3. Maintenances for Fixed Asset Module

You need to maintain certain details before you start entering the details of the assets.

Therefore, you need to maintain the following information as part of processing fixed assets:

- Asset category maintenance

- Locations maintenance

- Branch Parameters

- Class(es) for locations restrictions

- Class(es) for category restrictions

- Asset category restrictions

- Rule definition

This chapter enumerates the maintenance of the above mentioned parameters used by the Fixed Assets module in Oracle FLEXCUBE:

This chapter contains the following sections:

- Section 3.1, "Asset Category Details"

- Section 3.2, "Codes for Asset Locations"

- Section 3.3, "Branch Parameters Set-up for the Product"

- Section 3.4, "Location Restrictions Classes"

- Section 3.5, "Asset Category Restriction Classes"

- Section 3.6, "Asset Rules Definition"

- Section 3.7, "Asset Category and Location Rule Mapping"

3.1 Asset Category Details

This section contains the following topics:

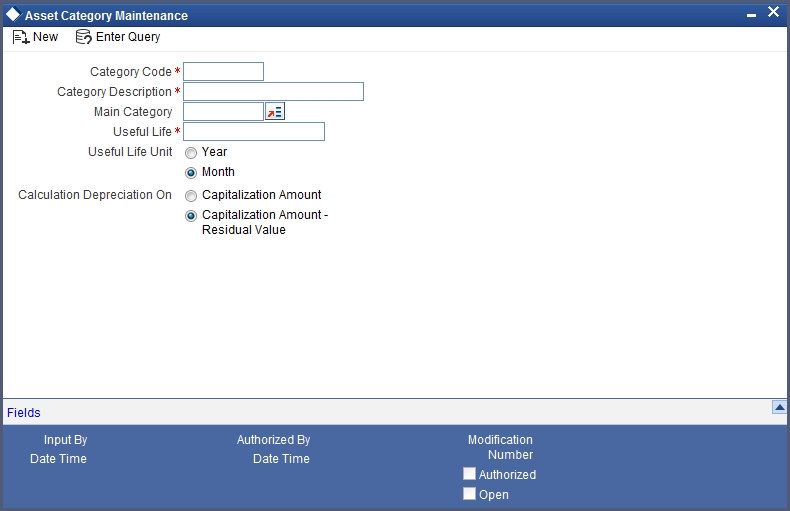

3.1.1 Invoking Assets Category Maintenance Screen

In the ‘Asset Category Maintenance’ screen, you can group all the assets that are similar under one category. This will be useful for charging a common depreciation rate, generating MIS reports etc. You can also define the useful life for different categories of assets.

You can invoke this screen by typing ‘FADACAT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specify the following:

Category Code

You have to specify the unique code to identify the category for the asset. You will not be able to modify the category code once it is authorized.

Note

You can restrict usage of any asset category by disallowing the category in Asset category restriction screen, accessed through the product maintenance screen.

Category Description

You have to capture a brief description about the asset category that you are defining. For example you could create a category called Land and categorize all immovable assets under this category. You could assign a description called Lands and Buildings to this category.

Main Category

You can choose the main category code for the asset from the drop down list. For example for an asset like car, you can have Vehicle as your main category. This is meant for information purposes only.

Useful Life

Mention the useful life of the asset in this field. If you select the Year as your useful life unit in the next field then you have to mention the number of years the asset will be active.

If your preference is Month then mention the number of months for which the asset is useful.

The significance of capturing this information is that if the depreciation is adhoc, the rates captured at the contract level should cover the useful life of the asset. Also, the sum of the depreciation rates should add up to hundred percent for the useful life period. However, if the depreciation is rule based, this will have no effect on the depreciation calculation.

Useful Life Unit

This is where you can mention the unit for measuring the useful life of an asset. The useful life unit can be Year or Month and this will determine the useful life mentioned in the previous field.

Calculation Depreciation On

Here you can mention whether you want to calculate the depreciation on the capitalization amount or on capitalization amount minus the residual value. You can indicate your preference by clicking against the option.

Note

Residual Value is the scrap value of the asset which can be realized when the asset is sold after its useful life is complete. Residual value is often determined on the basis of judgment. Hence, Oracle FLEXCUBE allows you to change the Residual Value of the asset during its existence.

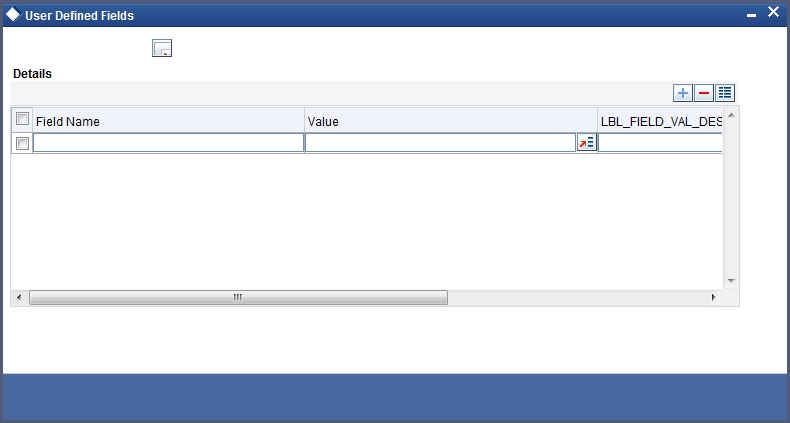

3.1.2 Fields Button

You can associate values to all the User Defined fields created and attached to the ‘Asset Category Maintenance’ screen. You can view the list of User Defined fields associated to this screen by clicking ‘Fields’ button on the ‘Asset Category Maintenance’ screen.

You can enter the value for the UDFs listed here in the ‘Value’ column.

For more details on how to create user Defined fields, refer chapter ‘Creating custom fields in Oracle FLEXCUBE’ in the User Defined Fields User Manual under Modularity.

3.2 Codes for Asset Locations

This section contains the following topics:

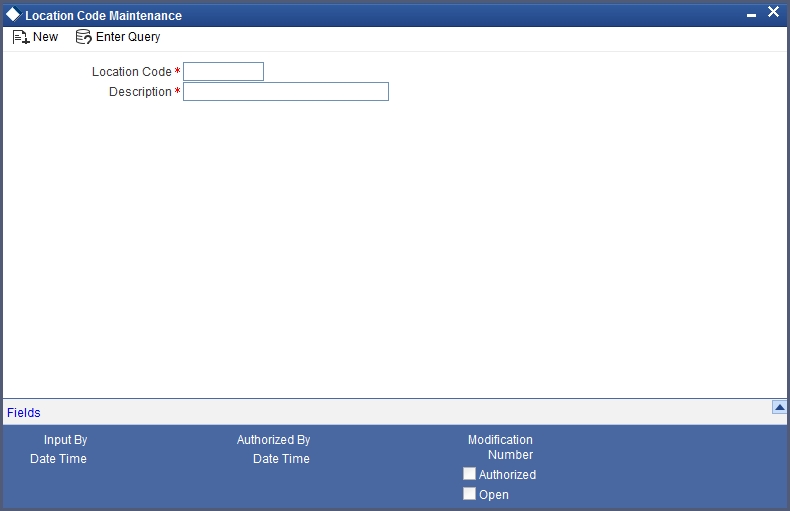

3.2.1 Invoking Location Code Maintenance Screen

Through the ‘Location Code Maintenance’ screen, you can assign a unique location code to identify different locations where the asset physically exists.

You can invoke this screen by typing ‘FADLOCN’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specify the following:

Location Code

You have to capture a code to identify the particular location. You will not be able to modify it once it is authorized. You can pick this code from the Asset Capture screen and the system will default the description for the location.

Note

You can restrict usage of any location by disallowing the location in Locations Restriction screen, accessed through the ‘Product Maintenance’ screen.

Description

In this field, you can specify any general information of the location such as the name of the city, pin code etc.

3.3 Branch Parameters Set-up for the Product

This section contains the following topics:

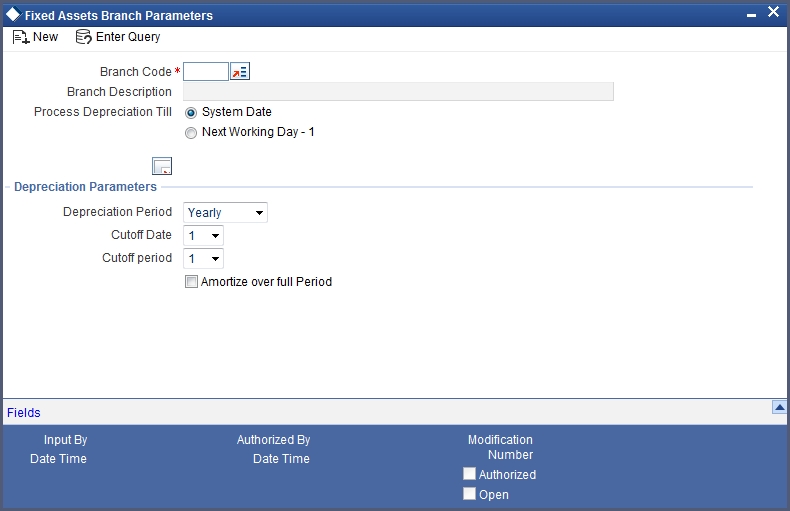

3.3.1 Invoking Branch Parameters - Fixed Assets Screen

You can define parameters at the branch level for functions such as depreciation period, residual value for writing off an asset, the cut off date for an asset to be included for depreciation for the particular period, etc.

You can invoke the ‘Branch Parameters – Fixed Assets’ screen by typing ‘FADBRMNT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specify the following:

Branch Code and Branch Description

Select the code for the branch, for which you want to define the parameters, from the option list. Once you select the branch code, the description of the branch is defaulted in the next field.

Process Depreciation Till

Here you have to mention the date on which the depreciation has to be processed. It can be either the System date or the Next Working Day – 1.

If you select the System date, the depreciation will be processed only till the day on which EOD is run. If your choice is Next Working Day – 1, then the depreciation will be processed till the last day before the next working day when the batch process is run during EOD. This is applicable only for working days within a month. For instance, if Today’s Date is 10th June and the Next Working Date is 15th June, the system will pass accounting entries for contracts falling due up to 14th June during the EOD processes executed on 10th June. But, if Today’s Date were 28th June and the Next Working Date happens to be 3rd July, the processing will be done only upto the 30th of June since it is the month end. The system will post the accounting entries for the first and second of July during the BOD process executed on the 3rd of July.

Note

This is with the assumption that the Accounting Period is Monthly. If it were to be Quarterly, the processing will be done till the end of the period which is the corresponding quarter.

3.3.1.1 Depreciation Parameters

Specify the following:

Depreciation Period

The calculation of depreciation for the year is based on the depreciation period, considering the cutoff period and date. You can choose the period from the option list positioned next to this field. The choices are:

- Monthly

- Quarterly

- Half-yearly

- Yearly

Cut Off Date and Cut Off Period

You need to mention the cut off date and cut off month for calculating the depreciation for the asset. If the asset is acquired before the mentioned cutoff date and cut off month, the depreciation is calculated for the full period.

If the depreciation period chosen in the previous field is Quarterly, Half Yearly or Yearly, you have to specify the cut off date and cut off month.

If the depreciation frequency chosen in the previous field is Monthly, then you need to mention only the cut off date.

The depreciation is calculated from the next period if the asset is acquired after the cut off period.

Amortize over full Period

Specify if you want to amortize over the full period by checking the box. When an asset is acquired after the specified cut off date and month, the depreciation will be calculated from the next period and it will amortize the depreciation over the period of acquisition also.

If you leave this box unchecked, then the amortization will be done from the next period.

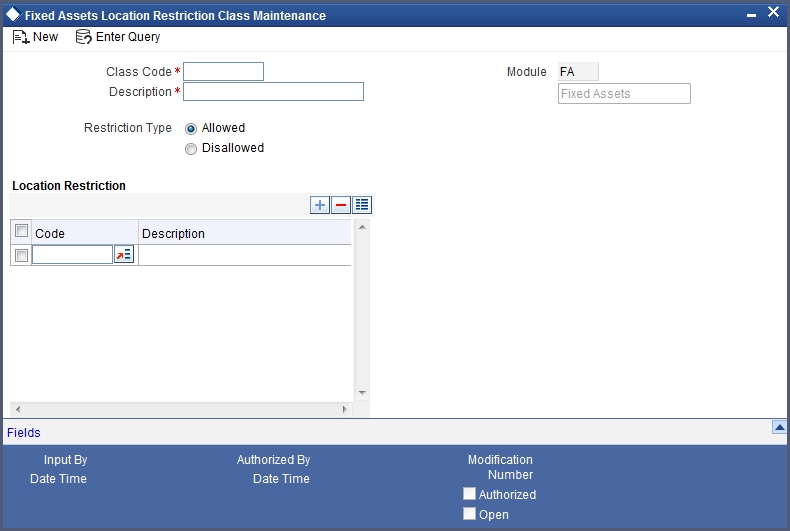

3.4 Location Restrictions Classes

This section contains the following topics:

3.4.1 Invoking Fixed Assets Location Restriction Class Maintenance Screen

You can define restrictions for certain locations that can be defaulted at the product level.

You can invoke the ‘Fixed Assets Location Restriction Class Maintenance’ screen by typing ‘FADLOCCL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specify the following:

Class Code and Description

You can identify a Location Restriction class that you build with a unique ten character Class Code and a brief description.

You can follow your own convention for devising the code. The description that you specify is for information purposes only and will not be printed on any customer correspondence.

Restriction Type

You can specify Location restrictions either in the form of an ‘Allowed’ type, or in the form of a ‘Disallowed’ type.

When you associate a restriction class with a product, those locations that do not figure in the list cannot offer the service. If you have maintained a disallowed type for a class, locations that do not figure in it can offer the service.

Location Restriction

Specify the following:

Code and Description

You can select location code from option list based on the ‘Restriction Type’ selected for a class.

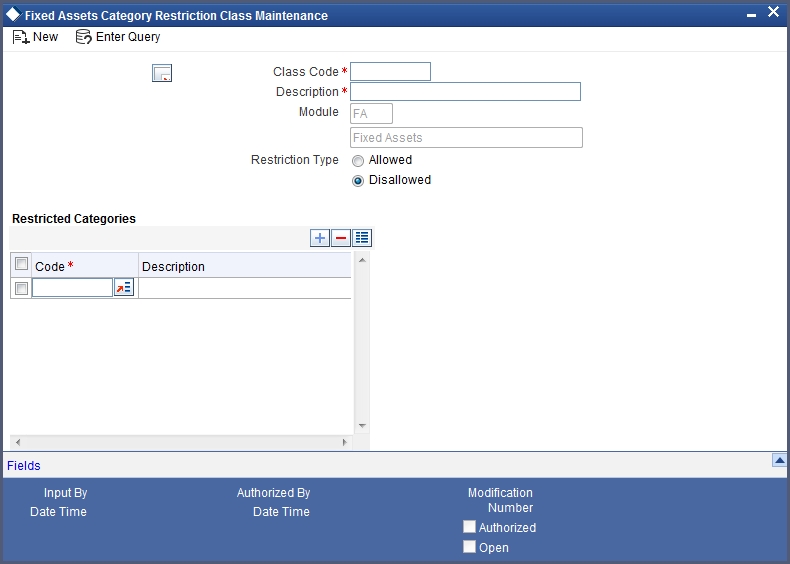

3.5 Asset Category Restriction Classes

This section contains the following topics:

3.5.1 Invoking Asset Category Restriction Class Maintenance Screen

An asset category restriction class identifies a unique list of allowed or disallowed categories. At your head office, you can associate a product that you propose to offer with any Asset Category Restriction Class that you have maintained. The asset category restrictions defined for the class will apply to the service.

Note

Any product that your bank offers is available to all asset categories, by default, unless you specifically restrict its availability.

You will be able to define Asset category restriction classes through the ‘Asset Category Restriction Class Maintenance’ screen. You can invoke this screen by typing ‘FADCATCL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. The asset category restriction classes that you define and authorize in this screen are the ones which can be used while creating the Fixed Assets products.

An Asset Category Restriction Class, is identified by a unique Code and a Description.

The asset category classes that you maintain have to be specific to a module in Oracle FLEXCUBE. This is because, a class maintained for one module would be unsuitable for another.

Class Code and Description

You can identify a Category Restriction class that you build with a unique ten character Class Code and a brief description.

Restriction Type

You can specify Category restrictions either in the form of an ‘Allowed’ type, or in the form of a ‘Disallowed’ type.

When you associate a restriction class with a product, those categories that do not figure in the list cannot offer the service. If you have maintained a disallowed type for a class, categories that do not figure in it can offer the service.

Restricted Categories

Specify the following:

Code and Description

You can select location code from option list based on the ‘Restriction Type’ selected for a class.

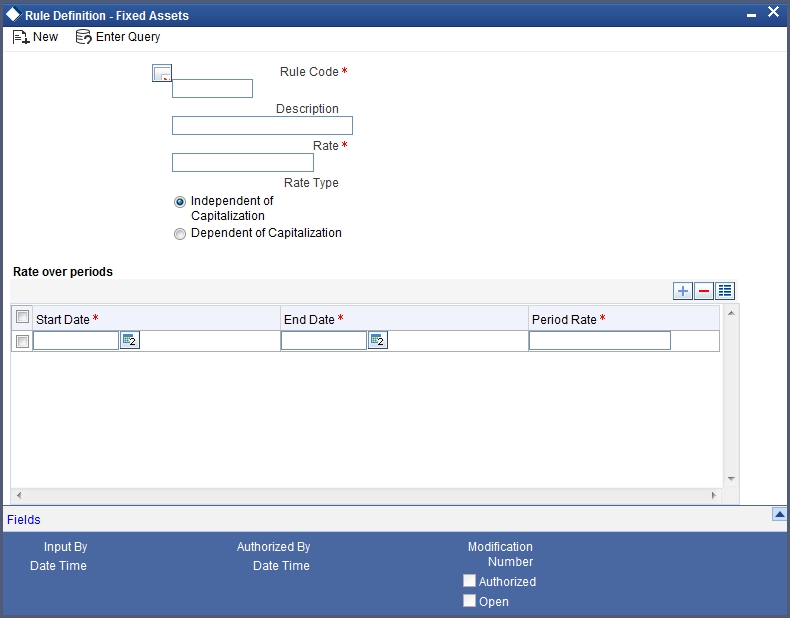

3.6 Asset Rules Definition

This section contains the following topics:

3.6.1 Invoking the Rule Definition – Fixed Assets Screen

For every asset and category combination, you can maintain different rates for depreciation. You can record the depreciation rates for the asset category and the location combination.

You can invoke the ‘Rule Definition – Fixed Assets’ screen by typing ‘FADRULDF’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specify the following:

Rule Code and Description

Give a unique code to identify the rule you are going to define. This code cannot be modified later. You can give a brief description for the code in the description field.

Rate

You have to specify rate for calculating the depreciation for the asset. This rate can be specified for time period in case the asset is dependent on capitalization. In this case, different rates can be maintained for the first year only. The Rate over Periods has to be entered in DD-MON format.

If you have selected Independent of capitalization as your rate type, then the rate will be set for the whole useful period of the asset.

Note

The depreciation rate has to be mentioned in percentage.

Rate Type

If you want to have a different depreciation rates for different periods of acquisition in the first year of the asset life then chose Dependent on capitalization. In contradiction to this, you can choose Independent of capitalization to keep a single rate type through out the life of the asset.

Rate over periods

Specify the following:

Start Date and End Date

If the rule type is dependent on capitalization, and if the effective depreciation date falls between the Start and End date, the rates that you specify in this section of the screen will be considered for computing depreciation. Else, the value that you have specified in the Rate field will be considered.

Note

This is applicable for the first year only.

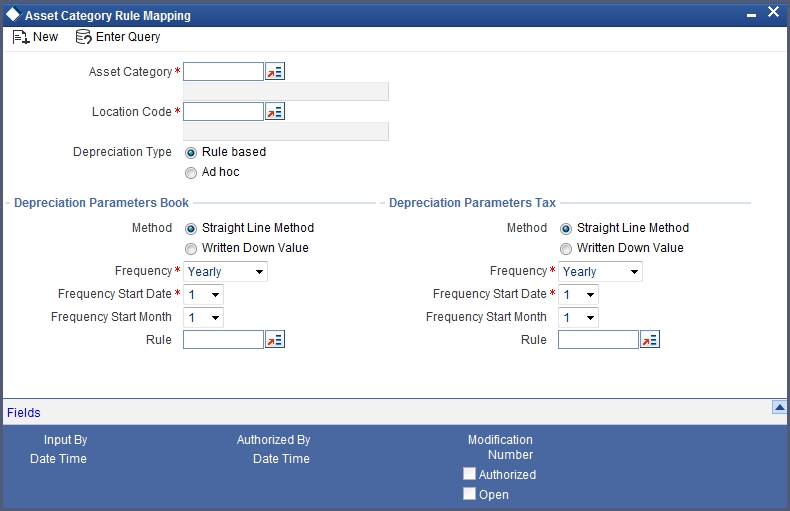

3.7 Asset Category and Location Rule Mapping

This section contains the following topics:

3.7.1 Invoking the Asset Category Rule Mapping screen

Through the asset category – location rule mapping screen, you can map predefined depreciation rules to a combination of asset category and location. You can also define various depreciation parameters such as depreciation method for book and tax purposes, frequency of depreciation, depreciation rate type etc.

You can invoke the ‘Asset Category Rule Mapping’ screen by typing ‘FADRULMP’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specify the following:

Asset Category

Choose the category code for the asset, from the list available. Once you choose the asset category code, the description for the category will be displayed in the next field.

Location Code

You can select the location code for the asset from the given option list.

Depreciation Type

You have to mention the type of depreciation required for the asset. The two options available are Rule based and Ad-hoc.

If you select Rule based type of depreciation, then a fixed percentage is depreciated every year.

If you chose ad-hoc as the depreciation type then you have to maintain depreciation rates in the Depreciation Maintenance screen at the Asset Capture level. In such a scenario, the fields for rule are not applicable.

Depreciation Parameters Book and Tax

Specify the following:

Method

Here you have to indicate if you want SLM (Straight Line Method) or WDV (Written Down Value Method) as your depreciation method. Choose the method of depreciation by clicking on the appropriate option.

This data is maintained for both book of accounts and tax purposes.

Frequency

You need to mention the start date and the start month to determine when the first cycle of the depreciation accounting entries are to be posted.

Select the frequency for calculating of depreciation from the option list. This data is recorded for both book of accounts and tax purposes.

Frequency Start Date

Mention the start date to determine when the first cycle of the depreciation accounting entries are to be posted.

This data is recorded for both book of accounts and tax purpose.

Frequency Start Month

Mention the start month to determine when the first cycle of the depreciation accounting entries are to be posted.

This data is recorded for both book of accounts and tax purpose.

Rule

Select the rule to be used for depreciation from the option list. This data is recorded for both book of accounts and tax purpose.

Refer the section on Depreciation Maintenance for details on maintaining depreciation percentage for each period.