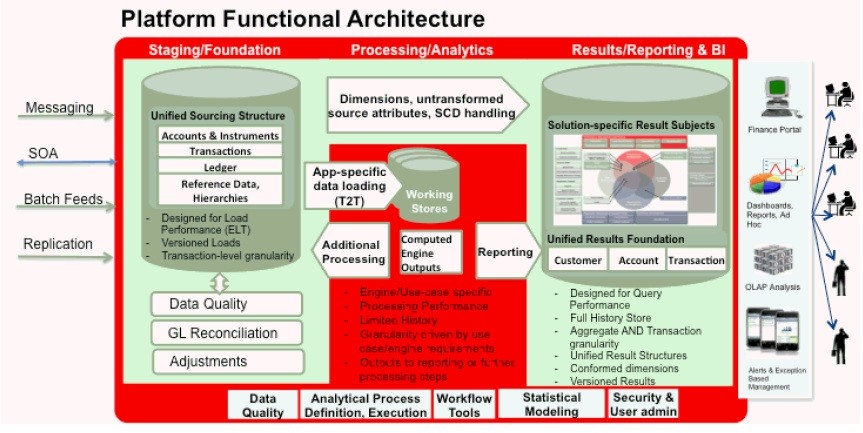

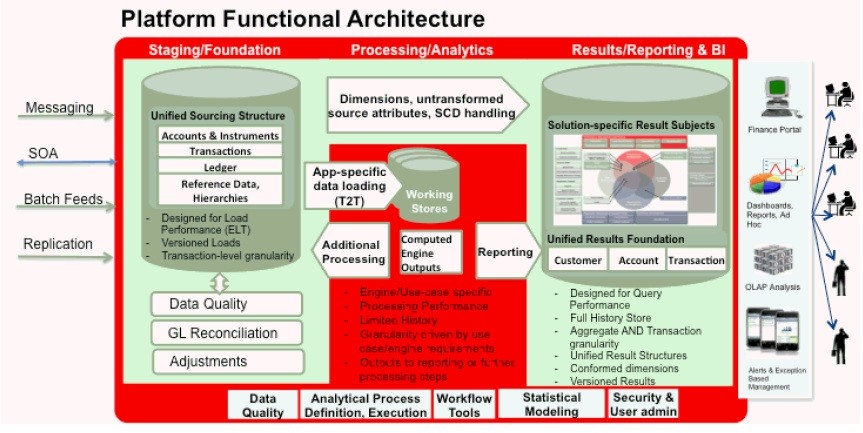

The following figure depicts the OFSDF Functional Architecture.

The OFSDF architecture can be thought of as two distinct, interacting components. The dark green colored cylindrical portions denote the data repository and the red colored portion denotes the management toolkit.

1. A data repository whose physical structure is given by the OFSDF physical data model (Here Physical Data Model = OFSDF Staging + OFSDF Reporting). This user guide only details the structure and organization of the data repository that is covered by the data models in the OFSDF.

2. A management toolkit provided by OFSAAI that is used to manage the data repository, by providing a collection of tools and frameworks based on a common metadata foundation. This user guide DOES NOT cover the details of the Analytical Application Infrastructure, as that is a separate product with its own documentation..

The architecture illustrates the following key concepts:

3. A unified data-sourcing area for analytics: The OFSDF Staging Data Model provides the basis for central, unified data-sourcing layer for a wide variety of analytical needs. The staging layer faces the operational (OLTP) and front office systems of a bank. It consists of tables to capture key business and operational data from these systems, which is then processed by one or more analytical engines.

4. A unified reporting/consumption layer: Analytical results can be simple to complex, quantitative and qualitative measures of a bank's Risk, Compliance, Customer and Financial Performance. The OFSDF Reporting data model is a dimensional data model spanning these key analytical functions. It forms the foundation of OFSAA Business Intelligence applications, but can clearly be used as the result data store for any equivalent engines and processes provided by other vendors, or custom-built solutions. By providing a single data repository for reporting needs, this layer provides a foundation for departmental as well as cross-departmental and cross-functional reporting.

Additionally, the schema of the reporting area is specifically built for Financial Services analytics. As an illustration, the reporting area has a 'Run dimension' that is shared across all BI/reporting use cases. Similarly, the aggregation of shared measures/reporting into a common set of output structures (Account Summary) allows for cross-functional reporting, which is increasingly the norm in Financial Institutions.

5. Single point of control and operation: The Oracle Financial Services Analytical Applications Infrastructure is a separate Oracle product that offers a set of tools that are built on a common metadata foundation. These tools are used to control and manage the lifecycle of data from sourcing to reporting. There is a collection of frameworks to manage the following lifecycle steps of data within OFSDF:

§ Metadata Management

§ Data Quality

§ Data Movement

§ Scheduling and runtime operations

§ Security/User management

§ Analytical Process Definition and Execution

6. Processing Area: As explained earlier, the primary purpose of the OFSDF is to serve as a container for analytical processing from sourcing to consumption. Such processing is usually delivered in the form of discrete units called analytical applications spanning different analytical use cases ranging from Finance to Risk to Compliance.

These applications consist of custom-built computational engines and numerical libraries, and may execute processes on the data that range from simple aggregations to complex, multi-step stochastic processes such as Monte-Carlo simulation.

Hence, analytical applications place varying demands on the data infrastructure in terms of volumes and speed, and hence place different demands on data architecture. In practice, the normalized (3NF) design favored for Enterprise Data Warehouses often fails to be efficient or performant when it comes to analytical processing across a wide range of use cases.

Therefore, the OFSDF recognizes the need for distinct application-specific working stores, separate from the staging and reporting area. For example, the OFSAA Asset/Liability Management application (ALM) has a distinct set of ALM-specific tables, as does the Market Risk solution.

|

NOTE |

The structure of these processing area stores is decided by the actual analytical application and engine used. The OFSAA suite of applications is organized this way, with each application managing a specific set of tables/schemas within the processing area. The processing area tables/schemas are NOT part of the OFSDF. This is because the OFSDF is intended to be an open platform. Other analytical applications and engines can equally provision data out of OFSDF by mapping their input requirements appropriately to the OFSDF staging area model. |