2. Secondary Loan Trading - An Overview

This chapter contains the following sections:

2.1 Introduction

Secondary Loan Trading module or the SLT module is primarily concerned with the trading of syndicated loans in the secondary market. The participants in a syndication deal can carry out trading operations on the loan, once the syndication deal is closed and allocated. Brokers also can get involved in the trading process.

There are two possible options for carrying out a sale:

- Assignment where bank is directly involved in the trade

- Participation where bank is silently participating in the trade

The SLT process at your bank can be classified as specified below:

- Par – normal trading that happens in the secondary market

- Total Return Swap (TRS) - two parties exchange cash flows for a set period of time

- Distressed Trading – defaulted trades are handled under this category

- Origination Trades – handles internal trade deals

Loans QT is a front-end application which books buy and sell deals processed under secondary loan trading. A unique reference number called CUSIP indicates the facility associated with a syndication trade deal.

The profitability of the financial instruments involved in a deal can be ascertained by a method known as ‘marking the position to the current market price’ (MTM), where the actual cost involved in the deal is compared to the current market price. Any profit or loss arising from this is booked to Unrealized P&L on a daily basis. In case of any buy or sell trade, the profitability of the transaction is arrived at by comparing the buy and sell prices. This gets booked into realized P&L on the trade date.

The settlement usually happens T+7 days from the trade date. On the settlement date, the seller sends out an advice called the ‘Funding Memo’ to the trade counterparty. Funding memo gets generated on or before trade settlement and funding memo advice gets generated during save or authorization of Funding Memo, based on the advice parameters that have been maintained.

Funding memo contains details regarding the fees, funded and unfunded amounts, settlement accounts, and so on. On the settlement date, the deal details are captured manually using the information gathered from trade ticket and funding memo.

The trade deals captured using external systems can be uploaded to the SLT module and further processing can be carried out. SLT module also allows you to capture buy or sell deals, amend the details, if required and carry out the settlement of the deal.

Note

SLT trades are applicable only for pro-rata tranches with ‘Cascade Participation’ option enabled.

2.2 Features

SLT module interfaces with Loans QT, which is an external front-end application used to book buy and sell deals. The details of new trade deals as well as amendments to the existing deals are exchanged between Loans QT and Oracle FLEXCUBE. SLT module also interfaces with other external systems like Hamper to get the market price details for the CUSIPs.

SLT module also allows you to capture new trade deals and amendments to existing deals, independent of Loans QT. The settlement of a deal can be initiated from the SLT Trade Settlement screen.

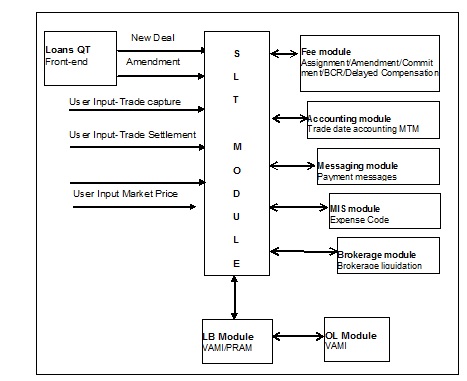

SLT module interacts with the following core modules also:

- Fee Module – for calculation of Assignment, Amendment, Line/Accommodation and Delayed Compensation Fees.

- Accounting Module – for passing all the accounting entries related to Fees, Trade Date Accounting & MTM entries

- Messaging Module – for generation of Payment messages and Funding Memo

- MIS Module – for passing the accounting entries with the relevant Expense Codes.

- Brokerage Module – for passing Brokerage entries into the Payable Account

- Loans Syndication – trading details are passed on from SLT to LB module which in turn will interface with the OL module

The following diagram graphically represents the way in which SLT module interfaces with the external applications as well as other modules:

The following list of activities can be performed using the Secondary Loan Trading module:

- Upload trades captured using external system into Oracle FLEXCUBE

- Capture trades using the front-end provided in SLT

- Maintain open and closed positions on facilities

- Allow pairing or squaring off deals using WAC, FIFO, and LIFO methodologies

- Calculate and pass unrealized P&L entries at EOD, using the market rate uploaded from external system

- Support calculation and settlement of fees incurred in the process of each trade transaction

- Support calculation of brokerage

- Perform trade date accounting

- Generate funding memo

- Generate payment messages on settlement

These activities and other related details are explained in the subsequent sections.