9. Batch Processes

The events that are to take place automatically are triggered off during what is called the Batch Process. The batch process is an automatic function that is run as a mandatory Beginning of Day (BOD) and/or End of Day (EOD) process. During EOD, the batch process should be run after end-of-transaction-input (EOTI) has been marked for the day, and before end-of-financial-input (EOFI) has been marked for the day.

This chapter contains the following sections:

- Section 9.1, "Configuring CL Batch Processes"

- Section 9.2, "Initiating the Batch Process"

- Section 9.3, "Multi-threading of Batch Processes"

- Section 9.4, "Excess Amount Allocation Batch"

- Section 9.5, "Status Change Batch Processing (CSDSTBTC)"

- Section 9.6, "Interest Posting (INTP Event)"

- Section 9.7, "CL Batch Processing"

- Section 9.8, "Minimum Amount Due Batch Processing"

- Section 9.9, "EMI Change Batch (EMIC) Processing"

- Section 9.10, "User Defined Events Trigger for CL Accounts"

- Section 9.11, "Commission Processing"

- Section 9.12, "Stamp Duty Tax Processing"

- Section 9.13, "Intermediary Commission Batch Run "

- Section 9.14, "Interest Payback Batch"

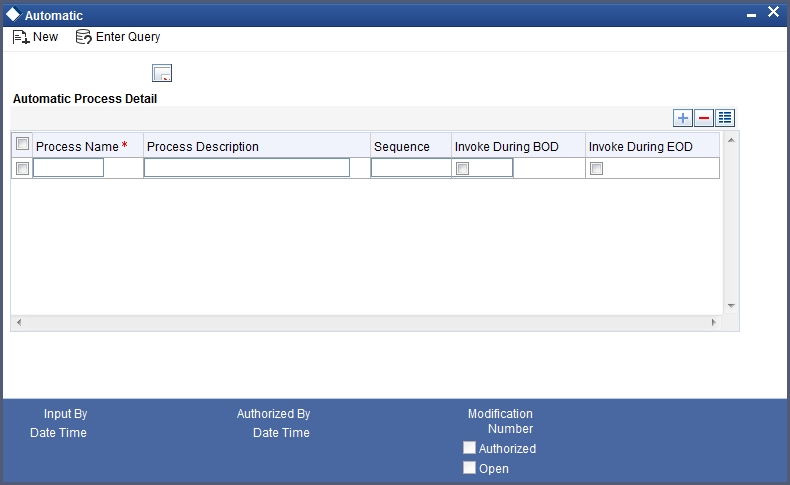

9.1 Configuring CL Batch Processes

You have the facility to configure the batch processes to be executed either at EOD or BOD or both, as per the bank’s requirement. This is achieved through the ‘Automatic Process Definition’ screen. You can invoke this screen by typing ‘CLDTPROC’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In this screen, you can amend the order of the various operations in the CL batch and choose to trigger them at EOD or BOD or both.

The default configuration is given below:

Batch Operation |

BOD/EOD |

Forward Init of Loan Accounts |

BOD |

Calculation |

EOD/BOD |

Accruals |

EOD/BOD |

Minimum Amount Due |

BOD |

Auto Liquidations |

EOD/BOD |

Auto Disbursements |

BOD |

Rate Revisions |

BOD |

UDE Cascade |

EOD |

Maturity processing – Rollovers , Auto Closures |

BOD/EOD |

Automatic Status Change Processing |

BOD |

FEES |

BOD |

INTP (Interest Posting) |

BOD |

Billing & Payment Notices |

BOD |

Statements generation |

EOD |

Penalty Computation |

BOD |

Forward VAMIs |

BOD |

Revaluation |

EOD |

Readjustment |

EOD |

These batch processes are factory shipped for your bank. Note that you need to set the ‘UDBATEVT’ batch as a predecessor to the CL batch ‘CLDBATCH’.

Defining Batch Processes

The CL batch processes are explained briefly:

Forward Init of Loan Accounts

Loan accounts maintained in the system are classified into two types:

- Active

- Inactive

When loan accounts become Active, the BOOK event is triggered for the Loan and you can specify a Value Date for the loan during this event.

This batch identifies all the accounts that are due for initiation on that day, at BOD and the INIT event is triggered for these accounts. The current system date will be taken as the value date for these accounts.

Re-Calculation

Loan parameter alterations directly affect the computation of accruals. This batch identifies such changes made to loan accounts, both at BOD and EOD. Further, it recalculates the accruals based on the altered loan components.

Accruals

This batch passes all the recalculated accrual changes required for the components. It is triggered, both at BOD and EOD.

Auto Liquidations

This batch processes the payments that are configured as auto payments and is triggered both at BOD and EOD.

Auto Disbursements

Disbursement schedules are maintained for products. As part of BOD process, the DSBR events for the accounts will be triggered.

This batch processes these schedules at BOD, which enables the DSBR events of the accounts to be initiated.

Rate Revision

As part of BOD program, this batch processes the Floating Rate revision schedules for products.

UDE Cascade

This batch is triggered at EOD in case of UDE value changes. The changes in UDE values are applied to all the affected accounts.

In case, a single account requires a UDE Change/Cascade, it can be performed online for that account alone. Such accounts are then excluded from this batch.

Maturity Processing

Maturity processing of loans is performed if the maturity date falls at BOD of a particular day. This results in either Auto Closure or Rollover of loans.

- Auto Closure: Loans that are liquidated on maturity are subject to Auto Closure, during maturity processing.

- Rollover: Loans that have auto rollover maintained are rolled over during maturity processing.

Status Change Processing

Certain accounts have automatic status changes, wherein the SDEs required for status change are evaluated. In such cases, this batch detects status changes at BOD. Once this is done, appropriate status change activities are triggered.

If you have selected the CIF/Group level status processing option (as part of the preferences for your branch), the status change batch picks up the worst status among all the loans and accounts (savings and current accounts) for a customer within the branch and updates this in all the customer’s loans (in the ‘User Defined Status’ field).

Notice Generation – Billing, Payments

For each loan, the number of days prior to which a Notice is to be generated is evaluated. In case of loans that carry dues, the Notice is generated as specified in the notice days maintained for the product. This batch is processed at BOD.

Statement Generation

At EOD, the statement is generated depending on the statement frequency and other statement based maintenance actions specified.

Forward VAMI

At BOD, this batch processes all value dated amendments that are booked with the date as Value Date.

Penalty

Penalty computations are evaluated at BOD by this batch. Any grace period maintained will have to be considered during this calculation. On completion of the grace period, the penalty components are computed from the due date till the current date.

Revaluation

At EOD, revaluation of assets and liabilities to the LCY are carried out.

Note

During collateral revaluation, if the collateral/collateral pool amount falls below the linked amount of the account, then the system automatically takes appropriate action.

Readjustment

This batch is processed at EOD. It is triggered in the presence of Index currencies that are not treated as a part of revaluation. It handles readjustments based on new index rates.

Minimum Amount Due

At BOD, this batch will identify the Open Line Loans accounts whose MAIN_INT component due date is equal to the application date and then calculate the minimum amount due details.

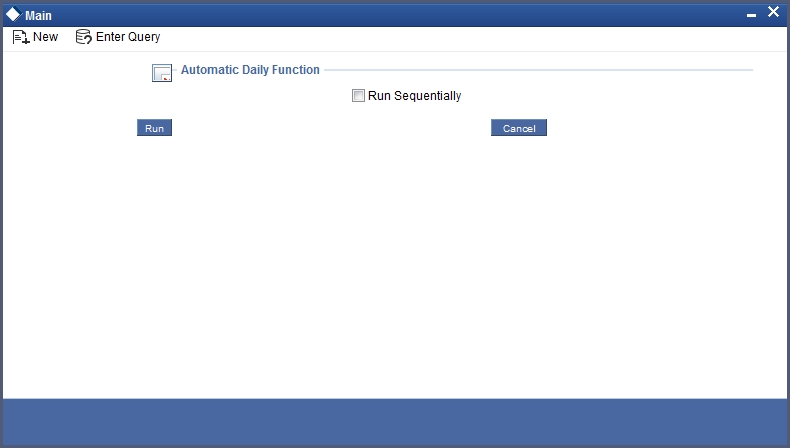

9.2 Initiating the Batch Process

If you have opted to trigger the CL batch programs at EOD, the same will be executed as part of the ‘End of Cycle Operations’ after marking the ‘EOTI’ for the day. If the trigger is maintained as ‘BOD’, the programs will be executed before the start of ‘Transaction Input’. However, the programs will be triggered both at EOD and BOD if you opt to trigger it at both the instances.

You also have the option to execute the batch programs through the ‘CL Batch’ screen. You can also invoke this screen by typing ‘CLDBATCH’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button

Run Sequentially

Check this box to opt to execute the processes as per the sequence maintained in the ‘Automatic Process Definition’ screen.

Click ‘Run’ button to run the batch process. Click ‘Cancel’ button to cancel the batch execution.

9.3 Multi-threading of Batch Processes

The CL Batch process handles multi threading. The number of parallel processes and the interval between processes is maintained as part of ‘CL Branch Parameters’.

Refer the section titled ‘Maintaining Branch Parameters’ in the ‘Maintenances and Operations’ chapter of this User Manual for details.

The accounts are split into multiple groups which can be processed in parallel for a particular sub process. Hence, all non conflicting parallel groups will complete the sub process after which the next sub process is taken up and so on. There is also an option to run it purely sequentially as shown above.

9.4 Excess Amount Allocation Batch

The Excess Amount Allocation batch is run to allocate the transfer amount available for each member against the outstanding balance in the corresponding loan accounts.

A member account is owned by a single member, but a loan account can be co-owned by several members in a certain ratio. Each member could be a borrower in multiple loans. For these reasons the amount allocations are necessitated.

The allocation process considers the following important parameters:

- % liability of each member in each loan where he is the borrower

- Transfer amount available per member

- Amount due (based on % liability) per member

To enable this fund allocation the rebate batch is run at the bank level. Common Settlement Account maintained in ‘Rebate Account Preferences’ screen is used as the ‘Common Bridge Account’. This will have the combined balance of all the member accounts, which can be utilized for loan re-payment. The Rebate account processing batch will provide the details like the member account number (CASA account), the member (CIF number) and the excess amount for the member. This data will act as the input for this batch program.

The batch does the following operations:

- It will get the due details for the next schedule of each loan, along with the Liability Split %. This will include the overdue amount, if any.

- Allocate the excess amount of each member to his loans, with the earliest unpaid schedule first.

- The due date of the schedule will be considered by the allocation batch for allocating the payments. The batch will ensure that the available amount is used to make advance payment for the immediate next component due before considering the next.

- While allocating the amount for the next schedule, the available amount will be available amount minus the amount already allocated against the previous schedule.

- With this info, CL payment will be triggered for each loan account. This will be an advance payment (not Pre payment) for an aggregate amount and will be initiated according to the liquidation order maintained for the components.

- On successful payment, process status will be changed to ‘P’ for all the records with this Loan account number.

- Status will be changed to ‘E’, in case of any error during the payment. As per the current functionality, the error details will be available in the exception table.

- After correcting the errors, you can re-initiate the process which will exclude the already processed loan accounts.

- Further generation of Payment advice will derive the amount after considering the amount paid through this batch process.

9.5 Status Change Batch Processing (CSDSTBTC)

For the CL module the Status change batch will be run along with the customer/Group and apply worst status change for the customer. This batch will use the status change events.

You can trigger the batches to run before the Common Status Change batch (CSDSTBTC). The following given batches can be run in any order:

- LCEOD

- BCAUSTCH

- CLBATCH

- ICEOD

- CIDBATCH

- MODBATCH

- CASABAT

- IAAUTDLY

- CSDSTBTC

- ICEOD

- CLDPROV

- MODPROV

- CIDPROV

The Process of Provisioning is handled by the following batches for CL, MO and CI modules respectively:

- CL provisioning batch (CLDPROV)

- Mortgage provisioning batch (MODPROV)

- Islamic loan provisioning batch (CIDPROV)

Note

The provisioning process is detached from the CLBATCH, MODBATCH and CIDBATCH.

If ‘Status Processing’ is at Individual Contract Level, then system will trigger status change based on the Customer Credit rating for the customer of the Contract /Account booked. The other contracts of the customers in the same Group will not be impacted. However if the ‘Status Processing’ is at CIF/Group level individual module (LC,CL, CI, MO, CA, IA and BC) batches will be updating common storage with the derived status of each contract and CIF/Group level status will be triggered by the common status change batch. The common status change batch will call the individual module function for status change processing.

9.6 Interest Posting (INTP Event)

You need to make a provision to post an income into a separate GL. This income is the interest which you pay to the customer who has a loan account. On the interest posting date, a transaction occurs to move the receivable and the income from one GL to another. This transaction distinguishes between receivables from the income which is due and not due. Also, this interest posting is applicable for the main interest component only.

The INTP event runs at the BOD for a loan product against which it has been defined.

The following points are noteworthy:

- You can pick the INTP event during the loan product definition and maintain the accounting entries against this event. To recall, you need to click on the ‘Events’ tab in the ‘Consumer Lending Product’ screen where you specify the various events which need to be run.

- At the time of loan account creation, Oracle FLEXCUBE populates the events diary with one record of the INTP event for each schedule due date. This has the status as ‘Unprocessed’. This is done for the main interest component schedule only.

- The system also creates a record for the end of each calendar quarter during the moratorium period in the case of amortized loan products.

- Any rebuilding of repayment schedules results in the rebuilding of records in the events diary.

- The batch process picks up all the unprocessed INTP records from the events diary having the execution date on or before the current application date. The process is limited to the active accounts belonging to the current branch.

- The amount and date of due for the main interest component is fetched from the component schedule due details.

- The accounting entries get passed on the schedule due date or the calendar quarter end, as defined for the event INTP through the ‘Consumer Lending Product’ screen under the ‘Events’ tab pertaining to a loan product maintenance.

- For term loans, the transaction posting date is the same as schedule due date of the main interest component. The same is followed for amortized loans also.

- For an amortized loan with a moratorium period, the transaction posting date is the end of the calendar quarter and the end of the moratorium period. If the moratorium period is different from the end of the calendar quarter, the entries passed will not tally with the actual amount due. This difference gets passed on the schedule due date of the moratorium period.

- There are no changes in the INTP event execution behaviour in case of a partial pre-payment.

- If a loan is getting pre-closed with a complete settlement, the system does not wait till the schedule due date or calendar quarter end for passing the INTP entries. It posts the interest accrued till the current date on the date of the pre-closure.

- In case of any failures during the INTP batch process, the system logs the error details for the account and processes the subsequent accounts.

9.7 CL Batch Processing

When prioritization rule is maintained for an L/C linked to the loan account, then bulk liquidation takes a different route during CL batch processing. Liquidation is triggered based on the preference rule defined for L/C. Preference with respect to ‘ALL’ is considered if a specific preference is not maintained for the corresponding L/C. This is treated as a normal payment once the respective component, schedule of the loan is identified for the payment. During the batch process prioritization for account liquidation takes place.

The batch process for liquidation takes place as follows

- Sub-process named as ‘BLIQ’ is used for Bulk Payment which runs before the ‘ALIQ’ Process. Event code used for this Prioritized liquidation is ALIQ.

- Accounts linked with L/C are grouped and liquidation process is done on the group.

- For the L/C linked to the loan account, if a prioritization rule is set, the same is considered for Bulk Payment. If prioritization rule is not maintained, the liquidation happens as part of ‘ALIQ’.

- When the bulk payment happens as part of batch, the prioritization rule determines which account is to be liquidated first. The account is attempted like any other ALIQ except for the component prioritization.

- Liquidation order is as per the prioritization rules defined for L/C.

- Verify funds facility is used as applied as part of loan processing.

- Missed or skipped schedules/accounts during Bulk liquidation due to specified preferences are picked up during ALIQ process and are allowed to succeed individually.

- The Accounts with ‘Liquidation Mode’ selected as ‘Component’ will be considered for auto liquidation.

- The system liquidates the component, for the accounts with the ‘Liquidation Mode’ selected as ‘Component’ and the ‘Liquidation Mode’ selected as ‘Auto’ at the component level.

Accounting entry netting is not available as part of Bulk Payment. There are multiple debits to the customer account for different CL account involved in the Bulk Payment.

For processing the daily Highest Outstanding balance for the entire active loan accounts, a process is maintained in auto CL automatic process table. This process runs as the last process in CL batch and invoked during EOD if it’s selected as ‘Y’.

Highest Outstanding Balance of an Account = Current Outstanding Balance of an Account. For month end HDB, system takes the highest debit balance during the month, which can be any day during that month.

9.8 Minimum Amount Due Batch Processing

The minimum amount due batch calculates the minimum amount due for open line loans. This batch will identify the OLL accounts whose MAIN_INT component due date is equal to the application date and compute minimum amount due details. The following details are available in the installment query details of a loan account:

- Billing date

- Min Amount due

- Pay by date

- Component details

- Component name

- Amount due

- Settled sum of payments made in the billing period.

This batch will calculate the minimum amount due to be paid by the customer on pay by date as per the chosen formula. The system will generate the billing advice with the calculated values.

The system will generate the billing advice based on the billing notice product setup. This advice is generated before the pay by date and not schedule due date for open line loans. The system will also create the new advice format for billing advice for open line loans with the following details:

- Loan account number

- Next Billing Date

- Available Credit Limit

- Amount Utilized

- (Loan Limit)

- Billing Period From

- Billing Period To

- Billed Date

- Payment Date

- Amount Due

- Minimum Amount Due

- Excess Payment (Will show the excess amount paid within the billing cycle)

- List of billed transactions

9.9 EMI Change Batch (EMIC) Processing

The event EMI Change (EMIC) processes the changes on the Effective Date from which the EMI amount is applicable for the customer. Based on the parameters specified for EMI change, the EMIC event derives the new EMI amount for the customer. The new EMI amount is then compared with Minimum EMI and Maximum EMI amount maintained in the ‘Account Details’ screen. If the new EMI amount is beyond the minimum and maximum limits, it is set to the minimum or maximum limit amount, as applicable. The new EMI comes into effect only from the next schedule. The current schedule remains unaffected by the change in EMI. For a schedule, if the interest is greater than the EMI, the EMI is set to the interest amount and the principal amount is set to zero. With effective from the next schedule, the system sets the new EMI amount and calculates the future schedules.

9.10 User Defined Events Trigger for CL Accounts

This section contains the following topics:

- Section 9.10.1, "Triggering User Defined Events"

- Section 9.10.2, "MIS Button"

- Section 9.10.3, "Rate Button "

- Section 9.10.4, "Charge Button"

- Section 9.10.5, "Events Button"

- Section 9.10.6, "Event Fields Button"

9.10.1 Triggering User Defined Events

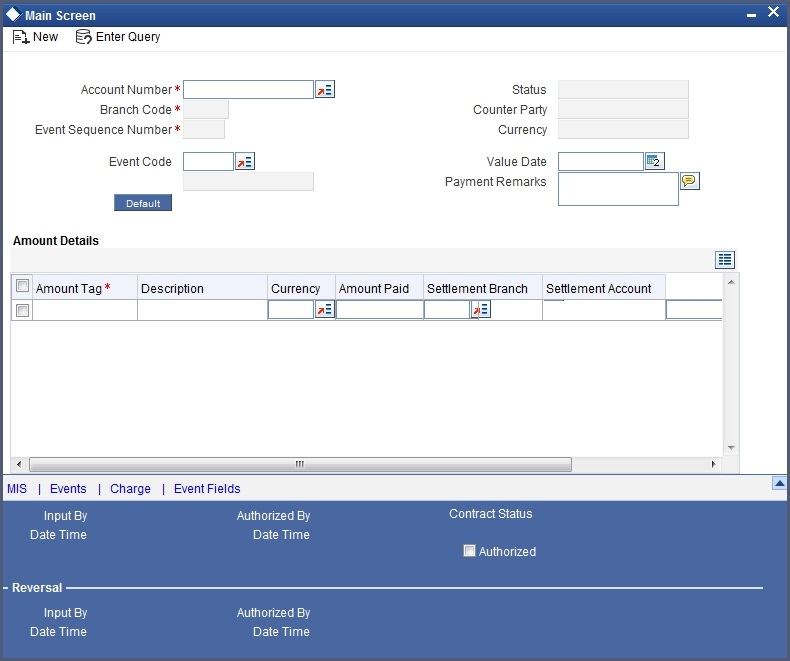

You can use the ‘CL User Defined Events Triggering’ screen to manually trigger the user defined events for CL accounts. You can invoke this screen by typing ‘UDDCLEVT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Here you need to specify the following details:

Account Number

Specify the account for which you want to trigger the user defined event. The adjoining option list displays all valid account numbers available in the system. You can select the appropriate one.

Branch Code

The system displays the code of the branch where the account resides.

Click ‘Default’ button. The system fetches values for the following fields based on the selected contract and displays them:

- Counter Party

- Currency

- Status

Event Sequence Number

The system displays the event sequence number.

Event Code

Specify the event that needs to be triggered for the selected account. The adjoining option list displays all events linked to the account. You can select the appropriate one.

A brief description of the event is displayed below.

Value Date

If the value date derivation rule has been maintained for the event code, the system will calculate the value date and display it here. However, you can change it.

Payment Remarks

Specify remarks pertaining to payment on the account.

Amount Details

Specify the following details.

Amount Tag

The amount tag is displayed based on the product-level maintenance of the specified account.

Description

The system displays a brief description of the amount tag.

Currency

If a derivation rule has been maintained for the event code, the system will derive the currency as per the rule and display it here. However, you can change it.

Amount Paid

If a derivation rule has been maintained for the event code, the system will derive the amount as per the rule and display it here.

Settlement Branch

Specify the branch where the settlement account resides. The adjoining option list displays all valid branch codes maintained in the system. You can select the appropriate one. Alternatively, if you have specified the settlement account, the system will display the corresponding branch code here.

Settlement Account

Specify the account that should be debited or credited. The adjoining option list displays all valid accounts maintained in the system. If you have specified the settlement branch, the option list will display all accounts available in that branch. You can select the appropriate one.

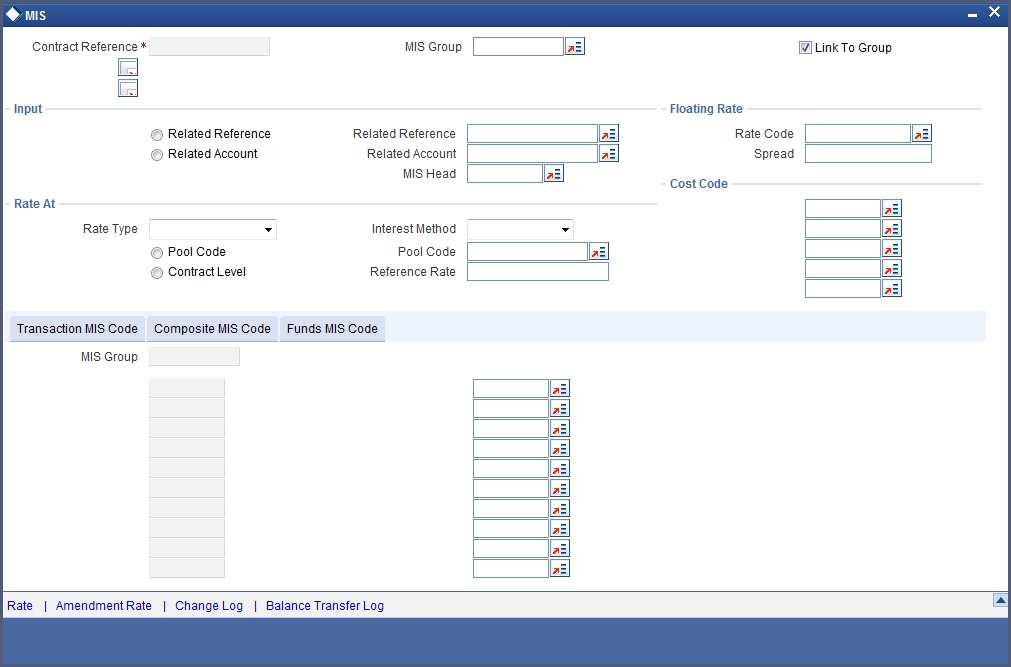

9.10.2 MIS Button

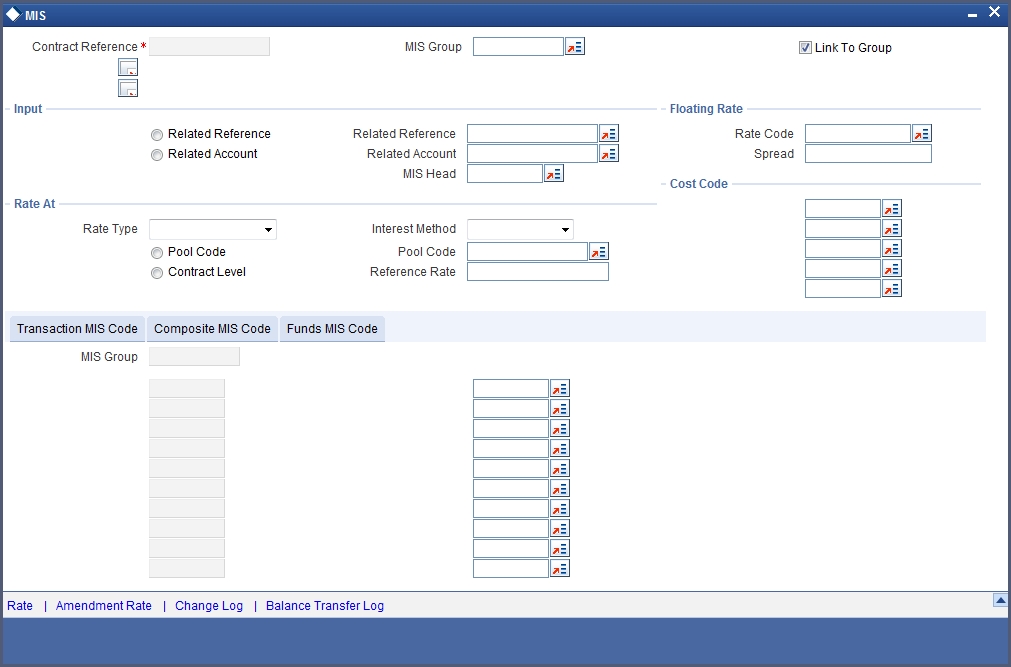

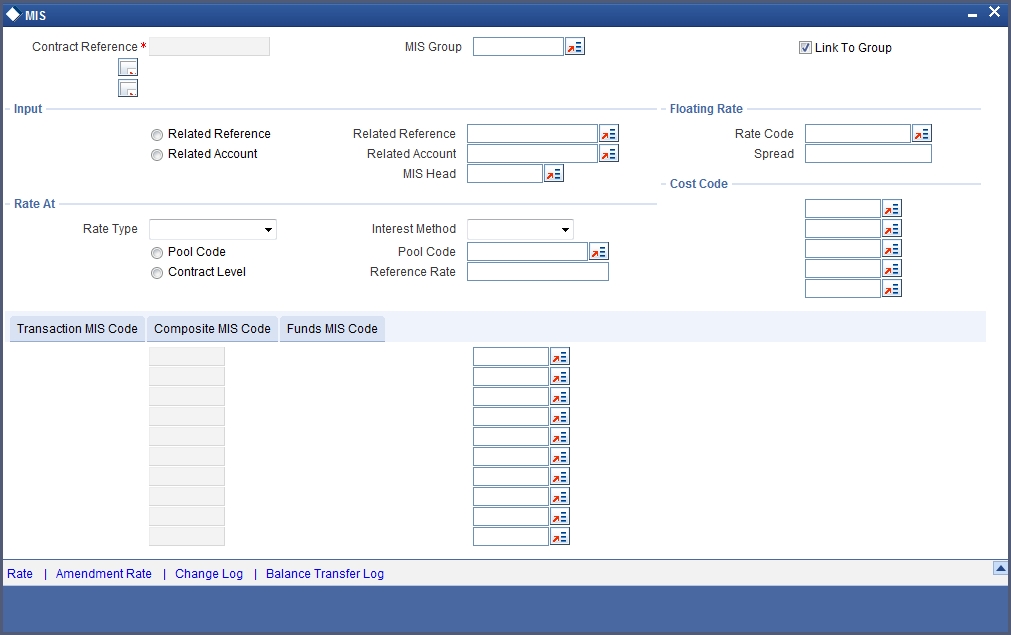

Click ‘MIS’ button the screen and invoke the ‘MIS’ screen.

You can view the following details:

- Contract Reference

- MIS Group

- Link to Group

- Input preference - Related reference/Related Account

- Related Account Number

- Related Reference Number

- MIS Head

- Floating Rate Code

- Floating Rate Spread

- Rate Type

- Rate at Pool Code/Contract Level

- Interest method

- Pool Code

- Reference Rate

- Cost Codes

The ‘Transaction MIS’ tab opens by default.

Here you can view the transaction MIS codes.

9.10.2.1 Composite MIS Code Tab

Click this tab to view composite MIS codes.

9.10.2.2 Fund MIS Tab

Click this tab to view fund MIS codes.

9.10.3 Rate Button

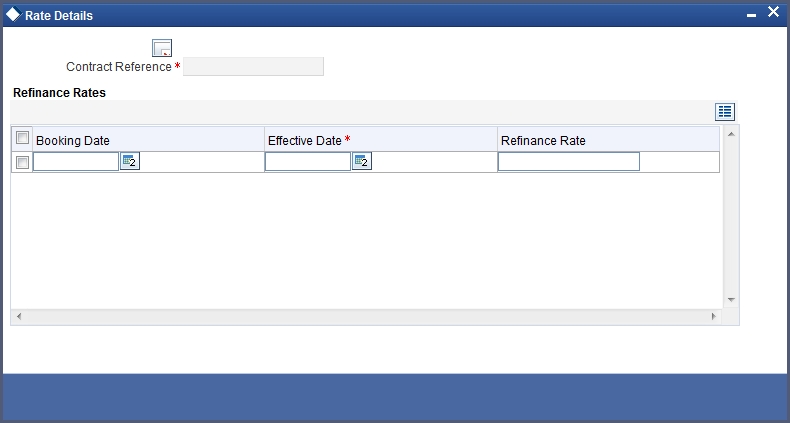

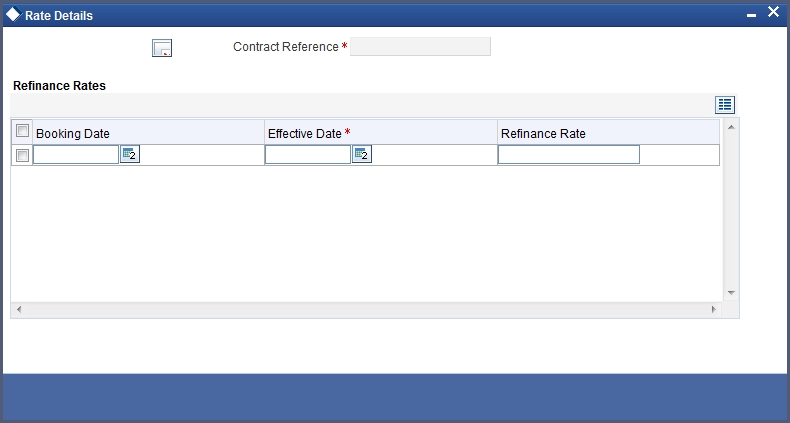

Click ‘Rate’ button on the ‘MIS’ screen and invoke the ‘Rate Details’ screen.

Here you can view the following details:

- Contract Reference Number

- Booking Rate

- Effective Date

- Refinance Rate

9.10.3.1 Amendment Rate Button

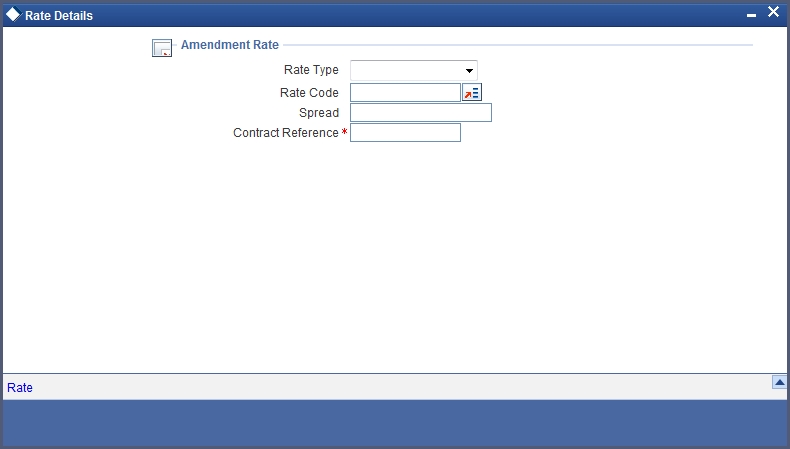

Click ‘Amendment Rate’ button and invoke the ‘Rate Details’ screen.

Here you can view the following details:

- Rate Type

- Rate Code

- Spread

- Contract Reference

9.10.3.2 Rate Button

Click ‘Rate’ button on the ‘Rate Details’ screen and invoke the ‘Rate Details’ screen.

Here you can view the following details:

- Contract Reference Number

- Booking Rate

- Effective Date

- Refinance Rate

9.10.3.3 Change Log Button

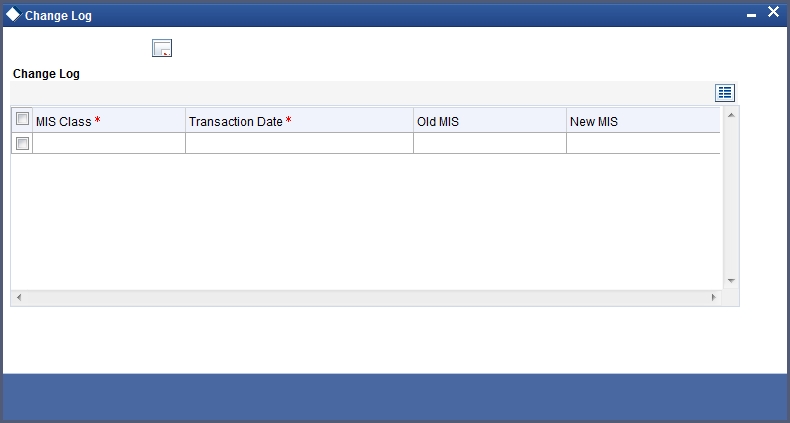

Click ‘Change Log’ button on the ‘MIS’ screen and invoke the ‘Change Log’ screen.

If MIS reclassification occurs, through changing the MIS codes for transaction or composite classes, the System stores the changes made, in a Contract MIS Change Log. The following details are stored in the Contract MIS Change Log for the contract in respect of which the MIS reclassification occurred:

- Contract Reference Number

- MIS Class that was changed

- Date on which the change was made.

- The old code for the changed MIS Class (this information is stored only for the first amendment during a day)

- The new MIS code for the changed MIS class.

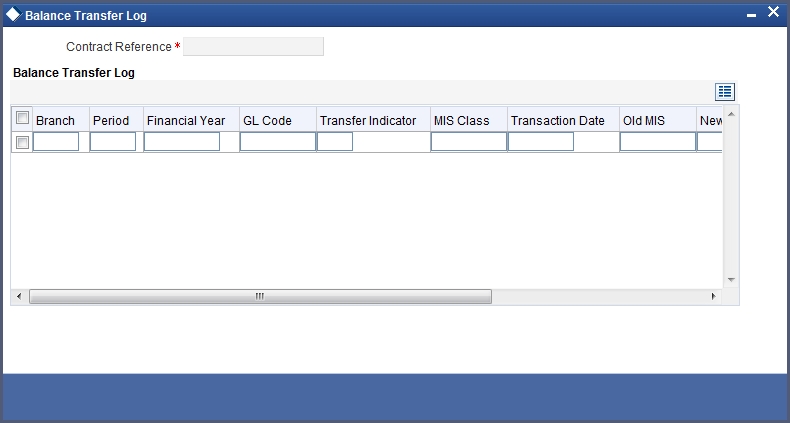

9.10.3.4 Viewing Balance Transfer Log

Click ‘Balance Transfer Log’ button on the ‘MIS’ screen and invoke the ‘Balance Transfer Log’ screen.

When an MIS reclassification occurs in respect of a the account, the balances in a GL associated with the old MIS code in each case are transferred to the GL for the new MIS code, if the option of transferring MIS balances upon reclassification has been set in the ‘Chart of Accounts’ screen for the GL.

You can view the following details:

- Contract Reference

- Branch

- Period

- Financial year

- Transfer Indicator

- MIS Class

- Transaction Date

- Old MIS

- New MIS

- Currency

- Amount

- Exchange Rate

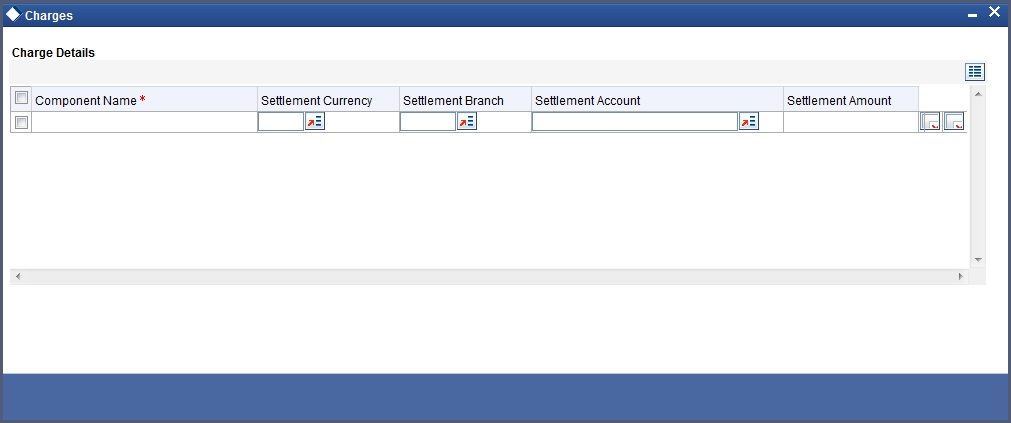

9.10.4 Charge Button

Click ‘Charge’ button on the ‘CL User Defined Events Triggering’ screen and invoke the ‘Charges’ screen.

You can view the following details:

- Component Name

- Settlement Currency

- Settlement Branch

- Settlement Account

- Settlement Amount

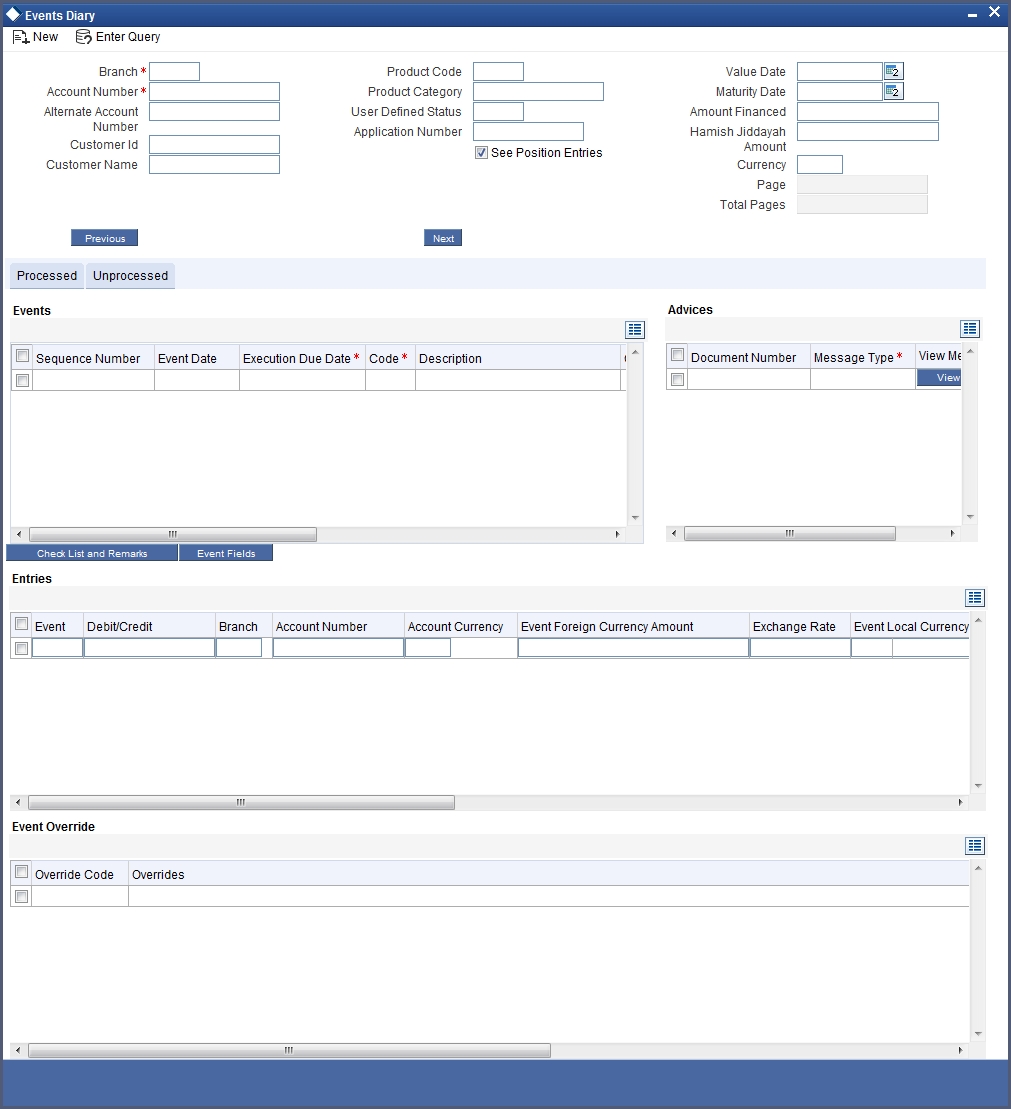

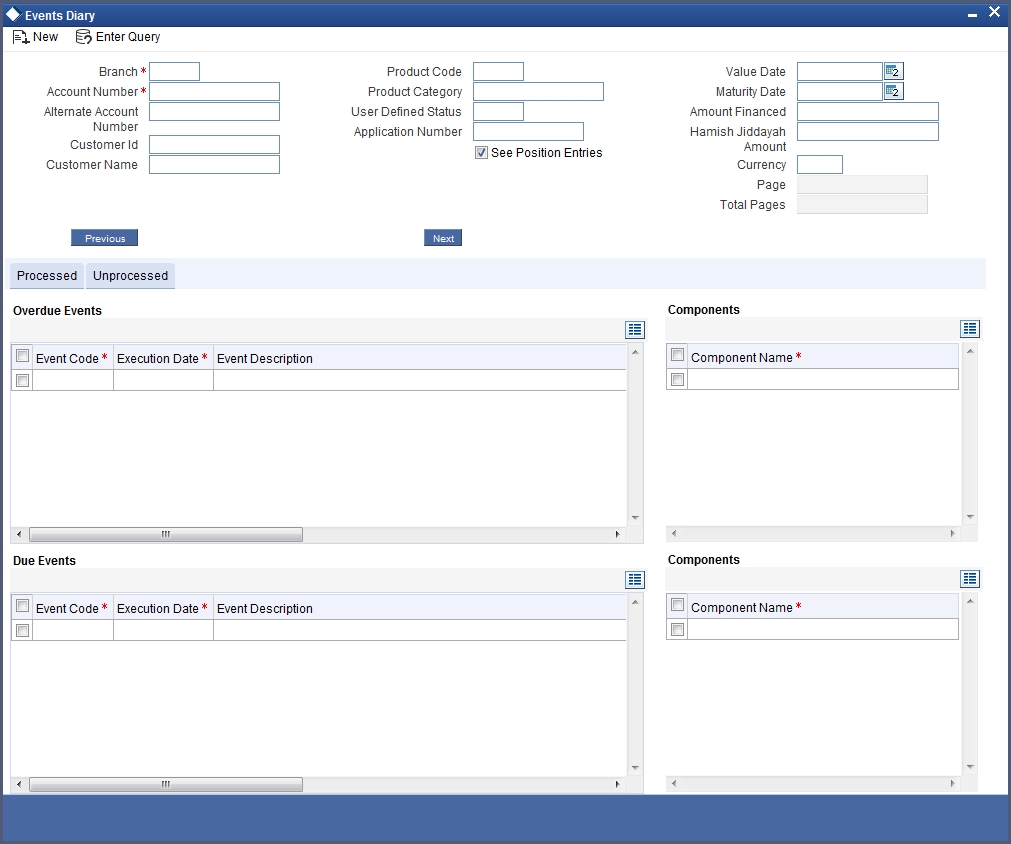

9.10.5 Events Button

Click ‘Events’ button on the ‘CL User Defined Events Triggering’ screen and invoke the ‘Events Diary’ screen.

9.10.5.1 Unprocessed Tab

Click this tab to view the unprocessed event details.

Refer the section ‘Events Diary’ in the chapter titled ‘Account Creation’ in this User Manual for details about the ‘Events Diary’ screen.

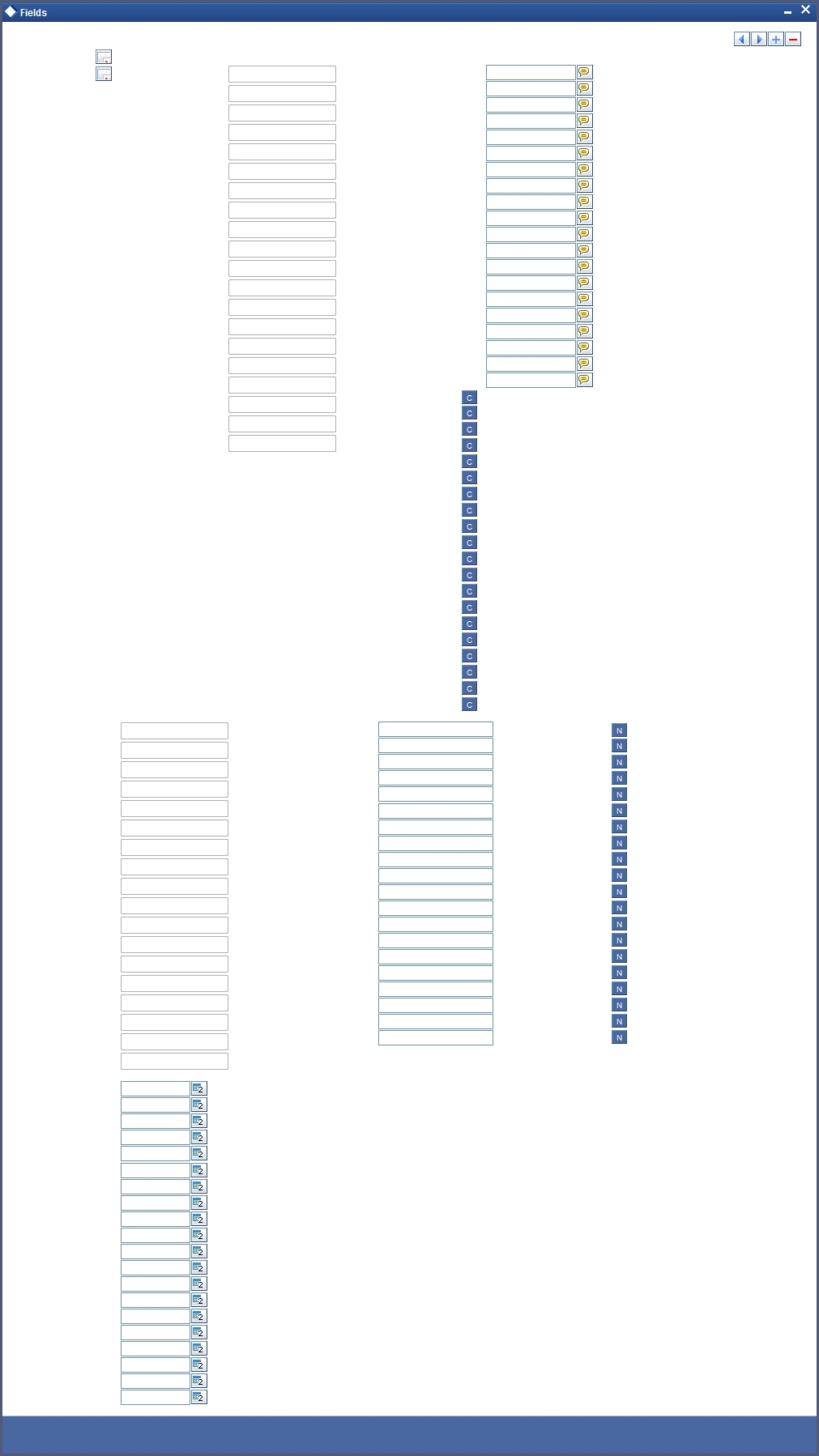

9.10.6 Event Fields Button

Click ‘Event Fields’ button on the ‘CL User Defined Events Triggering’ screen and invoke the ‘Fields’ screen.

Here you can view the UDFs and their values linked to the account.

Click save icon after specifying the details in order to trigger the event for the specified account. This record needs to be authorized for the event to be triggered.

Note that, you will not be able to perform any operation on the account on which there is an unauthorised event triggering record.

9.11 Commission Processing

This section contains the following topics:

- Section 9.11.1, "Processing Commission on Highest Debit Balance"

- Section 9.11.2, "Processing Commission Automatically at Month End"

- Section 9.11.3, "Processing Commission Automatically on Maturity"

- Section 9.11.4, "Processing Commission Manually"

9.11.1 Processing Commission on Highest Debit Balance

Oracle FLEXCUBE allows you to calculate commission for the Highest Debit Balance for a particular month from the customer. Bank debits commission from the customer account and credit the same on HDB GL. System collects the data for the Highest Outstanding Balance for loans and displayed in the account screen.

You need to maintain a User Data element in the product for the HDB commission rate which gets defaulted to the Account Screen and you can mention HDB commission rate. To waive the HDB commission for an account the Commission rate should be 0.

For calculating the commission on highest debit balance, you have to define a user defined event and Charge component with “HIGH_OUT_BAL” as basis element should be linked to the HDBC event. Accounting entries for the charges should also be defined in the HDBC event. The event trigger can be either auto or manual.

9.11.2 Processing Commission Automatically at Month End

During post-EOTI batch programs; HDBC event gets trigged which is run only on month-ends (last working day for the month).

Charge component is linked with HDBC event with formula as,

(HIGH_OUT_BAL* DR_COM_RATE)/(100)

But bank can define its own formula to calculate the commission on HDB using the SDE “HIGH_OUT_BAL”.

Note

During parameterization the HDB commission GL should be the same for all IC and Loan/Mortgage products which system does not validate.

9.11.3 Processing Commission Automatically on Maturity

If the maturity date of the account is today, the commission on Highest Outstanding balance for that loan account is collected using another process in CL batch. You can maintain it in auto CL automatic process table. This process runs daily before the ALIQ process in CL batch. If the Automatic Liquidation (ALIQ) fails for an account, then the reversal of commission on Highest Outstanding balance should be done manually.

9.11.4 Processing Commission Manually

You can manually liquidate the commission for Highest Outstanding balance for a mortgage account using the ‘Event Triggering’ screen. Before doing a full liquidation, you have to manually trigger the HDBC event.

9.12 Stamp Duty Tax Processing

This section contains the following topics:

- Section 9.12.1, "Processing Stamp Duty/Tax"

- Section 9.12.2, "Processing Stamp Duty Tax Manually"

- Section 9.12.3, "Processing Stamp Duty Tax Automatically"

9.12.1 Processing Stamp Duty/Tax

Oracle FLEXCUBE allows you to process Stamp Duty taxation through SDTX event. This event is triggered as part of a process in the CL batch running during post-EOTI. The process runs only on calendar quarter end days (last working day of the quarter).

9.12.2 Processing Stamp Duty Tax Manually

You can manually liquidate the stamp duty tax using the ‘User Defined Event Triggering’ screen. Before doing a full liquidation, you have to manually trigger the STDX event.

9.12.3 Processing Stamp Duty Tax Automatically

If the maturity date of the account is today, the Stamp Duty Tax on the outstanding debit balance loan and mortgage accounts which are getting fully liquidated is collected using another process in CL batch. You can maintain it in auto CL automatic process table. This process runs daily before the ALIQ process in CL batch. If the Automatic Liquidation (ALIQ) fails for an account, then the reversal of stamp duty tax is done manually.

9.13 Intermediary Commission Batch Run

The Intermediary commission batch run process is run at EOD to compute the values of existing volume level SDEs based on the ratio maintained for intermediary at CL account level.

For details on generic attributes that you can define for liquidation of a CL product, please refer the ‘Liquidation’ User Manual under Modularity.

9.14 Interest Payback Batch

The Interest Payback batch is run during EOD to process the interest payback amount and credit to the customer account. If the interest payback frequency period does not fall on the maturity date of the account then the interest payback will not be processed for the last frequency period.

For example:

Account Opening Date - 1-January -2014

Maturity Date - 30-November-2014

Interest Payback Frequency - Quarterly

For Interest payback frequency period 1-October-2014 to 31-December-2014, system will not process the Interest payback.

For details on Interest Payback, please refer ‘Interest Payback’ section of ‘Defining Product Categories and Products’ chapter in this User Manual.