2. Payments Maintenance

Oracle Banking Payments aims at providing a payment solution which cater to requirements of both Retail/Corporate segments.

This chapter enumerates the maintenance of reference information used by the Oracle Banking Payments. It is possible to maintain preferences and parameters applicable for different payment types using the maintenances available. In addition to common maintenances, certain common processes which are applicable across payment types are explained as well.

2.1 Payment Maintenances

Generic maintenances helps in defining various parameters as required by the bank, for payment processing.

2.1.1 Source Maintenance

Source maintenance screen is used to identify an external system or source from which payments system receives a payment request.

You can invoke the ‘Source Maintenance’ screen by typing ‘PMDSORCE’ in the field at the top right corner of the application toolbar and clicking the adjoining arrow button. Click new button on the Application toolbar.

Source codes are defined Host specific. User’s logged in Host is defaulted while creating a new source code.

You can specify the following fields:

Source Code

Specify a unique source code.

Description

Specify a brief description on the source code.

Source Type

Select the source type from the drop-down list. The list displays the following values:

- Upload

- Manual Input

MIS Group

Select the required MIS Group.

UDF Group

Select the required UDF Group.

Prefunded Payments

Prefunded Payments Allowed

Check this box to indicate that Pre funded payments are allowed for the source.

Prefunded Payments GL

Specify the required Prefunded Payments GL from the list of values.

Duplicate Check Fields

Duplicate Check Required

Check this box to indicate that Duplicate Check Required is required.

Duplicate Check Period in Days

Specify the days used for Duplicate Check.

Note

For the payment types, ACH and NACHA, the days pick up is from Non urgent Preferences. For all other payment types, the days pick up is from urgent preferences.

Other Preferences

SSI Handling

Select the option for SSI Handling.

- Not Required-Default SSI label pick up is not applicable for transactions received from this source.

- Default and Verify-The beneficiary/routing details is fetched from default SSI label if the transaction is received without SSI label and if default SSI label is available for the customer network and currency. The transaction is moved to a Settlement Review Queue for user verification.

- Default-The beneficiary/routing details is fetched from default SSI label if the transaction is received without SSI label and if default SSI label is available for the customer network and currency. No verification is required in this case and transaction processing proceeds to the next step.

Inbound credit to GL

This flag can be checked to replace the credit account of the incoming payments received from the source with the Intermediary Credit GL maintained.

Note

- The system verifies whether ‘Inbound Credit to GL’ is checked for the source if a transaction is input or received with ‘Credit to GL’ flag checked. If it is not preferred for the source, error is displayed.

- It is not mandatory to have a credit account /customer for the transaction if credit to GL flag is checked for the transaction. On enrich or save the system populates the credit account as the ‘Intermediary Credit GL’ maintained for the source.

- If credit account or customer is available, it is retained. However, all customer/ account related validations are skipped.

- Credit account currency is set same as transfer currency.

Intermediary Credit GL

Select the Intermediary Credit GL from the list of values.

Note

- Cutoff processing, Price pick up and External account validation are skipped for transaction with ‘Credit to GL’ flag checked.

- Sanction screening is applicable by default.

- While posting the credit accounting, the credit account is be considered as ‘Intermediary Credit GL’ maintained for the source.

Auto Queue Preferences-System action

This field has the drop-down options Auto Rollover, Cancel or Retain in Queue.

This preference maintained for the source is considered for the pre-funded payments in the following scenarios:

- For processing a payment which is pending in cutoff/network cutoff exception queues during end of the day.

- For deciding the next step of processing when a payment is released from SC on a future date.

- When the External Credit approval status received requires system action preference application.

Notification Required flag

This flag denotes whether notification generation is required for the source.

Note

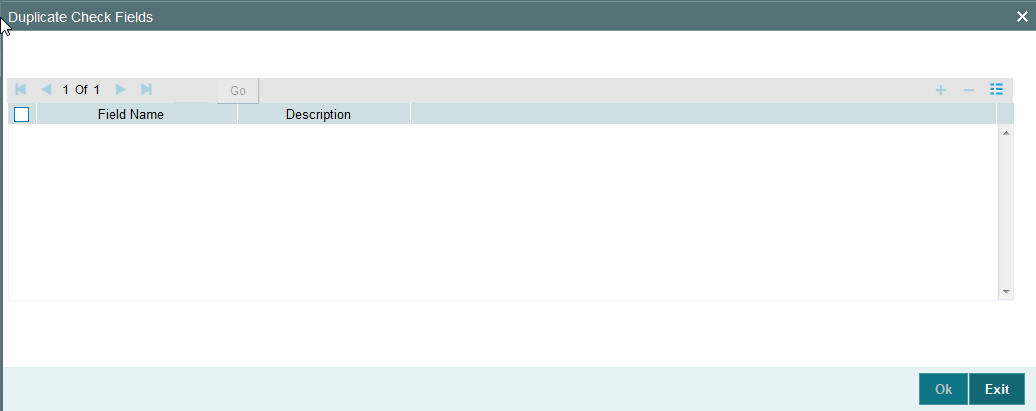

2.1.1.1 A new duplicate check parameter VALUE_DATE is provided in the Source maintenance PMDSORCE. This maps instruction date for cross-border, RTGS, ACH, US ACH and Fedwire payments. For Book transfer, Clearing and Collections, this will be mapped to transaction value date.Duplicate Check Fields

You can capture Duplicate Check Fields information.

You can invoke the ‘Duplicate Check Fields sub-screen in Source Maintenance Screen by clicking the “Duplicate Check Fields” link present at the bottom of the screen.

Specify the following details.

Duplicate Check Fields

Duplicate Check Required

Check this flag if duplicate check is applicable to the source.

Duplicate Check Period in Days

Specify the duplicate check period in days. Transactions booked during duplicate check period is compared to find the duplicate transactions.

Field Name

The fields based on which duplicate check has to be performed for a payment transaction if ‘Duplicate Check Required’ flag is checked.

The following are the fields listed:

- Transfer Currency

- Transfer Amount

- Debtor Account (if IBAN is required for a network Debtor IBAN field is considered)

- Creditor Account (if IBAN is required for a network Creditor IBAN field is considered)

- Creditor Bank BIC

- Debtor Bank BIC

- Creditor Bank Code

- Debtor Bank Code

- Customer Number

- End to End Id

- Transaction Id

- Network

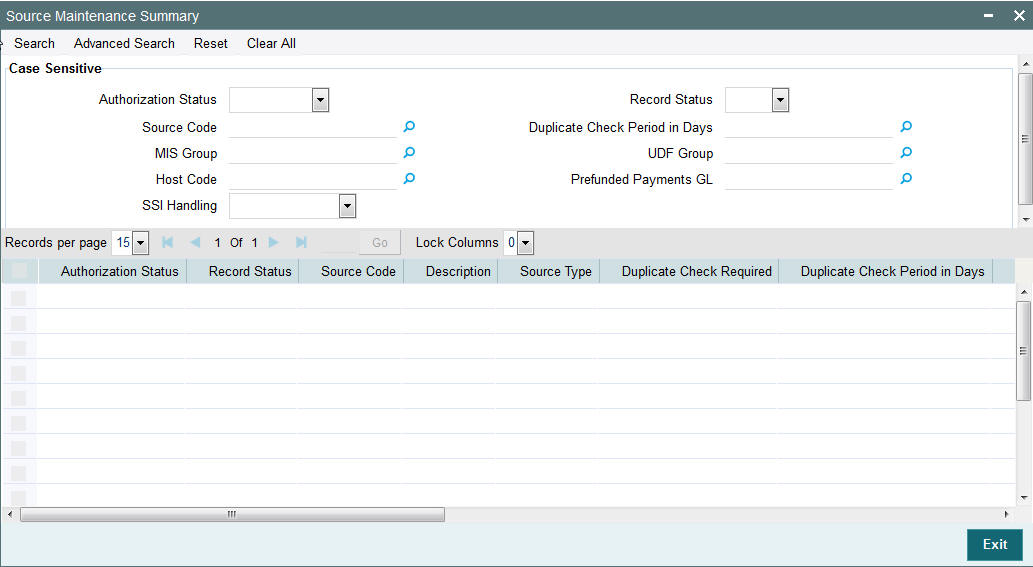

2.1.1.2 Viewing Source Maintenance

You can view all payment sources maintained in the system using ‘Source Maintenance Summary’. You can invoke the ‘Source Maintenance Summary’ screen by typing ‘PMSSORCE’ in the field at the top right corner of the application toolbar and clicking the adjoining arrow button.

You can search using one or more of the following parameters:

- Authorization Status

- Record Status

- Source Code

- Duplicate Check Period in Days

- MIS Group

- UDF Group

- Host Code

- Prefunded Payments GL

- SSI Handling

Once you have specified the search parameters, click ‘Execute Query’ button. The system displays the records that match the search criteria.

Double click a record to view the detailed source maintenance screen. You can also export the details of selected records to a file using ‘Export’ button.

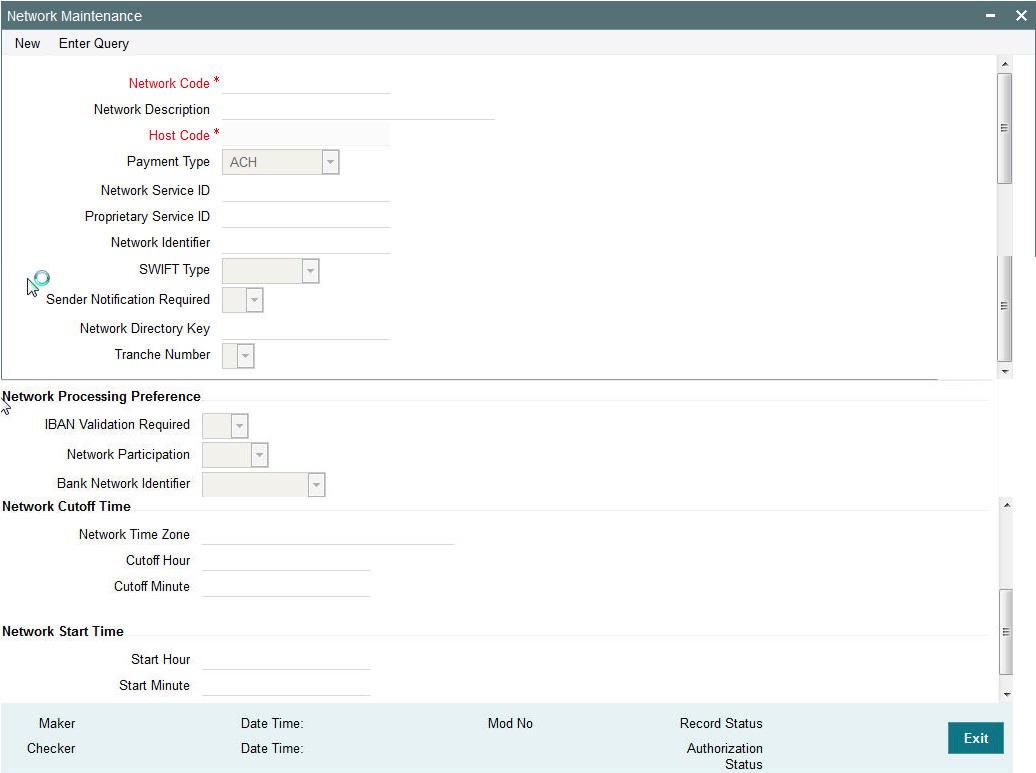

2.1.2 Network Maintenance

You can maintain clearing network that supports local payments using ‘Network Maintenance’ screen.

Every network code is linked to a payment type and host code. The same Network code is allowed to be maintained with multiple host combinations.

For current dated payments or warehoused payments picked up by Future value jobs, system would check if the network is open before dispatching the payment message/file to the network.

You can invoke the ‘Network Maintenance’ screen by typing ‘PMDNWMNT’ in the field at the top right corner of the application toolbar and clicking the adjoining arrow button.Click new button on the Application toolbar..

You can specify the following fields;

Network Code

Specify a unique code for the network.

Network Description

Specify a brief description on the network code.

Host Code

Host Code is defaulted as your logged in Host.

Payment Type

Select the payment type from the drop-down list. The list displays the following values:

- ACH

- Book Transfer

- RTGS

- Faster Payment

- Cross Border

- Direct Debits

- US NACHA

- FEDWIRE

Network Service ID

Specify the ISO clearing identification code. Alternatively, you can select the network service ID from the option list. The list displays all valid network service IDs maintained in the system.

Network Identifier

Specify the Network identifier from the LOV.

Proprietary Service ID

Specify the proprietary service ID if the network service ID is proprietary in nature.

Network Identifier

Specify the network BIC. Alternatively, you can select the network BIC from the option list. The list displays all valid network BIC maintained in the system. This is used in SEPA dispatch file generation.

SWIFT Type

Specify the type of SWIFT. Select any one of the following:

- FIN

- FIN Y-COPY

Sender Notification Required

Check this box to request MT012 for the outgoing RTGS message.

Network Directory Key

Specify the network directory key from the LOV.

Tranche Number

Select the required Tranche Number.

Network Processing Preferences

IBAN Validation Required

Select whether IBAN validation is required from the drop down list. Options are as follows:

- Yes

- No

This field is not applicable for the payment type ‘Book Transfer’.

Network Participation

Select the bank’s network participation type from the drop-down list. The list displays the following values:

- Direct

- Indirect

Bank Network Identifier

Select the bank network identifier from the drop-down list. The list displays the following values:

- SWIFT BIC - If SWIFT BIC is selected, then the SWIFT addresses maintained for the bank in local bank code directory will be used for bank identification.

- Local Bank Code - If Local Bank Code is selected, the bank codes maintained in Local Bank Directory will be applicable for bank identification.

Network Cutoff Time

Network Time zone

The system defaults the time zone applicable for the host.

Cutoff Hour

Specify the network cut-off hour.

Cutoff Minute

Specify the network cut-off minute.

Network Start Time

Start Hour

Specify the hour for the Network Start time.

Start Minute

Specify the minute for the Network Start time.

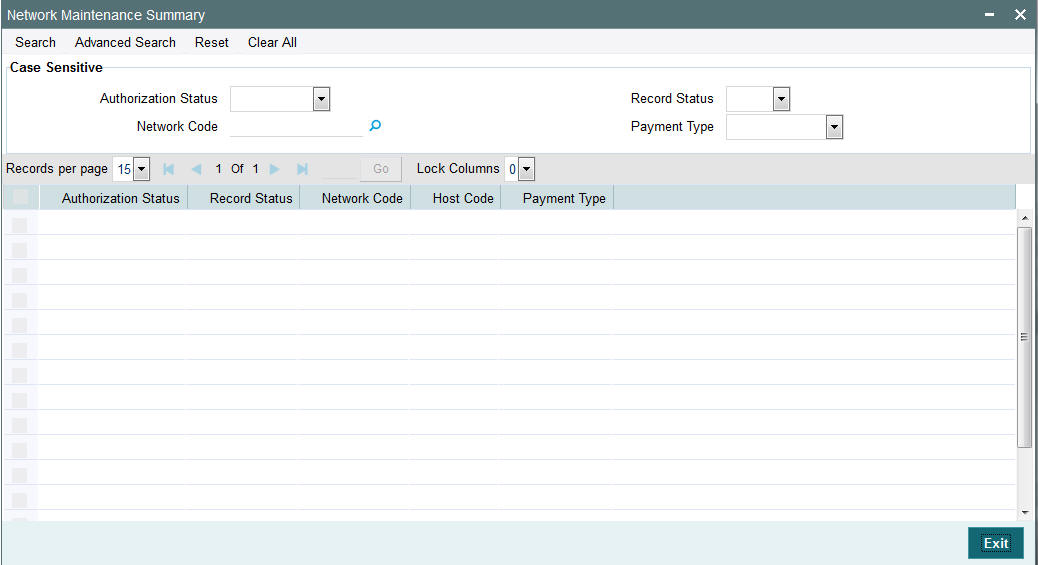

2.1.2.1 Viewing Network Maintenance Summary

You can view a summary of network using ‘Network Maintenance Summary’ screen. To invoke this screen, type ‘PMSNWMNT’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

You can search for the networks using one or more of the following parameters:

- Authorization Status

- Record Status

- Network Code

- Payment Type

Once you have specified the search parameters, click ‘Execute Query’ button. The system displays the records that match the search criteria.

Double click a record to view the detailed network maintenance screen. You can also export the details of selected records to a file using ‘Export’ button

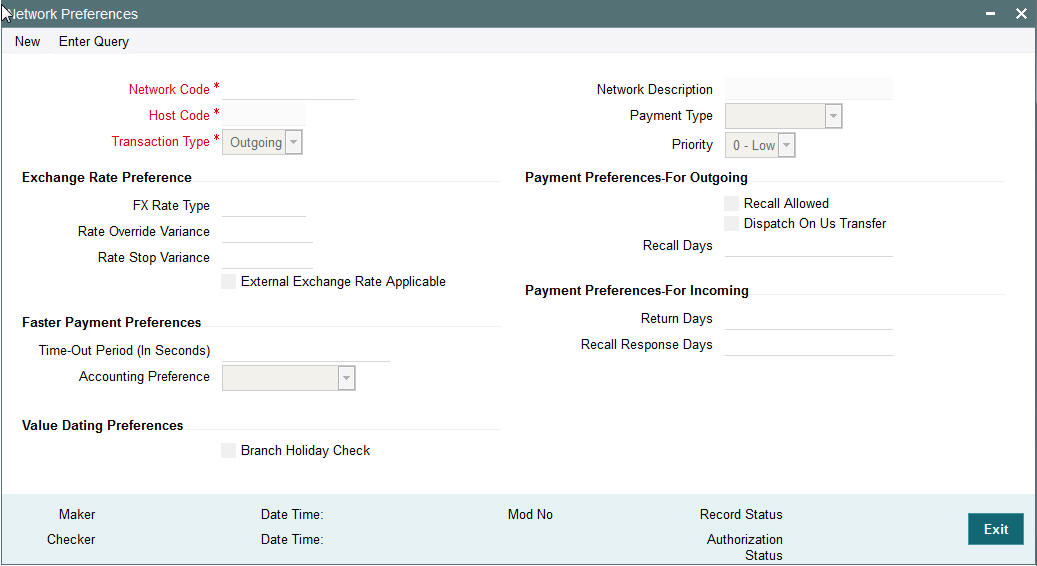

2.1.3 Network Preference

You can maintain network preferences for combination of Network and transaction type using ‘Network Preference’ screen.

In this screen, you can specify the following preferences:

- Exchange Rate Preferences

- Sanction System Preferences

- Charge Claim Preferences

- Exception Preferences for Domestic Low Value Payments

- Faster Payment Preferences

You can invoke the ‘Network Preference’ screen by typing ‘PMDNWPRF’ in the field at the top right corner of the application toolbar and clicking the adjoining arrow button. Click new button on the Application toolbar..

You can specify the following fields;

Network Code

Specify the network code. Alternatively, you can select the network code from the option list. The list displays all valid network codes applicable for the logged in Host, maintained in the system.

Network Description

The system displays the network code description.

Host Code

Host code is defaulted as the logged in Host.

Payment Type

The system displays the payment type based on the network code selected.

Priority

Select the priority. “0” indicates ‘Low’ priority and “9” indicates ‘High’ priority. This priority can be specified different from different networks and also different values for Outgoing and Incoming transactions of the same Network and Host.

Transaction Type

Select the payment transaction type from the drop-down list. The list displays the following values:

- Incoming

- Outgoing

Exchange Rate preferences

FX Rate Type

Specify the FX rate type. Alternatively, you can select the FX rate type from the option list. The list displays all open and authorised exchange rate types maintained in the system.

Rate Override Variance

Specify the rate override variance.

If the variance between the exchange rate manually provided for a payment with internal rate exceeds the override limit specified, then the system displays a message and the transaction is saved.

Rate Stop Variance

Specify the rate stop variance. The system displays an error message if the exchange rate variance exceeds the stop limit.

External Exchange Rate System Applicable

Check this box to receive the exchange rate from the external system.

Note

External rate fetch is applicable only if the transfer amount is above the small FX limit maintained in Network Currency preferences (PMDNCPRF).

Payment Preferences-For Outgoing

Recall Allowed

Check this box if the network allows recall of an outgoing payment already sent.

Dispatch Internal Transaction

Check this box to indicate whether an On Us transaction needs to be included in the Dispatch File.

Note

This flag, by default, is unchecked. This preference is applicable only for Networks of payment type ‘ACH’ (low value payments) and Direct Debits.

Recall Days

Specify the number of days within which the payment originating bank has to recall an outgoing payment.

Dispatch On Us Transfer

Check this box if the network allows Dispatch On Us Transfer for an outgoing payment.

Faster Payment Preferences

Time-out period

You can specify time out period in seconds.

Time out period is allowed to be maintained for both outgoing and incoming with different time in seconds. For outgoing payments, investigation message is generated after time out period. For incoming transaction, the system validates whether the message is received after the time out seconds or the response is sent within the time out seconds. If the validation fails, then reject response is sent.

Accounting Preference

Select the preference for accounting during the outgoing faster payment transaction processing. The options available are:

- On Confirmation from CI

- Before Messaging

If the preference selected is ‘On confirmation from CI’, the debit /credit accounting is passed only on getting an acceptance confirmation from the Clearing Infrastructure (CI/CSM). If the payment is rejected the balance block (ECA) reversal request is sent to DDA system.

If the accounting option chosen for the Network is ‘Before Messaging’, the outbound message is sent subsequent to debit/credit accounting. In case of payment rejection, accounting is reversed.

Payment Preferences-For Incoming

Return Days

Specify the number of days within which the payment originating bank has to return an incoming payment.

Recall Response Days

Specify the number of days within which the beneficiary bank has to respond to an incoming recall request.

Recall days is considered as working days based on Network holidays.

The system validates if the Recall days is applicable for payment types SCT Inst payment or ACH with transaction type as outgoing. Recall response days is applicable to SCT Inst payment or ACH payment types with transaction type as incoming.

Value Dating Preferences

Branch Holiday Check

Check this flag to indicate that Branch holiday check should be done for activation date as part of processing of the outgoing or incoming payment.

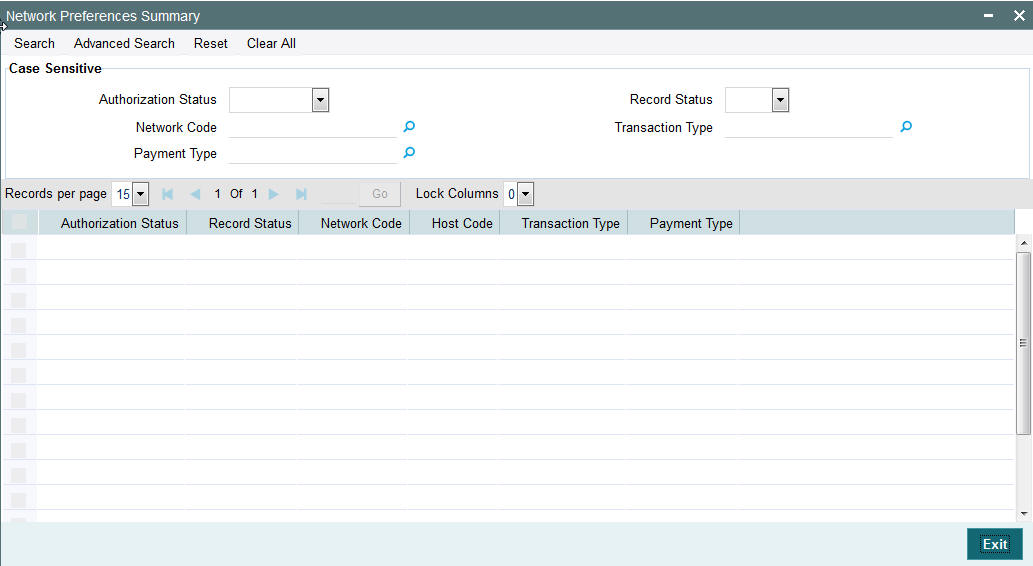

2.1.3.1 Viewing Network Preference

You can view a summary of network preferences using ‘Network Preference Summary’ screen. To invoke this screen, type ‘PMSNWPRF’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

You can search using one or more of the following parameters:

- Authorization status

- Record status

- Transaction Type

- Network Code

- Payment Type

Once you have specified the search parameters, click ‘Execute Query’ button. The system displays the records that match the search criteria.

Double click a record to view the detailed Network Preference screen. You can also export the details of selected records to a file using ‘Export’ button.

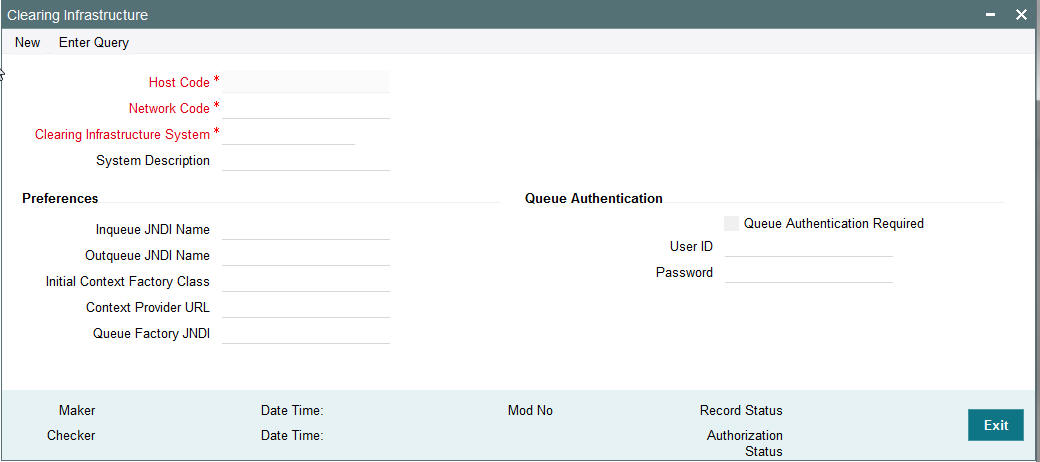

2.1.4 Clearing Infrastructure

You can maintain the Clearing Infrastructure details in the Clearing Infrastructure screen.

You can invoke the ‘Clearing Infrastructure’ screen by typing ‘PMDCLRMT’ in the field at the top right corner of the application toolbar and clicking the adjoining arrow button. Click new button on the Application toolbar..

You can specify the following fields:

Host Code

The system displays the host code based on logged in Host.

Network Code

Specify the network code. Alternatively, you can select the network code from the option list. The list displays all valid network codes applicable for the logged in Host.

Clearing Infrastructure System

Specify the Clearing Infrastructure System details.

System Description

Specify the Clearing Infrastructure System description.

Preferences

Inqueue JNDI Name

Specify the name for Clearing Infrastructure queue configured in Application server.

Outqueue JNDI Name

Specify the name for Clearing Infrastructure queue configured in Application server.

Initial Context Factory Class

Specify the initial context factory class.

Context Provider URL

Specify the context provider URL.

Queue Factory JNDI

Specify the queue factory JNDI.

Queue Authentication

Queue Authentication

Check this box to indicate that Queue Authentication is required for the Clearing Infrastructure System.

User Id

Specify the required User Name.

Password

Enter the password. The User Id and Password that you specify will be used for verification purposes. Password is encrypted and stored.

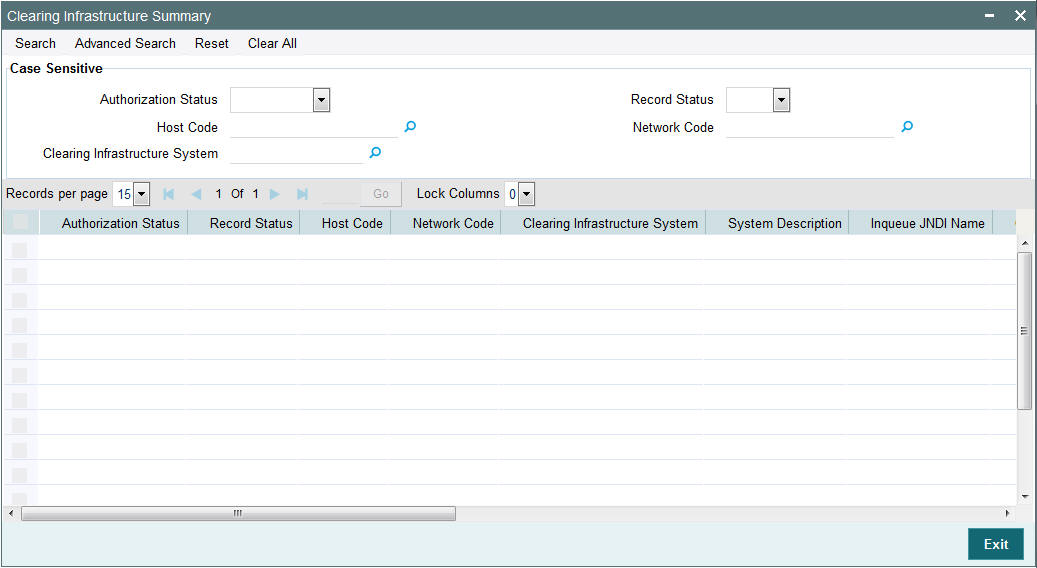

2.1.4.1 Viewing Clearing Infrastructure Summary

You can view summary of clearing Infrastructure using ‘Clearing Infrastructure Summary’ screen. To invoke this screen, type ‘PMSCLRMT’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

You can search using one or more of the following parameters:

- Authorization status

- Record status

- Host Code

- Network Code

- Clearing Infrastructure System

Once you have specified the search parameters, click ‘Search’ button. The system displays the records that match the search criteria.

Double click a record to view the detailed Clearing Infrastructure Summary screen. You can also export the details of selected records to a file using ‘Export’ button.

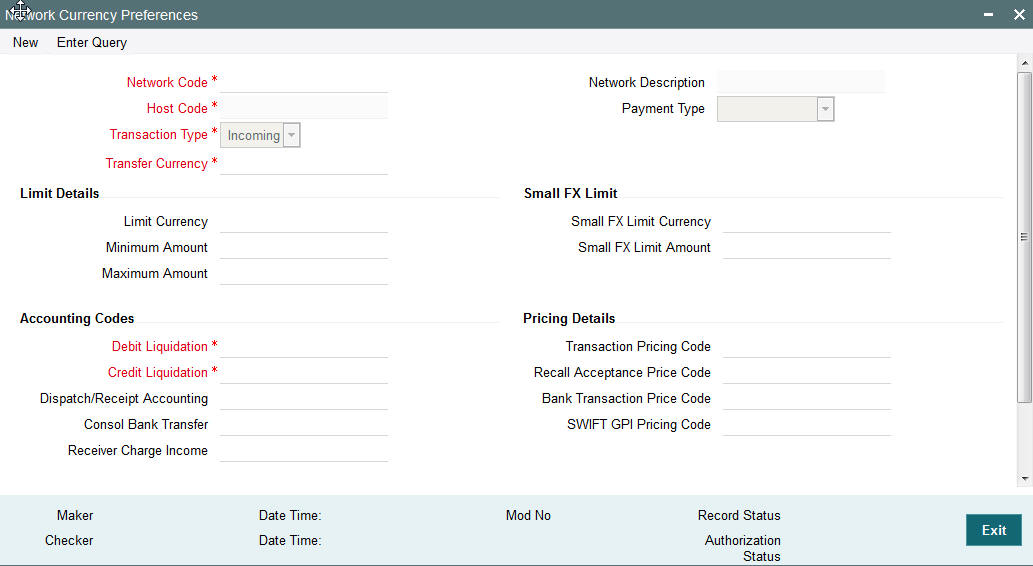

2.1.5 Network Currency Preferences

You can maintain all currency related parameters for a Network and transaction type combination using ‘Network currency preference’ screen.

You must maintain network currency preferences for all transfer currencies allowed for the network.

For book transfer payments, network currency preference for the allowed credit currencies is needed to be maintained.

You can invoke the ‘Network Currency Preference’ screen by typing ‘PMDNCPRF’ in the field at the top right corner of the application toolbar and clicking the adjoining arrow button. Click new button on the Application toolbar..

You can specify the following fields:

Network Code

Specify the network code. Alternatively, you can select the network code from the option list. The list displays all valid network codes applicable for the logged in Host.

Network Description

The system displays the network code description.

Host Code

The system displays the host code based on logged in Host.

Payment Type

The system displays the payment type based on the network code.

Transaction Type

Select the transaction type from the drop-down list. The list displays the following values:

- Incoming

- Outgoing

Transfer Currency

Specify the transfer currency. Alternatively, you can select the transfer currency from the option list. The list displays all valid currency codes maintained in the system. AL currency would be listed and would be applicable for SWIFT & BOOK transfer payment types.

Note

Selection of the *AL value in this Currency field indicates that the Network Currency Preferences record is applicable to transactions for the selected Network in all currencies of the selected Transaction Type (Outgoing or Incoming).Limits Details

Limit Currency

Specify the limit currency.

Note

This field is enabled for input only when Transfer Currency field has *AL value. You can input any valid currency (other than *AL).

Minimum Amount

Specify the minimum transaction amount.

Maximum Amount

Specify the maximum transaction amount.

Note

Payments booked should have transaction amount between the minimum and maximum amount specified in the transaction currency. If the transaction amount is not in the specified range, the system displays an error message.

Small FX Limit

Small FX Limit Currency

Specify the small FX limit currency code. Alternatively, you can select the currency code from the option list. The list displays all valid currency codes maintained in the system.

For payments with cross currency conversions, the transfer amount is converted to equivalent amount in the small FX limit currency and is compared with small FX limit amount. If the amount is less than the limit specified, then the internal rates maintained in the system is picked up for currency conversion.If it is more than the limit specified, and if external exchange rate is not applicable, then payments are moved to exchange rate queue. If external exchange rate is applicable, then request is sent to External Rate system.Payment is logged n External Exchange Rate Queue if the rate is not obtained from External system.

If no limit is maintained, then limit check is skipped and internal rates are applied for the payment.

Pricing Details

Pricing Code

Specify the pricing code applicable to the Network, transaction type and currency. You can also select the pricing code from the option list. The list displays all valid pricing codes maintained in the system.

Recall Acceptance Price Code

Specify the Recall Acceptance price code. This is applicable to domestic low value payments based on the Network support available for recall acceptance charges. Alternatively, you can select the pricing code from the option list. The list displays all valid Recall Acceptance Price codes maintained in the system.

Note

The option list has a list of all price codes with single component linkage.

Bank Transaction Pricing Code

Pricing code applicable for Bank transfers can be specified in this field.

GPI Pricing Code

Specify the GPI Pricing Code from the list of values. This Pricing Code is applicable to cross-border transactions that are GPI enabled.

Accounting Codes

Debit Liquidation

Specify the accounting code for debit liquidation. Alternatively, you can select the debit liquidation code from the option list. The list displays all accounting codes where main transaction is maintained with debit indicator.

Credit Liquidation

Specify the accounting code for credit liquidation. Alternatively, you can select the credit liquidation code from the option list. The list displays all accounting codes where main transaction is maintained with credit indicator.

Dispatch/Receipt Accounting

Specify the accounting code for dispatch accounting. Alternatively, you can select the dispatch accounting code from the option list. The list displays all valid codes maintained in the system.

Note

- Dispatch accounting is applicable to outgoing domestic low value payment files. Accounting code needs to be maintained for Transaction type 'Outgoing' if Dispatch accounting is required.

- Receipt accounting is for incoming files. Accounting code needs to be maintained for Transaction type 'Incoming' if Receipt accounting is required.

Consol Bank Transfer

Accounting code for cross-border consolidated bank transfer can be specified in this field.

Receiver Charge Income

Accounting code for receiver charge income posting for cross-border payments can be specified in this field.

Return Accounting

Payment Return GL

Specify the Return GL code. Alternatively, you can select the GL code from the option list. The list displays all GL codes maintained in the system.

Note

Return GL is used in scenarios when the incoming payment processing could not be completed and return is initiated from queues. Return GL is applicable for Incoming ACH, Cross border & RTGS.

Network Account Details

Network Account

Specify the Network Account. Only Nostro accounts will be listed in the LOV. This is applicable for RTGS payment types.

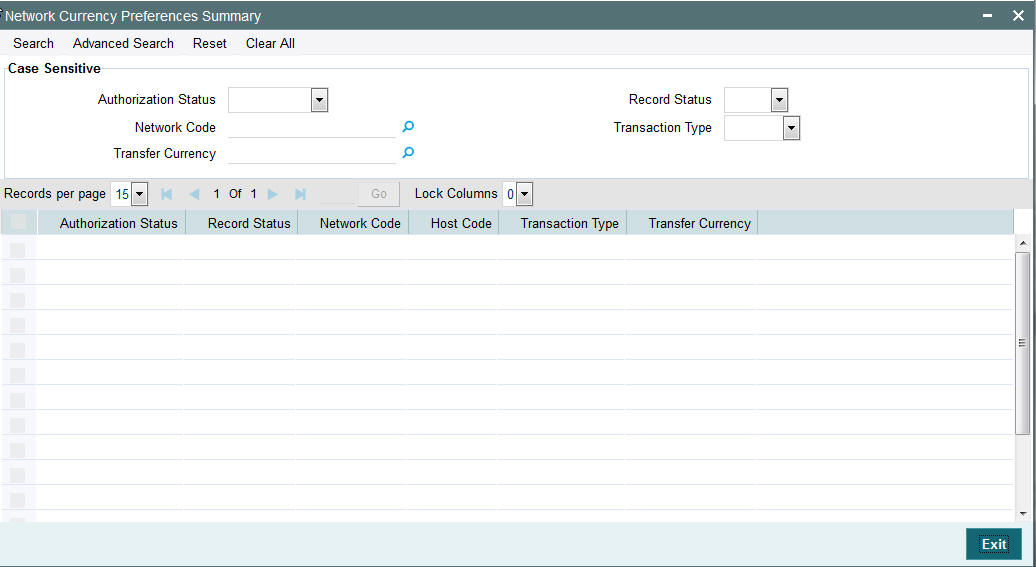

2.1.5.1 Viewing Network Currency Preference

You can view summary of network currency preferences using ‘Network Currency Preference Summary’ screen. To invoke this screen, type ‘PMSNCPRF’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

You can search using one or more of the following parameters:

- Authorization Status

- Network Code

- Transaction Type

- Record status

- Transfer Currency

Once you have specified the search parameters, click ‘Search’ button. The system displays the records that match the search criteria.

Double click a record to view the detailed Network Currency Preference screen. You can also export the details of selected records to a file using ‘Export’ button.

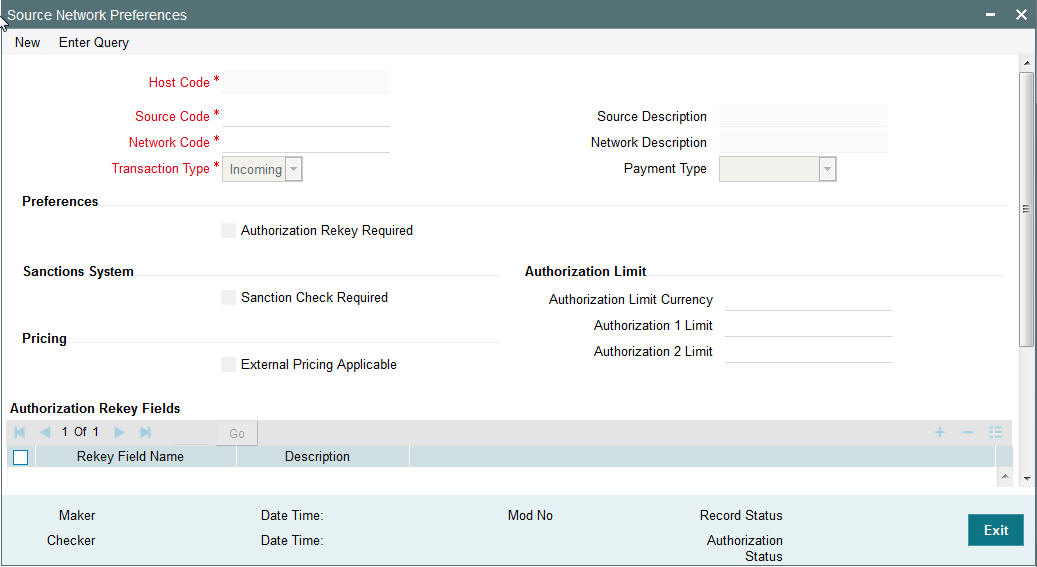

2.1.6 Source Network Preferences

You can maintain Source Network Preferences for capturing preferences at source and network level for each transaction type.

Usage of Source Network Preferences

- Authorization re-key required flag is added in Source Network preferences.If re-key is required, it is possible to maintain the re-key fields applicable.

- The list of fields is populated based on the payment type linked to the Network selected.

- Static maintenance is provided for populating available field values for each payment type/transaction type.

- All applicable re-key fields is part of the Authorization screen.For any of the available fields, if re-key is not applicable, actual field values are populated by system and the fields are disabled in authorization screen. In authorization screen, fields for which re-key is applicable will be null and editable by user.

- On processing authorization, the system checks whether re-key values by the authorizer are matching with actual values available as part of transaction details.

You can invoke ‘Source Network Preferences’ screen by typing ‘PMDSORNW’ in the field at the top right corner of the Application toolbar and clicking on the adjoining arrow button.

You can specify the following fields:

Host Code

Defaults the Host Code of the logged in branch.

Source Code

Specifies all valid source codes applicable.

Source Description

Displays the description of the source code.

Network Code

Specifies all valid network codes applicable to the host.

Network Description

Specifies the description of the network.

Payment Type

Specifies the type of payment linked to the network.

Transaction Type

Specifies the type of transaction. The options are Outgoing and Incoming.

Authorization Re-key Required

Check this box if Re-key is required for authorization.

Rekey Field Name

Select the required field that requires re-key authorization. All valid fields are listed

Field Description

This field is applicable based on the Rekey field chosen.

Sanctions System

Sanction Check Required

Check this box to introduce a Sanction Check.

Pricing

External Pricing Applicable

Check this box to introduce an External Pricing System Maintenance.

Authorization Limits

Authorization Limit 1

Payment Transactions are moved to Authorization Limit 1 Queue if transaction amount exceeds the authorization limit 1 maintained.

Authorization Limit 2

The transactions are moved to Authorization Limit Level 2 Queue if transaction amount exceeds the authorization limit 2 maintained.

Note

Authorization Limits should be greater than or equal to Minimum Network Limit maintained and should be less than or equal to Maximum Network Limit. Authorization Limit 2 should be greater than Authorization Limit 1.

- Payment transactions is be moved to Authorization Limit Level 1 Queue if transaction amount exceeds the authorization limit 1 maintained for Payment transactions.This check is done after initial validations.

- The transactions will be moved to Authorization Limit Level 2 Queue if transaction amount exceeds the authorization limit 2 maintained.

- These checks will be applicable for both channel and user input transactions. These checks are not applicable for payments processed in bulk.

- Authorization limits check are applicable for

- Domestic Low Value Payments (ACH)

- Book Transfer

- Domestic High value Payments (RTGS)

- Cross border Payments

Authorization Limit Currency

Select any valid currency in which the Authorization Limit amounts are maintained

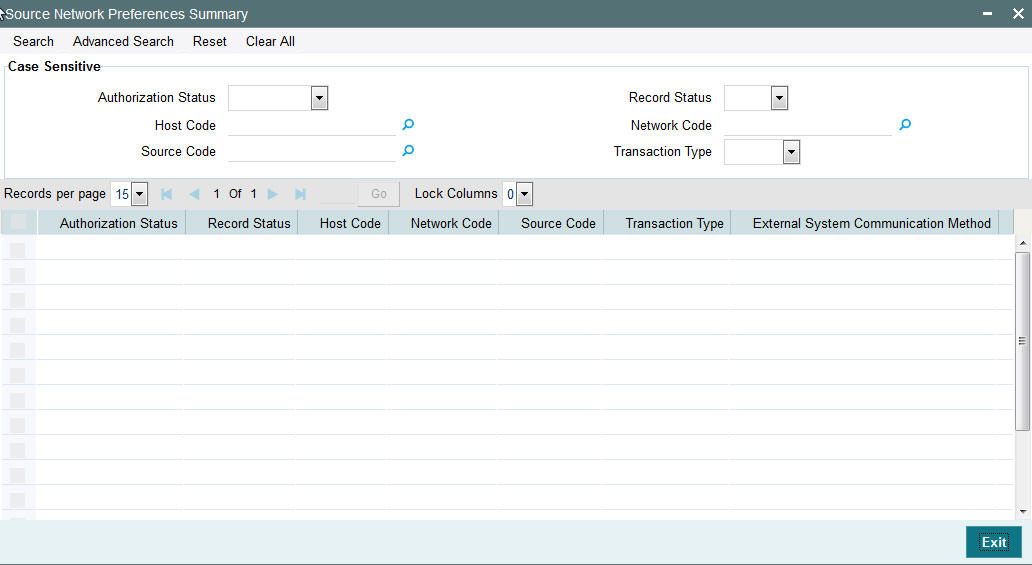

2.1.6.1 Viewing Source Network Preferences Summary

You can view summary of network preferences using ‘Network Preference Summary’ screen. To invoke this screen, type ‘PMSSORNW’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

You can search using one or more of the following parameters:

- Authorization Status

- Record Status

- Host Code

- Network Code

- Source Code

- Transaction Type

Once you have specified the search parameters, click ‘Search’ button. The system displays the records that match the search criteria.

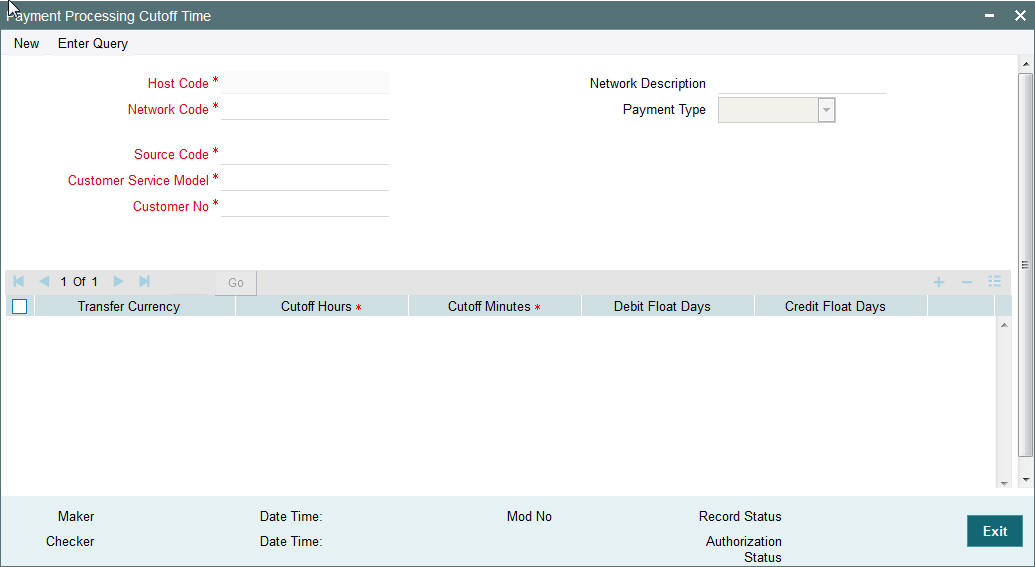

2.1.7 Payment Processing Cut off Time

You can define currency wise transaction cutoff time using ‘Payment processing cutoff time’ screen.

You can select applicable source, customer service model or customer, if required. The system displays an error, if processing cut off is maintained for Book transfer networks.

Note

- Cut-off time check is based on the application server time at the time of payment processing.

- Cut-off time maintenance is applicable for payments with ‘Outgoing’ transaction type.

You can invoke the ‘Payment Processing Cutoff Time’ screen by typing ‘PMDCTOFF’ in the field at the top right corner of the application toolbar and clicking the adjoining arrow button. Click new button on the Application toolbar..

You can specify the following fields:

Host Code

This field is displayed as user's logged in Host.

Network Code

Specify the network code. Alternatively, you can select the network code from the option list. The list displays all valid network codes maintained in the system.

Network Description

The system displays the network description.

Payment Type

The system displays the payment type based on the network selected.

Source Code

Specify the source code for which cutoff is maintained. Alternatively, you can select the source code from the option list. The list displays all valid source codes maintained in the system.

Note

You can also select the value ALL, if required.

Customer Service Model

Specify the customer service model for which cut off is maintained. Alternatively, you can select the Service model from the option list. The list displays all valid customer service models maintained in the system.

Note

You can also select the value ALL, if required.

Customer Number

Specify the customer number. Alternatively, you can select the customer number from the option list. The list displays all valid customer numbers maintained in the system.

Note

- If Service model is selected as ALL, then customer number should be selected as ALL only.

- If Service model is selected as specific, then specific CIF numbers of that Service model linkage alone will be listed.

Transfer Currency

Specify the payment currency. Alternatively, you can select the transfer currency from the option list. The list displays all valid currency codes maintained in the system.

Cutoff Hours

Specify the cutoff time in hours.

Cutoff Minutes

Specify the cutoff time in minutes.

Debit Float Days

You can specify Debit float days applicable only for the outgoing payment. Debit Float days are subtracted from the Instruction date to derive the Activation date for outgoing payment.

Credit Float Days

You can specify Credit float days applicable only for incoming payment. Credit Float days would be added to the Value date to derive the Credit Value Date for incoming payment.

Note

Float days are currently applicable to outgoing Domestic low value/Cross-border payments

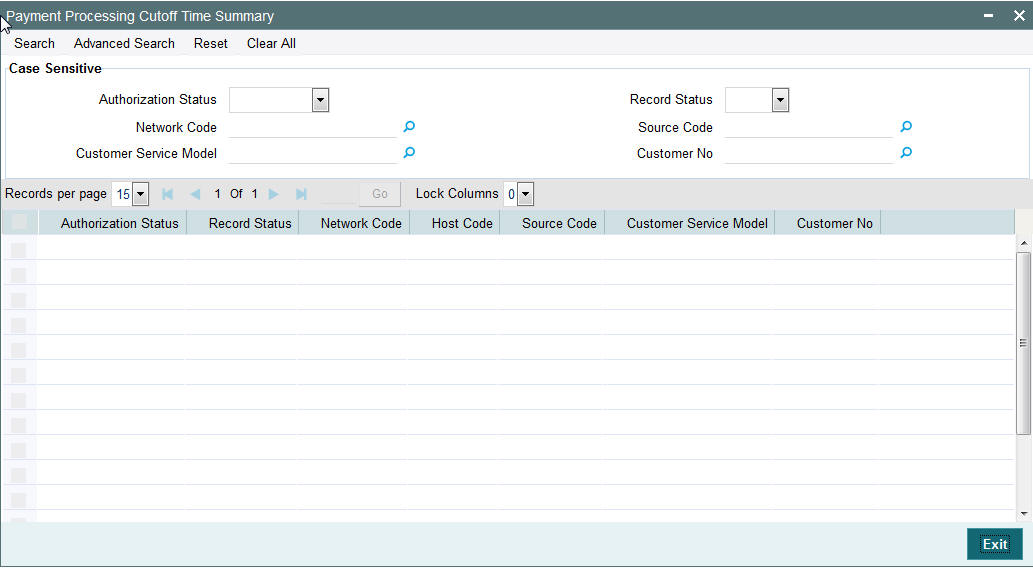

2.1.7.1 Payment Processing Cutoff Time Summary

You can view a summary of payment processing cutoff using ‘Payment Processing Cutoff Time Summary’ screen. To invoke this screen, type ‘PMSCTOFF’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

You can search using one or more of the following parameters:

- Authorization Status

- Record Status

- Network Code

- Customer no

- Source Code

- Customer Service Model

Once you have specified the search parameters, click ‘Execute Query’ button. The system displays the records that match the search criteria.

Double click a record or click the ‘Details’ button after selecting a record to view the detailed screen.

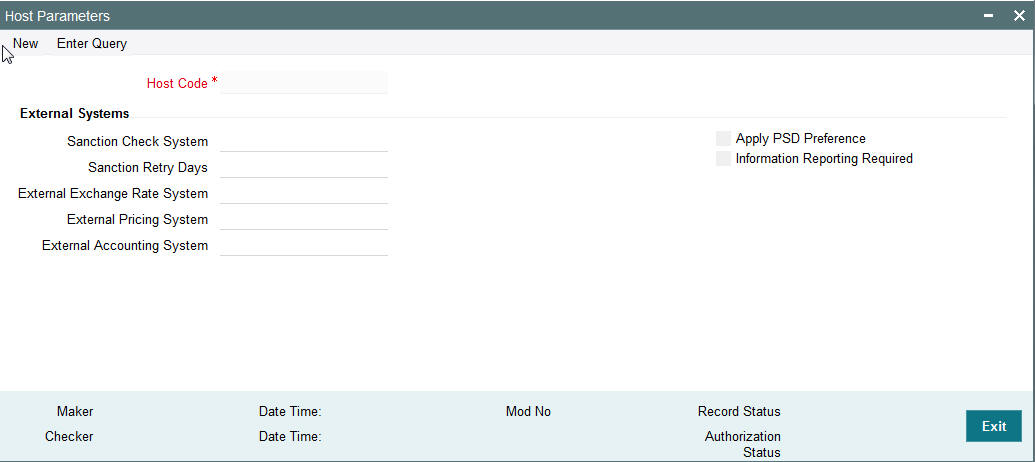

2.1.8 Host Parameters

You can maintain parameters for payments at the host level in the ‘Host Parameters’ screen. You can invoke the ‘Host Parameters’ screen by typing ‘PMDHSTPR’ in the field at the top right corner of the application toolbar and clicking the adjoining arrow button. Click new button on the Application toolbar.

You can specify the following details:

Host Code

Host Code is defaulted as Host code linked to user's logged in Branch.

External Systems

Sanction Check System

Specify the external sanction check system. Alternatively, you can select the sanction check system from the option list. The list displays all valid sanction check external systems.

Sanction Retry Days

Specify the sanction check retry days. Based on the sanction retry days, the sanctions are performed for future dated payments or current dated payments carried forward to next date.

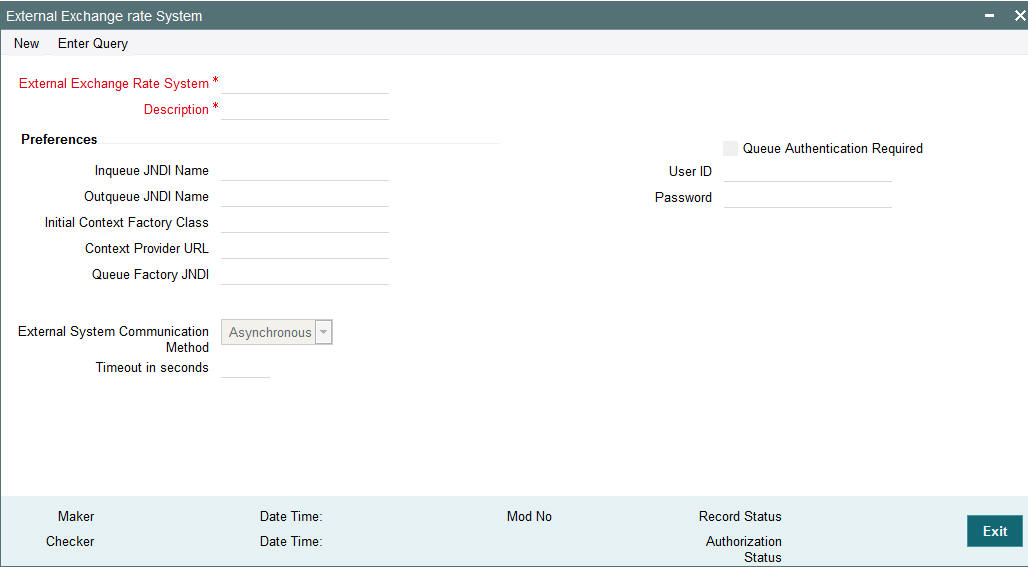

External Exchange Rate System

Specify the external exchange rate system. Alternatively, you can select the external exchange rate system from the option list. The list displays all valid external exchange rate systems.

External Price Code

Specify the External Price Code. Alternatively, you can select the external price code from the option list. The list displays all valid external price codes.

External Accounting System

Specify the External Accounting System to which the accounting entries are handed off. Alternatively, you can select the external accounting system from the option list. The list displays all valid external accounting systems.

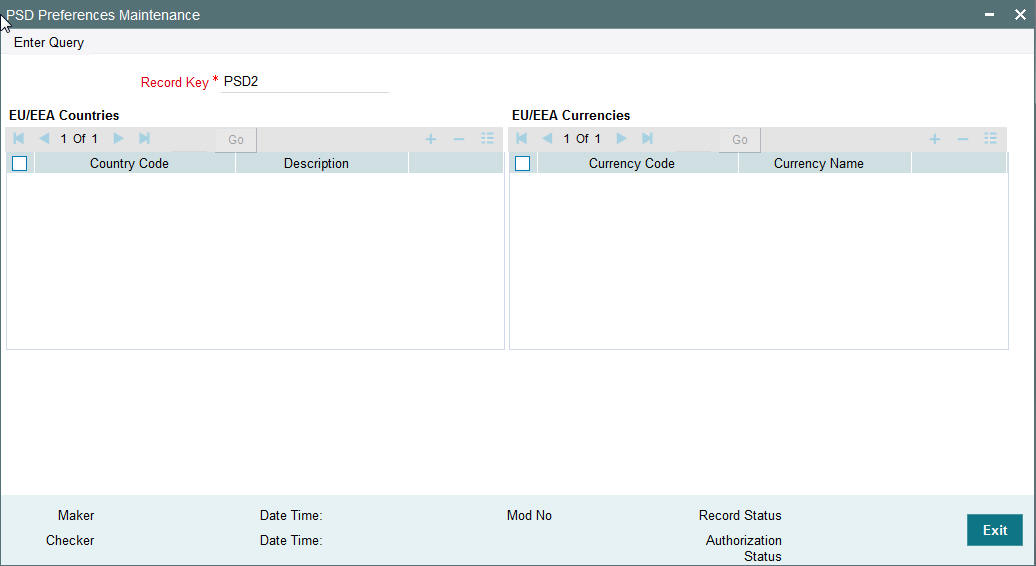

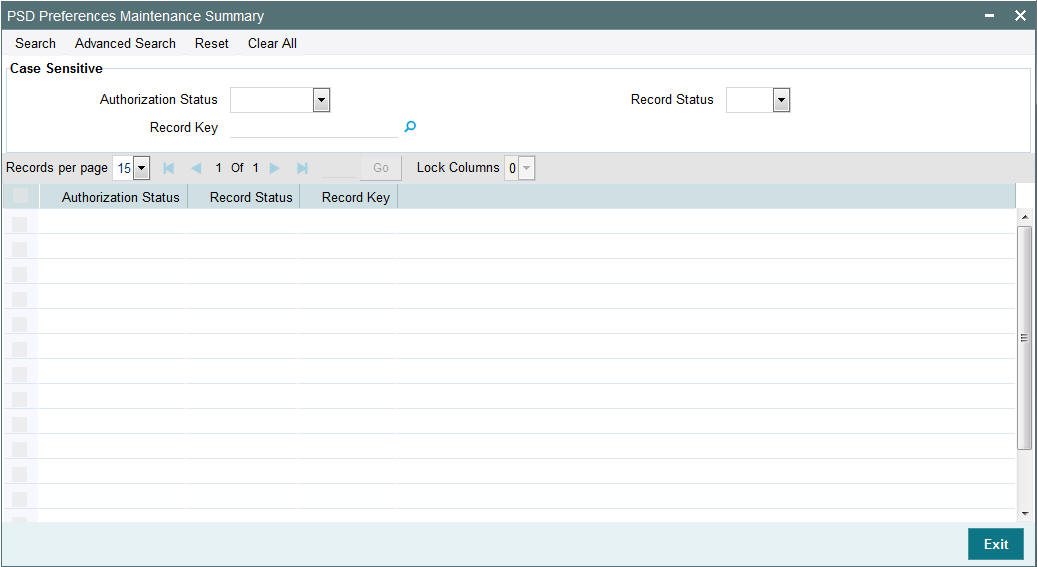

Apply PSD Preference

Check this box to apply PSD Preference.

Information Reporting Required

Check this box to indicate that transaction information has to be handed off to an internal JMS queue on completion of transaction processing.

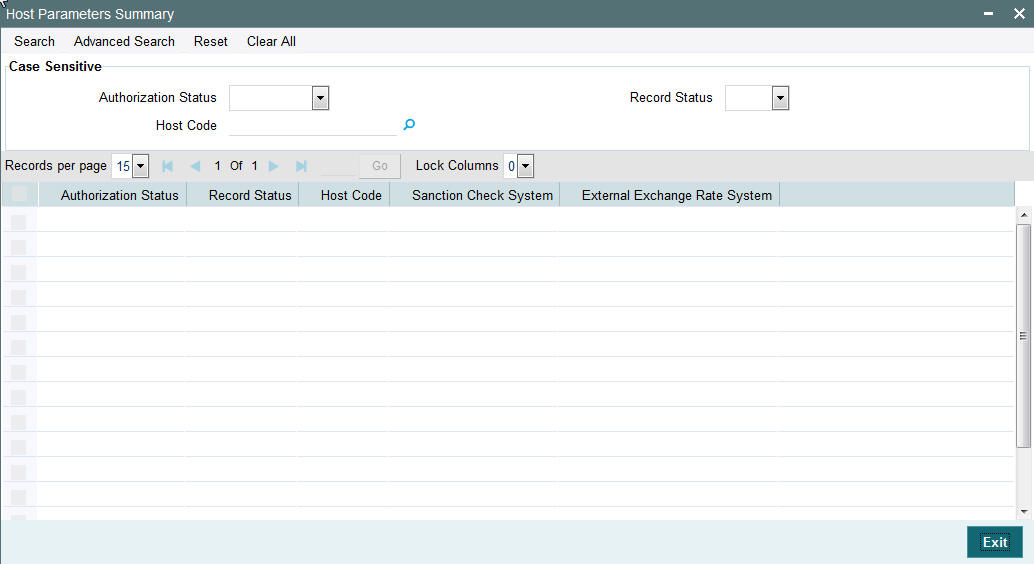

2.1.8.1 Viewing Host Parameter Summary

You can view summary of exchange rate in the ‘Host Parameters Summary’ screen. You can invoke the ‘Host Parameters Summary’ screen by typing ‘PMSHSTPR’ in the field at the top right corner of the application toolbar and clicking the adjoining arrow field at the top right corner of the application toolbar and clicking the adjoining arrow button.Click new button on the Application toolbar.

You can search using one or more of the following parameters:

- Authorization Status

- Record Status

- Host Code

Once you have specified the search parameters, click ‘Execute Query’ button. The system displays the records that match the search criteria.

Double click a record or click the ‘Details’ button after selecting a record to view the detailed screen.

2.1.9 Settlement Instructions Maintenance

- It is possible to maintain standard settlement instruction (SSI) for the customer and a beneficiary. The maintenance is specific to a Network and currency.

- The following are party details can be maintained for a customer

&SSI Label for SWIFT/RTGS payments:

- Beneficiary Institution/Ultimate Beneficiary

- Account with Institution

- Intermediary

- Sender to Receiver Information

- Remittance Details

- Receiver Correspondent

- Payment preferences for gpi payment & charge bearer

- Nostro Correspondent Credit /Debit account

- Customer ID and SSI Label will be a unique combination to identify the settlement party details.

- Facility for populating the beneficiary/routing details for a payment transaction based on the customer and SSI Label received in payment request is available.

- It is possible to mark one of the Settlement Instructions as the default instruction, and to fetch the beneficiary/routing details based on the default instruction if the SSI Label is not provided in the payment request

- Provision is given for viewing and authorizing the default SSI Label populated by the system when the payment requests are received from channels.

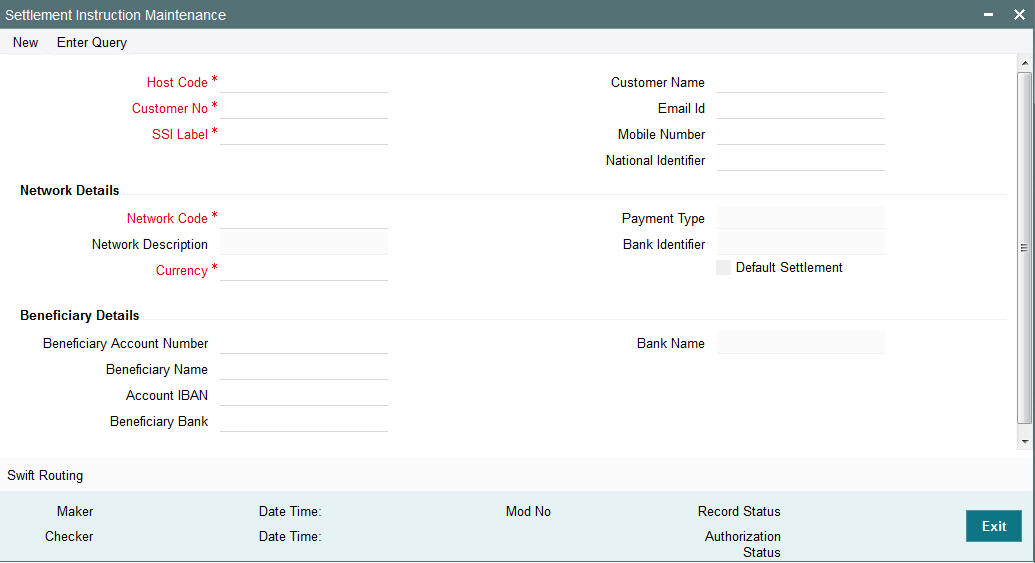

You can maintain the beneficiary details linked to a customer in “Settlement Instruction Maintenance” screen. You can invoke the “Settlement Instruction Maintenance” screen by typing ‘PMDSSIMT’ in the field at the top right corner of the Application toolbar and clicking on the adjoining arrow button.

You can specify the following fields:

Host Code

The system displays the Host code by default.

Customer Number

Specify the customer number for whom beneficiary details are maintained. Alternatively, you can select from the option list. The list displays all valid customer numbers maintained in the system.

SSI Label

You can provide the SSI label.Same SSI Label cannot be repeated for a customer, even though Network maintained is different. Every SSI Label will be linked to a Network.

Customer Name

The system displays the customer name for the customer number selected.

Email Id

You can enter the email address of the customer.

Mobile Number

You can enter the mobile number of the customer.

National Identifier

You can enter the National Identifier of the customer.

Note

Email ID, Mobile Number and Nation Identifier fields are optional fields.

Customer Name

The system displays the customer name.

Beneficiary Details

Network Code

Specify the network code from the LOV. This is a mandatory field.

Network Description

The system displays the description of the network based on the Network code selected.

Currency

Specify the currency from the LOV. This is a mandatory field.

Payment Type

The system displays the type of payment based on the network selected.

Bank Identifier

The system displays the Bank Identifier based on the network selected.

Default Settlement

Check this box to mark one of the SSI labels as ‘Default Settlement’ for a customer and network and currency combination.

Beneficiary Details

Beneficiary Account Number

Specify the Beneficiary Account Number.

Beneficiary Name

Specify the Beneficiary Name.

Account IBAN

Specify the Account IBAN.

Beneficiary Bank

Specify the Beneficiary Bank.

Bank Name

The system displays the bank name of the beneficiary.

Note

Entering Beneficiary details in the Main screen is not applicable for Cross-border/RTGS Networks.

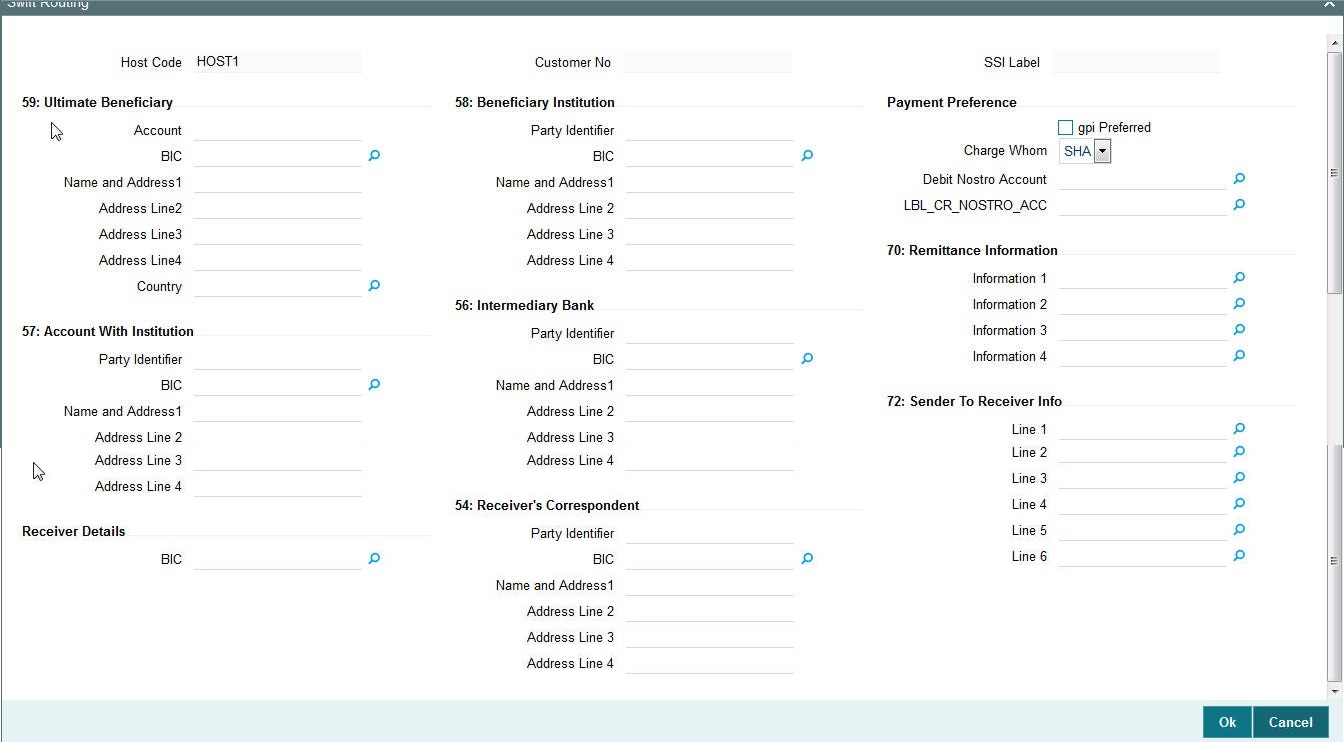

2.1.9.1 SWIFT Routing

Settlement party details for Cross-border/RTGS payments is maintained in SWIFT routing sub-screen.

Click the Swift Routing button at the bottom of the screen.

Specify the following fields beneficiary /other party details for a cross-border/RTGS payment::

59: Ultimate Beneficiary

Account

Specify the Ultimate Beneficiary Account Number.

BIC

Select the BIC from the LOV.

Name and Address1 - 4

Specify the name and address of the Ultimate Beneficiary in the lines specified.

Country

Select the country from the LOV.

58: Beneficiary Institution

Party Identifier

Specify the party identifier details.

BIC

Select the BIC from the LOV.

Name and Address1 - 4

Specify the name and address of the Beneficiary Institution in the lines specified.

Payment Preference

gpi Preferred

Check this box if GPI is preferred for the payment. This is applicable for cross-border payments.

Charge Whom

Select one of the following Charge options:

- SHA

- BEN

- OUR

Debit Nostro Account

Select the Debit Nostro Account from the LOV.

Credit Nostro Account

Select the Credit Nostro Account from the LOV.

57: Account With Institution

Party Identifier

Specify the Party identifier details.

BIC

Select the BIC from the LOV.

Name and Address1 - 4

Specify the name and address of the Institution in the lines specified.

56: Intermediary Bank

Party Identifier

Specify the Party identifier details.

BIC

Select the BIC from the LOV.

Name and Address1 - 4

Specify the name and address of the Intermediary Bank in the lines specified.

70: Remittance Information

Remittance 1 -4

You can enter the Remittance details.

Receiver Details

BIC

Select the BIC from the LOV.

54: Receiver's Correspondent

Party Identifier

Specify the Party identifier details.

BIC

Select the BIC from the LOV.

Name and Address1 - 4

Specify the name and address of the Receiver's Correspondent in the lines specified.

72: Sender To Receiver Info

You can enter the sender to receiver details.

Note

- The beneficiary details related fields in the main screen are disabled for input if the network selected is of payment type SWIFT/RTGS.

- If the Receiver provided in SSI label is not a currency correspondent, then cover is sent to default currency correspondent.

- Field 58 Beneficiary institution details can be specified only if the customer selected is of type ‘Bank’.

- If Receiver correspondent is part of SSI label, then it is mandatory to provide Nostro Credit account details in the SSI label maintenance.

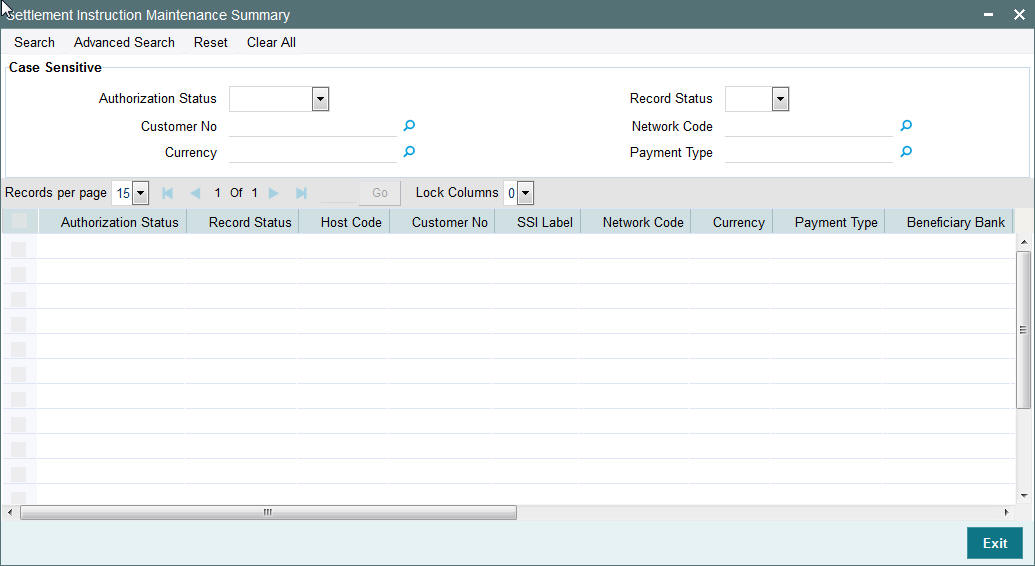

2.1.9.2 Viewing Settlement Instruction Maintenance Summary

You can view the summary of Settlement Instruction Maintenance using ‘Settlement Instruction Maintenance Summary’ screen. To invoke this screen, type ‘PMSSSIMT' in the field at the top right corner of the Application toolbar and clicking on the adjoining arrow button.

You can search for the records using one or more of the following parameters:

- Authorization status

- Customer No

- Currency

- Record status

- Network Code

- Payment Type

Once you have specified the search parameters, click ‘Search’ button. The system displays the records that match the required search criteria.

Double click a record or click the ‘Details’ button after selecting a record to view the detailed screen.

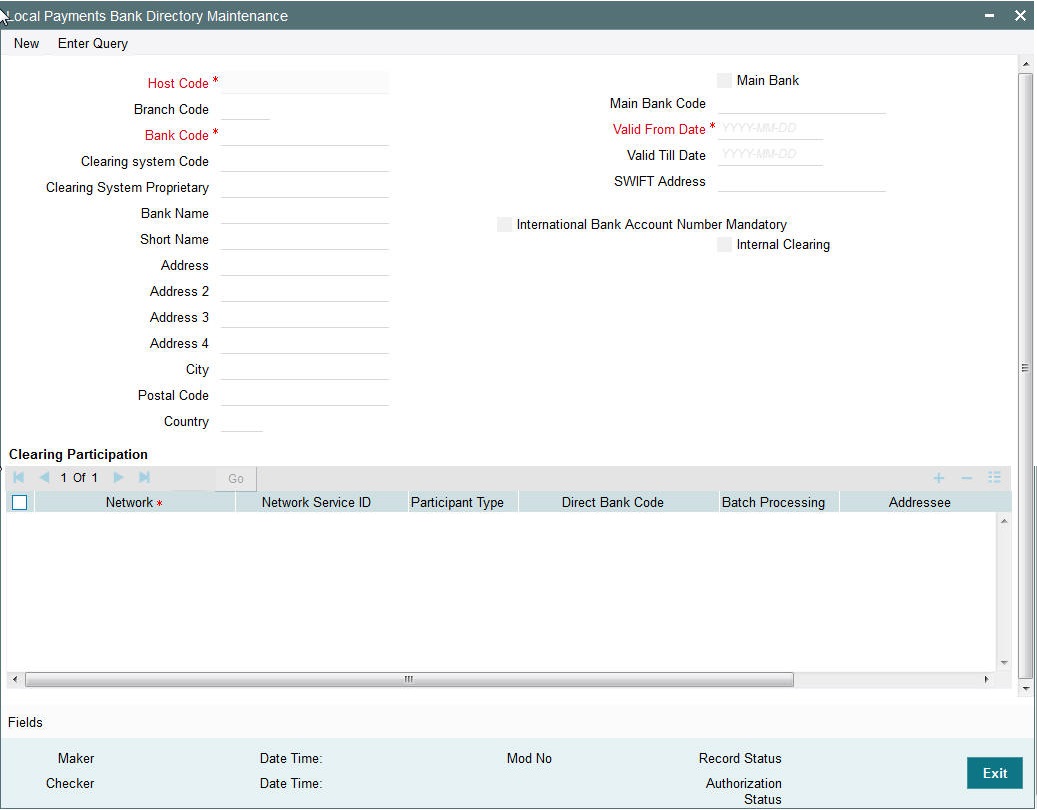

2.1.10 Maintaining Local Payments Bank Directory

The local clearing bank codes are maintained using the Local Clearing Bank Code Maintenance which is used for processing the local clearing payments.

Usage of this screen

- This is a Host level maintenance.

- This screen also provides the details of the clearing network participation (direct/indirect) for each clearing network

You can invoke the ‘Local Payments Bank Directory’ screen by typing ‘PMDBKMNT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specify the following details in this screen:

Host Code

Host Code is defaulted as the Host code linked to user's logged in branch.

Branch Code

Select the branch code from the adjoining option list. Alternatively, you can select branch code from the option list. The list displays all valid branch code maintained in the system.

You can use short name to specify the branch name also.

If you check ‘Main Bank’ check box, then this should be left blank.

The system will allow you to specify the value which is not available in the list.

Bank Code

Specify the bank code with which the processing bank can interact.

Clearing System Code

Specify the corresponding ISO code or clearing system Code in this field.

Clearing System Proprietary

Select the corresponding clearing system proprietary.

Bank Name

Specify the full name of the bank.

Short Name

Specify a short name to identify the bank.

Address 1 to 4

Specify the address of the bank.

City

Specify the city in which the bank is located.

Postal Code

Specify the postal code that forms a part of the address.

Country

Select the country code in which the bank is located, from the adjoining option list. All country codes maintained in the system is displayed in this list.

Main Bank

Check this box if the clearing bank code is for the main bank.

Main Bank Code

Select the clearing bank code of the bank which the branch belongs to. If you have specified a branch code, then it is mandatory to select the main bank code.

Valid From Date

Specify the date from which the clearing payments for the specified bank code is valid.

Valid Till Date

Specify the date till which the clearing payments for the specified bank code is valid.

Swift Address

Select the Swift address of the bank, from the adjoining option list. The list displays all valid swift codes maintained in the system.

International Bank Account Number Mandatory

Check this box, if the IBAN of the bank needs to be accompanied with the payment.

Internal Clearing

Check this box if the creditor bank is one of the internal banks maintained in the system.

Clearing Participation

Network Service ID

The system defaults the network service id.

Network

Select the clearing network from the adjoining option list. All valid clearing networks maintained by system are displayed in this field.

Participant Type

Select the participant type as direct or indirect from the drop down values. If indirect relationship is selected, then the direct participant bank codes along with the direct bank account number will be specified. If a message is received from the indirect participant bank code which is maintained in the local payment bank directory, the system derives the debit account for the payment from the direct bank account number specified for the bank code.

The networks from PMDNWMNT for which participant type is maintained are listed in the option list for Creditor bank BIC in PADOTONL.

Direct Bank Code

This field is enabled if participant type is indirect. Select the direct participant bank code from the adjoining option list.

Batch Processing

Check this flag is the dispatch files are to be generated in the ‘Batch Mode’. Batch processing is applicable for each payment record for dispatch, if the bank code is enabled for Batch processing.

Addressee

Specify the participant bank account number in this field. Batch processing is applicable for each payment record for dispatch, if the bank code is enabled for Batch processing.

Direct Debit Participation

Specifies if the agent code participates in Direct Debit for the corresponding network.

Note

The network will be used to process payment transactions, if you do not specify this field

Fields

Click the link to specify the field details.

2.1.10.1 Viewing Bank Maintenance Summary

You can view a summary of network maintenances using ‘Bank Maintenance Summary’ screen. To invoke this screen, type ‘PMSBKMNT’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

You can search for the networks using one or more of the following parameters:

- Authorization status

- Record status

- Country Code

- Bank code

- Valid From Date

Once you have specified the search parameters, click ‘Execute Query’ button. The system displays the records that match the search criteria.

Double click a record to view the detailed network maintenance screen. You can also export the details of selected records to a file using ‘Export’ button.

2.1.11 Maintaining Customer Service Model

Service Model classifies the customers into various level.

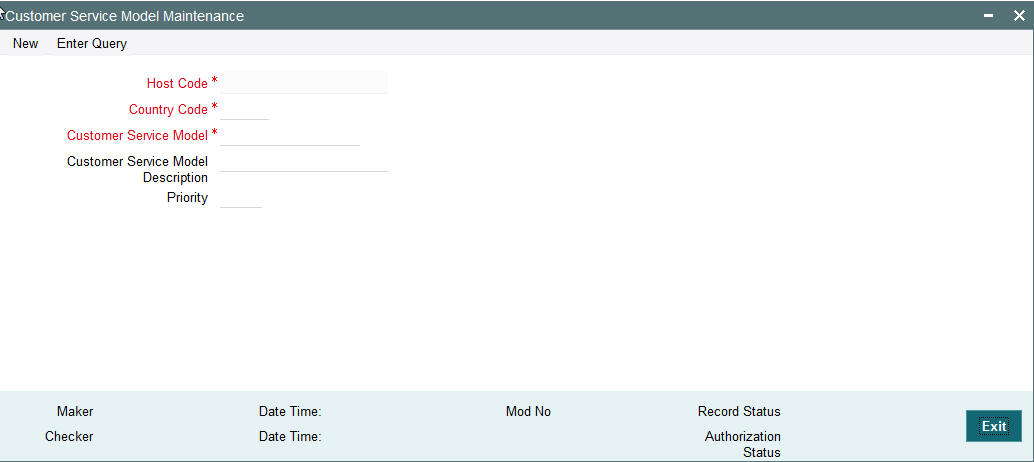

You can maintain service models for the customers using ‘Customers Service Model’ screen, invoked from the Application Browser. You can invoke this screen by typing ‘PMDSRMDL’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can specify the following details:

Host Code

Host Code is defaulted as the Host code linked to user's logged in branch.

Country Code

Specify the country code. Alternatively, you can select the country code from the option list. The list displays all valid country codes maintained in the system.

Customer Service Model

Specify the unique service model code for a customer.

Customer Service Model Description

Specify the brief description about the customer service model entered.

Priority

Specify the priority about the customer service model entered.

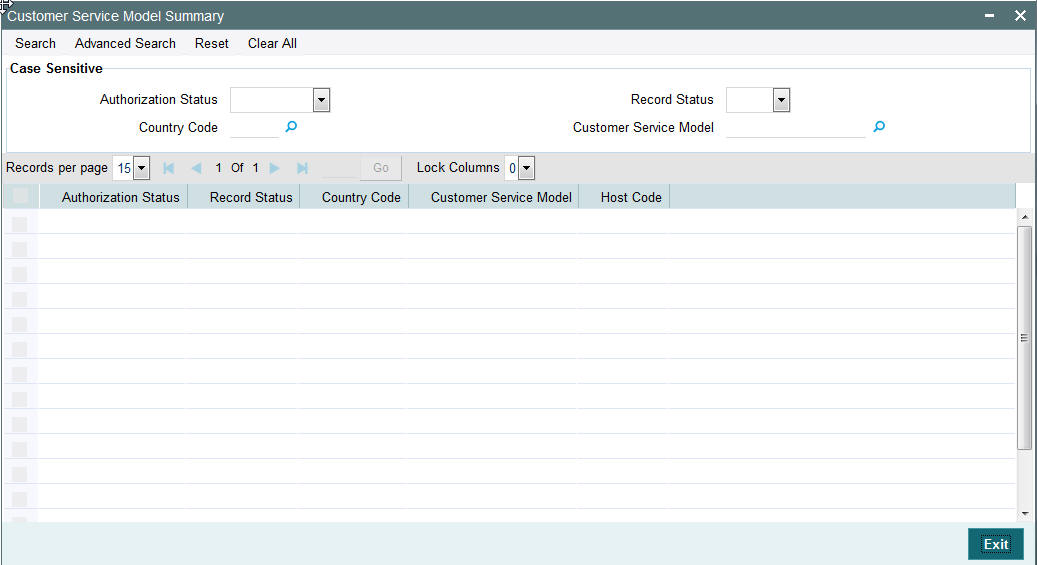

2.1.11.1 Viewing Customer Service Model Summary

You can view a summary of network maintenances using ‘Customer Service Model Summary’ screen. To invoke this screen, type ‘PMSSRMDL’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

You can search for the networks using one or more of the following parameters:

- Authorization status

- Record status

- Country Code

- Customer Service Model

- Priority

Once you have specified the search parameters, click ‘Execute Query’ button. The system displays the records that match the search criteria.

Double click a record to view the detailed network maintenance screen. You can also export the details of selected records to a file using ‘Export’ button.

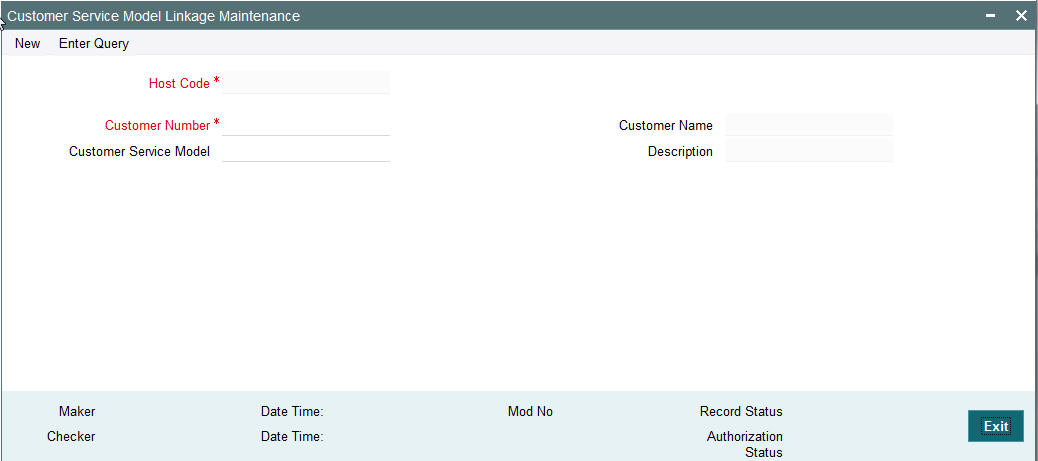

2.1.12 Maintaining Customer Service Model Linkage

You can link a customer to specific customer service model using ‘Customer Service Model Linkage’ screen. To invoke this screen, type ‘PMDCSMLK’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

Specify the following details:

Host Code

Logged in Host is defaulted.

Customer Number

Select the customer number for linking the service model.

Customer Name

Once you select the customer number, the system displays the name of the customer.

Customer Service Model

Specify the customer service model to link the above customer.

Description

The system displays the description once you select the customer service model.

After capturing the above details, save the maintenance.

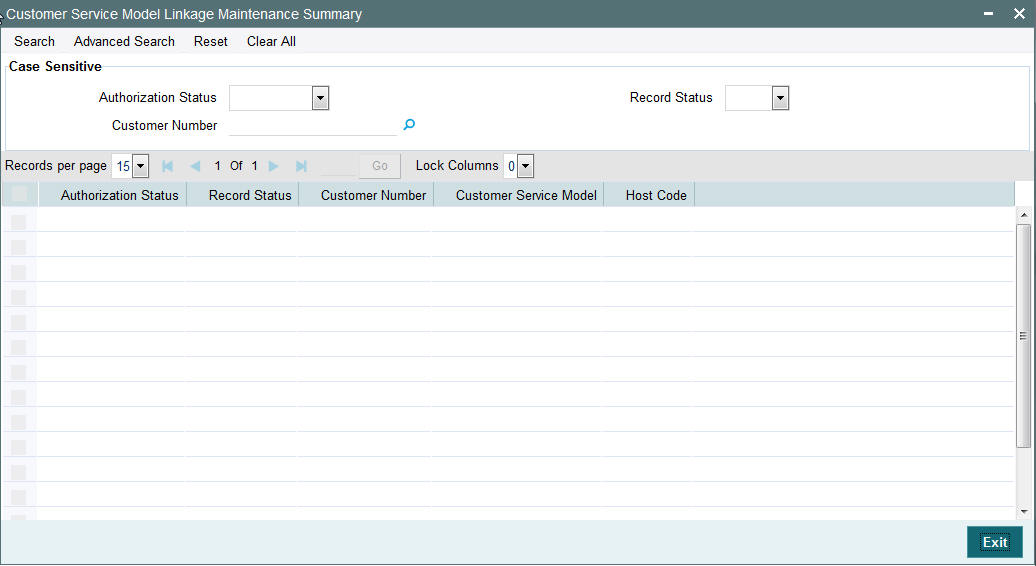

2.1.12.1 Viewing Customer Service Model Linkage Maintenance Summary

You can view a summary of network maintenances using ‘Customer Service Model Linkage Maintenance Summary’ screen. To invoke this screen, type ‘PMSCSMLK’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

You can search for the networks using one or more of the following parameters:

- Authorization status

- Record status

- Customer Number

Once you have specified the search parameters, click ‘Execute Query’ button. The system displays the records that match the search criteria.

Double click a record to view the detailed network maintenance screen. You can also export the details of selected records to a file using ‘Export’ button.

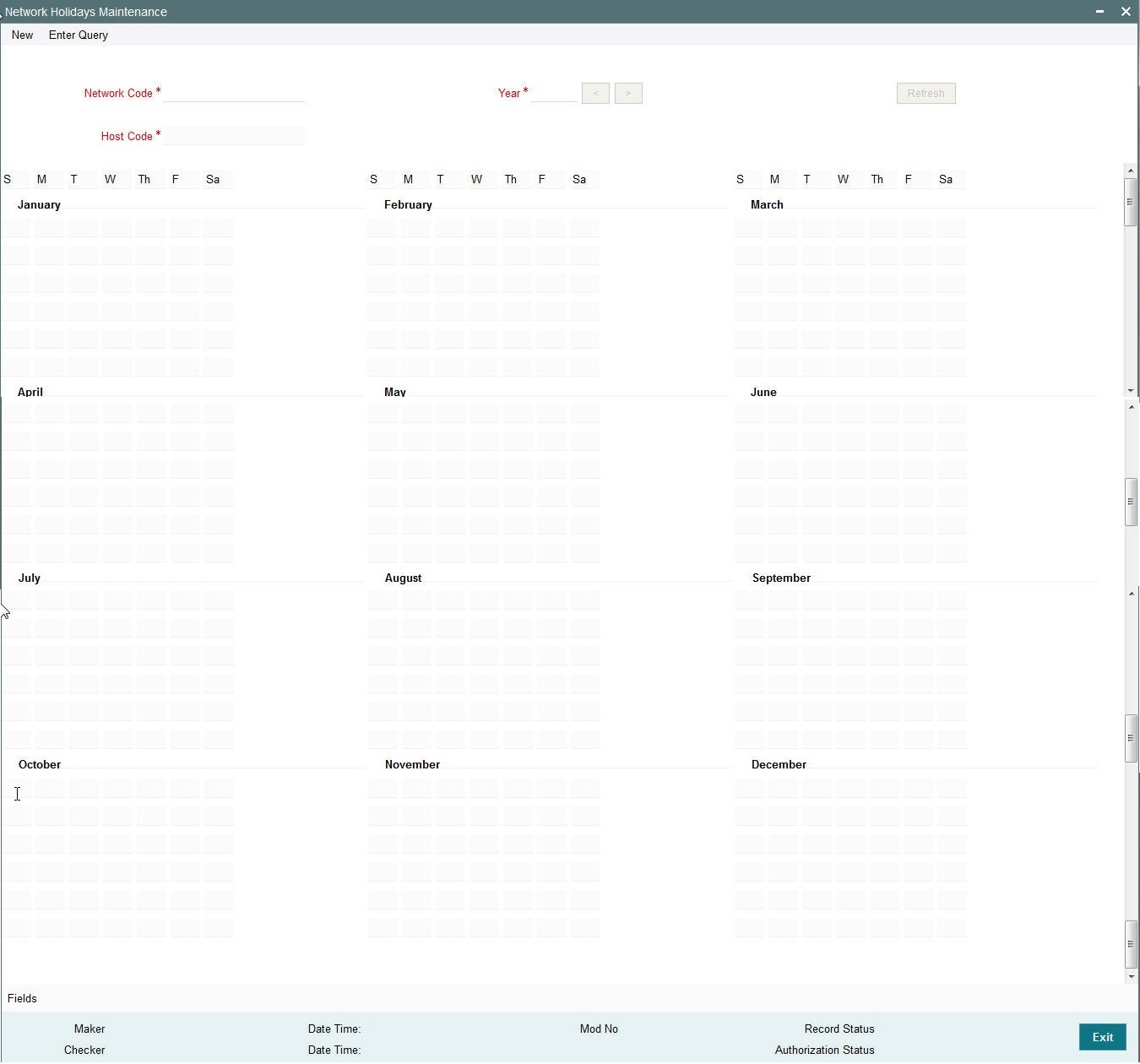

2.1.13 Maintaining Network Holidays

This maintenance allows you to specify working days and holidays for the year for the payment network. This function is accessible at a country code.

You can invoke the ‘Network Holidays Maintenance’ screen by typing ‘PMDNWHOL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. Click new button on the Application toolbar.

Network Code

Select the clearing network code from the adjoining option list. All valid clearing network codes are displayed in this list.

Host Code

Host code is defaulted based on the Network code selected.

Year

Select the calendar year details for which the network calendar is to be maintained.

Click the Refresh button after populating the above mentioned details. The calendar of the selected year is displayed. Now, you can click the specific dates on the calendar to define the holidays.

As you click a date in the calendar, the system will change the colour of the date text indicating whether it is a holiday or a working day. The colours applied to the text and their indications are as follows.

| Date Text Colour | Indication | ||

|---|---|---|---|

| Black | Working Day | ||

| Red | Holiday |

The system changes the colour of the text every time you click a date. Click the desired date until you need to set it to the colour as per requirement.

The details on each day of a month are displayed in the ‘Holiday Calendar Details’ section.

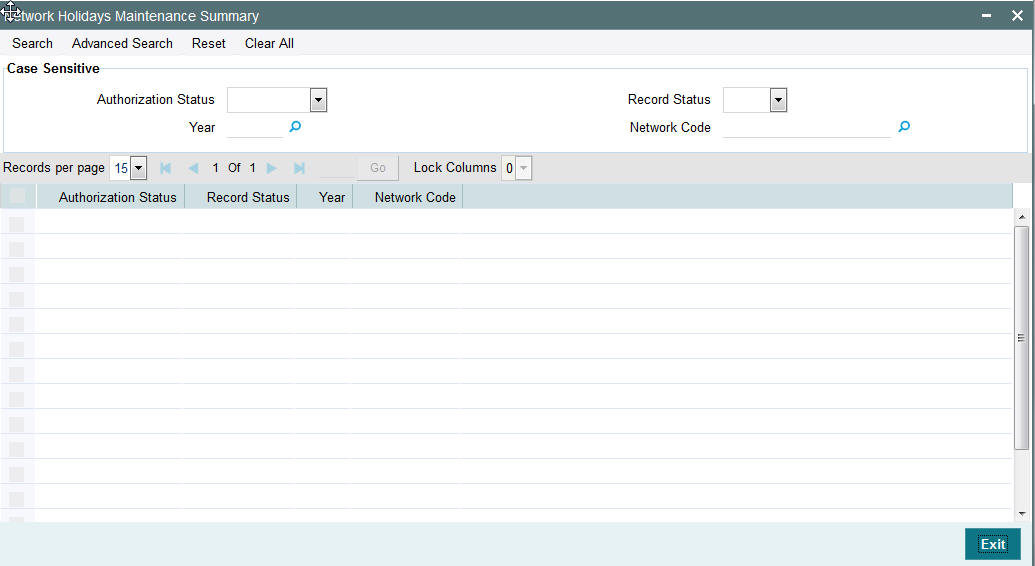

2.1.13.1 Viewing Network Holidays Maintenance Summary

You can view a summary of network holidays maintenances using ‘Network Holiday Maintenance Summary’ screen. To invoke this screen, type ‘PMSNWHOL’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

You can search for the networks using one or more of the following parameters:

- Authorization status

- Record status

- Network code

- Year

Once you have specified the search parameters, click ‘Execute Query’ button. The system displays the records that match the search criteria.

Double click a record to view the detailed network maintenance screen. You can also export the details of selected records to a file using ‘Export’ button.

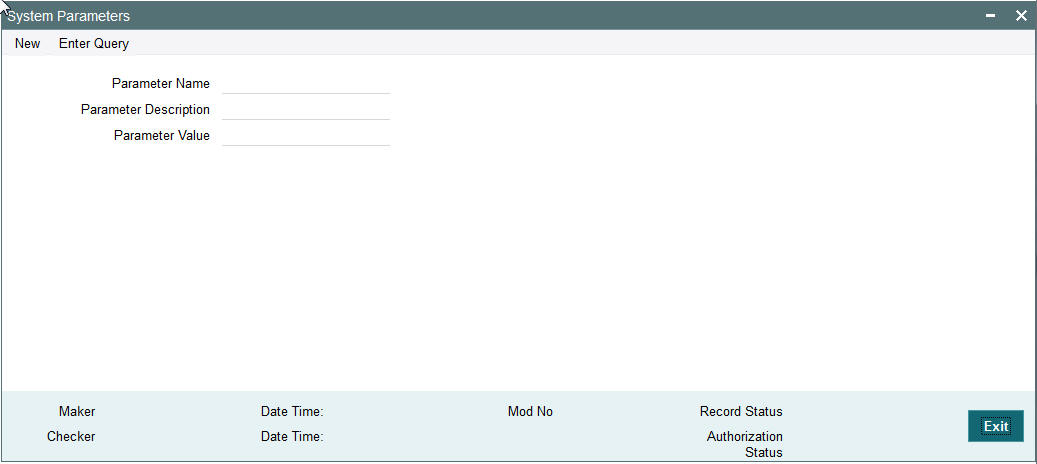

2.1.14 System Parameters

You can invoke this screen by typing ‘PMDSYSPM’ in the field at the top right corner of the Application tool bar and click the adjoining arrow button.

You can capture the following details

Parameter Name

Specify the parameter name. Alternatively, you can select the parameter name from the option list. The list displays all valid parameter names maintained in the system.

Parameter Description

Specify the parameter description.

Parameter Value

Specify the parameter value.

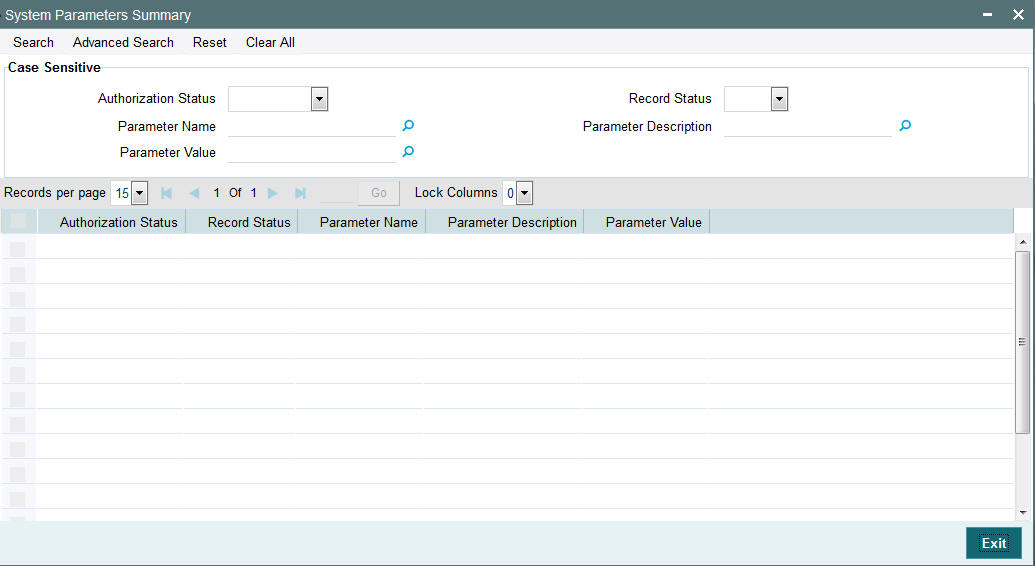

2.1.14.1 Viewing System Parameter Summary

You can view a summary of system parameters using ‘System Parameter Summary’ screen. To invoke this screen, type ‘PMSSYSPM’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

You can search for the networks using one or more of the following parameters:

- Authorization status

- Record status

- Parameter Name

- Parameter Value

- Parameter Description

Once you have specified the search parameters, click ‘Execute Query’ button. The system displays the records that match the search criteria.

Double click a record to view the detailed network maintenance screen. You can also export the details of selected records to a file using ‘Export’ button.

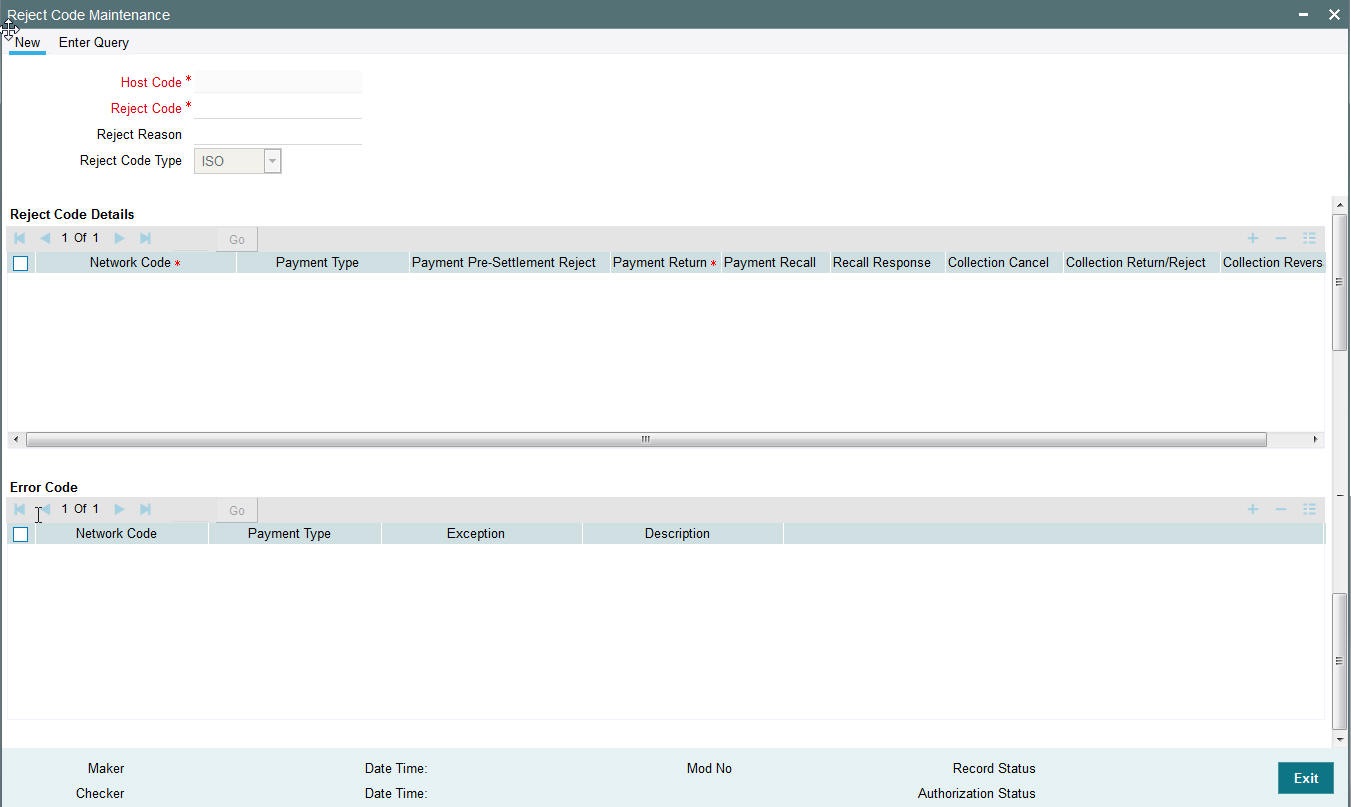

2.1.15 Reject Code

You can invoke the “Reject Code Maintenance” screen by typing ‘PMDRJMNT‘ in the field at the top right corner of the application tool bar and clicking on the adjoining arrow button.

You can capture the following details

Reject Code

Specify the Reject Code

Reject Reason

Specify the description of the Reject Code.

Reject Code Type

Specify the type of Reject Code. The type can be ISO or proprietary.

Applicable Networks and Exceptions

Network Code

Specify the network code. Alternatively, you can select the network code from the option list. The list displays all valid network codes maintained in the system.

Payment Type

Payment type will be defaulted based on the Network selected

Payment Pre-Settlement Reject

Check this flag if the new Reject Code maintained is applicable for payment rejects by CSM.

Payment Return

Specify the Payment Return. Choose among the following values:

- Null - This is the default value.

- Manual- If you select this option, the reject code will be applicable for processing of returns manually.

- Auto - If you select this option, the payment will be returned automatically, if the exception encountered by the incoming transaction is due to any of the error codes linked to this record in the Error Code Block.

Payment Recall

Check this flag if the Reject Code maintained is applicable for payment recalls by the Originating bank.

Recall Response

Check this flag if the Reject Code maintained is applicable for responses generated for payment recalls by the Beneficiary bank.

Collection Cancel

Check this flag if the new Reject Code maintained is applicable for recall of the outgoing Direct Debits.

Collection Return/Reject

Check this flag if the new Reject Code maintained is applicable forDirect debit returns/refunds/pre-settlement rejects.

Collection Reversal

Check this flag if the new Reject Code maintained is applicable for Direct Debit reversals by Originating Bank.

Clearing Return

Check this flag if the new Reject Code maintained is applicable for Clearing returns by Originating Bank.

Exception Code Block

If return of an incoming payment is to be triggered automatically by system on certain exceptions, you can maintain the related Error codes in this Block.

For other exceptions encountered by the incoming transaction manual return is to be initiated by the user from Repair Queue.

Note

Exception codes are not allowed to be repeated for the same network and reject code com- combination.

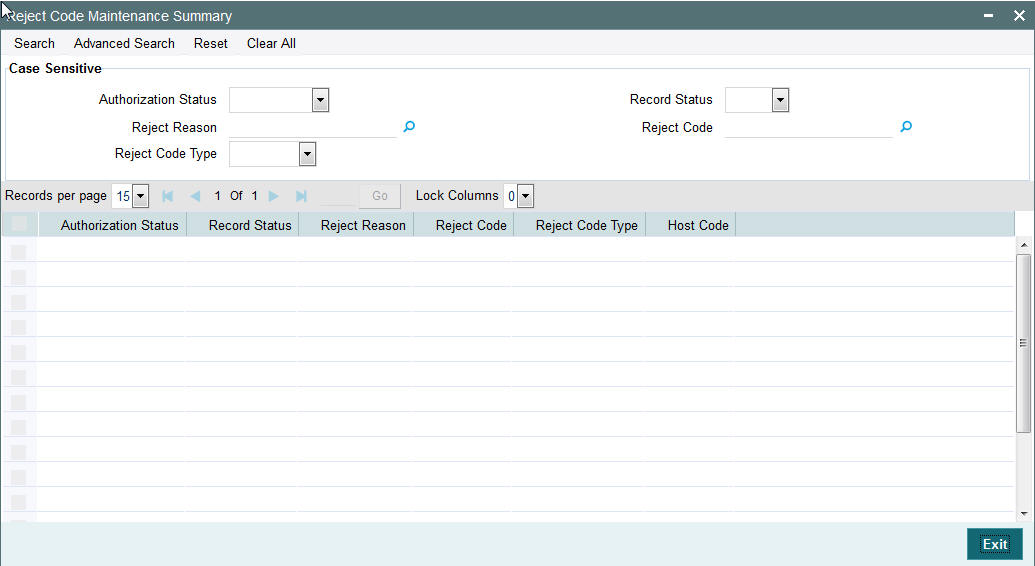

2.1.15.1 Viewing Reject Code Maintenance Summary

You can view a summary of Reject Code using ‘Reject Code Maintenance Summary’ screen. To invoke this screen, type ‘PMSRJMNT’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

You can search for the networks using one or more of the following parameters:

- Authorization status

- Record status

- Reject Reason

- Reject Code

- Reject Code Type

Once you have specified the search parameters, click ‘Execute Query’ button. The system displays the records that match the search criteria.

Double click a record to view the detailed maintenance screen.

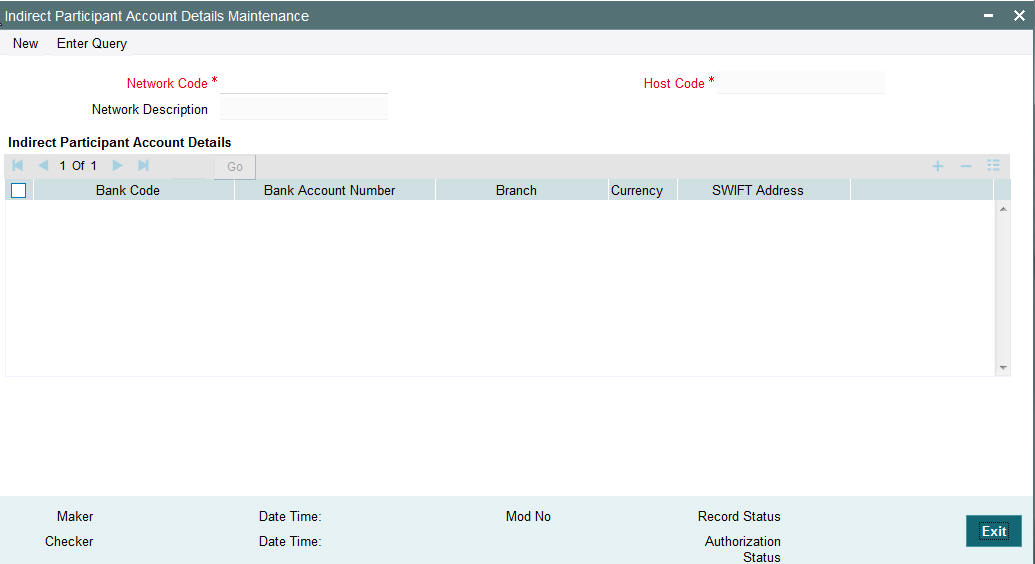

2.1.16 Indirect Participant Account Details Maintenance

You can invoke “Indirect Participant Account Details Maintenance” screen by typing ‘PMDIPACC’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. Click new button on the Application toolbar

Note

No transaction processing is supported, currently using this maintenance.

.

Specify the following details:

Network Code

Specify the network code for which indirect participant details are applicable. Alternatively, you can select the network code from the option list. The list displays all valid network codes maintained in the system

Network Description

The system displays the network description.

Host Code

The system defaults the host code linked to the network.

Bank Code

Specify the bank Code of the indirect participant. Alternatively, you can select the bank Code from the option list. The list displays all valid bank Codes maintained in the system

Bank Account Number

Specify the bank account number of the indirect participant. Alternatively, you can select the bank account number from the option list. The list displays all valid bank account numbers maintained in the system

Branch

The system displays the account branch.

Currency

The system displays the account currency.

Note

Only one record can be maintained for the same bank and currency in the multi-block for account details.

SWIFT Address

The system displays the BIC code of the indirect participant.

2.1.16.1 Indirect Participant Account Details Summary

You can invoke “Indirect Participant Account Details Summary” screen by typing ‘PMSIPACC’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. Click new button on the Application toolbar.

You can search for the networks using one or more of the following parameters:

- Authorization status

- Record status

- Network code

Once you have specified the search parameters, click ‘Execute Query’ button. The system displays the records that match the search criteria.

Double click a record to view the detailed maintenance screen. You can also export the details of selected records to a file using ‘Export’ button.

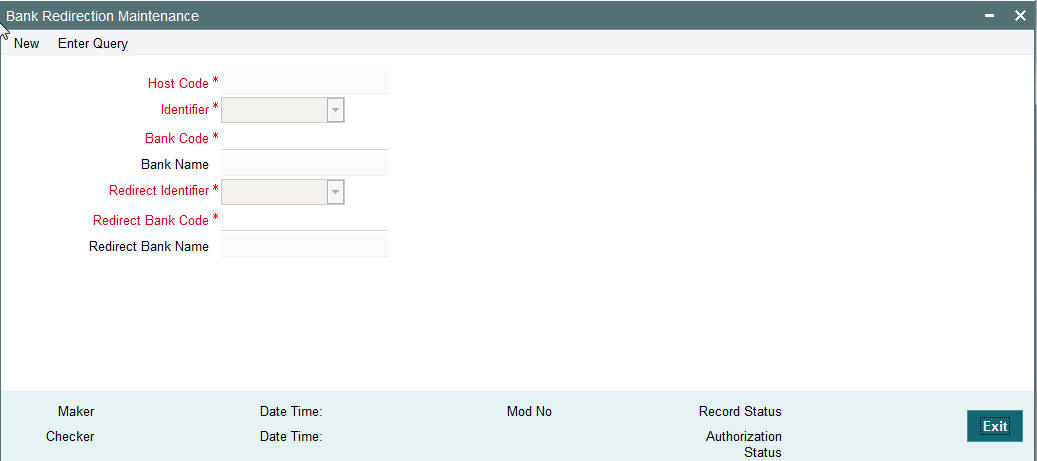

2.1.17 Bank Redirection

You can invoke the “Bank Redirection” screen by typing ‘PMDBKRED’ in the field at the top right corner of the Application tool bar and then clicking on the adjoining arrow button.

You can capture the following details:

Identifier

Select the required bank identifier

- BIC

- Local Bank Code

Bank Code

Specify the Bank Code for which redirection is required.

Bank Name

The system specifies the name of the bank.

Redirect Identifier

Specify the Redirect Identifier. Choose between BIC and Local Bank Code.

Redirect Bank Code

Specify the bank code to which payment needs to be redirected. The redirected bank codes can be a valid SWIFT BIC or Local Clearing Bank Code based on the Bank Code Identifier type chosen.

Redirect Bank Description

Redirect Bank Description is defaulted based on the Bank code chosen.

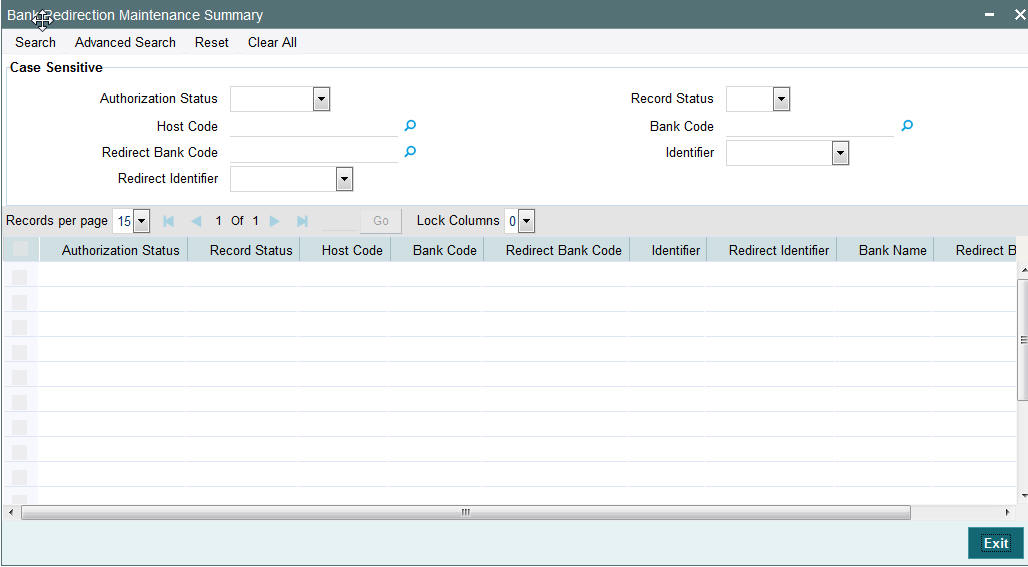

2.1.17.1 Bank Redirection Maintenance Summary

You can view the Bank Redirection Maintenances in the ‘Bank Redirection Maintenance Summary’ screen.

You can invoke “Bank Redirection Maintenance Summary” screen by typing ‘PMSBKRED’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. Click new button on the Application toolbar.

You can search using one or more of the following parameters:

- Authorization Status

- Record Status

- Host Code

- Bank Code

- Redirect Bank Code

- Identifier

- Redirect Identifier

Once you have specified the search parameters, click ‘Search’ button. The system displays the records that match the search criteria:

2.1.18 Account Redirection

You can use Account re-direction maintenance for replacing invalid/closed accounts Original Account in the payment transaction with the Redirected Account.

You can invoke the “Account Redirection” screen by typing ‘PMDACRED’ in the field at the top right corner of the Application tool bar and then clicking on the adjoining arrow button.

You can capture the following details:

Host Code

Specifies the Host Level function where the account redirection is maintained for the accounts of the host.

Account

Account Number

Specifies the original account number specified in the transaction.

Redirect Account

Redirect Account Number

Specify the redirected account number.

Redirect Account IBAN

The system displays the IBAN number along with redirect account if IBAN is maintained for the customer.

Branch Code

Account Branch Code is displayed.

Currency

Account Currency for the re-direct account is displayed.

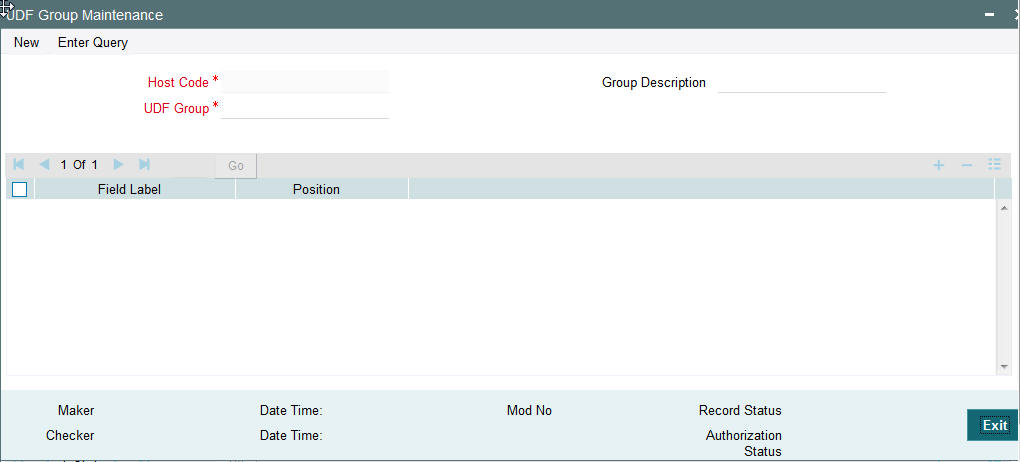

2.1.19 UDF Group Maintenance

UDF maintenance is used for creating UDF codes.

You can invoke ‘UDF Group Maintenance’ screen by typing ‘PMDGRUDF’ in the field at the top right corner of the Application toolbar and clicking on the adjoining arrow button.

You can specify the following fields:

Host Code

Host Code is defaulted as the logged in Host.

Group Description

Specifies the description of the UDF Group.

UDF Group

Specifies the group of the user defined field.

Field Label

Specify the name of the field that needs to be defined by the user. You can maintain up to 10 UDF fields.

Position

Specify the position of the user defined field.

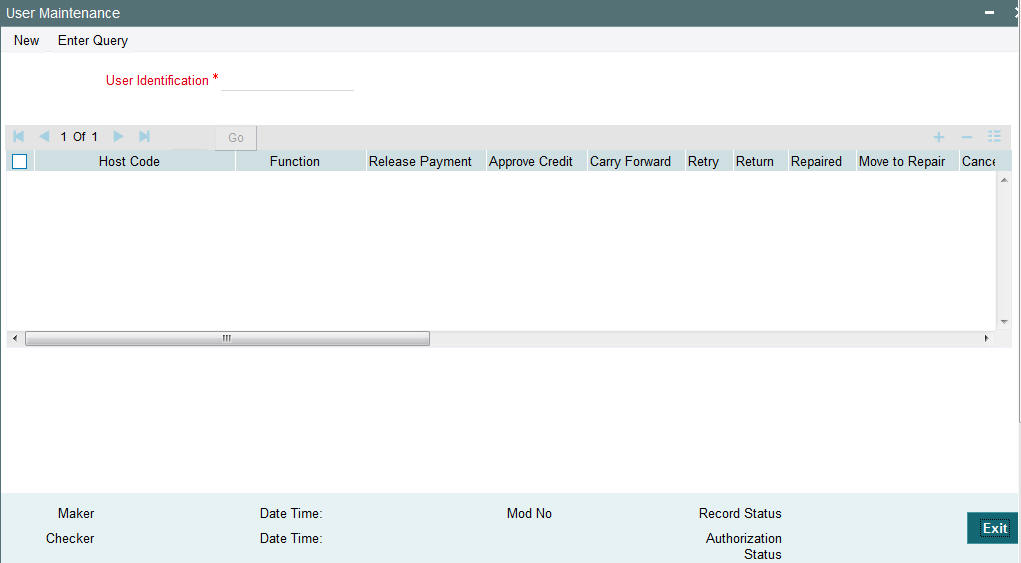

2.1.20 User Maintenance

You can invoke ‘User Maintenance’ screen by typing ‘PMDUSRDF’ in the field at the top right corner of the Application toolbar and clicking on the adjoining arrow button.

You can specify the following field:

User Identification

Specify the identification of the user.

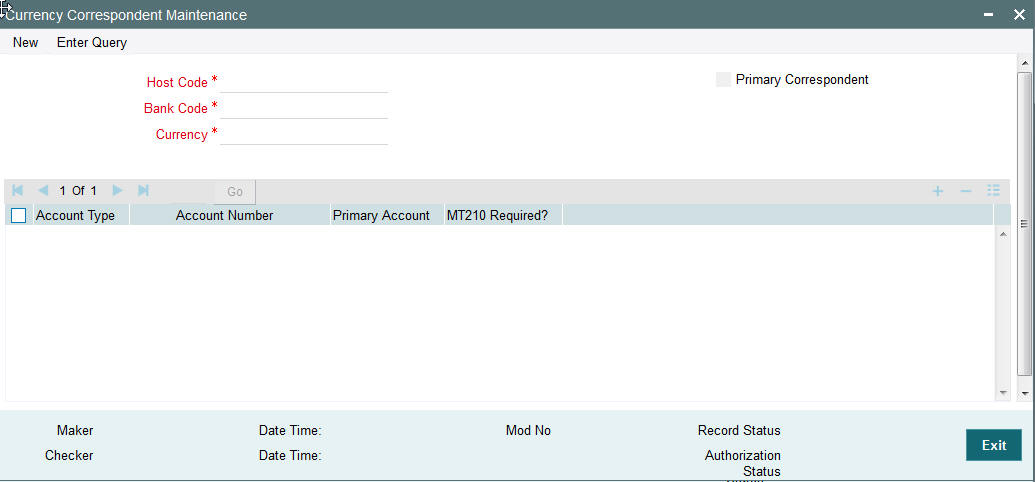

2.1.21 Maintaining Currency Correspondent

You can specify currency correspondent account details in this screen. Currency correspondent maintenance function is host specific.

You can invoke the ‘Currency Correspondent Maintenance’ screen by typing ‘PMDCYCOR’ in the field at the top right corner of the application toolbar and clicking the adjoining arrow button. Click new button on the Application toolbar.

You can specify the following fields:

Host Code

The system displays the logged in Host Code.

Currency

Specify the currency. Alternatively, you can select the currency from the option list. The list displays all valid currencies maintained in the system.

Account Type

Select the account type. The list displays the following values:

- Our- Currency correspondent is Bank’s currency correspondent

- Their- Processing bank is the currency correspondent bank for the other bank

Account Number

Specify the account number of the specified bank. Alternatively, you can select the parent account number from the option list. The list displays all Nostro accounts for Account type OUR and valid normal accounts for account type THEIR. The account currency displayed in the list should be same as the currency specified.

Account Name

The system displays the account name

Primary Correspondent

Check this box if one of the standard currency correspondents is identified as primary currency correspondent. This option is applicable only for Account type ‘OUR’. There can be only one primary currency correspondent for the combination of Account type, Currency. This option will be defaulted as yes for the first currency correspondent maintained.

MT210 required?

Check this box to indicate if MT210 is required to be sent to the Currency Correspondent in the scenarios where it is auto-generated like generation of outgoing MT200/MT201. Only if this check box is checked, the system would generate the MT210 as per the existing behavior, else system would not generate MT210.

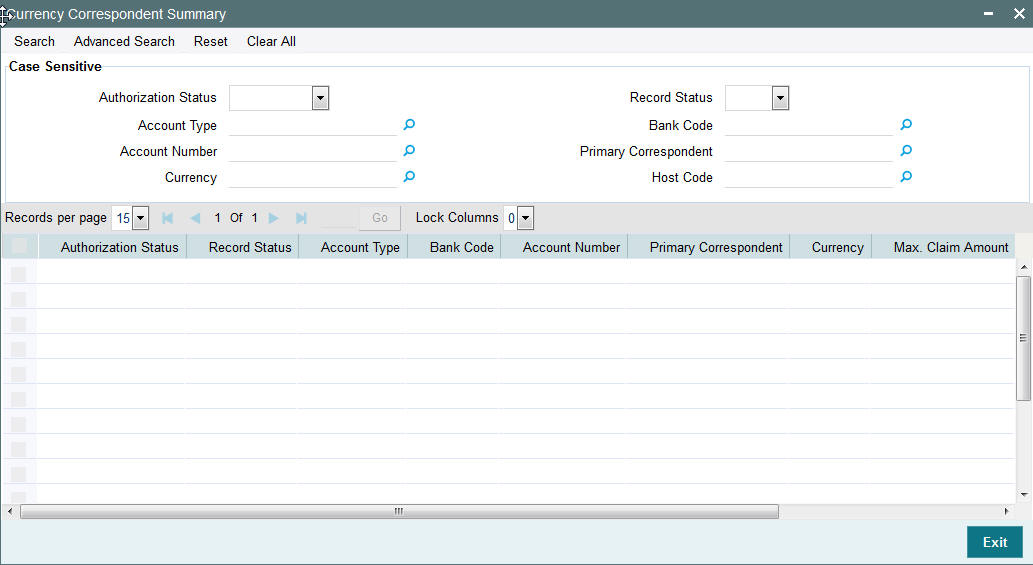

2.1.21.1 Viewing Currency Correspondent Summary

You can invoke “Currency Correspondent Summary” screen by typing ‘PMSCYCOR’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can search using one or more of the following parameters:

- Authorization Status

- Record Status

Once you have specified the search parameters, click ‘Execute Query’ button. The system displays the records that match the search criteria for the following

- Authorization Status

- Record Status

- Branch

- Account Type

- Alpha Code

- Primary correspondent

- Branch

- Primary Account

- Currency

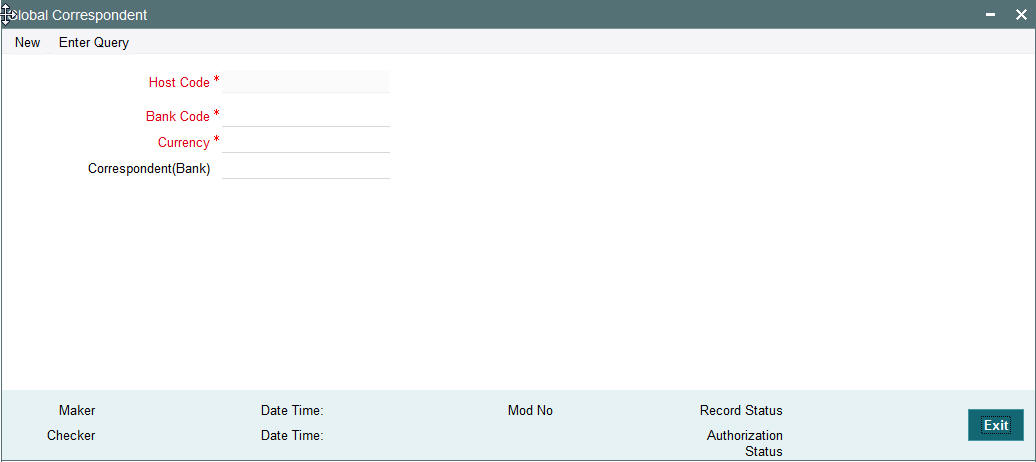

2.1.22 Maintaining Global Correspondent

You can maintain the currency correspondent of any bank in the Global correspondent screen

You can invoke the ‘Global correspondent Maintenance’ screen by typing ‘PMDGLCOR’ in the field at the top right corner of the application toolbar and clicking the adjoining arrow button. Click new button on the Application toolbar.

You can specify the following fields:

Bank Code

Specify the Bank code. Alternatively, you can select the Bank code from the option list. The list displays all valid Bank codes maintained in the system.

Host Code

The system displays the host code of the logged in user.

Currency

Specify the currency to be selected for which the correspondent alpha code will be selected. Alternatively, you can select the currency from the option list. The list displays all valid currencies maintained in the system.

Correspondent Bank Code Description

The system displays the correspondent Bank code description.

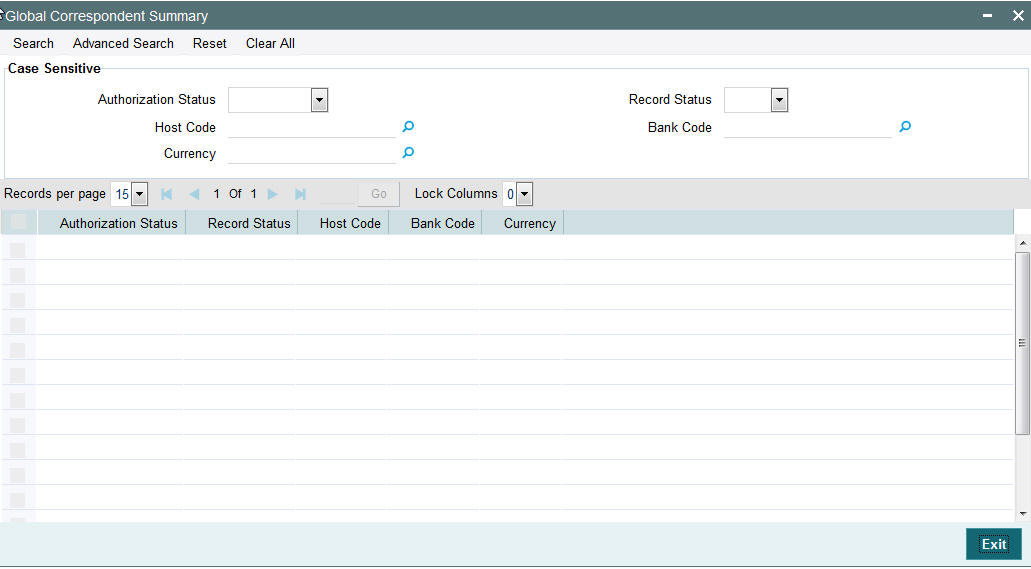

2.1.22.1 Viewing Global Correspondent Summary

You can invoke “Global Correspondent Summary” screen by typing ‘PMSGLCOR’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can search using one or more of the following parameters:

- Authorization Status

- Record Status

- Currency

- Alpha Code

Once you have specified the search parameters, click ‘Execute Query’ button. The system displays the records that match the search criteria.

- Authorization Status

- Record Status

- Currency

- Alpha Code

- Correspondent Alpha Code

2.1.23 Invoking D to A Converter

You can enable translation of information of the parties involved in the payment from ‘D’ option (names and addresses) to appropriate ‘A’ option (BIC codes).

This information is used during the STP of an incoming message to convert the names and address information to the appropriate BIC code.

You can invoke the ‘D to A Maintenance’ screen by typing ‘PMDDAMNT’ in the field at the top right corner of the application toolbar and clicking the adjoining arrow button.Click new button on the Application toolbar.

You can specify the following fields:

BIC Code

Specify the BIC codes. Alternatively, you can select the BIC code from the option list. The list displays all valid BIC codes maintained in the system.

BIC Code Description

The system displays the description of the BIC codes.

Address Line1

Specify the address line 1 maintained for the BIC code. This detail is compared with name and address received in the message to resolve the BIC Code. This line should match for successful conversion.

Address Line2

Specify the address line 2 maintained for the BIC code. This detail is compared with name and address received in the message to resolve the BIC Code. This line should match for successful conversion.

Address Line3

Specify the address line 3 maintained for the BIC code. This detail is compared with name and address received in the message to resolve the BIC Code. This line should match for successful conversion.

Address Line4

Specify the address line 4 maintained for the BIC code. This detail is compared with name and address received in the message to resolve the BIC Code. This line should match for successful conversion.

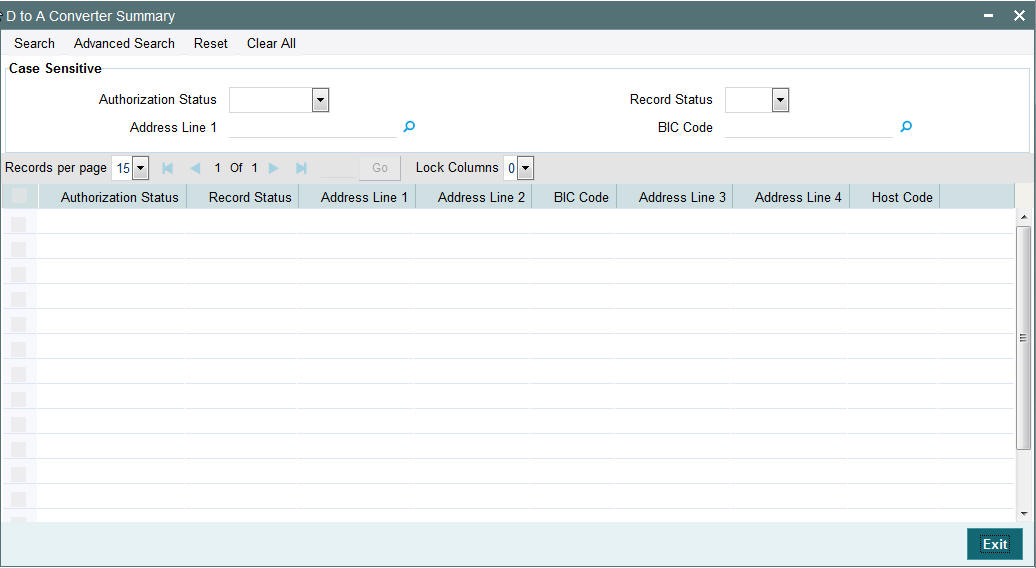

2.1.23.1 Viewing D to A Converter Summary

You can invoke “D to A Converter Summary” screen by typing ‘PXSDAMNT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can search using one or more of the following parameters:

- Authorization Status

- Record Status

- BIC Code

- Address Line1

Once you have specified the search parameters, click ‘Execute Query’ button. The system displays the records that match the search criteria for the following

- Authorization Status

- Record Status

- BIC Code

- Address Line1

- Address Line2

- Address Line3

- Address Line4

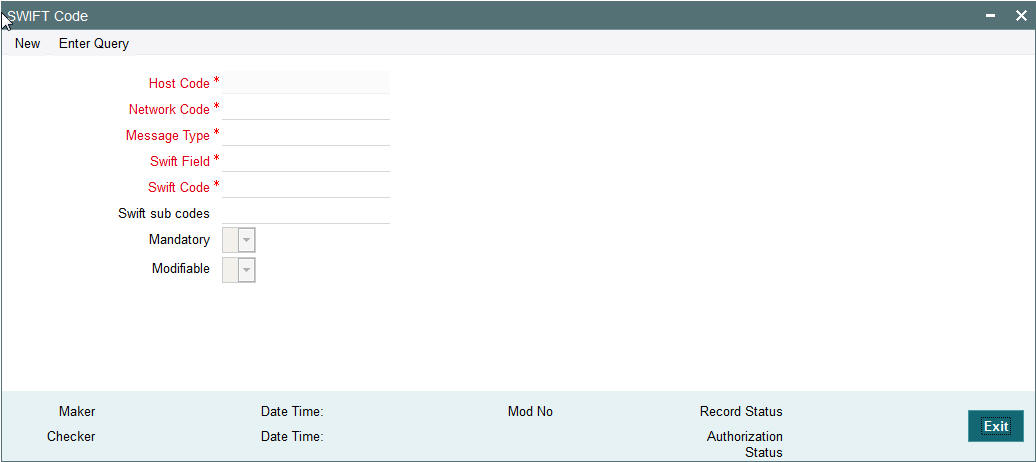

2.1.24 Maintaining SWIFT Code

You can maintain applicable SWIFT codes in this maintenance for a Network and message type.

You can invoke “SWIFT Code Maintenance” screen by typing ‘PMDVALDN’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specify the following details

Host Code

Specify the host code of the bank. Alternatively, you can select the host code from the option list. The list displays all valid host codes maintained in the system.

Network Code

Specify the network code. Alternatively, you can select the network code from the option list. The list displays all valid network codes maintained in the system.

Message Type

Specify the message type. Alternatively, you can select the message type from the option list. The list displays all valid message types maintained in the system.

Mandatory

Select an option to indicate whether the SWIFT tag is mandatory.

SWIFT Field

Specify the SWIFT field. Alternatively, you can select the SWIFT field from the option list. The list displays all valid SWIFT fields maintained in the system.

Modifiable

Select an option to indicate whether the SWIFT tag is modifiable.

SWIFT Code

Specify the SWIFT code.

SWIFT Sub Codes

Specify the sub SWIFT code.

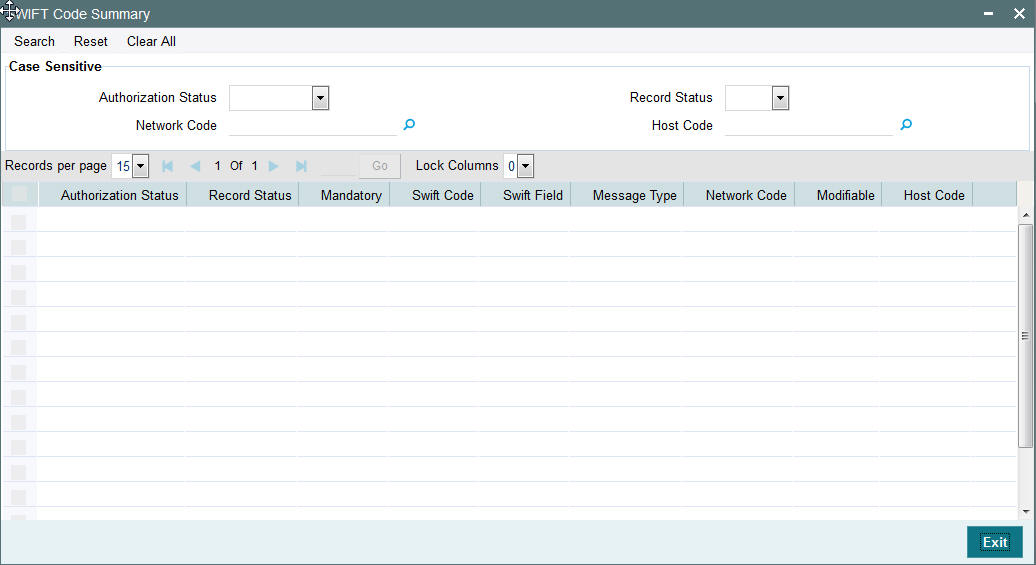

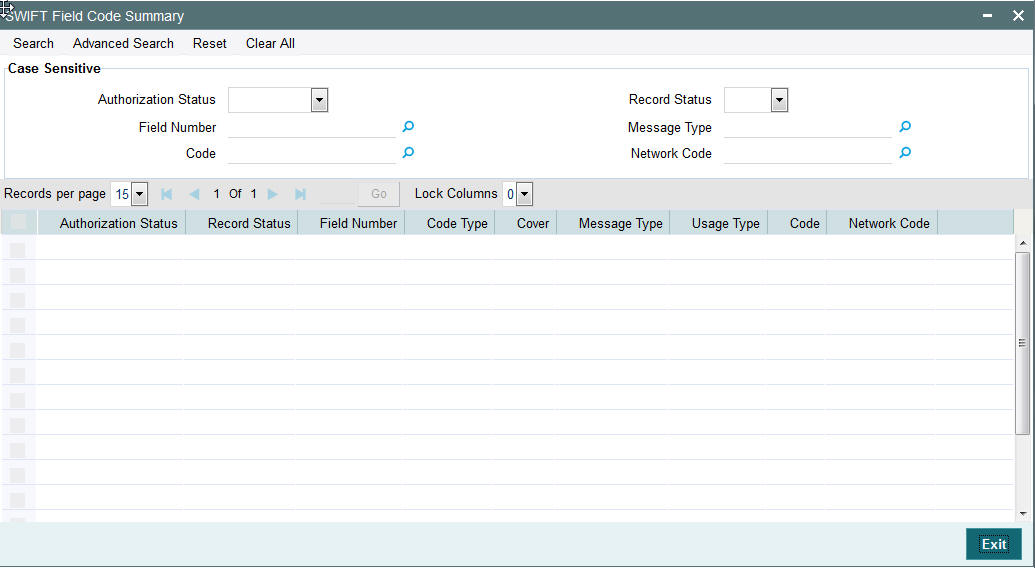

2.1.24.1 Viewing SWIFT Code Summary

You can invoke “SWIFT Code Summary” screen by typing ‘PMSVALDN’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can search using one or more of the following parameters:

- Authorization Status

- Record Status

- Network Code

- Host Code

Once you have specified the search parameters, click ‘Search’ button. The system displays the records that match the search criteria.

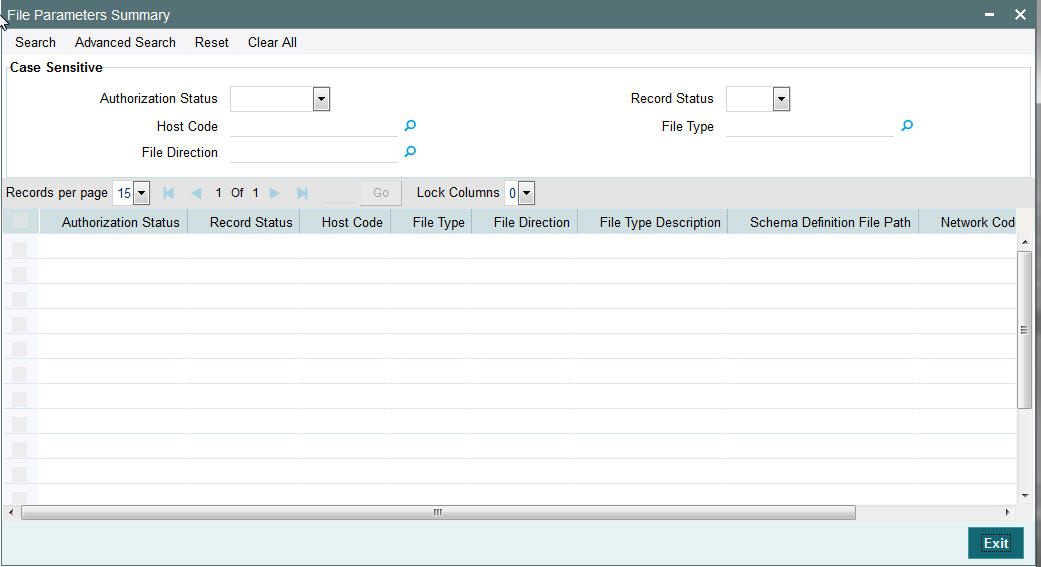

2.1.25 Maintaining File Parameters

You can specify parameters for handling files received from CSM/customers.

You can invoke the ‘File Parameters Maintenance’ screen by typing ‘PMDFLPRM’ in the field at the top right corner of the application toolbar and clicking the adjoining arrow button.Click new button on the Application toolbar.

Specify the following details

Host Code

The system specifies the host code that the user is logged in.

File Type

The system populates this field based on static maintenance available in Messaging for the file types handled.

File Type Description

The system populates this field based on the file type chosen.

File Direction

The system populates this field based on the file type chosen.

Schema File Definition Path

Specify the File path from where xsd files for format validation are fetched

Network Code

Specify the network code from the list of values.

Payment Type

The system populates this field based on the network chosen.

Connector Details

Destination Type

Select the required destination path. Choose among the following:

- Folder.

- Queue

- SwiftNet Connectivity

Folder Path

Specify the folder path.

Queue Name

Specify the name of the queue.

Protocol Type

Select the type of protocol.

SwiftNet Connectivity

Specify the required SwiftNet Connectivity.

Protocol Name

Specify the required protocol.

2.1.25.1 Viewing File Parameters Summary

You can invoke “File Parameters Summary” screen by typing ‘PMSFLPRM’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can search using one or more of the following parameters:

- Authorization Status

- Record Status

- Host Code

Once you have specified the search parameters, click the Search button. The system displays the records that match the search criteria.

2.1.26 Viewing Incoming File Summary

This screen is for viewing the uploaded inbound files for ACH and Direct Debits and the related file accounting.

You can invoke “Incoming File Summary” screen by typing ‘PMSINLOG’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can search using one or more of the following parameters:

- File Reference Number

- Received Date

- File Name

Once you have specified the search parameters, click the Search button. The system displays the records that match the search criteria.

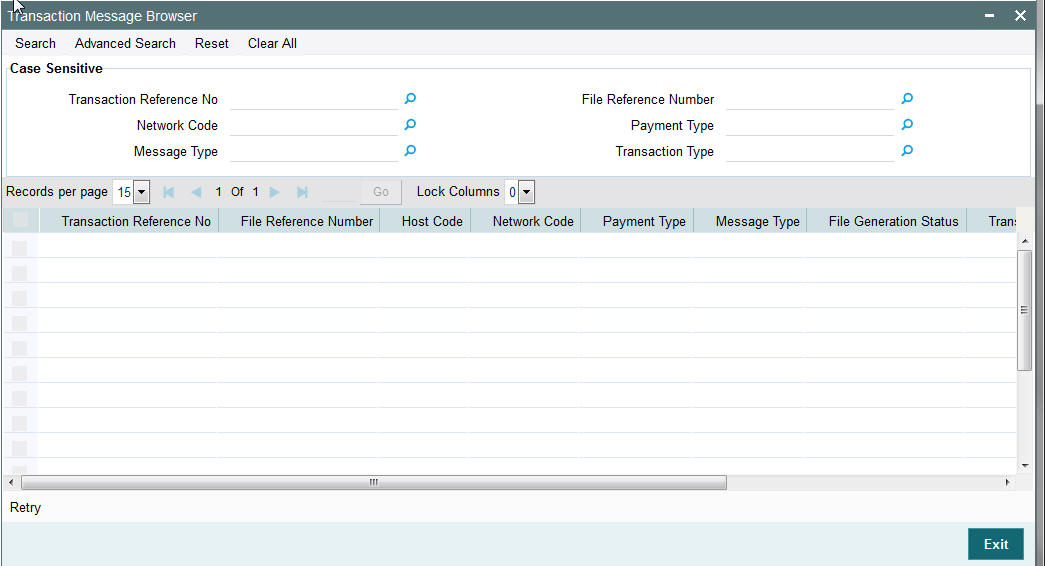

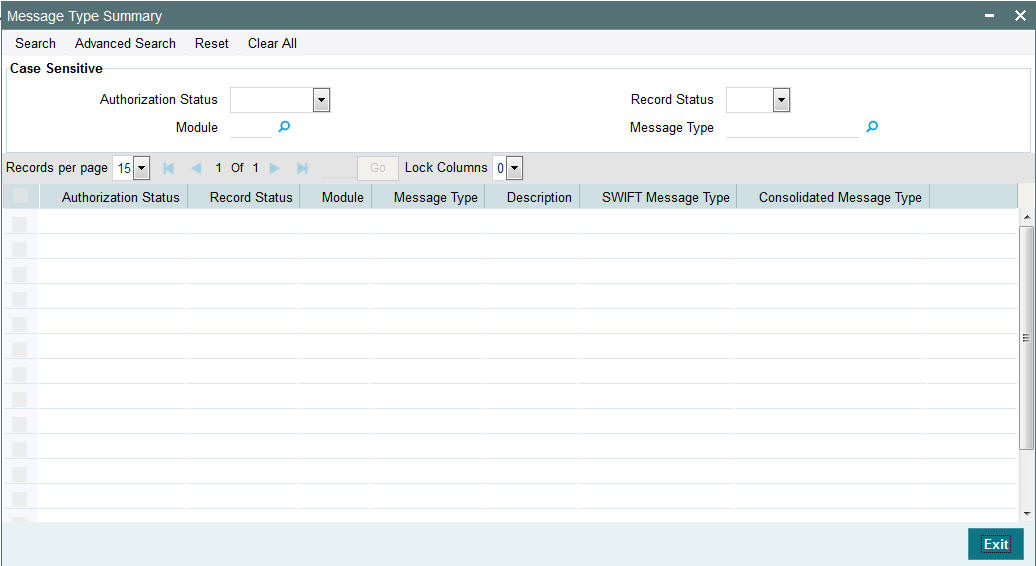

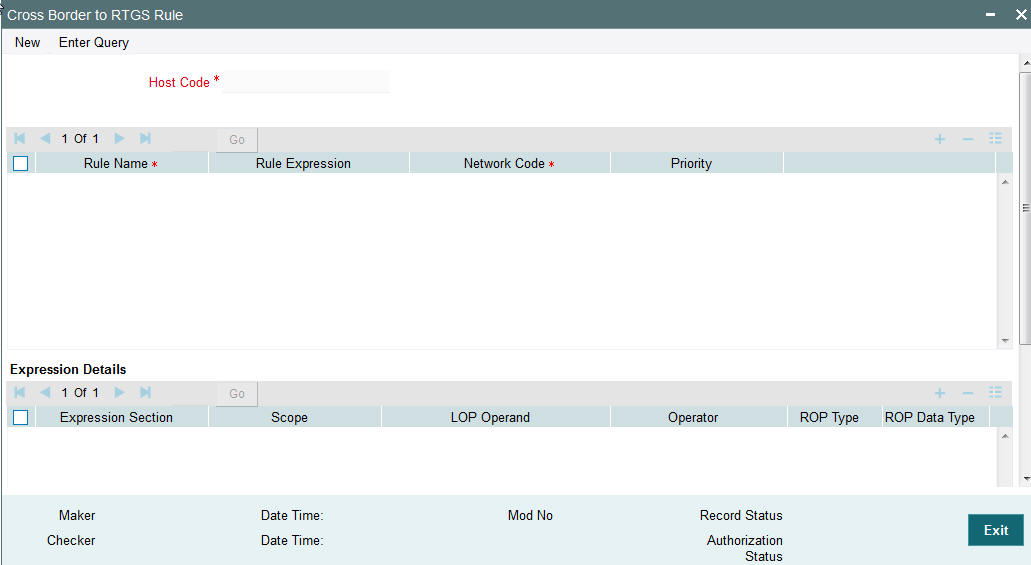

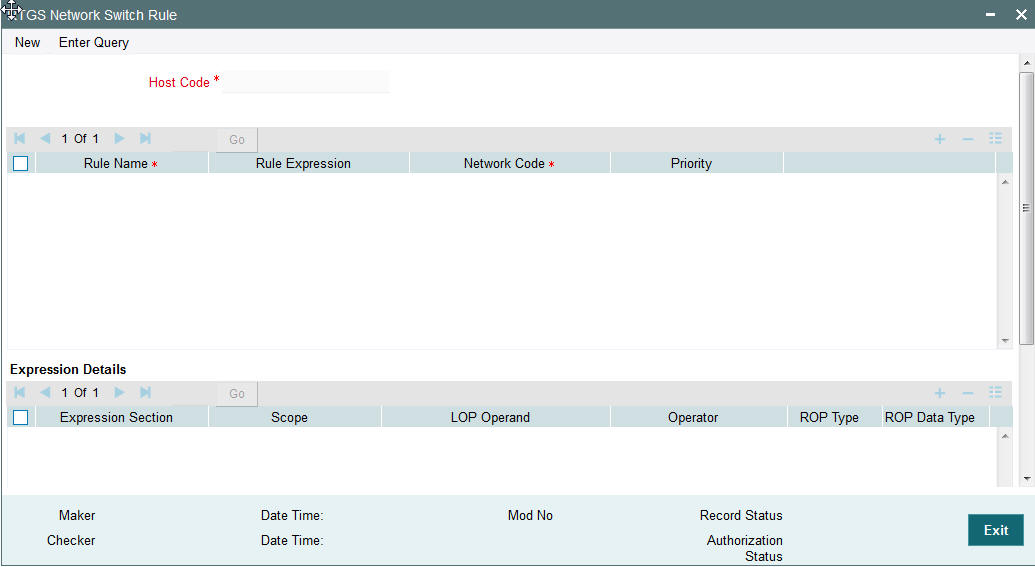

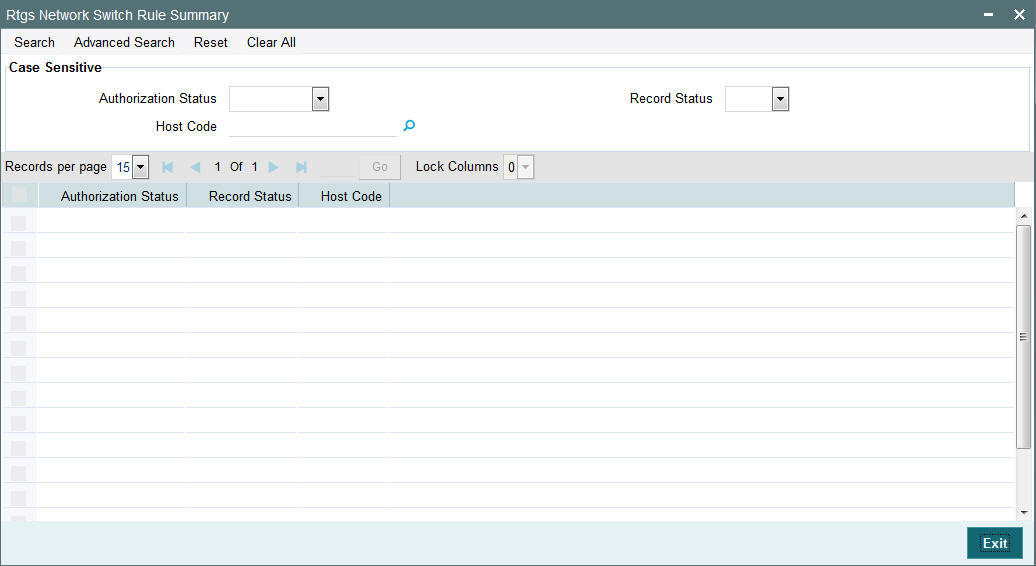

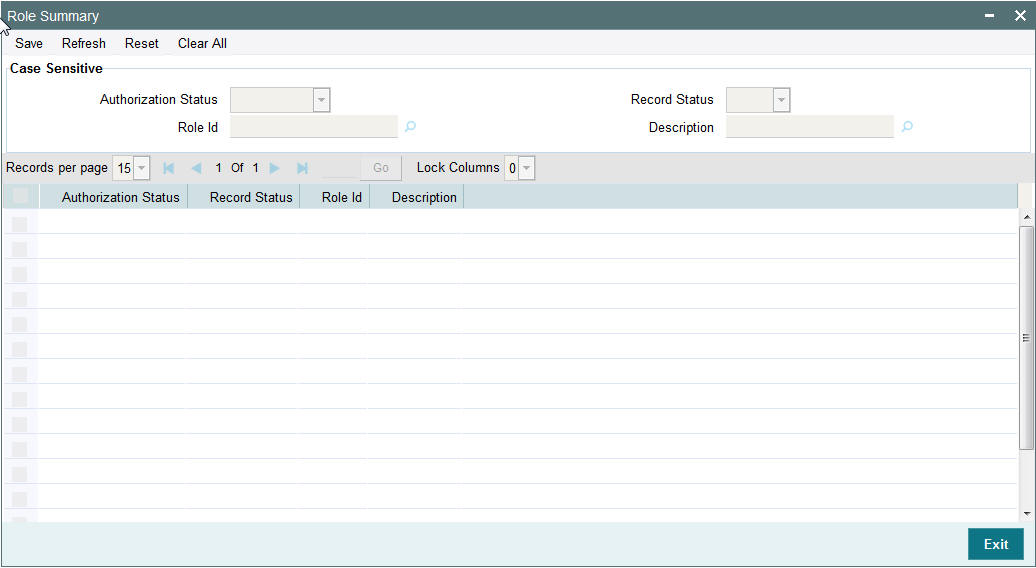

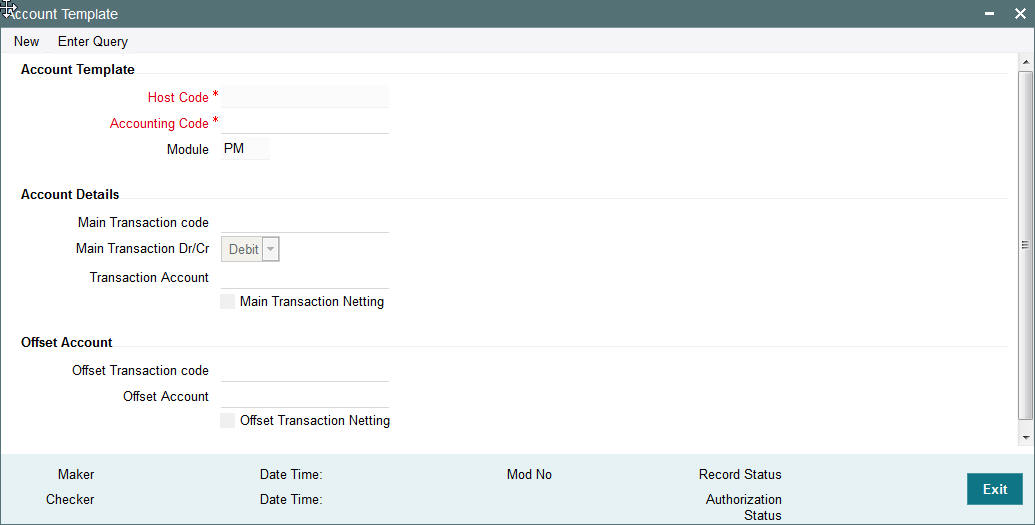

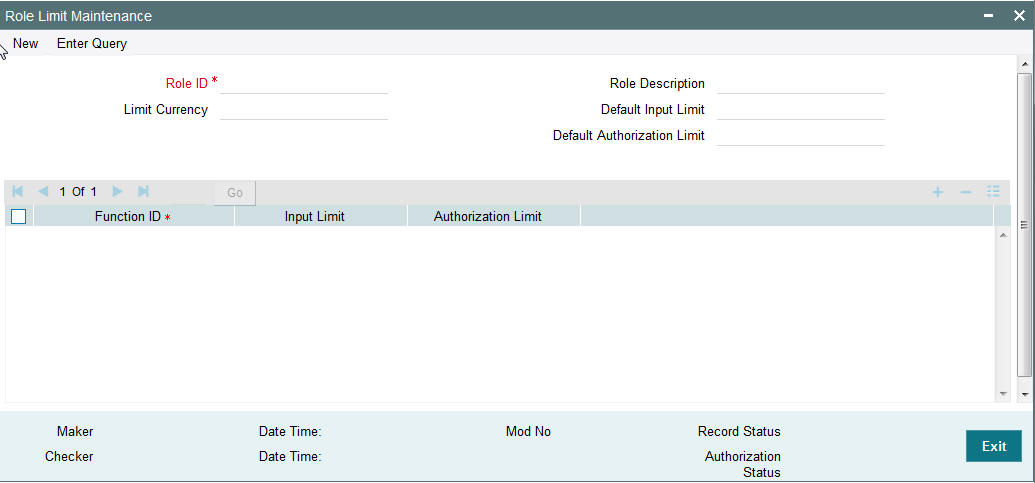

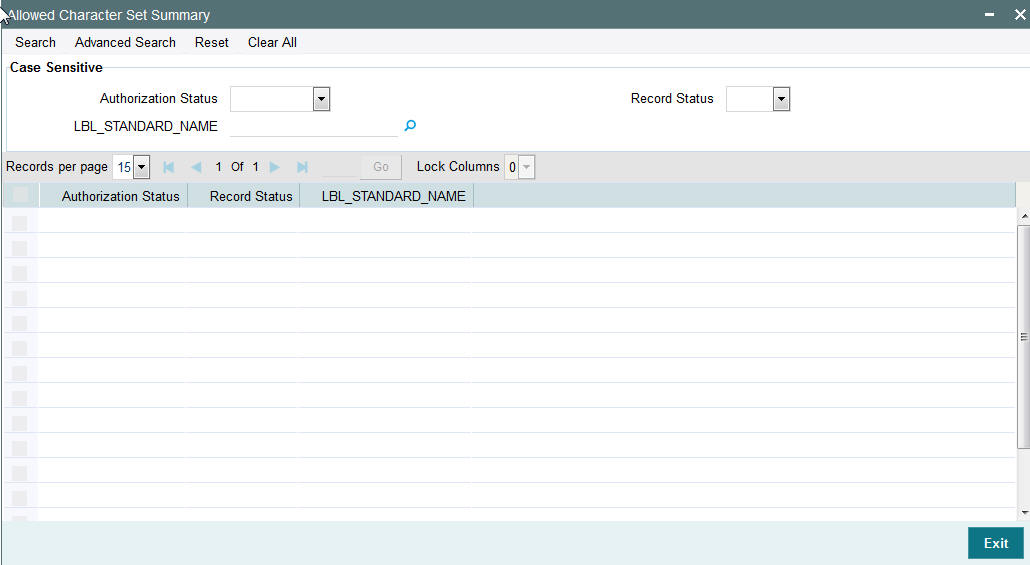

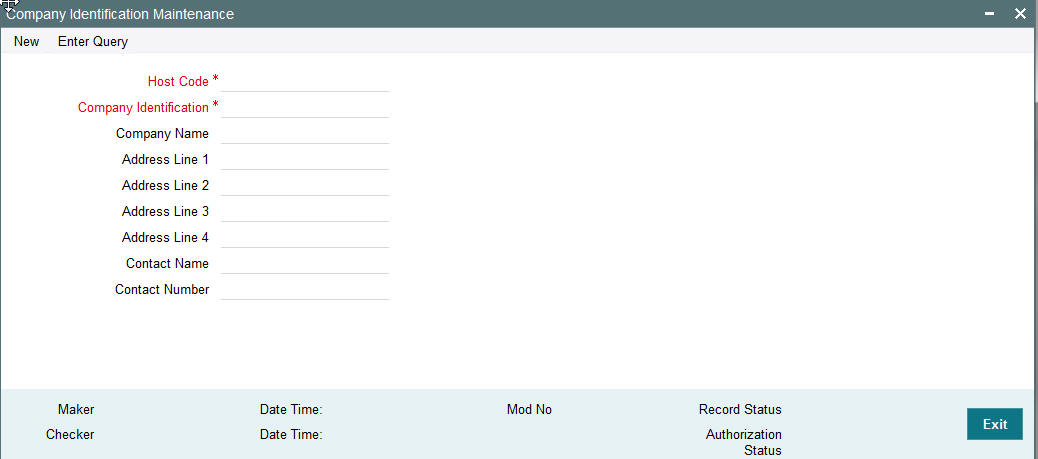

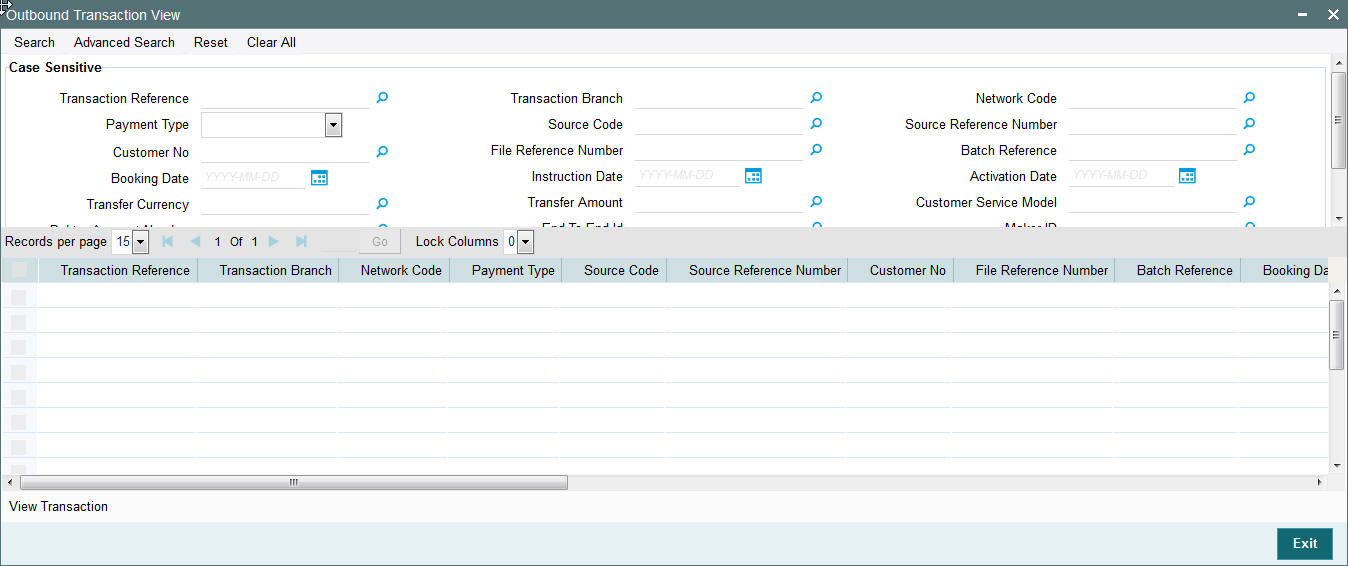

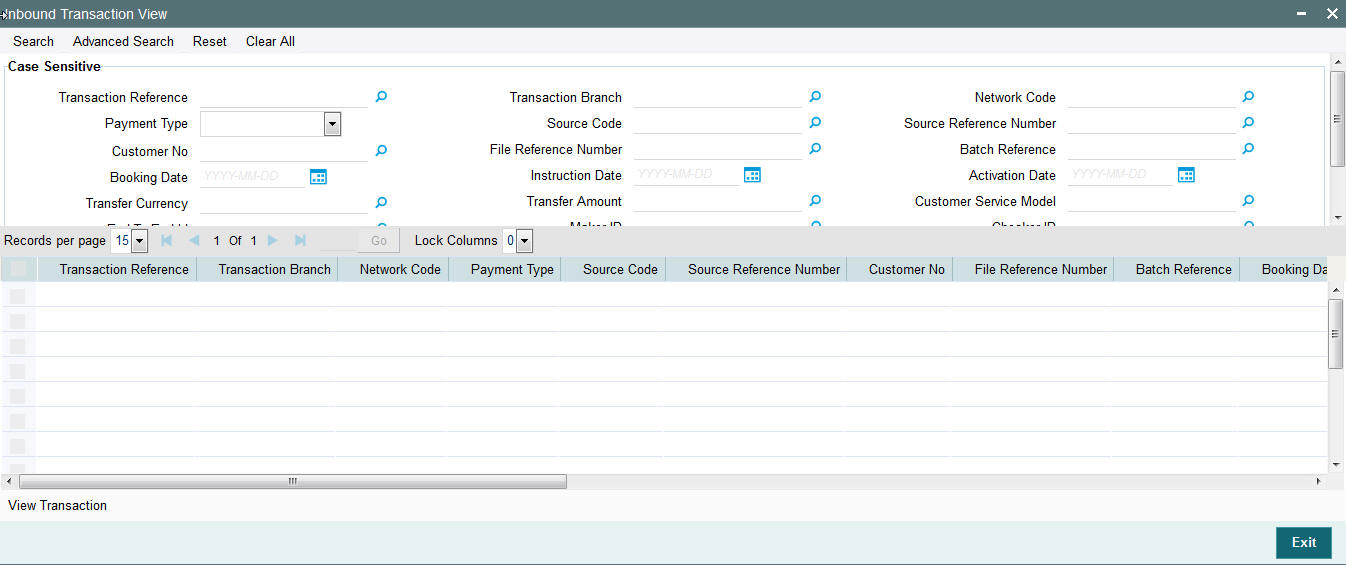

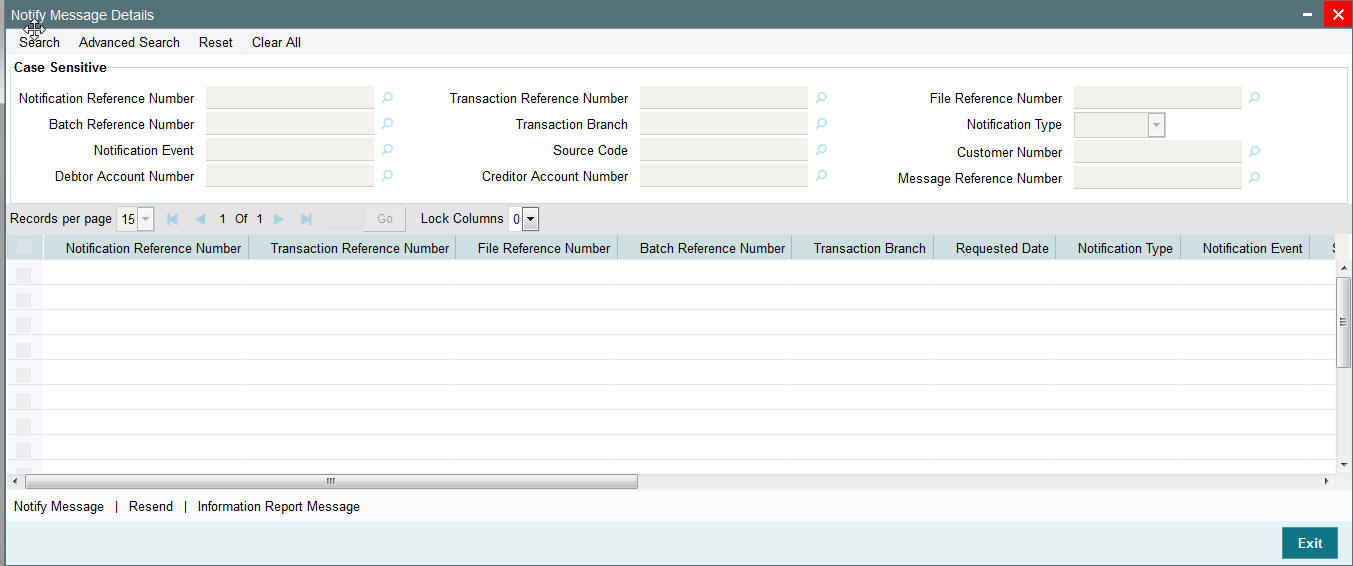

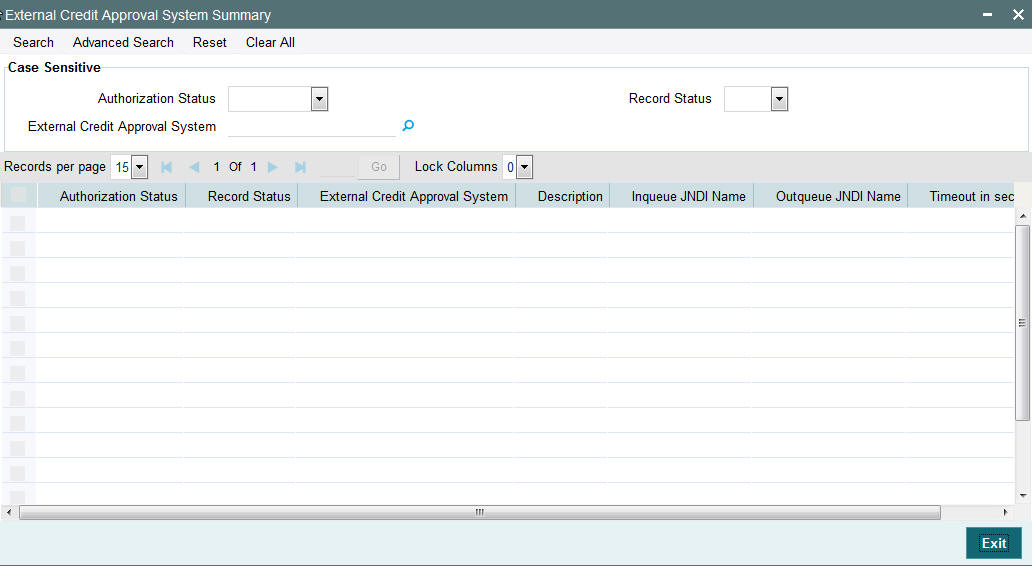

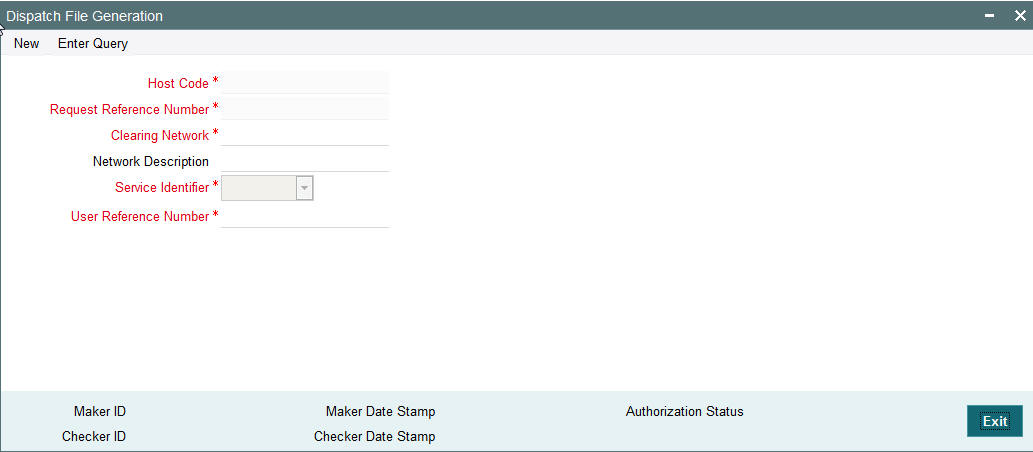

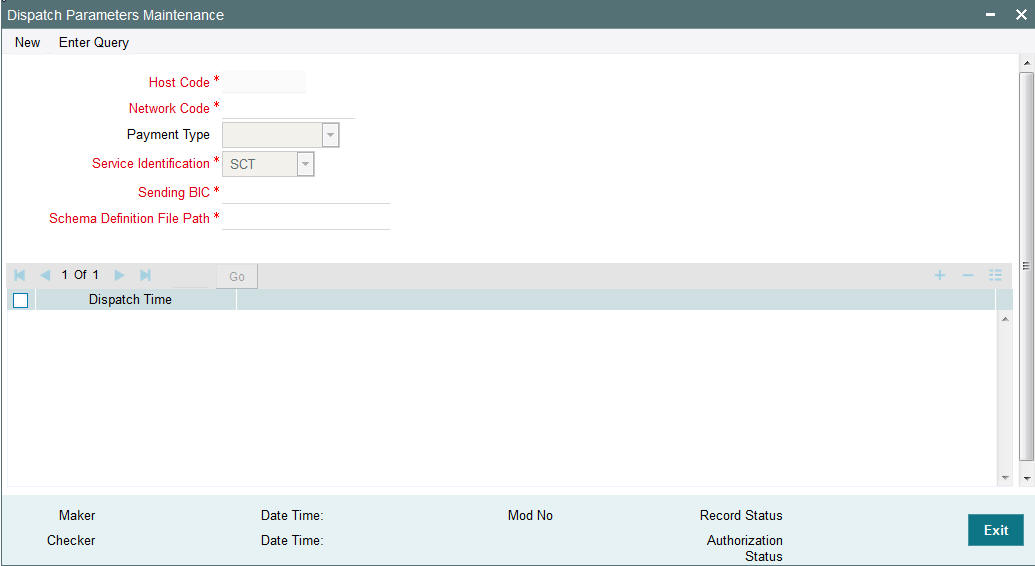

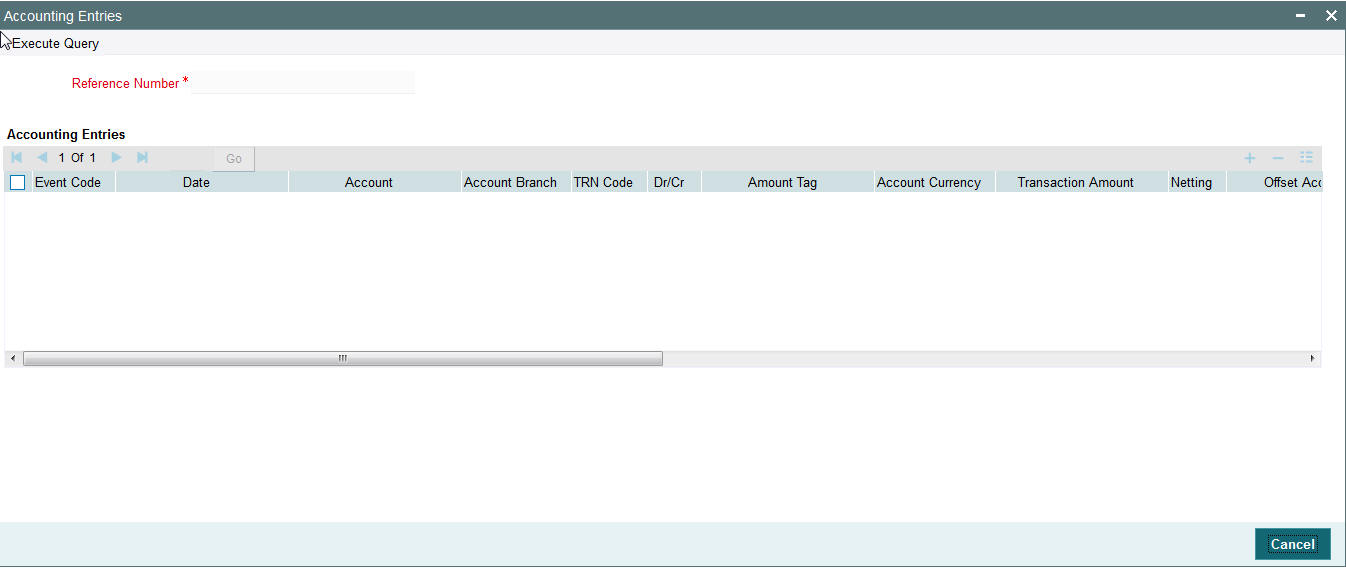

2.1.27 Transaction XML Regeneration