3. Reports and Advice

This chapter deals with the various BIP Reports and BIP Advices that are available for the Retail Loan Creation process.

This chapter contains the following topics:

To generate any of these reports go to Task tab, Under Origination menu, choose Reports. A list of reports in Origination module will be displayed. You can choose to View or Print the report on clicking of the particular report.The selection options that you specified while generating the report a printed at the beginning of every report.

3.1 BIP Reports

This section contains the following topics:

- Section 3.1.1, "Pipeline Deals"

- Section 3.1.2, "Approved Deals Over a Period"

- Section 3.1.3, "Trend Analysis Over a Period"

- Section 3.1.4, "Statistical Report"

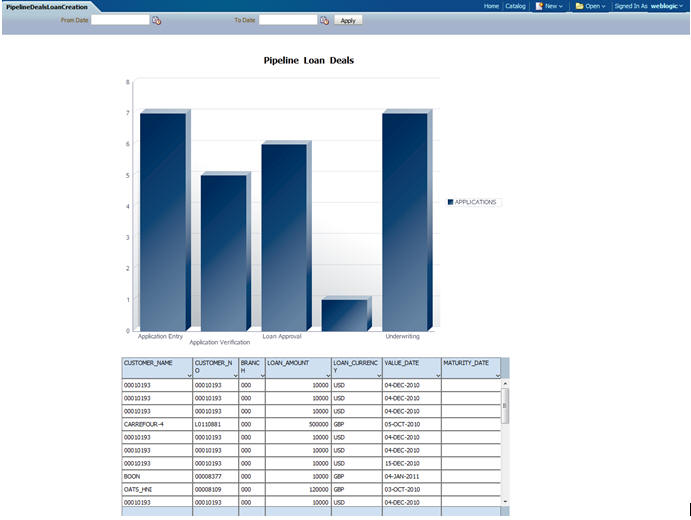

3.1.1 Pipeline Deals

You can view the list of tasks which are available in the review and approval stages of loan creation process in this interactive report. This report displays the pipeline task count summary. You can click the review and approval stages to view the task details like customer name, customer number, branch, amount, currency, value date, maturity date and so on.

3.1.1.1 Pipeline Loan Deals

In the interactive BIP report Pipeline Loan Deals the system displays the summary of the tasks based on the pipeline deals available in the specified years.

Header

The header carries the report title, from year and to year.

Body of the Report

The following details are displayed in the report:

Field Name |

Description |

First Section |

|

Stage |

The name of the stage. |

Pipeline Task Count |

The task count in the specific stage. |

Second Section |

|

Customer Name |

The name of the customer who has requested for loan. |

Customer No |

The customer reference number. |

Branch Code |

The branch code for the loan. |

Loan Amount |

The loan amount. |

Loan Currency |

The loan currency. |

Value Date |

The value date of the loan. |

Maturity Date |

The maturity date of the loan. |

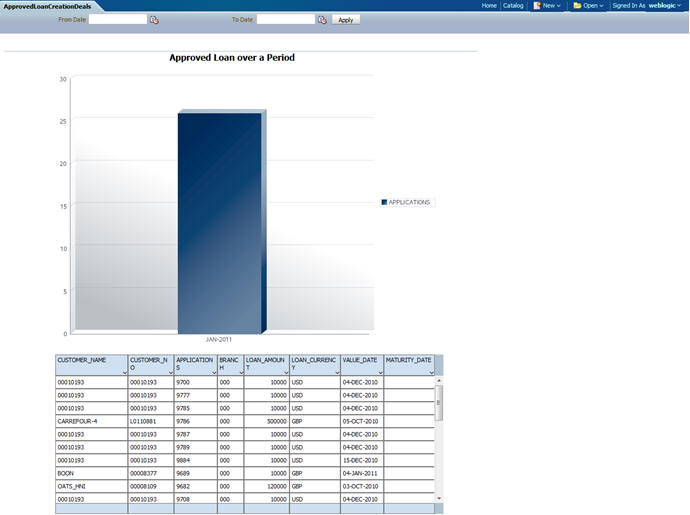

3.1.2 Approved Deals Over a Period

You can view the list of tasks which are approved over a specified period in ‘Approved Loan Over a Period’ report. This report displays the summary of new retail loan applications and corresponding tasks approved over the period. Click ‘Life Cycle Events’ to view the task details like customer name, branch, amount, currency, value date and maturity date.

3.1.2.1 Approved Loan Over a Period

In the interactive BIP report Approved Loan Over a Period, the system displays the task counts which are performed over the specific year. You can click each month to view the corresponding task details.

Header

The header carries the report title, from year and to year.

Body of the Report

The following details are displayed in the report:

Field Name |

Description |

First Section |

|

Month |

|

Creation |

|

Second Section |

|

Customer Name |

The name of the customer who has requested for loan. |

Customer No |

The customer reference number. |

Branch Code |

The branch code for the loan. |

Loan Amount |

The loan amount. |

Loan Currency |

The loan currency. |

Value Date |

The value date of the loan. |

Maturity Date |

The maturity date of the loan. |

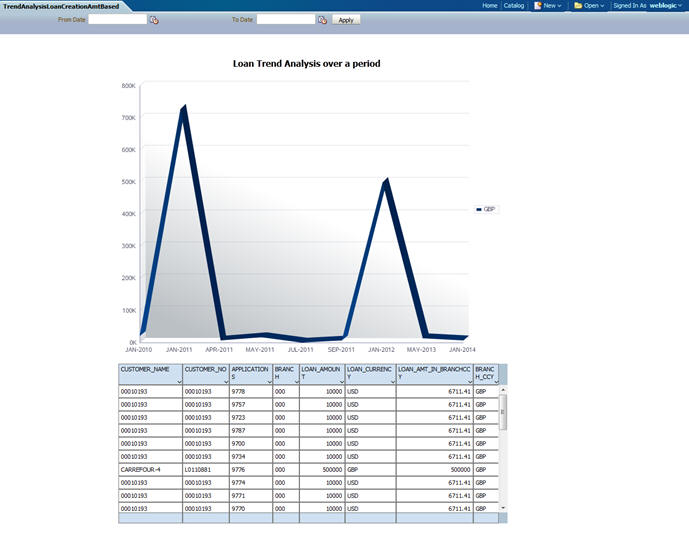

3.1.3 Trend Analysis Over a Period

You can view the list of tasks which are approved over a specified period in various dimensions like count, country, currency, product, amount and loan type in ‘Loan Trend Analysis Over a Period’ report. This report displays the loan life cycle events and the dimension. You can click ‘Events and Dimension’ to view the graph generated against the years.

3.1.3.1 Loan Trend Analysis Over a Period based on Amount

In the interactive BIP report Loan Trend Analysis Over a Period, the system displays the summary of transactions which are performed over the specific years based on the amount. It includes amendment, disbursement, payment, pre-payment and closure task. On click of each month, the corresponding task details are displayed

Header

The header carries the report title, from year and to year.

Body of the Report

The following details are displayed in the report:

Field Name |

Description |

First Section |

|

Month |

The name of the process flow. |

Amount |

|

Second Section |

|

Customer Name |

The name of the customer who has requested for loan. |

Customer No |

The customer reference number. |

Branch Code |

The branch code for the loan. |

Loan Amount |

The loan amount. |

Loan Currency |

The loan currency. |

Value Date |

The value date of the loan. |

Maturity Date |

The maturity date of the loan. |

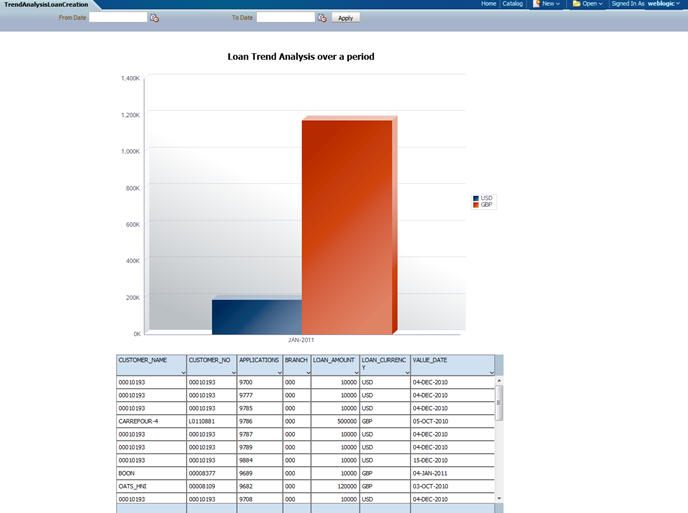

3.1.3.2 Loan Trend Analysis Over a Period based on Period

In the interactive BIP report Loan Trend Analysis Over a Period, the system displays the summary of transactions which are performed over the specific years based on the period. It includes amendment, disbursement, payment, pre-payment and closure task. On click of each month, the corresponding task details are displayed

Header

The header carries the report title, from year and to year.

Body of the Report

The following details are displayed in the report:

Field Name |

Description |

First Section |

|

Month |

The name of the process flow. |

Amount |

|

Second Section |

|

Customer Name |

The name of the customer who has requested for loan. |

Customer No |

The customer reference number. |

Branch Code |

The branch code for the loan. |

Loan Amount |

The loan amount. |

Loan Currency |

The loan currency. |

Value Date |

The value date of the loan. |

Maturity Date |

The maturity date of the loan. |

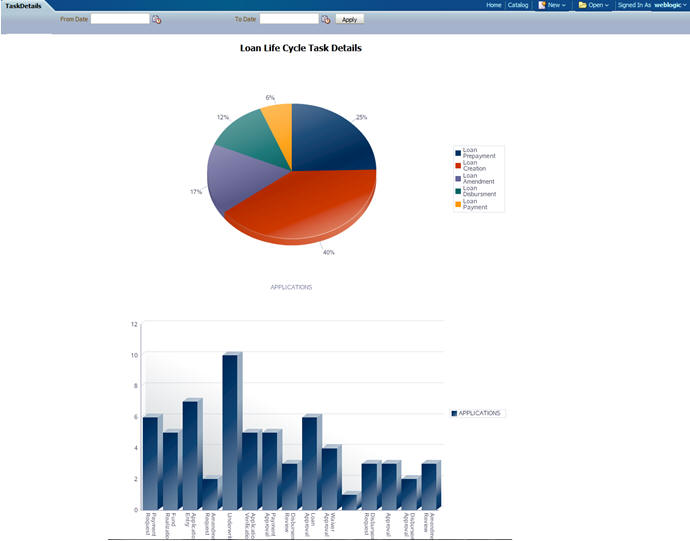

3.1.4 Statistical Report

You can view the statistical view of pipeline deals which are imitated through creation process. This report extracts the deal details from SOA schema.

3.1.4.1 Loan Life Cycle Task Details

In Loan Life Cycle Task Details, the system displays the summary of the tasks based on the pipeline deals available in the specific years. On click of the stages, the corresponding task details are displayed.

Header

The header carries the report title, from year and to year.

Body of the Report

The following details are displayed in the report:

Field Name |

Description |

First Section |

|

Process Flow |

The name of the process flow. |

Task Count |

The task count in specific workflow. |

Second Section |

|

Stage Name |

The name of the stage. |

Task Count |

The task count. |

3.2 BIP Advice

This section contains the following topics:

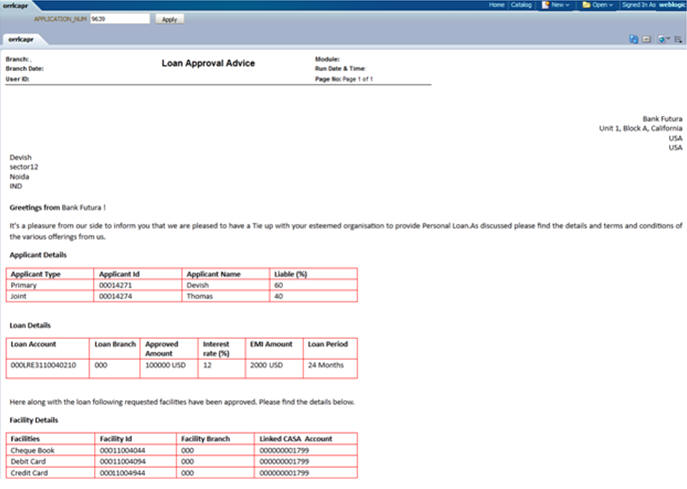

3.2.1 Loan Approval Advice

Loan Approval Advice report is associated with Loan Approval and Additional Approval Stage for PROCEED outcome. You can invoke this screen by typing ‘ORRLCAPR’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Application Number

Specify the application number of the loan.

3.2.1.1 Contents of the Report

The contents of the report are discussed under the following heads:

Header

The header carries the report title, run date and time, branch name, branch address, applicant name and customer address.

Body of the Report

The following details are displayed in the report:

Field Name |

Description |

Applicant Details |

|

Applicant Type |

The type of applicant. |

Applicant ID |

The applicant reference ID. |

Applicant Name |

The name of the applicant. |

Liable % |

The percentage of liable loan amount. |

Loan Details |

|

Loan Account |

The loan account reference number. |

Loan Branch |

The loan account branch. |

Approved Amount |

The approved loan amount. |

Interest Rate (%) |

The approved interest rate. |

EMI Amount |

The loan EMI amount. |

Loan Period |

The period of the loan. |

Facility Details |

|

Facilities |

The facilities like cheque book, credit card, debit card. |

Facility ID |

The facility reference ID. |

Facility Branch |

The facility branch. |

Linked CASA Account |

The linked customer account reference. |

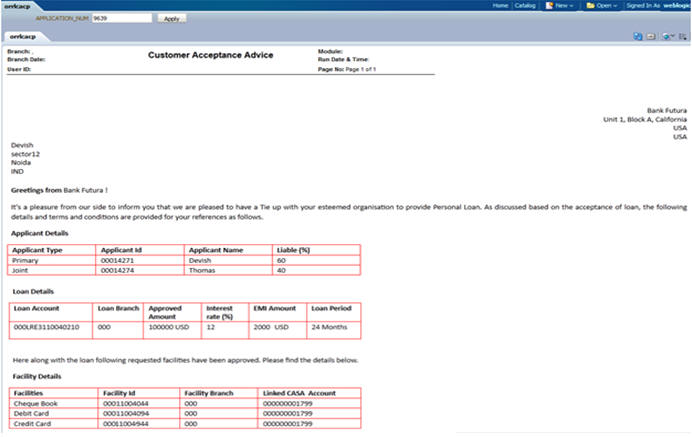

3.2.2 Customer Acceptance Advice

Customer Acceptance Advice report is associated with Customer Acceptance Stage for PROCEED outcome. You can invoke this screen by typing ‘ORRLCACP’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Application Number

Specify the application number of the loan.

3.2.2.1 Contents of the Report

The contents of the report are discussed under the following heads:

Header

The header carries the report title, run date and time, branch name, branch address, applicant name and customer address.

Body of the Report

The following details are displayed in the report:

Field Name |

Description |

Applicant Details |

|

Applicant Type |

The type of applicant. |

Applicant ID |

The applicant reference ID. |

Applicant Name |

The name of the applicant. |

Liable % |

The percentage of liable loan amount. |

Loan Details |

|

Loan Account |

The loan account reference number. |

Loan Branch |

The loan account branch. |

Approved Amount |

The approved loan amount. |

Interest Rate (%) |

The approved interest rate. |

EMI Amount |

The loan EMI amount. |

Loan Period |

The period of the loan. |

Facility Details |

|

Facilities |

The facilities like cheque book, credit card, debit card. |

Facility ID |

The facility reference ID. |

Facility Branch |

The facility branch. |

Linked CASA Account |

The linked customer account reference. |