2. RTGS Maintenance

RTGS Payments Overview

A RTGS system is defined as a gross settlement system in which both processing and final settlement of funds transfer instructions can take place continuously (i.e. in real time). As it is a gross settlement system, transfers are settled individually, that is, without netting debits against credits. As it is a real-time settlement system, the system effects final settlement continuously rather than periodically, provided that a sending bank has sufficient covering balances or credit. Moreover, this settlement process is based on the real- time transfer of central bank money.

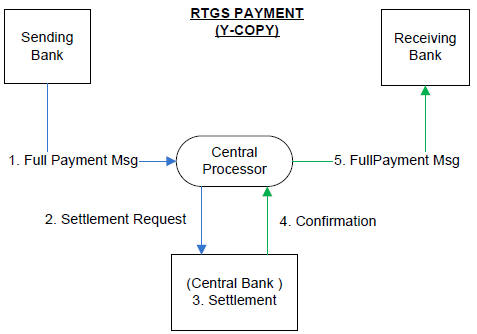

Given below is a schematic representation of how a RTGS payment is exchanged and processed in the RTGS network.

The RTGS product processor of Oracle Banking Payments processes an RTGS payment transaction initiated by an Operations user from the in-built user interface or by customers in the bank’s Customer Channels like Internet banking or Mobile banking. The payment instructions initiated from the bank Channels are received by Oracle Banking Payments through ReST or SOAP based interfaces. This product processor can process RTGS payments that are exchanged on SWIFT-based RTGS networks that use SWIFT messages.

An outgoing RTGS payment is processed through most of the typical processing steps applicable for a SWIFT payment and additionally some RTGS specific business validations and processing steps. After successful processing, an outward RTGS SWIFT message, say MT103, is generated and sent to the RTGS network. Likewise, Incoming RTGS payment messages from the network can be received and processed resulting in credit of a beneficiary bank account or an outward SWIFT payment to the ultimate beneficiary. The outward SWIFT payment is processed by the Cross-Border product processor which is covered by a separate user manual.

Key Features of RTGS product processor

- Supports incoming and outgoing RTGS payment transactions (within a country or within a region)

- Payment transactions are processed only in specified currencies of the network.

- Payment transaction is processed within the operating hours of the RTGS network and on RTGS working days.

- Provision to do balance check for the remitter account (ECA check)

- Sends RTGS payment message to the clearing network on behalf of a direct participant

- Supports processing of TARGET2 RTGS out of the box.

- Customer payments processed via TARGET2 are defined as payments in the SWIFT FIN MT103 format.

- Interbank payments processed via TARGET2 are defined as payment messages in the SWIFT Net FIN MT202 and MT202COV format.

- Supports processing of incoming Sender notification message (MT012) and abort notification message (MT019)

2.1 Network Maintenance

2.1.1 Network Maintenance

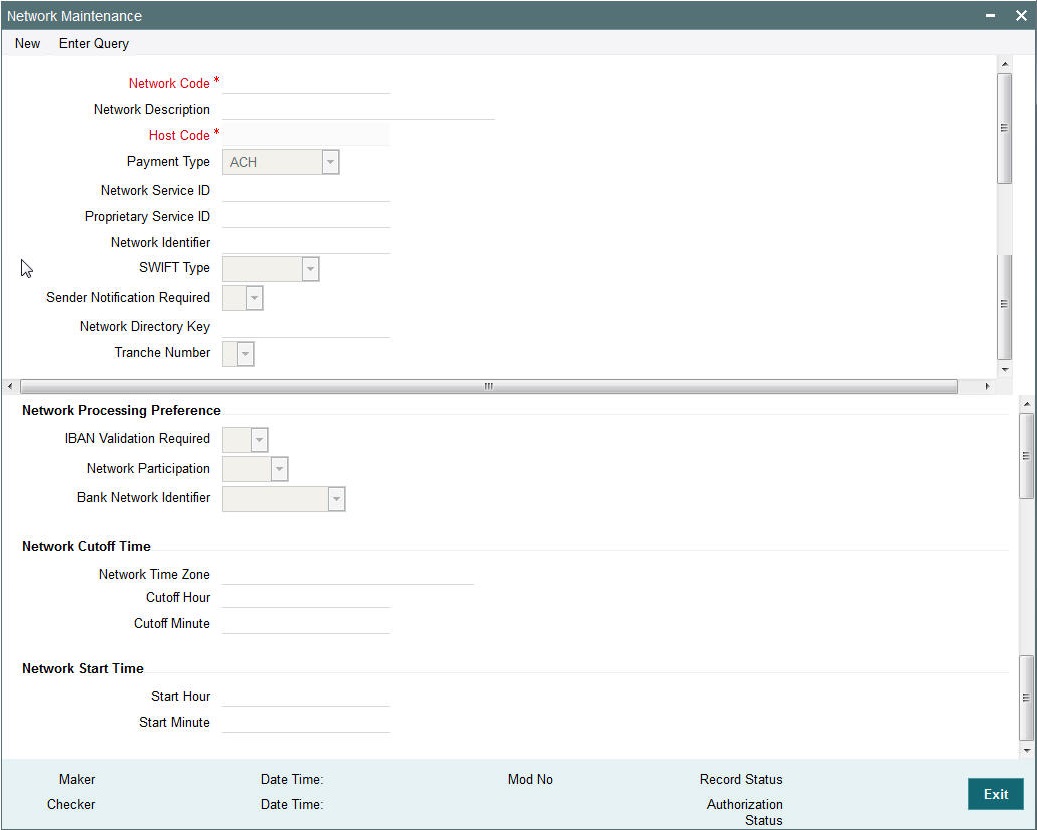

You can maintain clearing network that supports local payments using ‘Network Maintenance’ screen.

Every network code is linked to a payment type and host code. The same Network code is allowed to be maintained with multiple host combinations.

You can invoke the ‘Network Maintenance’ screen by typing ‘PMDNWMNT’ in the field at the top right corner of the application toolbar and clicking the adjoining arrow button.Click new button on the Application toolbar..

You can specify the following fields;

Network Code

Specify a unique code for the network.

Network Description

Specify a brief description on the network code.

Host Code

Host Code is defaulted host code of current user’s logged in branch.

Payment Type

Select the payment type from the drop-down list. The list displays the following values:

- ACH

- Book Transfer

- RTGS

- Faster Payment

- Cross Border

- Direct Debits

Network Service ID

Specify the ISO clearing identification code. Alternatively, you can select the network service ID from the option list. The list displays all valid network service IDs maintained in the system.

Proprietary Service ID

Specify the proprietary service ID if the network service ID is proprietary in nature.

Network BIC

Specify the network BIC. Alternatively, you can select the network BIC from the option list. The list displays all valid network BIC maintained in the system. This is used in SEPA dispatch file generation.

SWIFT Type

Specify the type of SWIFT. Select any one of the following:

- FIN

- FIN Y-COPY

Sender Notification Required

Check this box to request MT012 for the outgoing RTGS message.

Service Level

The value of the service level is SEPA.

Channel Id

This field is used to capture the Channel Id for each network.

Network Processing Preferences

IBAN Validation Required

Select whether IBAN validation is required from the drop down list. Options are as follows:

- Yes

- No

This field is not applicable for the network ‘BOOKTRANSFER’.

Network Participation

Select the bank’s network participation from the drop-down list. The list displays the following values:

- Direct

- Indirect

Bank Network Identifier

Select the bank network identifier from the drop-down list. The list displays the following values:

- SWIFT BIC - If SWIFT BIC is selected, then the SWIFT addresses maintained for the bank in local bank code directory will be used for bank identification.

- Local Bank Code - If Local Bank Code is selected, the bank codes maintained in Local Bank Directory will be applicable for bank identification.

Network Cutoff Time

Network Time zone

The system defaults the time zone applicable for the host.

Cutoff Hour

Specify the network cut-off hour.

Cutoff Minute

Specify the network cut-off minute.

Network Start Time

Start Hour

Specify the Start Hour for the network.

Start Minute

Specify the Start Minute for the network.

2.1.2 Viewing Network Maintenance Summary

You can view a summary of network using ‘Network Maintenance Summary’ screen. To invoke this screen, type ‘PMSNWMNT’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

You can search for the networks using one or more of the following parameters:

- Authorization Status

- Record Status

- Network Code

- Payment Type

Once you have specified the search parameters, click ‘Search’ button. The system displays the records that match the search criteria.

Double click a record to view the detailed network maintenance screen. You can also export the details of selected records to a file using ‘Export’ button

2.2 Network Preferences

This section contains the below topics:

- Section 2.2.1, "Invoking Network Preferences Maintenance Screen"

- Section 2.2.2, "Viewing Network Preferences Summary"

2.2.1 Invoking Network Preferences Maintenance Screen

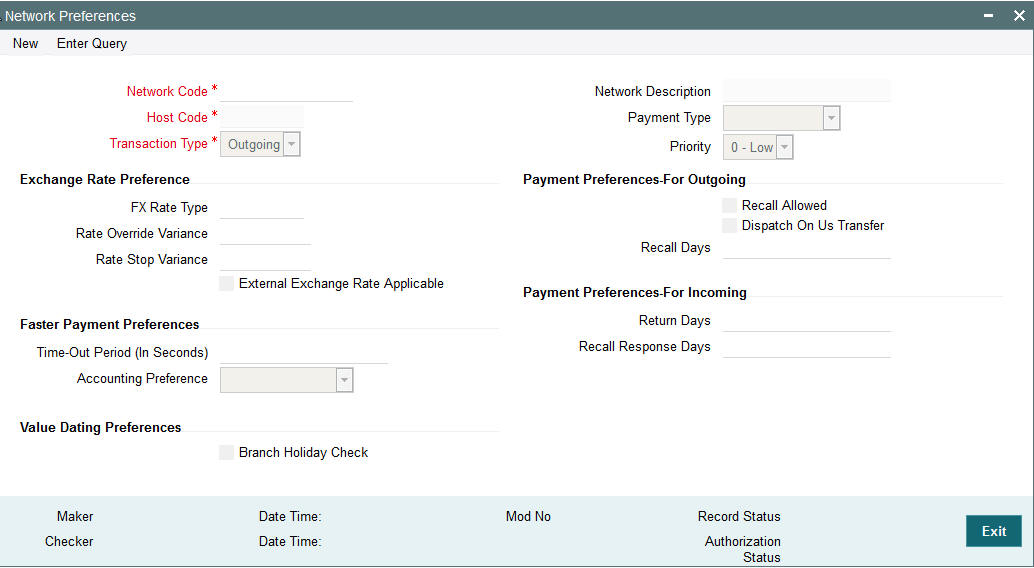

You can set preferences for RTGS payment networks using Network Preferences maintenance.

You can invoke the ‘Network Preferences Maintenance’ screen by typing PMDNWPRF in the field at the top right corner of the application toolbar and clicking the adjoining arrow button. Click new button on the Application toolbar.

You can specify the following fields:

Network Code

Specify the network code. Alternatively, you can select the network code from the option list. The list displays all valid network codes maintained in the system.

Network Description

The system displays the network code description.

Host Code

Host code is defaulted as the logged in Host.

Payment Type

The system displays the payment type based on the network code selected.

Transaction Type

Select the payment transaction type from the drop-down list. The list displays the following values:

- Incoming

- Outgoing

Exchange Rate preferences

FX Rate Type

Specify the FX rate type. Alternatively, you can select the FX rate type from the option list. The list displays all open and authorized exchange rate types maintained in the system.

Rate Override Variance

Specify the rate override variance. If the exchange rate provided for a payment transaction exceeds the override limit specified, then the system displays a message and the transaction is saved.

Rate Stop Variance

Specify the rate stop variance. The system displays an error message if the exchange rate exceeds the stop limit.

External Exchange Rate System Applicable

Check this box to receive the exchange rate from the external system.

Other Preferences

Sanction Check System Required

Check this box if the transaction details has to be sent for sanction check.

Domestic Low Value Payment Preferences

Recall Allowed

Check this box if the network allows recall of an outgoing payment already sent.

Recall Days

Specify the number of days within which the payment originating bank has to recall an outgoing payment.

Return Days

Specify the number of days within which the beneficiary bank has to return an incoming payment which cannot be credited to creditor account. Return days are always be considered as working days based on Network holidays. For an incoming return processing, the system validates whether the return is being processed within the allowed number of days from incoming payment settlement date.

Recall Response Days

Specify the number of days within which the beneficiary bank has to respond to an incoming recall request.

Recall days will always be considered as working days based on Network holidays.

While doing recall response processing, it is validated whether the response is being processed within the allowed number of days from recall received date.

Faster Payment Preferences

Time-out period

You can specify time out period in seconds for receiving the response from the CI (Receiving bank) for an outward Faster payment sent earlier.

Number of Re-tries

Number of times the Faster Payment outward message can be re-sent if a response is not received for the original outward message or the previous re-tried message. This is defaulted and fixed to “1” currently.

2.2.2 Viewing Network Preferences Summary

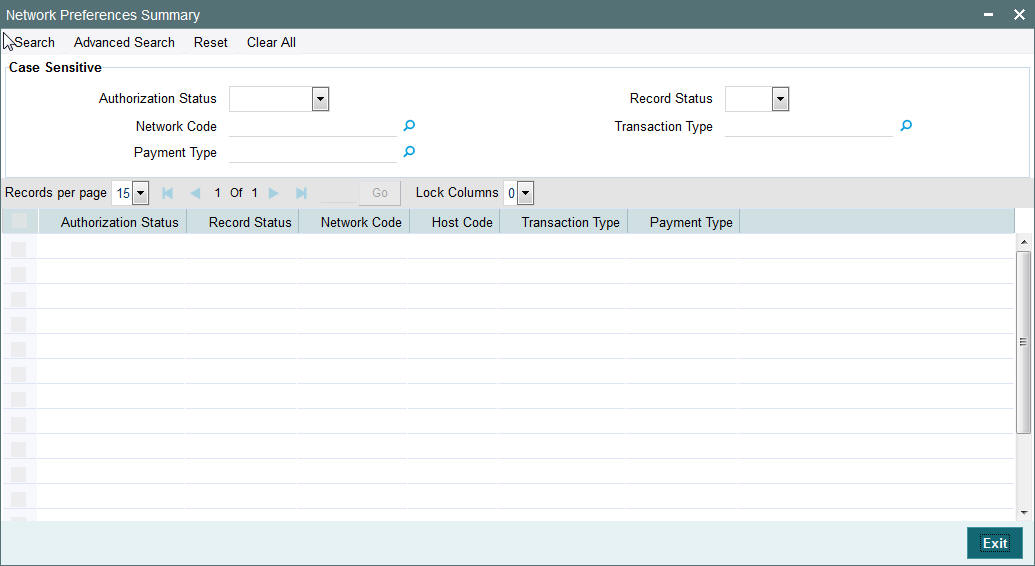

You can invoke “Network Preferences Summary” screen by typing ‘PMSNWPRF’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can search using one or more of the following parameters:

- Authorization Status

- Record Status

- Network Code

- Transaction Type

- Payment Type

Once you have specified the search parameters, click ‘Execute Query’ button. The system displays the records that match the search criteria for the following

- Authorization Status

- Record Status

- Network Code

- Host Code

- Transaction Type

- Payment Type

2.3 RTGS Directory Maintenance

A facility is provided for the upload of TARGET directory from fixed length ASCII format files.

This section contains the below topics:

- Section 2.3.1, "Invoking RTGS Directory Upload Screen"

- Section 2.3.2, "Invoking RTGS Directory Maintenance Screen"

- Section 2.3.3, "Viewing RTGS Directory Summary"

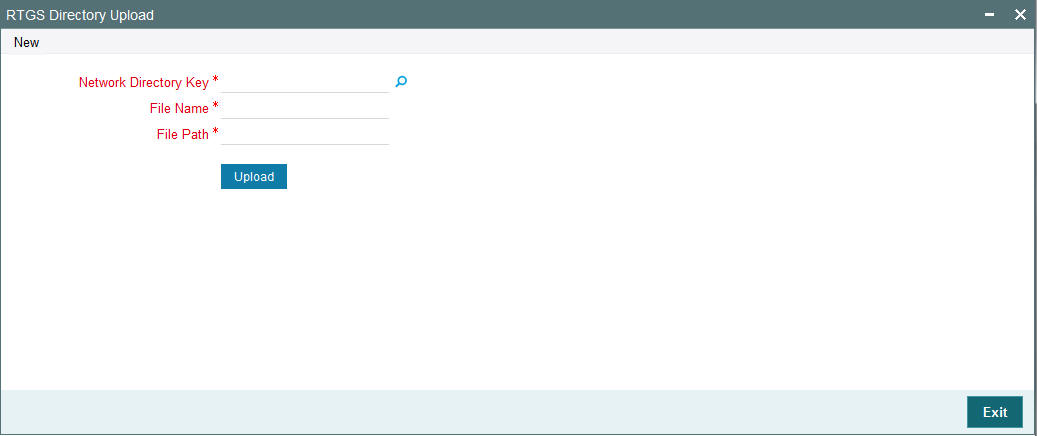

2.3.1 Invoking RTGS Directory Upload Screen

You can invoke “RTGS Directory Upload” screen by typing ‘PMDRTGSU’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specify the following details

Network Directory Key

Specify the network directory key.

File Name

Specify the updated file name (ASCII).

File Path

Specify the directory path in which the update file is available.

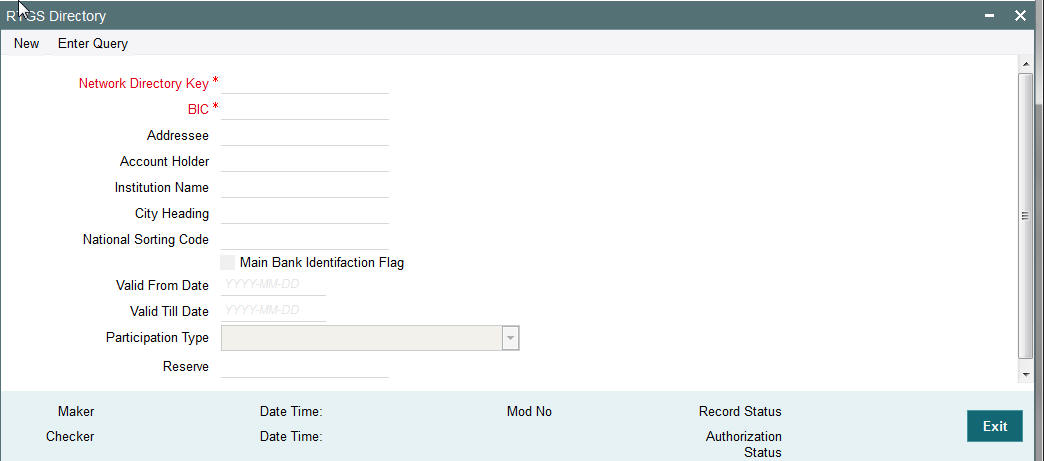

2.3.2 Invoking RTGS Directory Maintenance Screen

You can invoke “RTGS Directory Maintenance” screen by typing ‘PMDRTGSD’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following fields:

Network Directory Key

Specify the relevant Network Directory key.

BIC

Specify the BIC assigned to the participant.

Addressee

Specify the BIC of the addressee, i.e., the receiver of the payment message.

Account Holder

Specify the BIC of the settlement bank.

Institution Name

Specify the institution where the participant’s account is to be credited with the amount of the funds transfer.

City Heading

Specify the city where the institution is sited.

National Sorting Code

Specify the national clearing code to be used in case the system is not able to resolve the TARGET-2 participant based on the bank code. TARGET–2 is a high value Euro Payment clearing system.

Main Bank Identification Flag

Specify the Main BIC Flag is used to resolve 8 characters BIC. If this option is checked then the main BIC must be used if the bank code is incomplete.

Valid From Date

The date from which the clearing code is valid. The application date is defaulted here.

Valid Till Date

Specify the date up to which the clearing code is valid. If you do not specify the valid till date, then it will be set to 31-12-9999.

Participation Type

Select the type of participation from the drop-down. The options are as follows:

- Direct

- Indirect

- Multi-Addressee - Credit Institutions

- Multi-Addressee - Branch of Direct Participation

- Addressable BIC - Correspondent

- Addressable BIC - Branch of Direct participant

- Addressable BIC - Branch of Indirect participant

- Addressable BIC - Branch of Correspondent

Reserve

Indicates a reserve field that may be used in the future.

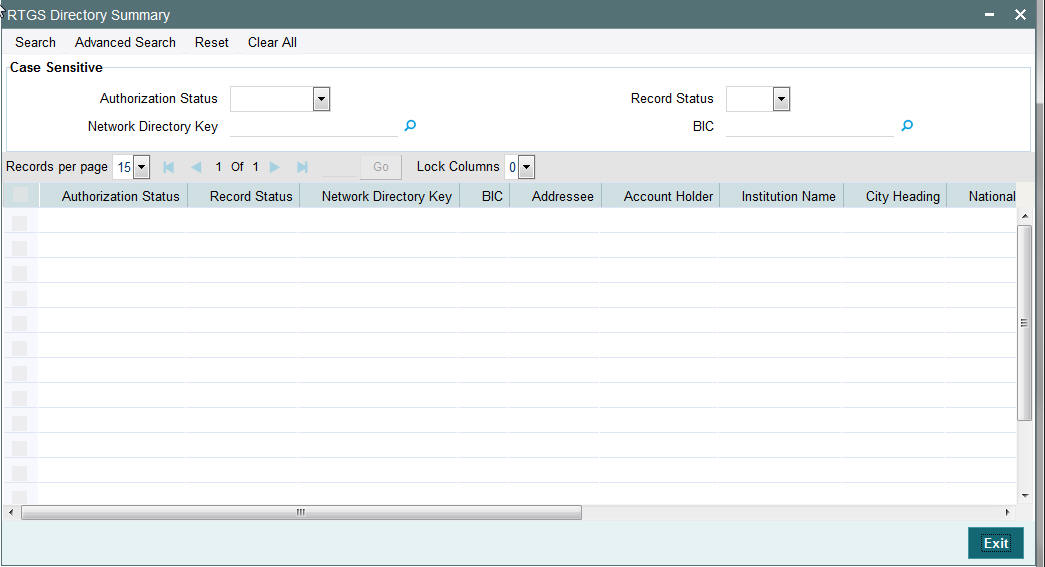

2.3.3 Viewing RTGS Directory Summary

You can invoke “RTGS Directory Summary” screen by typing ‘PMSRTGSD’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can search using one or more of the following parameters:

- Authorization Status

- Record Status

- Network Directory Key

- BIC

Once you have specified the search parameters, click ‘Search’ button. The system displays the records that match the search criteria for the following:

- Authorization Status

- Record Status

- Network Directory Key

- BIC

- Addressee

- Account Holder

- Institution Name

- City Heading

- National Sorting Code

- Main Bank Identification Flag

- Valid From Date

- Valid Till Date

- Reserve

2.4 Common Maintenances

The below mentioned common maintenances are used to process incoming and outgoing RTGS transactions:

- Customer Service Model Linkage (PMDCSMLK)

- External Customer Account Input (STDCRACC)

- External Customer Input (STDCIFCR)

- Payment Processing Cut off Time (PMDCTOFF)

- External Credit Approval System (PMDECAMT)

- Exchange Rate System (PMDERTMT)

- Host Parameters (PMDHSTPR)

- Currency Correspondent (PMDCYCOR)

- Network Currency Preferences (PMDNCPRF)

- Network Holidays (PMDNWHOL)

- Network Maintenance (PMDNWMNT)

- Network Preferences (PMDNWPRF)

- Source Network (PMDSORNW)

- Role (PMDROLDF)

- Sanction Check System (PMDSNCKM)

- Source Maintenance (PMDSORCE)

- Customer Service Model (PMDSRMDL)

- System Parameters (PMDSYSPM)

- User Maintenance (PMDUSRDF)

- Bank Redirection (PMDBKRED)

- Account Redirection (PMDACRED)

- Pricing Code (PPDCMNT)

- Pricing Value (PPDVLMNT)

- SWIFT Field Code (PMDSWFLD)

- Time Zone (PMDTMZON)

- Special Characters Maintenance (PMDSPCHR)