The following currency forecast methods are available when you select a currency (other than the reporting currency) from the Currency Codes list.

Select |

To |

Flat |

Forecast no change in the exchange rate for all dates beginning with the as-of date. |

Structured Change |

Forecast exchange rates as an incremental change from the previous period. |

Direct Input |

Type exchange rates to use in forecasting. |

Parity * |

Forecast the exchange rate between two currencies based on interest rate forecasts for the reference IRC associated with each of the currencies. |

No Arbitrage * |

Forecast the exchange rate required to maintain a no arbitrage condition between two currencies. |

* The above methods are available when the selected currency has an associated reference IRC as defined in Rate Management.

You can map your forecast scenario with Behavior Pattern Rule. For more information, refer to Behavior Pattern Rule Mapping.

Examples of Currency Forecasting

The examples below use the following data to demonstrate currency forecast methods:

· Reporting currency = U. S. dollars (USD is shown in the title bar)

· Local currency = Australian dollars – (converting from Australian dollars (AUD) to USD)

· Exchange rate loaded from Rate Manager = 1.108 AUD to 1 USD (rate in effect on the as-of date, 06/30/09)

· Modeling period = 07/01/2009 to 06/30/2010

To Begin: For all examples, begin by doing the following:

1. Create a new Forecast Rates assumption rule with USD as the reporting currency.

2. In the Forecast Rates window, add (or rename) a scenario:

§ Click Add (or Rename).

§ Type a name for the scenario.

§ Click Apply.

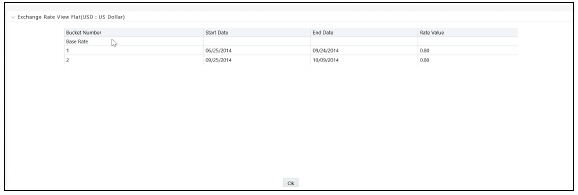

Flat Method: Calculate the exchange rate of Australian dollars to $1 U. S., modeling no change in the exchange rate during the modeling period.

In the Forecast Rates window, do the following:

1. From Currency Codes, select AUD: Australian Dollar.

2. From Currency Forecast Method, click Flat.

3. Click View.

Under Rate Value, you will see the exchange rate: $1.108 AUD s equal $1 USD. This rate is applied uniformly to all date buckets, based on the rate in effect at the as-of date in your Application Preferences.

4. Click OK.

5. At the bottom of the page, click Save.

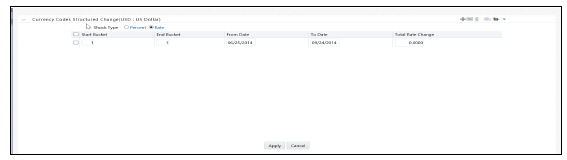

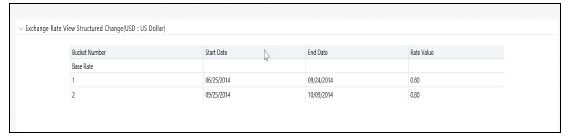

Structured Change: Model a change in the exchange rate so that the rate increases by a total of 0.5% over four months, levels off for four months, and then drops a total of 0.25% over three months.

In the Forecast Rates window, do the following:

1. From Currency Codes, select AUD: Australian Dollar.

2. From Currency Forecast Method, select Structured Change.

3. Click Define.

4. Add rows and type bucket numbers and rate changes as follows:

5. You can also use the Excel import/export feature to add the rate changes.

6. Click Apply.

7. Click View.

8. Click OK.

9. At the bottom of the page, click Save.

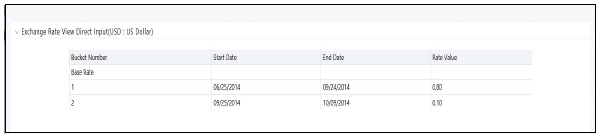

Direct Input: Model a change in the exchange rate so that rates reflect a stronger U. S. dollar during the spring of 2010.

In the Forecast Rates window, do the following:

1. From Currency Codes, select AUD: Australian Dollar.

2. From Currency Forecast Method, select Direct Input.

3. Click Define.

4. Click Apply.

5. Click View to see the output table.

6. You can also use the Excel import/export feature to add the rate values.

7. Click OK.

8. At the bottom of the page, click Save.

Parity: Model a period of rising interest rates for the U. S. and Australian dollars. Use the parity method to forecast the exchange rate of Australian dollars to $1 U. S. Parity is calculated based on the forecast interest rates of the reference IRCs of the Australian dollar and the U. S. dollar.

1. In the Forecast Rates window, forecast changes in the U. S. dollar interest rate:

2. From Currency Codes, select USD: US Dollar.

3. From Interest Rate Codes, select Treasury Index.

4. From Rate Forecast Method, click Direct Input.

5. Click Define.

6. Type interest rate changes for 02/01/2010 through 04/30/2010.

7. Click Apply.

In the Forecast Rates window, forecast changes in the Australian dollar reference Interest rate:

1. From Currency Codes, select AUD: Australian Dollar.

2. From Interest Rate Codes, select IRC AUD.

3. From Rate Forecast Method, click Direct Input.

4. Click Define.

5. Type interest rate changes for 02/01/2010 through 04/30/2010.

6. Click Apply.

7. At the bottom of the page, click Save.

Note The View button is not available for the parity feature. If you want to view results, enable the “forecast rate” option in the BSP process – Audit Block, for the relevant interest rate codes. Audit results will be written to the FSI_INTEREST_RATES_AUDIT table. |

No Arbitrage: Forecast the exchange rates required to maintain equilibrium between the U. S. and Australian dollars. The forecast is based on the historical interest rates from the reference IRC of each currency. This example assumes that the following reference IRCs have been assigned in Rate Management:

· U. S. dollar: Treasury Index

· Australian dollar: IRC AUD

In the Forecast Rates ID window, do the following:

1. From Currency Codes, select AUD: Australian Dollar.

2. From Currency Forecast Method, click No Arbitrage.

3. At the bottom of the page, click Save.

Note The View button is not available for the No Arbitrage feature. If you want to view results, enable the “forecast rate” option in the BSP process – Audit Block, for the relevant interest rate codes. Audit results will be written to the FSI_INTEREST_RATES_AUDIT table. |