13. Maintaining Currency Spread for Customer

This chapter contains the following section:

13.1 Currency Spread Maintenance

This section contains the following topics:

- Section 13.1.1, "Maintaining Customer Spread Details"

- Section 13.1.2, "Maintaining Currency Margins for Customer"

13.1.1 Maintaining Customer Spread Details

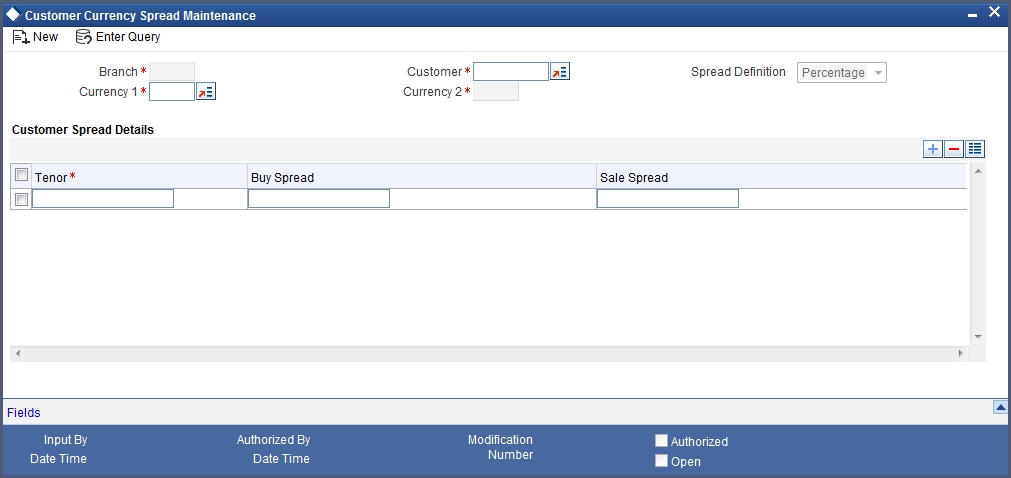

For a customer and currency pair, you can maintain tenor-wise spread details in the ‘Customer Currency Spread Maintenance’ screen.

You can invoke this screen by typing ‘CYDCUSPR’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

In this screen, for a customer and currency pair, you can maintain buy and sell spreads for different tenors.

You need to maintain customer spreads in each branch. Transactions initiated in a branch will pick up the spread(s) maintained for that branch.

Note

- Funds Transfer, Loans and Deposit contracts have tenor = 0 (zero). Therefore, you need to maintain Customer Spreads for zero tenor also.

- The tenor is specified in days

13.1.1.1 Specifying Spread Details

When processing an FX deal involving a customer (for whom you have maintained spread details), the system picks up the customer spread corresponding to the tenor of the deal and builds it into the exchange rate. If spread details are unavailable for a specific tenor, the system picks up the spread defined for the nearest lower tenor.

For example, assume for a customer and currency pair you maintain spread details for the following tenors: ‘3’, ‘5’, and ‘10’ days. When processing a deal with a tenor of ‘4’ days (involving the customer and the currency pair), the system picks up the spread details defined for a tenor of three days. This is because spread details for a ‘4’ day tenor is unavailable for the customer and currency pair.

Note

You can also maintain customer spreads for the wildcard entry – ALL. If spread details for a specific counterparty (for the currency pair) are unavailable, the System looks for the customer spread maintained for the wildcard ALL entry. If even that is not available, then the customer spread defaults to zero.

13.1.1.2 Computing Buy and Sell Spreads

Using percentage system -- suppose the bank wants to make a profit of 5% over and above the mid rate quoted. Suppose the dealing currencies are USD and AUD. 1USD = 1.4166 AUD for Standard rate type. (Mid rate being 1.4166). Now to arrive at the spread the bank will use the following formula:

Spread = 5 / 100 x Mid rate (1.4166) = 0.07083

Using the points system -- suppose the point quoted by the bank is 708.3. The points multiplier in this case would be 0.0001 (depends on the decimal points that the mid rate extends to. Usually it is 4 decimal places).

Spread = Points (708.3) x Points Multiplier (0.0001)

Now coming to the buy and sale rate computing, there are two ways of computing the buy and sale rates -- Direct and Indirect. Depending upon the quotation method you have specified in the Currency pair screen, the system computes the spreads.

In the Direct method, the buy and sell rates are calculated as follows:

Buy Rate = Mid-Rate - Buy Spread

Sell Rate = Mid-Rate + Sell Spread

For cross currency contracts, the rate for the currency pair is:

1 unit of Ccy 1 = Rate * 1 unit of Ccy 2

In the Indirect method, the buy and sell rates are calculated as follows:

Buy Rate = Mid-Rate + Buy Spread

Sell Rate = Mid-Rate - Sell Spread

For cross currency contracts, the rate for the currency pair is:

1 unit of Ccy 2 = Rate * 1 unit of Ccy 2

The method of spread definition – percentage or points – that you have maintained for the currency pair is displayed on this screen.

13.1.2 Maintaining Currency Margins for Customer

For each customer of your bank you can define buy and sell margins for a specific currency. This spread is applied to floating interest components that involve the customer and currency combination.

You can define buy and sell margins for a customer in the Customer Spread Maintenance screen invoked from the Application Browser. You can invoke this screen by typing ‘CFDCUMRG’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The margin that you define will be appropriately picked up and applied to arrive at the final rate that is applied to floating components of contracts that involve the customer - currency combination.

The buy and sell margins that you define are for a customer and currency combination. You can select the customer and currency combination from the option lists available.

For the selected currency – customer combination, you can define amount slabs and specify a Borrow and Lend margin for each slab. To add a slab to the list click add icon and enter the slab details. To remove a slab from the list, highlight it and click delete icon.

Whenever you enter a contract in Oracle FLEXCUBE that involves the customer and currency combination, the appropriate spread is applied to arrive at the floating rate to be charged. The slab is selected based on the contract amount and depending on the nature of the contract, the Borrow or Lend spread is applied.

13.1.2.1 Making Margin Applicable to All Customers

For a given currency, you can define borrow and sell margins to be applied to All customers. At the customer field choose ALL. However, if you have maintained currency margins for a specific customer and currency combination, it takes precedence over the margin defined for all customers.

Currency margins can be maintained for customers across branches. In effect, a branch can maintain margins for a customer belonging to another branch. These margins are propagated across branches of your bank.