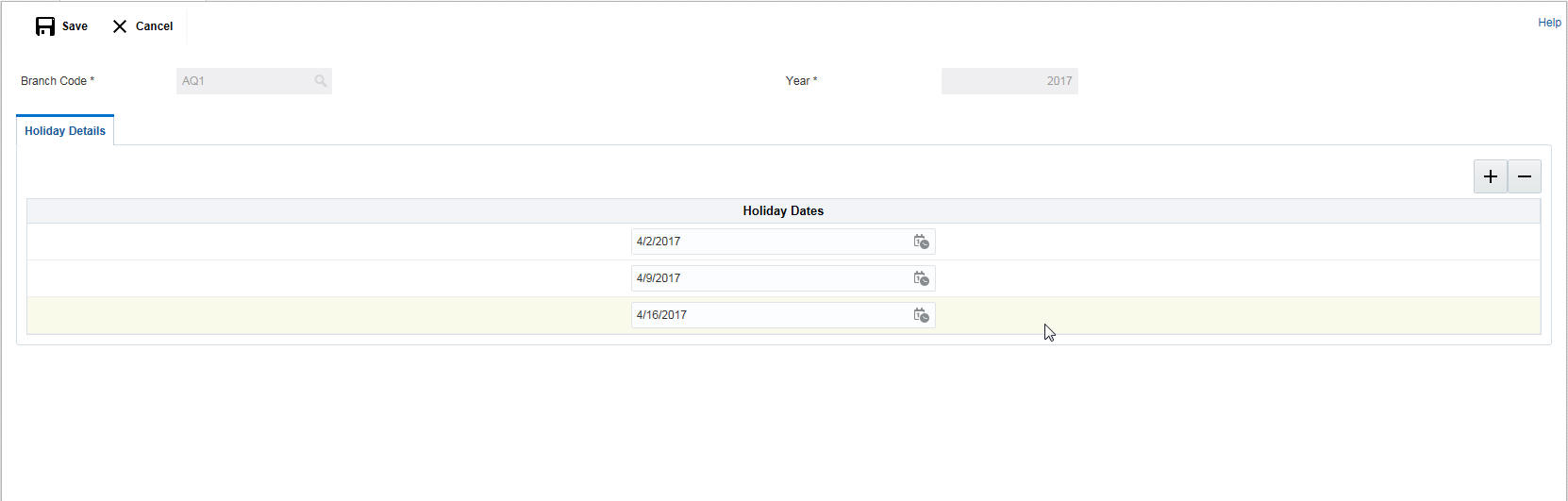

6.9 Maintaining Branch Holiday Setup

Branch Holiday setup allows you to define the holiday dates for a country. Click on Branch Holiday Setup link in the Setup page to open the Branch Holiday Set-Up page.

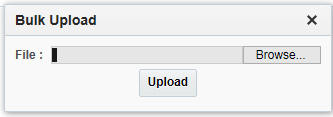

6.9.1 Uploading Branch Holidays

The holiday lists for any particular branch is usually uploaded either using CSV files or through web-service. Click on ‘Upload’ button to open the upload window.

Click ‘Browse’ to search for the file and click ‘Upload’.

To add ad hoc holidays, click on New button. You are required to input the following details in this screen:

Branch Code

Specify the branch code for which to set holidays

Year

Specify the year to set dates

Click ‘+ button to add rows in Holiday Dates section.

Click Save to save the details.

The holidays added will also be updated in the DDA.

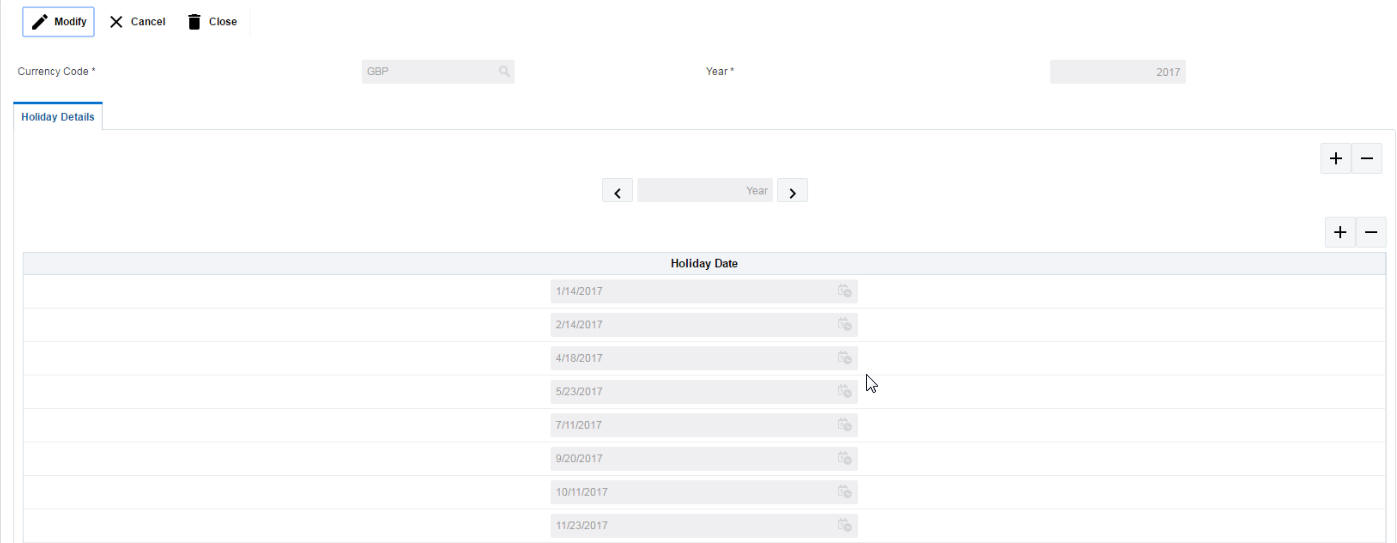

6.10 Maintaining Currency Holiday Setup

Currency Holiday setup allows you to define the dates on which there will be no settlement of prior transactions for a currency. Click on Currency Holiday Setup link in the Setup page to open the Currency Holiday Set-Up..\

Click on New button to setup holiday dates for a currency. You are required to input the following details in this screen:

Currency Code

Specify the currency code for which the holiday dates are to set. You can also select it from the option list. The list displays all the currencies maintained in the system.

Year

Click ‘+ button to add row under year section. Specify the year for which the holidays are to be set.

Holiday Date

Click ‘+ button to add row under Holiday Date section. Specify the holiday dates. You can select the holiday dates using the calender.

Click Save to save the details.

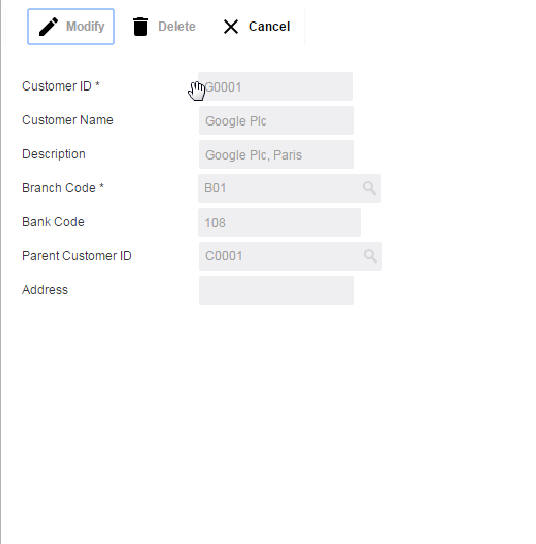

6.11 Maintaining Customer Setup

Customer setup allows you to define the customers. Click on Customer Setup link in the Setup page to open the Customer Maintenance page..\

Click on New button to add customer. You are required to input the following details in this screen:

Customer ID

Specify the customer ID.

Customer Name

Specify the name of the customer.

Description’

Specify a description for the added customer.

Branch Code

Specify the branch code to which the customer belong to. You can select the branch code form the option list. The list displays all the branch codes maintained in the system.

Bank Code

The system displays the bank code as per the selected branch code.

Parent Customer ID

Specify the parent customer of the new customer. You can select the parent customer ID from the option list. The list displays all the customer IDs maintained in the system

Address

Specify the address of the customer.

Click Save to save the details.

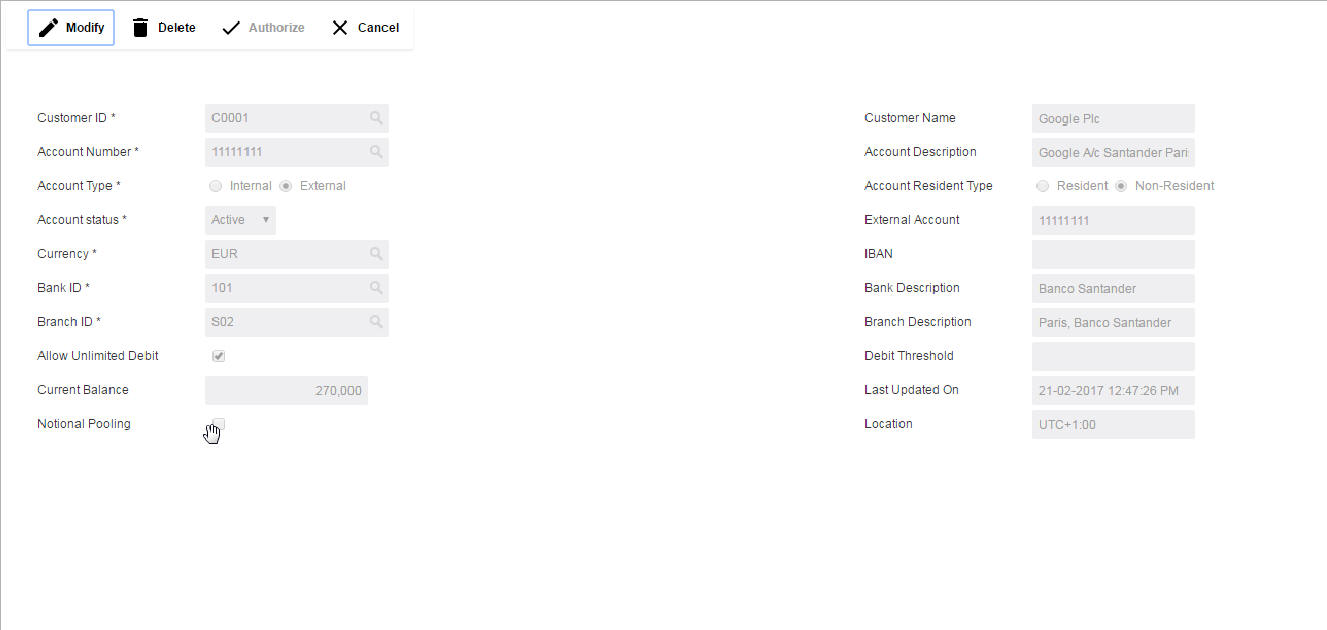

6.12 Maintaining Account Setup

Account setup allows you to define the participating accounts for a customer ID. Click on Account Setup link in the Setup page to open the Account Maintenance page..\

Click on New button to add an account. You are required to input the following details in this screen:

Customer ID

Specify the customer ID.You can select the customer ID from the option list. The list displays all the customer IDs maintained in the system

Customer Name

The system displays the name of the customer.

Account Number

Specify the account number of the customer.

Account Description

Specify a description for the account.

Account Resident Type

Indicate the resident type of the account to be maintained. The options are:

● Resident

● Non - Resident

Account Status

Select the status of the account from the drop down list. The options are:

● Active

● Blocked

Account Type

Indicate the type of the account to be maintained. The options are:

● Internal

● External

External Account

Specify the external account number. The field will be enabled only if the account type selected is External.

Currency

Specify the currency of the account. You can select the currency from the option list. The list displays all the currencies maintained in the system

Bank ID

Select the Bank associated with the account. You can select the bank ID from the option list. The list displays all the bank IDs maintained in the system

Bank Description

The system displays the description of the bank.

Branch ID

Select the Branch associated with the account. You can select the branch ID from the option list. The list displays all the branch IDs maintained in the system

Branch Description

The system displays the description of the branch.

Allow Unlimited Debit

Check this box to allow unlimited debit for the account.

Debit Threshold

Specify the debit threshold amount to be set. This field will be disabled if the ‘Allow Unlimited

Debit’ field is selected.

Current Balance

Specify the current balance of the account.

Last Updated On

The system displays the date of last update.

Notional Pooling

Check this box to allow notional pooling for this account.

Location

Specify the location of the account.

6.12.1 Maintaining MT Parameters

You can enter the following details:

Start Time MT920

Specify the start time from which to accept MT920 messages.

End Time MT920

Specify the end time till which to accept MT920 messages.

Generate Frequency Hour MT920

Specify the frequency of MT920 messages.

Cut Off MT101

Specify the cut off time after which the MT101 messages wont be accepted.

Cut Off MT103

Specify the cut off time after which the MT103 messages wont be accepted.

Click Save to save the details.

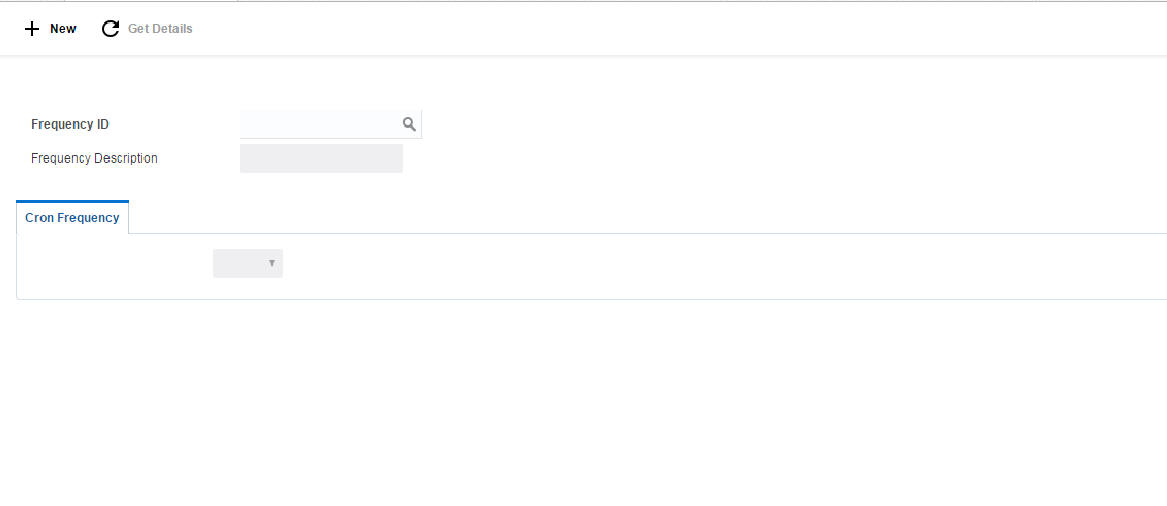

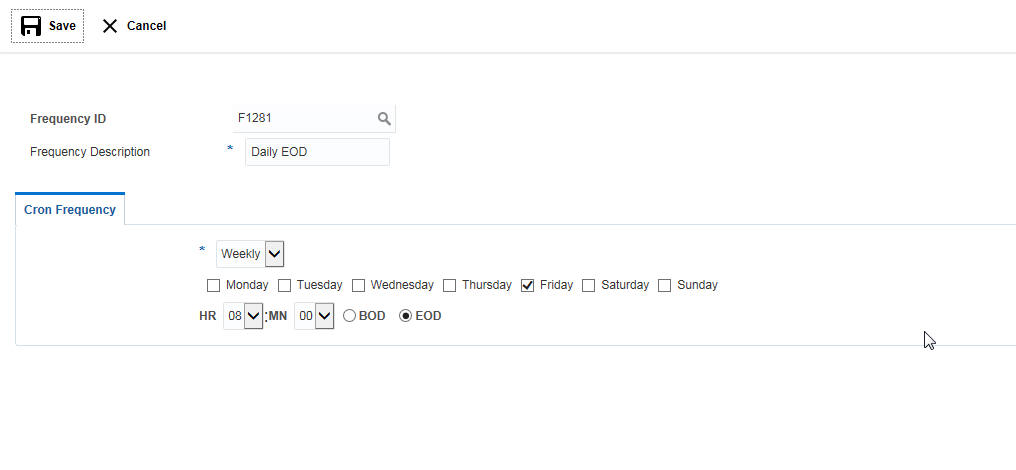

6.13 Maintaining Sweep Frequency Setup

Sweep Frequency setup allows you to define custom frequencies for sweeps. Click on Sweep Frequency Setup link in the Setup page to open the Frequency Maintenance page..\

Click on New button to add an new frequency. You are required to input the following details in this screen:

Frequency ID

Specify a frequency ID.

Frequency Description

Specify a description for the new frequency.

6.13.1 Maintaining Cron-based Frequency

Specify the details for Cron-based frequency type to set a time based frequency.

You are required to input the following details in this screen:

Frequency

Select the frequency in which the sweep is to be executed from the drop down menu. The options are:

● Daily -

● Weekly

● Monthly

● Yearly

Depending on the frequency selected, the system displays more options to set the correct frequency.

Click Save to save the details.

6.14 Maintaining External System Setup

External System setup allows you to define DDA interface. Click on External System Setup link in the Setup page to open the DDA Interface page.

Click on New button to add an new DDA interface. You are required to input the following details in this screen:

Branch ID

Specify the Branch ID.You can select the branch ID from the option list. The list displays all the branch IDs maintained in the system

Branch Description

The system displays the branch description.

Bank ID

The system displays the bank ID of the branch.

Bank Description

The system displays the bank description.

6.14.1 Maintaining External System Details

Click ‘+ button to add row under this section. You can input the following details:

DDA

Specify the core application with which ILM is to be interfaced.

Method Name

Specify the method name to be interfaced

Service Description

Specify a description for the method.

Integration Type

Select the type of integration to be done. The options are:

● WEB_SERVICE

● JMS_QUEUE

You can set customizable parameters for DDAs added. Select the DDA for which the parameters are to be added. Click ‘+ button to add row under ‘Parameter’ section.

You can input the following details:

Param Name

Specify the name of the parameter which has to be added.

Param Value

Specify the value for the parameter which has to be added.

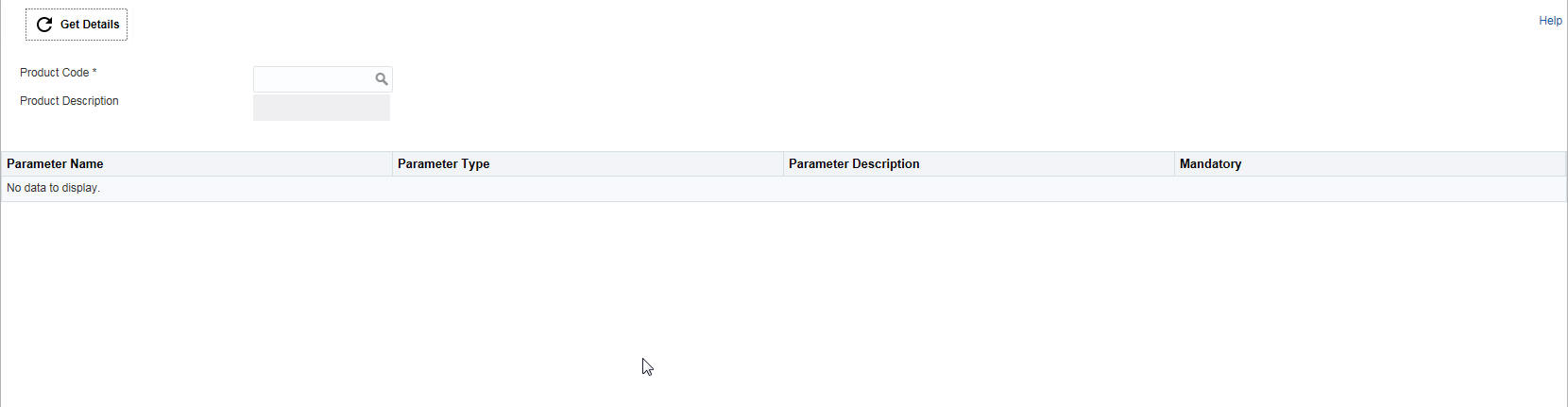

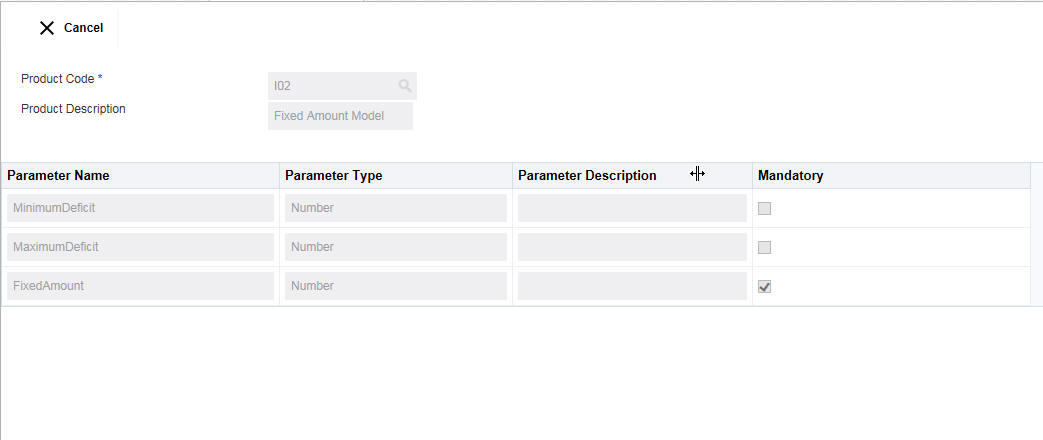

6.15 Maintaining Sweep Product Setup

Sweep Product setup allows you to maintain details of different sweep products, which are taken from the core banking system. Click on Sweep Product Setup link in the Setup page to open the Sweep Product Maintenance page.

You are required to input the following details in this screen:

Product ID

Specify the sweep product ID, which is to be maintained.You can select the product ID from the option list. The list displays all the product IDs maintained in the system.

Product Description

The system displays the product description of the selected product.

Click Get Details button to display the related details of the selected sweep product.

The details are as below:

Parameter Name

The system displays the parameter name.

Parameter Type

The system displays the parameter type.

Parameter Description

The system displays the description of the parameter.

Mandatory

The system displays if the parameter is mandatory or not. If the check box is selected, the parameter is mandatory.

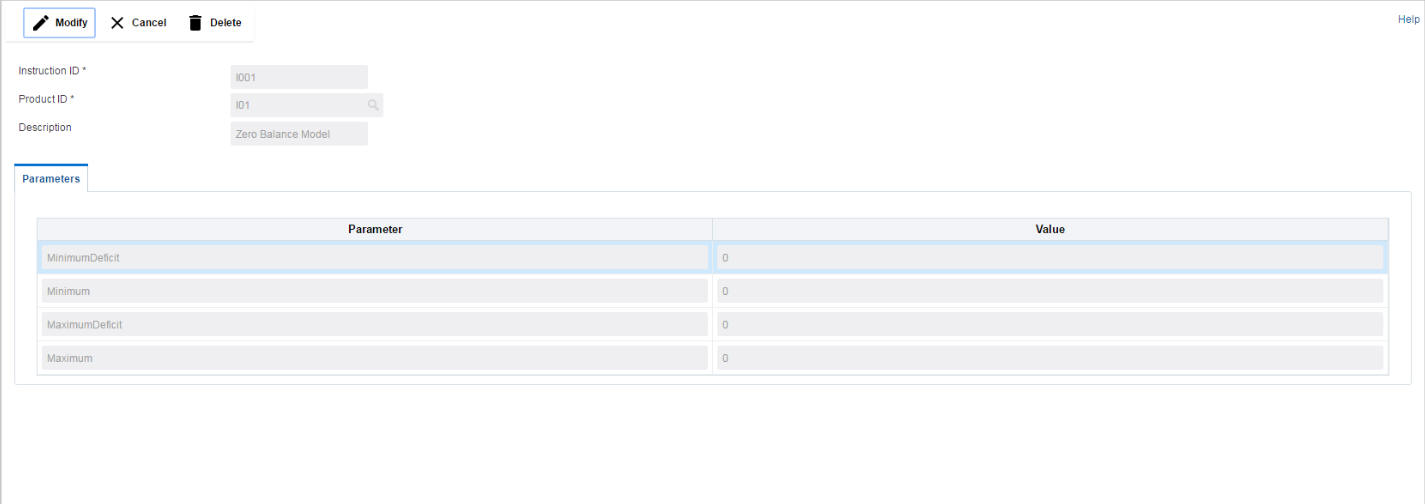

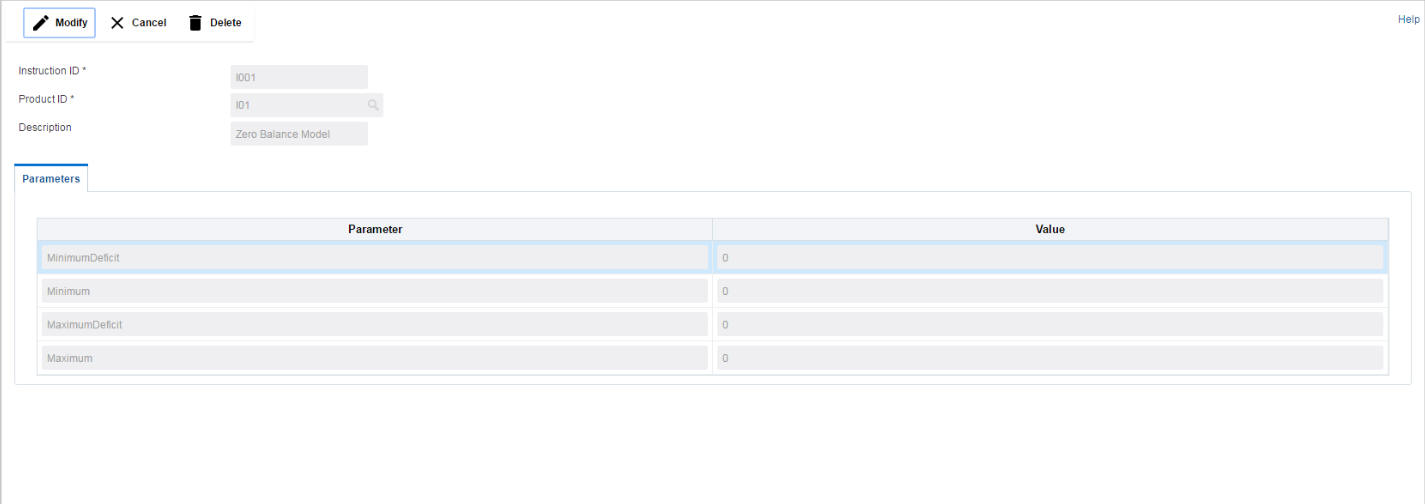

6.16 Maintaining Sweep Instruction Setup

Sweep Instruction setup allows you to maintain the different sweep instructions in LM system which are fetched from the core banking system. Click on Sweep Product Setup link in the Setup page to open the Sweep Product Maintenance page.

Click on New button to add an new sweep instruction. You are required to input the following details in this screen:

Instruction ID

Specify the instruction ID.You can select the instruction ID from the option list. The list displays all the instruction IDs maintained in the system.

Product ID

Specify the product ID.You can select the product ID from the option list. The list displays all the product IDs maintained in the system.

Description

The system displays the description of product.

Parameter

The system displays the list of parameters associated with the selected product ID and their values. You can enter the parameter values.

Click Save to save the details.

6.17 Maintaining Currency Cut off Setup

Currency Cutoff setup allows you to define the currency cut off times for a country. Click on MBCC Currency Cutoff Setup link in the Setup page to open the MBCC CCY Cut Off Maintenance page.

Click on New button to add currency cut off for a country. You are required to input the following details in this screen:

Country Code

Specify the country code to set up the currency cut off.You can select the country code from the option list. The list displays all the country codes maintained in the system

Country Description

The system displays the country description.

Region

Select the region from the drop down list. The list displays all the regions of the selected country.

6.17.1 Maintaining Cut Off Times

You can input the following details here:

Currency

Specify the currency for which the cut off time is to be set. You can select the currency from the option list. The list displays all the currencies maintained in the system

Message Type

Specify the message type to be associated with the currency.You can select the message type from the option list. The list displays all the message type maintained in the system

Incoming Cut Off Time (HH: MM)

Specify the incoming cut off time for the currency.

Outgoing Cut Off Time (HH: MM)

Specify the outgoing cut off time for the currency

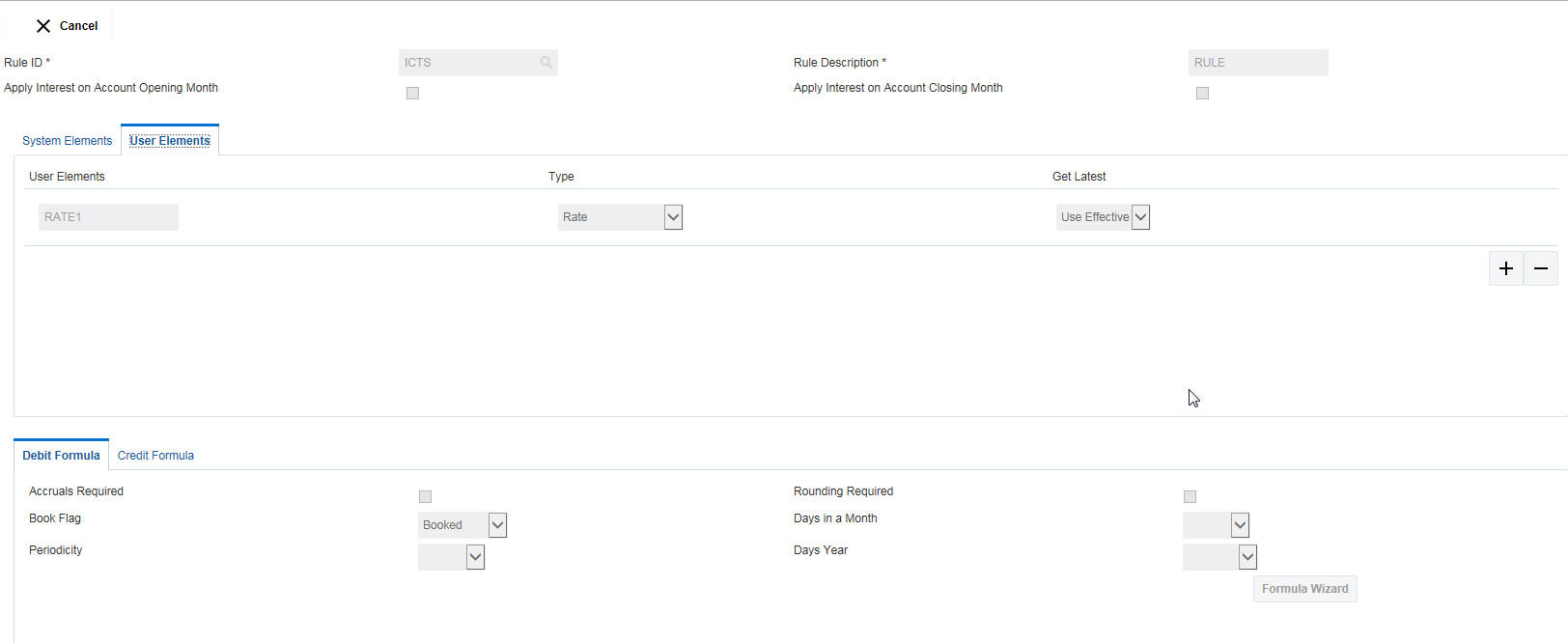

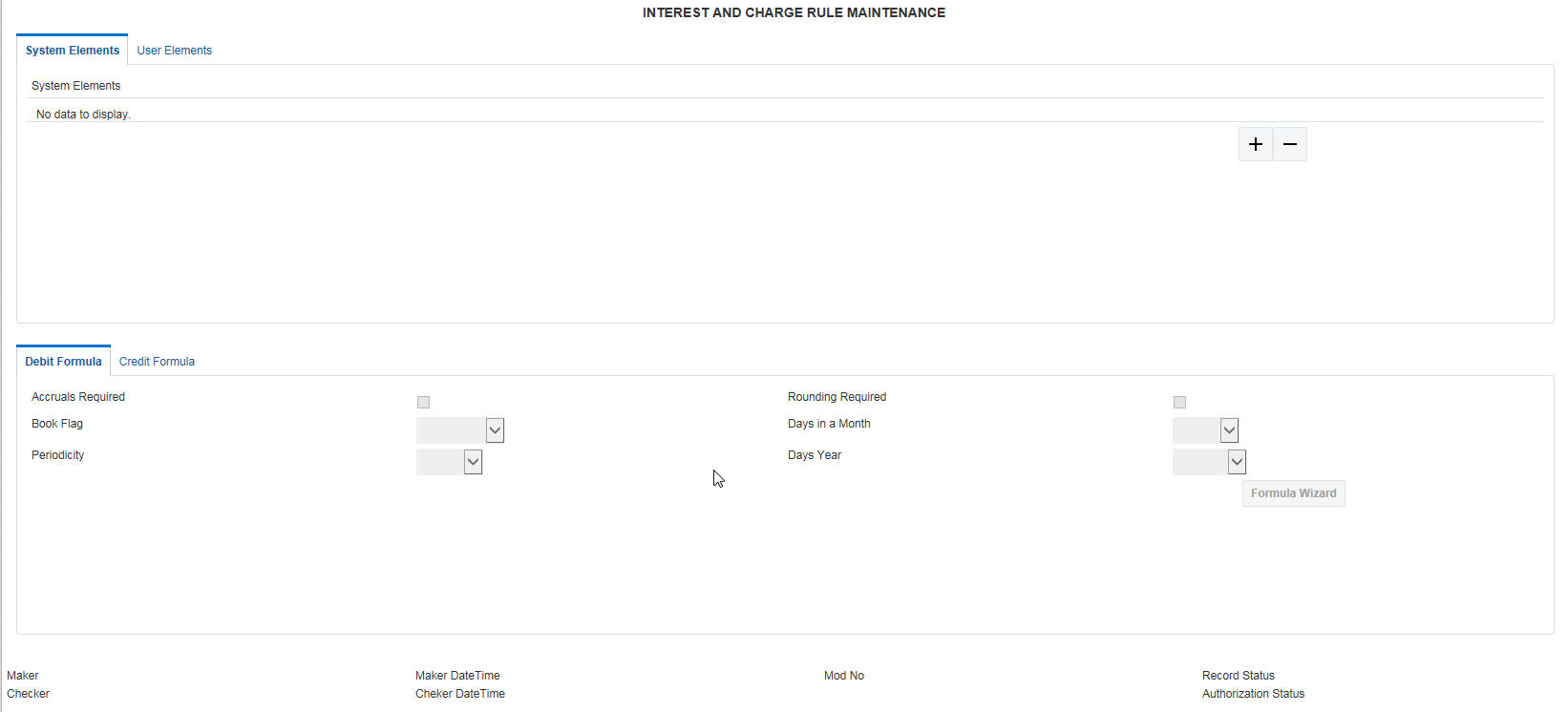

6.18 Maintaining Interest Rule Setup

Interest Rule setup allows you to maintain previously maintained UDEs to create formula which is used by the system for interest calculations. Click on Interest Rule Setup link in the Setup page to open the Interest and Charge Rule Maintenance page..\

Click on New button to add a new rule. You are required to input the following details in this screen:

Rule ID

Specify a rule ID.

Rule Description

Specify a description for the rule.

Apply Interest on Account Opening Month

Check this box to apply the interest on the account opening month.

Apply Interest on Account Closing Month

Check this box to apply the interest on the account closing month.

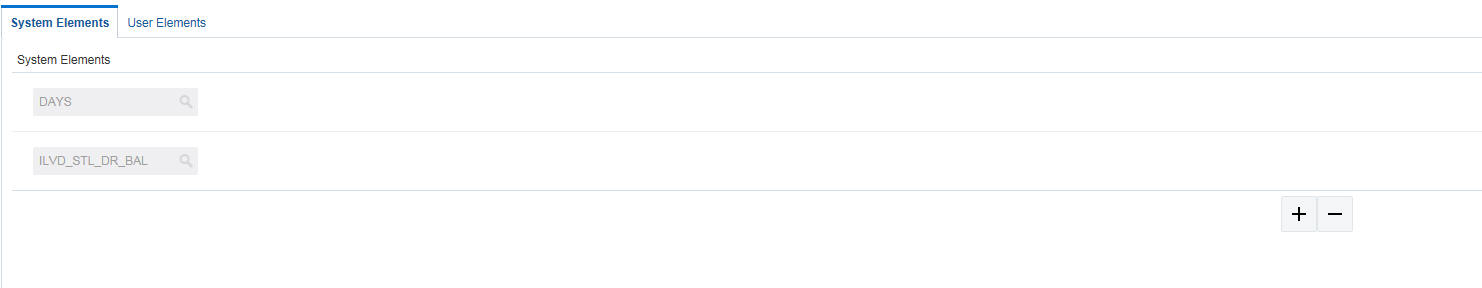

6.18.1 Maintaining System Elements

To calculate interest or charges for an account, you require the following data:

● Principal - The amount for which you want to calculate interest

● Interest period - The number of days for which you want to apply interest

● Interest rate

These components, required to calculate interest, are called ‘data elements’ (the elements that provide the required data to calculate interest). Data elements are of two types:

● System Data Elements (SDEs)

● User Data Elements (UDEs)

System Data Elements (SDEs) can include be any of the following:

● Values for data elements like the balance in an account, on which interest has to be applied

● Number of transactions in a day

Information, such as the ones listed above, is constantly updated in the system and is readily available for computation of interest. They are therefore called SDEs.

Click ‘+ button to add system elements.

Specify the system elements. You can select the system elements from the option list.

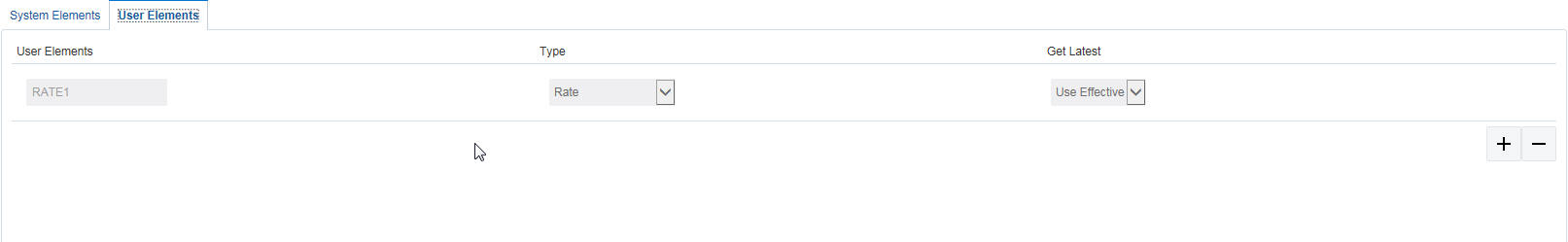

6.18.2 Maintaining User Elements

A rule consists of System Data Elements and the User Data Elements. Click ‘+ button to add User Elements under this section.

You can specify the following details:

User Elements

Specify a user element.

Type

Select the type of user element from the drop down list. The options are:

● Amount

● Rate

● Number

● Rate Code As Rate

Get Latest

Select the option which is to be used as latest. The options are:

● Use Current

● Use Effective

6.18.3 Maintaining Debit/ Credit Formula

Click ‘+ button to add debit/credit formula.

You can specify the following details:.

Accruals Required

Check this box if accrual are required.

Rounding Required

Check this box if rounding is required.

Book Flag

Select the book flag from the drop down list. The options are:

● Booked

● Non Booked

● Tax

Days in a Month

Select the number of days to be considered in a month from the drop down list. The options are:

● Actual

● 30 - Days’

● Euro-30

Periodicity

Select the frequency of using the formula from the drop down list. The options are:

● Daily

● Periodic

Days Year

Select the number of days to be considered in a year from the drop down list. The options are:

● Actual

● 360 Days’

● 365 Days’

To apply interest or charges on an account, you require certain data. For example, to calculate interest for an account you would require the following data:

● the principal (the amount for which you want to calculate interest)

● the period (i.e., the number of days for which you want to apply interest)

● the rate (the interest rate)

When you want to apply charges on an account, you may have to specify the conditions for which you would need to apply charges. The amount that is charged may be different for different conditions. For example, you may want to apply charges on every extra account statement that has to be given to the customer.

When you define a ‘Rule’, you specify exactly how such data is to be picked up for calculating either the interest or charge. A ‘Rule’ identifies the method in which interest or charges have to be calculated.

The data required to calculate interest and charges are broadly referred to as ‘data elements’. Data elements are of two types:

● System Data Elements

● User Data Elements

Using the System Data Elements and the User Data Elements that you define for a rule, you can create formulae. Formulae connect SDEs and UDEs to give a result. The result of a formula is the interest or charge that has to be applied on an account.

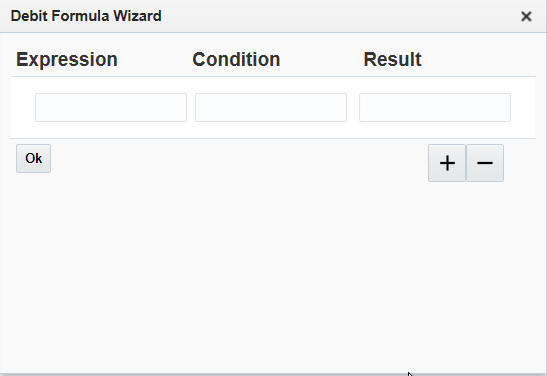

Click on the Formula Wizard button to open the Debit/Credit Formula wizard to create rules the result as per the set

Note

You can define any number of formulae for a rule.

6.18.4.1 Building Blocks of Formulae

Element

To build a formula you require certain building blocks. These blocks could be SDEs, UDEs or (the result of) other formulae that you have previously created.

Operators

Operators are symbols that you would use to build mathematical expressions while defining a formula. The following is a list of symbols that you would require to build a formula.

Operator |

Description |

+ |

Plus |

- |

Minus |

/ |

Divide by |

* |

Multiply |

Logical Operators

Logical Operators are indicators of certain conditions that you specify while building a formula. The following is a list of logical operators that you would require to build a formula: ‘AND’ ‘OR’ and:

Operator |

Description |

AND |

the conjunction ‘and’ |

OR |

the conjunction ‘or’ |

> |

greater than |

>= |

greater than or equal to (please note that there is no space between the two symbols) |

< |

less than |

<= |

less than or equal to (please note that there is no space between the two symbols) |

< > |

Not equal to (please note that there is no space between the two symbols) |

= |

equal to |

Functions

The following are the functional operators available while defining a formula:

Operator |

Description |

ABS |

Absolute value of |

LEAST |

minimum of |

GREATEST |

maximum of |

SUM |

the total value of |

ROUND |

round to |

TRUNC |

integer part of |

FLOOR |

round off to the (lower) nearest |

CEILING |

round off to the (higher) nearest |

POWER |

to the power of |

MOD |

the remainder |

6.18.4.2 Building Formulae

Using the building blocks discussed earlier, you can create or build formulae. You can build any number of formulae for a rule using the SDEs, UDEs and the results of formulae that you have defined for the rule

Click Save to save the details.

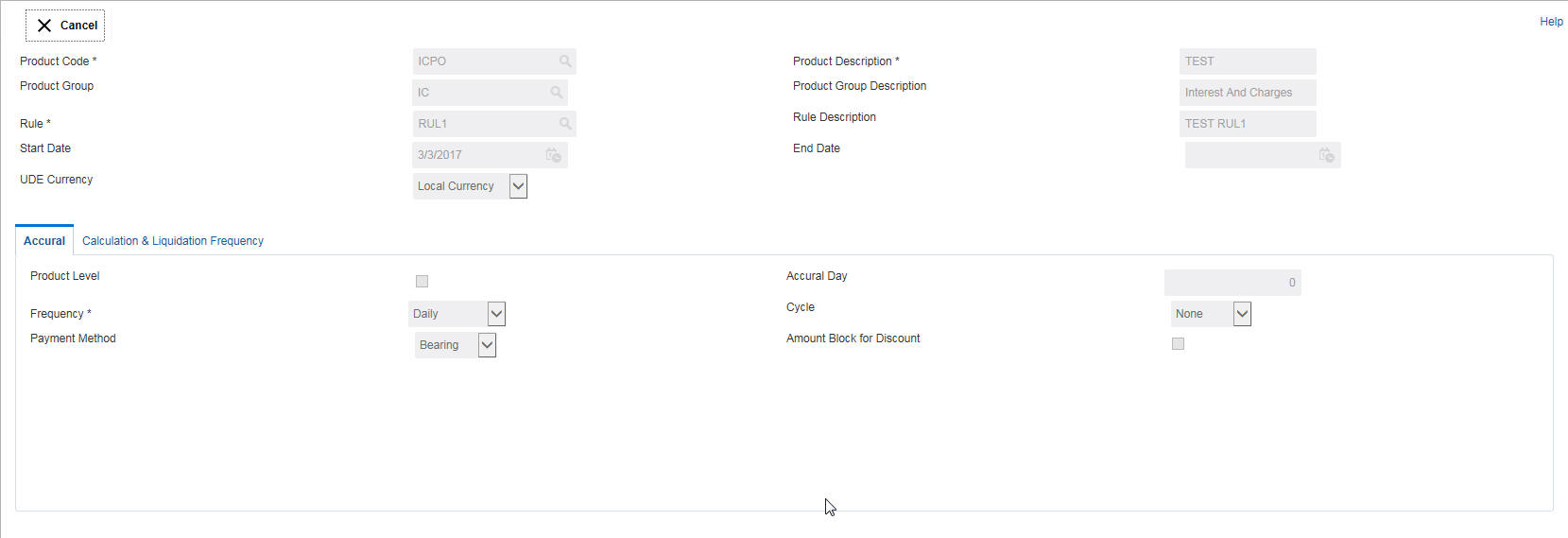

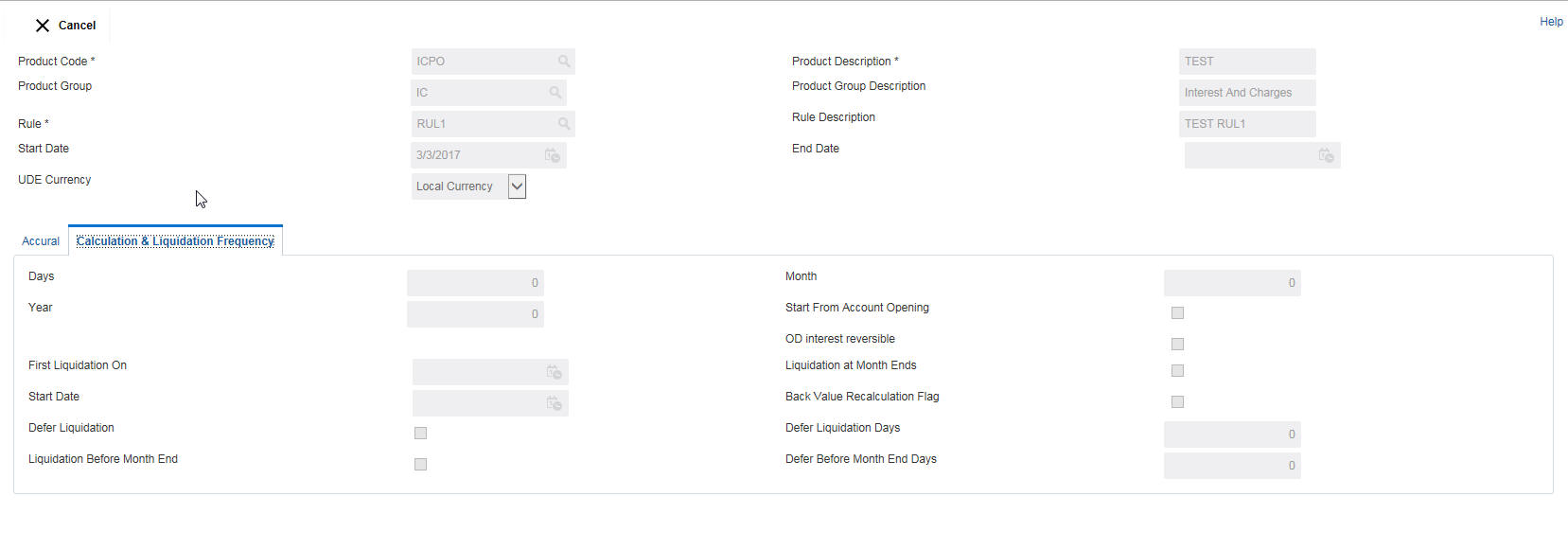

6.19 Maintaining Interest Product Setup

Interest Product setup allows you to create, edit and update various products in LM. Click on Interest Product Setup link in the Setup page to open the Interest Product Maintenance page..\

Click on New button to add a new interest product. You are required to input the following details in this screen:

Product Code

Specify a product code for the new interest product.

Product Description

Specify a description for the new interest product.

Product Group

Specify the product group under which the new product is based. You can select the product group from the option list. The list displays all the product groups maintained in the system

Product Group Description

The system displays the description for the selected product group.

Rule

Specify the rule to be associated with the interest product. You can select the rule from the option list. The list displays all the rules maintained in the system

Rule Description

The system displays the description for the selected rule.

Start Date

Specify the date from which the interest product will be active.

End Date

Specify the date till which the interest product will be active.

UDE Currency

Select the UDE currency to be associated with the product from the drop down list. The options are:

● Account Currency

● Local Currency

Main Interest Rate UDE

Specify the main interest rate UDE.You can select the interest rate from the option list. The list displays all the interest rate UDEs maintained in the system

Product Level

Check this box if the interest accrual is to be done at product level.

Accrual Day

Specify the day the accrual should happen.

Frequency

Select the frequency of accrual from the drop down list. The options are:

● Daily

● Monthly

● Quarterly

● Semi Annual

● Annual

● On Liquidation

Cycle

Select the cycle for the accrual from the drop down list.

Payment Method

Select the payment method for interest accrual from the drop down list. The options are:

● Bearing

● Discounted

Amount Block for Discount

Check this box to block amount for discount.

6.19.2 Maintaining Calculation and Liquidation Frequency

Click on Calculation and Liquidation Frequency tab to open it.

You can enter the following details:

Days

Enter the number of days after which the interest will get calculated and accrued regularly.

Month

Enter the number of months after which the interest will get calculated and accrued regularly along with the days.

Year

Enter the number of years after which the interest will get calculated and accrued regularly along with the months and days.

For example, if Days= 15 and Months= 1, Interest will get computed for every one and half month.

Start from Account Opening

Check this box to start the calculation of liquidation from the start of account opening.

Refund Tax on Pre Closure

Check this box to refund tax on pre closure.

OD Interest Reversible

Check this box if OD interest is reversible.

First Liquidation On

Specify the date for calculation of first liquidation.

Liquidation at Month Ends

Check this box to allow liquidation at month ends.

Start Date

Specify the start date of liquidation.

Back Value Recalculation Flag

Check this flag to allow back value recalculation.

Defer Liquidation

Check this flag to allow deferring of liquidation.

Defer Liquidation Days

Specify the number of days by which the liquidation can be deferred.

Liquidation Before Month End

Check this box to allow deferring of liquidation before month end.

Defer Before Month End Days

Specify the number of days by which the liquidation can be deferred before month end.

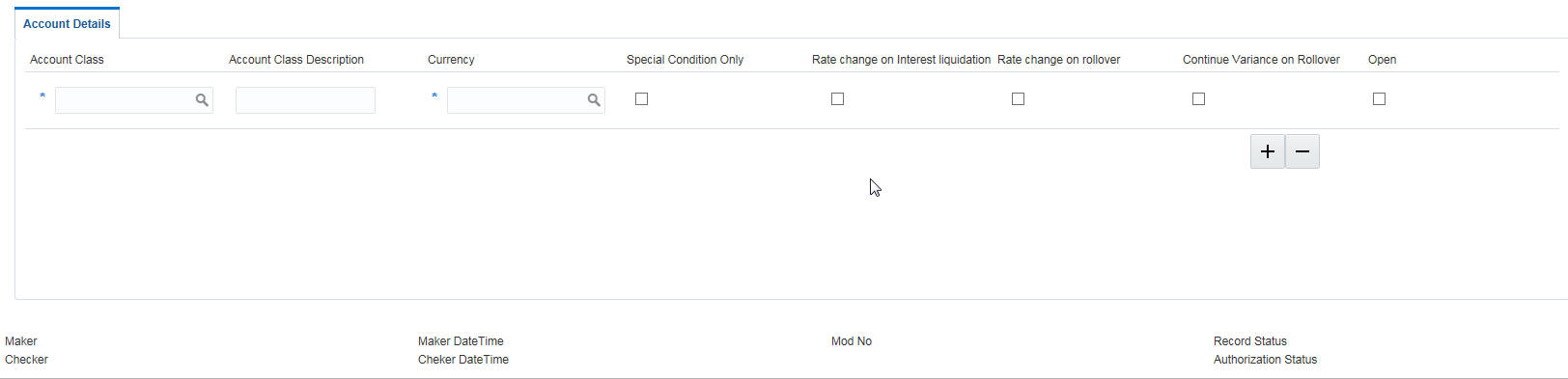

6.19.3 Maintaining Account Details

Click ‘+ button to add row under Account Details section.

Enter the following details:

Account Class

Specify the account class.You can select the account class from the option list. The list displays all the account classes maintained in the system

Account Class Description

The system displays the description for the selected account class.

Currency

Specify the currency.You can select the currency from the option list. The list displays all the currencies maintained in the system

Special Condition Only

Check this box

Rate Change on Interest Liquidation

Check this box to allow change of rate on interest liquidation.

Rate Change on Rollover

Check this box to allow change of rate on rollover.

Continue Variance on Rollover

Check this box to continue the variance on rollover.

Open

Check this box to keep

6.20 Maintaining Interest UDE Setup

Interest UDE setup allows you to create, edit and update user data elements like interest and tax. Click on Interest UDE Setup link in the Setup page to open the Interest Charges User Data Element Maintenance page..\

Click on New button to add a new product. You are required to input the following details in this screen:

Product Code

Specify the product code You can select the product code from the option list. The list displays all the product codes maintained in the system

Branch Code

Specify the branch code.You can select the branch code from the option list. The list displays all the branch codes maintained in the system

Currency Code

Specify the currency code.You can select the currency code from the option list. The list displays all the currency codes maintained in the system

Effective Date

Specify the date from which this will be effective.

User Data Elements

Click ‘+ button to add row under this section. Specify the User Element and User Element Value.

Click Save to save the details.

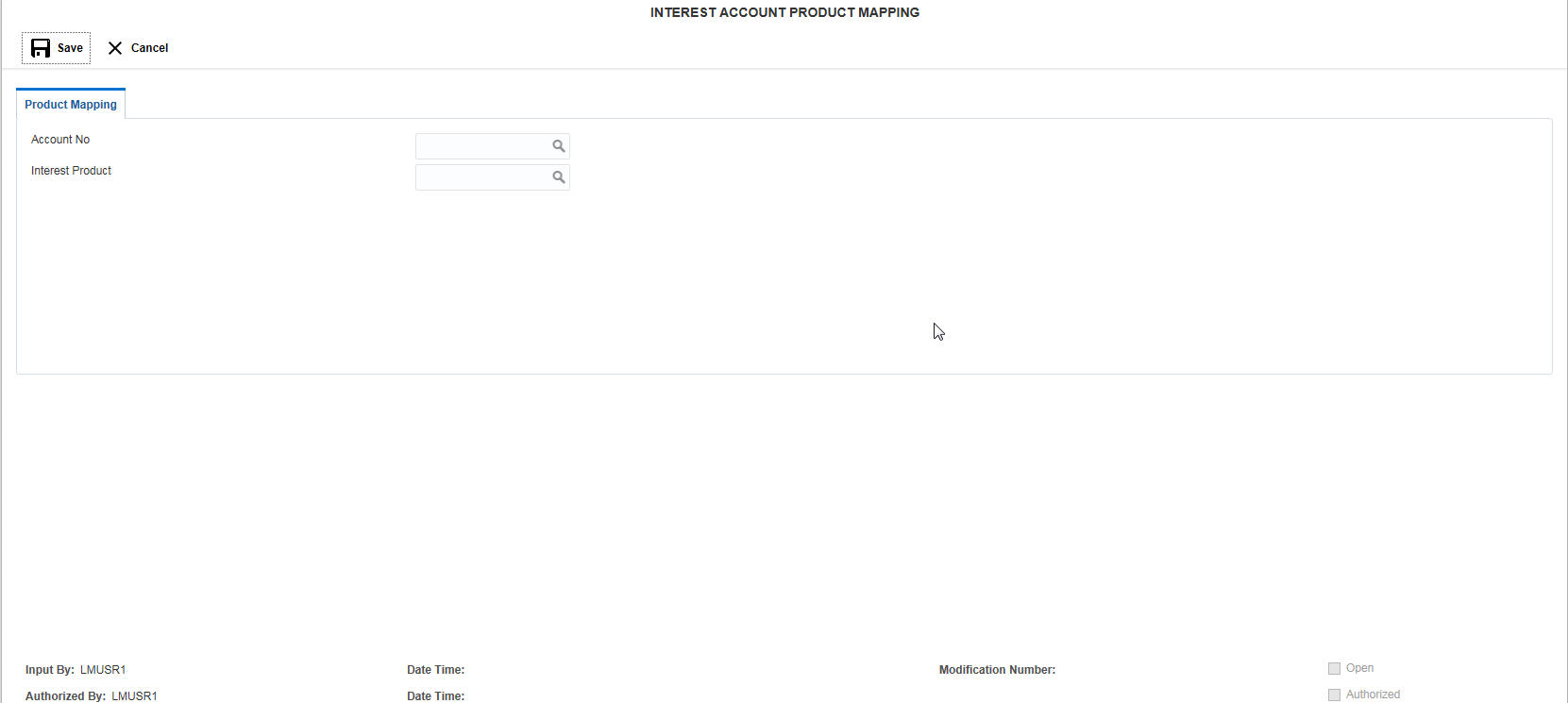

6.21 Maintaining Interest Product Mapping Setup

Interest Product Mapping setup helps you in account class maintenance. Click on Interest Product Mapping setup Setup link in the Setup page to open the Interest Account Product Mapping page..\

Click on New button to map a new product. You are required to input the following details in this screen:

Account No.

Specify the account number to be mapped.You can select the account number from the option list. The list displays all the account numbers maintained in the system.

Interest Product

Specify the interest product.You can select the interest products from the option list. The list displays all the interest products maintained in the system.

Click Save to save the details.

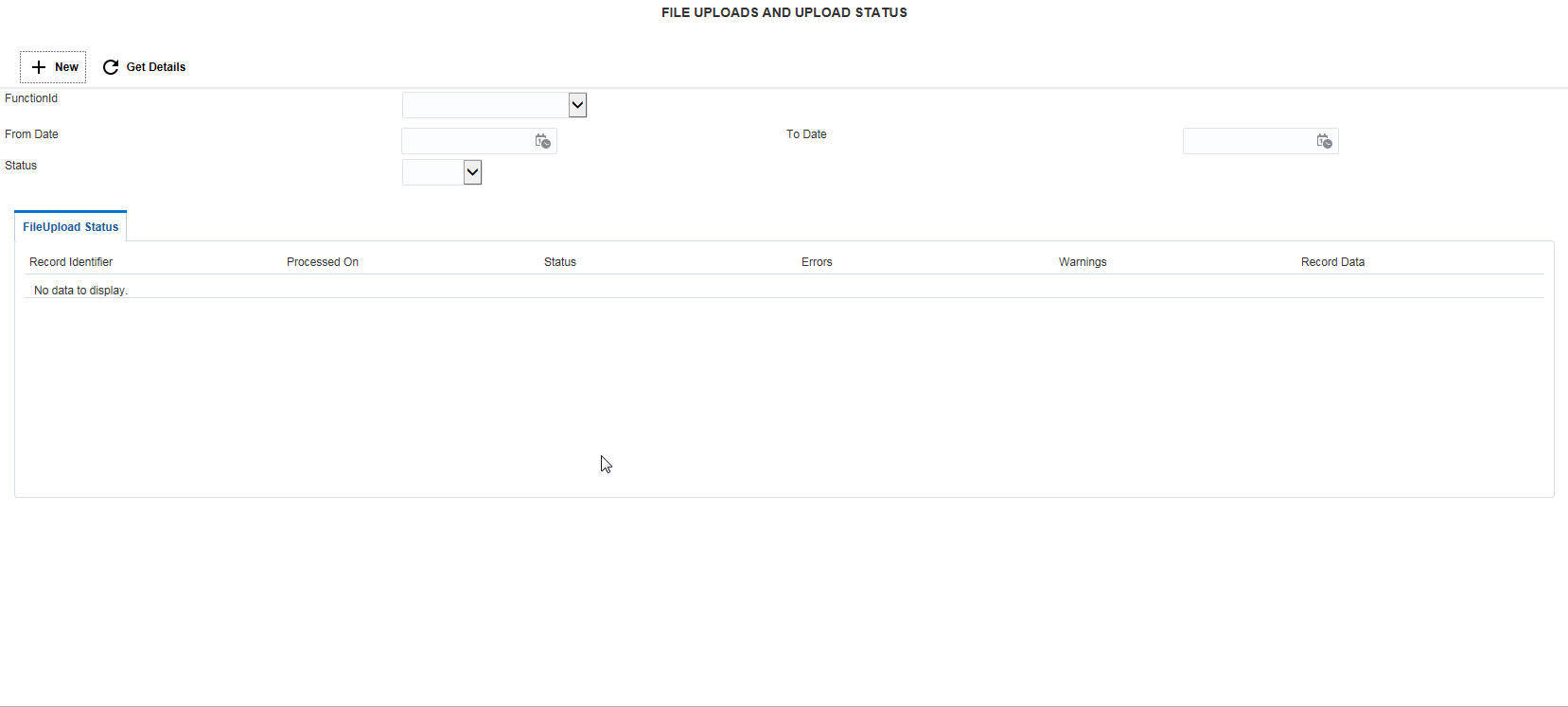

File upload allows you to do all the setups using file uploads. You can also view the upload status here. Click on File Upload link in the Setup page to open the File Uploads and Upload Status page..\

You can view Click on New button to upload a new file. You are required to input the following details in this screen:

Functions ID

Select the function ID for which the upload is to be done

Operations

Select the operation for which the upload is to be done

Input File

Specify the excel file that is to be upload. Browse for the file and upload.

6.22.1 Viewing the upload status

Enter the following details to view the upload status:

Function ID

Select the function ID for which the upload status is to be viewed from the drop down menu. The options are:

● Bank Setup

● Branch Setup

● Payment Network Setup

● Currency Cutoff Setup

● Country Regulatory Setup

● Currency Pair Setup

● Customer Setup

● Participating Account Setup

● Balance Upload

● Currency Definition

● Currency Pair Setup

● Currency Exchange Setup

● Interest UDE Setup

● Interest Product Mapping Setup

From Date

Specify the start date from which the upload status has to be generated.

To Date

Specify the end date till which the upload status has to be generated.

File Upload Status

Enter the details and click Get Details button. The system displays the file upload status for the selected criteria. You can view the following details for the upload:

● Record Identifier

● Processed On

● Status

● Errors

● Warnings

● Record Data