3. Instrument Clearing

Highlights of Instrument Clearing

- Lifecycle processing of instruments received for outward clearing

- Straight through processing of inward clearing file received from Clearing House

- Processing of cheque returns

3.1 Clearing Network Maintenance

New Network maintenance screen will be provided for capturing network details for Instrument Clearing.

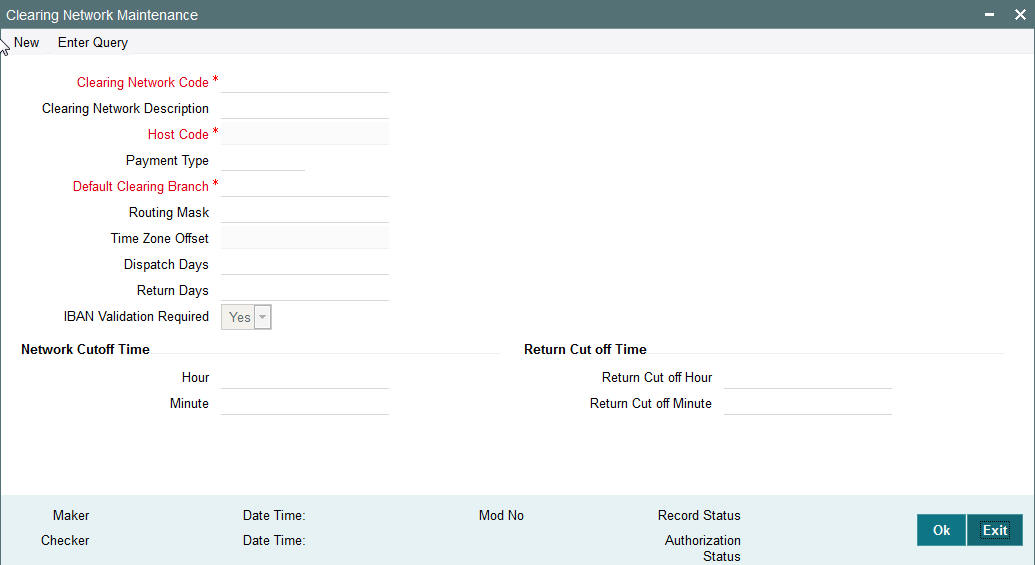

3.1.1 Invoking Clearing Network Maintenance Screen

You can invoke ‘Clearing Network Maintenance’ screen by typing ‘PGDINSCD’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button...

You can specify the following fields:

Clearing Network Code

Clearing Network Code can be captured in this field. For each clearing servicing centre of the bank, a different network needs to be maintained.

Clearing Network Description

Network Code description can be maintained in this field.

Host Code

Host code is defaulted based on user’s logged in branch.

Payment Type

The networks created using this screen will have default Payment type as ‘Clearing’

Default Clearing Branch

Specify the Default Clearing Branch from the list of values.

Routing Mask

Routing mask applicable for the network can be captured in this field.

Time Zone Offset

Time zone is defaulted based on the host.

Dispatch Days

This denotes the number of working days before clearing value date, the clearing file has to be generated and dispatched to the Network. Both branch & Network holidays will be considered to find the dispatch date.

Return Days

This denotes the number of working days after clearing value date, the return transactions to be dispatched to Network for an incoming clearing. For an outgoing clearing, the return transaction details should be received within the number of network working days after clearing value date.

IBAN Validation Required

This flag can be checked if IBAN validation is required for Credit/Debit accounts and banks identifiers.

Network Cutoff Time

Hour

Clearing Network cutoff time can be maintained. Specify the hour in HH format that is lesser than 24.

Minute

Clearing Network cutoff time can be maintained. Specify the hour in MM format that is lesser than 60.

Return Cutoff Time

Return Cut off Hour

Return cutoff time in hours can be maintained, if applicable.

Return Cut off Minute

Return cutoff time in minutes can be maintained, if applicable.

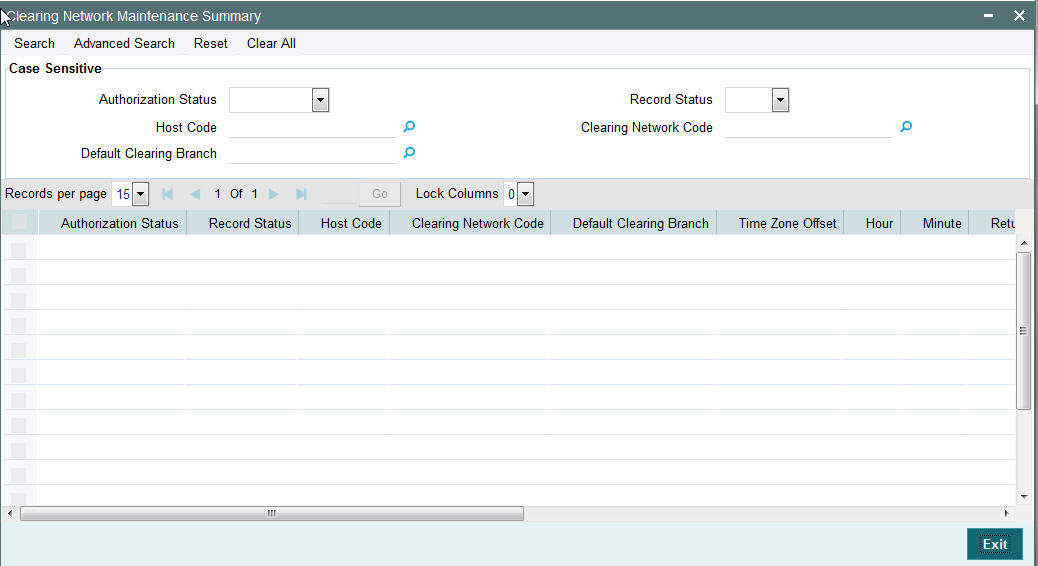

3.1.2 Viewing Clearing Network Maintenance Summary Screen

You can search for records in the Instrument Code Maintenance Summary Screen. You can invoke ‘Instrument Code Maintenance Summary’ screen by typing ‘PGSINSCD’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button..

You can search using one or more of the following parameters:

- Authorization Status

- Record Status

- Host Code

- Clearing Network Code

- Default Clearing Branch

Once you have specified the search parameters, click ‘Search’ button. The system displays the records that match the search criteria.

3.2 Clearing Bank Directory Maintenance

- A new Clearing Bank Directory Screen will be developed, to capture the Bank codes and related Branch codes for a Clearing Network.

- The Routing details for every branch of a bank which is participating in the clearing needs to be captured in this screen.

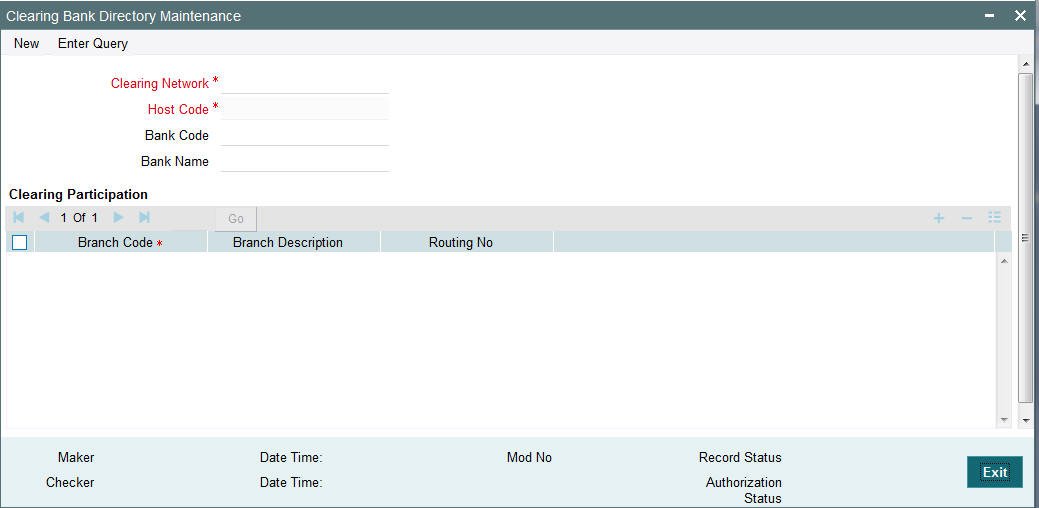

3.2.1 Invoking Clearing Bank Directory Maintenance

You can invoke ‘Clearing Bank Directory Maintenance’ screen by typing ‘PGDBANKD’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button...

You can specify the following fields:

Clearing Network

Specify the Clearing Network Code from the list of values of valid clearing networks available for the Host.

Host Code

The system specifies the host code of the logged in user.

Bank Code

Specify the bank code.

Bank Name

Specify the name of the bank

Clearing Participation

Branch Code

Specify every bank’s Branch, with which clearing transaction needs to be settled.

Branch Description

Specify the description of the branch.

Routing Number

The length of the mask is validated with the Routing mask maintained in Clearing Network Maintenance.

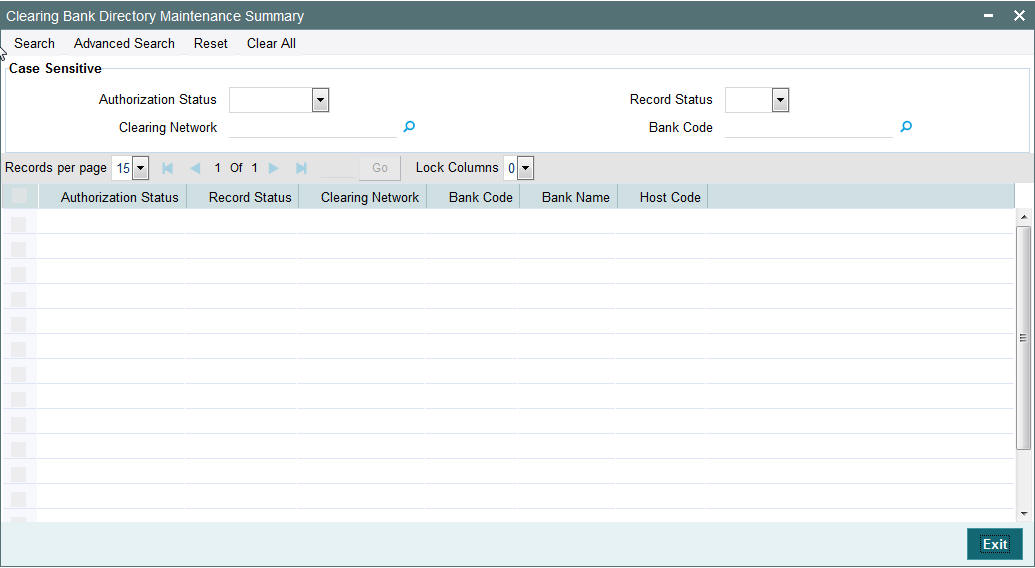

3.2.2 Viewing Clearing Bank Directory Maintenance Summary Screen

You can invoke Clearing Bank Directory Maintenance Summary’ screen by typing ‘PGSBANKD’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button..

You can search using one or more of the following parameters:

- Authorization Status

- Record Status

- Clearing Network

- Bank Code

Once you have specified the search parameters, click ‘Search’ button. The system displays the records that match the search criteria.

3.3 Clearing Branch Maintenance

- A new Clearing Branch Parameter screen is developed, to capture the

following details for each branch of the Bank:

- Clearing Branch Code

- Routing Number

- Branches under the same host will only be allowed to be mapped as a clearing branch.

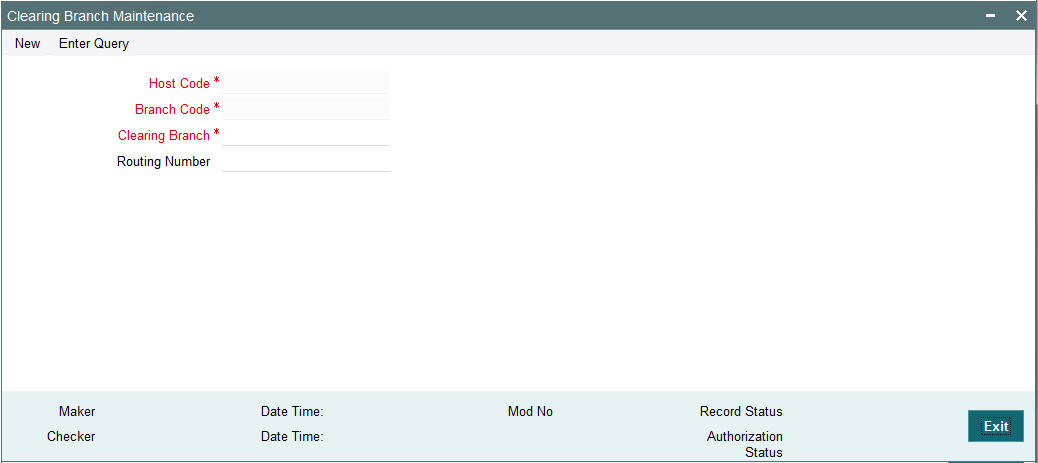

3.3.1 Invoking Clearing Branch Maintenance Screen

You can invoke ‘Clearing Branch Maintenance’ screen by typing ‘PGDBRANH’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button...

You can specify the following fields:

Host Code

The system indicates the host code that is linked to the logged in branch of the user.

Branch Code

The system displays the logged in branch code by default when you click New button.

Clearing Branch

All valid branch codes for the Host will be listed.

Routing Number

Specify the Routing Number. The length of the mask is validated with the Routing mask maintained in Clearing Network Maintenance

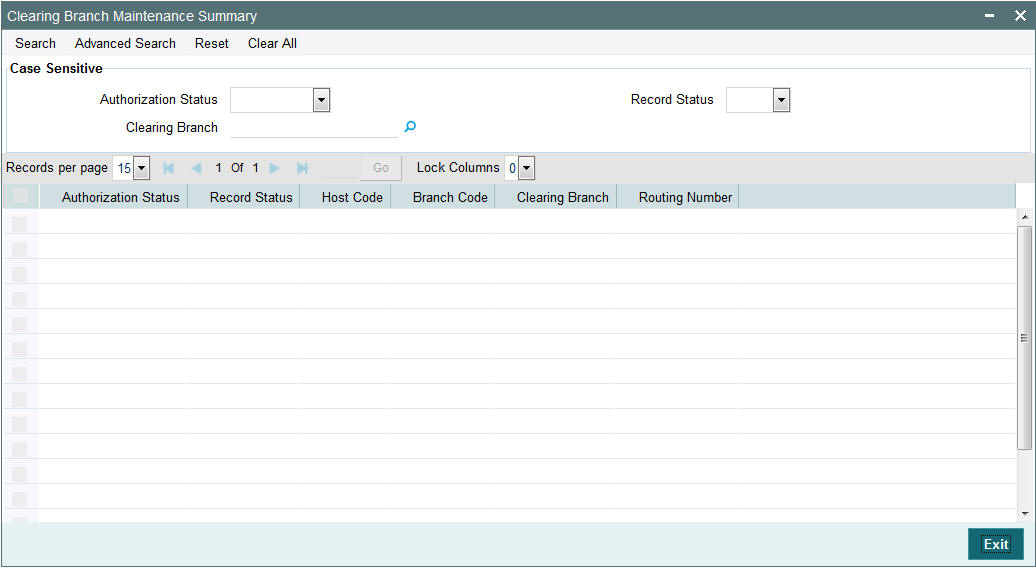

3.3.2 Viewing Clearing Branch Maintenance Summary Screen

You can search for records in the Instrument Inventory Maintenance Summary Screen. You can invoke ‘Instrument Inventory Maintenance Summary’ screen by typing ‘PGSBRANH’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button..

You can search using one or more of the following parameters:

- Authorization Status

- Record Status

- Clearing branch

Once you have specified the search parameters, click ‘Search’ button. The system displays the records that match the search criteria.

3.4 Instrument Code Maintenance

A new screen is developed to capture Instrument code per Host.

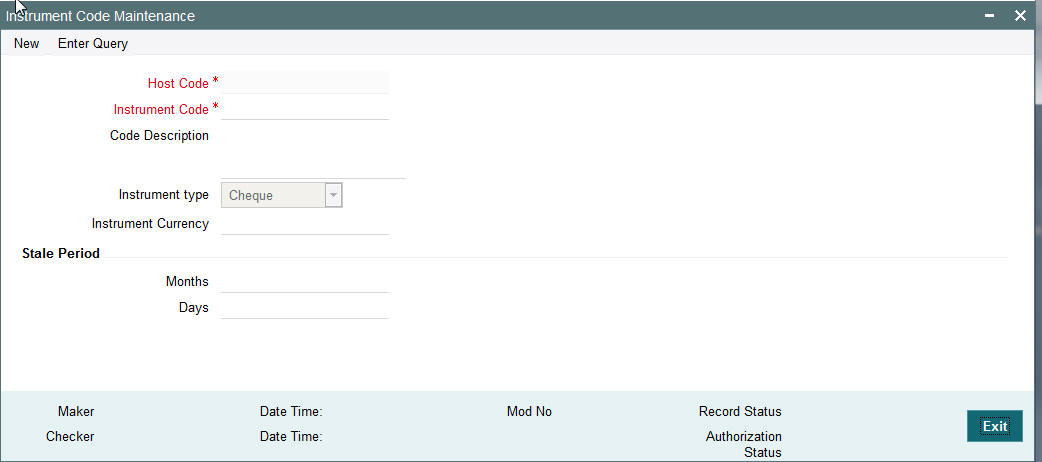

3.4.1 Invoking Instrument Code Maintenance Screen

You can invoke ‘Instrument Code Maintenance’ screen by typing ‘PGDINSCD’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button...

You can specify the following fields:

Host Code

This field is defaulted as user’s logged in Host.

Instrument Code

You can specify the instrument code.

Code Description

Based on the instrument code selected, Code Description gets auto-populated.

Instrument type

Select the required Instrument Type. The available options will be Cheque, Demand Draft and Manager’s cheque.

Instrument Currency

All valid currencies will be listed. You can choose the instrument currency for the instrument code maintained.

Stale Period

Months

You can specify the stale period in months.

Days

You can specify the stale period in days.

Note

Stale period can be maintained either in Months or in Days; not as a combination of both.

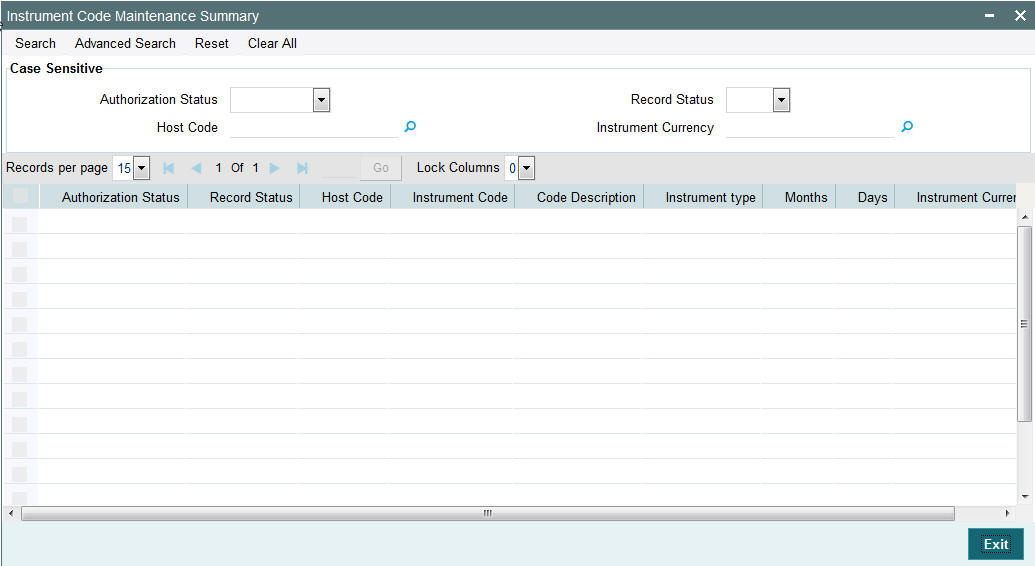

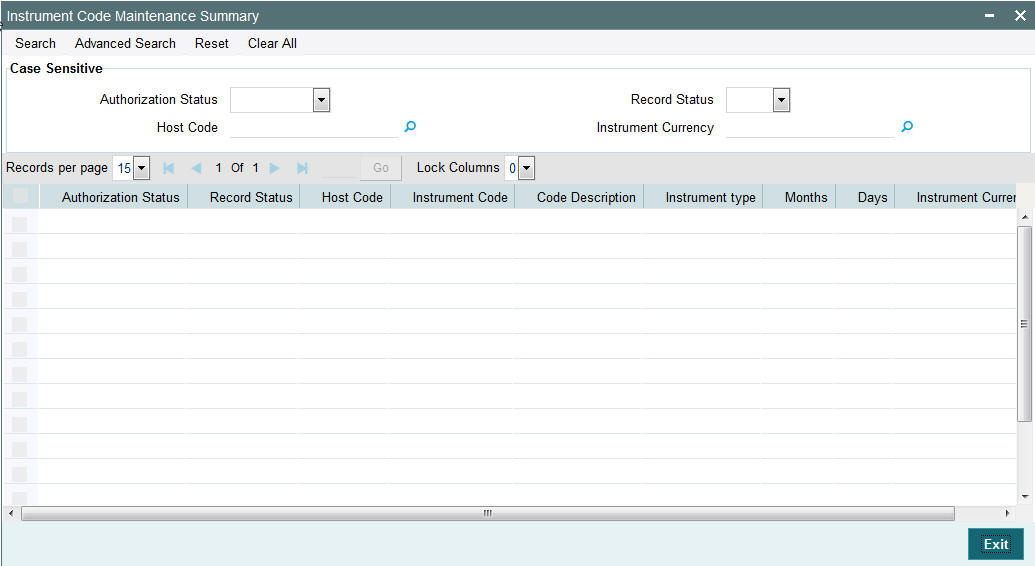

3.4.2 Viewing Instrument Code Maintenance Summary Screen

You can invoke ‘Instrument Code Maintenance Summary screen by typing ‘PGSINSCD’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button..

You can search using one or more of the following parameters:

- Authorization Status

- Record Status

- Host Code

- Instrument Currency

Once you have specified the search parameters, click ‘Search’ button. The system displays the records that match the search criteria.

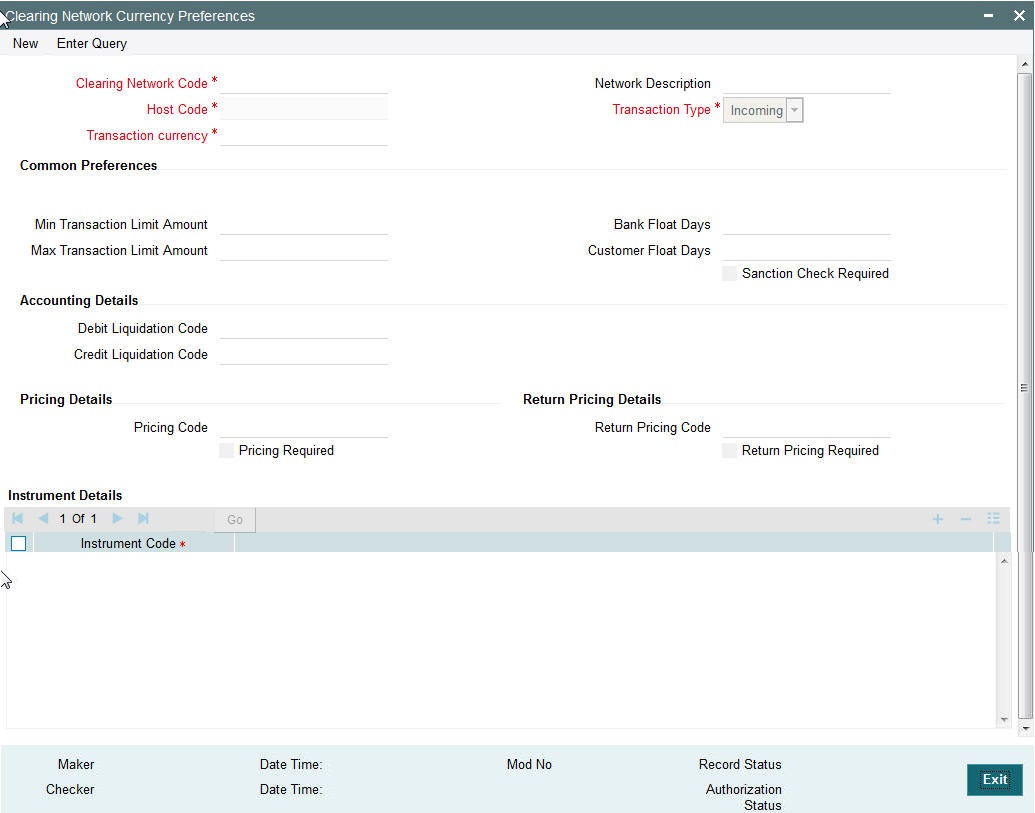

3.5 Clearing Network Currency Preference

A new screen to be developed to capture Clearing Network Currency Preference. For a combination of Network, direction, Clearing currency& Instrument code clearing preferences will be maintained in this screen.

3.5.1 Invoking Clearing Network Currency Preference Screen

You can invoke ‘Network Currency Preference’ screen by typing ‘PGDNCYPR’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button...

You can specify the following fields:

Clearing Network Code

You can select the Clearing Network for which preferences are to be maintained. All valid clearing network codes maintained for the Host will be listed.

Network Description

Network description is defaulted based on the Network chosen.

Host Code

This field is defaulted with the Host Code linked to user’s logged in branch.

Transaction Type

Transaction type can be Incoming or outgoing. Select any one.

Transaction currency

You can select the currency for which clearing preferences are to be maintained..

Common Preferences

Min Transaction Limit Amount

Minimum instrument amount allowed for the clearing Network is maintained in this field.

Max Transaction Limit Amount

Maximum limit of instrument amount allowed for the clearing Network is maintained.

Bank Float Days

You can maintain the Bank settlement days for the clearing. Working days is counted considering the Network holidays. Clearing settlement date will be Clearing date + Bank float days.

Customer Float Days

Clearing float days for clearing settlement will be maintained in this field. Working days is counted considering the Network holidays. Clearing value date will be Activation date + Bank float days

Sanction Check Required

This flag needs to be enabled if sanction verification is required during the clearing processing.

Accounting Details

Debit Liquidation Code

Specify the Accounting code for Debit Liquidation.

Credit Liquidation Code

Specify the Accounting code for Credit Liquidation.

Pricing Details

Pricing Code

If pricing required flag is checked, then maintaining pricing code is mandatory.

Pricing Required

Check this box to indicate that charge/tax application is required for a clearing return transaction.

Return Pricing Details

Return Pricing Code

Specify the Return Pricing Code from the list of values.

Return Pricing Required

Check this box to maintain Return Pricing Code.

3.5.2 Viewing Clearing Network Currency Preferences Summary Screen

You can invoke ‘Clearing Network Currency Preferences Summary screen by typing ‘PGSNCYPR’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button..

You can search using one or more of the following parameters:

- Authorization Status

- Record Status

- Clearing Code Network

- Transaction Type

- Transaction Currency

Once you have specified the search parameters, click ‘Search’ button. The system displays the records that match the search criteria.

3.6 Outgoing Clearing

Outgoing Clearing screen allows you to book an Outgoing Clearing Transaction by capturing details of the outgoing clearing instrument.

3.6.1 Invoking Outgoing Clearing Screen

You can invoke ‘Outgoing Clearing Screen’ by typing ‘PGDOTONL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following fields:

Transaction Branch

The system displays the logged in user’s logged in Branch code.

Host Code

The system displays the logged in host code.

Source Code

The displays the source code as MANL.

Transaction Reference

The system displays the auto-generated Transaction reference number.

User Reference

The system defaults the transaction number here. You can modify if required.

Network Code

Specify the network code. Alternatively you can select the network code from the option list. The list displays all valid clearing networks maintained for the Host.

If only once Network is available, that network will be auto populated on initiating New action.

3.6.2 Main Tab

You can specify the following details here:

Credit Details

Account/GL

Specify the Account / GL number. Alternatively, you can select the account number from the option list. The list displays all the valid account numbers maintained in the system.

Account IBAN

The system displays the account IBAN based on the account selected.

Account Currency

The system displays the account currency based on the account selected.

Account Branch

The system displays the account branch based on the account selected.

Account Name

The system displays the account name based on the account selected.

Credit Amount

The system displays the credit amount based on the instrument amount entered.

Customer Number

The system displays the customer number based on the account selected.

Customer Service Model

The system displays the customer service model applicable to the customer.

Drawer Details

Drawer Account

Specify the drawer account number.

Account IBAN

Specify the account IBAN.

Drawer Name

Specify the name of the drawer.

Note

Drawer details are optional fields.

Bank Routing No

Specify the routing number of the bank on which the instrument is drawn. Alternatively, you can select the routing number from the option list. The list displays all the all bank branches participating in the same clearing network.

Bank Name

The system displays the bank name based on the routing number selected.

Branch Name

The system displays the branch name based on the routing number selected.

Instrument Details

Instrument Code

Specify the instrument code. Alternatively, you can select the instrument code from the option list. The list displays all the all valid instrument codes for the host.

Instrument Number

Specify the instrument number.

Instrument Currency

The system displays the instrument currency based on the instrument selected.

Instrument Amount:

Specify the instrument amount.

Processing Dates

Booking Date

The system displays the current date as booking date and cannot be edited.

Instruction Date

The system defaults the current date as instruction date. You can modify instruction date to a future date, if required.

Clearing Date

The system defaults the clearing same as the instruction date if its a working day for the branch and network. In case of a holiday, this will be moved to the next working day.

Debit value date

The system calculates the debit value date as below:

Clearing Date+ Bank Float Days

Working days based on Network holidays maintained will be considered. This is the settlement date for clearing.

Credit Value Date

The system calculates the credit value date as below:

Clearing Date+ Credit float days

Working days based on Network holidays maintained will be considered

Dispatch Date

The system calculates the dispatch date as below:

Clearing date – Dispatch days

Working days based on Network holidays maintained will be considered. If dispatch date arrived at by system is a back date, then it will be set as current date and clearing date will be moved forward.

Return by Date

The system calculates the return by date as below:

Clearing Date+ Return days based on Network Working Days

Clearing Branch

The system defaults the clearing branch to which the transaction branch is linked based on the clearing branch linkage available.

Routing Number

The system displays the routing number based on the clearing branch selected.

Remarks

Specify any internal remarks related to the clearing transaction.

3.6.3 Pricing Tab

You can view the charge amount computed by the system for each of the Pricing components of the Pricing code linked to the network code of the transaction. Click the “Pricing” tab.

Specify the following details:

Pricing Component

The system displays each Pricing component of the Pricing code from the Pricing Code maintenance.

Pricing Currency

The system displays the Pricing currency of each Pricing component of the Pricing code.

Pricing Amount

The system displays the calculated Charge amount for each Pricing component of the Pricing code.

Waived

The system displays if charges for any Pricing component are waived in the Pricing maintenance.

Debit Currency

The system displays the currency of the Charge account to be debited for the charges.

Debit Amount

The system displays the Charge amount for each Pricing component debited to the charge account in Debit currency. If the Pricing currency is different from the Debit currency the calculated charges are converted to the Debit currency and populated in this field.

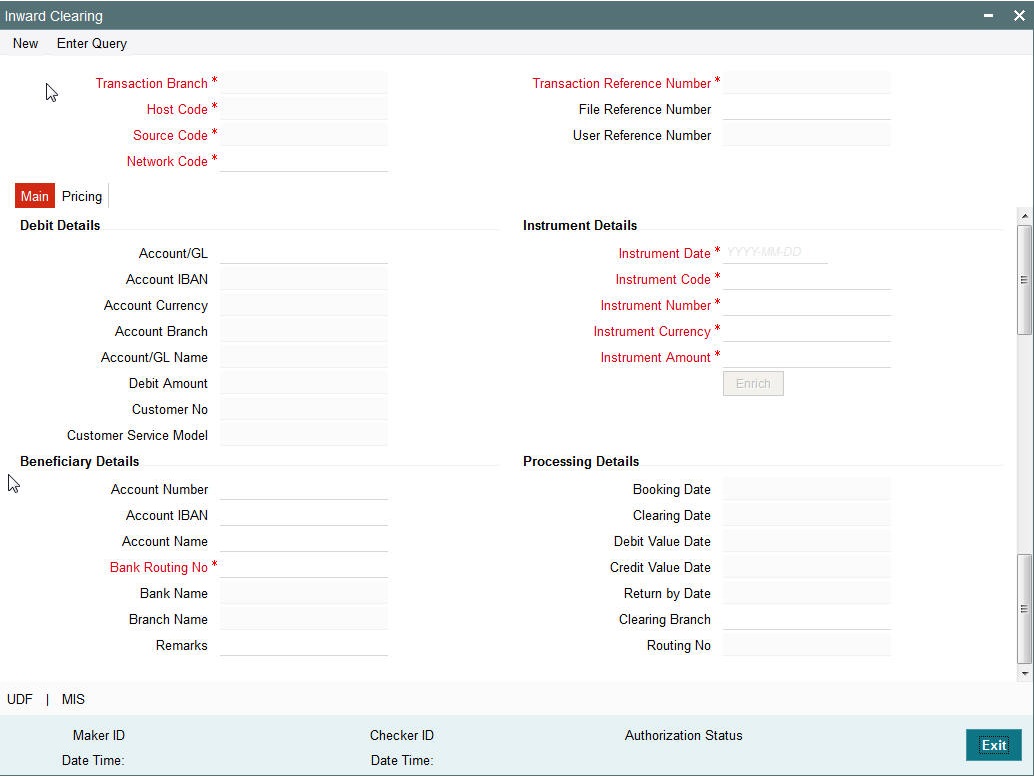

3.7 Inward Clearing

Inward Clearing screen allows you to book an inward Clearing Transaction by capturing details of the inward clearing instrument.

3.7.1 Invoking Inward Clearing Screen

You can invoke ‘Inward Clearing’ Screen by typing ‘PGDITONL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button

You can specify the following fields:

Transaction Branch

The system displays the logged in user’s Branch code.

Host Code

The system displays the logged in user’s host code.

Source Code

The displays the source code as MANL.

Transaction Reference

The system displays the auto-generated Transaction reference number.

User Reference

The system defaults the transaction number here. You can modify if required.

Network Code

Specify the network code. Alternatively you can select the network code from the option list. The list displays all valid clearing networks maintained for the Host.

If only once Network is available, that network will be auto populated on initiating New action.

3.7.2 Main Tab

You can specify the following details here:

Debit Details

Account/GL

Specify the Account / GL number. Alternatively, you can select the account number from the option list. The list displays all the valid account numbers maintained in the system.

Account IBAN

The system displays the account IBAN based on the account selected.

Account Currency

The system displays the account currency based on the account selected.

Account Branch

The system displays the account branch based on the account selected.

Account Name

The system displays the account name based on the account selected.

Credit Amount

The system displays the credit amount.

Customer Number

The system displays the customer number based on the account selected.

Customer Service Model

The system displays the account IBAN based on the account selected.

Beneficiary Details

Drawee Account Number

Specify the Beneficiary account number.

Account IBAN

Specify the account IBAN.

Account Name

Specify the name of the Beneficiary.

Bank Routing No

Specify the routing number of the bank on which the instrument is drawn. Alternatively, you can select the routing number from the option list. The list displays all the all bank branches participating in the same clearing network.

Bank Name

The system displays the bank name based on the routing number selected.

Branch Name

The system displays the branch name based on the routing number selected.

Instrument Details

Instrument Code

Specify the instrument code. Alternatively, you can select the instrument code from the option list. The list displays all the all valid instrument codes for the host.

Instrument Number

Specify the instrument number.

Instrument Currency

The system displays the instrument currency based on the instrument selected.

Instrument Amount:

Specify the instrument amount.

Processing Dates

Booking Date

The system displays the current date as booking date and cannot be edited.

Instruction Date

The system defaults the current date as instruction date. You can modify instruction date to a future date, if required.

Clearing Date

The system defaults the clearing same as the instruction date if its a working day for the branch and network. In case of a holiday, this will be moved to the next working day.

Debit value date

The system calculates the debit value date as below:

Clearing Date+ Bank Float Days

Working days based on Network holidays maintained will be considered. This is the settlement date for clearing.

Credit Value Date

The system calculates the credit value date as below:

Clearing Date+ Credit float days

Working days based on Network holidays maintained will be considered

Return by Date

The system calculates the return by date as below:

Clearing Date+ Return days based on Network Working Days

Clearing Branch

The system defaults the clearing branch to which the transaction branch is linked based on the clearing branch linkage available.

Routing Number

The system displays the routing number based on the clearing branch selected.

Remarks

Specify any internal remarks related to the clearing transaction.

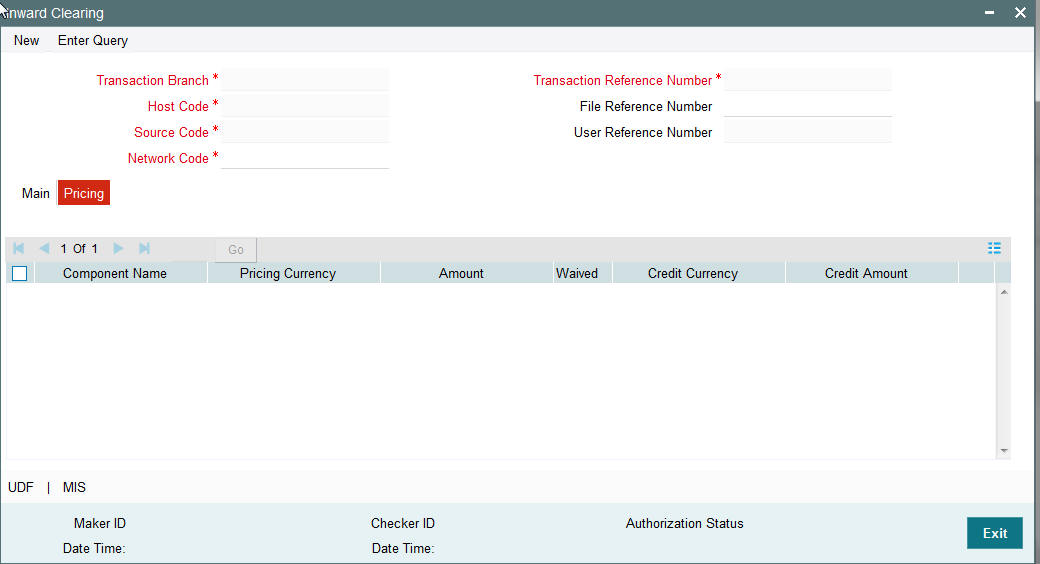

3.7.3 Pricing Tab

You can view the charge amount computed by the system for each of the Pricing components of the Pricing code linked to the network code of the transaction. Click the “Pricing” tab.

Specify the following details:

Pricing Component

The system displays each Pricing component of the Pricing code from the Pricing Code maintenance.

Pricing Currency

The system displays the Pricing currency of each Pricing component of the Pricing code.

Pricing Amount

The system displays the calculated Charge amount for each Pricing component of the Pricing code.

Waived

The system displays if charges for any Pricing component are waived in the Pricing maintenance.

Debit Currency

The system displays the currency of the Charge account to be debited for the charges.

Debit Amount

The system displays the Charge amount for each Pricing component debited to the charge account in Debit currency. If the Pricing currency is different from the Debit currency the calculated charges are converted to the Debit currency and populated in this field.

Click Save to save the transaction. On save, the initial validations will be executed.

When the transaction is received through channels or file upload, it will be auto authorized.