2. Positive Pay

Corporate customers can provide the bank with ‘Cheque Issue File’ which contains the details of the cheques issued. These details are matched against cheques received for payment in Inward clearing. If a cheque listed in the Cheque Issue File has been lost or stolen or otherwise cannot be accounted for, Customer can place a stop payment order on such cheque.

2.1 Positive Pay Agreement Maintenance

There is a provision to maintain Positive Pay Agreement for a customer account. If this maintenance is available, when a cheque comes in for payment, the instrument validation will be done with the Positive Pay details available for the account.

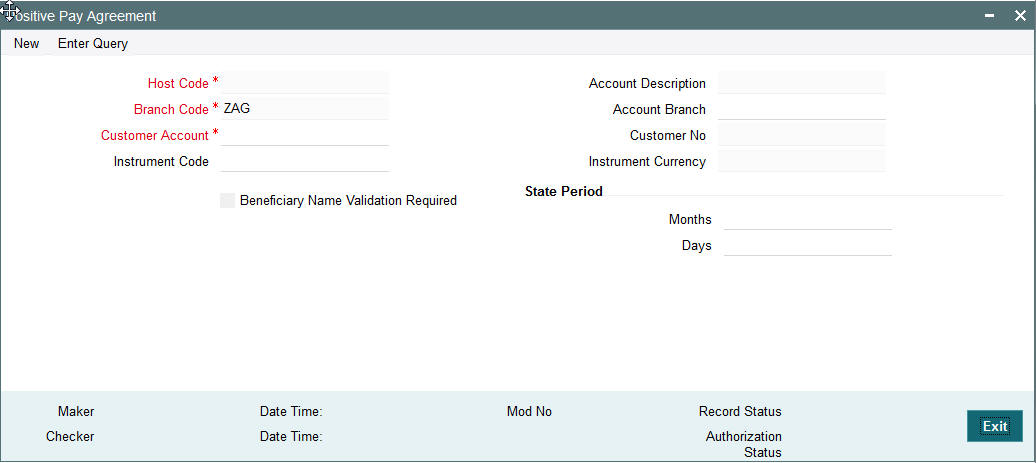

2.1.1 Invoking Positive Pay Agreement Screen

You can invoke “Positive Pay Agreement” screen by typing ‘PYDAGRMT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button...

You can specify the following fields:

Host Code

The system indicates the host code that is linked to the logged in branch of the user.

Branch Code

The system indicates the branch code of the logged in user.

Customer Account

All valid accounts available for the branch are listed. Based on the account chosen, account description and account branch details are populated.

Instrument Code

Instrument codes of type ‘Cheque’ and instrument currency same as account currency will be listed. Select the required one.

Beneficiary Name Validation Required

Check this flag to indicate whether the Beneficiary name validation is required while process an inward positive pay transaction in clearing.

Account Description

The system displays the account description.

Account Branch

The system displays the branch details.

Customer No

The system displays the customer number upon the selection of Customer Account.

State Period

Months

Stale period is defaulted based on Instrument code. You can modify the same. The number of months can be indicated for computing the expiry of the cheque.

Days

The number of days can be indicated for computing the expiry of the cheque.

Note

Stale period can be maintained either in Months or in Days. Maintaining stale period as a combination of Months and Days is not allowed.

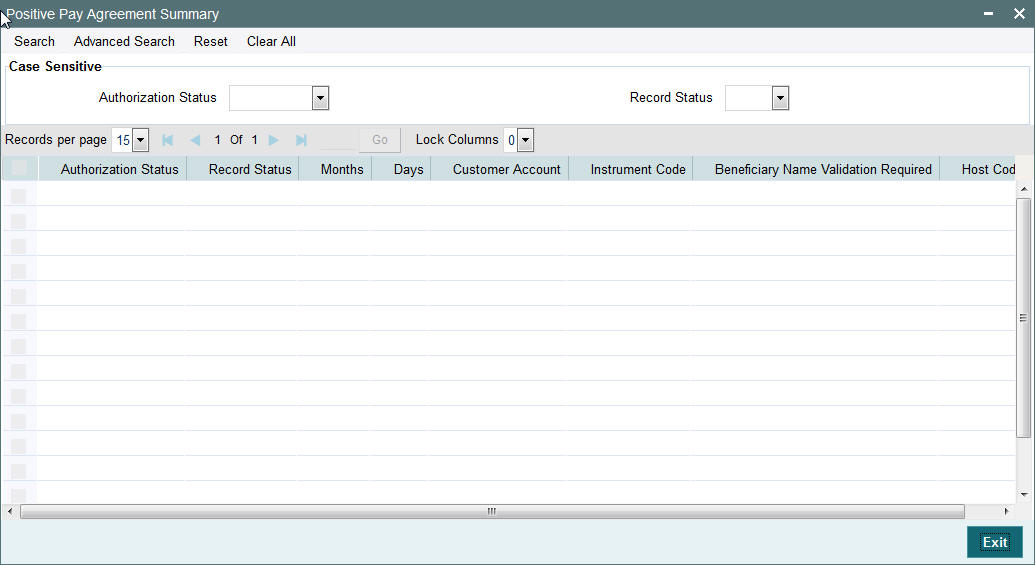

2.1.2 Viewing Positive Pay Agreement Summary Screen

You can search for records in the Positive Pay Agreement Summary Screen. You can invoke “Positive Pay Agreement Summary” screen by typing ‘PYSAGRMT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button..

You can search using one or more of the following parameters:

- Authorization Status

- Record Status

Once you have specified the search parameters, click ‘Search’ button. The system displays the records that match the search criteria.

2.2 Positive Pay File Upload

There is a provision for uploading and storing Positive Pay files received for an account. The combination of account number and the cheque number has to be unique. A reference is generated for each positive pay record getting uploaded.

Manual input screens are required when the request is received over fax. The Positive Pay File Upload screen is be provided to input, view or amend the positive pay details.

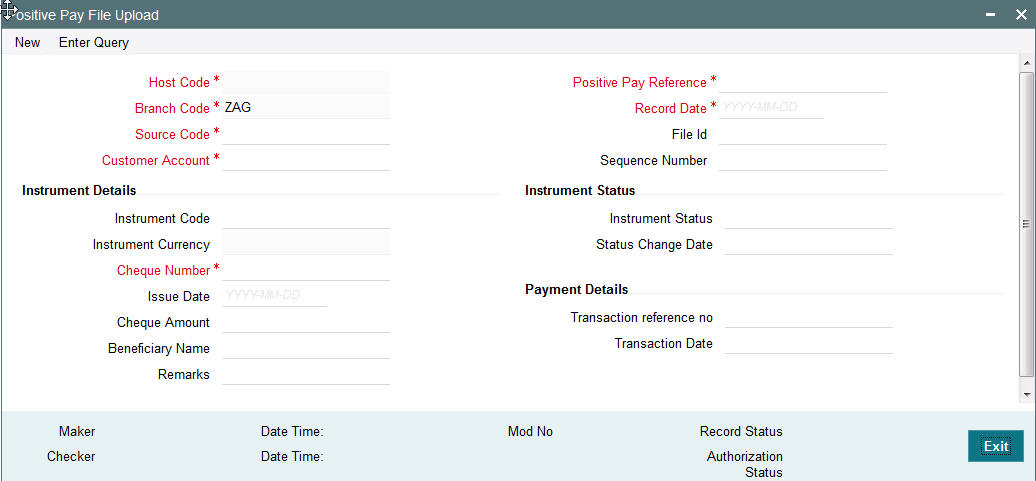

2.2.1 Invoking Positive Pay File Upload Screen

You can invoke “Positive Pay File Upload” screen by typing ‘PYDFUPLD’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button...

You can specify the following fields:

Host Code

The system indicates the host code that is linked to the logged in branch of the user.

Branch Code

The system indicates the logged in branch code of the user.

Source Code

This will be defaulted as MANL for entries using the user interface. For uploads, corresponding Source code will be defaulted.

Positive Pay Reference

This reference is generated and defaulted by system.

Record Date

This will be defaulted as current date.

File Id

Specify the File Id of the customer file received.

Customer Account

Accounts that have positive pay agreement maintained for the branch are listed. Based on the account chosen, account description and account branch details are populated.

Sequence Number

Specify the Sequence Number based on the details available in the customer file.

Instrument Details

Instrument Code

Specify the Instrument Code from the list of values.

Instrument Currency

The system displays the currency of the instrument.

Cheque Number

Specify the Cheque Number.

Issue Date

Specify the issue date as mentioned in the customer file.

Cheque Amount

Specify the amount as mentioned of the cheque issued.

Beneficiary Name

Specify the name of the beneficiary. This field is mandatory if Beneficiary Name validation is required as per Positive Pay agreement.

Remarks

Specify remarks, if any. It can be customer remarks or internal instructions. This field is optional.

Instrument Status

Instrument Status

Instrument status is populated by the system.

Status Change Date

Date of the latest status change is displayed in this field.

Payment Details

Transaction reference no

Once the cheque payment is done in the system, you can view the clearing transaction reference.

Transaction Date

You can view the clearing date of the transaction if the payment of the cheque is done.

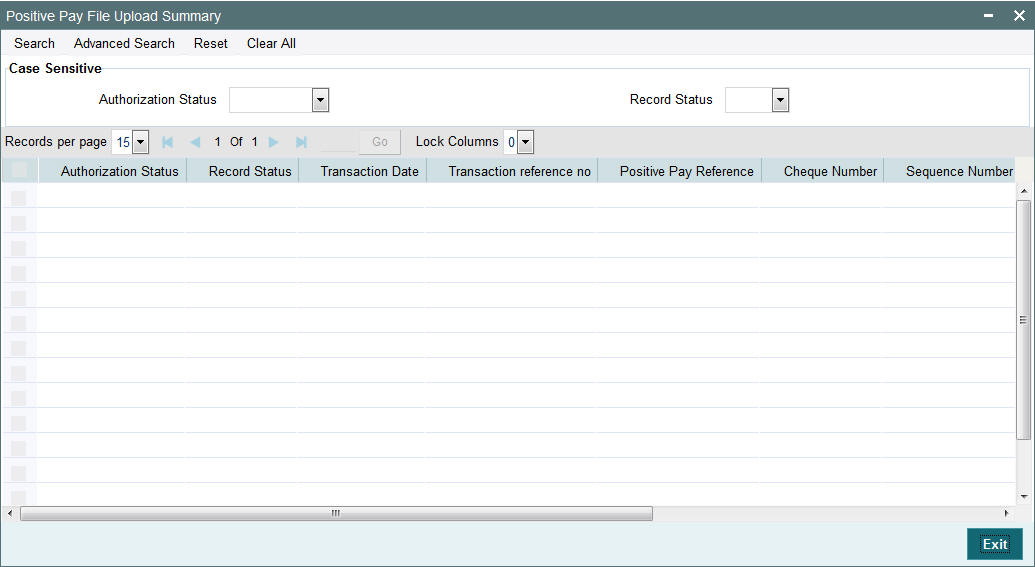

2.2.2 Viewing Positive Pay File Upload Summary

You can search for records in the Positive Pay File Upload Summary Screen. You can invoke “Positive Pay File Upload Summary” screen by typing ‘PYSFUPLD’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button..

You can search using one or more of the following parameters:

- Authorization Status

- Record Status

Once you have specified the search parameters, click ‘Search’ button. The system displays the records that match the search criteria.

The following actions can be performed for transactions from the Summary Screen.

| Actions | Functions | |||

|---|---|---|---|---|

| Amendment | It is possible to amend the positive pay records which are not in statuses like ‘Lliquidated’, ‘Cancelled’ or Payments Stopped’. The modifiable fields are Amount, Date and Beneficiary. | Instruments are marked as stale after the stale days maintained. This is done by a system job. It is possible to mark them as Open records when the revalidation o f the instrument is done with the new date. Whenever date is amended for the cheque system re-computes valid till date and cheque status is updated for instruments that has current status as ‘Active’ or ‘Stale’. | ||

| View | It is possible to view the records received through all channels from this screen. The positive pay records input /upload can be queried and viewed with the system reference number or account & cheque number combination. Cheque status is displayed for each record with date of status change. |

2.3 Positive Pay Status Movement

- Cheque status can be Active, Liquidated, Payment Stopped, Cancelled or Stale.

- Records with ‘Liquidated’ status will not be listed for Status movement. There will be facility to cancel a cheque and revoke the cancellation. Stop Payment can be marked and it will be possible to revoke the Stop Payment.

- Based on the Current status, the new status field will restrict the allowed values.

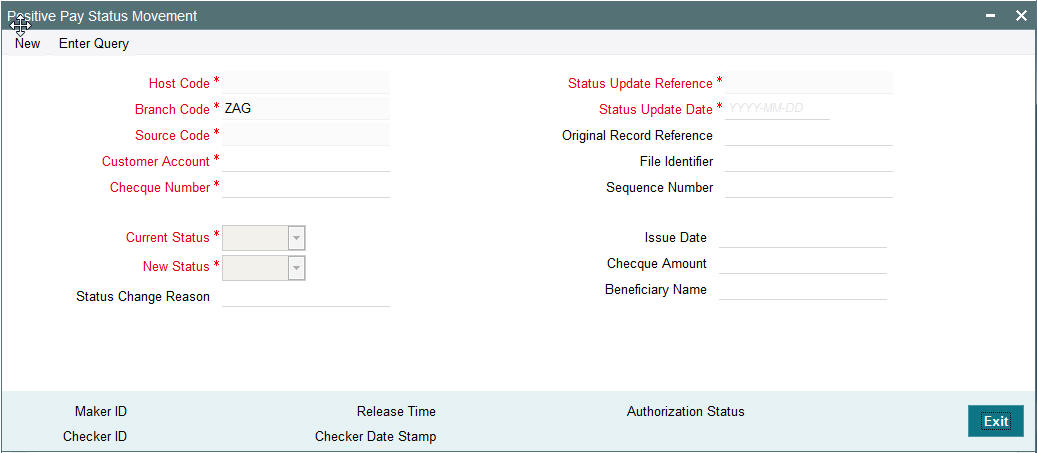

2.3.1 Invoking Positive Pay Status Movement Screen

You can invoke “Positive Pay Status Movement” screen by typing ‘PYDSTMOV’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button...

You can specify the following fields:

Host Code

The system indicates the host code that is linked to the logged in branch of the user.

Branch Code

The system indicates the branch code of the logged in user.

Customer Account

All valid accounts for which positive pay records are available are listed.

Cheque Number

Please select the cheque number for which status movement needs to be initiated.Based on the cheque number selected the following cheque details are populated:

- Original Record Reference

- File Identifier

- Sequence Number

- Issue Date

- Cheque Amount

- Beneficiary Name

Current Status

Current status of the instrument is displayed by the system.

New Status

Select the new status for the record.

- Cheque status can be Active, Liquidated, Payment Stopped, Cancelled or Stale.

- Records with ‘Liquidated’ status will not be listed for Status movement. There will be facility to cancel a cheque and revoke the cancellation. Stop Payment can be marked and it will be possible to revoke the Stop Payment.

- Based on the Current status, the new status field will restrict the allowed values.

-

Current Status Allowed List of New Status Open Payment Stopped, Cancelled or Liquidated Cancelled Open Payment Stopped Open

Note

- When one status update record is pending for authorization for a account and cheque number combination, system will not allow saving another status update record for the same combination.

- Close and reopen options are not available for this screen.

- An authorized record will be allowed to be amended only for Reason field. Other fields will be disabled while unlocking the record.

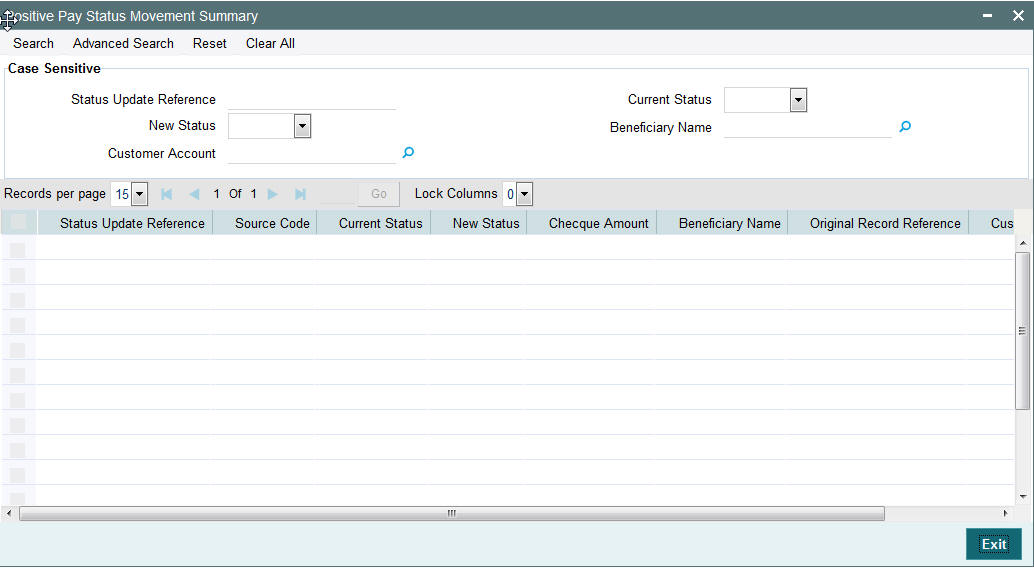

2.3.2 Viewing Positive Pay Status Movement Summary Screen

You can search for records in the Positive Pay Status Movement Summary Screen. You can invoke “Positive Pay Status Movement Summary” screen by typing ‘PYSSTMOV’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button..

You can search using one or more of the following parameters:

- Status Update Reference

- New Status

- Customer Account

- Current Status

- Beneficiary Name

Once you have specified the search parameters, click ‘Search’ button. The system displays the records that match the search criteria.

2.4 Positive Pay Cheque Processing

Positive pay cheques received in Inward clearing follows the process flow like paper cheques with the exception that instrument validation is done based on the positive pay record available. Positive Pay reference is stamped to the clearing record.

The following are the processing steps for a Positive Pay instruction:

- Initial Validations: System performs mandatory field checks and reference information checks. Account/Bank re-direction is also done at this stage. Instrument currency can be one of the local clearing currencies allowed for the Network. System segregates Positive Pay clearing records from normal cheque records at this stage.

- Customer/Account Status Check: Customer status check to be done during initial validations based on the details available in Payments. Customer a/c is validated at the time of transaction validation to verify that the credit account is a valid customer account with valid status.

- Instrument Stale Period Check: This validation is required if issue date of the instrument is back dated. Stale period is validated based on the maintenance available in Positive Pay agreement.

- Future dated Instruments Check: Future dated instruments aremoved to exception queue for return processing.

- Positive Pay Reconciliation: If Positive pay agreement is available for the account, the inward clearing transaction is marked for Positive Pay reconciliation. An open record is required for the account with same cheque number, amount and date. If beneficiary name validation is required as per the PP agreement, the same has to be done. If the Cheque status is invalid, the appropriate exception is raised. Any validation failure will move the transaction to cheque return queue. From where it can be approved or Returned.

- Duplicate Cheque: Validation is done to identify the duplication of the transaction using the below key values, as configured for the source:

- Sanction Check: If Sanction screening is required for inward clearing, then it should be possible to send the clearing party details to the external sanction system for verification.

- Charge Computation: If charge computation is applicable, system should be able to compute the charges at this stage. Charges applicable as on activation date should be picked up for application.

- External Credit Approval: For an incoming clearing, account status and account balance verification and blocking of the cheque amount is done with DDA system.

- Accounting: Accounting entries are handed off to Accounting System.

- Cheque Return: Return processing is the same as inward clearing return processing. Return processing is posted on individual cheque basis.