3 Library

Definitions

This section

enables you to create a library of definitions that are used across all the

MRMM components.

Topics:

· RFET

Common UI Elements

This section

describes the common UI elements in the Library menu.

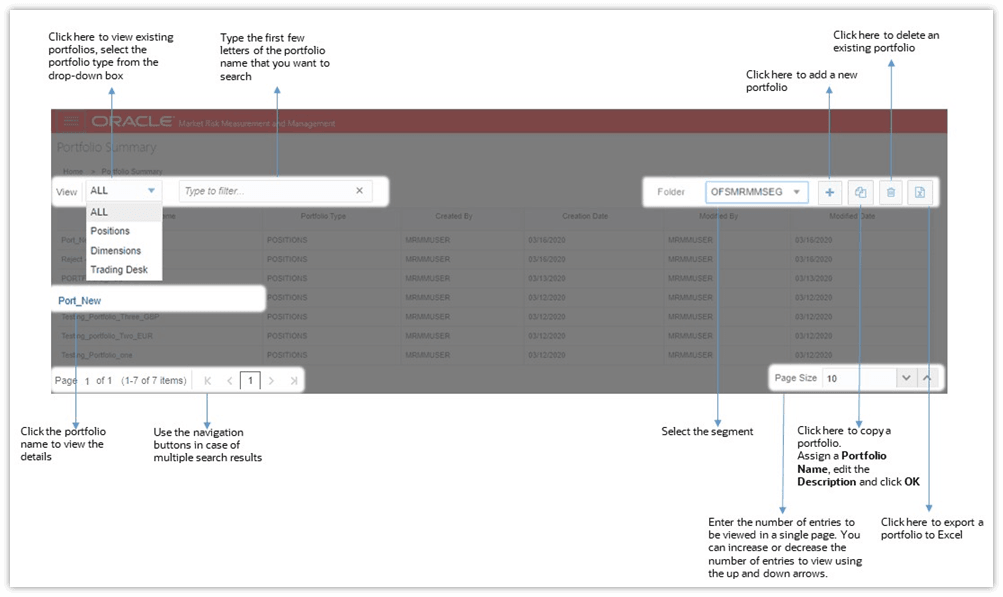

Figure 4: Common

UI Elements in the Library Menu Windows

The following table

describes the common UI elements in the Library menu windows.

|

Table

4: Common UI Elements in the Library Menu Windows |

||

|

Sl. No. |

Element |

Description |

|

1 |

View |

Click the View

drop-down list to view existing definitions. |

|

2 |

Search |

Type the

first few letters of the definition name that you want to search in the

search box. The summaries whose names consist of your search string are

displayed in a tabular format. In the Name column,

click the name of the definitions you want to view. If there are multiple

results for your search, try refining the search string by providing the

exact names of the portfolio. From the

breadcrumb on top, click the respective feature Summary link to return to the summary window

after viewing details of the definition. |

|

3 |

Add |

Enables you

to add a new definition. |

|

4 |

Copy |

Enables you

to copy a definition. This is available for Portfolio only. Assign a Portfolio

Name, edit the Description and click OK. |

|

5 |

Delete |

Enables you

to delete an existing definition in the respective feature summary window. To delete a

definition, follow these steps: 1. Select the definition name in the

respective feature Summary window and click Delete 2. Click OK to delete the portfolio. Note: You can perform this action for Portfolio, Risk Factor, RFET,

Stress Scenario, Bucket Definition, and Pricing Policy. |

|

6 |

Export |

Enables you

to export a definition to Excel, for offline viewing. To export a

definition, follow these steps: 3. 1. Select the definition name in

the respective feature Summary window and click Export 4. The portfolio is exported as an XLS

file and gets downloaded. Note: You can perform this action for Portfolio, Risk Factor, RFET,

Stress Scenario, Bucket Definition, and Pricing Policy. |

|

7 |

Approve or Reject |

To approve

or reject a definition, follow these steps: 5. 1. Select the definition from the

respective feature Summary window. The feature Definition

window is displayed. 6. Click Edit 7. Click Approve The

respective message is displayed. Approved definitions cannot be edited. Note: You can perform this action for Portfolio and Bucket

Definition. |

|

8 |

Page View

Options |

· Page Size

Enter the

number of entries to be viewed on a single page in the Page Size field on the

bottom. You can increase or decrease the number of entries to view, using the

up and down arrows. · Page Navigation

To

navigate easily, use the First Page To

navigate to the desired page, type a different page number in the View

bar control and press Enter. |

Portfolio

A portfolio is a

group of financial instruments bundled together. It gives business users the

flexibility to analyze a group of instruments together, which results in better

business decisions. This section discusses the procedure for defining and

maintaining a Portfolio.

A portfolio is the

base for any evaluations performed in MRMM. For example, in Instrument

Valuation, all the analysis that are performed are at the granularity of the

portfolio. Portfolio definition functionality provides flexibility to create a

portfolio based on positions, dimensions, or trading desks. The business

hierarchy provides flexibility to cut across any supported hierarchy and create

a desired portfolio for further analysis. Alternatively, MRMM also provides the

option to select individual instruments and create a portfolio. The options

provide a wider view of analysis using various dimensions.

You can define a

portfolio to specify the criteria for portfolio identification of on and

off-balance sheet exposures. This will be available to calculate risk measures

for portfolio-level analysis. Portfolio defined in this section will be used in

the analysis of instrument valuations and portfolio valuations.

Topics:

· Navigate to the Portfolio

Summary Window

Navigate to the Portfolio Summary Window

From the MRMM Home page,

select Market Risk Measurement and Management. Click the Navigation

Menu ![]() ,

select Library, and then select Portfolio. In the View drop-down list, select the type of

portfolio you want to view. The available options are All, Positions, Dimensions, Trading Desk.

,

select Library, and then select Portfolio. In the View drop-down list, select the type of

portfolio you want to view. The available options are All, Positions, Dimensions, Trading Desk.

See the Common

UI Elements section for details on tasks such as view, search, copy,

delete, export, approve, reject, and page view options.

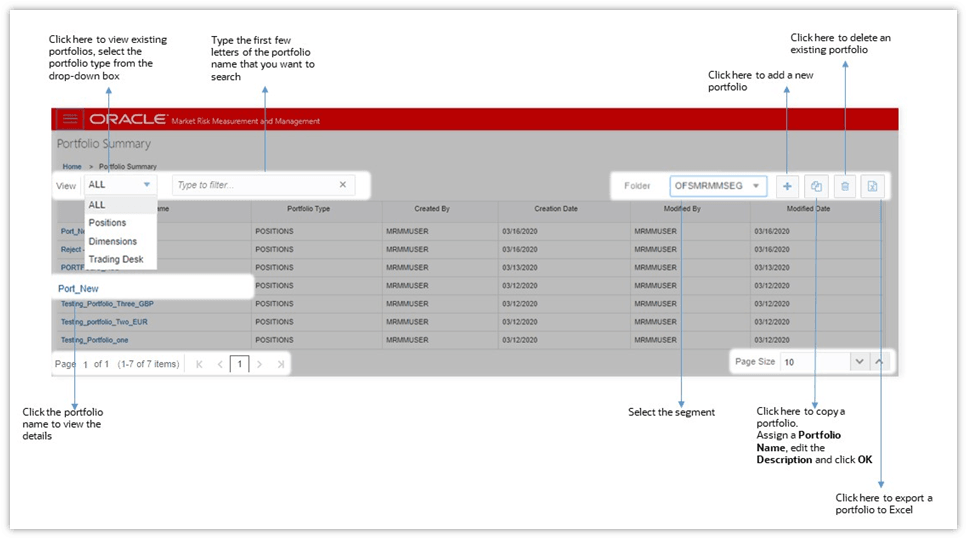

Figure 5:

Portfolio Summary Window

View and Search for a

Portfolio

In the Portfolio Summary

window, follow these steps:

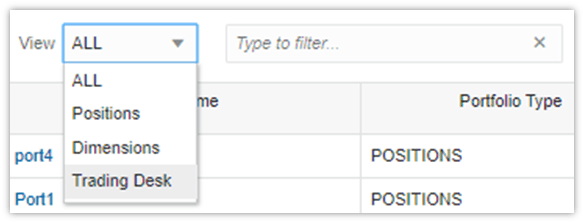

Figure 6:

Portfolio Summary - View Drop-down List

1. In the View drop-down list, select the type of

portfolio. The available options are All, Positions, Dimensions, and Trading

Desk.

2. Select the Portfolio you want to view

and click the portfolio name. The Portfolio Definition window opens and displays the details

of the selected Portfolio. You cannot edit any details in view mode.

3. In the Search field, type the first few letters of

the portfolio that you want to search. The summaries whose names consist of

your search string are displayed in a tabular format.

· In the Portfolio

Name column, click the

name of the portfolio you want to view. If there are multiple results for your

search, try refining the search string by providing the exact names of the

portfolio.

· Use the page navigation buttons at the

bottom of the table for multiple search results.

· From the breadcrumb on top, click the Portfolio Summary

link to return to the summary window after viewing details of the portfolio.

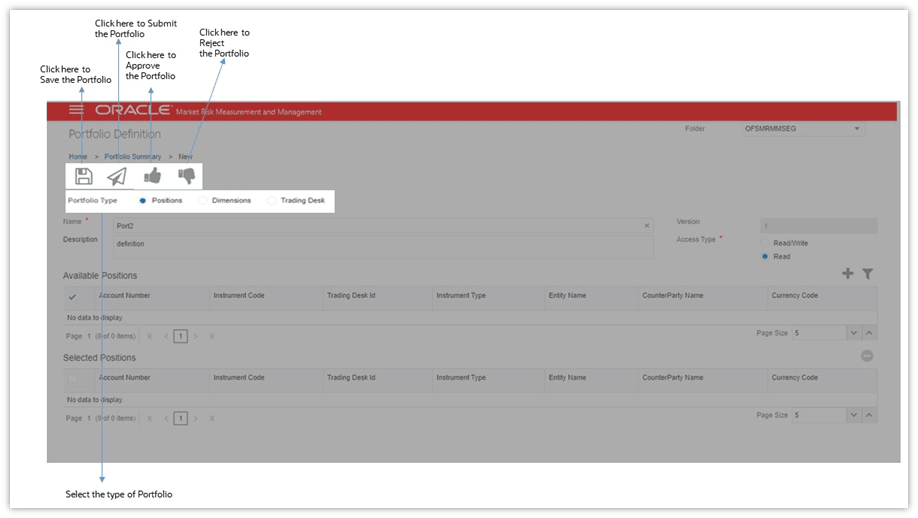

Define a Portfolio

Portfolios can be

created based on multiple filters, represented as portfolio type. You can

define a portfolio based on Positions, Dimensions, or Trading Desk. The

portfolios created in this window are used for computations in the MRMM

Instrument Valuation module.

In the Portfolio Summary

window, click Add ![]() to create a new portfolio. The Portfolio

Definition window is

displayed.

to create a new portfolio. The Portfolio

Definition window is

displayed.

Define a Portfolio – Based on Positions

To define a new

Portfolio based on Positions, follow these steps:

1. In the Portfolio

Definition window,

populate the details mentioned in the following table. Fields marked in red

asterisk (*) are mandatory.

|

Table

5: Portfolio Definition Based on Position - Fields and Descriptions |

|

|

Fields |

Description |

|

Name* |

Enter the

portfolio name. |

|

Description |

Enter a

short description of the portfolio. |

|

Folder |

Select the

folder in which you want to save the definition. |

|

Access Type* |

Specify

whether the Portfolio is Read-Only/ Read-Write. |

|

Version |

Displays the

workflow version. |

|

Portfolio

Type |

Select Position. In this

option, the portfolio can be defined at a most granular level based on trades

or positions. This indicates that specific positions can be selected and

defined as a part of the portfolio definition- these positions can be

selected by applying filters such as Instrument type, currency, and so on. |

|

Available

Positions |

Displays the

available positions. |

|

Selected

Positions |

Displays the

selected positions. |

|

Filters |

If you have

selected the Available Position option, then you will be provided with

filters such as Instrument Type, Entity Name, Counterparty Name, Currency. |

2. Select Positions in Portfolio

Type.

Figure 7: Portfolio Definition Window - Position

3. Click Filter ![]() to add the required Available

Positions for Instrument Type, Entity Name, Counterparty

Name, or Currency, and

click Apply

to add the required Available

Positions for Instrument Type, Entity Name, Counterparty

Name, or Currency, and

click Apply ![]() . The application allows multiple selections for this section. The

filtered positions are listed in the Available

Positions section. Click Reset

. The application allows multiple selections for this section. The

filtered positions are listed in the Available

Positions section. Click Reset ![]() to

refresh the list. You can sort the columns in ascending or descending order,

using the sorter

to

refresh the list. You can sort the columns in ascending or descending order,

using the sorter ![]() .

.

4. You can select multiple entries using Ctrl + Click to group the required entries in the

Available Positions and click Add ![]() . These selected entries from Available

Positions are added in the

Selected Position section.

. These selected entries from Available

Positions are added in the

Selected Position section.

5. If you want to remove any entry from

the Selected Position, select the entry and click Remove ![]() .

.

6. Click Submit ![]() to save and submit the portfolio

for approval. A confirmation dialog box is displayed.

to save and submit the portfolio

for approval. A confirmation dialog box is displayed.

Or,

Click Save ![]() to

update the portfolio before submitting it for approval.

to

update the portfolio before submitting it for approval.

7. Click OK. You can now view the Portfolio in the

Portfolio Summary window.

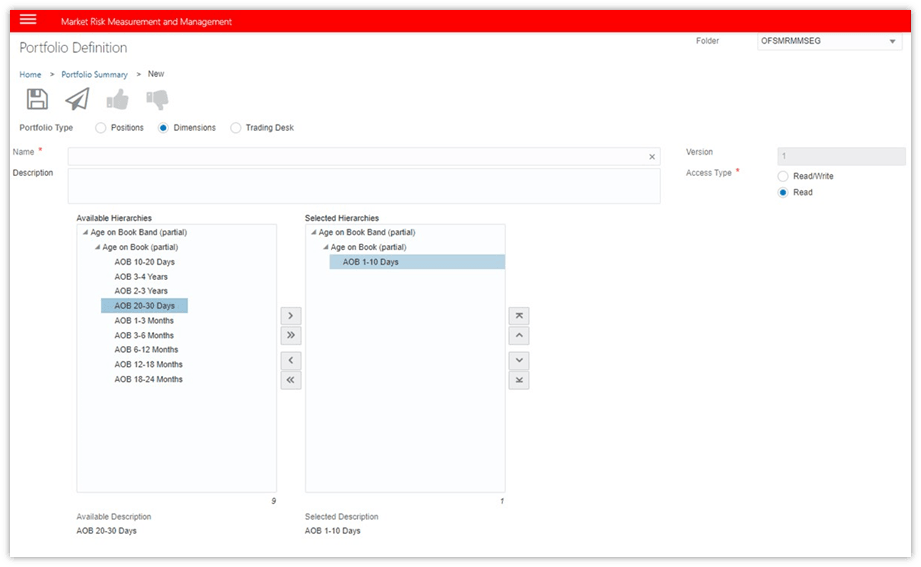

Define a Portfolio – Based

on Dimensions

To define a new

Portfolio based on dimensions, follow these steps:

1. In the Portfolio

Definition window,

populate the details mentioned in the following table. Fields marked in red

asterisk (*) are mandatory.

|

Table

6: Portfolio Definition Based on Dimensions - Fields and Descriptions |

|

|

Fields |

Description |

|

Name* |

Enter the

portfolio name. |

|

Description |

Enter a

short description of the portfolio. |

|

Folder |

Select the

folder in which you want to save the definition. |

|

Access Type* |

Specify

whether the Portfolio is Read-Only/Read-Write. |

|

Version |

Displays the

workflow version. |

|

Portfolio

Type |

Select Dimension. In this

option, the portfolio can be defined based on a more aggregate level as

compared to the position type. You can apply filters based on dimensions such

as Country, Market Risk Asset class, and so on. |

|

Available

Hierarchies |

Displays the

available hierarchies. |

|

Selected

Hierarchies |

Displays the

selected hierarchies. |

2. Select Dimensions in Portfolio

Type.

Figure 8: Portfolio Definition Window - Dimension

3. To select one value, select the value

and click Move ![]() , to select all the Available Values, click Move All

, to select all the Available Values, click Move All ![]() . To

remove any selected value from the list, select the value and click Remove

. To

remove any selected value from the list, select the value and click Remove ![]() . To

remove all the selected values, click Remove All

. To

remove all the selected values, click Remove All ![]() .

.

4. Click Submit ![]() to save and submit the portfolio

for approval. A confirmation dialog box is displayed.

to save and submit the portfolio

for approval. A confirmation dialog box is displayed.

Or,

Click Save ![]() to

update the portfolio before submitting it for approval.

to

update the portfolio before submitting it for approval.

5. Click OK. You can now view the Portfolio in the

Portfolio Summary window.

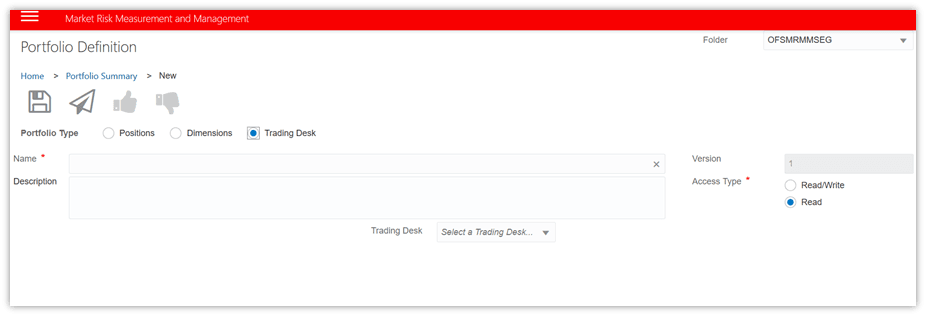

Define a Portfolio – Based on Trading Desk

To define a new

Portfolio based on the trading desk, follow these steps:

1. In the Portfolio

Definition window,

populate the details mentioned in the following table. Fields marked in red

asterisk (*) are mandatory.

|

Table

7: Portfolio Definition Based on Trading Desk - Fields and Descriptions |

|

|

Fields |

Description |

|

Name* |

Enter the

portfolio name. |

|

Description |

Enter a

short description of the portfolio. |

|

Folder |

Select the

folder in which you want to save the definition. |

|

Access Type* |

Specify

whether the Portfolio is Read-Only/ Read-Write. |

|

Version |

Displays the

workflow version. |

|

Portfolio

Type |

Select Trading Desk.

This option allows a trading desk to be represented as a separate portfolio. |

|

Trading Desk |

Displays the

available trading desk information. Select the required trading desk from the

drop-down list. |

2. Select Trading

Desk in Portfolio Type.

Figure 9: Portfolio Definition Window – Trading Desk

3. Enter details in the fields Name and Description.

4. Select a Trading

Desk from the drop-down

list.

5. Click Submit ![]() to save and submit the portfolio

for approval. A confirmation dialog box is displayed.

to save and submit the portfolio

for approval. A confirmation dialog box is displayed.

Or,

Click Save ![]() to

update the portfolio before submitting it for approval.

to

update the portfolio before submitting it for approval.

6. Click OK. You can now view the Portfolio in the

Portfolio Summary window.

Edit a Portfolio

You can edit a

portfolio at any point from the Portfolio Summary window. To edit an existing portfolio,

follow these steps:

1. Click the Portfolio Name you want to edit.

2. Click Edit ![]() and modify the required fields.

and modify the required fields.

3. Click Save ![]() . The updated information can be viewed in the Portfolio Summary

page.

. The updated information can be viewed in the Portfolio Summary

page.

NOTE:

You can edit the portfolio in the draft

stage only.

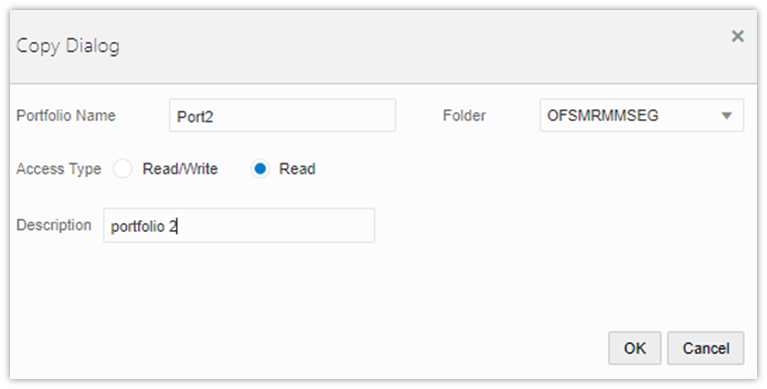

Copy a Portfolio

You can copy a

portfolio at any given point from the Portfolio Summary window. To copy an existing portfolio,

follow these steps:

1. Select the Portfolio

Name and click Copy ![]() . The Copy

Dialog box is displayed.

. The Copy

Dialog box is displayed.

2. Assign a new Portfolio

Name and edit the Description field if required.

3. You cannot modify the fields Access Type and

Folder.

Figure 10: Copy a Portfolio – Dialog Box

4. Click OK. You can view the created copy in the Portfolio Summary

window.

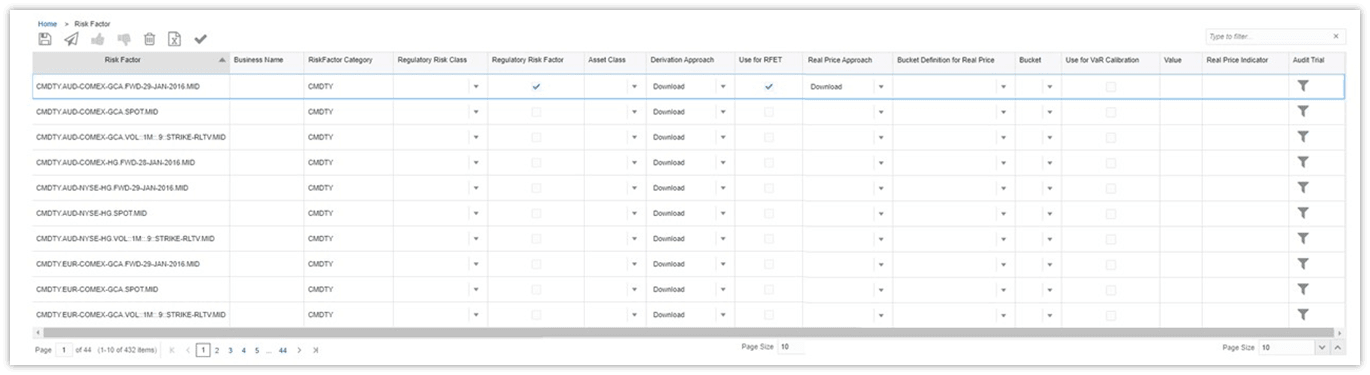

Risk Factor

This window

displays the preseeded risk factors in OFS MRMM. It is a repository of various

risk factors covering the market data elements that are used for the pricing of

different financial instruments of the bank.

In Release 8.1,

this window is enhanced to include the columns for the modellable and

non-modellable Risk Factor Eligibility Test (RFET) under FRTB.

Navigate to the Risk Factor Window

From the MRMM Home page,

select Market Risk Measurement and Management, click the Navigation Menu

![]() ,

select Library, and then select Risk Factor.

,

select Library, and then select Risk Factor.

See the Common

UI Elements section for details on tasks such as view, search, copy,

delete, export, approve, reject, and page view options.

Figure 11: Risk

Factor Page

Define a Risk Factor

To define a new

Risk Factor, follow these steps:

1. In the Risk

Factor window, for every

risk factor you want to test for RFET, populate the required details mentioned

in the following table.

|

Table

8: Risk Factor Window - Columns and Descriptions |

|

|

Columns |

Description |

|

Risk Factor |

Displays the

risk factor name. |

|

Business

Name |

Assign a

business name to the risk factor. |

|

Risk Factor

Category |

Displays the

preseeded risk factor categories. |

|

Regulatory

Risk class |

Select the

regulatory risk class for the risk factor. |

|

Regulatory

Risk Factor |

Select the

check box if the risk factor is regulatory in nature. |

|

Asset Class |

Select the

asset class from the drop-down list. |

|

Derivation

Approach |

Select the

derivation approach as Download. |

|

Use for RFET |

Select the

check box if the risk factor is to be used for RFET. |

|

Real Price

Approach |

Specify the

approach for real price computation. Select Download or Bucket from the

drop-down list. |

|

Bucket

Definition for Real Price |

Select the

bucket definition to be used for real price computation from the drop-down

list. |

|

Bucket |

Select the

bucket from the drop-down list. |

|

Use for VaR

Calibration |

Select the

check box if the risk factor is to be used for VaR Calibration. |

|

Value |

This is the

value generated after executing the risk factor. |

|

Real Price

Indicator |

This is the

value generated after executing the risk factor. |

|

Audit Trail |

Click the Filter |

2. Click Submit ![]() to save and submit the risk

factor for approval. After a risk factor is submitted, it cannot be edited

until it is approved or rejected. A confirmation dialog box is displayed.

to save and submit the risk

factor for approval. After a risk factor is submitted, it cannot be edited

until it is approved or rejected. A confirmation dialog box is displayed.

Or,

Click Save![]() to update

the risk factor before submitting it for approval.

to update

the risk factor before submitting it for approval.

3. Click OK. The risk factor created in this

module is used for RFET computations in the RFET window.

Approve or Reject a Risk

Factor

To approve or

reject a risk factor, follow these steps:

1. In the Risk Factor window, submit the risk factor for

approval.

2. Click Approve ![]() or Reject

or Reject ![]() .The

respective message is displayed.

.The

respective message is displayed.

3. Click OK.

Execute a Risk Factor

To execute a risk

factor, follow these steps:

1. Select the risk factor and click Execute ![]() .

.

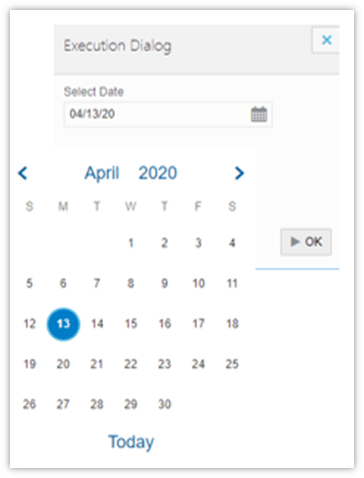

2. Specify a date in the Date editor.

Figure 12: Executing a Risk Factor - Date editor

3. Click OK. A confirmation dialog box is

displayed.

4. Click OK. The risk factor is executed

successfully.

RFET

A risk factor is

referred to as modellable when the price of the risk factor is real and is

continuously available. All the risk factors must be classified into modellable

and non-modellable.

As part of the FRTB

regulations, every risk factor the bank or financial institution wants to get

through has to go undergo checks for Real Price (RP) and Risk Factor

Eligibility Test (RFET). After Identifying the data sourced from the data

provider, the bank transactions, and committed quotes against the selected risk

factors banks must perform an RFET and calculate if the value is real price.

RFET analysis aims

to find if a risk factor has enough data points in a year. Banks or Financial

institutions must identify at least 24 real price observations for the risk

factor for the observation period. Additionally, over the historical period

there must not be a 90-day period in which fewer than four real price observations

have been identified for the risk factor. The preceding criteria must be

monitored on a monthly basis; or the bank must identify at least 100 real price

observations over the selected historical period for the risk factor. The

results of the RFET test enables you to find out if the outcome is modellable

or non-modellable.

Rules are set for

the risk factors before proceeding for the identification of the modellable

risk factors. After the configuration of rules, modellable or non-modellable

classification is performed.

Real Price can be

identified as follows:

· Download: In the download approach, you

must specify the real price as per the download value and as part of the market

data, specify the Real Price indicator as Yes or No.

· Bucket: In the bucket approach, you

must obtain all the instruments associated with a bucket and perform the

following validation. If any one instrument passes the following criteria then

mark the risk factor price as Real Price.

The RP value is

computed as Yes for each risk factor if the following conditions are met:

|

Table

9: Identification of Real Price for Each Risk Factor |

||||

|

Vendor Certified |

Arms Length Transaction |

Committed Quote |

Transaction of Same Instrument |

Real Price |

|

Yes |

Yes |

Yes |

NA |

Yes |

|

No |

Yes |

No |

NA |

Yes |

|

No |

No |

Yes |

NA |

Yes |

|

No |

No |

No |

Obtain all

the transactions performed for the instrument on a specific business day. If

any of the transaction price matches with the instrument price, then the risk

factor is marked as Real Price. |

|

The flag for Modellable

is computed with values as Yes or No. Risk Factor is identified

as Modellable if Real Price is Yes and Continuously Available

is Yes.

Navigate to the RFET Window

From the MRMM Home page,

select Market Risk Measurement and Management, click Navigation Menu ![]() ,

select Library, and then select RFET.

,

select Library, and then select RFET.

See the section Common

UI Elements, for details on tasks such as view, search, copy, delete,

export, approve, reject, and page view options.

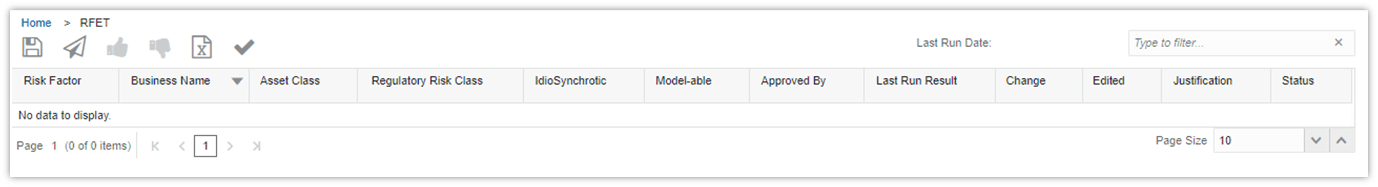

Figure 13: RFET

Page

RFET Test

In this window you

can identify risk factors as modellable or non-modellable.

To test a risk

factor for RFET, follow these steps:

1. In the RFET window, the required

details mentioned in the following table are populated.

|

Table

10: RFET Window - Columns

and Descriptions |

|

|

Columns |

Description |

|

Risk Factor |

Displays the

risk factor name. |

|

Business

Name |

Displays the

business name assigned to the risk factor. |

|

Asset Class |

Displays the

asset class of the risk factor. |

|

Regulatory

Risk class |

Displays the

regulatory risk class of the risk factor. |

|

Idiosyncratic |

Displays if

the risk factor is idiosyncratic. You can modify this field. |

|

Model-able |

Displays if

the risk factor is modellable or non-modellable. After execution, you can

modify this field and mention the justification in the Justification

field. |

|

Approved By |

Displays the

approver of the risk factor. |

|

Last Run

result |

Displays the

result after the last execution. |

|

Change |

Displays

whether the result of the RFET was modified after the last run execution. |

|

Edited |

Displays the

modification made to the result of the RFET after the last run execution. |

|

Justification |

If you

change the status of the RFET, justify the reason in this field. |

|

Status |

Displays the

execution status. |

2. Select the RFET and click Execute ![]() .

.

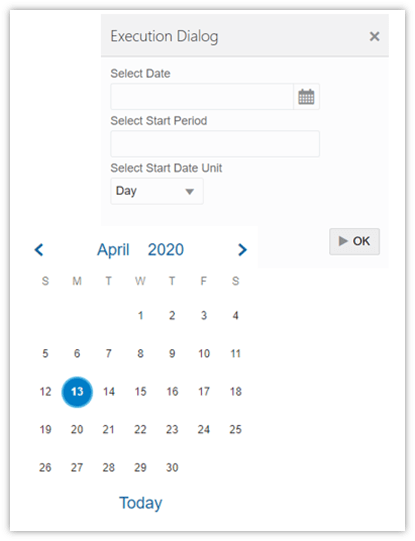

3. Click Calendar to select a date from the Date editor

window. In the Select Start Date Unit field, specify the number of

historical days to be considered for the RFET execution.

Figure 14: RFET Execution – Date Editor

4. Click OK. A confirmation dialog box is

displayed.

5. Click OK to confirm.

6. Click Submit ![]() to save and submit the RFET for

approval. After an RFET is submitted, it cannot be edited until it is approved

or rejected. A confirmation dialog box is displayed.

to save and submit the RFET for

approval. After an RFET is submitted, it cannot be edited until it is approved

or rejected. A confirmation dialog box is displayed.

Or,

Click Save![]() to update

the RFET before submitting it for approval.

to update

the RFET before submitting it for approval.

7. Click OK.

Edit an RFET

To edit an existing

RFET, follow these steps:

1. Double-click the risk factor you want

to edit from the RFET window. The fields become editable.

2. In the columns Change, Edited, and Justification, mention the relevant details.

3. Click Submit ![]() .

.

Approve or Reject an RFET

To approve or

reject an RFET, follow these steps:

1. In the RFET window, submit the RFET for approval.

2. Click Approve ![]() or Reject

or Reject ![]() .The respective message is displayed.

.The respective message is displayed.

Execute an RFET

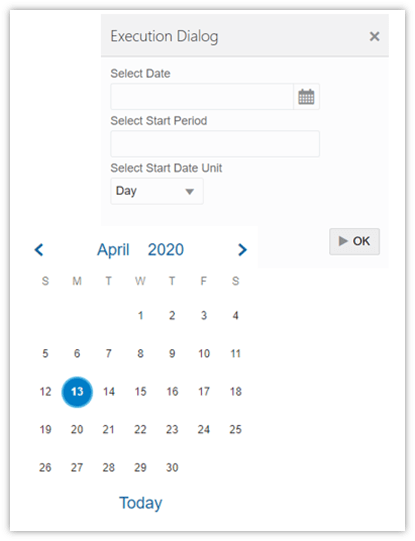

To execute an RFET,

follow these steps:

1. Select

the RFET and click Execute ![]()

2. Click Calendar to select a date from the Date editor

window. In the Select Start Date Unit field, specify the number of

historical days to be considered for the RFET execution.

Figure 15: RFET Execution – Date Editor

3. Click OK. A confirmation dialog box is

displayed.

4. Click OK to confirm.

Stress Scenario

OFS MRMM uses a

variety of market data such as Rate, Price, Curve, and Volatility to perform

Instrument and Portfolio level risk analysis.

A scenario is a set

of changes that can be applied to a base market. Current market data can be

used for business as usual analysis. However, to perform What-if analysis and

other scenario analysis modified market data is required. Market Scenarios

section in the MRMM application enables you to define market data under

multiple scenarios, which can be further used to perform valuations.

Navigate to the Stress Scenario Summary Window

From the MRMM Home page,

select Market Risk Measurement and Management, click Navigation Menu ![]() ,

select Library, and then select Stress Scenario.

,

select Library, and then select Stress Scenario.

In the Stress Scenario Summary window, click Add ![]() to create a new stress scenario. The Stress

Scenario Definition window

is displayed. See the Common

UI Elements section, for details on tasks such as view, search, copy,

delete, export, approve, reject, and page view options.

to create a new stress scenario. The Stress

Scenario Definition window

is displayed. See the Common

UI Elements section, for details on tasks such as view, search, copy,

delete, export, approve, reject, and page view options.

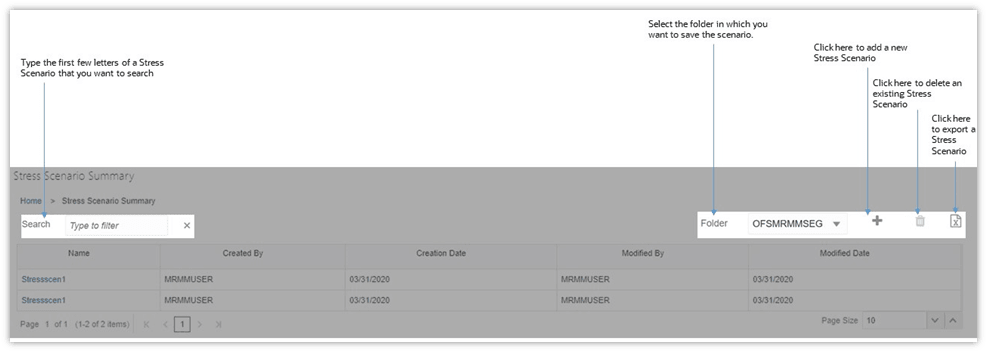

Figure 16:

Stress Scenario Summary Window

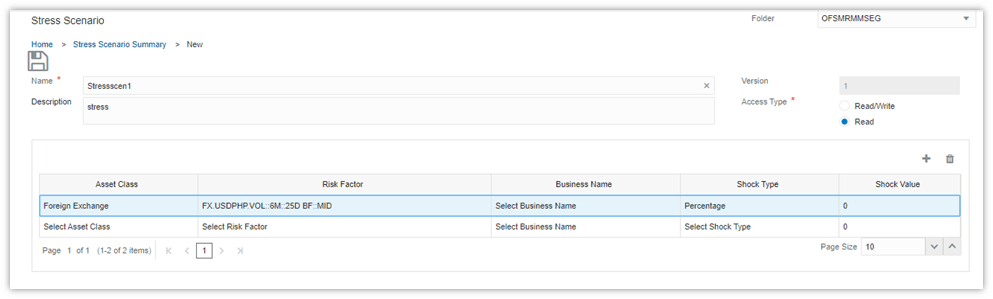

Define a Stress Scenario

You can define a

new scenario in the Stress Scenario Definition window.

Figure 17:

Stress Scenario Definition Window

To define a new

stress scenario, follow these steps:

1. In the Stress

Scenario Definition window

populate the details mentioned in the following table. Fields marked in red

asterisk (*) are mandatory.

|

Table

11: Stress Scenario

Definition Window - Fields and Descriptions |

|

|

Fields |

Description |

|

Name* |

Enter the

stress scenario name. |

|

Description |

Enter a

short description for the stress scenario |

|

Folder |

Select the

folder in which you want to save the scenario. |

|

Access Type* |

Specify

whether the scenario is Read-Only/Read-Write |

|

Version |

Displays the

workflow version. |

2. Click Add ![]() , and select the Asset Class, Risk Factor, and Business

Name from the drop-down

list. If the risk factor has been assigned a business name, it is displayed.

, and select the Asset Class, Risk Factor, and Business

Name from the drop-down

list. If the risk factor has been assigned a business name, it is displayed.

3. Select the Shock

Type and assign a Shock Value.

For details, see Shock

Definition Parameters. You can create multiple shocks in a scenario.

4. Click Delete![]() to delete any entry from the table.

to delete any entry from the table.

5. Click Save![]() . A confirmation dialog box is

displayed.

. A confirmation dialog box is

displayed.

6. Click OK. The Scenario is defined and displayed

in the summary page.

Shock Definition Parameters

Shock can be

defined at the level of risk factor, market data, and market quotes. You need

to select the risk factors based on which the shock needs to be defined. You

can select multiple risk factors and define unique scenarios.

The shocks defined

above are used to revalue the portfolio subjected to stress using the perturbed

values. For example, if the scenario consists of all risk factors relevant to a

yield curve for a specific currency type, the instruments for which these risk

factors are mapped for pricing will be revalued with the perturbed values.

For example, if the

shock value for IR-USD-LIBOR-3M is 1% and that for IR-USD-LIBOR-6M is 2%.for a

particular stress scenario definition. In this case a three-month term point

will be shocked by 1% and six month risk factor curve will be shocked by 2%.

Type of Shocks

Shock types are

defined as a set of additive and multiplicative operations. It results in

either an increase or decrease of the base market quotes. Shock can be defined

as Percent, Basis Points, or Absolute Value.

Shock in Terms of

Percent

In this scenario

the shock value is defined in terms of percent. For example: 1%, -2% and so on.

This is applicable to all the risk factors.

Following are a few

examples:

· Example 1:

If the Base

quote = 2 and the Shock value = - 2%

Modified quote =

2 * [1 + (-2%)] = 1.96

· Example 2:

If the Base

quote = 2 and the Shock value = 1%

Modified quote =

2 * [1 + (1%)] = 2.02

Shock in Terms of

Basis Points

In this scenario

the shock value is defined in terms of Basis Points (BP). For example, 1 BP up,

5 BP down and so on. This is applicable to risk factors expressed in terms of

rate such as Interest Rate, Swap Rate, and Forward Rate Agreement (FRA) Rate, and

so on. Following are a few examples:

· Example 1:

If the Base

quote = 2 and the Shock value = - 5 BP

Modified quote =

2 + (-0.05) = 1.95

· Example 2:

If the Base

quote = 2 and the Shock value = 4 BP

Modified quote =

2 + 0.04 = 2.04

Shock in Terms of

Absolute Value

In this scenario

the shock value is defined in absolute terms. For example, USD 10 up, GBP 5

down and so on. This is applicable to risk factors expressed in terms of price

such as Equity Spot Price, Index, Futures, Bond Price, and so on. Following are

a few examples:

· Example 1:

If the Base

quote = 112 and the Shock value = 5

Modified quote =

112 + 5 = 117

· Example 2:

If the Base

quote = 112 and the Shock value = - 8

Modified quote =

112 + (- 8) = 94

Pricing Policy

Pricing policy

enables you to select models and methods to be used for pricing the instrument.

On this page, you can define the pricing policies to be used for instrument

pricing.

The Define option

allows you to select the models and methods at the granularity level of

Instrument Type and Currency. The pricing policy of an instrument can be

defined based on the instruments considered for valuation. You can select the

models and methods for the corresponding Instrument type and Currency.

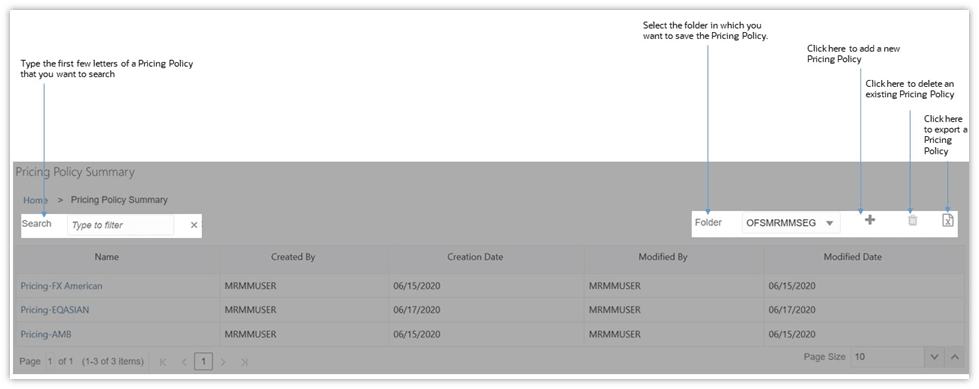

Navigate to the Pricing

Policy Summary Window

From the MRMM Home page,

select Market Risk Measurement and Management, click Navigation Menu ![]() ,

select Library, and then select Pricing Policy.

,

select Library, and then select Pricing Policy.

In the Pricing Policy Summary

window, click Add ![]() to create a new pricing policy. The Pricing

Policy Definition window

is displayed. See the Common

UI Elements section for details on

tasks such as view, search, copy, delete, export, approve, reject, and page

view options.

to create a new pricing policy. The Pricing

Policy Definition window

is displayed. See the Common

UI Elements section for details on

tasks such as view, search, copy, delete, export, approve, reject, and page

view options.

Figure 18:

Pricing Policy Summary Window

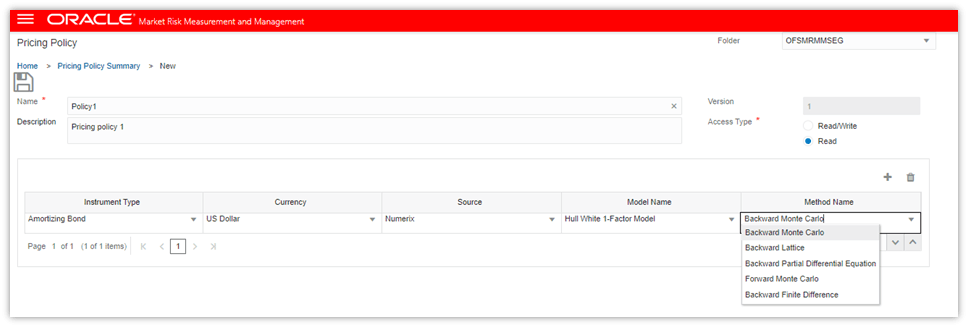

Define a Pricing Policy

You can define a

new Pricing Policy in the Pricing Policy Definition window.

Figure 19:

Pricing Policy Definition Window

To define a pricing

policy, follow these steps:

1. In the Pricing

Policy Definition window

populate the details mentioned in the following table. Fields marked in red

asterisk (*) are mandatory.

|

Table

12: Pricing Policy Definition – Fields and Descriptions |

|

|

Fields |

Description |

|

Name* |

Enter the

pricing policy name. |

|

Description |

Enter a

short description for the pricing policy. |

|

Folder |

Select the

folder in which you want to save the policy. |

|

Access Type* |

Specify

whether the policy is Read-Only/Read-Write. |

|

Version |

Displays the

workflow version. |

2. Click Add ![]() , and select the Instrument Type, Currency, Source, Model Name, and Method

Name. You can create

multiple entries in a pricing policy.

, and select the Instrument Type, Currency, Source, Model Name, and Method

Name. You can create

multiple entries in a pricing policy.

NOTE:

Release 8.1 supports only Numerix as

the Source.

3. Click ![]() to delete any entry from the

table.

to delete any entry from the

table.

4. Click Save ![]() . A confirmation dialog box is displayed.

. A confirmation dialog box is displayed.

5. Click OK. The pricing policy is defined and

displayed in the Pricing Policy Summary window.

Bucket Definition

FRTB guidelines

allow the banks to define risk buckets based on the group of risk factors with

similar characteristics. A bucket can be defined as a set of risk factors that

are grouped together by common characteristics.

Navigate to the Bucket Summary Window

From the MRMM Home page,

select Market Risk Measurement and Management, click Navigation Menu ![]() ,

select Library, and then select Bucket Definition.

,

select Library, and then select Bucket Definition.

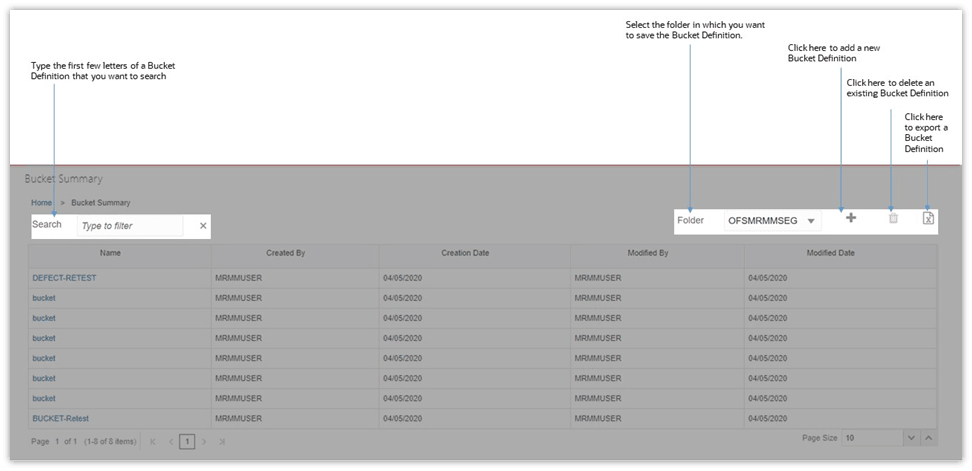

In the Bucket Summary

window, click Add ![]() to create a new bucket definition. The Bucket Definition

window is displayed. See the Common

UI Elements section for details on tasks such as view, search, copy, delete,

export, approve, reject, and page view options.

to create a new bucket definition. The Bucket Definition

window is displayed. See the Common

UI Elements section for details on tasks such as view, search, copy, delete,

export, approve, reject, and page view options.

Figure 20:

Bucket Summary Window

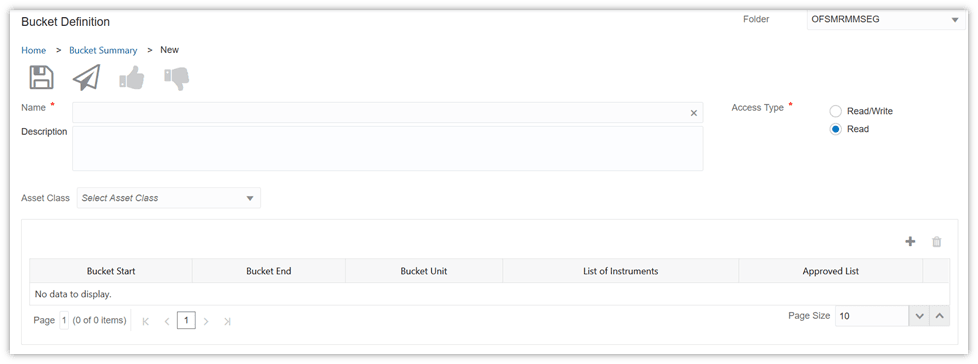

Define a Bucket

You can define a

new bucket in the Bucket Definition window.

Figure 21:

Bucket Definition Window

To define a new

bucket, follow these steps:

1. In the Bucket

Definition window,

populate the details mentioned in the following table. Fields marked in red

asterisk (*) are mandatory.

|

Table

13: Bucket Definition: Fields and Descriptions |

|

|

Fields |

Description |

|

Name* |

Enter the

bucket name. |

|

Description |

Enter a

short description for the bucket. |

|

Folder |

Select the

folder in which you want to save the bucket. |

|

Access Type* |

Specify

whether the bucket is Read-Only/Read-Write. |

|

Version |

Displays the

workflow version. |

2. Select the Asset

Class from the drop-down

list.

3. Click Add ![]() , and specify details for fields Bucket

Start and Bucket End.

Enter numeric values in these fields.

, and specify details for fields Bucket

Start and Bucket End.

Enter numeric values in these fields.

4. Specify the Bucket

Unit in terms of Day,

Month, or Year. Select the relevant option from the drop-down list.

5. Click Filter ![]() to add instruments in the List of Instruments

column.

All the instruments that the bank has exposure such as Bonds, Equity, and so

on, must be added here. The List of Instruments column is updated after the

Bucket definition is saved.

to add instruments in the List of Instruments

column.

All the instruments that the bank has exposure such as Bonds, Equity, and so

on, must be added here. The List of Instruments column is updated after the

Bucket definition is saved.

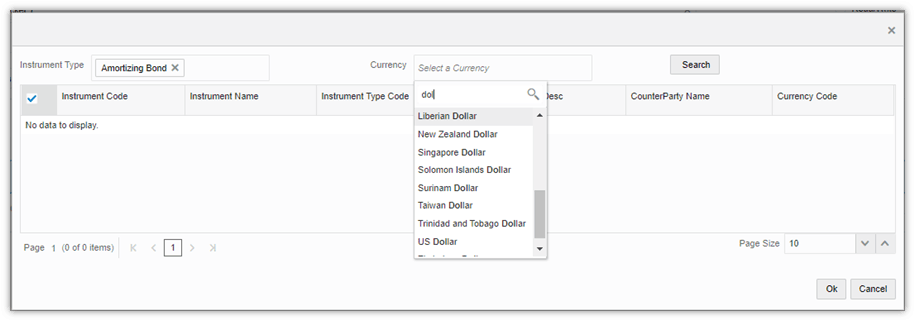

The

following window is displayed. You can create multiple entries in a definition.

Figure 22: Add Instruments in the Bucket Definition

6. Specify the Instrument

Type and Currency and click Search. The results get listed in the columns Instrument

Code, Instrument Name, Instrument

Type Code,

Instrument Type Desc, Counterparty Name, and Currency Code. Click OK.

7. The Approved List column is updated

after the bucket definition is approved.

8. Click Submit ![]() to save and submit the bucket for

approval. A confirmation dialog box is displayed.

to save and submit the bucket for

approval. A confirmation dialog box is displayed.

Or,

Click Save ![]() to

update the bucket before submitting it for approval. A confirmation dialog box

is displayed. After

Save the Bucket Start, Bucket End and Bucket Unit fields become uneditable.

to

update the bucket before submitting it for approval. A confirmation dialog box

is displayed. After

Save the Bucket Start, Bucket End and Bucket Unit fields become uneditable.

9. Click OK. The bucket is defined and displayed in

the summary page.

Approve or Reject a Bucket Definition

To approve or

reject a bucket definition, follow these steps:

1. Select the bucket definition from the Bucket Definition Summary window. The Bucket Definition window is displayed.

2. Click Edit ![]() .

.

3. Click Approve ![]() or Reject

or Reject ![]() .

.

The respective message

is displayed. Approved bucket definitions cannot be edited.

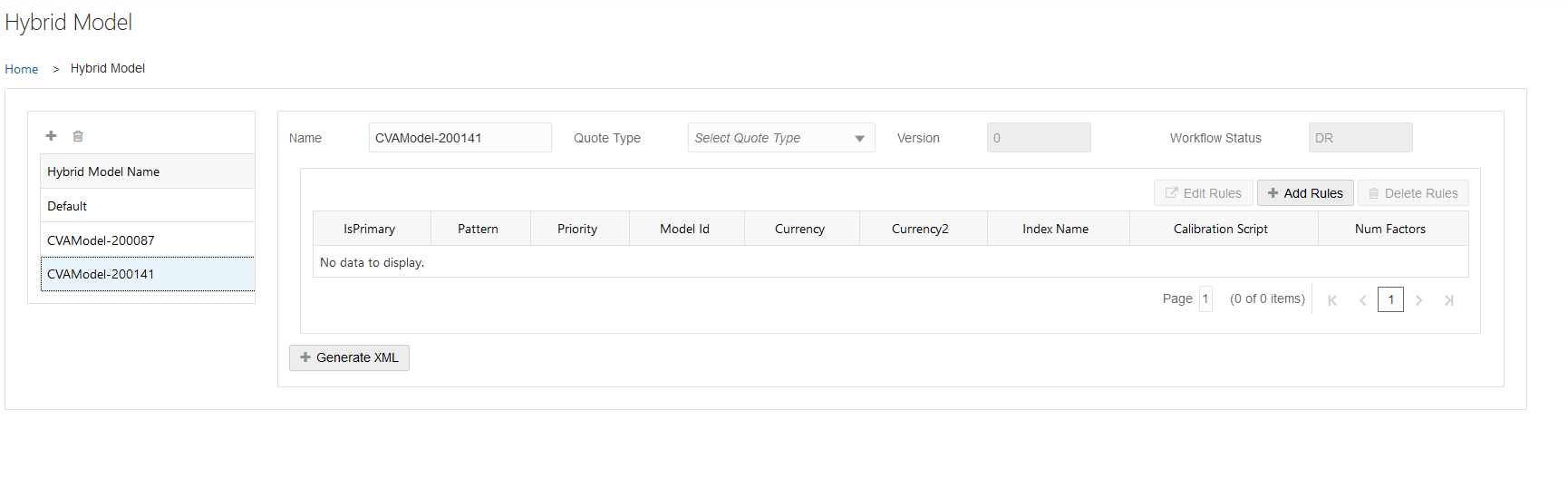

Hybrid Model

Hybrid model is a

combination of models used to price multi-asset class deals. The Monte Carlo

technique used for Counterparty Risk calculation requires a global hybrid model

to be constructed and used for the exposure calculation of each trade. The

hybrid model is composed of a set of component models, for which parameters,

correlation values, and calibration strategies must be defined.

Rule within a

hybrid model defines a pattern that is used to match the name of the

underlyings specified by the trades. If a rule’s pattern matches the name of an

underlying, other attributes in the Rule element specify what type of model

should be generated, and the parameters for that (such as calibration strategy,

and primary or secondary selection). Multiple rules can match an underlying,

since the same underlying can require multiple factor models.

Navigate to the Hybrid Model Window

From the MRMM Home page,

select Market Risk Measurement and Management, click Navigation Menu ![]() ,

select Library, and then select Hybrid Model.

,

select Library, and then select Hybrid Model.

Adding a Hybrid Model

This section

details the procedure for adding a hybrid model. The following table describes

the fields in the Hybrid Model window:

To add a hybrid

model, follow the below steps:

1. Navigate to the Hybrid Model

window.

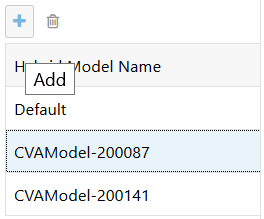

Figure 23 Hybrid

Model Definition Screen

2. Click Add ![]() . A new model is created.

. A new model is created.

Figure 24 Hybrid

Model Add

3. Select the new model. It is added in

the definition pane. Populate the relevant details in the fields.

Table 14 Fields

and their Descriptions in Hybrid Model Pane

|

|

|

|

Fields |

Description |

|

Fields

marked in red asterisk(*) are mandatory |

|

|

Name* |

The Hybrid Model name is

displayed. |

|

Quote Type |

Correlation

factors are found by looking in the market data, and this element notes how

to form the full key of those correctly factor quote keys. Select any one

value from available list – ASK, BID, FIX, LAST, MID Select the Quote Type

from the drop-down list. |

|

Version* |

Displays the

workflow version. |

|

Workflow

Status |

Displays the

status of the workflow. |

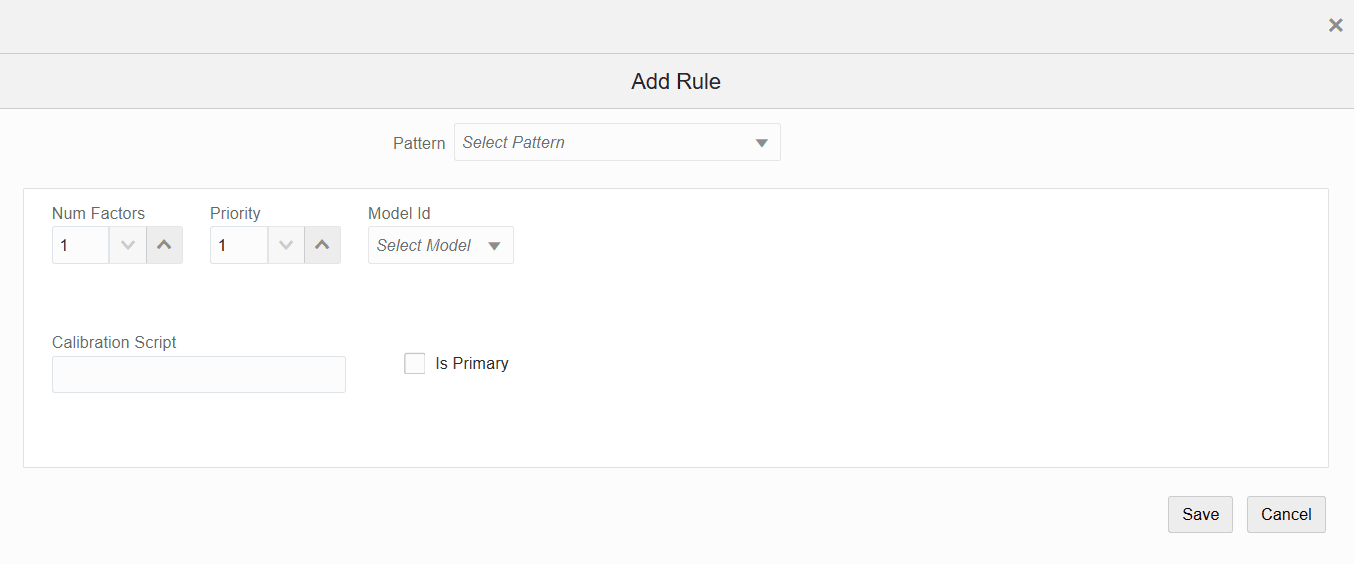

4. Click Add Rules ![]() . The Add Rule Window is displayed.

. The Add Rule Window is displayed.

Figure 25 Add

Rule Window

5. Follow these steps:

a. Select the Pattern from the drop-down list. It defines a

pattern with positional strings that is used to match the name of an

underlying. This determines if the rule is applicable for a specific trade’s

underlying. If the pattern matches, the rule is used to generate one or more

factor models in the output hybrid model setup. For example,

"IR.<Currency>" will match any underlying with the pattern that

it starts with the string "IR." and ends with some currency string.

The positional strings are set with the specified name (or names), and will be

substituted in the value of other attributes of the rule. Based on the selected

Pattern, the fields are displayed. Enter the relevant details in the fields.

The below table lists the mapping between pattern and fields displayed:

|

Table 15 Fields and their

Descriptions in Add Rules Window |

||

|

Pattern |

Fields |

Description |

|

Common

fields |

Number

Factor |

The number

of factors for the underlying component model, if it can be configured with

multiple factors. Specify the

Num Factor. |

|

Priority |

It indicates

the priority that is used when two or more pattern match the name of an

underlying. Specify the

Priority. |

|

|

Model ID |

This field

indicates the ID string of the model to be created for the single-factor

model. It can refer to positional strings found when the Pattern was matched.

For example, “IR.MODEL.HW1F.<Currency>" will be the string "IR.MODEL.HW1F.USD"

if the previous example’s Pattern matched the underlying "IR.USD". Select the

Model ID from the drop-down list. |

|

|

Is Primary |

Set this to

"true" or "false" to indicate if the generated model is a

primary or secondary one. Secondary models are separate from other secondary

models, and are only correlated with the primary models. Check the Is

Primary check box, if applicable. |

|

|

Calibration

Script |

A Numerix

Extension Library (NXEL) script function to call to generate the calibration

instruments for the model |

|

|

IR.Currency |

Currency |

Select the

Currency. |

|

FX.<Basecurrency>/<Termcurrency> |

Base

Currency |

Select the

Base Currency. |

|

Term

Currency |

Select the

Term Currency. |

|

|

CR.<Currency>-<ReferenceEntity>_<DebtType>_<RestructuringClause> |

Currency |

Select the

Currency. |

|

Debt Type |

Select the

Debt Type. |

|

|

Reference

Entity |

Select the

Reference Entity. |

|

|

Restructuring

Clause |

Select the

Restructuring Clause. |

|

|

EQ.<Currency>-<Exchange>-<Ticker> |

Currency |

Select the

Currency. |

|

Exchange |

Select the

Exchange. |

|

|

Ticker |

Select the

Ticker. |

|

|

CMDTY.<Currency>-<Exchange>-<Ticker> |

Currency |

Select the

Currency. |

|

Exchange |

Select the

Exchange. |

|

|

Ticker |

Select the

Ticker. |

|

|

CPI.<Currency>-<InflationIndex> |

Currency |

Select the

Currency. |

|

Inflation

Index |

Select the

Inflation Index. |

|

|

RR.<Currency>-<InflationIndex> |

Currency |

Select the

Currency. |

|

Inflation

Index |

Select the

Inflation Index. |

|

b. Click Save.

6. Click Generate

XML. A message XML

generation is Successful is displayed. This file is used while defining a

business definition in Monte-Carlo simulation user interface, Hybrid Model Name

field.

Edit a Hybrid Rule

You can edit all

the fields in an XML if it is not used in any business definition.

Delete a Hybrid Rule

You can delete XMLs

which are not used in any business definition.