Prepayment for mortgage loans occur often as they are generally very long tenured. When a prepayment is made for a mortgage loan before the stipulated tenure, it affects the profitability for the bank. The probability of this occurring must be identified during pricing the mortgage product, along with the effects on profitability and loss. This must be done in order to help the banker identify what offers and rates can be offered to the customer considering the effect of prepayment on net income being generated by the bank.

Prepayment Analysis for mortgage products is supported in PCD only when the bank also has CI (IPA/RPA). The prepayment information is available in CI. It is derived using historical data of existing accounts. PCD can consume this information and use to analyze the prepayment tendency of an account. This prepayment tendency affects the profitability of an account. The modified profitability is represented in an alternate report.

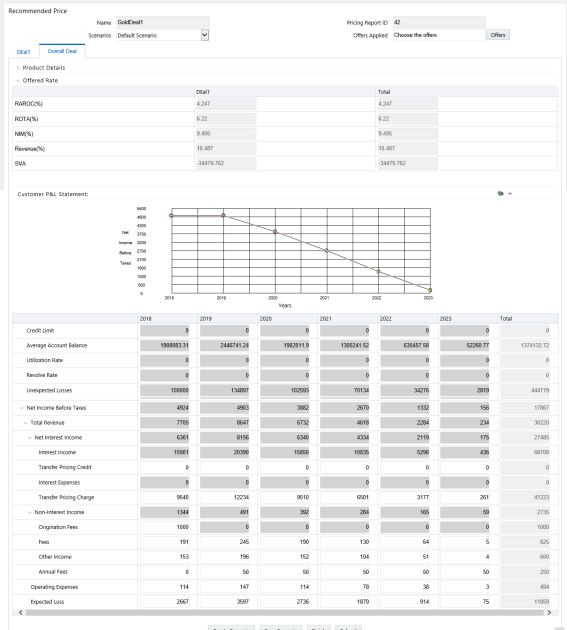

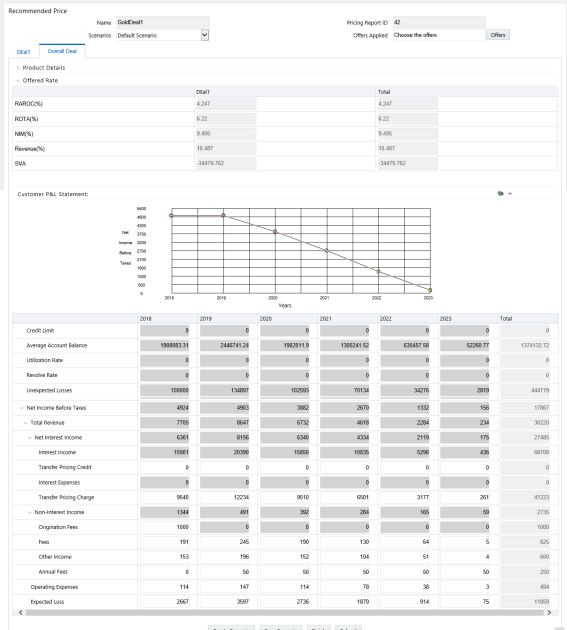

The following tabs are available in the Recommended price report:

1. Product pricing details tab - This tab contains details about the product, such as the product type, offered rate, P & L statement, and the recent mortgage deals.

2. Overall Deal tab - This tab contains details of the overall deal inclusive of all the products which have pricing deals.

|

NOTE |

In the aggregated report, the prepayment information is considered. This prepayment report is available as a reference to the probable change in profitability. |