6. Levying Charges on Payments and Collections Transactions

At your bank you can opt to levy charges on payments and collection transactions in any of the following ways:

- As a flat amount

- As a percentage of the transaction amount

You can also apply charges depending upon the level at which they need to be applied when levied on a transaction, by building a charge rule and a charge class:

- For all the accounts of a customer

- For a particular customer account

- For all transaction currencies

- For a specific transaction currency

Charges that you levy on a payments or collection transaction are computed when the transaction is initiated, and are liquidated along with the transaction.

The Charge Mode

Also, you can levy charges either as a premium (collected over and above the transaction amount) or a discount (discounted from the transaction amount). This is known as the charge mode, and can be specified for each payments / collections product category, so as to default to any transactions processed under the product category.

This chapter contains the following sections:

- Section 6.1, "Charge Specifications for a Payment/Collection Product".

- Section 6.2, "Charge Rules"

- Section 6.3, "Parameter Specification for Charge Rule Application"

- Section 6.4, "Charge Account Maintenance"

- Section 6.5, "Charge Product Categories Maintenance"

6.1 Charge Specifications for a Payment/Collection Product

This section contains the following topics:

- Section 6.1.1, "Invoking the Products Condition Maintenance Screen"

- Section 6.1.2, "Specifying Charge Components"

- Section 6.1.3, "Specifying Charges "

6.1.1 Invoking the Products Condition Maintenance Screen

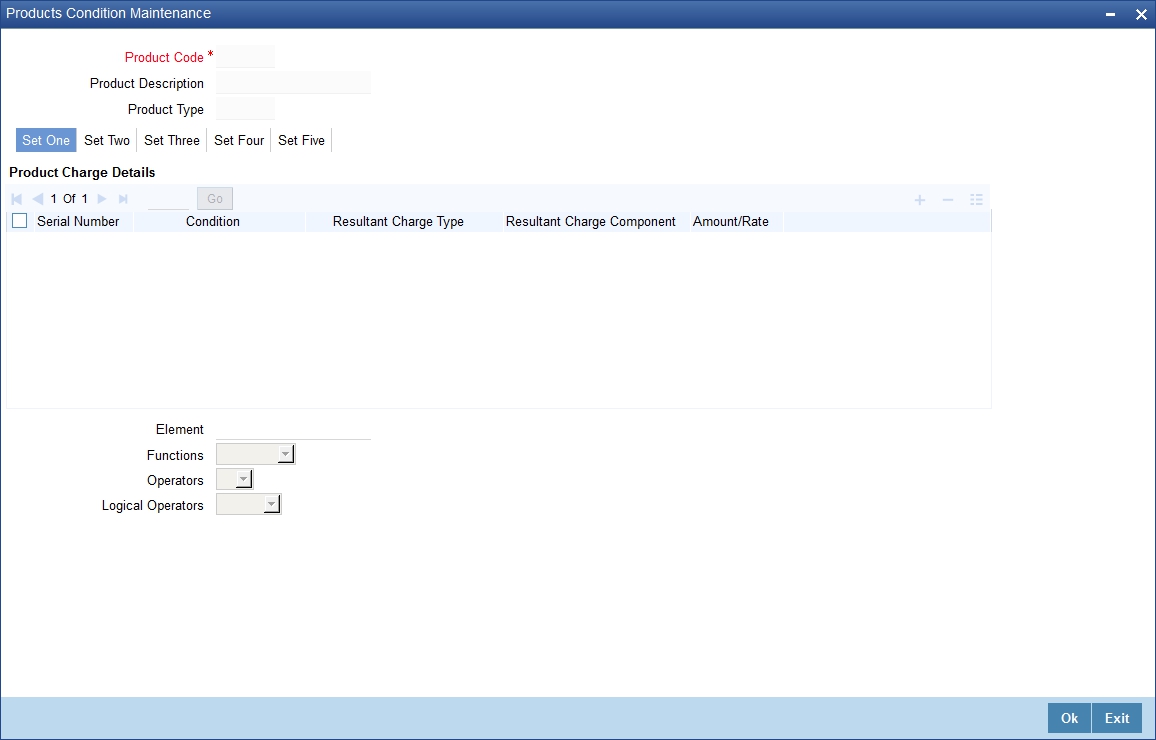

When maintaining a Payment / Collection product, you can define the manner in which charges should be levied on transactions processed under the product. You can ‘build’ your specifications in the ‘Products Condition Maintenance ‘screen. Invoke this screen by clicking ‘Expression’ button in the ‘Payments and Collection Product Maintenance’ (PCDPRMNT) screen.

For each set of conditions that you build, you can indicate whether the resultant charge must be a flat amount, a percentage of the transaction amount or computed as a charge component such as a charge rule or a charge class. You must indicate this in the Resultant Charge field, by choosing from the drop down list.

For details about building charges as components such as charge rules and charge classes, refer the section Building Charge Rules found later on in this chapter.

The following example illustrates the manner in which you can build your charge specifications for a product.

For example, assume you would like to define the following charges for a product linked to the clearing network:

- A network charge

- Charges for transactions initiated manually

- Charges for transactions initiated through EB

You would build the expression for the first charge (for processing transactions over the clearing network) as follows:

Set |

Condition No. |

Case |

Charge Code |

1 |

1 |

No condition |

CNSY |

You would build the expression for the second charge as follows:

Set |

Condition No. |

Case |

Charge Code |

2 |

1 |

IF Manual and Internal payments THEN |

CMIN |

2 |

2 |

ELSE IF Manual and Inter-branch payments THEN |

CMIB |

2 |

3 |

ELSE IF Manual and Standing order charge THEN |

CMSO |

2 |

4 |

ELSE IF Manual and Payment remittance by fax THEN |

CMPF |

2 |

5 |

ELSE IF Manual and Payment remittance on paper form THEN |

CMPP |

You would build the expression for the last charge as follows:

Set |

Condition No. |

Case |

Charge Code |

3 |

1 |

IF Through EB and Internal payments THEN |

CEIN |

3 |

2 |

ELSE IF Through EB and Inter-branch payments THEN |

CEIB |

3 |

3 |

ELSE IF Through EB and Standing order charge THEN |

CESO |

3 |

4 |

ELSE IF Through EB and Payment remittance by fax THEN |

CEPF |

3 |

5 |

ELSE IF Through EB and Payment remittance on paper form THEN |

CEPP |

Note that the expressions ‘IF’, ‘THEN’, and ‘ELSE’ are used to better explain the procedure of setting up a charge for different transactions conditions. When building an expression in this screen, these are implicit and exclusive within a single set. Note that you should use single quotation marks while defining the value of the condition. For example: IF value is =’0’.

The charges defined for a product are automatically applied on all transactions processed under the product. The charges applied on transactions are liquidated according to the frequency specified for the Charge Class.

6.1.2 Specifying Charge Components

After you have built the conditions based on which the charges will be levied, you must also indicate, during product definition, the accounting roles and amount tags to be used to pass the requisite accounting entries for charges.

To recall, charges levied on payments and collection transactions are computed at the time of transaction initiation, and are liquidated along with the contract.

The amount tags available for charges on payments and collection transactions are the CHG_AMT tags, which must be mapped to the CRLQ and DRLQ events, (depending upon which of these is the event for the customer leg of the transaction) during product definition.

For details about associating accounting roles and amount tags, and accounting entries for events, during product definition, refer the chapter Defining a Product in this user manual.

6.1.3 Specifying Charges

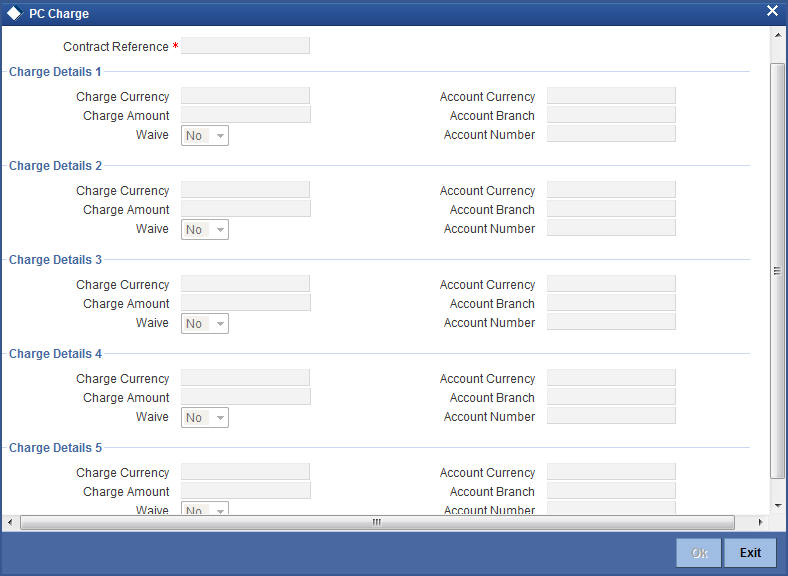

Charges on a payments / collection contract are computed based on the condition sets maintained (in the ‘Product Conditions Maintenance’ screen) for the product that the contract uses. Click ‘Charges’ button in the ‘Payments & Collections Transaction Input’ and invoke this screen.

When you enter a payments / collection contract, you can:

- View the details of charges computed for each set of conditions maintained for the product

- Alter the computed charge amount. The system will consider the transaction currency for charge computation.

- Waive the charge altogether, if waivers are allowed in the Product

Preferences.

The details of the charges computed for each condition set are displayed, and you can make your changes, or waive the charge, if necessary.

If you make any changes to the charge amount, or waive it, an override is sought when you attempt to save the contract.

6.2 Charge Rules

This section contains the following topics:

6.2.1 Setting up Charge Rules

In Oracle FLEXCUBE, you can define charges for different types of payment / collection transactions, which could be applied at the following levels:

- For all the accounts of a customer

- For a particular customer account

- For all transaction currencies

- For a specific transaction currency

6.2.2 Invoking the ICCF Rule Maintenance Screen

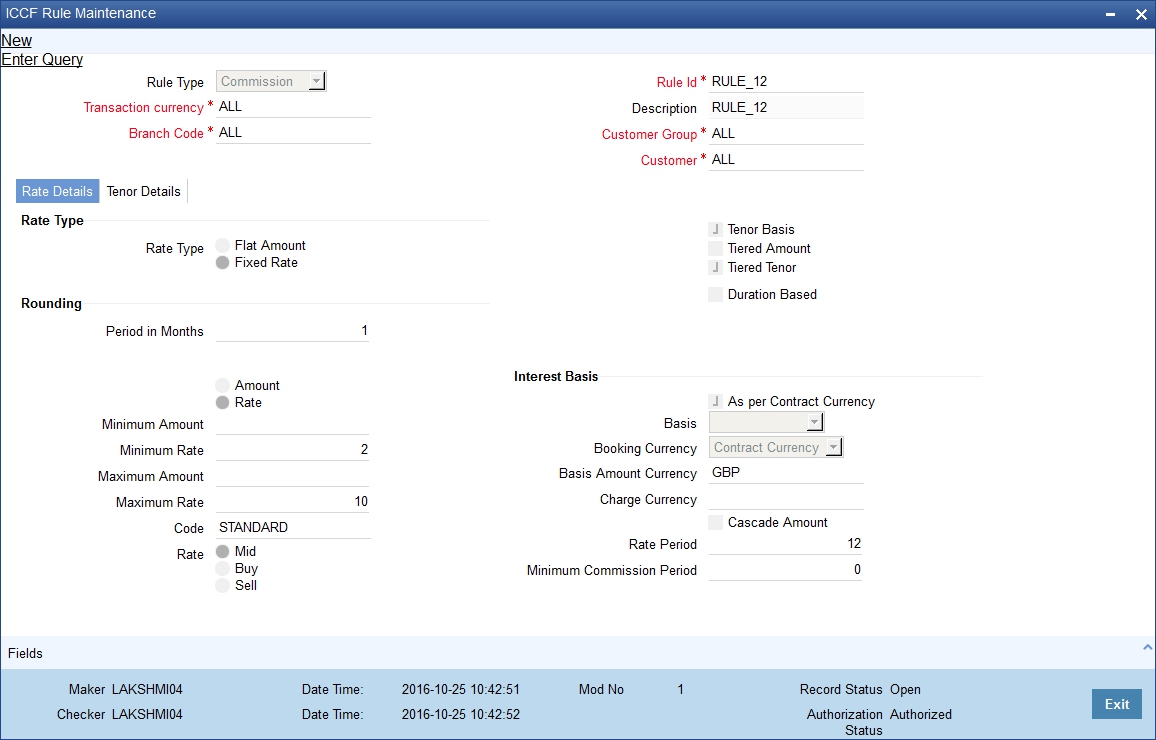

You can specify the level at which a transaction charge applies when building a Charge Rule at your bank in ‘ICCF Rule Maintenance’ screen (‘CFDRUMNE’).

When building a charge rule, you can identify the transaction currency and customer on which the rule applies. To define a standard charge rule that applies across your bank, you would choose the ‘ALL’ option at all levels. (That is, you would select ‘All’ at the transaction currency and customer fields). When defining a charge rule, you can choose to apply it selectively at one or more levels.

For details on building Charge Rules, refer the ‘Charges’ chapter in the Modularity User Manual.

6.3 Parameter Specification for Charge Rule Application

This section contains the following topic:

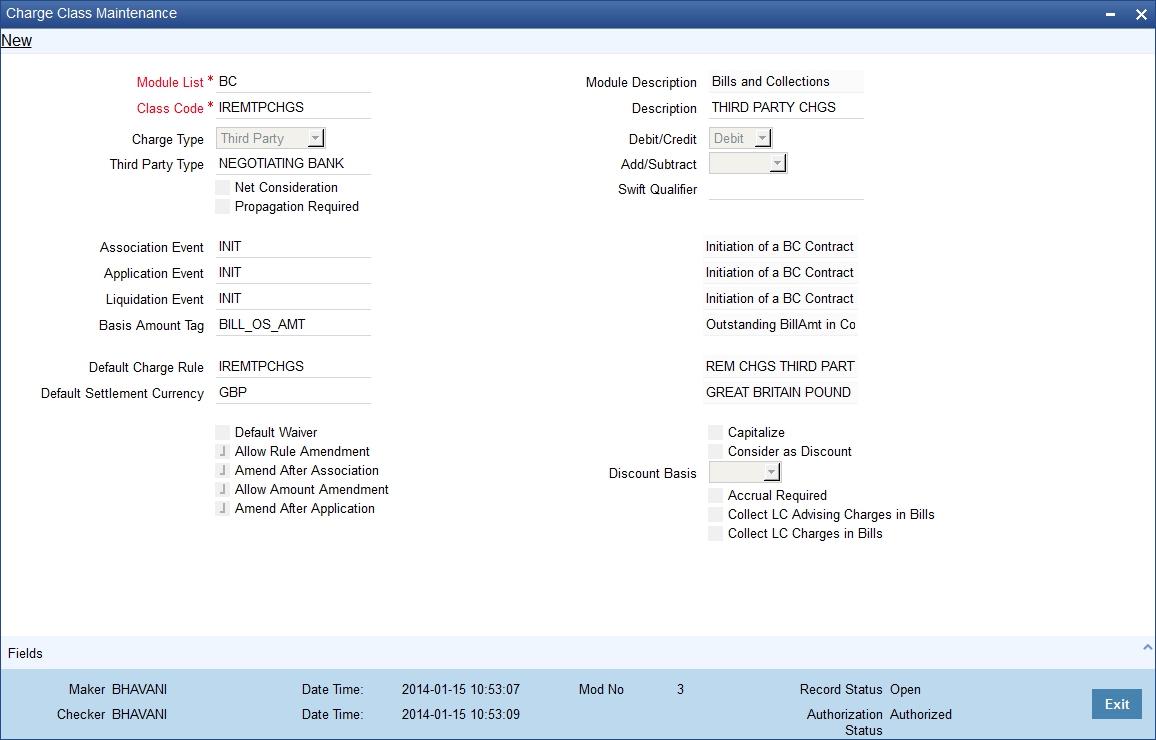

6.3.1 Invoking the Charge Class Maintenance Screen

You can specify the parameters for charge rule application when building the Charge Class to which you associate the charge rule.To invoke this screen, type ‘CFDCHGCE’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

The charge rule specifies the amount to be charged to the customer.

To recall, charges levied on payments and collection transactions are computed at the time of transaction initiation, and are liquidated along with the contract.

The amount tags available for charges on payments and collection transactions are the CHG_AMT tags, which must be mapped to the CRLQ and DRLQ events, (depending upon which of these is the event for the customer leg of the transaction) during product definition.

The accounting entries and advices that would be generated during the payment or collection lifecycle depend, therefore, on the specifications made at the product definition level.

For details relating to building Charge Classes, refer the ‘Charges’ chapter in the Modularity User Manual.

6.4 Charge Account Maintenance

This section contains the following topics:

- Section 6.4.1, "Maintaining Charge Accounts"

- Section 6.4.2, "Invoking the Charge Account Maintenance Screen"

6.4.1 Maintaining Charge Accounts

Oracle FLEXCUBE allows you to book charges for payment / collection transactions to an account different from the transaction account. The charge account, so designated accumulates the charges levied across transactions, and the sum of the accumulated charges is swept in to the transaction account at a desired frequency.

You can specify a charge account to be applicable to:

- One, many or all accounts of a particular customer

- One, many or all products

- One, many or all charge components

- One, many or all currencies

- Any combination of the above

6.4.2 Invoking the Charge Account Maintenance Screen

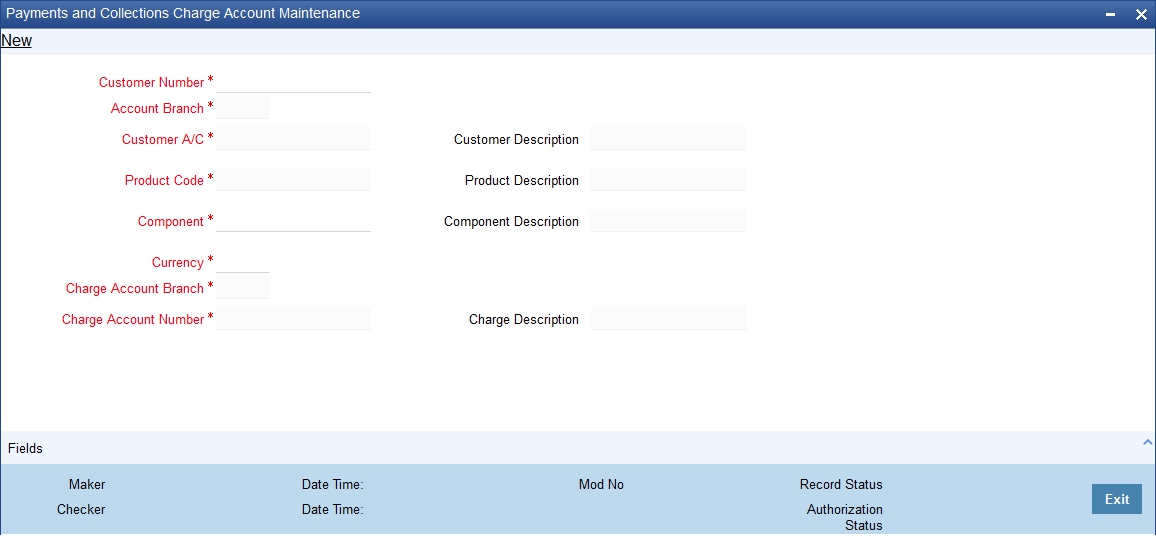

The ‘Charge Account Maintenance’ screen allows you to set up the charge account. You can invoke this screen by typing ‘PCDCHACM’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Charge Account Mapping

Customer Number

Select the number of the customer that is stored for charge mapping.

To view the joint holder’s details of an account and the mode of operation maintained at the account level, place the cursor on the Customer Number field and press Ctrl+J. The system displays the ‘Joint Holder’ screen.

For more information on the ‘Joint Holder’ screen refer to the section ‘Joint Holder Maintenance’ in the Core User Manual.

Customer Accounts Branch

Select the branch of the account that a customer is holding for charges mapping.

Customer Account

Select an account for the customer that is eligible for charge mapping.

Product code

Select the product code that is applicable for charge mapping.

Component

Select the component that is used to levy the charge.

Currency

Select a currency that will be used collecting the charges.

Charge Account Branch

Select the branch where the charge is levied on the customers account.

Charge Account

Charge account is an income GL where the charges collected by the bank will be posted.

To view the joint holder’s details of an account and the mode of operation maintained at the account level, place the cursor on the Charge Account Number and press Ctrl+J. The system displays the ‘Joint Holder’ screen.

For more information on the ‘Joint Holder’ screen refer to the section ‘Joint Holder Maintenance’ in the Core User Manual.

6.5 Charge Product Categories Maintenance

This section contains the following topics:

6.5.1 Invoking the Payments and Collections Charge Category Maintenance Screen

Your bank may wish to obtain statistics relating to transaction volumes of a customer for the purpose of extending preferential service / charges. You may wish to collect such volume statistics separately for transactions involving different product categories. When you compute the total business volumes that a customer has given your bank over a certain period, you might wish to consider only certain product categories.

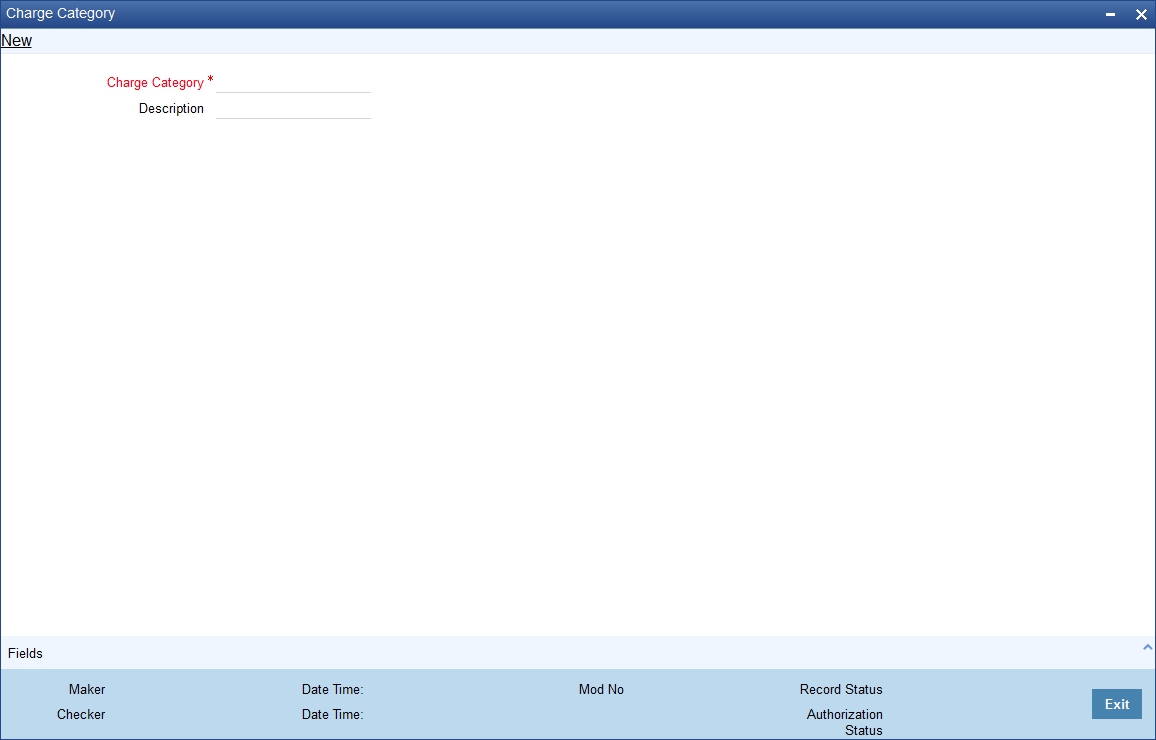

The ‘Payments and Collections Charge Category Maintenance’ screen allows you to name and describe such product categories as will be considered for computing transaction volume statistics in the ‘Product Preferences’ screen. You can invoke this screen by typing ‘PCDPROCH’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Charge Product Category

Specify the category to which a charge product belongs to.

Description

You can describe the category for charges which are maintained by the bank.

The transaction statistics so collated under various product categories may be used to define charge rules at the product definition level.