This chapter provides an understanding of the Oracle Financial Services Regulatory Reporting for the US Federal Reserve – Integration Pack application and its scope. It includes:

· Overview

· OFSAA Regulatory Reporting Architecture

· Scope

Regulatory reporting and financial services have evolved to be an inseparable combination. It has worsened since the 2008 financial crisis. Today, banks and financial institutions must file hundreds of regulatory reports. For the U.S. Federal Reserve alone, institutions must file multiple submissions of FFIEC-101, call reports, stress testing reports, and so on. Reporting requirements increase rapidly in number and complexity for banks operating regionally or globally, where they must file in multiple jurisdictions.

The OFS REG REP US FED solution enables financial services organizations to manage and execute regulatory reporting in a single integrated environment. It automates end-to-end processes from data capture through submission with industry-leading solutions. It leverages Oracle Financial Services Analytical Application (OFSAA) and Oracle Financial Services Data Foundation (OFSDF) for managing analytical application data. The AgileREPORTER in Regulatory Reporting (REG REP) Solution enables firms to automate the final mile of the reporting process. It provides pre-built integration to Lombard Risk Reporting, eliminating the need for further manual intervention. The solution ensures data integrity allowing banks to focus more time on analyzing and gaining new business insight from their growing stores of data instead of preparing data and reports with the sole objective of meeting submission deadlines.

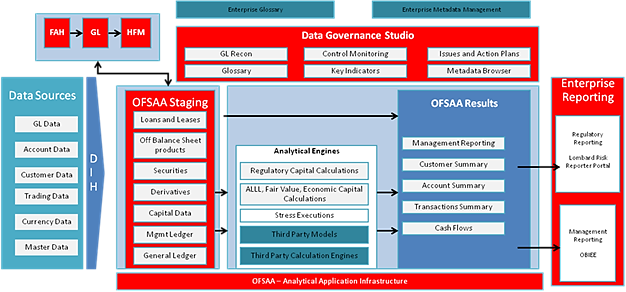

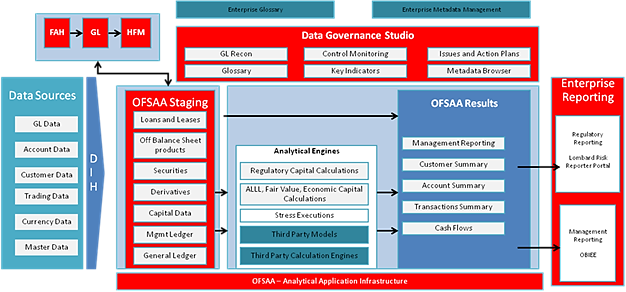

Figure 1: Regulatory Reporting (REG REP) Solution Architecture

This interface connects the Oracle FSDF to Vermeg Portal. As you can see in the Architecture figure above, Data flows from OFSAA to Vermeg Portal.

OFSDF is an analytical data warehouse platform for the Financial Services industry. It combines an industry data model for Financial Services along with a set of management and infrastructure tools that allows Financial Services Institutions to develop, deploy, and operate analytical solutions spanning key functional areas in Financial Services, including:

1. Enterprise Risk Management

2. Enterprise Performance Management

3. Customer Insight

4. Financial Crime and Compliance Management

OFSDF is a comprehensive data management platform that helps institutions to manage the analytical data life cycle from sourcing to reporting and business intelligence/BI using a unified, consistent platform and toolset.

AgileREPORTER is a form and workflow tool that enables both creation and submission of regulatory returns. AgileREPORTER addresses the financial reporting requirements of both domestic and international banks and financial institutions by automating compliance with mandated reports to central banks, regulatory agencies. AgileREPORTER works easily with multiple sources of information as it standardizes data elements and automates regulatory report production in prescribed templates with the associated workflow for automatic submission. It is a reliable and efficient infrastructure to compile, generate, and submit regulatory reports. It collects data from a wide universe (not just OFSAA Results). It provides automated repeated manual adjustments, variance analysis, and validation checks. It provides features to explain and justify a number quickly, including links to OBIEE.

The solution provides a pre-built interface or integration between FSDF and AgileREPORTER. With this integration, you can automate the end-to-end reporting process covering data preparation to the last mile of reporting.

Oracle Financial Services Regulatory Reporting for US Federal Reserve – Integration Pack covers the following regulatory reports for specified release as mentioned in the table:

Table 2: Scope of Regulatory Reports and Schedules

Report |

Report |

Report Name |

Released Version |

|---|---|---|---|

FR Y-9C |

FR Y-9C |

Consolidated Financial Statements for Holding Companies |

8.1.1.0.0 |

FR Y-20 |

FR Y-20 |

Financial Statements for a Bank Holding Company Subsidiary Engaged in Bank-Ineligible Securities Underwriting and Dealing |

8.1.1.0.0 |

FR Y-15 |

FR Y-15 |

Banking Organization Systemic Risk Report |

8.1.1.0.0 |

FFIEC-009 |

FFIEC-009 |

Country Exposure Report |

8.1.1.0.0 |

FFIEC-009A |

FFIEC-009A |

Country Exposure Information Report |

8.1.1.0.0 |

FR Y-11 |

FR Y-11 |

Financial Statements of U.S. Nonbank Subsidiaries of U.S. Holding Companies |

8.1.1.0.0 |

FR Y-11S |

FR Y-11S |

Abbreviated Financial Statements of U.S. Nonbank |

8.1.1.0.0 |

FR-2314 |

FR-2314 |

Financial Statements of Foreign Subsidiaries of U.S. Banking Organizations |

8.1.1.0.0 |

FR-2314S |

FR-2314S |

Abbreviated Financial Statements of Foreign Subsidiaries of U.S. Banking Organizations |

8.1.1.0.0 |

FR Y-9LP |

FR Y-9LP |

Parent Company Only Financial Statements for Large Holding Companies |

8.1.1.0.0 |

FFIEC-031 |

FFIEC-031 |

Consolidated Reports of Condition and Income for a Bank with Domestic and Foreign Offices |

8.1.1.0.0 |

FR Y-12 |

FR Y-12 |

Consolidated Holding Company Report of Equity Investments in Nonfinancial Companies |

8.1.1.0.0 |

FFIEC-041 |

FFIEC-041 |

Consolidated Reports of Condition and Income for a Bank with Domestic Offices Only |

8.1.1.0.0 |

FR-2052A |

FR-2052A |

Complex Institution Liquidity Monitoring Report |

8.1.1.0.0 |

FR Y-7N |

FR Y-7N |

Financial Statements of U.S. Nonbank Subsidiaries Held by Foreign Banking Organizations |

8.1.1.0.0 |

FR Y-7NS |

FR Y-7NS |

Abbreviated Financial Statements of U.S. Nonbank Subsidiaries Held by Foreign Banking Organizations |

8.1.1.0.0 |

FR-2644 |

FR-2644 |

Weekly Report of Selected Assets and Liabilities of Domestically Chartered Commercial Banks and U.S. Branches and Agencies of Foreign Banks |

8.1.1.0.0 |

FR-2886B |

FR-2886B |

Cash and Balances Due from Depository Institutions |

8.1.1.0.0 |

FR-2900 |

FR-2900 |

Report of Transaction Accounts, Other Deposits, and Vault Cash (Commercial Banks) |

8.1.1.0.0 |

FR Y-14Q |

FR Y-14Q |

Schedule M.1 – Balances |

8.1.1.0.0 |

FR Y-14Q |

FR Y-14Q |

Schedule K – Supplemental |

8.1.1.0.0 |

FR Y-14Q |

FR Y-14Q |

Schedule A – Retail |

8.1.1.0.0 |

FR Y-14Q |

FR Y-14Q |

Schedule H – Wholesale Risk |

8.1.1.0.0 |

FR Y-14M |

FR Y-14M |

Capital Assessments and Stress Testing Report - Monthly |

8.1.1.0.0 |

FFIEC-101 |

FFIEC-101 |

Regulatory Capital Reporting for Institutions Subject to the Advanced Capital Adequacy Framework |

8.1.1.0.0 |

FDIC-8020 |

FDIC-8020 |

Statement of Deposits |

8.1.1.0.0 |

FFIEC-002 |

FFIEC-002 |

Assets and Liabilities of U.S. Branches and Agencies of Foreign Banks |

8.1.1.0.0 |

FR 2420 |

FR 2420 |

Selected Money Market Rates |

8.1.1.0.0 |

FFIEC-030 |

FFIEC-030 |

Foreign Branch Report of Condition |

8.1.1.0.0 |

FFIEC-030S |

FFIEC-030S |

Abbreviated Foreign Branch Report of Condition |

8.1.1.0.0 |

FR Y-7Q |

FR Y-7Q |

The Capital and Asset Report for Foreign Banking Organizations |

8.1.1.0.0 |

FR 2835A |

FR 2835A |

Quarterly Report of Credit Card Plans |

8.1.1.0.0 |

FR 2502Q |

FR 2502Q |

Quarterly Report of Assets and Liabilities of Large Foreign Offices of U.S. Banks |

8.1.1.0.0 |

The following table lists the detailed scope.

Table 3: Detailed Scope of Reports and Schedules

Sl. No. |

Sl. No. |

Report Code |

Schedule Code |

Sl. No. |

Report Code |

Schedule Name |

|---|---|---|---|---|---|---|

1 |

1 |

FDIC-8020 |

– |

1 |

FDIC-8020 |

Statement of Deposits |

2 |

2 |

FFIEC-009 |

C Part I |

2 |

FFIEC-009 |

Claims on an Immediate Risk Basis |

3 |

3 |

FFIEC-009 |

C Part II |

3 |

FFIEC-009 |

Claims on an Ultimate Risk Basis and Memorandum Items |

4 |

4 |

FFIEC-009 |

D |

4 |

FFIEC-009 |

Claims from Positions in Derivative Contracts |

5 |

5 |

FFIEC-009 |

L |

5 |

FFIEC-009 |

Foreign-Office Liabilities |

6 |

6 |

FFIEC-009 |

O |

6 |

FFIEC-009 |

Off-Balance-Sheet Items |

7 |

7 |

FFIEC-009A |

A |

7 |

FFIEC-009A |

Country Exposure Information Report Part A |

8 |

8 |

FFIEC-009A |

B |

8 |

FFIEC-009A |

Country Exposure Information Report Part B |

9 |

9 |

FFIEC-031 |

RC-S |

9 |

FFIEC-031 |

Servicing, Securitization, and Asset Sale Activities |

10 |

10 |

FFIEC-031 |

RC-V |

10 |

FFIEC-031 |

Variable Interest Entities |

11 |

11 |

FFIEC-031 |

RC |

11 |

FFIEC-031 |

Balance Sheet |

12 |

12 |

FFIEC-031 |

RC-A |

12 |

FFIEC-031 |

Cash and Balances Due from Depository Institutions |

13 |

13 |

FFIEC-031 |

RC-B |

13 |

FFIEC-031 |

Securities(bugs) |

14 |

14 |

FFIEC-031 |

RC-C |

14 |

FFIEC-031 |

Loans and Lease Financing Receivables(bugs) |

15 |

15 |

FFIEC-031 |

RC-D |

15 |

FFIEC-031 |

Trading Assets and Liabilities |

16 |

16 |

FFIEC-031 |

RC-E |

16 |

FFIEC-031 |

Deposit Liabilities |

17 |

17 |

FFIEC-031 |

RC-F |

17 |

FFIEC-031 |

Other Assets |

18 |

18 |

FFIEC-031 |

RC-G |

18 |

FFIEC-031 |

Other Liabilities |

19 |

19 |

FFIEC-031 |

RC-H |

19 |

FFIEC-031 |

Selected Balance Sheet Items for Domestic Offices |

20 |

20 |

FFIEC-031 |

RC-I |

20 |

FFIEC-031 |

Assets and Liabilities of IBFs |

21 |

21 |

FFIEC-031 |

RC-K |

21 |

FFIEC-031 |

Quarterly Averages |

22 |

22 |

FFIEC-031 |

RC-L |

22 |

FFIEC-031 |

Derivatives and Off-Balance-Sheet Items |

23 |

23 |

FFIEC-031 |

RC-M |

23 |

FFIEC-031 |

Memoranda |

24 |

24 |

FFIEC-031 |

RC-N |

24 |

FFIEC-031 |

Past Due and Nonaccrual Loans, Leases, and Other Assets |

25 |

25 |

FFIEC-031 |

RC-O |

25 |

FFIEC-031 |

Other Data for Deposit Insurance and FICO Assessments |

26 |

26 |

FFIEC-031 |

RC-P |

26 |

FFIEC-031 |

1–4 Family Residential Mortgage Banking Activities in Domestic Offices |

27 |

27 |

FFIEC-031 |

RC-Q |

27 |

FFIEC-031 |

Assets and Liabilities Measured at Fair Value regularly |

28 |

28 |

FFIEC-031 |

RC-R Part I |

28 |

FFIEC-031 |

Regulatory Capital Components and Ratios |

29 |

29 |

FFIEC-031 |

RC-R Part II |

29 |

FFIEC-031 |

Risk-Weighted Assets |

30 |

30 |

FFIEC-031 |

RC-T |

30 |

FFIEC-031 |

Fiduciary and Related Services |

31 |

31 |

FFIEC-031 |

RI |

31 |

FFIEC-031 |

Income Statement |

32 |

32 |

FFIEC-031 |

RI-A |

32 |

FFIEC-031 |

Changes in Equity Capital |

33 |

33 |

FFIEC-031 |

RI-B |

33 |

FFIEC-031 |

Charge-offs and Recoveries and Changes in Allowance for Loan and Lease Losses |

34 |

34 |

FFIEC-031 |

RI-C |

34 |

FFIEC-031 |

Disaggregated Data on the Allowance for Loan and Lease Losses |

35 |

35 |

FFIEC-031 |

RI-D |

35 |

FFIEC-031 |

Income from Foreign Offices |

36 |

36 |

FFIEC-031 |

RI-E |

36 |

FFIEC-031 |

Explanations |

37 |

37 |

FFIEC-041 |

RC |

37 |

FFIEC-041 |

Balance Sheet |

38 |

38 |

FFIEC-041 |

RC-A |

38 |

FFIEC-041 |

Cash and Balances Due from Depository Institutions |

39 |

39 |

FFIEC-041 |

RC-B |

39 |

FFIEC-041 |

Securities |

40 |

40 |

FFIEC-041 |

RC-C |

40 |

FFIEC-041 |

Loans and Lease Financing Receivables |

41 |

41 |

FFIEC-041 |

RC-D |

41 |

FFIEC-041 |

Trading Assets and Liabilities |

42 |

42 |

FFIEC-041 |

RC-E |

42 |

FFIEC-041 |

Deposit Liabilities |

43 |

43 |

FFIEC-041 |

RC-F |

43 |

FFIEC-041 |

Other Assets |

44 |

44 |

FFIEC-041 |

RC-G |

44 |

FFIEC-041 |

Other Liabilities |

45 |

45 |

FFIEC-041 |

RC-K |

45 |

FFIEC-041 |

Quarterly Averages |

46 |

46 |

FFIEC-041 |

RC-L |

46 |

FFIEC-041 |

Derivatives and Off-Balance-Sheet Items |

47 |

47 |

FFIEC-041 |

RC-M |

47 |

FFIEC-041 |

Memoranda |

48 |

48 |

FFIEC-041 |

RC-N |

48 |

FFIEC-041 |

Past Due and Nonaccrual Loans, Leases, and Other Assets |

49 |

49 |

FFIEC-041 |

RC-O |

49 |

FFIEC-041 |

Other Data for Deposit Insurance and FICO Assessments |

50 |

50 |

FFIEC-041 |

RC-P |

50 |

FFIEC-041 |

1–4 Family Residential Mortgage Banking Activities |

51 |

51 |

FFIEC-041 |

RC-Q |

51 |

FFIEC-041 |

Assets and Liabilities Measured at Fair Value on a Recurring Basis |

52 |

52 |

FFIEC-041 |

RC-R Part I |

52 |

FFIEC-041 |

Regulatory Capital Components and Ratios |

53 |

53 |

FFIEC-041 |

RC-R Part II |

53 |

FFIEC-041 |

Risk-Weighted Assets |

54 |

54 |

FFIEC-041 |

RC-S |

54 |

FFIEC-041 |

Servicing, Securitization, and Asset Sale Activities |

55 |

55 |

FFIEC-041 |

RC-T |

55 |

FFIEC-041 |

Fiduciary and Related Services |

56 |

56 |

FFIEC-041 |

RC-V |

56 |

FFIEC-041 |

Variable Interest Entities |

57 |

57 |

FFIEC-041 |

RI |

57 |

FFIEC-041 |

Income Statement |

58 |

58 |

FFIEC-041 |

RI-A |

58 |

FFIEC-041 |

Changes in Bank Equity Capital |

59 |

59 |

FFIEC-041 |

RI-B |

59 |

FFIEC-041 |

Charge-offs and Recoveries and Changes in Allowance for Loan and Lease Losses |

60 |

60 |

FFIEC-041 |

RI-C |

60 |

FFIEC-041 |

Disaggregated Data on the Allowance for Loan and Lease Losses |

61 |

61 |

FFIEC-041 |

RI-E |

61 |

FFIEC-041 |

Explanations |

62 |

62 |

FFIEC-101 |

– |

62 |

FFIEC-101 |

Advanced Capital Adequacy Framework |

63 |

63 |

FR Y-11 |

BS |

63 |

FR Y-11 |

Balance Sheet |

64 |

64 |

FR Y-11 |

BS-A |

64 |

FR Y-11 |

Loans and Lease Financing Receivables |

65 |

65 |

FR Y-11 |

BS-M |

65 |

FR Y-11 |

Memoranda |

66 |

66 |

FR Y-11 |

IS |

66 |

FR Y-11 |

Income Statement (calendar year-to-date) |

67 |

67 |

FR Y-11 |

IS-A |

67 |

FR Y-11 |

Changes in Equity Capital |

68 |

68 |

FR Y-11 |

IS-B |

68 |

FR Y-11 |

Changes in Allowance for Loan and Lease Losses |

69 |

69 |

FR Y-11S |

List |

69 |

FR Y-11S |

Detailed Listing of Subsidiaries |

70 |

70 |

FR Y-12 |

A |

70 |

FR Y-12 |

Type of Investments |

71 |

71 |

FR Y-12 |

B |

71 |

FR Y-12 |

Type of Security |

72 |

72 |

FR Y-12 |

C |

72 |

FR Y-12 |

Type of Entity within the Banking Organization |

73 |

73 |

FR Y-12 |

D |

73 |

FR Y-12 |

Non-financial Investment Transactions During Reporting Period |

79 |

79 |

FR Y-14M |

– |

79 |

FR Y-14M |

Capital Assessments and Stress Testing Report |

80 |

80 |

FR Y-14M |

A-1 |

80 |

FR Y-14M |

Domestic First Lien Closed-end 1-4 Family Residential Loan Data – Loan Level Table |

81 |

81 |

FR Y-14M |

A-2 |

81 |

FR Y-14M |

Domestic First Lien Closed-end 1-4 Family Residential Loan Data – Portfolio Level Table |

82 |

82 |

FR Y-14M |

B-1 |

82 |

FR Y-14M |

Domestic Home Equity Loan and Home Equity Line – Loan Level Table |

83 |

83 |

FR Y-14M |

B-2 |

83 |

FR Y-14M |

Domestic Home Equity Loan and Home Equity Line – Portfolio Level Table |

84 |

84 |

FR Y-14M |

C-1 |

84 |

FR Y-14M |

Address Matching Loan Level Data |

85 |

85 |

FR Y-14M |

D-1 |

85 |

FR Y-14M |

Domestic Credit Card Data – Loan Level Table |

86 |

86 |

FR Y-14M |

D-2 |

86 |

FR Y-14M |

Domestic Credit Card Data – Portfolio Level Table |

87 |

87 |

FR Y-14QA1 |

– |

87 |

FR Y-14QA1 |

Retail |

88 |

88 |

FR Y-14QBAL |

M |

88 |

FR Y-14QBAL |

Balances |

89 |

89 |

FR Y-14QCIL |

H.1 |

89 |

FR Y-14QCIL |

Corporate Loan Data |

90 |

90 |

FR Y-14QCRE |

H.2 |

90 |

FR Y-14QCRE |

Commercial Real Estate |

91 |

91 |

FR Y-14QFVOHFS |

J |

91 |

FR Y-14QFVOHFS |

Retail Fair Value Option/Held for Sale (FVO/HFS) |

92 |

92 |

FR Y-14QMSR |

I |

92 |

FR Y-14QMSR |

MSR Valuation |

93 |

93 |

FR Y-14QopsriskBL |

E.2 |

93 |

FR Y-14QopsriskBL |

Business Line |

94 |

94 |

FR Y-14QopsriskMS |

E.1 |

94 |

FR Y-14QopsriskMS |

Operational Loss History |

95 |

95 |

FR Y-14QOpsriskRFR |

E.5 |

95 |

FR Y-14QOpsriskRFR |

Legal Reserves Frequency |

96 |

96 |

FR Y-14QopsriskTH |

E.4 |

96 |

FR Y-14QopsriskTH |

Threshold Information |

97 |

97 |

FR Y-14QOpsriskUOM |

E.3 |

97 |

FR Y-14QOpsriskUOM |

Unit-0f-Measure |

98 |

98 |

FR Y-14QPPNR |

G |

98 |

FR Y-14QPPNR |

Pre-Provision Net Revenue |

99 |

99 |

FR Y-14QRCI |

C |

99 |

FR Y-14QRCI |

Regulatory Capital Instruments |

100 |

100 |

FR Y-14QRCT |

D |

100 |

FR Y-14QRCT |

Regulatory Capital Transitions |

101 |

101 |

FR Y-14QretailAuto |

A.2 |

101 |

FR Y-14QretailAuto |

US Auto Loan |

102 |

102 |

FR Y-14QretailIntauto |

A.1 |

102 |

FR Y-14QretailIntauto |

International Auto Loan |

103 |

103 |

FR Y-14QretailIntcard |

A.3 |

103 |

FR Y-14QretailIntcard |

International Credit Card |

104 |

104 |

FR Y-14QretailIntfm |

A.5 |

104 |

FR Y-14QretailIntfm |

International First Lien Mortgage |

105 |

105 |

FR Y-14QRetailINTHE |

A.4 |

105 |

FR Y-14QRetailINTHE |

International Home Equity |

106 |

106 |

FR Y-14QretailIntlothcons |

A.6 |

106 |

FR Y-14QretailIntlothcons |

International Other Consumer Schedule |

107 |

107 |

FR Y-14QretailIntsb |

A.8 |

107 |

FR Y-14QretailIntsb |

International Small Business |

108 |

108 |

FR Y-14QretailStudent |

A.10 |

108 |

FR Y-14QretailStudent |

Student Loan |

109 |

109 |

FR Y-14QretailUSothcons |

A.7 |

109 |

FR Y-14QretailUSothcons |

US Other Consumer |

110 |

110 |

FR Y-14QretailUssb |

A.9 |

110 |

FR Y-14QretailUssb |

US Small Business |

111 |

111 |

FR Y-14QSEC |

B |

111 |

FR Y-14QSEC |

Securities |

112 |

112 |

FR Y-14QSUPMNT |

K |

112 |

FR Y-14QSUPMNT |

Supplemental |

113 |

113 |

FR Y-14QTRADING |

F |

113 |

FR Y-14QTRADING |

Trading |

114 |

114 |

FR Y-15 |

– |

114 |

FR Y-15 |

Banking Organization Systemic Risk Report |

115 |

115 |

FR Y-15 |

A |

115 |

FR Y-15 |

Size Indicator |

116 |

116 |

FR Y-15 |

B |

116 |

FR Y-15 |

Interconnectedness Indicators |

117 |

117 |

FR Y-15 |

C |

117 |

FR Y-15 |

Substitutability Indicators |

118 |

118 |

FR Y-15 |

D |

118 |

FR Y-15 |

Complexity Indicators |

119 |

119 |

FR Y-15 |

E |

119 |

FR Y-15 |

Cross-Jurisdictional Activity Indicators |

120 |

120 |

FR Y-15 |

F |

120 |

FR Y-15 |

Ancillary Indicators |

121 |

121 |

FR Y-15 |

G |

121 |

FR Y-15 |

Short-Term Wholesale Funding Indicator |

122 |

122 |

FR Y-15 |

H |

122 |

FR Y-15 |

FBO Size Indicator |

123 |

123 |

FR Y-15 |

I |

123 |

FR Y-15 |

FBO Interconnectedness Indicators |

124 |

124 |

FR Y-15 |

J |

124 |

FR Y-15 |

FBO Substitutability Indicators |

125 |

125 |

FR Y-15 |

K |

125 |

FR Y-15 |

FBO Complexity Indicators |

126 |

126 |

FR Y-15 |

L |

126 |

FR Y-15 |

FBO Cross-Jurisdictional Activity Indicators (Column B) Combined U.S. Operations (Column A) U |

127 |

127 |

FR Y-15 |

M |

127 |

FR Y-15 |

FBO Ancillary Indicators |

128 |

128 |

FR Y-15 |

N |

128 |

FR Y-15 |

FBO Short-Term Wholesale Funding Indicator |

129 |

129 |

FR Y-20 |

– |

129 |

FR Y-20 |

Financial Statements for a Bank Holding Company Subsidiary Engaged in Bank-Ineligible Securities Underwriting and Dealing |

130 |

130 |

FR Y-7N |

– |

130 |

FR Y-7N |

Financial Statements of U.S. Nonbank Subsidiaries Held by Foreign Banking Organizations |

131 |

131 |

FR Y-7N |

IS |

131 |

FR Y-7N |

Income Statement |

132 |

132 |

FR Y-7N |

IS-A |

132 |

FR Y-7N |

Changes in Equity Capital |

133 |

133 |

FR Y-7N |

IS-B |

133 |

FR Y-7N |

Changes in Allowance for Loan and Lease Losses |

134 |

134 |

FR Y-7N |

BS |

134 |

FR Y-7N |

Balance Sheet |

135 |

135 |

FR Y-7N |

BS-A |

135 |

FR Y-7N |

Loans and Lease Financing Receivables |

136 |

136 |

FR Y-7N |

BS-M |

136 |

FR Y-7N |

Memoranda |

137 |

137 |

FR Y-7NS |

– |

137 |

FR Y-7NS |

Abbreviated Financial Statements of U.S. Nonbank Subsidiaries Held by Foreign Banking Organizations |

138 |

138 |

FR Y-9C |

– |

138 |

FR Y-9C |

Consolidated Financial Statements for Holding Companies |

139 |

139 |

FR Y-9C |

HI |

139 |

FR Y-9C |

Consolidated Income Statement |

140 |

140 |

FR Y-9C |

HI-A |

140 |

FR Y-9C |

Changes in Holding Company Equity Capital |

141 |

141 |

FR Y-9C |

HI-B |

141 |

FR Y-9C |

Charge-Offs and Recoveries on Loans and Leases and Changes in Allowance for Loan and Lease Losses |

142 |

142 |

FR Y-9C |

HI-C |

142 |

FR Y-9C |

Disaggregated Data on the Allowance for Loan and Lease Losses |

143 |

143 |

FR Y-9C |

HC |

143 |

FR Y-9C |

Consolidated Balance Sheet |

144 |

144 |

FR Y-9C |

HC-B |

144 |

FR Y-9C |

Securities |

145 |

145 |

FR Y-9C |

HC-C |

145 |

FR Y-9C |

Loans and Lease Financing Receivables |

146 |

146 |

FR Y-9C |

HC-D |

146 |

FR Y-9C |

Trading Assets and Liabilities |

147 |

147 |

FR Y-9C |

HC-E |

147 |

FR Y-9C |

Deposit Liabilities1 |

148 |

148 |

FR Y-9C |

HC-F |

148 |

FR Y-9C |

Other Assets |

149 |

149 |

FR Y-9C |

HC-G |

149 |

FR Y-9C |

Other Liabilities |

150 |

150 |

FR Y-9C |

HC-H |

150 |

FR Y-9C |

Interest Sensitivity |

151 |

151 |

FR Y-9C |

HC-I |

151 |

FR Y-9C |

Insurance-Related Underwriting Activities (Including Reinsurance) |

152 |

152 |

FR Y-9C |

HC-K |

152 |

FR Y-9C |

Quarterly Averages |

153 |

153 |

FR Y-9C |

HC-L |

153 |

FR Y-9C |

Derivatives and Off-Balance-Sheet Items |

154 |

154 |

FR Y-9C |

HC-M |

154 |

FR Y-9C |

Memoranda |

155 |

155 |

FR Y-9C |

HC-N |

155 |

FR Y-9C |

Past Due and Nonaccrual Loans, Leases, and Other Assets |

156 |

156 |

FR Y-9C |

HC-P |

156 |

FR Y-9C |

1–4 Family Residential Mortgage Banking Activities in Domestic Offices |

157 |

157 |

FR Y-9C |

HC-Q |

157 |

FR Y-9C |

Assets and Liabilities Measured at Fair Value on a Recurring Basis |

158 |

158 |

FR Y-9C |

HC-R |

158 |

FR Y-9C |

Regulatory Capital |

159 |

159 |

FR Y-9C |

HC-S |

159 |

FR Y-9C |

Servicing, Securitization, and Asset Sale Activities |

160 |

160 |

FR Y-9C |

HC-V |

160 |

FR Y-9C |

Variable Interest Entities |

161 |

161 |

FR Y-9LP |

– |

161 |

FR Y-9LP |

Parent Company Only Financial Statements for Large Holding Companies |

162 |

162 |

FR Y-9LP |

PI |

162 |

FR Y-9LP |

Parent Company Only Income Statement |

163 |

163 |

FR Y-9LP |

PI-A |

163 |

FR Y-9LP |

Cash Flow Statement |

164 |

164 |

FR Y-9LP |

PC |

164 |

FR Y-9LP |

Parent Company Only Balance Sheet |

165 |

165 |

FR Y-9LP |

PC-A |

165 |

FR Y-9LP |

Investments in Subsidiaries and Associated Companies |

166 |

166 |

FR Y-9LP |

PC-B |

166 |

FR Y-9LP |

Memoranda |

167 |

167 |

FR-2052A |

– |

167 |

FR-2052A |

Complex Institution Liquidity Monitoring Report |

168 |

168 |

FR-2314 |

– |

168 |

FR-2314 |

Financial Statements of Foreign Subsidiaries of U.S. Banking Organizations |

169 |

169 |

FR-2314 |

IS |

169 |

FR-2314 |

Income Statement (calendar year-to-date) |

170 |

170 |

FR-2314 |

IS-A |

170 |

FR-2314 |

Changes in Equity Capital |

171 |

171 |

FR-2314 |

IS-B |

171 |

FR-2314 |

Changes in Allowance for Loan and Lease Losses |

172 |

172 |

FR-2314 |

BS |

172 |

FR-2314 |

Balance Sheet |

173 |

173 |

FR-2314 |

BS-A |

173 |

FR-2314 |

Loans and Lease Financing Receivables |

174 |

174 |

FR-2314 |

BS-M |

174 |

FR-2314 |

Memoranda |

175 |

175 |

FR-2314S |

– |

175 |

FR-2314S |

Abbreviated Financial Statements of Foreign Subsidiaries of U.S. Banking Organizations |

176 |

176 |

FR-2644 |

– |

176 |

FR-2644 |

Weekly Report of Selected Assets and Liabilities of Domestically Chartered Commercial Banks and U.S. Branches and Agencies of Foreign Banks |

177 |

177 |

FR-2886B |

RI-A |

177 |

FR-2886B |

Changes in Equity Capital |

178 |

178 |

FR-2886B |

RC-B |

178 |

FR-2886B |

Securities |

179 |

179 |

FR-2886B |

RC |

179 |

FR-2886B |

Balance Sheet |

180 |

180 |

FR-2886B |

RC-C |

180 |

FR-2886B |

Loans and Lease Financing Receivables |

181 |

181 |

FR-2886B |

RC-M |

181 |

FR-2886B |

Claims on and Liabilities to Related Organizations |

182 |

182 |

FR-2886B |

RC-N |

182 |

FR-2886B |

Past Due and Nonaccrual Loans, Leases, and Other Assets |

183 |

183 |

FR-2886B |

RC-R |

183 |

FR-2886B |

Regulatory Capital |

184 |

184 |

FR-2886B |

RI |

184 |

FR-2886B |

Income Statement |

185 |

185 |

FR-2886B |

RI-B |

185 |

FR-2886B |

Changes in Allowance for Loan and Lease Losses |

186 |

186 |

FR-2886B |

RC-A |

186 |

FR-2886B |

Cash and Balances Due from Depository Institutions |

187 |

187 |

FR-2886B |

RC-L |

187 |

FR-2886B |

Derivatives and Off-Balance Sheet Items |

188 |

188 |

FR-2900 |

– |

188 |

FR-2900 |

Report of Transaction Accounts, Other Deposits, and Vault Cash |

189 |

189 |

FR-2420 |

A |

189 |

FR-2420 |

Federal Funds |

190 |

190 |

FR-2420 |

AA |

190 |

FR-2420 |

Selected Borrowings from Non-Exempt Entities |

191 |

191 |

FR-2420 |

B |

191 |

FR-2420 |

Eurodollars |

192 |

192 |

FR-2420 |

C |

192 |

FR-2420 |

Time Deposits and Certificates of Deposit (CDs) |

193 |

193 |

FFIEC-002 |

RAL |

193 |

FFIEC-002 |

Assets and Liabilities |

194 |

194 |

FFIEC-002 |

A |

194 |

FFIEC-002 |

Cash and Balances Due from Depository Institutions |

195 |

195 |

FFIEC-002 |

C Part I |

195 |

FFIEC-002 |

Loans and Leases |

196 |

196 |

FFIEC-002 |

C Part II |

196 |

FFIEC-002 |

Loans to Small Businesses and Small Farms |

197 |

197 |

FFIEC-002 |

E |

197 |

FFIEC-002 |

Deposit Liabilities and Credit Balances |

198 |

198 |

FFIEC-002 |

K |

198 |

FFIEC-002 |

Quarterly Averages |

199 |

199 |

FFIEC-002 |

L |

199 |

FFIEC-002 |

Derivatives and Off-Balance-Sheet Items |

200 |

200 |

FFIEC-002 |

N |

200 |

FFIEC-002 |

Past Due, Nonaccrual, and Restructured Loans |

201 |

201 |

FFIEC-002 |

O |

201 |

FFIEC-002 |

Other Data for Deposit Insurance Assessments |

202 |

202 |

FFIEC-002 |

P |

202 |

FFIEC-002 |

Other Borrowed Money |

203 |

203 |

FFIEC-002 |

Q |

203 |

FFIEC-002 |

Financial Assets and Liabilities Measured at Fair Value on a Recurring Basis |

204 |

204 |

FFIEC-002 |

T |

204 |

FFIEC-002 |

Fiduciary and Related Services |