3. NACHA Payments

NACHA payments are US ACH payments managed and governed by NACHA (previously, ‘National Automated Clearing House Association’). They include both Credit Transfers and Direct Debit collections. The ACH Network serves as a network for direct consumer, business, and government payments, and annually facilitates billions of payments such as Direct Deposits and Direct Payments (Collections). It is used by more than 10,000 Direct and Indirect financial institutions and numerous Third party Service providers.

The NACHA Payments module in Oracle Banking Payments has capability for end to end processing of outgoing and incoming NACHA payments, right from receipt of file from customer or ACH Operator up until generation of outgoing NACHA file or posting to beneficiary accounts in case of incoming NACHA payments.

The NACHA Payments solution is designed for a depository institution who directly sends/receives ACH files to/from ACH Operator on behalf of its own customers.

High-lights of NACHA Payments

- Manual Payment Initiation

- Receipt of individual payment requests from bank channels and systems

- Processing of individual transactions specific to SEC Code of CIE

- NACHA rule validation

- STP of individual transactions up until the Dispatch activity, comprising activities like

- Validation, Dates resolution, Cut-off check, Sanctions check etc.

- Enabling manual intervention in case of various exceptions through specific Operations (Exception) queues

- Generation and Dispatch of outgoing NACHA file comprising Credit Transfers Transactions

- Sanctions check by interfacing with an external Sanctions screening system

- External Credit Approval Check while processing outgoing Credit transfers.

- Accounting

- NACHA file generation

- Receipt and STP of incoming ACH file from ACH network

3.1 NACHA Outgoing

Bank staff of Originating Depository Financial Institution (ODFI) can manually book an outgoing NACHA payment on behalf of the originator. Alternatively, system can receive a SOAP request from the Originator’s system for initiating an outgoing NACHA payment which would be processed on receipt. Currently, processing of outgoing NACHA payments for Standard Entry Class Code of CIE i.e., Customer Initiated Entry is supported by the system.

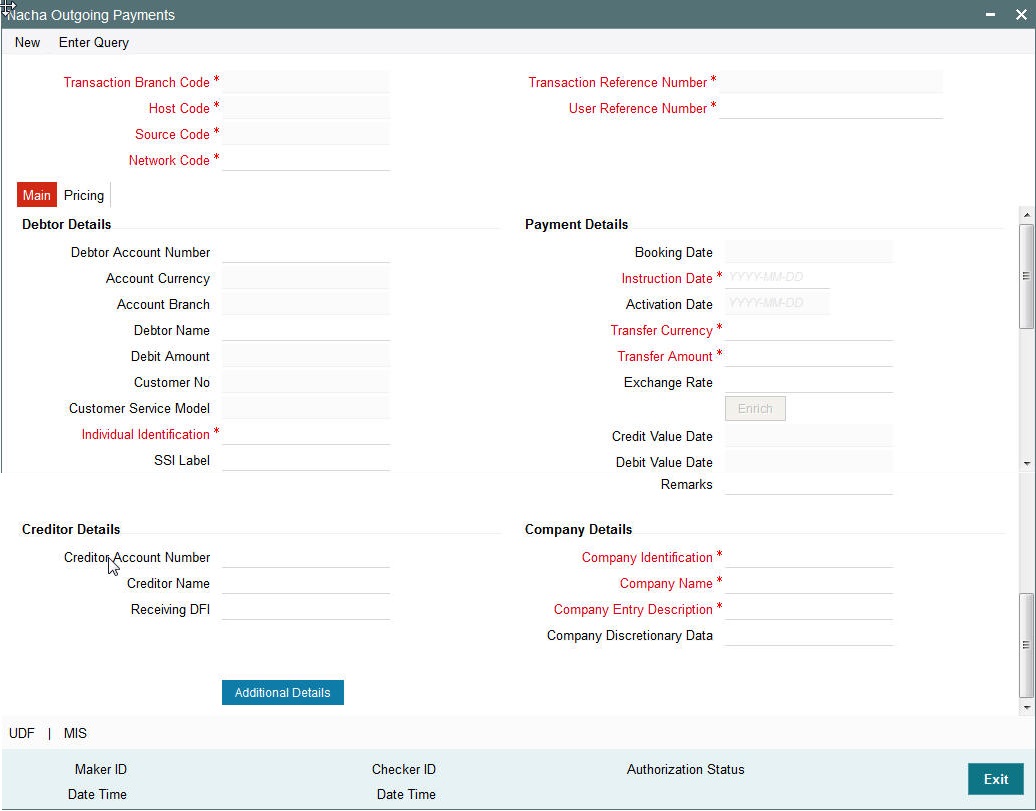

3.1.1 Invoking NACHA Outgoing Payment Transaction Input Screen

To manually initiate US NACHA Outgoing Payment, new Screen is provided with Function ID PNDOTONL. You can invoke this screen by typing ‘PNDOTONL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. Click new button on the Application toolbar.

In this screen, you are provided with all necessary fields to capture US NACHA Payment details for SEC code of CIE.

.

Below listed fields are mandatory to process outgoing NACHA Payment.

Debtor Account Number

Please select the Account of the Originator to be debited. Option is available to use the Pick-list which displays all valid Account Numbers available in the system.

Debtor Account Currency

Defaulted on Selecting Debtor Account Number

Debtor Account Branch

Defaulted on Selecting Debtor Account Number

Debtor Name

Defaulted on Selecting Debtor Account Number

Debtor Customer Number

System identifies the Customer number maintained in the system for the Originator based on the selected Debtor Account Number and the same is defaulted in this field.

Customer Service Model

Defaulted with Customer Service Model linked to the identified customer (originator)

Individual Identification

Please enter the Individual Identification Number

For Standard Entry Class Code: CIE – this field contains the accounting Number by which the Originator (Payer) is known to the Receiver (Payee). This data is used by the Receiver to update accounts receivable Records. It should be the Number shown on an invoice, statement, billhead, notice or other communication as the reference. Numbers may be policy, customer, invoice, meter, sequence and/or Alphanumeric Combinations

Creditor Account Number

Please Enter the Beneficiary Account Number

Receiving DFI

This field is used to capture Creditor Bank ABA Number. Option is available to use the pick-list which displays the ABA numbers of all valid DFIs (Depository Financial Institutions).

Instruction Date

This is the Effective Entry date, date specified by the Originator on which it intends the payment to be settled by NACHA with the RDFI. This is defaulted to current date but can be changed to any future date.

Transfer Currency

Please enter the Transfer Currency which should always be USD.

Transfer Amount

Please enter the Amount to be transferred.

Company Identification

For Standard Entry Class Code: CIE, this field contains the bill payment service provider’s identification number.

Option is available to use the pick-list which displays all valid Originator Details from Company Identifier Maintenance (Function ID – PMDORGDT).

Company Name

Defaulted on Selecting Company Identification

For Standard Entry Class Code: CIE, this field contains the bill payment service provider’s name.

Company Entry Description – Please enter appropriate data as supplied by the Originator like the purpose of payment e.g. gas bill payment, phone bill payment etc. This data is important to the Receiver to know the purpose of this NACHA payment.

Below listed mandatory fields are defaulted on Click of New

Transaction Reference Number

Unique Reference number for the payment generated by the System

Transaction Branch Code

Defaulted with logged in Branch Code

Host Code

Defaulted with Host Code to which the Logged in Branch is associated with

Source Code

Defaulted as ‘MANL’; for Manually Input transactions. For transactions received through channel, relevant source code from Source maintenance would be defaulted.

Network Code

User has to select the appropriate network Code from the pick-list. If only one NACHA network is maintained (which will generally be the case) then the same will be defaulted.

User Reference Number

Defaulted with Transaction Reference Number, but can be modified to include any specific reference number provided by the originator.

Booking Date

Defaulted with current date

Below Listed optional fields that can be captured for Outgoing NACHA Payment.

Additional Details Button

Please click on this button to capture Additional Payment Related Information. For Standard Entry Class Code: CIE, only one occurrence of Addenda record containing payment related Information in the outgoing NACHA file is allowed

Creditor name

Enter the Creditor name.

Company Discretionary Data

Enter the data as supplied by the originator. For Standard Entry Class Code: CIE, this field can contain the Biller’s Name

Remarks

User can input operational remarks specific to this payment. This data is not communicated to the Receiving DFI

Enrich Button

On click of this button, System computes the Exchange Rate & Charges if applicable, and the Value dates.

Exchange rate is computed if the debtor account currency is different from Transfer currency. User can view the computed rate in the Exchange Rate field in Main Tab

You can view the Computed Charges in Pricing Tab

Credit Value Date

Defaulted to Instruction Date.

Debit Value Date

Defaulted to Instruction Date.

Creditor name

Enter the Creditor name.

Pricing Tab

The below mentioned attributes will be available in the Pricing tab.

Pricing Component

Displays the Name of the pricing component, applicable for the transaction, for which charges are computed.

Pricing Currency

Displays the Currency in which the charge amount is calculated for the Pricing component.

Pricing Amount

Displays the charge amount calculated for each pricing component.

Waived

Check this box to indicate that the charge is waived for the pricing component.

Debit Currency

Displays the currency in which the charge amount is debited for the pricing component. This is the currency of the debit (originator) account.

Debit amount

Displays the charge amount in debit currency to be debited. This amount is different from the calculated Pricing amount if the debit currency is different from the Pricing Currency. The Debit amount for charges is calculated by converting the Pricing amount in Pricing Currency to Debit currency using specified Exchange Rate type in Pricing Code maintenance.

User must click on save button in PNDOTONL Screen to save the outgoing payment and make it available for authorization. On authorization by a different user, system starts processing the US NACHA Outgoing Payment.

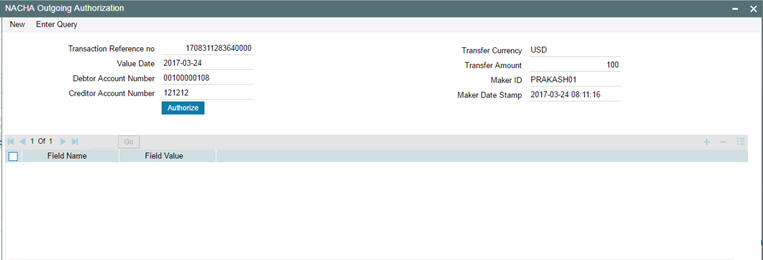

3.1.2 Transaction Authorization/Verification (Outgoing)

From the Transaction Input screen, you can also query for a particular transaction using Enter Query option and then authorize the transaction by clicking the Authorize button..

On clicking the Authorize button, the above screen is launched displaying some of the key transaction details (listed below) as seen in the above screen shot.

- Transaction Reference Number

- Transaction Amount

- Transfer Amount

- Debtor Account Number

- Creditor Account Number

- Maker Id

- Maker Date Stamp

- Instruction Date

- Transaction Currency

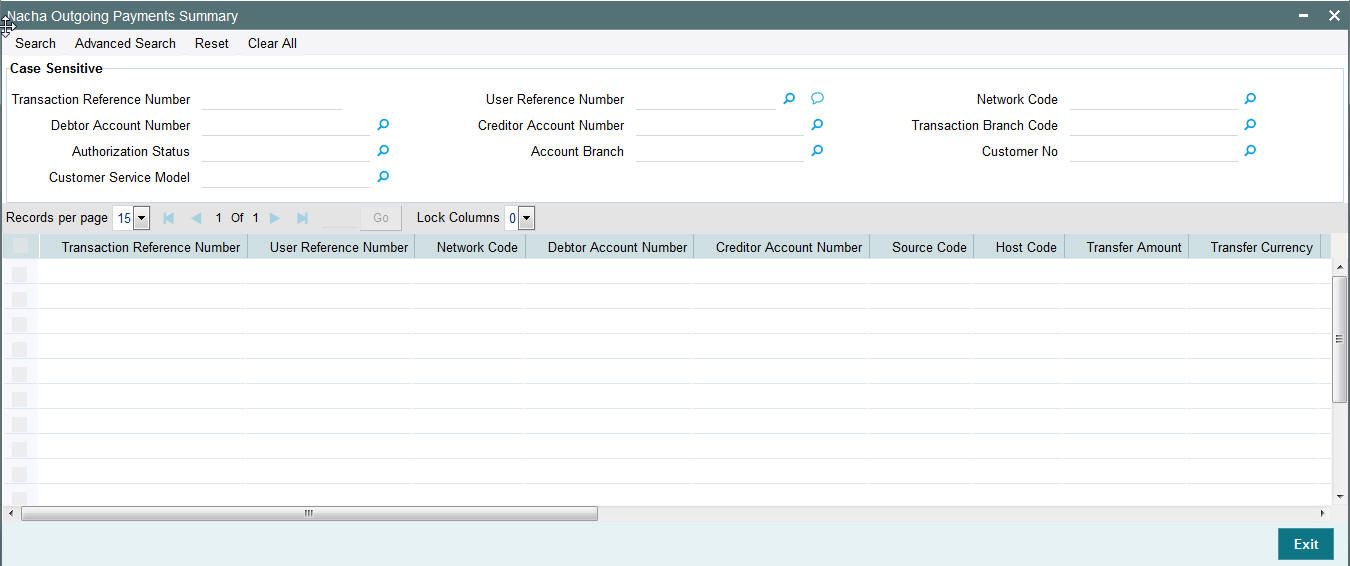

3.1.3 Viewing NACHA Outgoing Payments Summary Screen

You can search for outgoing payment records in the NACHA Outgoing Payments Summary Screen. You can invoke ‘NACHA Outgoing Payments Summary’ screen by typing ‘PNSOTONL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button..

You can search using one or more of the following parameters:

- Transaction Reference Number

- User Reference Number

- Network Code

- Debtor Account Number

- Creditor Account Number

- Transaction Branch Code

- Authorization Status

- Account Branch

- Customer No

- Customer Service Model

Once you have specified the search parameters, click ‘Search’ button. The system displays the records that match the following search criteria.

- Transaction Reference Number

- User Reference Number

- Network Code

- Debtor Account Number

- Creditor Account Number

- Source Code

- Host Code

- Transfer Amount

- Transfer Currency

- Debit Amount

- Account Currency

- Transaction Branch Code

- Authorization Status

- Activation Date

- Exchange Rate

- Booking Date

- Account Branch

- Customer No

- Customer Service Model

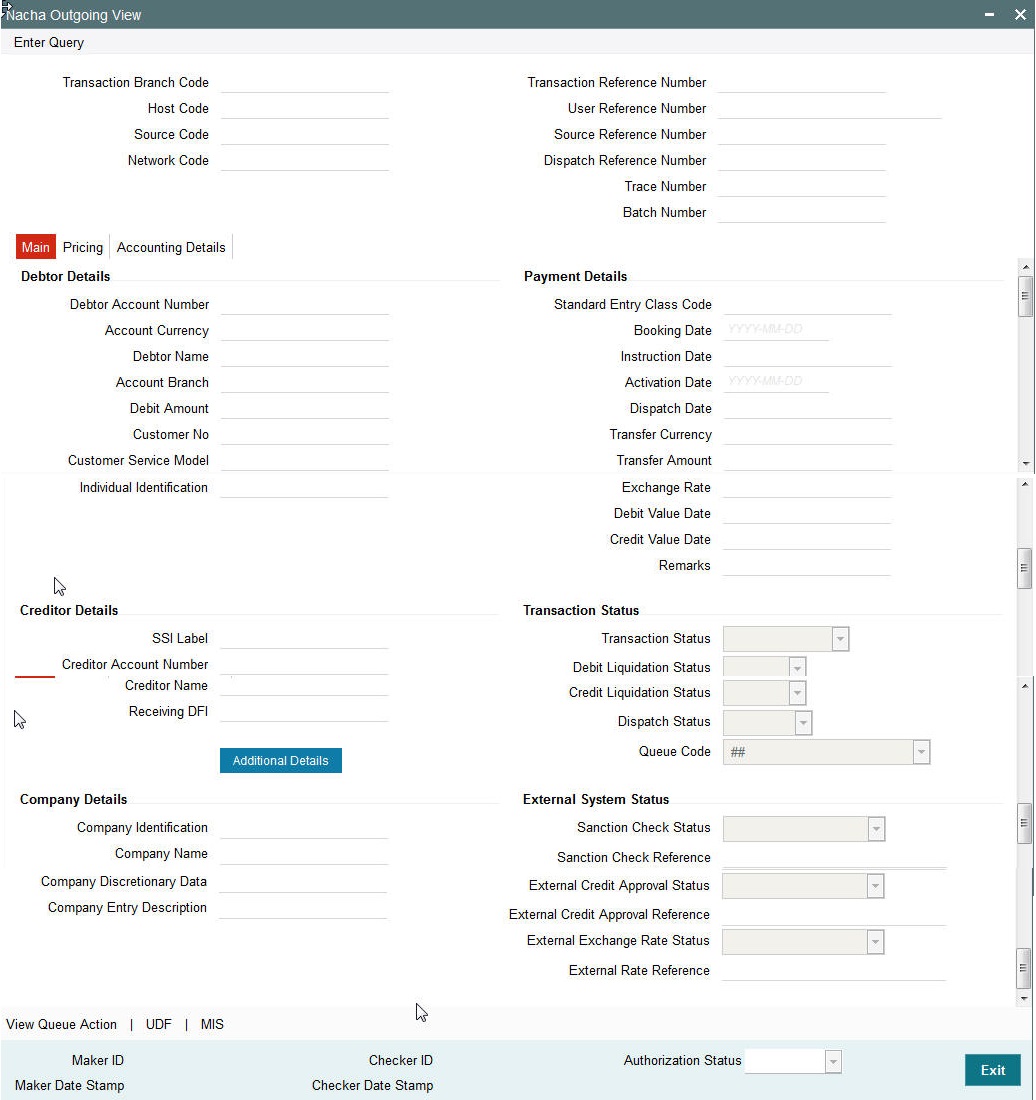

3.2 Invoking NACHA Outgoing Payment View Screen

You can invoke ‘NACHA Outgoing View’ screen by typing ‘PNDOVIEW’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can view the payment data and the payment processing statuses as well as external system statuses in the Main Tab.

Trace Number

This is a unique identification of each ACH entry record in the outgoing NACHA file, which is generated during file generation.

Batch Number

This is a unique identification of every batch in the outgoing NACHA file, which is generated during file generation.

Pricing Tab

You can view the charges applied on the Outgoing NACHA Payment in the Pricing Tab.

Accounting Details Tab

You can view the Accounting Entries posted for the Outgoing NACHA Payment in Accounting Details Tab.

View Queue Action Log –

User can view the different actions taken by system or user when the transaction was moved to various exception queues as part of the processing.

UDF sub-screen

Refer to description in sec. 2.1.1 for Outgoing NACHA Payment

MIS sub-screen

Refer to description in sec. 2.1.1 for Outgoing NACHA Payment

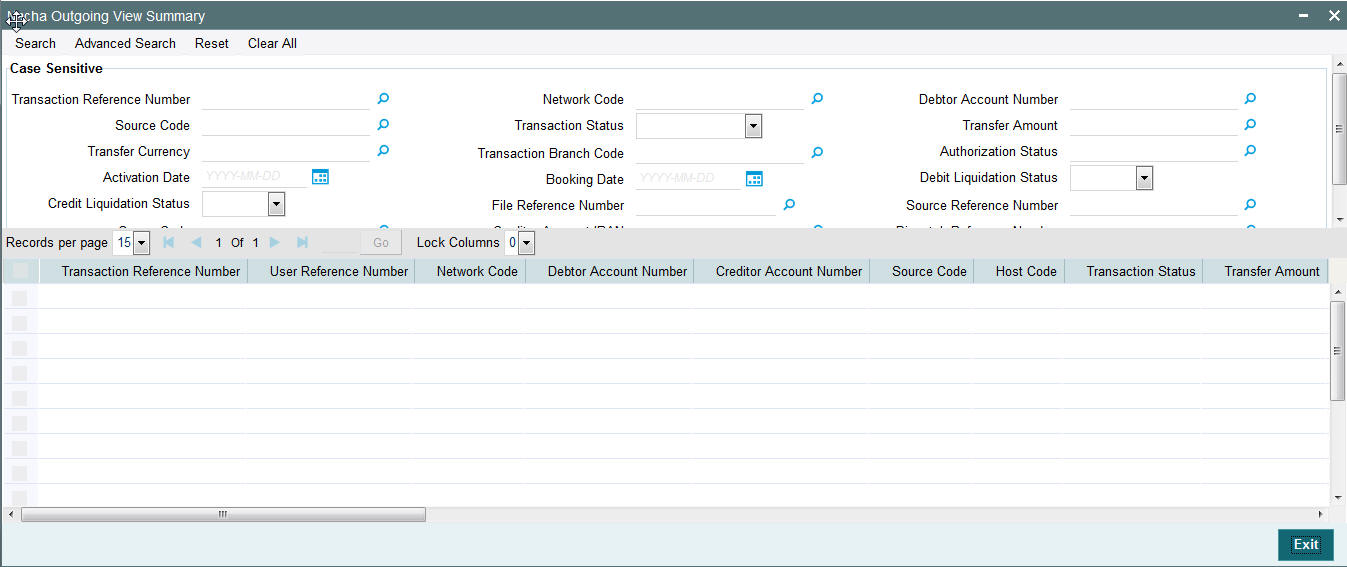

3.2.1 Viewing NACHA Outgoing View Summary Screen

You can search for records in the NACHA Outgoing View Summary Screen. You can invoke ‘NACHA Outgoing View Summary’ screen by typing ‘PNSOVIEW’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can search using one or more of the following parameters:

- Transaction Reference Number

- Network Code

- Debtor Account Number

- Source Code

- Transaction Status

- Transfer Amount

- Transfer Currency

- Transaction Branch Code

- Authorization Status

- Activation Date

- Booking Date

- Debit Liquidation Status

- Credit Liquidation Status

- File Reference Number

- Source Reference Number

- Queue Code

- Creditor Account Number

- Dispatch Reference Number

- Creditor Account IBAN

Once you have specified the search parameters, click ‘Search’ button. The system displays the records that match the search criteria with the following details in the search results grid.

- Transaction Reference Number

- User Reference Number

- Network Code

- Debtor Account Number

- Creditor Account Number

- Source Code

- Host Code

- Transaction Status

- Transfer Amount

- Transfer Currency

- Debit Amount

- Account Currency

- Transaction Branch Code

- Authorization Status

- Activation Date

- Exchange Rate

- Booking Date

- Debit Liquidation Status

- Credit Liquidation Status

- Account Branch

- File Reference Number

- Source Reference Number

- Queue Code

- Creditor Account IBAN

- Dispatch Reference Number

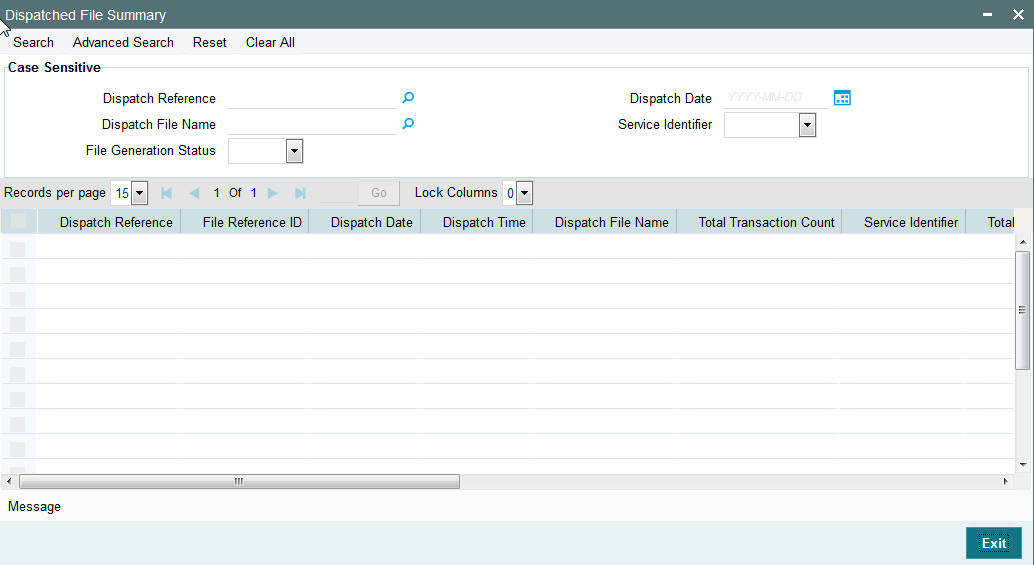

3.2.2 Viewing Dispatched NACHA Outbound File

You can Search for the Dispatched NACHA Outbound files in Dispatched File Summary Screen which is a common screen for viewing Dispatch file details related to other Low value clearing networks set up in the system.

You can invoke ‘Dispatched File Summary’ screen by typing ‘PMSDSLOG’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

To view the dispatched NACHA Outbound File, follow the below steps:

- Click on Search button the NACHA specific Service identifier selected in the relevant search field and optionally any other search criteria

- Dispatched NACHA File records will be displayed

- Select any record and Click on ‘Message’ button at the bottom of the screen

- Dispatched NACHA File will be displayed in a separate window

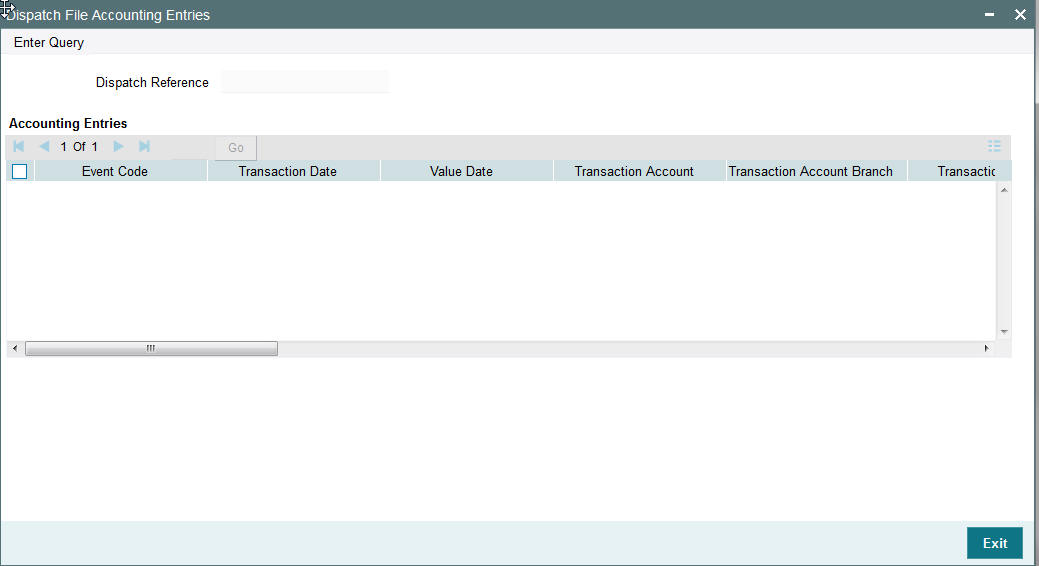

3.2.3 Viewing Dispatch Accounting Entry

You can view the Dispatch Accounting Entry in Dispatched File Summary Screen described above.

To view the dispatch Accounting Entry

- Click on Search button with / without search criteria

- Dispatched File records will be displayed

- Double Click on any Record

- Dispatch Accounting Entry gets displayed in a separate window.

3.3 NACHA Incoming Payments

Oracle Banking Payments will process the NACHA Incoming Payments received from ACH Operator.

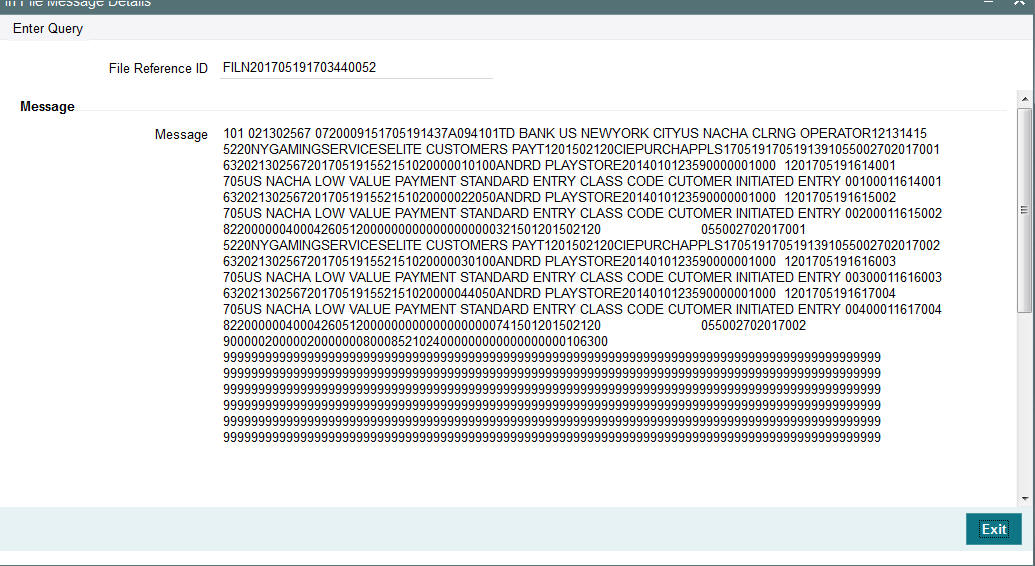

3.3.1 Viewing Received NACHA Inbound File

You can Search for the Received NACHA Inbound files in Incoming File Summary Screen which is a common screen for viewing inbound Clearing files from other Low value clearing networks set up in the system. You can invoke ‘Incoming File Summary’ screen by typing ‘PMSINLOG’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button

To view the received NACHA Inbound File, follow the steps given below:

- Click on Search button with / without search criteria

- Sort on the Network Code to locate the records for the NACHA network.

- Received NACHA Inbound records can be seen.

- Select any record and Click on ‘Message’ button at the bottom of the screen

- Received NACHA File will be displayed in a separate window.

3.3.2 Viewing Receipt Accounting Entry

You can view the Receipt Accounting Entry in Incoming File Summary Screen described above.

To view the Receipt Accounting Entry

- Click on Search button with / without search criteria

- Sort on the Network code to locate the records for the NACHA network.

- Received NACHA Inbound records can be seen

- Double Click on any record

- Receipt Accounting Entry will be displayed in a separate screen

3.3.3 Incoming Accounting Entries

From the Incoming File Summary screen, double-click a record. The Incoming Accounting Entries appears.

The following fields are displayed:

File Reference Number

Defaulted on Selecting Creditor Account Number

Accounting Entries

Event Code

Displays the Event Code

Transaction Date

Displays the transaction date

Value Date

Displays the value date

Transaction Account

Displays the Transaction Account

Transaction Account Branch

Displays the Transaction Account Branch

Txn Code

Displays the transaction code

Dr/Cr

The systems indicates if the transaction is debit or credit transaction.

Amount Tag

Displays the Amount Tag

Transaction currency

Displays the transaction currency.

Transaction Amount

Displays the Transaction Amount

Netting

Displays if any Netting is applied or not.

Offset Account

Displays the offset Account.

Offset Ac Branch

Displays the Offset Account Branch

Offset Transaction code

Displays the Offset Transaction Code

Offset Amount Tag

Displays the Offset Amount Tag

Offset Currency

Displays the Offset Currency

Offset Amount

Displays the Offset Amount

Offset Netting

Displays the Offset Netting

3.3.4 Invoking NACHA Incoming Payment Transaction Input Screen

In case of NACHA Inbound file cannot be received or processed due to any reason.A back up screen, is provided to the user to manually capture NACHA Incoming Payments.

In this screen, user is provided with all necessary fields to capture US NACHA Payment details for Standard Entry Class Code – CIE i.e., Customer Initiated Entry.

You can invoke ‘NACHA Incoming Payments’ screen by typing the function ID ‘PNDITONL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button...

Below listed fields are mandatory to process Incoming NACHA payments

Creditor Details

Creditor Account Number

Please Select the Customer Account to be credited. Option is available to use the Pick-list which displays all valid Account Numbers available in the system.

Creditor Account Currency

Defaulted on Selecting Creditor Account Number

Creditor Account Branch

Defaulted on Selecting Creditor Account Number

Creditor Name

Defaulted on Selecting Creditor Account Number

Creditor Customer Number

System identifies the Customer number maintained in the system for the Creditor based on the selected Creditor Account Number and the same is defaulted in this field.

Customer Service Model

Defaulted with Customer Service Model linked to the identified customer.

Debtor Details

Individual Identification

Please enter the Individual Identification Number as per the ACH entry (payment) in the Incoming NACHA file.

Originating DFI

Specify the Debtor Bank ABA Number. Option is available to use the pick-list which displays all ABA numbers of all DFIs.

Instruction Date

This is the Effective Entry date or Settlement date on which the payment is settled as part of the Incoming file by NACHA.

Transfer Currency

Please Enter the Transfer Currency as USD.

Transfer Amount

Please enter the Amount to be credited to the Customer.

Company Identification

Specify the Company Id as per the ACH entry in the incoming file.

Company Name

Defaulted on Selecting Company Identification

Company Entry Description

Specify the data as per the ACH entry in the incoming file.

Below listed mandatory fields are defaulted on Click of New

Batch Number

Batch Number of the batch to which the incoming Payment belongs to as per in the received incoming NACHA File

Trace Number

Trace Number of the incoming Payment (ACH entry) in the received incoming NACHA File

Transaction Reference Number

Unique Reference generated by the system for the incoming payment.

File Reference Number

Unique Reference generated by the system for the incoming NACHA file.

Transaction Branch Code

Defaulted with logged in Branch Code

Host Code

Defaulted with Host Code to which the Logged in Branch is associated with

Source Code

Defaulted as ‘MANL’; for Manually Input transactions

Network Code

User has to select the appropriate NACHA network Code from the list

Booking Date

Defaulted with current date

Below listed are the optional fields

Additional Details Button

Please click on this button to capture Additional Payment Related Information in the Addenda record for the ACH entry in the incoming file.

Debtor Account Number

Specify the debtor account number of the received payment.

Debtor name

Specify the Debtor name as per the ACH entry in the incoming file.

Company Discretionary Data

Specify the data as per the ACH entry in the incoming file.

Remarks

User can input remarks specific to this payment.

Enrich Button

On click of this button, System Computes the Exchange Rate & Charges if applicable.

Exchange rate is computed if the creditor account currency is different from Transfer currency. User can view the computed rate in the Exchange Rate field in Main Tab.

User can view the computed Charges in pricing Tab.

UDF sub-screen

Refer to description in sec. 2.1.1 for Outgoing NACHA Payment

MIS sub- screen

Refer to description in sec. 2.1.1 for Outgoing NACHA Payment

Pricing tab

Refer to description in sec. 2.1.1 for Outgoing NACHA Payment.

User must click on save button in PNDITONL Screen screen to save the incoming payment and make it available for authorization. On authorization by a different user, system starts processing the US NACHA Incoming Payment.

3.3.5 Authorization of incoming NACHA payment

Refer to description in sec. 2.1.1 for Outgoing NACHA Payment.

3.3.6 Viewing NACHA Incoming Payments Summary Screen

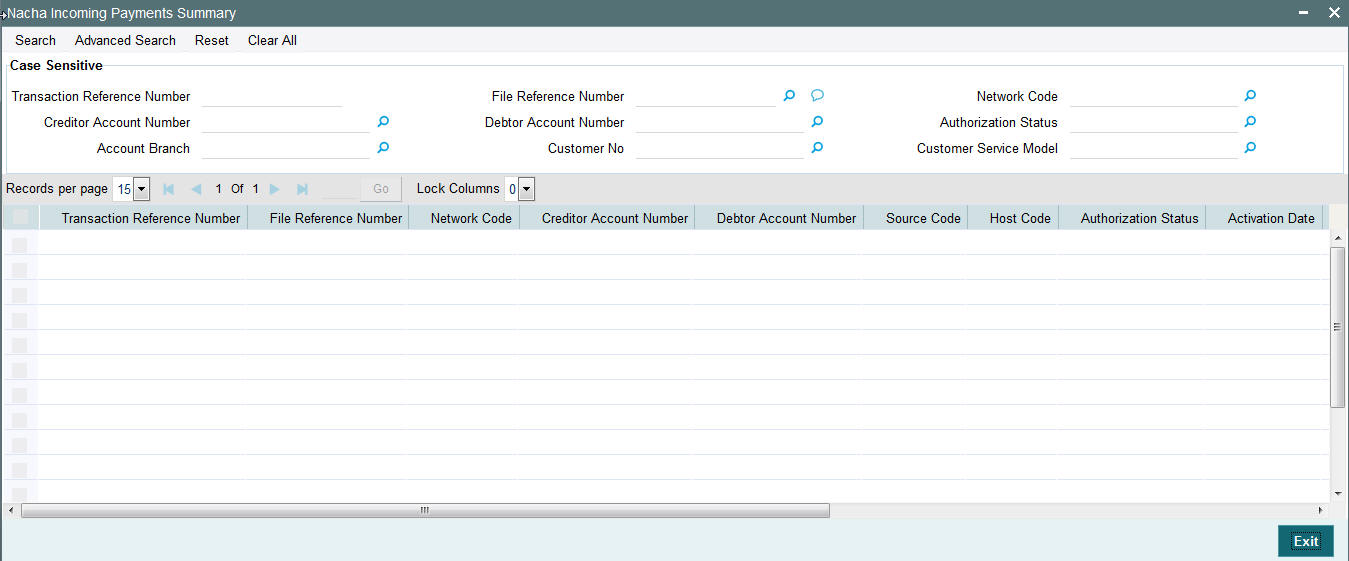

You can invoke ‘NACHA Incoming Payments Summary’ screen by typing ‘PNSITONL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button..

You can search using one or more of the following parameters:

- Transaction Reference Number

- File Reference Number

- Network Code

- Creditor Account Number

- Debtor Account Number

- Transaction Branch Code

- Authorization Status

- Account Branch

- Customer No

- Customer Service Model

Once you have specified the search parameters, click ‘Search’ button. The system displays the records that match the search criteria with the following details in the search results grid:

- Transaction Reference Number

- File Reference Number

- Network Code

- Creditor Account Number

- Debtor Account Number

- Source Code

- Host Code

- Authorization Status

- Transaction Branch Code

- Authorization Status

- Account Branch

- Customer No

- Customer Service Model

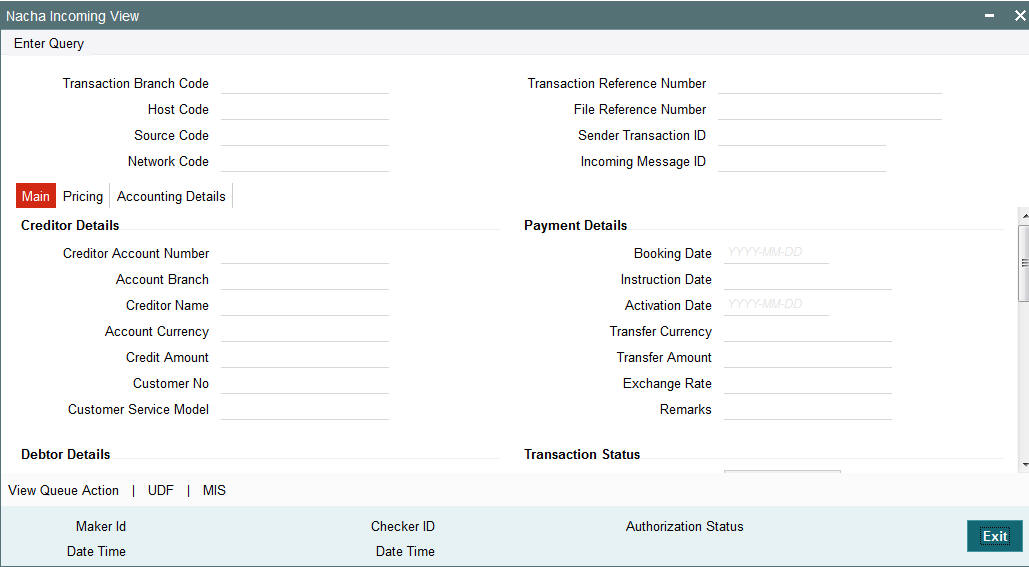

3.4 Invoking NACHA Incoming View Screen

You can invoke ‘NACHA Incoming View’ screen by typing ‘PNDIVIEW’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button..

‘Main’ Tab

User can view the payment data and its corresponding the payment processing statuses s as well as external system statuses in the Main Tab.

‘Pricing’ Tab

User can view the charges applied on the Incoming NACHA Payment in the Pricing Tab.

‘Accounting Details’ Tab

User can view the Accounting Entries posted for the Incoming NACHA Payment in Accounting Details Tab.

View Queue Action Log

User can view the different actions taken by system or user when the incoming payment was moved to various exception queues as part of the processing. Please refer to sec. 2.1.5 - Outgoing View screen for field details

UDF sub-screen

Refer to sec. 2.1.1 - Outgoing NACHA Payment, for field details

MIS sub-screen

Refer to sec. 2.1.1 - Outgoing NACHA Payment, for field details

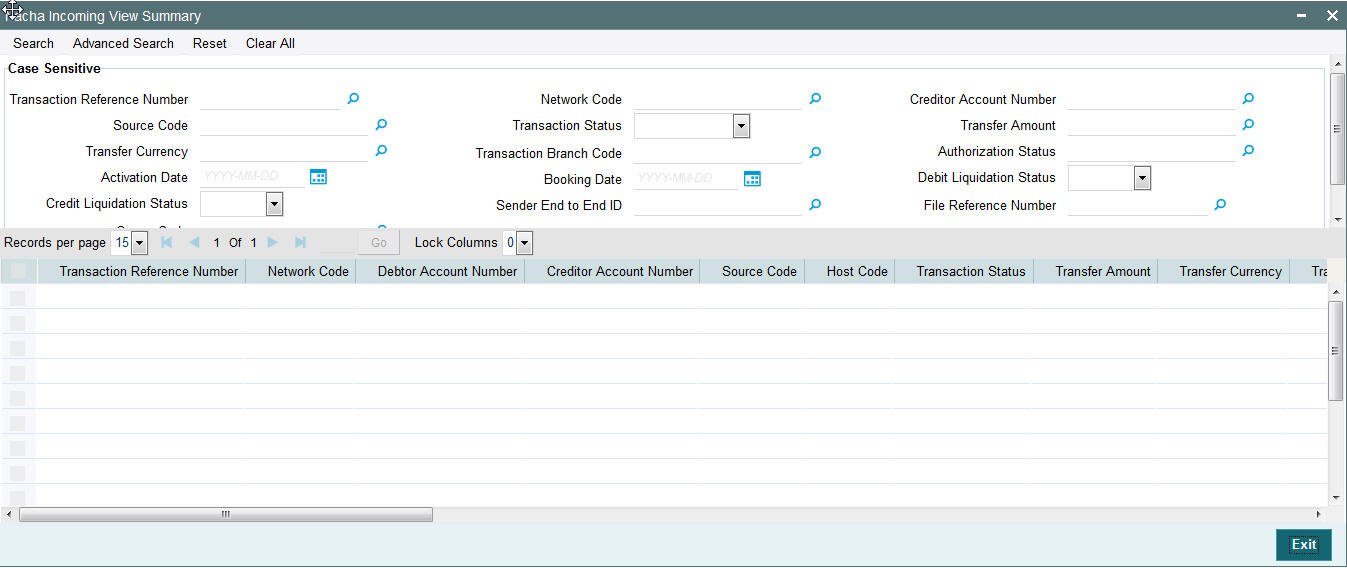

3.4.1 Viewing NACHA Incoming View Summary Screen

You can search for records in the NACHA Incoming View Summary Screen. You can invoke ‘NACHA Incoming View Summary’ screen by typing ‘PNSIVIEW’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can search using one or more of the following parameters:

- Transaction Reference Number

- Network Code

- Creditor Account Number

- Source Code

- Transaction Status

- Transfer Amount

- Transfer Currency

- Transaction Branch Code

- Authorization Status

- Activation Date

- Booking Date

- Debit Liquidation Status

- Credit Liquidation Status

- File Reference Number

- Queue Code

Once you have specified the search parameters, click ‘Search’ button. The system displays the records that match the search criteria.

- Transaction Reference Number

- Network Code

- Debtor Account Number

- Creditor Account Number

- Source Code

- Host Code

- Transaction Status

- Transfer Amount

- Transfer Currency

- Transaction Branch Code

- Authorization Status

- Activation Date

- Booking Date

- Debit Liquidation Status

- Credit Liquidation Status

- Account Branch

- Account Currency

- File Reference Number

- Queue Code

- Debtor Account IBAN

- Maker Id

- Checker Id

- Sanction Check Status

- External Account Check Status