A loan is nothing but an amount of money that is lent by a bank to a borrower for a certain period of time. Banks charge borrowers interest for the amount lent. Hence, loan accounts are valuable income generating assets for banks. It is therefore important for banks to enrich the end user’s loan servicing experience so as to increase customer satisfaction and retention. In order to achieve this, banks are constantly making efforts to enhance the online channel banking experience for their customers by introducing and revamping loans servicing features on the digital platform.

The application provides a platform by which banks are able to offer their customers an enriching online banking experience in servicing their loans.

Customers can manage their banking requirements efficiently and effectively through the OBDX self-service channels. The loan module offers customers a host of services that include, but are not limited to, viewing their loan account details, schedules and balances and also the facility to make loan repayments.

Features Supported In Application

The retail loans module of the OBDX application supports the following features:

Pre-requisites

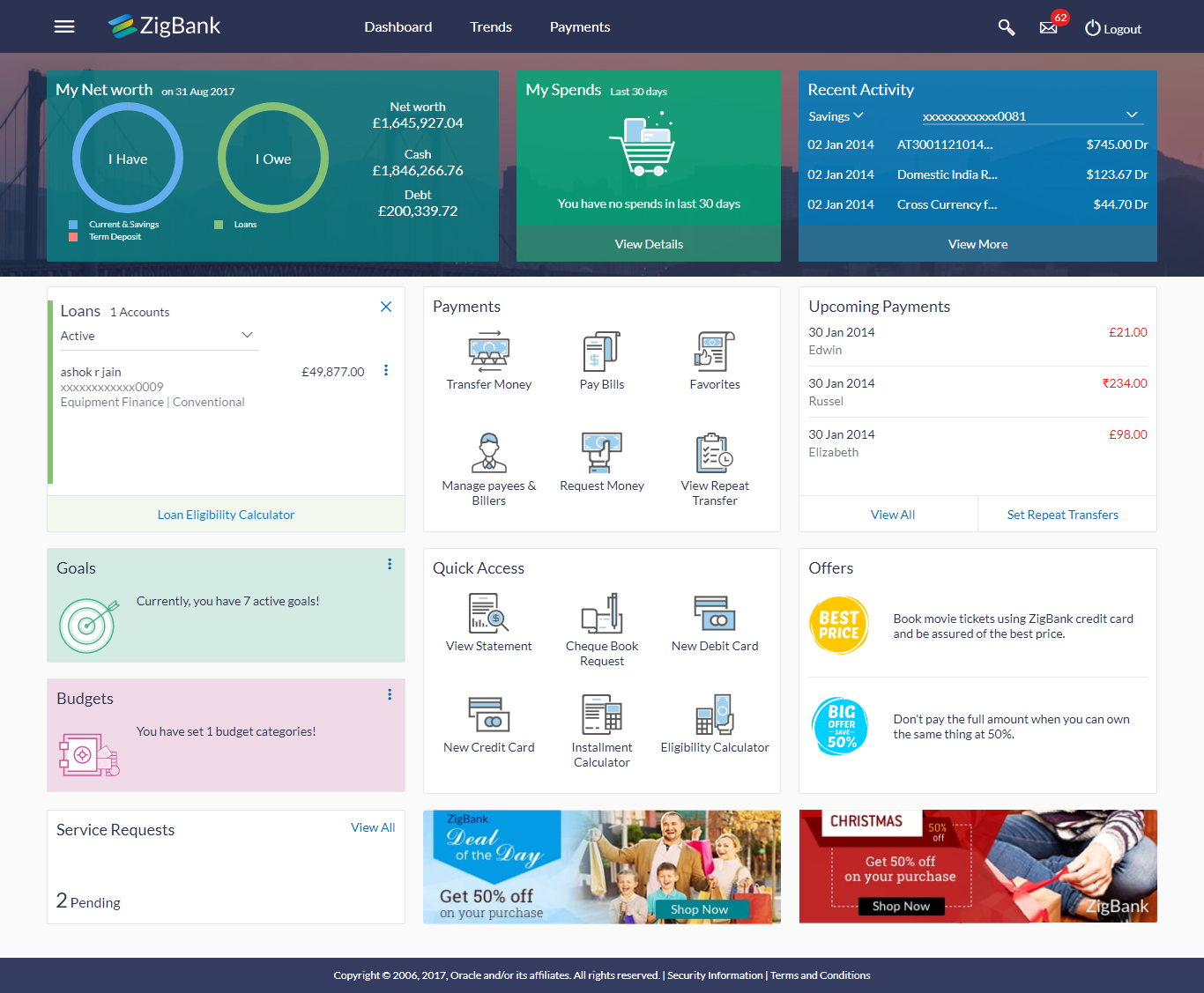

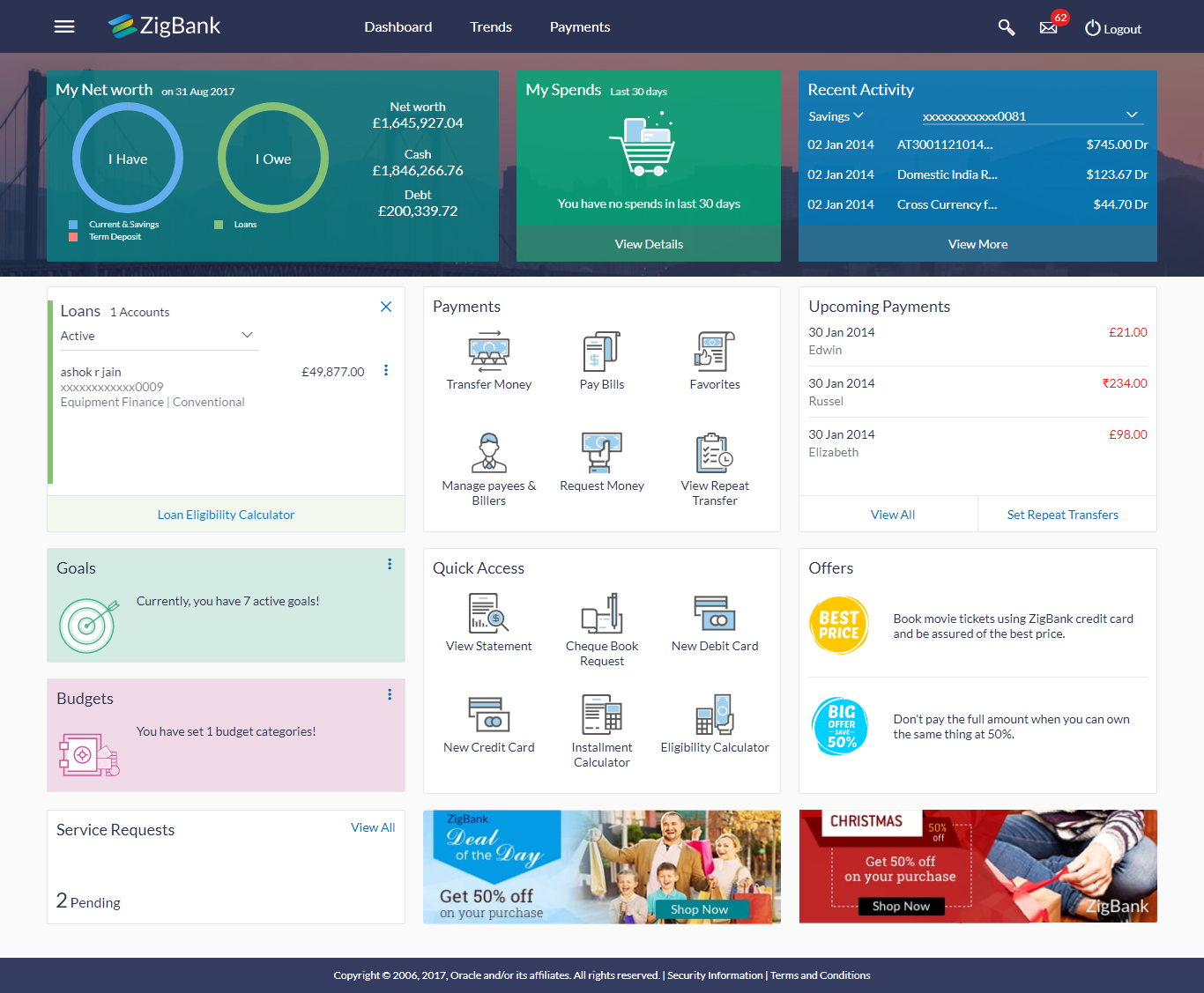

The retail overview/dashboard page displays an overview of the customer’s holdings with the bank as well as links to various transactions offered to the customer. The ‘My Accounts’ widget displays the customer’s holdings in each account type such as Current and Savings Accounts, Term Deposits, Loans and Credit Cards. On clicking on any account type record, the widget displaying details specific to that account type is displayed. One such widget is the Loans widget which is displayed on selection of account type, ‘Loans’ under the My Accounts widget.

The loans widget has been designed to showcase the lending profile of a customer. By viewing the loans widget, the customer should be able to gain an insight into the current position of the loans he holds with the bank.

|

Active Loans The loans widget provides the customer with the option to view the summary of both the active loans and closed loans individually. On selecting the status option ‘Active’, all the active loan accounts of the customer held with the bank are listed down. Each account is displayed along with the outstanding amount, the name of the primary holder (along with nickname if enabled), the loan offer name, as well as the type of loan i.e. conventional or Islamic. The customer is able to view further details and perform various tasks on any loan account by selecting a specific loan from the widget. |

|

|

Inactive/ Closed Loans: On selecting the status option ‘Inactive/ Closed’, all the loans of the customer that have been closed are listed down in the widget. The total number of closed loans is displayed and each loan account is listed along with the name of the primary holder (along with nickname if enabled), the loan offer name, loan type i.e. conventional or Islamic and outstanding balance as zero. The customer is able to view further details of any closed loan by selecting a loan from the widget. |

|

|

Eligibility Calculator: The loans widget also contains a link by clicking on which the customer can navigate to the loan eligibility calculator. This calculator enables customers to compute the amount of loan they are eligible for based on certain criteria. |

|

|

Installment Calculator: In addition to the link provided to navigate to the loan eligibility calculator, the loans widget also contains a link by which the customer can navigate to the loan installment calculator. The installment calculator enables the customer to identify the installment amount payable on a loan of a certain amount for a specific duration. |