2. Book Transfer

2.1 Introduction

You can do fund transfer between two accounts of the same bank in Payments. Account to account transfers can be initiated as single payments or can be initiated as a part of bulk file uploads. A network of type "Book Transfer” has to be maintained in Network Maintenance (PMDNWMNT) for supporting book transfer transactions. ‘Book Transfer’ is the payment type attached for this network. Payments can be initiated with this Payment type only if both credit and debit accounts are available in External Account Maintenance. Payment type ‘Book transfer’ allows only ‘outgoing’ transaction type.

This chapter contains the following sections:

- Section 2.2, "Book Transfer Input"

- Section 2.3, "Book Transfer View"

- Section 2.4, "Book Transfer - Web Services/REST Services"

- Section 2.5, "Book Transfer Processing"

2.2 Book Transfer Input

This section contains the below topics:

- Section 2.2.1, "Initiating Book Transfer"

- Section 2.2.2, "Main Tab"

- Section 2.2.3, "Pricing Tab"

- Section 2.2.6, "Viewing Book Transfer Summary"

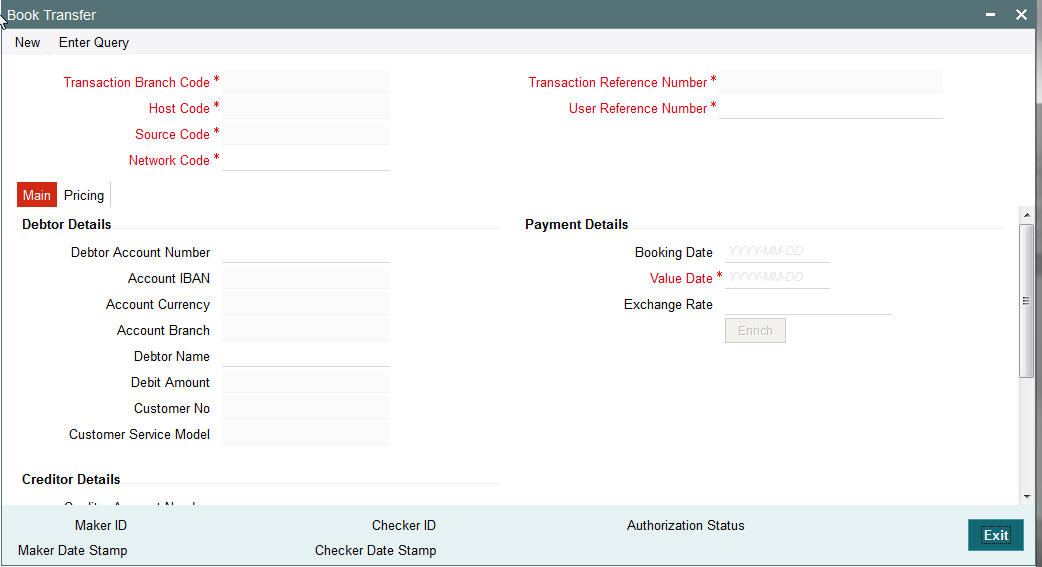

2.2.1 Initiating Book Transfer

You can initiate book transfer transaction between accounts of the bank using ‘Book Transfer Input’ screen. You can invoke “Book Transfer Input” screen by typing ‘PBDOTONL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. Click new button on the Application toolbar..

You can specify the following fields:

Transaction Branch code

The system defaults the transaction branch code with the user’s logged in branch code.

Host code

The system defaults the host code of transaction branch.

Source Code

For manually input transactions source code is defaulted as ‘MANL’. For transactions received through web services or rest services, the source code is populated as received in the request.

Network Code

This field would always get defaulted network maintained with payment type as 'Book Transfer’.

Transaction Reference number

The System generates the transaction reference number. For more details on the format, refer the Payments Core User Guide.

User Reference Number

The system defaults the transaction reference number as user reference number. However you can modify this.

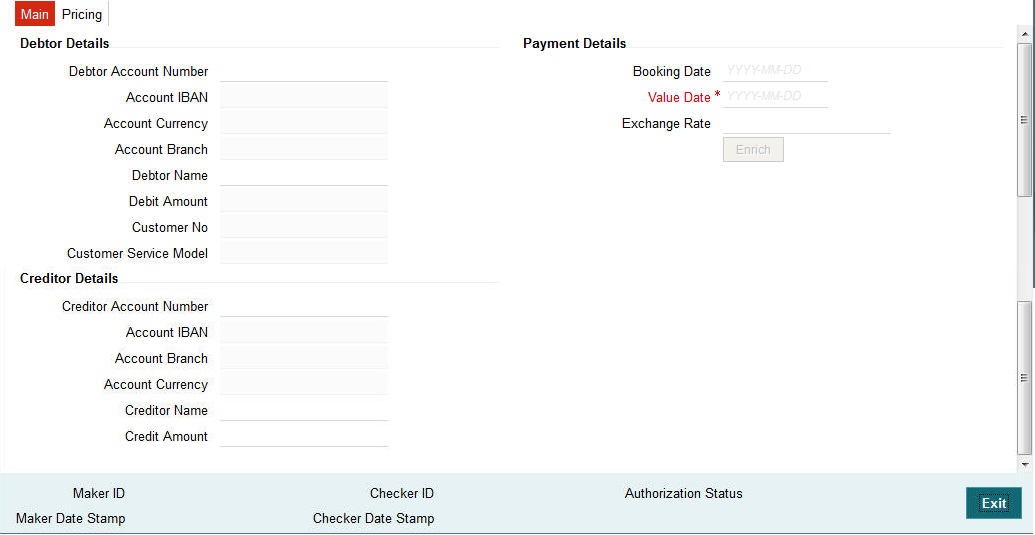

2.2.2 Main Tab

You can capture Debtor/ Creditor and payment details in this screen.

Specify the following details:

Debtor Details

Debtor Account Number

Specify the debtor account number. Alternatively, you can select the debtor account number from the option list. The list displays all open and authorized accounts maintained in the ECA-CIF account mapping.

Account IBAN

The system displays the Account IBAN of the debtor account based on the selected Debtor Account Number.

Account Branch

The system defaults account branch based on the debtor account number selected.

Account Currency

The system defaults account currency based on the debtor account number selected.

Debtor Name

Specify the debtor name.

Debit Amount

The system populated the debit amount based on the credit amount and exchange rate between debit/credit currencies.

Creditor Details

Creditor Account Number

Specify the creditor account number. Alternatively, you can select the creditor account number from the option list. The list displays all open and authorized accounts maintained in the External Account Maintenance.

Account IBAN

The system displays the Account IBAN of the Creditor account.

Account Branch

The system defaults account branch based on the creditor account number selected.

Account Currency

The system defaults account currency based on the creditor account number selected.

Creditor Name

The system displays the creditor name.However you can modify it.

Credit Amount

Specify the credit amount.

Payment Details

Booking Date

The system defaults the booking date as the application server date.

Value Date

The system defaults the value date as current system date. However you can select a future date.The payment is processed on the value date.

Note

- If value date is input as a holiday, during save, the system displays an error. You must update the value date before proceeding with saving.

- If value date is input as back date, then value date will be moved to current date while processing.

Exchange Rate

Specify the exchange rate if debit account currency and credit account currency is different. The system retains the input value and validate the same against override and stop variances maintained in the Network preference.

Note

- If credit currency & debit currency are different, FX rate can be fetched by pressing enrich button. Rate pick up will be based on FX rate preferences maintained in Network preference screen (PMDNWPRF) & Small FX limits maintained in Network Currency preferences.

- If Credit amount is more than small FX limit, rate pick up will happen during transaction processing, provided External Exchange rate is applicable.

- Exchange rate can be manually provided by user also. System will retain the input value and will validate the same against override and stop variances maintained at Network Preferences.

Enrich button

Enrich button is provided in transaction input screen to populate exchange rate, debit amount and charge/tax amounts.

Note

If exchange rate pick up or charge pick up fails, system will throw error.

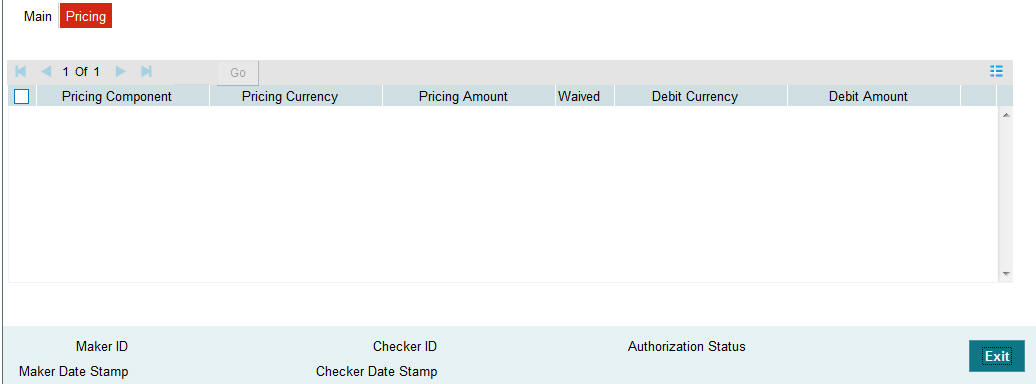

2.2.3 Pricing Tab

For Book Transfer payments transaction, Charge/ Tax is applied based on the pricing code linked in the Network Currency Preferences (PMDNCPRF).

You can view and modify charge/tax details from this screen..

Specify the following details:

Pricing Component

The system defaults the pricing component based on the pricing code.

Pricing Currency

The system defaults the pricing currency.

Pricing Amount

The system defaults the pricing amount from Pricing Value Maintenance screen (PPDVLMNT) as applicable for the payment value date, Payment Source code & Debit Customer Service Model. However you can modify this value.

Note

If rate is maintained for Charge/Tax, then the same is applied on transfer amount and final amount that will be populated component wise in the Pricing tab.

Waiver

Check this box to waive a charge/tax component.

Debit Currency

The system displays the debit currency.

Debit Amount

The system displays the debit amount.

2.2.4 UDF button

Click on the ‘UDF’ button to invoke this screen.

You can specify user defined fields for each transaction.

2.2.5 MIS button

Click on the ‘MIS’ button to invoke this screen.

You can specify the MIS details in this sub-screen.

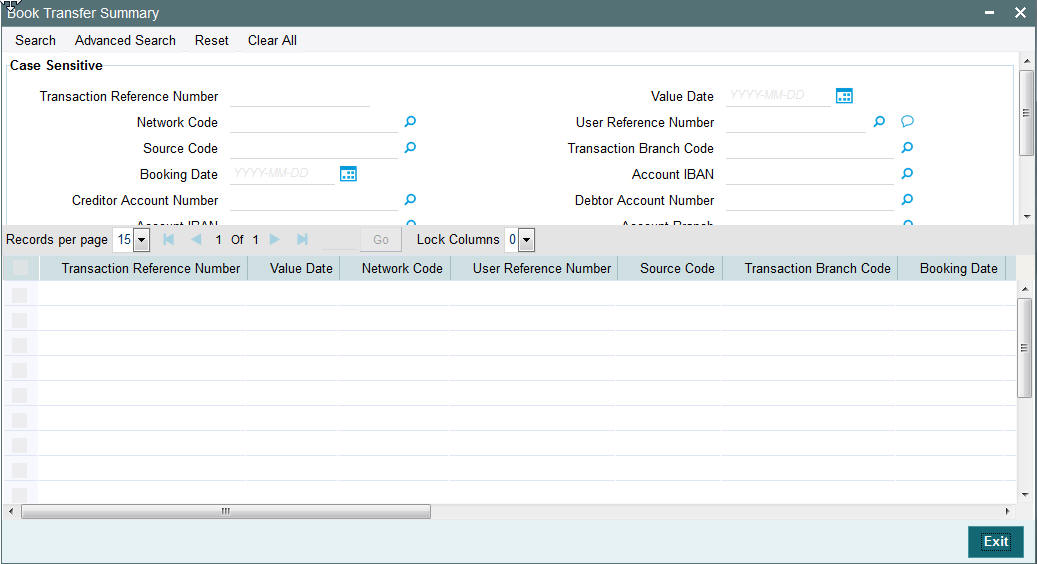

2.2.6 Viewing Book Transfer Summary

You can invoke “Book Transfer Summary” screen by typing ‘PBSOTONL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can search using the following parameter:

- Transaction reference number

- Network code

- Source code

- Booking Date

- Creditor Account Number

- Account IBAN

- Value Date

- User Reference Number

- Transaction Branch Code

- Debtor Account Number

- Account Branch

Once you have specified the search parameters, click ‘Execute Query’ button. The system displays the records that match the search criteria for the following:

- Transaction reference number

- Network code

- Source code

- Booking Date

- Creditor Account Number

- Account IBAN

- Value Date

- User Reference Number

- Transaction Branch Code

- Debtor Account Number

- Account Branch

2.3 Book Transfer View

This section contains the below topics:

- Section 2.3.1, "Viewing Book Transfer Outgoing Transactions"

- Section 2.3.2, "Main Tab"

- Section 2.3.3, "Pricing Tab"

- Section 2.3.4, "Accounting Details Tab"

2.3.1 Viewing Book Transfer Outgoing Transactions

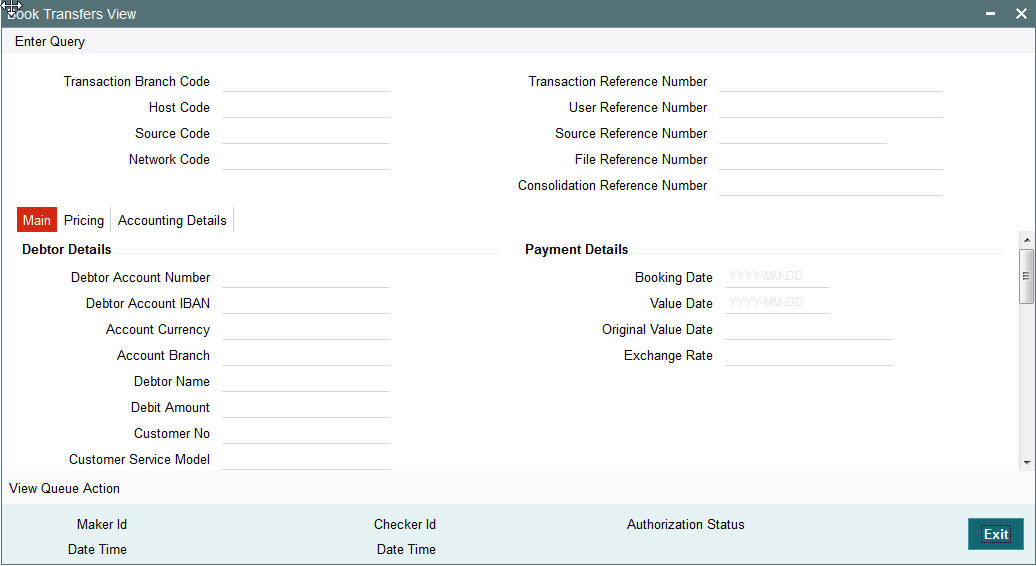

You can view the Book Transfer outgoing transaction in this screen. You can invoke “Book Transfer View” screen by typing ‘PBDOVIEW’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. Click new button on the Application toolbar..

You can specify the following fields:

Transaction Reference Number

Specify the transaction reference number. Alternatively, you can select the transaction reference number from the option list. The list displays all valid transaction reference numbers maintained in the system.

The system displays all the fields in the below mentioned tabs based on the transaction reference number selected.

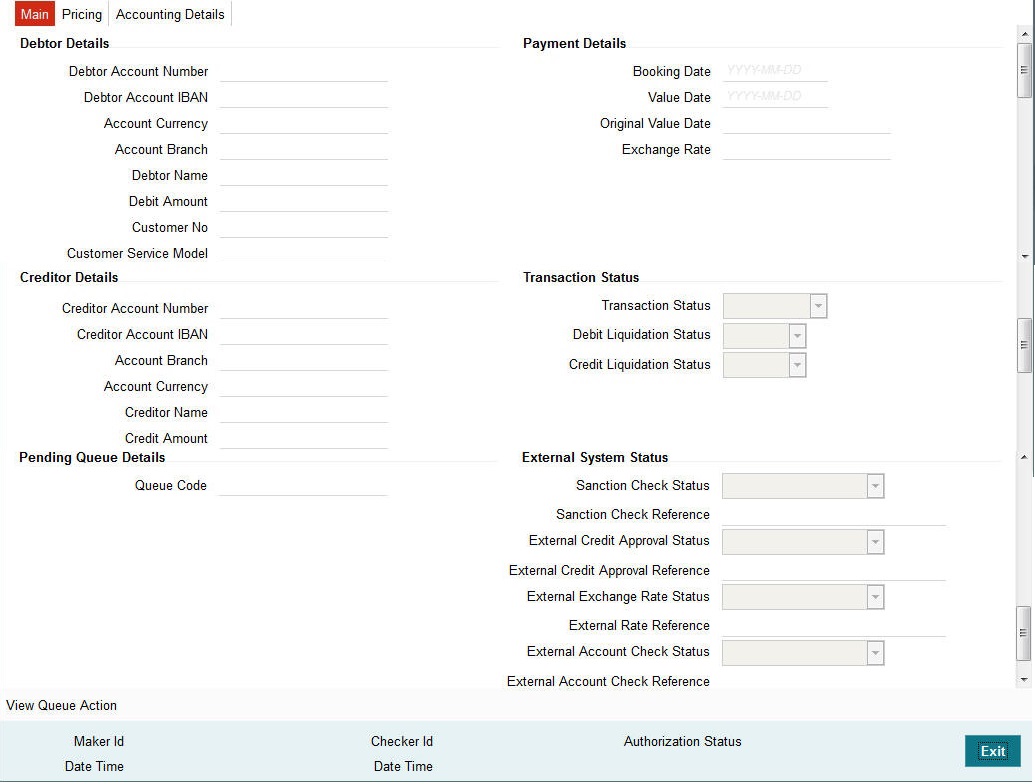

2.3.2 Main Tab

You can view debtor/Creditor details in this screen. Click on the ‘Main’ tab to invoke this screen.

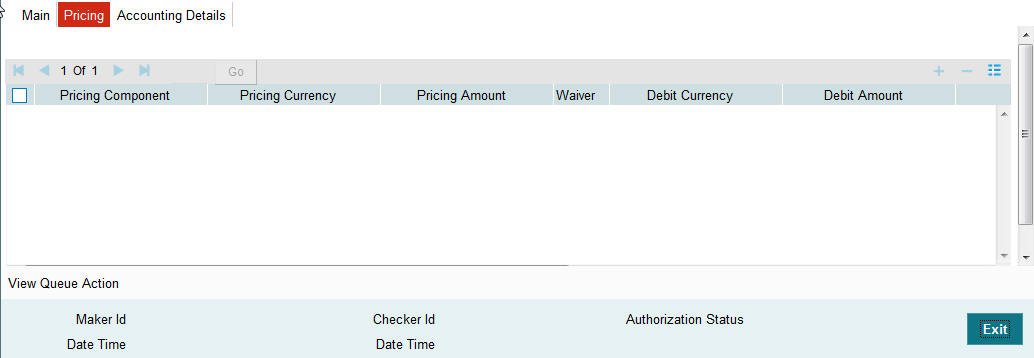

2.3.3 Pricing Tab

You can view pricing details in this screen. Click on the ‘Pricing’ tab to invoke this screen.

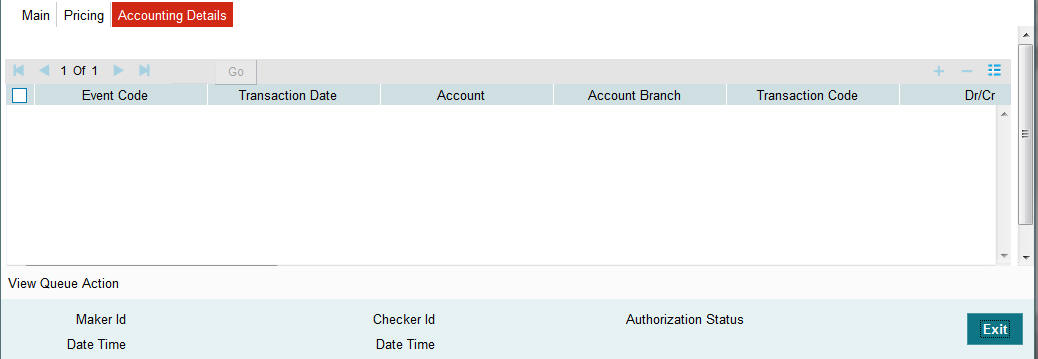

2.3.4 Accounting Details Tab

Click on the ‘Accounting Details’ tab to invoke this screen.

You can view the consolidated accounting entries of the transaction.

2.3.5 UDF button

Click on the ‘UDF’ button to invoke this screen.

You can specify user defined fields for each transaction.

Note

You can invoke ‘UDF’ screen by typing ‘PMDTRUDF’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. Click new button on the Application toolbar.

2.3.6 MIS button

Click on the ‘MIS’ button to invoke this screen.

You can specify the MIS details in this sub-screen.

Note

You can invoke ‘MIS’ sub-screen by typing ‘PMDTRMIS’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. Click new button on the Application toolbar.

2.4 Book Transfer - Web Services/REST Services

Book transfer request from web services or REST services are processed in ACH payment.

Following fields are mandatory in the request required:

- Source Reference number

- Host code

- Source Code

- Debtor Account

- Creditor Account

- Credit Amount

- Value Date

For transactions received through web services or REST services, the source code will be defaulted as received in the request.

2.5 Book Transfer Processing

This section contains the below topics:

- Section 2.5.1, "Processing Book Transfer"

- Section 2.5.2, "Mandatory Field Check"

- Section 2.5.3, "Referential Integrity Check"

- Section 2.5.4, "Holiday Check"

- Section 2.5.5, "Debit/Credit Accounting"

- Section 2.5.6, "Notifications"

2.5.1 Processing Book Transfer

System performs below mentioned checks while saving a transaction:

- Mandatory Field Check

- Referential Integrity Check

- Holiday Check

For ‘Book Transfer’ payment types, and branch holiday checks are performed.

2.5.2 Mandatory Field Check

Below mentioned fields are mandatory in the request for ACH transaction:

- Host Code

- Network of type 'Book Transfer'

- Debtor Account

- Creditor Account

- Credit Amount

2.5.3 Referential Integrity Check

Following parameters are validated with the static maintenances available for existence of the values:

- Network code –Validated against the static maintenances (PMDNWMNT) available.

- Currency Codes –Validated against open and authorized currency codes (CYDCDEFE). In Network Currency preferences, a record should be available for the Network, transaction type ‘Outgoing’ and transaction currency.

- Host Code-Validated against host codes available in Host Code maintenance (STDHSTCD)

- Transaction Branch Code- Should be a valid branch maintained in the system.

- Debit Account – Debit account would be verified to check whether it is valid & existing. Account status is validated to check it is not in ‘No Debit’, ’Blocked’, ’Dormant’ or Frozen status.

- Credit Account – Credit account would be verified to check whether it is valid & existing. Account status is validated to check it is not in ‘No Credit’, ‘Blocked’, ‘Dormant’ or ‘Frozen’ status.

- Customer Status Check - Validation against the status of the customer. The values are ‘Deceased’, ‘Frozen’ and “Whereabouts Unknown”.

If any of the above mentioned validation fails then the transaction will be rejected with an error message.

2.5.4 Holiday Check

For transactions received from channels or bulk file, if the payment value date falls on a local branch holiday, then based on network preferences the value date is moved forward to nearest working date. A message is displayed on transaction booking to indicate the value date change. Initial value date will be stored as instruction date internally.

If transaction value date is a future date, then transaction processing follows future dated transaction specific process flow.

For a current dated transaction, processing is done during transaction authorization in the following order:

- Sanction Check

- Charge processing, if applicable

- Exchange Rate pickup

- External Credit Approval/External Account Check

- Debit /Credit entry hand off

2.5.5 Debit/Credit Accounting

Accounting entries for credit and debit accounting are handed off to accounting system with debit/credit liquidation accounting code linked at Network Currency preferences.

As a part of debit/Credit liquidation, the following details are sent to accounting system:

| Values handed off for Accounting | Debit Liquidation | Credit Liquidation | ||||

|---|---|---|---|---|---|---|

| Event | DRLQ | CRLQ | ||||

| Amount Tag | XFER_AMT | XFER_AMT | ||||

| *Transaction Account | Debit Account | Credit Account | ||||

| Offset Account | This is maintained as part of accounting code | This is maintained in accounting system as part of accounting code | ||||

| Transaction Currency | Debit Account Currency | Credit Account Currency | ||||

| Transaction Amount | Debit Amount | Credit Amount | ||||

| Value Date | Transaction Value Date | Transaction Value Date | ||||

| Offset Currency | Credit Currency | Credit Currency | ||||

| Offset Amount | Credit Amount | Credit Amount | ||||

| Local Currency Amount | If either debit currency or credit currency is local currency, corresponding amount will be handed off as local currency amount | If not, debit amount will be converted to local currency in mid rate. | Local currency amount of DRLQ will be used |

Charge/tax related entries are handed off along with debit liquidation details. Transaction code, Debit/Credit indicator and Netting flag is applicable based on accounting code maintained.

If debit and credit liquidation are on same day, then the credit entries are sent with debit entries in a single hand off.

2.5.6 Notifications

Following notifications are supported for Book Transfer transactions:

| Notification Code | Details | Text | |||

|---|---|---|---|---|---|

| PM_BTR_DR_1 -Book Transfer-Notification for debtor-on debit liquidation | Debit Account | Account <Debit

Account>is debited for <Debit Currency >,<Debit Amount>

on <Debit Liquidation Date> for Payment Reference Number<Transaction

Reference Number>. Charge or Tax component amount deducted details are <Charge Currency> <Charge Amount> |

|||

| Debit currency | |||||

| Debit Amount | |||||

| Debit liquidation date | |||||

| Transaction Reference number | |||||

| Charge/Tax debit amount | |||||

| Charge/Tax debit currency | |||||

| PM_BTR_CR_1 - Book Transfer-Notification for creditor - on credit liquidation | Credit Account | Account <Credit Account>is credited for <Credit Currency >,<Credit Amount> on <Credit Liquidation Date> for Payment Reference Number<Transaction Reference Number>. | |||

| Credit Account currency | |||||

| Credit Amount | |||||

| Credit liquidation date | |||||

| Transaction Reference number | |||||

| PM_ACH_BT_1 -for Debtor on auto/manual cancellation of payment on SC rejection | Transaction number,transfer currency,transfer amount | Payment Transaction No.<> for <Transfer currency> <Transfer Amount> is cancelled as sanction check failed | |||

| PM_ACH_BT_2 - For Debtor on auto/manual cancellation of payment on ECA rejection | Transaction number | Payment Transaction No.<> for <Transfer currency> <Transfer Amount> is cancelled as approval from account system failed |

Notifications are posted asynchronously to Notification Queue (JMS Queue-NOTIFOUTQ) and will be available for consumption to external systems.