6. Provisioning for Customer Accounts

Your bank may wish to set up certain guidelines according to which provision must be made for outstanding overdrafts on customer accounts.

For instance, it may be necessary to set the provisioning amount for an account in respect of which there is an outstanding overdraft, based on the status of the account, as well as the financial standing of the customers.

You might also wish to include exposure due to loans issued to a customer, as well as total outstanding overdraft in all accounts of a customer, or a group of customers as a whole, and assign the status of all loans issued to the group as well as all accounts under a group, as the worst status among all loans and accounts, belonging to the group.

This chapter explains how you can use the system to perform the processes related to provisioning for customer accounts.

In order to maintain provisioning guidelines, you must

- Specify whether you wish to track the status of customer accounts and loan contracts at a customer group/CIF level, or at the level of individual contracts or accounts, for your branch.

- Set up the categories under which you wish track exposure and specify the provisioning percentages for each exposure category type

- Maintain the logic according to which the exposure category would be arrived at, based on the customer type, and the amount limits applicable for each customer type.

- Set up classifications for considering the financial standing of customers, for the purpose of status processing

- Set up the customer groups for which you wish to track exposure as a whole

- Set up rules for deriving the status of accounts for a group or CIF

- Set up rules for deriving the provisioning amount, for accounts using an account class

- Set up the frequency at which the provisioning batch would be executed, if the status processing is done at group/CIF level

This chapter contains the following sections:

- Section 6.1, "Status Processing"

- Section 6.2, "Setting up Customer Groups for Provisioning"

- Section 6.3, "Setting up Customer Classifications for Status Processing"

- Section 6.4, "Exposure Category Maintenance"

- Section 6.5, "Maintaining Rules for Provisioning"

- Section 6.6, "Derivation Rules for Status Change"

- Section 6.7, "Provision Processing for Accounts"

- Section 6.8, "Computation of Provision Amount"

- Section 6.9, "Specifying Rebooking Provision Entries"

- Section 6.10, "Maintaining Accounting Entries for Provisioning"

6.1 Status Processing

This section contains the following topics:

- Section 6.1.1, "Specifying Basis for Status Processing"

- Section 6.1.2, "Status Processing at Group/CIF Level"

- Section 6.1.3, "Processing at Individual Contract/Account Level"

6.1.1 Specifying Basis for Status Processing

In the Branch Parameters, you can indicate the basis upon which status processing must be done at the branch, for customer accounts as well as loan contracts.

Status processing can be done at two levels:

- at individual contracts and accounts

- at a customer group or CIF level

6.1.2 Status Processing at Group/CIF Level

If you opt for group or CIF-level processing, it is done in two stages:

- The worst status among all loan contracts and accounts under a specific customer group or CIF is arrived at

- All accounts and contracts involving the customer group or CIF are then moved to the worst status that was arrived at. The individual status of the account and contract, apart from the worst status being assigned, is also captured and displayed in the respective account and contract screens.

6.1.3 Processing at Individual Contract/Account Level

If you opt for status processing at individual contract/account level, the status of each contract or account would be assigned according to the status processing parameters that are operative for the contract or account.

For details about the Branch Parameters screen, refer the Core Services user manual.

6.2 Setting up Customer Groups for Provisioning

You may wish to track exposure due to loans issued to a group of customers as a whole, and assign the status of all loans issued to the group as the status of the loan with the worst status, among those issued to the group.

You may similarly wish to include the exposure due to outstanding overdraft in respect of a group of customer accounts as a whole, and assign the status of all customer accounts belonging to the group as the status of the customer account with the worst status among the accounts and loans belonging to the group.

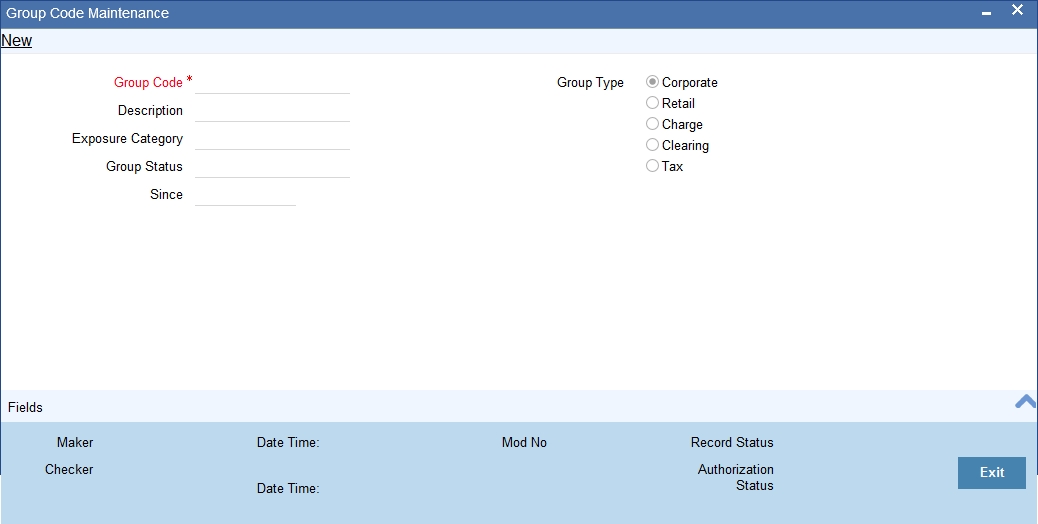

You can set up such customer groups, for tracking exposure due to loans as well as overdraft customer accounts, in the ‘Group Code Maintenance’ screen. Invoke this screen by typing ‘STDGRPCD’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Each group code that you define is associated with an appropriate exposure category that must be used to track exposure due to loans issued to customers in the group, as well as customer accounts with outstanding overdrafts.

The exposure category for a group is either derived from the logic maintained in the Exposure Type Category Linkage maintenance for the group type, or explicitly specified. If it is derived, it is displayed in this screen, by the End of Day batch program. The type of the group indicates the type of customers that belong to the group – retail, corporate, Charge Clearing or Tax. If no logic has been maintained in the Exposure Type Category Linkage for the group type, you can indicate the applicable exposure category for the group.

Group Code

When you maintain CIF details for customers, in the Customer Information Maintenance screen, you can specify the customer group to which the customer belongs, for provisioning and status processing. You must specify a group code defined for a group type that is the same as the customer type, for instance, if the customer is a retail customer, you must specify a group defined for retail customers.

Group Status

All loans and overdraft accounts issued to customers in the group will be assigned the same status, which will be the status of the loan/overdraft account with the worst status among those issued to customers in the group. The Group/CIF and the loan contracts and overdraft accounts are all updated with this worst status if they have been marked for automatic status processing. The individual status for the accounts and loan contracts (apart from assigning the worst status) is also captured and displayed. In the Group Code Maintenance screen and the CIF Maintenance screen, the status for the group is displayed, as well as the date since which the current status came into effect.

For details about loan status processing and provisioning, consult the Loans user manual.

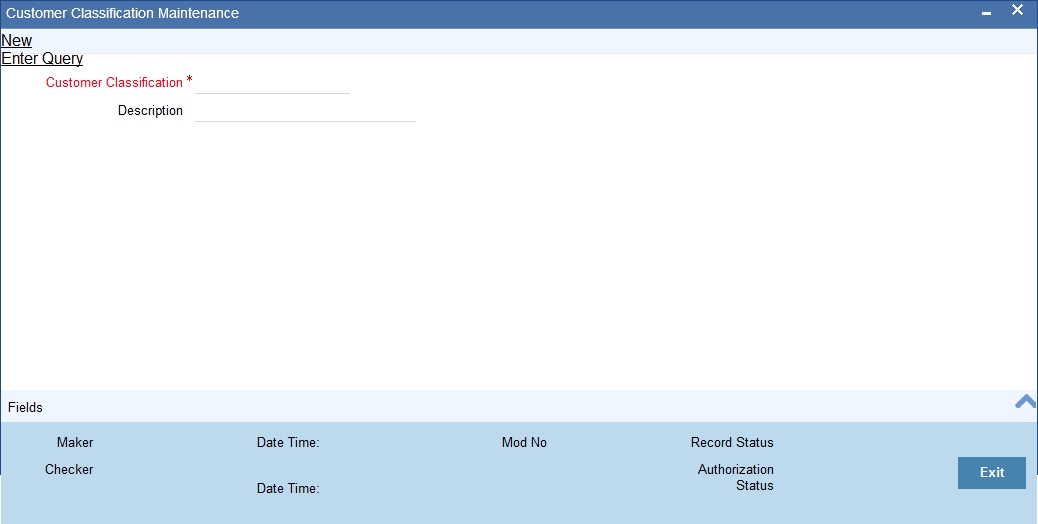

6.3 Setting up Customer Classifications for Status Processing

You can set up the different classifications under which the financial standing of the customer would be considered, for status processing. You can set up these classifications in the ‘Customer Classification Details’ screen. You must specify an appropriate classification code and description.

You can invoke this screen, by typing ‘STDCCMNE’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

For instance, you could set up the following classifications:

- Good – for customers with no bad loans and no accounts with outstanding overdrafts

- Unstable – for customers with a few bad loans and accounts with outstanding overdrafts

- Not Good – for customers with many bad loans and accounts with outstanding overdrafts

- Deteriorate – for customers with mostly bad loans and accounts with outstanding overdrafts

- Bad – for customers with only bad loans and accounts with outstanding overdrafts

Customer Classification

When you specify CIF details for a customer in the Customer Information Maintenance screen, you can also specify the appropriate classification for the customer.

Description

Enter a description for the classification.

6.4 Exposure Category Maintenance

This section contains the following topics:

- Section 6.4.1, "Setting up Exposure Categories"

- Section 6.4.2, "Specifying Status-wise Provisioning Percentages for Each Exposure Category"

- Section 6.4.3, "Specifying Exposure Category for Customer"

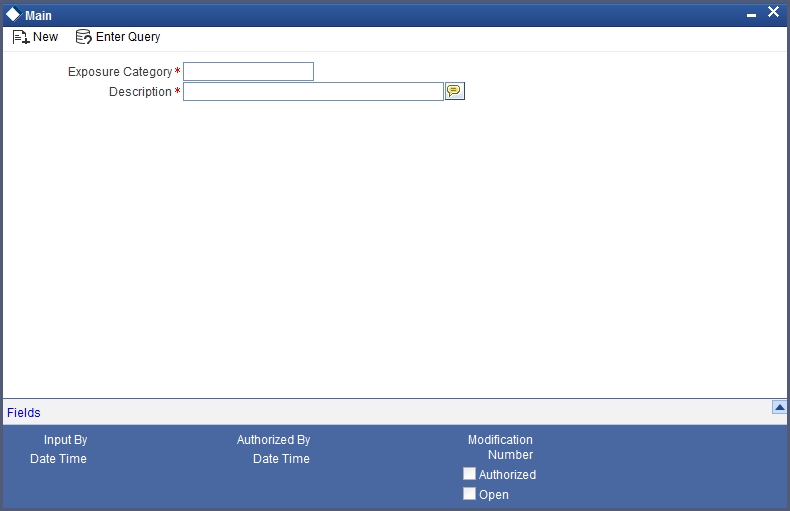

6.4.1 Setting up Exposure Categories

You can maintain the different categories under which you wish to track total exposure due to loans issued to customers in customer groups or CIF’s, as well as due to total overdraft in accounts belonging to customer groups or CIFs, for the purpose of ascertaining the amount of provisioning required.

You can maintain such exposure categories in the ‘Exposure Category Maintenance’ screen, by specifying the name of the exposure category, and a short description.

Invoke this screen by typing ‘LDDECMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can view the summary of the exposure categories in the ‘Exposure Category Maintenance Summary’ screen.

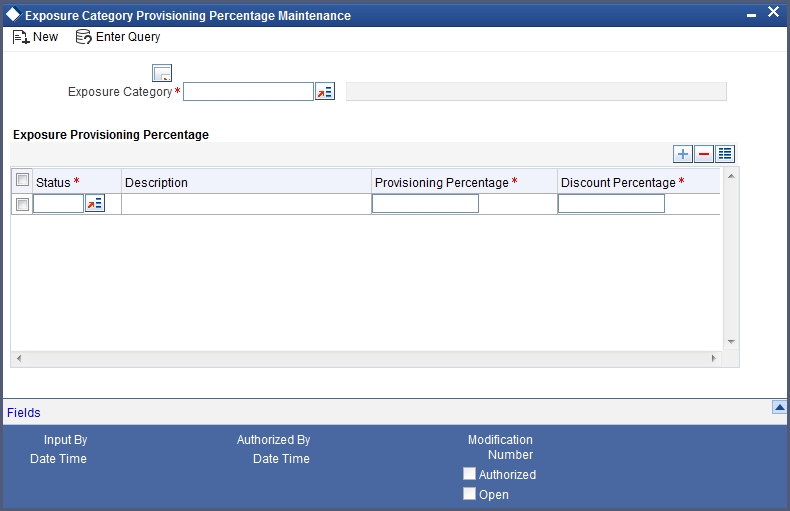

6.4.2 Specifying Status-wise Provisioning Percentages for Each Exposure Category

After you have maintained exposure categories, you must maintain the appropriate provisioning percentages to apply to each exposure category, for contracts as well as accounts in each of the statuses. You must also maintain the applicable discount percentages. You can do this in the ‘Exposure Category Provisioning Percent Maintenance’ screen, where you can specify the applicable provisioning percentage and discount percentage for each status.

Invoke this screen by typing ‘LDDPRVMN’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

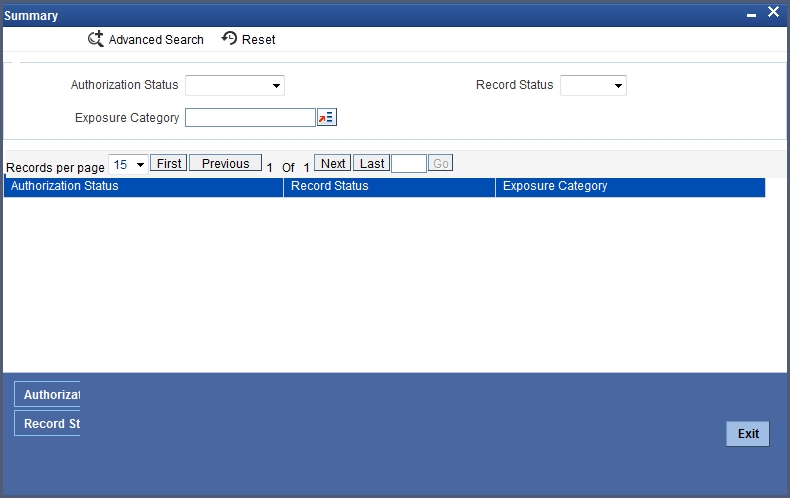

You can view the summary of the provisioning details in the ‘Exposure Category Provisioning Percent Maintenance’ Summary screen.

Invoke this screen by typing ‘LDSPRVMN’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

In the above screen, you can base your queries on any or all of the following parameters and fetch records:

- Authorization Status

- Record Status

- Exposure Category

Select any or all of the above parameters for a query and click ‘Search’ button. The records meeting the selected criteria are displayed.

System displays the following details pertaining to the fetched records:

- Authorization Status

- Record Status

- Exposure Category

For contracts and accounts involving a customer whose exposure is being tracked under the exposure category, the applicable provisioning percentage (as well as the discount percentage) is picked up from this maintenance, if not specified at contract input (or in the case of accounts, in the Customer Account Maintenance).

6.4.2.1 Specifying Logic for Deriving Exposure Category

After you have maintained exposure categories, you must also specify how the system would derive the exposure category under which contracts and accounts must be tracked. The exposure category can be derived from the following parameters:

Category Type

You may wish to track the exposure in respect of customers from different categories such as retail or corporate, under different exposure categories.

Amount Limits

You may wish to specify an amount range within which the total exposure would be tracked, for the customer or group.

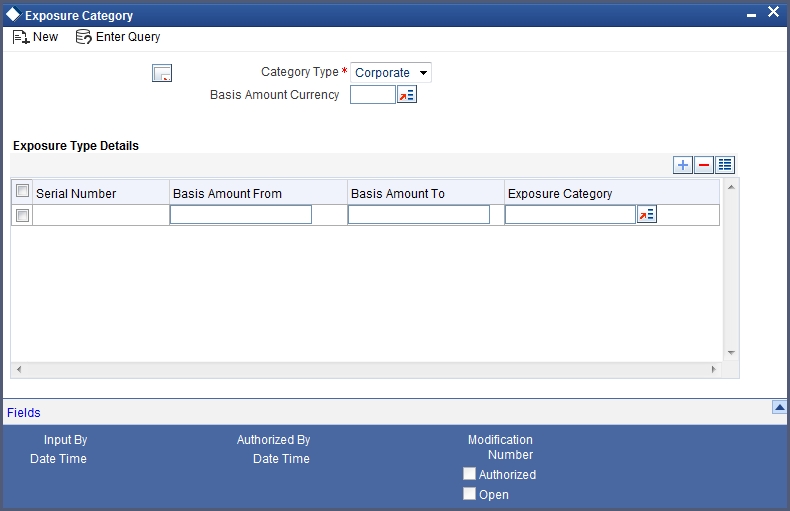

In the ‘Exposure Category - Category Type Linkage’ screen, you can link the exposure category to be used for tracking different customer category types and total exposure in respect of a customer group.

Invoke this screen by typing ‘LDDETMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The screen is as shown below:

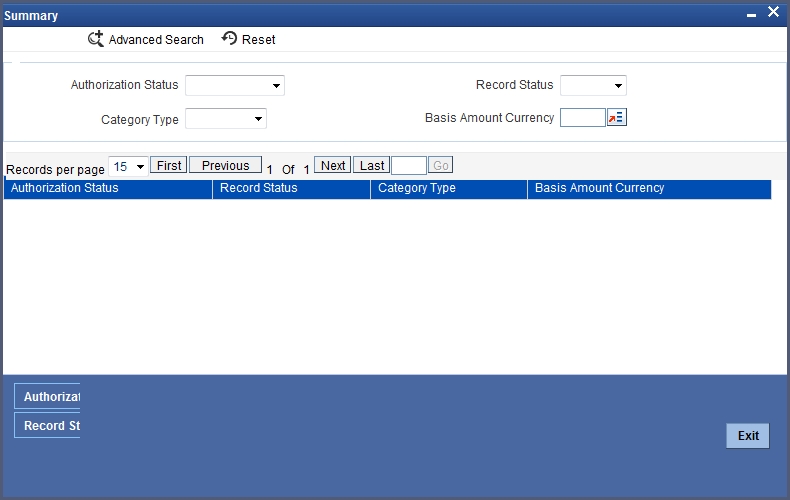

You can view the summary of the exposure category linkages in the ‘Exposure Category - Category Type Linkage Summary’ screen.

Invoke this screen by typing ‘LDSETMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

In the above screen, you can base your queries on any or all of the following parameters and fetch records:

- Authorization Status

- Record Status

- Category Type

- Basis Amount Currency

Select any or all of the above parameters for a query and click ‘Search’ button. The records meeting the selected criteria are displayed.

System displays the following details pertaining to the fetched records:

- Authorization Status

- Record Status

- Category Type

- Basis Amount Currency

Note

When the exposure category for a CIF or customer group is derived according to the logic maintained in the Exposure Category Type Linkage screen, the outstanding overdraft in all accounts belonging to the group/CIF, as well as the exposure due to loans issued to the group / CIF is summed, to compute the total exposure.

6.4.3 Specifying Exposure Category for Customer

When you maintain CIF details for customers, in the Customer Information Maintenance screen, you can specify the exposure category under which exposure due to loans issued to the CIF will be tracked. The exposure category is derived by the End of Day batch program and displayed, if the applicable logic has been maintained for the specified customer provisioning group, in the Exposure Type Category Linkage maintenance. If no logic has been maintained for the group, you can specify the applicable exposure category.

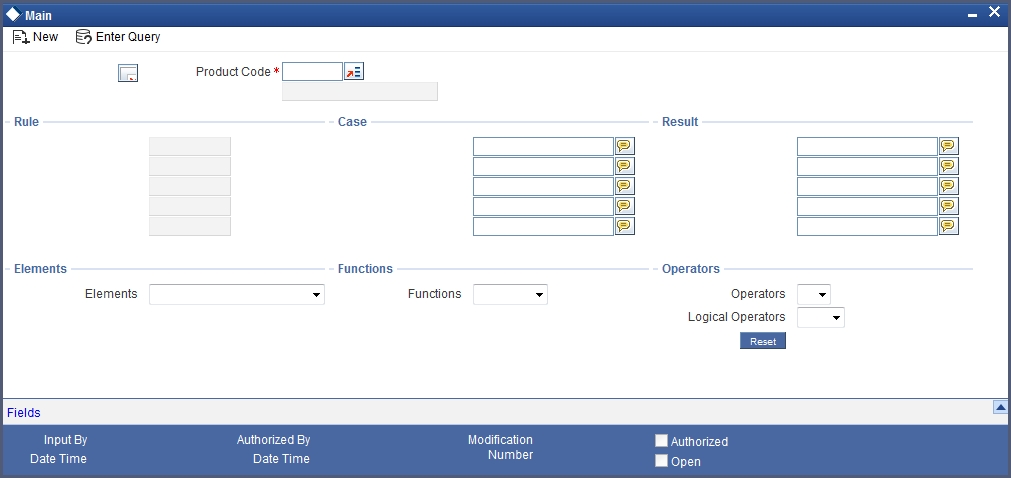

6.5 Maintaining Rules for Provisioning

For each account class for which you have defined account provisioning to be applicable, you can define the rules according to which the provisioning amount would be computed, when applied to an account using the class. You can define the provision rules in the Account Class Provisioning Rule Maintenance screen.

Invoke this screen by typing ‘LDDPRULE’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The screen is as shown below:

To define rules, you can use the following elements, for the account for which provision is being made:

- Outstanding Balance ACY – This is the book-dated debit balance, in account currency, in the account for which provision is being made

- Outstanding Balance LCY – This is the book-dated debit balance, in local currency, in the account for which provision is being made

- Receivable Interest – This is the interest receivable on the account for which provision is being made

- Accrued Interest – This is the interest that has been accrued but not liquidated as yet in the account for which provision is being made; typically, the interest that has accrued during the current liquidation cycle

- Receivable Interest LCY – This is the interest receivable, in local currency, on the account for which provision is being made

- Accrued Interest LCY – This is the interest that has been accrued but not liquidated as yet, in local currency, on the account for which provision is being made

- Account Status – This is the user-defined status for the account for which provision is being made

- Exposure Category– This is the exposure category of the account for which provision is being made. It is picked up from the account details; if it has not been specified in the account details, it is picked up from the maintenance for the CIF or customer group to which the account belongs.

- Risk-Free Exposure Amount – This indicates the risk-free amount (collateral) specified in the details of the account for which provisioning is being made.

- Provisioning Percentage – The provisioning percentage is generally picked up from the account details. If not specified in the account details, it is picked up from the Exposure Category Provisioning Percentage maintenance, for the exposure category of the customer of the account and the account status.

- Discount Percentage – The discount or loss percentage is used to compute the recoverable value of the account for which provision is being made. It is picked up from the account (if specified in the account details) or from the Exposure Category Provisioning Percentage maintenance, for the exposure category and status of the account for which provision is being made.

- Status Seq – This indicates the sequence number that represents the status, as defined in the Status Definition. It can be used with arithmetic operators for ease of status rule definition.

6.6 Derivation Rules for Status Change

For accounts, the basis for processing of status changes is governed by an attribute that you set in the Branch Parameters. You could opt for status processing at a group or CIF level, or at contract-level.

If processing is done at a customer group or CIF level, it is done in two stages:

- The worst status among all accounts and loan contracts belonging to the customer group or CIF is arrived at

- All accounts and contracts belonging to the customer group or CIF are then moved to the worst status that was arrived at

In the Status Rule Derivation screen, in the Derivation Rule field, you can define the conditions according to which the status of all accounts using an account class (the aging analysis) could be tracked. For each account class, you can maintain a derivation rule, which would be used during status processing to arrive at the status of each account (if status processing is at a contract level) or the worst status among all accounts and loans belonging to groups or CIF level (if status processing is at a Group/CIF level)

To define the derivation rule, you could use a combination of multiple elements, and arithmetic and logical operators. The following elements may be used:

- Frozen

- Dormant

- Nodebits

- Nocredits

- Stoppayment

- Current Status

- Customer Classification

In addition, the following elements will also be available for processing:

- OD (overdraft) Days

- Inactive Days

- Overline Days

- TOD (Temporary Overdraft) Days

- Debit Interest OD Days

- OD Limit Breach Days

- OD Expiry Days

- No Credit days

For details regarding the maintenance of other status control parameters in the Status Rule Definition screen, refer the chapter Maintaining Mandatory Information in this user manual.

6.7 Provision Processing for Accounts

This section contains the following topics:

- Section 6.7.1, "The Provisioning Batch"

- Section 6.7.2, "Specifying Frequency at which Provisioning Batch is Executed"

6.7.1 The Provisioning Batch

Provision processing for customer accounts is only done if indicated in the account details. Provision processing depends upon the status processing for accounts.

For accounts for which provisioning has been indicated, a batch process is run subsequent to the following processes, to perform provisioning:

- Status processing for accounts

- Interest and Charges (IC) batch process

- The Automatic Daily Contract Update process in the Loans module

To trigger the provisioning batch, you can use the Provisioning Batch screen. When the batch is triggered, the provisioning events SPRO (provision) and SPWB (write back) are executed.

6.7.2 Specifying Frequency at which Provisioning Batch is Executed

To recall, provision processing depends upon status processing for accounts and contracts. The provisioning batch executes after the status processing batch, as explained in the previous section. If status processing is indicated to be processed at group/CIF level, you can indicate the frequency at which the provisioning batch is to be executed for your branch.

You can specify the provisioning frequency in the Branch Parameters Preferences screen. The frequency options available are daily and monthly.

To view the Branch Parameters Preferences screen, refer the Core Services user manual.

The Provisioning Process

If status processing for your branch is done at customer group/CIF level, (as specified in the Branch Parameters), the provisioning process executes according to the frequency defined in the Branch Parameters. The process executes as described below:

- The exposure categories for the customer group or CIF are first derived, either from the specification for the same in the contract and account details, or depending upon the total exposure of the group or CIF, according to the logic maintained for deriving the exposure category, in the Exposure Type – Category Linkage maintenance

Note

When the exposure category for a CIF or customer group is derived according to the logic maintained in the Exposure Category Type Linkage screen, the outstanding overdraft in all accounts belonging to the group/CIF, as well as the exposure due to loans issued to the group/CIF is summed, to compute the total exposure

- The provisioning percentage applicable is then derived, either from the contract and account details, or using the exposure category of the CIF and the status of all accounts and contracts involving the CIF, according to the linkage maintained in the Exposure Category Provisioning Percentage maintenance

- Having obtained the provisioning percentage applicable, the system then computes the provision amount, based on the rule defined in the Loans Provisioning Rule maintenance (for loans) and the Account Provisioning Rule Maintenance (for accounts).

- The computed provision amount would then be stored for the accounts and contracts, and appropriate accounting entries passed. The computed provision amount is stored and displayed in the Amount Tab in the Customer Account Maintenance. The current status and exposure category of the account is also stored along with the balances.

Note

In case of contracts, the provision amount is not re-computed when a contract amendment, value-dated amendment, or automatic or manual payment is done, but only as part of the provisioning batch. On maturity of the contract, the provision amount is reversed. Similarly in the case of accounts, the provision amount is written back when the account is closed.

6.8 Computation of Provision Amount

When status processing is done at a group or CIF level,

- The worst status among all contracts and accounts under a specific customer group or CIF is arrived at

- All accounts and contracts with automatic status processing involving the customer group or CIF are then moved to the worst status that was arrived at.

- The total exposure of customers in a group or CIF is considered as the sum of all outstanding overdrafts in respect of accounts belonging to the group/ CIF, as well as the loans issued to the group or CIF. This total exposure is considered for deriving the provision percentage, and computation of the provision amount.

- The computed provision amount is stored and displayed in the Amount Tab in the Customer Account Maintenance. The current status and exposure category of the account is also stored along with the balances.

The provision amount is computed for each account using the provision rule defined for the account class that the account uses. Typically, the computation could be done according to the following guidelines:

For instance, let us suppose the statuses for accounts belonging to a CIF are derived according to the following guidelines:

|

Delay Period |

||||

Debtor Financial Standing |

Up to 30 days |

Between 31 and 60 days |

Between 61 and 90 days |

Between 91 and 180 days |

Beyond 180 days |

Good |

Regular |

Watch |

Substandard |

Doubtful |

Loss |

Unstable |

Watch |

Substandard |

Doubtful |

Loss |

Loss |

Not Good |

Substandard |

Doubtful |

Loss |

Loss |

Loss |

Deteriorate |

Doubtful |

Loss |

Loss |

Loss |

Loss |

Bad |

Loss |

Loss |

Loss |

Loss |

Loss |

Provision for General Credit Risk

General Credit Risk includes all contracts and accounts in ‘Regular’ status. The provision amount computation could be done as follows, according to the following categories:

Exposure to Corporate Customers

The expression used for this category could be:

, where,

PA = Provisioning Amount,

OD = Outstanding Overdraft Amount = Principal + Overdue Interest,

RFC = Risk-free Collateral,

PP = Provisioning Percentage

The provisioning percentage could be computed as shown:

Loan Type |

Categorization |

Provision |

Corporate Small – (CS) |

Exposure <= BGN 50,000 |

1.5% |

Corporate Intermediate – (CI) |

Exposure > BGN 50,000 and <= BGN 500,000 |

2.0% |

Corporate Large – (CL) |

Exposure > BGN 500,000 and < L-Sig |

3.0% |

Corporate Big – (CB) |

Exposure >= L-Sig |

0.0% |

Here, L-Sig could correspond to one percent of bank’s capital base rounded to nearest lower amount divisible by 50,000. Typically, the bank sets this figure.

Note

In arriving at the total exposure figure (as shown in the table above), the outstanding overdraft in the account as well as the outstanding amounts on all loans issued to the group/CIF that the account belongs to, are summed.

For example,

Customer |

Exposure |

Amount (BGN) |

Type |

Account 1 |

Loan 1 |

20,000 |

CI |

|

Loan 2 |

15,000 |

CI |

|

Account Overdraft |

12,000 |

CI |

Account 2 |

Loan 3 |

5,000 |

CI |

|

Loan 4 |

5,000 |

CI |

|

Account 1 Overdraft |

26,000 |

CI |

|

Account 2 Overdraft |

15,000 |

CI |

|

Sum of total exposure amounts |

98,000 |

|

Exposure to Retail Customers

The expression used for this category could be:

, where

PA = Provisioning Amount

OD = Outstanding Overdraft Amount = Principal + Overdue Interest

RFC = Risk-free Collateral

PP = Provisioning Percentage

The provisioning percentage could be computed as shown:

Loan Type |

Categorization |

Percentage |

Retail OD – (RO) |

Retail Overdrafts |

1.5% |

Retail Mortgages – (RM) |

Retail Loans that has mortgages as collateral |

2.0% |

Retail Consumer (RC) |

Other than the above |

1.5% |

Provisioning for Impairment Losses

Impairment losses include loans that are not in the ‘Regular’ status. The provision amount computation could be done as follows, according to the following categories:

All Corporate customers regardless of exposure and Retail customers with exposure exceeding BGN 5000

The expression used for this category could be:

Where

PA = Provisioning Amount

BVE = Balance Value of Risk Exposure = Outstanding Overdraft amount (which is, Principal + Balance Overdue Interest)

RFC = Risk-free Collateral

RV = Recoverable Value

PP = Provisioning Percentage

The recoverable value could be computed by applying the discount percentage to the balance expected cash flow, as shown:

Status |

Minimum Limit |

Accepted discount |

Watch |

10% |

25% |

Substandard |

30% |

50% |

Doubtful |

50% |

75% |

Loss |

100% |

100% |

The resultant amount could be discounted using the overdraft interest rate. For loans in status ‘LOSS’, the recoverable value is zero.

6.9 Specifying Rebooking Provision Entries

In the Status Details function, you can indicate whether provisioning entries for an account must be rebooked when provisioning is done after an automatic status change for the account. Rebooking essentially means that fresh provisioning is done, after reversing the previous provisioning amount.

The provisioning batch process, when executed, not only computes the provisioning amount; it also records the current status of the account and checks whether the current status is different from the status that was prevalent when the process was previously executed. If so, the old provisioning amount is written back into the write back GL of the old status (if the Rebook Provision option has been set in the Status Details), and the entries for the new provisioning amount are booked into the provisioning GLs maintained for the current status in the Status Details.

If the Rebook Provision has not been set, there is no reversal of the old provisioning amount, and the differential provisioning entries are be passed, as usual, into the GLs maintained for the current status. When there is a status change between two provisioning cycles, the Rebook Provision option is set for the status with the higher sequence number. For instance, while moving from status NORM (Normal) to PDO1 (Past Due Obligation), the Rebook Provision option is set for the status PDO1 and while moving from PDO1 to NORM, the Rebook Provision option is set for the status PDO1 again.

Note

If manual provisioning has been done, the entries for the differential amount are passed or written back into the GLs associated with the NORM (normal) status.

6.10 Maintaining Accounting Entries for Provisioning

The computed provision amount is stored and displayed in the Amount Tab in the Customer Account Maintenance. The current status and exposure category of the account is also stored along with the balances.

For account provisioning, accounting entries are passed for the following:

- Changes in provisioning amount without status change

- Reversal of provisioning amount as a result of status change

Accounting Entries for Changes in Provision Amount without Change in Status

The entries passed for new provisions or increase of provision amount:

Dr/Cr |

GL |

Dr: |

Expense GL |

Cr: |

Provisioning GL |

Entries for decrease in provision amount: |

|

Dr: |

Provisioning GL |

Cr: |

Reintegration GL |

Accounting entries for change in status with/without changes in provision Amount and with the Rebook Provision option applicable

In this case, the existing entries are reversed into a reintegration GL and new provisioning entries are booked, provided the ‘Rebook Provision on Status Change’ option has been set for the new status of the account. In this case, the following entries would be passed

For reversal of provision amount

Dr/Cr |

GL |

Dr: |

Provisioning GL |

Cr: |

Reintegration GL |

For booking of new provision amount |

|

Dr: |

Expense GL |

Cr: |

Provisioning GL |