3. Payment Initiation

3.1 Payment Initiation Screen

Payment Initiation Screen - Highlights

The Payment Initiation screen allows payment request input for initiating a payment transaction. Payment initiation can be done by providing a specific payment network to which the payment needs to be forwarded or without providing the network details. If network is not provided for a payment, system has the capability to derive the same using the network rule maintained for the processing Host. The Payment Initiation screen is provided with major fields that are supported by ISO pain.001 message format. Payment Initiation for the following payment types can be done using this screen:

- Low Value Payments

- High Value Payments

- Book Transfers

- Cross Border Payments

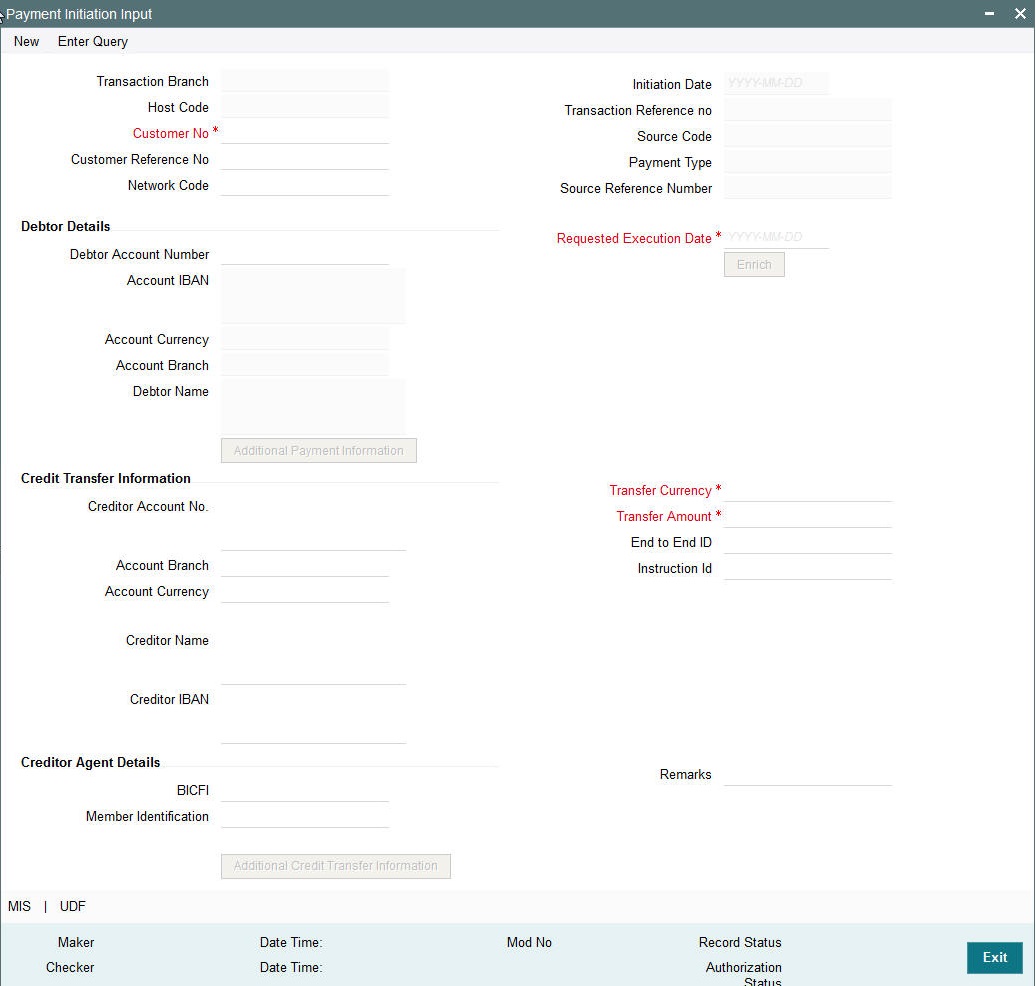

3.1.1 Invoking Payment Input Initiation Screen

The Payments Initiation Screen allows payment request input for single transaction. In this screen, you can accept payment initiation requests irrespective of the payment type.

You can invoke ‘Payment Input Initiation’ screen by typing ‘PMDPMONL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button...

You can specify the following fields:

Transaction Branch

This is defaulted as user's logged in branch.

Host Code

Indicates the host code of logged in branch.

Customer Number

Specify the Customer Number. Alternatively, you can select the Customer Number from the option list. The list displays a list of customer numbers maintained in the system for the Host.

Initiation Date

This date indicates the booking date of payment initiation. Initiation date is defaulted as current date.

Customer Reference

Specify the Customer reference number for the payment, if available.

Transaction Reference

16 digit transaction number is populated by system.

Network Code

Specify the Network Code. Alternatively, you can select the Network Code from the option list. The list displays all valid network codes maintained in the system.

This is an optional field. If the network is not provided, system will derive the same using the Network rule maintenance available

Payment Type

Payment type is defaulted based on the network.

Debtor Details

Debtor Account Number

Specify the Debtor Account. Alternatively, you can select the Debtor Account from the option list. The list displays all open and authorised accounts maintained in the system for the Host.

Account IBAN

Based on the debtor account chosen, IBAN of the account is defaulted. This value is mandatory if IBAN validation is applicable for the network chosen.

Account Currency

Customer account currency is displayed based on the Debtor account number chosen.

Account Branch

Debtor account branch is displayed based on the Debtor account number chosen.

Debtor Name

Debtor Name is displayed based on the Debtor account number chosen.

Credit Transfer Information

Creditor Account Number

Specify the Creditor Account Number.

Account Branch

Specify the creditor account branch. This is an optional field.

Account Currency

Specify the Creditor Account currency. This is an optional information

Creditor Name

Specify the Creditor Name.

End to End Identification

Specify the end to end identification provided by the customer for the payment request.

Transfer Currency

Specify the currency in which the credit transfer must be initiated.

Transfer Amount

Specify the amount that must be transferred to the Creditor Account.

Credit Agent Details

BIC

Specify the BIC. Alternatively, you can select the BIC from the option list. The list displays all valid BIC codes maintained in the system.

Member Identification

Specify the Member Identification. Alternatively, you can select the Member Identification from the option list. The list displays all valid bank codes maintained in the Local Bank directory system.

Remarks

Enter internal remarks, if any.

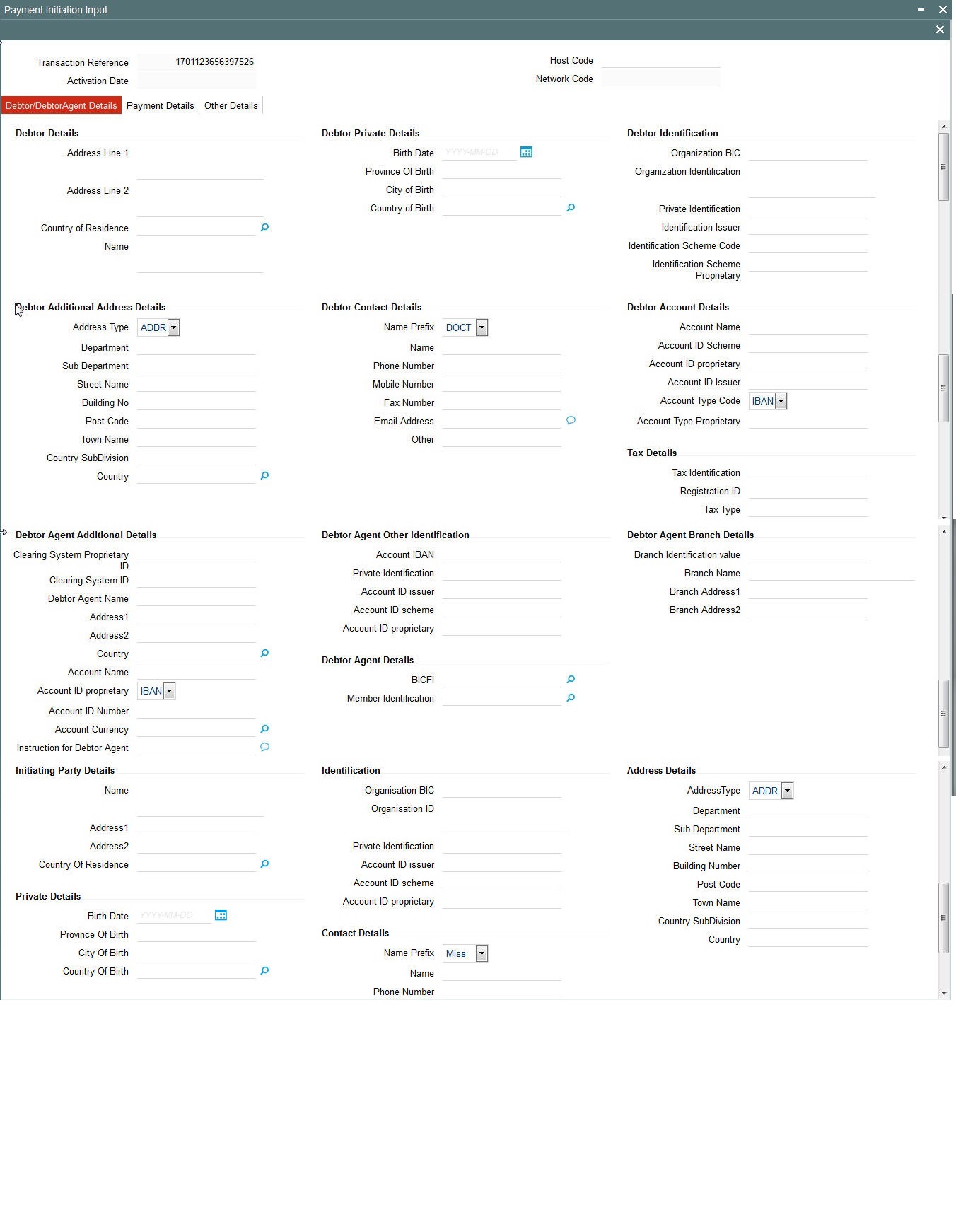

3.1.2 Debtor/Debtor Agent Details

Click the Additional Payment Information button from the Payment Input Initiation screen:

You can specify the following fields:

Debtor Details

Address

Specify the first line of the debtor’s address in the two Address lines provided.

Country of Residence

Specify the debtor’s country of residence.

Debtor Private Details

Birth Date

Specify the date of birth of the debtor.

Province of Birth

Specify the province of birth of the debtor.

City of Birth

Specify the city in which the debtor was born.

Country of Birth

Select the country in which the debtor was born.

Debtor Identification

Organization BIC

Specify the organization of the BIC.

Organization Identification

Specify the organization.

Private Identification

Specify the Private Identification number.

Note

The fields explained above are optional fields. You can provide data only in one the fields as per ISO standards, if required i.e. Organization BIC, Organization Identification and Private Identification.

Identification Issuer

Specify the name of the Identification issuer.

Identification Scheme Code

Specify the Identification Scheme Code.

Identification Scheme Proprietary

Specify the proprietary value of Identification Scheme.

Debtor Additional Address Details

Address Type

Specify the Address Type. Alternatively, you can select the Address Type from the option list. The list displays all valid Address Types allowed in ISO pain.001 format.

Department

Specify the department in the debtor address.

Sub Department

Specify the sub-department.

Street Name

Specify the street name.

Building Number

Specify the building number.

Post Code

Specify the postal code.

Town Name

Specify the name of the town.

Country Sub Division

Specify the country sub-division.

Debtor Contact Details

Name Prefix

Specify the required prefix. Alternatively, you can select the name prefix from the option list. The list displays all valid name prefixes maintained in the system.

Name

Specify the name.

Phone No

Specify the number of the debtor.

Mobile No

Specify the mobile number of the debtor.

Fax No

Specify the fax number of the debtor.

Email Address

Specify the email address of the debtor.

Other

Specify the any other details of the debtor.

Debtor Account Details

Account ID Scheme

Specify the Account Id Scheme.

Account ID Proprietary

Specify Proprietary value for Account ID. You can provide either Scheme or Proprietary value, not both.

Account Id Issuer

Specify the Account ID Issuer.

Account Type Form

Specify the Account Type Form. Alternatively, you can select the Account Type Form from the drop down list. The drop-down list displays all valid options such as ‘IBAN’ or ‘Others’.

Account Type

Specify the Account Type if account type form is Others.

Tax Debtor Details

Tax Identification

Specify the tax identification details.

Registration ID

Specify the Registration Identification details.

Tax Type

Specify the Tax Type details.

Debtor Agent Additional Details

Clearing System Id

Specify the Clearing System Id.

Clearing System Proprietary ID

Specify the Clearing System proprietary value. You can provide either Clearing system ID or Clearing System Proprietary ID.

Debtor Agent Name

Specify the name of the Debtor Agent.

Address 1

Specify the Debtor Agent’s address in the two address lines provided.

Country

Specify the country of the Debtor Agent.

Account Name

Specify the name of the Debtor’ Agent’s account name.

Account Id Type

Specify the Account Id Type. Alternatively, you can select the Account Id Type from the option list. The list displays all valid Account Id Types maintained in the system.

Account Id Number

Specify the Account Id Number.

Account Currency

Specify the Account Currency. Alternatively, you can select the currency from the option list. The list displays all valid currencies maintained in the system.

Instruction for Debtor Agent

Enter any Instruction for Debtor Agent.

Debtor Agent Additional Details

Private Identification

Specify the Private Identification details.

Identification Issuer

Specify the Identification Issuer details.

Identification Scheme Code

Specify the Identification Scheme Code.

Identification Scheme Proprietary

Specify the Identification Scheme Proprietary.

Debtor Agent Additional Details

Branch Identification Value

Specify the Branch Identification Value.

Branch Name

Specify the name of the branch.

Branch Address 1

Specify the branch’s address in the two lines provided.

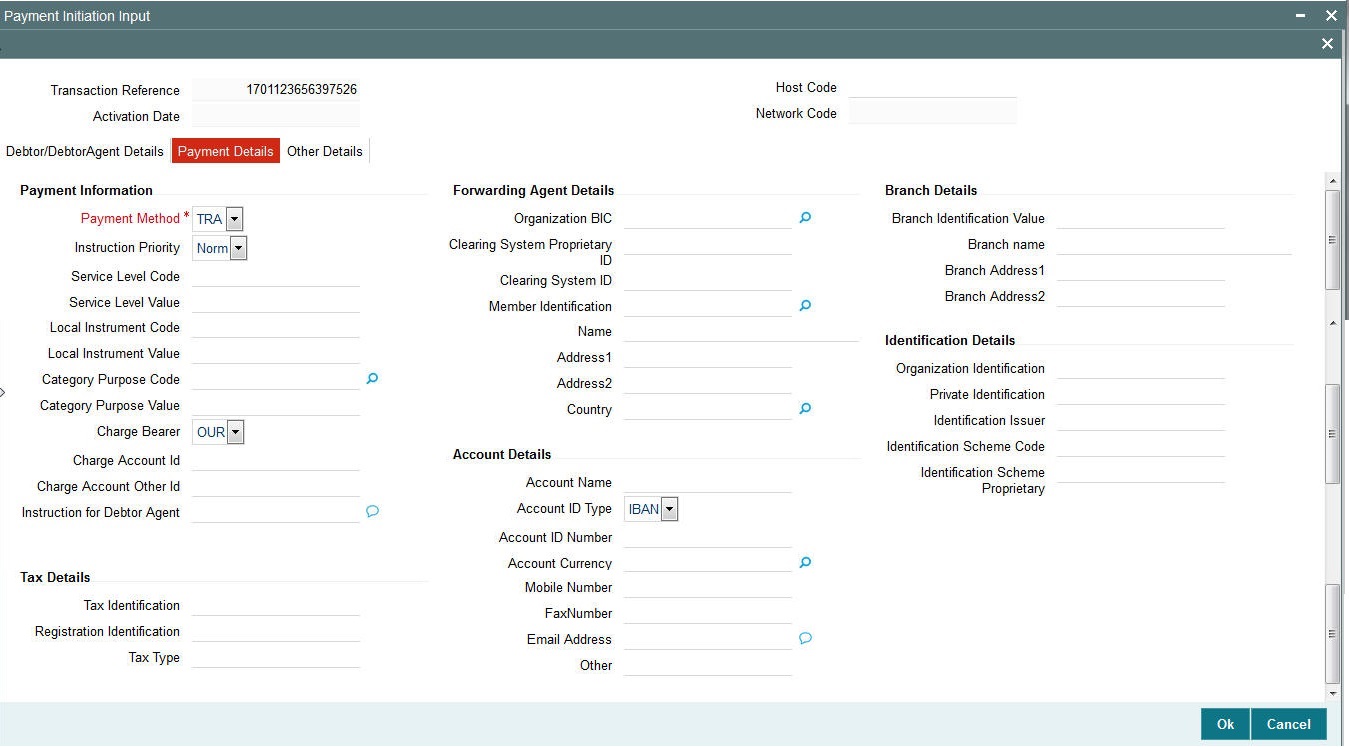

3.1.3 Payment Information Details

Click the Payment Details tab from the Additional Payment Information screen.

You can specify the following fields:

Payment Information

Payment Method

Select the method of payment. Choose among the three options.

- TRF

- CHK

- TRA

Instruction Priority

Select the Instruction Priority of the payment information. Choose any of the following:

- Normal

- High

Service Level Code

Specify the Service level code applicable for the payment.

Service Level Value

Specify the Service Level Value, if it is a proprietary value.

Local Instrument Code

Specify the Local Instrument Code.

Local Instrument Value

Specify the Local Instrument Value, if it is a proprietary value.

Category Purpose Code

Specify the Category Purpose Code. Alternatively, you can select the Category Purpose Code from the drop down list. The list displays all valid Category Purpose Codes maintained in the system.

Category Purpose Value

Specify the Category Purpose Value, if it is a proprietary value.

Charge Bearer

Specify the Charge Bearer.

Charge Account

Specify the Charge Account if applicable. Otherwise Debit account is considered as Charge Account.

Instruction for Debtor Agent

Specify the instruction for Debtor Agent.

Forwarding Agent Details

Similar to Debtor Agent details captured, you can capture Forwarding Agent Details. Forwarding Agent details are optional. The following fields are available for input:

- Organization BIC

- Clearing System Proprietary ID

- Clearing System ID

- Member Identification

- Name

- Address

- Country

- Account Details

- Account Name

- Account ID Type

- Account Number

- Currency

- Branch Details

- Branch Identification Value

- Branch Name

- Branch Address

- Identification Details

- Organization BIC

- Organization ID

- Private Identification

- Identification Issuer

- Identification Scheme Code

- Identification Scheme Proprietary

Initiating Party Details

You can capture Initiating Party details, similar to the debtor additional details.These details are optional for input.

The following fields are available for Initiating Party details:

- Name

- Address

- Country of Residence

- Private Details

- Birth Date

- Province of Birth

- City of Birth

- Country of Birth

- Identification Details

- Organization BIC

- Organization ID

- Private Identification

- Identification Issuer

- Identification Scheme Code

- Identification Scheme Proprietary

- Contact Details

- Name

- Phone Number

- Mobile Number

- Fax Number

- Email Address

- Other

- Address Details

- Address type

- Department

- Sub-department

- Street Name

- Building Number

- Post Code

- Town Name

- Country Sub-division

- Country

- Tax Details

- Tax Identification

- Registration Identification

- Tax Type

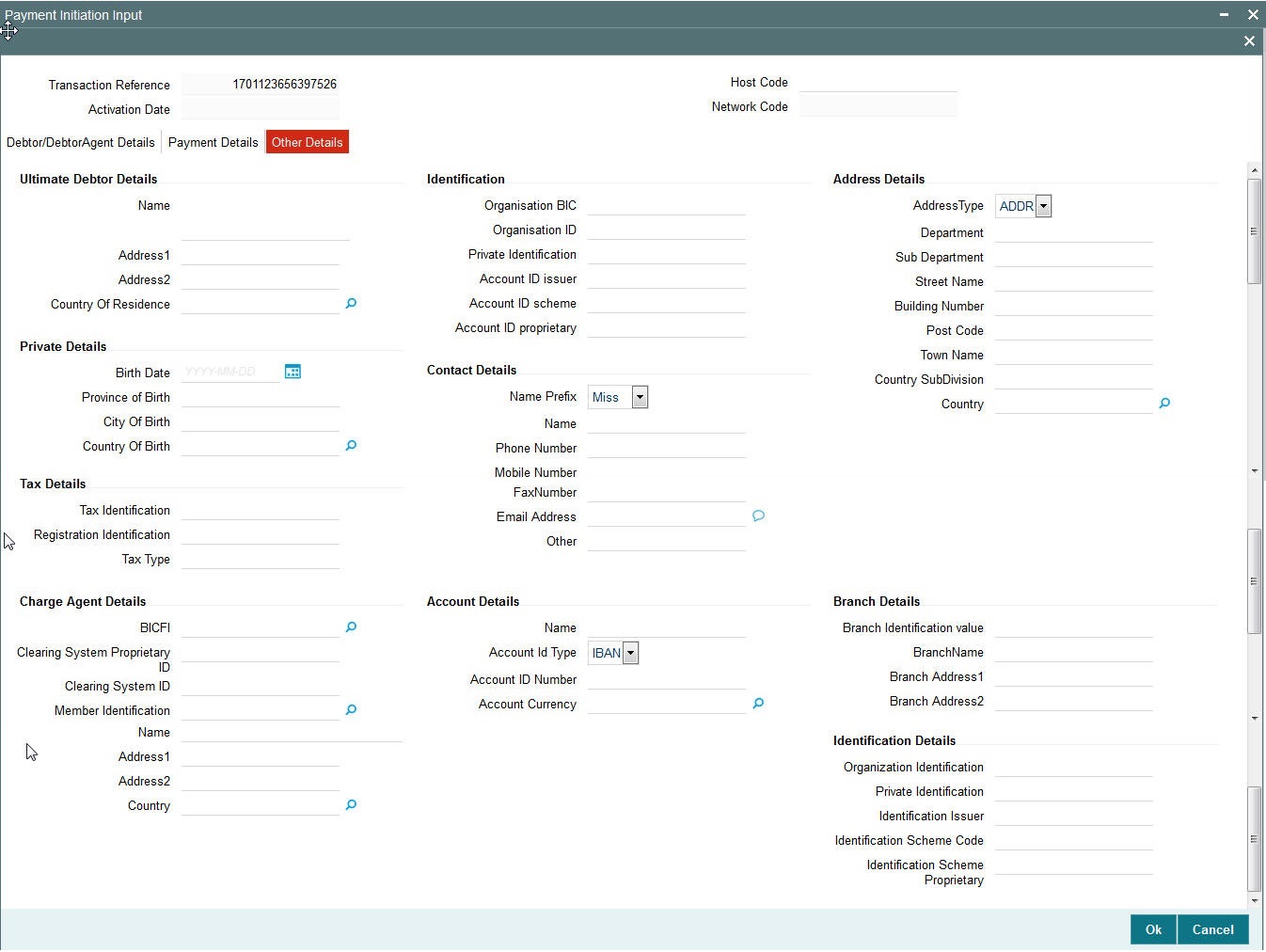

3.1.4 Other Details

Click the Other Details tab from the Additional Payment Information screen.

You can specify Ultimate Debtor Details and Ultimate Debtor Agent details in this tab.These are optional information

Input fields available for Ultimate Debtor is similar to Debtor Additional Details fields. Ultimate Debtor agent details are similar to Debtor agent information fields:

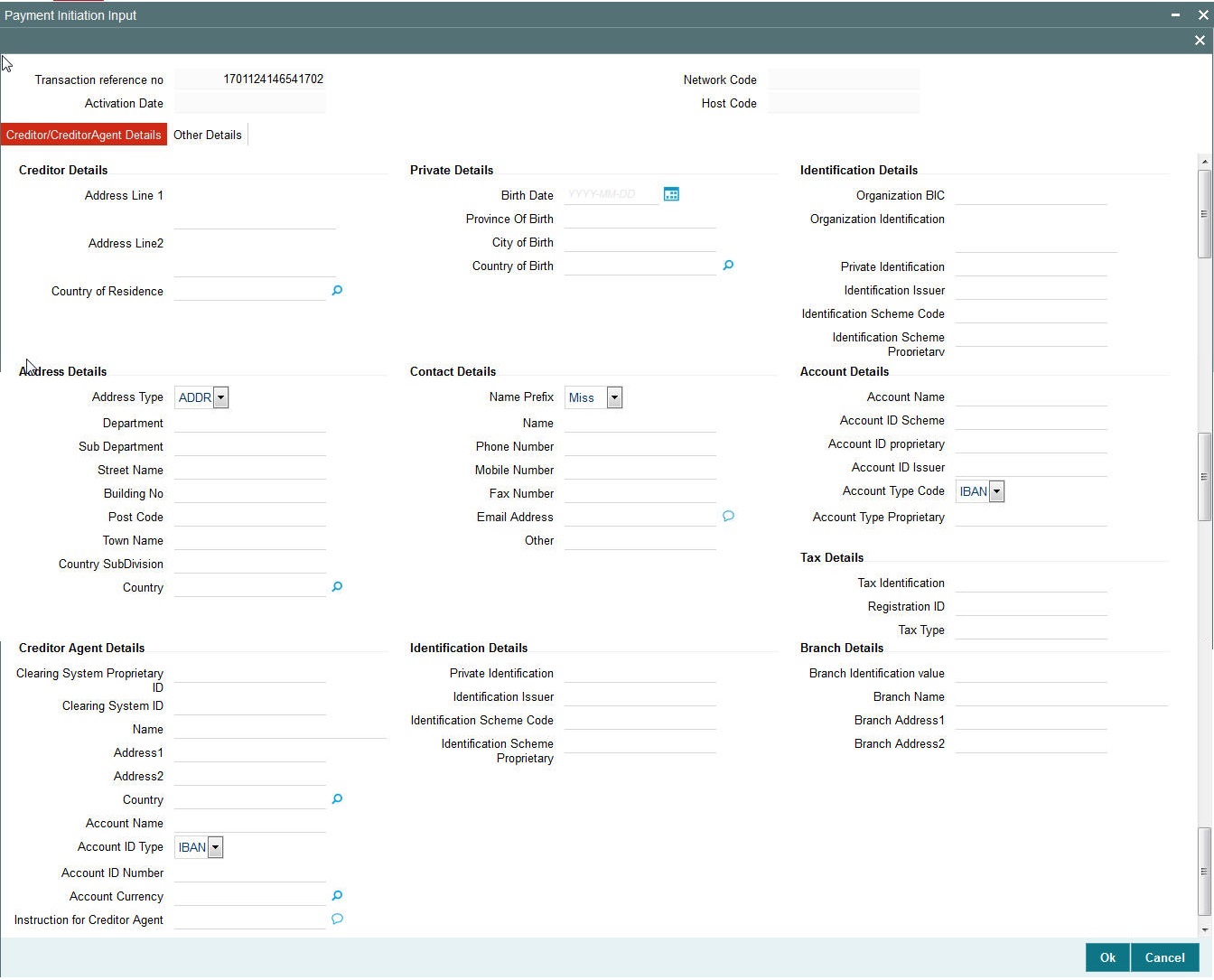

3.1.5 Creditor/Creditor Agent Details

Click the Additional Credit Transfer Information button in the Payment Initiation screen.

You can specify the following fields:

Creditor/ Creditor Agent Details

You can specify Creditor Additional Details and Creditor Agent Additional Details in the Creditor /Creditor Agent Details tab.The additional information fields are similar to the fields available for debtor/debtor agent.

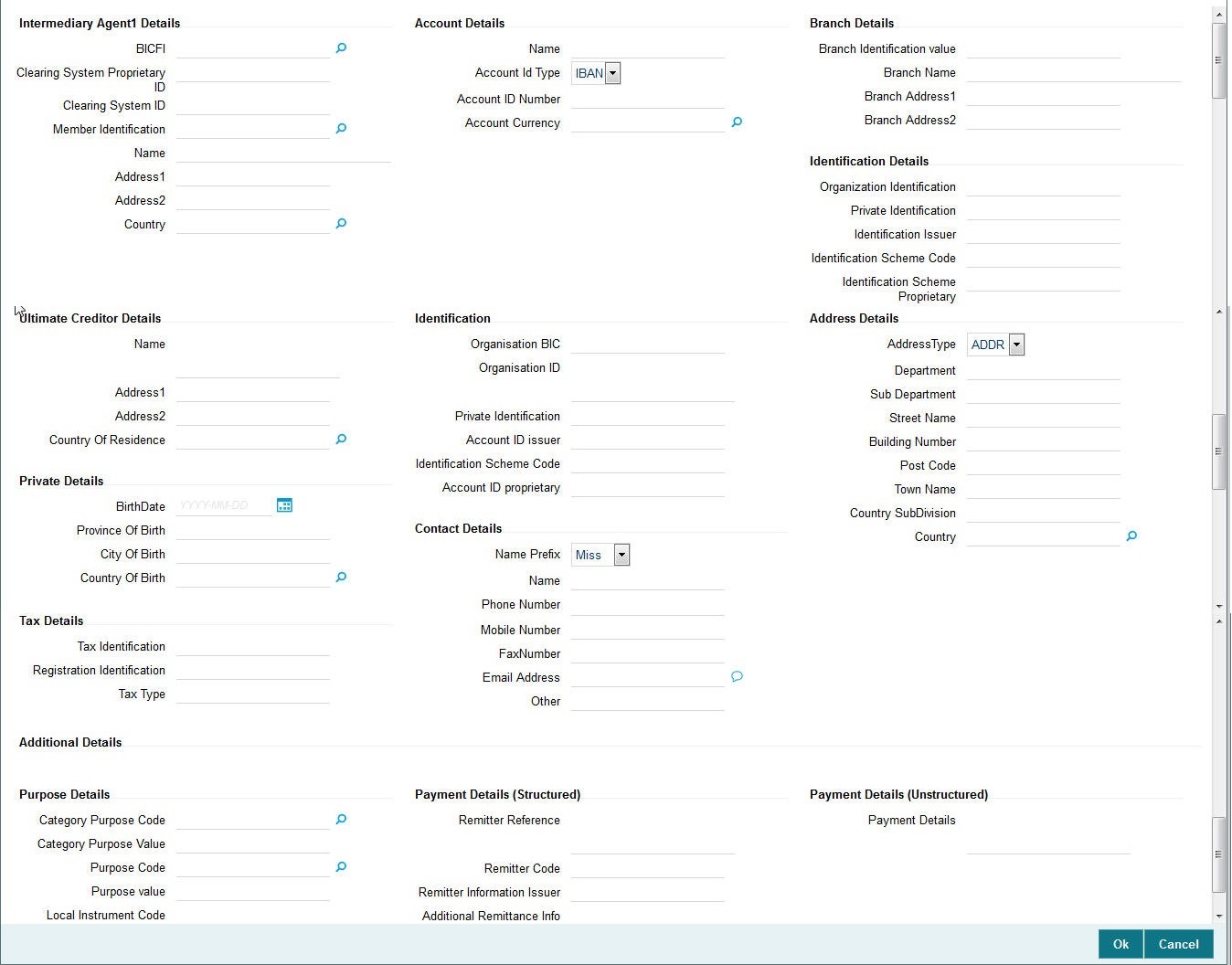

3.1.6 Other Details

Click the Additional Credit Transfer Information button in the Payment Initiation screen and then click the Other Details tab.

In other details tab you can specify Intermediary Agent Details and Ultimate Creditor Details. The related information fields are similar to Debtor agent/Debtor agent additional details.

Purpose Details

Category Purpose Code

Specify the Category Purpose Code. Alternatively, you can select the Category Purpose Code from the option list. The list displays all valid Category Purpose Codes maintained in the system.

Category Purpose Value

Specify the Category Purpose Value.

Purpose Code

Specify the Purpose Code. Alternatively, you can select the Purpose Code from the option list. The list displays all valid Purpose codes maintained in the system

Purpose Value

Specify the purpose value if it is a proprietary value.

Local Instrument Code

Specify the local instrument code

Local Instrument Value

Specify the local instrument value.

Payment Details (Structured)

Remitter Reference

Specify the Remitter Reference details.

Remitter Code

Specify the Remitter Code details.

Remitter Information Issuer

Specify the Remitter Information Issuer details.

Additional Remittance Info

Specify the Additional Remittance information.

Payment Details (Unstructured)

Payment Details

Specify any payment details.

Processing of Payment Request

On doing enrich, network resolution & payment type resolution are done. Initial transaction validation are carried out on saving the request. Payment transaction for the specific payment type gets created on authorizing the payment initiation.

3.1.7 Web service Support

REST and SOAP services are available for this screen.A subset of the fields, primarily the mandatory fields are supported as part of REST service format.

Note

If Transaction Branch and Host Code are not passed in the ReST service, then system should not process the request as both Host Code and Transaction Branch cannot be null.