2. Exchange Traded Derivatives – An Overview

2.1 Introduction

The Exchange Traded Derivatives (ETD) module of Oracle FLEXCUBE is an automated and flexible back office system with the capability to process exchange traded derivative instruments such as Options and Futures.

Using this module you can capture details of long and short deals and liquidation type of deals entered at your front office, process them and track life-cycle events of holdings in your own, or in your customer’s portfolio.

This chapter contains the following sections:

- Section 2.2, "Portfolios"

- Section 2.3, "Interaction with the Margin Maintenance Sub-System"

- Section 2.4, "Illustration of the ETD Workflow"

2.2 Portfolios

This section contains the following topics:

- Section 2.2.1, "Features of Portfolios"

- Section 2.2.2, "Own Portfolio"

- Section 2.2.3, "Customer Portfolio"

- Section 2.2.4, "Advices"

2.2.1 Features of Portfolios

Listed below are the various features of portfolios in the ETD module of Oracle FLEXCUBE.

2.2.2 Own Portfolio

- Opening long and short positions:

- You can book contingent entries for the Long and Short positions opened during the day.

- You can define the premium exchange involved in Option Style Options, and book the premium amount.

- You have the facility to define and book the brokerage amount and charges involved in the deal.

- Closing long and short positions:

- You can reverse contingent entries for all contracts that have been closed.

- You have the facility to calculate the closing gains and losses and book appropriate entries for the same.

- Revaluation of Futures and Options

- As part of the End of Day activities you can perform realized revaluation on futures and future style options based on the closing price of the instrument and the series.

- For option style options you can perform a Memo or Notional revaluation for the entire portfolio depending on the frequency that you choose to maintain.

- Exercise of Options

- Facility to reverse the contingent entries for those contracts that have been exercised.

- Facility to calculate the exercise gain based on the difference between the price of the underlying asset and the Strike Price of the instrument and book accounting entries for the same.

- Assignment of Options

- Facility to reverse the contingent entries for contracts that have been exercised.

- Facility to calculate the assignment loss based on the difference between the price of the underlying asset and the strike price of the instrument and book entries for the same.

- Exchange of futures for physicals

- Facility to reverse the contingent entries while exchanging futures for physicals.

- Facility to calculate the exchange loss or gain based on the difference between the price of the underlying asset and the acquisition price and book entries for the same.

- Expiry of Options

- On the expiry date, if the series is Out of the Money, the system will process an automatic expiry for the series. Similarly if the series is In the Money, an automatic exercise/assignment of options event will be processed.

- The system also calculates the expiry loss or gain depending on whether it is a long or short deal. The respective accounting entries are also booked.

- Expiry of Futures

- In the case of futures, on the expiry date the system automatically exchanges futures for physicals.

Note

While exercising and assigning options, or during expiry of options and futures only the price differential (i.e., the Exercise Gain or the Loss) will be processed by the ETD module.

For options the price differential is the difference between the spot price of the underlying asset and the strike price of the instrument. For futures the price differential is calculated as the difference between the spot price of the underlying asset and the acquisition price of the instrument.

2.2.3 Customer Portfolio

- Opening long and short positions:

- You can define the premium exchange involved in Option Style Options, and book the premium amount.

- You have the facility to define and book the charges involved in the deal.

- Closing long and short positions:

- You can calculate the closing gains and losses and book appropriate entries for the same.

- Revaluation

- Based on the closing price of the instrument and the series you can perform realized revaluation on futures and future style options on a daily basis as part of the end of day activities.

- Exercise of Options

- You can book the premium for future style options.

- The difference between the Strike Price and the Underlying Asset Price is calculated and the appropriate accounting entries are booked for the same.

- Assignment of Options

- You can book the premium for future style options

- You can book the difference between the Price of the Underlying Asset and the Strike Price of the instrument and pass entries for the same.

- Exchange of futures for physicals

- You can book the difference between the price of the underlying asset and the acquisition price and book entries for the same.

- Expiry of Options

- As on the expiry date if the series is Out of the Money, the system will process an automatic expiry for the series. Similarly if the series is In the Money automatic exercise/assignment of options event will be processed.

- Expiry of Futures

- In the case of futures with future style options the system automatically books the deal premium amount.

2.2.4 Advices

For every deal that is entered in the system a deal confirmation advice can be generated and sent to the portfolio customer.

2.3 Interaction with the Margin Maintenance Sub-System

The ETD module interacts with the Margin Maintenance sub-system for the purpose of resolving money settlements arising due to the various events processed in the ETD module. The margin maintenance module offers you the flexibility of netting all settlements for a counterparty (Broker or Portfolio Customer).

For additional information about the sub-system refer to the Margin Maintenance user manual.

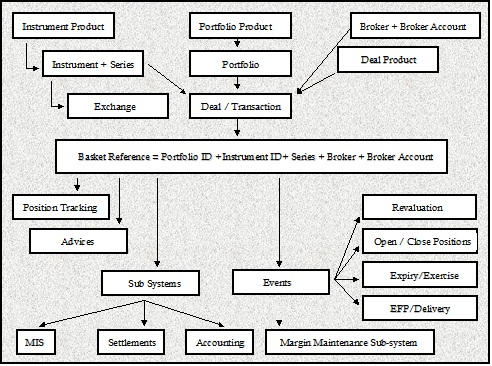

2.4 Illustration of the ETD Workflow

The data diagram given below adequately illustrates the work-flow of the ETD module: