3. RTGS Processing

3.1 Outgoing Message Processing

The system sends the following messages, as part of outgoing message generation process for RTGS messages.

| RTGS Message Type | SWIFT Message Type | Normal Message | |||

|---|---|---|---|---|---|

| CUST_TFR_RTGS | 103 | CUST_TRANSFER | |||

| BANK_TFR_RTGS | 202 | BANK_TRANSFER | |||

| COVER_RTGS | 202 | COVER |

3.2 Support for RTGS in Queues

RTGS Payment supports a number of exception & investigation queues that are factory shipped and there is a facility to take appropriate actions on the payments.

The below mentioned queues are supported with RTGS:

- Exchange Rate Queue

- External Exchange Rate Queue

- Processing Cut-off Queue

- Network Cutoff Queue

- Processing Cutoff Queue

- Repair Queue

- Business Override Queue

- Auth Limit1 Queue

- Auth Limit2Queue

- Process Exception Queue

- Sanctions Check Queue

- ECA Queue

3.3 Facility to Generate MT103 and MT205 in LVTS Format

- For all Canadian dollar payment messages with the value date as today’s date should be sent as a LVTS message. LVTS is a Canadian payment system used for large value settlements. LVTS accepts MT103 and MT205. The LVTS messages need to have a user header in the message header. Following is the format of the user header:

{3 :{ 103: CAD} {108 :< Tranche No>}}

- In MT103 & 205 messages field 103 should always contain CAD and field 108 should have the tranche number used for the payment. LVTS payments can be in Tranche 1 or 2 or R. Tranche 2 is by default. If Tranche needs to be changed for a payment message, then it will be changed manually before releasing the payment message in SWIFT alliance.

- The presence of the user header in the message enables Y-copy supported by SWIFT. The following diagram illustrates the flow of payment messages between two LVTS members:

-

- MT103 – Customer Payment Message

- MT205 – Inter-Bank Payment Message

- MT096 – Partial message sent to LVTS by SWIFT

- MT097 – Message from LVTS to SWIFT containing the payment

- MT012 – Acceptance notice sent to sender

- MT019 – Reject notice sent to sender

3.4 Outgoing Transaction Input Screen

This section contains the following topics:

- Section 3.4.1, "Invoking RTGS Outgoing Payments Screen"

- Section 3.4.2, "Main Tab"

- Section 3.4.3, "Pricing Tab"

- Section 3.4.4, "Additional Tab"

- Section 3.4.5, "UDF button"

- Section 3.4.6, "MIS button"

- Section 3.4.7, "Saving of Outgoing RTGS Payment Transaction"

- Section 3.4.8, "Authorization of Outgoing RTGS Payment Transaction"

- Section 3.4.9, "Outgoing RTGS Payment - SOAP and REST web services"

- Section 3.4.10, "Operations supported for Outgoing Transaction"

- Section 3.4.11, "Branch Holiday Parameter"

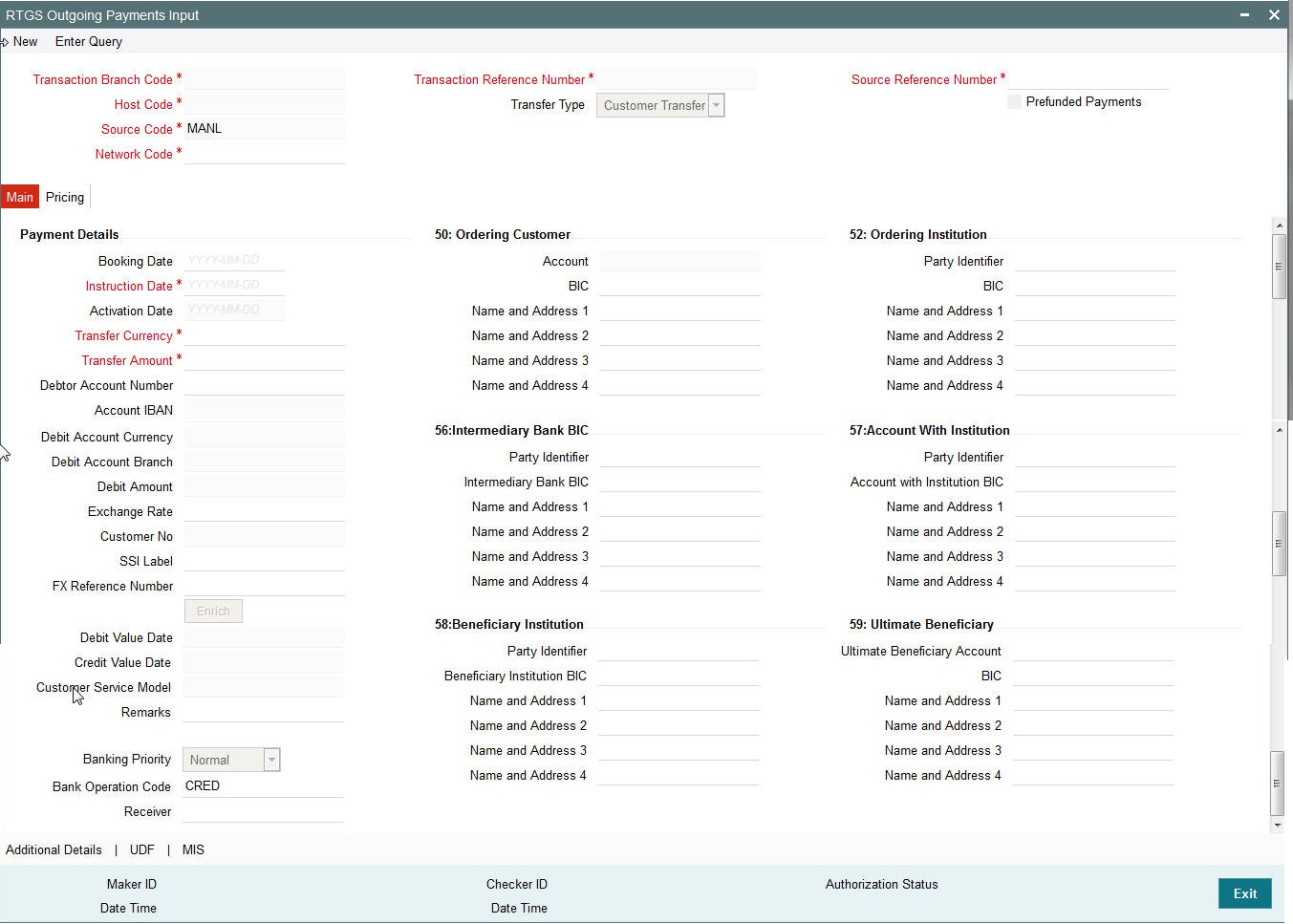

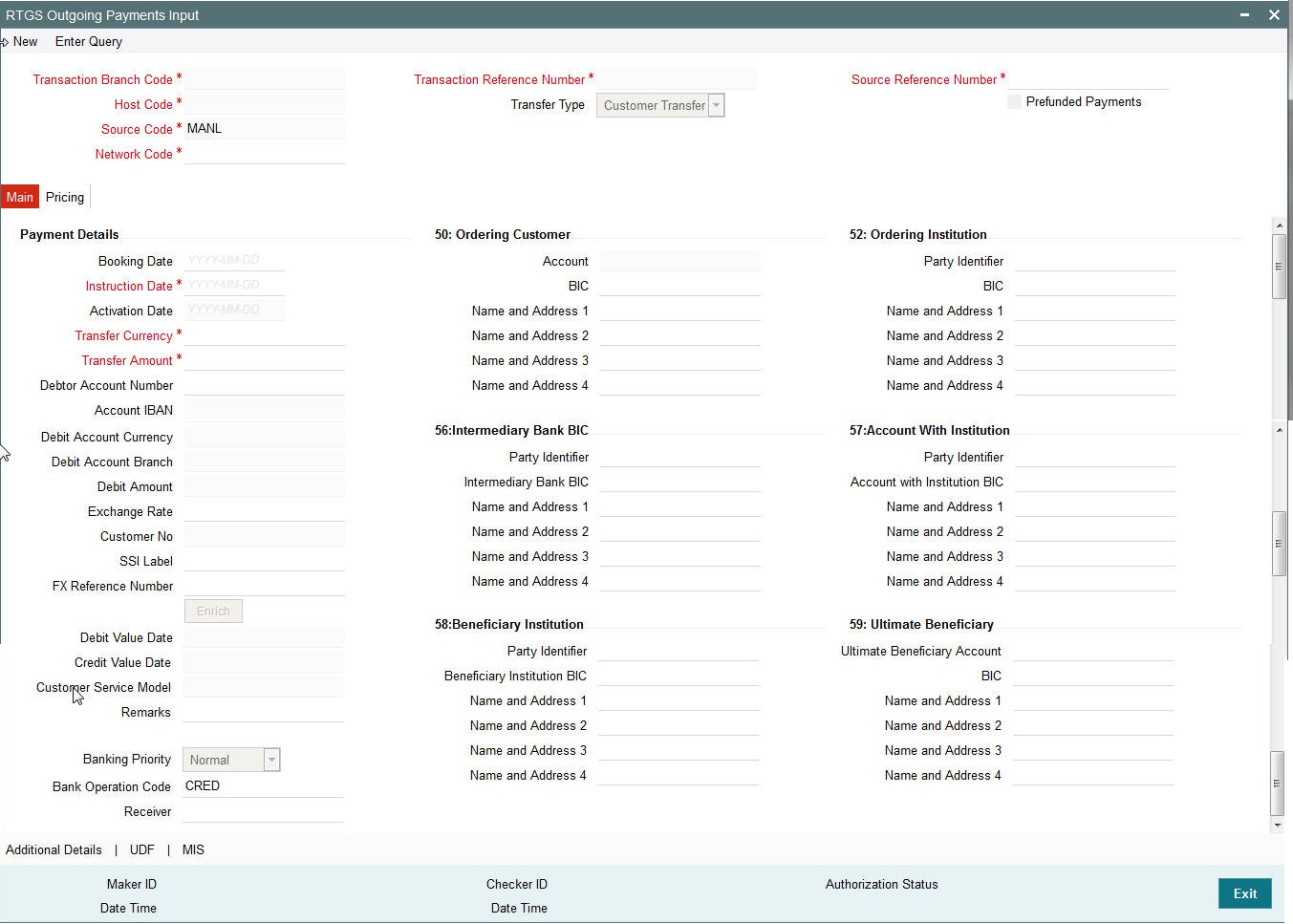

3.4.1 Invoking RTGS Outgoing Payments Screen

You can perform RTGS outgoing transaction. All transactions that are entered using this screen has payment type as ‘RTGS’ and transaction type as ‘Outgoing’. You can invoke ‘RTGS Outgoing Payment’ screen by typing ‘PRDOTONL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. Click new button on the Application toolbar..

You can specify the following fields:

Transaction Branch code

The system defaults the transaction branch code with the user’s logged in branch code.

Host code

The system defaults the host code of transaction branch.

Source Code

The system defaults the source code field. For manual transactions source code is defaulted as MANL.

Network Code

You can select the required network. All open and authorized networks for a transaction and transfer type are listed.

Transaction Reference number

The system generates the transaction reference number. For more information on the format, refer the Payments Core User Manual.

User Reference Number

The system displays transaction reference number. However you can modify this.

Transfer Type

Select the required type of transfer.

- C - Customer Transfer

- B - Bank Transfer

Pre-funded Payments:

Checking this flag indicates that this is a pre-funded payment, so only the Credit leg of accounting i.e. Nostro accounting would need to be performed by the system.

3.4.2 Main Tab

Click ‘Main’ tab to capture the Debit/ Payments details:

Specify the following details

Debit Details

Debit Account Number

Specify the debit account number. Alternatively, you can select the debit account number from the option list. The list displays all open and authorized accounts.

Account IBAN

The system defaults the account IBAN based on the debit account number field selected.

Account Currency

The system defaults account currency based on the debit account number selected.

Debit Amount

The system populates this field as the transfer amount converted in debtor account currency.

Payment Details

Booking Date

The system defaults the booking date as application server date.

Instruction Date

The system defaults this date as application server date and the payment will be processed on the Instruction Date.

User can modify the date to a future date, if required. Back valued payments will not be allowed. Instruction date will be validated for network holidays maintained and error message will be thrown. User will be forced to change the instruction date to a working date for the network.

Activation Date

The system defaults the activation date same as application server date.

Transfer Currency

The system defaults transfer currency if the network allows only single currency as per Network currency preferences (PMDNCPRF).

If multiple currencies are allowed then the system allows you to specify the transaction currency. Alternatively, you can select the transaction currency from the option list. The list displays all valid transaction currencies maintained in the system.

Transfer amount

Specify the transaction amount.

Exchange Rate

Specify the exchange rate if debit account currency is different from the transfer currency. The system retains the input value and validates the same against override and stop variances maintained in the Network preference.

If exchange rate is not specified, then the system populates the exchange rate on enrich or save, if the transfer amount is less than small FX limit maintained. If transfer amount is more than small FX limit and, if external exchange rate is applicable, then rate pick up will happen during transaction processing.

Remarks

Specify the internal remarks, if any.

Debit Value Date

The system would derive the debit value date as part of transaction processing. This field will be disabled for user input.

Credit Value Date

The system would derive the credit value date as part of transaction processing. This field will be disabled for user input.

Customer

The system displays the CIF of the debit customer for outgoing transactions.

SSI Label

Select the required SSI label from the list of values.

Note

This list will be populated with valid SSI Labels, applicable for the customer and the Network. If Customer or Network details are not available, the fetch action of the list of values displays the information message to this effect. The list of values is queried based on the fields SSI Label, Beneficiary Bank ID, Beneficiary Account & Account IBAN.

Customer Service Model

This is the Service model to which the customer is attached. System will derive the customer service model from the customer service model linkage maintenance (PMDCSMLK)

Note

Customer and Customer Service Model is not applicable if the debit account is GL.

Enrich button

Click the Enrich button to populate the exchange rate, debit amount and charge/tax amounts.

If exchange rate pick up or charge pick up fails, system will throw error. User can then provide the required values and proceed with the transaction.

Operation Code

23B: Bank Operation Code

The value of CRED would be defaulted in this field. If any other value is desired then select one of the following codes using LOV:

- CRED - This message contains a Credit Transfer where there is no SWIFT Service Level involved.

- CRTS - This message contains a Credit Transfer for test purposes.

- SPAY - This message contains a Credit Transfer that must be processed according to the Swift Pay Service Level.

- SPRI - This message contains a Credit Transfer to be processed according to the Priority Service Level.

- SSTD - This message contains a Credit Transfer to be processed according to the Standard Service Level.

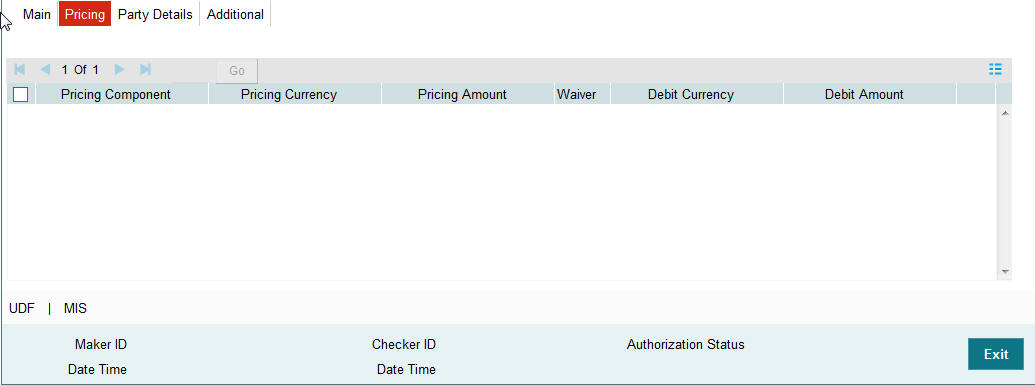

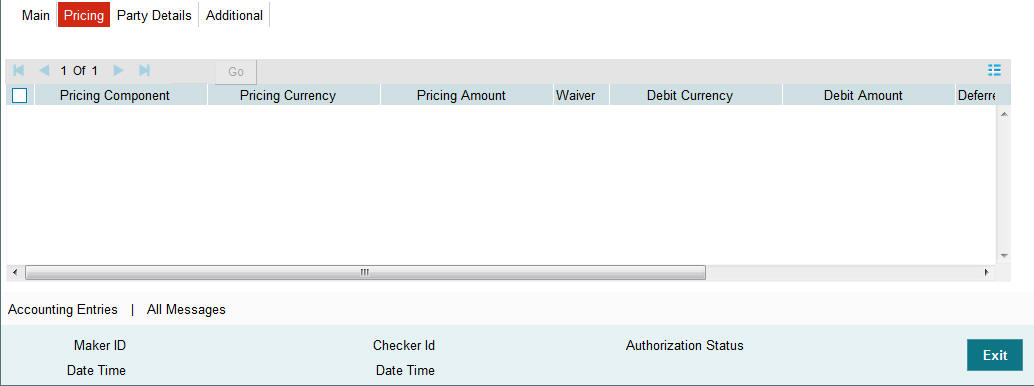

3.4.3 Pricing Tab

This tab displays the pricing details of the charges computed by system based on the transaction attributes in the Main tab.

The below mentioned attributes will be available in the Pricing tab

Pricing Component

Displays the name of the pricing component applicable for the transaction.

Pricing Currency

Displays the currency in which the charge amount is calculated for the Pricing component.

Pricing Amount

Displays the charge amount calculated for each pricing component.

Waived

Check this box to indicate that the charge is waived for the pricing component.

Debit currency

Displays the currency in which the charge amount is debited for the pricing component.

Debit amount

Displays the amount in debit currency to be debited.

Debit account

Displays the account from which the charge would be debited.

Exchange Rate

Displays the exchange rate applied to calculate the charge in debit amount.

50: Ordering Customer

During enrichment (or save), the debtor account number will be populated in the Account field. Name and address will be populated with customer details of the account present in Customer maintenance (CIF).

You can modify the following details:

Account

This field is disabled for user input.

BIC

You can select the BIC using LOV.

Name and Address 1

Specify the name or the first line of the Ordering Customer’s address. A maximum of 35 characters are allowed in each of these Name and Address fields.

Name and Address 2

Specify the continuation of name and the second line of the address.

Name and Address 3

Specify the third line of the address.

Name and Address 4

Specify the fourth line of the address.

52: Ordering Institution

Party Identifier

Specify a national clearing code. The following codes should be used, preceded by '//’.

| AT | 5!n | Austrian Bankleitzahl | |||

| AU | 6!n | Australian Bank State Branch (BSB) Code | |||

| BL | 8!n | German Bankleitzahl | |||

| CC | 9!n | Canadian Payments Association Payment Routing Number | |||

| CH | 6!n | CHIPS Universal Identifier | |||

| CN | 12..14n | China National Advanced Payment System (CNAPS) Code | |||

| CP | 4!n | CHIPS Participant Identifier | |||

| ES | 8..9n | Spanish Domestic Interbanking Code | |||

| FW | without 9 digit code | Pay by Fedwire | |||

| GR | 7!n | HEBIC (Hellenic Bank Identification Code) | |||

| HK | 3!n | Bank Code of Hong Kong | |||

| IE | 6!n | Irish National Clearing Code (NSC) | |||

| IN | 11!C | Indian Financial System Code |

BIC

Select the BIC using LOV.

Name and Address 1

Specify the name or the first line of the Ordering Customer’s address. A maximum of 35 characters are allowed in each of these Name and Address fields.

Name and Address 2

Specify the continuation of name and the second line of the address.

Name and Address 3

Specify the third line of the address.

Name and Address 4

Specify the fourth line of the address.

57: Account with Institution

Party Identifier

Specify a national clearing code. The following codes should be used, preceded by '//’.

| AT | 5!n | Austrian Bankleitzahl | |||

| AU | 6!n | Australian Bank State Branch (BSB) Code | |||

| BL | 8!n | German Bankleitzahl | |||

| CC | 9!n | Canadian Payments Association Payment Routing Number | |||

| CH | 6!n | CHIPS Universal Identifier | |||

| CN | 12..14n | China National Advanced Payment System (CNAPS) Code | |||

| CP | 4!n | CHIPS Participant Identifier | |||

| ES | 8..9n | Spanish Domestic Interbanking Code | |||

| FW | without 9 digit code | Pay by Fedwire | |||

| GR | 7!n | HEBIC (Hellenic Bank Identification Code) | |||

| HK | 3!n | Bank Code of Hong Kong | |||

| IE | 6!n | Irish National Clearing Code (NSC) | |||

| IN | 11!C | Indian Financial System Code |

Name and Address 1

Specify the name or the first line of the Ordering Customer’s address. A maximum of 35 characters are allowed in each of these Name and Address fields.

Name and Address 2

Specify the continuation of name and the second line of the address.

Name and Address 3

Specify the third line of the address.

Name and Address 4

Specify the fourth line of the address.

58: Beneficiary Institution

Party Identifier

Specify a national clearing code. The following codes should be used, preceded by '//’.

| AT | 5!n | Austrian Bankleitzahl | |||

| AU | 6!n | Australian Bank State Branch (BSB) Code | |||

| BL | 8!n | German Bankleitzahl | |||

| CC | 9!n | Canadian Payments Association Payment Routing Number | |||

| CH | 6!n | CHIPS Universal Identifier | |||

| CN | 12..14n | China National Advanced Payment System (CNAPS) Code | |||

| CP | 4!n | CHIPS Participant Identifier | |||

| ES | 8..9n | Spanish Domestic Interbanking Code | |||

| FW | without 9 digit code | Pay by Fedwire | |||

| GR | 7!n | HEBIC (Hellenic Bank Identification Code) | |||

| HK | 3!n | Bank Code of Hong Kong | |||

| IE | 6!n | Irish National Clearing Code (NSC) | |||

| IN | 11!C | Indian Financial System Code |

Name and Address 1

Specify the name or the first line of the Ordering Customer’s address. A maximum of 35 characters are allowed in each of these Name and Address fields.

Name and Address 2

Specify the continuation of name and the second line of the address.

Name and Address 3

Specify the third line of the address.

Name and Address 4

Specify the fourth line of the address.

59: Ultimate Beneficiary

These fields should not be input in case of Bank Transfer.

BIC

Select the BIC using LOV.

Name and Address 1

This field is an display field. Ultimate Beneficiary name will be defaulted here from the Main tab.

Name and Address 2

Specify the name and the first line of the Ultimate Beneficiary’s address.

Name and Address 3

Specify the name and the second line of the Ultimate Beneficiary’s address.

Name and Address 4

Specify the name and the third line of the Ultimate Beneficiary’s address.

Intermediary Institution BIC

Specify the Intermediary bank BIC, if applicable. Alternatively, you can select the BIC from the option list. This field is an optional input field. All BIC present in BIC directory and all Local Bank Code belonging to RTGS payment type network will be listed. You can select the BIC.

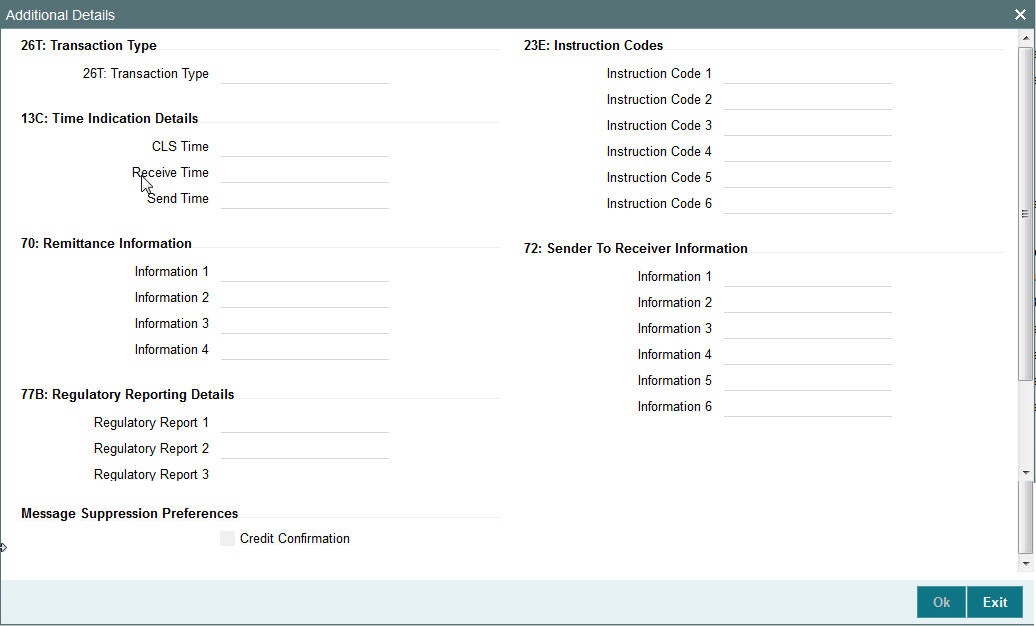

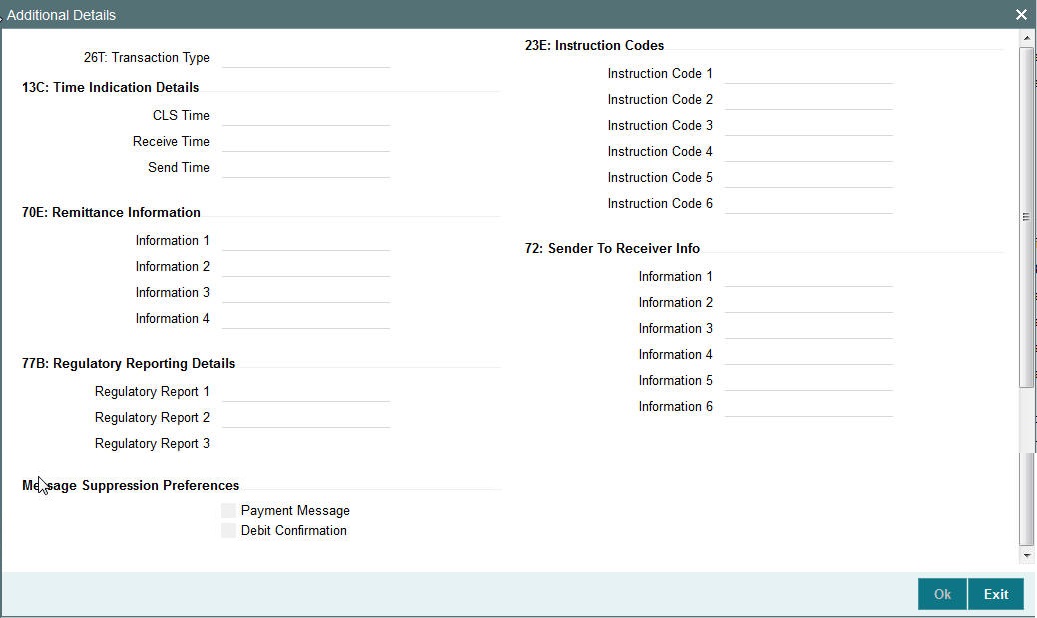

3.4.4 Additional Tab

Specify the additional details in this screen. Click on the ‘Additional’ tab to invoke this screen.

13C: Time Indication Details

This field specifies one or several time indication(s) related to the processing of the payment instruction.

TilTime

Specify the time up to which the transactions must be executed.

FroTime

Specify the time from which the transactions that must be executed.

RejTime

Specify the time from which the transactions that must be executed up to a certain time.

Time should be input in the hhmm+/-iinn format, as per the SWIFT standard. ii and nn are the hours and minutes of UTC shift whereas the “hhmm“ are to be filled with the local time.

70E: Remittance Information

70: Remittance Information

Specify the information for the Ultimate Beneficiary of the transfer. This is applicable for customer transfer only.

72: Sender to Receiver Information

70: Remittance Information

Specify the sender to receiver information.

77B: Regulatory Reporting

77 B: Regulatory Reporting

Specify the codes for the statutory and regulatory information required by the authorities in the country of Receiver or Sender.

26T: Transaction Type

26 T: Transaction Type

Specify the nature of the transaction. Maximum of 3 alpha-numeric characters are allowed. This is applicable for Customer Transfers only.

23E: Instruction Codes

23E: Instruction Codes

Select the type of instruction codes, using that are SWIFT compliant and applicable to the transaction accounts:

- CHQB - Indicates that beneficiary customer must be paid by cheque only.

- CORT - Indicates that Payment is made in settlement for a trade.

- HOLD - Indicates that beneficiary customer or claimant will call upon identification.

- INTC - Indicates a payment between two companies that belongs to the same group.

- PHOB - Please advise the intermediary institution by phone.

- PHOI - Please advise the intermediary by phone.

- PHON - Please advise the account with institution by phone.

- REPA - Payments has a related e-Payments reference.

- SDVA - Indicates that payment must be executed with same day value to the beneficiary.

- TELB - Please advise contact or beneficiary by the most efficient means of telecommunication.

- TELE - Please advise the account with institution by the most efficient means of telecommunication.

Banking Priority

Select the required priority of payment messages.

- Highly Urgent

- Urgent

- Normal

Default value will be Normal.

Receiver

This is a display field. It is auto-populated with the Receiver BIC of the outgoing payment transaction. This field is derived while processing the outgoing RTGS transaction.

Message Suppression Preferences

Payment Message

This is unchecked by default. Check this box to indicate that the message generation is for the payment messages like MT 103, MT202 and MT205.

Debit Confirmation

This is unchecked by default. Check this box to indicate debit confirmation. MT 900 is to be suppressed.

3.4.5 UDF button

Click on the ‘UDF’ button to invoke this screen.

You can specify user defined fields for each transaction.

3.4.6 MIS button

Click on the ‘MIS’ button to invoke this screen.

You can specify the MIS details in this sub-screen.

3.4.7 Saving of Outgoing RTGS Payment Transaction

- System performs mandatory field checks & transaction validations as mentioned below while saving a transaction:

- Charge bearer is always ‘SHA’ for RTGS payment

- Customer status check is done as part of saving of the RTGS Payment transaction.

- All the SWIFT related fields in Transaction have characters supported by SWIFT only.

- If Intermediary institution BIC is null then Account with institution BIC must not be null and must be a RTGS BIC

- If Intermediary institution BIC is not null and a RTGS BIC then Account with institution BIC is not mandatory for input

- If Intermediary institution BIC is not null and a RTGS BIC then Account with institution BIC must not be a RTGS BIC

- For Customer Transfer, either Ultimate Beneficiary name or BIC must be present

- For Bank Transfer,

- If Account with Institution BIC and intermediary BIC is not present then Beneficiary institution BIC must be specified.

- Beneficiary Institution BIC or Beneficiary Institution Name and address 1/2/3/4 is mandatory for specified

- If Intermediary institution BIC is not null and a RTGS BIC then Beneficiary Institution BIC must not be a RTGS BIC.

- If any of the transaction validation fails, transaction is rejected with proper error code.

- For transaction created through upload of file or message, the transaction is moved to repair queue.

3.4.8 Authorization of Outgoing RTGS Payment Transaction

- On authorization, the system starts to process various payment transactions. Only the transaction whose activation date as today is picked for processing.

- The RTGS outgoing payment would be processed through the following

steps:

- Transaction Validations

- Customer and Account Status Check

- Bank Redirection

- Account Redirection

- RTGS Receiver Identification

- Payment Dates Resolution

- Processing Cut-off time check

- Small FX Limit Check & Currency Conversion

- Computation of Charge & Tax

- Authorization Limit 1 Check

- Authorization Limit 2 Check

- Duplicate Check

- Network Cutoff Time Check

- Sanction Check

- ECA Check

- Debit /Credit Accounting Handoff

- Message Generation

3.4.9 Outgoing RTGS Payment - SOAP and REST web services

- Outgoing RTGS payment request received from SOAP/ REST web services is also processed as RTGS Payment.

- If Transaction Branch is not received as part of the request, the same is populated as debit account branch. Based on transaction branch Host code is populated.

- Host date is considered as booking date for the transaction.

- Debit account name, debit currency, customer are derived based on the debit account number received.

- Transactions created from requests received from SOAP/REST web services are always auto authorized.

3.4.10 Operations supported for Outgoing Transaction

- New

- This option enables to create a new transaction. The transaction reference number is generated based on format specified in this document

- Execute Query

- This option enables to modify an existing transaction.

3.4.11 Branch Holiday Parameter

In addition to Currency and Network Holidays, Branch holidays is considered in determining the Value date and Activation date.

Processing Branch holidays is considered in the Dates resolution only if a particular parameter in Network Preferences for the ‘Outgoing’ or ‘Incoming’ transaction type is checked.

This new parameter is called ‘Branch Holiday Check.

This parameter is added to this maintenance under a new sub-section called “Value Dating Preferences”.

3.5 Support for RTGS in Queues

RTGS Payment supports a number of exception & investigation queues that are factory shipped and there is a facility to take appropriate actions on the payments.

The below mentioned queues are supported with RTGS:

- Exchange Rate Queue

- External Exchange Rate Queue

- Network Cutoff Queue

- Processing Cutoff Queue

- Repair Queue

- Business Override Queue

- Auth Limit1 Queue

- Auth Limit2Queue

- Process Exception Queue

- Sanctions Check Queue

- ECA Queue

- Warehouse Queue

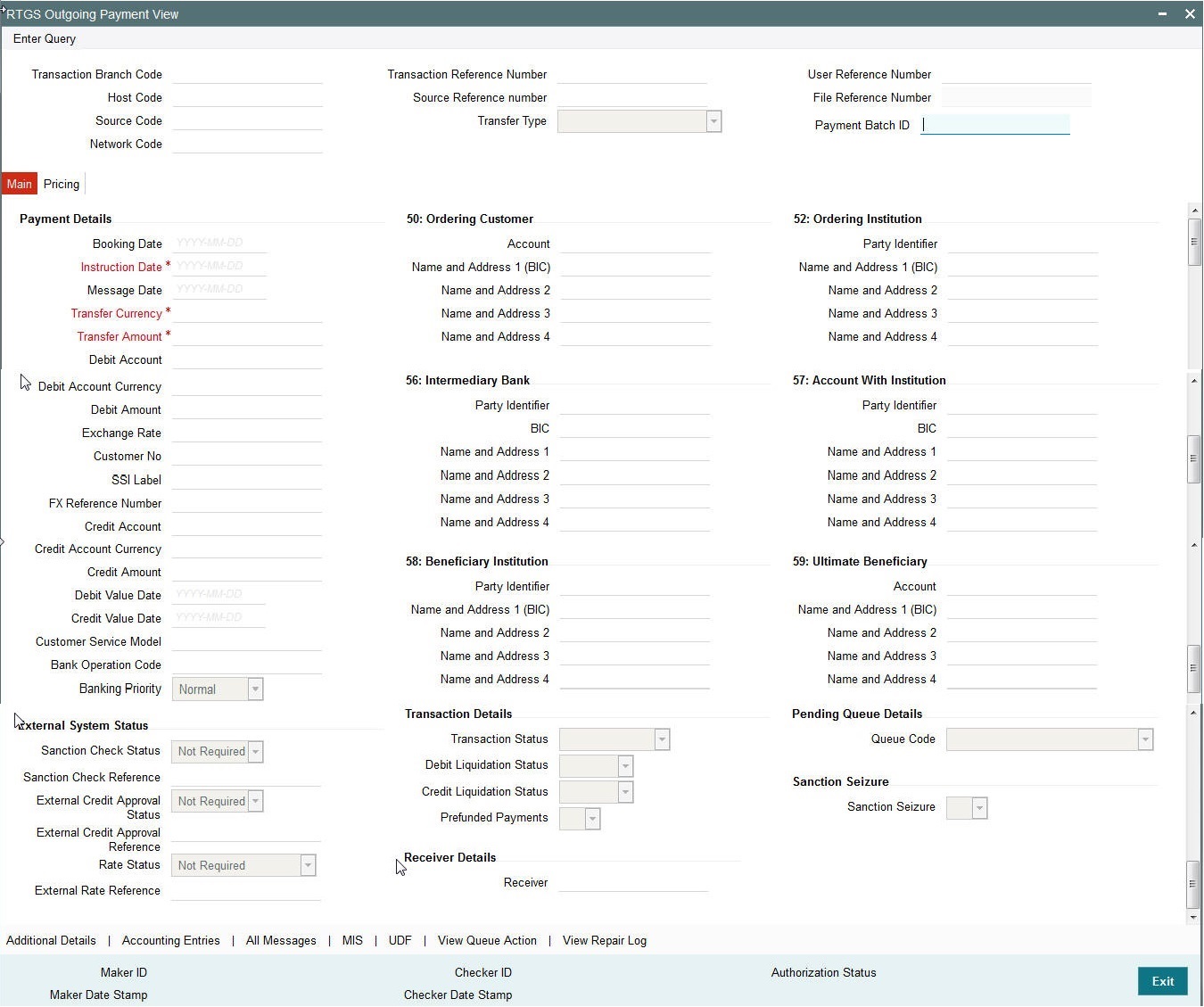

3.6 RTGS Outgoing Payment View

3.6.1 Invoking RTGS Outgoing Payments View Screen

You can view the RTGS outgoing transaction in this screen.

You can invoke “RTGS Outgoing Payment View” screen by typing ‘PRDOVIEW’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. Click new button on the Application toolbar..

You can view any outgoing RTGS transaction that is initiated by specify inputting the Transaction Reference number and clicking ‘Enter Query’ button.

The transaction is displayed containing values populated for following different fields:

Transaction Branch Code

Specify the transaction branch code.

Transaction Reference Number

The system specifies the transaction reference number.

Host Code

Specify the host code.

User Reference Number

The system specifies the User Reference Number.

Source Code

Specify the Source Code.

Transfer Type

The system specifies the type of transfer.

Network Code

Specify the required network code. The system displays all the fields in the below mentioned tabs based on the transaction reference number selected.

Payment Batch ID

Specify the Payment Batch ID.

3.6.2 Main Tab

Click ‘Main’ tab to invoke this screen.to view the field. Refer Section 3.4.2 for details.

3.6.3 Pricing Tab

You can view pricing details in this screen that are computed by the system during the processing. Click on the ‘Pricing’ tab to invoke this screen and view the field details. Refer to Section 3.4.2 for description of any field..

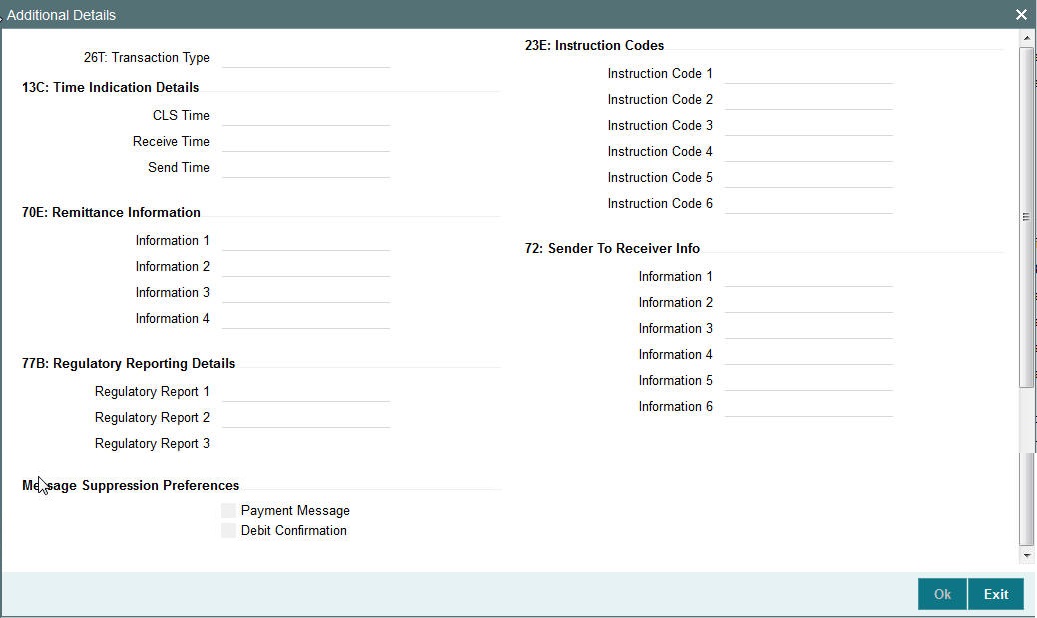

3.6.4 Additional Details Tab

Click on the ‘Additional Details’ tab to view the field details. Refer to sec. 3.4.5 for description of any field

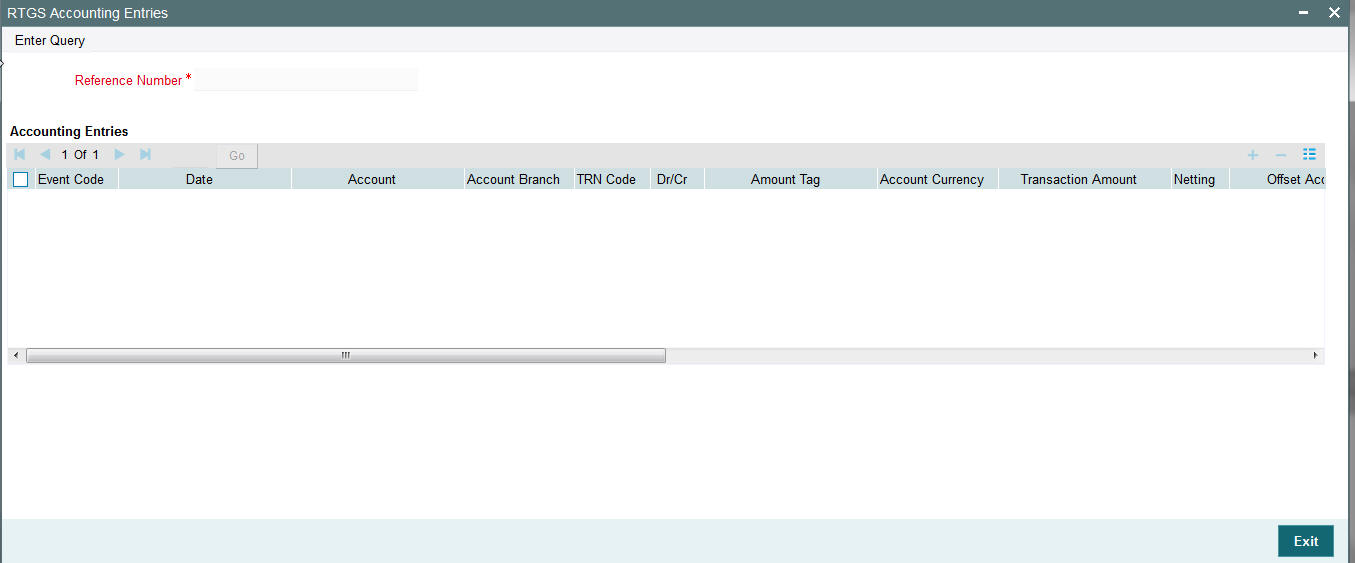

3.6.4.1 Accounting Entries Tab

You can capture accounting entries in this screen Click the Accounting Entries tab.

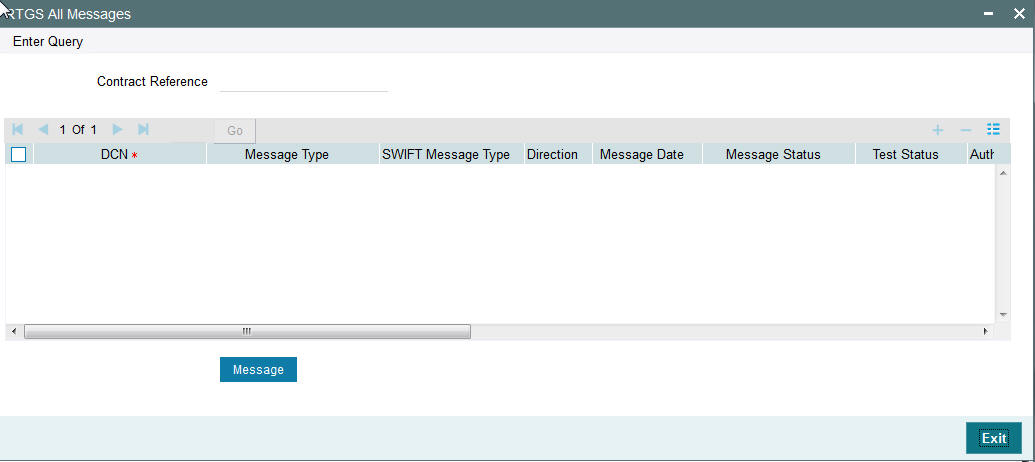

3.6.4.2 All Messages Tab

You can capture details of RTGS messages in this screen Click the All Messages tab.

3.6.5 UDF button

Click on the ‘UDF’ button to invoke this screen.

You can specify user defined fields for each transaction.

Note

You can invoke ‘UDF’ screen by typing ‘PMDTRUDF’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. Click new button on the Application toolbar.

3.6.6 MIS button

Click on the ‘MIS’ button to invoke this screen.

You can specify the MIS details in this sub-screen.

Note

You can invoke ‘MIS’ sub-screen by typing ‘PMDTRMIS’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. Click new button on the Application toolbar.

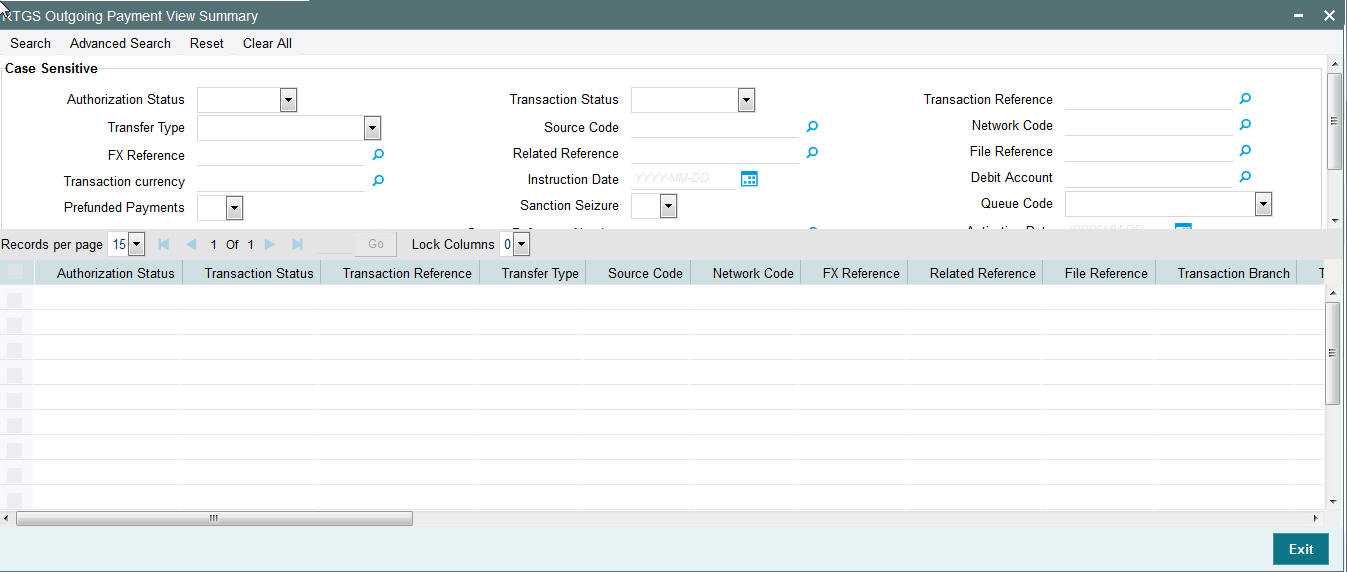

3.6.7 RTGS Outgoing Payment View Summary

You can invoke “RTGS Outgoing Payment View Summary” screen by typing ‘PRSOVIEW’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. Click new button on the Application toolbar..

You can search for the records using one or more of the following parameters:

- Authorization Status

- Transaction Status

- Transaction Reference

- Transfer Type

- Source Code

- Network Code

- FX Reference

- Related Reference

- File Reference

- Transaction currency

- Instruction Date

- Debit Account

- Prefunded Payments

- Sanction Seizure

- Queue Code

- SSI Label

- Source Reference Number

- Activation Date

- Payment Batch ID

Once you have specified the search parameters, click ‘Search’ button. The system displays the records that match the search criteria

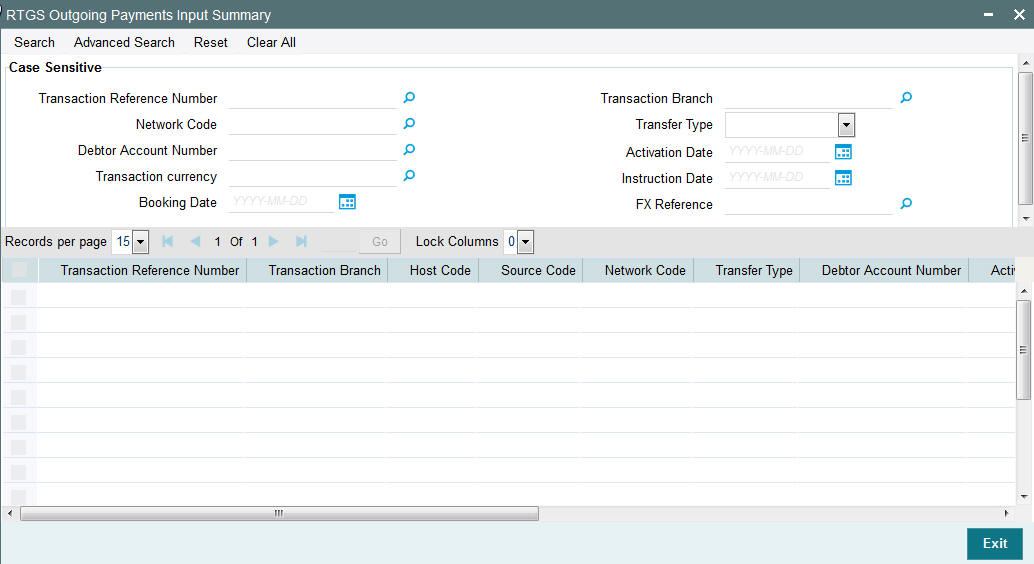

3.6.8 RTGS Outgoing Payments Input Summary

You can invoke “RTGS Outgoing Payments Input Summary” screen by typing ‘PRSOTONL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. Click new button on the Application toolbar..

You can search for the records using one or more of the following parameters:

- Transaction Reference no

- Network Code

- Debtor Account Number

- Transaction currency

- Booking Date

- Transaction Branch

- Transfer Type

- Activation Date

- Instruction Date

- FX Reference

Once you have specified the search parameters, click ‘Search’ button. The system displays the records that match the following search criteria.

- Transaction Reference no

- Transaction Branch

- Host Code

- Source Code

- Network Code

- Transfer Type

- Booking Date

- Instruction Date

- Activation Date

- Transaction Currency

- Transaction Amount

- FX Reference

3.7 Incoming Transaction Input Screen

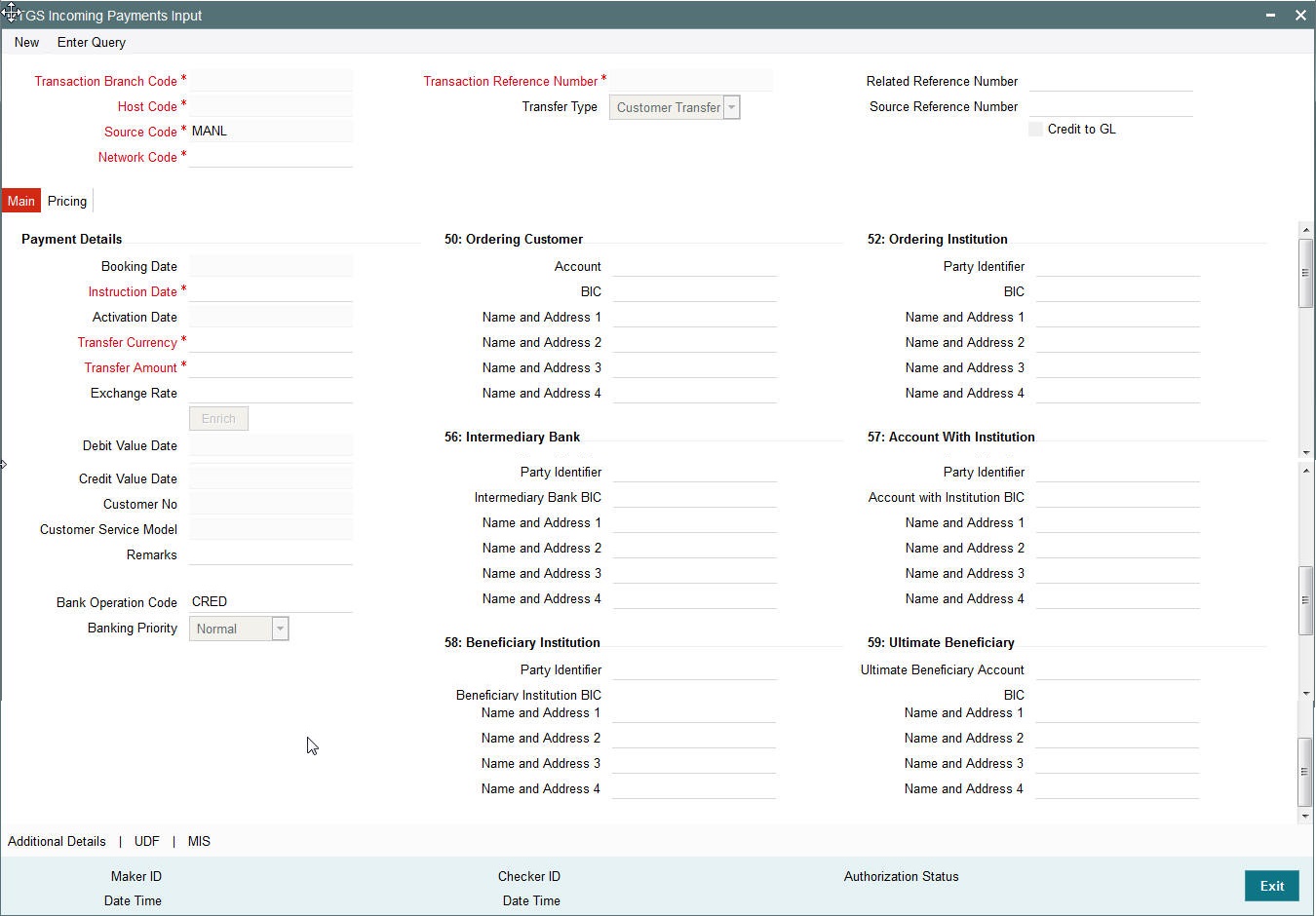

3.7.1 Invoking RTGS Incoming Payments Screen

You can create RTGS incoming transaction. All transactions that are entered using this screen has payment type as ‘RTGS’ and transaction type as ‘Incoming’. Incoming RTGS transactions of transfer type – Customer Transfer (MT103, MT103+) or Bank Transfer (MT202) – can be created from this screen. This screen should be used as a “fallback” mechanism for processing incoming payments when the incoming RTGS payment messages cannot be received automatically from SWIFT.

You can invoke ‘RTGS Incoming Payment’ screen by typing ‘PRDITONL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. Click new button on the Application toolbar..

You can specify the following fields:

Transaction Branch code

The system defaults the transaction branch code with the user’s logged in branch code.

Host code

The system defaults the host code of transaction branch.

Source Code

The system defaults the source code field. For manual transactions source code is defaulted as MANL.

Network Code

You can select the required network. All open and authorized networks for a transaction and transfer type are listed.

Transaction Reference number

The system generates the transaction reference number. For more information on the format, refer the Payments Core User Manual.

User Reference Number

The system displays transaction reference number. However you can modify this.

Transfer Type

Select the required type of transfer.

- C - Customer Transfer

- B - Bank Transfer

Credit to GL

Check this flag to receive inbound payments from other systems internal to the Bank, for which actual credit is processed by that system itself. This flag indicates that the incoming RTGS payment needs to be credited to a GL instead of a beneficiary customer account.

Note

It is not mandatory to have a credit account /customer for the transaction if credit to GL flag is checked. On enrich or save the system populates the credit account as the ‘Intermediary Credit GL’ maintained for the source.

3.7.2 Main Tab

50: Ordering Customer

During enrichment (or save), the debtor account number will be populated in the Account field. Name and address will be populated with customer details of the account present in Customer maintenance (CIF).

You can modify the following details:

Account

This field is disabled for user input.

BIC

You can select the BIC using LOV.

Name and Address 1

Specify the name or the first line of the Ordering Customer’s address. A maximum of 35 characters are allowed in each of these Name and Address fields.

Name and Address 2

Specify the continuation of name and the second line of the address.

Name and Address 3

Specify the third line of the address.

Name and Address 4

Specify the fourth line of the address.

52: Ordering Institution

Party Identifier

Specify a national clearing code. The following codes should be used, preceded by '//’.

| AT | 5!n | Austrian Bankleitzahl | |||

| AU | 6!n | Australian Bank State Branch (BSB) Code | |||

| BL | 8!n | German Bankleitzahl | |||

| CC | 9!n | Canadian Payments Association Payment Routing Number | |||

| CH | 6!n | CHIPS Universal Identifier | |||

| CN | 12..14n | China National Advanced Payment System (CNAPS) Code | |||

| CP | 4!n | CHIPS Participant Identifier | |||

| ES | 8..9n | Spanish Domestic Interbanking Code | |||

| FW | without 9 digit code | Pay by Fedwire | |||

| GR | 7!n | HEBIC (Hellenic Bank Identification Code) | |||

| HK | 3!n | Bank Code of Hong Kong | |||

| IE | 6!n | Irish National Clearing Code (NSC) | |||

| IN | 11!C | Indian Financial System Code |

BIC

Select the BIC using LOV.

Name and Address 1

Specify the name or the first line of the Ordering Customer’s address. A maximum of 35 characters are allowed in each of these Name and Address fields.

Name and Address 2

Specify the continuation of name and the second line of the address.

Name and Address 3

Specify the third line of the address.

Name and Address 4

Specify the fourth line of the address.

57: Account with Institution

Party Identifier

Specify a national clearing code. The following codes should be used, preceded by '//’.

| AT | 5!n | Austrian Bankleitzahl | |||

| AU | 6!n | Australian Bank State Branch (BSB) Code | |||

| BL | 8!n | German Bankleitzahl | |||

| CC | 9!n | Canadian Payments Association Payment Routing Number | |||

| CH | 6!n | CHIPS Universal Identifier | |||

| CN | 12..14n | China National Advanced Payment System (CNAPS) Code | |||

| CP | 4!n | CHIPS Participant Identifier | |||

| ES | 8..9n | Spanish Domestic Interbanking Code | |||

| FW | without 9 digit code | Pay by Fedwire | |||

| GR | 7!n | HEBIC (Hellenic Bank Identification Code) | |||

| HK | 3!n | Bank Code of Hong Kong | |||

| IE | 6!n | Irish National Clearing Code (NSC) | |||

| IN | 11!C | Indian Financial System Code |

Name and Address 1

Specify the name or the first line of the Ordering Customer’s address. A maximum of 35 characters are allowed in each of these Name and Address fields.

Name and Address 2

Specify the continuation of name and the second line of the address.

Name and Address 3

Specify the third line of the address.

Name and Address 4

Specify the fourth line of the address.

58: Beneficiary Institution

Party Identifier

Specify a national clearing code. The following codes should be used, preceded by '//’.

| AT | 5!n | Austrian Bankleitzahl | |||

| AU | 6!n | Australian Bank State Branch (BSB) Code | |||

| BL | 8!n | German Bankleitzahl | |||

| CC | 9!n | Canadian Payments Association Payment Routing Number | |||

| CH | 6!n | CHIPS Universal Identifier | |||

| CN | 12..14n | China National Advanced Payment System (CNAPS) Code | |||

| CP | 4!n | CHIPS Participant Identifier | |||

| ES | 8..9n | Spanish Domestic Interbanking Code | |||

| FW | without 9 digit code | Pay by Fedwire | |||

| GR | 7!n | HEBIC (Hellenic Bank Identification Code) | |||

| HK | 3!n | Bank Code of Hong Kong | |||

| IE | 6!n | Irish National Clearing Code (NSC) | |||

| IN | 11!C | Indian Financial System Code |

Name and Address 1

Specify the name or the first line of the Ordering Customer’s address. A maximum of 35 characters are allowed in each of these Name and Address fields.

Name and Address 2

Specify the continuation of name and the second line of the address.

Name and Address 3

Specify the third line of the address.

Name and Address 4

Specify the fourth line of the address.

59: Ultimate Beneficiary

These fields should not be input in case of Bank Transfer.

BIC

Select the BIC using LOV.

Name and Address 1

This field is an display field. Ultimate Beneficiary name will be defaulted here from the Main tab.

Name and Address 2

Specify the name and the first line of the Ultimate Beneficiary’s address.

Name and Address 3

Specify the name and the second line of the Ultimate Beneficiary’s address.

Name and Address 4

Specify the name and the third line of the Ultimate Beneficiary’s address.

Intermediary Institution BIC

Specify the Intermediary bank BIC, if applicable. Alternatively, you can select the BIC from the option list. This field is an optional input field. All BIC present in BIC directory and all Local Bank Code belonging to RTGS payment type network will be listed. You can select the BIC.

Payment Details

Booking Date

The system defaults the booking date as application server date.

Instruction Date

The system defaults this date as application server date and the payment will be processed on the Instruction Date.

Activation Date

The system defaults the activation date same as application server date.

Transfer Currency

The system defaults transfer currency if the network allows only single currency as per Network currency preferences (PMDNCPRF).

If multiple currencies are allowed then the system allows you to specify the transaction currency. Alternatively, you can select the transaction currency from the option list. The list displays all valid transaction currencies maintained in the system.

Transfer amount

Specify the transaction amount.

Exchange Rate

Specify the exchange rate if debit account currency is different from the transfer currency. The system retains the input value and validate the same against override and stop variances maintained in the Network preference.

If exchange rate is not specified, then the system populates the exchange rate on enrich or save, if the transfer amount is less than small FX limit maintained. If transfer amount is more than small FX limit and, if external exchange rate is applicable, then rate pick up will happen during transaction processing.

Remarks

Specify the internal remarks, if any.

Debit Value Date

The system would derive the debit value date as part of transaction processing. This field will be disabled for user input.

Credit Value Date

The system would derive the credit value date as part of transaction processing. This field will be disabled for user input.

Customer

The system displays the CIF of the debit customer for outgoing transactions.

Customer Service Model

This is the Service model to which the customer is attached. System will derive the customer service model from the customer service model linkage maintenance (PMDCSMLK).

Note

Customer and Customer Service Model is not applicable if the debit account is GL.

Enrich button

Click the Enrich button to populate the exchange rate, debit amount and charge/tax amounts.

If exchange rate pick up or charge pick up fails, system will throw error. User can then provide the required values and proceed with the transaction.

23B: Bank Operation Code

23B: Bank Operation Code

The value of CRED would be defaulted in this field. If any other value is desired then select one of the following codes using LOV:

- CRED - This message contains a Credit Transfer where there is no SWIFT Service Level involved.

- CRTS - This message contains a Credit Transfer for test purposes.

- SPAY - This message contains a Credit Transfer that must be processed according to the SWIFT Pay Service Level.

- SPRI - This message contains a Credit Transfer to be processed according to the Priority Service Level.

- SSTD - This message contains a Credit Transfer to be processed according to the Standard Service Level.

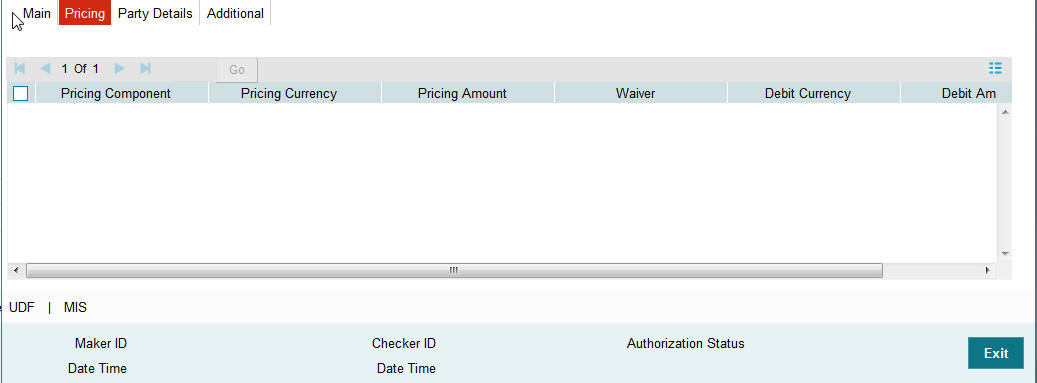

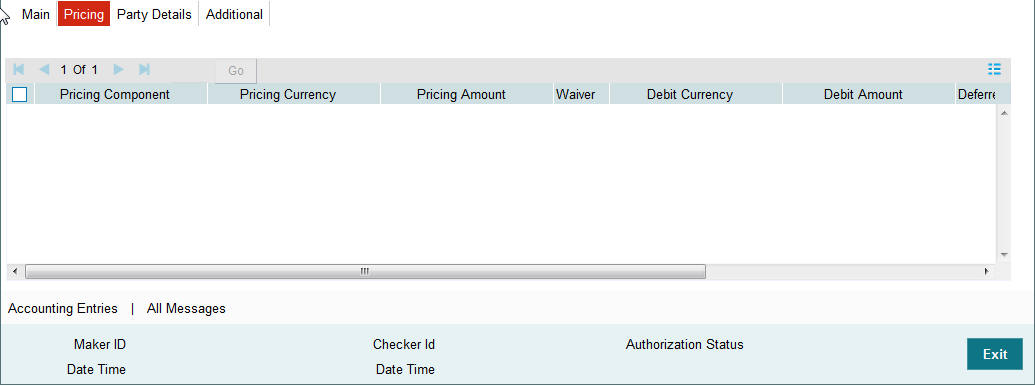

3.7.3 Pricing Tab

This tab displays the pricing details of the charges computed by system based on the transaction attributes in the Main tab..

The below mentioned attributes will be available in the Pricing tab

Pricing Component

Displays the Name of the pricing component applicable for the transaction.

Pricing Currency

Displays the Currency in which the charge amount is calculated for the Pricing component.

Pricing Amount

Displays the charge amount calculated for each pricing component.

Waived

Check this box to indicate that the charge is waived for the pricing component.

Debit currency

Displays the currency in which the charge amount is debited for the pricing component.

Debit amount

Displays the amount in debit currency to be debited.

Debit account

Displays the account from which the charge would be debited.

Exchange Rate

Displays the exchange rate applied to calculate the charge in debit amount.

50: Ordering Customer

During enrichment (or save), the debtor account number will be populated in the Account field. Name and address will be populated with customer details of the account present in Customer maintenance (CIF).

You can modify the following details

Account

This field is disabled for user input.

BIC

You can select the BIC using LOV

Name and Address 1

Specify the name and the first line of the Ordering Customer’s address. A maximum of 35 characters are allowed in each of these Name and Address fields.

Name and Address 2

Specify the continuation of the name and the second line of the address.

Name and Address 3

Specifies the third line of the address.

Name and Address 4

Specifies the fourth line of the address.

52: Ordering Institution

Party Identifier

Specifies a national clearing system code.

| AT | 5!n | Austrian Bankleitzahl | |||

| AU | 6!n | Australian Bank State Branch (BSB) Code | |||

| BL | 8!n | German Bankleitzahl | |||

| CC | 9!n | Canadian Payments Association Payment Routing Number | |||

| CH | 6!n | CHIPS Universal Identifier | |||

| CN | 12..14n | China National Advanced Payment System (CNAPS) Code | |||

| CP | 4!n | CHIPS Participant Identifier | |||

| ES | 8..9n | Spanish Domestic Interbanking Code | |||

| FW | without 9 digit code | Pay by Fedwire | |||

| GR | 7!n | HEBIC (Hellenic Bank Identification Code) | |||

| HK | 3!n | Bank Code of Hong Kong | |||

| IE | 6!n | Irish National Clearing Code (NSC) | |||

| IN | 11!C | Indian Financial System Code |

BIC

Select the BIC using LOV.

Name and Address 1

Specify the name and the first line of the Ordering Customer’s address. A maximum of 35 characters are allowed in each of these Name and Address fields.

Name and Address 2

Specify the continuation of the name and the second line of the address.

Name and Address 3

Specifies the third line of the address.

Name and Address 4

Specifies the fourth line of the address.

57: Account with Institution

Party Identifier

Specify a national clearing code. The following codes should be used, preceded by '//’.

| AT | 5!n | Austrian Bankleitzahl | |||

| AU | 6!n | Australian Bank State Branch (BSB) Code | |||

| BL | 8!n | German Bankleitzahl | |||

| CC | 9!n | Canadian Payments Association Payment Routing Number | |||

| CH | 6!n | CHIPS Universal Identifier | |||

| CN | 12..14n | China National Advanced Payment System (CNAPS) Code | |||

| CP | 4!n | CHIPS Participant Identifier | |||

| ES | 8..9n | Spanish Domestic Interbanking Code | |||

| FW | without 9 digit code | Pay by Fedwire | |||

| GR | 7!n | HEBIC (Hellenic Bank Identification Code) | |||

| HK | 3!n | Bank Code of Hong Kong | |||

| IE | 6!n | Irish National Clearing Code (NSC) | |||

| IN | 11!C | Indian Financial System Code |

Name and Address 1

Specify the name and the first line of the Ordering Customer’s address. A maximum of 35 characters are allowed in each of these Name and Address fields.

Name and Address 2

Specify the continuation of the name and the second line of the Ordering Institution’s address.

Name and Address 3

Specify the name and the third line of the address.

Name and Address 4

Specify the name and the fourth line of the address.

58: Beneficiary Institution

These fields should not be input in case of Bank Transfer.

Party Identifier

Specify a national clearing code. The following codes should be used, preceded by '//’.

| AT | 5!n | Austrian Bankleitzahl | |||

| AU | 6!n | Australian Bank State Branch (BSB) Code | |||

| BL | 8!n | German Bankleitzahl | |||

| CC | 9!n | Canadian Payments Association Payment Routing Number | |||

| CH | 6!n | CHIPS Universal Identifier | |||

| CN | 12..14n | China National Advanced Payment System (CNAPS) Code | |||

| CP | 4!n | CHIPS Participant Identifier | |||

| ES | 8..9n | Spanish Domestic Interbanking Code | |||

| FW | without 9 digit code | Pay by Fedwire | |||

| GR | 7!n | HEBIC (Hellenic Bank Identification Code) | |||

| HK | 3!n | Bank Code of Hong Kong | |||

| IE | 6!n | Irish National Clearing Code (NSC) | |||

| IN | 11!C | Indian Financial System Code |

Name and Address 1

Specify the name and the first line of the Ordering Customer’s address. A maximum of 35 characters are allowed in each of these Name and Address fields.

Name and Address 2

Specify the continuation of the name and the second line of the Ordering Institution’s address.

Name and Address 3

Specify the name and the third line of the address.

Name and Address 4

Specify the name and the fourth line of the address.

59: Ultimate Beneficiary

These fields should not be input in case of Bank Transfer.

BIC

Select the BIC using LOV.

Name and Address 1

This field is an display field. Ultimate Beneficiary name will be defaulted here from the Main tab.

Name and Address 2

Specify the continuation of the name and the second line of theUltimate Beneficiary’s address.

Name and Address 3

Specify the name and the third line of the Ultimate Beneficiary’s address.

Name and Address 4

Specify the name and the fourth line of the Ultimate Beneficiary’s address.

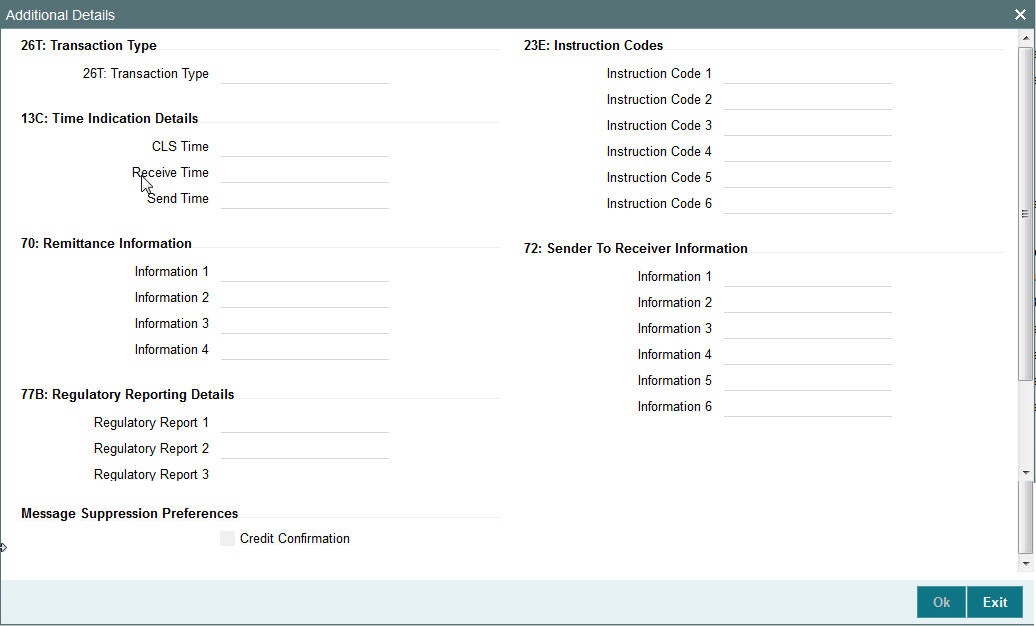

3.7.4 Additional Tab

Specify the additional details in this screen. Click on the ‘Additional’ tab to invoke this screen.

13C: Time Indication Details

This field specifies one or several time indication(s) related to the processing of the payment instruction.

TilTime

Specify the time up to which the transactions must be executed.

FroTime

Specifies the time up to which the transactions that must be executed.

RejTime

Specifies the time up to which the transactions must be executed.

Time should be input in the hhmm+/-iinn format, as per the SWIFT standard. ii and nn are the hours and minutes of UTC shift whereas the “hhmm“ are to be filled with the local time.

70E: Remittance Information

70: Remittance Information

Specify the information for the Ultimate Beneficiary of the transfer. This is applicable for customer transfer only.

72: Sender to Receiver Information

70: Remittance Information

Specify the sender to receiver information from the sender.

77B: Regulatory Reporting

77 B: Regulatory Reporting

Specify the codes for the statutory and regulatory information required by the authorities in the country of Receiver or Sender.

26T: Transaction Type

26 T: Transaction Type

Specify the nature of the transaction. Maximum of 3 alpha-numeric characters are allowed. This is applicable for Customer Transfers only.

23E: Instruction Codes

23E: Instruction Codes

Select the type of instruction codes using LOV, which are SWIFT compliant and applicable to the transaction accounts:

- CHQB - Indicates that beneficiary customer must be paid by cheque only.

- CORT - Indicates that Payment is made in settlement for a trade.

- HOLD - Indicates that beneficiary customer or claimant will call upon identification.

- INTC - Indicates a payment between two companies that belongs to the same group.

- PHOB - Please advise the intermediary institution by phone.

- PHOI - Please advise the intermediary by phone.

- PHON - Please advise the account with institution by phone.

- REPA - Payments has a related e-Payments reference.

- SDVA - Indicates that payment must be executed with same day value to the beneficiary.

- TELB - Please advise contact or beneficiary by the most efficient means of telecommunication.

- TELE - Please advise the account with institution by the most efficient means of telecommunication.

Banking Priority

Select the required priority of payment messages.

- Highly Urgent

- Urgent

- Normal

Default value will be normal.

Receiver

This is a display field, It is auto-populated with the Receiver BIC of the outgoing payment transaction. This field is derived while processing the outgoing RTGS transaction.

Message Suppression Preferences

Credit Confirmation

This flag is unchecked by default. Check this box to indicate that credit confirmation message MT 910 is to be suppressed.

3.7.5 UDF button

Click on the ‘UDF’ button to invoke this screen.

You can specify user defined fields for each transaction.

3.7.6 MIS button

Click on the ‘MIS’ button to invoke this screen.

You can specify the MIS details in this sub-screen.

3.7.7 Saving of Incoming Transaction

The system performs the mandatory field checks and the transaction validations, as mentioned below, during the save of RTGS incoming payment transaction.

- Charge bearer will always be ‘SHA’ for RTGS payment.

- Customer status check will be done as part of saving of the RTGS Payment transaction.

- For Customer Transfer user must enter Ordering customer details.

- For Bank Transfer user must enter Beneficiary Institution details.

If any of the transaction validation fails, transaction will be rejected with proper error code.

For transaction created through upload of file or message, the transaction will be moved to repair queue.

3.7.8 Authorization of Incoming Transaction

On authorization, the system will start to process various transactions. Only the transaction whose activation date as today will be picked for processing. The transaction authorization process involves the following steps:

- Bank Redirection

- Account Redirection

- Payment Dates Resolution

- Small FX Limit Check & Currency Conversion

- Computation of Charge and tax

- Authorization Limit 1 Check

- Authorization Limit 2 Check

- Duplicate Check

- Sanction Check

- EAC Check

- Debit/Credit Accounting Handoff

Incoming RTGS payment messages received from SWIFT will be booked and a transaction would be automatically created for the same. A Transaction reference number with the mask YYYYMMDDnnnnnnnn would be generated. Currency of the Interbank settlement amount will be considered as transfer currency for incoming transactions. This transaction would also be processed through the processing steps mentioned above and additionally the following steps:

- Transfer Type Resolution

- Transaction Type Resolution

- Transaction Validations.

3.7.9 Operations supported for Incoming Transaction

- New

- This option enables to create a new transaction as described above. The transaction reference number is generated based on format specified in this document

- Delete

- This enables the user to delete unauthorized transactions from the system.

- If a transaction has been authorized at least once, deletion of the transaction is not allowed.

- After the transaction has been reversed and authorized, it is not possible to do further operations on the transaction.

- Transaction in any of the exception queues can be reversed.

- Copy

- This option enables copying an existing transaction details to create a new transaction. New Transaction reference number will be generated for the new transaction.

- All details of copied (existing) transaction are retained in the new transaction created.

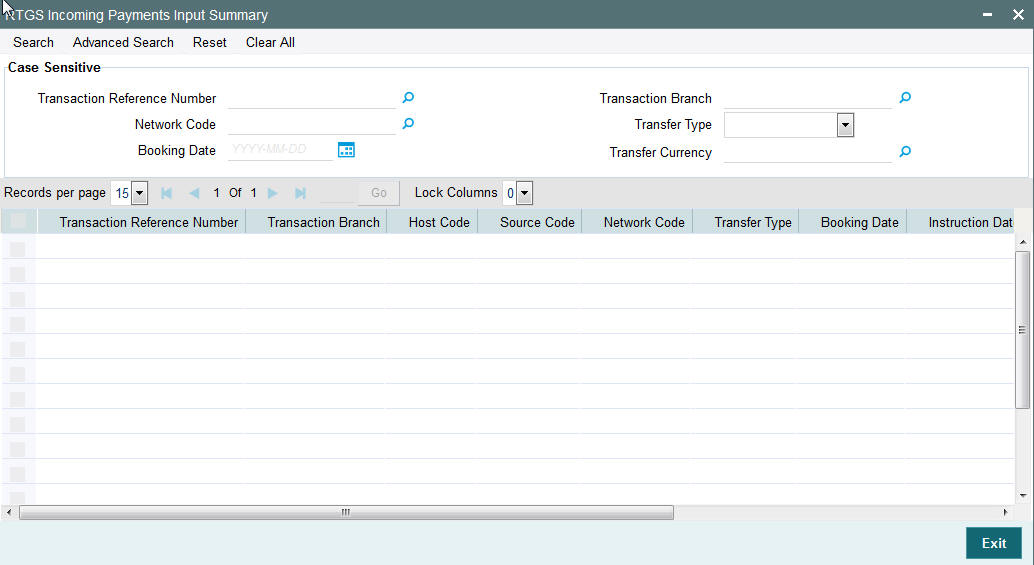

3.7.10 RTGS Incoming Payments Input Summary

You can invoke “RTGS Incoming Payments Input Summary” screen by typing ‘PRSITONL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. Click new button on the Application toolbar..

You can search for the records using one or more of the following parameters:

- Transaction Reference no

- Network Code

- Booking Date

- Transaction Branch

- Transfer Type

- Transfer Currency

Once you have specified the search parameters, click ‘Search’ button. The system displays the records that match the following search criteria.

- Transaction Reference no

- Transaction Branch

- Host Code

- Source Code

- Network Code

- Transfer Type

- Booking Date

- Instruction Date

- Activation Date

- Transfer Currency

- Transfer Amount

3.8 RTGS Incoming Payment View

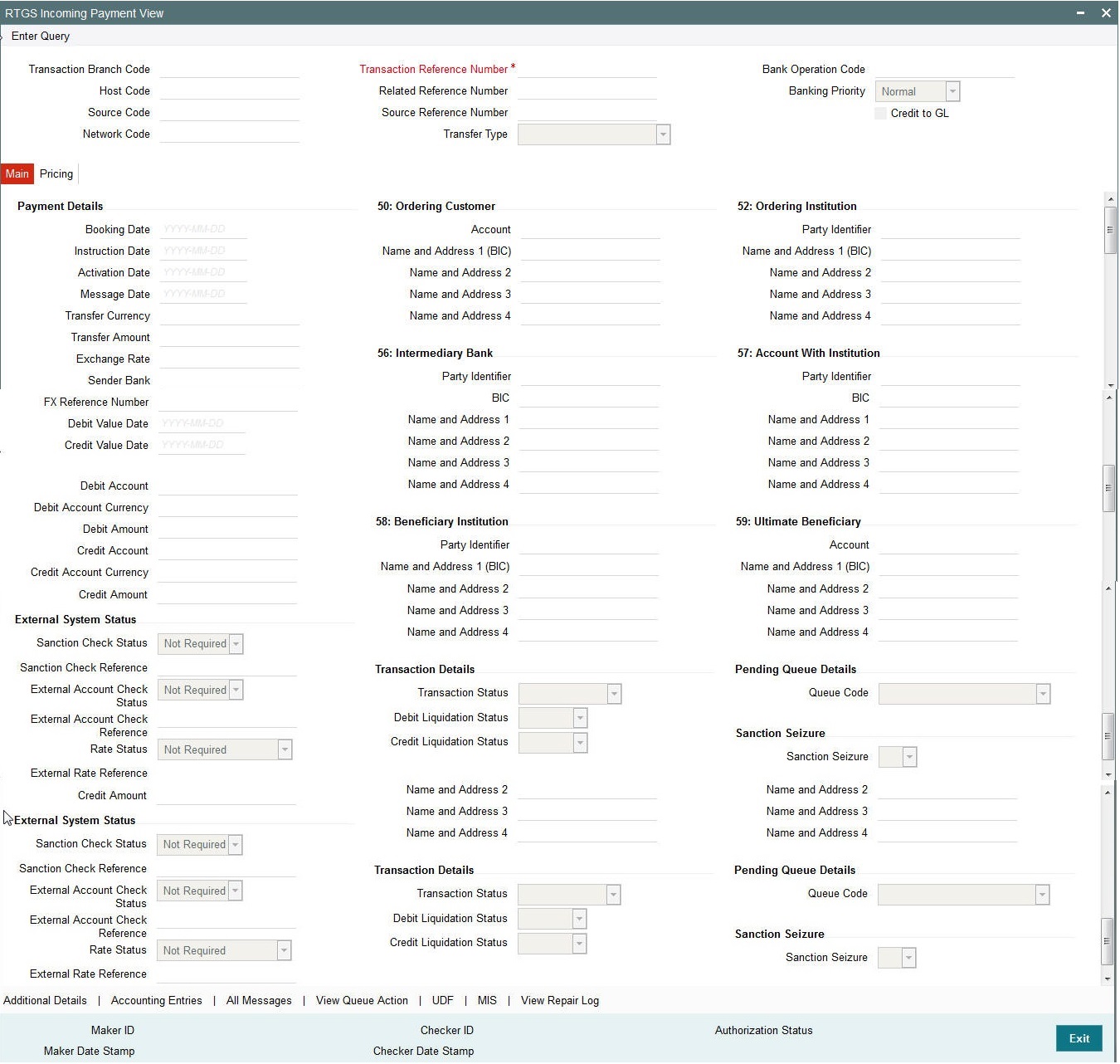

3.8.1 Invoking RTGS Incoming Payments View Screen

You can view the RTGS incoming transaction in this screen.

You can invoke “RTGS Incoming Payments” screen by typing ‘PRDIVIEW’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. Click new button on the Application toolbar..

You can view any incoming RTGS transaction that is initiated by specify inputting the Transaction Reference number and clicking ‘Enter Query’ button.

The transaction is displayed containing values populated for following different fields:

Transaction Branch Code

Displays the transaction branch code.

Transaction Reference Number

Displays the transaction reference number.

Host Code

Displays the host code.

User Reference Number

Displays the User Reference Number.

Source Code

Displays the Source Code of the transaction.

Transfer Type

Displays the specifies the transfer type of transfer the transaction.

Network Code

Displays the Network code. The system further displays values of all applicable fields in the below mentioned tabs based on the transaction reference number that was input.

3.8.2 Main Tab

Click on the ‘Main’ tab to invoke this screen and view the field details. Refer Section 3.7.2 for description of any field.

3.8.3 Pricing Tab

You can view pricing details in this screen that are computed by the system during the processing. Click on the ‘Pricing’ tab to invoke this screen and view the field details. Refer to section 3.7.3 for description of any field..

3.8.4 Additional Details Tab

Click on the ‘Additional Details’ tab to view the field details. Refer to sec. 3.7.5 for description of any field.