18. Transaction Code

In the ‘Transaction Codes Maintenance’ screen you define transaction codes to representing various types of transactions, for example, transfer charges, incoming mail transfer, incoming telex transfer, reserve, incoming clearing transfer etc. All similar transactions can be grouped under a common transaction code with a description. This description will be printed on the account statements, reports and advices generated.

For a transaction type you also maintain other related processing details which will be applicable to all transactions posted under a common code. Details about availability of funds for liability checking, SWIFT code for the transaction type, preferences regarding charges to be levied on turnovers, payment to be made through cheques etc.

This chapter contains the following sections:

18.1 Transaction Code Maintenance

This section contains the following topic:

18.1.1 Invoking Transaction Code Screen

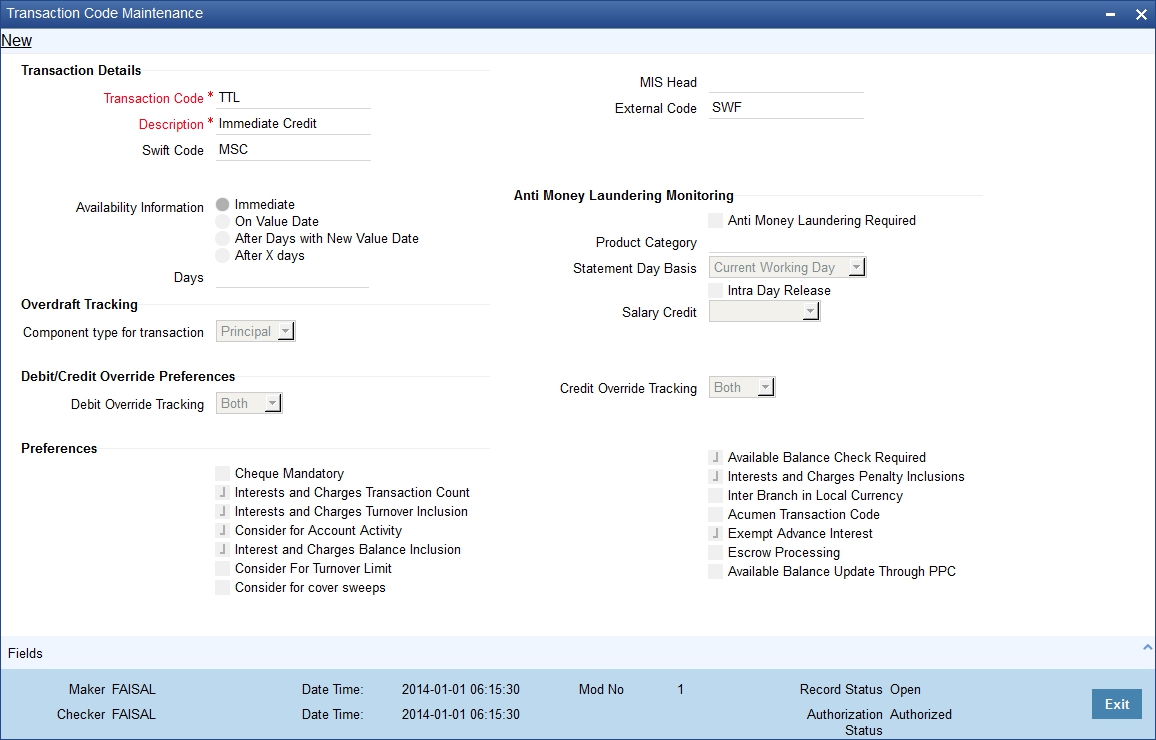

You can invoke ‘Transaction Code Maintenance’ screen by typing ‘STDTRNCD’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

In this screen you maintain the following for a transaction:

- A code representing the transaction type

- Description of the transaction type

- The interval after which funds should be made available after the transaction

- Preferences regarding charges to be levied or not on number of transaction counts and total turnover amounts

- Preference stating whether a transactions booked under this code should cause an account marked as ‘dormant’ by the system to be re-instated to ‘active’

- Preference whether payment for a transactions posted under this code should be made through cheque

- Preference indicating whether payment for a transaction booked under this code should be considered for Escrow transfer processing

Maintaining Transaction Details

The following parameters need to be maintained for a transaction type:

Transaction Code

This is the code you assign to a transaction type. This code identifies the type of transaction.

Enter 3 characters, Alphanumeric. For example, for all transfer charges transaction you can give the code as TCT; for incoming telex transfer you can input - ITT. In case, you want to assign numeric codes only, then for ease of operation similar transaction types should be grouped into a range. For example, you can set a range for all Money Market transactions say, A1-A30; a different range for Bills and Collections B1-B30 and so on.

Description

This is the description of the transaction type

Enter the description using a maximum of 35 characters, alphanumeric. For example, for TCT code you can enter ‘Transfer Charges Transaction’.

SWIFT Code

This is the SWIFT code to which this transaction code is linked. It is used for posting transaction details on SWIFT format.

Select from the option list. It will display a list of SWIFT formatted codes representing transaction types. The following list is displayed:

SWIFT CODES |

TRANSACTION TYPE |

BOE |

Bill of Exchange |

BRF |

Brokerage fee |

CHG |

Charges and other Expenses |

CHK |

Cheques |

CLR |

Cash Letter/Cheque Remittance |

COL |

Collections |

COM |

Commission |

DCR |

Documentary Credit (for Principal Amount) |

DIV |

Dividends - Warrants |

EQA |

Equivalent Amount |

ECK |

Euro checks |

FEX |

Foreign Exchange |

INT |

Interest |

LBX |

Lock Box |

LDP |

Loan Deposit |

MSC |

Miscellaneous |

RTI |

Returned Item |

SEC |

Securities |

STO |

Standing Order |

TCK |

Travelers Cheques |

TRF |

Transfer |

VDA |

Value Date Adjustment |

The codes COL -Collections, DCR - Documentary Credit and SCC- Securities are used when entering a principal amount.

MIS Head

Each Transaction Code that is created can be linked to an MIS Head. An MIS Head indicates the manner in which the type of entry should be considered for profitability reporting purposes.

Indicating Availability Information

This states the different time intervals after which funds will be available for withdrawal in case of all transactions posted under this transaction code.

The system defaults to immediate, which means that funds will be immediately available for withdrawal (the immediate option on the screen). Example: Teller Transaction. For all Clearing transactions you have the option to specify as to when will funds be made available for withdrawal. Click the desired option.

Click ‘On Value Date’ option if you want funds to be available on the date the transaction became effective. Example: A loan or a deposit

Incase you want to specify the number of days after which funds should be available for withdrawal, click on the option After Days. Enter the number in the box. It could be any two digit positive integer from 1 to 99. This option will make funds available for all transactions posted under this code, on the specified date from the value date. Example: Demand Draft

When you click the last option that is, After Days with New Value Date and enter the number of days in the box; then the original value date of the contract will take a new value date. This new value date = old value date + the number of days input by the user in the box against the option. Example: Future dated funds transfer.

The difference between the third and fourth option being that in the latter case the old value date changes; while in the former the value date does not change.

Intra-day Release

If you want uncollected funds on a transaction posted using the transaction code, to be manually released intra-day (that is, within the day), select the Intraday Release option. The Intraday Funds Batch, when manually executed during the day, picks up those transactions that are due for release on or before the system date, which have been posted with the transaction code (with the Intraday Release option enabled), for release of uncollected funds.

The Intraday Release option cannot be enabled if the Availability specified for the transaction code is Immediate.

You can use the ACUNCOLB (Intraday Funds Release) batch process to perform the intra-day release of uncollected funds in respect of transactions posted using a transaction code for which the Intraday Release option has been enabled.

For details about invoking the batch process, refer the Current and Savings Account user manual.

Tracking Overdraft

Component type for transaction

Select the component type for transaction from the drop-down list. The options available are:

- Principal - Select ‘Principal’, if a transaction type is not an interest or charge

- Interest - Select ‘Interest’, if a transaction code is used for debiting interest for an overdraft account.

- Charge - Select ‘Charge’, if a transaction code is used for debiting charge for an overdraft account.

The component type for the transaction code is mandatory for maintaining transaction code and cannot be modified after the first authorization.

Debit/Credit Override Preferences

Debit Override Tracking

Select the debit override tracking to validate debit override status from the drop-down list. The options available are:

- Both - Selecting ‘Both’ will display an override message for online transaction and fails during batch transactions

- Online - Selecting ‘Online’ will display an override message for online transaction and ignore during batch transactions

- Batch - Selecting ‘Batch’ will ignore the tracking during online transaction and fails during batch transaction.

The system defaults ‘Both’ as debit override tracking value.

Credit Override Tracking

Select the credit override tracking to validate credit override status from the drop-down list. The options available are:

- Both - Selecting ‘Both’ will display an override message for online transaction and fails during batch transactions

- Online - Selecting ‘Online’ will display an override message for online transaction and ignore during batch transactions

- Batch - Selecting ‘Batch’ will ignore the tracking during online transaction and fails during batch transaction.

The system defaults ‘Both’ as credit override tracking value.

Processing Debit and Credit Override Transactions

If a customer account is marked as Debit/Credit Override for all the Debit/Credit transactions to the account then the system does the following:

- If a debit/credit transaction to the account is performed through FCUBS user interface, the system checks the configuration for Debit/Credit Override Tracking at ‘Transaction Code Maintenance’ (STDTRNCD) screen. If the tracking is ‘Online’ or ‘Both’, then the system displays an override message as “Account 'CASA#' is in “Debit/Credit Override” status”. If the tracking is enabled for batch transactions alone, then online transactions will go without any additional overrides.

- The user can either accept the override and go ahead with the debit/credit transaction or reject the override. The transaction gets dismissed if the override is rejected. If the override is accepted it is logged along with the transaction details.

- For all FCUBS transactions, the override will only get displayed during posting of accounting entries to the account.

- For the transactions where accounting entries are posted online, the system displays the override on the transaction screen itself.

- During bulk transaction processing in PC and Clearing transactions, where the accounting entries are deferred, the transactions moves to a debit/credit exception queue. From the queue these overrides can be accepted or rejected by the user.

Automatic Batch Process

During the automatic batch process, the transactions from batch will fail if ‘Debit/Credit Override Tracking’ is selected as ‘Both’ or ‘Batch’ at transaction code level. If the debit and credit override tracking is enabled for Online transactions, then the automatic batch process can be run.

Transaction from Interfaces

All the transactions initiated from an external interface will be stopped for the customer accounts whose status is marked as ‘Debit Override’ and ‘Credit Override’ status. This validation is applicable to all debit/credit transactions to the account and system will not consider the exceptions maintained at transaction code level.

If there are any debit or credit to account through accounting data entry upload or any generic interface upload, the system treats it as a request from the interface and rejects it based on Debit Override or Credit Override status.These transactions from external interfaces are handled through error code conversion functionality in Override maintenance (CSDOVDME) screen.

You can maintain the error code conversion based on the channel names. The new error codes can be ‘Error/Override/Ignore’ type. The conversion should be supported on the basis of 'Function ID' or a combination of 'Function ID and Source Code'. The error code maintained in conversion sub-screen should be unique for a combination of Parent error code, Branch Code, Source Code and Function ID.

Specifying Preferences

This field indicates your preferences regarding transactions booked against this transaction code. The preferences marked relate to the following:

Interest and Charges Transaction Count

Every debit or credit entry is passed under a transaction code. If for a transaction code you have checked ‘I&C transaction count’ then all entries made under that code would be picked up by the system as chargeable transaction counts which would be used by the I&C system to compute charges.

Therefore, you should take care not to check for all bank induced transactions like - service charges, interest payment, calculation, brokerage and charges, etc.

For example, your bank has a policy of limiting savings withdrawals without additional charges to only 8 in a month. Beyond which all withdrawals would be charged. For the ninth and onward withdrawals in the month from any account the system will maintain a count for computing charges. However, care should be taken to exclude all bank-induced transactions from the count.

Interest and Charges Turnover inclusion

Every debit or credit entry is passed under a transaction code. If for a transaction code you have checked ‘I&C turnover inclusion’ then the debit turnover/ credit turnover balance under that code would be picked up by the system as chargeable depending upon the option specified in the I&C module. Therefore you should take care not to check for all bank induced transactions like - service charges, interest payment, calculation, brokerage and charges, etc.

Interest and Charges Balance Inclusion

Check this box to indicate that the transactions posted under this code should be considered for the purpose of computation of Remuneration (Interest). By default this option is checked. Uncheck this box for such loan transactions or any other transactions for which you wish to exclude computation of remuneration (interest).

Note

Once the transaction code is authorized, you cannot change your preference.

Consider for Turnover Limit

Check this box to indicate that all transactions posted under this code should be considered as part of the turnover limit processing.

Consider for Cover Sweeps

Only if you check this box, the system will consider the debit transactions for sweep from cover accounts/auto linked TD/linked term deposits. .

If a particular transaction should not be considered for sweep, then the related transaction codes should be maintained with 'Consider for cover sweeps' as unchecked.

The above field is applicable only for clearing and teller modules. Oracle FLEXCUBE repays loan from multiple accounts. In Oracle FLEXCUBE, the loan account is the primary account and all the other accounts linked to it are cover accounts. While paying the settlement if the primary account has insufficient amount, the system will check the cover accounts for the remaining amount according to the preference.

Consider for Account activity

If you check the field ‘Consider for A/C activity’ for a transaction code, then any debit or credit posted under this code would reinstate the status of an account from dormant to active and accounting activity shall be considered.

Cheque Mandatory

If for a transaction code you check ‘Cheque Mandatory’ then, for all transactions posted under this code, transaction will take place through cheque. For example: Incoming Clearing transfer.

Cheque Mandatory should be checked only for SB cheque withdrawals and Cash Account Cheque withdrawals.

Available Balance Check Required

Select this option if you want the system to check for the availability of funds before posting a debit entry to a customer account. The system will check for the available balance in all customer accounts associated with the Transaction Code for which the option is enabled. If the available balance check fails i.e. if the system detects insufficient funds in the customer account, it will display a warning message.

Note

However, the system will check for the available balance only if you have selected the ‘Available Balance Check required’ option for both the transaction code associated with the accounting entry and the Customer Account Class to which the customer’s account that is being debited, belongs. The check will not be performed if the option is not selected in both places.

Interest and Charges Penalty Inclusion

In the transaction code that you use for debit entries to time deposit accounts, you must indicate the computation of penalties on debit entries due to withdrawals from the account before the maturity date. You must select the IC Penalty Inclusion check box to indicate this.

Inter Branch in Local Currency

This indicates whether inter branch entries passed with this transaction code should be in Local currency. If this option is checked, the inter branch transactions would be passed in local currency. This way, the Treasury would be able to track its profit and the branch’s profit by passing a single consolidated entry (Position transfer from one branch to the Treasury branch) at the treasury rate.

Note

- This option is applicable only if the local currency of the different branches is the same. This option is applicable only for Fcy1- Fcy1 transactions. For other transactions, namely, Fcy1-Fcy2, Lcy-Fcy, Fcy-Lcy, IB entries would be based on IB Parameters Maintenance.

- For position transfer, the ‘Inter Branch in Local Currency‘ check box in the Transaction Code maintenance screen should be checked to avoid creating position due to IB posting.

Acumen Transaction Code

You need to check this option in order to eliminate the deals/transactions uploaded from the Acumen in the Hand-off of transactions affecting FCY Position to Acumen from Oracle FLEXCUBE.

Note

This is applicable where Oracle FLEXCUBE interfaces with Acumen. Acumen is an Integrated Turn-key solution for Treasury, Derivatives and Capital Markets Covering Front, Risk Control, Middle Office from Login SA.

Exempt Advance Interest

Check this box to indicate that all the postings with this transaction code should not be considered for penalty interest calculation.

Escrow Processing

Check this box to indicate that all the payments related to this transaction code should be considered for Escrow sweeps. If this box is checked and the credit account (Project account) is Escrow enabled then the system will automatically compute predefined percentage of transaction amount and places an amount block on the credit account (Project account).

Note

Escrow processing is possible only if the trust account and escrow account are of the same currency and are with-in Oracle FLEXCUBE.

Available Balance update through PPC

Check this box to update the available balance on the project through PPC.

Salary Credit

Select the type of salary credit from the adjoining drop-down list. This list displays the following values:

- Normal Salary

- Bulk Salary

By default, the system selects null value.

Note

- The value ‘Bulk Salary’ can be selected only if the ‘Availability Information’ is ‘Immediate’.

- This applies when you use the option ‘Bulk Salary’ along with a transaction code. When a credit is made to an account through salary upload table along with a bulk salary enabled transaction code, the system blocks the entire credit amount on that account with effect from the date of upload. This block remains active for the period maintained in CSTB_PARAM against the parameter ‘BULKSALARY_BLOCK_DAYS’. The number of days for expiry is mentioned terms of calendar days. The system does not allow manual operations on the amount block for these accounts.

Statement Day Basis

You need to specify when the transaction associated with the selected Transaction Code should appear in the account statement. The available options are:

- Current Working Day

- Previous Working Day

18.1.1.1 Accounting Entry Processing to Calculate Statement Date

The accounting entry processing will be enhanced to calculate the Statement Date based on the Transaction Code Maintenance and the Statement Status at the Branch level. The following illustration explains the calculation of Statement Date.

Assume two Transaction Codes TXN1 and TXN2 have been defined with Statement Date Basis as Current Working Day and Previous Working day respectively. The Statement Date would be derived as follows:

For a transaction C1 posted on say 25th Jan, 2004 with TXN1, the Statement Date would be derived as 25th Jan, 2004 irrespective of the Branch Statement Status.

For a transaction C2 posted on 25th Jan, 2004 with TXN2, the Statement Date would be derived as the Previous Working Day of 25th Jan, 2004 if the Branch Statement Status is set to ‘N’ specifying that the Branch is not yet ready for periodic statements processing.

For a transaction C3 posted on 25th Jan, 2004 with TXN2, the Statement Date would be derived as 25th Jan, 2004 if the Branch Statement Status is set to ‘Y’ specifying that the Branch is ready for periodic statements processing.

The Statement Date would be stored as part of the archived data also

The Statement Date would be recomputed during the reversal entry in the same logic

Monitoring Anti Money Laundering

Anti Money Laundering Required

Check this box to indicate that AML monitoring is required for all accounting entries linked to the particular transaction code. Leave it unchecked to indicate otherwise.

Product Category

If you indicate that AML tracking is required for all transactions linked to the particular transaction code you have to identify the product category for which AML tracking is necessary.