10. Currency Maintenance

This chapter contains the following sections:

- Section 10.1, "Specifying Currency Cut-Off Parameters "

- Section 10.1, "Specifying Currency Cut-Off Parameters "

- Section 10.2, "Handling Euro"

- Section 10.3, "Maintaining Sequence Generation Format"

- Section 10.4, "Maintaining Corporate Deposits Currency Limits"

10.1 Specifying Currency Cut-Off Parameters

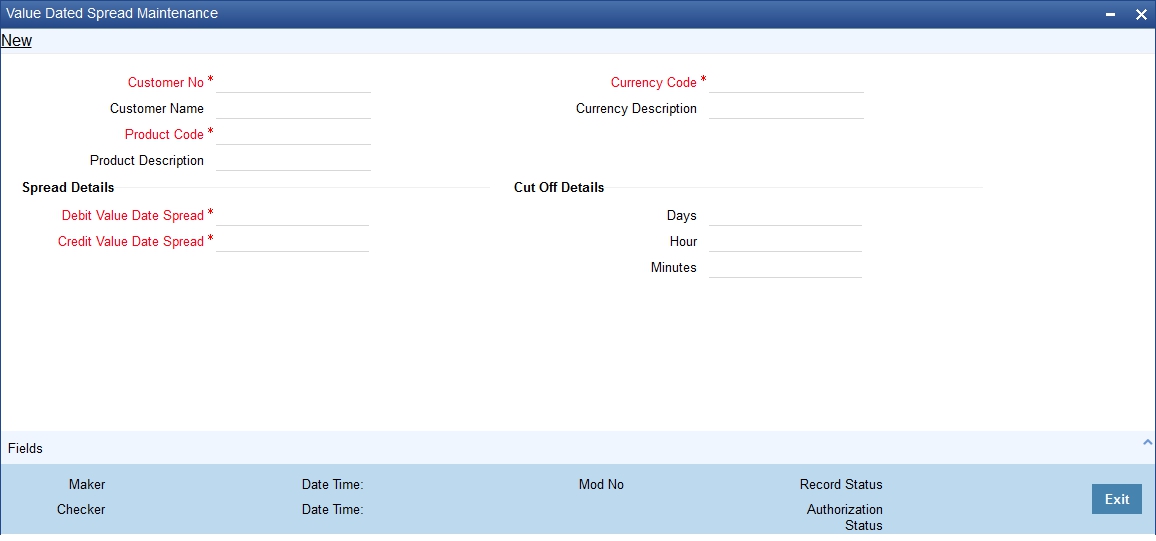

You can choose to restrict the time within which (or before which) funds transfer transactions involving a specific customer, product, and a currency, must be received for processing. For a specific customer, product, and a currency, you can specify a certain number of days before which a transaction involving the combination must be received, as well as a cut-off time before which transactions must be received. These parameters are known as currency cut-off parameters, and you maintain these parameters in the ‘Value Dated Spread’ maintenance screen.

Invoke this screen by typing ‘FTDVDSPR’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button. The screen is as shown below:

In this screen, you can maintain the cut-off time, cut-off days and the value spreads to be applicable for:

- Each customer, for a product and currency combination

- All customers, for each product and currency combination

These currency cut-off parameters are validated in respect of a funds transfer transaction only if currency cut-off checks are specified as applicable in the product preferences, for the product involving the transaction.

For details about how the currency cut-off checks are applied on a funds transfer transaction, refer the chapter ‘Processing a Funds Transfer Contract’ in the Funds Transfer User Manual.

10.2 Handling Euro

This section contains the following topics:

10.2.1 Maintaining Euro Related Information

On 1 January 1999, eleven countries that are part of the European Union embarked on the first phase of economic integration, called the ‘Economic and Monetary Union’ (EMU). In Oracle FLEXCUBE, the eleven countries participating in the first phase of the EMU are referred to as ‘In’ countries and the respective national currencies as ‘In’ currencies. All other countries are referred to as ‘Out’ countries.

The first phase of the EMU, referred to as the ‘transition period’, ushered in a new, single European currency: the Euro (EUR). During this phase, the National Currency Denominations of ‘In’ countries would co-exist with the Euro. That is, transactions involving an ‘In’ currency would, typically, be routed through the Euro during this phase. At the end of the transition period, in mid 2002, however, the national currencies of the participating countries would cease to exist as valid legal tenders. The Euro would be the only legal tender in ‘In’ countries.

In Oracle FLEXCUBE, you can handle the Euro and the attendant implications for your bank, by capturing additional currency and settlements related information. This chapter details how this information is to be captured, and its implications.

In Oracle FLEXCUBE, the details that you need to maintain in order to handle the EMU include:

- Maintaining Euro as a valid currency

- Indicating if a currency is ‘In’, ‘Out, ‘Euro’, or ‘Euro Closed’

- Maintaining Currency Redenomination details

- A common conversion GL and a transaction code to identify the redenomination entry

- Maintaining a ‘Tolerance Limit’ for a currency (to check against ERI information)

- Capturing additional settlement details (Euro related information for the MT 100 and MT 202 SWIFT messages)

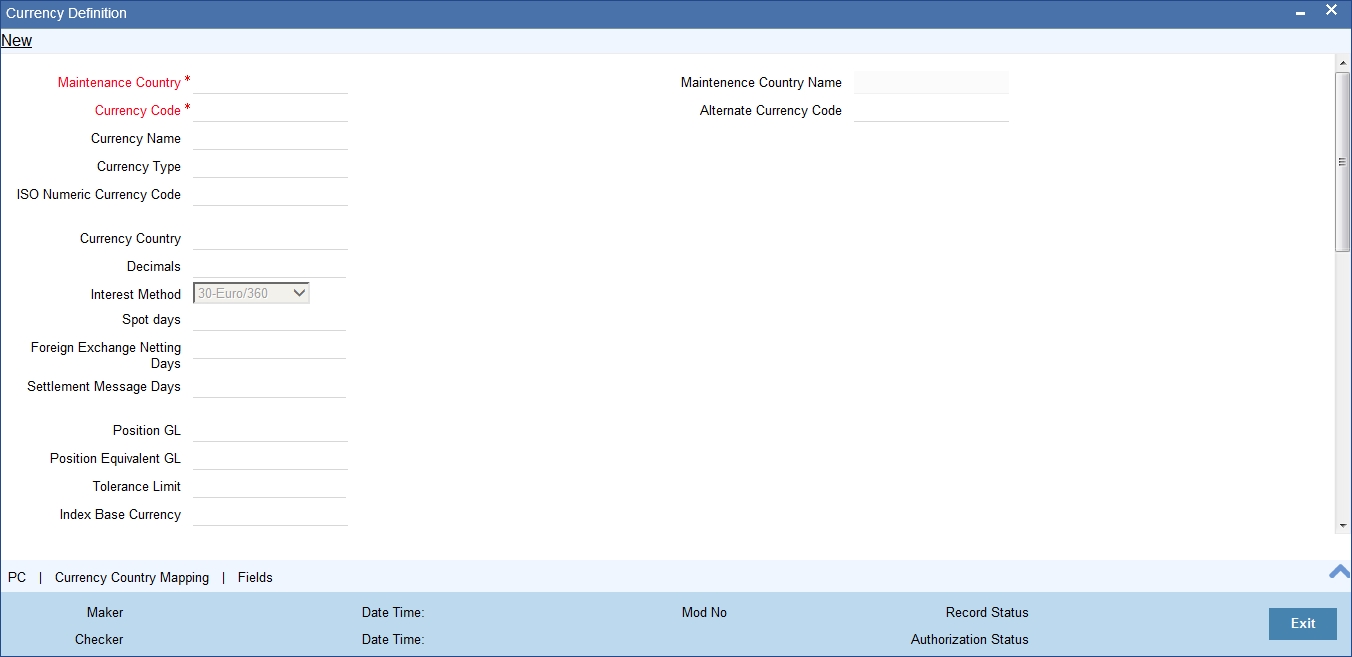

You can maintain currency related information in the Currency and the Currency Pair Definition screens. ‘Settlement’ details can be captured in the Settlement Instruction Details screen.

10.2.1.1 Maintaining Currency Details

Your specifications for a currency in the Currency Definition screen determine the manner in which transactions in the currency are handled in Oracle FLEXCUBE.

Currency Type

When maintaining a currency in the Currency Definition screen, you have to specify the ‘type’ of the currency. You can do this in the ‘Euro Type’ field. Choose the appropriate option from the following:

- The Euro itself

- An ‘In’ currency

- An ‘Out’ currency

- ‘Euro Closed’

National currencies of ‘In’ countries are referred to as ‘In’ currencies. When maintaining other currencies, you have to choose the ‘Out Ccy’ option under Euro Type.

When the transition period ends, the national currencies of the participating countries would cease to exist as valid legal tenders. The Euro would be the only legal tender in the participating countries. Consequently, the Euro changes made to Oracle FLEXCUBE will no longer be required.

You can turn off the changes at the end of the transition period by:

- Closing all ‘In’ currencies, and

- Choosing the ‘Euro Closed’ option (for the Euro)

Tolerance Limit

When you are maintaining an ‘In’ Currency, or the Euro, in the Currency Definition screen, you can define a ‘Tolerance Limit’ for it. The limit is expressed as a percentage.

The Implication:

During the transition period, settlements of components in ‘In’ currencies can be made either in the same currency or in the Euro (EUR) depending on the settlement account(s) maintained. (Similarly, components in Euro can either be settled in EUR or in an ‘In’ currency.) In the settlement messages that are generated (MT 100, MT202), the settlement amount would be reported in the Settlement Account Currency. However, you can opt to additionally furnish the value of the component in Euro Related Information (ERI) currency. You have to manually specify the settlement amount value, in the ERI currency, in the Settlement Message Details screen.

When generating the message towards settlement (MT100, MT202), the system ensures that the value you specify as the ERI Amount conforms to the Tolerance Limit defined for the ERI Currency (in the Currency Definition screen). That is, the system computes the ERI equivalent of the settling amount using the pegged rates, and compares the same against the ERI amount input by the user. If the difference is within the tolerance limits defined for the ERI currency, the user specified amount is used.

If the user specified ERI amount breaches the Tolerance Limit defined for the ERI currency, the system calculates and reports the ERI Amount on the basis of the exchange rate defined for the settlement currency vis-à-vis the ERI currency.

The following example illustrates the application of the Tolerance Limit.

Note

The system validates the ERI amount only when generating the settlement messages. It does not validate the ERI amount at the time of input (in the Settlement Message Details screen).

Currency pairs

In the Currency Pair Definition screen, you can specify a ‘Through Currency’. When maintaining a pair involving an ‘In’ currency (‘In’ – ‘Out’ and ‘In’ – ‘In’), you can only specify the Euro as the ‘Through Currency’.

Note

You cannot maintain a ‘Through Currency’ for a pair constituted by an ‘In’ currency and the Euro.

10.2.1.2 Maintaining Conversion GLs

To facilitate the currency conversion process, two additional parameters need to be maintained in the ‘Branch Parameters’ screen. You have to maintain a common Conversion GL and a Transaction Code that identifies redenomination entries.

The screen is as shown below:

Indicating Euro Redenomination General Ledger

Conversion GL

The conversion GL that you specify will be identified as the common Suspense GL for all balance conversions while re-denominating the currency of an account either for specific customers or for generic conversions.

Transaction Code

In addition to the conversion GL, you have to indicate a Transaction Code, which identifies conversion related entries.

10.2.1.3 Implications of Currency Redenomination

In the IC Product Accounting Role Definition screen

For the purpose of currency conversion, an accounting role called ‘Acquired’ is available.

End of day processes

Maintaining a Conversion GL and Transaction Code simplifies the End of day process. Basically two important things happen when the End of day processes are run. Firstly interest is liquidated to the Acquired Interest GL and secondly all balances will be reduced to zero.

When you run the Beginning of day processes the next day the change in the currency conversion will be in place. In addition balances will get restored.

Change in field values due to conversion

The change in currency re-denomination impacts amount based fields pertaining to Accounts, Collaterals, Credit Lines and Customer Limits. The change in the value of these fields is reflected when you run the beginning of day processes.

The amount-based fields, which are affected by the change in currency denomination, will be updated with the equivalent value in the new currency

Accounts

The following fields will reflect the new values:

- Temporary Over Draft limit

- Sub-limit

- Uncollected Funds limit

- Offline limit

- Account Currency

These fields can be found in the Customer Accounts Maintenance screen.

Collateral

In the Limits Maintenance Collaterals screen the following fields will be updated:

- Collateral Currency

- Collateral Value

- Limit Contribution

- Issuer Exposure Amount

Credit Lines

In the Limits screen of the Limits Maintenance module the following fields will reflect the new values:

- Credit Line Currency

- Tenor limits

- Tenor utilization

- All Related Amounts

Customer Limits

In the Customer Maintenance screen of the Core Services module the following fields will be updated at BOD.

- Limit Currency

- Liability Risk Limit

- Customer Risk Limit

Note

Once the conversion process is complete the advices generated for your customer will carry the following information:

- The Old Value

- The New Value

- And the Exchange Rate used for the conversion

As a consequence of currency re-denomination you will not be able to pass entries where the value date falls before the currency conversion date.

10.2.1.4 Specifying Preferred ERI Currency for Counterparty

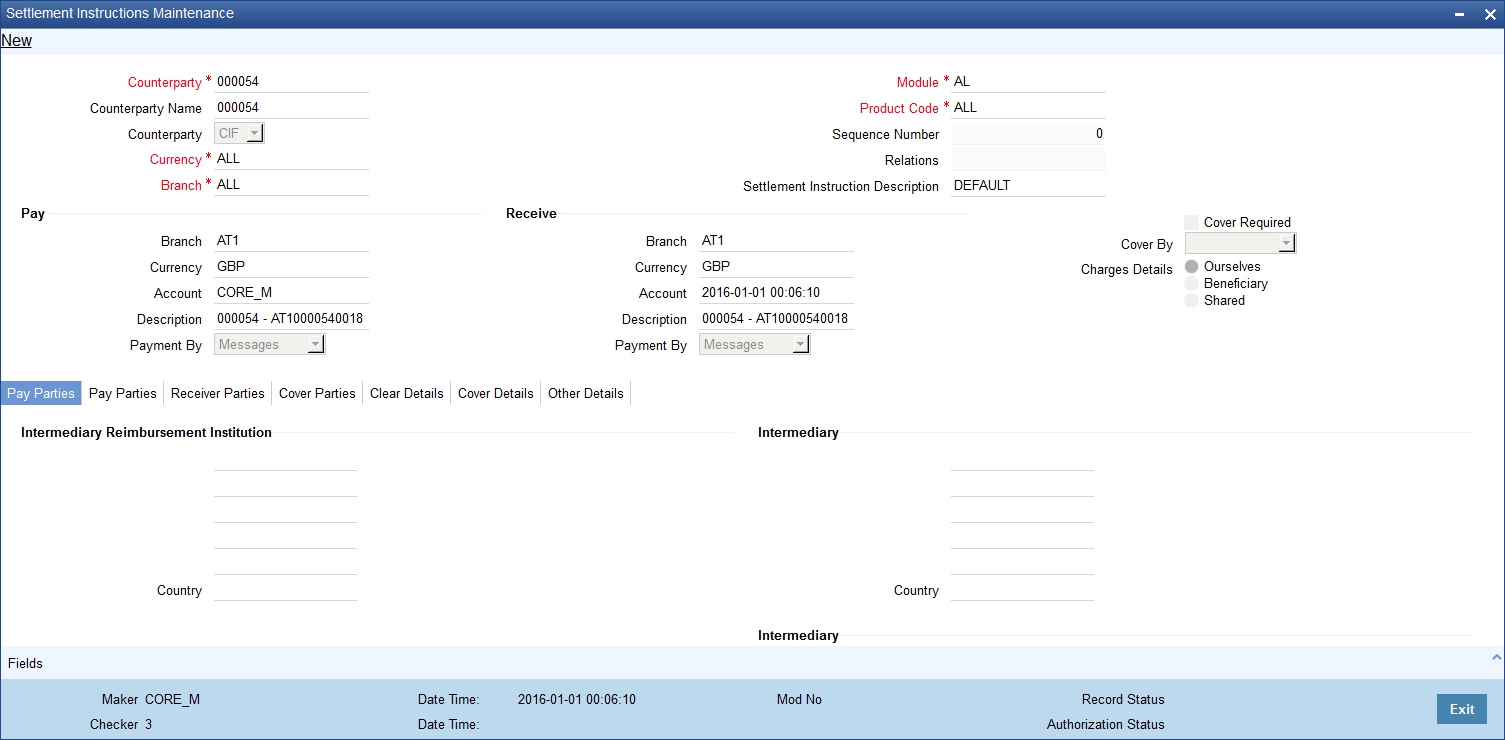

For a counterparty and currency (combination), you can maintain a preferred ERI currency. You can state this preference in the ‘Settlement Instructions’ screen.

The Implication

During the transition period, settlements of components in ‘In’ currencies can be made either in the same currency or in the Euro (EUR) depending on the settlement account(s) maintained. (Similarly, components in Euro can either be settled in EUR or in an ‘In’ currency.) In the settlement messages that are generated (MT 100, MT202), the settlement amount would be reported in the Settlement Account Currency. However, you can opt to additionally furnish the value of the component in Euro Related Information (ERI) currency. You can maintain this ERI currency (for a counterparty and currency combination) in the ‘Settlement Instructions Maintenance’ screen.

In the SWIFT messages that are generated towards settlement of a component (involving the counterparty and the currency), the component value will be expressed in this (ERI) currency, by default. Invoke this screen by typing ‘ISDINSTN’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The screen is as shown below:

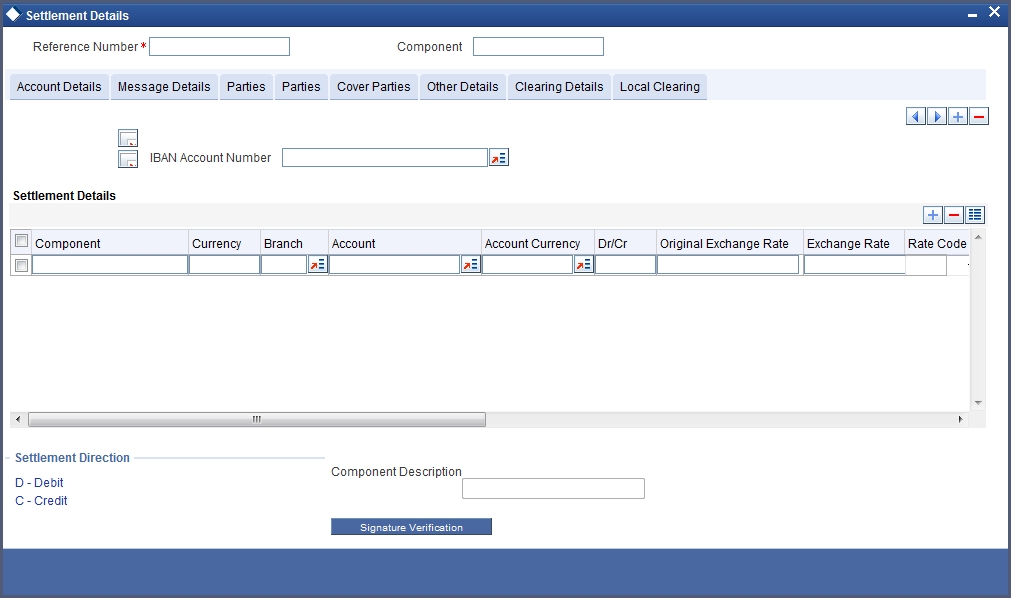

10.2.1.5 Specifying Settlement Message Details

SWIFT messages (MT 100/MT202) generated towards settlement can furnish the value of the settlement amount in both the settlement account currency, and an ‘ERI’ currency. If you opt to furnish the ERI value of the amount, you have to enter the following in the ‘Settlement Details’ screen:

- The ERI currency

- The ERI Amount

The screen appears as shown below on clicking ‘Settlements’ button in the contract screen:

The system defaults to the ERI currency specified for the customer and currency combination. You can change the default ERI currency. The ERI amount that you specify will be validated against the Tolerance Limit specified for the ERI currency.

10.2.1.6 Settlements of Foreign Exchange Deals

Oracle FLEXCUBE allows cross currency settlements of foreign exchange deals that involve an ‘In’ currency. You can settle the ‘In’ currency leg in another ‘In’ currency or in ‘Euro’.

10.2.1.7 Reports and Advices

The following reports furnish the equivalent Euro values of amounts in an ‘In’ currency. The ‘locked in’ exchange rates defined for the Euro against the ‘In’ currency will be used for currency conversions.

The reports with this feature are the:

- Currency Position report

- Cash Flow report

- FX Maturity report

Note

These reports will not furnish the ‘In’ currency and equivalent Euro values when you close the ‘In’ currencies, and choose the ‘Euro Closed’ option (for the Euro) in the Currency Definition screen.

All advices that provide ‘In’ currency details will also provide the equivalent Euro values

Account Statements

Statements provided for accounts in an ‘In’ currency provide the Euro equivalent values of the following:

- The opening balance

- The closing balance

- Every transaction

10.2.2 Maintaining Limits Type

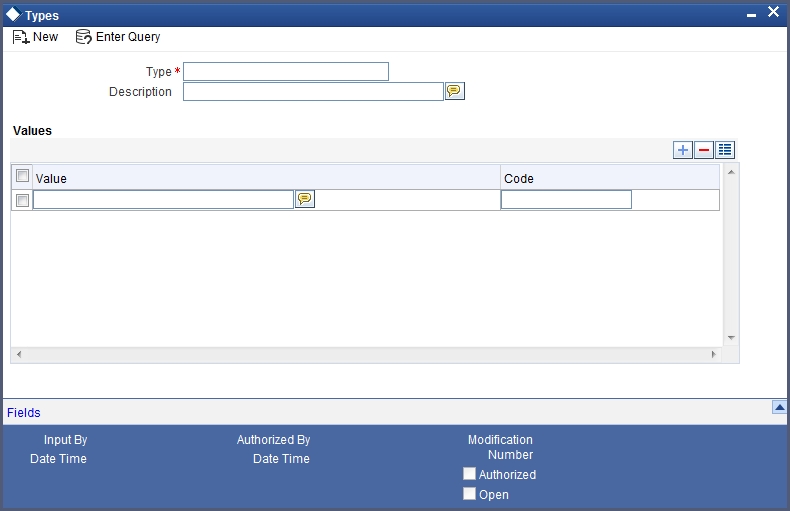

You can maintain various limit types and their values through the ‘Limits Types Maintenance’ screen. For example, you can define and maintain various Limit types like price codes, collateral types and price through this screen.

You can invoke this screen by typing ‘LMDTYPES’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The screen is as shown below:

Type

Specify the limit type for which you want to maintain values

Description

Specify the description for the limit type you are maintaining

Values

The values for the limit type that you are maintaining can be listed here. To add a value to the list of values, click on the ‘Add’ icon, and type the value. To remove a value from the list of values, check the box against that value and click on the ‘Delete’ icon.

Value

Specify the list of supported values. For example, MAIL, COURIER, BRANCH and so on.

Code

Specify the codes for the list of value. For example, CO, ML and so on.

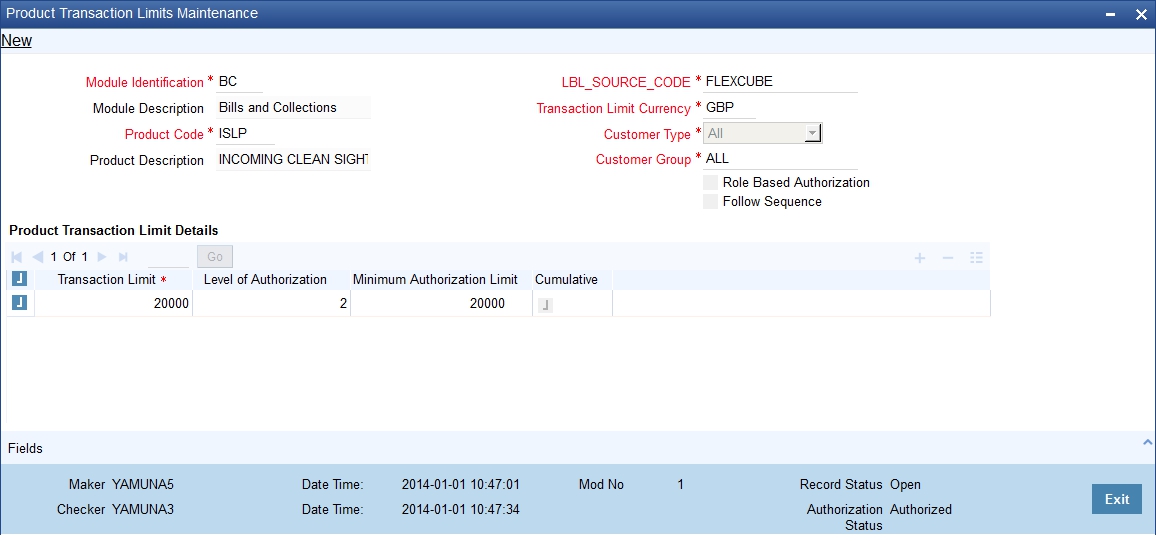

10.2.3 Maintaining Transaction Limits

This section explains in detail about maintaining transaction limits, level of authorisations required for the transaction amounts and minimum user authorisation limit required for a transaction.

Oracle FLEXCUBE offers you a facility, whereby, each time a particular transaction processed in the system exceeds a certain limit; an override will be generated by the system.

You can maintain transactional limits for a module and product combination through the ‘Product Transactional Limits Maintenance’ screen. Invoke this screen by typing ‘CSDPLMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The screen appears as shown below:

Module Identification

Each module in Oracle FLEXCUBE is identified by a code. First, you have to identify the module for which the currency-wise transactional limit is to be maintained. A list of all the modules operational at your bank will be displayed in the option list. You can choose the appropriate module code.

Module Description

The description associated with the module will be defaulted in the adjacent field.

Product Code

Each module contains a number of products within it. After you identify the module, indicate the product within the module for which you would like to maintain a currency-wise transactional limit. You can select the appropriate product code from the option list.

In the Product Transactional Limits screen, you can maintain the limits for:

- A specific module and a specific product

- A specific module and all products (select ‘ZALL’ as the Product Code)

- All modules (Select ‘AL’ as the Module Code) and all products

Product Description

The description associated with the module will be defaulted in the adjacent field.

Source Code

Specify the source code based on which you need to maintain the product transactional limits. The adjoining option list displays all valid source codes. The transaction limit amount maintained for the selected source code is used to validate transaction limit while authorizing the contract.

If the source code is available in Oracle FLEXCUBE, then the system enables all the fields available under ‘Product Transaction Limit Details’ multi grid.

If the source code external, then the system enables only ‘Transaction Limit’ available under ‘Product Transaction Limit Details’ multi grid.

Note

You cannot select a source code more than once.

Transaction Limit Currency

The transaction limit currency is the currency in which you would like to maintain the amount limit.

Customer Type

Select the type of customer for whom you are maintaining the transaction limits from the adjoining drop-down list. The following are the options available:

- Corporate

- Individual

- Bank

- All

Customer Group

Specify the customer group to which the authorization matrix is applicable. Alternatively, you can select the customer group from the option list. The list displays all the customer group maintained in the system.

Role Based Authorization

Check this box to authorize the transaction based on the roles defined in ‘Authorization Role Mapping’ section.

If you select this check box, it is mandatory to define authorization rules in the ‘Authorization Role Mapping’ section.

Follow Sequence

Check this box to follow a sequence during various levels of multiple authorization of a transaction. This field is enabled if the ‘Role Based Authorization’ is checked.

Product Transaction Limit Details

Specify the following transaction limit details:

Transaction Limit

Specify a transaction limit. Each time you process a transaction, the system checks the transaction amount involved in the contract against the limit specified here. If the contract currency is different from the transaction limit currency, then the system converts the contract amount using the standard mid rate to the transaction limit currency and check against the transaction limit amount maintained for the product

The system displays an appropriate message indicating the levels of authorization if the transaction amount booked is in excess of the maintained transaction limit.

Level Of Authorization

Specify the levels of authorization to be involved in the authorizing a particular transaction amount.

Note

The level of authorization should be greater than one. If the number of authorization levels are greater than five, the system displays an error message.

Minimum Authorization Limit

This option is enabled only if the ‘Cumulative’ option is checked. Specify the minimum authorization limit required for a transaction. The authorization limit cannot be greater than the transaction limit. This amount is used to validate authorizer limit while authorizing the contract.

Cumulative

Check this option to indicate that multiple authorisers are allowed to authorise a transaction. The authorisers must have equal or greater than the minimum authorization limit maintained in this screen. The system displays an appropriate error message if the authoriser tries to authorise a transaction having transaction amount greater than the minimum authorising limit.

This field is not applicable if you check the ‘Role Based Authorization’ check box,

Authorization Role Mapping

Authorization Rule

The system displays the authorization rule maintained in the system. The list displays the following values:

- Primary - To authorize the transaction level.

- Alternate - To authorize the transaction for the respective level in addition to the users attached to the role in Primary rule.

Level 1

Specify the user role eligible to authorize the transaction in the first level.

Level 2

Specify the user role eligible to authorize the transaction in the second level.

Level 3

Specify the user role eligible to authorize the transaction in the third level.

Level 4

Specify the user role eligible to authorize the transaction in the fourth level.

Note

For Primary rule, you should specify the role for at least one level.

10.2.3.1 Validating Transaction Amount during Contract Processing

While saving a contract, the system will check the transaction amount against the cut-off amount maintained for the module and product currency involved in the transaction. If both the transaction currency and the limits currency are same, the comparison will be done directly. If different currencies are involved, the system will first convert the transaction amount into the cutoff amount currency using the STANDARD mid rate and then perform the validations.

To perform the check, the System will look for the limits maintained, in the following order:

- The System looks for the limits maintained for a specific module and specific product combination

- If the first option is not available, it checks the limits maintained for a specific module + ZALP (all products) combination

- It checks the maintenance for AL (all modules) + ZALP (all products) combination

If the third option is also not available, the system displays an error message

When a transaction exceeds the amount limit, the system displays an override message while saving the transaction

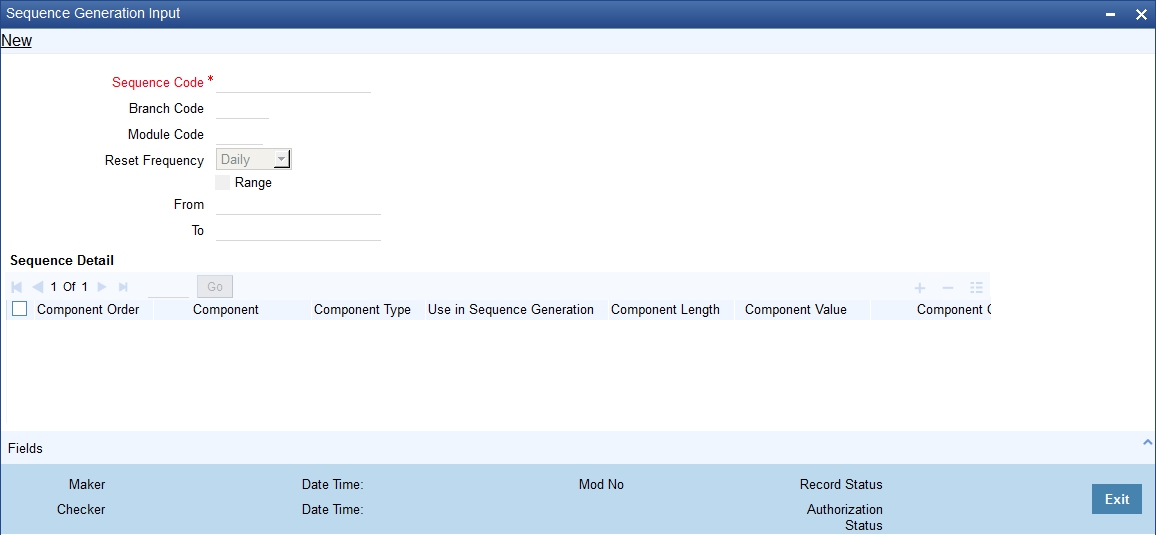

10.3 Maintaining Sequence Generation Format

Every contract in Oracle FLEXCUBE is identified by a unique Contract Reference Number that is generated internally by the system. You are not allowed to modify this number. In addition, a contract is also identified by a unique User Reference Number. By default, the Contract Reference Number will be taken as the User Reference Number. But you have the option to change the User Ref Number.

Oracle FLEXCUBE also provides you the facility to generate the user reference number in a specific format.

To maintain a specific format, you need to identify the various components that would be part of the user reference number including details such as the length, order, value etc. of each component.

You can maintain a unique format through the ‘Sequence Generation Input’ screen. You can invoke this screen by typing ’ ‘CSDSQGEN’in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The screen appears as shown below:

You can maintain the following details of the sequence format:

Sequence Code

Each sequence format is identified by a unique sequence code. You can devise a code comprising a maximum of 20 alphanumeric characters.

Branch Code and Module Code

You can maintain the format for a specific branch and module combination. Select the branch code and the module code from the option-list. All authorized and active records will be displayed in the list.

Alternatively, you can maintain a sequence format that will be applicable to all the branches (ALL) and all the modules (AL) available in your bank.

Reset Frequency

You need to specify the frequency at which the system will drop and recreate the sequence numbers once again. At the reset frequency that you specify, all sequence numbers of the sequence format will be dropped and recreated again during the End of Day processing.

The options available are:

- None

- Daily

- Monthly

- Yearly

For example, let us assume that the running number in the sequence format is 4 characters long (starting from 0001) and the reset frequency is Monthly. Further, let us assume that the sequence number of the last contract processed on the last day of the month is 0199. At EOD of the last day of the month, the sequence numbers generated till date will be dropped and the system will begin regeneration starting from 0001 once again for all subsequent contracts.

Range

You can specify a range of sequential reference numbers. If you specify such a range, then no additional details need be specified. If you do not specify a range, you can specify additional details specific to each component of the sequence format.

In addition to the above details, you should also maintain details specific to each component of the sequence format. The details are as follows:

Component Order

Each component is assigned an order number based on which they would appear in the user reference number. The component order is automatically generated by the system and is non-editable.

Component

Each component in the sequence format is identified as one of the following:

- An Oracle FLEXCUBE Component – If your sequence format uses an Oracle FLEXCUBE column directly, you can specify it as an Oracle FLEXCUBE Component. For instance, you may want to include the product group associated with the product code involved in a contract, as a component in sequence number generation. To achieve this, you will use the Oracle FLEXCUBE column PRODUCT_GROUP (available in the table CSTM_PRODUCT) as an Oracle FLEXCUBE Component.

- A User Component – You may want the first two characters of your bank’s name to be part of all the user reference numbers generated at your bank. You can define it as a user component. In addition, if you want to use the manipulated value of an Oracle FLEXCUBE Column in the sequence format, you can specify it as a User Component. For eg, you may want to include ONLY the first four characters of the product group in the sequence number. In this case, the component would be defined as a User Component.

- A Separator – To separate the various components from one another, you can use the component known as the separator. Eg: a back slash, a hyphen etc.

- A Running Number – Each contract is identified by a unique sequence number. It is mandatory to maintain a running number as a component in the sequence format. If not included, you will not be allowed to save the details of the format. A running number is internally generated by the system.

Component Type

You need to identify the type of each component in the sequence format. A component can be constant through out or change for every contract processed at your bank. You can associate a component with one of the following types:

- Static – To include any hard coded component in the sequence format, you will specify the type to be static. For instance, you may want the first two characters of your bank’s name to be part of all the user reference numbers generated at your bank. The component type would be static in this case.

- Dynamic – You will specify the component to be of the dynamic type if its value is picked up from the Oracle FLEXCUBE table. Eg: Product Group. A running number would always be dynamic in nature.

Use in Sequence Generation

You need to indicate whether the component being defined should be used in sequence generation or not. Specify ‘YES’ or ‘NO’ as per your choice.

You can also choose to display the reference number in the advices that are generated for a contract.

Component Length

You can also specify the length of each component in the sequence format. The component value is dependent on the component length maintained. For instance, if you specify 2 as the component length, the value should comprise of only two characters.

Component Value

As stated earlier, the component value is dependent on the component length. Based on the length, you can specify a value comprising of as many characters as specified in the Component Length field. However, this field is used only if the value of the component is required to be constant (static type) in all the user reference numbers generated at your bank. If the component value is changing constantly (Dynamic type) for every contract, the system will automatically pick up the value from the DB table based on the SQL query that you maintain for the purpose.

Component Column and Component Table

If your component is of the dynamic type, you will need to mention the name of the Oracle FLEXCUBE column from where the system will pick up the component value. Further, if you wish to include a manipulated column value in sequence generation, you will need to include ‘SUBSTR’ as well in the column name. For eg, to include only the first four characters of the product group associated with the product code involved in a contract, you will specify the following in the Component Column field:

SUBSTR (PRODUCT_GROUP, 1, 4)

You need to mention the table name also, if the component type is dynamic. The following table names are available in the option-list provided.

- DUAL

- STTM_BANK

- STTM_BRANCH

- CSTM_PRODUCT

For our example, the table name would be CSTM_PRODUCT.

Component Where Clause

The condition or the ‘where clause’ of the SQL code is specified here. In the example discussed above, the system will pick up the appropriate product group depending on the product code involved in the contract being processed. You can specify the following where clause as an extension of the SQL statement specified earlier:

WHERE PRODUCT_CODE = SUBSTR (P_CRN, 4, 4);

Click add icon to define each subsequent component in the format. Use the navigating icons to move between the various components of a sequence format.

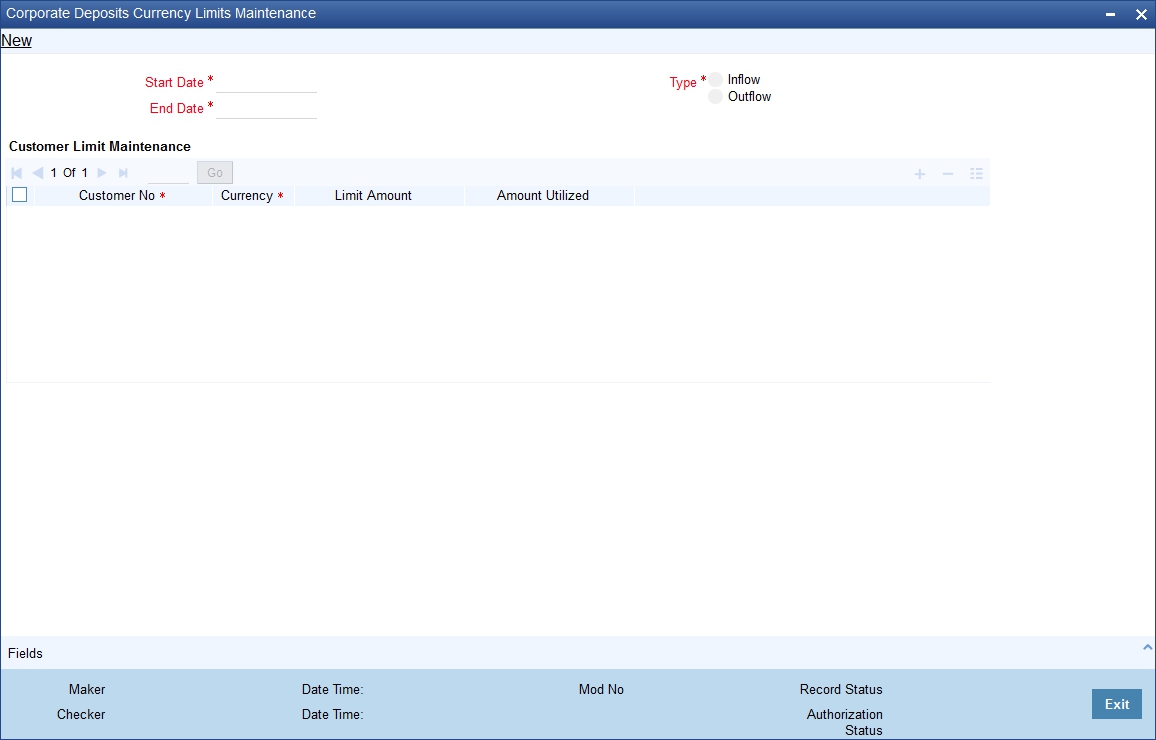

10.4 Maintaining Corporate Deposits Currency Limits

You can invoke the ‘Corporate Deposits Currency Limits Maintenance’ screen by typing ‘CSDXCCLM’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

The ‘Corporate Deposits Currency Limits Maintenance’ screen is shown below:

You can specify the following here:

Start Date

You need to specify the period for which the limit maintenance is applicable. Select the start date of the period here.

End Date

You need to specify the period for which the limit maintenance is applicable. Select the end date of the period here.

Type

Select the type of fund flow to which the limit should be applied.

Customer Number

Specify the CIF of the customer for whom the currency limit should be applied. You can select the appropriate CIF from the option list.

Currency

Specify the currency code for which the limit should be applied. You can select the appropriate currency code from the option list.

Limit Amount

Specify the limit amount. The customer will be allowed to transact using the selected currency for a maximum of this limit amount.

Amount Utilized

The system displays the amount that has already been utilized by the customer.

Once you have captured the details, save the maintenance.

Currency Maintenance explained in this chapter are specific to Oracle FCUBS. For more details on Currency, Currency Pair and Currency Rates Maintenance refer Common Core - Core Entities and Services User Guide.