2. About charges and fee

This chapter contains the following sections:

2.1 Introduction

In Oracle Lending, you can define the different types of charges or fees that apply on a product as “classes”. A charge class is a specific type of charge component. For example, ‘Charges for amending the terms of a loan’.

When defining a product, you merely have to attach the required classes. In this manner, a contract processed under a particular product acquires the classes (components) associated with the product.

To apply a charge or fee on a Loans product, you should first define attributes for each of the components. You can define these attributes by specifying a Rule for the charge or fee. These charge rules should in turn be linked to a product through a class, so that the attributes of the charge rule is applied on all contracts linked to the product. However, while capturing the details of a contract, you can modify some of the attributes defined for a rule. Further, for a contract, you can also indicate whether the application of a specific charge component should be waived.

More than one charge or fee can be applied on a product. For example, you could link two charge to an outgoing transfer product, one with 0.05% of the transfer amount as the charge and another with a flat amount of say 200 local currency units. The first one could be your commission on the transfer and the second, for the SWIFT or cable charges incurred to effect the transfer. These are processed as two different charge components. The income accounts can be different for these components. The two charge components are reported in all reports and in the customer correspondence regarding the transfer.

Steps involved in processing charges or fees

The following steps are involved in processing charges or fee:

- Defining charge or fee rules

- Defining charge or fee classes

- Associating charge or fee classes with a product

- Specifying charges or fee for a contract.

2.2 Defining charge or fee rules

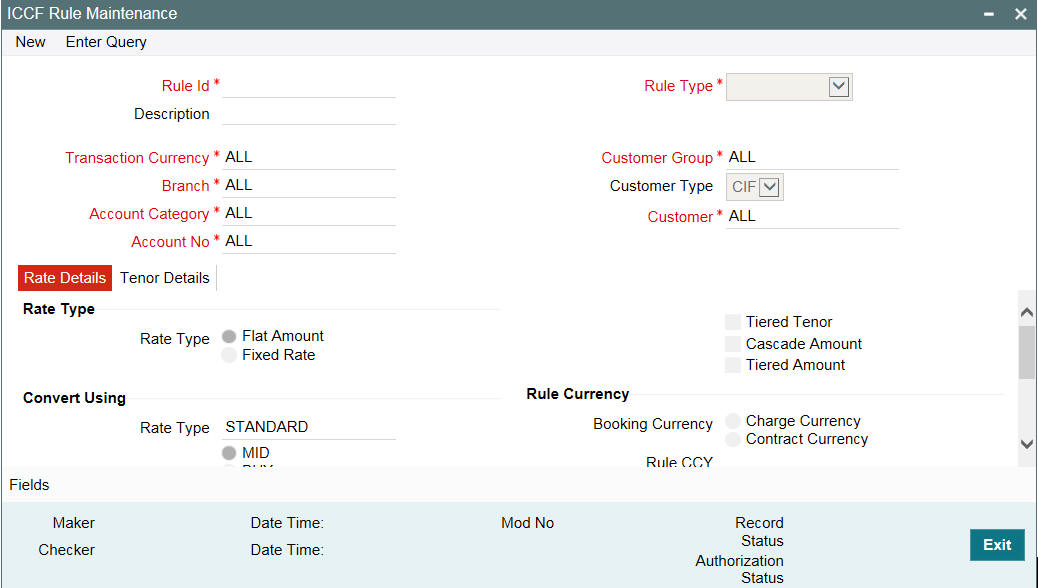

A charge rule is built with the logic to calculate a specific type of charge component. You can define charge rules in the ’ICCF Rule Maintenance’ screen.

Note

The process of defining charge or fee rule is same. In this section, charge rule is mentioned.

This section contains the following topics:

- Section 2.2.1, "Invoking ICCF Rule Maintenance Screen"

- Section 2.2.2, "Indicating Rule Application conditions"

- Section 2.2.3, "Defining charges to be applied on a slab or tier structure"

- Section 2.2.4, "Defining charge rule application conditions"

- Section 2.2.5, "The sequence in which ICCF rules are resolved "

2.2.1 Invoking ICCF Rule Maintenance Screen

You can invoke the ‘ICCF Rule Maintenance’ screen by typing ‘LFDRUMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

If you are calling a charge rule that has already been defined, choose the Summary option under ‘ICCF Rule Summary’ in the Application Browser. From the ‘ICCF Rule Summary’ screen, double-click a rule of your choice to open it.

The following are the features of the ‘ICCF Rule Maintenance’ screen.

Rule ID and Description

Every charge rule is identified by a unique ten-character code, called a Rule ID. You can link a valid Charge Rule ID to the charge classes that you maintain in your bank. Charges or fees for all products with which you associate a charge class is calculated on the basis of the Rule ID that is associated with the class.

Rule Type

The Rule Type identifies the type of component you are defining. The attributes applicable for a component depend on the Rule Type. In this chapter, we shall discuss the procedure for setting up rules for charge components.

For every rule that you define, you can enter a description. Specifying a description helps identify a rule.

Transaction Currency

If you want to define the attributes for all currencies, you can select the ALL option in the Currency Code field to indicate this. If you are maintaining the attributes for the selected ICCF rule in specific currency other than the ALL, select the Transaction Currency on which the rule mapping maintenance is to be made applicable.

Customer Group

Select the customer group on which the rule mapping maintenance is to be made applicable.

Note

You can create a generalized charge rule mapping record by selecting the ALL option in the Customer Group field. This specification is defaulted to the Customer and Customer Account fields. You will not be allowed to change the specification.

Customer

Specify the customer identification number (CIF) of the customer for whom you are maintaining the rule mapping.

Branch Code

If you are maintaining the attributes for the selected ICCF rule from the head office branch, you can select the branch for which the attributes are being defined. If you want to define the attributes for all branches, you can select the ALL option in the Branch Code field to indicate this.

If you are maintaining the attributes for the selected ICCF rule from a branch other than the head office, you can only select those branches that are found in the allowed list of branches for:

- the ICCF rule definition Restriction Type (ICCFRULE), in the Common Branch Restrictions maintenance for the current branch

- the selected rule being built, according to the ICCF Rule Availability maintenance

In other words, the option-list in the Branch Code field would display only those branches that are allowed both for the rule and the current branch.

Specifying the Rate Type

The rate type indicates whether the charge or fee to be applied for the Rule ID is a flat amount or a percentage of the contract amount. Contract amount here refers to:

- Principal amount in the case of a loan or a commitment

- Transaction amount in the case of a teller entry.

- Transfer amount in case of a Remittance.

- SI Amount in case of Standing Instruction.

- LC amount in the case of a Letter of Credit.

- Bill amount in the case of a Bill.

- Buy/Sell amount in the case of an FX deal.

- Deal Nominal amount for a Security Deal.

If the Charge Rule that you are defining calculates charges on a rate basis, choose the ‘Fixed Rate’ option. To levy a flat amount as charge, say a postal charge on the products that are associated with the Charge Class, choose the ‘Flat Amount’ option.

You can choose to indicate the Rate Code and whether the rate is ‘MID’, ‘BUY’ or ‘SELL’ only when the basis amount currency and the rate currency is different from the contract currency.

You can indicate the specific rates and amounts that you would like to apply, in the subsequent fields in this table. These rates or amounts can be changed during contract processing.

2.2.2 Indicating Rule Application conditions

By default, a charge rule that you define can be applied on transactions in

- All currencies

- All customers

However, to restrict the application of a rule to transactions involving a specific customer or currency, you can specify the same in the Customer or Transaction Currency fields, respectively.

Conditions for the application of a charge rule can be defined in the following manner:

- The rule can be applied to any contract, irrespective of the currency of the contract and the customer involved

- The rule can be applied on contracts in a particular currency, irrespective of the customer involved

- The rule can be applied on contracts in a particular currency, involving a particular customer

Thus, the most generally applied condition can be that a charge rule is applicable to contracts in any currency and involving any customer. An interim condition is that a charge rule is applied on contracts in a specific currency but involving any customer.

Example

Requirement:

You would like to levy a special flat charge, in EUR, for maintaining customer portfolios in DEM - EUR being the more convenient currency. Further, you would like to exempt corporates and Financial institutions and levy the charge only on individual portfolios.

Set up:

Step 1

To the rule defined for calculating the special charge, assign a unique Rule ID, SplChPort1. Briefly describe the charge for easy identification: EUR charge: individual portfolios.

Step 2

Choose the Flat Amount option in the Rate Type field.

Step 3

Choose EUR in the Currency field. Choose Individuals in the Customer field. Enter the other details such as the Charge Currency and the tiers or slabs on which you would like to levy the charge.

Step 4

Save this record. Another user with the requisite rights should authorize this record before it can be used.

Note

You are not allowed to define an ICCF Rule for a specific combination unless you maintain a record for the same Rule at the generic level. For instance, while creating the Rule ID called SplChPort1 for the very first time the system defaults the values in the Transaction Currency, Branch, Account Category, Customer, Customer Group, and Account fields to All. Only after saving this record you are allowed to create a second record for a specific combination for the same Rule ID.

2.2.3 Defining charges to be applied on a slab or tier structure

You can create a Charge Rule that would calculate charges on the basis of an amount structure. This structure could be in tiers or in slabs. Select the Tiered Amount check box if the Basis Amount structure is Tiers. Leave it blank if the Basis Amount structure is Slabs.

The following example illustrates how this works:

Example

You have defined a Charge Rule, SplChgPor01, which you would like to apply on deals in DEM, with the following amount basis structure:

Amount |

Rate |

0 to 250 Thousand |

0.05% |

> 250 Thousand <= 1 Million |

0.06% |

> 1 Million <= 3 Million |

0.07% |

> 3 Million |

0.08% |

When this rule is applied on a deal of value 1.5 Million DEM, the rate of the charge is calculated depending on whether the basis has been defined as Slab or Tier as indicated below.

Tier basis

- The first 250,000 (of the total value of 1.5 million) is charged at 0.05%

- The amount from 250,000 to 1,000,000 at 0.06%

- The amount from 1,000,000 to 1,500,000 at 0.07%

- The total amount levied as charge is DEM 925.

Slab basis

- The entire DEM 1.5 million is charged at 0.07%

- Therefore, the amount charged is DEM 1,050.

2.2.3.1 Specifying the Maximum and Minimum Charge amount

Specifying the Maximum Amount

If the charge is based on a fixed rate, you should specify the maximum amount that can be applied on a contract involving the Rule ID. If the aggregate charge calculated using this Rule ID exceeds this amount for a contract, the maximum amount specified in this field is applied instead of the amount calculated using the fixed rate.

Example

The charge applicable for processing a loan is 0.05% of the outstanding loan amount. The maximum charge that can be applied is USD 10. Assume your customer Gem Granites has borrowed USD 30,000 as a loan.

The charge amount works out to USD 15 at 0.05%. However, since the maximum charge amount has been specified as USD 10, this is what is applied on the loan as charges.

Specifying the Minimum Amount

If the charge is based on a fixed rate, you should specify the minimum amount that can be applied on a contract involving the Rule ID. If the aggregate charge calculated using this Rule ID falls below this amount for a contract, the minimum amount specified in this field is applied instead of the amount calculated using the fixed rate.

Example

The processing charge applicable on a loan is 0.05%. The minimum charge that can be applied is USD 5. Assume your customer Gem Granites has taken a loan of USD 5,000.

The charge amount works out to be USD 2.5 at 0.05%. But since the minimum charge amount has been specified as USD 5, this is the amount that is applied on the loan as charge.

Specifying Slab Level Min/Max Amount Currency

You can indicate the currency in which the minimum charge / maximum charge should be applied at each slab. By default, the Basis Amount Currency is the Slab level Min/Max Amount Currency

Example

- Consider a Charges & Fees rule with the following attributes

- Rate Type = Fixed, Tenor Basis

- Rule Currency = Charge Currency

- Rule Amount Currency = INR

- Charges

Basis Amount

Charge

Slab Floor Charge

0 to 10,000

0.50%

5

10,000 to 20,000

0.40%

5

> 20,000

0.30%

5

Minimum Charge = INR 1000

Slab Level Min/Max Currency = USD

Basis Amount Currency = GBP

The currency conversion rates maintained are USD: GBP = 2, INR: GBP = 75, INR: USD = 50

For a loan of USD 350,000, the charges are calculated as follows.

GBP equivalent of USD 350,000 is 175,000

Slab |

Charge (INR) |

Equivalent Charge (USD) |

Effective Charge (INR) |

50,000 |

250 |

5 |

250 |

100,000 |

400 |

8 |

400 |

25,000 |

75 |

1.5 |

250 # |

|

|

Total |

900 |

Note

# INR Equivalent of minimum slab charge of USD 5.

Since the aggregate charge of INR 900 is less than minimum charge of INR 1000, the total charge that is levied for this loan is INR 1000.

2.2.3.2 Specifying the Basis Amount and the Charge Currencies

The Charge Currency is the currency in which the flat amount charge in a contract is to be reckoned.

When building a charge rule, if the Rate Type is a Flat Amount, you have to indicate the currency of the charge or fee. The charge or fee when applied on a transaction is collected in this currency. The input to this field can either be the local currency or the contract currency. By default, the Charge Currency is the Transaction Currency. You can change it to the local currency.

The amount itself is specified subsequently through this screen. This amount can be changed during contract processing.

Example

If the Charge Currency is specified as the local currency and the flat amount is 500, for all contracts involving this Rule ID, an amount of LCY 500 is applied.

If the Charge Currency is specified as the contract currency and the flat amount is 1000; for a bill in US Dollar involving this Rule ID, an amount of USD 1000 is applied, for a contract in Great British Pound involving this Rule ID, an amount of GBP 1000 is applied, and so on.

Charges or fees can be calculated for a transaction on the basis of tiers or slabs. When building a charge rule, you should also indicate the currency of the tiers or slabs based on which you levy the charge. This is the Basis Amount Currency. If the transaction is in a different currency, then the charge is calculated after converting it to the currency of the tiers and slabs.

2.2.3.3 Tenor Details

Basis Amount To

You should specify the upper limit of the slab or tier to which a particular rate or amount should be applied as a charge.

Example

Suppose the following is the slab or tier structure you want to specify:

Amount |

Rate |

0 to 250 thousand |

0.05% |

> 250 thousand <= 1 Million |

0.06% |

> 1 Million <= 3 Million |

0.07% |

> 3 Million |

0.08% |

The Basis Amount To for the first slab or tier should be indicated as 250,000; that for the second slab or tier as 1,000,000 and so on.

Specifying the Fixed Rate

If the charge is a percentage of an amount, specify the applicable rate. This rate is applied on the Basis Amount To, depending on whether you have defined the application basis, as a slab or a tier.

Specifying the Charge Unit

The Charge Unit specifies the unit for rounding up a charge or fee to the nearest amount. The charge or fee is calculated for multiples of the charge unit.

Example

If the Charge Unit has been specified as 10 and the charge is to be calculated for USD 85, then the charge is calculated for the rounded up figure of USD 90.

Similarly if the Charge Unit has been specified as 100 and the charge is to be calculated for USD 750; the charge is calculated for the rounded up figure of USD 800.

Specifying the Floor Amount

If you are defining a Fixed rule type of component, you have to specify the Floor Amount which is to be added to the charge calculated. The floor amount is added to the charge based on the rate defined in the rule.

Specifying the Flat (CCF) Amount

To levy a flat charge, specify the flat amount. This amount is applied on the Basis Amount, depending on whether you have defined the application basis as a slab or a tier.

Specifying the Minimum and Maximum Slab Level Charges

If the charge is based on a fixed rate, you should specify the minimum amount and maximum slab level charges that can be applied on a contract involving the Rule ID. This charge is based on the slab level minimum and maximum amount currency.

If the charge (applicable to the slab) calculated using this Rule ID falls below this amount for a contract, the minimum amount specified in this field is applied instead of the amount calculated using the fixed rate.

Tenor Details – Tenor From and Tenor To

The tenor is in days. For instance, If Tenor from and Tenor to are given as '0' and 91, the tenor slab is from '0' days to '91' days.

2.2.4 Defining charge rule application conditions

When you have built charge rules, you are ready to build Charge Classes. When creating a product, you can link it with a Charge Class you have built. Thus, the definition of charge rules should precede the definition of Charge Classes and Product Definition.

2.2.5 The sequence in which ICCF rules are resolved

While processing charges, the charge rules maintained are resolved in the following sequence:

Level |

Branch |

Transaction CCY |

Customer Group |

Customer |

Account Category |

Account |

1 |

Specific |

Specific |

Specific |

Specific |

Specific |

Specific |

2 |

Specific |

Specific |

Specific |

Specific |

Specific |

All |

3 |

Specific |

Specific |

Specific |

Specific |

All |

All |

4 |

Specific |

All |

Specific |

Specific |

All |

All |

5 |

Specific |

Specific |

Specific |

All |

All |

All |

6 |

Specific |

All |

Specific |

All |

All |

All |

7 |

Specific |

Specific |

All |

All |

All |

All |

8 |

Specific |

All |

All |

All |

All |

All |

9 |

All |

All |

All |

All |

All |

All |