RELEASE NOTES

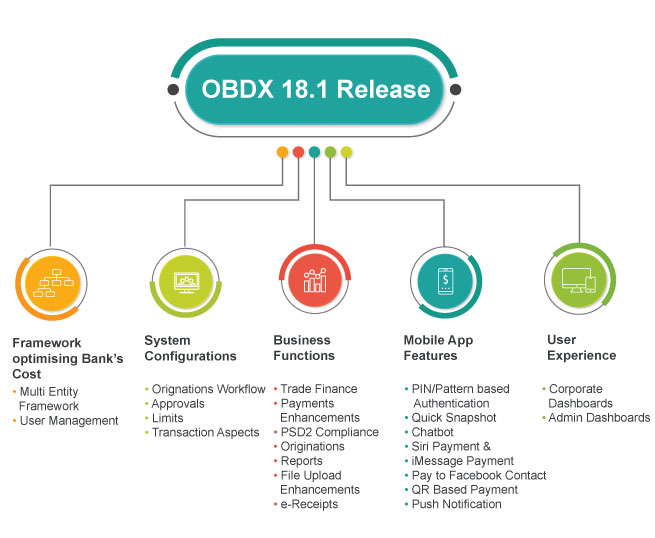

This document includes following topics:

- System Configurations

- Business Functions

- Customer Experience

- Mobile Application Features

- System Configurations

- Business Functions

- Customer Experience

- Mobile Application Features

- Qualifications

Overview

Banks are always known to have a trust relationship with their customers, with digitalization disrupting the conventional way of banking, this responsibility to retain the trust with customers has shifted to digital banking. In order to provide the same level of comfort to customers as of traditional banking, banks must focus on providing intuitive customer experience and maximize the degree to which the customer can perform his banking operation using digital channels in a secured manner.

The next biggest challenge for banks is to keep the pace with the rapid evolution of mobile technology and its impact on banking and especially on the payments.

Apart from the above objectives, the theme of OBDX 18.1 release was also to offer cost effective value propositions to Banks by developing features like Multi Entity Framework and in-house User Management module that the Bank can consume without incurring the additional cost.

Highlights

This chapter gives a brief summary about the enhancements done in the four areas.

Framework Optimizing Bank’s Cost

With the idea of building OBDX as one stop shop for bank’s various needs, new frameworks i.e. Multi Entity and User management are introduced. This will not only help banks in setting up one instance of OBDX for various entities and provide the ease of using in house user management module, but it will also enable banks in lowering their total cost of ownership.

System Configurations

These are the functions that enables System/Bank administrator to configure the various system maintenance from a front end screen. These configurations are the enablers that provide flexibility to banks in terms of various setup required for the different features and functions being offered to business users.

Business Functions

For any digital banking platform the ultimate aim is to facilitate maximum number of services that a customer could have done by visiting the branch therefor in OBDX18.1 we increased our functional offerings to end user.

Customer Experience

Mobile Application Features

It is a well-known fact now that mobile banking plays a crucial role in digital transformation of Banks and the key to success is to provide value added services to increase customer engagement apart from providing the regular banking transactions.

System Configurations

Under this area following enhancements are done as part of 18.1 release.

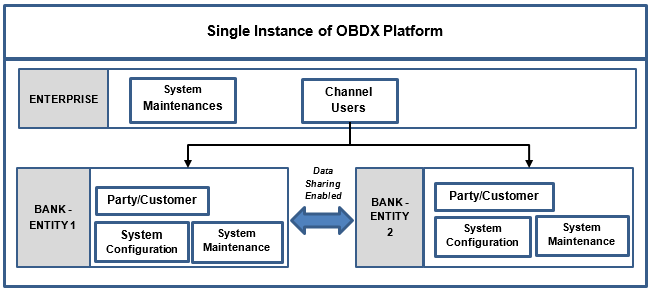

Multi Entity

Multi Entity capability is to have various entities of a same bank in different geographies or having different brands under a legal entity at one location and in such a set up a business user (typically a corporate customer) can have relationship with multiple entities of a same bank.

Multi Entity support built by OBDX will enable banks to deploy a single instance of OBDX platform and onboard multiple entities onto the platform. The same platform can host data of multiple entities on a single instance. The banks will have data sharing enabled across multiple entities so that users from one entity can have access to data of other entities if required.

The below diagram depicts the role of OBDX in a multi entity setup.

Major highlights of this framework:

- Multi-tenant support enabling multiple brands of a bank in same or different geographies to deploy on common infrastructure

- Enabling corporates to access all accounts across brands and geographies from single sign-on

Entities of the bank could have varying Time zones or could be within the same Time zone. There are certain attributes/maintenances in the system that are defined for each of the entity and some of them are defined at enterprise level i.e. same across entities.

- User Onboarding in Multi Entity setup: System Administrator will have access to all the created entities in the system and at the time of onboarding users can be provided access to various entities.

The Administrator![]() Administrator is a set of individuals that administer the applicant/Affiliate entity. For example, Accountants, Authorized Signatories for organizations, Power of Attorney for individuals. having access to multiple entities can onboard users of the retail and corporate by selecting the default entity and party. As part of onboarding, the user is assigned accessible entities and also the limits package for each of the entity. Application role (child role) of the user will be the same across all entities

Administrator is a set of individuals that administer the applicant/Affiliate entity. For example, Accountants, Authorized Signatories for organizations, Power of Attorney for individuals. having access to multiple entities can onboard users of the retail and corporate by selecting the default entity and party. As part of onboarding, the user is assigned accessible entities and also the limits package for each of the entity. Application role (child role) of the user will be the same across all entities

Once the user logs in he will have an option of entity selection from all the entities he has access to which includes both the home entity and accessible entities. User can switch to the required entity to inquire or transact on accounts of the respective entity

- System Configuration for Multi Entity: There is a default entity created as part of installer and system administrator can add new entities along with details like Time zone for each of the entity and also define system configuration for each of the entities.

As part of System Configuration, user can select the host along with version, bank, branch and module details for each of the created entities.

- Mobile Application for Multi Entity: mobile features i.e. Siri Payments, iMessage and Chatbot, system will always consider the home/default entity of the user logged in.

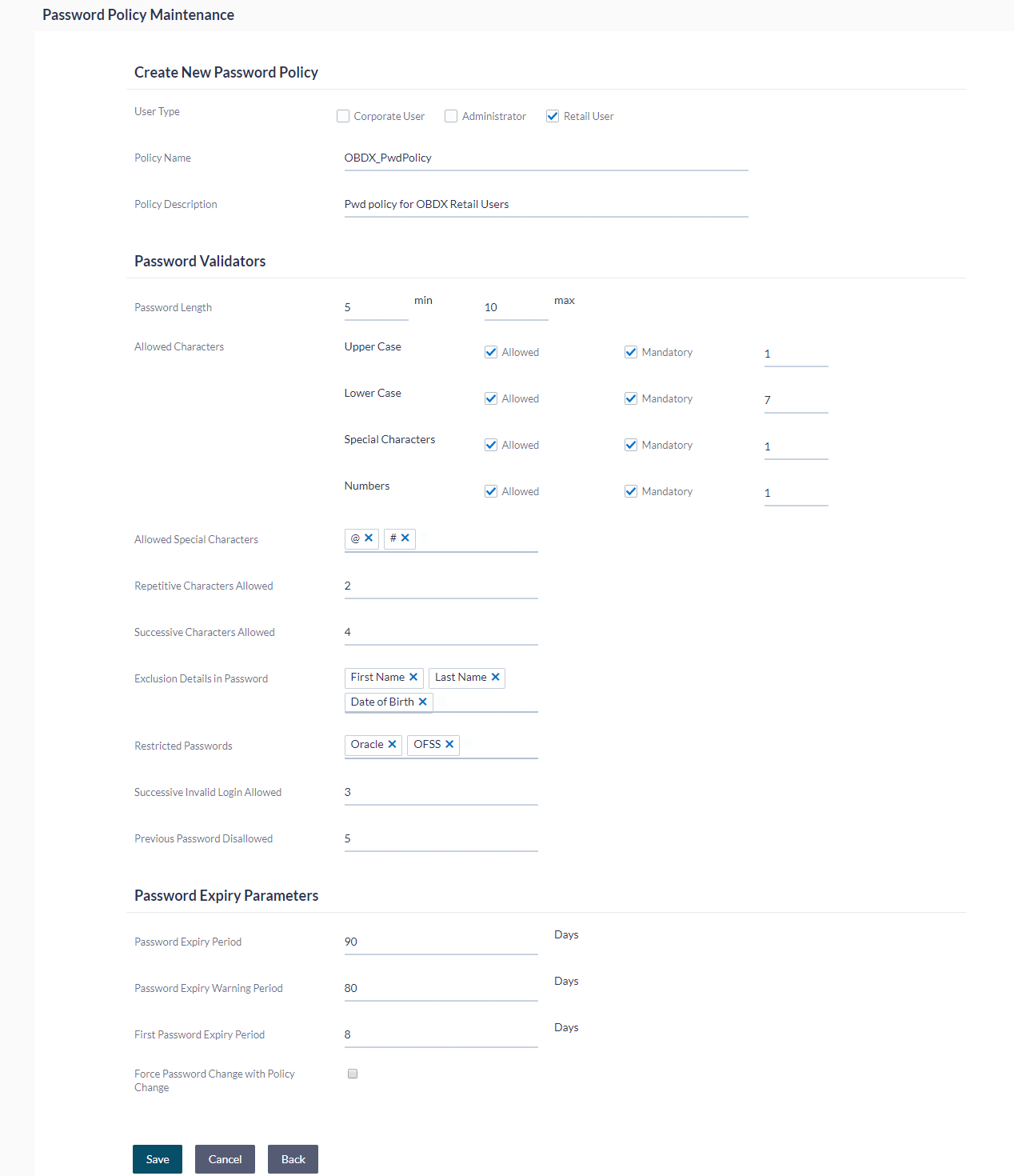

Password Policy Maintenance

Creating a strong password policy is the primary step for safeguarding the customer accounts from fraudulent activities. Password policy comprises of a set of validators to which the user’s password should adhere to.

Password policy maintenance will enable system administrator to define the set of parameters like minimum/maximum length of the password, allowed and mandatory characters, number of repetitive and successive characters allowed restricted password, number of invalid attempts allowed, expiry period of the password etc.

Bank will have the option of creating different policies for different user roles (Retail, Corporate, and Administrator).

Print User password

This feature will enable the Bank administrator to print the password along with documents like Welcome letter, Terms & Conditions document and applicable promotional offers for new users as well as for existing users who have requested for reset password.

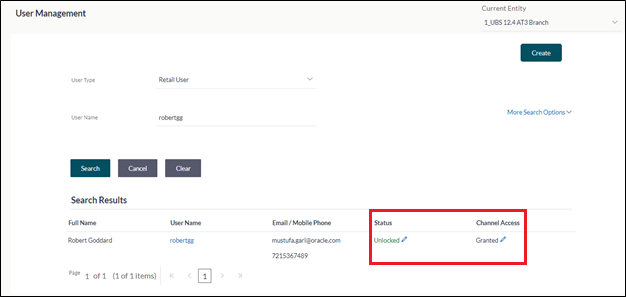

Channel Access Permission & User Status Change

Channel Access feature is developed in the existing User Management screen. This feature enables the bank to grant and revoke the channel access for a particular user incase the user does not want to access his channel banking (Mobile and Internet Banking).

Also the existing feature of changing the User status (Lock/Unlock) has been bought on the search screen of User Management so that it’s easily accessible to the administrator

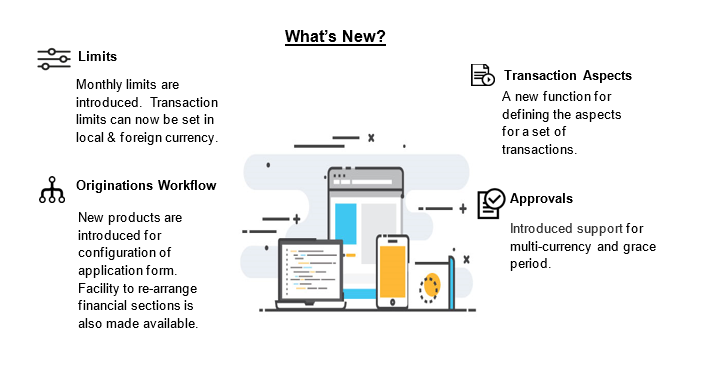

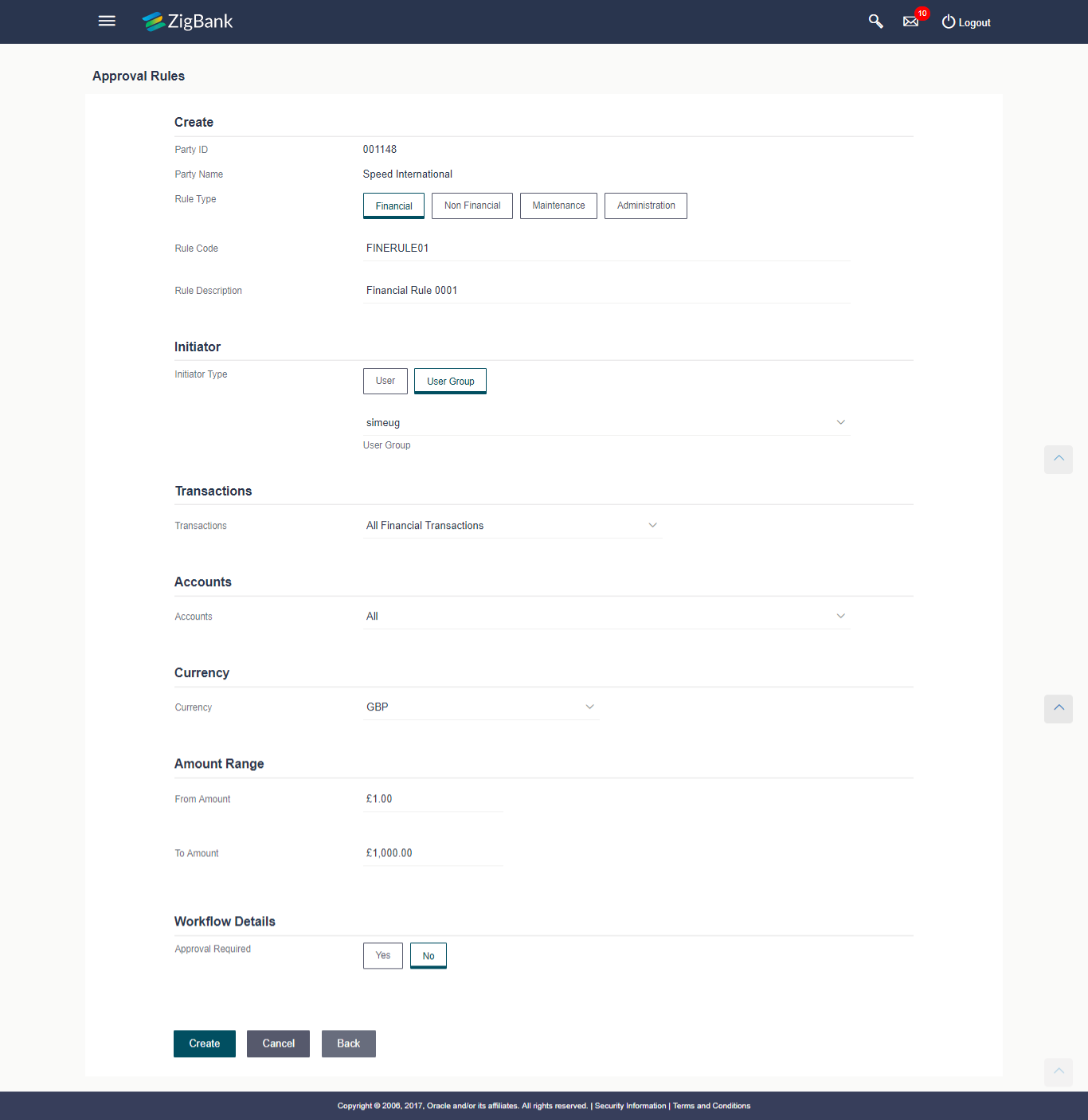

Approvals

Corporate Approval enhanced to support:

- Currency: Application now supports setting up approval rules in local currency as well as foreign currency for the same transaction.

- Grace Period: Grace Period is the time provided to the corporate approver to approve or reject the transactions, beyond transaction value date. Now the grace period facility can be enabled for specific transactions of an entity as Day1 configurations and can further be granted for specific corporate while defining party level preferences.

Transactions pending for an approval beyond the value date can be clearly distinguished from the Approver’s Dashboard

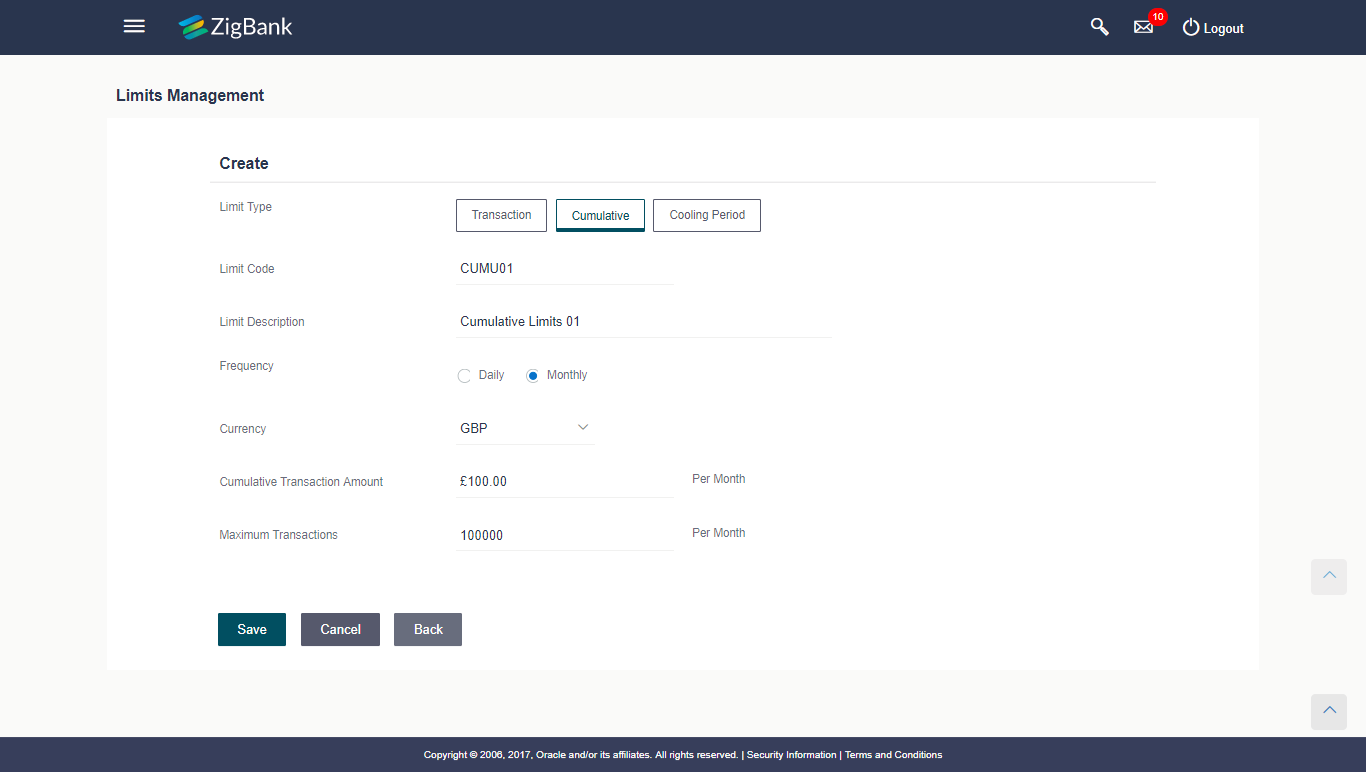

Limits

Limits module of an Administrator users (Bank Administrator and Corporate Administrator) have been enhanced to support following features.

- Monthly Limits: Cumulative limit (Cumulative amount and total number of transactions) is a collective transaction limit that can be assigned to the corporate user to perform specific transaction/s within specific time period. Support has been now extended for setting up cumulative monthly transaction limits. Further these daily and/or monthly transaction limits can be clubbed together in a limit package and can be assigned to specific users.

- Currency: Application now supports setting up transaction limits in local currency as well as foreign currency.

- View Limits: Existing screen of business users to view transaction limits have been enhanced to show following details:

- Monthly and daily transaction limits

- User and Customer cumulative transaction limits

Transaction Aspects

New function introduced in the system through which the system administrator can define the aspects for a set of transactions. There is a provision in the system to view the aspects by selecting the transaction and the administrator can also edit the aspects i.e. enable/disable if required.

Following are the aspects available

- Limits Check

- Approvals

- Grace Period

- Working Window

- Blackout

- 2 Factor Authentication

- Audit

- e-Receipts

Not all aspects are applicable for all transactions and the system will not allow the administrator to enable the aspect(s) not applicable to the selected transaction.

Workflow Configuration

Following enhancements are done in the existing originations workflow configuration transaction:

- Introduction of new products: The Originations Workflow Configuration transaction available to bank administrators has been enhanced to support the configuration of the application forms of the four products (Savings Accounts, Current Accounts, Auto Loans and Unsecured Personal Loans) that are supported through UBS integration.

- Facility to Re-arrange Financial Sections: In this release, the Financial Profile section (in the application forms of products Auto Loans and Unsecured Personal Loans) has been broken down into individual sections of Income, Expenses, Assets and Liabilities. This, in turn, ensures further flexibility in configuring the application form of these products as the bank can now re-arrange all the sections (with the exception of sections such as Offers, Review & Submit and Confirm) of the application form so as to arrive at a sequence that best suits the needs of the bank in capturing information required in the processing of the applications.

Business Functions

Under this area following enhancements are done as part of 18.1 release

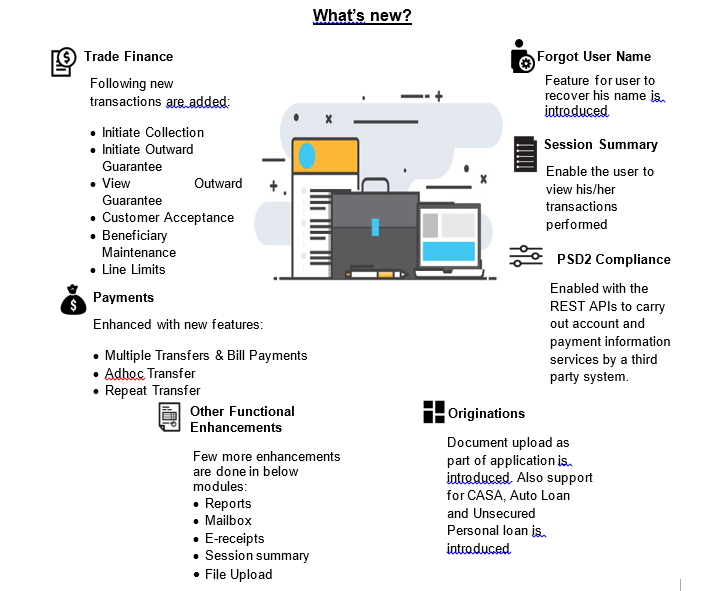

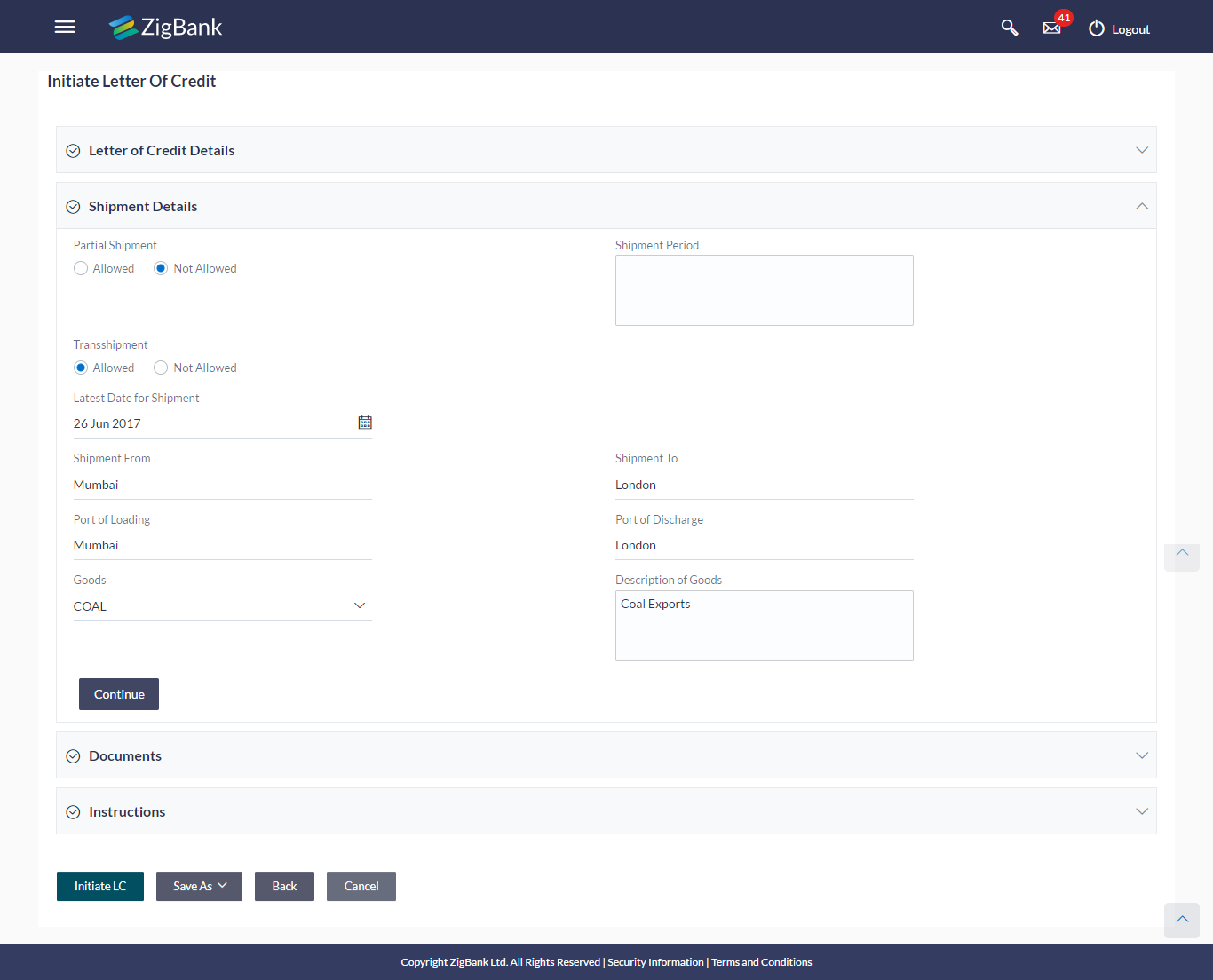

Trade Finance

Trade Finance Module has been enhanced by bringing in the below new functions:

- Initiate Collection: Bill collection is a trade transaction, in which the exporter forwards the required commercial documents to the importer’s bank, against which the payment is to be done. Banks facilitates documents movement, makes the required checks and then process payments to the exporter against the bill.

Import bill collection offers a view about the collection from the point of view of an importer and export bill collection offers the same from the point of view of an exporter.

In OBDX18.1, using this option user can request his bank to collect payment of goods and he can also initiate collection or export bills under LC. It may be documentary or clean in nature, and may have payment option as sight or usance type

User has the below three options to initiate Collection:

- Using existing Templates

- Using existing Drafts

- Initiating Collection (New Application)

User also has the option to save a collection application as a template or as a draft, so that the same can be used for creation of similar kind of collections in future. User will have options to choose private or public access, while saving as a template.

Collection initiated may be linked with existing Letter of credit in the system or may stand on its own. In case it is linked with an existing Letter of Credit, system automatically fetches values for common fields.

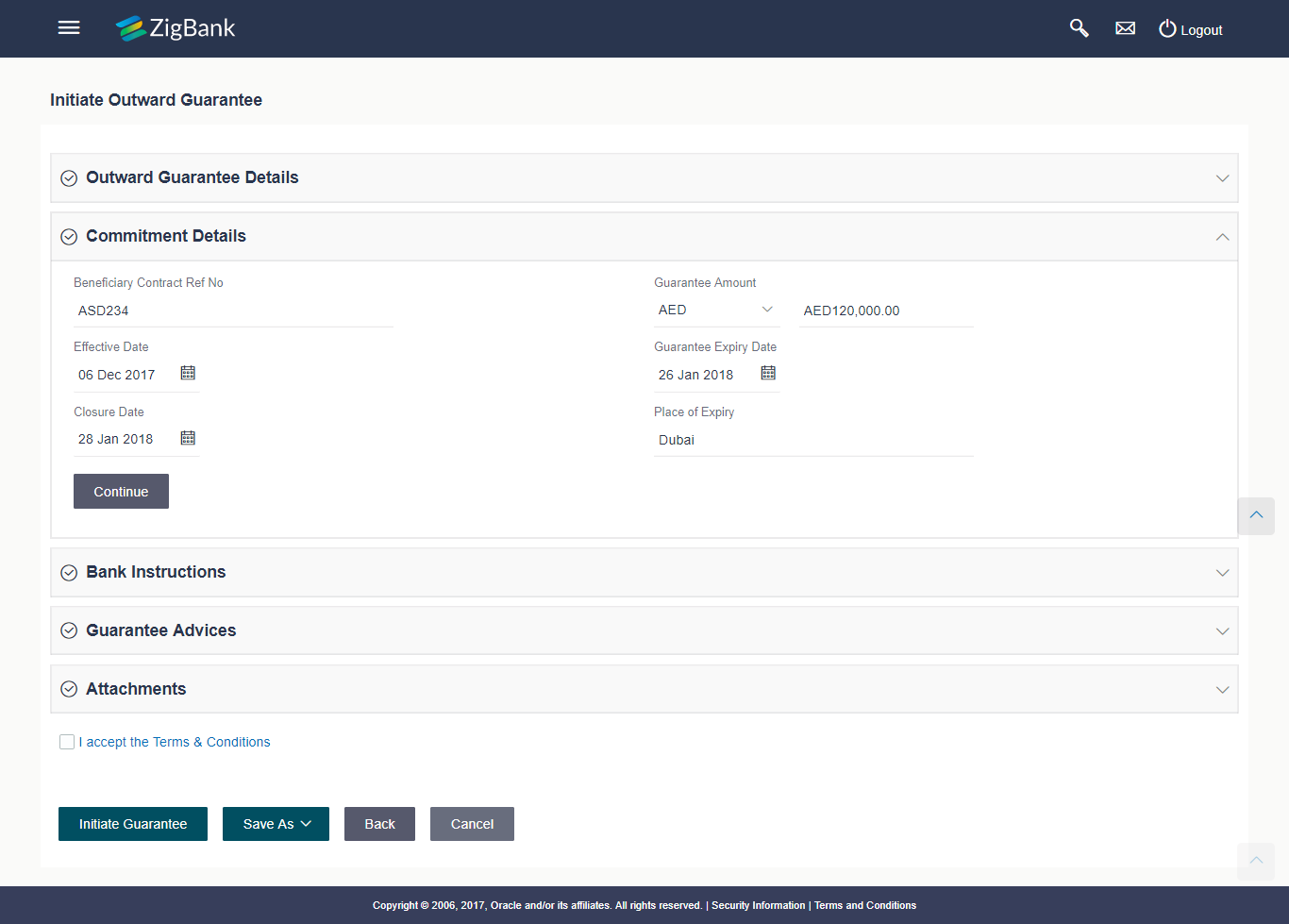

- Initiate Outward Guarantee (Bank Guarantee): It is a contract issued by bank for its customer, who has signed an agreement to purchase goods from a supplier and agrees to fulfil any financial obligations to the supplier in case of any default. In other words, if the debtor fails to settle a debt, the bank will cover it. Using this option, user can apply for an Outward Bank Guarantee.

In OBDX 18.1 for the Outward Guarantee application, user must enter the details in the four tabs available in this option which are Parties, Commitment Details, Bank Instructions and Guarantee. The Outward Guarantee application goes through the "Maker-Checker" cycle and once it is authorized, the details are sent to the host system.

User has three options to initiate guarantee

- Using existing Templates

- Using existing Drafts

- Initiating Guarantee (New Application)

User will have the option to choose private or public access, while saving the Outward Guarantee as a template. If he saves the template as ‘Public’, all the corporate users mapped to that Party![]() A party is any individual or business entity having a banking relationship with the bank. ID, can access it.

A party is any individual or business entity having a banking relationship with the bank. ID, can access it.

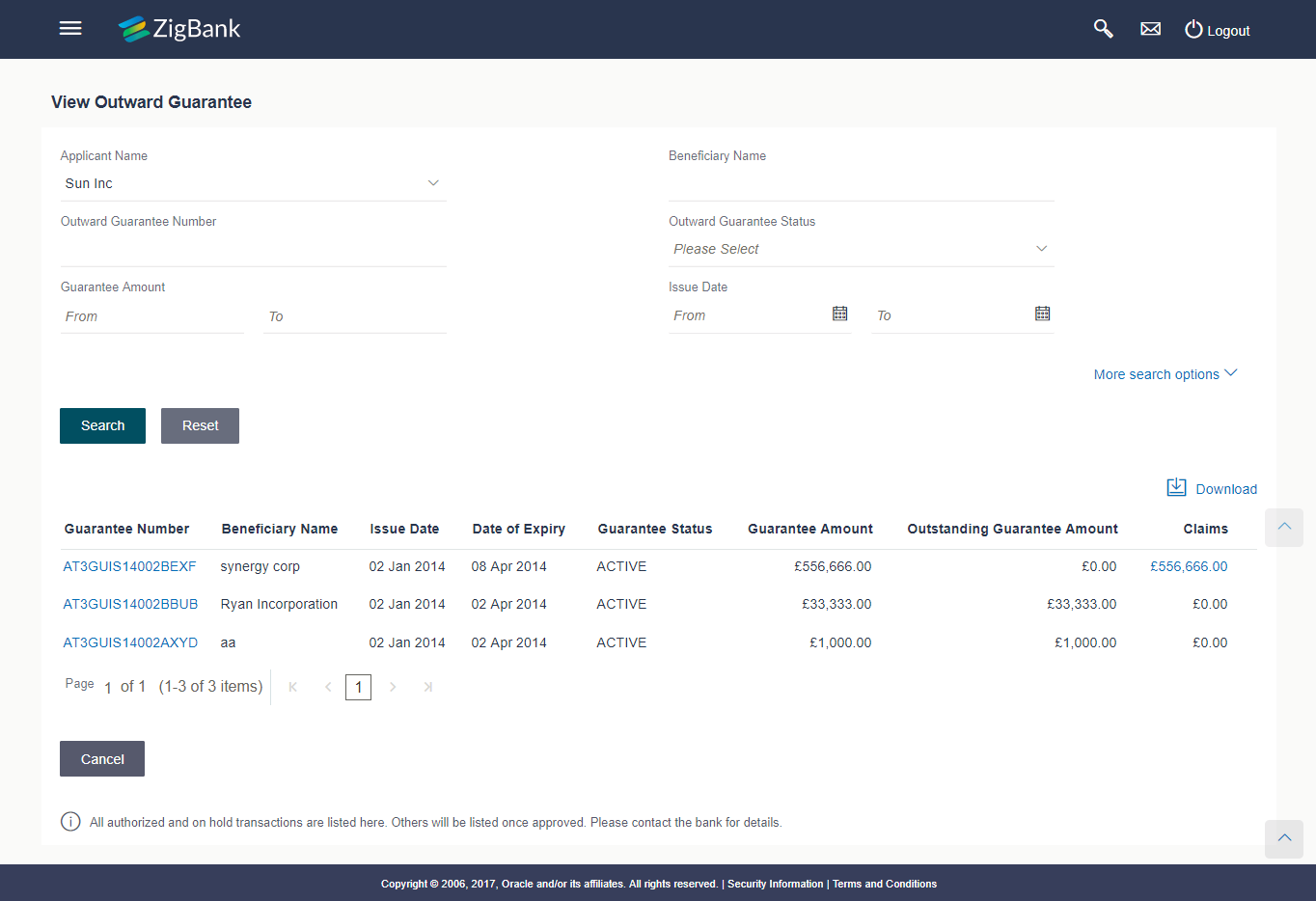

- View Outward Guarantee: Using this option, user can view existing outward guarantees in the application. User can search for guarantees based on search criteria like Beneficiary Name, Guarantee Number, Expiry Date etc. It allows the user to view a list of bank guarantees (also called Outward Guarantee) for the selected customer. Details of an individual guarantee can be viewed and amendments can be done if required

User can view existing amendments raised on the guarantee, or can amend the existing guarantee. Also, he can view attached documents or add new document. Further he can view the charges, swift messages exchanged and advices received by the options available in the side panel on view guarantee page

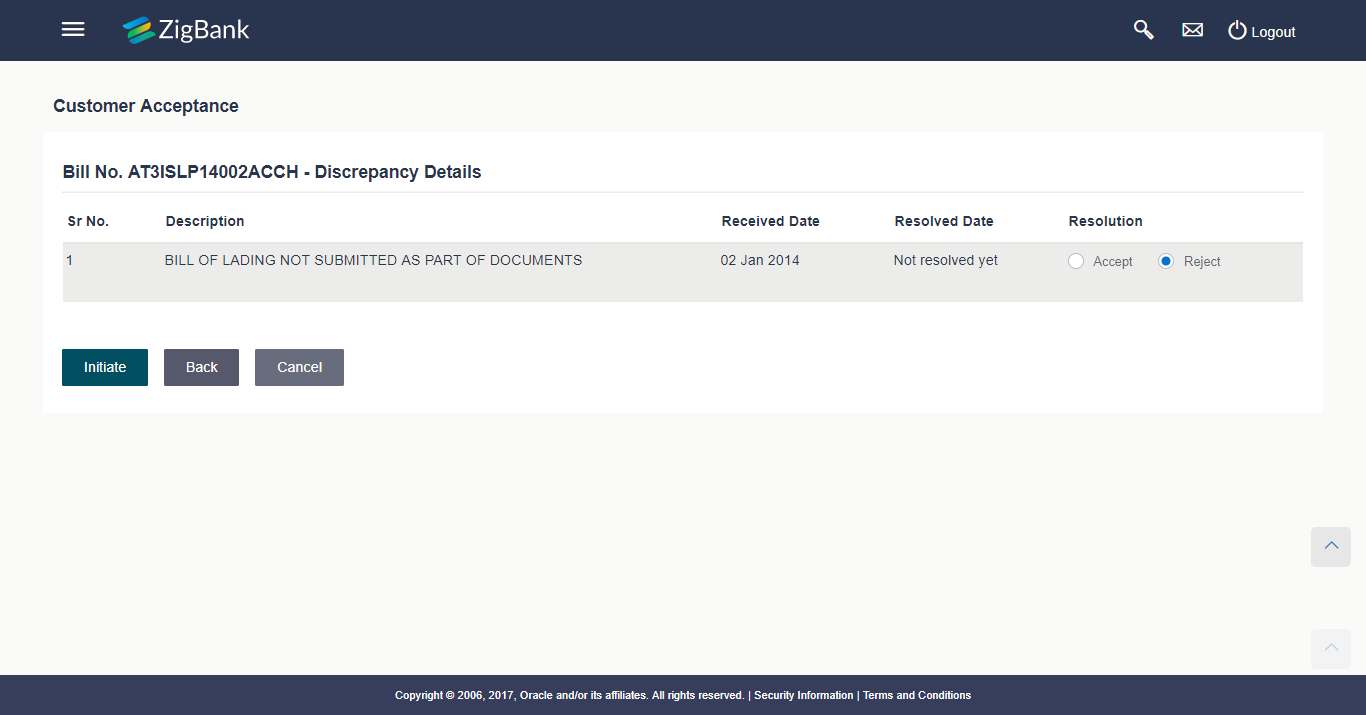

- Customer Acceptance: In some situations the sales contract goes for modification, and in order to replicate the same over bills and letter of credits, acceptance from other party is also required. Using this option, user can accept or reject, the discrepancies raised in import bills or amendments under export Letters of Credit. It is then forwarded for further approval from his bank. A search facility is also provided to easily locate the discrepancy or amendment raised.

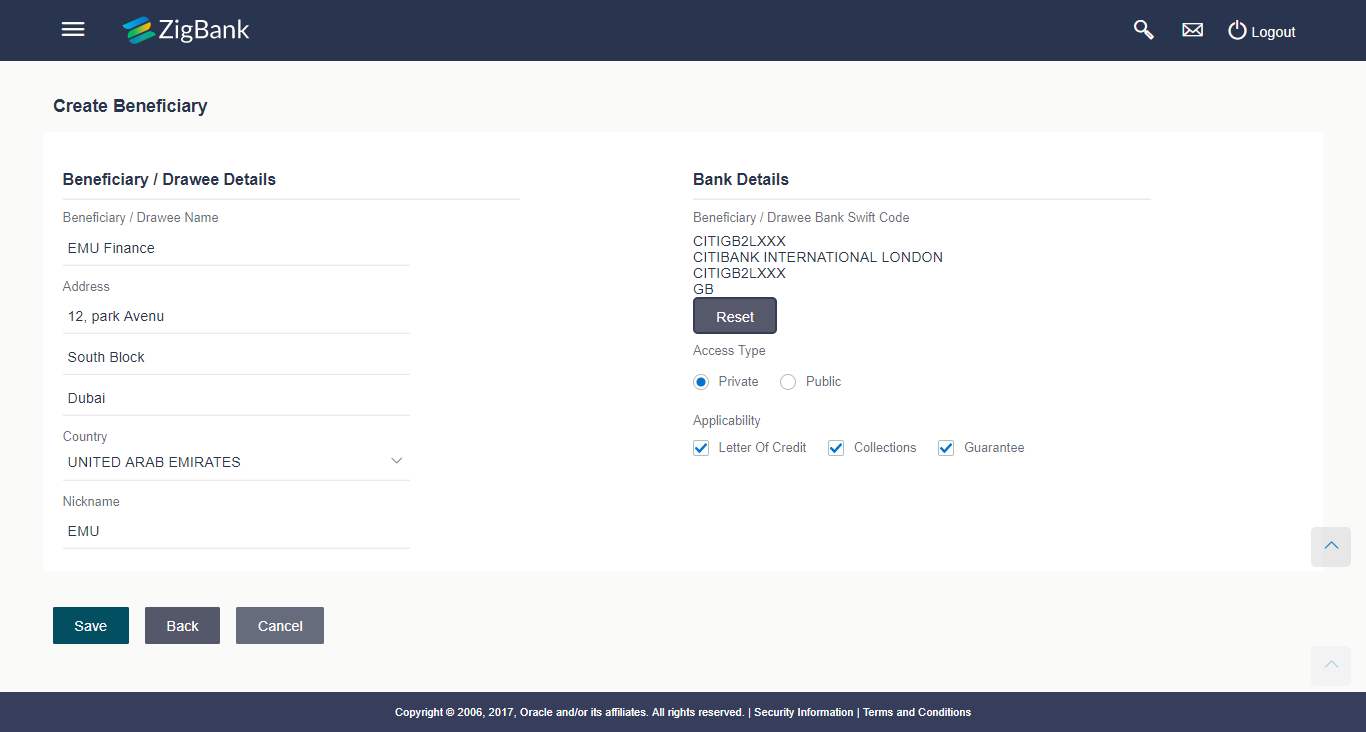

- Beneficiary Maintenance: To ease the user from filling up the details of beneficiary, a facility to maintain beneficiary is added. User can create add, edit or delete beneficiary details and also have different access type, if he wants to share the same beneficiary with other users. Also, it can be defined as in which functions will be able to use the beneficiaries viz. LC, BG or collection. This enables user to directly choose a beneficiary from the maintained list and save time of filling up the detail every time he is initiating a new transaction.

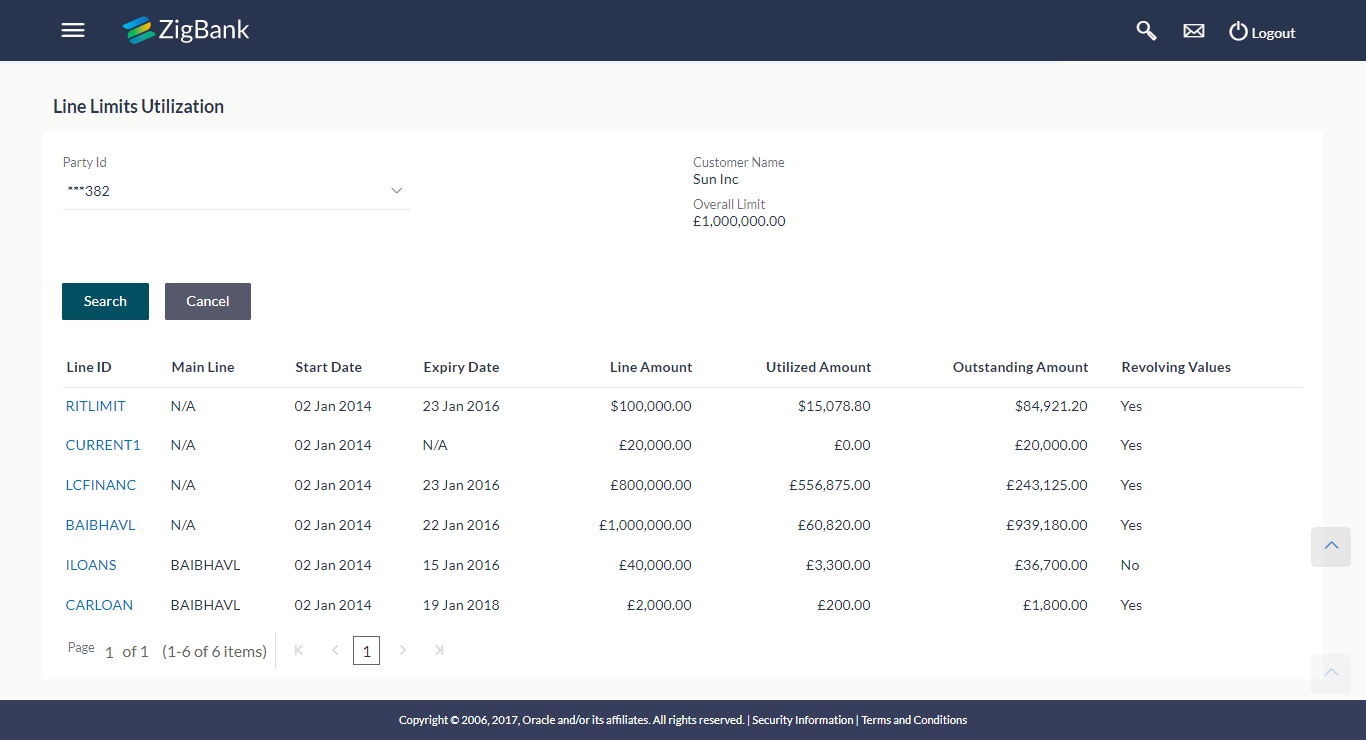

- Line Limits: Banks provide various limits to its customers, which they can use as a credit for different purposes. There can be main lines and sub lines with their limits assigned. There may be some trade finance instruments which are tagged to various lines. This feature will show all the existing lines a customer has and allows user to see the amount is used for which transaction.

There is also a widget provided on the corporate dashboard for a brief snapshot on the existing lines of customer. User can see the lines based on individual party or all the parties at a time.

Payments

As part of the OBDX 18.1 release, the following enhancements have been made in the Payments module so as to further enrich the user’s experience with making online banking payments:

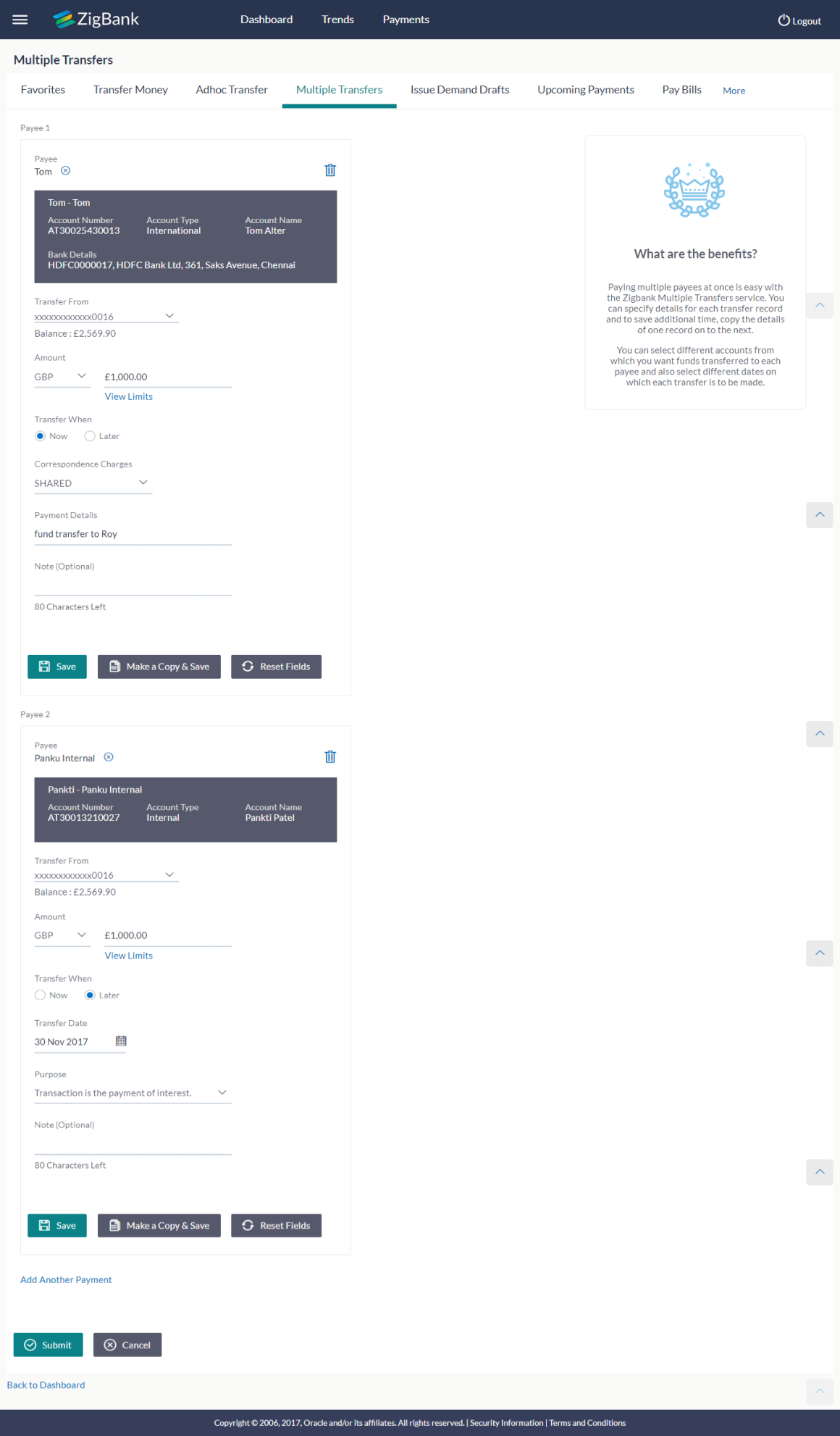

- Multiple Transfers: The Multiple Transfers feature has been introduced to enable users (both retail and corporate) to initiate transfers towards multiple payees as part of a single transaction. Through this feature, users can initiate transfers towards registered payees of different transfer types (internal, domestic and international) for different amounts and transfer dates all at once from a single screen.

- Multiple Bill Payments: Similar to Multiple Payments, Multiple Bill Payments feature has been introduced to enable users to pay multiple utility bills at once from a single screen. This feature has been introduced for both retail as well as corporate users.

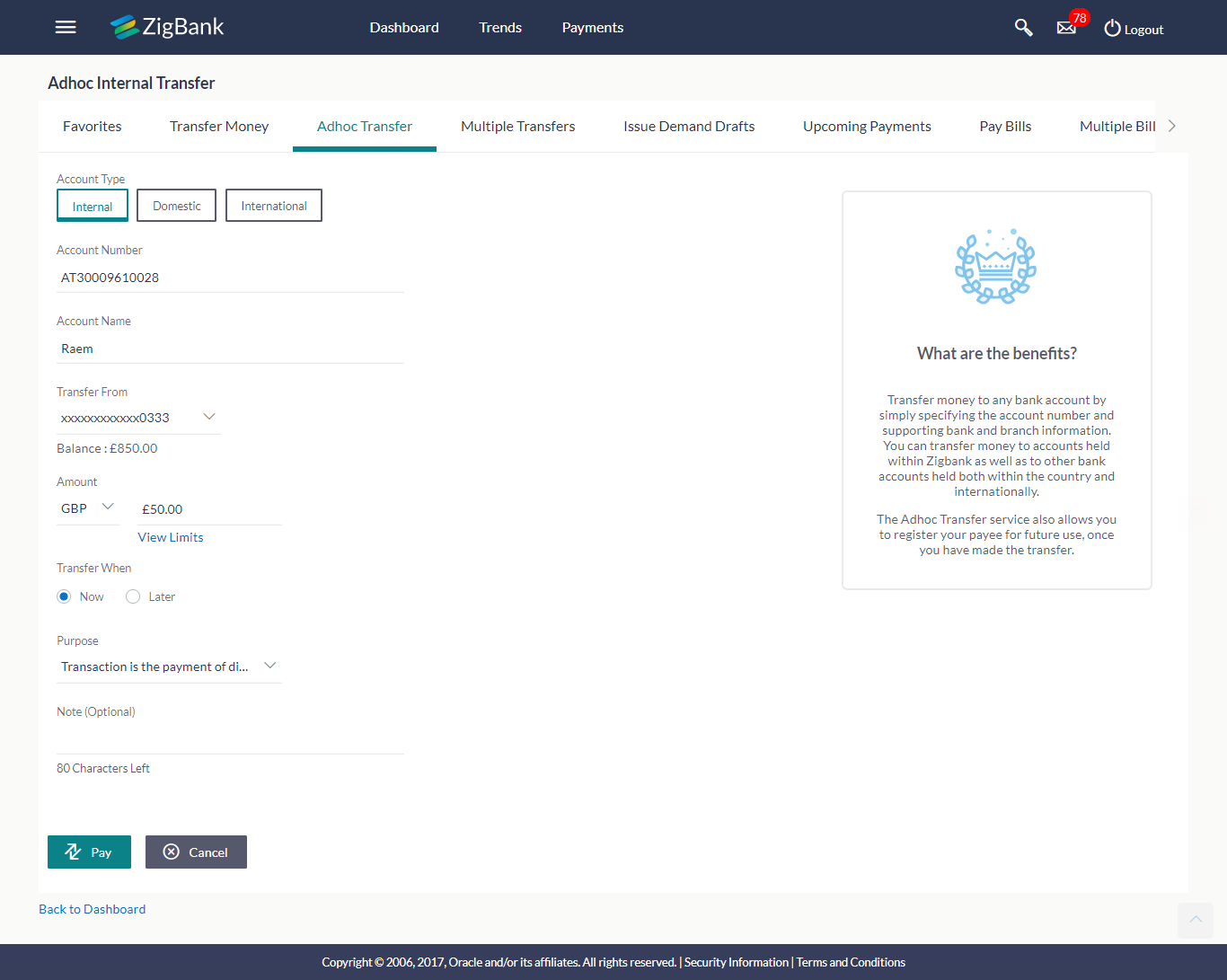

- Adhoc Transfer: As part of this release, the Adhoc Transfer feature has been provided to retail users. Hence, in addition to corporate users, retail users are also able to initiate transfers towards beneficiaries who are not registered as payees.

- Facility to register Adhoc Transfer Beneficiaries as Payees: The facility to register the beneficiary towards whom an adhoc transfer was initiated has been added on the Adhoc Transfer confirmation page. Hence, if the user anticipates making regular payments towards the beneficiary in the future, he can opt to register the beneficiary as a payee by selecting the option provided on the confirmation page. By doing so, the user will be spared the effort of having to enter all the information of the payee while initiating a transfer. On selecting the ‘Add as Payee’ option on the Adhoc Transfer confirmation page, the user will be navigated to the Add Payee page on which the beneficiary’s information (including account and branch or bank information, depending on transfer type) will be prepopulated in the respective fields. This feature is available to both Retail and Corporate users.

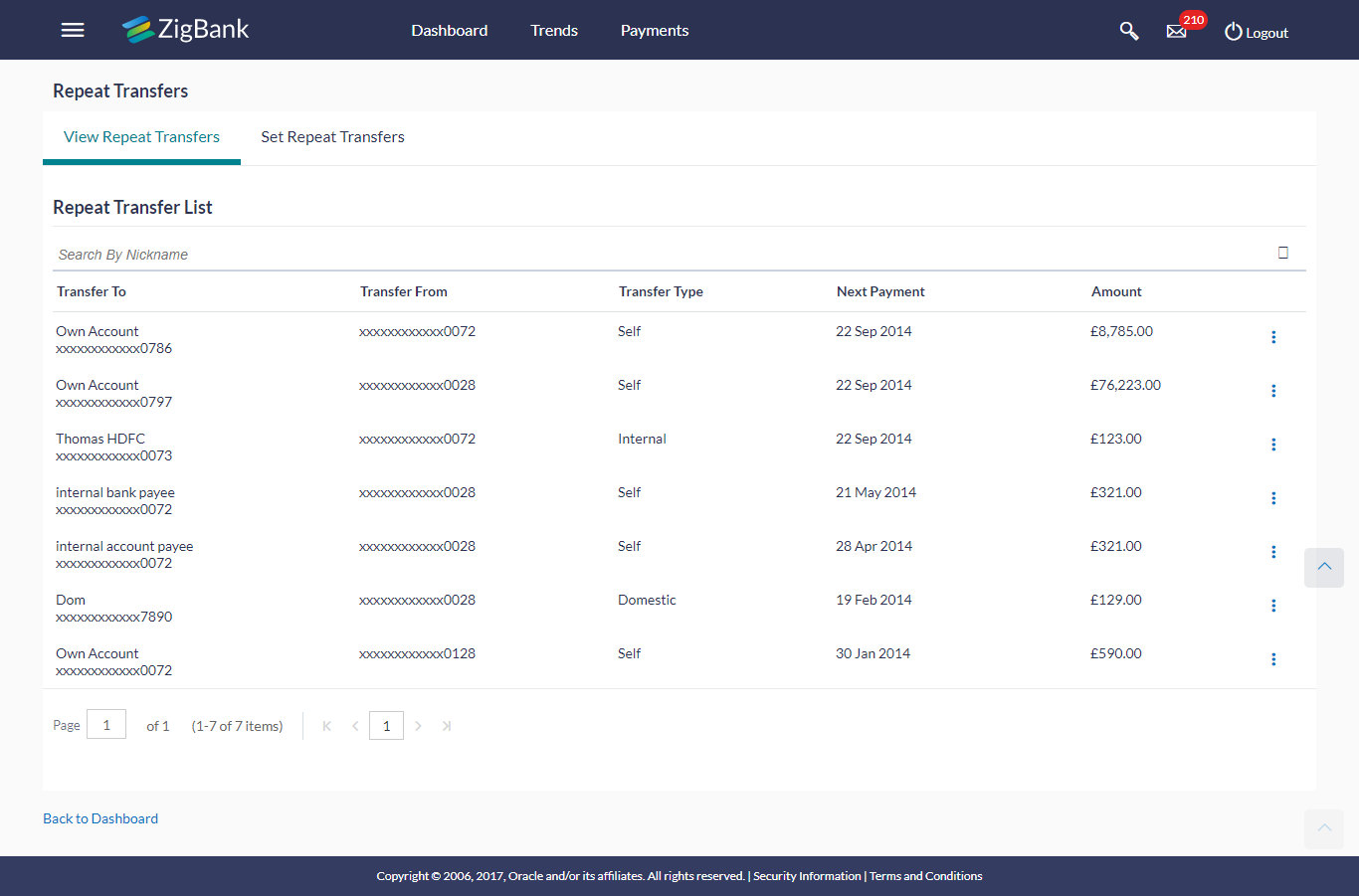

- Repeat Transfers Enhancements: Repeat Transfers feature has been enhanced so as to enable users to view extensive details of all initiated repeat transfer transactions. Details include basic transaction details such as source and beneficiary account, transfer amount, start and end dates of execution, frequency of execution, etc. as well as details specific to each instruction i.e. the date of execution as well as the status of each instruction. In case the instruction failed, the system also displays the reason for failure.

- Transaction confirmation screens enhancements: As a part of OBDX 18.1 release, payee and payment transaction confirmation screens have been enhanced to show important transaction details along with the transaction reference number and status. An option is also provided to business users on payment confirmation pages to share the transaction details with others using messaging platforms and social media.

PSD2 Compliance

PSD2 is the second Payment Services Directive, designed by the European Union that allows companies to give their customers the option of using third-party providers to manage their finances. This will require banks to open their payments infrastructure and customer data assets to third parties that can then develop payments and information services to the customers

Consumers and businesses will experience faster payments, improved consumer protection and a wider choice of payment services.

OBDX has been enabled with some of the required REST APIs to carry out account and payment information services. Some of the new REST APIs developed for PSD2 are:

- Loan Drawdown: It will enable the customer to get the list of drawdown instructions maintained on a loan account.

- Currency List and Conversion Rate: It will enable to get the currency list for a transaction and also the currency conversion exchange rate applicable.

- Manage Consents: It will enable the customer to view the list of consents provided to the third party application(s) and also allow to revoke/grant consents to the third party.

- Cancel Payments: It will enable the customer to cancel the unprocessed initiated payment if required.

Originations

As part of the OBDX 18.1 release, following enhancements are done in Originations Module:

- Integration with FCUBS

As part of this release, the OBDX system is integrated with FCUBS12.4 as the host system to support the origination of the following products:

- Savings Accounts

- Current Accounts

Note: The process type used for integration with UBS is BPEL.

- Auto Loans

- Unsecured Personal Loans

Note: The process type used for integration with UBS is BPMN.

Document Upload in Application

The applications of all four products have been enhanced so as to enable the applicant to upload supporting documents in the application form itself instead of in the application tracker. The option to upload documents is available as a link on the application landing page and the applicant can opt to upload documents at any stage prior to application submission. A check is in place to ensure that all mandatory documents are uploaded before the application is submitted.

Reports

Reports are an integral part of actively managing any organization. Management uses the reports to track progress toward its various goals, control expenditures, increase revenue, track fraudulent transactions if any. Processing timely data and the proper reporting and analytic capabilities enhances the ability to make more informed, evidence-based decisions.

Report module has been enhanced to schedule, generate, view, download and cancel the scheduled reports. Following corporate reports in addition to the existing list of reports are

- Daily Balance Position Report

- Transaction Summary Report

- Party wise pending Approval Report

- Party wise Payee Maintenance Report

New feature to provide an access of specific reports to specific corporate user is now available to the administrators (Bank and Corporate administrators).

Mailbox

Secured mailbox to support.

- Business users to compose new mails using available subjects.

- Business users to check mails received in Inbox and reply

- Business users to check sent mails and delete

- Business users to permanently delete mails

Secured mailbox functionality have been integrated with Interaction module of FCUBS. Mails initiated from secured mailbox get assigned to FCUBS users as per departments they belong to for further action. This integration provides bank choice to use common interaction across banks from FCUBS or OBDX individually to handle customer interactions.

File Upload Enhancements

In File Upload functionality, user can now also delete a particular file or record if it is not processed in the host system and is of future date. User cannot delete a complete file if the File is having authorization type as record level (like SDMC and MDMC files having Record level authorization) and if even a single record has been processed in that file.

User can also download the e-receipt for the individual records which are processed in the host system.

E-receipts

E-receipts are proof of payment, showing that a payment or a transaction has been done in your bank accounts. Existing e-receipts framework of OBDX is enhanced. Now e-receipts can only be generated from OBDX when the debit transaction gets posted in Host system.

Forgot User Name

In OBDX18.1, a feature for recovering the User Name is built on the login page. User can get his User name by inputting his email ID. On successful validation of the same, system will authenticate the user by sending a second factor authorization, which could be OTP, Security Questions or via Soft Token app. Once the user is authenticated, system sends his User ID on his registered email id/mobile number (as per alert preference) and user can login using the same.

Session summary

In the current release, session summary feature is built that lets the user to view his session details like session start and end time, channel though with he had logged in and ip address for that session. User can further drill down to view the transactions performed under each session.

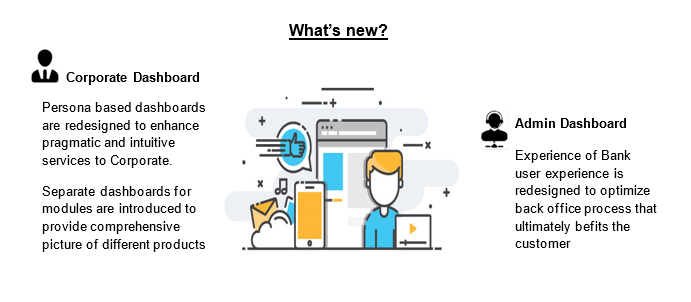

Customer Experience

Under this area following enhancements are done as part of 18.1 release:

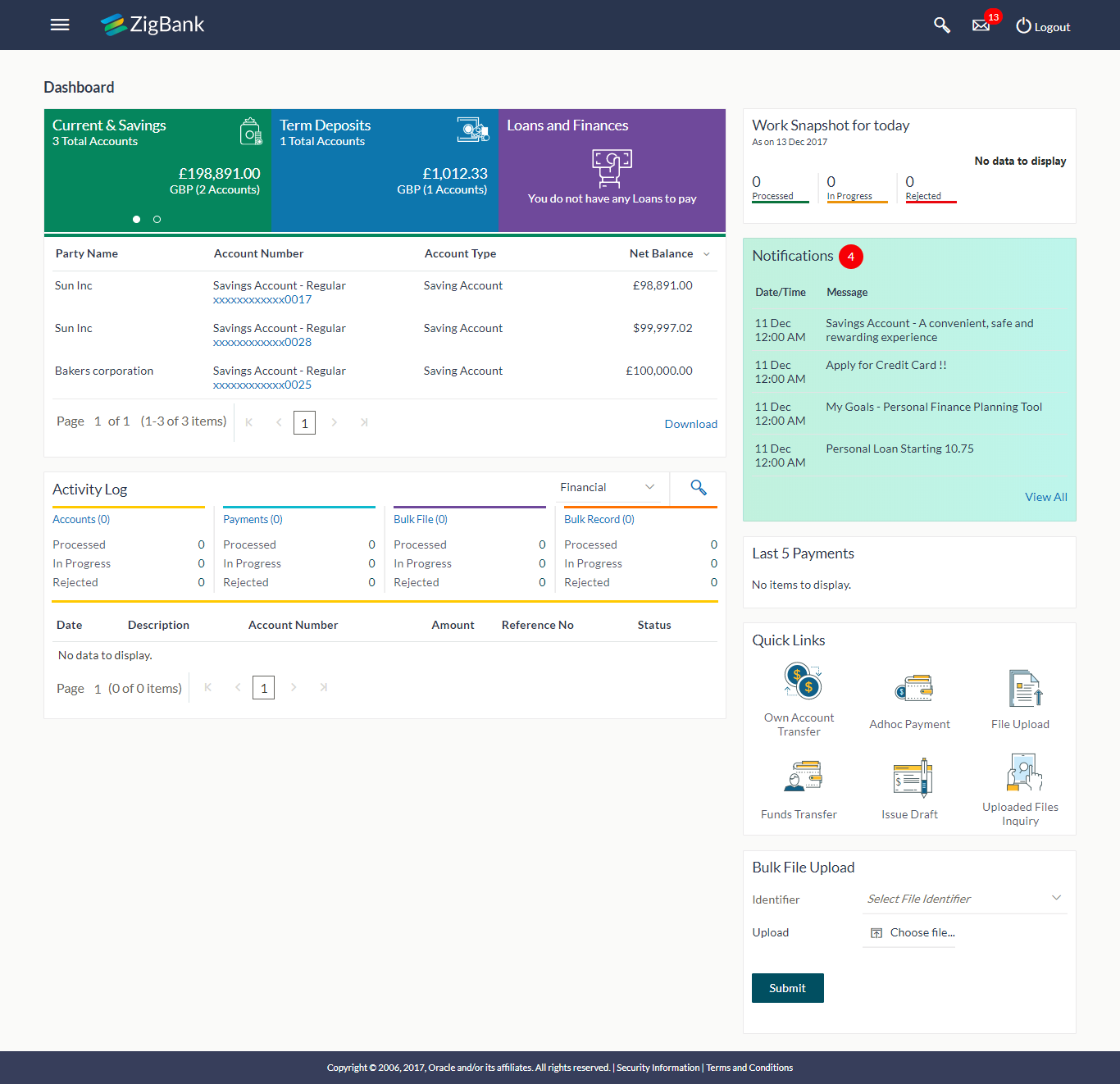

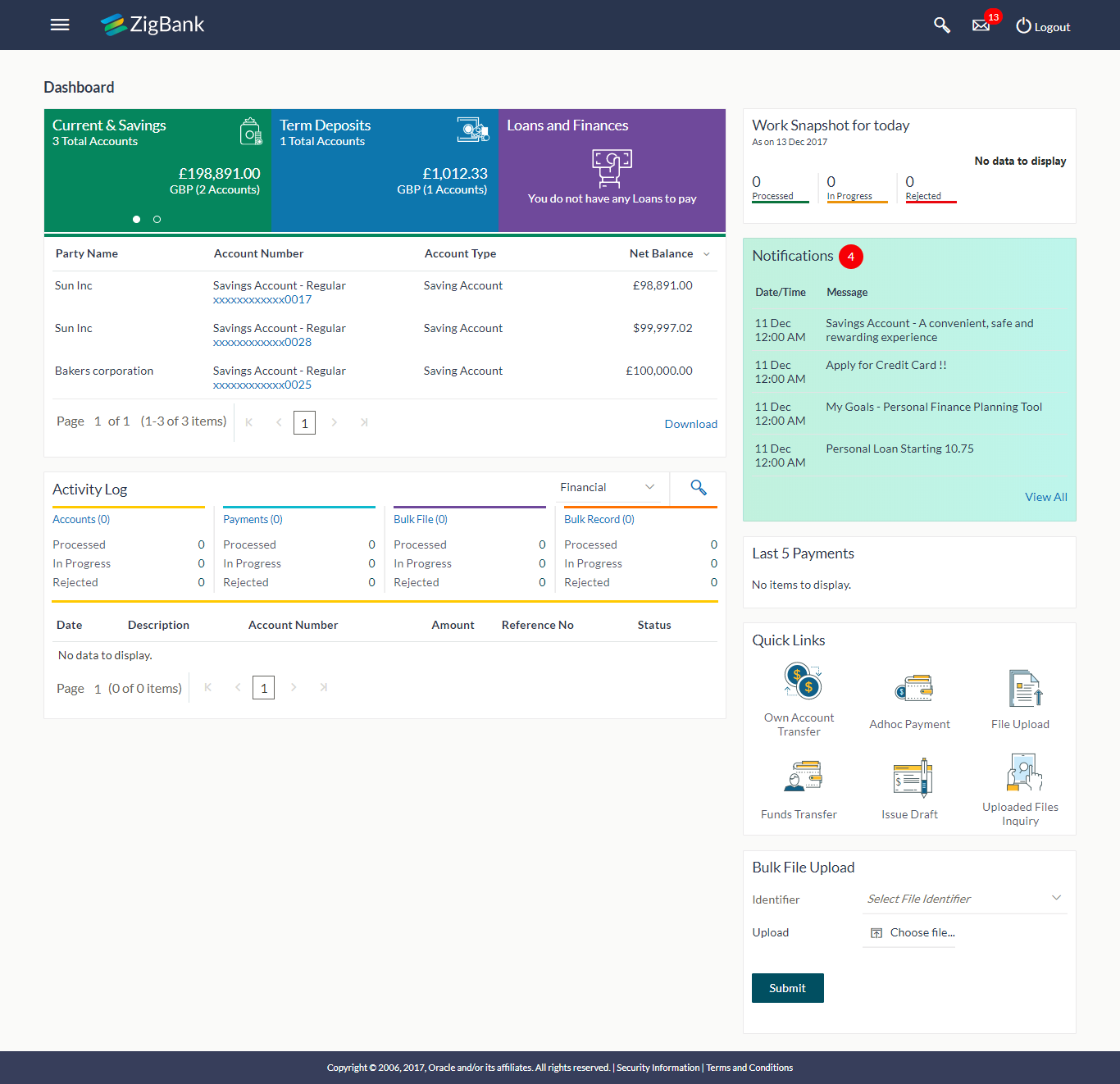

Corporate Dashboard Experience Refresh

OBDX Corporate user’s Dashboard features have been enhanced with User Experience and Design which is more intuitive and user friendly. Especially role based dashboards have been designed to deliver the right information to the right people at the right time so they can make optimal business decisions. Multiple dashboards are made available to the users based on their roles in a corporate.

Over Viewer Dashboard

This service provides the top management of any corporate with a consolidated and easy to understand view of their business immediately after logging in. This helps them to take speedy and accurate decisions to meet their short term and long term business goals.

The key information displayed on the Over viewer Dashboard is as follows:

- Financial Overview and account details

- Financial Position in different currencies

- Credit line details

- Analytical reports

- Trade contracts overview

- Corporate cumulative transaction limits

Maker Dashboard

This Dashboard is designed to cater to the corporate users who are the transaction executors. An option of Quick Links have been provided on the Dashboard for an easy access to some of the more commonly used features in the system along with the few important features like account details, activity log etc.

The key information displayed on the Maker Dashboard is as follows:

- Account summary and details

- Quick access of commonly used transactions

- Work snapshot

- Notifications

- Activity Logs

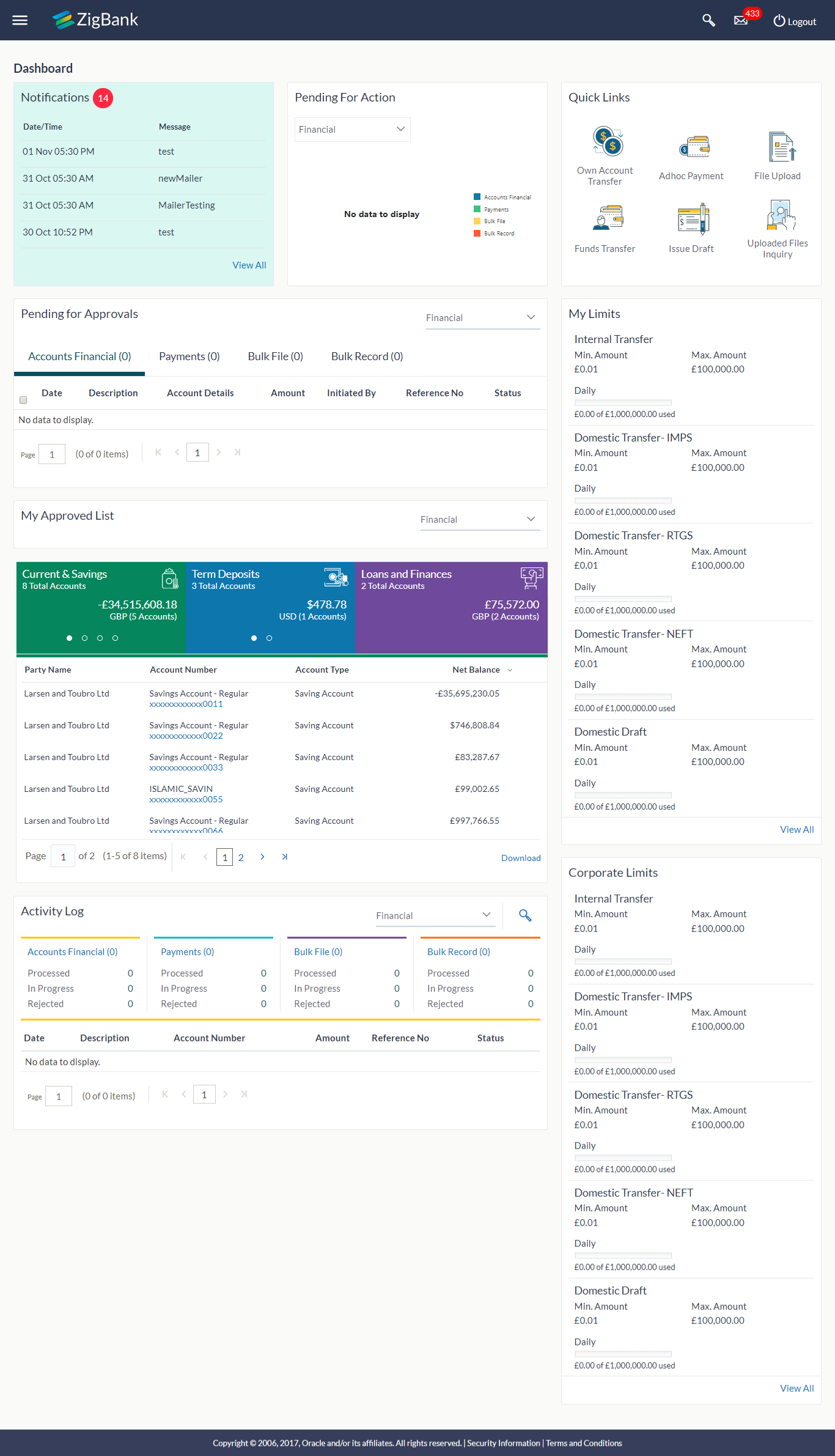

Approver Dashboard

This dashboard is available for corporate users whose significant responsibility is of approving the transactions. Approver has the responsibility to ensure correctness of financial or non-financial transaction as per the bank and corporate mandate, to ensure speedy and accurate processing.

The key information displayed on the Approver Dashboard is as follows:

- Module wise summary and details of transactions pending for action

- Option to approve or reject single or multiple transactions

- Account summary and details

- User and Corporate cumulative transaction limits

- Approved transaction details and logs

- Notifications

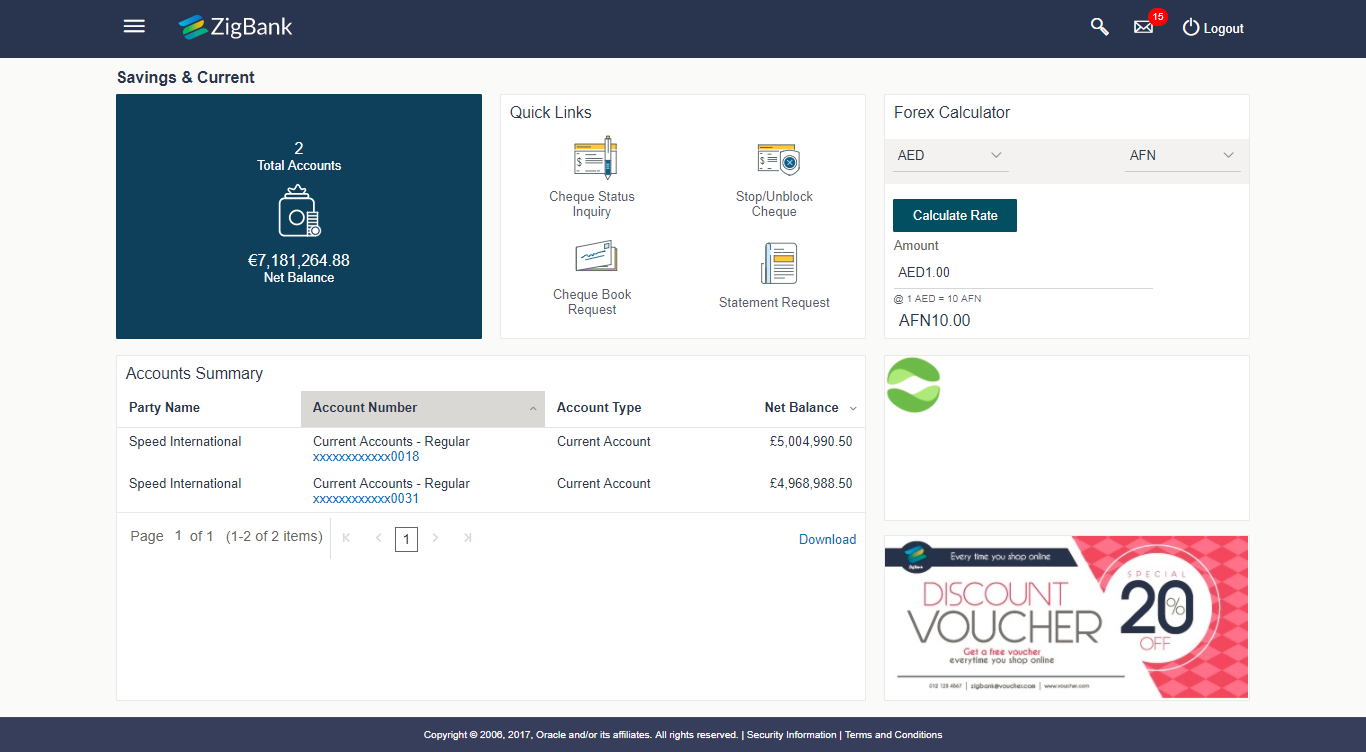

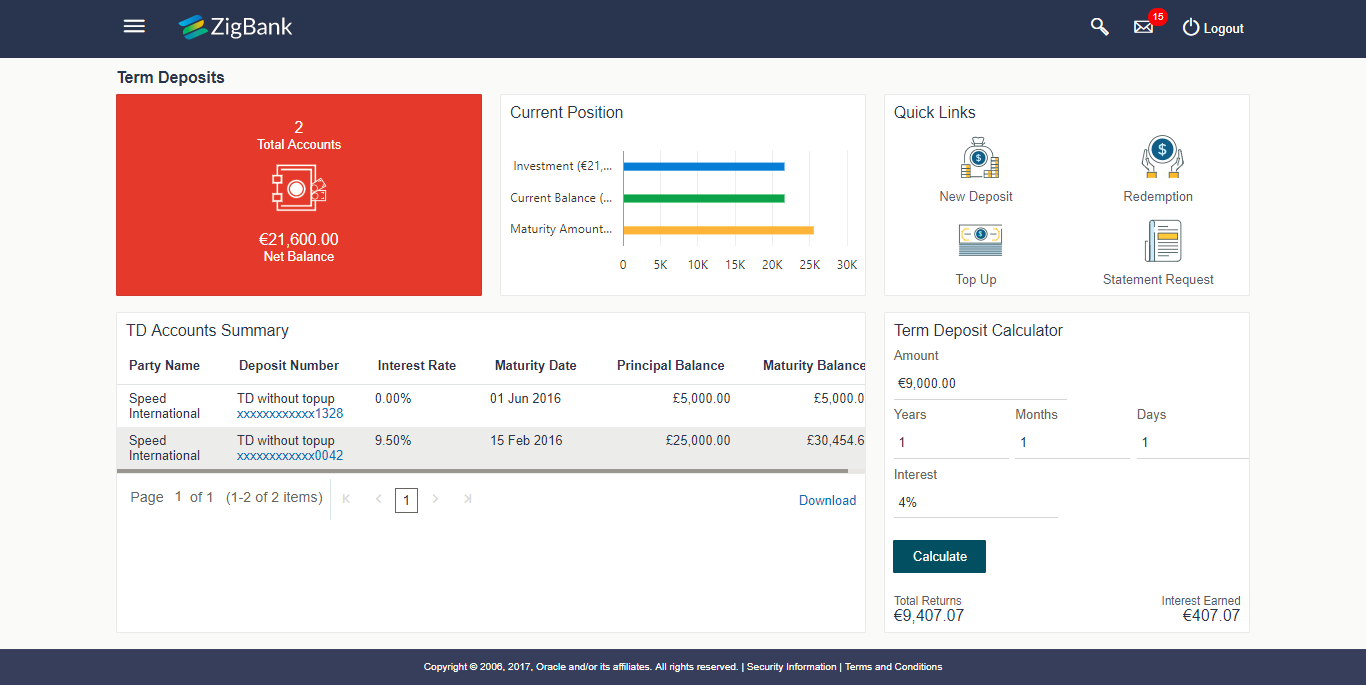

Dashboards

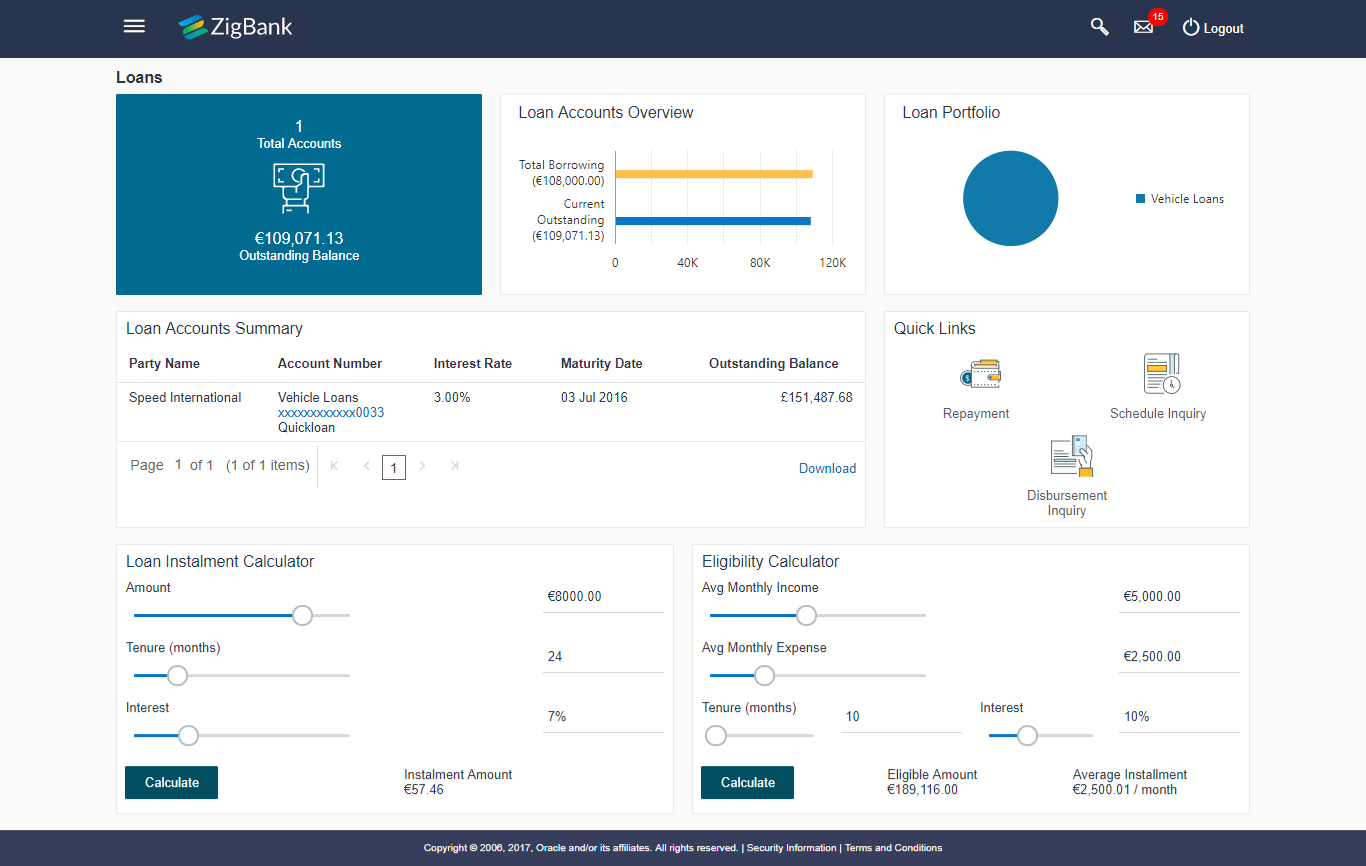

OBDX Corporate user’s module dashboards (Current and Savings Accounts, Term Deposits and Loans) have also been enhanced. The module dashboards provide a summary of the respective accounts and related transactions.

Term Deposit

Loan

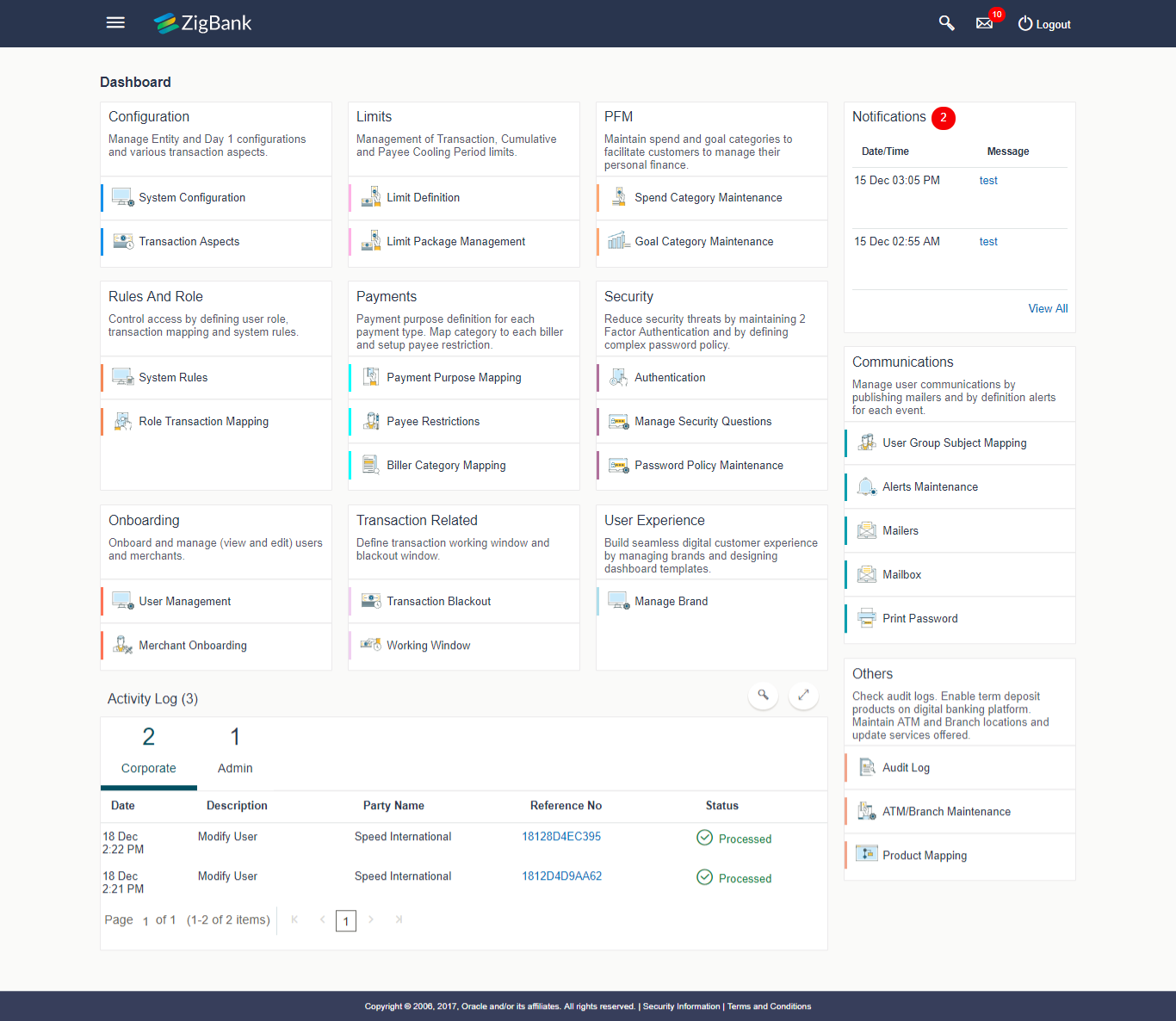

Admin Module Dashboard Refresh

Dashboard for Admin module is redesigned for a better User experience. Features and information available on the admin dashboard is logically grouped so that the user can access the transaction he is looking for.

Mobile Application Features

Under this area following enhancements are done as part of 18.1 release:

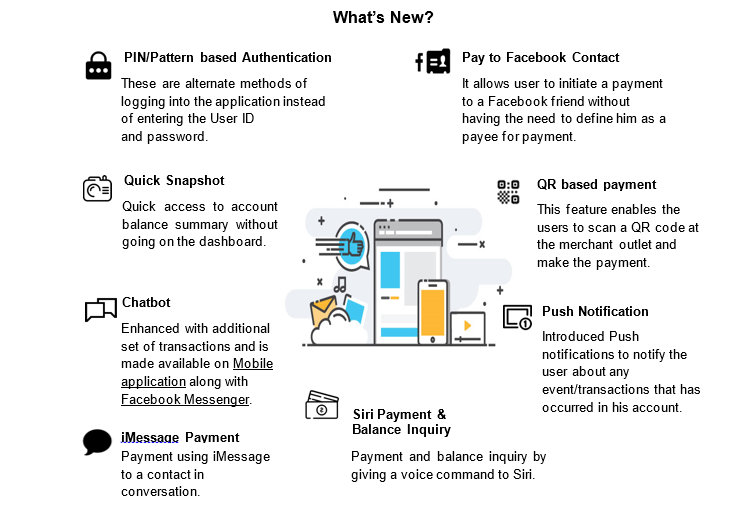

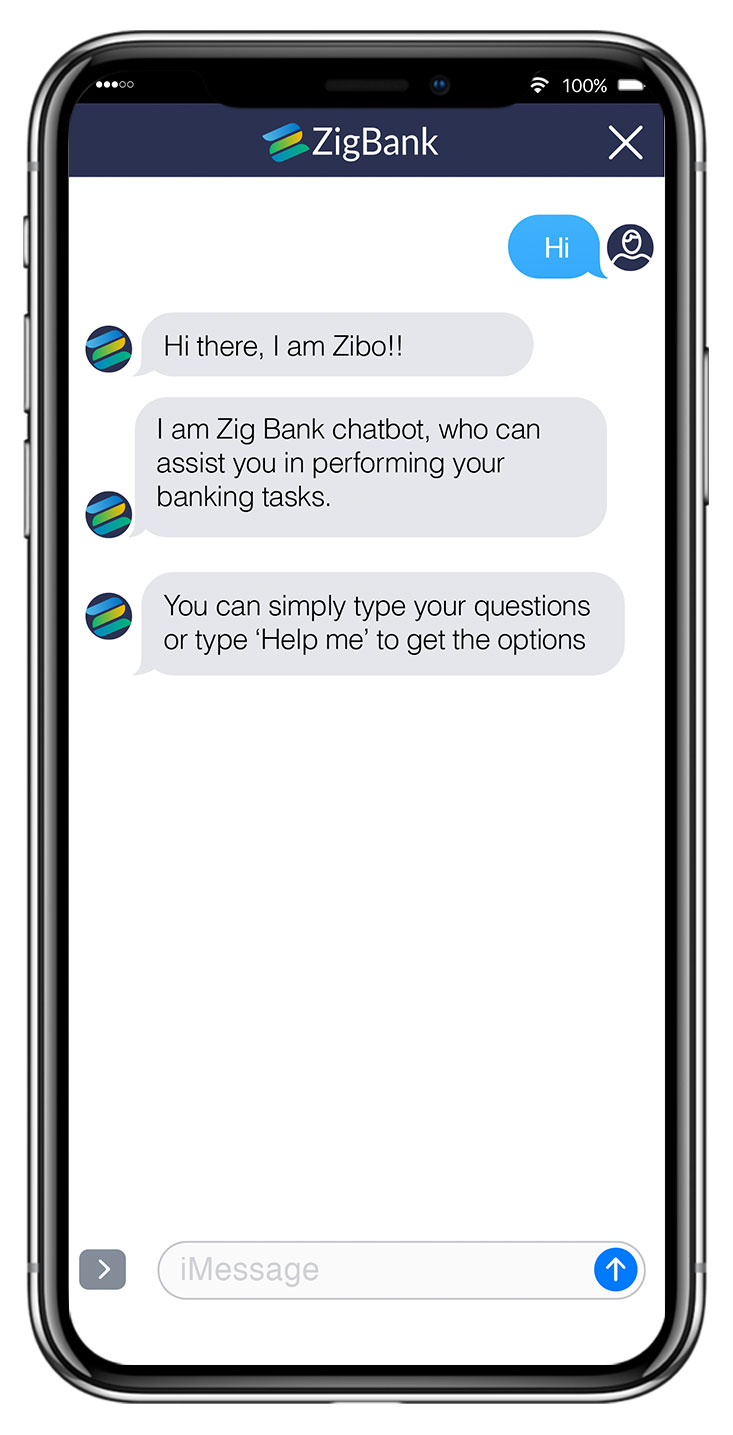

Chatbot

Chabot is a service, powered by rules and artificial intelligence that can interact with customers over a chat interface. It can answer customer queries and can perform a number of tasks requested by customer over chat.

OBDX had already introduced Chatbot service over the Facebook Messenger in the last release (OBDX17.2). In the current release, Chatbot has been enhanced with additional set of transactions and is made available on Mobile application login page as well.

New transactions introduced in Chatbot

- Spend inquiries

- Upcoming payments

- Credit card limit and due date

- Loan outstanding balance

- Loan installment date and Installment amount

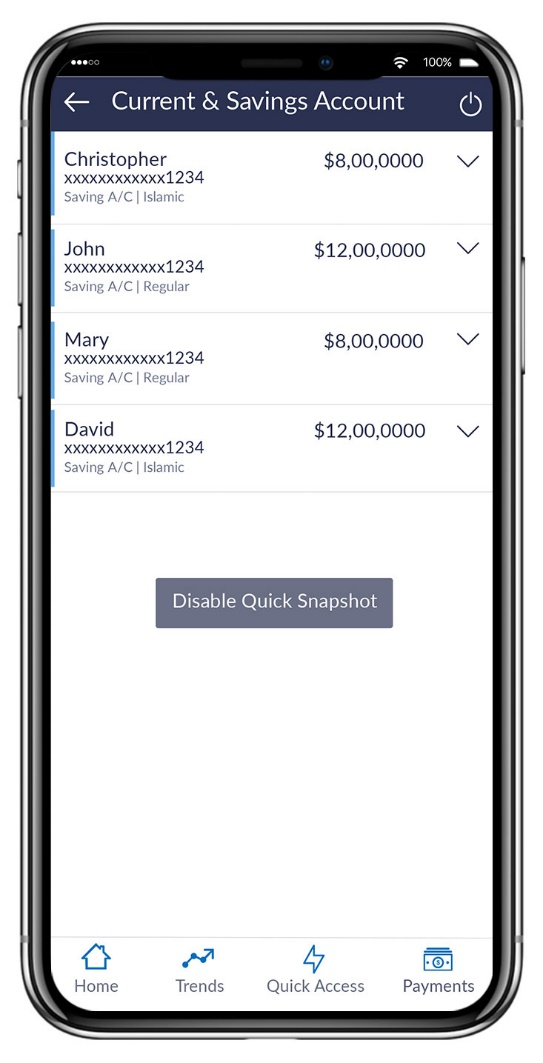

Quick Snapshot

Quick Snapshot is a summary of account information which the user can access quickly without having to go to the account dashboard.

In OBDX 18.1, Quick Snapshot feature is available on Mobile application login page, which the user can access using his alternate login method (Fingerprint/Pin/Pattern). It displays the account balance of user’s Current and Savings account and last 5 transactions on the respective accounts.

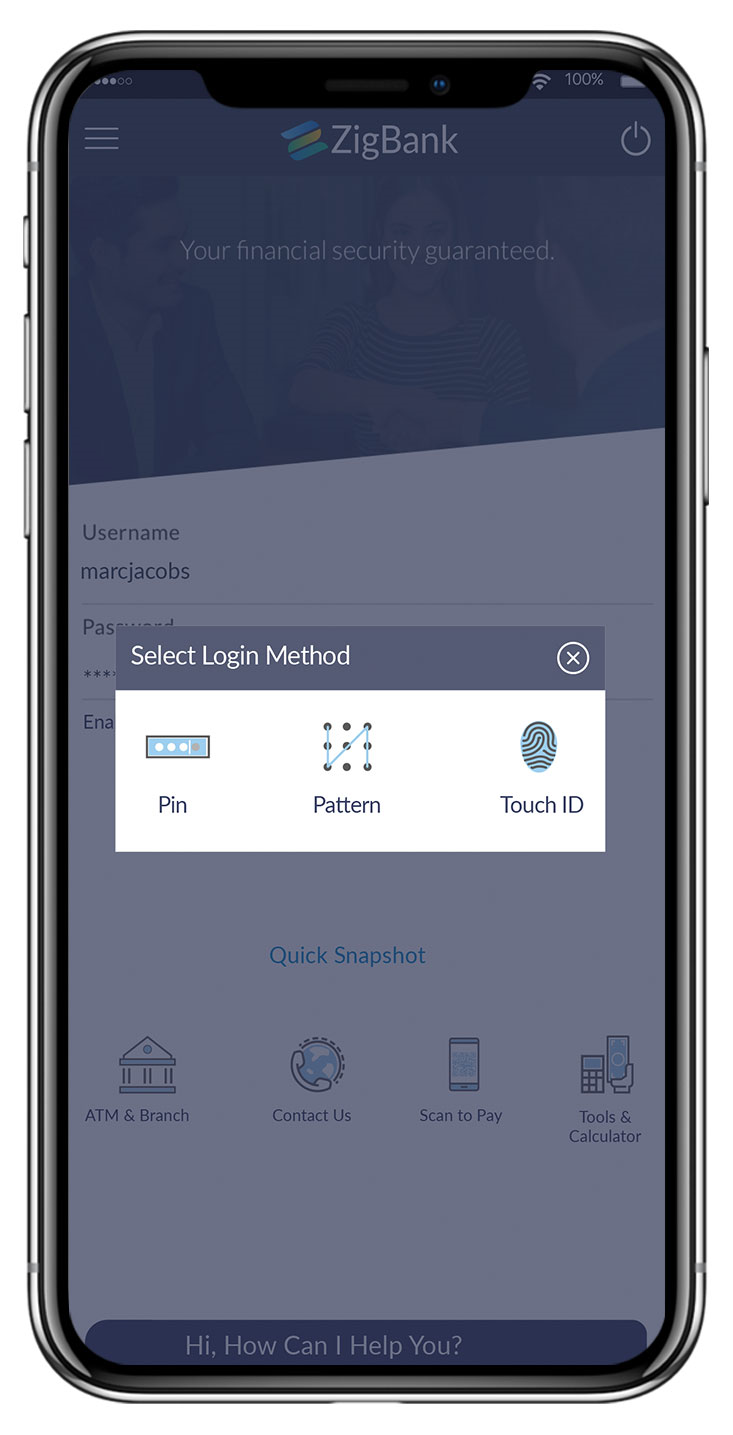

PIN/Pattern Based Authentication

PIN![]() Personal identification number (PIN) is a secret number given to an account holder to be used when they put their credit card or cash card into an automatic teller machine (ATM). If the number they use is correct they will be allowed to access their account. and Pattern are the alternate ways of logging into the application instead of entering the User ID and password.

Personal identification number (PIN) is a secret number given to an account holder to be used when they put their credit card or cash card into an automatic teller machine (ATM). If the number they use is correct they will be allowed to access their account. and Pattern are the alternate ways of logging into the application instead of entering the User ID and password.

As part of OBDX 18.1, the above two methods have been introduced to log into the Mobile Application. User can set a four or six digit PIN as his logging PIN and use the same every time to login into the application. Similarly the user can define a pattern by connecting the nine dots on the screen, which he can draw every time for logging in to Mobile application. User also has a choice to decide on the pattern visibility i.e. if the user wishes to keep the pattern visible when he/she draws to login.

User also has the option of resetting the PIN/Pattern or changing the login method from one to other.

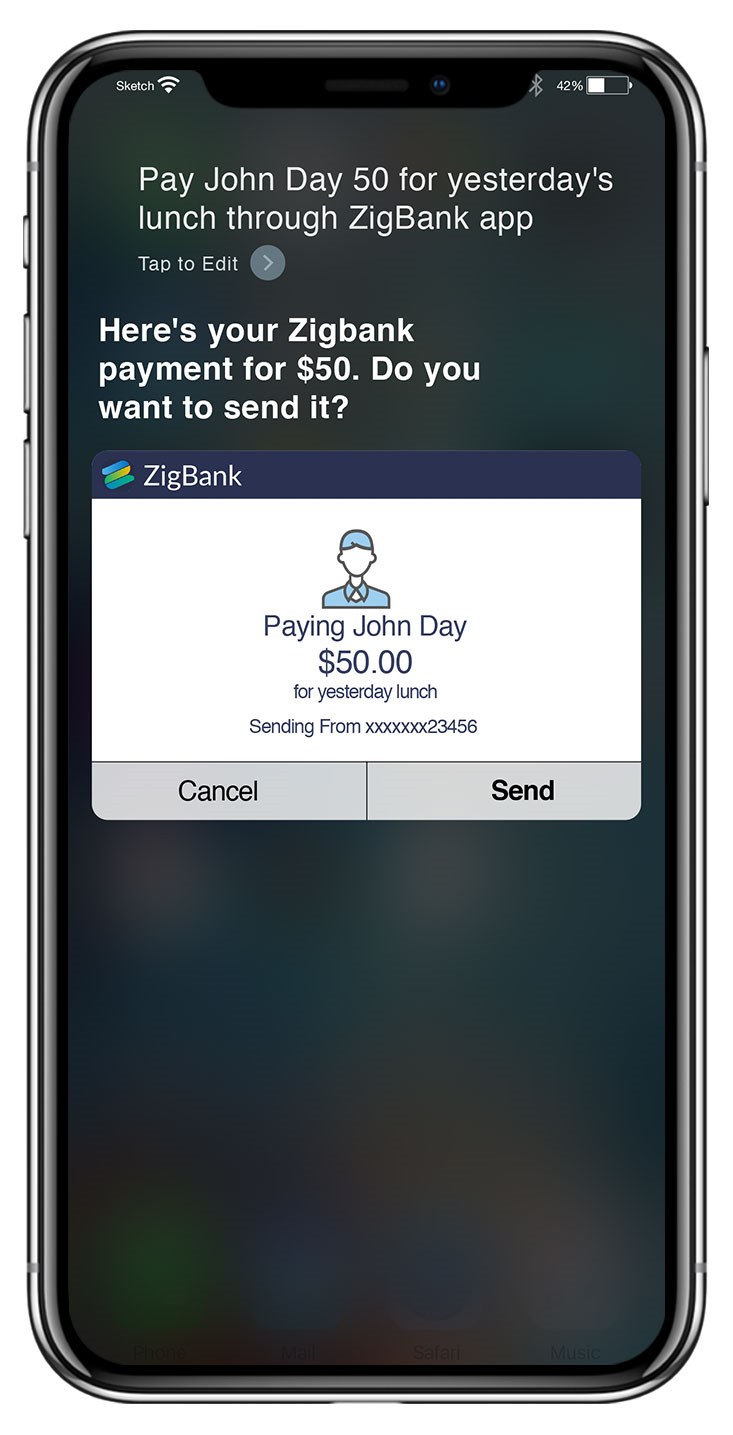

Siri Payment and Balance Inquiry

Siri Payment is another feather in the payment suite offered by OBDX. Now iOS users can simply give a voice command to Siri and tell who they want to transfer money to, without even logging into the Bank’s mobile application. The authentication of the transaction can be done by your touch Id.

In OBDX18.1 release, Siri payments can be made to the maintained payees of the user and the payment is authenticated by touch ID.

Similarly user can inquire about their account balance from Siri. User can inquire balance for Checking, Savings, Mortgage Loan and Credit Card![]() A credit card is a payment card issued to users (cardholders) as a method of payment. Accounts.

A credit card is a payment card issued to users (cardholders) as a method of payment. Accounts.

In case the user does not specify his account number at the time of inquiry; Siri will display the account balance for all his accounts.

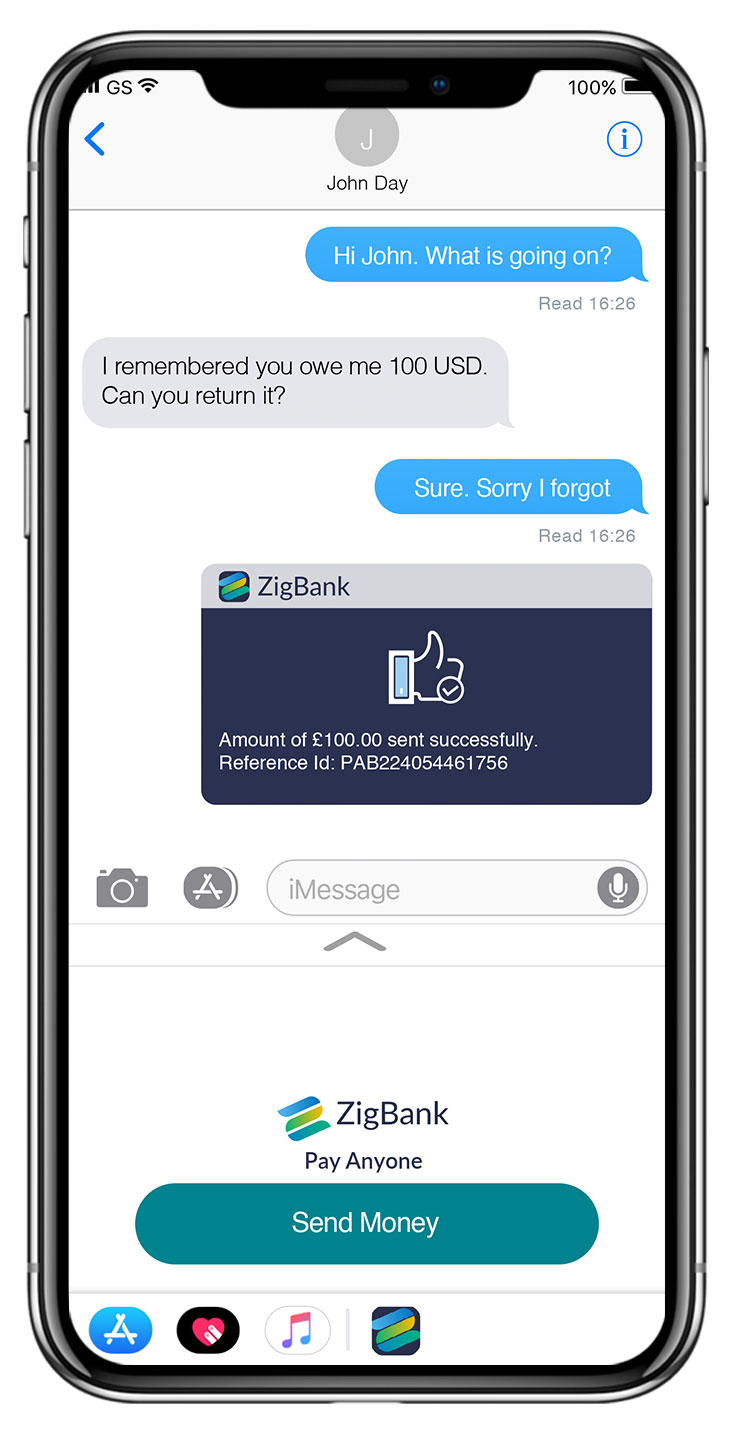

iMessage Payment

Using this feature iOS user will now be able to send money to their friends via iMessage. It allows user to make a payment to a contact in text conversation.

In OBDX18.1 release, user can make payment to a contact in text chat by selecting OBDX Mobile banking application from iMessage, user will initiate a payment by clicking on ‘Send Money’ and will be taken to an authentication screen which can be done using his touch ID. On successful authentication, the user will enter payment details and confirm the payment

System will send a link to the beneficiary to claim the payment and also generates a security code that is displayed to the initiator which needs to be shared with the beneficiary separately.

The recipient of the payment will need to click on the sent link to claim the payment by entering the security code provided by the sender.

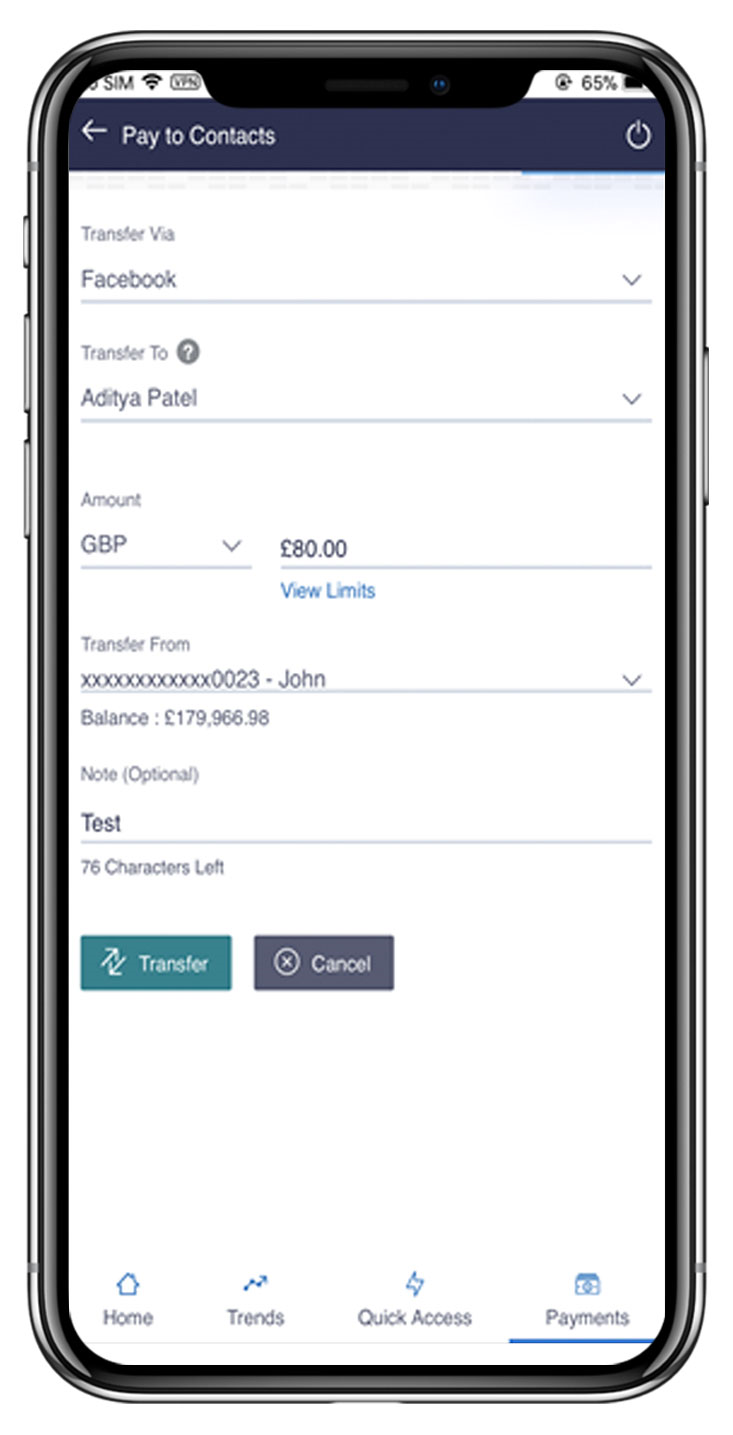

Pay to Facebook Contact

Payment to Facebook contact is a P2P payment that allows user to initiate a payment to a Facebook friend without having the need to define him as a payee for payment. Keeping in mind a segment of users where Facebook is an integral part of daily life, Facebook Payment becomes the most convenient way of payment.

Pay to Facebook contact feature is available on Mobile application as well as on web browser in OBDX Release 18.1. On clicking this option, user is asked to login with his Facebook credentials, select contact from the friend list and enter payment details. On confirmation of the payment, system generates a security code that is displayed to the initiator which needs to be shared with the Facebook contact to claim the payment.

System also creates a link and posts it on the Facebook messenger of the contact to claim the payment.

Please note that system will list only those Facebook contacts who have provided permission to the Bank to access Facebook account.

Scan to Pay (QR Payment)

Scan to Pay feature enables the users to scan a QR code at the merchant outlet and make the payment. This method provides extra security over card payments as user doesn’t have to provide his card to the merchant to swipe and he can simply make the payment using his mobile banking application. Similarly the merchant also doesn’t have to share his account details with his customers for any payments.

In OBDX 18.1 release, this feature is available on the mobile application pre-login and post login page; user can scan the QR code given by Merchant. On scanning the same, system will display the Merchant name and user will select the CASA account from which payment needs to be made and will enter the payment details to complete the transaction.

Merchant will have to get his QR code generated from his Bank. System administrator will have this option to generate the QR code for the merchants.

Please note that only internal payments can be made using this feature for now wherein the merchant and the customer both need to have accounts with the same Bank.

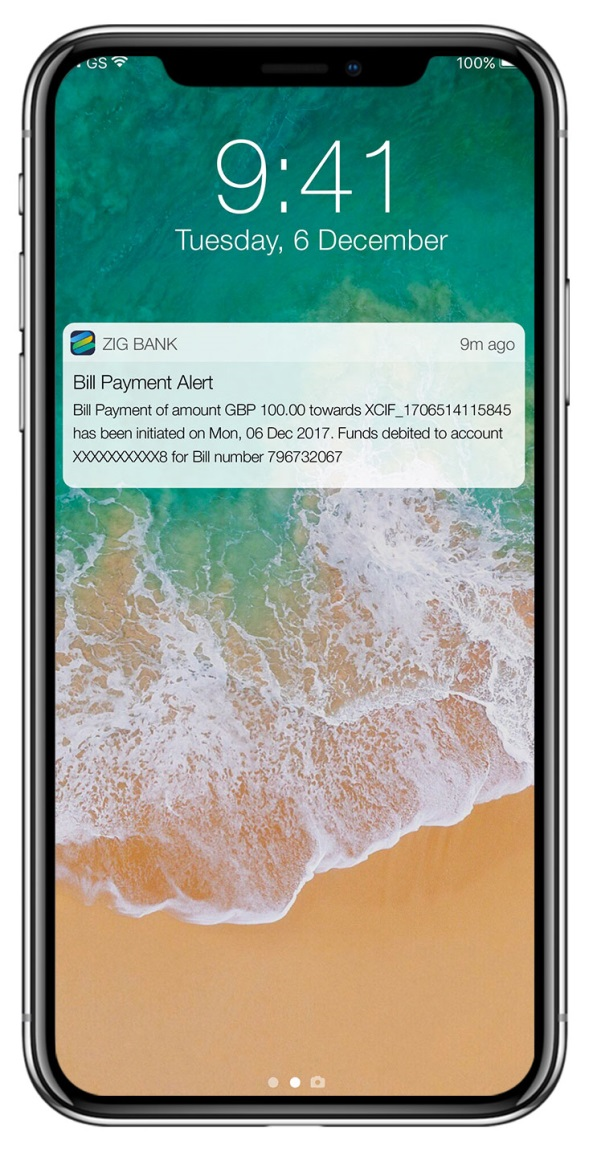

Push Notification

Push notification is a way of propagating message to the user device(s) registered with the bank. App publishers can send them at any time; users don't have to be in the app or using their devices to receive them.

Push notifications look like SMS text messages and mobile alerts, but they only reach users who have installed the mobile app and enabled push notifications on the device. Each mobile operating system (OS) i.e. Android or iOS have their own services to push notifications to the user on the basis of push token and device ID.

The main purpose of push notification is to notify the user about any event/transactions that has occurred in his account.

If the user does not wish to receive notifications through push messages then he can disable notifications through device settings.

In OBDX 18.1 user has an option to subscribe for alerts with an additional option of ‘push notification’ as the delivery mode for specific transactions in the application. If the user does not wish to receive notifications through push notifications for specific event(s), then user can disable push notification against that event.

Device De-registration

This option lets the user to disable his alternate login options (Touch ID/PIN/Pattern) incase if he loses his phone/device (on which his mobile application was installed) and wants to disable his alternate login to prevent it from getting misused by anyone.

This option can be accessed from both Mobile Application and Web browser by business user. Also the System/bank Administrator also has this option of de-registering the device from the existing User Management screen.

Qualifications

This chapter lists the qualification details of Oracle Banking Digital Experience 18.1.0.0.0 release with the Oracle’s Core banking systems and with various browsers.

|

Oracle Banking Digital Experience Modules |

Host Core Banking Systems |

|---|---|

|

Oracle Banking Digital Experience Originations Module |

Oracle Banking Platform 2.5.0.2.0 Base Version Oracle Banking Platform 2.5.0.2.0 – US Localized Version |

|

Oracle Banking Digital Experience Originations Module : Auto and Pay Day Loan |

Oracle Financial Services Leasing and Lending – 14.3.0.0.0 |

|

Oracle Banking Digital Experience Retail & Corporate Servicing |

Oracle FLEXCUBE Universal Banking 12.4.0.0.0 and 12.3.0.0.0* |

|

Oracle Banking Digital Experience Originations Module |

Oracle FLEXCUBE Universal Banking 12.4.0.0. |

* All the modules of Retail & Corporate servicing except Trade Finance are qualified with FLEXCUBE Universal Banking 12.3.0.0.0

Browser Support

|

|

Chrome |

Firefox |

Microsoft Browser |

Safari |

|---|---|---|---|---|

|

Android |

Supported * |

Not Supported |

N/A |

N/A |

|

iOS |

Not Supported |

Not Supported |

N/A |

Supported |

|

Mac OS X |

Supported |

Supported |

N/A |

Supported |

|

Windows |

Supported |

Supported |

Supported |

Not Supported |

* Support on the Android operating system is limited to Chrome for Android

For complete Browser support policy, please refer to below link:

http://www.oracle.com/technetwork/indexes/products/browser-policy-2859268.html

Known Issues and Limitations

This chapter covers the known anomalies and limitations in of Oracle Banking Digital Experience Release 18.1.0.0.

Oracle Banking Digital Experience Known Issues

There are no known issues

Oracle Banking Digital Experience Limitations

- Originations is not supported for Multi Entity setup

- Existing customer cannot open or originate a new account via originations flow

- Corporate Administrator cannot onboard users with access to multiple entities