5. Maintaining Account, Rate, and Charge Details

Once you have captured the basic information required for processing clearing transactions in Oracle FLEXCUBE, you have to maintain information that would be required to process clearing transactions involving a specific product. In the Account, Rate, and Charge (ARC) Maintenance screen, you have to maintain information that will be used to:

- Route transactions belonging to a specific product, branch and currency combination to a specific Clearing House/Sector Code

- Post accounting entries generated by clearing transactions involving a specific product to specific accounts

- Calculate and apply the specified charges

Note

In order to compute applicable charge, the following screens need to be maintained, before proceeding with ARC Maintenance:

- Charge Code Maintenance

- Entity Maintenance

Details on the above mentioned maintenances are provided in subsequent sections of this chapter.

This chapter contains the following sections:

- Section 5.1, "ARC Maintenance Screen"

- Section 5.2, "Charge Code Maintenance"

- Section 5.3, "ARC Branch Group Maintenance"

- Section 5.4, "Entity Maintenance"

5.1 ARC Maintenance Screen

This section contains the following topics:

5.1.1 Invoking ARC Maintenance Screen

The ARC Maintenance screen can be accessed from the Application Browser. You can invoke this screen by typing ‘IFDATMMN’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In the ARC Maintenance screen, you primarily define parameters for processing clearing transactions involving a specific product, currency, and branch combination, and involving a specific Clearing House (in case of an inward clearing transaction) or a Sector (in case of an outward transaction). Towards this, you must specify the following details:

- The details of accounts or GL’s to which offset accounting entries should be posted. (Typically, you would post the accounting entries generated by transactions involving a specific clearing house to an account or GL maintained for the purpose.)

- The details of any charges that your bank would need to collect or levy, for the clearing service.

If you are maintaining ARC details for a product and a specific clearing house/sector, the details maintained in this screen will be used for posting entries generated by clearing transactions involving the product, clearing house/sector, branch and currency code combination.

Note

You must maintain ARC details for all possible combinations of products, currencies, branches, and clearing houses/sectors.

Product

In the ARC Maintenance screen, you have to first of all indicate the clearing product for which you are maintaining ARC details.

Transaction Type

Specify the type of transaction for the ARC maintenance. This adjoining option list displays all valid transaction types maintained in the system. You can choose the appropriate one.

Currency

ARC details are maintained for a product, branch, currency, and clearing house combination. Indicate the currency of the combination in the currency field.

Branch

The ARC record is maintained for a Branch + Product + Type + Ccy.

Account Class/Product

ARC record can be maintained for a Module specific Product Combination or for a specific Account Class level.

Note

The ARC pickup is based on Customer Group code in addition to branch- product-customer-transaction currency and customer. If an ARC record is not maintained at a branch-product-customer-currency level, system checks the ARC record for branch-product-customer group-currency before doing a wild card search.

The order of replacement of the parameters with wild card entries will be done based on the following order:

- Branch

- Product

- Transaction Currency

- Transaction Type

Customer Group

Specify the customer group to define charges. This adjoining option list displays all valid customer groups of type charge maintained in the system. You can choose the appropriate one. Input to this field is mandatory.

Account Class Group

Select the account class group from the adjoining option list.

Note

If ARC is maintained for an account class group, then the charges computed is applicable for all the account classes defined under that account class group,

The ARC resolution logic is as below:

Sequence |

Account Class Group |

Branch |

Product |

Currency |

Customer Group |

Transaction Type |

1 |

Specific |

Specific |

Specific |

Specific |

Specific |

Specific |

2 |

Specific |

*.* |

Specific |

Specific |

Specific |

Specific |

3 |

Specific |

Specific |

Specific |

*.* |

Specific |

Specific |

4 |

Specific |

Specific |

Specific |

Specific |

*.* |

Specific |

5 |

Specific |

Specific |

Specific |

Specific |

Specific |

*.* |

6 |

Specific |

*.* |

Specific |

*.* |

Specific |

Specific |

7 |

Specific |

*.* |

Specific |

Specific |

*.* |

Specific |

8 |

Specific |

*.* |

Specific |

Specific |

Specific |

*.* |

9 |

Specific |

Specific |

Specific |

*.* |

*.* |

Specific |

10 |

Specific |

Specific |

Specific |

*.* |

Specific |

*.* |

11 |

Specific |

*.* |

Specific |

*.* |

*.* |

Specific |

12 |

Specific |

*.* |

Specific |

*.* |

Specific |

*.* |

13 |

Specific |

*.* |

Specific |

Specific |

*.* |

*.* |

14 |

Specific |

Specific |

Specific |

*.* |

*.* |

*.* |

15 |

Specific |

*.* |

Specific |

*.* |

*.* |

*.* |

16 |

*.* |

Specific |

Specific |

Specific |

Specific |

Specific |

17 |

*.* |

*.* |

Specific |

Specific |

Specific |

Specific |

18 |

*.* |

Specific |

Specific |

*.* |

Specific |

Specific |

19 |

*.* |

Specific |

Specific |

Specific |

*.* |

Specific |

20 |

*.* |

Specific |

Specific |

Specific |

Specific |

*.* |

21 |

*.* |

*.* |

Specific |

*.* |

Specific |

Specific |

22 |

*.* |

*.* |

Specific |

Specific |

*.* |

Specific |

23 |

*.* |

*.* |

Specific |

Specific |

Specific |

*.* |

24 |

*.* |

Specific |

Specific |

*.* |

*.* |

Specific |

25 |

*.* |

Specific |

Specific |

*.* |

Specific |

*.* |

26 |

*.* |

*.* |

Specific |

*.* |

*.* |

Specific |

27 |

*.* |

*.* |

Specific |

*.* |

Specific |

*.* |

28 |

*.* |

*.* |

Specific |

Specific |

*.* |

*.* |

29 |

*.* |

Specific |

Specific |

*.* |

*.* |

*.* |

30 |

*.* |

*.* |

Specific |

*.* |

*.* |

*.* |

Indicating Offset Details

You can indicate the offset currency to be used for processing FX contracts involving different currency combinations. Exchange rate for the contract is based on the rate code and type defined for the currency combination in the Retail Teller product definition, Product preference screen. Based on the transaction currencies chosen and the exchange rate defined for the currency combination, the system will pass the relevant accounting entries.

Note

The Offset currency field will be enabled for all products and not for account classes.

The ARC pickup in branch and host will be based on offset currency in addition to branch, product, transaction currency, customer and customer group. The order of replacement of the parameters with wild card entries is done in the following order:

- Branch

- Product

- Offset currency

- Transaction Currency

- Allowed Value

For FX transactions, the second currency from FX screens is used as offset currency for ARC pickup. For RT transactions, offset currency will also be used for ARC pickup.

The order of replacement of the parameters with the wild card entries will be as per the matrix given in the Annexure I.

The Rate code and type pickup in branch and host for the Retail transactions will be from the product preferences for the currencies involved in the transaction. If a record is not maintained for the given product and specific currency combination, the system will check for the currency combinations given in Annexure II. If no record is found for all the given combinations, the system will pickup the rate code and type from the product definition.

Indicating the Offset Details

You can specify the branch and the offset account or GL into which offset entries are to be booked. In case of an inward clearing transaction, this would typically be the Liability GL for Inward Checks to which the credit entries would be posted. (The customer account would be debited.) In case of an outward clearing transaction, this would be the Liability GL maintained for Outward Checks to which the debit entries would be posted. (The customer, in this case, would be credited.)

Indicating Transaction Details

You can specify the branch and the account number in which the transaction is taking place. The account in this field is the customer account. In case of inward clearing transactions, this account number would be available on upload of clearing transactions.

Indicating Transaction Codes

A unique Transaction Code identifies all transactions in Oracle FLEXCUBE. As part of ARC maintenance, you can indicate the offset transaction code and the main transaction code. You have to choose a transaction code for which the status of the option ‘Cheque Mandatory’ is checked at the definition. By this, the system can track the used cheques.

End Point

If you are maintaining ARC details for an outward clearing type product, you should specify the branch, the currency, and the sector code that are part of the combination. In addition, you should specify the end point (or clearing house) to which branches in this sector report to and the bank and customer float days.

If you are maintaining ARC details for an inward clearing type product, you should specify the branch, currency, and end points that form part of the combination.

From the pick list available in the Clearing House field, specify the Clearing House for which you are maintaining ARC details.

Clearing Houses are also referred to as End Point Codes in Oracle FLEXCUBE. Select the End Point Code of the Clearing House in the End Point field.

Generate MT101

Check this box to generate MT101.

Bank and the Customer Float Days

“Float days,” indicate the number of days that are added to the booking date of an outward clearing transaction to arrive at its value date (that is, the day on which an account is actually debited or credited with funds). As part of the ARC Maintenance for a transaction type, you have to indicate the Bank and Customer Float days.

The term “bank float days” refers to the days that will be used to calculate the value date of the bank leg of a transaction. The term “customer float days” refers to the days that will be used to calculate the value date of the customer leg of a transaction. The following example illustrates the implications.

If you have maintained float days, the system will validate the Clearing House Holiday Maintenance also.

Note

You can choose to maintain an ARC Wildcard record for a Branch, Currency and Customer combination or for any one or more of these entities. Ensure that the wildcard symbol that you are using is a *.

Float Days Basis

Float days applicable for outward clearing customer transactions are defined through the Customer Float Days Maintenance screen. The float days can either be considered as:

- Calendar days – indicating that the float days will not be dependent on any holiday maintenance.

- Working days - indicating that the float days will be based on the clearing house calendar and they will be working days on the basis of clearing house calendar.

You can select the appropriate option, which will be used to arrive at the value date for outward clearing customer transactions.

For details about defining float days for a customer or customer group, refer the Core Entities user manual.

Charge Debit Account

You can choose the charge debit account from the adjoining drop-down list. The available options are:

- Offset Account

- Transaction Account

Netting Charges

You have the option to net the accounting entries for the debit leg of the charges along with the main transaction entries.

Check this box to indicate that the debit leg of the charges is to be netted before passing the accounting entries. Leave the box unchecked to pass the entries without netting the charges of the debit leg.

Main Offset Accounting Entries Required

If this box is checked, the system will pass the main accounting entries along with charges defined at ARC for a Product. Otherwise only the charges accounting entries defined for the product will be passed which is used for online charge collection.

Note

When RT products are used for On-line charge definition (STDCHGMN), then this check box has to be unchecked.

Generate Transaction Advice

Whether an Advice needs to be generated for the Transaction (redundant for J2EEBranch, might still be used for other Interfaces).

5.1.1.1 Indicating Service Charges for Inter-branch Transactions

In a transaction, if the account branch of the teller transaction is different from the transaction branch, then charges maintained by inter-branch product will be applied to the transaction.

If you select the IB transaction as 'Yes' for a RT product at ARC, the system picks up and process the charge entries as maintained.

If you select the IB transaction as 'NO' for a RT product at ARC, then the charges maintained in non-ib product are applied to the transaction.

IB Transaction

Check this box if you want the system to pick up the product, for inter-branch transactions.

You will notice the difference in the service charges processed for two transactions with same kind of product.

Note

This will be supported for Cash Deposit (1401), Cash Withdrawal (1001) and Account to Account Transfer (1006)

5.1.1.2 Indicating Exchange Rate Revaluation

You can specify the following details:

Profit Revaluation GL

Specify the profit revaluation GL details.

Loss Revaluation GL

Specify the loss revaluation GL details.

5.1.2 Defining Charge Details

You can define a maximum of five charges. A charge can be computed based either on the transaction amount or on an earlier charge amount

As part of defining the Charge details for each charge, you need to capture the following details:

Charge Type

The Charge Type that should be applied on the transaction. It could either be a Percentage of the transaction amount or a Flat Charge.

Slab Type

Whether the Charge computation has to be over different Amount Slabs or Tiers (0-100 @ 10, 101-500 @ 15 etc.).

Basis

You can indicate the basis amount on which the charge is to be computed.

Since you can maintain five different charge amounts, the basis amount that you enter could either be the ‘Transaction Amount’ or any of the earlier charge amounts. For example, let us assume you are maintaining Charge 1. The only basis for charge 1 can be the transaction amount. While defining Charge 2 you can choose either the transaction amount or Charge 1 as the basis. Similarly while defining Charge 3, you can choose the transaction amount or Charge 1 or Charge 2 as the basis. NUM-ACC=OPN-DAYS' is used as basis to define the Account closure Charge product. When this basis is used, Slab type should be maintained as "SLAB”. As system will check the slab for charges to be collected based on the Number of days account kept open by the customer. ‘System Entity’ can be selected to calculate those teller transactions that exceeds the restriction amount. If ‘System Entity’ is selected, then the linked system entity returns the basis amount on which the charge is calculated.

Entity Name

The field is enabled if ‘System Entity’ is selected in the ‘Basis’ field. Select the Entity Name, from the adjoining option list. The list of values are populated from the ‘Entity Maintenance’ screen (STDENMNT). Further details on the ‘Entity Maintenance’ screen is provided in subsequent sections of this chapter.

Based on Charge Code

Check this box to indicate whether the charge is based on the charges maintained in the charge code maintenance. If this field is checked, then the system checks the parameters applicable to the said charge code from the Charge Code Maintenance (which is detailed in the subsequent section) and passes the relevant parameter value(s). The system also passes the “Basis” amount to the charge code as the basis is captured at ARC charge level.

If the system is unable to pass a parameter value to a charge code because of unavailability of data, the same parameter is treated as *.*.

Subsequently, charges are calculated based on the charge calculating preferences for the said record. Charge Code

This field is enabled if ‘Based on Charge Code’ field is checked. Select the charge code from the adjoining option list. All charge codes as maintained in the charge code maintenance screen is listed in this field.

Currency

You can indicate the currency in which the charge amount would be expressed. If the transaction currency is different from the charge currency, a conversion would be done, using the rate code and rate type that you specify for each charge.

Their Charges

For outward clearing checks, you can indicate whether the charge is being collected on behalf of the collecting bank. If you set this option, you need not specify the charge account. Since the charge amount would not known upfront, you need not specify the amount either.

This can also be used to indicate the charge product is used to collect the presenting bank charges in case of Outward Returns.

Charge Debit Account

Select the charge debit account into which charge related entries are to be posted from the adjoining option list.

Note

- If charge debit account is maintained at both ARC and charge level with different values, the system will take precedence of the charge debit account at the charge level to debit the charges.The charge debit account can either be "TXN_ACC" or "OFS_ACC" or GL's (Income or Expense)

- If netting charge is checked at ARC level, charge debit account should be maintained at ARC level. This charge debit account and charge credit account is used when bank has to remit tax on income they receive as part of each and every RT transactions.

Charge Credit Account

Select the charge credit account from the adjoining option list. The other leg of the charge is posted to a GL, as specified in the ARC record.

For example,

To collect tax from the income received will be as follows:

For cash deposit transactions, bank wants to collect a charge of 5% on the transaction amount (inclusive of tax). The bank has to remit Tax @ 9.090909% of gross charge collected from the income GL.

The ARC maintenance can be done as follows to achieve the same:

Charge 1:

Charge Basis: Transaction Amount

% Charge: 5 %

Charge Debit Account: Transaction Account

Charge Credit Account: Income GL (say INC00001)

Charge 2:

Charge Basis: Charge 1

% Charge: 9.090909%

Charge Debit Account: Income GL (INC00001)

Charge Credit Account: Tax Payable GL (say PAYB0001)

For a cash deposit of USD 1000 in account CASA0001, the gross charge (inclusive of tax) will be USD 50 and Tax will be 4.55 after rounding.

The accounting entries for the maintained ARC will be as below:

Dr/Cr |

Account |

Currency |

Amount |

DR |

CASH GL |

USD |

1000 |

CR |

CASA0001 |

USD |

1000 |

DR |

CASA0001 |

USD |

50 |

CR |

INC00001 |

USD |

50 |

DR |

INC00001 |

USD |

4.55 |

CR |

PAYB0001 |

USD |

4.55 |

Netting Charge

If two or more accounting entries, for the same event, are to be passed to the same account, on the same Transaction Date, these entries can be netted. You can choose to net charges by choosing this option.

Transaction Code

You can indicate the code using which the accounting entries would be booked, for each charge.

Rate Code and Rate Type

While settling charges for cross currency transactions, you can choose to debit the customer by applying the mid rate, buy rate or by using the buy/sell spread over the mid-rate. Therefore, you need to specify the Exchange Rate details for each ARC definition record that you maintain in the system.

Firstly, indicate the Rate Code for which different rates can be maintained. A list of all the rate codes maintained in the Floating Rates Maintenance screen is displayed in the list. You can choose the appropriate code.

In addition to specifying the Rate Code, you have to indicate the Rate Type which should be picked up for exchange rate conversions involving settlement of charges for cross currency transactions. You can maintain any one of the following as the Rate Type:

- Buy

- Mid

- Sell

After identifying the Rate Code and Rate Type you can indicate the basis amount on which charges are to be computed.

Amount

You have to specify the flat amount only when the charge type is a Flat Amount.

The flat amount will be collected in the currency that you have specified in the Charge Currency field.

Rate

If you have indicated that the charge should be a percentage of the transaction amount, you have to necessarily capture the rate that is to be applied on the transaction amount. The rate that you specify will be applied after converting the amount into the Account Currency.

Minimum and Maximum Charge Amount

When the charge type applicable on the transaction is a percentage of the transaction amount you have to capture the minimum and maximum charge amounts that should be applied on the transaction.

If the charge percentage involving a particular transaction is less than the minimum charge, the system will, by default, debit the customer account with the minimum charge amount. If the charge percentage exceeds the maximum amount, the system will debit the customer account with the maximum charge amount.

Note

The charge amount will be deducted in the currency that you specified in the Charge Currency field.

MIS Head

Specify the MIS Head that is applicable for the charge-related accounting entry.

Description

You can indicate a short description for the charge.If you have provided a charge, it is mandatory to enter the description.

Charge Tracking Preference

Select charge tracking preference from the adjoining drop-down list. The options available are:

- Part Debit/Part Waive - If your account does not have an amount sufficient to collect the full charge, then the system collects the available amount and waives off the remaining amount. There will not be any tracking for the waived amount. For example: If the charge amount is Rs100 and there is Rs70 in the customer account, then Rs70 will be collected as the charge and the remaining Rs30 would be waived off.

- Part Debit/Part Track - If your account does not have an amount sufficient to collect the full charge, then the system collects the available amount and tracks the remaining amount. For example: If the charge amount is Rs100 and there is Rs70 in the customer account, then Rs70 will be collected as the charge and the remaining Rs30 would be tracked for collection.

- Full Waive - If your account does not have sufficient balance then the system waives off the full charge amount. For e.xample: If the charge amount is Rs100 and there is Rs70 in the account, the entire Rs100 charge will be waived off.

- Full Track - If your account does not have sufficient balance to cover the charge, then the system tracks the entire amount as receivable. For example: If the charge is Rs100 and the amount in the account is Rs70, charge will not be collected, instead Rs100 will be tracked as receivable and this would be tracked till closure.

- Force Debit - The system debits the charge amount forcefully from your account. If the amount available in the account is not sufficient then force debit results in negative balance. For example: If the charge is Rs100 and the customer account has Rs70, then the system forcibly debits the customer account of Rs100 resulting in the customer account balance of Rs30. The amount is not tracked in this case. This option if selected, ignores all other validations for balance check and will debit the customer account for the charge amount. The same balance check validations are skipped here too which are currently skipped by the system if balance check required flag is unchecked at transaction code level. However, other validations such as No debit, account freeze will not be skipped.

- Not Required - Select ‘Not Required’ if charge for tracking is not preferred. The system behaves in the same manner as it is when “Tracking required auto liquidation” flag is unchecked. This will consider the validations for balance check, that is preference at transaction code level or account overdraft errors (e.g. AC-OVD)

- Reject - If the account does not have sufficient balance, then the system rejects entire transaction.

Note

- If “Charge Tracking Preference” is any of the above other than “Not Required”, the given preference will take precedence over the account overdraft check validation (AC-OVD). For example, if account overdraft check validation (AC-OVD) is set up as an override, but tracking preference is selected as full track or part debit/ part track, the charge amount will be tracked if available balance is insufficient to cover the charges. If tracking preference is selected as “Not Required”, then the system will debit the account for charge even if available balance is insufficient to cover the charges.

- If account overdraft check validation (ACOVD) is set up as an error, but tracking preference is selected as “Force Debit”, then the charge amount will be debited to the customer account by skipping the balance check validation and if available balance is insufficient to cover the charges. But if the tracking preference is selected as “Not Required”, the transaction fails due to insufficient fund.

Note

- The charge tracking preference is not applicable if the charge debit account is a GL

- The charge tracking preference is not applicable for Account close out products or NUM-ACC-OPN-DAYS if selected as basis.

Liquidation Preference for Tracked Charges

- Select liquidation preference for tracked charges from the adjoining drop-down list. The options available are:Partial - If ‘Partial’ is selected, the system liquidates the tracked charge amounts partially during EO only if part amount is available in the account. For example: If Rs.30 is tracked for an account and during next day EOD, system finds Rs10 is available in the account, system will try to collect the available Rs10.

- Full - If this is selected, then the system tries to liquidate the individual tracked charge amount fully during EOD. If only part amount is available in the account, system will not try to collect the part amount. For example: If Rs30 is tracked for a charge in an account and during next day EOD, system finds Rs10 is available in the account; system will not try to collect the available Rs10. But, system will wait till the time balance available in the account becomes Rs30.

Note

- The system does not validate the “Charge Tracking Preference” selected and “Liquidation Preference for Tracked Charges” selected for a given charge. This has to be operationally controlled. The “Liquidation Preference for Tracked Charges” is applicable only if the Charge tracking preference is selected as “Full Track” or “Part Debit/ Part Track”. In all other cases, the liquidation preference can be maintained as “Full” or “Partial” which will not have any impact unless any charges are tracked.

- Liquidation of IC tracked charges are done as per the logic available for other tracked amounts like RT, CL tracked amounts.

- You can define the priority of liquidation order product-wise at account class AMT block screen for IC charge products also.

The system displays override messages when:

- Available balance is sufficient to cover the transaction amount but not sufficient for the charge.

- Product level tracking is checked and when transaction amount is greater than the available balance.

The non sufficient funds tracked transactions can be reversed on the same day only, next day reversal is not allowed.

If netting is disabled for credit transactions, the charges will be deducted from the account. Hence, NSF charge tracking preference will be applicable if system is unable to collect the charge amount.

For further details refer ‘Maintaining Accounting Details’ chapter of Retail Teller user manual.

5.2 Charge Code Maintenance

This section contains the following topic:

5.2.1 Invoking Charge Code Maintenance Screen

In the ‘Charge Code Maintenance’ screen, charges based on some additional parameters which are not part of ‘ARC maintenance’ can be maintained. The charge matrix in this screen can be attached to the ARC maintenance screen for arriving at charges based on additional parameters.

You can invoke this screen by typing ‘STDCHGCD’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Specify the following details in this screen:

Charge Code

Specify a unique identifier to identify a charge code.

Charge Code Description

The description of the charge code will be defaulted here.

Parameters Mapping

In this section, actual parameter(s) based on which charges are differentiated is mapped to fixed parameter IDs. There are 5 parameter IDs provided in this section. At least one parameter should be mandatorily defined. Select the appropriate value from the adjoining option list. This list contains the following values:

- TRANSACTION_BRANCH_GROUP- This is the ARC branch group code to which the transaction branch belongs to. If the transaction branch is not grouped under any ARC branch group *.* is returned for the same.

- ACCOUNT_BRANCH_GROUP - This is the ARC branch group code to which the Account branch belongs to. If the account branch is not grouped under any ARC branch group *.* is returned for the same.

- PAYABLE_BANK_CODE - This is the beneficiary Bank Code which is used while sending an outgoing interbank BC/DD/TT.

- PAYABLE_BRANCH_CODE- This is the beneficiary Bank’s branch Code which is used while sending an outgoing interbank BC/DD/TT.

The list of factory shipped parameters which is made available in this screen are as follows:

Parameter Specific To |

Differentiating Parameter |

Description |

Applicable to transaction |

Customer |

CUSTOMER_CATEGORY |

Customer category specified at customer CIF level |

ALL |

GROUP_CODE |

Group code specified at customer CIF >Additional tab level |

ALL |

|

CLEARING_GROUP |

Clearing group specified at customer CIF >Additional tab level |

ALL |

|

TAX_GROUP |

Tax group specified at customer CIF >Additional tab level |

ALL |

|

CUSTOMER_CLASSIFICATION |

Customer Classification specified at customer CIF >Additional tab level |

ALL |

|

NATIONALITY |

Nationality specified at customer CIF level> personal/corporate tab |

ALL |

|

Transaction |

TRANSACTION_BRANCH |

Branch code at which transaction is being done |

ALL |

TRANSACTION_BRANCH_GROUP |

Branch group to which transaction branch belongs to |

ALL |

|

ACCOUNT_BRANCH |

Branch code of the transaction account |

ALL |

|

ACCOUNT_BRANCH_GROUP |

Branch group to which account branch belongs to |

ALL |

|

PAYABLE_BANK_CODE |

Payable bank code for BC/DD/TT |

BC/DD/TT |

|

PAYABLE_BRANCH_CODE |

Payable Branch for BC/DD/TT |

BC/DD/TT |

|

TO_ACCOUNT_BRANCH |

Branch code of the Credit account |

LOCH and Account to Account transfer |

|

TO_ACCOUNT_BRANCH_GROUP |

Branch group to which credit account branch belongs to |

LOCH and Account to Account transfer |

Charge Matrix

Values 1 to 5

Values 1 to 5 correspond to the respective parameter values in the Parameter Mapping section. For example Value 1 corresponds to Parameter Value 1 and so on and so forth. Select the specific values from the adjoining option list.

Charge Type

Select the charge type from the drop down list. The charge type can be flat or percentage.

Amount

Specify the charge amount in this field.

Rate

Specify the rate in this field.

Minimum Charge

Specify the minimum charge in this field.

Maximum Charge

Specify the maximum charge in this field.

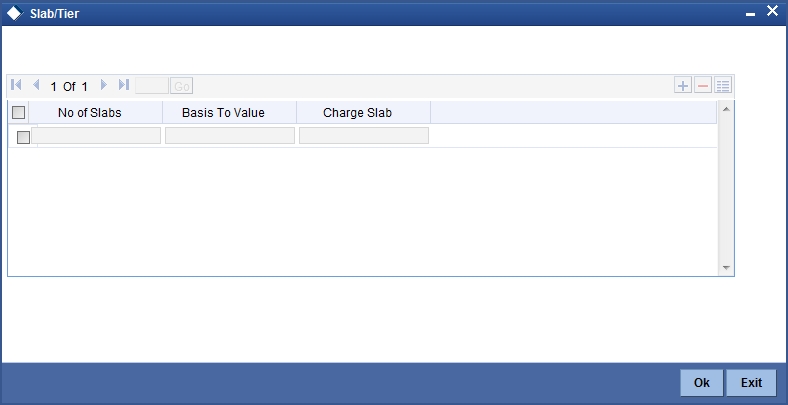

Slab Type

Select the Slab Type as Slab or Tier from the drop down list. If Slab Type is Slab or Tier, then provide the slab or tier details in the slab or tier sub-screen by clicking ‘S’ button.

In this screen, you need to specify the number of slabs, the basis to value, and charge slab details.

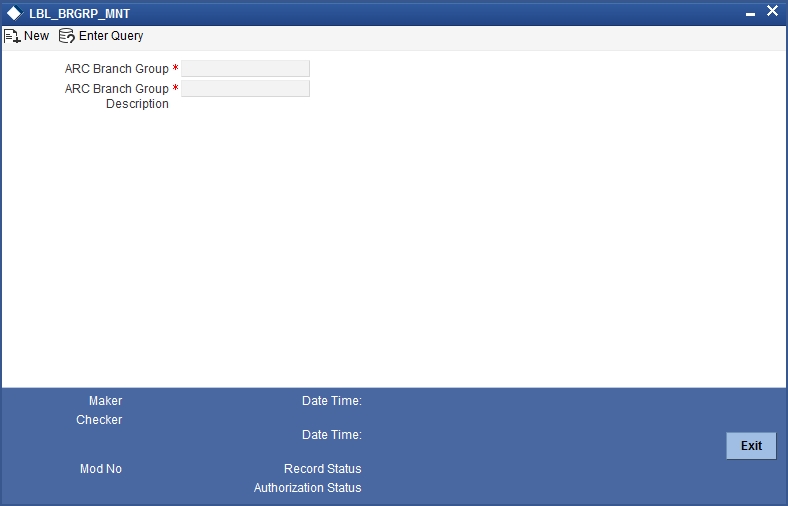

5.3 ARC Branch Group Maintenance

This section contains the following topics:

5.3.1 Invoking ARC Branch Group Maintenance

To define branch groups which are equivalent to cities or regions that the bank operates in, invoke the ‘ARC Branch Group Maintenance’ screen by typing ‘STDBRGMT’ in the field at the top right corner of the application tool bar and clicking the adjoining arrow button.

Specify the following details in this screen:

ARC Branch Group

Specify a group code to identify a group of branches.

ARC Branch Group Description

Specify a description for the branch group.

After specifying details in the ‘ARC Branch Group Maintenance’ screen, all the ARC branch groups are displayed in the ‘Branch Parameter Maintenance’ screen (STDBRANC). Select the branch group from the ‘ARC Branch Group’ field.

For more information on the Branch Parameters Maintenance screen, refer section 5 ‘Branch Parameters’ in the Core Service module.

5.4 Entity Maintenance

This section contains the following topics:

5.4.1 Invoking Entity Maintenance Screen

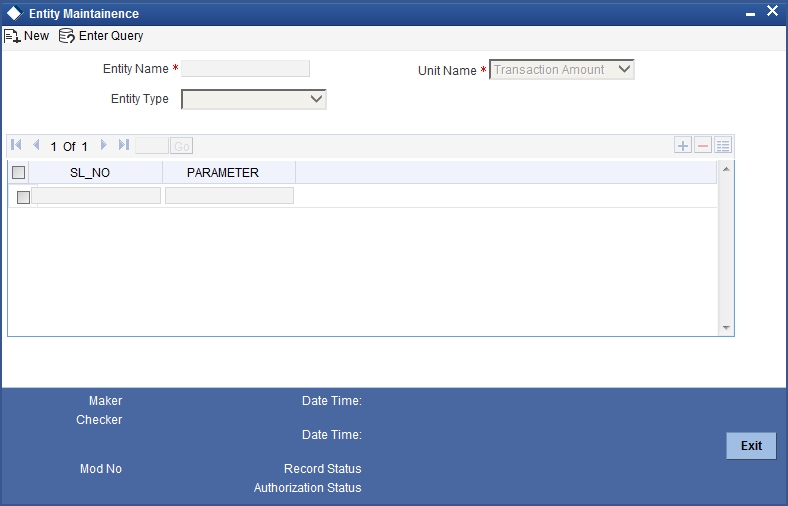

In the ARC Maintenance screen, fees or charges as a percentage of the transaction amount can be calculated for transactions exceeding the restriction amount. To calculate this fee or charge, you need to select ‘System Entity’ in the ‘Basis Field’ in the ARC Maintenance screen. Thereafter, the ‘Entity Name’ field is enabled which displays values obtained from the ‘Entity Maintenance’ screen. You can invoke this screen by typing ‘STDENMNT’ in the field at the top right corner of the application tool bar and clicking the adjoining arrow button.

Specify the following in this screen:

Entity Name

Specify the entity name to be considered for Fee Maintenance.

Unit Name

Select a value for charge consideration from the drop down list. The value provided in the drop down list are as follows:

- Exceeded Amount

- Transaction Amount

During ARC Maintenance, the following scenarios are considered if exceeded amount is selected:

- If the transaction is not exceeding the restriction utilization, then the value provided is 0.

- If the transaction is exceeding the restriction utilization partially, then the portion of the transaction amount which exceeds the restriction amount, is provided.

During ARC Maintenance, the following scenarios are considered if transaction amount is selected

- If the transaction is not exceeding the restriction utilization, then the value provided is 0.

- If the transaction is exceeding the restriction utilization partially, then the transaction amount is provided.

- If the transaction is exceeding the restriction utilization fully, then the transaction amount is provided.

Entity Type

Select the Entity Type from the drop down list. The values provided in the drop down list are as follows:

- Null

- Restriction Code

Parameter

Select the Parameter if ‘Restriction Code’ is selected in the Entity Type field, from the adjoining option list. All active restriction codes as maintained in the system are displayed in this field. For more information on restriction code maintenance, refer to the section ‘Restriction Amount Maintenance’ in the Core Services Module.

5.4.1.1 Viewing Entity Types

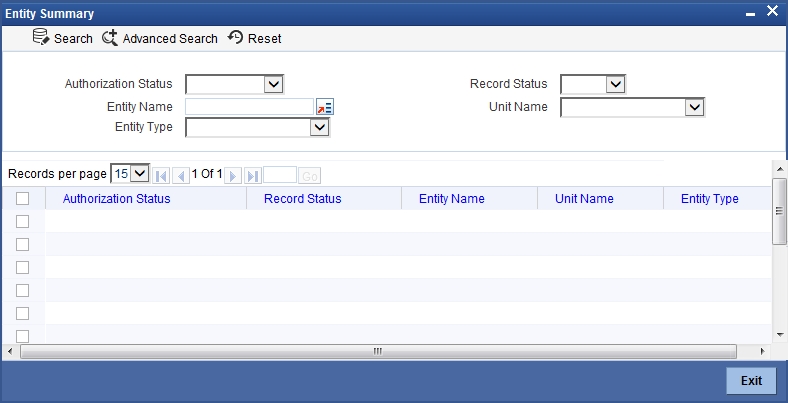

You can view the entity types in the ‘Entity Summary’ screen. You can invoke this screen by typing ‘STSENMNT’ in the field at the top right corner of the application tool bar and clicking the adjoining arrow button.

You can search for entity types by specifying values in the following fields:

- Authorization Status

- Record Status

- Entity Name

- Unit Name

- Entity Type

On updating these details and clicking the ‘Search’ button, the following columns are populated:

- Authorization Status

- Record Status

- Entity Name

- Unit Name

- Entity Type

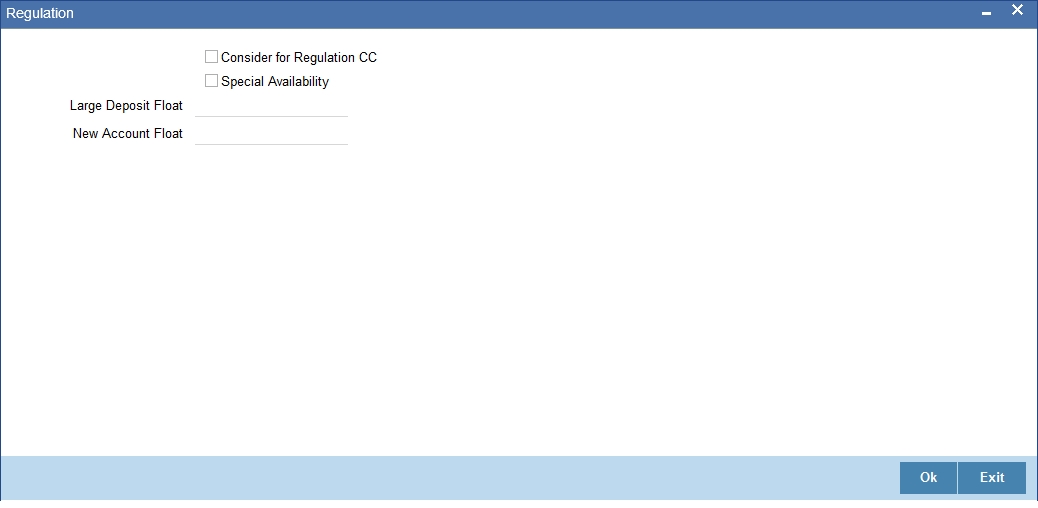

5.4.1.2 Specifying Regulation CC Availability for Clearing Products

In addition to the accounting entry and charge definition you will also have to maintain the following ARC details to incorporate the Regulation CC requirements:

- Indicate whether Regulation CC rules apply to the product that you are defining

- Each check deposited will have a nine digit routing number or a four digit routing code associated with it, which determines the clearing float days for the check and the funds availability schedule .You will have to indicate the Float Days for the product for large deposits (>5000). (For deposits falling within the 5000 range you can specify the float days in the existing Customer Float Days screen.

- Float days for new accounts

- Indicate that Special Checks that are given the next day availability should not be included in the next day availability calculation and are also not considered for large deposit exception. Checks given such special availability will not be governed by the Reg CC schedules.

Note

- In case of cash deposits, electronic payments and transactions through proprietary/non-proprietary ATM, the next day availability can be enabled through the appropriate transaction code, and these transactions must not be considered for Regulation CC.

- Checks for which collection is doubtful and re-deposited checks should be posted using separate products that are not considered for Regulation CC, with the desired float for the products being defined in the ARC Maintenance.

Availability depends upon the specifications in the Clearing House Holiday Maintenance and the Branch Holiday Maintenance. The value date is first arrived at using the clearinghouse calendar, and if it happens to be a branch holiday, it is moved to the next working day.

During transaction processing the value date for Reg CC availability for the check deposit gets defaulted based on the Credit Account and the ARC Maintenance for the Clearing Product.

To specify the Reg CC details, click ‘Regulation’ button in the ARC Maintenance screen. The Reg Details screen is opened, where you can specify the details.

The schedule for the availability of funds for check deposits under Reg CC will be calculated in the following manner:

For local and non local checks when the aggregate deposit amount in a day < 5000

Schedule |

Day |

Amount |

Sch1 |

Transaction day + 1 |

100 |

Sch2 |

Available day – 1 |

400 |

Sch3 |

Available day |

Balance |

For local and non local checks when the aggregate deposit amount in a day > 5000

Schedule |

Day |

Amount |

Sch1 |

Transaction day + 1 |

100 |

Sch2 |

Available day – 2 |

400 |

Sch3 |

Available day - 1 |

4500 |

Sch4 |

Available day |

Balance |

For federal or special checks the funds are made available only on the next business day irrespective of the amount deposited, and the checks are not considered for Regulation CC scheduling.

Account Statements

All the details of the checks deposited on a given day and the funds cleared as per the schedule will be displayed in the account statement.