3. Reports

This chapter contains the following section:

3.1 Tax Payable Report

This section contains the following topics:

3.1.1 Generating the Tax Payable Report

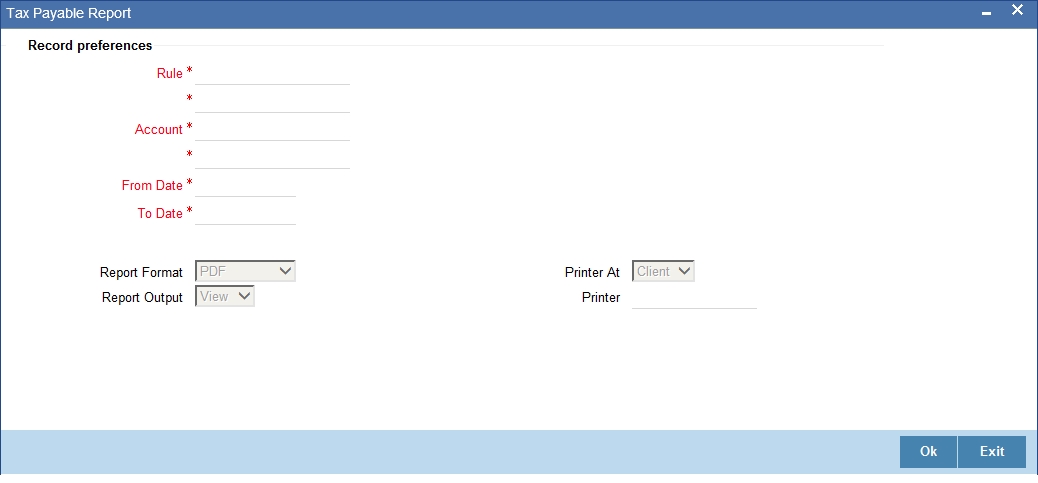

The Tax Payable Report gives details of all taxes that are to be paid over a period in time. You can specify the period for which you require the report when you invoke the report function. In the Application Browser, this report is available under the Modularity/Tax module.

To invoke this screen type ‘TARAYABL’ in the field at top right corner of the Application tool bar and click the adjoining arrow button.

3.1.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. The contents of this report are discussed under the following heads:

Header

The Header carries the title of the report, information on the branch code, the ID of the user who generated the report, the date and time at which it was generated, the branch date, the modules covered in the report.

Body of the Report

The following details are displayed in the report

Rule |

The rule of the transaction |

Account |

The account class of the transaction |

Currency |

The currency of the transaction |

From |

The period of the transaction from when the tax has to be paid |

To |

The period of the transaction till when the tax has to be paid |

Reference Number |

The contract reference number |

Value Date |

The value date of the transaction |

Amount |

The amount payable |