7. Defining Deal Products

A Deal product is a category or type of deal. It provides a general framework and serves to classify or categorize deals. A deal product can also represent a specific service offered by your bank.

The first attribute you can define for a product is its Type. In other words you indicate the type of deals that the product can cater to. In Oracle FLEXCUBE you can set up products for the following deal types:

- Liquidation deals (LQ deals)

- Long / Short deals (LS deals)

You can use Liquidation type of deal products for processing deals which involve any of the following activities:

- Manual exercise of options

- Manual assignment of options

- Exchange for physicals of futures

Long /Short type of deal products can be used for processing deals involving the following activities:

- Opening of Long/Short Positions in Futures and Options

- Closing of Long/Short Positions in Futures and Options

The accounting entries passed, the messages that are generated and the processing of deals involving a product are determined by your entry in the Product Type field.

Whenever a product is created or modified, on authorization of the deal product, Oracle FLEXCUBE notifies the external system of the modification and creation of deal products. The notification code used will be NOTIF_ET_DEALPRODUCT.

Refer the documentation on Messages for further information on Notification Message.

This chapter contains the following topics:

- Section 7.1, "Deal Product Creation"

- Section 7.2, "ET Deal Processing"

- Section 7.3, "Liquidation Deals"

- Section 7.4, "Deals Matching"

7.1 Deal Product Creation

This section contains the following topics:

- Section 7.1.1, "Invoking the Exchange Derivatives Deal Product Definition Screen"

- Section 7.1.2, "Preferences Button"

- Section 7.1.3, "Charge Button"

- Section 7.1.4, "Events Button"

- Section 7.1.5, "Branch Currency Button"

- Section 7.1.6, "Portfolio Restrictions Button"

- Section 7.1.7, "Instrument Restrictions Button"

- Section 7.1.8, "Fields Button"

- Section 7.1.9, "MIS Button"

7.1.1 Invoking the Exchange Derivatives Deal Product Definition Screen

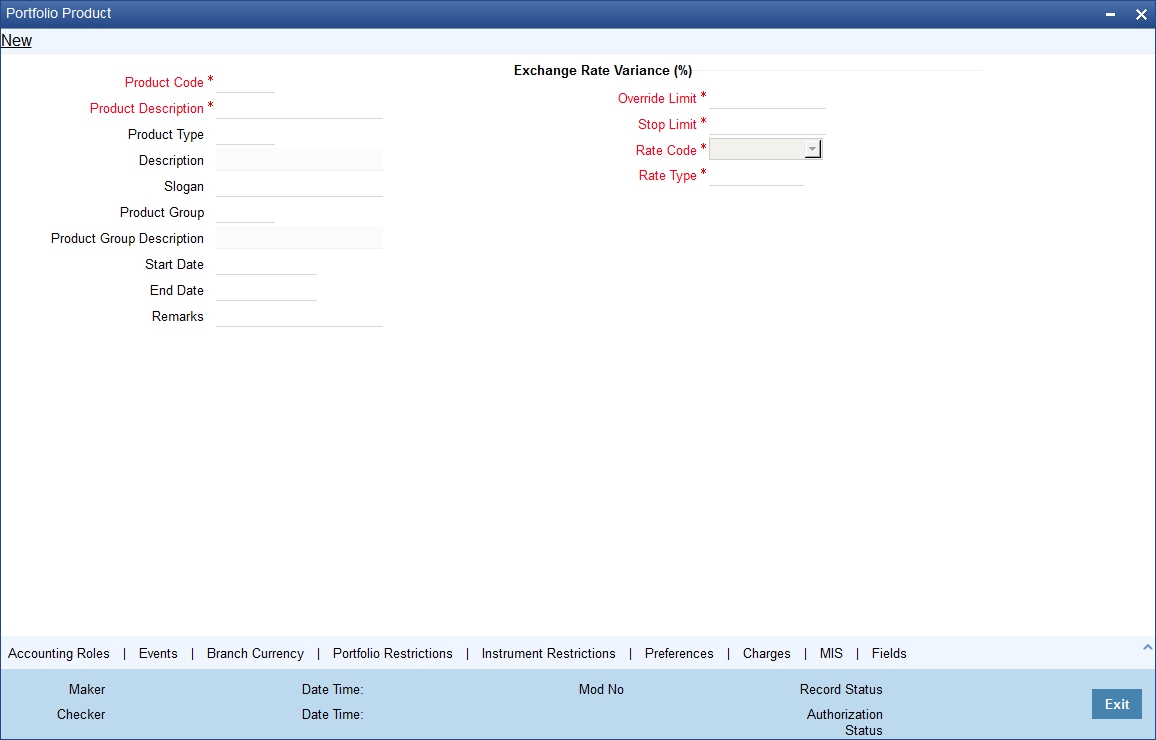

The information about the deal product is captured through the ‘Exchange Derivatives Deal Product Definition’ screen.

You can invoke this screen by typing ‘EDDDLPRD’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In this screen, you need to capture the basic information about the product. This includes:

- Assigning a Code and Description to the product

- Specifying the type of product

- Associating the product with a Product Group

- Creating a slogan for the product

- Specifying the life-span of a product

The basic details about the product are common for every product that you capture in the ETD module of Oracle FLEXCUBE. However, while defining a deal product you need to specifically indicate the exchange rate variance that is to be associated with the product.

Indicating the Exchange Rate Variance

For a special customer, or in special cases, you may want to use an exchange rate (a special rate) that is greater than the exchange rate maintained for a currency pair. The variance is referred to as the Exchange Rate Variance.

When creating a product, you can express an Exchange Rate Variance Limit in terms of a percentage. This variance limit would apply to all deals associated with the deal product.

Override Limit

If the variance between the default rate and the rate input varies by a percentage between the Rate Override Limit and the Rate Stop Limit, you can save the deal by providing an override.

Stop Limit

If the variance between the defaulted rate and the rate that is entered varies by a percentage greater than or equal to the Rate Stop Limit, you cannot save the deal.

Rate Code

While settling charges for cross currency settlements, you can choose to debit the customer by applying the mid rate or by using the buy/sell spread over the mid-rate.

Rate Type

In addition to specifying the Rate Code you have to indicate the Rate Type which should be picked up for exchange rate conversions involving settlement of charges for cross currency deals. You can maintain any one of the following as the Rate Type:

- Cash Rate

- TT Rates

- Bill Rates

Note

Information pertaining to specific attributes of a product has to be defined in the sub – screens within the Product Definition Main screen.

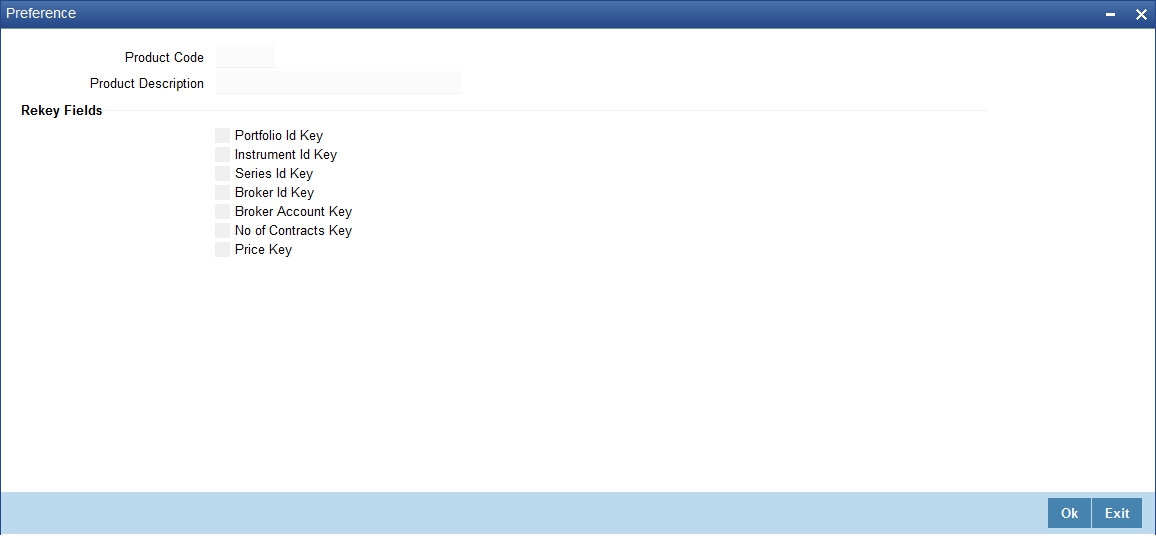

7.1.2 Preferences Button

Click ‘Preferences’ button to specify preferences for the product. The ‘Deal Product Preferences’ screen is invoked.

Indicating Rekey Fields

In Oracle FLEXCUBE, all operations on a deal (input, amendment, modification, etc.) have to be authorized by a user other than the one who entered the deal details. These operations have to be carried out before the end-of-day activities have begun. Authorization is a way of checking the entries made by a user.

As part of specifying the preferences for a deal product, you can indicate that details of certain fields should be re-entered when a deal is invoked for authorization, as a cross-checking mechanism. The complete details of the deal will be displayed only after the values to these fields are entered. The fields for which the values have to be given are called the ‘re-key’ fields.

You can specify any or all of the following as re-key fields:

- Broker Account

- Instrument ID

- Portfolio ID

- Series ID

- Broker ID

- Number of Contracts

- Price

If no re-key fields have been defined, the details of the deal involving the product will be displayed immediately when the authorizer calls the deal for authorization. The re-key option also serves as a means of ensuring the accuracy of inputs.

You can specify the authorization re-key fields through the Deal Product Preferences screen.

7.1.3 Charge Button

In the ETD module of Oracle FLEXCUBE, charges can be associated and accounted for, only with the Booking of the deal. You can calculate and deduct charges as a percentage of the deal amount.

You can specify the charge components applicable to a product, when your bank has to

- Collect money from the Customer/Broker

- Pay money to the Customer/Broker

For deals under a Long/Short type of deal products the deal amount is calculated as follows:

Futures Deals |

= |

Future Price X Number of Contracts. |

Options Deals |

= |

Option Premium X Number of Contracts. |

For option and future deals under a Liquidation type of deal product the charge amount is calculated as:

Futures Deals |

= |

Underlying Spot Price X Number of Contracts. |

Option Deals |

= |

Underlying Spot Price X Number of Contracts. |

You should necessarily use a charge class to indicate the charge components applicable to the product. A charge class is a specific type of component that you can build with certain attributes. You can build a charge class, for instance, with the attributes of a specific type of charge component, such as ‘Charges for booking an LS deal’. The charges that you link to the deal product will be made applicable to all the deals involving the product.

You can link charge components with the deal product through the Deal Charge Definition screen.

7.1.4 Events Button

The different stages in the life cycle of a deal are referred to as Events. In the ETD module the following events are possible for a deal:

Event Code |

Description |

EBOK |

Booking a deal |

EAMD |

Amendment of trade time stamp of a deal that is yet to be booked |

EMAT |

Deal Matching |

EREV |

Reversal of a deal |

At an event, you may want to generate advices, or post accounting entries. For instance, while booking a deal in your customer portfolio, you would:

- Pass the requisite charge related entries

- Print a confirmation advice for the benefit of your customer

When defining a deal product, firstly, you have to identify the accounting roles and heads for the product in the Product Accounting Role to Head Mapping screen. Similarly you have to specify the different event details in through the Product Event Accounting Entries and Advices screen, by either of the following ways:

- Associating the product with an appropriate Role to Head Mapping class and an Events Class

- Mapping accounting roles to heads and defining event details specifically for the product.

The appropriate accounting entries will be posted and the relevant advices can be generated only while booking a deal (EBOK event). During amendment of trade time stamp of a deal that is yet to be processed in the system, (EAMD) and for deal matching (EMAT), the system will not post any accounting entries. Neither will you be allowed to generate any advices for these events.

For reversing a deal (EREV), the system does an automatic reversal of all the accounting entries that were passed when the particular deal was booked (EBOK).

For further details on maintaining Accounting Entries and Advices refer ‘Product Definition’ User Manual under Modularity.

7.1.5 Branch Currency Button

The deal product that you create is, by default, available for use in all the various branches of your bank. You can choose to restrict the branches of your bank, which can offer it. In addition to restricting the branches that can offer the deal product, you have the option of identifying currencies in which an ‘allowed’ branch can offer the product.

Through the Product Branch and Currency screen you can restrict the use of the deal product to specific branches and currencies of your bank.

When the pricing currency of instruments involving the deal product happens to be a restricted currency you will not be allowed to deal in the respective instruments.

Note

Refer to the 'Common Procedures' User Manual of Oracle FLEXCUBE for a detailed procedure on how to restrict specific branches and currencies for a deal product.

7.1.6 Portfolio Restrictions Button

You can establish certain controls over the portfolios that your branches can deal in. You can achieve these controls by specifying ‘restrictions’. While defining a deal product, you can choose to specify portfolio restrictions for the product, either by:

- Using a portfolio restriction class or

- Defining these restrictions specifically for the product.

The respective branch of your bank will not be allowed to trade in deals involving the portfolio that you have chosen to restrict.

Note

Refer to the 'Common Procedures' User Manual of Oracle FLEXCUBE for a detailed procedure on how to restrict specific portfolios for a deal product.

7.1.7 Instrument Restrictions Button

You can choose to restrict specific instruments from trading in the deal product through the Instrument Restriction screen. You can maintain a list of allowed/disallowed instruments for a specific deal product through the Instrument Restrictions screen in the Deal Product Definition screen.

Note

For a detailed procedure refer to the 'Common Procedures' User Manual of Oracle FLEXCUBE.

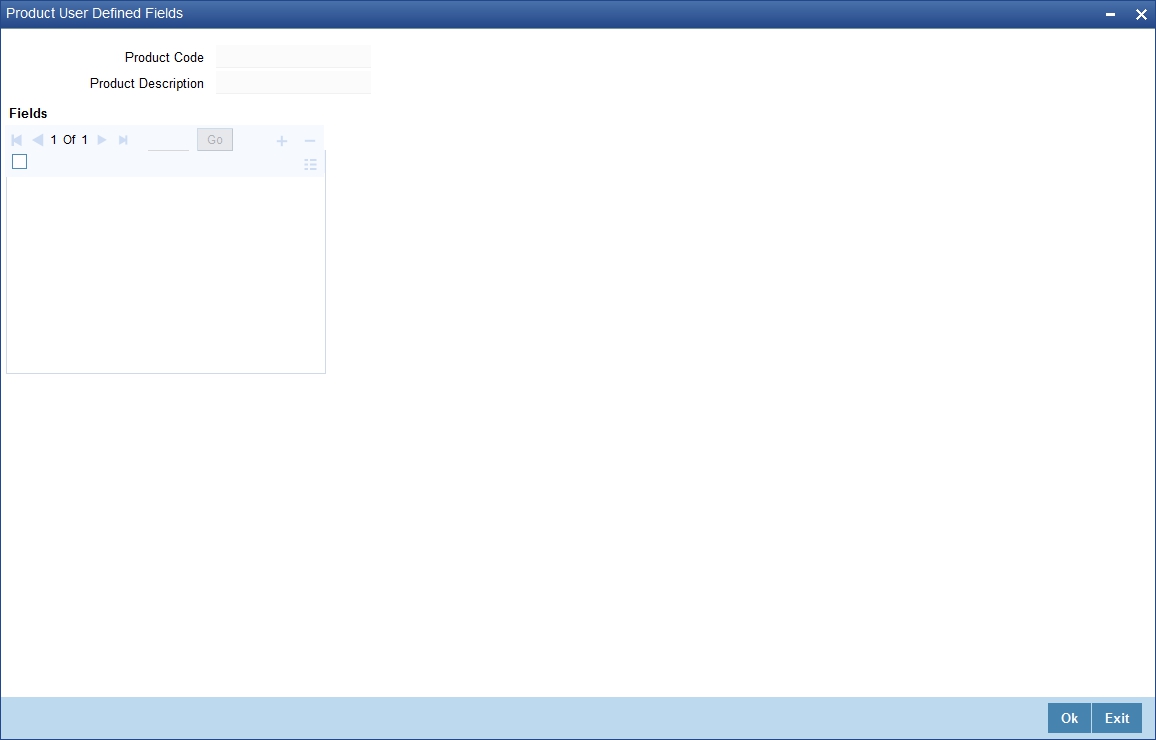

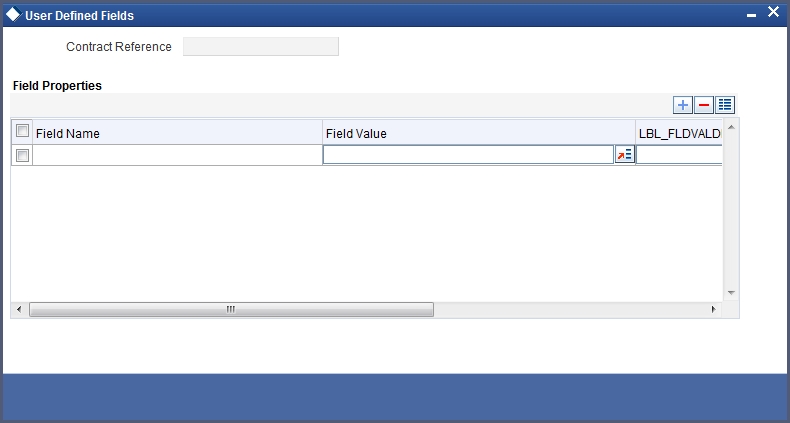

7.1.8 Fields Button

The User Defined Fields (UDFs) are additional fields that are available for use depending on the bank’s requirement. You can define UDFs in the ‘Product User Defined Fields’ screen. Click ‘Fields’ button to invoke the screen below.

For a detailed discussion about maintaining UDFs refer the User Defined Fields manual.

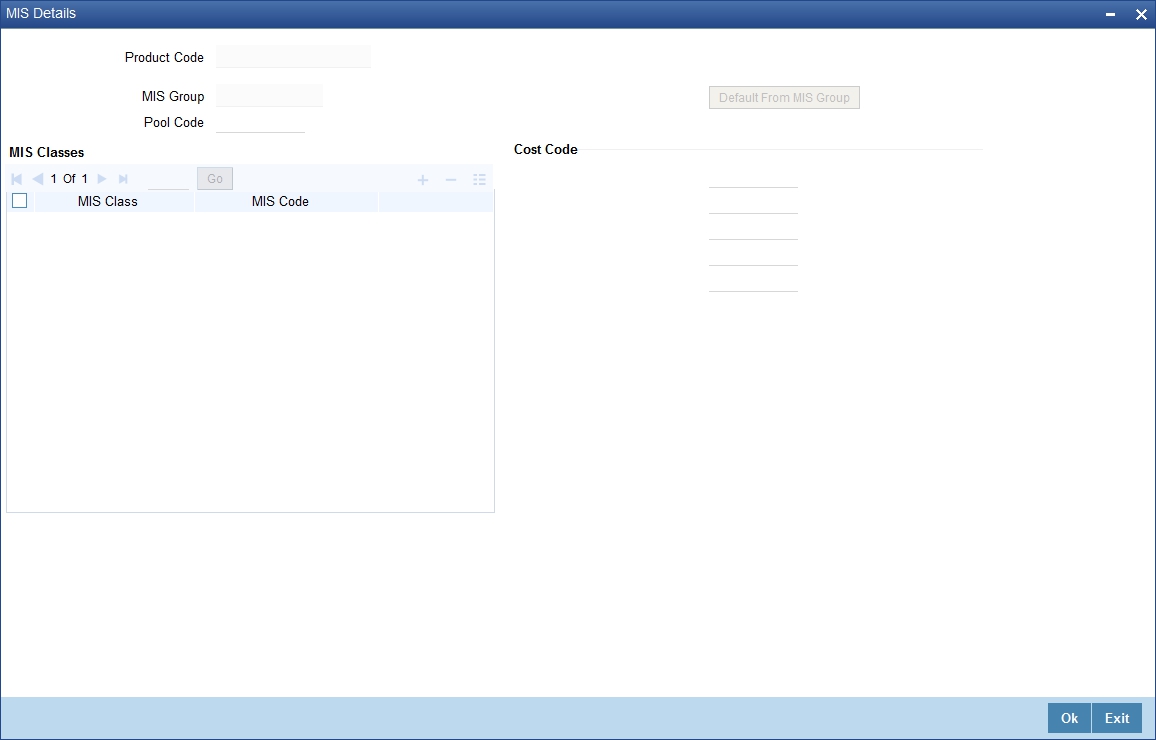

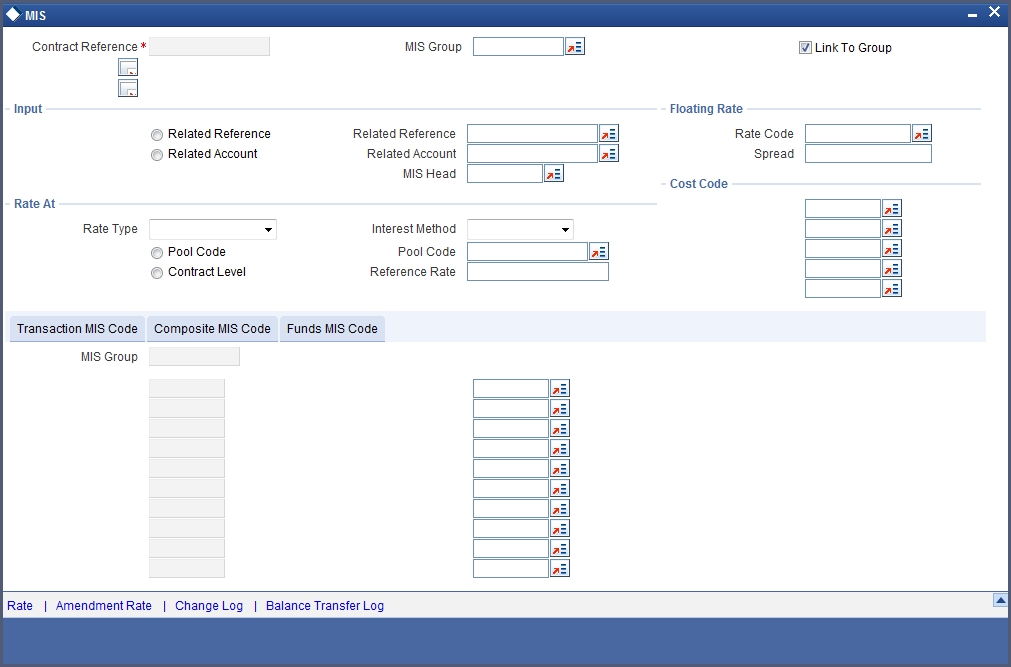

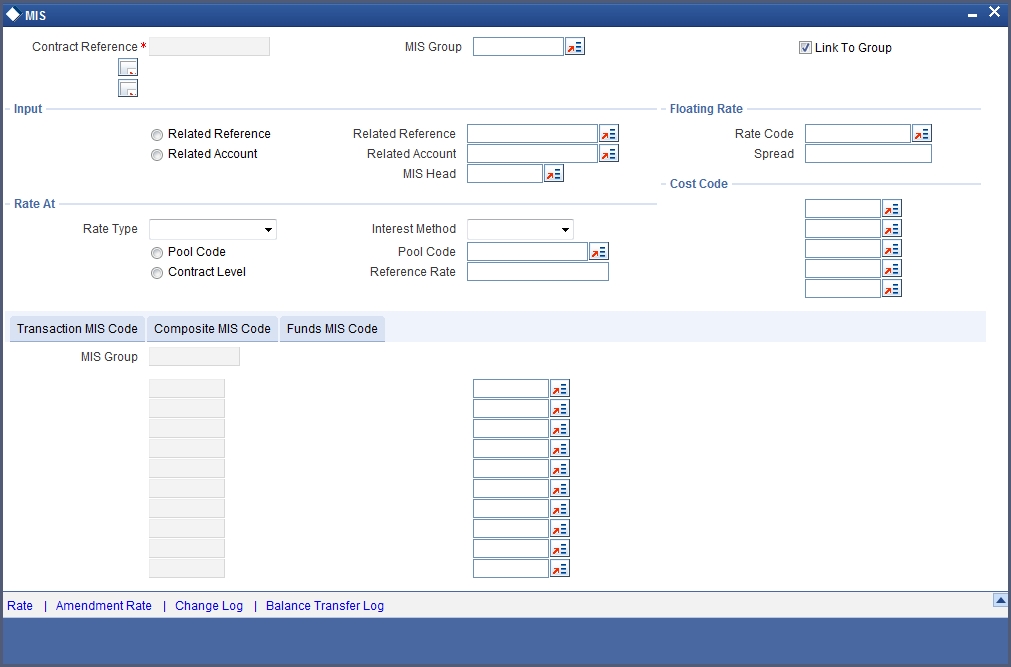

7.1.9 MIS Button

You can define the Management Information Details (MIS) details for the deal product that you are creating by clicking ‘MIS’ button from the ‘Deal Product Maintenance’ screen.

MIS Group

You should link a product to an MIS group. By doing so, you indicate the MIS group under which all deals linked to the product should be tracked.

Pool Code

On linking the product to an MIS group, you should also indicate the Pool code from the product will borrow and lend.

Transaction Codes

If you have linked a product to an MIS Group, the Transaction MIS Codes defined for the group will be displayed by default.

If you have not linked an MIS Group, you can specify the applicable Transaction Codes here. The number of transaction codes displayed depends on the number of transaction MIS codes miantained for your bank.

Cost Codes

Similarly, if you have linked an MIS Group to the product, the cost codes defined for the group will be displayed. You have the option to change them. If you have not linked an MIS Group with the product, you can indicate the applicable cost codes.

After you make the specifications, click Ok to save them. On saving you entries, you are returned to the ET Product Definition screen.

For further details refer to the MIS user manuals.

7.2 ET Deal Processing

This section contains the following topics:

- Section 7.2.1, "Processing the ET Deals"

- Section 7.2.2, "Charges Button"

- Section 7.2.3, "Events Button"

- Section 7.2.4, "Settlements Button"

- Section 7.2.5, "Specifying Advices for the Deal"

- Section 7.2.6, "Fields Button"

- Section 7.2.7, "MIS Button"

- Section 7.2.8, "Associating a Broker and Product with a Rule"

- Section 7.2.9, "Long Short Deal Financial Amendment"

7.2.1 Processing the ET Deals

Using the ETD module of Oracle FLEXCUBE, you can process the following deal types:

- Liquidation Deals

- Long/Short Deals

These could be value dated today, or back value dated deals.

Each deal that you enter in Oracle FLEXCUBE should necessarily be associated with a deal product.

You have already defined deal products to group together or categorize deals that share broad similarities. Deal products provide a general framework and serve to classify or categorize deals.

Under each Product that you have defined, you can enter specific deals based on your requirement. By default, a deal inherits all the attributes of the product, which is associated with it.

A deal would require information on the following:

- ET instrument involved in the deal

- Series, which is being traded

- Number of contracts that are traded

- Deal Type being processed (whether it is a buy/sell or liquidation type of deal)

- Option Premium or the price at which an option is bought or sold excluding any commissions, trading fees and applicable levies. The option premium is expressed in index points per contract. While capturing future deals you will have to indicate the Future Price.

- Value Date of the money settlement

- Portfolio involved in the deal – whether it is a customer or bank portfolio

- Broker involved in the deal

- Details of the broker account involved in the deal

In the ETD module you have to process Long/Short and Liquidation deals using two separate screens. They are:

- Long Short deal input screen

- Liquidation deal input screen

Moreover, these deals could be directly captured in Oracle FLEXCUBE or uploaded from an external system. You can nevertheless amend an uploaded deal in Oracle FLEXCUBE. In case of uploaded deals, users other than the maker also can unlock an unauthorized deal and modify the details of the record.

For deal matching purposes of your bank’s own portfolios, you can use the ET Deal Matching screen.

These details, and several others, required to process the two types of ET deals in Oracle FLEXCUBE have been discussed in the course of this chapter.

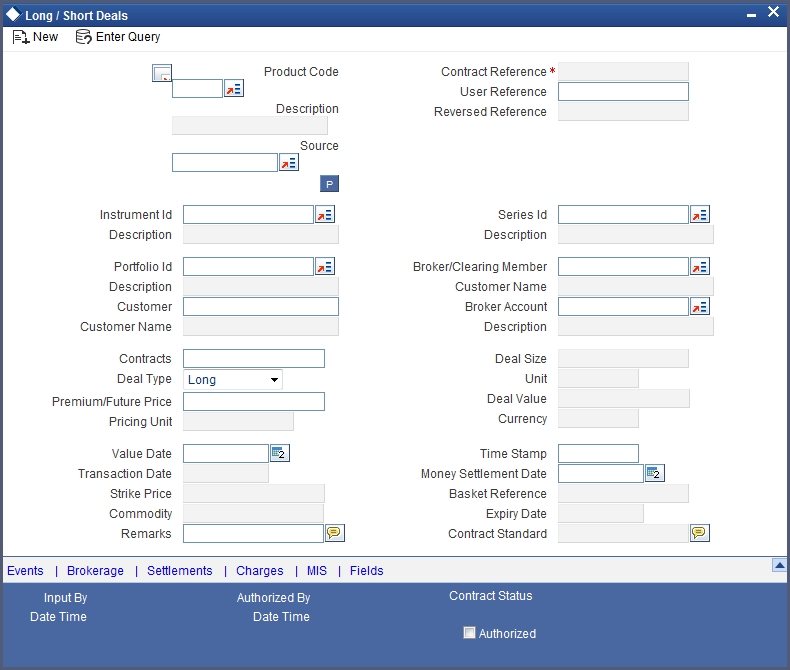

You can process buy sell type of deals. through the ‘Long/Short Deals’ screen.

You can invoke this screen by typing ‘EDDLSONL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can choose to enter the details of a deal either by using a deal product. You should necessarily use a long/short deal product that has already been created to enter the details of a long/short deal. Based on the type of deal you are entering, you can select a product from the list of options positioned next to the Product field.

The details, which you can view or specify in the ‘Long/Short Deals’ screen are explained below.

Contract Reference

In Oracle FLEXCUBE, reference numbers are generated automatically and sequentially by the system. This number tag is used to identify the deal you are entering, it is also used in all the accounting entries and transactions related to this deal. Hence the system generates a unique number for each deal.

User Reference

You can enter a reference number for the deal. A deal will be identified by this number in addition to the Deal Reference Number generated by the system. This number should be unique and cannot be used to identify any other deal. By default, the Deal Reference Number generated by the system will be taken as the User Reference Number.

External Ref No

If the transaction is being uploaded from an external source, you can specify the identification for the deal in the external source, as the external reference number.

Reversed Reference

The reference number of the contract that is being reversed and rebooked is displayed here.

Source

You have to specify the source from which deal is to be uploaded.

Instrument Identification and Series Identification

While entering the details of a deal, you should indicate the instrument and series that the deal involves.

You have already restricted specific instruments from trading in the deal product in the Instrument Restriction screen of the Deal Product screen. When you associate a product with the deal, the restrictions defined for the particular product are made applicable to the deal.

You have to select the Instrument Identification which is to be associated with the deal. A list of all the ‘allowed’ instruments is available alongside. As you have already maintained the instrument, all the attributes of the deal like the contract size and unit, underlying details, pricing details, initial margin per contract, days of settlement, will be processed based on these details.

After you associate an instrument with the deal, you can the series identification.

Contracts

Indicate the number of contracts that are to be traded. The system multiplies the Number of Contracts and the Contract Size to arrive at the quantity of the actual underlying that is involved in the trade.

Based on the number that you specify, the system calculates the quantity of the actual underlying that is involved in the trade and displays it in the adjacent field.

Example

Let us assume, you are processing a contract with the following details:

Field |

Value |

Deal Reference |

000DP01003260006 |

User Reference |

LDeal001 |

Product |

Long Short deals for Portfolio Customers. |

Instrument ID |

CME90DTB-PUTE-OP. |

Description |

Chicago Mercantile Exchange – 90 Day T-bill Put Option |

Series |

96-NOV-2000 |

Contract |

15 |

Deal Type |

Long |

Where the Long holder, for each long contract held, has the right to sell hundred units of the T-bill. Consequently, a deal involving 15 Contracts translates to 1500 (15 x 100) units of the T-bill involved in the trade.

Deal Type

While capturing the details of a specific deal you have to indicate whether it is a Buy (Long) or Sell (Short) type of deal.

You can select the appropriate preference from the available list.

Premium/Future Price

For Options, the Option Premium is the price at which an option is bought or sold excluding any commissions, trading fees and applicable levies.

For index based options, the price has to be specified in index points per contract. For non index based options, the premium has to be expressed in terms if the Instrument Pricing Unit specified at the time of defining the instrument.

While capturing future deals you will have to indicate the Future Price. For index based futures, the price has to be specified in index points per contract. For non index based futures, the price has to be expressed in terms of the Instrument Pricing Unit indicated at the time of instrument definition.

For instance, let us assume that you are capturing the details of a commodity Option. The commodity involved in the instrument is Wheat and the Option Premium is quoted in the market in terms of kilograms. Accordingly you have priced the instrument in the following manner:

Field |

Value |

Instrument Pricing Size |

1 |

Instrument Pricing Size Unit |

Kilogram |

The system calculates and displays the Deal Value of the contract in the adjacent field, based on your entry in this field. The Deal Value is calculated in the following manner:

Example: Futures Price/Option Premium X Number of Contracts X Instrument Pricing Multiple

You are capturing the details of a Short type of deal with the following details:

Field |

Value |

Deal Reference |

000DP01003280008 |

User Reference |

WheatF1 |

Product |

DP01 (Long Short deals for Portfolio Customers) |

Instrument ID |

CBOWHEAT-CALE-FP |

Description |

Chicago Board of Trade, European Style call option. |

Series |

4.00-NOV-2000 |

Number of Contracts |

12 |

Deal Type |

Short |

Option Premium |

0.25 (USD Per KG) |

The Instrument Details, which will be taken into account for processing, are:

- The Contract Size – 10 Kilograms.

- The Asset Currency - USD.

- The Pricing Currency - USD.

- The Pricing Multiple = 10.

Since the Number of Contracts involved is 12, the quantity of the actual commodity involved in the trade will be calculated as follows:

12 (Number of Contracts) X10 (Contract Size) = 120 KGs.

The Option Premium is 0.25 USD Per Kilogram. Therefore the Deal Value will be calculated as follows:

0.25 (Option Premium) X 12 (Number of Contracts) X 10 (Pricing Multiple).

The Deal Value will be displayed as 30 USD

Value Date

Specify the Value Date here. The Value Date represents the date from which the obligation or the right on the underlying asset takes effect on the parties involved in the deal.

The Value Date you specify can be one of the following:

- Today’s date

- Past Date

Time Stamp and Transaction Date

The Time Stamp is the exact time at which the deal transaction took place in the exchange. You have to specify the time at which the deal transaction took place.

The transaction date is the date on which you entered the deal into Oracle FLEXCUBE. The system gives the present date as the transaction date. You cannot change it.

Money Settlement Date

The Money Settlement Date (or the MSTL Date) represents the Value Date of the Money Settlement of the Premium Amount in a Long/Short option deal.

If there is any money settlement involved in the deal you are processing, you can indicate the date on which the money settlement for the Premium Amount in a long/short option should be done.

Portfolio Identification

Every deal that you capture in Oracle FLEXCUBE should be associated with the respective portfolio. For instance, if you are capturing the details of a deal on behalf of your bank’s customer you must link it to the relevant customer portfolio. Similarly, while entering the details of a deal on behalf of your bank, you have to link it to the appropriate bank portfolio.

While defining a deal product, you would have established certain controls over the portfolios that your branches can deal in by defining restrictions for the product. The list provided alongside this field contains all the ‘allowed’ portfolios for this product. Select the appropriate portfolio form this list.

Note

If you are capturing the details of a deal on behalf of your customer’s portfolio, then the CIF ID and the Name of the customer involved in the portfolio are defaulted in the respective fields.

Broker/Clearing Member

Specify the Broker ID of the broker through whom the deal was brokered. You can select a Broker ID from the available list. The available list contains the codes assigned to brokers with whom you can enter deals.

Broker Account

Select the Broker Account from the adjoining list. This account represents the actual account where the positions will be updated.

Basket Reference

The Basket Reference number is the unique reference number or identifier that the system assigns, each time you process a deal with the following combination:

Portfolio ID + Instrument ID + Series ID + Broker + Broker Account

The reference number is referred to as the Basket Reference.

Once generated, all subsequent deals in the same combination will be referenced with this ID. Life cycle processing for all events in the basket will be carried out based on the basket reference number.

Other Details

These details of the instrument involved in the deal are displayed in the respective fields. These details include:

- Strike Price (if any) of the instrument series).

- Expiry date of the instrument series.

- Underlying Asset associated with the instrument involved in the deal.

- Contract Standard or any additional details of the instrument involved in the deal.

7.2.2 Charges Button

You can specify the charges that should be levied on every deal that is booked in the ETD module. The charge components linked to the deal product are defaulted to the deal.

You can choose to recover the charges either from the Broker or the Portfolio Customer.

When a charge component that is applied to a deal is liquidated, the relevant accounting entries are passed based on the accounting entry set-up for the deal product.

7.2.3 Events Button

As stated earlier, in the ETD module you can collect charges for booking the deal in Oracle FLEXCUBE. You have already associated the required charge components at the time of defining the product. Additionally, you have also identified the GL/SLs that ought to be impacted when accounting entries are posted for these charges.

You can view the accounting entries for the deal-booking (EBOK) event through the Events Accounting Entry and Overrides screen. All the accounting entries that were passed for the booking event will be displayed.

The following information is provided for each event:

- Branch

- Account

- The currency of the Account

- The amount tag

- The transaction code associated with the deal

- Dr/Cr indicator

- Value Date

- The Charge Amount in the Currency of the Account, when the currency is a foreign currency.

- The exchange rate that was used for the conversion, if the Account is a foreign currency account.

- Amount in local currency

- All the overrides that were encountered for the event will also be displayed.

- The date and time on which the entry was entered in Oracle FLEXCUBE.

7.2.4 Settlements Button

Along with other charge related details of a deal, you have to specify the accounts that have to be debited or credited depending on whether the charges are to be collected or paid. The Debit and Credit accounts and the amount indicate the accounting entry that has to be passed at your bank to effect the deal.

Apart from the details of accounts that have to be debited and credited for the charge amount you will have to capture the following details to effect a deal successfully:

- Details about the route through which the money settlement should take place.

- Indicate whether a payment message needs to be generated.

7.2.5 Specifying Advices for the Deal

While defining the deal product you have already maintained the list of advices that need to be generated for deals associated with the product.

The details of the advices applicable for an event are displayed in the Advices screen. The party ID to whom a specific advice should be sent is picked up automatically based on the Party/Advice mapping done for the counterparty.

7.2.6 Fields Button

You can view the UDFs only if you have maintained the same for the product involved in the deal. To view the UDFs defined for the product, click ‘Fields’ button. The list of fields and default values specified for the product to which the deal is associated is displayed.

You can add to the list of fields defaulted from the product but you will not be allowed to remove a field from the defaulted list.

You can change the values defaulted from the product to suit the deal you are processing.

For more details on defining custom fields in Oracle FLEXCUBE, refer the ‘User Defined Fields’ User Manual.

7.2.7 MIS Button

You can choose to perform MIS Refinancing on a daily basis for all bill contracts, only if this option has been enabled in the Bank-wide Preferences screen. If the MIS refinancing has been set to a daily frequency, you have to indicate the refinance rate pick up specification through the transaction MIS sub-screen while processing the contract.

Click ‘MIS’ button to invoke the ‘MIS’ screen.

In this screen, the transaction type of MIS class, the cost code and pool code will be picked up from the product under which the deal is processed. The composite MIS code will be picked up from the definition made for the customer, on behalf of whom the deal is being processed.

You have to indicate whether the system should pick up the MIS Rate associated with the pool linked to the contract or whether you would like to maintain a rate specific to the contract. You can indicate your choice by selecting any one of the following options:

- Pool Code – indicating that the MIS Rate maintained for the pool code should be used for refinancing.

- Contract Level – indicating that you would like to maintain a specific MIS Rate for the particular contract.

Refer the ‘MIS’ User Manual for more details on maintaining MIS related information for a product and contract.

7.2.8 Associating a Broker and Product with a Rule

While capturing details of a contract, brokerage can also be specified if the broker code chosen is associated with the deal product. Brokerage association enables you to link a product, a rule, a currency or a currency pair (in the case of foreign exchange products) and a broker. The attributes of the brokerage rule that you apply will be associated with contracts defined in this combination. This can be done through the Brokerage Association screen.

For further information on the Brokerage Association screen, refer to the chapter Processing Brokerage in the Brokerage User Manual.

7.2.9 Long Short Deal Financial Amendment

During amendment, if any field other than the ‘Time Stamp’ and ‘Remarks’ fields of a deal is modified, system will treat the amendment as a financial amendment. System will reverse the previous deal and book a new deal with modified details. The external reference number of the original deal is retained and the two deals are linked by the external reference number.

Oracle FLEXCUBE provides the facility to amend the financial details of an LS deal through external upload. If an amendment is uploaded without settlement details but there is no change in the product ID, instrument ID and the portfolio, system will default the settlement details of the original deal.

Financial amendments of LS deals are uploaded by the service FCUBSETDService with the operation ETDLSDealModify.

Note

System allows financial amendments of LS deals only through Gateway uploads and not through the front-end.

7.3 Liquidation Deals

This section contains the following topics

- Section 7.3.1, "Invoking the Liquidation Deals Screen"

- Section 7.3.2, "Settlement Button"

- Section 7.3.3, "Charges Button"

- Section 7.3.4, "Viewing the Accounting Entries posted for an LQ transaction"

- Section 7.3.5, "Specifying the Advices for a Deal"

- Section 7.3.6, "Fields Button"

- Section 7.3.7, "MIS Button"

- Section 7.3.8, "Brokerage Button"

- Section 7.3.9, "Liquidation Deal Financial Amendment"

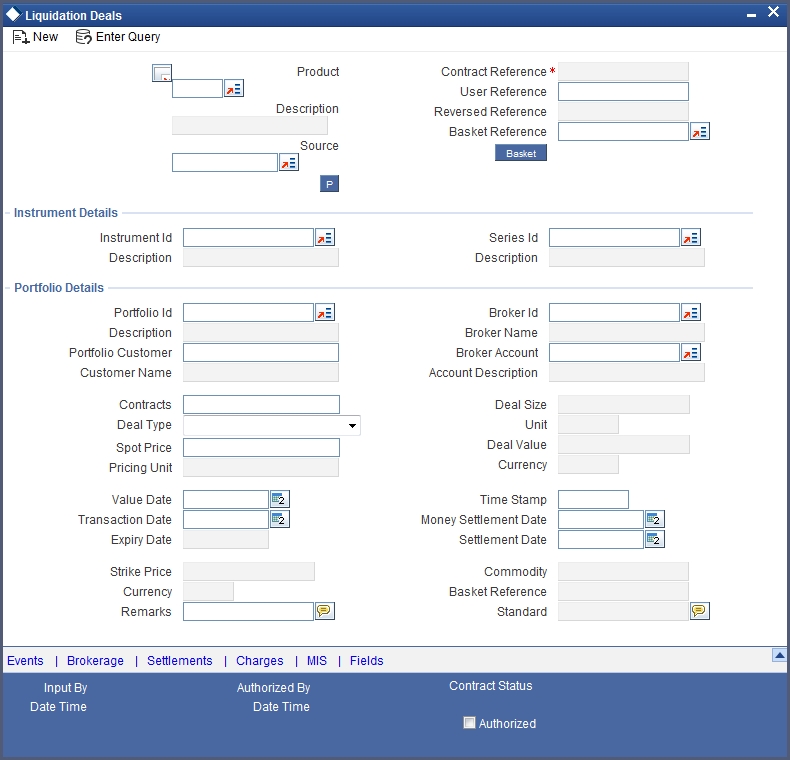

7.3.1 Invoking the Liquidation Deals Screen

Through the Liquidation Deal (LQ) Input you can:

- Manually exercise European Options for Long Positions on the Expiry Date.

- Manually exercise American Options for Long Positions on or before the Expiry Date.

- Manually assign European Options for Short Positions on the Expiry Date.

- Manually assign American Options for Short Positions on or before the Expiry Date.

- Manually exchange for Physicals for Long/Short Future Positions.

You can invoke the ‘Liquidation Deals’ screen by typing ‘EDDLQONL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

While entering the details of a liquidation deal you should necessarily use an LQ product that exists in the system. You can select the appropriate product code from the available list.

User Reference

If the transaction is being uploaded from an external source, you can specify the identification for the deal in the external source, as the external reference number.

Reversed Reference

The reference number of the contract that is being reversed and rebooked is displayed here.

Source

You have to indicate the source from which deal is to be uploaded.

Basket Reference

After you identify the product, which should be used to capture the details of the deal you have to specify the Basket to which the deal belongs. Select the Basket Reference number from the list of options alongside this field. After selecting the reference number, click ‘Basket’ button.

On indicating the Basket reference number the following details about the basket are displayed:

- Portfolio ID

- Instrument ID

- Series ID

- Broker

- Broker Account

If you are processing a Customer Deal, the name of the customer involved in the portfolio will be displayed in as well.

Note

- The current balance in the basket will also be displayed for your reference. You have to identify the basket to which the deal you are liquidating belongs.

- If you select the portfolio, the instrument and the broker, and for this combination that you have specified, there is no Basket Reference Number, the basket will be created and the balance of the same will be updated. If the liquidation amount of the contracts is more than the balance available in the basket, the system will save the liquidation deal, but at EOD display the message ‘Insufficient Balance in Basket’.

Contracts

The number of contracts that have been liquidated in the basket is defaulted as the current balance in the basket. You can change this default value and indicate the number of contracts within the basket that have to be liquidated.

Deal Type

After identifying the number of contracts that have to be liquidated, you have to indicate the type of liquidation that has to be performed on the contracts. The options available are:

- Exercise of Options

- Assignment of Options

- EFP of Futures Long

- EFP of Futures Short

Select the appropriate option from the list.

Spot Price

Specify the Spot Price of the underlying asset involved in the instrument. The spot price is to be expressed in terms of the Underlying Pricing Unit as maintained in the Underlying Asset Definition screen.

Value Date

The Value Date represents the date on which the basket is to be liquidated. This is the date as of which the accounting entries will be posted for booking the liquidation gains and losses.

Time Stamp and Transaction Date

You have to capture the exact time at which the deal transaction took place in the exchange.

The transaction date is the date on which you entered the deal into Oracle FLEXCUBE. The system puts today's date as the transaction date. You cannot change this date.

Settle Date

If the basket involves physical settlement of the underlying asset you have to indicate the date on which the physical settlement of futures should be done.

Note

The ETD module of Oracle FLEXCUBE does not support any processing with respect to the physical settlement of deals.

Money Settlement Date

If there is any money settlement involved in the liquidation deal you are processing, you can indicate the date on which the money settlement of liquidation gains/losses is to be done.

Other details of the LQ Details screen

The following details of the Liquidation details screen are picked up from the Instrument Definition screen and displayed in their respective fields on saving your entries:

- Strike Price at which the option buyer can purchase the asset for a call option or sell the asset in the case of a put option.

- Underlying Asset involved in the deal

- Basket Reference number involved in the deal

- Expiry Date of the series

- Additional information about the instrument pertaining to the instrument itself, or the underlying asset, the physical settlement of the deal or the money settlement of the deal is displayed in the Standard field.

7.3.2 Settlement Button

The settlement accounts are the accounts, which will be impacted (debited/credited) for settling the liquidation gains and losses.

7.3.3 Charges Button

You can specify the charges that should be levied on every LQ deal that is booked in the ETD module. The charge components linked to the deal product will be defaulted to the LQ deal.

You can choose to recover the charges either from the Broker or the Portfolio Customer.

During liquidation, the relevant accounting entries are passed based on the accounting entry set-up for the deal product.

7.3.4 Viewing the Accounting Entries posted for an LQ transaction

The charge components associated with the liquidation product will be defaulted to the deal. You can view the GL/SLs that will be impacted when accounting entries are posted for booking (EBOK) the liquidation deal through the Liquidation Events Accounting Entries and Overrides screen.

The accounting entries will be displayed along with the overrides that were encountered while processing the transaction.

7.3.5 Specifying the Advices for a Deal

The details of the advices applicable for an event are displayed in the Advices screen. The party ID to whom a specific advice should be sent is picked up automatically based on the Party/Advice mapping done for the counterparty.

7.3.6 Fields Button

You can view the UDFs only if you have maintained the same for the product involved in the deal. To view the UDFs defined for the product, click ‘Fields’ button. The list of fields and default values specified for the product to which the deal is associated is displayed.

You can add to the list of fields defaulted from the product but you will not be allowed to remove a field from the defaulted list.

You can change the values defaulted from the product to suit the deal you are processing.

For more details on defining custom fields in Oracle FLEXCUBE, refer the ‘User Defined Fields’ User Manual.

7.3.7 MIS Button

You can choose to perform MIS Refinancing on a daily basis for all bill contracts, only if this option has been enabled in the Bank-wide Preferences screen. If the MIS refinancing has been set to a daily frequency, you have to indicate the refinance rate pick up specification through the transaction MIS sub-screen while processing the contract.

Click ‘MIS’ button to invoke the ‘MIS’ screen.

In this screen, the transaction type of MIS class, the cost code and pool code are picked up from the product under which the deal is processed. The composite MIS code is picked up from the definition made for the customer, on behalf of whom the deal is being processed.

You have to indicate whether the system should pick up the MIS Rate associated with the pool linked to the contract or whether you would like to maintain a rate specific to the contract. You can indicate your choice by selecting any one of the following options:

- Pool Code – indicating that the MIS Rate maintained for the pool code should be used for refinancing.

- Contract Level – indicating that you would like to maintain a specific MIS Rate for the particular contract.

Refer the ‘MIS’ User Manual for more details on maintaining MIS related information for a product and contract.

7.3.8 Brokerage Button

While capturing details of a contract, brokerage can also be specified if the broker code chosen is associated with the deal product. Brokerage association enables you to link a product, a rule, a currency or a currency pair (in the case of foreign exchange products) and a broker. The attributes of the brokerage rule that you apply will be associated with contracts defined in this combination. This can be done through the Brokerage Association screen.

For further information on the Brokerage Association screen, refer to the chapter Processing Brokerage in the Brokerage User Manual.

7.3.9 Liquidation Deal Financial Amendment

During amendment, if any field other than the ‘Time Stamp’ and ‘Remarks’ fields of a module is modified, system will treat the amendment as a financial amendment. System will reverse the previous deal and book a new deal with modified details. The external reference number of the original deal is retained and the two deals are linked by the external reference number.

Oracle FLEXCUBE provides the facility to amend the financial details of a liquidation deal through external upload. If an amendment is uploaded without settlement details but there is no change in the product ID, instrument ID and the portfolio, system will default the settlement details of the original deal.

Financial amendments of liquidation deals are uploaded by the service FCUBSETDService with the operation ETDLQDealModify.

Note

System allows financial amendments of LQ deals only through Gateway uploads and not through the front-end.

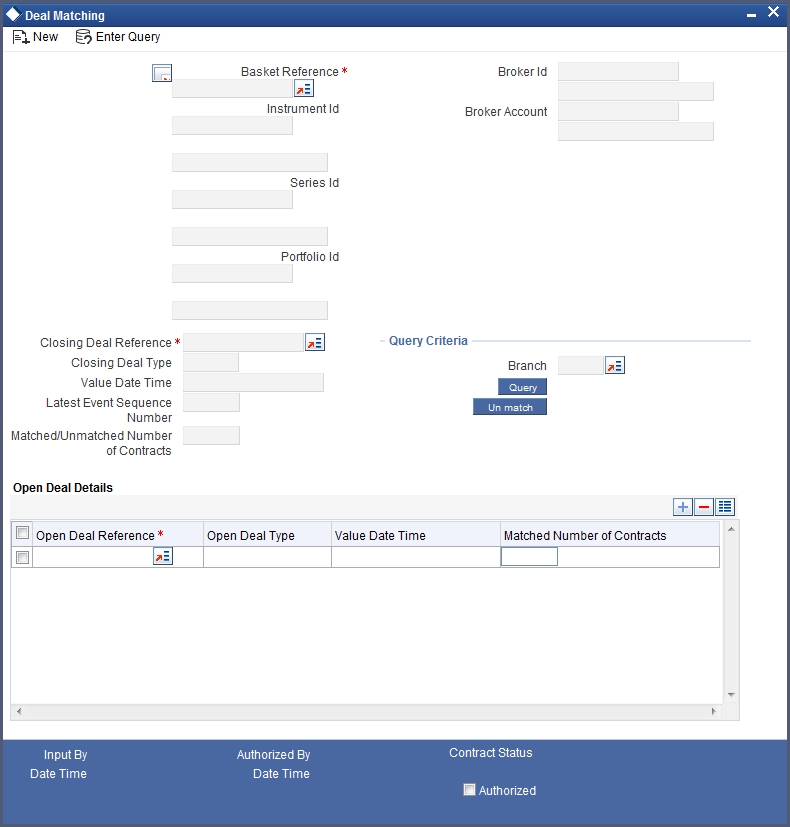

7.4 Deals Matching

This section contains the following topics:

- Section 7.4.1, "Invoking Liquidation Deals Screen"

- Section 7.4.2, "Operations you can perform on a Matched and Unmatched Deal"

7.4.1 Invoking Liquidation Deals Screen

You can match deals for your bank’s own portfolios through the ETD module of Oracle FLEXCUBE. If the portfolio from which you are buying or selling is priced using the Deal Matching methodology, you should identify the buy deal against which the sell/liquidation deal is to be matched. You can do this through the ‘Deal Matching’ screen of the ETD module.

You can invoke the ‘Liquidation Deals’ screen by typing ‘EDDMATCH’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Basket Reference

In this screen, first you specify the Basket Reference for which you intend to do the Deal Matching. The Basket Reference number available in the option list is displayed based on the following criteria:

- The Portfolio involved in the basket should be your Bank’s own portfolio.

- The Option Costing Method specified for the portfolio should be Deal Matching.

- The Instrument involved in the Basket should be an Option with Option Style Premium.

You can select a valid Basket Reference Number from the available list. The other details involved in the Basket are displayed in the respective fields on saving your entries. These details include:

- Instrument ID

- Series ID

- Portfolio ID

- Broker ID

- Broker Account

Closing Deal Reference

After having specified the Basket Reference, you should indicate the closing deal reference number. The Closing Deal can either be a Long/Short type of a deal or can be an Exercise/Assignment Deal.

This closing deal has to be matched to one or more opening deals. However, while matching deals you should take care of the following:

- The Value Date of the Opening Deal should be less than or equal to the Value Date of the Closing Deal.

- If value date of the Closing Deal is equal to the Value Date of the Opening Deal, then the Trade Time Stamp of the Opening Deal should be less than the Trade Time Stamp of Closing Deal.

Also, the total number of contracts of the Closing Deal that should be matched should be equal to the number of contracts that you wish to close.

Example

Scenario I

Let us assume, you are 20 Contracts long in a particular instrument where the instrument details are as follows:

Strike Price = 10 USD.

Contract Size is 1 Unit of the Underlying Asset.

The balance of 20 Contracts have been built up by the following deals.

10 Contracts |

Long |

Deal001 |

Premium Paid= 2 USD per Contract |

4 Contracts |

Long |

Deal002 |

Premium Paid= 3 USD per Contract |

6 Contracts |

Long |

Deal003 |

Premium Paid= 4 USD per Contract |

Let us assume you are doing an Exercise Deal for 12 Contracts (Deal004 – Underlying Price = 12 USD). You would like to match this Exercise Deal of 12 Contracts partially to Deal001 and Deal003.

Your deal matching preferences in the Deal Matching screen will read as follows:

Deal004 matched to |

Deal001 |

6 Contracts |

Deal004 matched to |

Deal003 |

6 Contracts |

After, this matching

- Deal001 will have unmatched number of Contracts as 4.

- Deal002 will have unmatched number of Contracts as 4.

- Deal003 will have unmatched number of Contracts as 0.

- Deal004 will have unmatched number of Contracts as 0.

The system will compute the Exercise Gain / Loss as follows:

- Cost of Deal001 for 6 Contracts = 6 x 2 = 12 USD

- Cost of Deal003 for 6 Contracts = 6 x 4 = 24 USD

Total Cost = 36 USD.

The difference between the Underlying Price and Strike Price will be computed as:

- 12 – 10 = 2 USD per Contract

- 2 x 6 = 12 USD for 6 Contracts

Thus, the Exercise Loss will be computed as 36 USD – 12 USD = 24 USD

In the above example, the number of Contracts matched were equal to the Number of Contracts of the Closing Deal (exercise deal) i.e. 12.

Now, consider this scenario.

Scenario II

You are long in an Option for 5 Contracts |

- |

Deal001 |

Subsequent to that, you do a Short Deal for 10 Contracts |

- |

Deal002 |

Since, Deal002 is subsequent to Deal001, deal matching should be done as follows:

Deal002 Matched to |

Deal001 |

5 Contracts |

This will result in,

- Deal001 having ‘0’ unmatched number of Contracts.

- Deal002 having ‘5’ unmatched number of Contracts.

Deal002 will be processed for the following events:

- ECLG - Closing of Long Position for 5 Contracts.

- EOSH - Opening of Short Position for 5 Contracts.

The Basket will now result in a balance of 5 Short.

7.4.2 Operations you can perform on a Matched and Unmatched Deal

The deal matching operation results in the event EMAT for the closing deal. You will need to authorize this event either through the Long/Short or the Liquidation deal depending on the Deal Type of the Closing Deal.

To Un-match the deal, you must first select the Matched deal which has to be Unmatched using the list of values under the ‘Branch’ field. Then click ‘QUERY’ Button

If you need to ‘unmatch’ or remove the matching associated with a particular deal you can do so by clicking ‘Unmatch’ button in the Deal Matching screen. The unmatching operation also introduces an event EUMT in the closing deal. You will have to authorize this event.

Note

Authorization of the EUMT (Unmatching) event results in the reversal of the Closing Deal.

During the end of day batch run, the system will compute the number of contracts for which a closing operation has to be performed (EXRL, EAXS, ECLG, ECSH). If the number of contracts that have been matched for the closing deal does not tally with the number of contracts that need to be closed, the entire basket will be skipped as an exception. This basket will be subsequently picked up for processing the next day provided the matching has been rectified.