5. Customer Interactions

Using Oracle FLEXCUBE, you can capture the interactions with the customers. This helps you to track and address the request of the customers. You can also capture the internal interactions (within the bank) triggered by the original interaction with the customer.

Consider the following examples.

Scenario 1

Mrs. Catherine calls up her Bank Helpdesk and informs that her Account has been debited twice for last evening’s ATM transaction. She complained that she has withdrawn 200 $ but her online account statement show 200 $ been debited twice.

Mr. Edward, the bank’s helpdesk representative Mr. Edward takes down her complaint and informs her that he will get back to her at the earliest. He logs an interaction by filling in the necessary details and assigns the interaction to Accounts department.

Mr. Jones from the Accounts department gets this in his dashboard and takes up the interaction and figures out the problem and takes steps to resolve the issue and credits back the 200$ to Mrs. Catherine’s account . Jones closes the interaction and gives the closure remarks “200$ debited extra accidentally, has been credited back to the Account. The bank is extremely sorry for the inconvenience caused and will take all steps to ensure that this does not happen again”.

Mrs. Catherine logs into her online account later and sees that her account balance has increased by 200$ and the closure remarks message in her inbox.

Scenario 2

Mr. John has a compliant regarding amount deducted from his current account. Assuming that it was an extra EMI deducted for a loan, he contacts Mr. Jonathan from Loans Department explaining his concern. Mr. Jonathan then opens an interaction for the customer. He finds out that the amount debited was not an EMI amount. So he assigns the interaction to Mr. Jones of the Accounting Department.

Mr. Jones concludes that the amount deducted was an annual maintenance fee. So he closes the interaction with a reply to the customer stating that the amount debited was an annual maintenance fee levied on the current account.

Mr. John receives this message on his inbox.

Scenario 3

Mr. Mark is interested in a new Term Deposit product for investment. He calls up the banks help desk number inquiring about the same. The bank’s helpdesk person opens a new interaction based on the details provided by Mr. Mark. The helpdesk person assigns the interaction to a TD role. This action will result in a query being raised to all the users mapped to that role.

Mr. Taylor from the Term Deposits department pickup up the interaction and assigns it to his subordinate Mr. Collin. Mr. Collin then responds to Mr. Mark with all the details of Term Deposit product.

Mr. Mark can view the message in his inbox.

This chapter contains the following sections:

5.1 Interactions in Oracle FLEXCUBE

The captured interactions are assigned to the corresponding users. The dashboard of respective bank user displays the interaction.

The details of the interaction during its life cycle are captured in such a way that it resembles an actual interaction. The details section will be in reverse chronological order with the most recent updates being shown in the top.

Consider the following example.

Step 1: Mrs. Catherine calls up her Bank and speaks to Mr. Edward from the Call Center “Helpdesk” of the bank informing that her Account has been debited twice for an ATM transaction that she carried out last evening. She complained that she has withdrawn 200 $ whereas her online account statement show 200 $ been debited twice.

Step 2: Mr. Edward takes down her complaint and informs her that he will get back to her at the earliest. He creates a new interaction. The below table is the snapshot.

Field Name |

Value |

Interaction Details |

$200 has been debited twice from 0008341002 HELPDSK Help Desk @12-FEB-2012 14:30 |

Step 3: Mr. Edward then assign the interaction to role mapped to accounts department (ACCDEPT_ROLE)

Field Name |

Value |

Interaction Details |

Assign to: HELPDESK Help Desk : ACCDEPT_ROLE Account Department HELPDSK Help Desk @14-FEB-2012 14:30 $200 has been debited twice from 0008341002. HELPDSK Help Desk @12-FEB-2012 14:30 |

Step 4: Mr. Jones from the Accounts department sees this in his dashboard and takes up the interaction and figures out the problem and takes steps to resolve the issue and credits back the 200$ to Mrs. Catherine’s account . Jones close the interaction and gives the closure remarks “200$ debited extra amount has been credited back to the Account. The bank is extremely sorry for the inconvenience caused and will take all steps to ensure that this does not happen again”.

Field Name |

Value |

Interaction Details |

Problem occurred due to faulty EOD batch (STBACC) maintenance. Corrected the batch. Interaction Status: W: C Assigned to: ACCDEPT_ROLE Account Department : JONES JONES@14-FEB-2012: 15:01 ---------------------------------------------------------------- Assigned to: HELPDESK Help Desk : ACCDEPT_ROLE Account Department HELPDSK@14-FEB-2012 14:30 ---------------------------------------------------------------- $200 has been debited twice from 0008341002. HELPDSK Help Desk @12-FEB-2012 14:30 |

Closure Remarks |

Y |

Display Closure Remarks to Customer |

$200 debited extra amount has been credited back to the Account. The bank is extremely sorry for the inconvenience caused and will take all steps to ensure that this does not happen again |

Step 5: Mrs. Catherine logs into her online account later and sees that her account balance has increased by 200$ and the closure remarks message in her inbox.

Example 2

Step 1: Mr. John has compliant regarding amount deducted from his current account. Assuming that it was an extra EMI deducted for a loan, he contacts Mr. Edward from Loans Department explaining his concern. Mr. Edward then opens an interaction assigned to his name and begins an analysis.

Field Name |

Value |

Interaction Details |

An amount of $23 has been debited from account 00073482. BLON01@07-FEB-2012:13:29 |

Step 2: Mr. Edward finds out that that the amount debited was not an EMI amount. So he transfers the interaction to Mr. Jones from the Accounting Department asking him to look into the matter.

Field Name |

Value |

Interaction Details |

The debited amount is not EMI amount. Mr. Jones, please look into this. Assigned to: EDWARD (user name/role of the user is displayed: JONES (user name/role of the user is displayed) Department: LOAN : ACC EDWARD@15/2/20 12:05 -------------------------------------------------------------- An amount of $23 has been debited from account 00073482. BLON01@07-FEB-2012:13:37 |

Step 3: Mr. Jones concludes that the amount deducted was an annual maintenance fee. So he closes the interaction with a reply to the customer stating that the amount debited was an annual maintenance fee levied on the current account.

Field Name |

Value |

Interaction Details |

Debited amount is an annual fee on current account. Interaction Status: W : C Status: WIP : Closed JONES@15/2/2012 7:35 -------------------------------------------------------- The debited amount is not EMI amount. Mr. Jones, please look into this. Assigned to: EDWARD (user name / role of the user is displayed) JONES user name / role of the user is displayed) Interaction Status: O: W Department: LOAN : ACC EDWARD@15/2/20 12:05 -------------------------------------------------------- An amount of $23 has been debited from account 00073482. EDWARD@07-FEB-2012:13:37 |

Closure Remarks |

Y |

Display Closure Remarks to Customer |

Please note that the debited amount is an annual maintenance fee levied on the current account. |

Step 4: Mr. John receives this message on his inbox.

Example 3

Step 1: Mr. Mark is interested in a new Term Deposit product for investment. He calls up the banks help desk number inquiring about the same. The bank’s helpdesk person opens a new interaction based on the details provided by Mr. Mark.

Field Name |

Value |

Interaction Details |

Provide details about product TD04 HELPDSK@07-FEB-2012:13:29 |

Step 2: Helpdesk person assigns the interaction to TD department (TDDEPT). The system auto assigns the interaction to TD role (TD_ROLE). This action will result in a query being raised to all the users mapped to that TD role.

Field Name |

Value |

Interaction Details |

Assigned to: HELPDESK Help Desk: TD_ROLE HELPDESK@11/2/2012:1:35 ------------------------------------------------------------------ Provide details about product TD04 HELPDSK@07-FEB-2012:13:29 |

Step 3: Mr. Taylor from the Term Deposits department pickup up the interaction an assigns it to his subordinate Mr. Collin.

Field Name |

New Value |

Interaction Details |

Mr. Collin, Please clarify the customer with the required details. Interaction Status: O : W Assigned to: TD_ROLE : COLLIN HELPDESK@11/2/2012:1:35 TAYLOR@11/2/2012 3:45 ------------------------------------------------------------------ Assigned to: HELPDESK Help Desk : TD_ROLE HELPDESK Help Desk @11/2/2012:1:35 ------------------------------------------------------------------ Provide details about product TD04 HELPDSK@07-FEB-2012:13:29 |

Step 4: Mr. Collin then responds to Mr. Mark with all the details of Term Deposit product.

Field Name |

Value |

Interaction Details |

Providing details. Interaction Status: W: R Assigned to: TD_ROLE : COLLIN COLLIN@15/2/2012 20:43 ------------------------------------------------------------------ Mr. Collin, Please clarify the customer with the required details. Interaction Status: O : W Assigned to: TD_ROLE : COLLIN TAYLOR@11/2/2012 3:45 ------------------------------------------------------------------ Assigned to: HELPDESK Help Desk : TD_ROLE HELPDESK@11/2/2012:1:35 ------------------------------------------------------------------- Provide details about product TD04 HELPDSK@07-FEB-2012:13:29 |

Closure Remarks |

Y |

Display Closure Remarks to Customer |

Product Name: TD04 Rate of Interest: 10% Redemption period: 5 years |

5.2 Create Interactions

This section contains the following topics:

- Section 5.2.1, "Creating Interactions"

- Section 5.2.2, "Uploading Documents"

- Section 5.2.3, "Viewing Interaction Summary"

- Section 5.2.4, "Viewing Interactions on User Dashboard"

5.2.1 Creating Interactions

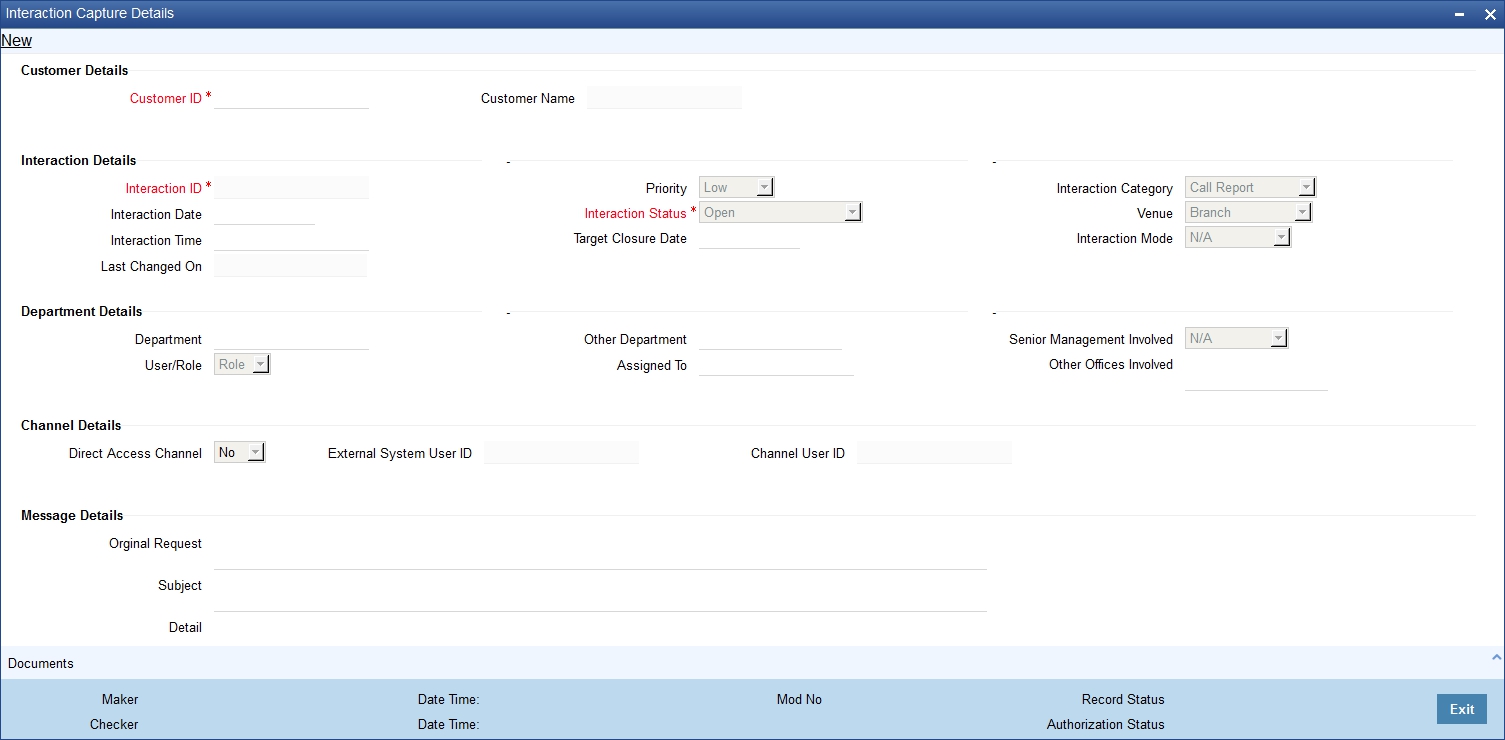

You can create an interaction using the ‘Interaction Input’ screen. To invoke this screen, type ‘ITDINTRN’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

In this screen, you need to specify the following information:

Interaction Details

Interaction ID

The system generates and displays the interaction ID. This is a unique identifier of the interaction.

Interaction Status

The system displays the interaction status as ‘Open’. However, you can modify the interaction status. The drop-down list displays the following statuses:

- Open - Select ‘Open’ when create a new interaction.

- WIP - Select WIP when you assign the interaction to a user.

- Close - Select Close when the interaction is closed.

- Pending with Customer - Select Pending with Customer if the interaction is pending with Customer.

- Re-Open - Select Re-Open to modify a closed interaction.

Customer ID

Specify the customer ID. The option list displays all valid customer IDs maintained in the system. You can select the appropriate one.

Customer Name

Based on the customer ID selected, the system displays the name of the customer.

Department

Specify the corresponding Department. You can also click on the adjoining option list and select the corresponding Department.

Other Department

Specify other departments, if any.

User/Role

Select the category to which the interaction is being assigned to from the following options:

- User

- Role

Assigned To

Specify the bank user or role, to which the interaction needs to be assigned by clicking on the adjoining option list.

Interaction Category

Select the category of the corresponding interaction from the following list:

- Call Report

- Courtesy Meeting

- Customer Interaction

- Service Request

- Complaints

- Lead

Venue

Select the venue of the corresponding interaction from the following list:

- Branch

- Face to Face

- Client Office

- Client Residence

- Public Place

Interaction Date

Specify the date when the interaction started. The system defaults the interaction date in accordance with the system date and branch offset. Interaction Date cannot be future dated.

Interaction Time

Specify the time when the interaction started. The system defaults the interaction time in 24 hours format.

Senior Management Involved

Select the corresponding senior management involved from the following options:

- COO

- Region Head

- Senior RM

- CEO

Other Offices Involved

Specify other offices involved, if any.

Last Changed On

Last Changed On is a read-only field displaying the date and time of the last modification.

Priority

The system defaults the priority as Low. Select the priority of the corresponding interaction from the following list:

- Low

- Medium

- High

Target Closure Date

Specify the tentative interaction closure date that was communicated to the customer.

Interaction Mode

Select the mode of interaction from the following options:

- Meeting

- Telephone

- Other

- Face to Face

Subject

Specify a subject for the corresponding interaction.

Detail

Specify the additional details if the corresponding interaction, if any.

Original Request

Specify the initial interaction message.

Documents Presented

Specify the details of the documents presented.

Display Closure Remarks for Customer

Select the option to specify whether to display closure remarks for customer or not. The system defaults the Closure Remarks for Customer as ‘Yes’.

Closure Remarks

Specify the closure remarks

Note

Closure Remarks is mandatory if ‘Display Closure Remarks to Customer’ is opted; and Interaction Status belongs to the following options:

- Open

- WIP

- Pending with Customer

- Close

Direct Access Channel

The system displays the Direct Access Channel as checked if interaction is initiated from FCDB-Direct access channels

External System User ID

The system displays the system user ID of FCDB.

Channel User ID

The system displays the channel used by FCDB for the interaction.

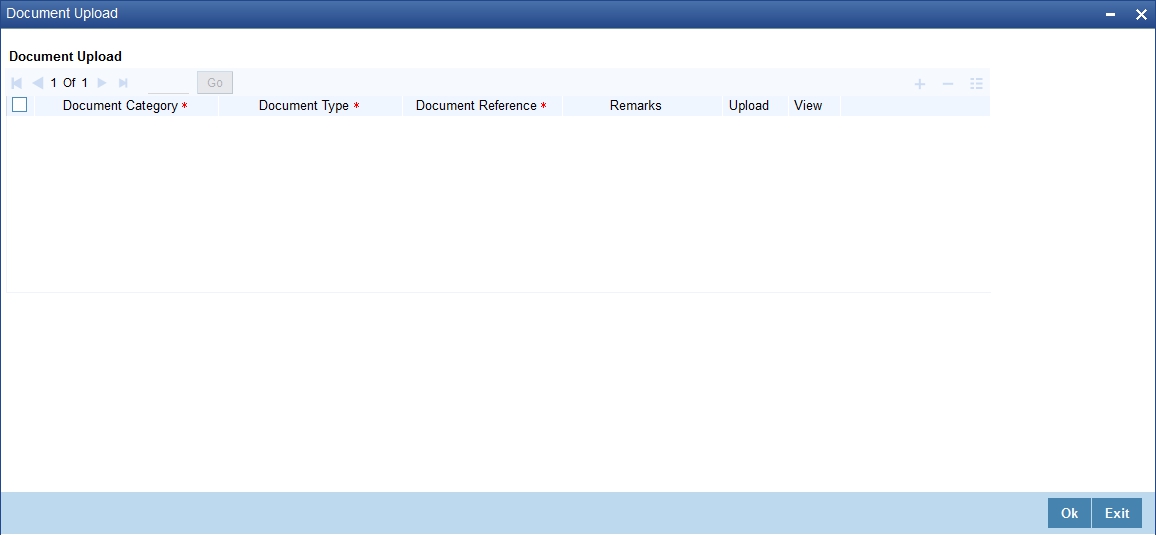

5.2.2 Uploading Documents

You can upload documents during interaction using 'Document Upload' screen. These documents are retrievable to the bank users or customers involved in the interaction. To invoke this screen, click 'Documents' button in 'Interaction Input' screen.

You can specify the following details here:

Document Category

Select the appropriate Document Category from the adjoining option list.

Document Type

Select the appropriate Document Type from the adjoining option list.

Document Reference

System displays the document reference number when you upload the document in the server.

Remarks

Provide the additional remarks related to the document to be uploaded.

Upload

Click 'Upload' button to upload the document.

You can browse through the document path and click 'Submit' to generate the document reference number.

View

Click 'View' button to retrieve and view the uploaded document.

System stores the uploaded documents in the server as a binary image in the Web Content Management Repository. The bank users and customers will be able to retrieve these documents and documents related information during interaction enquiries.

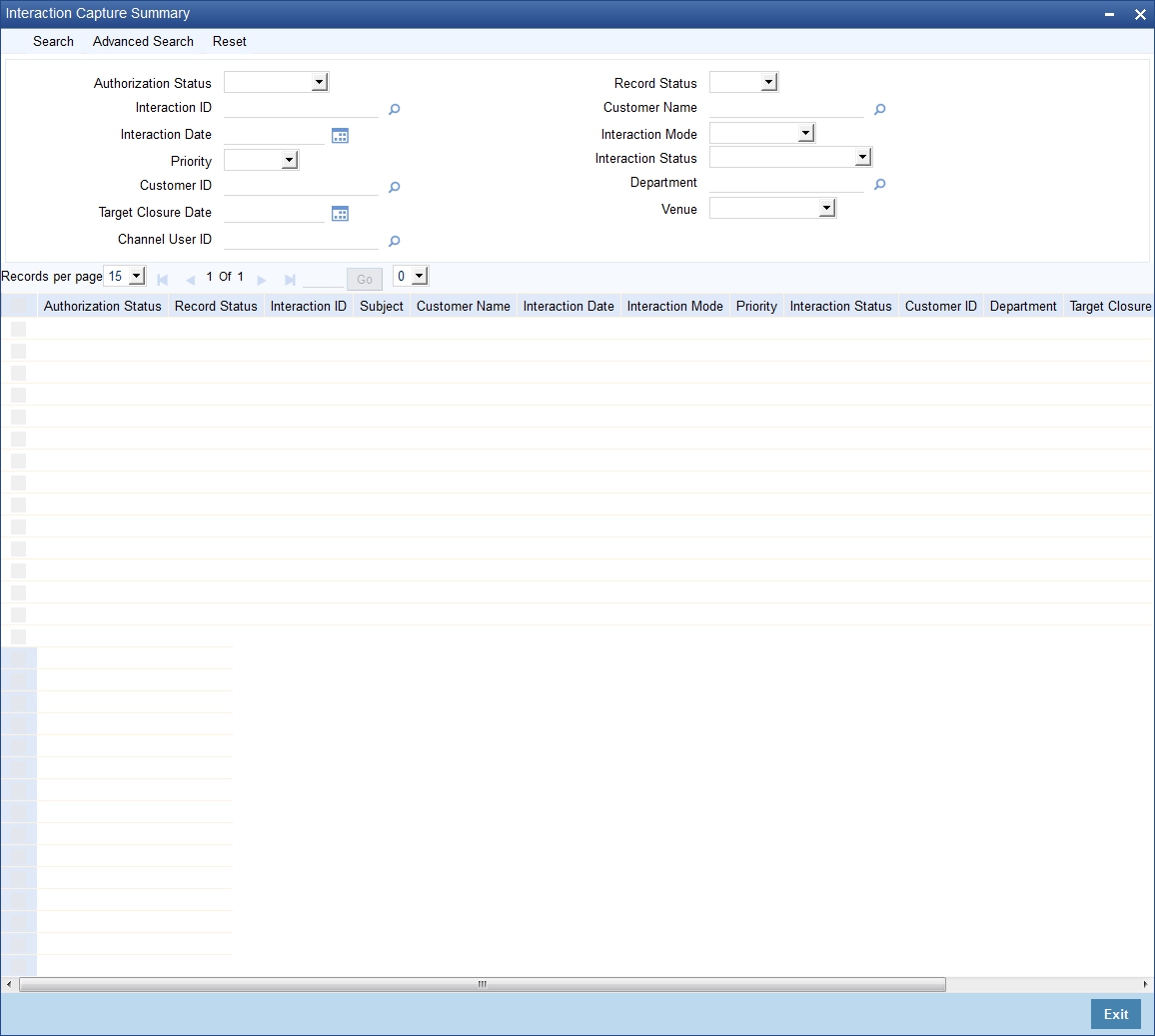

5.2.3 Viewing Interaction Summary

You can view the summary of all interaction created in Oracle FLEXCUBE using the ‘Interactions Summary’ screen. To invoke this screen, type ‘ITSINTRN’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can search for the interactions based on one or more of the following parameters:

- Authorization Status

- Record Status

- Interaction ID

- Customer Name

- Interaction Date

- Interaction Mode

- Priority

- Interaction Status

- Customer ID

- Department

- Target Closure Date

- Venue

- Channel User ID

Once you have set the search parameters, click the ‘Search’ button. The summary screen displays the following information:

- Interaction ID

- Subject

- Customer Name

- Interaction Date

- Interaction Mode

- Priority

- Interaction Status

- Customer ID

- Department

- Target Closure Date

- Venue

- Channel User ID

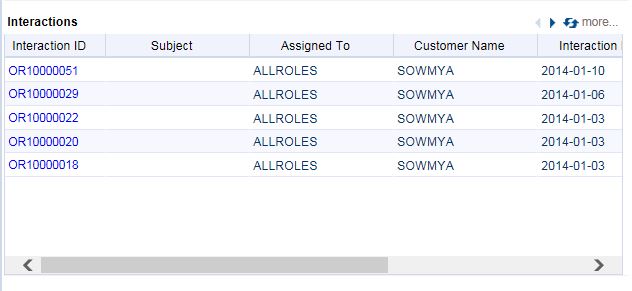

5.2.4 Viewing Interactions on User Dashboard

You can view the interaction details through ‘Dashboard Maintenance, screen. You can invoke this screen by clicking on the ‘Interactions’ tab available on the main screen.

The interaction dashboard is mapped to the role ‘IT-CONV-VW’.

The dashboard displays the following information pertaining to the first five interactions:

- Interaction ID

- Subject

- Assigned to

You can use the arrow buttons on the top right corner of the dashboard to view the next/previous set of interactions.

The system displays the interaction details in the following sequence starting with the oldest interaction:

- Assigned to me and Open

- Assigned to my role and Open

- Assigned to me and in WIP status

- Assigned to my role and in WIP status

- Assigned to me and in Pending with customer status

- Assigned to my role and in Pending with customer status