3. Maintaining Information Specific to Payments and Collections

Before you begin operations in the Payments and Collections (PC) module of Oracle FLEXCUBE, you must maintain certain basic information in the system. For example, you must maintain the:

- Local Bank Directory

- Clearing Networks

- Upload Sources

- Bank Redirection details

This data is essential for processing the payments and collections transactions during the course of the day.

Data of this sort is referred to as ‘Static Data’ because it remains constant over a period of time.

This chapter contains the following sections:

- Section 3.1, "Static Data Maintenance"

- Section 3.2, "Information Maintenance Specific to PC Module"

- Section 3.3, "Bank Code Types"

- Section 3.4, "Bank Directory"

- Section 3.5, "Clearing Network Details"

- Section 3.6, "Redirection Details Maintenance for Bank"

- Section 3.7, "Clearing Network Qualifier Details"

- Section 3.8, "Network Calendar"

- Section 3.9, "Purpose Code"

- Section 3.10, "Window Period Information"

- Section 3.11, "Redirection Details Maintenance for Account"

- Section 3.12, "Beneficiary Accounts for Counterparty Bank"

- Section 3.13, "P2P Beneficiary Details"

- Section 3.14, "P2P Payments Parameters"

- Section 3.15, "P2P Payments Beneficiary Registration Queue"

- Section 3.16, "Upload Sources"

- Section 3.17, "Parameter Specification for a Source"

- Section 3.18, "Customer Agreements"

- Section 3.19, "Creditors Maintenance"

- Section 3.20, "DD Agreement Details Maintenance for Creditors"

- Section 3.21, "DD Agreement Details Maintenance for Debtors"

- Section 3.22, "Debtor Direct Debit Instructions Maintenance"

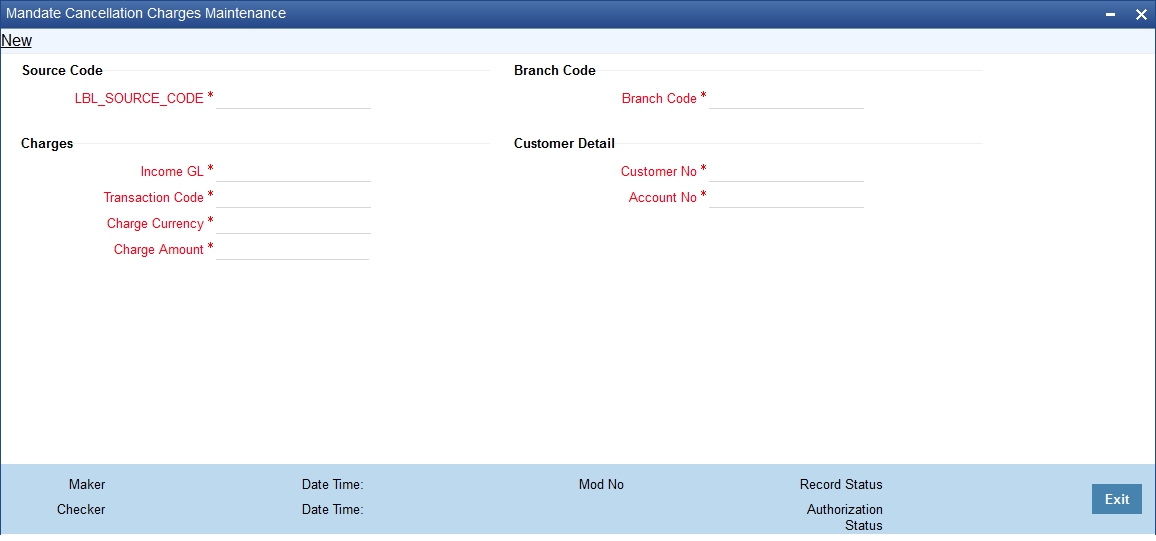

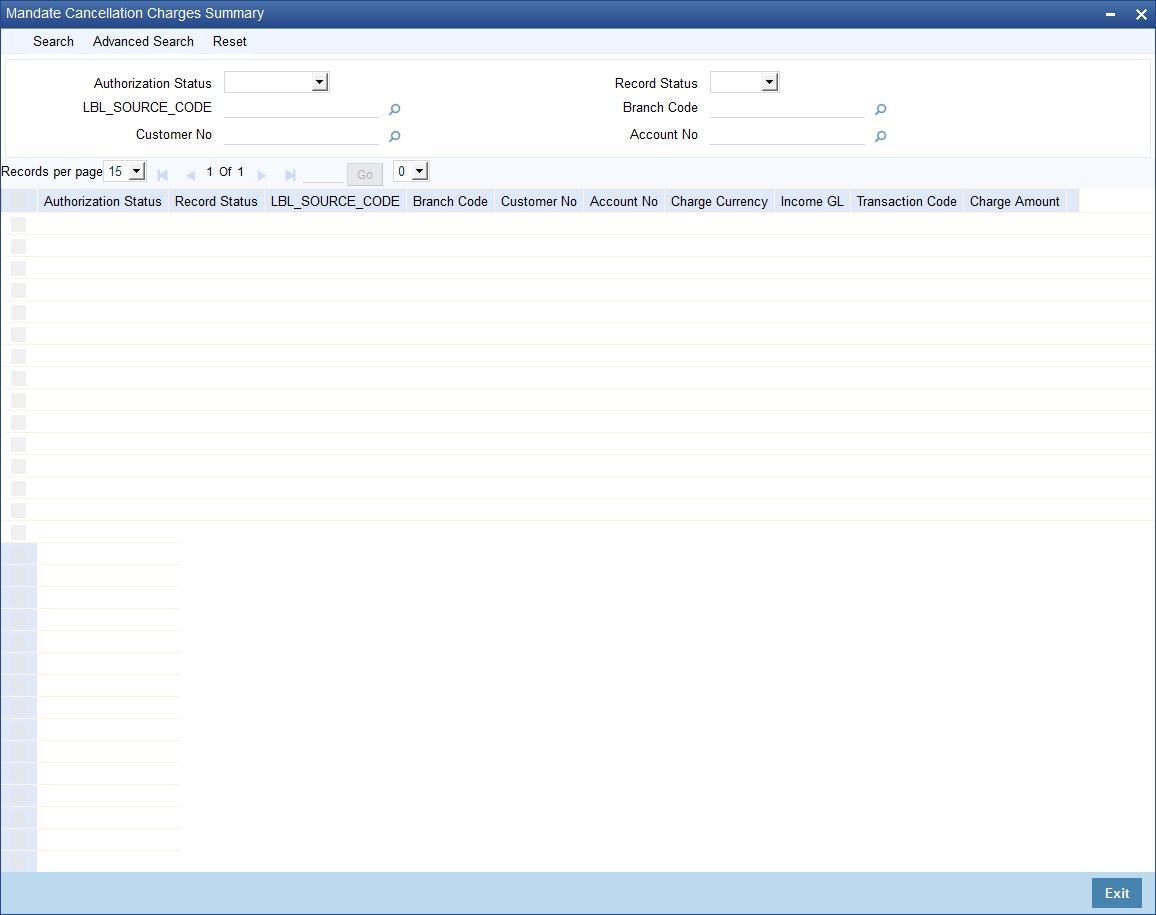

- Section 3.23, "Mandate Cancellation Charge Details"

- Section 3.24, "Customer Stations"

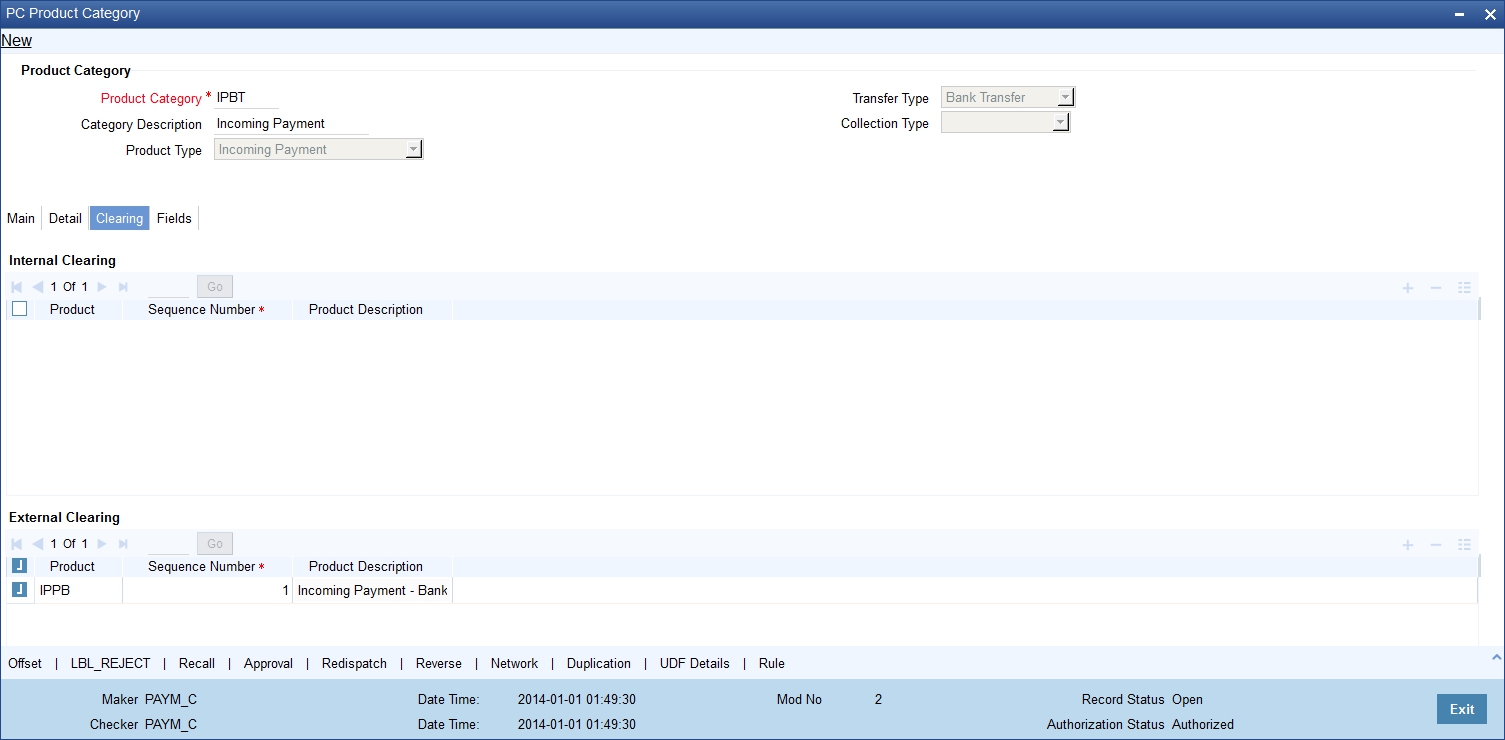

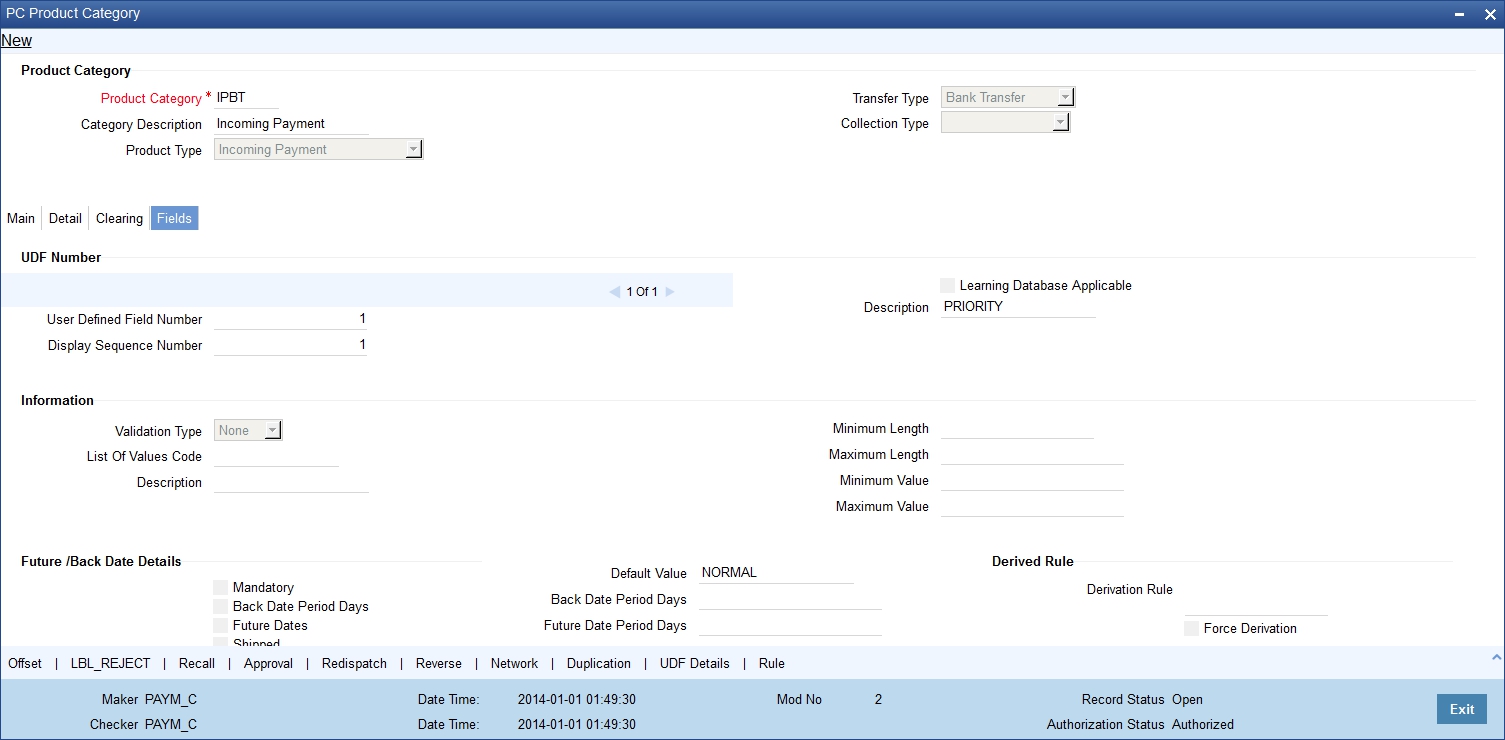

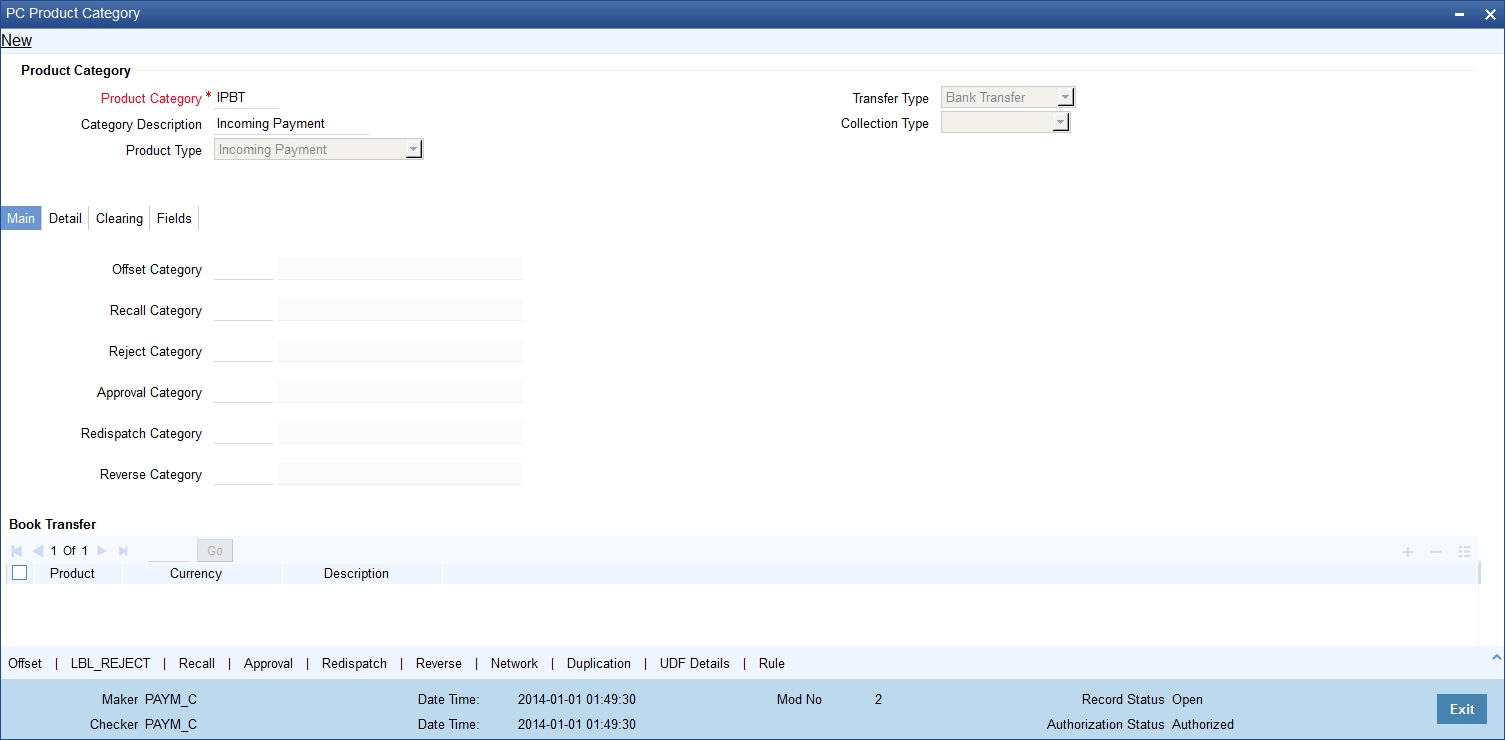

- Section 3.25, "Product Categories Maintenance"

- Section 3.26, "Learning Database Creation"

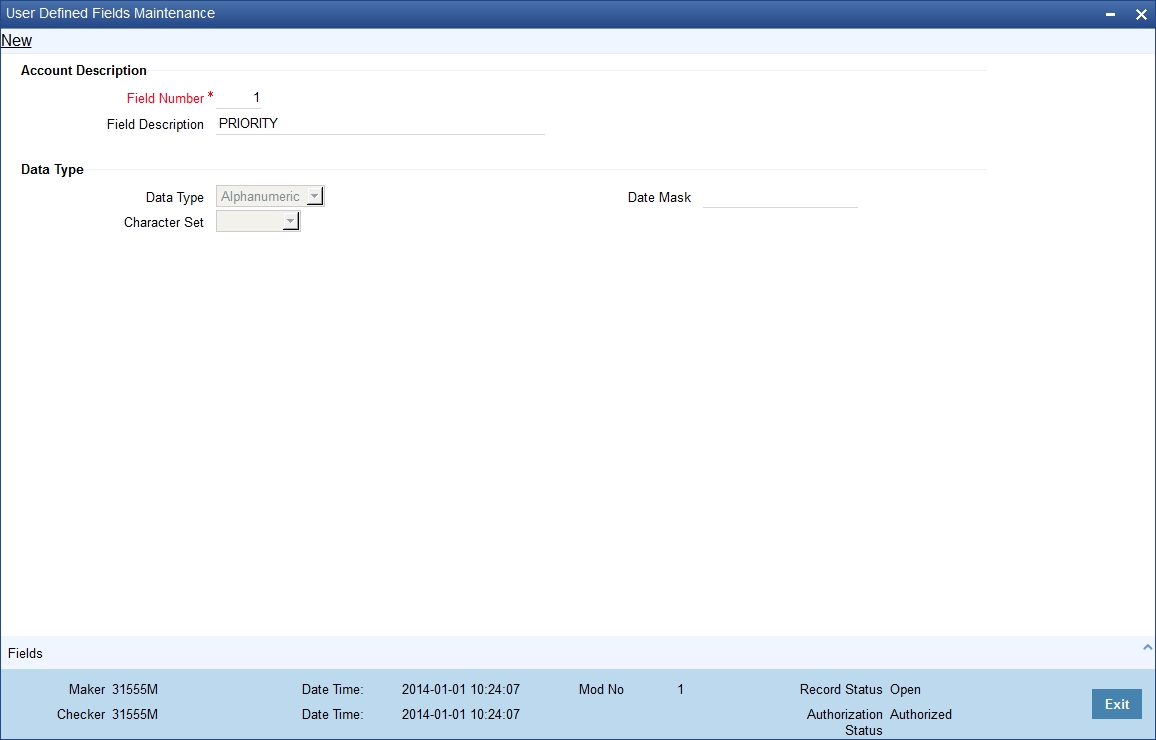

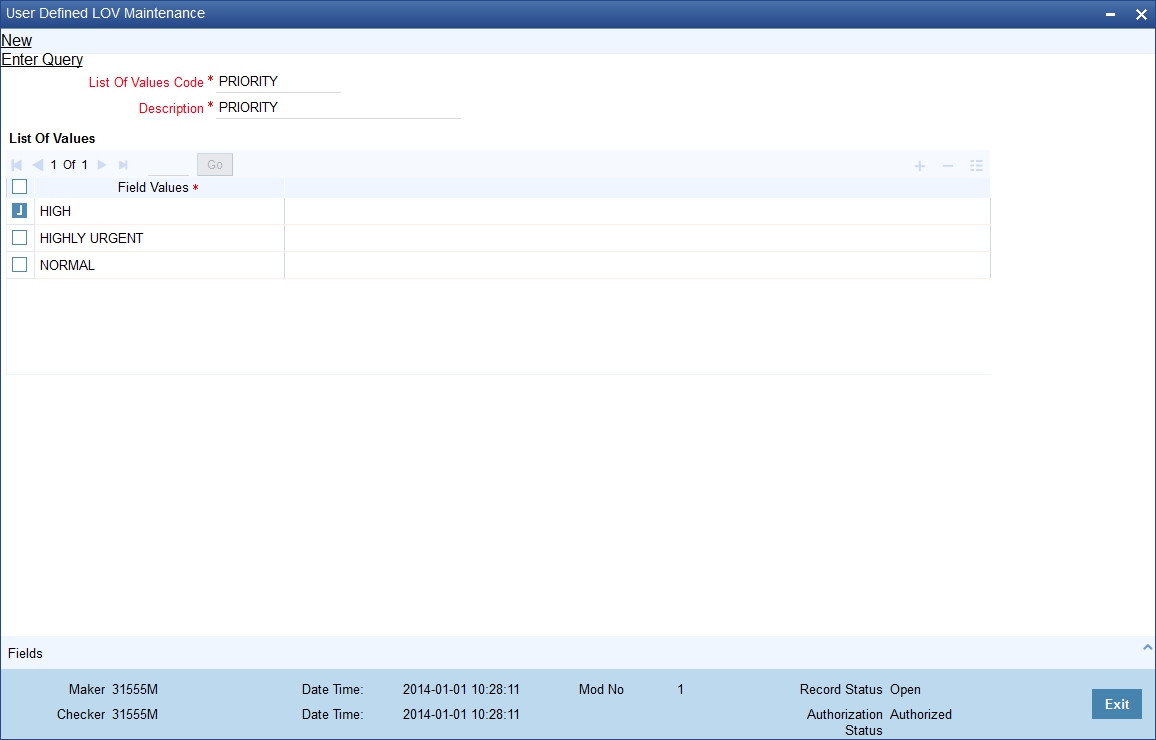

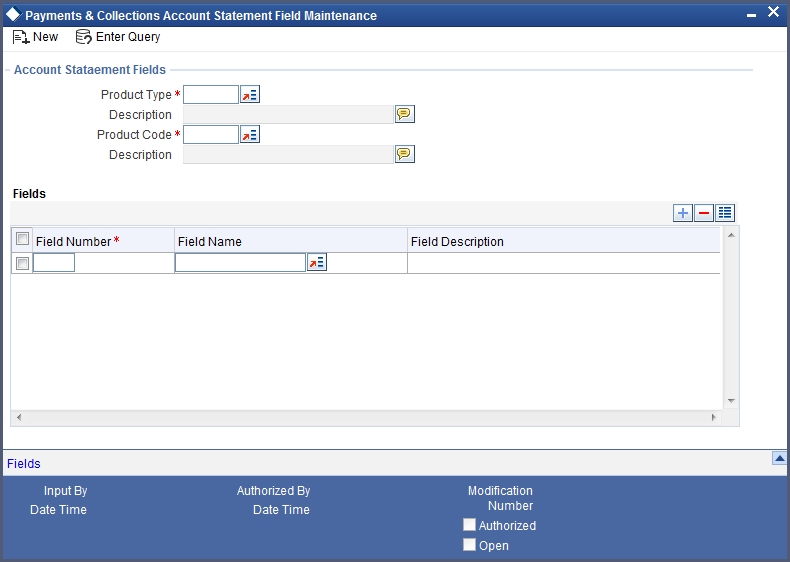

- Section 3.27, "User Defined Fields for Account Statements"

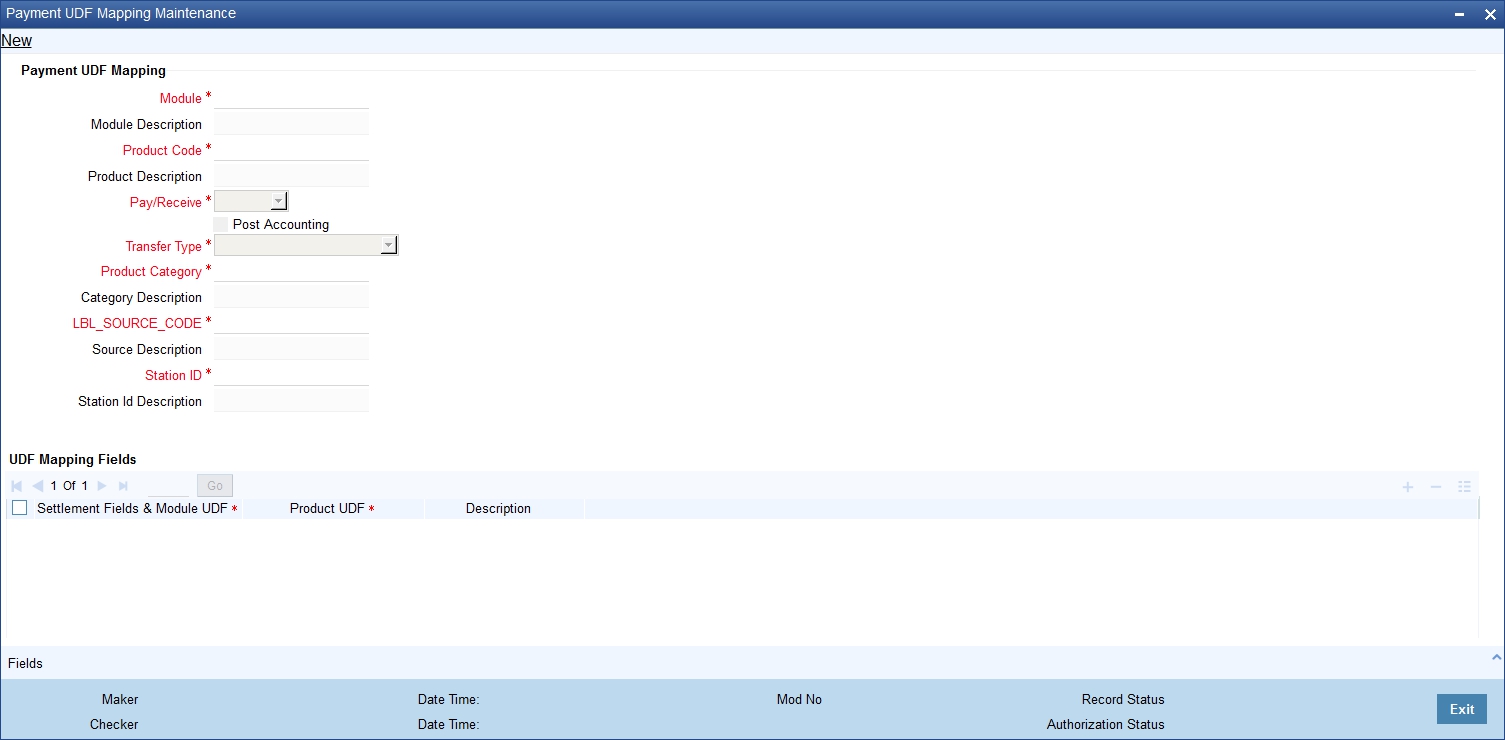

- Section 3.28, "UDF Details"

- Section 3.29, "Fields to be Included in Account Statements"

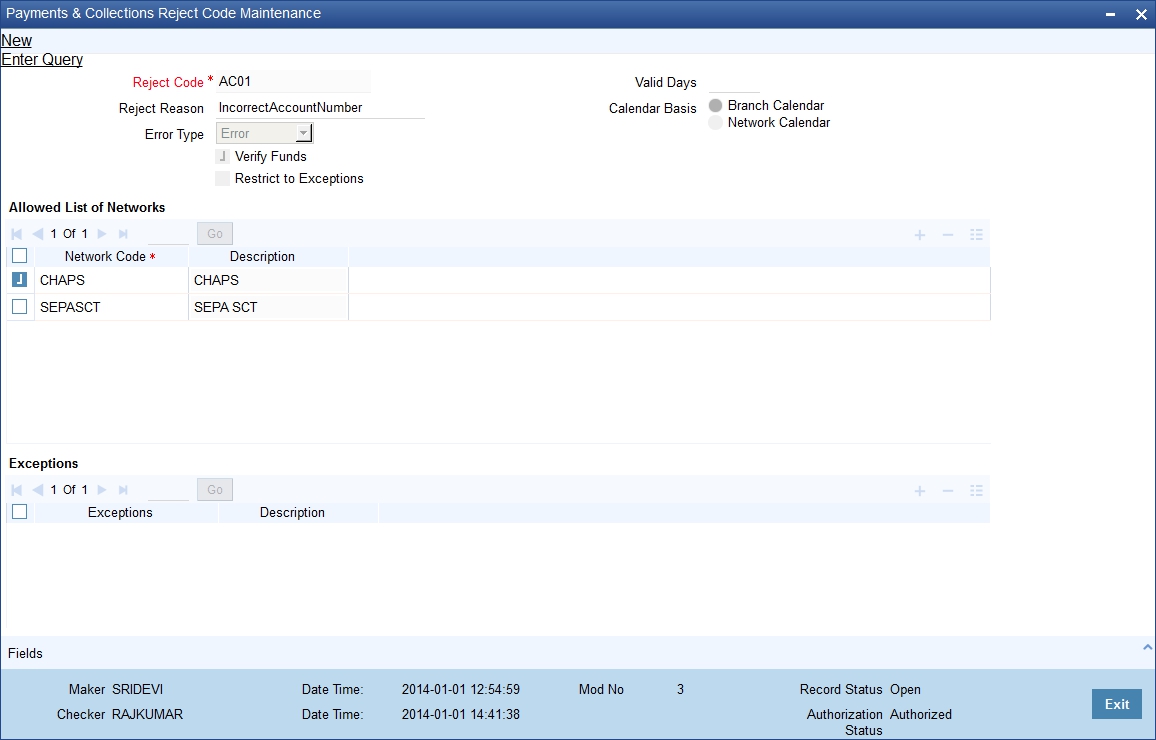

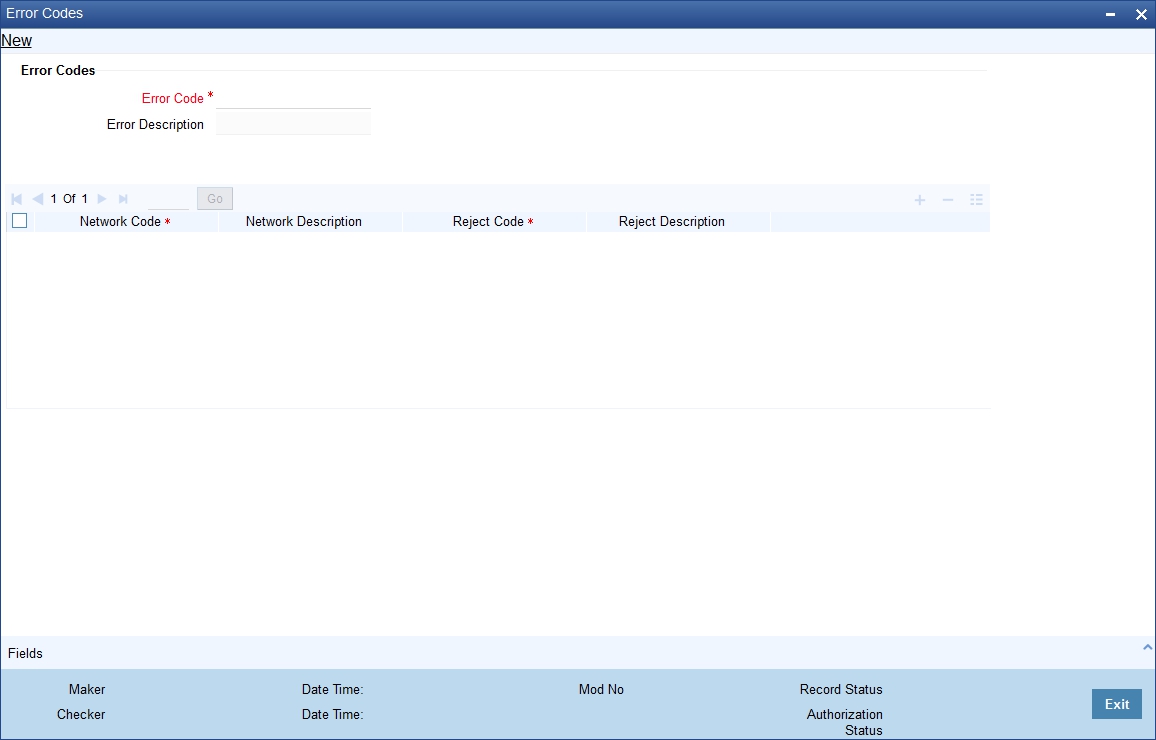

- Section 3.30, "Reject Code Maintenance"

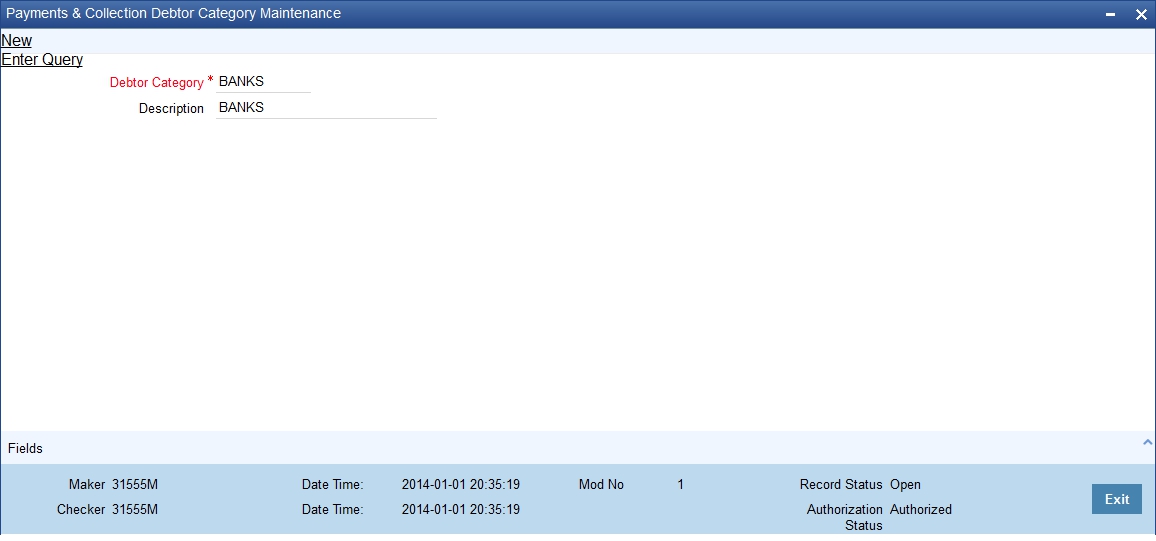

- Section 3.31, "Debtor Customer Categories"

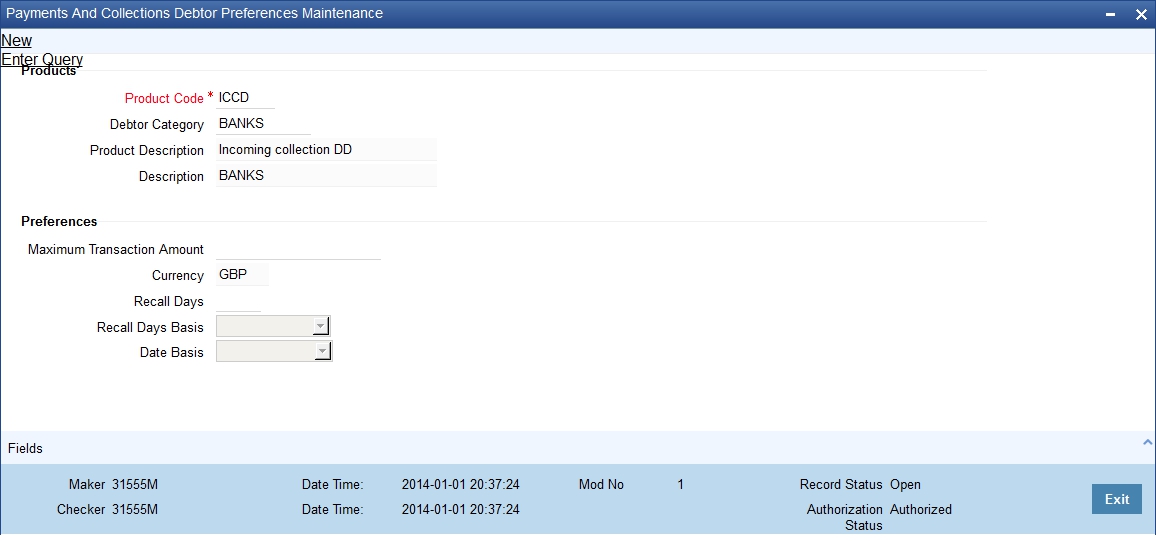

- Section 3.32, "Preferences Definition for a Combination of a Product and a Debtor Category"

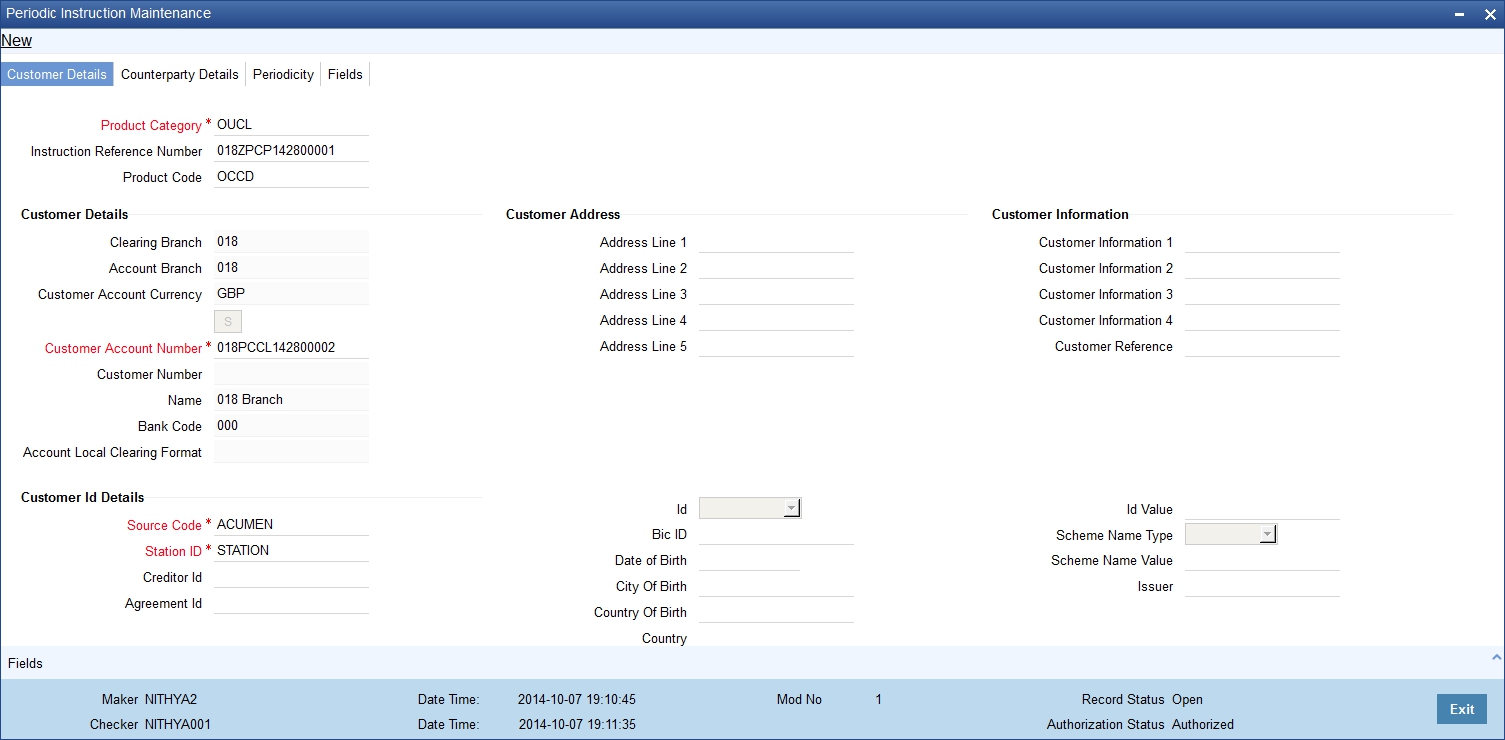

- Section 3.33, "Periodic Instructions Maintenance"

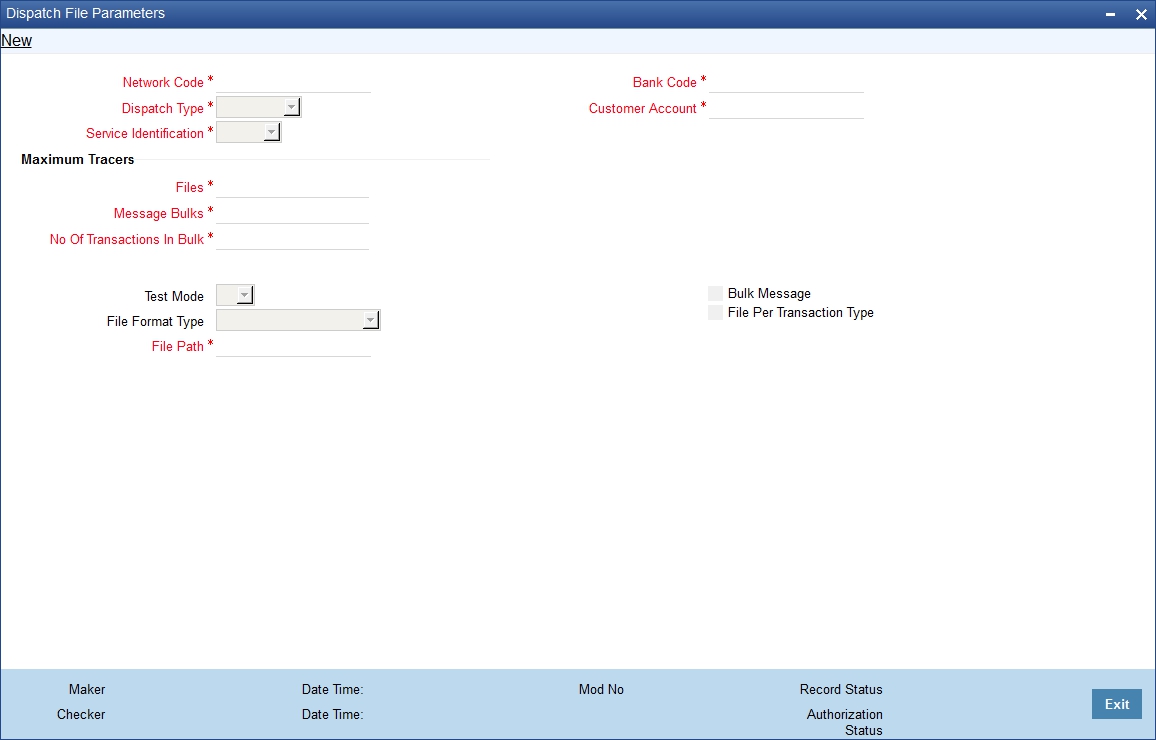

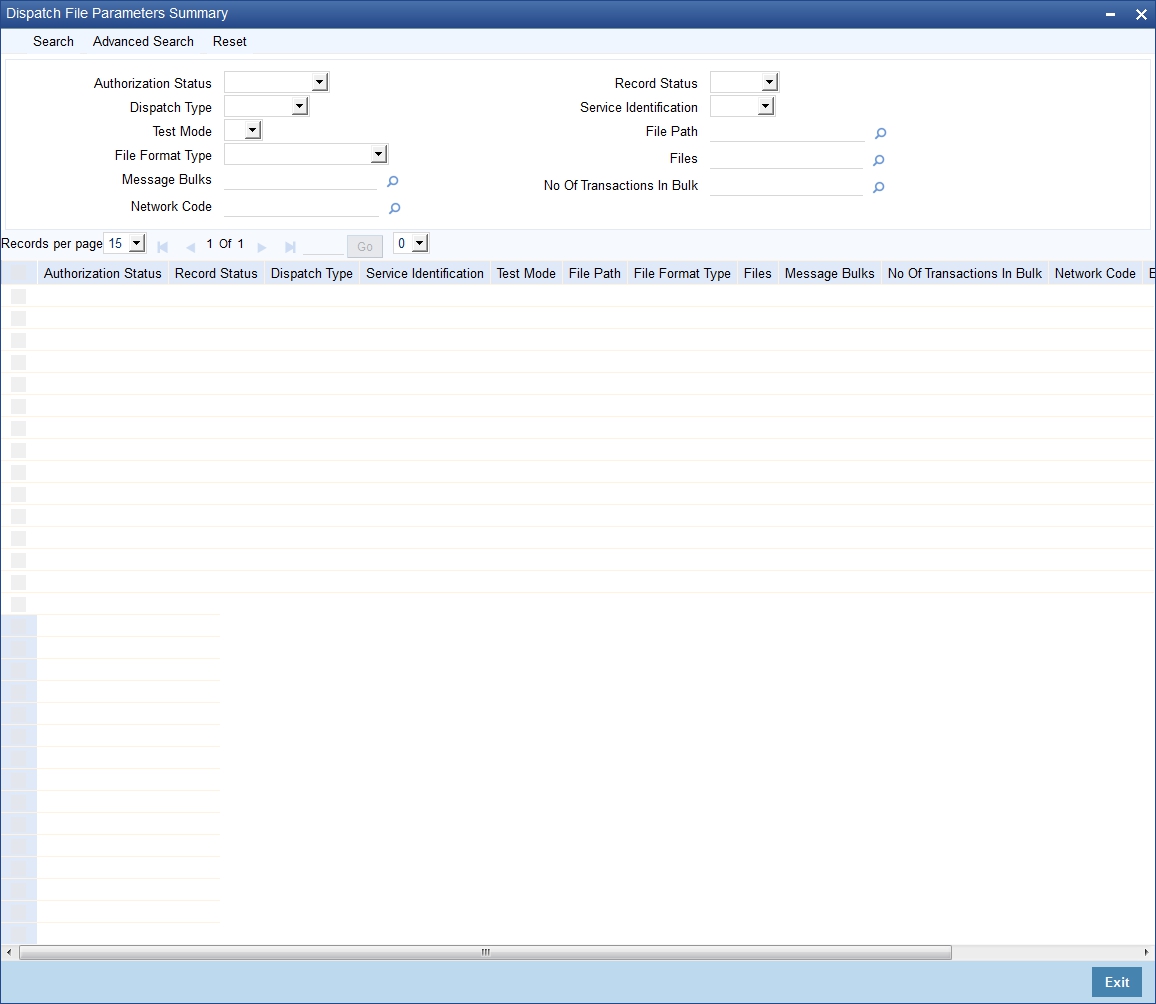

- Section 3.34, "Dispatch File Maintenance"

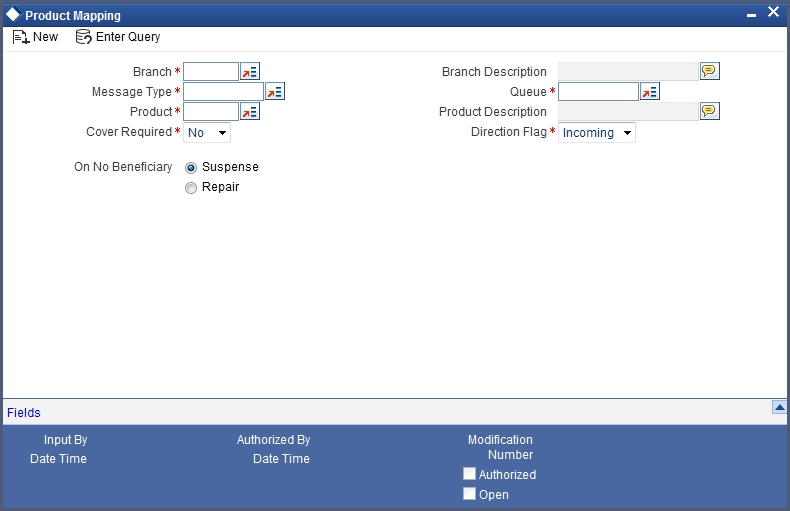

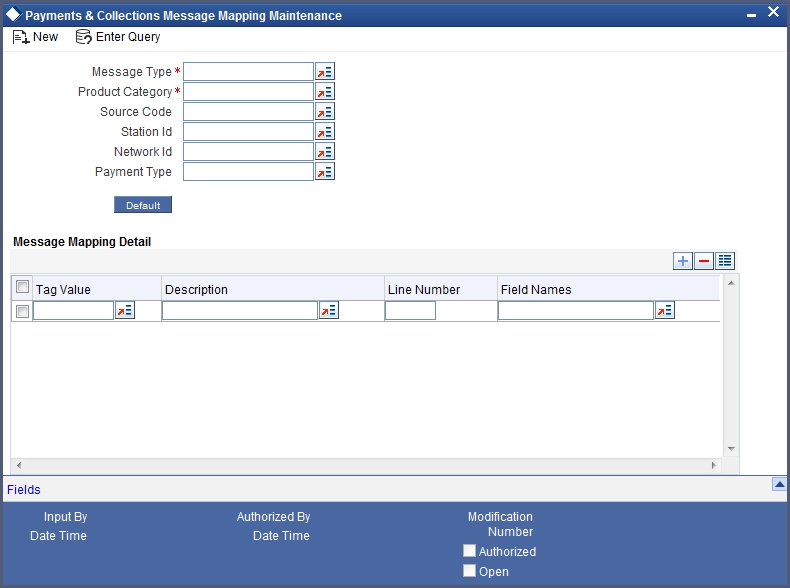

- Section 3.35, "Incoming Payments"

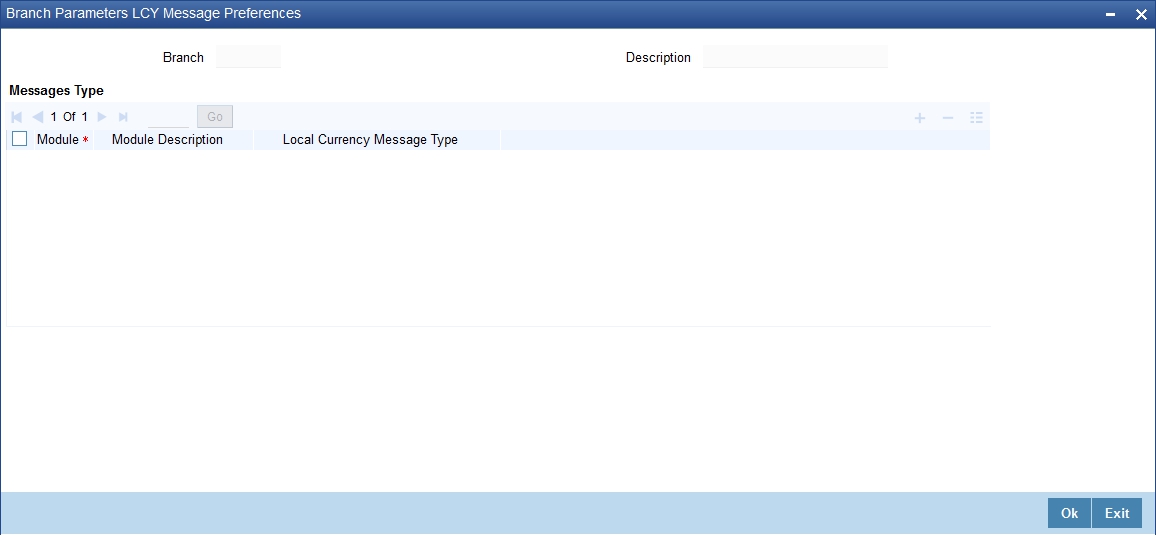

- Section 3.36, "Outgoing Payments for Local Currency Transactions in Other Modules"

- Section 3.37, "Payments Module Settlement Details to other Modules"

- Section 3.38, "Local Clearing and Cover Details for Customer Settlement Instructions"

- Section 3.39, "Local Clearing and Cover Details for Settlement Messages"

- Section 3.40, "Generation of the Local Payments Contract for Local Currency Transactions"

- Section 3.41, "Correspondent Bank Maintenance"

- Section 3.42, "Creditor Direct Debit Agreement History"

- Section 3.43, "Debtor Direct Debit Agreement History"

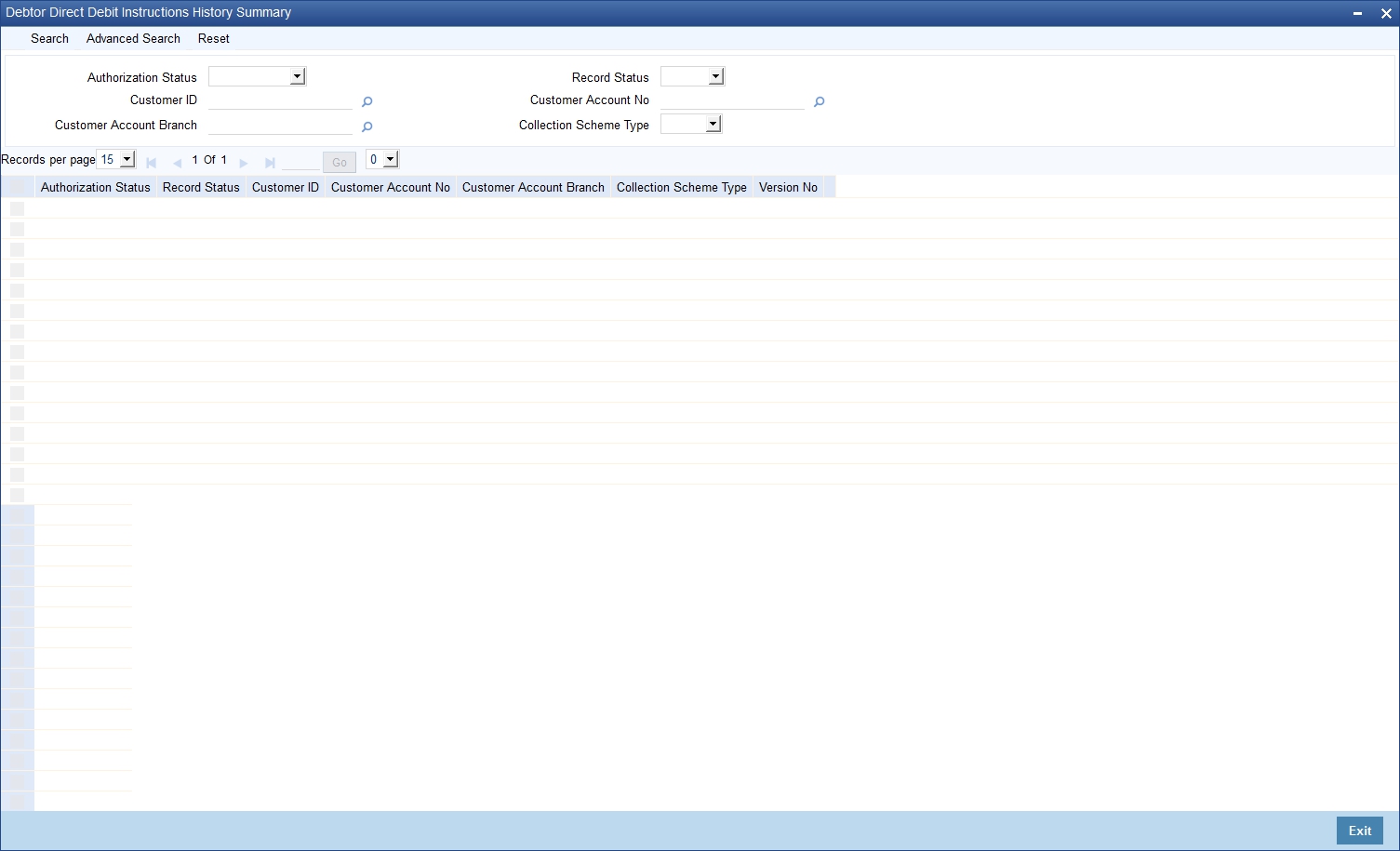

- Section 3.44, "Debtor Direct Debit Instructions History"

3.1 Static Data Maintenance

The static data maintained in Oracle FLEXCUBE can either be common to several modules or be specific to a module. For example, data relating to exchange rates is common to modules such as Foreign Exchange, Funds Transfer, Payments, etc. Static Data that is commonly accessed by several modules is maintained in the Core Services module.

Data that is specific to a module is maintained in the module itself. For example, the details relating to the clearing networks that you support are specific to the Payments and Collections module. It is, therefore, maintained in the PC module.

3.2 Information Maintenance Specific to PC Module

Before you proceed with operations in the Payments and Collections module, you must maintain the following information:

- Local Bank Directory

- Clearing Networks

- Bank Redirection details

- Account Redirection details

- Upload Sources

- Upload Source Parameters

- Products

- Client Agreements (after product maintenance)

- Customer Station details

- Details of Creditors

- Product Category (after product maintenance)

- Account Statement Fields

- User Defined Fields (UDF) and User Defined LOVs

- Reject Codes

- Debtor Customer Categories

- Charge Product Categories

- Charge Account Mappings

- Cover requirement

You can maintain this information in screens that are invoked from the Application Browser. The subsequent sections of this chapter talk about each of the above mentioned maintenances in detail.

3.3 Bank Code Types

This section contains the following topics:

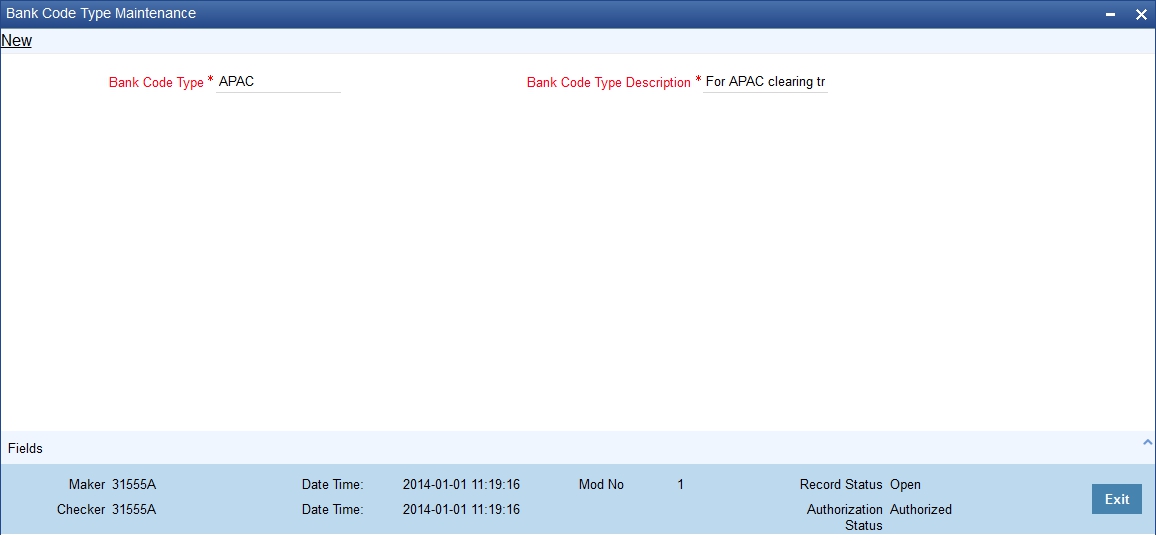

3.3.1 Maintaining the Bank Code Type

You can maintain the different types of bank codes that you intend to maintain for banks in the System, through the ‘Bank Code Type Maintenance’ screen. This maintenance is required to distinguish between the types of bank codes.

You can invoke the ‘Bank Code Type’ screen by typing ‘PCDNKTYP’ in the field at the top right corner of the Application tool bar and click the adjoining arrow button.

In this screen, you can specify the following details:

Bank Code Type

Specify the type of identifying code that will be maintained for a bank in the system – for instance, SWIFT, BIC, BLZ, IFSC and so on. This code is used to identify the type of Bank code maintained in bank directory.

IFSC code is a unique code used to identify the banks in NEFT/RTGS network.

Description

Specify an appropriate description of the type of bank code specified in the Bank Code Type field.

3.4 Bank Directory

This section contains the following topics:

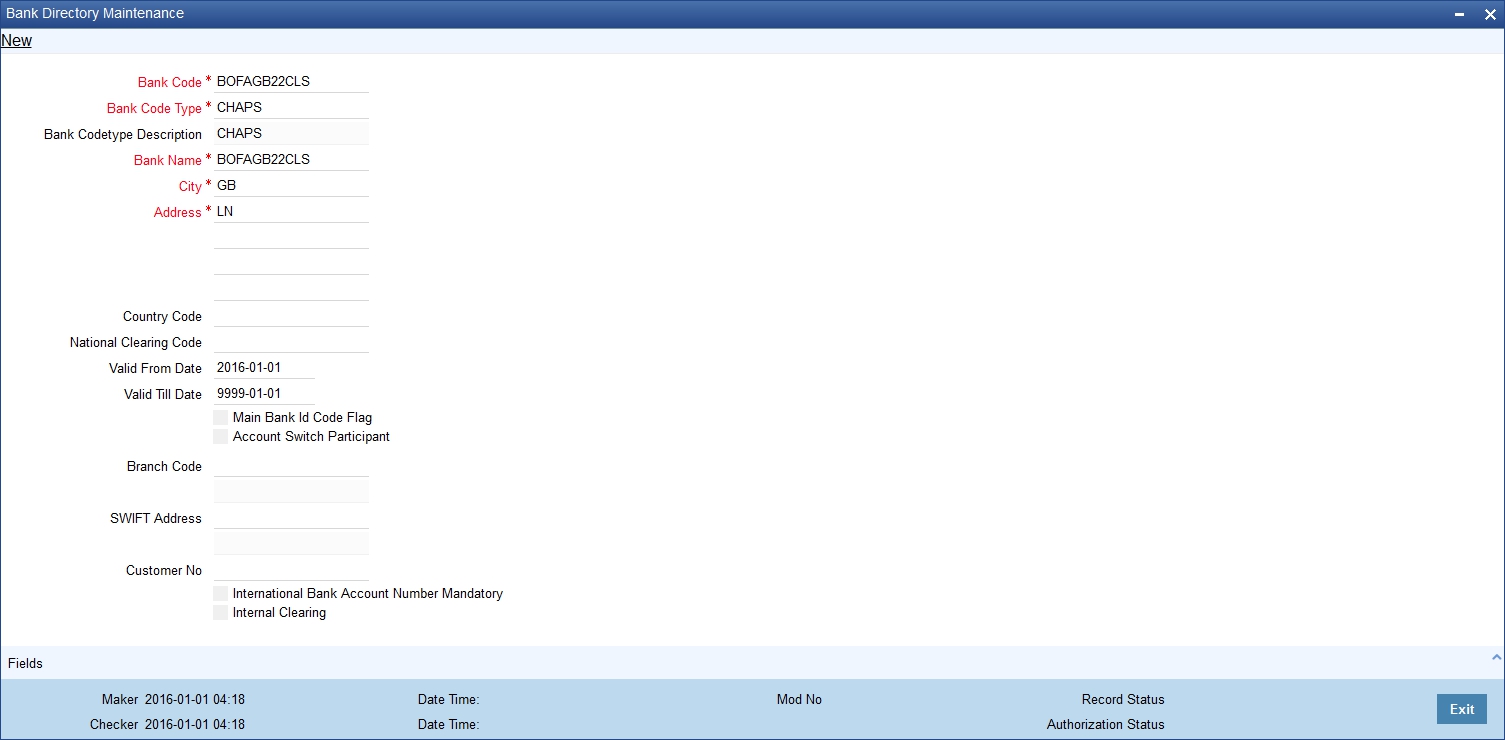

3.4.1 Maintaining the Bank Directory

You can maintain a list of ‘Clearing Banks’ participating in payments and collections transactions in the ‘Bank Directory Maintenance’ screen. You can invoke this screen by typing ‘PCDBNKMT’ in the field at the top right corner of the Application tool bar and click the adjoining arrow button.

In this screen, you can to maintain the following details:

Bank Code

Every bank with which you have a relationship for processing local payments, direct debits and requests for debit should be identified by a unique code. The clearing bank will be referred by this code throughout the system.

Bank Code Type

You can select the type of identification code being specified for the bank in the directory. For instance, it could be SWIFT, BIC, BLZ, IFSC and so on. The drop down list contains the bank code types maintained in the system, and you can choose the appropriate code type.

Bank Name

Specify the name of the bank maintained in the directory.

City

Specify the name of the city of the bank in the bank directory.

Address

In addition to the bank code, you can also capture the name of the bank and the address for correspondence.

Country

Specify the country of the bank in bank directory. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one.

Note

The country information is captured to enable Mantas to analyse the transactions for possible money laundering activities.

For more details on Mantas, refer 'Mantas' interface document.

National Clearing Code

Enter the national clearing code to be used in case the system is not able to resolve the TARGET-2 participant based on the bank code.

TARGET–2 is a high value Euro Payment clearing system.

For more information on TARGET-2, refer Maintaining Clearing Network details section.

Valid From Date

Specify the date from which the clearing code is valid.

Valid Till Date

Specify the date up to which the clearing code is valid.

Main Bank Identification Code Flag

Main BIC Flag is used to resolve 8 characters BIC. Check this option to indicate that the main BIC must be used if the bank code is incomplete.

Account Switch Participant

Check this box to indicate that the bank has registered for account switch service.

Branch Code

If the clearing bank being defined is a Oracle FLEXCUBE branch, you can select the appropriate branch code from the option-list available. Every branch in Oracle FLEXCUBE is identified by a unique branch code. A transaction routed through an internal branch will be processed as an Internal Book transfer.

SWIFT Address

If the clearing bank is part of the SWIFT network, you can select the corresponding SWIFT address from the available option-list.

Customer

You can indicate the customer CIF linked to the clearing bank code, for which the bank directory details are being maintained. For incoming messages in which the clearing bank code (for which the CIF has been maintained) is the counterparty bank code, the CIF maintained here is used, along with the product category of the incoming queue to which the message has been routed, to determine the settlement account.

International Bank Account Mandatory

You can indicate whether outgoing payments booked for the bank with clearing networks for which IBAN validations are made, would be subject to IBAN validation for the counterparty account number.

Cover would be generated along with the payment Message as long as Payment message is linked as an advice to the PC Product [DCLG Event].

The cover message is sent to Direct Participant and Payment message to the addressable Indirect Participant.

Internal Clearing

You need to determine whether the Clearing Bank being defined is an internal entity or an external entity. (A transaction is recognized as an ‘internal’ type when it involves accounts maintained in Oracle FLEXCUBE and another maintained in any other system at your bank. In other words, the accounts belong to the same bank but are maintained in two different systems, Oracle FLEXCUBE being one of them. A transaction is recognized as an ‘external’ type when it involves accounts maintained in Oracle FLEXCUBE and an external entity.

When processing transactions, the system looks up this directory and identifies a clearing bank as ‘internal’ if you have associated it with a valid branch code maintained in Oracle FLEXCUBE and opted for the ‘Internal Clearing’ option. If the clearing bank of the transaction is not specified for Internal Clearing, the system recognizes the clearing bank as an external entity.

Clearing Participation

Clearing Network

Typically, you would specify the clearing network for clearing banks that are defined for external clearing. To recall, external clearing involves accounts maintained in Oracle FLEXCUBE and an external entity. The clearing network will be used to send local payments, direct debits and requests for debit instructions from the bank.

Direct/Indirect

For each clearing network, you can specify the nature of the clearing relationship (whether direct or indirect). If the relationship with the entity is indirect, you have to indicate the name of the redirecting bank also.

Mention the account number that your bank maintains with the clearing network.

Cover

For each RTGS and Network combination, you can choose to generate both cover message and payment message for the direct participant of the counterparty. Check the Cover Message option against the clearing network if the cover message has to be generated along with the payment message. The system generates the cover message only if you have linked an advice format in the Dispatch event of Payment Product and also opted for cover message generation for the specified contract.

Direct Bank Code

For processing incoming payment messages, you can setup the following details in the ‘PC Bank Directory’ screen for the clearing network:

- For direct participants, the ‘Direct’ option can be chosen in the Direct / Indirect field

- For Addressable Indirect Participants, the ‘Indirect’ option can be specified, with Cover enabled and the Direct Bank Code (the option list in the Direct Bank Code field contains those bank codes for which the ‘Direct’ option has been specified for the Clearing Network)

- For Non - Addressable Indirect Participants, the ‘Indirect’ option can be specified, without Cover and the Direct Bank Code.

Addressee

This will default to the Bank Code in case the Bank Code is a Direct Participant in the Network.

If the Bank Code is a Non-addressable indirect participant, then this will default to the Direct Participant Bank Code.

If the Bank Code is an addressable Indirect Participant, then this will default to the Bank Code.

You can also change the defaulted value if required.

Participation in Direct Debit and Request For Debit Transactions

You also need to indicate the type of transactions supported by the clearing network (whether DD and/or RFD transactions). This specification will be validated when the appropriate transaction type is being processed at your bank.

If not specified, the network will be used to process only payment transactions.

3.4.2 Fields Button

Click ‘Fields’ button to provide values for the UDFs associated with the screen.

3.5 Clearing Network Details

This section contains the following topics:

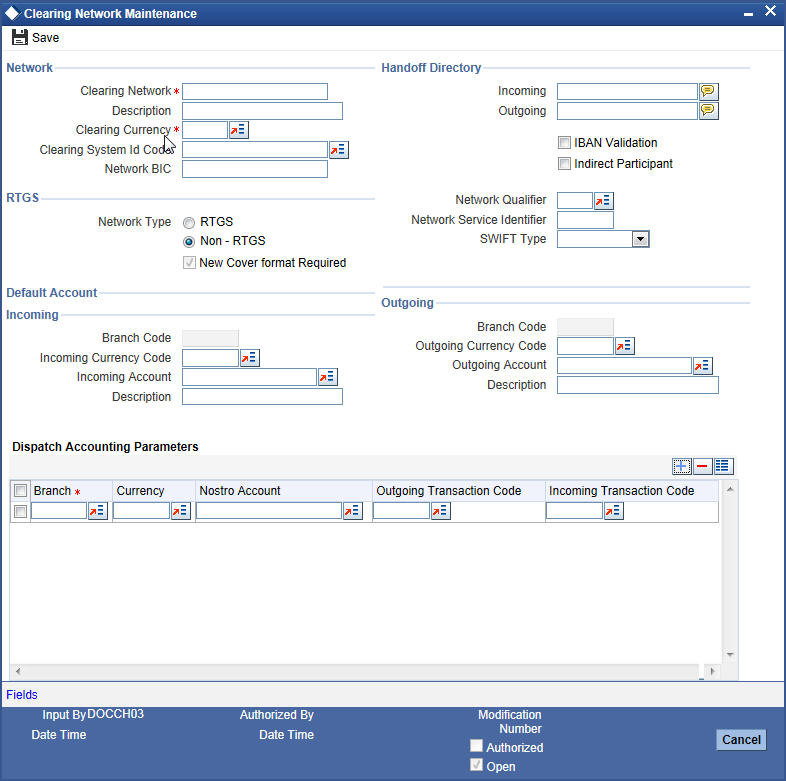

3.5.1 Maintaining Clearing Network Details

In the Clearing Networks screen, you can maintain the networks (such as SORBNET and ELIXIR) through which you communicate with other banks and financial institutions for funds transfers.

You can invoke this screen by typing ‘PCDCLRNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button. The screen is as below:

In this screen, you should specify the following details:

Network

- The Name of the Clearing Network. This will uniquely identify the network in Oracle FLEXCUBE.

- A brief description of the network

- Clearing currency of the network

- Clearing system ID code - Specify a value for the field, to identify a CSM .It is same for all the clearing networks created for different schemes. Also, static data for clearing system ID 'ST2' with description as 'EBA Clearing STEP 2' is available.

- Direct Participant - Check the box, to indicate that the processing bank is either 'Direct Participant' or 'Indirect Participant' of the clearing network and /or the scheme.

- Clearing Network BIC

Handoff Directory

- The Incoming and Outgoing Handoff directories. Incoming and Outgoing transactions will be handed off to the respective directories that you indicate in this screen.

- IBAN validation for the Counterparty Account Number is required for outgoing payments and incoming collections using the clearing network.

Note

For SEPA products (PC products where Service Level Code is SEPA) system will do the IBAN validation even if the IBAN Validation check box is not checked. For Non SEPA products (PC products where Service Level Code is not SEPA) system will do IBAN validation only when the IBAN Validation check box is checked.

- Indicate whether the processing bank is an indirect participant of the clearing network. If yes, then the counterparty account will be replaced with the currency correspondent account.

RTGS

The following RTGS network details should be specified:

Network Type

Select the network type. This can be RTGS or Non-RTGS. By default, system selects Non–RTGS. The network type is RTGS for RTGS networks and Non-RTGS for SKN networks.

If you select the ‘Network Type’ as ‘RTGS’ and ‘Network Qualifier’ as ‘RTGS’, then while saving, the system will check if the ‘Network Qualifier’ is ‘RTGS’. If yes, then the Network Type will be ‘RTGS’

If you select the ‘Network Type’ as ‘Non-RTGS’ and ‘Network Qualifier’ as ‘NEFT’, then while saving, the system will check if the ‘Network Qualifier’ is ‘NEFT’. If yes, then the Network Type will be ‘Non-RTGS’

Network Qualifier

If the network type is RTGS, indicate whether the network is TARGET 2 system. To enable the system to perform TARGET -2 specific validations during contract input and message generation, select TARGET-2 from the network qualifier option list.

You can select ‘S’ for SKN, ‘I’ for RTGS, ‘TARGET 2’ or ‘Others’ as the network qualifier. The default value is ‘Others’.

Note

This field is enabled only if the network type is chosen as ‘RTGS’.

TARGET-2 is a RTGS clearing system for high value Euro payments. All the participants in the current National RTGS system automatically become members of TARGET-2.

Following are the units of TARGET-2:

- Direct TARGET-2 participant

- Indirect TARGET-2 participant

If payment is done from direct TARGET-2 participant to another direct TARGET-2, the account of the sender will be debited and that of receiver is credited.

If payments are sent from a direct TARGET-2 participant to a direct TARGET-1 participant, an interlinking account is used.

Swift Type

Select the swift type from the drop down list. The drop down list contains the options ‘FIN’ and ‘FIN Y- Copy’. This preference is used in Funds Transfer module.

Network Service Identifier

The service identifier that is specified here will be displayed in Field 113 of Block 3 header in the RTGS message.

Note

This will be enabled if network type chosen is ‘RTGS’.

Customer cover messages are always generated in new format (MT202COV or MT205COV). This preference is used in the Funds Transfer module.

For more details on new cover message formats, refer to the Settlements user manual.

Incoming

Branch Code

Specify the code for the branch that is participating in the incoming account process.

Incoming Currency Code

If you select the currency code, all the accounts associated with the chosen currency code will be displayed in the option list provided in the adjacent field.

Incoming Account

In case of incoming transactions received over the network, the account that you indicate here will be debited by default.

Description

In case of TARGET 2 clearing network, the default incoming account will be the primary nostro account with the central bank that should be debited while processing an incoming TARGET 2 payment.

Outgoing

Branch Code

For all outgoing transactions sent over the network you are maintaining, you can specify the default account that should be credited.

Outgoing Currency code

If you select the currency code, all the accounts associated with the chosen currency code will be displayed in the option list provided in the adjacent field.

Outgoing Account

In case of outgoing transactions received over the network, the account that you indicate here will be credited by default.

Description

In case of TARGET 2 clearing network, the default incoming account will be the primary nostro account with the central bank that should be credited while processing an outgoing TARGET 2 payment.

Note

You are not allowed to maintain the same default incoming or outgoing accounts for different networks.

Dispatch Accounting Parameters

To consolidate the accounting entries such that the Clearing Nostro GL is netted to post single debit and credit entries for each file that is dispatched, you will need to identify the Clearing Nostro account through the Dispatch Accounting Parameters section in the ‘Clearing Network’ screen.

Branch

Select the appropriate branch code and the currency code from the corresponding option lists available.

Nostro Account

You can maintain different clearing Nostro accounts for the above combination of branch and currency.

Outgoing and Incoming Transaction Code

After you identify the nostro account to which the consolidated entry will be passed for all Dispatch entries you have to select separate transactions codes against which all the incoming and outgoing transactions are to be tracked. The BIC codes for the clearing network will be derived using the Nostro Account so maintained.

3.5.2 Fields Button

Click ‘Fields’ button to provide values for the UDFs associated with the screen.

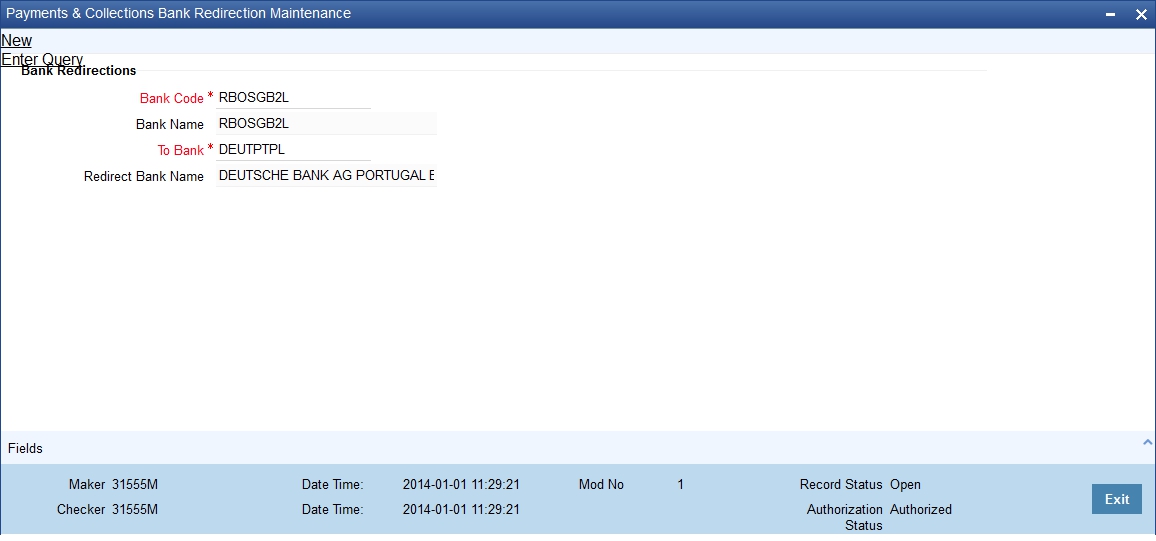

3.6 Redirection Details Maintenance for Bank

This section contains the following topics:

3.6.1 Maintaining Redirection Details for a Bank

On occasions, transactions involving a specific bank may have to be redirected to another bank. In the ‘Bank Redirection Maintenance’ screen, you can maintain the redirection details for a bank. You can invoke this screen by typing ‘PCDBKRED’ in the field at the top right corner of the Application tool bar and click on the adjoining arrow button.

In this screen, you can specify:

From Bank

Select the bank for which you are maintaining redirection details

To Bank

Select the bank to which transactions should be redirected.

All transactions involving the bank for which you are maintaining redirection details will be automatically redirected to the bank you specify here.

Note

You can maintain redirection details only for banks maintained in the Bank Directory screen.

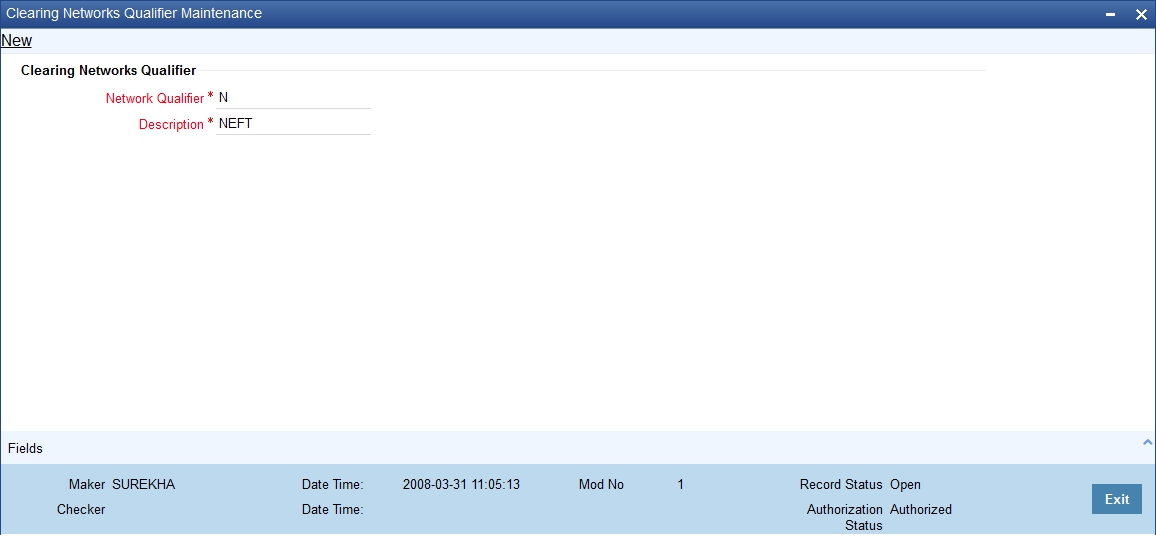

3.7 Clearing Network Qualifier Details

This section contains the following topics:

3.7.1 Maintaining the Clearing Network Qualifier Details

In the Clearing Network Qualifier Maintenance screen, you can maintain the network qualifiers.You can invoke this screen by typing ‘PCDCLNTQ’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Network Qualifier

Specify the network qualifier details.

For BI-SKN network specify the network qualifier as ‘S’ and for BI-RTGS network specify the network qualifier as ‘I’.

Description

Specify the network qualifier description.

Network Qualifiers will be factory shipped as follows:

Network Qualifier |

Description |

T |

TARGET-2 |

O |

Others |

R |

RTGS-INR |

N |

NEFT |

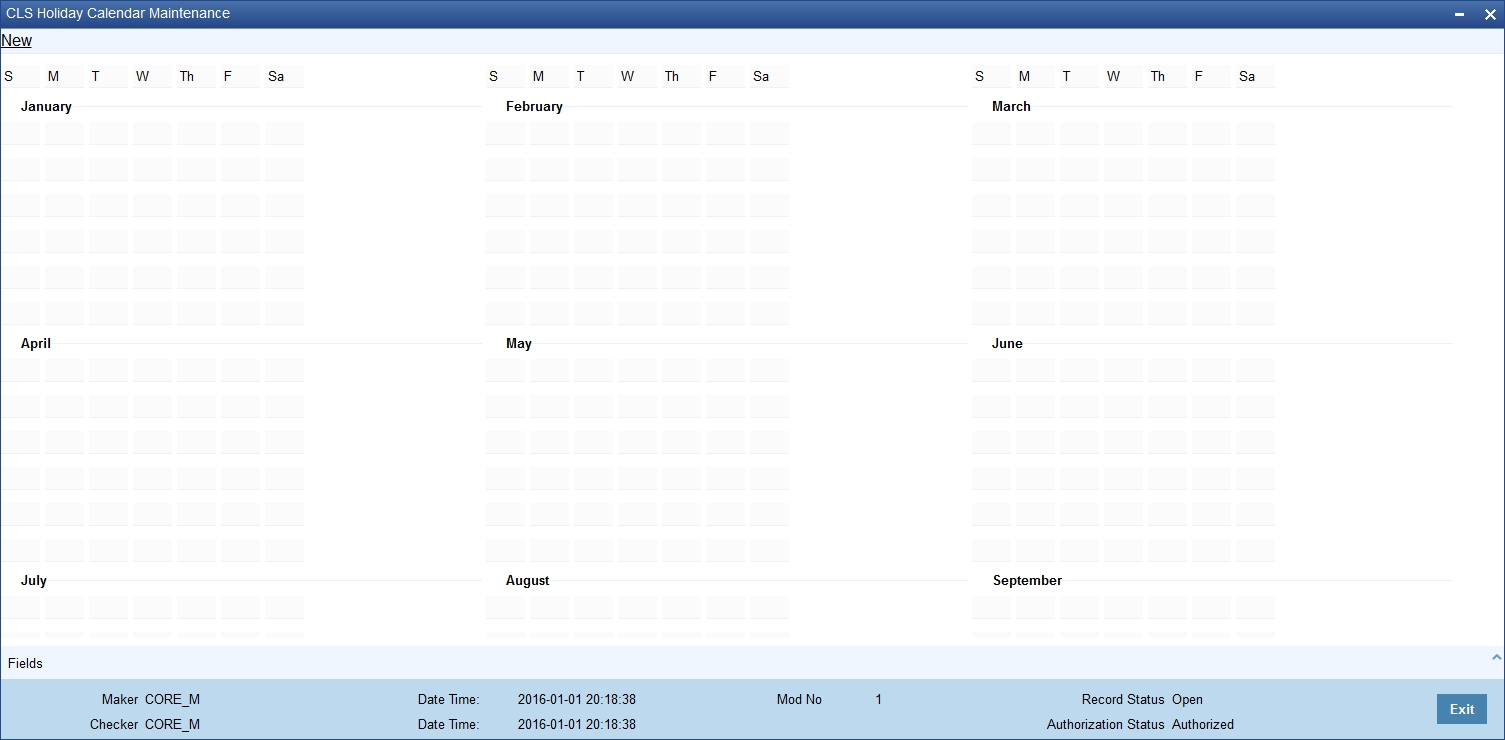

3.8 Network Calendar

This section contains the following topics:

3.8.1 Maintaining the Network Calendar

In the ‘Network Holiday Maintenance’ screen, you can maintain the working days, half working days and holidays for the year and network.

You can invoke this screen by typing ‘PCDNWHOL’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Network Code

Specify the network code.

Year

Specify the calendar year.

When calendar is added for a year, by default the system will mark all Sundays as holiday with Red color and Saturdays are marked as half-day with Orange color and remaining days are marked as Green color that indicates working day.

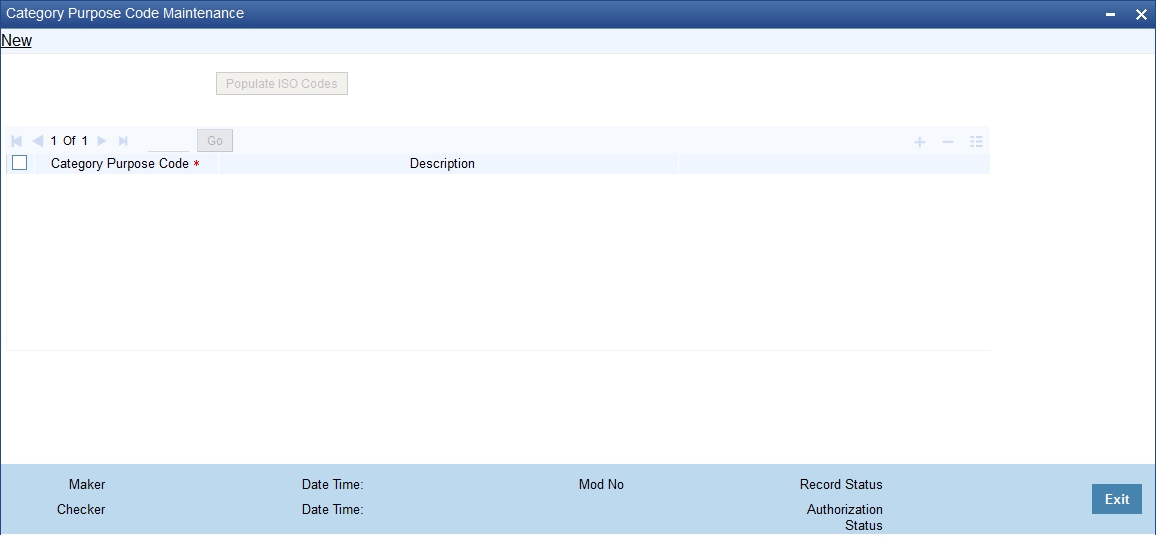

3.9 Purpose Code

This section contains the following topics:

3.9.1 Maintaining the Purpose Code

Purpose code specifies the purpose of the payment based on the agreement between the initiating party and the debtor’s bank. Purpose code maintained through this maintenance is made available during Payment Transaction Input.

You can invoke this screen by typing ‘PCDPCDMT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Specify the following details:

Purpose Code

For maintaining the purpose code first time click on 'Populate ISO Codes' to view all the factory shipped purpose codes maintained by the system. Subsequently you can click Enter Query and Execute Query to view the same.

You can also add or delete the purpose code by clicking on ‘+’ or ‘-’ button respectively.

Purpose Code Description

The description is auto populated in this field. However, if a new purpose code has been specified, then specify a relevant description in this field.

3.10 Window Period Information

This section contains the following topics:

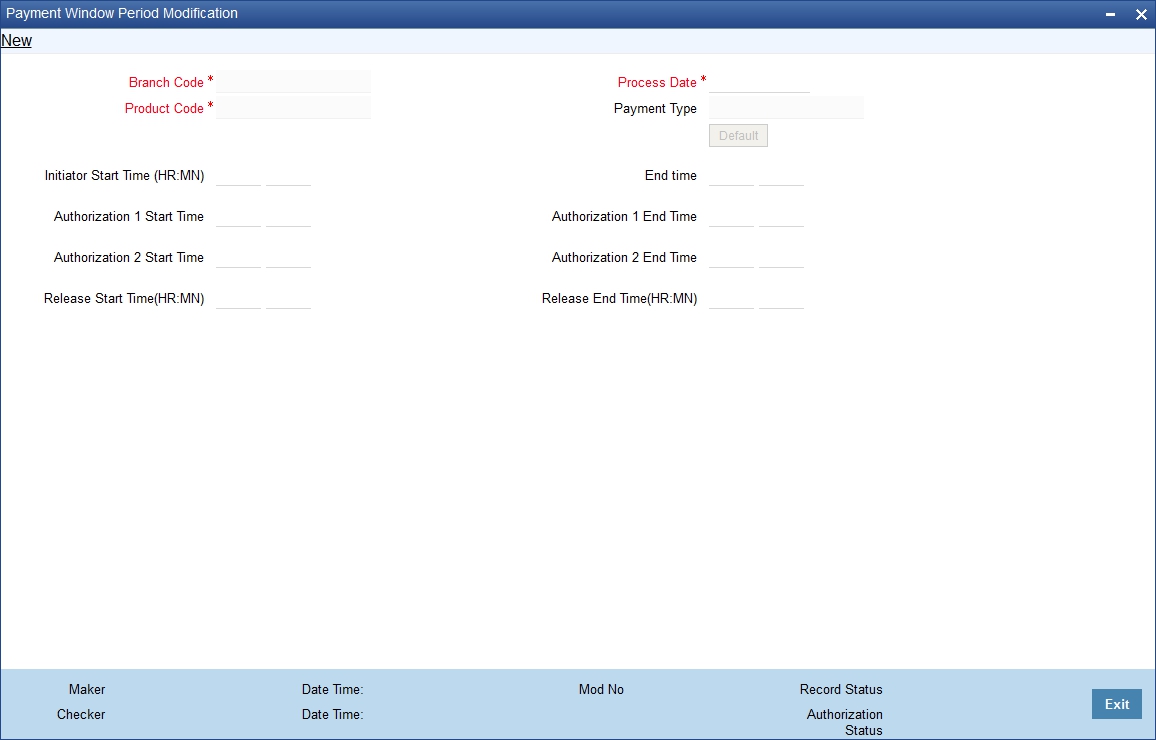

3.10.1 Maintaining Window Period Information

In the Payment Window Period Modification screen, you can modify the window period information for a product for a branch for the current process date. The window periods maintained in this screen is applicable only to the current process date.

You can invoke this screen by typing ‘PCDPRDAT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Branch Code

Specify the branch code.

Product Code

Specify the product code.

Process Date

Specify the process date.

Payment Type

The system will display the product type of the selected product.

Initiator Start Time

Specify the contract initiation start time in hours and minutes for Full Day.

End Time

Specify the contract initiation end time in hours and minutes.

Auth1 Start Time

Specify the contract Level 1 Auth start time in hours and minutes for Full Day.

Auth1 End Time

Specify the contract Level 1 Auth end time in hours and minutes for Full Day.

Auth2 Start Time

Specify the contract Level 2 Auth start time in hours and minutes for Full Day.

Auth2 End Time

Specify the contract Level 2 Auth end time in hours and minutes for Full Day.

Release Start Time

Specify the contract Release start time in hours and minutes for Full Day.

Release End Time

Specify the contract Release end time in hours and minutes for Full Day.

Clicking on the ‘Default’ button, the system will default the window period information for the given product. If the current process date is Full Day then system will default the Full Day window period information else if the Process Date is Half Day then system will default the Half Day window period information.

3.11 Redirection Details Maintenance for Account

This section contains the following topics:

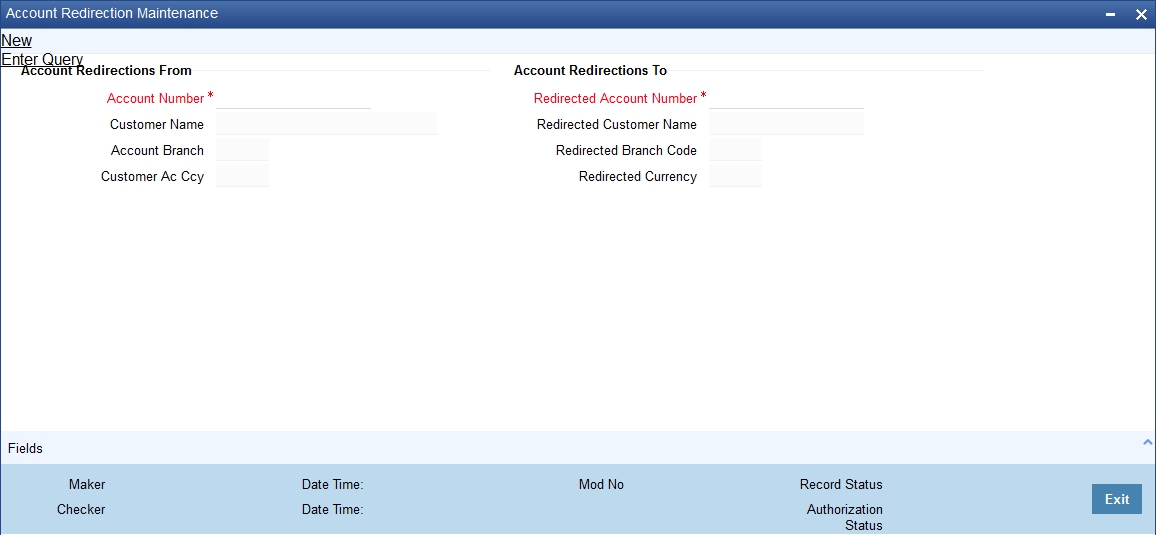

3.11.1 Maintaining the Redirection Details for Account

Just as you redirect transactions from one bank to another, so also on occasions, transactions involving a specific account maintained in Oracle FLEXCUBE may have to be redirected to another valid account maintained in Oracle FLEXCUBE. In the ‘Account Redirection Maintenance’ screen, you can maintain the redirection details for an account.

You can invoke this screen by typing ‘‘PCDACARE’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

In this screen, you can specify:

From

Select the account number for which you are maintaining redirection details. The following are displayed:

- The branch code of the selected account number

- The currency of the account number

- The customer name who is holding the account

To

Select the account to which transactions should be redirected.

On selection of the account number from the option-lists available, the following details get displayed:

- The branch code of the selected account number

- The currency of the account holder

- The customer name who is holding the account

All transactions involving the account for which you are maintaining redirection details will be automatically redirected to the account that you specify here.

To view the joint holder’s details of an account and the mode of operation maintained at the account level, place the cursor on the Account Number or Redirected Account Number fields and press Ctrl+J. The system displays the ‘Joint Holder’ screen.

For more information on the ‘Joint Holder’ screen refer to the section ‘Joint Holder Maintenance’ in the Core User Manual.

3.12 Beneficiary Accounts for Counterparty Bank

This section contains the following topics:

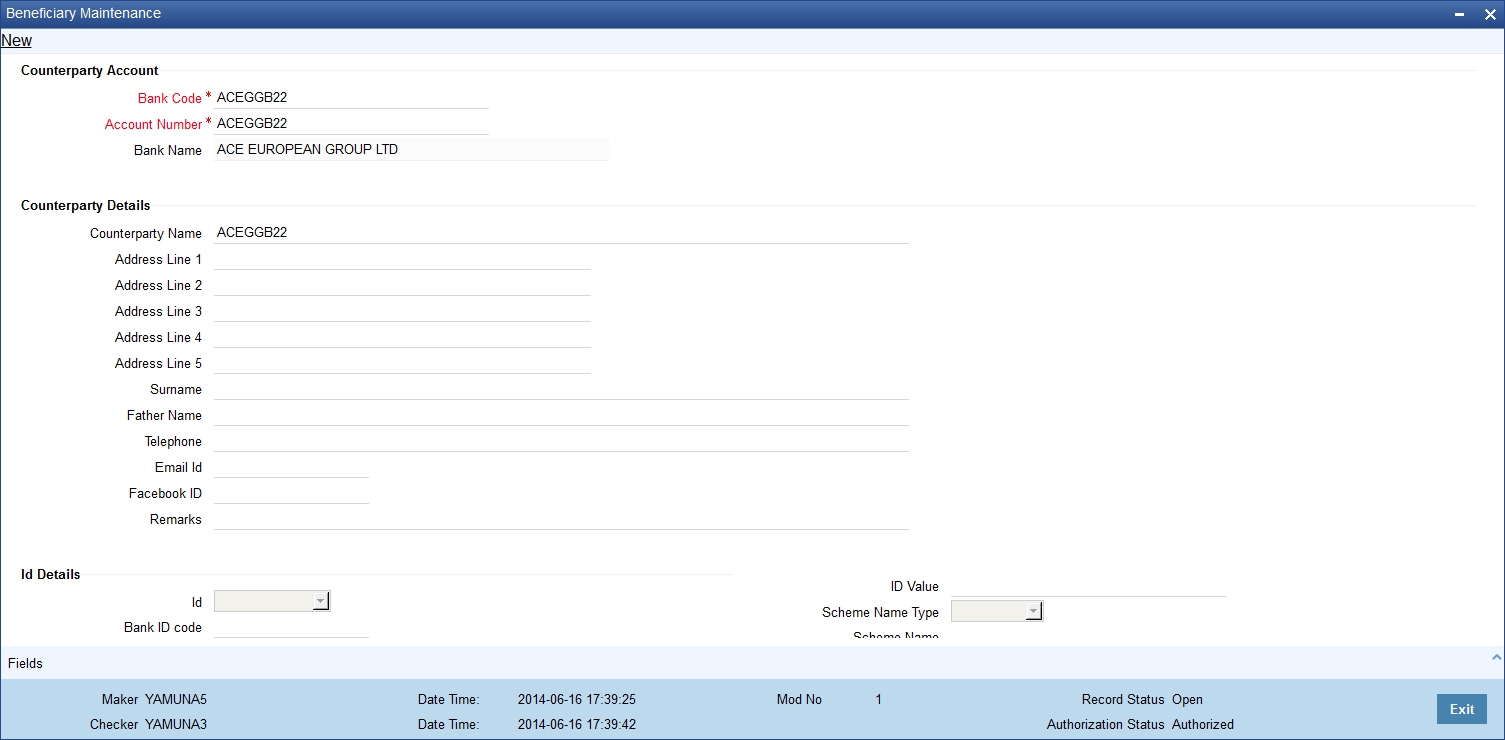

3.12.1 Maintaining the Beneficiary Accounts for Counterparty Bank

You can maintain a list of beneficiary accounts for a counter party bank for local payments and collections transactions through the ‘Beneficiary Maintenance’ screen.

You can invoke this screen by typing ‘PCDBENMT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Counterparty Account

Bank Code

You need to specify the Bank Code of the Counterparty Account from the option list provided. The Bank Name will be displayed alongside.

Account Number

You need to specify the Account Number of the counterparty account. This along with the Bank Code will be uniquely identified in the system.

If you have checked the option ‘IBAN Check Required’ at clearing network level, the system validates IBAN for the counterparty account for outgoing payments and incoming collections. However, the system does not validate the account number that you specify here. You need to specify the correct account number for the counterparty.

Bank Name

The system displays the name of the bank.

Counterparty Details

Counterparty Name

You need to specify the counterparty name for the local payment transaction.

Address Line1, 2, 3, 4 and 5

Specify the address of the counterparty. You can maintain up to five lines of address information.

Surname

Specify the surname of the counterparty.

Fathers Name

Specify the fathers’ name of the counterparty.

Telephone

Specify the telephone number of the counterparty.

Email Id

The system defaults the email ID if an existing beneficiary is maintained in P2P Beneficiary Maintenance screen or new records of a new beneficiary is registered.

Facebook ID

The system defaults the Facebook ID if an existing beneficiary is maintained in P2P Beneficiary Maintenance screen or new records of a new beneficiary is registered.

Remarks

Specify the free hand text related information of the beneficiary.

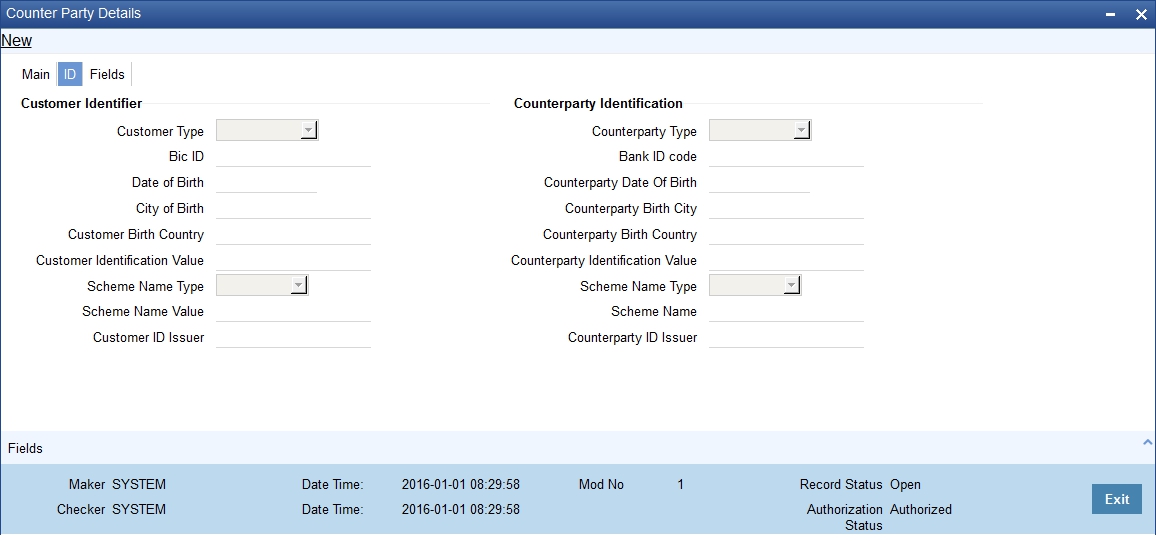

Identification Details

Identification

Select the option to identify the counterparty either by Organization details or by Individual person details. The options available in the drop-down list are:

- Organization Identification

- Private Identification

BIC ID

Specify the Bank Identification Code of the Counter Party.

Identification Value

Specify the identification value for the Counterparty for the given identification type. This is mandatory only if the Identification type is specified.

Issuer

Specify the Identification Issuer of the counterparty. This is used to identify if Organization identification is used as Proprietary Identification or Private Identification.

Counter Party Scheme Name Type

Select the Identification Scheme Type of the counterparty from the select list.

The valid values are:

- C - Codes

- P - Proprietary

Counter Party Scheme Name

Specify the value for Identification Scheme Name field.

If Scheme Name type is C then the Scheme Name can be selected from LOV and can have one of the values mentioned in value list depending on Organization Identification or Private Identification. If the Scheme Name Type is P then you can enter the value for the field.

Counter Party Date of Birth

Specify the date of birth of the Counter Party.

City of Birth

Specify the city of birth of the Counterparty. This is enabled and is mandatory if you have selected identification type as ‘Date and Place of birth’.

Country of Birth

Select the country of birth of the Counterparty from the option list. This is enabled and is mandatory if you have selected the identification type as ‘Date and place of Birth’.

3.13 P2P Beneficiary Details

This section contains the following topics:

- Section 3.13.1, "Maintaining the P2P Beneficiary Details"

- Section 3.13.2, "Viewing P2P Beneficiary Details"

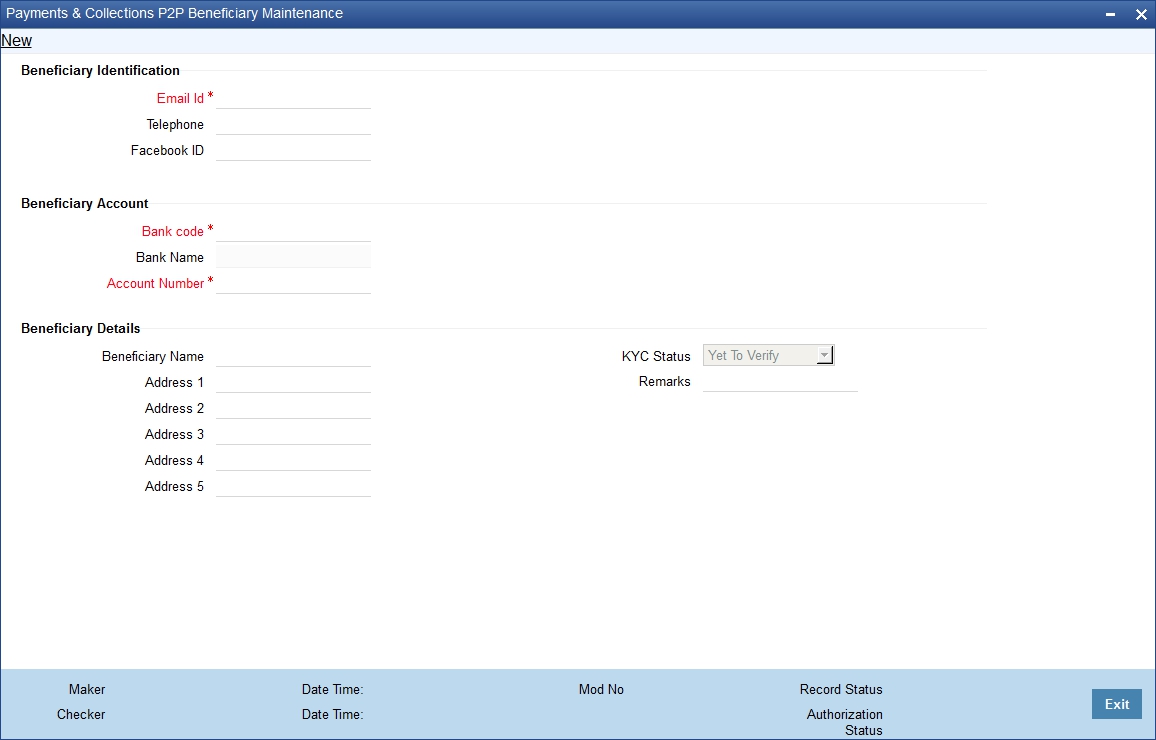

3.13.1 Maintaining the P2P Beneficiary Details

You can maintain peer to peer payment transactions by registering beneficiary details in the ‘P2P Beneficiary Maintenance’ screen. P2P beneficiary maintenance can be done for any of the following combinations:

- Email ID

- Email ID and Telephone

- Email ID and Facebook ID

- Email ID, Telephone and Facebook ID

You can maintain same beneficiary account details with multiple email IDs or multiple combinations of Email ID, Telephone and Facebook ID.

You can invoke this screen by typing ‘PCDPTPBN’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Beneficiary Identification

Email ID

Specify the email identification of the beneficiary.

Telephone

Specify the contact number detail of the beneficiary.

Facebook ID

Specify the facebook identification of the beneficiary.

Beneficiary Account

Bank Code

Select the bank code where the beneficiary holds the account from the adjoining option list.

Bank Name

The system defaults the name of the bank based on the bank code selected.

Account Number

Specify the account number of the beneficiary.

Beneficiary Details

Beneficiary Name

Specify the name of the beneficiary.

Address 1,2,3,4 and 5

Specify the address of the beneficiary.

KYC Status

Select the KYC status from the adjoining drop-down list. The options available are:

- Yet to Verify

- Verified

- Verification Failed

By default the system maintains ‘Yet to Verify’ as the KYC status.

Remarks

Specify remarks, if any.

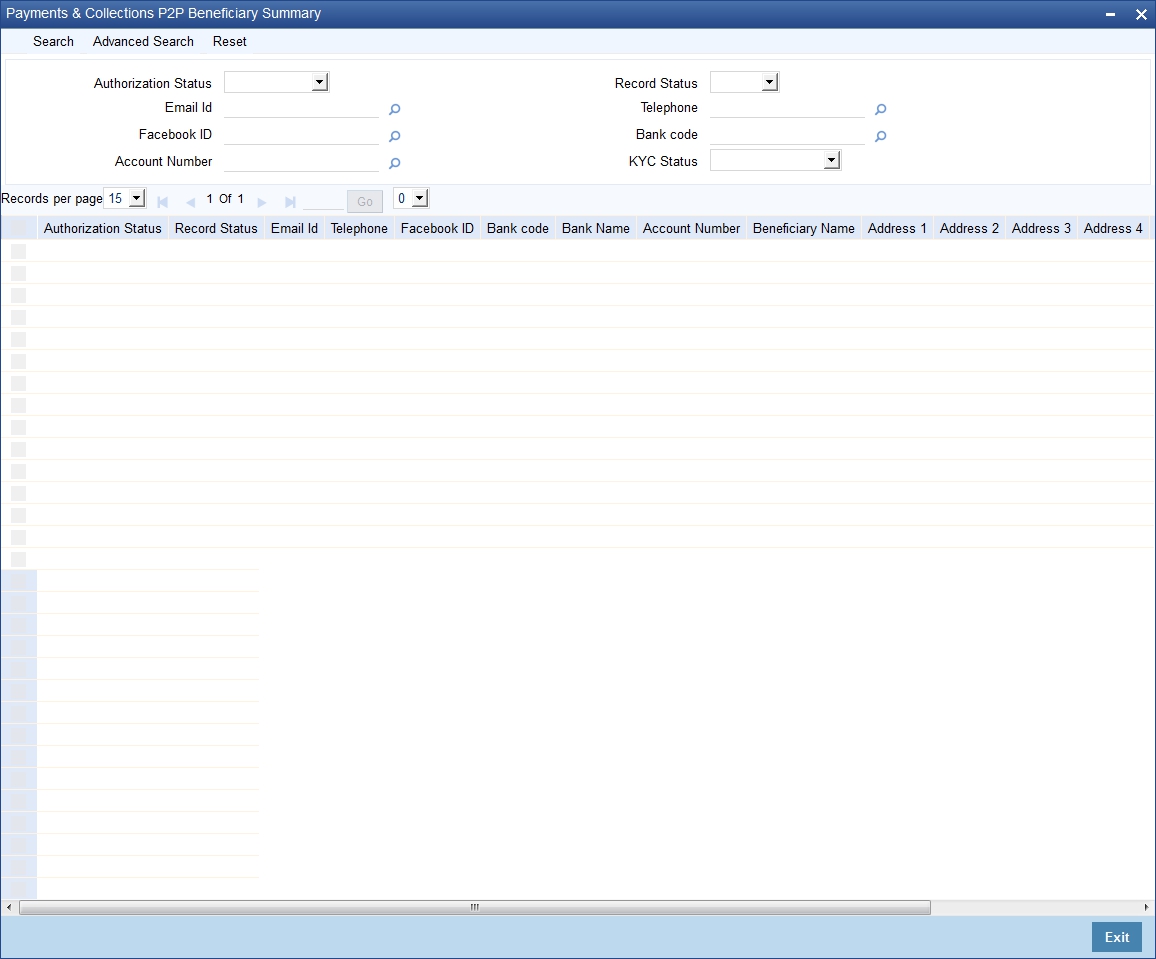

3.13.2 Viewing P2P Beneficiary Details

You can view the peer to peer beneficiary details maintained in the 'P2P Beneficiary Maintenance' screen using the 'P2P Beneficiary Summary' screen. You can invoke this screen by typing 'PCSPTPBN' in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In the above screen, you can base your queries on any or all of the following parameters and fetch records:

- Authorization Status

- Email ID

- Facebook ID

- Account Number

- Record Status

- Telephone

- Bank Code

- KYC Status

Select any or all of the above parameters for a query and click ‘Search’ button. The records meeting the selected criteria are displayed.

If you are allowed to query beneficiary details, then system displays the following details pertaining to the fetched records:

- Authorization Status

- Record Status

- Email Id

- Telephone

- Facebook ID

- Bank Code

- Bank Name

- Account Number

- Beneficiary Name

- Address 1, 2, 3 4 and 5

- KYC Status

- Remarks

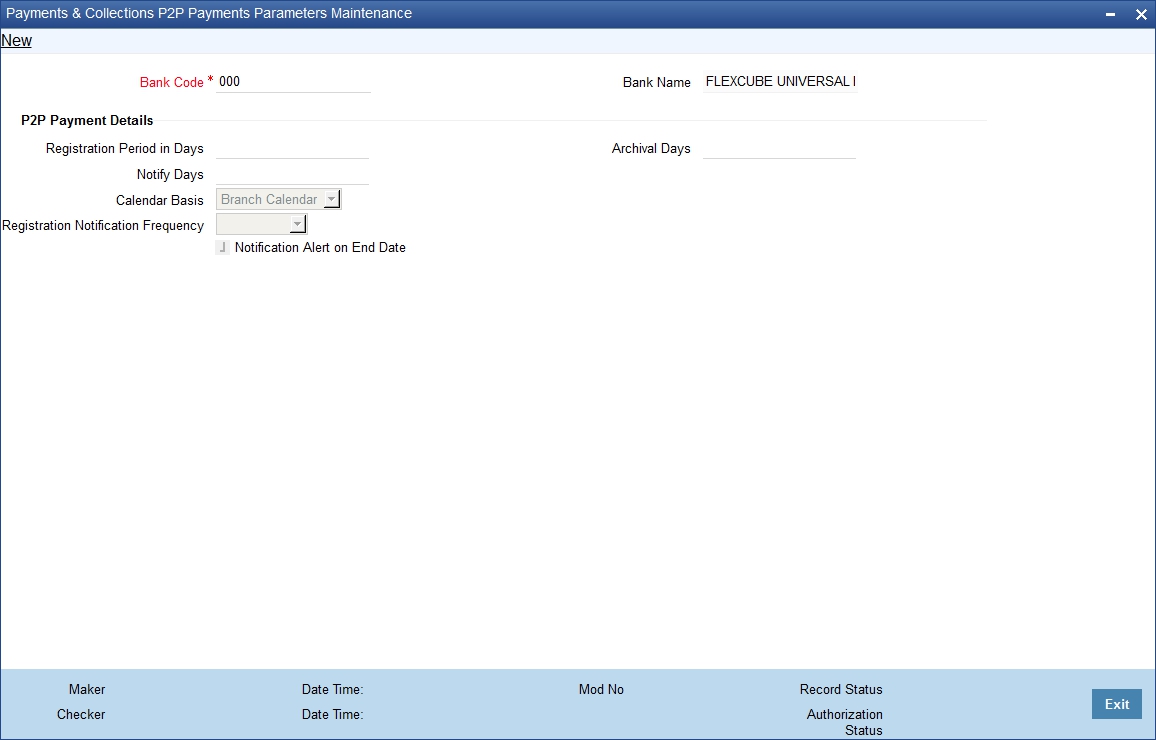

3.14 P2P Payments Parameters

This section contains the following topics:

3.14.1 Maintaining the P2P Payment Parameters

You can maintain peer to peer payment processing details in the ‘P2P Payments Parameters Maintenance’ screen.

You can invoke this screen by typing ‘PCDPTPPM’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can specify the following in this screen:

Bank Code

Select the bank code from the adjoining option list.

Bank Name

The system displays the bank name.

P2P Payment Details

Registration Period in Days

Specify the number of days within which beneficiary has to register in the sender’s bank to receive the payments.

The activation date of the customer debit or effective date of the amount block request will be considered as ‘From Date’ to calculate the end date for beneficiary registration.

Notify Days

Specify the days to notify the end date for beneficiary registration in sender’s bank. Notify Days is mandatory if the Registration Period in Days is mentioned. Registration Notification Start Date is derived based on notify days and end date for beneficiary registration.

Note

Notify days cannot be greater than or equal to ‘Registration Period in Days’.

Calendar Basis

Select the calendar basis from the adjoining drop-down list. The options available are:

- Calendar Days - Select Calendar Days to consider all days in a calendar.

- Branch Calendar - Select Branch Calendar to consider only the working days of a transaction branch.

By default the system selects ‘Branch Calendar’

Registration Notification Frequency

Select the frequency for generating registration notification from the adjoining drop-down list. The options available are:

- Daily

- Weekly

- Monthly

- Quarterly

- Half Yearly

- Yearly

The system defaults ‘Daily’ as Registration Notification Frequency.

Notification Alert on End Date

Check this box to indicate that the notification needs to be generated on the registration expiry date.

Archival Days

Specify the days after which the record should be moved from P2P Payments Registration Queue to corresponding history data store. The data movement is done if any record becomes older than the archival days maintained..

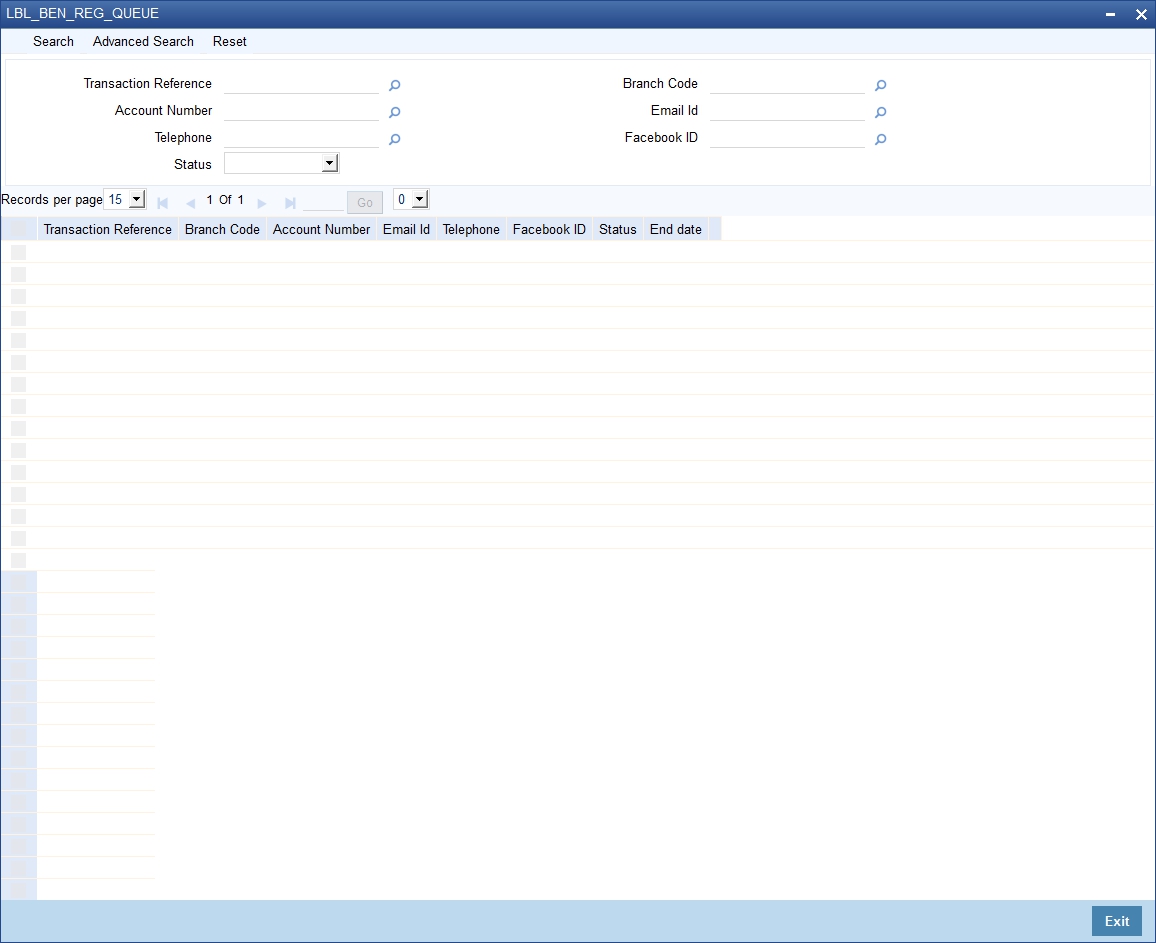

3.15 P2P Payments Beneficiary Registration Queue

This section contains the following topics:

3.15.1 Viewing P2P Beneficiary Registration Queue

You can view the customer debit transactions and amount block requests for the P2P payments in the ‘P2P Payments Beneficiary Registration Queue’ screen.

You can invoke this screen by typing ‘PCSBERGQ’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In the above screen, you can base your queries on any or all of the following parameters and fetch records:

- Transaction Reference

- Account Number

- Telephone

- Status

- Branch Code

- Email Id

- Facebook ID

Select any or all of the above parameters for a query and click ‘Search’ button. The system displays the following details pertaining to the fetched records:

- Transaction Reference

- Branch Code

- Account Number

- Email ID

- Telephone

- Facebook Id

- Status

- End Date]

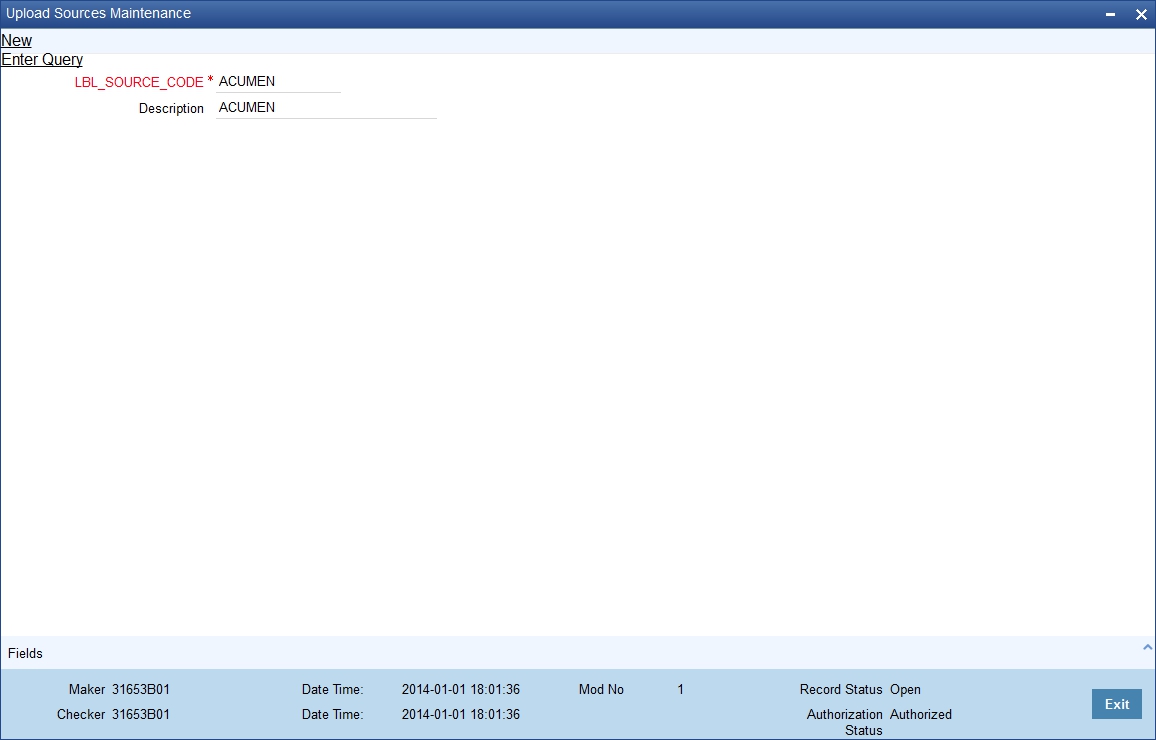

3.16 Upload Sources

This section contains the following topics:

3.16.1 Maintaining Upload Sources

You can identify the sources from which you would like to receive payment and collection transactions for processing. The transactions are uploaded from these sources into Oracle FLEXCUBE. You can identify a source in the PC - Upload Sources screen and invoke the ‘Upload Sources’ screen by typing ‘PCDUPLDM’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

In this screen, you must enter the following details:

Source Code

Specify a unique code that will identify the source throughout the system.

Description

Enter a brief description of the source.

Oracle FLEXCUBE has the following inbuilt upload sources:

- MANUAL_BOOK (Manual Book)

- MANUAL_REJT (Manual Reject)

- MANUAL_APPR (Manual Approval)

- MANUAL_RECL (Manual Recall)

- MANUAL_RDSP (Manual Redispatch)

Note

Users at your bank can ONLY process payment transactions received from a source that is maintained in this screen.

3.17 Parameter Specification for a Source

This section contains the following topics:

3.17.1 Invoking the Source Parameters Maintenance Screen

For a combination of product category, source code and customer, you can maintain certain upload parameters such as:

- An Automatic Authorization Limit

- Whether uploaded transactions can be deleted

- The fields that can be amended

- The number of working days (calculated from the initiation date of the transaction) for which the messages need to be retained in the system

- The source parameter maintenances should be in sync with the maintenances for external systems in Gateway module

For more information on ‘Gateway Maintenances’, please refer to Gateway Maintenance user manuals.

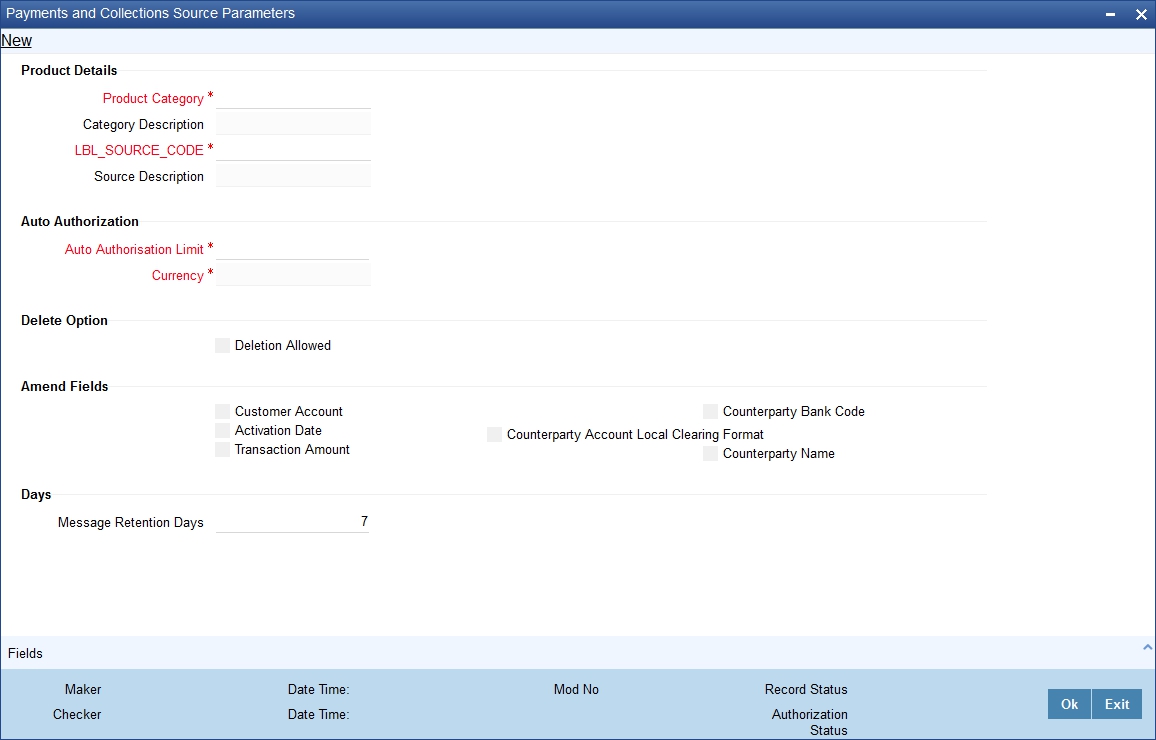

You can setup upload parameters in the ‘Source Parameters Maintenance’ screen and invoke this screen by typing ‘PCDUPLDT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

In this screen, you can specify the following details:

Product Details

Product Category

Select the product category from the list of options available.

Source Code

Select the source code from the list of options available.

Auto Authorization

Auto Authorization Limit

If you specify an automatic authorization limit, transactions (belonging to the product category and source combination) involving amounts less than or equal to the limit will be automatically authorized on upload. Transactions exceeding the limit specified have to be authorized manually after upload. The authorization limit is maintained in the local currency of the bank.

If you do not specify an authorization limit, all transactions belonging to the customer, source and product category combination will be automatically authorized on upload.

Deletion Option

Deletion Allowed

Check this box to indicate that the uploaded transaction can be deleted.

Amendable Fields

For a combination of customer, source code and product, you can also specify a list of fields that can be amended on upload. This implies that on upload, the transaction details corresponding to the fields you specify here can be amended before the transaction is processed. You can amend the following fields:

- Customer Account

- Activation Date

- Transaction Amount

- Counterparty Bank Code

- Counterparty Account Local Clearing Format

- Counterparty Name

Days

Message Retention Days

The number of working days (calculated from the initiation date of the transaction) for which the messages need to be retained in the system.

As stated earlier, Oracle FLEXCUBE has the following inbuilt sources, for which you need to maintain the corresponding preferences:

Upload Source |

Product category |

Manual Book |

Incoming Collection Reject Of Outgoing Collection Recall of Outgoing Collection |

Manual Redispatch |

Outgoing Collection |

Manual Approval |

Approval of Incoming Collection (RFD) |

Manual Reject |

Reject Of Incoming Collection |

Manual Recall |

Recall of Incoming Collection (DD) |

3.18 Customer Agreements

This section contains the following topics:

- Section 3.18.1, "Maintaining Customer Agreements"

- Section 3.18.2, "Automatic Cancellation of the Mandate"

3.18.1 Maintaining Customer Agreements

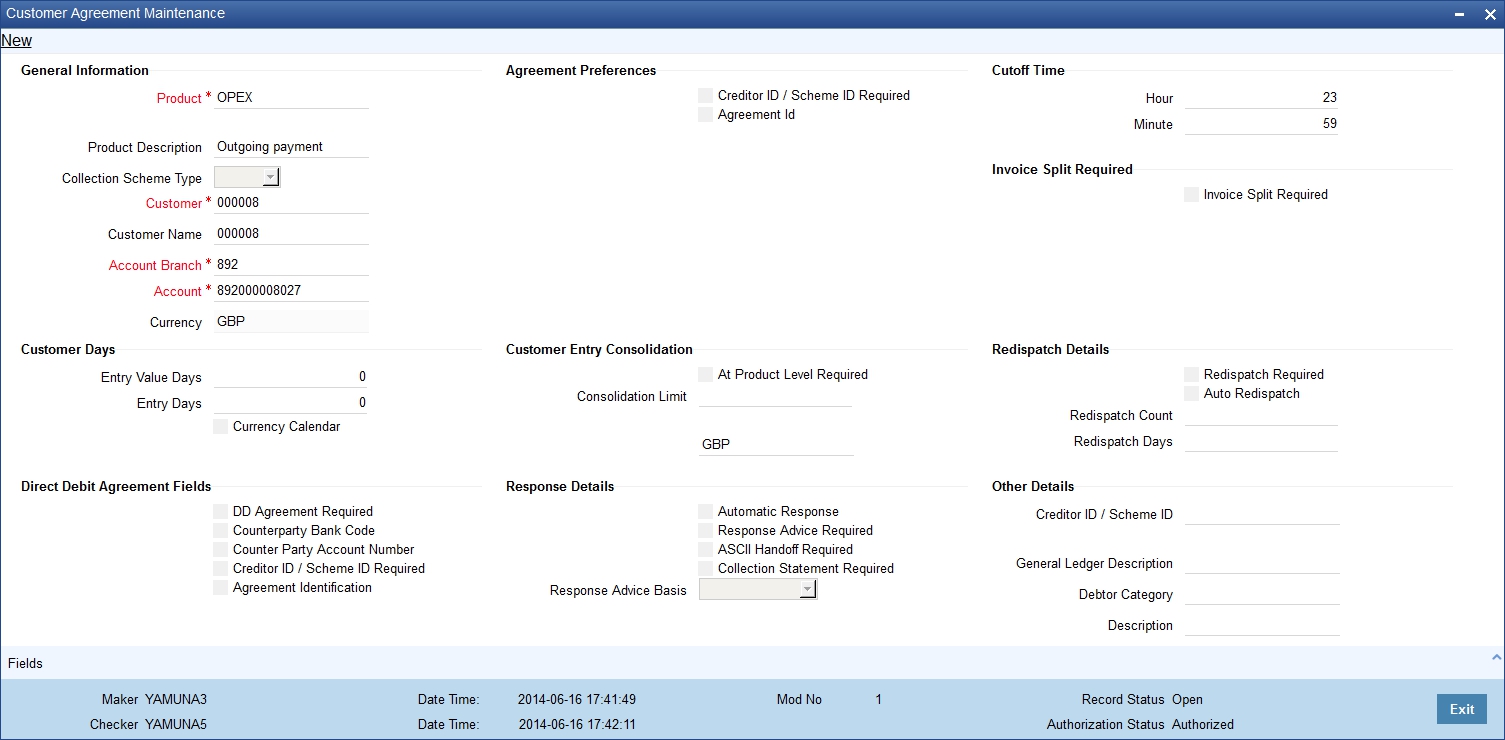

Prior to processing payment and collection transactions, you need to capture the details of the agreement between your bank and the customer involved in the transaction. The agreement details maintained in the ‘Customer Agreement Maintenance’ screen, are for a product, customer and account combination.

You can invoke this screen by typing ‘PCDCLAGT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The following agreement details can be maintained:

General Information

Product

You can select the product for which the agreement details are being maintained. The agreement details will be validated only for transactions involving the product selected in this field.

Collection Scheme Type

The value for the field is defaulted from the selected product. The field is used to differentiate 'B2B' scheme customer agreements from 'CORE/COR1' scheme customer agreements.

Customer

In this field, you will select the name of the customer taking part in the agreement.

The ‘ALL’ option is available for all payment product types and for recall and reject collection product types. An incoming/outgoing DD or RFD may be rejected or recalled (applicable only to DDs) for various reasons. Thus, a reject or recall transaction (involving the appropriate reject or recall product) is in effect the child transaction of the corresponding incoming or outgoing (parent) transaction. At the time of processing the parent transactions, the system will perform the necessary validations. When processing a reject or recall (child) transaction, you will need to specify the ‘Original Collection Reference Number’ (of the parent transaction) as mandatory information. The system will use this number to associate the child transaction with the appropriate parent transaction. No further validations will be performed on the child transaction. In other words, the agreement details for a reject or recall transactions will necessarily be the same for all customers and not specific to a customer. Therefore, you can use the ‘ALL’ option in this field.

Branch

Specify the branch that is that is associated with the customer for whom the agreement is being maintained.

Account

You can specify the account for which the agreement details are being maintained. The currency of the selected account will get displayed in the adjacent field, based on the product linked.

In this field also, you can select the ‘ALL’ option for payments, reject and recall products ONLY, for reasons discussed above.

Note

- If you have specified an account that uses an account class that is restricted for debit or credit transactions for the product, an override is sought when you attempt to save the agreement.

- If a branch has been maintained as a customer of your bank, and you are specifying an internal GL of the branch as the account for the agreement, you can choose the CIF ID of such a branch in the Customer field, and the requisite GL in this field. Such agreements would be validated for whenever a direct debit transaction is entered with a GL as the account, and the branch CIF ID as the customer of the transaction.

- You can also select the CL account number as the customer account.

Mandatory Fields

Creditor ID/ Scheme ID Required

Check the box if you have the counterparty account number that is involved in the DD agreement It is mandatory to check this box to process mandate updates/validations.

Agreement Identification

Check the box if you have the DD agreement identification details. It is mandatory to check this box to process mandate updates/validations.

Cut Off Time

Hour/Minutes

You can indicate the cut off time (in hr and min) for the customer and product combination involved in the agreement. The cut off time specified here takes precedence over the one specified at the product level.

During product resolution, based on the cut off time maintained, the system will determine whether the transaction is received before the cut off time. For transactions received after the cut off time, the system will resolve the product for which ‘post cut off’ is allowed. The activation date (the current system date) of such transactions will be moved to the next day.

Transactions with activation dates in the past or future will be resolved as received before the cut off time (pre cut off).

Customer Days

Entry Days

For the transactions processed under a specific product, involving a specific customer, you can specify the manner in which the booking date of the transaction should be arrived at.

Your specification in the Customer Entry Days field will be added to the activation date to arrive at the Customer Entry Date for transactions received before the cutoff time specified for the product.

Entry Value Days

For the transactions processed under a specific product, involving a specific customer, you can specify the manner in which the value date of the accounting entries for customer leg of the transaction should be arrived at.

Your specification in the Pre-cutoff field will be added to the activation date to arrive at the Customer Entry Value Date for transactions received before the cutoff time specified for the product.

Customer Entry Consolidation

You can opt to consolidate the customer leg of transactions involving the customer and product combination.

At Product Level Required

Check the box to if you require transactions to be consolidated at product level.

Consolidation Limit

If the customer leg of the transactions should be consolidated, you can specify a transaction amount limit for the transactions that should be considered for consolidation. Transactions that exceed the limit you specify will not be taken up for consolidation. If you do not specify a consolidation limit, the customer leg of all transactions involving the customer and product will automatically be consolidated.

Note

Note that your specifications in this screen take precedence over any product or account level parameters.

Invoice Split Required

Invoice Split Required

Oracle FLEXCUBE allows you to split a transaction into multiple transactions if the transaction amount exceeds the maximum transaction amount limit specified above. However, you can choose to split the amount for transactions involving an outgoing product.

Direct Debit Agreement Fields

Agreement Required

For the product and customer combination, you have to indicate if a direct debit (DD) agreement is required for processing Incoming and Outgoing transactions. Unlike the customer agreement, which is used to validate the product and customer involved in a transaction, a DD agreement exists between the customer and the counterparty participating in a transaction.

If the selected customer is 'Individual' type then a static data for error code 'PC-SVV-09M' with description as 'Customer type cannot be Individual for B2B Collection Scheme 'will be generated.

Counterparty Bank Code

Check the box if you have the counterparty bank code that is involved in the DD agreement.

Counterparty Account Number

Check the box if you have the counterparty account number that is involved in the DD agreement.

Creditor ID / Scheme ID Required

Check the box if you have the counterparty account number that is involved in the DD agreement .Agreement Identification

Check the box if you have the DD agreement identification details.

Redispatch Details

Redispatch Required

An outgoing DD/RFD may be rejected for various reasons, one such reason being the lack of funds in the customer (debtor’s) account. The debtor’s bank may therefore, reject the Incoming DD/RFD. The creditor’s bank will process the same as a reject of Outgoing DD/RFD. However, the system allows you to redispatch a rejected outgoing DD/RFD. A redispatch initiates a new transaction, which is referred to as the child contract of the original, rejected transaction. On initiation of the child contract, the corresponding parent contract gets closed. The child contract inherits all attributes of the parent contract. The redispatched contract may be rejected by the debtor’s bank again. In such a case the creditor’s bank may redispatch the collection based on the parameters maintained in the agreement. Every redispatch creates a new child contract. The activation date of a rejected redispatch will be used to determine the date of the subsequent redispatch.

Auto Redispatch

You can also select the ‘Auto Redispatch’ option to indicate that the redispatch will be done automatically by the system.

Redispatch Count

For an automatic redispatch, you can specify the number of times a transaction can be redispatched in the ‘Redispatch Count’ field. A redispatch may eventually result in a funds transfer, if sufficient funds are available in the debtor’s account. If funds are not available even after the last redispatch, the system will process it as a reject transaction.

Redispatch Days

For an automatic redispatch, you can indicate the number of working days (redispatch days) to be added to the activation date to arrive at the date on which a transaction is to be redispatched.

Response Details

Auto Response

An RFD transaction, if not approved within the response period is considered closed. Select the ‘Auto Response’ option to indicate that the approval or closure will be handled automatically by the system.

ASCII Handoff Required

For contracts involving the product and customer combination, you can specify whether the contract information is to be written into handoff tables, to be picked up or referenced by the external agency.

Collection stmt Required

Collection statements can be generated for contracts involving the customer and product combination, if indicated in this screen.

Response Advice Required

You can also choose to generate a response advice for Incoming/Outgoing DD and RFD transactions. If selected, one of the following advices will be generated:

- Approval: An advice of approval will be sent to the creditor’s bank if the Incoming DD/RFD is approved by the debtor’s bank.

- Reject: Reject of an Incoming DD/RFD will result in the generation of the reject advice. This will be from the debtor’s bank to the creditor’s bank.

- Closure: A closure advice is sent when the transaction is closed by the system.

If you have opted to generate a response advice, you need to indicate when the advice needs to be sent. You can send the advice on the event date or on the response date.

Basis

Select the basis for response. You can select any one of the following options:

- Response Date

- Event Date

Other Details

Creditor ID/ Scheme ID

For outgoing collections initiated by the customer, you can specify the creditor ID of the customer.

Whenever an outgoing transaction involves an outgoing product and customer combination, the system defaults the creditor ID as mentioned in the customer agreement.

Debtor Category

For outgoing collections initiated by the customer, you can specify the debtor categories with which the customer deals.

Whenever an outgoing transaction involving an outgoing product and customer combination, the system defaults the preferences maintained for the debtor category that has been specified in the customer agreement.

3.18.2 Automatic Cancellation of the Mandate

For a given mandate, if there are no transactions for 36 months, system automatically cancels the mandate so that no further transactions are processed for this mandate. The End of Day batch in Oracle FLEXCUBE, which is run daily as part of EOD, checks the mandate details maintained in ‘Payments & Collections Debtor DD Agreements’ screen. System checks is the latest ‘Effective Date’ for any mandate record is earlier than the current application date by more than 36 months and the ‘Mandate Status’ is not ‘Cancelled’. In this case, ‘Mandate Status’ is updated to ‘Cancelled’ and the ‘Effective Date’ is updated to the current processing date. Also, ‘Amendment reason’ is updated as ‘AUTO CANCEL’.

For a mandate record, if the ‘Effective Date’ is either not earlier than 36 months or the ‘Mandate Status’ is maintained as ‘AUTO CANCEL’, then this record is skipped by the system.

For more details on End of Day batch process, refer the ‘AEOD’ user manual.

Note

The parameter ‘MANDATE AUTO CANCEL MONTHS’ has the configurable value of 36 and is factory shipped.

3.19 Creditors Maintenance

This section contains the following topics:

3.19.1 Maintaining the Creditors Details

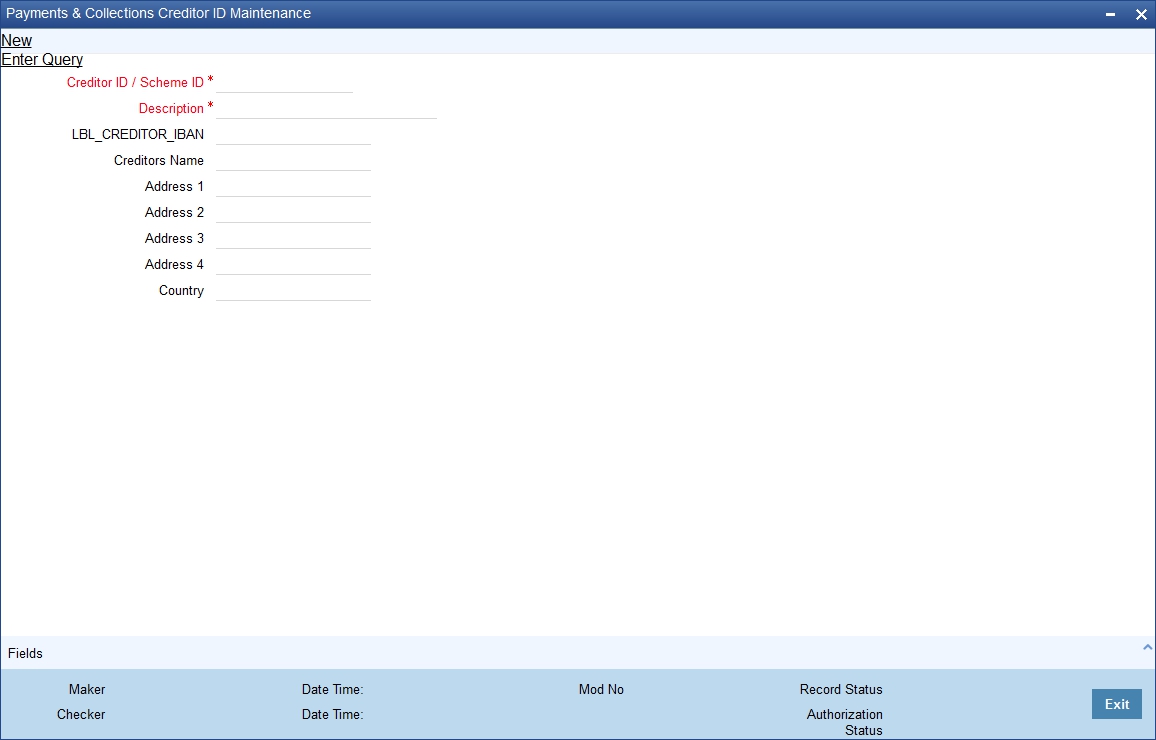

You can maintain the creditor identification like the Creditor ID and description for creditors with whom your bank transacts. These details are maintained in the ‘Payments and Collections Creditor ID Maintenance’ screen.

You can invoke this screen by typing ‘PCDCREID’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Creditor Id/ Scheme ID

Specify the Creditor Scheme ID for SEPA scheme and Creditor ID for Non-SEPA scheme.

For SEPA scheme the value for Creditor ID/ Scheme ID can be provided as below:

- Positions 1 and 2 contain the ISO country code

- Position 3 and 4 contain the check digits.

- Positions 5 to 7 contain the creditor business code. When the creditor business code is not used, then value is set to ‘ZZZ’. The creditor business code is not considered while checking for existence of the agreement.

Description

Enter a description for the creditor id that you have entered.

Creditor IBAN

Specify the International Bank Account Number of the Creditor.

Creditors Name

Specify the creditor’s name.

Address 1, 2, 3 and 4

Specify the complete address of the Creditor.

Country

Select the country from the adjoining option list.

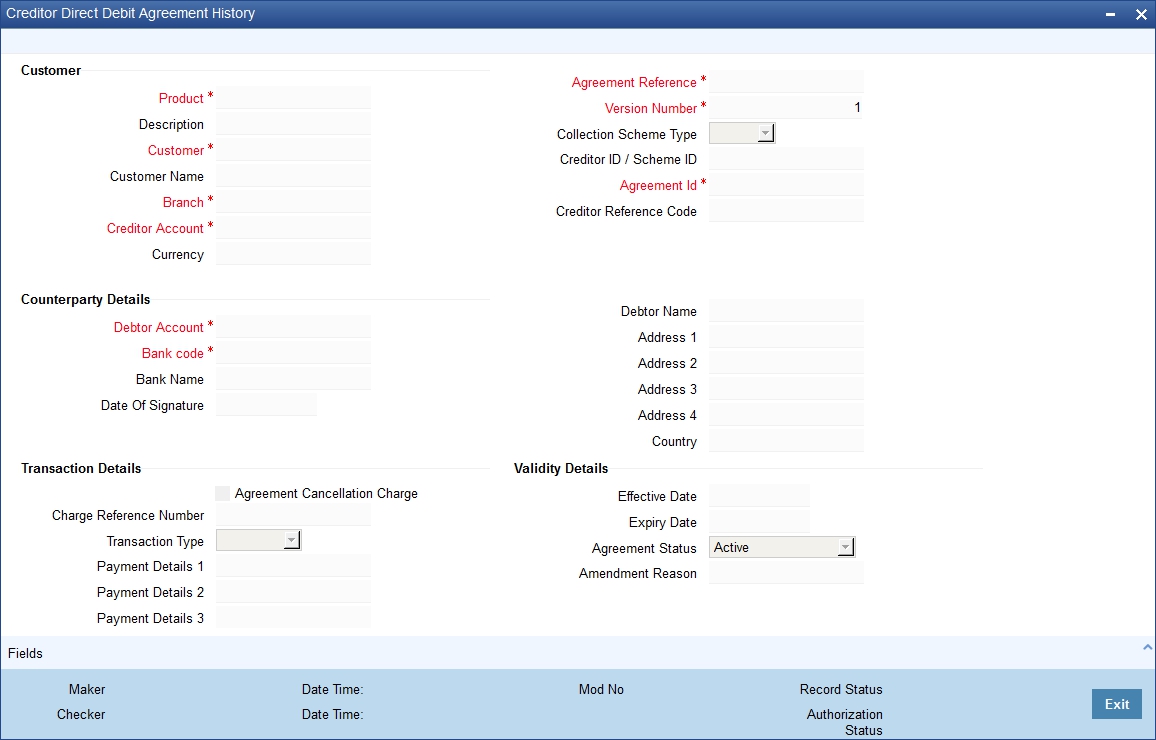

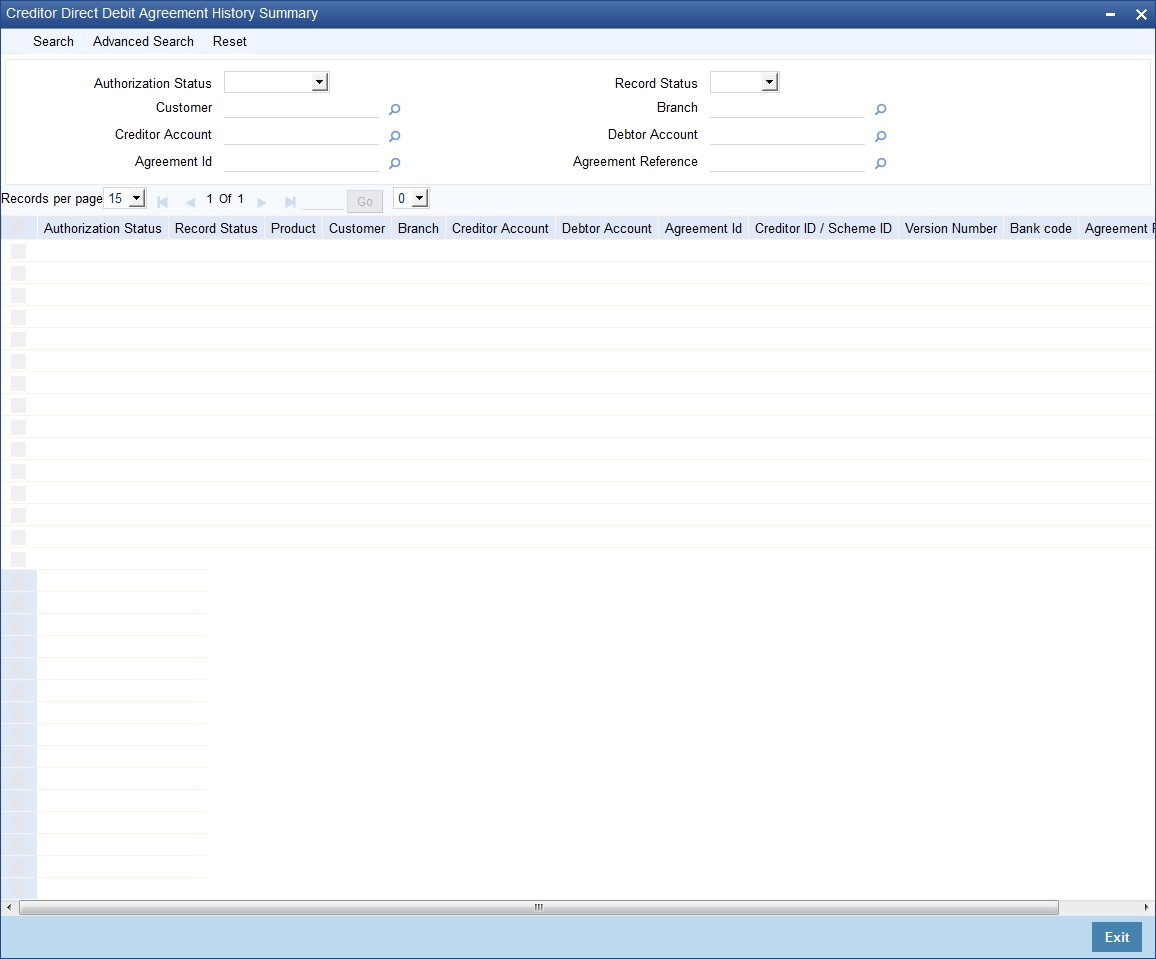

3.20 DD Agreement Details Maintenance for Creditors

This section contains the following topics:

3.20.1 Maintaining DD Agreement Details for Creditors

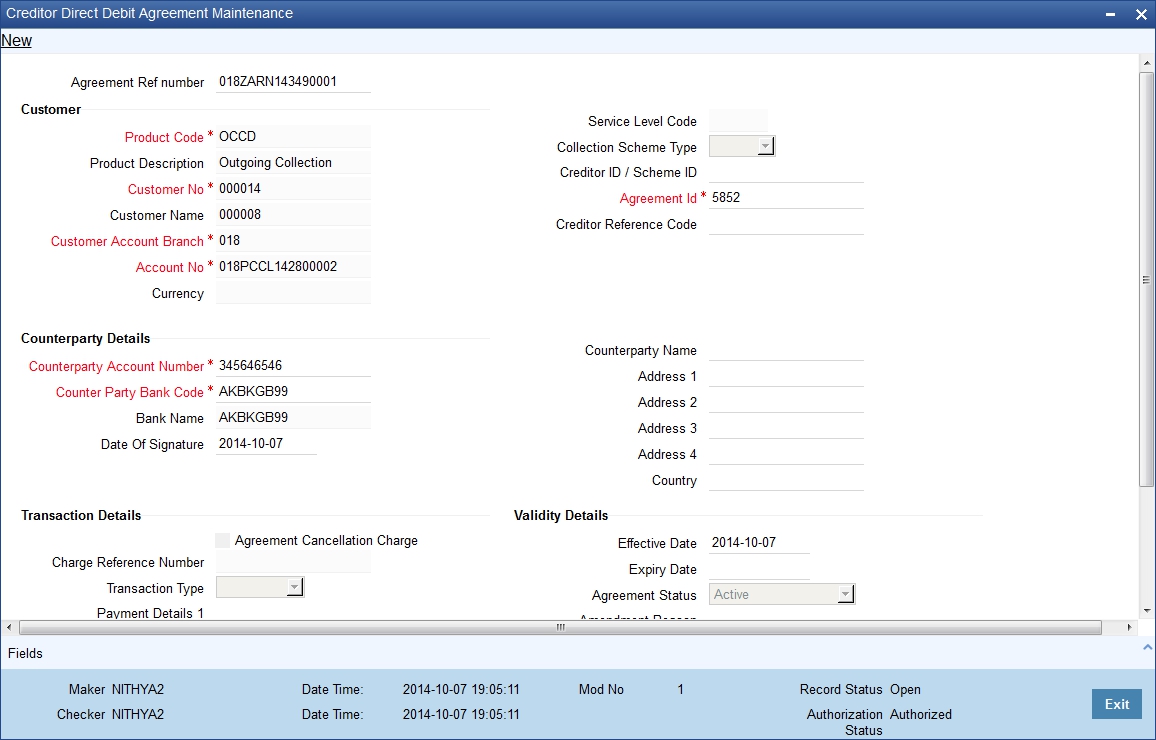

This agreement is maintained by your bank on behalf of customers who participate as creditors in a direct debit transaction. The details are maintained in the ‘Creditor Direct Debit Agreement Maintenance’ screen.

You can invoke this screen by typing ‘PCDCRAGT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The details maintained here will be used to validate outgoing transactions (initiated by the creditor).

Note

If a branch has been maintained as a customer of your bank, and you are specifying an internal GL of the branch as the account for the agreement, you can choose the CIF ID of such a branch in the Customer field, and the requisite GL in this field. Such agreements would be validated for whenever a direct debit transaction is entered with a GL as the account, and the branch CIF ID as the customer of the transaction.

Product Code

Select the product code from the list option provided. This is applicable only if the corresponding customer agreements exist and you have indicated that a DD agreement is required for the respective customer agreements.

Product Description

Give a brief description on the product.

Customer No

Specify the customer if the corresponding customer agreements exist and you have indicated that a DD agreement is required for the respective customer agreements.

Customer Account Branch

Specify the branch if the corresponding customer agreements exist and you have indicated that a DD agreement is required for the respective customer agreements.

Account No

Specify the account if the corresponding customer agreements exist and you have indicated that a DD agreement is required for the respective customer agreements.

You can also select CL account number as the customer account.

Service Level Code

The system displays the value of 'Service Level Code' maintained at product level, once you select the product code.

Collection Scheme Type

The value for the field is defaulted from the selected product. The value is specified in Payments and collections product definition screen (PCDPRMNT).

The field is used to differentiate 'B2B' scheme mandates from 'CORE/COR1' scheme mandates.

Creditor ID / Scheme ID

Specify the value for the collection scheme types CORE, COR1 and B2B.The field value is validated against the format specified for 'Creditor ID/Scheme ID' field in 'Payments and Collections Creditors details maintenance (PCDCREID).While processing contracts for collection transaction, the system will validate Creditor Scheme Identifier for the space between the positions 5 and 7 in Creditor Scheme Identifier.

If there are spaces, then the system displays an error during manual contract creation in 'Payment & Collection Transaction Input'. Then the incoming messages will be moved to Transaction Repair queue. Positions 5 to 7 contain the creditor business code. When the creditor business code is not used, then value is set to 'ZZZ'. The creditor business code is not considered while checking for existence of the agreement.

Agreement Identification

Specify a unique ID to identify the agreement between the creditor and the debtor participating in a transaction.

Creditor Reference Code

Specify creditor's reference code here, the field is optional. The maximum length of the value in the field is 35 characters.

Counterparty Details

Couterparty Account Number

Specify the counterparty account number.

Counterparty Bank Code

Select the counterparty bank code from the adjoining option list.

Bank Name

Specify the name of the bank.

Date of Signature

Specify the date of signature from the adjoining calendar.

Counterparty Name

Specify the counterparty name.

Address 1, 2, 3 and 4

Specify the complete address of the counterparty.

Country

Specify the country from the adjoining option list.

Transaction Details

Agreement Cancellation Charge

To indicate applicability of charges or fees levied on setting up and / or amending direct debit creditor or debtor agreements, you can enable the Charges Applicable option in the PC Creditor Agreements screen.

The applicable charges are computed through the Interest and Charges (IC) module. For details, refer the Interest and Charges module user manual.

The preferences for product debtor categories are discussed in a later section of this chapter.

Payment Details 1, Payment Details 2, Payment Details 3 and Payment Details 4

Specify unstructured remittance information. The fields hold free format text of 35 characters each

Purpose of Collection

Specify the need of the collection transaction here. The field is optional.

Charge Reference Number

Specify the charge reference number in this field.

Transaction Type

Select the debit transaction type from the drop-down list. The options are:

- One-off

- Recurrent

Validity Details

Expiry Date

Specify the end date for a particular Creditor DD agreement here. On the maintained date, agreement status will get updated as 'Expired' as part of the existing batch process.

Agreement Status

Specify the value for the field. The value determines the status of the mandate at any point of time.

Options available for this field:

- Active - The agreement is available for usage.

- Used - One-Off transaction sent.

- Auto Cancelled - Agreement auto cancelled because of non-usage for specified period.

- Final - FRST, RCUR and FNAL transactions sent.

- Customer Cancelled - Agreement closed by Creditor.

- Expired - Agreement has crossed expiry date.

- Amended - Unique identification of an agreement changes.

Agreements with agreement status as 'Active' and record status as 'Open' is considered as valid agreement.

Modify operation changes the agreement status from 'Active' to 'Customer Cancelled' when creditor is initiating the closure of agreement.

Agreements with status as 'Used/Auto Cancelled/Final/Expired/Amended' cannot be changed back to 'Active'. There are validations to restrict this status change.

'Used/Auto Cancelled/Final/Expired/Amended' agreements can be closed and these agreements cannot be re-opened.

'Customer Cancelled' agreements can be closed and can be re-opened.

The agreement status is 'Active' for future effective dated agreements.

If a Final collection is rejected/cancelled/returned/reversed (i.e. any R transaction on a FNAL collection) then the agreement status will be changed back from 'Final' to 'Active'.

However if a Used collection is rejected/cancelled/returned/reversed (i.e. any R transaction on a OOFF collection) then the agreement status will not be changed back to Active but remain as Used.

For Outgoing Collection transactions, there will be a check for the existence of Creditor Mandate for the 'B2B' scheme if 'DD Agreement Required' is checked at customer agreement level. If the creditor mandate for the B2B scheme is not found, the outgoing collection will not be saved.

Effective Date

Specify the date from which the agreement is valid or invalid.

At the Customer Agreement level, you can choose the Agreement ID, Counterparty Bank and / or the Counterparty Account fields to validate the DD agreement details.

Amendment Reason

Specify the reason for which the mandate details are amended.

Effective date

Effective Date

Specify the date from which the agreement is valid or invalid.

Note

At the Customer Agreement level, you can choose the Agreement ID, Counterparty Bank and / or the Counterparty Account fields to validate the DD agreement details.

Amendment Reason

Specify the reason for which the mandate details are amended.

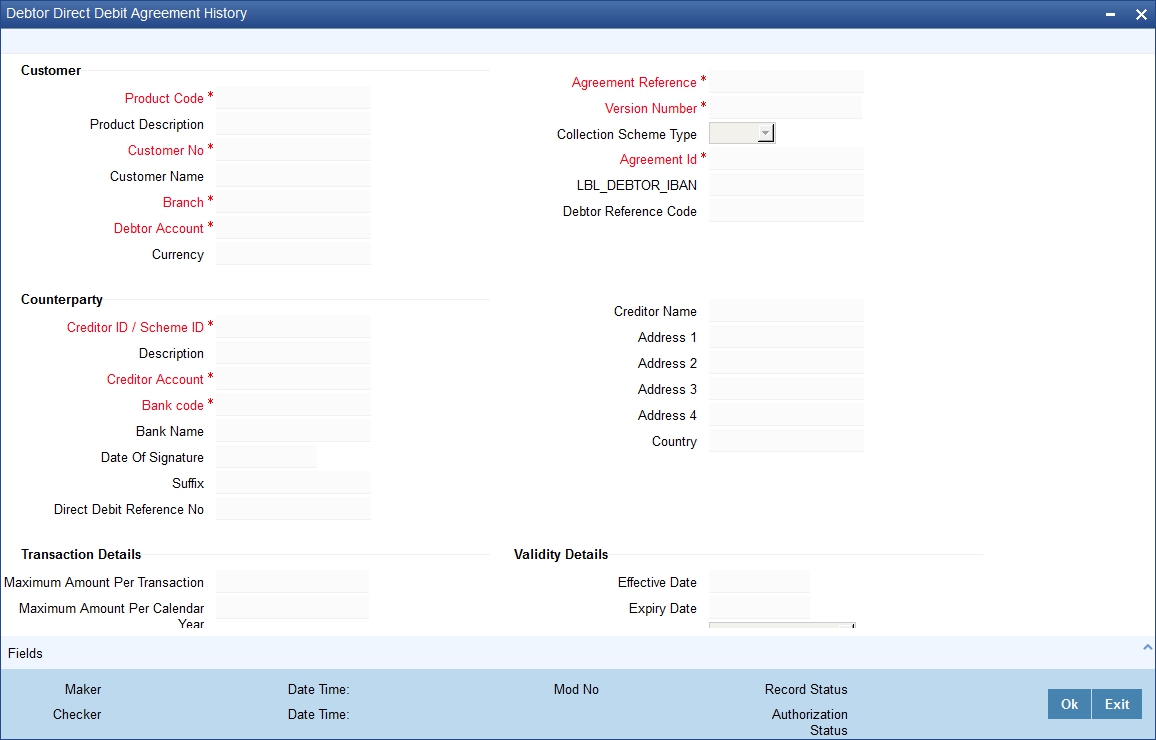

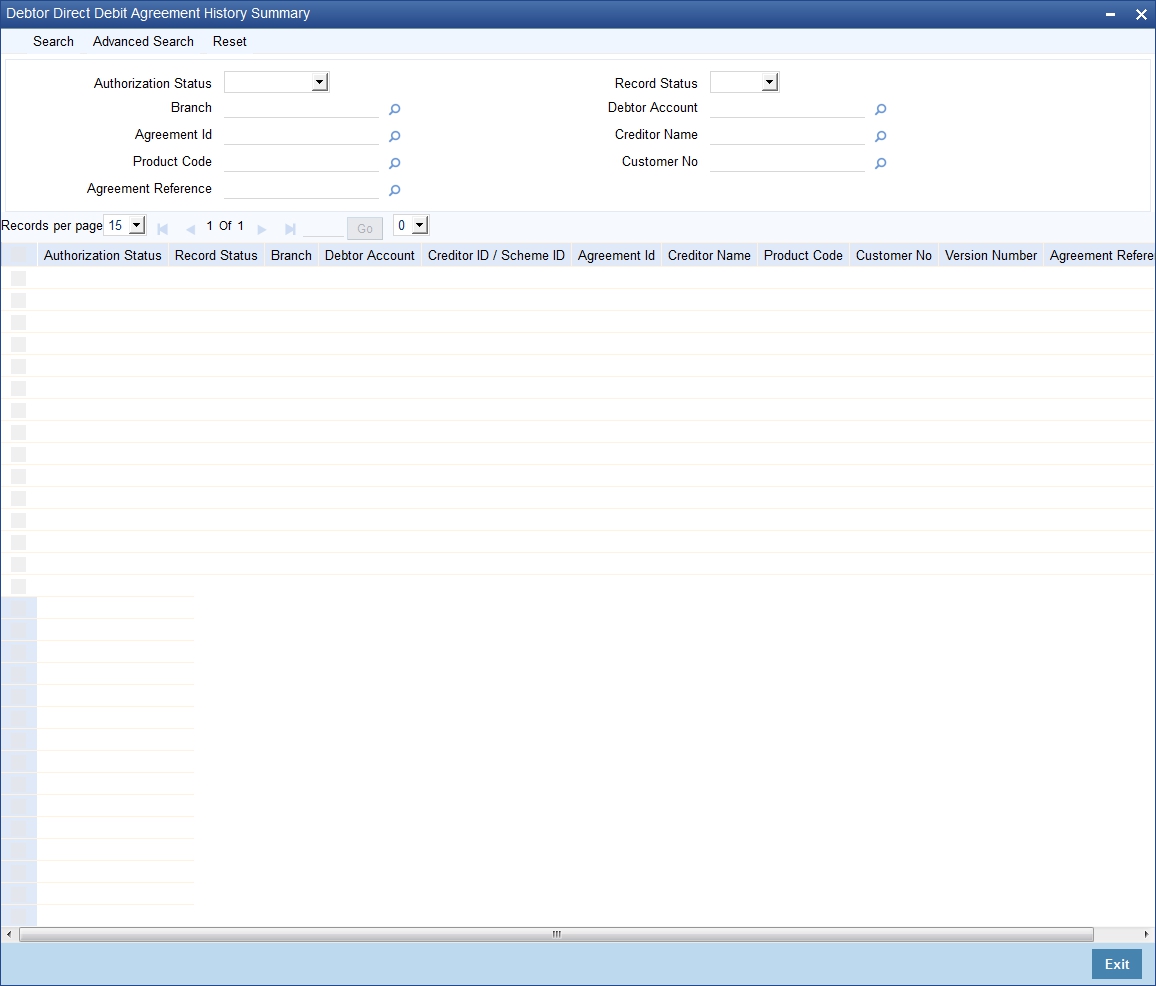

3.21 DD Agreement Details Maintenance for Debtors

This section contains the following topics:

3.21.1 Invoking the Debtor Direct Debit Agreement Maintenance

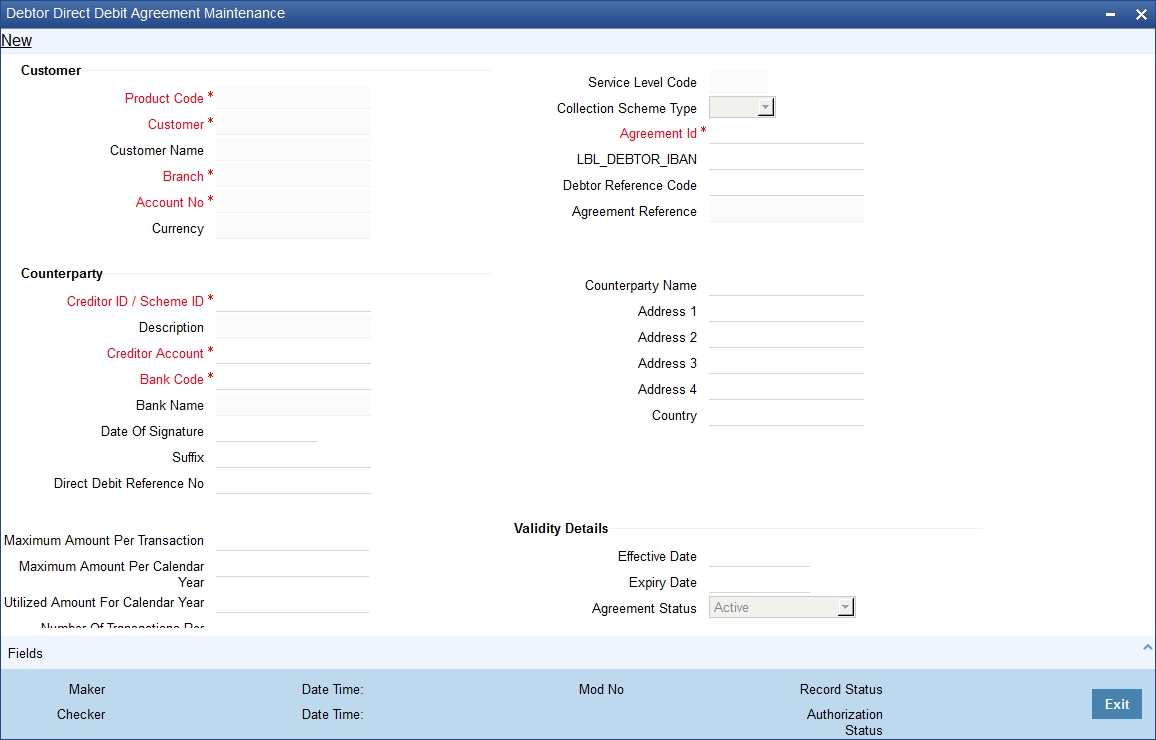

This agreement is maintained by your bank on behalf of customers who participate as debtors in a direct debit transaction. The details are maintained in the ‘Debtor DD Agreements’ screen.You can invoke this screen by typing ‘PCDDRAGT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The details maintained here will be used to validate incoming transactions (initiated by the creditor). The agreement is maintained for a Product, Customer and Customer Account combination only if the corresponding customer agreements exist and you have indicated that a DD agreement is required for the respective customer agreements.

Customer

Product Code

Select the product from the list option provided. This is applicable only if the corresponding customer agreements exist and you have indicated that a DD agreement is required for the respective customer agreements.

Customer

Specify the customer if the corresponding customer agreements exist and you have indicated that a DD agreement is required for the respective customer agreements.

Branch

Specify the branch if the if the corresponding customer agreements exist and you have indicated that a DD agreement is required for the respective customer agreements.Account No

Specify the account if the corresponding customer agreements exist and you have indicated that a DD agreement is required for the respective customer agreements.

Service Level Code

The system displays the value of 'Service Level Code' maintained at product level, once you select the product code.

Collection Scheme Type

The value for the field is defaulted from the selected product. The value is initially Specified in Payments and collections product definition screen (PCDPRMNT).

The field is used to differentiate 'B2B' scheme mandates from 'CORE/COR1' scheme mandates.

Agreement Id

Specify a unique ID to identify the agreement between the creditor and the debtor participating in a transaction.

Debtor IBAN

Specify International Bank Account Number of Creditor from the adjoining list of values (displaying IBAN number).If the number is not available in the list, and then insert the number in the field.

Debtor Reference Code

Specify the reference of the debtor of the mandate as the value for the field. The Maximum length of the field is 35 characters.The field is optional.

Charges Applicable

To indicate applicability of charges or fees levied on setting up and / or amending direct debit creditor or debtor agreements, you can enable the Charges Applicable option in the PC Debtor DD Agreements screen.

The applicable charges are computed through the Interest and Charges (IC) module. For details, refer the Interest and Charges module user manual.

Counterparty

Creditor ID / Scheme ID

Specify a value from a list of values. The list of values fetches the creditor ID's from 'Payments and Collections Creditor Details Maintenance'.

On selecting Creditor ID from list of values, FLEXCUBE defaults the address details in the corresponding fields.

Specify the value for the collection scheme types CORE, COR1 and B2B.The field value is validated against the format specified for 'Creditor ID/Scheme ID' field in 'Payments and Collections Creditors details maintenance (PCDCREID).

If the value is not available in the list of values. During save of the agreement, FLEXCUBE maintains a record for the entered Creditor ID in 'Payments and Collections Creditor Details Maintenance'.

While processing contracts for collection transaction, the system will validate Creditor Scheme Identifier for the space between the positions 5 and 7 in Creditor Scheme Identifier.

If there are spaces, then the system displays an error during manual contract creation in 'Payment & Collection Transaction Input'. Then the incoming messages will be moved to Transaction Repair queue. Positions 5 to 7 contain the creditor business code. When the creditor business code is not used, then value is set to 'ZZZ'. The creditor business code is not considered while checking for existence of the agreement.

Description

The system displays a description of the creditor identification specified.

Creditor Account

Specify the creditor account in Local Clearing Format (LCF). Banks within the same local clearing network will be assigned unique account numbers based on the local clearing format specific to the network.

Bank code

Select the bank of the counterparty (creditor).

Bank Name

Specify the name of the counterparty bank.

Date of Signature

Specify the date of signature from the adjoining calendar.

Suffix

Specify the suffix for the creditor.

Debtor IBAN

Specify International Bank Account Number of Creditor from the adjoining list of values (displaying IBAN number).If the number is not available in the list, and then insert the number in the field.

Direct debit Reference No

Specify the direct debit reference number.

Maximum Amount per Transaction

Specify maximum transaction amount allowed per incoming collection in this field.The amount is in Debtor's customer account's currency.The default value is null.

Maximum Amount per Calendar Year

Specify maximum sum of incoming collection transactions, allowed against particular mandate per calendar year as a value for the field.

Maximum value for this field is 999999999999999.99.The amount is in Debtor's customer account's currency.The field is optional and has a default value as null.

Utilized Amount for Calendar Year

The field displays sum of successful incoming collection transactions amount against particular mandate at any point of the time within a calendar year.

Number of Transactions per Calendar Year

Specify maximum number of incoming collection transactions allowed against particular mandate per calendar year.

Maximum value for this field is 999.

The field is optional and has a default value as null.

Utilized Transactions for Calendar Year

The field displays number of successful incoming collection transactions against particular mandate at any point of the time within a calendar year.

Address 1 2 3 and 4

Specify the counterparty address.

Agreement Cancellation Charge

To indicate applicability of charges or fees levied on setting up and / or amending direct debit creditor or debtor agreements, you can enable the Charges Applicable option in the PC Debtor DD Agreements screen.

The applicable charges are computed through the Interest and Charges (IC) module. For details, refer the Interest and Charges module user manual.

System applies mandate cancellation charge only if 'Charge Applicable' is checked.

For more details on mandate cancellation charges, refer section 'Maintaining Mandate Cancellation Charge Details' later in this chapter.

Charge Reference Number

System displays a reference number for the mandate cancellation charge.

For more details on mandate cancellation charges, refer section 'Maintaining Mandate Cancellation Charge Details' later in this chapter.

Transaction Type

Specify the value from the adjoining drop-down list.

The list has following options:

- One-off

- Recurrent

Maximum length for this field is 9. Transaction type is mandatory if the collection scheme type is 'B2B'.

Payment Details 1, Payment Details 2, Payment Details 3 and Payment Details 4

Specify unstructured remittance information. The fields hold free format text of 35 characters each.

Purpose of Collection

Specify the need of the collection transaction here. The field is optional.

Validity Details

Expiry Date

Specify the end date for a particular Creditor DD agreement here. On the maintained date, agreement status will get updated as 'Expired' as part of the existing batch process.

Agreement Status

Specify the value for the field. The value determines the status of the mandate at any point of time.

Options available for this field:

- Active - The agreement is available for usage.

- Used - One-Off transaction sent.

- Auto Cancelled - Agreement auto cancelled because of non-usage for specified period.

- Final - FRST, RCUR and FNAL transactions sent.

- Customer Cancelled - Agreement closed by Creditor.

- Expired - Agreement has crossed expiry date.

- Amended - Unique identification of an agreement changes.

Agreements with agreement status as 'Active' and record status as 'Open' is considered as valid agreement.

Modify operation changes the agreement status from 'Active' to 'Customer Cancelled' when creditor is initiating the closure of agreement.

Agreements with status as 'Used/Auto Cancelled/Final/Expired/Amended' cannot be changed back to 'Active'. There are validations to restrict this status change.

'Used/Auto Cancelled/Final/Expired/Amended' agreements can be closed and these agreements cannot be re-opened.

'Customer Cancelled' agreements can be closed and can be re-opened.

The agreement status is 'Active' for future effective dated agreements.

If a Final collection is rejected/cancelled/returned/reversed (i.e. any R transaction on a FNAL collection) then the agreement status will be changed back from 'Final' to 'Active'.

However if a Used collection is rejected/cancelled/returned/reversed (i.e. any R transaction on an OOFF collection) then the agreement status will not be changed back to Active but remain as Used.

For Outgoing Collection transactions, there will be a check for the existence of Creditor Mandate for the 'B2B' scheme if 'DD Agreement Required' is checked at customer agreement level. If the creditor mandate for the B2B scheme is not found, the outgoing collection will not be saved.

Effective Date

Specify the date from which the agreement is valid or invalid.

- The effective date from which the debtor agreement becomes valid

Note

At the Customer Agreement level, you can choose the Agreement ID, Counterparty Bank and / or the Counterparty Account fields to validate the DD agreement details.

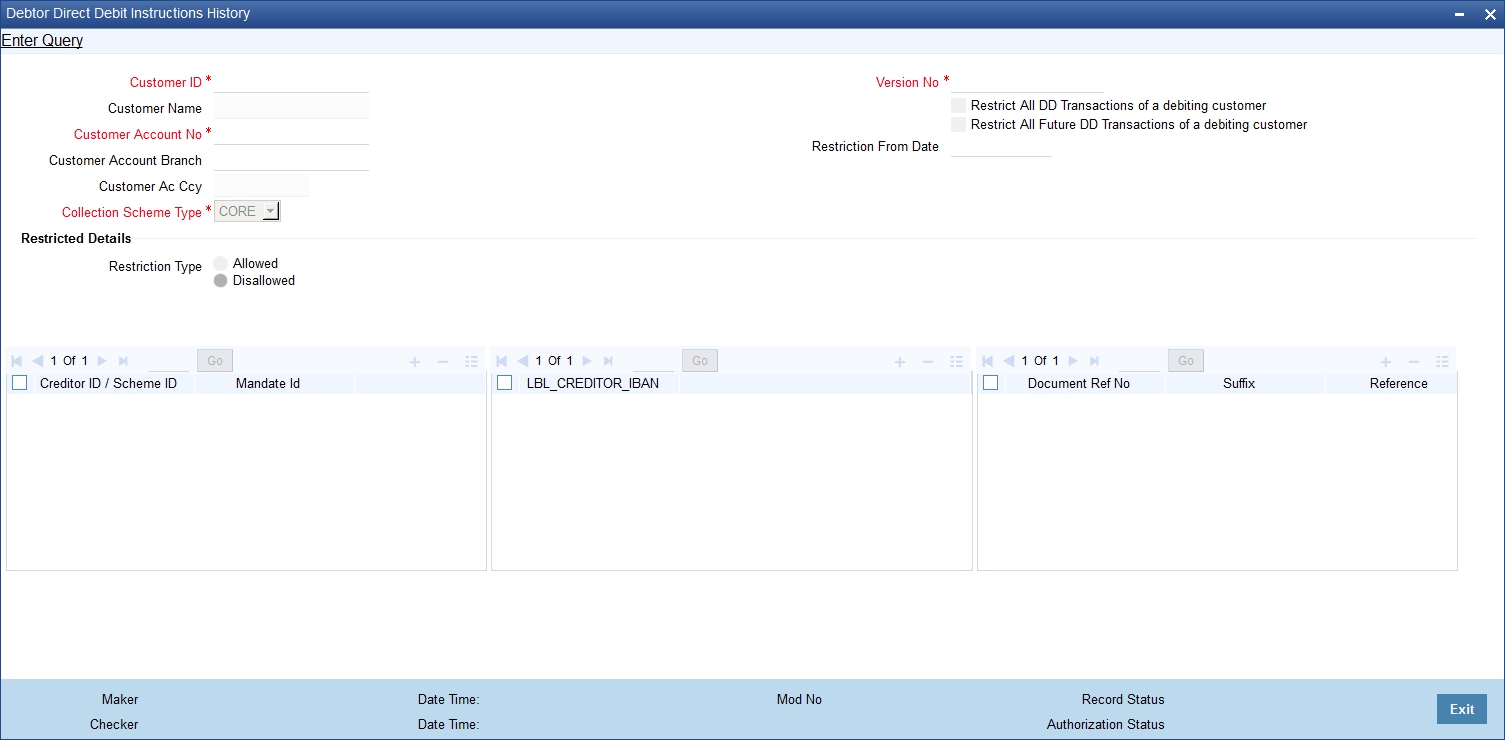

3.22 Debtor Direct Debit Instructions Maintenance

This section contains the following topics:

- Section 3.22.1, "Maintaining the Debtor Direct Debit Instructions"

- Section 3.22.2, "Processing of Incoming Collection Transaction for a Mandate"

- Section 3.22.3, "Processing Based on Sequence Type"

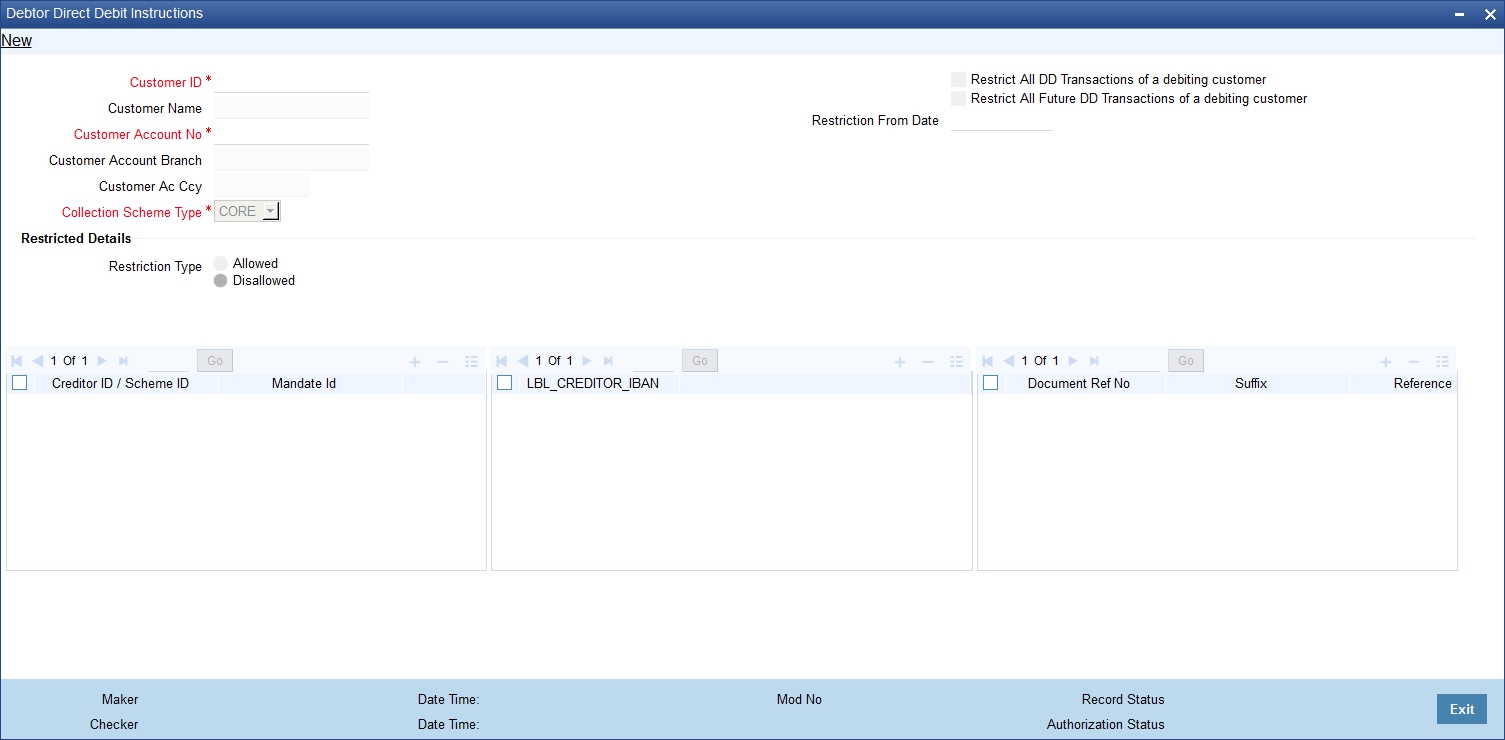

3.22.1 Maintaining the Debtor Direct Debit Instructions

You can maintain details of debtor direct debt instructions in 'Debtor Direct Debit Instructions' screen. You can invoke this screen by typing 'PCDIDRES' in the field at the top right corner of the Application tool bar and click on the adjoining arrow button.

The following details are captured in the screen:

Customer Id

Select the customer ID from the adjoining option list

Customer Name

System defaults the Customer name based on the Customer ID selected.

Customer Account No

Specify the value for the field. It helps in identifying a particular instruction.

List of values will be attached to display the list of customer accounts. List of values will also have 'ALL' value.

The Debtor DD instruction can be set up at a customer level or at a customer account level. If specified at a customer level then the customer account and Branch should be with value 'ALL'.

Customer Account Branch

The field displays customer account branch. The value for the field gets populated on selecting Customer Account.

Collection Scheme Type

Specify the value for the field from the adjoining drop-down list, to distinguish the Debtor restriction instructions across collection scheme types.

The following options are available for this field:

- CORE

- COR1

- B2B

- ALL

The field is mandatory.

Customer Account Currency:

The field displays customer account currency. The value for the field gets populated on selecting Customer Account.

Restrict All DD Transactions

Check this box to reject all Incoming DD transactions for the selected customer

Restrict All Future DD Transactions

Check this box to reject all Incoming future DD transactions for the selected customer

Restriction from Date

Select the date from which the future DD transactions to be restricted using the adjoining calendar. You need to enter the date only if you have selected the option 'Restrict All Future DD Transactions'.

Restrict All DD Transactions of Ordering Customer

Restriction Type

A list of creditors are either allowed or restricted from initiating the collection transactions.

The restriction types are:

- Allowed - > Represents the approved (White Listed) Creditors.

- Disallowed - > Represents the disapproved (Black listed) Creditors.

The parameters that are used to identify the incoming collection transaction and restrict or allow collection from processing are:

- Creditor ID/Scheme ID

- Debtor Mandate ID

- Creditor IBAN

The default value is 'Disallowed'.

Creditor ID / Scheme ID

The field is optional and accepts multiple values.

Specify the Creditor ID for NON-SEPA scheme and Creditor Scheme ID for SEPA scheme here.

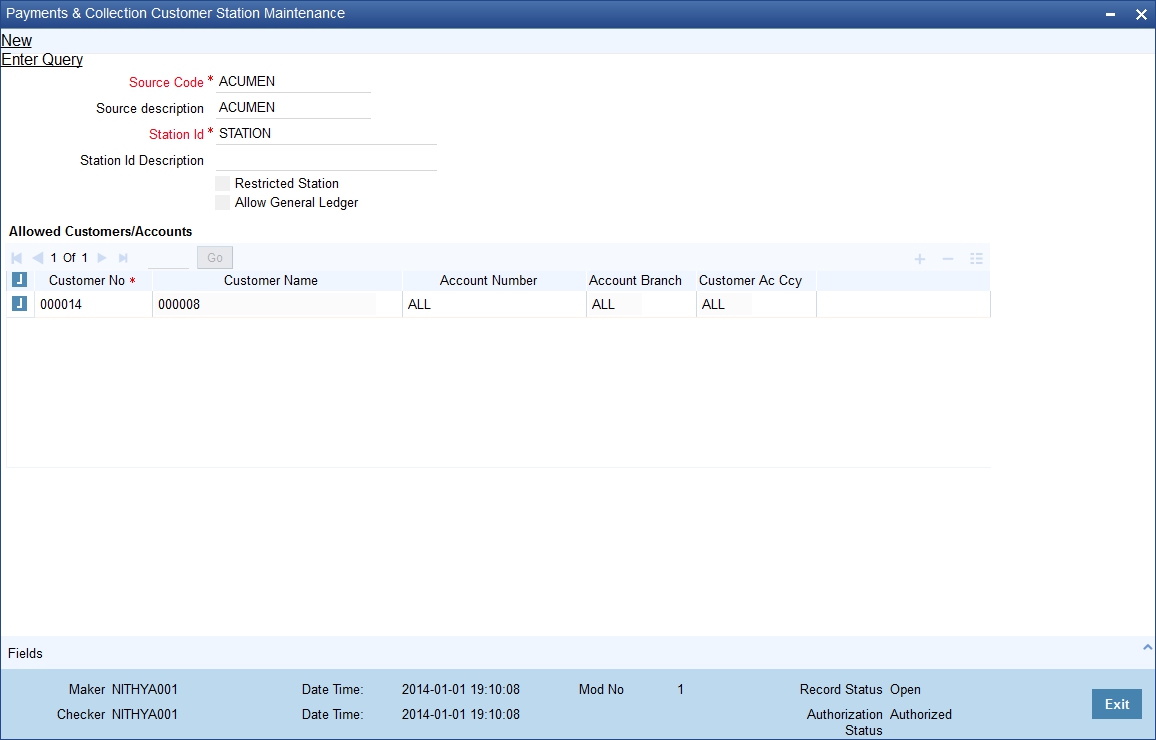

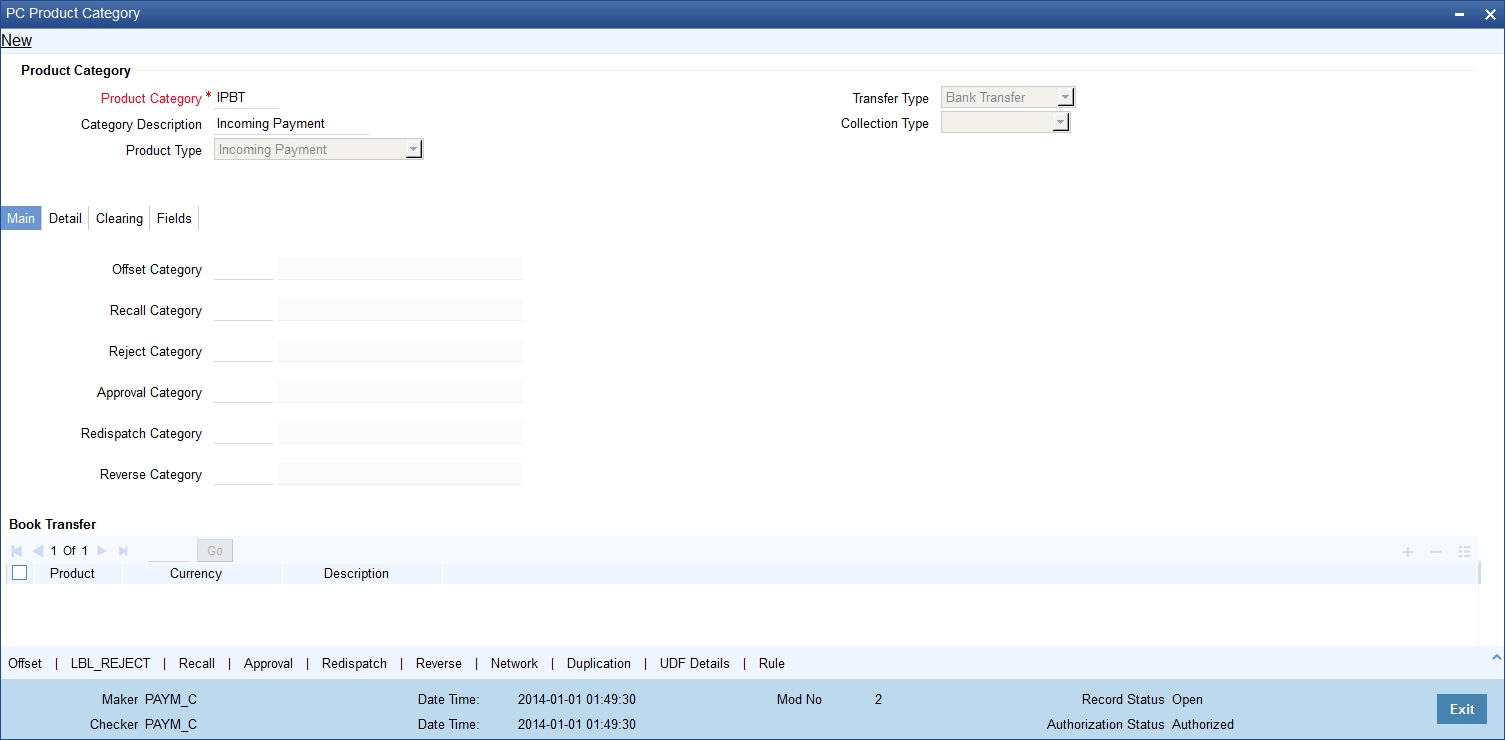

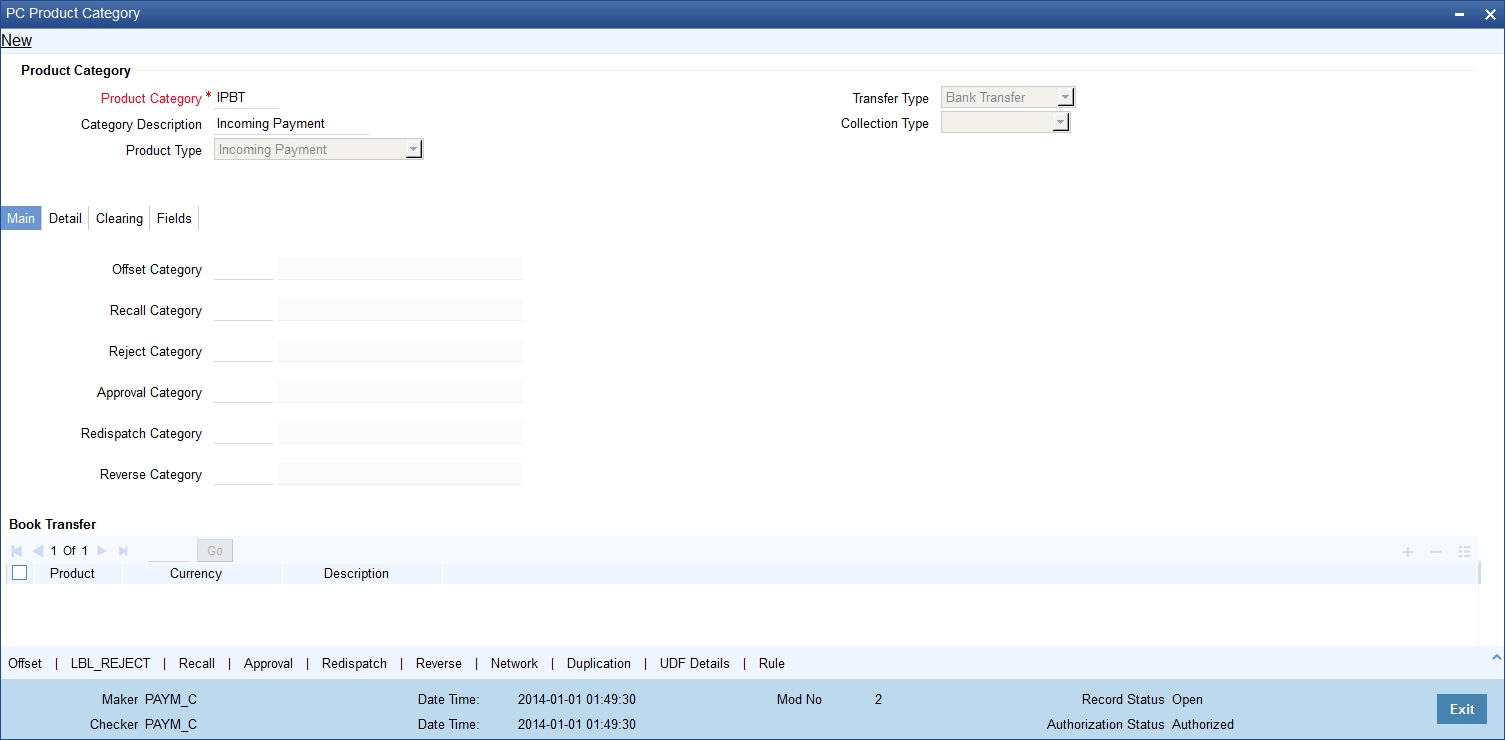

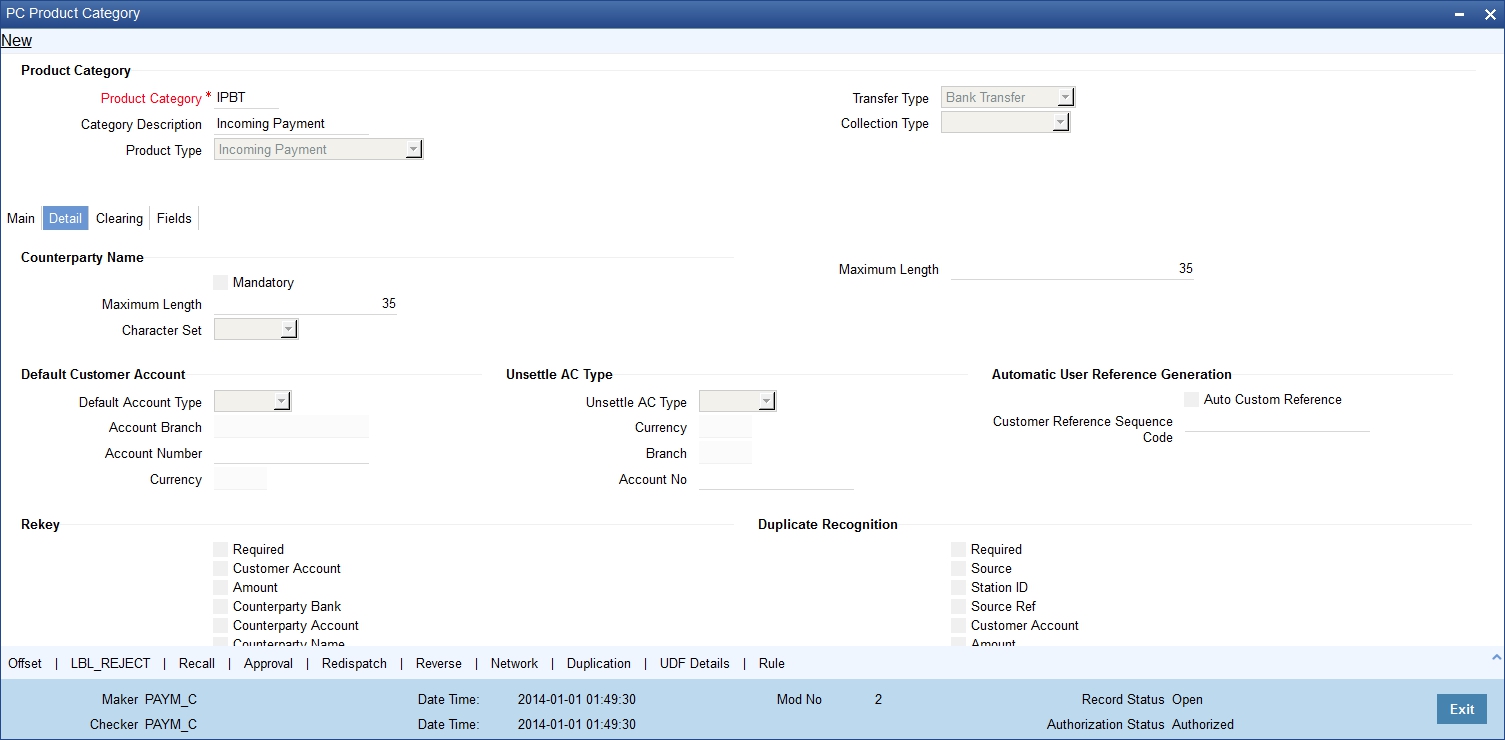

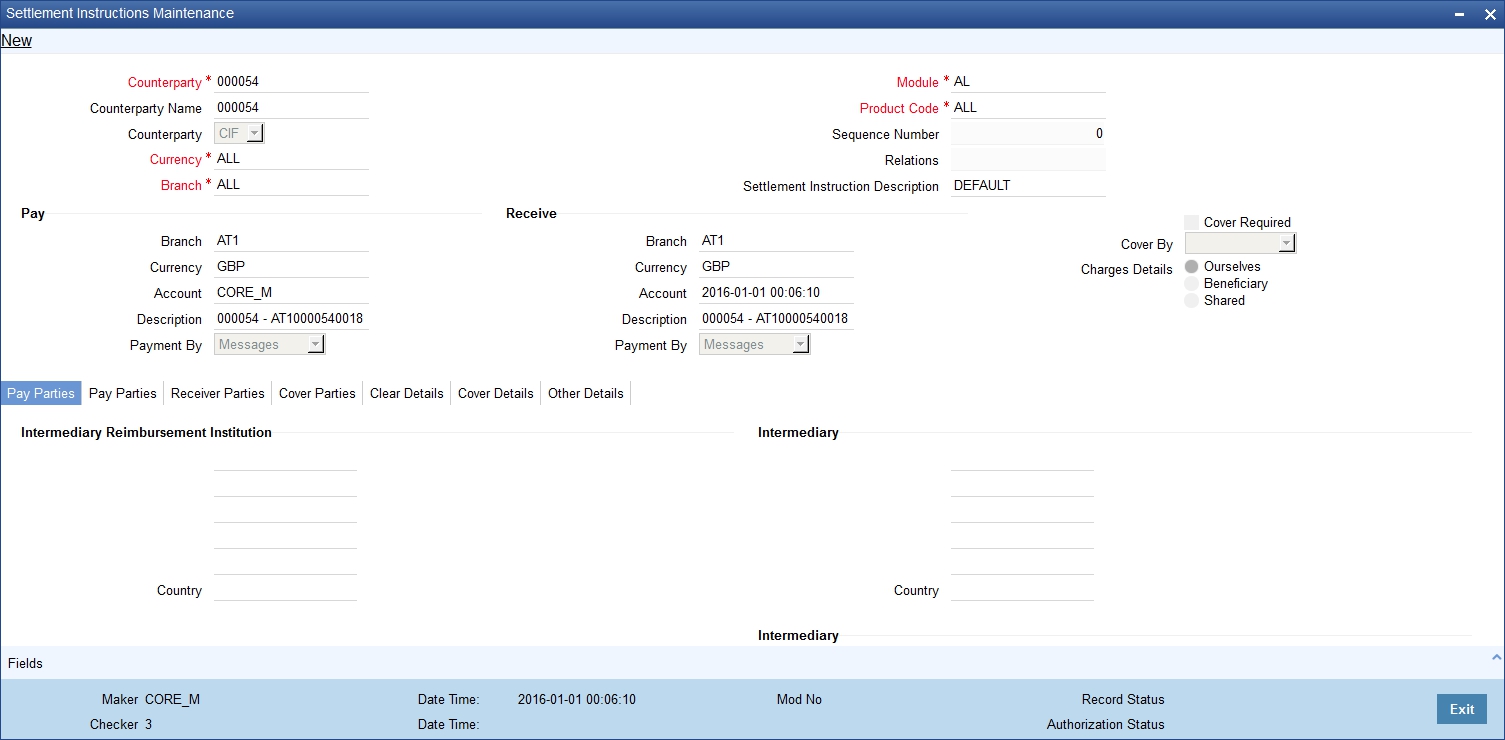

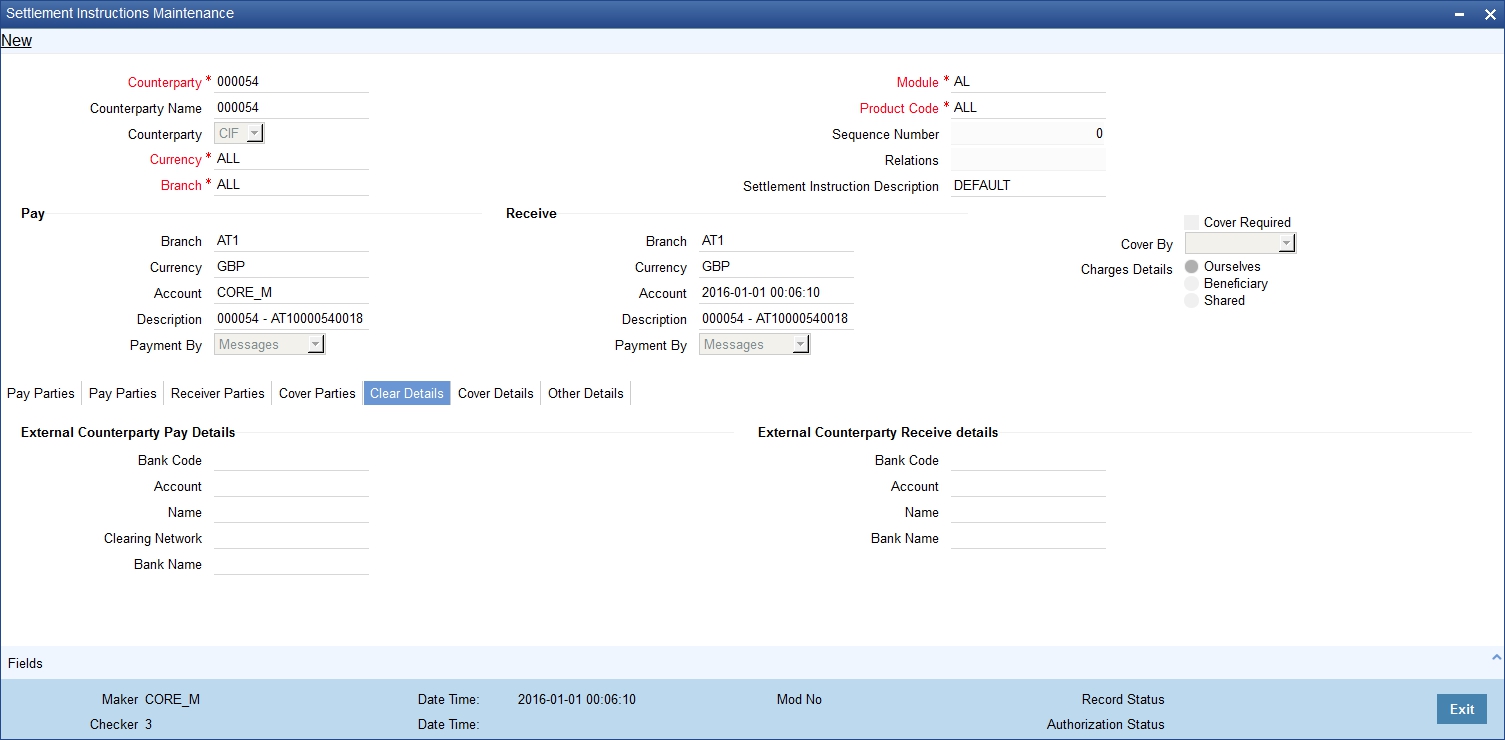

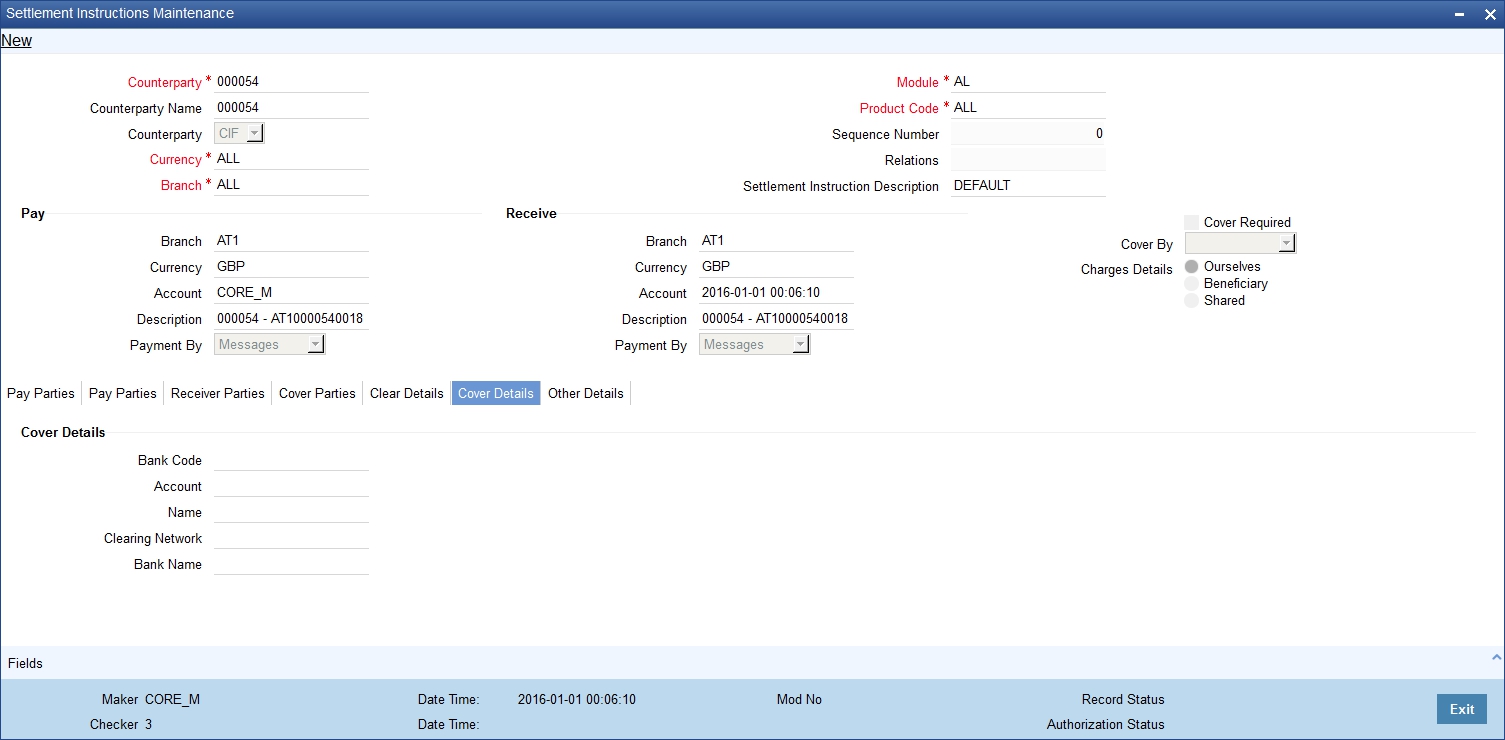

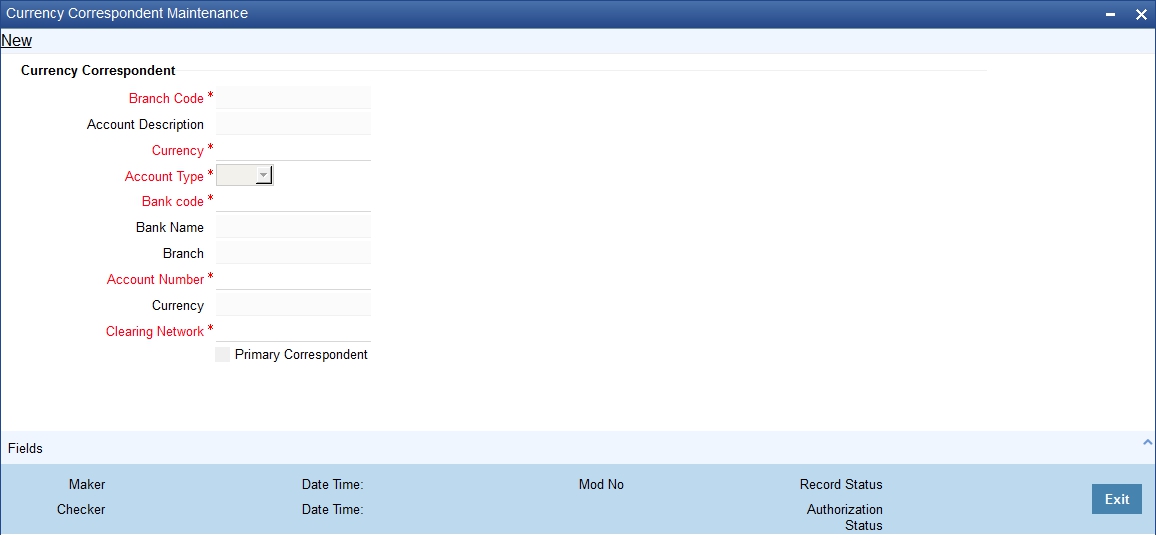

The value for the field can be specified from a list of values. The list of values fetches the creditor ID's from 'Payments and Collections Creditor Details Maintenance'.