2. Processing Interest

This chapter contains the following sections:

- Section 2.1, "Introduction"

- Section 2.2, "Applying Floating Interest Rate"

- Section 2.3, "Defining Interest Rules"

- Section 2.4, "Defining Interest Details "

- Section 2.5, "Capturing Composite Rate for Loans"

- Section 2.6, "Specifying Interest Details for a Contract"

2.1 Introduction

Interest is an important component of contracts processed by your bank.

You should define the attributes for interest components by way of defining Interest Rules. These Interest Rules should, in turn, be linked to a product, so that the attributes of the Interest Rule is applied on all contracts involving the product. However, while capturing the details of a contract, you can modify some of the attributes defined for a rule. Further, for a contract, you can also indicate that the application of a specific Interest component should be waived.

In this chapter, we shall discuss the processing of interest on contracts. This include defining Interest Rules, linking them to a product, and applying them on a contract.

Example

You could link two Interest Rules to a product, one with 20% fixed interest and another with floating interest. These two interest rules are processed as two different interest components. The expense and accrual accounts can be different for these components. The two interest components are reported as different components in all reports and also in the customer correspondence relating to the contract.

Processing Interest

You process interest in Oracle Lending in the following manner:

- Before a product module becomes operational, you need to maintain certain basic information on interest, which is later linked to a product. To create this information, you have to define floating rate codes and interest rules.

- You create Interest Rules for interest with attributes suitable for the product where these rules are applied. You can give each interest rule a specific Rule ID.

- When you define a product, you can choose the required interest rules that are applicable for contracts in the product and link these rules to the product. The product inherits the Rule ID’s that are linked in this manner.

- When you input a contract, the interest details defined for the product in which the contract has been entered would be applied automatically on the contract. In other words, the interest rule is ‘defaulted’ from the product under which the contract is processed. However, if required, you can change some of the attributes for interest, for a specific contract.

This section contains the following topics:

- Section 2.1.1, "The Concept of Main Interest"

- Section 2.1.2, "Methods of Interest Application"

- Section 2.1.3, "Methods of Interest Collection"

- Section 2.1.4, "Specifying Accrual Related Details"

- Section 2.1.5, "Mode of Repayment"

2.1.1 The Concept of Main Interest

If a product, and hence a contract involving the product, has more than one type of interest applicable, you should designate one of them as the Main Interest. You can do this while defining the interest details for the product. For capitalization and amortization (repayment in Equated Installments) purposes, the main interest component is considered.

Commission, if any, can be defined as another interest rule (It is a rate and is tenor based like interest and can be processed similarly.) For example, you can define your main interest as a rule with ID INT1 and your commission can be defined as another interest rule with Rule ID INT2. You can have as many interest rules as you want to apply on the product and the contract.

2.1.2 Methods of Interest Application

Interest can be applied in different ways, as follows:

Fixed

An interest rate is fixed at the time of initiating the contract. The repayment amounts are computed based on this rate of interest and the repayment schedule.

However, the interest rate applicable on a contract can be changed after the contract has been initiated. You should indicate that this change should come into effect as of a date called the Value Date. The interest amount is computed based on the new rate effective from the Value Date.

Floating

The market rates (with a spread or without it) are applied on the contract. This application can be done in two ways:

- every time the market rate changes

- only at periodic intervals

The market rates are stored in the Floating Rates table. The rates are defined for a combination of Rate Codes and Currency. If the rates have to be applied periodically, the frequency of application should be defined for each contract.

2.1.3 Methods of Interest Collection

Bearing

The Interest is liquidated on schedule payment date(s).

Discounted

In this interest payment method, the interest is deducted at the time of initiating the contract.

True Discounted

In this interest payment method, the interest is calculated on the principal in a manner that is slightly different from the ‘Discounted’ method. The interest rate is applied on the Principal instead of the Nominal, as it is done in the ‘Discounted’ method.

2.1.4 Specifying Accrual Related Details

You have to specify two aspects about interest accruals:

- Whether accruals have to be carried out

- If yes, their frequency

For a product you should specify, accruals to be carried out by clicking ‘Interest’ tab in the ‘Loans and Commitment Product Definition’ screen. If yes, the frequency of accruals (whether daily, monthly, quarterly, half-yearly or annual), should be specified for the product ‘Preferences’ options available in the ‘Interest Class’ screen. This applies to the accruable components of all contracts involving the product.

Accruals are carried out at the specified frequency by the Automatic Contract Update function. In addition, interest is accrued whenever a back-dated event (like a rate change with a Value Date, a payment, and so on.) is triggered as of a date beyond the date on which the last accruals were carried out.

2.1.5 Mode of Repayment

The repayment schedules for interest should be defined for each contract. Depending on the mode of payment applicable, the interest is liquidated, either automatically or manually, according to this schedule.

The mode of repayment for interest can either be automatic or manual. When the repayment is automatic, interest is liquidated on the schedule repayment dates automatically by the Automatic Contract Update program. On the other hand, if the repayment is manual, instructions for liquidation should be entered in the system when the repayment is made.

The mode of repayment has to be specified for a product, but you can change it for a contract.

2.1.5.1 Repayment type

You can capitalize the interest payment on a contract by:

- Specifying the type of schedule (through the Product Preferences screen) as Capitalized. The contract inherits this from the product

- Specifying the frequency for the capitalization through the Product Default Schedules screen.

The outstanding interest is added to the outstanding principal on the schedule date and this becomes the principal for the next schedule.

Note

Capitalization is done only for the “main” interest and only if it is a fixed interest of the bearing type.

You can have equated installments for the contract on the schedule dates by specifying Amortization as the schedule type and specifying the frequency. These repayment schedules are drawn up taking into consideration the Principal and the Main Interest. If an amount is to be amortized, it should have fixed type of interest and bearing interest payment method.

If you specify the schedule type as Normal, you can tailor schedules for the various components to suit your needs.

A schedule date:

- Should be later than or the same as the Value Date

- You can have only one schedule, for a component for a date

- It cannot be beyond the Maturity Date

2.2 Applying Floating Interest Rate

The Interest Rate Type of a product can be one of the following:

- Fixed,

- Floating, or

- Special

A Floating Rate corresponds to the market rates for the day. These rates are maintained and updated daily (or whenever they change,) in the Floating Rates Table. The rates can be applied on a contract with or without a spread.

This section contains the following topics:

- Section 2.2.1, "Capturing Rate Code Details"

- Section 2.2.2, "Capturing Currency Details"

- Section 2.2.3, "Specifying Effective Date and Amount Slab Details"

- Section 2.2.4, "Tenor and Interest Rate Details "

- Section 2.2.5, "Specifying Rate Code Usage"

- Section 2.2.6, "Viewing last authorized data"

- Section 2.2.7, "Charging penalty interest"

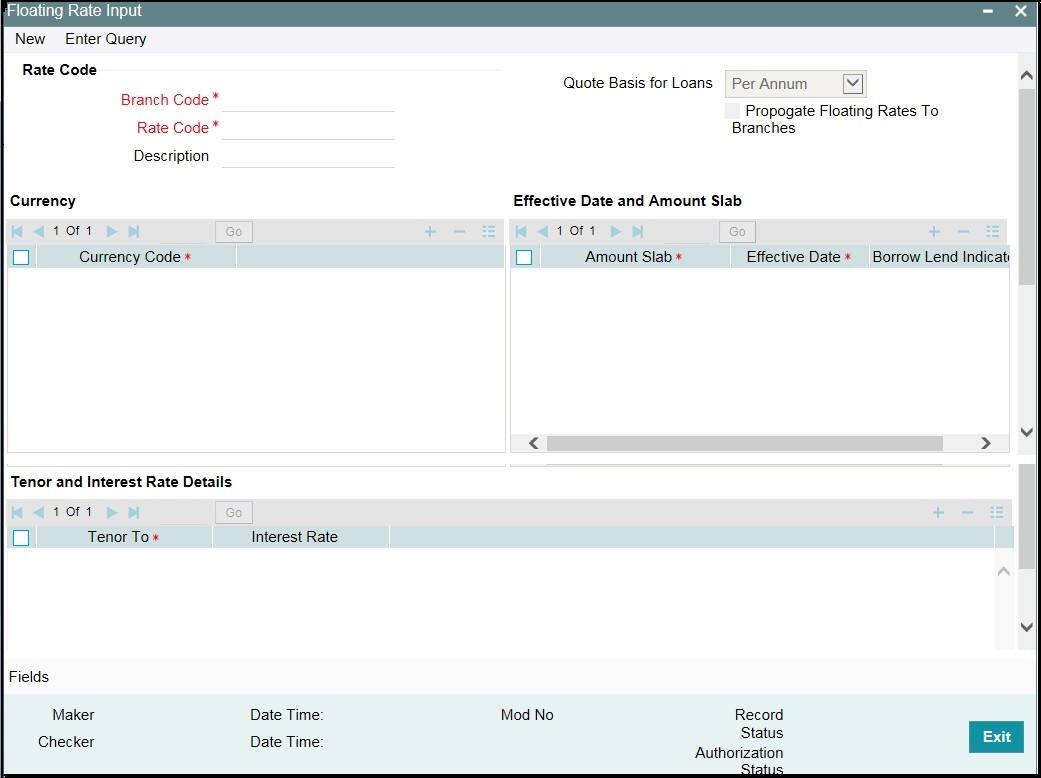

You can invoke the ‘Floating Rate Input’ screen by typing ‘CFDFLTRI’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The floating interest rates are defined through this screen.

2.2.1 Capturing Rate Code Details

Each Rate Code is associated with a currency. You can define rates for the same Rate Code in different currencies.

A Rate Code identifies a set of rates defined for a combination of Currency, Amount Limit (optional) and Effective Date. When processing a contract initiation, you should link it to the Floating Rate Table by indicating the Rate Code. The rates defined for the Rate Code are applied on the contract.

Propagate Floating Rates To Branches

Select this option to indicate that the rate code should be available across all branches.

2.2.2 Capturing Currency Details

Each Rate Code is associated with a currency. You can define rates for the same Rate Code in different currencies.

2.2.3 Specifying Effective Date and Amount Slab Details

Amount Slab

For a specific Rate Code and Currency combination, you can define an amount slab structure for application of interest rates. You should specify the upper limit of the slab to which a particular rate should be applied. A rate that has been defined for an Effective Date - Amount Slab combination is applicable to an amount less than or equal to the specified amount. You can define interest rates for a slab structure.

Effective Dates

Each rate that you define for a Rate Code and Currency combination should have an Effective Date associated with it. This is the date on which the rate comes into effect. Once a rate comes into effect, it is applicable till a rate with another Effective Date is given for the same Rate Code and Currency combination.

Note

The rates are applied to a contract depending on whether it has been defined with Auto Rate Code Usage or Periodic Rate Code Usage. You can specify this in the ‘Interest Class Maintenance’ sub-screen of the ‘Loans and Commitment Product Definition’ screen.

Borrow/Lend Rate Indication

For every Amount Limit - Effective Date combination, you should define the rate to be applied as a borrow rate or a lend rate. Borrow rates are applied for loans taken by the bank and lend rates apply on placements. You also have the option to specify mid-rate.

2.2.4 Tenor and Interest Rate Details

The rates that are applied for a given combination of Amount Limit – Effective date – Lend/Borrow Indication can be tenor based. In the table, you can define the interest rates for different tenors. The rate that is applied to a contract is based on the interest parameters specified in the ‘Interest Class Maintenance’ sub -screen of the ‘Loans and Commitment Product Definition’ screen.

The index rate code which was picked up to derive the resultant composite rate is stored as ‘Picked Rate Code’ for the effective date, which has the reset tenor zero.

The rates picked for the index rate codes are for the maximum amount maintained in the amount slab. The composite rate rebuilt is stored with the amount slab as “999,999,999,999.00”. After applying the additional rate (specifically when the additional rate indicator is ‘-‘), if the resultant rate becomes –ve, then it is considered as 0 as –ve rate is not allowed.

2.2.5 Specifying Rate Code Usage

If you specify Auto Rate Code usage, all the rate changes made during the liquidation or accrual period will be considered. If you specify periodic rate code usage, the rates are periodically refreshed and the rates as of a specific frequency is applied.

This frequency is specified in the Contract Schedules screen while the Rate Code Usage is specified in the ‘Interest Class Maintenance’ sub -screen of the ‘Loans and Commitment Product Definition’ screen.

Note

If you want the floating rates to be applied automatically every time they change, you should specify Auto Rate Code usage in the ‘Interest Class Maintenance’ sub-screen of the ‘Loans and Commitment Product Definition’ screen.

2.2.6 Viewing last authorized data

You have the facility to view the latest authorized version in the Query Mode (F7 and F8). Once you execute the query, the system displays the latest authorized version.

Note

You are not allowed to create, copy, close, reopen, or amend a record in the ‘View Last Authorized’ Mode.

2.2.7 Charging penalty interest

Penalty interest is charged when a principal repayment is defaulted on. Penalty interest is charged either on the entire outstanding principal amount or on the principal schedule that is overdue, for the overdue period. You also have the choice of applying different penal interest rates for different overdue periods.

Let us assume that the total outstanding amount on a credit card is USD 10,000 as on September 30, 2002. The card customer is required to pay 10% of the total outstanding amount, that is., USD 1,000 by October 05. On default, he is charged penalty interest at 2% per month, say, for the first two months, 3% per month for the next two months and 4% per month thereafter. The bank has the choice of charging this penalty interest on the entire outstanding principal of USD 10,000 or on the overdue principal of USD 1,000.The rate maintained for this overdue tenor is applied.

2.3 Defining Interest Rules

An Interest Rule identifies the basic nature of an interest component. Each Interest Rule is defined by a four-character code, called the Rule ID. Attributes are defined for this Rule ID, which is then linked to a product. When a contract is processed, the interest attributes defined for the Rule ID linked to the product is applied on the contract, some of which can be changed.

This chapter contains the following sections:

- Section 2.3.1, "Specifying Rule Type"

- Section 2.3.2, "Specifying Rate Type"

- Section 2.3.3, "Defining ICCF Rule Application Factors"

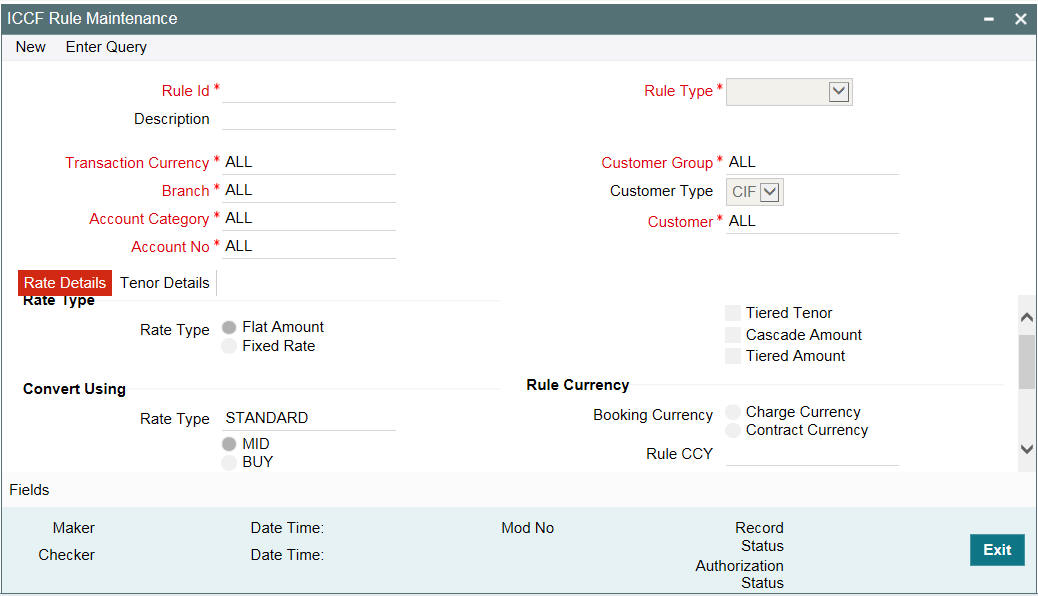

An Interest Rule is defined in the ‘ICCF Rule Maintenance’ screen. You can invoke the ‘ICCF Rule Maintenance’ screen by typing ‘LFDRUMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

As you are defining an interest type of component, (that is, a tenor based component), you need to specify only the following details through the ‘ICCF Rule Maintenance’ screen:

- Rule Type

- Rule ID

- Rule Description

- Rule Currency and Customer combinations

- Rate Type

- Tenor Basis

All the other details of the component are to be specified through the ‘Interest Class Maintenance’ sub -screen of the ‘Loans and Commitment Product Definition’ screen.

2.3.1 Specifying Rule Type

The Rule Type identifies the type of ICCF component you are defining. In this case it is Interest. The attributes applicable for a component depends on its Rule Type.

For example, you can define any component that is tenor based − an annual fee, for example - as a component of Rule Type Interest. If INTEREST1 is your main interest, your annual fee can be defined as INTEREST2, as it is tenor based. Only on an Interest type of component, you can have the floating rates.

2.3.2 Specifying Rate Type

The Rate Type indicates whether the rate to be applied for the Rule ID is a flat amount or a percentage of the contract amount. The specific rates and amounts applicable have to be specified in subsequently through this screen. These rates or amounts can be changed during contract processing.

2.3.3 Defining ICCF Rule Application Factors

You can apply an Interest Rule in the following manner:

- The rule can be applied on any contract, irrespective of the currency of the contract and the customer involved

- The rule can be applied on contracts in a particular currency only, irrespective of the customer involved

- The rule can be applied on contracts in a particular currency, involving a particular customer only

Thus, the most general interest application condition can be that an Interest Rule, which is applicable to contracts in any currency, and involving any customer.

An interim condition is when the Rule is applied on contracts in a specific currency, involving any customer. A Rule that is applied on contracts in a specific currency and involving a specific customer is a specific condition.

Once an Interest Rule has been defined, you can link it to a product. This linkage has to be achieved while defining the product. Thus, the definition of a product should ideally be preceded by the definition of all Interest Rules applicable to the product. If not, the product definition has to be put on hold, the Interest Rules defined, and then the product linked to the Interest Rules.

2.4 Defining Interest Details

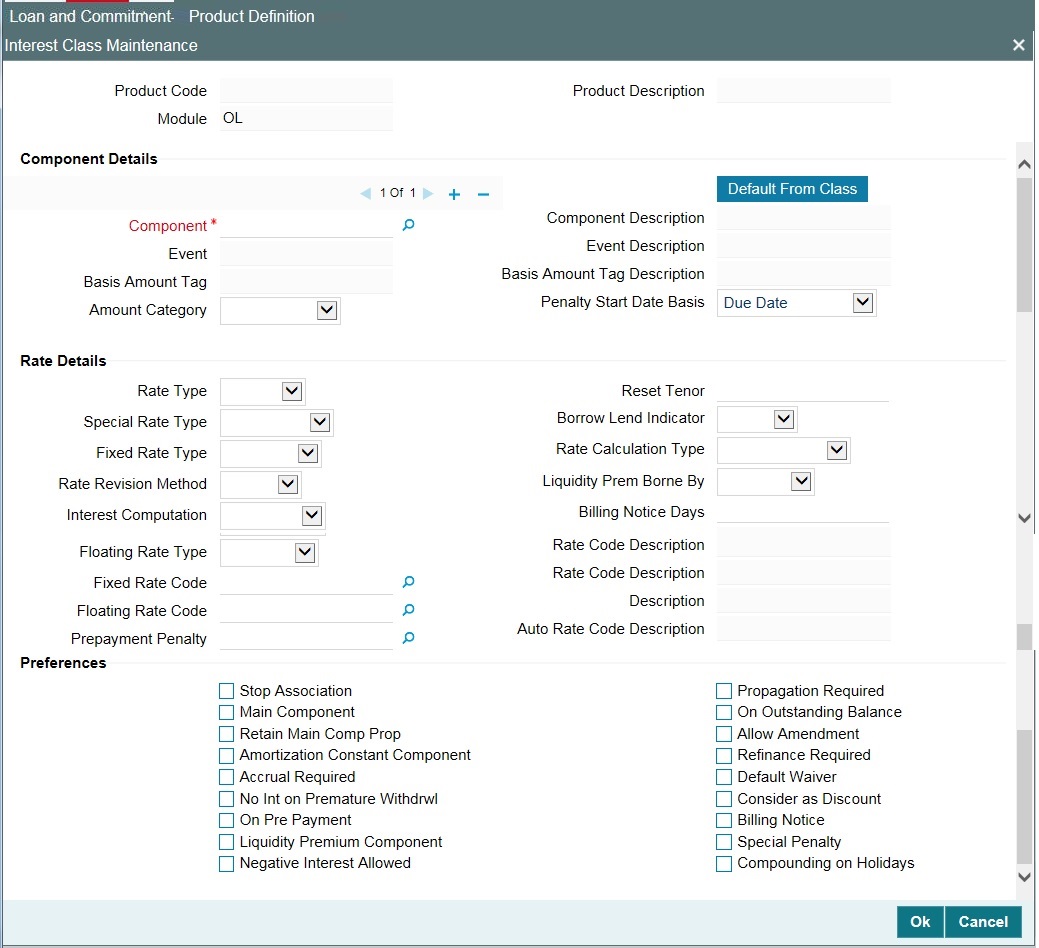

You can specify the interest components applicable to a product in the Interest Class Maintenance’ sub -screen of the ‘Loans and Commitment Product Definition’ screen.

From the Loans and Commitment Product Definition screen (OLDPRMNT), click ‘Interest’ to access ‘Interest Class Maintenance’ sub-screen.

You should necessarily use an interest class that you have created, to indicate the interest components applicable to the product. An interest class is a specific type of interest component that you can build with certain attributes.

Associating an interest class with a product

- Select the appropriate Interest class from the list of classes, defined specifically for the Loans module of Oracle Lending.

- To associate an interest class with a loan product, click ‘Default From Class’ in the ‘Interest Class Maintenance’ sub-screen.

The attributes defined for the interest class defaults to the product. You have the option to modify the attributes defined for the class, to suit the requirement of the product you are creating.

Associating several interest classes with a product

You can associate several interest classes with a product.

- To add to the list of classes associated with the product, click ‘Add row’ button.

- Click ‘Default From Class’ and select a class from the option list that is displayed.

To navigate between the classes associated with a product, you can use the arrow icons that are provided.

To disassociate a class from the product, navigate to the class using the arrow icons described above and click ‘Delete row’ button.

For an interest class, you can define the following:

Dissociating an Interest class from a product

The interest classes defined for a product is automatically applied to all contracts involving the product. If, for some reason, you want to stop applying a particular interest class to new contracts that are initiated (involving the product), you can do so by selecting the ‘Stop Association’ check box.

In effect, stopping the application of an interest class component for a product would be equivalent to deleting the class from the product. By specifying that the application of a class should be stopped, you have the advantage of using the definition made for the class again. To do this, you have to deselect ‘Stop Association’ check box t. Contracts that are subsequently initiated picks up the class.

Specifying the main interest component

You can define any number of interest classes for a product. If you have defined more than one interest class, you can specify one of them as the main interest component. This interest component that is used for capitalization or amortization purposes if the repayment schedules are defined.

The details of this Main Component is shown in the Loans and Commitment - Contract Input’ screen (OLDTRONL) and you can change them there without having to invoke the ‘ICCF Details’ sub-screen. Components other than the main component have to be processed through the ‘ICCF Details’ screen.

Specifying to retain main component properties

You can specify to retain the properties of main component for a particular component. The details of main component including gets applied to the selected component. And any changes made to the attributes of main component are reflected to this particular component also. When you select this option, you cannot enter the interest definition details either at product or contract level other than selecting this component for discount.

You have to define an interest class first with the ‘Amount Category’ as ‘Expected’ and the same component can be linked at the product with ‘Retain Main Comp Prop’ selected. As per this component, interest is computed on Expected Balance which is later be used for IRR computation.

Note

Rate revision schedule definition can not be done for such components.

Specifying the event for association

Specify the association event in ‘Event’ field. The event, at which you would like to associate an interest component to a contract, is referred to as the association event.

At this event, no accounting entry (for the interest component) is passed.

Specifying the basis amount tag

The basis on which interest is calculated is referred to as the basis amount. In ‘Basis Amount Tag’ field, you have to specify the ‘tag’ associated with the basis amount. Interest is calculated on the amount represented by this tag.

Specifying the amount category

Indicate the category of the component on which the interest has to be applied. The available options are:

- Expected

- Overdue

- Outstanding

- Overdue OS

- Sch-Overdue

If the Basis Amount Category is Normal, the balance on which interest has to be applied is the Expected Balance (assuming that all the scheduled repayments, defined for the contract, are made on time). An example of this category is the application of interest on the principal of a loan.

If the Basis Amount Category is Overdue, the balance on which interest has to be applied is the amount that is outstanding, based on the repayment schedule defined for the contract. An example of this category is the application of penalty interest, on the principal or interest, when a repayment has not been made as per the schedule.

Select the applicable category using the drop-down list. The system defaults to Normal.

An example of this category is the application of interest on the principal of a loan.

Example

Let us consider a loan of USD 1000, the contract spanning 10 months. The number of schedules by which the principal has to be paid back is 10 installments, each schedule amounting to USD 100.

The details are as follows:

Contract start date |

1 March 1997 |

Contract end date |

31 December 1997 |

Schedule dates |

End of every month |

Schedule frequency |

Monthly |

Schedule amount |

USD 100 plus interest applicable |

The schedule details are given below:

Date |

Principal Schedule Amount |

Expected Balance |

31 March 1997 |

100 |

900 |

30 April 1997 |

100 |

800 |

31 May 1997 |

100 |

700 |

30 June 1997 |

100 |

600 |

31 July 1997 |

100 |

500 |

31 August 1997 |

100 |

400 |

30 September 1997 |

100 |

300 |

31 October 1997 |

100 |

200 |

30 November 1997 |

100 |

100 |

31 December 1997 |

100 |

None |

When you specify the Basis Category as Expected, the interest is applied on the Expected Balance.

Specifying whether Interest is to be accrued

For a product, you should specify whether accruals have to be carried out for the accruable components. If yes, the frequency of accruals (daily, monthly, quarterly, half-yearly or annually) should be specified for each product (through the ‘Loans and Commitment Product Definition Preferences’ screen).

The accruals are carried out at the specified frequency by the Automatic Contract Update function. In addition, accruals are done whenever an event (like a rate change with a Value Date, a payment, and so on.) is triggered as of a date beyond the date on which the last accruals were carried out.

Specifying the penalty start day

Oracle Lending calculates the penalty in case the loan payment is not made on the schedule date. However, if the payment date falls on a holiday, the penalty can be calculated depending on the start date that you specify in this screen:.

If you have specified that penalty start date basis as the due date, the penalty is calculated from the due date of payment even if it falls on a holiday.

If you have specified that the penalty start basis be next working day, the penalty is calculated from the working day following the holiday. Thus, the system l waives the penalty for the holiday (s).

The ‘Penalty Start Date Basis’ specifications you maintain for the Interest Class is defaulted here and the system does not allow you to change these options.

Example

Assume a loan principal payment schedule falls on 11th October 2003, which is maintained as a holiday in Oracle Lending. In addition, there is a deficit of funds in the customer’s account for making the payment.

If you have selected the due date option, Oracle Lending calculates the penalty from 11th October 2003.

If you have selected the next working day option, the system calculates the penalty from 13th October 2003 and waives the penalty for 11th and 12th October.

Interest Rate Details

Rate Type - The Rate Type indicates whether the interest is a Fixed Rate, a Floating Rate or a Special amount. When creating a product, you should specify the Rate Type based on which interest is computed.

Floating Rate Code - If the Interest Rate Type has been specified as Floating, indicate the Rate Code to which the product has to be linked. The Rate Code corresponds to the rates, defined in the Floating Rates table, that have to be applied for the product. A Rate Code identifies a set of rates defined for a combination of Currency, Amount (if it is necessary) and an Effective Date.

Select the Rate Code applicable for the product you are defining from the option-list provided. The Rate Code can be changed during contract processing.

Floating Rate Type - In addition, you should specify the method in which the rates in the Floating Rates table have to be applied on the loan. It could either be automatic application (meaning the rate has to be applied every time it changes), or periodic application (meaning the rate has to be applied at a regular frequency, defined for each contract involving the product).

Borrow Lend Ind - For floating rate interest, you should also indicate if the interest rate for a given rate code to be applied, from the Floating Rates table, is the Borrow rate, Lend rate or Mid rate.

Reset Tenor - If interest rates are defined for the tenor of a contract, you should specify the Reset tenor. This will indicate the tenor for which the floating rate (when applied automatically) needs to be picked up from the Floating Rates Table, for contracts using this product.

Rate Calc Type - Interest rates based on the tenor of a contract could be applied in any of the following ways:

- Rate Cycle ‘Down’ -. Indicates that the rate of the lower tenor slab should be used

- Rate Cycle ‘Up’ - Indicates that the rate of the upper tenor slab should be used

- Rate Cycle ‘Interpolate’ - Indicates that the rate should be interpolated between the rates of the upper and the lower slabs

- Rate Cycle ‘Round-off’ - Indicates that the tenor of the component should be rounded off to the nearest whole number. The rate defined for the derived tenor will be applied to the component.

Example

The Floating Rates table has the following tenor-based interest rate definitions:

Tenor |

Interest Rate |

5 |

12% |

15 |

16% |

The tenor of the contract to be processed is 9 days. This falls between the 5 day and 15 day slabs for which interest rates are defined in the table.

Depending on the Rate Cycle Type specified, the interest rate for 9 days are applied as follows:

- Up: The interest rate for 15 days is applied, that is 16%

- Down: The interest rate for 5 days is applied, that is 12%

- Interpolated: The interest rate is interpolated from the available rates for 5 days and 15 days on a straight-line basis. The interest rate for 9 days will be 13.6%.

- Round Off: The tenor of the contract is rounded off to the nearest tenor value for which a rate is maintained. In this case, a rate of 12% is applied since the nearest tenor value for which a rate is maintained is 5 days. If the tenor of the contract were 12 days, the interest rate applied would be 16%

You can specify the various floating rate parameters explained above for a fixed rate type of interest. The appropriate floating rate is then applied at the beginning of the contract, however, this rate is subsequently remain fixed during the contract.

Fixed Rate Type - If the rate type is ‘Fixed’, you have to indicate whether the rate would be entered by the user or needs to be picked up from the rate maintenance table. The following options are available:

- User Input (U) – This option may be used if you want the user to specify the rate of interest applicable on the contract.

- Standard (S) – If you opt for this option, the system pick-ups the rate from the Standard Rate Maintenance screen. This rate is a combination of the Standard Rate, Amount-Slab-Wise Spread and Tenor-wise Spread. However, you can change this rate at the contract level.

- Agency - If the loan product is of ‘Agency Contract’ type (specified in the ‘Loans and Commitment – Product Preferences’ screen), select the rate type as ‘Agency’. The system allows you to associate only those interest components with the loan product for which ‘Rate Type’ is ‘Fixed’ and ‘Fixed Rate Type’ is ‘Agency’.

For more details, refer the section titled ‘Identifying products for agency contract creation’ in the ‘Defining the Attributes specific to a Loan product’ chapter of the Bilateral Loans User Manual.

Interest Computation - You have to specify the method to be used for computation of interest. The available options are:

- Simple - indicates that the interest would be computed using the Simple Interest formula

- Compound - indicates that the interest would be compounded

Compounding on holidays - You can opt to compound interest on holidays. Select the ‘Compounding on Holidays’ option to indicate the same.

The ‘Interest Computation’ and ‘Compounding on Holidays’ options are available only for Loan and Commitments products. These options can be specified only for a product. You cannot change them at the contract level.

The example given below explains the method used for compounded interest calculation:

Assume that you have a Normal-Bearing contract with the following details:

- Value Date - 2nd April ‘02

- Maturity Date - 10th April 02

- Principal Amount - 10, 000, 000.00

- Rate of Interest - 10 % (Main Interest Component)

- Holiday - 6th April 02

Further, the contract has Interest and Principal payment as bullet schedules.

Case 1:

Now, if you opt for ‘Interest Computation’ method as ‘Compound’ and compound interest on holidays, the computation of compounding Interest would be done as shown below:

Schedule Date |

Start Date |

End Date |

Basis Amount |

Compound Interest |

Rate |

Calculated Amount |

No of Days |

Daily Ave. Amount |

04-02-02 |

04-01-02 |

04-02-02 |

10,000,000 |

0.00 |

10.00 |

2,739.73 |

1 |

2,739.73 |

04-03-02 |

04-02-02 |

04-03-02 |

10,000,000 |

2,739.73 |

10.00 |

2,740.48 |

1 |

2,739.73 |

04-04-02 |

04-03-02 |

04-04-02 |

10,000,000 |

5,480.21 |

10.00 |

2,741.23 |

1 |

2,739.73 |

04-05-02 |

04-04-02 |

04-05-02 |

10,000,000 |

8,221.44 |

10.00 |

2,741.98 |

1 |

2,739.73 |

04-07-02 |

04-05-02 |

04-06-02 |

10,000,000 |

10,963.42 |

10.00 |

2,742.73 |

1 |

2,739.73 |

04-07-02 |

04-06-02 |

04-07-02 |

10,000,000 |

13,706.15 |

10.00 |

2,743.48 |

1 |

2,739.73 |

04-08-02 |

04-07-02 |

04-08-02 |

10,000,000 |

16,449.63 |

10.00 |

2,744.23 |

1 |

2,739.73 |

04-09-02 |

04-08-02 |

04-09-02 |

10,000,000 |

19,193.86 |

10.00 |

2,744.98 |

1 |

2,739.73 |

04-10-02 |

04-09-02 |

04-10-02 |

10,000,000 |

21,938.84 |

10.00 |

2,745.74 |

1 |

2,739.73 |

Case 2:

If you select the ‘Interest Computation’ method as ‘Compound’ but do not opt for compounding interest on holidays, the computation of compounding Interest would be as shown below:

Schedule Date |

Start Date |

End Date |

Basis Amount |

Compound Interest |

Rate |

Calculated Amount |

No of Days |

Daily Ave. Amount |

04-02-02 |

04-01-02 |

04-02-02 |

10,000,000 |

0.00 |

10.00 |

2,739.73 |

1 |

2,739.73 |

04-03-02 |

04-02-02 |

04-03-02 |

10,000,000 |

2,739.73 |

10.00 |

2,740.48 |

1 |

2,739.73 |

04-04-02 |

04-03-02 |

04-04-02 |

10,000,000 |

5,480.21 |

10.00 |

2,741.23 |

1 |

2,739.73 |

04-05-02 |

04-04-02 |

04-05-02 |

10,000,000 |

8,221.44 |

10.00 |

2,741.98 |

1 |

2,739.73 |

04-07-02 |

04-05-02 |

04-07-02 |

10,000,000 |

8,221.44 |

10.00 |

5,483.96 |

2 |

2,739.73 |

04-08-02 |

04-07-02 |

04-08-02 |

10,000,000 |

13,705.40 |

10.00 |

2,743.48 |

1 |

2,739.73 |

04-09-02 |

04-08-02 |

04-09-02 |

10,000,000 |

16,448.88 |

10.00 |

2,744.23 |

1 |

2,739.73 |

04-10-02 |

04-09-02 |

04-10-02 |

10,000,000 |

19,193.11 |

10.00 |

2,744.98 |

1 |

2,739.73 |

Fixed Rate Code - You would have maintained several Standard rate codes in the ‘Standard rate code maintenance’ screen. Subsequently, you would have also maintained the rates for each of these codes in the ‘Standard Rate Maintenance’ screen.

If you select the Fixed Rate Type as ‘Standard’, you have to select the appropriate rate code from the option-list provided. The Standard rates maintained for the selected rate code will be applicable on all contracts processed under the product being maintained.

Prepayment Penalty Rate Code - Likewise, select the rate code based on which the system will pick-up the prepayment penalty rate for all contracts under the product.

Specifying the prepayment details

Waiving interest on premature withdrawal - You can opt to waive Interest on premature withdrawal of the loan. Select the ‘No interest on premature withdrawal’ option to indicate that interest needs to be waived if premature withdrawal (partial of full) is done for the loan.

Reapplying Interest rate on prepayment – If the ‘Fixed’ rate type is ‘Standard’, you can opt to reapply interest when a prepayment is made.

You can reapply interest on one of the following:

- On Prepaid Amount – Select this option to indicate that interest on the prepaid amount would be recalculated during prepayment based on the rate applicable for the current tenor of the loan.

- On Outstanding Balance – This option will indicate that interest will be recalculated on the outstanding balance during prepayment based on the rate applicable for the current tenor of the loan.

Specifying the Rule ID

You can link a rule to a product. In the Product ICCF Details screen, in the Rule ID field, pick the rule you want to link to the product. For an interest type of rule, all the interest-related details have to be specified in the Product ICCF Details screen.

Specifying the Settlement Currency

The Settlement Currency is the currency in which the interest amount will be calculated. The interest amount applicable for a contract will be calculated in this currency. The appropriate conversion rate (defined for the product as the applicable Rate Type) will be applied to carry out a conversion if the repayment account is in a different currency.

Specifying whether Interest Details can be amended

A change to a contract (after it has been authorized) that involves a change in its financial details constitutes an Amendment on the contract. You can indicate whether such an Amendment, called a Value Dated Change, should be allowed for the interest component being defined.

You can amend the following through this function:

- Interest rate

- Rate code

- Spread

- Interest amount

- Acquired interest - If the contract was already initiated when it was input, the interest amount that has been accrued should be entered here. The amount is taken into account during the next liquidation cycle. You can make changes to the acquired interest through this screen.

- Waiver - The attributes of an interest component that have been defined for a product is applied on a contract involving the product. If, for some reason you do not want to apply the interest component for the contract you are processing, you can do so by checking this field. The interest is calculated but it is not applied on the contract.

To amend a contract, you have to invoke the contract, ICCF Details’ screen of the ICCF module through the Value Dated Changes function.

Specifying whether refinancing is required

While creating a loan product, you have the option of indicating whether the accruals/liquidations involving a particular component should be tracked for refinancing. Select the check box positioned next to this field to indicate that Refinancing is required

Specifying the original component

If you enable the ‘Refinancing Required’ option, you have to identify the original component for the refinance component.

Enabling the Consider as Discount option

While defining an interest component for either the loans or the bills module, you can indicate whether the interest component is to be considered for discount accrual on a constant yield basis.

The consider as discount option is available for

- Export Bill products, for the Discount operation

- Discounted or True Discounted loans

The value of this field is defaulted from the ‘Interest Class Maintenance’ screen. However you can change it over here.

For Bearing contracts, if the option ‘Consider as Discount’ is checked then the option ‘Accrual Required’ also has to be checked. If the option ‘Accrual Required’ is not checked, the option ‘Consider as Discount’ is disabled.

For Discounted contracts, you can select either one of the options or both together. If the options ‘Accrual Required’ and ‘Consider as Discount’ are selected then discounted interest is considered for IRR calculation. If the option ‘Accrual Required’ is not selected and ‘Consider as Discount’ is selected, then discounted interest is considered a part of the total discount to be accrued.

If neither option is selected, the interest is directly recognized as income during interest liquidation.

Note

This option is not available if the amount category is Penalty.

Enabling Negative Interest Allowed option

Negative Interest Allowed is added at interest class level which is applicable for main interest classes of OL module. Following are the important functionalities of the ‘Negative Interest Allowed’ option.

- A negative interest class is internally generated on saving of negative interest allowed interest classes.

- Negative interest component is linked to OL product, if negative interest is applicable for main interest component.

- Negative interest component tracks accrual and liquidation of negative interest rate

- Processing changes are done at contract level to support life cycle events with negative interest.

- Float rate codes with negative interest rate can be attached to these modules.

Note

- The ‘Negative Class Code’ gets updated on save with the name of Negative Class Code auto generated.

- If any interest class already exists with same class code as the negative class code being auto generated, an error appears on saving the main interest class code itself. You can input name in ‘Negative Class Code ‘field manually and save the record.

The ’Net Negative Interest ‘ check box is available in the ‘Product Preferences’ screen.

If this check box is selected, then during interest liquidation, the system will internally net the positive and the negative amounts being paid to the customer.

This check box is only for products with negative interest allowed is selected for main component.

2.5 Capturing Composite Rate for Loans

You can link composite rate codes to loans. Based on the formula maintained at the composite rate maintenance, system derives at a composite rate for floating rate.

To link composite rate code with an Oracle Lending (OL) product, you need to select composite rate code from the ‘Float Rate Input’ screen (CFDFLTRI).

To link composite rate code with OL contract, select composite rate code from the list of options available for ‘Floating Rate Code’ in the Loans and Commitment - Contract Input’ screen (OLDTRONL). During reprice, composite rate code can be linked to a contract by selecting ‘Rate Code’ available in ‘Consolidate Details ‘reprice screen (OLDREPRC).

Any rate change in Head Office for the index rate codes triggers a re-pickup of the rate for composite rates also and propagate the same to other branches for composite rate code. Branch wise changes to the index rate codes are not considered for re-pickup of composite rate code.

Note

At any point there can be either a composite rate code or a floating rate code, both cannot co-exist in a single contract. Composite rates are supported for Floating Periodic Auto and Floating Automatic type of loans. Composite rate code definition does not have any impact on the rate revision of a contract.

If there is any change in the index codes for a Composite rate code, the underlying Floating Automatic type of contracts are impacted and the new rate is arrived based on the derivation logic on that day’s EOD. In case of Floating Periodic Auto type of loans, the rate is derived on the EOD of the revision schedule. There is no impact of back value rate change of the index codes on the underlying Floating Periodic (Auto) type of Contracts.

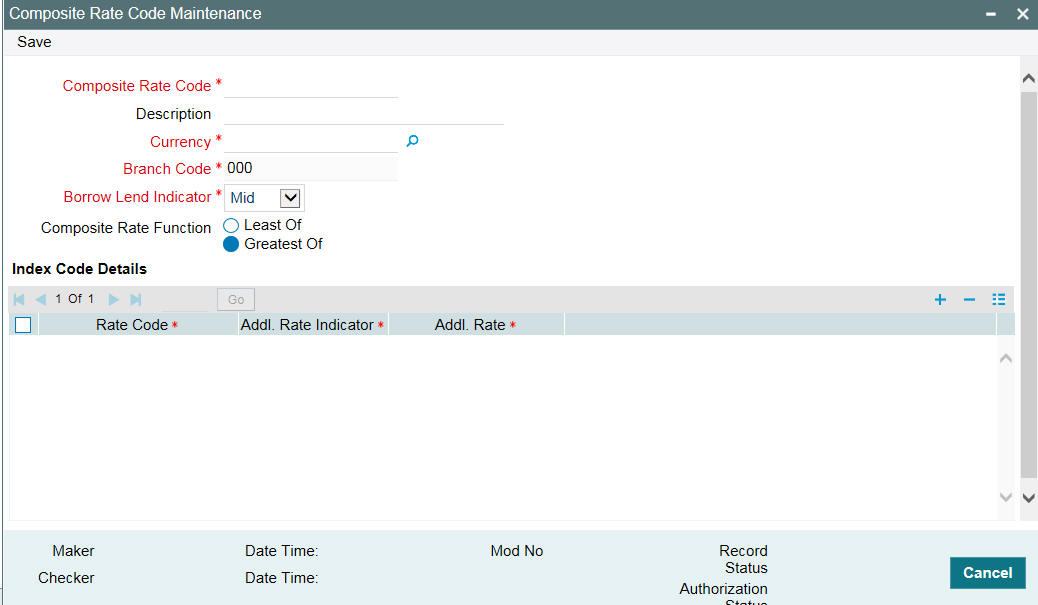

2.5.1 Maintaining Composite Rate Codes

You can maintain the composite rate code from the head office using ‘Composite Rate Code Maintenance’ screen.

You can access this screen by typing ‘OLDCMPMT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Specify the following details here:

Composite Rate Code

Specify the code you wish to maintain for the composite rate.

Description

Specify a small description for the composite rate code.

Currency

Select the currency for which the composite rate code is maintained.

Branch Code

Select the branch for which the composite rate code is maintained.

Rate Function

Select if the composite rate should be the least or greatest of the rates maintained plus the additional rate for the rate codes.

Following index code details are populated here:

- Rate Code

- Addl Rate Indicator

- Addl Rate

You can perform following operations in the ‘Composite Rate Code Maintenance’ screen:

- New

- Unlock

- Save

- Authorize

- Delete

2.5.2 Specifying limits for Interest Rate Application

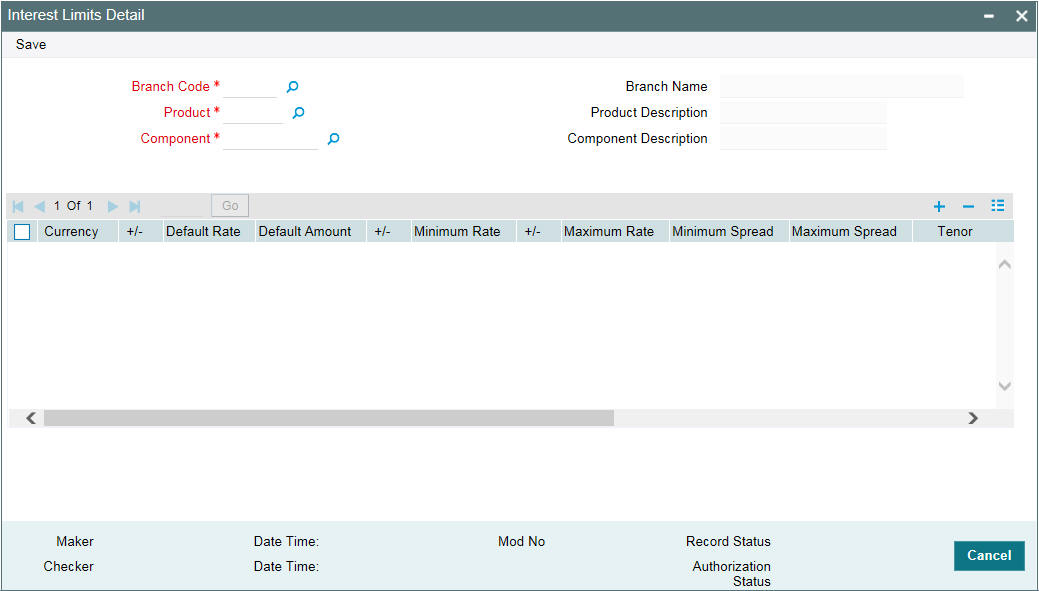

You can maintain tenor based, currency-wise interest limits for a combination of Product and Interest Component through the ‘Interest Limits Detail’ screen. You can access this screen by typing OLDINTLM in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

When an interest class for which currency-wise interest limits have been maintained is associated with a Loans product (in the Interest Class Maintenance’ screen), the product inherits the limits, by default. Such default limits can be modified if required, when the interest limits for the product and branch combination are maintained, in the ‘Interest Limits Detail’ screen.This maintenance would be applicable for all contracts for which:

- The interest component for which the limits have been maintained

- The product used is the product for which the limits have been maintained

- The contract branch is the branch for which the interest limits have been maintained

- The contract currency is one of the currencies for which interest limits have been maintained, for the interest component, product, and branch combination.

You can maintain the following information to set up the tenor-based, currency-wise interest limits for a product, interest component, and branch combination:

Capturing the Default Amount or Default Rate for Late Payment Charge

For components defined with Rate Type ‘SPECIAL’ in ‘Interest Class Maintenance’ screen, you can specify a default flat amount or a default rate at the interest limit level which is defaulted to the ‘Interest Limits Details’ screen.

Based on the value of ‘Special Rate Type’, you can either maintain the ‘Default Rate’ or ‘Default Amount’ for late payment charge applicable to the loan product.

If the value of ‘Rate Type’ is ‘SPECIAL’ and ‘Special Rate Type’ is ‘FIXED’ in the ‘Interest Class Maintenance’ screen, then you can specify the default fixed rate to be applied as late payment charge to all loans created under this loan product.

You can specify the default late payment charge (either fixed rate or flat) by selecting the loan product code and the late payment charge component. This component should already be linked to the loan product through the ‘Interest Class Maintenance’ screen.

For Fixed Rate products

- The standard rate that is applicable for contracts involving the product

- The Minimum and Maximum interest rate that can be applied on a contract

If the interest rate specified for a contract is less than this minimum rate, the minimum rate is applied on the contract. Similarly, if the interest rate specified for a contract is greater than this maximum rate, this rate is applied on the contract.

By defining minimum and maximum rates for a fixed interest, you can ensure that your rates stay within the stipulated limits.

For penal interest components, you can specify the overdue tenor for which the penalty interest should be applied.

For Rate Products

For Floating Rate products, specify the Minimum and Maximum spread that can be applied on the floating rate.

If the spread specified during contract processing is less than the value specified as the minimum spread, this value will be picked up as the spread. Similarly, if the spread specified during contract processing is more than the value specified as maximum spread, this value is picked up as the spread.

By defining minimum and maximum spread for floating interest, you can ensure that your spread stays within the stipulated limits.

The rate maintained for the maximum tenor is used if the Overdue days extend beyond the maximum tenor maintained.

The interest for each currency is calculated using the interest basis, which you select:

- 30 Euro / 360

- 30 US / 360

- Actual / 360

- 30 Euro / 365

- 30 US / 365

- Actual / 365

- 30 Euro / Actual

- 30 US / Actual

- Actual / Actual

Each of these interest bases has been explained in detail in the Currency Maintenance chapter of the Core Services manual.

Specifying the interest period basis

You can indicate how the system must consider the tenor basis upon which interest is computed over a schedule or interest period, in respect of the interest component for which the limits are being maintained, which is associated with the selected product. Currency-wise interest period bases may be maintained. This specification is inherited from the interest component class being chosen.

You can choose any of the following options:

- Including the From Date

- Including the To Date

- Including both From and To Dates

- Excluding both From and To Dates

For details about the four options, refer the section Specifying the Interest Basis under the head Building Interest Classes, in this user manual.

2.6 Specifying Interest Details for a Contract

When the details of a contract are captured, the interest details defined for the product involved are automatically be applied on the contract. However, you can change certain attributes.

At the time of processing the contract, you can change the following attributes:

- The rate for contracts with a fixed rate

- The rate code for contracts with floating/fixed rate. The spread defined for a rate code can also be changed

- Consider as Discount and Accrual Required options

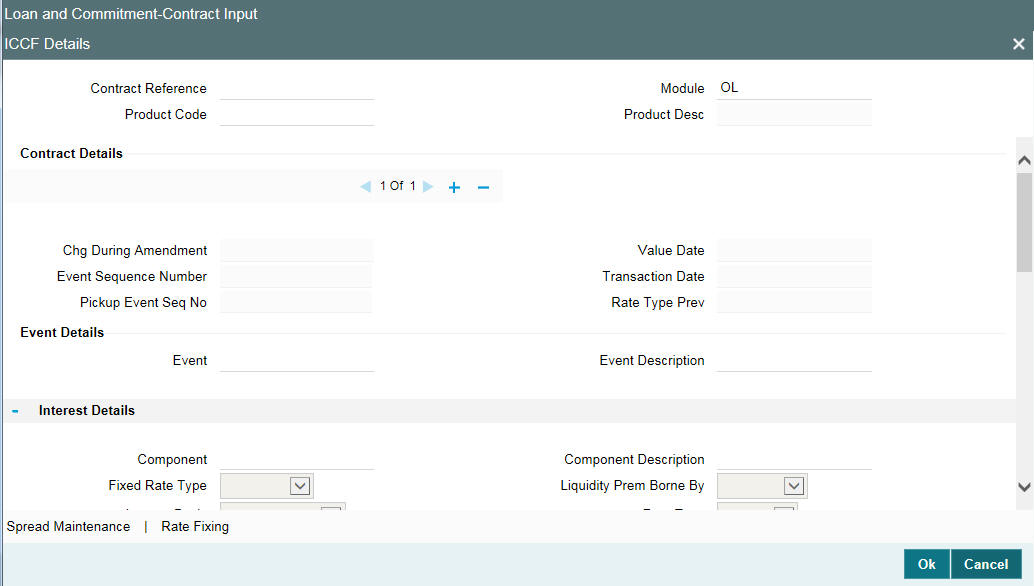

From the ’Loan and Commitment- Contract Input’ screen, click ‘ICCF’ to access the contract ‘ICCF Details’ screen.

It is possible to define more than one interest component. You can have several interest components, which you link to a product. The contract involving the product, in turn, will be linked to these interest rules.

Example

There can be one interest rule for the main interest (for example, 14%). You can have a tenor-based commission defined as an interest rule for the same product (for example, 3%). Both these are applicable to the contract.

In the contract ‘ICCF Details’ screen use the set of two buttons to go to the next or previous that has been linked.

Specifying the Fixed Rate Type

For a ‘Fixed’ rate type, this indicates whether the rate would be user specified or will be picked up from the rate maintenance table. The options are:

- User Input (U) – This option indicates that the user will specify the rate of interest applicable on the contract

- Standard (S) – This option indicates that the system picks-up the rate from the Standard Rate Maintenance screen. This rate will be a combination of the Standard Rate and Tenor-wise Spread

This specification is defaulted from the loan product involved in the contract and you cannot change it at the contract level.

Special Rate Type

System defaults the maintenance done for ‘Special Rate Type’ in the ‘Interest Limits Maintenance’ screen. However, you can edit this value and select the special rate type from the adjoining drop-down list. This list displays the following values:

- Fixed Rate

- Flat Amount

Specifying the Fixed Rate Code

If the Fixed Rate Type is ‘Standard’, this indicates the Standard Rate Code based on which the system pick ups the rate applicable on the contract.

This specification is defaulted from the product. However, you are allowed to change it at the time of contract processing.

Specifying the Penalty Rate Code

If pre-payment penalty is allowed for the loan product, select the rate code based on which the system pick-ups the prepayment penalty rate for the contract.

This specification is also be defaulted from the product. However, you are allowed to select a different rate code at the contract level.

Choosing Revision Method

Select the revision method option for the periodic floating type of loans from the list of option provided:

- Auto

- Manual

Enabling the Consider as Discount option

While defining an interest class for either the loans or the bills module, you can indicate whether the interest component is to be considered for discount accrual on a constant yield basis.

The value for this field is defaulted from the Interest Definition and it can be changed here.

If ‘Accrual Required’ option is not selected then ‘Consider as Discount’ option is disabled for Bearing Contracts.

If you select this option the interest received against the component is used in the computation of the constant yield and subsequently amortized over the tenor of the associated contract.

Note

You are allowed to enable the Consider as Discount option for loans only when the payment method specified is Discounted or True Discounted and for the Discount operation for Export bills.

For bearing type of contracts, all future interest cash flows are considered for computation of constant yield. For discount type of contracts, only the interest amount received for the components with the ‘Consider as Discount’ option enabled are considered for the computation of constant yield; subsequently the interest amount received in advance for these components is amortized over the tenor of the associated contract.

Specifying whether the Interest Component is to be accrued

While defining an interest class for either the loans or the bills module, you can indicate whether the interest component is required to be accrued.

The value for this field is also defaulted from the ‘Interest Class Maintenance’ screen. However, you can change it here.

Note

If both ‘Consider as Discount’ and ‘Accrual Required’ fields have not been enabled for the product, you cannot enable these for contracts.

If the ‘Special Penalty Component’ check box is selected for a component, then system deselects the ‘Accrual Required’ box for such components and disable it.

Special Penalty Comp

System automatically checks this box for late payment charge components (based on the maintenance done in ‘Interest Class Maintenance’ screen) and you cannot modify it.

Specifying the interest period basis

You can indicate how the system must consider the tenor basis upon which interest is computed over a schedule or interest period, in respect of interest components applicable for the contract. This preference is inherited from the Interest Limits definition for the product used by the contract, and you can change the default option chosen.

You can choose any of the following options:

- Including the From Date

- Including the To Date

- Including both From and To Dates

- Excluding both From and To Dates

For details about the four options, refer the section ‘Specifying the Interest Basis’ under the head ‘Building Interest Classes’, in this User Manual.

Waiving an Interest Rule

You have the option of waiving those rules (defined for the product), which you do not wish to apply on a contract.

Example

For a product, there can be one interest rule for the main interest (for example, 14%). You can have a tenor-based commission defined as an interest rule for the same product (for example, 3%). Both these will apply to contracts involving the product. However, you can waive these rules for a specific contract. For instance, you can waive the 3% commission on the contract (by checking the Waive field.)

Interest Amount

System defaults the value maintained for ‘Default Amount’ in the ‘Interest Class Maintenance’ screen for a late payment component which has ‘Rate Type’ as ‘SPECIAL’ and ‘Special Rate Type’ as ‘Flat Amount’. However, you can edit this value during contract input.

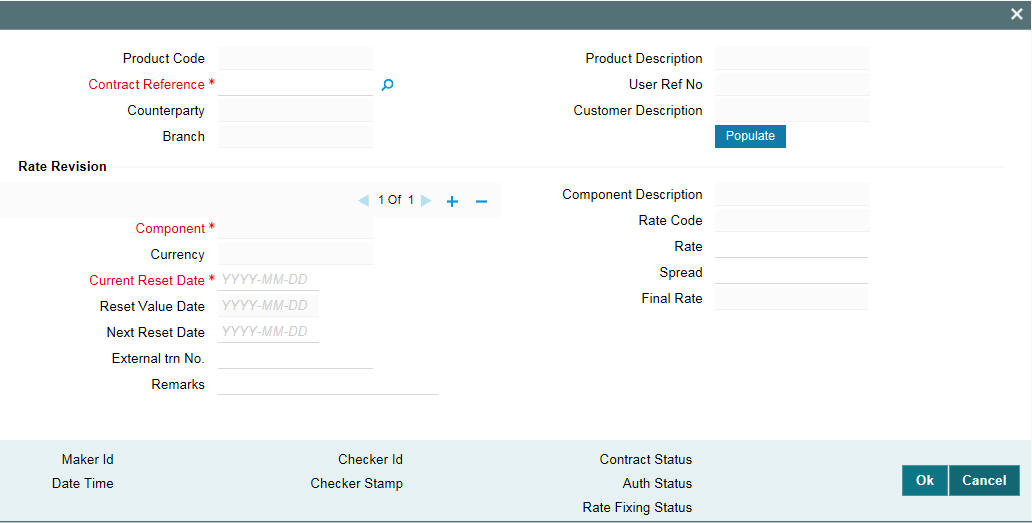

2.6.1 Capturing Rate Fixing

You can fix the rate of interest for floating periodic manual type of loans while contract booking. Click ‘Rate Fixing’ button in the ‘ICCF Details’ screen, the ‘Manual Rate Revision’ screen gets displayed.

You can specify the periodic rate manually here.

The following details in the screen are displayed from the parent screen:

- Product Code

- Contract Ref No

- User Ref No

- Customer

- Component

- Currency

- Rate Code

- Current Reset Date

Reset Value Date

Specify the effective date from which the rate should be applicable for the contract.

Next Reset Date

Specify the end date of rate effective end date. The last effective date of the rate entered here.

Rate

The interest rate applicable for Main Interest Component is defaulted from previous period. However you can edit it.

Spread

The spread rate applicable for the Main Interest Component (User Input) is from the previous period. However you can edit it.

Final Rate, the net rate applicable for the Contract (Rate + Spread) gets displayed here.

Note

Current Reset Date is populated as Value date of the contract for both current dated and back valued contracts.

You can perform following operations in the ‘Manual Rate Revision’ screen:

- NEW

- UNLOCK

- SAVE

- AUTHORISE

2.6.2 Amending Interest Components

Once a contract is authorized, any change in details that would affect the financial information of the contract has to be made through the Value Dates Changes function.

If a Value Dated Change demands a change in interest, you can change the following in the ICCF screen (invoked through the Value Date Changes screen):

- Interest basis

- Rate

- Rate Code

- Acquired Interest

- Rate Code

- Spread

- Amount of charge or fee

2.6.3 Defining Interest Repayment Schedules

You can define interest payment schedules for the product. These are applicable to all contracts involving the product. But at the time of processing a contract you can change the schedules to suit its requirements.

In defining interest payment schedules, both for the product and the contract, the following steps are involved:

- First define schedule preferences or attributes

- Then define the actual schedules

2.6.4 Defining interest Payment Schedules for the Product

You have to specify the following attributes or preferences through the Product Preferences screen:

- Mode of liquidation - auto or manual. This can be changed at the time of contract processing

- Liquidation of back valued schedules upon initiation of a contract. This can be changed at the time of contract processing

- Re-computation of interest on the future schedules of a contract when a repayment of principal is made before it is due

- The schedule type - amortized, capitalized or normal

Once these attributes of the schedules are defined in the ‘Product Preferences’ screen, the frequency of repayments has to be defined through the ‘Product Default Schedules’ screen.

If you do not define any schedules for the product, by default, the contracts involving the product l have bullet (or balloon) schedules. That is, all the components are liquidated at maturity.

2.6.5 Defining Interest Payment Schedules for the Contract

Schedule preferences are the attributes of the repayment schedules defined for the contract. Through a set of fields in the ‘Loan and Commitment -Contract Input Preferences’ screen, you can specify:

- How liquidation dates falling on holidays should be handled

- Whether back valued schedules should be liquidated on loan initiation

- The type of amortization, if amortization has been specified for the product and therefore, the loan.

- Whether schedule dates should be cascaded in case you have indicated that they (schedule dates) be moved forward or backward in case of a holiday

- The holiday table of the country of the loan currency that has to be checked before setting automatic schedules

Certain attributes are inherited from the product and these can be changed here:

- Liquidating schedules that fall due before the day on which the contract is booked

- Liquidation mode (auto to manual)

The schedule type - amortized, capitalized, or normal is inherited from the product and displayed for the contract.

2.6.6 Revision Schedules and Repayment Schedules

In the Contract Schedules screen, you can define two types of schedules:

- Those for the revision of interest rates for a contract with floating interest rates. Those for repayment of the various components.