3. Processing Structured Deposit Contracts

Once you have set up Structured Deposits (SD) products, you will be able to capture the details pertaining to every fund raising activity. These are maintained as SD contracts in Oracle FLEXCUBE.

This chapter contains the following sections:

- Section 3.1, "Fund Raising Activity"

- Section 3.2, "Subscriptions for Structured Deposits"

- Section 3.3, "Status Tracking"

- Section 3.4, "Structured Deposit Launch"

- Section 3.5, "Launching of Structured Deposits "

- Section 3.6, "Closing Structured Deposits"

- Section 3.7, "Exceptions for Structured Deposits"

- Section 3.8, "Net Asset Values"

3.1 Fund Raising Activity

This section contains the following topics:

- Section 3.1.1, "Capturing the Fund Raising Activity Details"

- Section 3.1.2, "Specifying the Structured Deposit Details"

- Section 3.1.3, "Interest Button"

- Section 3.1.4, "Subscription Button"

3.1.1 Capturing the Fund Raising Activity Details

As mentioned earlier, for every fund raising activity, your bank can accept funds from existing saving accounts. Once the customers confirm the amount that they wish to invest in the structured deposit, you need to record it in the system as a contract. The system will block that amount in their savings account. Once the bank receives the necessary amount through various subscriptions, it can launch the SD scheme. Consequently, all the subscriptions that the bank had entered into will also be launched. The system will release the amount from their savings account and creates term deposits.

The Structured Deposit details are maintained as Contract Details in the ‘SD Definition’ screen The contract details basically will include all the properties for the SD like interest, currency, maturity date (SD End Date). After you enter and save the SD contracts, your bank can accept subscriptions for the contracts. Effectively, subscription is the way in which the bank raises the money for any SD. These details are maintained as Subscription details.

3.1.2 Specifying the Structured Deposit Details

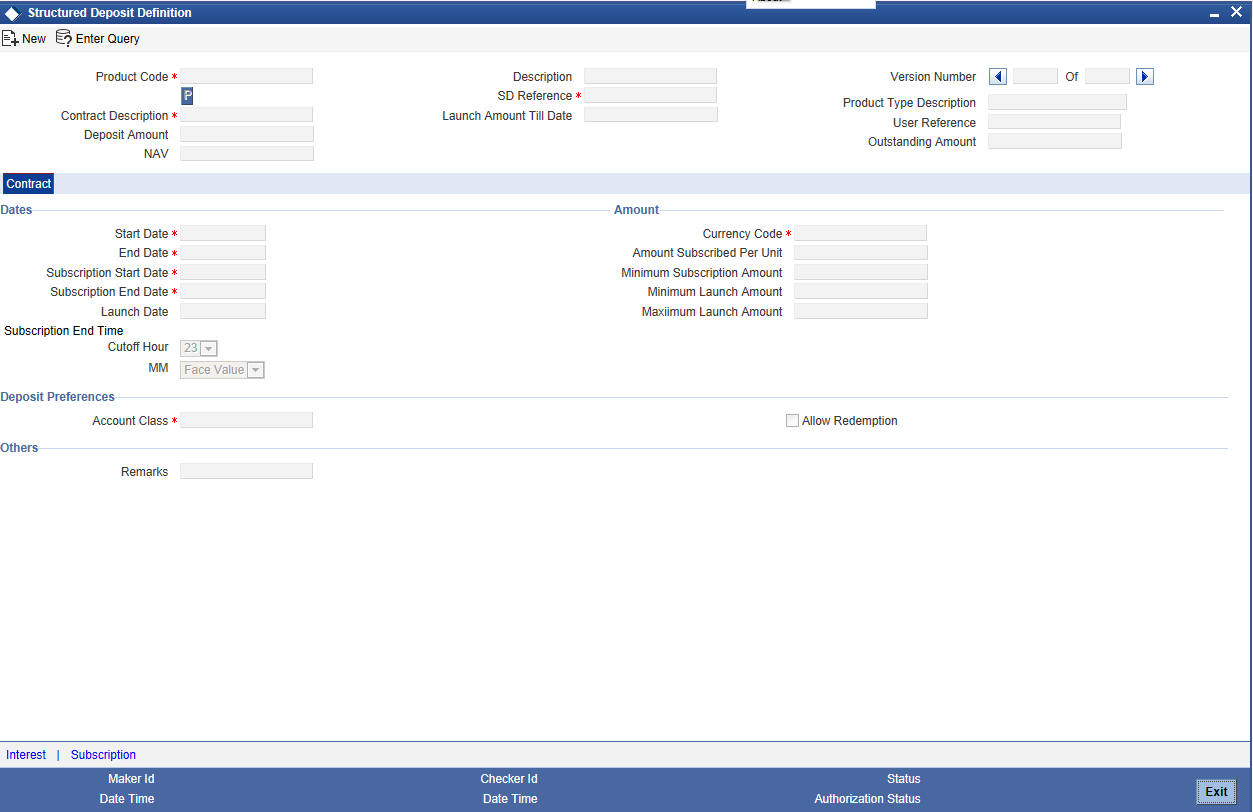

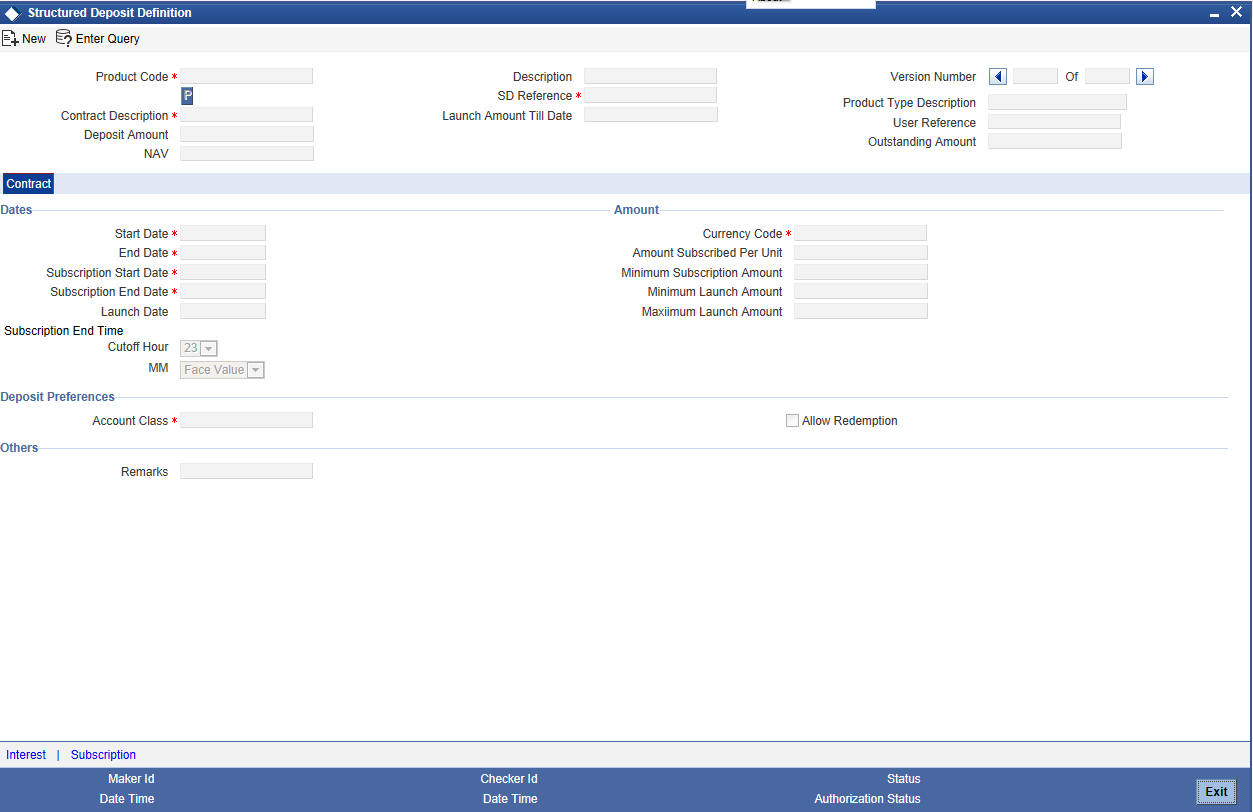

The SD contracts are maintained in the ‘Structured Deposit Definition’ screen. You can invoke this screen by typing ‘SFDTRONL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. The ‘Structured Deposit Definition’ screen is displayed.

The details that need to be maintained at the time of recording each fund raising activity are discussed below:

Product Code

Select the product from the list of products created under Structured Deposits. The details of this product get defaulted from the Product screen.

Product Description

A brief description of the SD Product is displayed in this field.

Product Type Description

A brief description of the SD Product Type is displayed in this field.

Contract Description

You can enter a brief description of the contract, which will be associated with the contract for information retrieval purposes.

Structured Deposit Reference Number

Specify the SD Reference Number based on the mask maintained in ‘Account Mask Parameters’ screen at the Branch Parameters level. However, The system would generate the SD Reference Number if the field, ‘Loan Account Auto Generate’ is checked in ‘Account Mask Parameters’ screen at the Branch level.

The SD Reference Number is a combination of the branch code, the product code, the date on which the contract is booked (in Julian format) and a running serial number for the booking date.

The Reference Number consists of a three-digit branch code, a four-character product code, a five-digit Julian Date and a four-digit serial number.

The Julian Date has the following format:

YYDDD

Here, YY stands for the last two digits of the year and DDD for the number of day(s) that has/have elapsed, in the year.

SD User Reference Number

In addition to Contract Reference Number, a unique User Reference Number also identifies a contract. By default, the Contract Reference Number generated by the system will be taken as the User Reference Number. But you have the option to change the User Ref Number. However, the User Reference Number has to be unique across various modules of Oracle FLEXCUBE.

Oracle FLEXCUBE also provides you the facility to generate the user reference number in a specific format

Note

You can specify a format for the generation of the User Reference Number in the ‘Sequence Generation’ screen available in the Application Browser. Refer to the Core Services User Manual for details on maintaining a sequence format.

Subscription Amount Till Date

Based on the number of subscriptions received, the system displays the amount that the bank has raised through the subscriptions. The system displays the amount after taking into account the unauthorized subscriptions also.

NAV

This is applicable only after the contracts for the SD is launched. After the SD is launched, you can feed the Net Asset Value for the contracts in the NAV Input screen. Consequently, the system picks up the NAV and displays here.

Refer to the section ‘Feeding the Net Asset Values’ in this chapter for details.

Launch till Date

This is the amount equal to the total subscription amount on the date of launch.

Outstanding Amount

The system updates this amount during TD redemptions. You can partially redeem subscriptions. For example, let us assume that the bank decides on the launch amount as USD 10000 and is offering 10 subscriptions of 1000 USD each. A customer can redeem USD 500. Consequently, the outstanding amount will be USD 9500.

Dates

As part of recording each fund raising activity, you need to capture the dates of each subscription.

Start Date

This indicates the start date of the contract.

End Date

This is the end date of the contract. If the bank raises the funds successfully, this end date will be the maturity date of the term deposits. The system defaults the end date to the end date of the associated product.

The system validates the end date with the holidays maintained for your branch. If the end date falls on a branch holiday, the system displays an override message.

Note

The system validates the end date against branch holidays every time you modify the end date of the contract.

Subscription Start Date

This is the date from which the bank starts the fund raising activity to float the structured deposit scheme. The customers can start subscribing for the SD scheme from this date. The subscription start date should necessarily be within the SD Start and End date.

Subscription End Date

This is the date by which the bank has to raise the money for floating the SD scheme. The customers can subscribe till this date.

Launch Date

The bank will launch the structured deposit scheme on the launch date. The bank can also launch the contracts manually if the necessary funds are raised through various subscriptions. On launching the contract manually, the launch Date will be the Next Working Date of the Branch. On the day of launching, the system will convert all amount blocks into term deposits.

If you do not specify the launch date, the system will default the launch date as the next working date after the subscription end date.

Subscription End Time

In addition to the end date for subscription, the bank can also specify the cut off time for the last day of the subscription till subscriptions are accepted for the SD scheme.

Amount

You need to specify the following amount details for the contract.

Currency Code

You need to indicate the currency of the SD contract.

Amount Subscribed Per Unit

You need to enter the amount for each subscription unit. For example, let us assume that the launch amount is USD 10,000. If a customer subscribes for ten subscriptions, the amount subscribed per unit will be USD 1000.

Minimum Subscription Amount

The bank can specify that the customers cannot subscribe less than a specific amount to enter into a SD contract. You need to enter this as the minimum subscription amount.

Minimum Launch Amount

The bank can launch the SD scheme after it receives a certain amount of funds. This refers to the minimum launch amount.

Maximum Launch Amount

This is the maximum amount that the bank needs to float the SD scheme. The funds required to start the SD scheme should be within the Minimum Launch Amount and Maximum Launch Amount range.

Deposit

As part of entering the contract details, you need to specify the account class which will be used to create the term deposits on successful launching of the SD scheme.

Account Class

During the launch of a SD scheme, the system releases the amount blocks from the participating savings accounts and converts them to term deposits. Therefore, you need to associate the account class Deposit with the SD contracts.

You need to capture the Account class before the launch. Consequently, the system will automatically generate the term deposits during the launching of the SD scheme. Additionally, the subscription details will also be updated with the term deposit account details accordingly.

Premature Redemption

Select the option ‘Allow Premature Redemption’ to allow cancellation of SD after launch, premature closing individual TDs and individual TD partial liquidation.

Other

Remarks

Specify any additional information about the SD.

In Oracle FLEXCUBE, the returns from structured deposits will include term deposit interest as well as performance gain or loss.

All structured deposits can have two kinds of returns:

- Term Deposit returns

- Performance based returns

Term Deposit returns is assured returns. The term deposit interest will be given to the participating savings accounts by means of setting up TD and corresponding IC products. The system will propagate the basic interest rate of return given during the SD fund raising activity to the term deposit accounts.

Performance based returns or performance gain or loss is booked by means of an external system to the associated customer account. The external system will feed the total income for each of the underlying term deposits. Subsequently, Oracle FLEXCUBE calculates the performance based return as net of the interest computed for the term deposit and distributes amongst the term deposits.

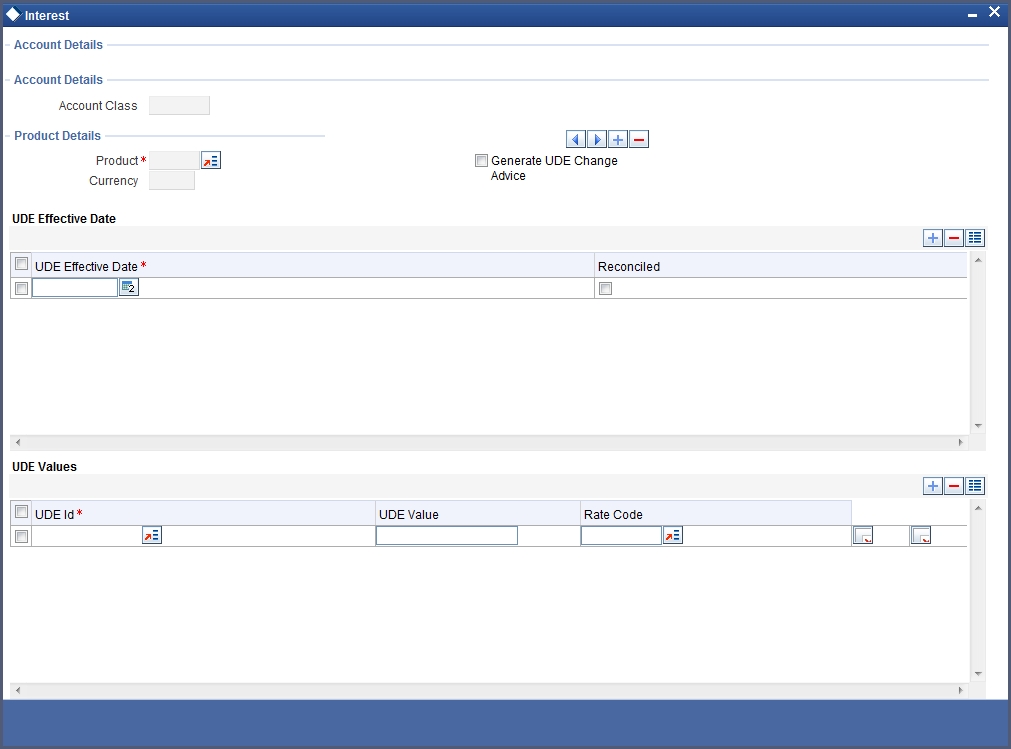

3.1.3 Interest Button

You need to specify the method for calculation of interest on the term deposits.

In Oracle FLEXCUBE, interest is calculated using the interest rules that you define. You can define the interest rules to suit the peculiar requirements of your bank. The rules are then associated to Interest and Charges products.

For further information on the Defining Interest Rules and Products, refer to the following Oracle FLEXCUBE User Manuals:

- Interest and Charges

- Products

Click ‘Interest’ button to specify the conditions for calculating the interest on the deposits. The ‘IC Special Conditions Maintenance’ screen is displayed.

The features of this screen are as discussed below:

Account Details

Account Class

The system defaults the account class from the SD Contract main screen.

Product Details

Product Code

Select the IC product based on which you want the system to calculate the interest. The interest accrual and liquidation will happen based on the periodic frequency set for the IC product that you select.

UDE Currency

Based on the IC product that you select, the system displays the corresponding currency. You are not allowed to modify the currency.

Generate UDE Change Advice

Check this field to indicate advice generation in the events of interest liquidation and interest rate change.

UDE Dates

You need to indicate the date from which the system should start calculating the interest on the automatically generated term deposits.

For more details on defining UDE Dates and UDE Values, refer to the section, ‘Defining Special Condition’ in the chapter, ‘Applying Interest Product on Account’ of the ‘Interest and Charges‘User Manual.

3.1.4 Subscription Button

You need to enter the subscription details for the SD contracts in the Structured Deposit Subscription screen. This is discussed in the next section of this chapter. You can enter the subscription details after saving the SD contracts.

At the time of defining a SD contract, you can click ‘Subscription’ button to view if there are any subscriptions for the contract.

At the time of creating a new contract, you will not be able to view the subscriptions as you would not have recorded any subscriptions before saving the contract. The system will display the subscription details after you enter subscriptions against the contracts.

You can view the following fields in this screen:

- Subscription Reference Number

- Customer Account Number

- Date

- Amount

- Subscription Branch

- Currency

- Subscription Status

- TD Account Number

- TD Branch

Refer to the next section ‘Capturing Subscriptions for Structured Deposits’ for detailed explanation.

3.2 Subscriptions for Structured Deposits

This section contains the following topics:

- Section 3.2.1, "Capturing Subscriptions for Structured Deposits"

- Section 3.2.2, "Redeeming Structured Deposits"

- Section 3.2.3, "Cancelling Structured Deposits"

- Section 3.2.4, "Viewing Subscription Summary"

- Section 3.2.5, "Saving the Structured Deposit Subscriptions"

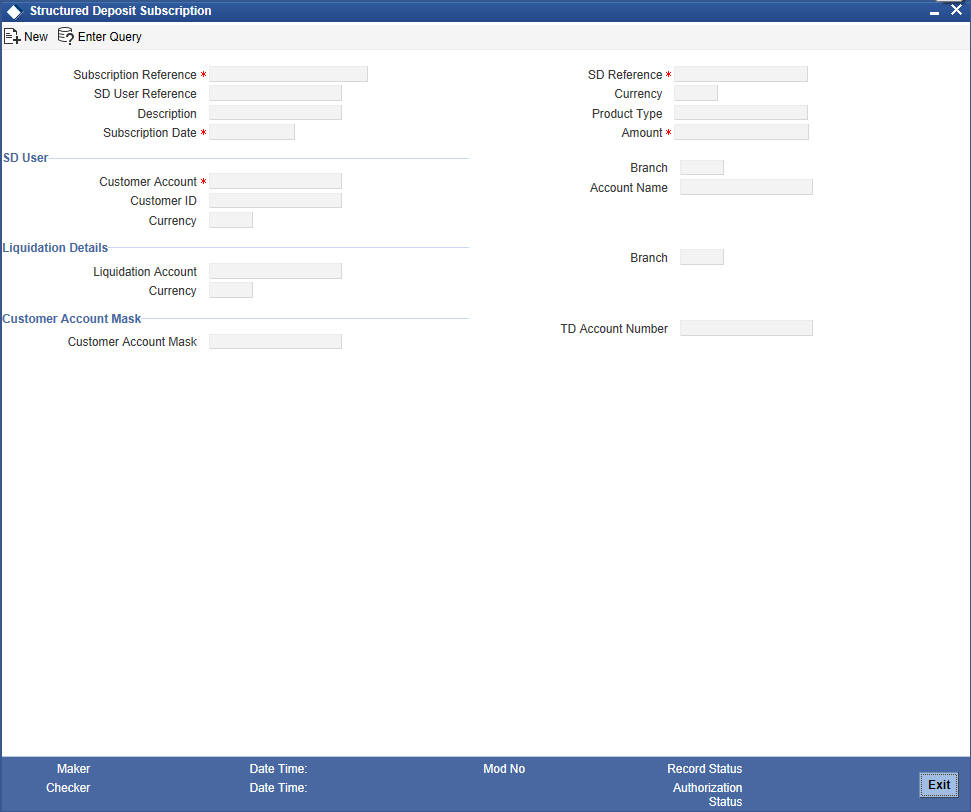

3.2.1 Capturing Subscriptions for Structured Deposits

After saving the SD contracts, you can record the subscriptions against the SD contracts in the ‘Structured Deposit Subscription’ screen. You can invoke this screen by typing ‘SFDSUBSC’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In this screen, you can enter the subscriptions for the SD contracts.

SD Reference Number

Select the contract for which you are entering the subscription. The system displays the corresponding contract description, SD User Reference Number and the product type.

Subscription Ref Number

The system sequentially generates and displays the reference number for each subscription that you enter.

SD User Reference

The system displays the SD User Reference maintained at ‘Structured Deposit Definition’ screen for the SD Reference Number you selected.

Description

The system defaults a brief description of the SD maintained at ‘Structured Deposit Definition’ screen for the SD Reference Number you selected.

Subscription Date

You need to enter the date on which the system should block the amount from the account. This date should effectively be within the Subscription Start and End Date for the selected contract. The system defaults the application date. The subscription date cannot be greater than the application date. If you are recording the subscription on the last specified for subscriptions, the system checks for the corresponding SD contract’s subscription cut-off time.

Currency

The currency of the account is displayed.

Product Type

The SD product type is displayed.

Amount

Enter the subscription amount. The subscription that you enter should be greater than or equal to the minimum subscription amount for the contract. This amount will be blocked in the customer account that you specify next.

Subscription Details

Customer Account

You need to enter the account number of the customer who is subscribing for the Structured Deposit. The system displays all the savings accounts maintained for the branch that you are logged into. Select the appropriate customer account number for which the system needs to block the subscription amount.

Note

The currency code of the customer account and the Structured Deposit contract should be the same.

Customer ID

The CIF number of the subscribing customer is displayed.

Currency

The currency of the customer account is displayed.

Branch

The branch of the subscribing customer’s account is displayed.

Account Name

The account name of the subscribing customer is displayed.

Liquidation Details

Liquidation Account

On maturity of the SD contract, the system will credit the returns into the liquidation account that you specify here.

Note

- If the SD product is of type Normal, the liquidation account currency should be the same as the SD currency.

- If the SD product is of type Dual Currency Deposit, the liquidation

account currency can be different from the SD currency

If you do not specify the liquidation account, the system will use the customer subscription account for liquidation. If you specify a liquidation account which does not belong to the subscription account customer, the system displays an override to indicate the same.

The liquidation account can be of any currency.

Currency

The currency of the liquidation account is displayed

Branch

The branch of the liquidation account is displayed.

TD Account Details

Customer Account Mask

The system displays the format defined for account numbers for the branch

TD Account No

On successful launching of the SD, the system releases the amount block from the savings account and creates a term deposit account for each subscription. You need to enter the account number for the term deposit that has to be created for the subscription that you are entering. The account number should be in line with the account mask.

3.2.2 Redeeming Structured Deposits

If the bank is not successful in raising the necessary funds for starting the SD scheme, the bank can reverse/ redeem the SD contract after it is launched. In other words, if the total subscription amount is lesser than the minimum threshold amount and the date is greater than the subscription date, you will need to reverse the SD contract.

You can reverse a structured deposit contract through the ‘Structured Deposit Definition’ screen. Invoke the contract that you wish to reverse.

The status of the deposit will be ‘Active’ and the authorization status as ‘Authorized’. To reverse the contract, click reverse icon or select the option ‘Reverse’. The status of the contract will be set to Cancellation Initiated.

You have to unlock and enter the pre-closure date from the Structured Deposit Definition screen to redeem the SD after launch before maturity and the ‘REVERSE’ operation in the toolbar is disabled.

The SD BOD Batch will pre-redeem all the TD’s under the SD’s for the current branch which are in the status as ‘Redemption initiated’ or ‘Redeemed Partially’ on the pre-closure date.

During SD batch processing for all deposits with the status Redemption Initiated or Redeemed Partially, the amount block done during the subscription on the customer account will be released Incase of any exceptions, the SD contract will be reversed partially

3.2.3 Cancelling Structured Deposits

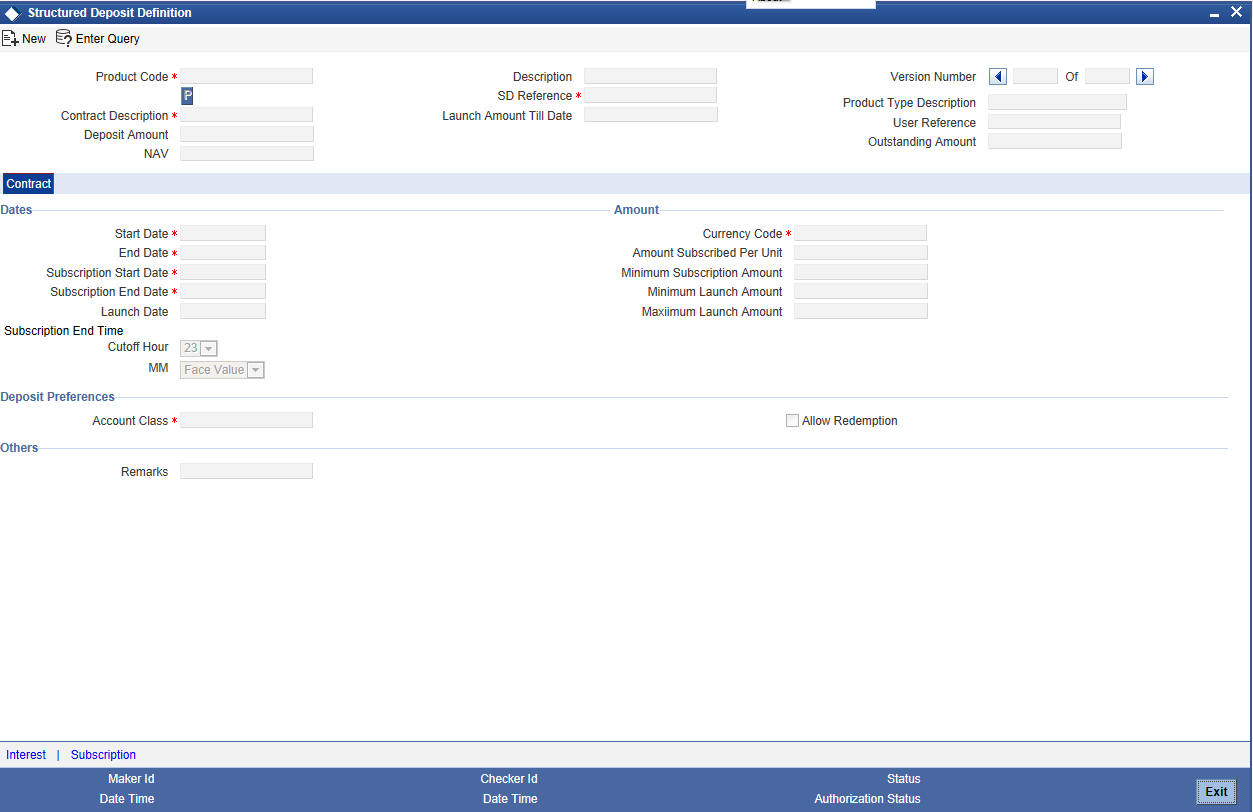

You can cancel structured deposit contracts that have been launched but to mature You can cancel a structured deposit contract through the ‘Structured Deposit Definition’ screen Invoke the contract that you wish to cancel.

The ‘Structured Deposit Definition’ screen is given below:

The status of the deposit will be ‘Launched’.

The Structured Deposit Definition screen facilitates to enter the effective date for pre-closure of a Structured Deposit (SD) after launch before the maturity date is provided This enables the system to process pre-closure of the TD under that SD during the BOD of the effective Date

The criteria for pre-closure date are as follows:

- The pre-closure date should be greater than the launch date and should be before the maturity date. The pre-closure date should be later than the current transaction date also.

- The system should process this date and pre-redeem all the Term Deposits (TD) under this SD during the BOD on this pre-closure date.

- The SD is auto closed on the maturity date if the pre-closure date is not provided

- An override message is provided, whenever the pre-closure date is newly given or when modified the existing pre-closure date

The system internally tracks the following SD Reference Status:

SD Status |

Details |

Redemption initiated |

User enters a pre-closure date which is after launch before maturity |

Redeemed Partially |

In case the reversal process in the BOD results in exception |

Redeemed |

When the SD has been closed after launch before maturity |

- The pre-closure date cannot be entered, if the SD contract is open

- The pre-closure date should be allowed to be amended if the SD contract is launched

- The status changes to ‘Redemption initiated’ after entering pre-closure date if the user has authorized the transaction.

- The pre-closure date can be amended by the user till one day before the pre- closure. The new pre-closure date should always be greater than the application date.

On cancellation, during the EOD operations, the premature redemption of the term deposits will occur. The principal liquidation branch/account of the TD will be used in case of normal deposits. In case of dual currency deposits; the principal will be liquidated into the liquidation account. The status of the contract will be set to Cancelled.

Incase of exceptions where in the term deposits cannot be closed, the status will be set to ‘Cancelled Partially’

3.2.4 Viewing Subscription Summary

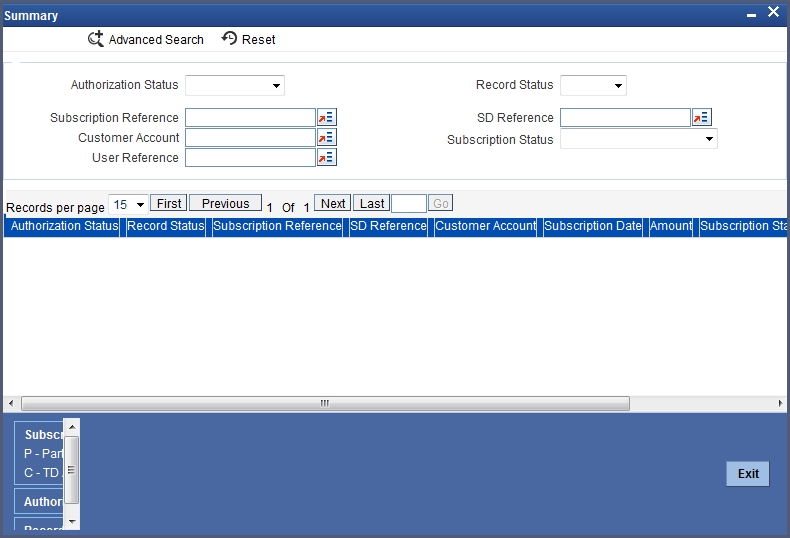

You can search for the subscription details in the ‘Subscription Summary’ screen. You can invoke this screen by typing ‘SFSSUBSC’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In this screen, you can filter the search based on the following criteria:

- Authorization Status

- Subscription Reference Number

- Customer Account

- Subscription Status

- Record Status

- SD Reference Number

- Currency

- User Reference Number

3.2.5 Saving the Structured Deposit Subscriptions

After you enter all the subscription details, you need to save the subscription details. Click save icon to save the contract.

Upon saving the subscription, the system:

- Validates the SD maximum launch amount If the maximum launch amount is reached (inclusive of all subscriptions done till that point of time – both authorized and unauthorized subscriptions) upon booking a particular subscription against the contract, an override message “Maximum Launch Amount has been breached” is displayed indicating the same.

- Updates the Subscription Till Date

- Validates the subscription amount against the minimum subscription amount and amount subscribed per unit An error message is displayed if there is any error

- Validates the subscription account and liquidation account as per the deposit type validations

- Validates the TD Account Number format based on the TD Account Number mask

- Validates for duplicate account numbers When doing this validation, the system considers account numbers created using both Subscription and Customer Account modules.

- Generates the TD account automatically if the option ‘Auto Generate’ in the ‘Branch Parameters’ screen is selected.

Note

On saving a subscription, the system checks if there is sufficient balance in the customer savings account. Incase of insufficient balance, the system will not allow the subscription.

3.3 Status Tracking

The system will internally track the status of the structured deposits. It marks the status of the SD in its lifecycle.

The various statuses that a SD contract can have are depicted in the table below:

SD Status |

Details |

Active |

Status when the SD has been created and is open for subscriptions |

Reversal Initiated |

Status when you initiate a reversal of the SD. You can initiate a reversal only before the SD is launched |

Reversed Partially |

Status when the reversal process results in exceptions |

Reversed |

Status when the fund raising has been terminated due to minimum threshold not being met |

Launch Initiated |

Status when the launch is initiated |

Launched Partially |

Status when the launch process results in exceptions |

Launched |

Status when the SD launch has been completed i.e., Term Deposits have been created during the SD Batch process |

Cancellation Initiated |

Status when you initiate a closure after launch before maturity incase of deteriorating performance of the SD |

Cancelled Partially |

Status when the cancellation process results in exceptions |

Cancelled |

Status when you close a SD after launch and before maturity |

Closed |

Status when the SD runs successfully for the entire tenor and closes on the maturity date |

The stage wise possible status change is shown below:

To Status→ |

Open |

Cancellation initiated |

Cancelled Partially |

Cancelled |

Launch initiated |

Launched Partially |

Launched |

Redemption initiated |

Redeemed Partially |

Redeemed |

Closed |

Open |

√ |

√ |

X |

X |

√ |

X |

X |

X |

X |

X |

X |

Cancellation initiated |

X |

X |

√ |

√ |

X |

X |

X |

X |

X |

X |

X |

Cancelled Partially |

X |

X |

√ |

√ |

X |

X |

X |

X |

X |

X |

X |

Cancelled |

X |

X |

X |

X |

X |

X |

X |

X |

X |

X |

X |

Launch initiated |

X |

X |

X |

X |

X |

√ |

√ |

X |

X |

X |

X |

Launched Partially |

X |

X |

X |

X |

X |

√ |

√ |

X |

X |

X |

X |

Launched |

X |

X |

X |

X |

X |

X |

X |

√ |

X |

X |

√ |

Redemption initiated |

X |

X |

X |

X |

X |

X |

X |

X |

√ |

√ |

X |

Redeemed Partially |

X |

X |

X |

X |

X |

X |

X |

X |

√ |

√ |

X |

Redeemed |

X |

X |

X |

X |

X |

X |

X |

X |

X |

X |

X |

Closed |

X |

X |

X |

X |

X |

X |

X |

X |

X |

X |

X |

3.4 Structured Deposit Launch

This section contains the following topics:

3.4.1 Initiating the Structured Deposit Launch

You can launch a structured deposit contract after you receive sufficient subscriptions to raise the necessary fund. The Structured Deposit contract can be launched from the branch where the contract was created.

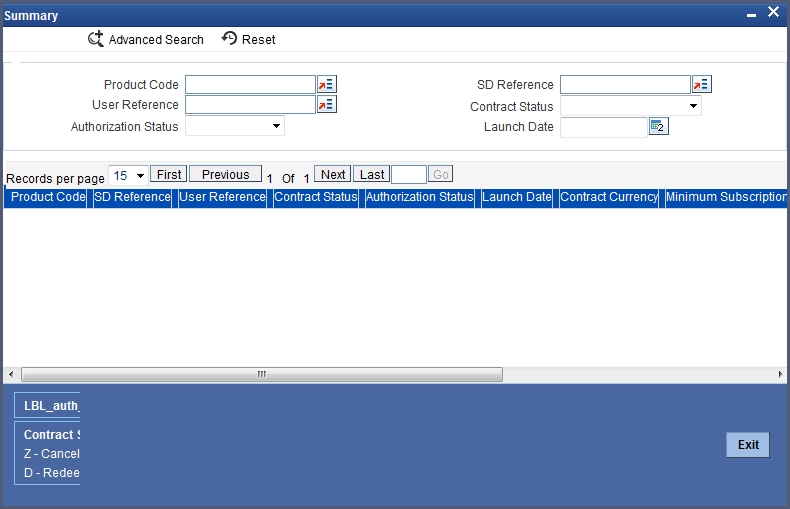

You can launch a SD scheme from the Structured Deposit Definition screen. You can invoke this screen by typing ‘SFSCONON’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. Invoke the contract that you wish to launch from this screen.

The status of the deposit will be ‘Active’ and the authorization status as ‘Authorized’. To launch the contract, click on liquidate icon or select the option ‘Liquidate’. The status of the contract will be set to ‘Launch Initiated’.

3.5 Launching of Structured Deposits

During Beginning of Day operations, the system will run the branch–wise SD batch process in addition to other batch processes

All subscriptions captured for the structured deposit with status as Open or Launch Initiated or Launched Partially and Launch Date less than or equal to the application date and created in the current branch will be processed during the SD batch process.

During SD Batch processing:

- The amount block done during subscription will be released and new term deposits will be created in the branch of the associated SD contract

- The subscription amount will be the term deposit amount.

- The charge booking branch and account will be through the new TD account

- The interest booking branch and account will be through the customer branch and account of the subscription in case the SD product type is normal. In case of DCD type deposits, the interest booking branch/account will be the liquidation customer branch/account given during subscription.

- Calculation of interest and charges will start from the date of launch. Interest and charges will be calculated according to the selected IC product

- The UDE details for the RATE will be defaulted with the basic interest rate of the SD product

The deposit details of the TD accounts created by the system during SD batch process will be as follows:

- Principal liquidation branch/account will be the customer branch/account of the subscription if the SD product type is Normal. If the SD product is of Dual Currency Deposit type, the Principal will be liquidated to the liquidation account number specified during subscription

- Calculation of interest from the launch date The tenor for interest calculation purpose will be from the launch date to the SD End date. The last date of the SD is set as the maturity date for the SD scheme.

- Customer branch/account of the subscription will be the offset branch/account.

- The SD will be closed on the maturity date

- TD pay-in option will be TD pay-in by Savings

- Customer branch/account of the subscription will be the offset branch/account

- Currency will be the currency of the SD contract

- Auto Rollover will not be done

- For all term deposits created through SD’s, the system will not allow modification of interest and deposit parameters in the TD maintenance screen.

- The exchange rate will be used as the standard rate for currency conversion in case of Dual Currency Deposit types

- The status against the SD Reference Number will be set to ‘Launched’ and subscription will be marked as processed successfully.

The Structured Deposit will be launched partially under the following circumstances:

- If the amount block cannot be released

- If the term deposit account cannot be created

3.6 Closing Structured Deposits

If all the term deposits are closed after the tenor of the structured deposit, the status of the SD contract will be updated to ‘Closed’ during EOD operations. The status will be updated to closed for the SD contracts whose application date is greater than or equal to the SD end date

If the term deposits have not matured, the SD cannot be marked as closed Under such circumstances, the status of the contract will be updated to ‘Closed Partially’

3.7 Exceptions for Structured Deposits

This section contains the following topics:

3.7.1 Handling Exceptions for Structured Deposits

During SD batch process, the system might encounter errors while processing certain structured deposits. For example, the system might not be able release the amount block during the launch of a SD. The system will handle such circumstances as Exception Handling.

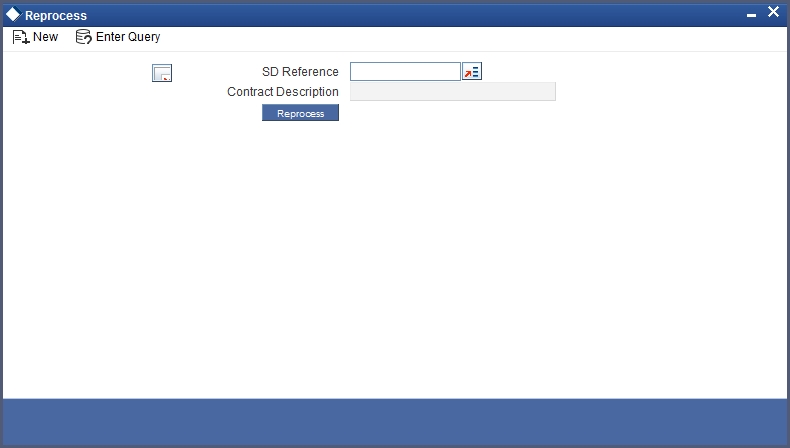

In Oracle FLEXCUBE, you can reprocess the structured deposit contracts that failed earlier. This is done in the ‘Structured Deposit Reprocess’ screen. You can invoke this screen by typing ‘SFDREPRO’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Select the option ‘Reprocess’ under ‘Structured Deposits’ menu item in the Application Browser.

SD Reference Number

Specify the SFD reference number. The system displays the description based on the selected reference number.

Status

You can reprocess the SD’s with the following statuses:

- Launched Partially

- Reversed Partially

- Cancelled Partially

Select the SD contract that you wish to reprocess and click ‘Reprocess’ button.

3.8 Net Asset Values

This section contains the following topics:

3.8.1 Feeding the Net Asset Values

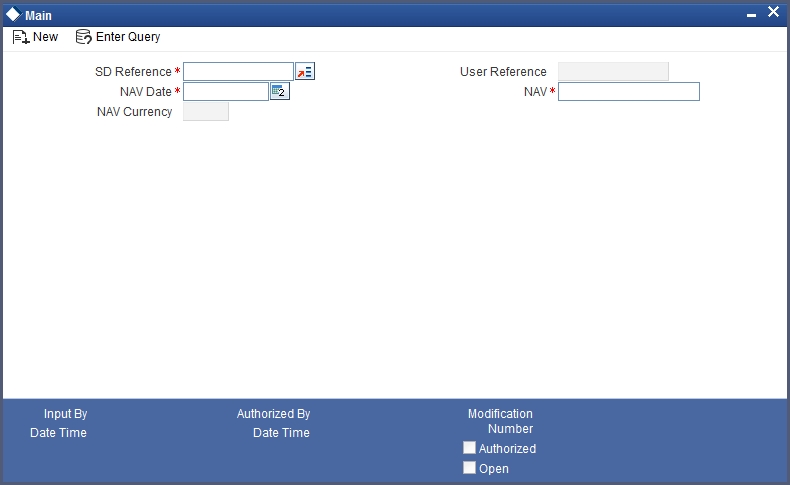

As mentioned earlier, you need to maintain the Net Asset Values (NAV) after the SD contracts are launched You need to enter the NAV for the SD contracts that you have launched in Oracle FLEXCUBE.

The NAV’s are captured in the SD NAV Input screen. You can invoke this screen by typing ‘SFDNAVIN’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In this screen, you need to enter:

- The SD contract reference for which you want to enter the NAV

- The date on which you are feeding the NAV

- The currency of the NAV

- NAV