This chapter explains the validation or edit checks for various data schedules supported within the Regulatory Reporting application.

As per regulatory references, edit checks are used during regulatory report submission to verify and improve overall data quality and communicate key structural features of the collection. "DATA COLLECTED" for the Regulator is "DATA SUBMITTED" for a reporting entity.

For template reports, edit checks are exclusively handled in VERMEG (Lombard Risk) AgileREPORTER and are not covered in the OFSAA application.

Perform the following configurations to validate / edit check for the data schedules before the Edit Check execution:

1. After logging into the OFSAAI applications page, navigate to Regulatory Reporting for US Federal Reserve application.

Figure 207: Regulatory Reporting Us Federal Reserve page

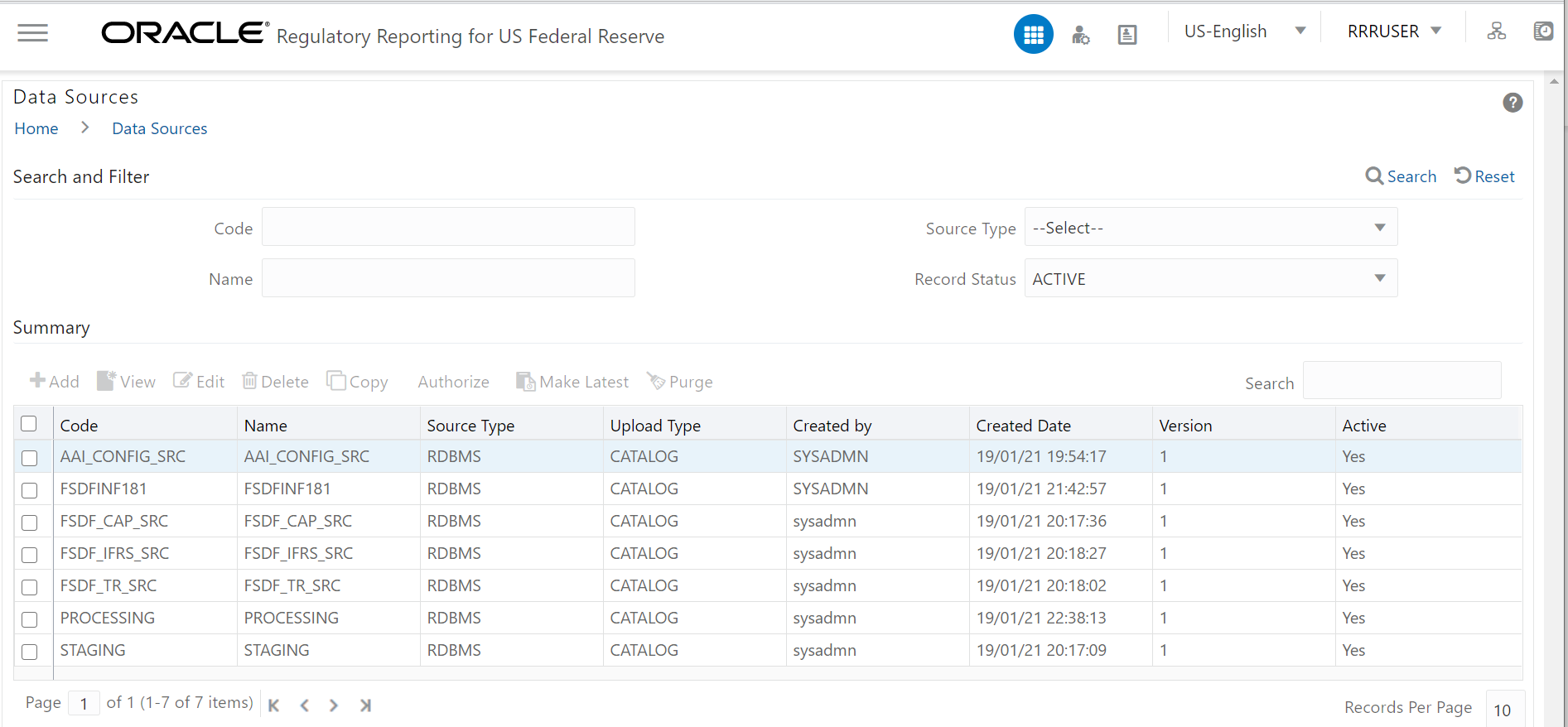

2. Navigate to Data Management Framework and select Data Sources. A new window is displayed as follows.

Figure 208: Data Sources page

3. In the Summary pane, select PROCESSING and click the Edit icon. A new edit pane is displayed.

Figure 209: Data Sources Edit page

4. Select Catalog and enter the required details.

Figure 210: Generate Model Catalog Details page

5. Click Save to complete the configuration.

The SETUP_MASTER table must be updated with the top-most parent entity for the Bank that is used for consolidation with the following SQL statement:

UPDATE SETUP_MASTER

SET V_COMPONENT_VALUE = <Topmost Parent Entity Code>

WHERE V_COMPONENT_CODE = '2052A_CONS_ENTITY_CODE';

Perform the following batch run to complete the Edit Check execution:

FSDFINFO_USFED_EDIT_CHECK_FR_2052A batch.

Perform the following steps to complete the Edit Check Batch execution:

1. Log in to OFSAA application GUI.

2. Navigate to Regulatory Reporting for US Federal Reserve, select Process and Operations, select Operations, and then select Batch Execution. The Batch Execution window is displayed as follows.

Figure 211: Batch Execution page

3. Enter the edit check name in Batch ID Like and click Search. The Batch ID is displayed in the Batch Details pane.

Figure 212: Batch Details page

4. Select the Batch ID, click the Date icon to choose the batch execution run date, and click Execute Batch.

For Batch log, navigate to Regulatory Reporting for US Federal Reserve, select Process and Operations, select Operations, and then select Batch Monitor to check the status of the batch.

The Edit Check log is classified into two types:

1. Summary Table

The FSI_EDIT_CHECK_SUMMARY table stores the summary of the edit check executions for all the OFSAA implementations of edit checks. The summary table attributes and descriptions are as follows.

Table 45: FSI Edit Check Summary Table

Attribute Name |

Attribute Description |

V_BATCH_ID |

This is the ID provided by the batch execution. |

N_EDIT_CHECK_SKEY |

This is the surrogate key (SKey) of the edit check from the FSI_EDIT_CHECK_MASTER table. |

V_DQ_CHECK_ID |

This is the ID from the DQ_CHECK_MASTER table populated for the Data Quality Check-based edit checks. |

RUN_STATUS |

The following are the values for RUN_STATUS: F – Failed E – Error I – Information W – Warning P – Pass Null – Data Quality makes no entry is for RUN_STATUS if there is no data being processed. |

FAILED_ROWS |

The number of rows for the RUN_STATUS. |

FIC_MIS_DATE |

Date of the Batch execution. |

ENTITY |

Data Transformation edit checks populate the individual entity names of the checks. |

Edit Check does not make an entry for either ENTITY or DQ_CHECK_ID if it is aggregated validations performed across multiple FR-2052A report data schedules.

2. Detail Table

The following table shows the mapping for each Edit Check and its Details Table.

Table 46: Detail Table

Edit Check No. |

Edit Check Description |

Edit Check Type |

Details Table |

2 |

Internal Transactions Reported on Consolidated Reporting Entity |

Data Quality |

DQ_RESULT_SUMM_MASTER DQ_RESULT_DETL_MASTER |

3 |

Internal Transactions Reported Without Internal Counterparty |

Data Quality |

DQ_RESULT_SUMM_MASTER DQ_RESULT_DETL_MASTER |

4 |

Lendable Value in Excess of Market Value |

Data Quality |

DQ_RESULT_SUMM_MASTER DQ_RESULT_DETL_MASTER |

5 |

Third-Party Reporting Entity Exposures versus Consolidated |

Data Transformation |

|

6 |

Symmetry of Intercompany Transactions |

Data Transformation |

|

7 |

Large Haircuts on Secured Transactions |

Data Quality |

DQ_RESULT_SUMM_MASTER DQ_RESULT_DETL_MASTER |

9 |

Missing Required Products by Entity Type |

Data Transformation |

|

10 |

Improper Intra-entity Consolidation |

Data Quality |

DQ_RESULT_SUMM_MASTER DQ_RESULT_DETL_MASTER |

12 |

Invalid or Missing Counterparty Field |

Data Quality |

DQ_RESULT_SUMM_MASTER DQ_RESULT_DETL_MASTER |

13 |

Missing or Not Applicable [Collateral Class] Field |

Data Quality |

DQ_RESULT_SUMM_MASTER DQ_RESULT_DETL_MASTER |

14 |

Large Other Product or Counterparty Balance |

Data Transformation |

FSI_EDIT_CHECK_SUMMARY |

15 |

FRY-14MD2 |

Control Total Check |

AAI_DQ_CTC_RESULT_DETAIL AAI_DQ_CTC_RESULT_SUMMARY FSI_EDIT_CHECK_SUMMARY |

16 |

FRY-14MD2 |

Specific Check |

DQ_RESULT_SUMM_MASTER DQ_RESULT_DETL_MASTER |

The Data Transformation Details Tables with the attributes and descriptions are as follows.

This table stores the result of the comparison between aggregation of maturity value, collateral value, lendable value, and market value of the top-most parent entity with its child entities.

Table 47: FSI Edit Check 5 Log

Attribute Name |

Attribute Description |

D_FIC_MIS_DATE |

FIC MIS DATE of the batch provided during execution |

N_MATURITY_STATUS |

Maturity status has two values: 0 – Maturity values of the parent not matching child entities 1 – Maturity Values of the parent matching child entities |

N_COLLATERAL_STATUS |

Collateral status has two values: 0 – the Collateral value of the parent not matching the child entities 1 – the Collateral value of parent matching the child entities |

N_LENDABLE_STATUS |

Lendable status has two values: 0 – Lendable value of the parent not matching the lendable value of the child entities 1 – Lendable values of the parent matching the lendable values of child entities |

N_MARKET_STATUS |

Market status has two values: 0 – Market value of the parent not matching child entities 1 – Market value of parent matching child entities |

V_BATCH_ID |

The batch ID of the batch being executed |

This table stores the result of the comparison between the maturity outflow amount versus the maturity inflow amount.

Table 48: FSI Edit Check 6 Log

Attribute Name |

Attribute Description |

V_INTERNAL_COUNTERPARTY |

Internal Counterpart value of the Inflow / Outflow |

D_FIC_MIS_DATE |

FIC MIS DATE of the batch provided during execution |

N_ED_STATUS |

ED status has two values: 0 – Maturity value sum of inflow not matching outflow 1 – Maturity value sum of inflow matching outflow |

V_BATCH_ID |

The batch ID of the batch being executed |

V_REPORTING_ENTITY |

Legal Entity Name / Internal Counterparty of the views |

5. FSI_RUN_PROD_BY_ENT_TYP_LOG

This table stores the availability status of PIDs for the reporting entity’s entity type.

Table 49: PID Reporting Entity Type

Attribute Name |

Attribute Description |

RUN_SKEY |

RUN SKEY is the run from the views |

FIC_MIS_DATE |

FIC MIS Date of the batch being executed |

ENTITY_TYPE |

Entity Type of the Reporting Entity |

PID |

PID of the record from view |

STATUS_FLAG |

Status values have two flags: 1 – PID is present for that entity type of Reporting Entity 0 – PID missing for that entity type of Reporting Entity |

BATCH_ID |

The batch ID of the batch being executed |

The status of validation/edit checks are stored in the following SQL statement:

SELECT T1.FIC_MIS_DATE, T2.V_ED_CHK_ID, T2.V_ED_CHK_NAME, T2.V_ED_CHK_DESC,

NVL(T1.V_DQ_CHECK_ID, T1.ENTITY)

ENTITY, T1.FAILED_ROWS, T1.RUN_STATUS

FROM

FSI_EDIT_CHECK_SUMMARY T1,

FSI_EDIT_CHECK_MASTER T2

WHERE T1.N_EDIT_CHECK_SKEY = T2.N_EDIT_CHECK_SKEY

AND T1.V_BATCH_ID = <Batch ID>

This section outlines the automated validation applied to each FR 2052A submission to verify and improve overall data quality and communicate key structural features of the collection. These checks represent the early foundation of a validation framework for the FR 2052A report and are refined and expanded upon as the collection progresses. OFS Regulatory Reporting performs the following checks either through Data Quality or Design.

Validation Check |

Performed in: |

Approach: |

Internal Transactions Reported on Consolidated Reporting Entity |

Regulatory Reporting |

Data Quality |

Internal Transactions Reported Without Internal Counterparty |

Regulatory Reporting |

Data Quality |

Lendable Value in Excess of Market Value |

Regulatory Reporting |

Data Quality |

Third-Party Reporting Entity Exposures versus Consolidated |

Regulatory Reporting |

Data Transformation |

Symmetry of Intercompany Transactions |

Regulatory Reporting |

Data Transformation |

Large Haircuts on Secured Transactions |

Regulatory Reporting |

Data Quality |

Mismatched Currency Reporting |

Regulatory Reporting |

Design (this is handled as part of OFS Regulatory Reporting Model design) |

Missing Required Products by Entity Type |

Regulatory Reporting |

Data Transformation |

Improper Intra-entity Consolidation |

Regulatory Reporting |

Data Quality |

Invalid or Missing Counterparty Field |

Regulatory Reporting |

Data Quality |

Missing or Not Applicable (Collateral Class) Field |

Regulatory Reporting |

Data Quality |

Large Other Product or Counterparty Balance |

Regulatory Reporting |

Data Transformation |

Weekend Maturities (in respective source system) |

Processing |

– |

This section outlines the different checks performed for FR Y-14MD2 to verify and improve overall data quality. The total number of DQ checks available in the release for FR Y-14MD2 submission is 143. To get the count (Integrity Check), "Control Total Check" is configured, and for others "Specific Check". All checks are part of DQ GROUP "FRY_14M_D2_GROUP".

Table 50: Post Submission Validation Checks

Validation Check |

Performed in: |

Approach: |

Count of portfolios with negative values |

Regulatory Reporting |

Data Quality |

Count of portfolios less than/greater than the reference value |

Regulatory Reporting |

Data Quality |

Count of portfolios not equal to the reference value |

Regulatory Reporting |

Data Quality |

Field with Null Value |

Regulatory Reporting |

Data Quality |

Field format N12.4. |

Regulatory Reporting |

Data Quality |

Bank ID is not in the format N10. |

Regulatory Reporting |

Data Quality |

Credit Card Type/Credit Card Lending Type has value other than 1-4 |

Regulatory Reporting |

Data Quality |

Period ID should be the last day of the reporting period of the data set. This field must be always a past date and must be different from Period Id in the previous month’s dataset. |

Regulatory Reporting |

Design (this is handled as part of OFSAA DQ check as we are passing mis_date while executing the DQ) |