31. Anti-Money Laundering

This chapter contains the following sections:

31.1 Anti-Money Laundering Reporting

This section contains the following topics:

- Section 31.1.1, "Guarding Against Money Laundering"

- Section 31.1.2, "Creating Product Categories in Oracle FLEXCUBE"

- Section 31.1.3, "Maintaining Limit Codes"

- Section 31.1.4, "Maintaining Anti Money Laundering Customer Groups"

- Section 31.1.5, "Linking Product Category with Customer Group"

31.1.1 Guarding Against Money Laundering

In Oracle FLEXCUBE you can guard against Money Laundering by using the anti-money laundering option wherein you will be required to maintain certain basic information as a safeguard against Money Laundering activities that customers may indulge in.

The information that you need to maintain includes the maintenance of:

- Product Categories

- Limit Codes

- Customer Groups

31.1.2 Creating Product Categories in Oracle FLEXCUBE

You have to create product categories in Oracle FLEXCUBE, for the purpose of grouping common transactions. A product is a specific service that you offer your customers. Each transaction that you process in Oracle FLEXCUBE should be linked to a product. By maintaining amount limits at the product level, each time you link a transaction with a product the system verifies the amount limit maintained for the product. If the transaction amount exceeds the amount maintained at the product level the system intimates you with an override.

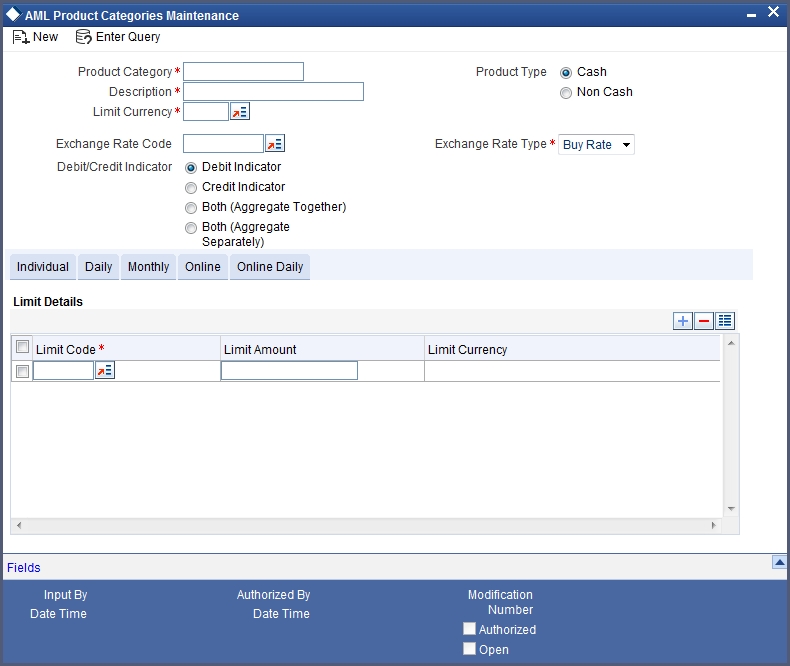

You can invoke the ‘AML Product Categories Maintenance’ screen by typing ‘CSDAMLPC’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Product Category

You should identify each product category with an identification code by giving it a unique name.

Description

With each product category you have to associate a brief description. This description is meant for information purposes and will not be used for any processing.

Limit Currency

You have to identify the currency in which limits have to be tracked for transactions associated with the product category.

A list of all the currencies maintained in Oracle FLEXCUBE is available in the option list positioned next to this field. You can select the appropriate.

Product Type

Transactions grouped under a product can either be cash based or non-cash based. Therefore, you would have created products catering to cash based and non-cash based transactions.

While creating a product category, you have to indicate whether the products grouped under the respective category cater to cash based or non-cash based transactions. You can select the appropriate option.

Exchange Rate Code and Rate Type

The rate associated with this rate code will be used to derive the exchange rate when the currency of the transaction is different from the limit currency of the product category.

Similarly, you have to select the Rate Type that is to be associated with the rate code. The options available are as follows:

- Mid

- Buy

- Sell

The rate code along with the rate type will determine the exchange rate that is to be used.

Debit/Credit Indicator

As part of Anti-Money Laundering you can indicate the manner in which the system should track the Debit and Credit turnover limits for any of the limit types, for the product category. The options available are:

- Both (Aggregate Together) – absolute values of debits and credits will be aggregated together

- Both (Aggregate Separately) – debits and credits will be aggregated separately

- Debits alone or Credits alone

Limit Code and Limit Amount

At the product category level, you can specify the limit amount that should be associated with each limit code for a limit type.

A list of all the limit codes maintained for the specific limit type (Online, Individual, Daily turnover Batch, Daily turnover Online and Monthly turnover), in the Limit Codes Maintenance screen, will be displayed in the option list positioned next to this field. You can select the appropriate limit code and specify the limit amount that is to be linked with the code.

Note

For a particular product category you can choose to maintain Limit Code and Amount combinations for all of any of the five Limit types. They are:

- The Online transaction limit

- Individual limits

- Daily turnover limits

- Monthly turnover limits

- Online daily turnover limits

The transaction limits that you specify will be tracked online on a daily basis, whenever you process a transaction involving the product category. However, individual, daily and monthly turnover limits will be tracked only when the after the End of Day processes have been run successfully.

31.1.3 Maintaining Limit Codes

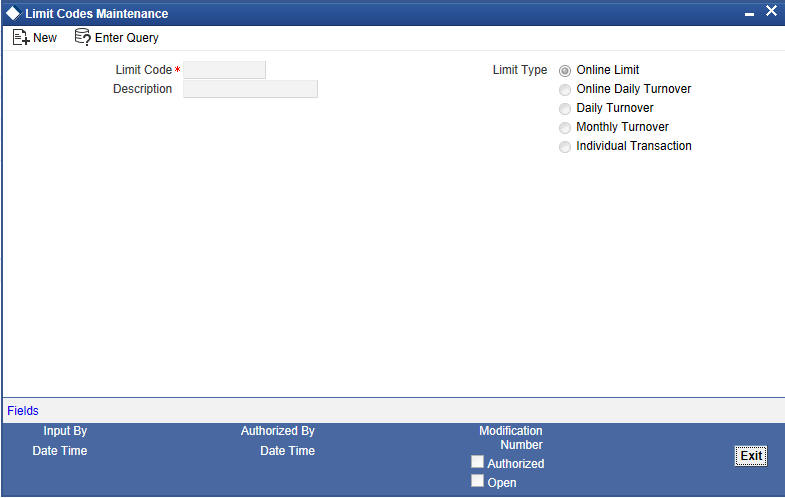

Before you begin the maintenance of product category records, you should necessarily maintain limit codes through the Limit Code Maintenance screen. While linking a limit amount with a limit code in the product category screen, only valid limit codes that you have maintained through this screen will be made available for mapping.

You can invoke this screen by typing ‘CSDAMLLM’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Limit Code

You can maintain limit codes for the various types of limit types like online tracking limits, individual tracking limits, daily turnover limits and monthly turnover limits.

You have to specify a unique name to identify each Limit Code that you would like to define. Subsequently, you can assign a brief description with each limit code that you define.

Limit Type

Since you can maintain separate limit codes for each limit type, you have to associate a limit code with each limit type. The options available are:

- Online Limit – tracks the limits of all online transaction that exceed limits

- Individual Transaction – during the batch processed executed at EOD the limit maintained for this type is used to tack all individual transactions that exceed the limit

- Online Daily Turnover –all transactions processed during the day are considered for an online tracking and an online reporting is done when the specified limit exceeds

- Monthly Turnover – all transactions processed during the month that have exceeded the specified limit will be reported

- Daily Turnover – during the batch processes executed at EOD all transactions for the business day that have exceed the limit will be reported

You can select the appropriate type from the list.

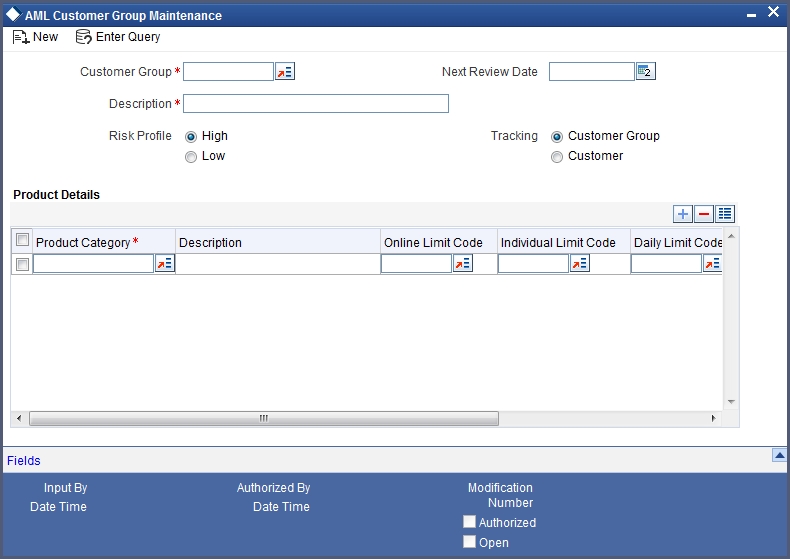

31.1.4 Maintaining Anti Money Laundering Customer Groups

Since you need to define transaction online, individual, daily and monthly limits for each customer, each product category that you maintain should be linked with a customer. To facilitate this linking, you are required to maintain AML Customer Groups. You have to link one of the limit codes of the respective type attached to the product category to the customer group

You can define product categories applicable to customer groups through the ‘AML Customer Group Maintenance’ screen. You can invoke this screen by typing ‘CSDAMLCG’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Customer Group

This is the AML group to which the particular customer belongs. You can select from the available option list and identify the AML group to which the customer belongs.

Note

In the CIF maintenance screen when you capture the customer code of a customer, the same will be defaulted in the AML Customer Group field since the system recognizes each customer code as a customer group. You can either choose to categorize the customer under the same group or choose another customer group.

You can capture a brief description that should be associated with every AML group

Next Review Date

While maintaining customer group and product category records you can specify the next date on which you would like to review the limits maintained for the various limit types.

Tracking

You have to specify whether the AML tracking is required for a customer or for all customers within a group. The system performs a group level tracking if you select Customer group. Conversely if you select Customer, the AML reporting, online tracking and data collection is done only at the customer level.

Note

If you fail to indicate your preference specifically the system will perform a customer group level tracking by default

Risk Profile

You can identify the risk profile of the customer group by selecting any one of the following options:

- High – indicating that the limits for the customer group need to be tracked regardless of the amount involved since the customer group is meant for high-risk customers.

- Low – indicating that the customer group is meant for low risk customers therefore amount limits need not be tracked if the amount involved falls within the limit amount.

You can select the required specification.

31.1.5 Linking Product Category with Customer Group

You have the option of selecting and linking as many limit codes as required for each limit type from the product categories maintained in the system. After you select the product category that is to be linked to the customer group, you have to identify the limit code associated with the limit type and in turn link it with the customer group.

Given below is a sample of the Customer Group maintenance record:

The Main details of the record are as follows:

Customer Group |

AMLCUS01 |

Description |

AMLCUSTOMER GROUP 1 |

Next Review Date |

10-FEB-2003 |

Risk Profile |

High |

The Product Category linkage details are as follows:

Product Category |

Description |

Online Limit Code |

Individual Limit Code |

Daily Limit Code |

Monthly Limit Code |

Online Daily Turnover |

PDT01 |

Product 1 |

LIM31 |

LIM01 |

LIM11 |

LIM21 |

LIM41 |

PDT02 |

Product 2 |

LIM36 |

LIM06 |

LIM16 |

LIM26 |

LIM46 |

Note

- Consequently, while processing transactions for all customers linked to the Customer Group AMLCUS01, the system does an online verification of transaction limits based on the amount limits maintained for the limit code LIM31 (linked to the product category PDT01) and LIM36 (linked to the product category PDT02) respectively.

- It is mandatory for you to maintain a generic Customer Group called ALL for the customers of your bank. When product categories have not been linked to a specific customer or a customer group, the system picks up the limits maintained at the generic level for AML tracking purposes. Also, any new product category created and associated to the transaction code should be mandatorily associated with the ALL group.

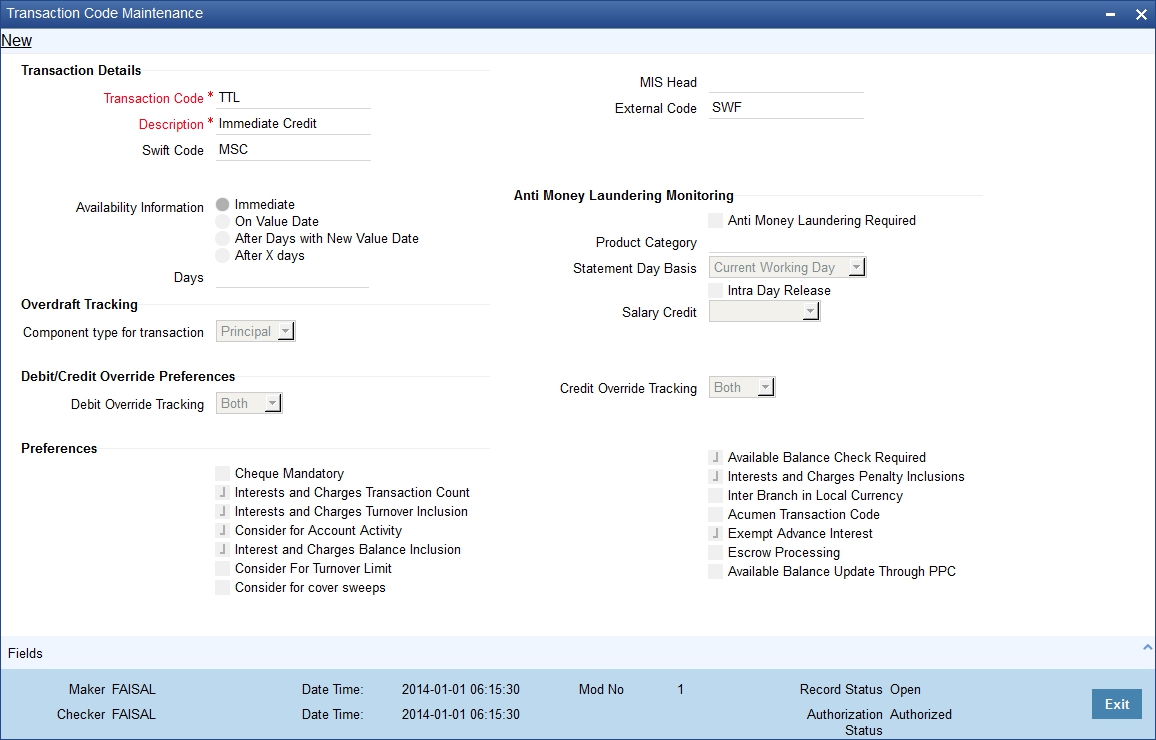

31.2 Monitoring AML Accounting

For AML reporting purposes, while maintaining a transaction code you need to indicate whether AML monitoring is required for all accounting entries linked to the transaction code.

You can invoke this screen by typing ‘STDTRNCD’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The screen is as shown below:

If you indicate that AML tracking is required for transactions linked to the transaction code you have to identify the product category with which the transaction code is to be linked.

Consequently, the system does a check for every accounting entry passed during online processing. The system checks the transaction amount of the entry with the transaction online limit maintained for the specific customer group (of the customer to whose account the entry has been posted) and the product category (for the transaction code of the entry). If the system finds that the limit amount has been exceed an override message informing you of the same will be displayed.

During the End of Day (EOD) processing, the system identifies all accounting entries posted during the day, which have been marked for AML monitoring, and verifies the individual amount limit for the customer group and product category combination and stores this data in the system. You will be able to view this data when you generate an AML report using Business Objects.

As part of the EOD processes the system also updates the daily turnover limits for the particular customer group and product category combination. Monthly turnovers are updated for the Customer Number, Product Category and Currency combination.