2. Oracle FCUBS - OFSAA Integration

The integration between the Oracle FLEXCUBE Universal Banking System (FCUBS) and the Oracle Financial Services Analytical Applications (OFSAA) enables the financial institutions to:

- get insights to customer patterns based on the data captured in core banking

- achieve end-to-end improvement in business delivery

- achieve effective performance and risk free management using the available customer data

This integration is achieved by handing off FCUBS core banking data via staging tables to OFSAA using DIH connector.

This chapter contains the following sections:

- Section 2.1, "Scope"

- Section 2.2, "Prerequisites in Oracle FLEXCUBE Universal Banking"

- Section 2.3, "Prerequisites in Oracle Financial Services Analytical Applications"

- Section 2.4, "Integration Architecture"

- Section 2.5, "Integration Process"

- Section 2.6, "Assumptions"

2.1 Scope

This section describes the scope of the integration with respect to each system, i.e. FCUBS and OFSAA.

This section contains the following topics:

- Section 2.1.1, "Integration Scope in Oracle FLEXCUBE Universal Banking System"

- Section 2.1.2, "Integration Scope in Oracle Financial Services Analytical Applications"

2.1.1 Integration Scope in Oracle FLEXCUBE Universal Banking System

During the integration following data are provided to OFSAA in the FCUBS staging table. .

Module |

Hand off Details |

Core Entities |

|

Current Account and Savings Account |

|

Consumer Lending |

|

Term Deposit |

|

Enterprise Limits and Collateral Management |

|

General Ledger |

|

Foreign Exchange |

|

Money Marketing |

|

Corporate Deposit |

|

Securities |

|

Letters of Credit |

|

Bills and Collections |

|

Exchange Trade Derivatives |

|

Derivatives |

|

Loan Syndication |

|

Collections |

|

Leasing |

|

2.1.2 Integration Scope in Oracle Financial Services Analytical Applications

Refer ‘FCUBS Connectors User Guide’ and ‘Data Integration Hub User Guide’ to know about integration scope in OFSAA.

2.2 Prerequisites in Oracle FLEXCUBE Universal Banking

Set up Oracle FLEXCUBE Universal Banking Application. OFSAA user will have read-only access to this application. The access is provided only to particular extraction tables.

Refer the ‘Oracle FLEXCUBE Universal Banking Installation’ manual.

This section contains the following topic:

2.2.1 Maintenances

Complete the maintenances discussed below.

2.2.1.1 Interest Rates Parameters

To calculate the interest rates of CASA and OD accounts, you need to maintain the following parameters in ‘Interest and Charges Product Maintenance’ (ICDPRMNT) screen:

- Default Credit Interest IC Product - IC product linked with credit interest rule

- Default Debit Interest IC Product - IC product linked with debit interest rule

The CASA account classes are linked to default credit and debit interest IC product to derive CASA interest rates.

Note

If an IC product is linked to both debit and credit interest rules, then you can maintain that IC product as Default Credit Interest IC Product and Default Debit Interest IC Product.

2.2.1.2 Interest Rate UDE

You need to maintain the UDE for CASA interest rate in ‘Interest and Charges Product Maintenance’ screen (ICDPRMNT). The Interest Rate UDE maintained in this screen is used as Interest Rate UDE in Rule Maintenance screen (ICDRUMNT).

If the account class of a CASA or OD account is linked to one or more credit or debit interest IC product, then the interest rate of that account will be the main UDE maintained in the default credit or debit interest IC product. If main UDE is not maintained in the IC product, the interest rate can be left blank.

Note

You need to manually maintain the data for default credit and debit IC product and UDE in the table AATB_ICTM_INTEREST_RATE to calculate the interest rates for CASA and OD accounts.

For further details on ‘Interest and Charges Product Maintenance’ screen and Rule Maintenance screen, refer to Interest and Charges User Manual.

2.2.1.3 Maintaining Batch Programs

You need to maintain the batch program ‘EMXTRACT’ using ‘Mandatory Batch Program Maintenance’ (EIDMANPE) screen. This batch extracts the data from Oracle FLEXCUBE during end of financial input (EOFI) stage. It is recommended that the extraction of data from FLEXCUBE UBS is done from the reporting environment and not the production environment. You also need to maintain the extraction routine.

2.2.1.4 Maintaining Extraction Routines

You can maintain the data extraction routines in the maintenance table called ‘ESTM_DEST_TABLES’. This table is used to maintain extraction routines and should be maintained manually with the following values along with other details:

Column Name |

Description |

ORD_OF_EXT |

Order of extraction in which routine will be executed. This should be a unique value. |

TABLE_NAME |

Name of the staging table to be populated with data. |

ROUTINE |

Routine to be executed. The format should be ‘Package.procedure’ |

INTEGRATION_NAME |

OFSAA |

All the parameters such as extraction date, previous extraction date, log required and so on are maintained in maintenance table ‘CSTB_EIS_PARAM’. In this table the KEYID is the primary key.

2.3 Prerequisites in Oracle Financial Services Analytical Applications

Refer ‘FCUBS Connectors User Guide’ and ‘Data Integration Hub User Guide’ for details on the prerequisites in OFSAA.

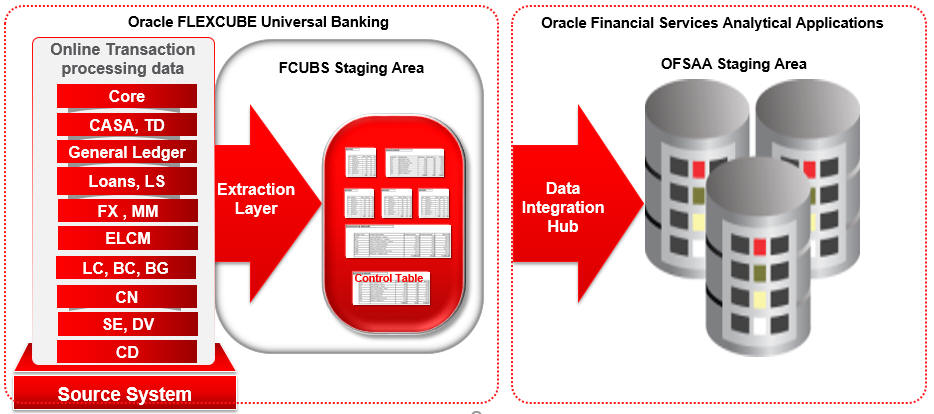

2.4 Integration Architecture

The following diagram provides information on the integration architecture followed in FCUBS-OFSAA integration.

2.5 Integration Process

FLEXCUBE has pre-defined staging tables required for OFSAA extracts. During EOFI batch, the module wise data is extracted to staging tables in FCUBS. FCUBS provides a control table to indicate successful data extraction. OFSAA pulls the data from the tables in FCUBS using the DIH connector.

The transfer or extraction of data from FCUBS to OFSAA differs based on the staging tables as follows:

- Master table - Incremental data between two extraction dates are transferred.

- Maintenances and contract tables - Entire transaction data are transferred in each extraction.

- Transaction table - Data related to the transactions created on the extraction date are transferred.

During data extraction you can check the status of the extraction routines in the table ESTB_JOB_CONTROL. The column STATUS shows whether the routine is in progress (W) or has failed (F) or has completed successfully (S). At the time of extraction all the routines from maintenance table ‘ESTM_DEST_TABLES’ are inserted to ‘ESTB_JOB_CONTROL’ for the current extraction date with initial status as ‘W’. This status will be updated accordingly when the routine is completed successfully (S) or unsuccessfully (F).

Extraction Log

You can have the logs generated as part of EOD for each table. EOD log captures the complete extraction process. The table level extraction log contains the details of each data transfer.

Errors in the data extraction process and the failure reasons are logged in an error data store. These errors are rectified manually and the batch is run again for the failed data.

2.6 Assumptions

Unique Names for Loan Products and Loan Account Classes

Ensure that the loan products and loan account classes maintained in FCUBS have unique names. Name of any loan product should not be identical to the name of an account class.