Trade finance is process of financing commerce, i.e. both domestic and international trade based transactions. It comprises a seller, a buyer along with other service providing institutions to facilitate transactions such as banks, insurers, credit rating agencies etc. This may be considered as a tool to safeguard against the distinct risks present in doing international trade viz. fluctuations in currency conversions, political conditions, creditworthiness of the buyer etc. Some of the majorly used tools are Letter of Credits, Import and Export Bills, Outward Guarantees.

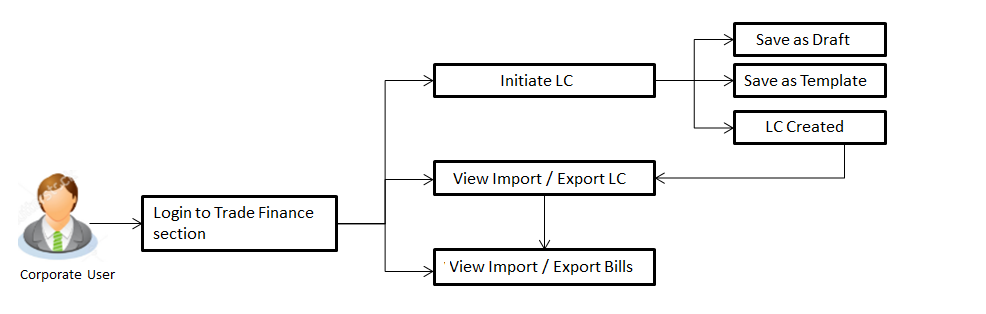

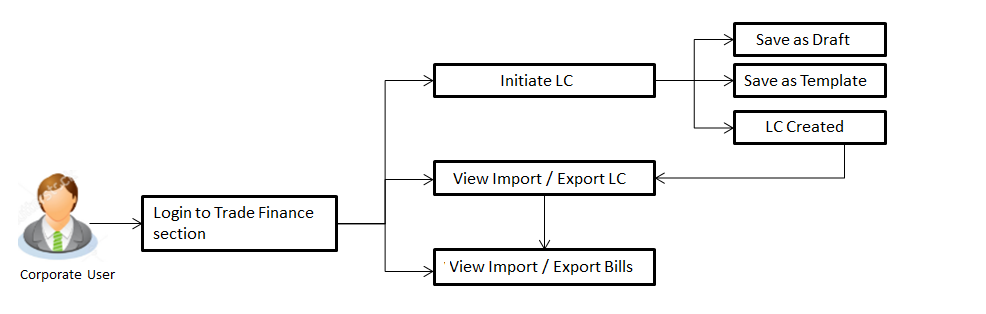

In the Trade Finance module, you can initiate, amend and view Letter of Credits (LC). You can also view details of import and export bills, and export bills under LC. You can attach documents required for the Trade Finance transactions. You can also create and maintain various details that form part of the trade finance transactions.

Workflow

Letter of credit is a financial tool which acts as an obligation of the issuing bank to pay the agreed amount to the seller on behalf of the buyer, if buyer provides compliant documents about those goods as specifically mentioned in the sales contract or purchase agreement to the advising bank. They are governed by rules set by International Chamber of Commerce known as Uniform Customs and Practice for Documentary Credits (UCP 600).

It is of different types; most commonly used ones are irrevocable LC, transferrable LC, back to back LC and standby LC. Mostly they are used in situations where both parties i.e. seller and buyer are new to each other and are operating in different countries and seller thinks to safeguard against multiple risks involved in the trade.

Import bill collection is a method of doing an international trade transaction given that the seller forwards the required commercial documents to the importer, against which the payment is done. Banks facilitates documents movement and payments to suppliers.

An export bill for collection is a way of trade finance whereby an exporter approaches bank to control document movement and release them. Exporters generally instruct their Bank (called the "Remitting Bank") to send commercial documents (e.g. invoices, bill of lading or shipping bills) or financial documents (e.g. bills of exchange, advices etc) on a collection basis to the "Presenting Bank", located in the buyer’s' country. On receiving the needed documents, presenting Bank acknowledges the receipt and then release documents as per the guidelines received from the remitting bank.