2. Creating Structured Deposit Products

2.1 Introduction

Structured Deposits enable customers to invest in instruments linked to difference asset classes such as interest rates, equities, commodities, foreign exchange and credit without directly investing in the underlying assets. Structured Deposits gives an opportunity to the customers to earn higher returns than in a regular savings account. The returns from structured deposits are potentially higher than a plain vanilla deposit. However, the returns are not assured as it depends on the performance of the underlying assets.

Oracle FLEXCUBE facilitates the processing of structured deposits. Your bank can raise funds and offer structured deposits for a specific period with a pre-determined amount. The bank will decide on the fund raising amount for launching a structured deposit scheme and invites customers to invest in the scheme. The system will allow you to offer the facility of investing in structured deposit scheme for a certain period of time. After the end date if the bank successfully receives the fund raising amount required to offer the structured deposit scheme, it can launch the scheme. Consequently, the system creates term deposits for each contribution.

The bank can raise funds from any of the savings account held in the fund raising currency. The process of raising funds by utilizing the amount from the savings account is called as Subscription. The system will block the customer’s savings account for the amount that the customer wants to invest in the structured deposit till the scheme is launched. On the successful launch of the scheme, the system will release the amount from the savings account and creates term deposits.

The structured deposit can have two kinds of returns such as the Assured Returns (i.e., Term Deposit returns) and the Performance Based Returns (i.e., Performance gain or loss). You can book Assured Returns interest to the participating savings accounts by setting up the TD and corresponding IC products. The system propagates the basic interest rate of return given during the SD fund raising activity to the term deposit accounts. You can book Performance Based Returns by means of an external feed to the associated customer account created for the corpus. The performance loss or gain for each of the underlying term deposits is uploaded into the system. Subsequently the performance based return is distributed by IC products.

This chapter contains the following sections:

2.2 Structured Deposit Product Maintenance

This section contains the following topics:

- Section 2.2.1, "Invoking the SD Product Definition Screen"

- Section 2.2.2, "Viewing SD Product Summary"

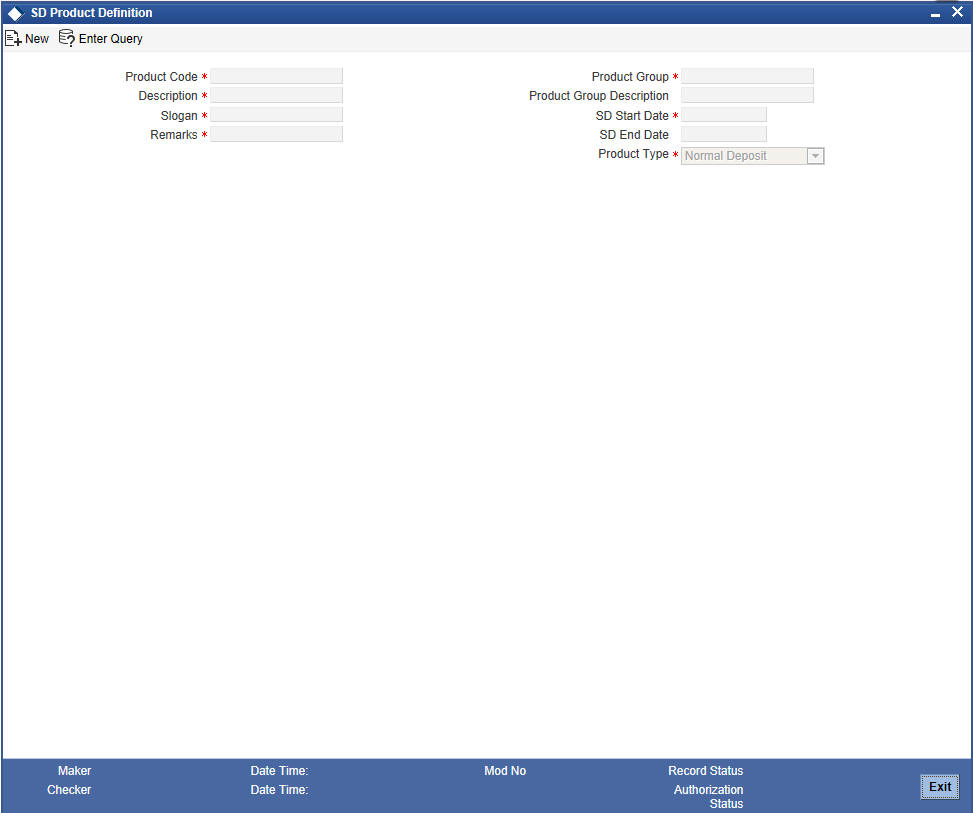

2.2.1 Invoking the SD Product Definition Screen

You first need to set up Structured Deposit (SD) products to start the fund raising activity to launch a Structured Deposit scheme. Subsequently, you can capture details of every SD fund raising activity. You can initiate several fund raising activities using a single productYou need to maintain Structured Deposit Products in the ‘SD Product Definition’ screen. You can invoke this screen by typing ‘SFDPRODT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

For any product you create in FLEXCUBE, you can define the generic attributes. Consequently, the contracts associated with the product will inherit the attributes defined for the product.

Product Code

The code you assign to a product will identify the product throughout the module. The code should contain four alphanumeric characters. You can follow your own convention for devising the code.

Since the code that you define is used to identify the product, it should be unique across the modules of FLEXCUBE. For instance, if you have assigned the code ‘SD01’ to a particular product in this module, you cannot use it as a code in any other module.

Product Description

You can enter a brief description of the product, which will be associated with the product for information retrieval purposes.

Slogan

You can specify a marketing punch-line to be associated with the product. This slogan will be printed on all the advices that are sent to the customer, for an SD involving this product.

Remarks

You can enter information about the product, intended for the internal reference of your bank. The remarks are displayed when the details of the SD are displayed or printed However, this information will not be printed on any correspondence with the customer.

Product Group

Each product is classified under a specific group. The different groups are defined in the Product Group Definition table.

Start Date

A SD product can be set up for use over a specific period, by defining a start and an end date.

The start and end dates of a product come in handy when you are defining a product for a scheme, which is open for a specific period.

End Date

A SD product can be set up for use over a specific period, by defining a start and an end date.

Enter the date till which the product should be available in the system

After the product is set up, you can associate SD contracts with the SD products. This is discussed in the next chapter of this manual.

Product Type

The product type identifies the basic nature of a product. An SD product that you create in Oracle FLEXCUBE can be of the following types:

- Normal Deposit

- Dual Currency Deposit

If you indicate the product type as Normal Deposit, the liquidation account currency of the subscription should be same as the currency of the Structured Deposit.

If you indicate the product type as Dual Currency Deposit, the liquidation account currency can differ from the currency of the Structured Deposit.

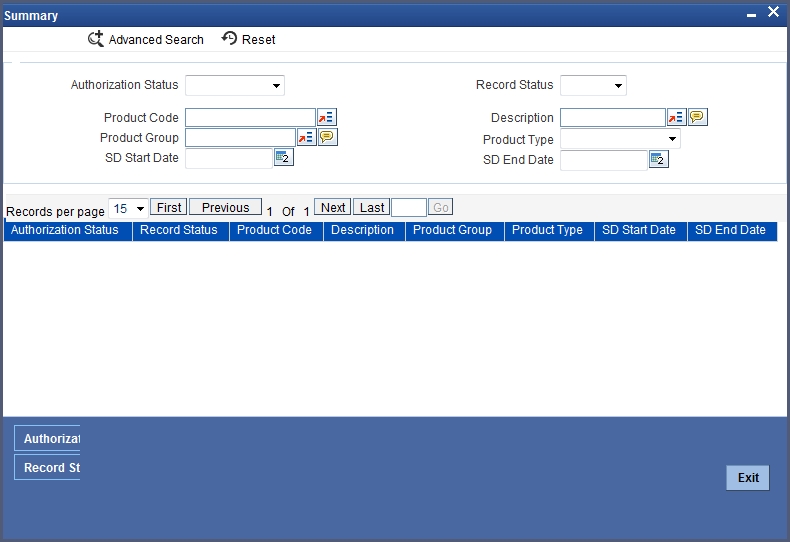

2.2.2 Viewing SD Product Summary

You can search for the SD Products in the ‘SD Product Summary’ screen. You can invoke this screen by typing ‘SFSPRODT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In this screen, you can filter the search based on the following criteria:

- Authorization Status

- Product Code

- Product Group

- Start Date

- Record Status

- Description

- Product Type

- End Date

Note

In case you do not specify the ‘End Date’, the system considers the product you filter, as open ended.